Artificial Intelligence Software Adoption in Manufacturing Companies

Abstract

:1. Introduction

2. Literature Review

2.1. AI in Manufacturing

2.2. Industry 4.0 and AI Adoption

2.3. AI Adoption in the Organizational and Technological Classification Context

3. Methodology

3.1. European Manufacturing Survey

3.2. Sampling Strategy

3.3. Industry 4.0 Readiness Index

- Enterprise resource planning—ERP and

- Product Lifecycle Management—PLM.

- Digital visualization technologies and

- Mobile devices.

- Near-real-time production control systems,

- Technologies for automation and management of internal logistics,

- Technologies for digital data exchange.

- Level 0—Company does not use any of the seven technologies.

- Level 1—Company uses one technology in either of the three technology groups.

- Level 2—Company uses two technologies in two of the three technology groups.

- Level 3—Company uses at least one technology in the first two groups and at least one technology in group cyber-physical system (CPS)-related processes.

- Level 4—Company uses at least one technology in the first two groups and at least two technologies in group cyber-physical system (CPS)-related processes.

- Level 5—Company uses at least one technology in the first two groups and all three technologies in group cyber-physical system (CPS)-related processes.

3.4. Variables

- Management of production processes (e.g., process monitoring).

- Quality control (e.g., defect detection).

- Maintenance of machinery and equipment (e.g., condition monitoring).

- Management of internal logistics (e.g., warehouse, transport, etc.).

- Energy management.

- Improvement or innovation of production processes.

- Producer of finished goods—for consumers.

- Producer of finished goods for companies—capital goods.

- Producer of finished goods for companies—operating resources, other products.

- Supplier—parts/components supplier.

- Supplier—system supplier.

3.5. Logistic Regression

- Β is the transposed vector of regression coefficients,

- X is the vector of k explanatory variables.

4. Results

4.1. Descriptive Statistics

4.2. Logistic Regression Results

5. Discussion

6. Conclusions

- Company size does not contribute to a higher likelihood of AI adoption.

- Technology intensity does not contribute to a higher likelihood of AI adoption.

- The role of the manufacturer in the supply chain does not contribute to a higher likelihood of AI adoption.

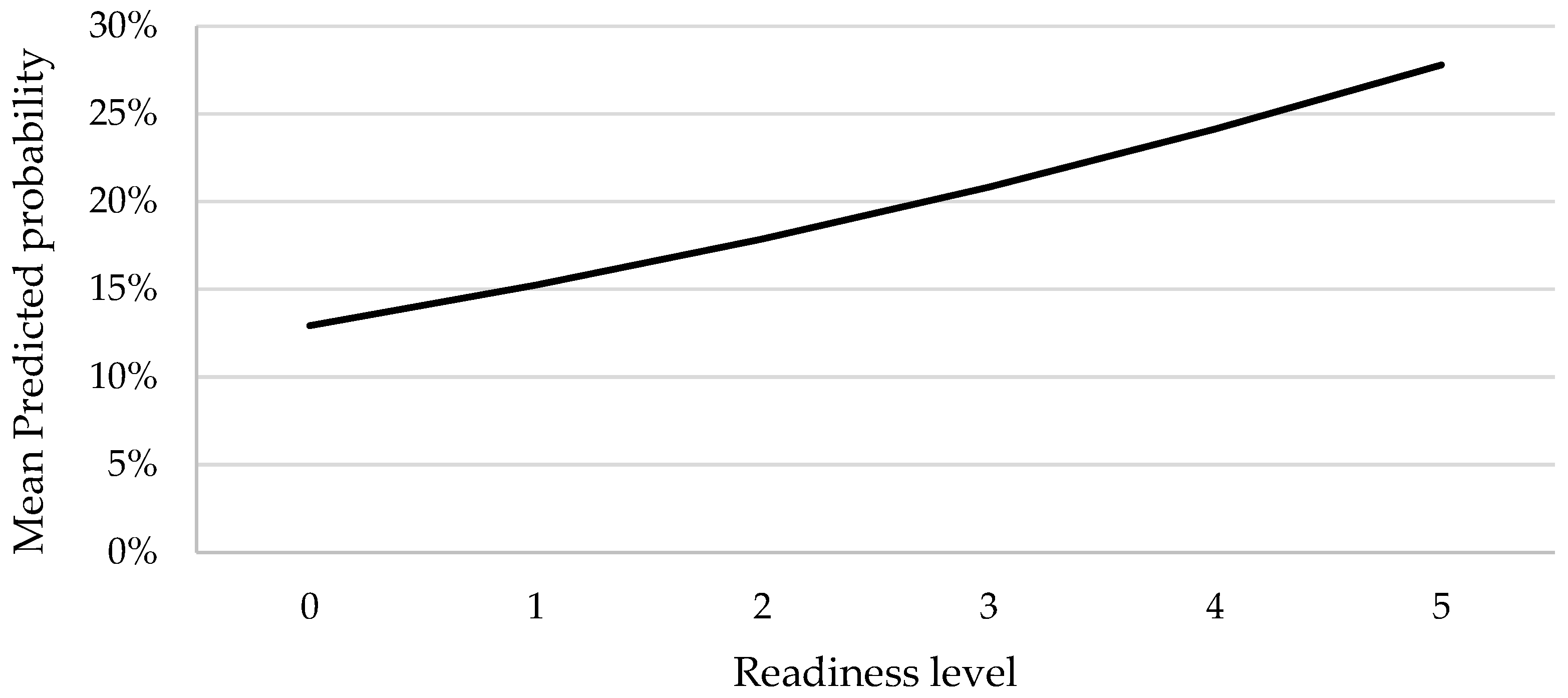

- Higher I4.0 readiness contributes to the likelihood of AI adoption.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Haraguchi, N.; Cheng, C.F.C.; Smeets, E. The Importance of Manufacturing in Economic Development: Has This Changed? World Dev. 2017, 93, 293–315. [Google Scholar] [CrossRef]

- Kagermann, H.; Wahlster, W.; Helbig, J. Recommendations for Implementing the Strategic Initiative Industrie 4.0: Final Report of the Industrie 4.0 Working Group; Forschungsunion: Berlin, Germany, 2013. [Google Scholar]

- Hermann, M.; Pentek, T.; Otto, B. Design Principles for Industrie 4.0 Scenarios. In Proceedings of the 2016 49th Hawaii International Conference on System Sciences (HICSS), Koloa, HI, USA; 2016; pp. 3928–3937. [Google Scholar] [CrossRef]

- Xu, L.D.; Xu, E.L.; Li, L. Industry 4.0: State of the Art and Future Trends. Int. J. Prod. Res. 2018, 56, 2941–2962. [Google Scholar] [CrossRef]

- Oztemel, E.; Gursev, S. Literature Review of Industry 4.0 and Related Technologies. J. Intell. Manuf. 2020, 31, 127–182. [Google Scholar] [CrossRef]

- Wamba-Taguimdje, S.L.; Fosso Wamba, S.; Kala Kamdjoug, J.R.; Tchatchouang Wanko, C.E. Influence of Artificial Intelligence (AI) on Firm Performance: The Business Value of AI-Based Transformation Projects. Bus. Process Manag. J. 2020, 26, 1893–1924. [Google Scholar] [CrossRef]

- Makar, K.Š. Driven by Artificial Intelligence (AI)—Improving Operational Efficiency and Competitiveness in Business. In Proceedings of the 2023 46th MIPRO ICT and Electronics Convention (MIPRO), Opatija, Croatia, 22–26 May 2023; pp. 1142–1147. [Google Scholar] [CrossRef]

- Lee, M.C.M.; Scheepers, H.; Lui, A.K.H.; Ngai, E.W.T. The Implementation of Artificial Intelligence in Organizations: A Systematic Literature Review. Inf. Manag. 2023, 60, 103816. [Google Scholar] [CrossRef]

- Elibal, K.; Özceylan, E. A Systematic Literature Review for Industry 4.0 Maturity Modeling: State-of-the-Art and Future Challenges. Kybernetes 2020, 50, 2957–2994. [Google Scholar] [CrossRef]

- Hizam-Hanafiah, M.; Soomro, M.A.; Abdullah, N.L. Industry 4.0 Readiness Models: A Systematic Literature Review of Model Dimensions. Information 2020, 11, 364. [Google Scholar] [CrossRef]

- Nguyen, T.P.Q.; Yang, C.L.; Le, M.D.; Nguyen, T.T.; Luu, M.T. Enhancing Automated Defect Detection through Sequential Clustering and Classification: An Industrial Case Study Using the Sine-Cosine Algorithm, Possibilistic Fuzzy c-Means, and Artificial Neural Network. Adv. Prod. Eng. Manag. 2023, 18, 237–249. [Google Scholar] [CrossRef]

- Pang, J.L. Adaptive Fault Prediction and Maintenance in Production Lines Using Deep Learning. Int. J. Simul. Model. 2023, 22, 734–745. [Google Scholar] [CrossRef]

- Plathottam, S.J.; Rzonca, A.; Lakhnori, R.; Iloeje, C.O. A Review of Artificial Intelligence Applications in Manufacturing Operations. J. Adv. Manuf. Process. 2023, 5, e10159. [Google Scholar] [CrossRef]

- Peta, K.; Żurek, J. Prediction of Air Leakage in Heat Exchangers for Automotive Applications Using Artificial Neural Networks. In Proceedings of the 2018 9th IEEE Annual Ubiquitous Computing, Electronics & Mobile Communication Conference (UEMCON), New York, NY, USA, 8–10 November 2018; pp. 721–725. [Google Scholar] [CrossRef]

- Zonta, T.; da Costa, C.A.; da Rosa Righi, R.; de Lima, M.J.; da Trindade, E.S.; Li, G.P. Predictive Maintenance in the Industry 4.0: A Systematic Literature Review. Comput. Ind. Eng. 2020, 150, 106889. [Google Scholar] [CrossRef]

- Mobley, R.K. An Introduction to Predictive Maintenance; Butterworth-Heinemann: Oxford, UK, 2002; ISBN 0750675314. [Google Scholar]

- Hsu, C.C.; Jiang, B.H.; Lin, C.C. A Survey on Recent Applications of Artificial Intelligence and Optimization for Smart Grids in Smart Manufacturing. Energies 2023, 16, 7660. [Google Scholar] [CrossRef]

- Willenbacher, M.; Wohlgemuth, V.; Risch, L. Neural Networks for Energy Optimization of Production Processes in Small and Medium Sized Enterprises. In Proceedings of the Advances and New Trends in Environmental Informatics (EnviroInfo 2022), University of Hamburg, Hamburg, Germany, 26–28 September 2022; pp. 129–145. [Google Scholar] [CrossRef]

- Danishvar, M.; Danishvar, S.; Katsou, E.; Mansouri, S.A.; Mousavi, A. Energy-Aware Flowshop Scheduling: A Case for AI-Driven Sustainable Manufacturing. IEEE Access 2021, 9, 141678–141692. [Google Scholar] [CrossRef]

- Helo, P.; Hao, Y. Artificial Intelligence in Operations Management and Supply Chain Management: An Exploratory Case Study. Prod. Plan. Control 2022, 33, 1573–1590. [Google Scholar] [CrossRef]

- Dash, R.; McMurtrey, M.; Rebman, C.; Kar, U.K. Application of Artificial Intelligence in Automation of Supply Chain Management. J. Strateg. Innov. Sustain. 2019, 14. [Google Scholar] [CrossRef]

- Weichert, D.; Link, P.; Stoll, A.; Rüping, S.; Ihlenfeldt, S.; Wrobel, S. A Review of Machine Learning for the Optimization of Production Processes. Int. J. Adv. Manuf. Technol. 2019, 104, 1889–1902. [Google Scholar] [CrossRef]

- Aphirakmethawong, J.; Yang, E.; Mehnen, J. An Overview of Artificial Intelligence in Product Design for Smart Manufacturing. In Proceedings of the 2022 27th International Conference on Automation and Computing (ICAC), Bristol, UK, 1–3 September 2022; pp. 1–6. [Google Scholar] [CrossRef]

- Wang, Y.; Mo, D.Y.; Tseng, M.M. Mapping Customer Needs to Design Parameters in the Front End of Product Design by Applying Deep Learning. CIRP Ann. 2018, 67, 145–148. [Google Scholar] [CrossRef]

- Zhou, F.; Ayoub, J.; Xu, Q.; Yang, X.J. A Machine Learning Approach to Customer Needs Analysis for Product Ecosystems. J. Mech. Des. 2020, 142, 011101. [Google Scholar] [CrossRef]

- Yoo, S.; Lee, S.; Kim, S.; Hwang, K.H.; Park, J.H.; Kang, N. Integrating Deep Learning into CAD/CAE System: Generative Design and Evaluation of 3D Conceptual Wheel. Struct. Multidiscip. Optim. 2021, 64, 2725–2747. [Google Scholar] [CrossRef]

- Merayo, D.; Rodríguez-Prieto, A.; Camacho, A.M. Comparative Analysis of Artificial Intelligence Techniques for Material Selection Applied to Manufacturing in Industry 4.0. Procedia Manuf. 2019, 41, 42–49. [Google Scholar] [CrossRef]

- Bermejillo Barrera, M.D.; Franco-Martínez, F.; Díaz Lantada, A. Artificial Intelligence Aided Design of Tissue Engineering Scaffolds Employing Virtual Tomography and 3D Convolutional Neural Networks. Materials 2021, 14, 5278. [Google Scholar] [CrossRef] [PubMed]

- Vasantha, G.; Purves, D.; Quigley, J.; Corney, J.; Sherlock, A.; Randika, G. Assessment of Predictive Probability Models for Effective Mechanical Design Feature Reuse. Artif. Intell. Eng. Des. Anal. Manuf. 2022, 36, e17. [Google Scholar] [CrossRef]

- Borah, S.; Kama, C.; Rakshit, S.; Vajjhala, N.R. Applications of Artificial Intelligence in Small- and Medium-Sized Enterprises (SMEs). In Cognitive Informatics and Soft Computing; Mallick, P.K., Bhoi, A.K., Barsocchi, P., de Albuquerque, V.H.C., Eds.; Springer: Singapore, 2022; pp. 717–726. [Google Scholar] [CrossRef]

- Kusiak, A. Convolutional and Generative Adversarial Neural Networks in Manufacturing. Int. J. Prod. Res. 2020, 58, 1594–1604. [Google Scholar] [CrossRef]

- Malhan, R.; Gupta, S.K. The Role of Deep Learning in Manufacturing Applications: Challenges and Opportunities. J. Comput. Inf. Sci. Eng. 2023, 23. [Google Scholar] [CrossRef]

- Monek, G.D.; Fischer, S. Expert Twin: A Digital Twin with an Integrated Fuzzy-Based Decision-Making Module. Decis. Mak. Appl. Manag. Eng. 2024, 8, 1–21. [Google Scholar] [CrossRef]

- Ghodake, S.P.; Ramchandra Malkar, V.; Santosh, K.; Jabasheela, L.; Abdufattokhov, S.; Gopi, A.; Tashkent, I. Enhancing Supply Chain Management Efficiency: A Data-Driven Approach Using Predictive Analytics and Machine Learning Algorithms. Int. J. Adv. Comput. Sci. Appl. 2024, 15, 672–686. [Google Scholar] [CrossRef]

- William, P.; Nirsanametla, Y.; Al-Samalek, A.; Hussain, A.; Varshney, N.; Rao, A. AI and Machine Learning Techniques for Managing Complexity, Changes and Uncertainties in Manufacturing. In Proceedings of the 2024 4th International Conference on Innovative Practices in Technology and Management (ICIPTM), Noida, India, 21–23 February 2024; pp. 1–6. [Google Scholar] [CrossRef]

- Fahle, S.; Prinz, C.; Kuhlenkötter, B. Systematic Review on Machine Learning (ML) Methods for Manufacturing Processes—Identifying Artificial Intelligence (AI) Methods for Field Application. Procedia CIRP 2020, 93, 413–418. [Google Scholar] [CrossRef]

- Paturi, U.M.R.; Cheruku, S. Application and Performance of Machine Learning Techniques in Manufacturing Sector from the Past Two Decades: A Review. Mater. Today Proc. 2021, 38, 2392–2401. [Google Scholar] [CrossRef]

- Lasi, H.; Fettke, P.; Kemper, H.-G.; Feld, T.; Hoffmann, M. Industry 4.0. Bus. Inf. Syst. Eng. 2014, 6, 239–242. [Google Scholar] [CrossRef]

- Hofmann, E.; Rüsch, M. Industry 4.0 and the Current Status as Well as Future Prospects on Logistics. Comput. Ind. 2017, 89, 23–34. [Google Scholar] [CrossRef]

- Piccarozzi, M.; Aquilani, B.; Gatti, C. Industry 4.0 in Management Studies: A Systematic Literature Review. Sustainability 2018, 10, 3821. [Google Scholar] [CrossRef]

- Schneider, P. Managerial Challenges of Industry 4.0: An Empirically Backed Research Agenda for a Nascent Field. Rev. Manag. Sci. 2018, 12, 803–848. [Google Scholar] [CrossRef]

- Erol, S.; Schumacher, A.; Sihn, W. Strategic Guidance towards Industry 4.0–A Three-Stage Process Model. In Proceedings of the International Conference on Competitive Manufacturing Proceedings of the International Conference on Competitive Manufacturing (COMA), Stellenbosch, South Africa, 27–29 January 2016; pp. 495–501. [Google Scholar]

- Bauer, W.; Schlund, S.; Marrenbach, D.; Ganschar, O. Studie: Industrie 4.0—Volkswirtschaftliches Potenzial Für Deutschland. Available online: https://www.bitkom.org/Publikationen/2014/Studien/Studie-Industrie-4-0-Volkswirtschaftliches-Potenzial-fuer-Deutschland/Studie-Industrie-40.pdf (accessed on 31 May 2024).

- Ünlü, H.; Demirörs, O.; Garousi, V. Readiness and Maturity Models for Industry 4.0: A Systematic Literature Review. J. Softw. Evol. Process 2023, 36, e2641. [Google Scholar] [CrossRef]

- Zamora Iribarren, M.; Garay-Rondero, C.L.; Lemus-Aguilar, I.; Peimbert-García, R.E. A Review of Industry 4.0 Assessment Instruments for Digital Transformation. Appl. Sci. 2024, 14, 1693. [Google Scholar] [CrossRef]

- Angreani, L.S.; Vijaya, A.; Wicaksono, H. Systematic Literature Review of Industry 4.0 Maturity Model for Manufacturing and Logistics Sectors. Procedia Manuf. 2020, 52, 337–343. [Google Scholar] [CrossRef]

- Mittal, S.; Khan, M.A.; Romero, D.; Wuest, T. A Critical Review of Smart Manufacturing & Industry 4.0 Maturity Models: Implications for Small and Medium-Sized Enterprises (SMEs). J. Manuf. Syst. 2018, 49, 194–214. [Google Scholar] [CrossRef]

- Müller, J.M.; Kiel, D.; Voigt, K.I. What Drives the Implementation of Industry 4.0? The Role of Opportunities and Challenges in the Context of Sustainability. Sustainability 2018, 10, 247. [Google Scholar] [CrossRef]

- Klingenberg, C.O.; Borges, M.A.V.; Antunes, J.A.V., Jr. Industry 4.0 as a Data-Driven Paradigm: A Systematic Literature Review on Technologies. J. Manuf. Technol. Manag. 2019, 32, 570–592. [Google Scholar] [CrossRef]

- Camisón-Zornoza, C.; Lapiedra-Alcamí, R.; Segarra-Ciprés, M.; Boronat-Navarro, M. A Meta-Analysis of Innovation and Organizational Size. Organ Stud. 2004, 25, 331–361. [Google Scholar] [CrossRef]

- Clohessy, T.; Acton, T. Investigating the Influence of Organizational Factors on Blockchain Adoption. Ind. Manag. Data Syst. 2019, 119, 1457–1491. [Google Scholar] [CrossRef]

- Yao, J.E.; Xu, X.; Liu, C.; Lu, J.; Yao, J. Organizational Size: A Significant Predictor of IT Innovation Adoption. J. Comput. Inf. Syst. 2003, 43, 76–82. [Google Scholar] [CrossRef]

- Na, S.; Heo, S.; Choi, W.; Han, S.; Kim, C. Firm Size and Artificial Intelligence (AI)-Based Technology Adoption: The Role of Corporate Size in South Korean Construction Companies. Buildings 2023, 13, 1066. [Google Scholar] [CrossRef]

- Kinkel, S.; Baumgartner, M.; Cherubini, E. Prerequisites for the Adoption of AI Technologies in Manufacturing—Evidence from a Worldwide Sample of Manufacturing Companies. Technovation 2022, 110, 102375. [Google Scholar] [CrossRef]

- Poba-Nzaou, P.; Tchibozo, A.S. Understanding Artificial Intelligence Adoption Predictors: Empirical Insights from A Large-Scale Survey. In Proceedings of the 2022 International Conference on Information Management and Technology (ICIMTech), Semarang, Indonesia, 11–12 August 2022; pp. 323–326. [Google Scholar] [CrossRef]

- Dachs, B.; Kinkel, S.; Jäger, A. Bringing It All Back Home? Backshoring of Manufacturing Activities and the Adoption of Industry 4.0 Technologies. J. World Bus. 2019, 54, 101017. [Google Scholar] [CrossRef]

- Bughin, J.; Hazan, E.; Sree Ramaswamy, P.; DC, W.; Chu, M. Artificial Intelligence the Next Digital Frontier. Available online: https://www.mckinsey.com/~/media/mckinsey/industries/advanced%20electronics/our%20insights/how%20artificial%20intelligence%20can%20deliver%20real%20value%20to%20companies/mgi-artificial-intelligence-discussion-paper.pdf (accessed on 31 May 2024).

- Lu, D. Fundamentals of Supply Chain Management; Bookboon: Copenhagen, Denmark, 2011. [Google Scholar]

- Benjamin, R.; Rolf, I.; Jackson, M.M.S.L.T.R.; Ivanov, D. A Review on Reinforcement Learning Algorithms and Applications in Supply Chain Management. Int. J. Prod. Res. 2023, 61, 7151–7179. [Google Scholar] [CrossRef]

- Sharma, R.; Shishodia, A.; Munim, Z.H. The Role of Artificial Intelligence in Supply Chain Management: Mapping the Territory. Int. J. Prod. Res. 2022, 60, 7527–7550. [Google Scholar] [CrossRef]

- Hendriksen, C. Artificial Intelligence for Supply Chain Management: Disruptive Innovation or Innovative Disruption? J. Supply Chain Manag. 2023, 59, 65–76. [Google Scholar] [CrossRef]

- Zamani, E.D.; Smyth, C.; Gupta, S.; Dennehy, D. Artificial Intelligence and Big Data Analytics for Supply Chain Resilience: A Systematic Literature Review. Ann. Oper. Res. 2023, 327, 605–632. [Google Scholar] [CrossRef] [PubMed]

- Wang, M.; Pan, X. Drivers of Artificial Intelligence and Their Effects on Supply Chain Resilience and Performance: An Empirical Analysis on an Emerging Market. Sustainability 2022, 14, 16836. [Google Scholar] [CrossRef]

- Dora, M.; Kumar, A.; Mangla, S.K.; Pant, A.; Kamal, M.M. Critical Success Factors Influencing Artificial Intelligence Adoption in Food Supply Chains. Int. J. Prod. Res. 2022, 60, 4621–4640. [Google Scholar] [CrossRef]

- Kutz, J.; Neuhüttler, J.; Spilski, J.; Lachmann, T. Implementation of AI Technologies in Manufacturing—Success Factors and Challenges. Hum. Side Serv. Eng. 2022, 62, 256–261. [Google Scholar] [CrossRef]

- European Manufacturing Survey. Available online: https://www.isi.fraunhofer.de/en/themen/wertschoepfung/fems.html (accessed on 26 April 2024).

- Lerch, C.; Jäger, A.; Meyer, N. I4.0-Readiness-Baden-Württemberg Auf Dem Weg Zur Industrie 4.0? Available online: https://kmu-digital.eu/de/service-kompetenz/publikationen/dokumente/studien/327-i4-0-readiness-baden-wuerttemberg-auf-dem-weg-zur-industrie-4-0 (accessed on 31 May 2024).

- Tabachnick, B.G.; Fidell, L.S. Using Multivariate Statistics: International Edition, 6th ed.; Pearson: London, UK, 2012; ISBN 9780205849574. [Google Scholar]

- Ransbotham, S.; Khodabandeh, S.; Kiron, D.; Candelon, F.; Chu, M.; Lafountain, B. Expanding AI’s Impact with Organizational Learning. Available online: https://sloanreview.mit.edu/projects/expanding-ais-impact-with-organizational-learning/ (accessed on 24 June 2024).

| Variable Category | Variable Name | Variable Description |

|---|---|---|

| Dependent | AI usage | Yes |

| No | ||

| Independent | Company size | Large (>250 employees) |

| Medium (50–249 employees) | ||

| Small (20–49 employees) | ||

| Role | OEM producer | |

| Supplier | ||

| Both | ||

| Technology intensity | High | |

| Medium-high | ||

| Medium-low | ||

| Low | ||

| Industry 4.0 readiness | Level 5—Very high users | |

| Level 4—High users | ||

| Level 3—Advanced users | ||

| Level 2—Advanced beginners | ||

| Level 1—Beginners | ||

| Level 0—Non-users |

| Production Area | Specialized SW [%] | Share of AI Users [%] | Total Share of AI Users [%] |

|---|---|---|---|

| Process management | 55.7% | 14.4% | 8.0% |

| Quality control | 39.6% | 22.2% | 8.8% |

| Maintenance | 36.8% | 20.4% | 7.5% |

| Internal logistics | 37.3% | 14.6% | 5.4% |

| Energy management | 22.8% | 18.2% | 4.1% |

| Improvement or innovation | 19.4% | 22.7% | 4.4% |

| Size | Share of Companies [%] | Share of AI Users [%] |

|---|---|---|

| Small | 29.2 | 15.2 |

| Medium | 50.8 | 17.9 |

| Large | 20.1 | 24.7 |

| Total | 100 |

| Role in the Supply Chain | Share of Companies [%] | Share of AI Users [%] |

|---|---|---|

| Supplier | 30.6 | 20.3 |

| OEM producer | 64.0 | 17.4 |

| Both | 5.4 | 19.0 |

| Total | 100 |

| Technology Intensity | Share of Companies [%] | Share of AI Users [%] |

|---|---|---|

| Low | 27.2 | 16.2 |

| Medium-low | 42.7 | 18.8 |

| Medium-high | 24.1 | 17.2 |

| High | 6.0 | 30.4 |

| Total | 100 |

| Readiness Level | Share of Companies [%] |

|---|---|

| Level 0 | 17.4 |

| Level 1 | 19.9 |

| Level 2 | 29.5 |

| Level 3 | 14.8 |

| Level 4 | 9.6 |

| Level 5 | 8.8 |

| Variable | β | S.E. | Wald | df | Sig. | Exp(β) | LB | UB |

|---|---|---|---|---|---|---|---|---|

| Small | 2.771 | 2 | 0.250 | |||||

| Medium | 0.201 | 0.323 | 0.387 | 1 | 0.534 | 1.222 | 0.649 | 2.301 |

| Large | 0.605 | 0.373 | 2.626 | 1 | 0.105 | 1.831 | 0.881 | 3.804 |

| Constant | −1.721 | 0.263 | 42.692 | 1 | <0.001 | 0.179 | ||

| Model information: | Χ2 = 2.706 | Sig. = 0.258 | Nagelkerke r2 = 0.01 | |||||

| Variable | β | S.E. | Wald | df | Sig. | Exp(β) | LB | UB |

|---|---|---|---|---|---|---|---|---|

| Supplier | 0.462 | 2 | ||||||

| OEM producer | −0.192 | 0.284 | 0.457 | 1 | 0.499 | 0.826 | 0.47 | 1.44 |

| Both | −0.082 | 0.601 | 0.018 | 1 | 0.892 | 0.922 | 0.28 | 2.99 |

| Constant | −1.365 | 0.229 | 35.635 | 1 | 0.000 | 0.255 | ||

| Model information: | Χ2 = 0.458 | Sig. = 0.795 | Nagelkerke r2 = 0.002 | |||||

| Variable | β | S.E. | Wald | df | Sig. | Exp(β) | LB | UB |

|---|---|---|---|---|---|---|---|---|

| Low | 2.579 | 3 | 0.461 | |||||

| Low-medium | 0.180 | 0.332 | 0.296 | 1 | 0.587 | 1.198 | 0.625 | 2.293 |

| Medium-high | 0.073 | 0.382 | 0.036 | 1 | 0.849 | 1.076 | 0.509 | 2.273 |

| High | 0.817 | 0.525 | 2.425 | 1 | 0.119 | 2.265 | 0.809 | 6.336 |

| Constant | −1.644 | 0.265 | 38.513 | 1 | <0.001 | 0.193 | ||

| Model information: | Χ2 = 2.398 | Sig. = 0.494 | Nagelkerke r2 = 0.01 | |||||

| Variable | β | S.E. | Wald | df | Sig. | Exp(β) | LB | UB |

|---|---|---|---|---|---|---|---|---|

| I4.0 readiness | 0.19 | 0.087 | 4.783 | 1 | 0.029 * | 1.21 | 1.02 | 1.43 |

| Constant | −1.91 | 0.241 | 62.390 | 1 | <0.001 | 0.15 | ||

| Model information: | Χ2 = 4.771 | Sig. = 0.029 | Nagelkerke r2 = 0.02 | |||||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kovič, K.; Tominc, P.; Prester, J.; Palčič, I. Artificial Intelligence Software Adoption in Manufacturing Companies. Appl. Sci. 2024, 14, 6959. https://doi.org/10.3390/app14166959

Kovič K, Tominc P, Prester J, Palčič I. Artificial Intelligence Software Adoption in Manufacturing Companies. Applied Sciences. 2024; 14(16):6959. https://doi.org/10.3390/app14166959

Chicago/Turabian StyleKovič, Klemen, Polona Tominc, Jasna Prester, and Iztok Palčič. 2024. "Artificial Intelligence Software Adoption in Manufacturing Companies" Applied Sciences 14, no. 16: 6959. https://doi.org/10.3390/app14166959

APA StyleKovič, K., Tominc, P., Prester, J., & Palčič, I. (2024). Artificial Intelligence Software Adoption in Manufacturing Companies. Applied Sciences, 14(16), 6959. https://doi.org/10.3390/app14166959