Forecasting Cost Risks of Corn and Soybean Crops through Monte Carlo Simulation

Abstract

Featured Application

Abstract

1. Introduction

2. Materials and Methods

2.1. Case Study

2.2. Data Collection

2.3. Descriptive Analysis

2.4. Spearman Correlation Coefficient (r) and Coefficient of Determination (R2)

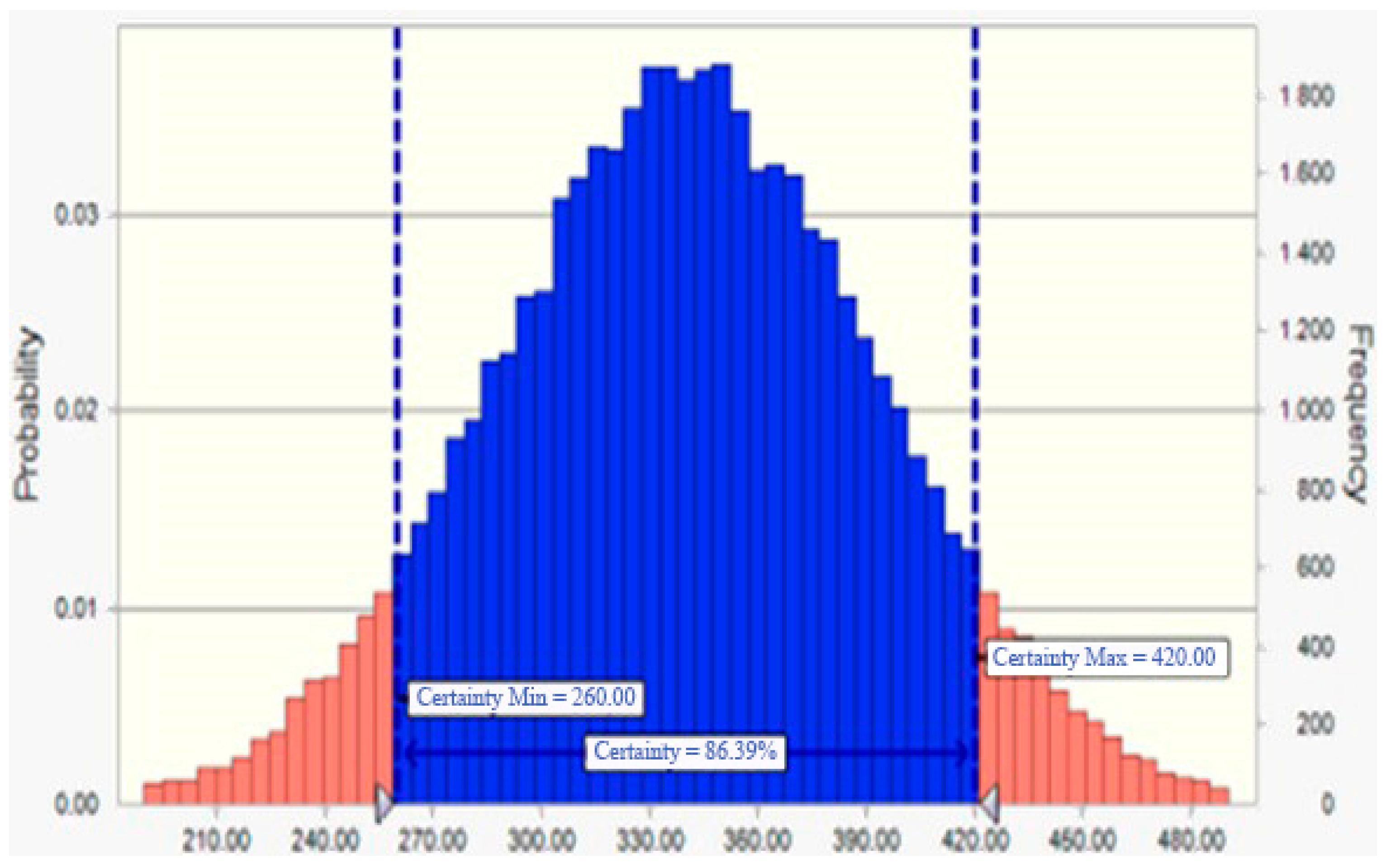

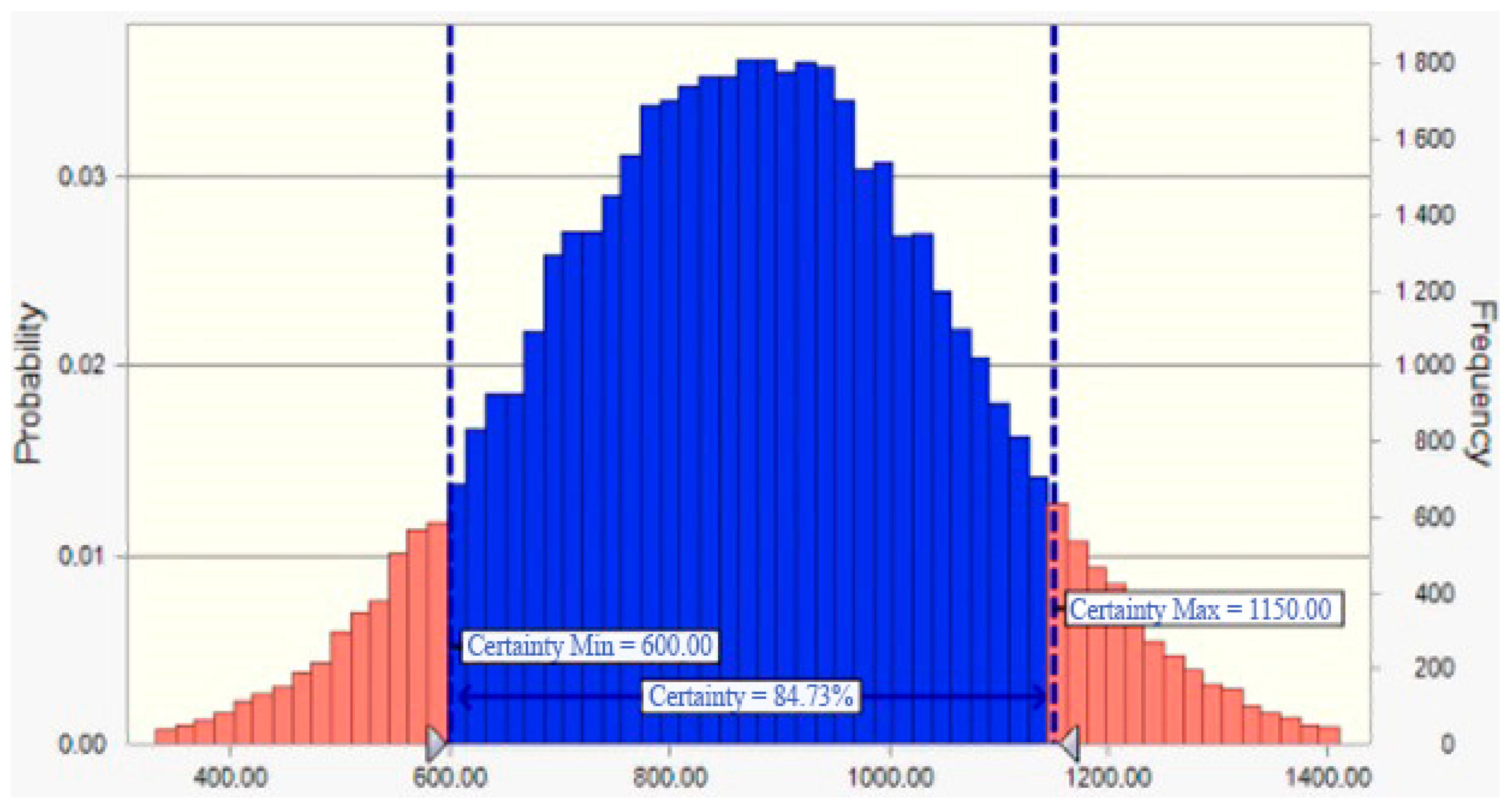

2.5. Monte Carlo Simulation

2.5.1. Simple Exponential Smoothing (SES)

2.5.2. Autoregressive Integrated Moving Average (ARIMA)

2.5.3. Damped Trend Non-Seasonal (DTN-S)

2.5.4. Double Moving Average (DMA)

2.5.5. Non-Seasonal Smoothed Trend (TANS)

2.5.6. Double Exponential Smoothing (DES)

3. Analysis and Discussion of Results

3.1. Descriptive Analysis

3.2. Economic Analysis of Corn and Soybeans

3.3. Spearman Correlation Coefficient (ρ) and Coefficient of Determination (R2)

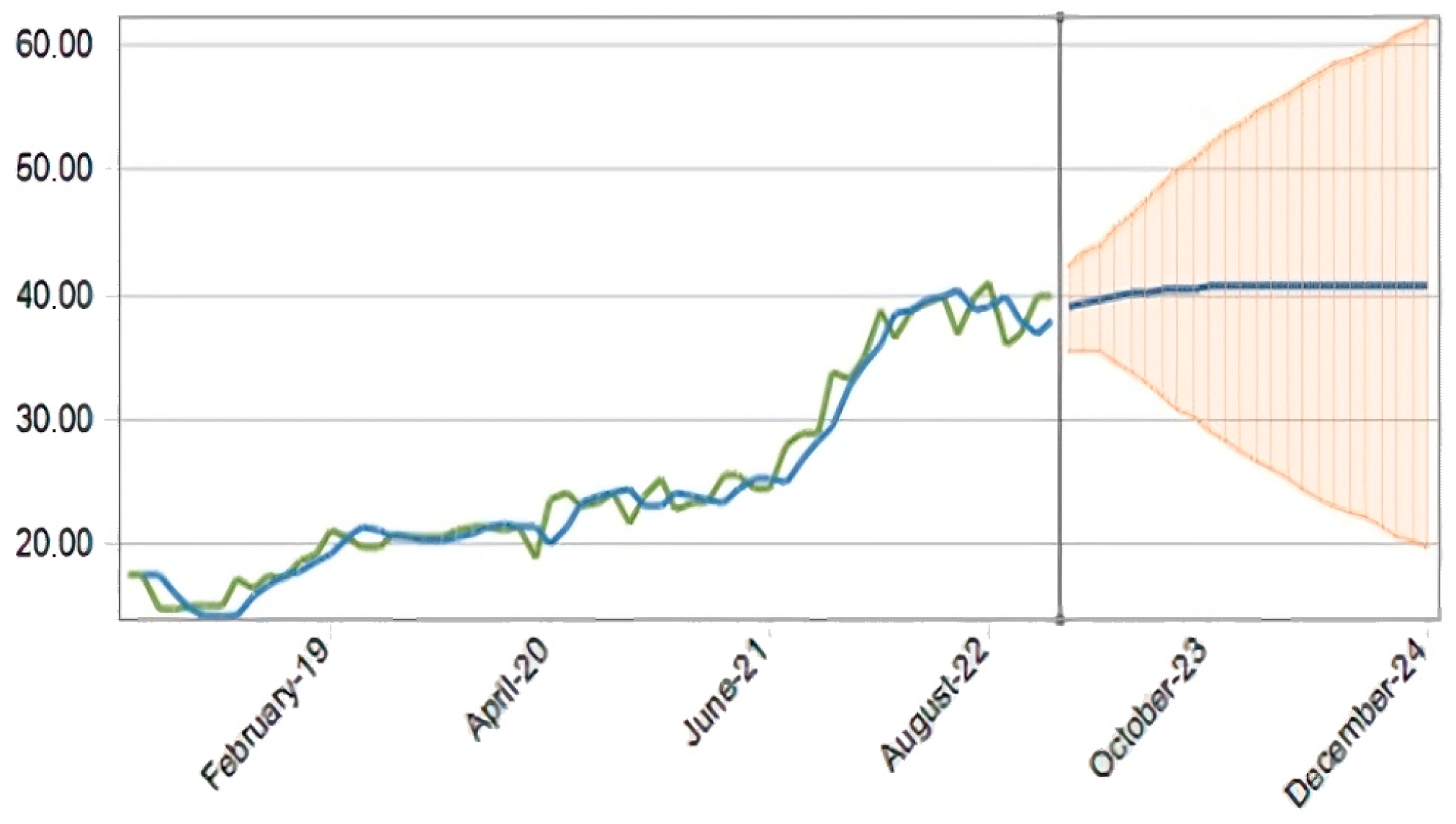

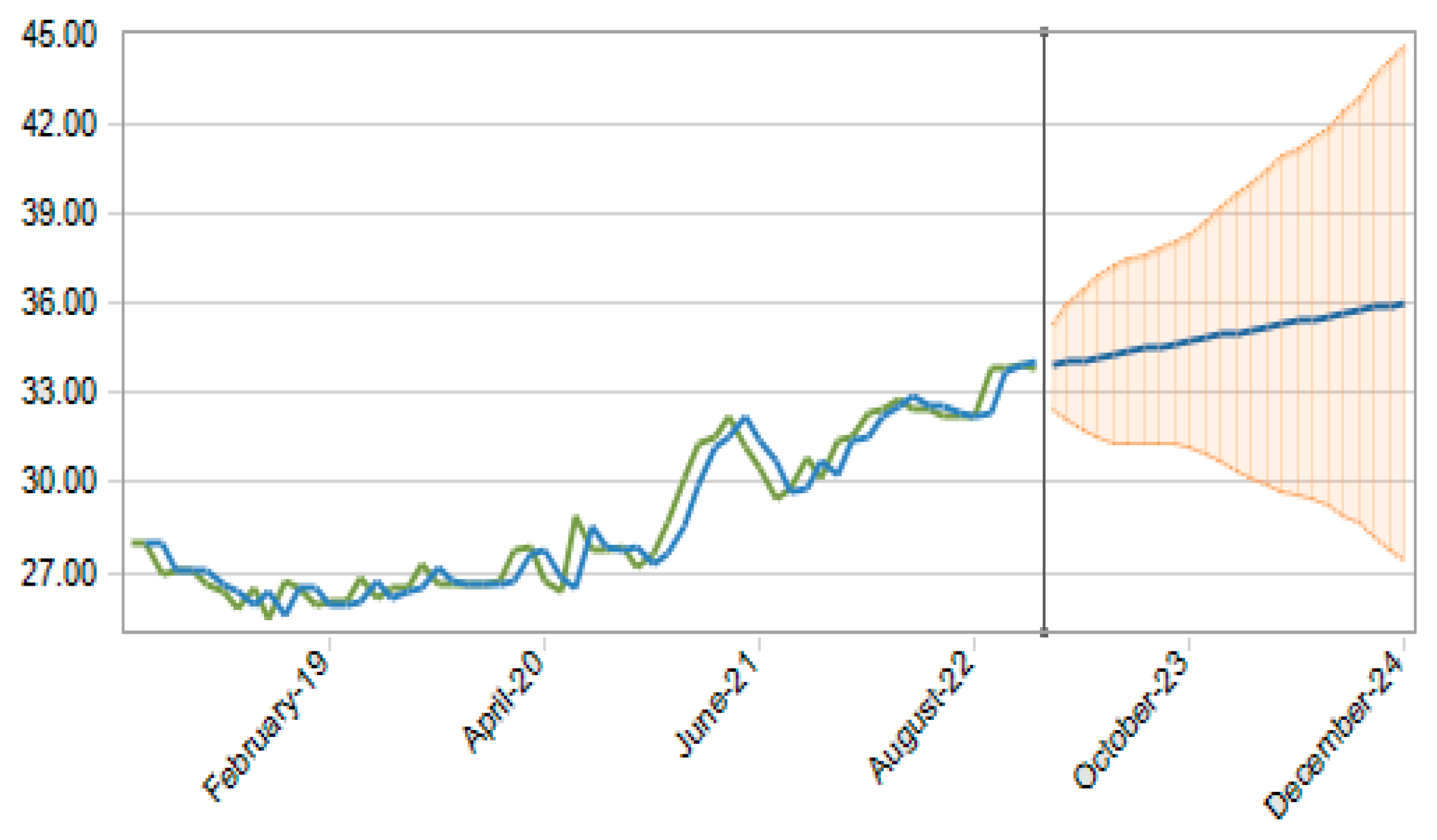

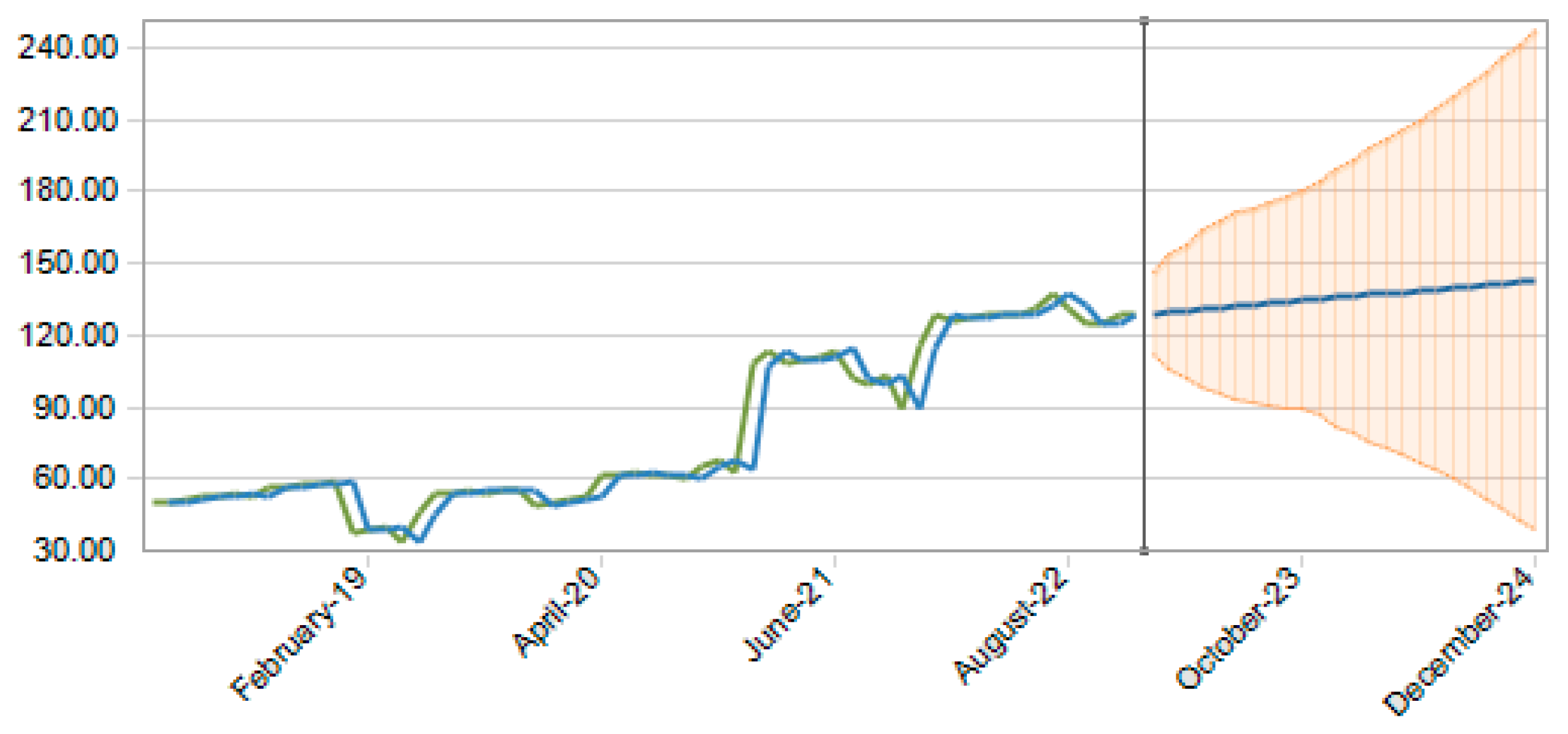

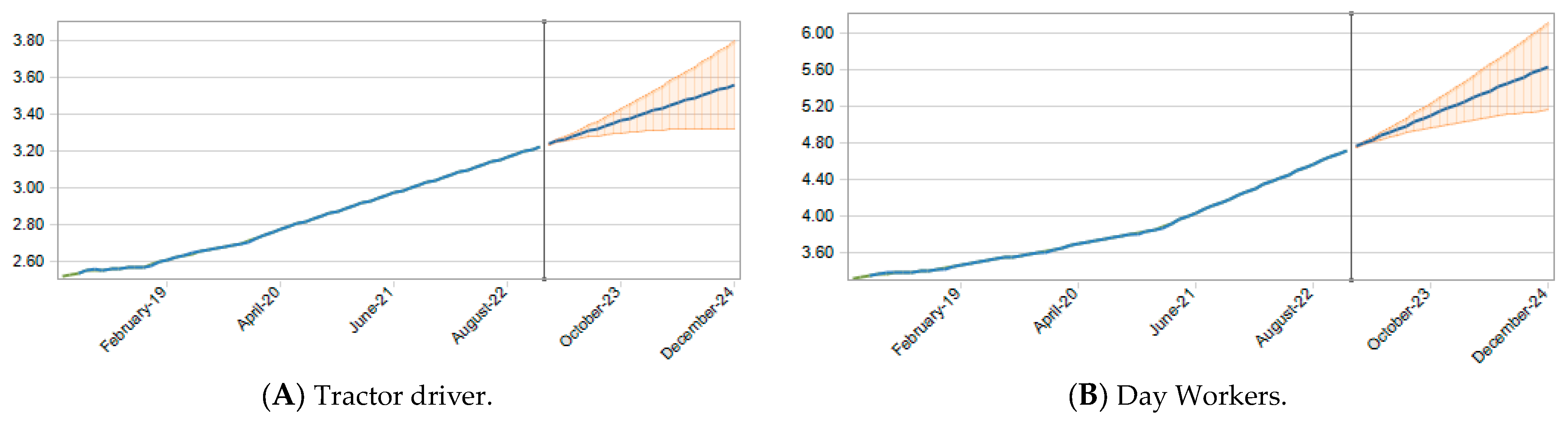

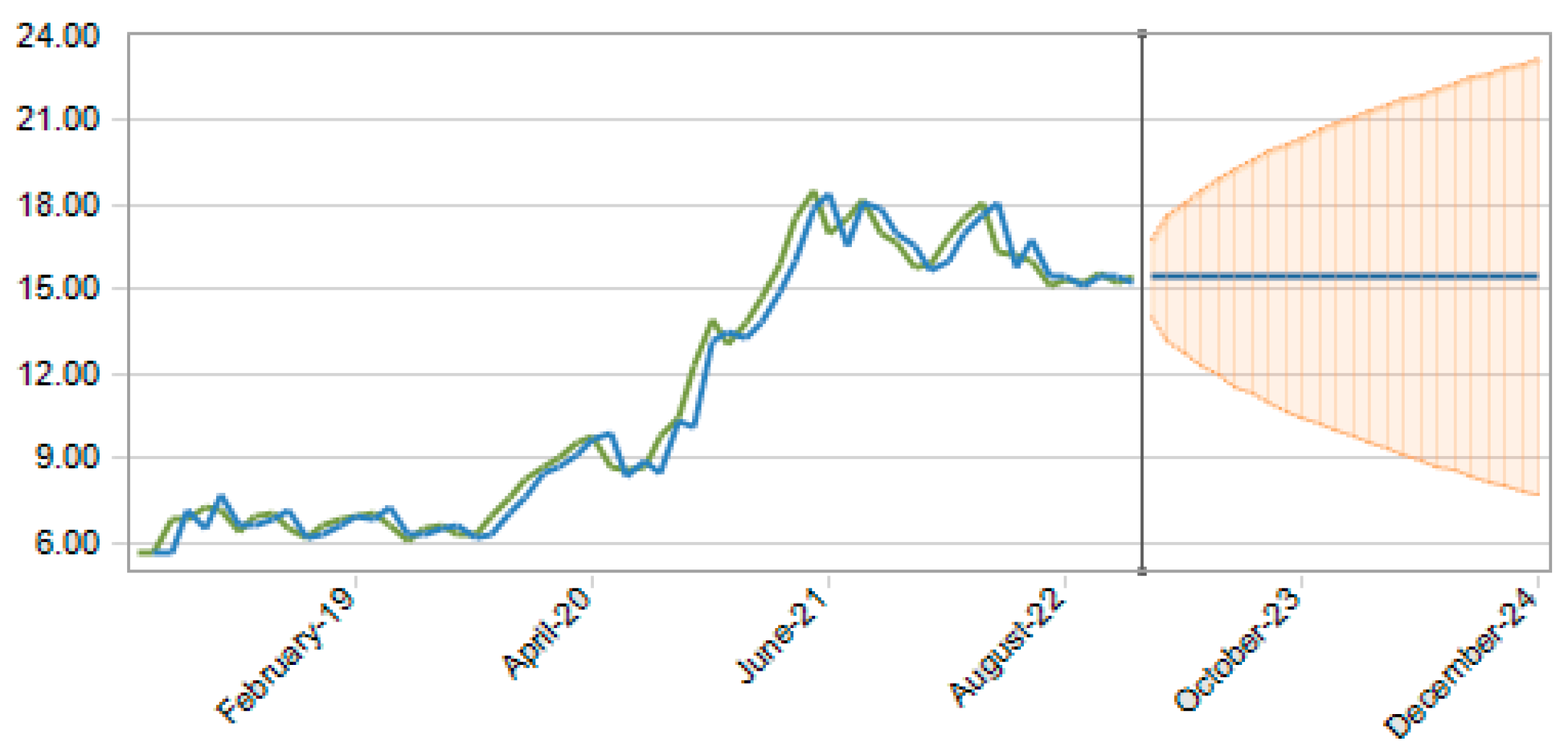

3.4. Time Series Forecasting Based on Historical Data

4. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Aragão, A.; Contini, E. O Agro no Brasil e no Mundo: Um Panorama do Período de 2000 a 2021; Embrapa: Brasilia, Brazil, 2022. [Google Scholar]

- Meade, B.; Puricelli, E.; McBride, W.D.; Valdes, C.; Hoffman, L.; Foreman, L.; Dohlman, E. Corn and Soybean Production Costs and Export Competitiveness in Argentina, Brazil, and the United States; USDA Economic Information Bulletin; World Bank Group Agricuture: Washington, DC, USA, 2016. [Google Scholar]

- Belik, W. Sustainability and Food Security after COVID-19: Relocalizing Food Systems? Agric. Econ. 2020, 8, 23. [Google Scholar] [CrossRef]

- Amorim, F.R.; Silva, S.A.; Andrade, A.G.; Pigatto, G. Reflexo Pós-Pandemia Nos Preços das Ações de Três Grupos do Setor Sucroalcooleiro No Brasil. Navus 2021, 11, 1–19. [Google Scholar] [CrossRef]

- Oliveira, S.C.D.; Amorim, F.R.D.; Barbosa, C.C.; Andrade, A.G.D.; Solfa, F.D.G. Effect of Production Costs on the Price per Ton of Sugarcane: The Case of Brazil. Int. J. Soc. Sci. Stud. 2022, 10, 15. [Google Scholar] [CrossRef]

- Sun, Z.; Katchova, A.L.; Lee, S. Economic Perspective on the U.S. Agricultural Commodity Market for the 2022/23 Marketing Year; Department of Agricultural, Environmental and Development Economics: Columbus, OH, USA, 2023. [Google Scholar]

- Grafton, M.; Manning, M. Establishing a Risk Profile for New Zealand Pastoral Farms. Agriculture 2017, 7, 81. [Google Scholar] [CrossRef]

- Lips, M. Disproportionate Allocation of Indirect Costs at Individual-Farm Level Using Maximum Entropy. Entropy 2017, 19, 453. [Google Scholar] [CrossRef]

- Gao, J.; McBride, W.D.; Ren, Z.; Ao, C.; Lei, G.; Gaiser, T.; Srivastava, A.K. A Fertilization Decision Model for Maize, Rice, and Soybean Based on Machine Learning and Swarm Intelligent Search Algorithms. Agronomy 2023, 13, 1400. [Google Scholar] [CrossRef]

- Pitrova, J.; Krejčí, I.; Pilar, L.; Moulis, P.; Rydval, J.; Hlavatý, R.; Horáková, T.; Tichá, I. The Economic Impact of Diversification into Agritourism. Int. Food Agribus. Manag. Rev. 2020, 23, 713–734. [Google Scholar] [CrossRef]

- Amorim, F.R.; Patino, M.T.O.; Bartmeyer, P.M.; Santos, D.F.L. Productivity and Profitability of the Sugarcane Production in the State of Sao Paulo, Brazil. Sugar Tech 2020, 22, 596–604. [Google Scholar] [CrossRef]

- Goldsmith, P. Soybean Costs of Production. Afr. J. Food Agric. Nutr. Dev. 2020, 19, 15140–15144. [Google Scholar] [CrossRef]

- Ishikawa-Ishiwata, Y.; Furuya, J. Fungicide Cost Reduction with Soybean Rust-Resistant Cultivars in Paraguay: A Supply and Demand Approach. Sustainability 2021, 13, 887. [Google Scholar] [CrossRef]

- Huerta, A.I.H.; Martin, M.A. Soybean Production Costs: An Analysis of the United States, Brazil and Argentina. In Proceedings of the 2002 Annual Meeting, Long Beach, CA, USA, 28–31 July 2002. [Google Scholar]

- Osaki, M.; Alves, L.R.A.; Lima, F.F.; Ribeiro, R.G.; Barros, G.S.C. Risks Associated with a Double-Cropping Production System—A Case Study in Southern Brazil. Sci. Agric. 2019, 76, 130–138. [Google Scholar] [CrossRef]

- Arce, C.; Arias, D.; Caballero, J. Paraguay Agricultural Sector Risk Assessment; World Bank Group Agricuture: Washington, DC, USA, 2015. [Google Scholar]

- Krah, K. Maize Price Variability, Land Use Change and Forest Loss: Evidence from Ghana. Land Use Policy 2023, 125, 106472. [Google Scholar] [CrossRef]

- Wang, W.; Wei, L. Impacts of Agricultural Price Support Policy on Price Variability and Welfare: Evidence from China’s Soybean Market. Agric. Econ. 2021, 52, 3–17. [Google Scholar] [CrossRef]

- De Oliveira Quadras, D.L.; Cavalcante, I.; Kück, M.; Mendes, L.G.; Frazzon, E.M. Machine Learning Applied to Logistics Decision Making: Improvements to the Soybean Seed Classification Process. Appl. Sci. 2023, 13, 10904. [Google Scholar] [CrossRef]

- Koroteev, M.; Romanova, E.; Korovin, D.; Shevtsov, V.; Feklin, V.; Nikitin, P.; Makrushin, S.; Bublikov, K.V. Optimization of Food Industry Production Using the Monte Carlo Simulation Method: A Case Study of a Meat Processing Plant. Informatics 2022, 9, 5. [Google Scholar] [CrossRef]

- Silva, S.A.; Abreu, P.H.C.; Amorim, F.R.; Santos, D.F.L. Application of Monte Carlo Simulation for Analysis of Costs and Economic Risks in a Banking Agency. IEEE Lat. Am. Trans. 2019, 17, 409–417. [Google Scholar] [CrossRef]

- Oktoviany, P.; Knobloch, R.; Korn, R. A Machine Learning-Based Price State Prediction Model for Agricultural Commodities Using External Factors. Decis. Econ. Financ. 2021, 44, 1063–1085. [Google Scholar] [CrossRef]

- Miura, M. Estimativa de Oferta e Demanda de Milho no Estado de São Paulo em 2022; Instituto de Economia Agrícola: São Paulo, Brazil, 2022; pp. 1–4. [Google Scholar]

- SEADE. Valor da Produção Agrícola da Soja Ultrapassa o da Laranja em SP; Sistema Estadual de Análise de Dados: São Paulo, Brazil, 2022. [Google Scholar]

- AGROSTAT—Estatisticas de Comércio Exterior do Agronegócio Brasileiro—2023; Ministério da Agricultura, Pecuária e Abastecimento: Brasilia, Brazil, 2023.

- Gajić, T.; Petrović, M.D.; Blešić, I.; Radovanović, M.M.; Spasojević, A.; Sekulić, D.; Penić, M.; Demirović Bajrami, D.; Dubover, D.A. The Contribution of the Farm to Table Concept to the Sustainable Development of Agritourism Homesteads. Agriculture 2024, 14, 1314. [Google Scholar] [CrossRef]

- Camargo, F.P.; Fredo, C.E.; Lago, C.S.; Ghobril, C.N.; Bini, D.L.; Angelo, J.A.; Miura, M.; Coelho, P.J.; Martins, V.A.; Nakama, L.M.; et al. Previsões e Estimativas das Safras Agrícolas do Estado de São Paulo, Levantamento Parcial, Ano Agrícola 2022/23 e Levantamento Final, Ano Agrícola 2021/2; Análises e Indicadores do Agronegócio: São Paulo, Brazil, 2023; pp. 1–20. [Google Scholar]

- Moriasi, D.N.; Arnold, J.G.; Van Liew, M.W.; Bingner, R.L.; Harmel, R.D.; Veith, T.L. Model Evaluation Guidelines for Systematic Quantification of Accuracy in Watershed Simulations. Trans. ASABE 2007, 50, 885–900. [Google Scholar] [CrossRef]

- São Paulo Banco de Dados; Instituto de Economia Agrícola-IEA: São Paulo, Brazil, 2023.

- Ferraudo, A.S. Técnicas de Análise Multivariada: Uma Introdução. Apostila Técnica. Curso Análise Exploratória de Dados-Estatística Multivariada; Universidade Estadual Paulista: Jaboticabal, Brazil, 2014; 72p. [Google Scholar]

- Hair, J.F.J.; Anderson, R.E.; Tatham, R.L.; Black, W.C. Análise Multivariada dos Dados; Bookman: Porto Alegre, Brazil, 2005. [Google Scholar]

- EPM Information Development Team Oracle@Cloud. Como Trabalhar com Planejamento Preditivo no Smart View; Oracle Corporation: Austin, TX, USA, 2015; Available online: https://docs.oracle.com/cloud/help/pt_BR/pbcs_common/CSPPU/CSPPU.pdf (accessed on 2 April 2023).

- Thompson, N.M.; Armstrong, S.D.; Roth, R.T.; Ruffatti, M.D.; Reeling, C.J. Short-run Net Returns to a Cereal Rye Cover Crop Mix in a Midwest Corn–Soybean Rotation. Agron. J. 2020, 112, 1068–1083. [Google Scholar] [CrossRef]

- CEPEA. Custos Grãos; Centro de Estudos Avançados em Economia Aplicada: Piracicaba, Brazil, 2018. [Google Scholar]

- CEPEA. Custos Grãos; Centro de Estudos Avançados em Economia Aplicada: Piracicaba, Brazil, 2019. [Google Scholar]

- CEPEA. Custos Grãos; Centro de Estudos Avançados em Economia Aplicada: Piracicaba, Brazil, 2020. [Google Scholar]

- CEPEA. Custos Grãos; Centro de Estudos Avançados em Economia Aplicada: Piracicaba, Brazil, 2021. [Google Scholar]

- CEPEA. Custos Grãos; Centro de Estudos Avançados em Economia Aplicada: Piracicaba, Brazil, 2022. [Google Scholar]

- Shadidi, B.; Najafi, G. Impact of Covid-19 on Biofuels Global Market and Their Utilization Necessity during Pandemic. Energy Equip. Syst. 2021, 9, 371–382. [Google Scholar] [CrossRef]

- Lin, B.; Zhang, Y.Y. Impact of the COVID-19 Pandemic on Agricultural Exports. J. Integr. Agric. 2020, 19, 2937–2945. [Google Scholar] [CrossRef]

- Facuri, F.G.; Ramos, M.R. Fatores de Influência Na Formação do Preço dos Herbicidas à Base de Glifosato No Brasil. Enciclopédia Biofesta 2019, 16, 882–894. [Google Scholar] [CrossRef]

- Rabelo, C.G.; Souza, L.H.; Oliveira, F.G. Análise dos Custos de Produção de Silagem de Milho: Estudo de caso. Cad. Ciências Agrárias 2017, 9, 8–15. [Google Scholar]

- Batista, A.; Lopes, A.C.V.; Costa, J.R.M. Gestão de Custos na Produção Agrícola: Um estudo na cultura da soja. In Proceedings of the XXIX Congresso Brasileiro de Custos, João Pessoa, Brazil, 16–18 November 2022. [Google Scholar]

- Palma, A.A. Balanço de Pagamentos, Balança Comercial e Câmbio–Evolução Recente e Perspectivas; Instituto de Pesquisa Econômica Aplicada: Brasilia, Brazil, 2023. [Google Scholar]

- Seidler, E.P.; Costa, N.L.; Almeida, M.; Coronel, D.A.; Santana, A.C. Formação de Preços do Milho em São Paulo e Suas Conexões Com o Mercado Interno e Internacional. Colóquio–Rev. Desenvolv. Reg. 2022, 19, 259–278. [Google Scholar]

- Alves, L.R.A.; Costa, M.S.; Lima, F.F.; Souza, F.F.J.B.; Osaki, M.; Ribeiro, R.G. Diferenças nas Estruturas de Custos de Produção de Milho Convencional e Geneticamente Modificado no Brasil, na segunda safra: 2010/11, 2013/14 e 2014/15. Custos Agronegócio Online 2018, 14, 364–389. [Google Scholar]

- Staugaitis, A.J.; Vaznonis, B. Short-Term Speculation Effects on Agricultural Commodity Returns and Volatility in the European Market Prior to and during the Pandemic. Agriculture 2022, 12, 623. [Google Scholar] [CrossRef]

- Brum, A.L.; Baggio, D.K.; Souza, F.M.; Batista, G.; Schneider, I.N. Influência dos Fundos de Investimento Na Formação das Cotações do Milho Na Bolsa de Cereais de Chicago. Rev. Econ. Sociol. Rural 2023, 61, e251575. [Google Scholar] [CrossRef]

- DIESSE. Redução do ICMS dos Combustíveis, Energia Elétrica, Transportes e Comunicação; Nota Técnica número 270; Departamento Intersindical de Estatística e Estudos Socioeconômicos: São Paulo, Brazil, 2022. [Google Scholar]

- Olortegui, J.A.C.; Marçal, E.F.; Rocha, R.A.; Apolinário, H.C.F.; Teixeira, P.C.M. Avaliação de Áreas Agrícolas Através de Uma Abordagem de Opções Reais por Simulação de Monte Carlo Com Mínimos Quadrados Ordinários. Braz. J. Dev. 2021, 7, 118237–118255. [Google Scholar] [CrossRef]

- Abreu, P.H.C.; Amorim, F.R. Gerenciamento Dos Riscos em Projetos de Software: Uma Aplicação da Simulação de Monte Carlo No Cronograma de Um Projeto. INFA 2017, 14, 53–71. [Google Scholar]

- Joubert, F.; Pretorius, L. Using Monte Carlo Simulation to Create a Ranked Check List of Risks in a Portfolio of Railway Construction Projects. S. Afr. J. Ind. Eng. 2017, 28, 133–147. [Google Scholar] [CrossRef]

- Custos-Soja-1997 a 2022; CONAB—Companhia Nacional de Abastecimento: Brasilia, Brazil, 2022.

- Série Histórica-Custos-Milho 2a Safra-2005 a 2022; CONAB—Companhia Nacional de Abastecimento: Brasilia, Brazil, 2022.

- Ventura, M.V.A.; Batista, H.R.F.; Bessa, M.M.; Pereira, L.S.; Costa, E.M.; Oliveira, M.H.R. Comparison of Conventional and Transgenic Soybean Production Costs in Different Regions in Brazil. RSD 2020, 9, e154973977. [Google Scholar] [CrossRef]

- Münch, T.; Berg, M.; Mirschel, W.; Wieland, R.; Nendel, C. Considering Cost Accountancy Items in Crop Production Simulations Under Climate Change. Eur. J. Agron. 2014, 52, 57–68. [Google Scholar] [CrossRef]

- Artuzo, F.D.; Foguesatto, C.R.; Souza, A.R.L.D.; Silva, L.X.D. Gestão de Custos na Produção de Milho e Soja. Rev. Bras. Gestão Negócios 2018, 20, 273–294. [Google Scholar]

- Nóia Júnior, R.S.; Sentelhas, P.C. Soybean-Maize Succession in Brazil: Impacts of Sowing Dates on Climate Variability, Yields and Economic Profitability. Eur. J. Agron. 2019, 103, 140–151. [Google Scholar] [CrossRef]

- Brookes, G.; Barfoot, P. GM Crop Technology Use 1996-2018: Farm Income and Production Impacts. GM Crops Food 2020, 11, 242–261. [Google Scholar] [CrossRef]

- Baio, F.H.R.; Neves, D.C.; Souza, H.B.; Leal, A.J.F.; Leite, R.C.; Molin, J.P.; Silva, S.P. Variable Rate Spraying Application on Cotton Using an Electronic Flow Controller. Precis. Agric. 2018, 19, 912–928. [Google Scholar] [CrossRef]

- Freitas, J.M.; Vaz, M.C.; Dutra, G.A.G.A.; Souza, J.L.; Rezende, C.F.A. Response of Corn Productivity to Mineral and Organomineral Fertilization. Res. Soc. Dev. 2021, 10, 26810514301. [Google Scholar]

- Costa, F.G.; Caixeta Filho, J.V.; Arima, E. Influence of Transportation on the Use of the Land: Viabilization Potential of Soybean Production in Legal Amazon Due to the Development of the Transportation Infrastructure. Rev. Econ. Sociol. Rural. 2019, 39, 155–177. [Google Scholar]

- Marchuk, S.; Tait, S.; Sinha, P.; Harris, P.; Antille, D.L.; McCabe, B.K. Biosolids-Derived Fertilisers: A Review of Challenges and Opportunities. Sci. Total Environ. 2023, 875, 162555. [Google Scholar] [CrossRef]

- Smith, W.B.; Wilson, M.; Pagliari, P. Organomineral Fertilizers and Their Application to Field Crops. In Animal Manure: Production, Characteristics, Environmental Concerns, and Management; ASA Special Publications; Waldrip, H.M., Pagliari, P.H., He, Z., Eds.; American Society of Agronomy: Madison, WI, USA; Crop Science Society of America: Madison, WI, USA; Soil Science Society of America: Madison, WI, USA, 2020; pp. 229–243. ISBN 978-0-89118-371-6. [Google Scholar]

- Van Lenteren, J.C.; Bolckmans, K.; Köhl, J.; Ravensberg, W.J.; Urbaneja, A. Biological Control Using Invertebrates and Microorganisms: Plenty of New Opportunities. BioControl 2018, 63, 39–59. [Google Scholar] [CrossRef]

- Parra, J.R.P. Biological Control in Brazil: State of art and perspectives. Sci. Agric. 2023, 80, e20230080. [Google Scholar] [CrossRef]

- CEPEA. Custos do Leite; Centro de Estudos Avançados em Economia Aplicada: Piracicaba, Brazil, 2018. [Google Scholar]

- Beerling, D.J.; Leake, J.R.; Long, S.P.; Scholes, J.D.; Ton, J.; Nelson, P.N.; Bird, M.; Kantzas, E.; Taylor, L.L.; Sarkar, B.; et al. Farming with Crops and Rocks to Address Global Climate, Food and Soil Security. Nat. Plants 2018, 4, 138–147. [Google Scholar] [CrossRef] [PubMed]

- Wolfert, S.; Ge, L.; Verdouw, C.; Bogaardt, M. Big Data in Smart Farming—A Review. Agric. Syst. 2017, 153, 69–80. [Google Scholar] [CrossRef]

- Klerkx, L.; Rose, D. Dealing with the Game-Changing Technologies of Agriculture 4.0: How Do We Manage Diversity and Responsibility in Food System Transition Pathways? Glob. Food Secur. 2020, 24, 100347. [Google Scholar] [CrossRef]

- Rose, D.C.; Chilvers, J. Agriculture 4.0: Broadening Responsible Innovation in an Era of Smart Farming. Front. Sustain. Food Syst. 2018, 2, 87. [Google Scholar] [CrossRef]

- Sundmaeker, H.V.C.; Verdouw, C.; Wolfert, S.; Freire, L.P. Internet of Food and Farm 2020. In Digitising the Industry-Internet of Things Connecting the Physical, Digital and Virtual Worlds; River Publishers: Alborg, Denmark, 2016; Volume 1, pp. 129–151. ISBN 978-1-00-333796-6. [Google Scholar]

- Kamilaris, A.; Kartakoullis, A.; Prenafeta-Boldú, F.X. A Review on the Practice of Big Data Analysis in Agriculture. Comput. Electron. Agric. 2017, 143, 23–37. [Google Scholar] [CrossRef]

| DOIL | FUTT | HEGL | INTL | DLLC | NPKF | DLR | SOY | COR | SOYS | CORS | TRAC | DAI | PCF | URF | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| n | 60 | 60 | 60 | 60 | 60 | 60 | 60 | 60 | 60 | 60 | 60 | 60 | 60 | 60 | 60 |

| MIN | 0.57 | 16.95 | 18.91 | 29.59 | 14.8 | 278.4 | 3.18 | 12.61 | 5.66 | 0.57 | 2.33 | 302.26 | 13.25 | 352.38 | 339.04 |

| MAX | 1.41 | 22.66 | 92.02 | 48.68 | 40.98 | 1205.24 | 5.67 | 36.51 | 18.53 | 2.29 | 4.31 | 387.01 | 18.9 | 1256.63 | 1201.48 |

| RANGE | 0.84 | 5.71 | 73.11 | 19.09 | 26.18 | 926.84 | 2.49 | 23.9 | 12.87 | 1.72 | 1.98 | 84.75 | 5.65 | 904.25 | 862.43 |

| MEAN | 0.80 | 19.28 | 36.22 | 38.17 | 25.28 | 576.043 | 4.66 | 22.57 | 11.27 | 1.332 | 3.299 | 2.83 | 15.37 | 602.53 | 580.38 |

| VAR | 0.0586 | 3.1021 | 625.35 | 24.85 | 64.30 | 104,435 | 0.5986 | 72.132 | 20.392 | 0.3075 | 0.114 | 706.85 | 2.81 | 113,307.91 | 85,958.13 |

| SD | 0.24 | 1.7613 | 25.0071 | 4.9851 | 8.0191 | 323.1645 | 0.77 | 8.4931 | 4.5157 | 0.55 | 0.33 | 26.58 | 1.67 | 336.61 | 293.18 |

| CV | 30.1% | 9.1% | 69.0% | 13.1% | 31.7% | 56.1% | 16.6% | 37.6% | 40.0% | 41.6% | 10.2% | 7.8% | 10.9% | 55.8% | 50.5% |

| SKEW (g1) | 1.2158 | 0.5324 | 1.3291 | 0.3488 | 0.73 | 0.947 | −0.265 | 0.2153 | 0.2287 | 0.4712 | −0.2119 | 0.2294 | 0.6285 | 1.0545 | 1.0692 |

| KURT (g2) | 0.0765 | −1.2306 | 0.026 | −0.7111 | −0.7596 | −0.8431 | −1.443 | −1.7728 | −1.693 | −1.4971 | 1.1549 | −1.2933 | −0.8398 | −0.7136 | −0.5489 |

| Items | Description | Unit | Crop | Cost/ha (USD) | Cost/ha/Corn (%) | Cost/ha/Soybean (%) |

|---|---|---|---|---|---|---|

| DOIL | 36 | L/ha | Corn/soybean | 29.8 | 4.7 | 5.8 |

| FUTT | 0.750 | L/ha | Corn/soybean | 28.9 | 4.6 | 5.7 |

| HEGL | 5 | L/ha | Corn/soybean | 36.2 | 5.8 | 7.1 |

| INTL | 0.750 | L/ha | Corn/soybean | 28.6 | 4.6 | 5.6 |

| DLLC | 1 | T/ha | Corn/soybean | 25.3 | 4.0 | 5.0 |

| NPKF | 500 | T/ha | Corn/soybean | 288.0 | 45.9 | 56.5 |

| COR | 60 | kg/ha | Soybean | 10.5 | NA | NA |

| SOY | 20 | kg/ha | Corn | 11.3 | NA | NA |

| SOYS | 60 | kg/ha | Soybean | 79.9 | NA | 15.7 |

| CORS | 20 | kg/ha | Corn | 66.0 | 10.5 | NA |

| TRAC | 2 | 2 h/ha | Corn/soybean | 2.83 | 0.5 | 0.6 |

| DAI | 2 | 2 h/ha | Corn/soybean | 3.84 | 0.6 | 0.8 |

| PCF | 100 | kg/ha | Corn | 60.2 | 9.6 | NA |

| URF | 100 | kg/ha | Corn | 58.0 | 9.2 | NA |

| TCOST | NA | ha | Corn | 627.7 | 100 | NA |

| NA | ha | Soybean | 509.5 | NA | 100 | |

| Productivity Data | ||||||

| EPROD | 91 bag/ha | 60 kg/bag | Corn | 11.3 | NA | NA |

| 50 bag/ha | 60 kg/bag | Soybean | 22.6 | NA | NA | |

| Gross Income | USD | |||||

| Corn | 1026.3 | |||||

| Soybean | 1128.6 | |||||

| DV | IV | p | R2 | DC | IV | p | R2 | DC |

|---|---|---|---|---|---|---|---|---|

| DOIL | Corn | 0.72 | 0.52 | Strong | Soy | 0.81 | 0.65 | Strong |

| FUTT | Corn | 0.88 | 0.77 * | Strong | Soy | 0.92 | 0.85 * | very strong |

| HEGL | Corn | 0.65 | 0.42 | moderate | Soy | 0.74 | 0.54 | Strong |

| INTL | Corn | 0.79 | 0.64 | Strong | Soy | 0.83 | 0.68 | Strong |

| DLLC | Corn | 0.81 | 0.65 | Strong | Soy | 0.87 | 0.77 * | Strong |

| NPKF | Corn | 0.80 | 0.64 | Strong | Soy | 0.86 | 0.75 * | Strong |

| DLR | Corn | 0.79 | 0.62 | Strong | Soy | 0.77 | 0.59 | Strong |

| SOY | Corn | 0.92 | 0.93 * | very strong | Soy | 0.97 | 0.93 * | very strong |

| SOYS | Corn | 0.92 | 0.93 * | very strong | Soy | 0.97 | 0.93 * | very strong |

| CORS | Corn | 0.15 | 0.02 | negligible | Soy | 0.27 | 0.08 | Negligible |

| TRAC | Corn | 0.91 | 0.83 * | very strong | Soy | 0.95 | 0.90 * | very strong |

| DAI | Corn | 0.87 | 0.75 | Strong | Soy | 0.92 | 0.85 * | very strong |

| PCF | Corn | 0.72 | 0.54 | Strong | Soy | 0.81 | 0.66 | Strong |

| URF | Corn | 0.77 | 0.60 | Strong | Soy | 0.84 | 0.70 | Strong |

| Statistic DW | Theil’s U | ||||||

|---|---|---|---|---|---|---|---|

| DTN-S | Arima (1, 1, 2) | DES | DTN-S | Arima (1, 1, 2) | DES | EM RMSE | |

| NPKF (soybean) | 1.92 | 1.92 | 1.97 | 0.96 | 0.96 * | 0.97 | 9.9% |

| URF (soybean) | Tans | Arima (0, 1, 1) | Sed | Tans | Arima (0, 1, 1) | Sed | 27.2% |

| 1.91 | 2.0 | 1.64 | 0.94 | 0.92 * | 0.94 | ||

| DLLC (soybean) | DTN-S | DMA | DES | DTN-S | DMA | DES | 9.0% |

| 1.82 | 1.76 | 2.00 | 0.99 * | 0.96 | 0.94 | ||

| FUTT (soybean) | DES | DTN-S | SES | DES | DTN-S | SES | 3.9% |

| 2.00 | 2.01 | 2.01 | 0.98 * | 0.98 | 0.98 | ||

| CORS | DES | DTN-S | SES | DES | DTN-S | SES | 3.6% |

| 1.99 | 1.99 | 1.99 | 0.96 * | 0.96 | 0.97 | ||

| TRAC (corn/soybean) | DTN-S | Arima (0, 2, 0) | DES | DTN-S | Arima (0, 2, 0) | DES | 6.0% |

| 1.70 | 2.00 | 1.70 | 0.99 | 0.99 * | 0.99 | ||

| Day (corn/soybean) | DTN-S | Arima (0, 2, 0) | DES | DTN-S | Arima (0, 2, 0) | DES | 2.0% |

| 1.58 | 1.82 | 1.58 | 0.99 | 0.99 * | 0.99 | ||

| CORB (corn/soybean) | DTN-S | Arima (1, 1, 1) | DES | DTN-S | Arima (1, 1, 1) | DES | 2.7% |

| 1.99 | 1.85 | 1.61 | 0.99 | 0.94 * | 0.99 | ||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Amorim, F.R.d.; Guimarães, C.C.; Afonso, P.; Tobias, M.S.G. Forecasting Cost Risks of Corn and Soybean Crops through Monte Carlo Simulation. Appl. Sci. 2024, 14, 8030. https://doi.org/10.3390/app14178030

Amorim FRd, Guimarães CC, Afonso P, Tobias MSG. Forecasting Cost Risks of Corn and Soybean Crops through Monte Carlo Simulation. Applied Sciences. 2024; 14(17):8030. https://doi.org/10.3390/app14178030

Chicago/Turabian StyleAmorim, Fernando Rodrigues de, Camila Carla Guimarães, Paulo Afonso, and Maisa Sales Gama Tobias. 2024. "Forecasting Cost Risks of Corn and Soybean Crops through Monte Carlo Simulation" Applied Sciences 14, no. 17: 8030. https://doi.org/10.3390/app14178030

APA StyleAmorim, F. R. d., Guimarães, C. C., Afonso, P., & Tobias, M. S. G. (2024). Forecasting Cost Risks of Corn and Soybean Crops through Monte Carlo Simulation. Applied Sciences, 14(17), 8030. https://doi.org/10.3390/app14178030