1. Introduction

In recent years, policy changes and market volatility in dairy markets in the European Union (EU) including the termination of the EU milk quota, the Russian ban on EU dairy products, Brexit, Euro exchange rate fluctuations and so on, have brought greater challenges, as well as incentives, for EU policymakers and dairy exporters to expand in international markets [

1,

2]. Meanwhile, China has increasingly become a key international market destination for dairy exporters across the globe, attributing to its rising demand for dairy products, the embracing of westernized food consumption patterns, and consumers’ trust issues with domestic dairy safety, etc. [

3,

4,

5,

6,

7,

8]. As a result, the past five years has seen rapid expansion by major EU dairy exporting countries to the Chinese market. For example, Denmark and the Netherlands experienced 133% and 26% increases, respectively, in the export of condensed milk to China. The intensification of the trade facilitation strategies is expected to stimulate price transmission and market integrations. While at the same time, Irish dairy exports face uncertainties with new opportunities and challenges due to Brexit and dairy quota abolition: (1) possible Non-Tariff Barriers to trade (NTBs) and market loss in the UK; (2) the increasing of milk production and an intensive milk powder investment would cause a surplus that needs to be exported to new markets. In the near future, the Chinese market for SMP will become more important and competitive with anticipation of SMP market integration that will be determined by several factors. Firstly, deepening and the ongoing bilateral and multilateral trade agreements such as the updated China-New Zealand Free Trade Agreement and Regional Comprehensive Economic Partnership (RCEP), will strengthen the international trade with China in Asia-Pacific Region. Secondly, the efforts of major SMP importers, such as China, to boost their domestic dairy industry and build up consumer confidence in domestic milk powder products will intensify competition in the Chinese market. Thirdly, predictable and strategic market extensions for EU dairy exporters after the abolition of milk production quotas will make EU dairy exporting countries try harder to find new markets. For example, Ireland has turned its focus on the Chinese market and is trying to establish an Irish dairy products image under Origin Green (e.g., healthy, “green”, sustainable inherent to the Irish dairy sector) to Chinese consumers who have an increasing demand for dairy food but are still affected by the trauma of domestic milk powder safety disasters thereby looking towards imports of premium milk powder products [

1].

However, competing for the Chinese market is no easy task for EU dairy exporters facing strong competition from other international players. In particular, New Zealand, a major dairy exporter in the Southern Hemisphere, has been a dominant player in China’s dairy market, accounting for 57.3% of its total dairy imports, thanks to its strong export orientation, close geographic proximity, and free-trade agreement with the Chinese government [

9] (Data source: OEC. Authors calculated by aggregating products catagorized as HS Code: 0401, 0402, 0403, 0404, 0405 and 0406). In increasingly integrated global markets and intensified market competition has heightened price volatility, causing further risks for the dairy industry [

10]. Thus, to dairy exporters, policymakers and economists, a better understanding of the price dynamics and linkages among geographically separated markets (aka, spatial price transmission) are of crucial importance to facilitate trade policymaking, investment decisions, and export management.

Spatial price dynamics and transmission of food commodities have been extensively explored in the literature over the years. According to the Law of One Price (LOP), the price for commodities in inefficient and undistorted international trade markets acts as a primary mechanism linking various regions, subject to costs associated with space, time and various marketing activities [

11,

12]. In reality, LOP may no longer hold due to the presence of various factors (such as transaction costs, trade policies, and market power) that constrain the pass-through of price signals from one market to another (see [

13] for a comprehensive review on this topic). Therefore, different econometric models have been developed and applied to study asymmetric spatial price transmissions and explore market integrations and price dynamics. Despite the literature available on spatial price transmission, more current studies that incorporate the increasing scale of international market integration and capture changing price dynamics for key export commodities in specific markets are much needed. In particular, there has been no empirical study that explicitly explores the asymmetries in price transmission between two competitors in a specific market such as the Chinese market. The proposed study aims to address this gap in the literature.

The objective of the paper was to investigate spatial price transmissions relevant to international dairy competitors in China, to decipher underlining dynamics and potential interactions of price movements. Given New Zealand’s dominant position and the changing market landscape following the rapid growth of imports from EU dairy exporters, we focused our investigation on the price dynamics between the dominant player (New Zealand) and a new player to identify price leadership. Ireland was chosen as the representative new market entrant in this study, because: (1) the Irish dairy industry is highly export-oriented (with more than 80% of its dairy products exported and consumed overseas every year) and faces challenges to explore new export destinations besides the UK to tackle challenges raised by Brexit; (2) its territory and population sizes and geographic feature are similar to New Zealand. To some extent, New Zealand and Ireland share similar natural endowments for dairy but with distinctive operations and trade patterns; and (3) China has become its second-largest export market since 2014 as well as an important target market [

1,

14] Irish dairy industry has increasing interests and efforts to expanding its market share in the Chinese market; (4) Major EU dairy exporting countries have been trying hard to expand its market share in the Chinese market, Ireland can be as a case to study and conclusions drawn from Ireland can give valuable implications for other EU dairy exporting countries. The study also examined asymmetry in export prices transmission for New Zealand and Ireland in international and in Chinese markets, to identify the level of market integration and the importance of the Chinese market. The empirical analysis of price dynamics provides insights and policy implications for other European and international dairy exporters facing similar situations.

Among various dairy products, SMP is chosen as the product to investigate in this study for the following reasons: (a) The vital export position of SMP in the world: SMP has remained the third largest internationally traded dairy commodity (after whole milk powder and cheese) in recent years, in terms of trade weight [

15] It is a vital commodity besides butter that is sustained by stocks and intervention price policies by major dairy exporters such as the EU and the United States (US). Substantial amounts have been invested by the European dairy sector in powder drying facilities for export markets, and SMP production is expected to reach 1.6 million tonnes in 2024, driven by strong global demand [

2] In addition, current heightened trade frictions between the US and China may lead to more opportunities for EU exporters in the Chinese market. (b) China is heavily dependent on imported SMP and is a key importer of SMP. (See

Section 2 for more details on this). (c) In principle, the price dynamics of SMP among different exporters can be linked to each other because of market integration and a substitution effect between two homogenous products and SMP is relatively homogenous compared with other dairy products [

16,

17].

The rest of the paper is organized as follows.

Section 2 provides details of China’s SMP imports, with a special focus on the export situation of New Zealand and Ireland.

Section 3 presents the methodology and the empirical models for spatial price relationships.

Section 4 reports the empirical results for own-country price relationships.

Section 5 presents empirical results of the cross-country price relationship in the Chinese Market.

Section 6 presents discussions for this study. Lastly,

Section 7 sets out the conclusions of the study.

2. Import SMP Market in China

In this section, we provide an overview of China’s SMP market and its potential growth. We also explain the growth and development of SMP exports from New Zealand and Ireland in recent years, with a special focus on expansion in the Chinese market.

China is a key importer of several dairy products and has become a competitive arena for major dairy exporters, especially for SMP. In 2018, the imported skim milk powder accounted for approximately 93.34%, while the domestic production accounted for only 6.66% (Data from OECD-FAO Agricultural Outlook 2019–2028).

The future perspective of China’s SMP imports is promising for the following reasons: (a) The Chinese government has been promoting the consumption of milk to enhance citizen’s nutrition for many years and Chinese citizens have been changing their diet habits. The main consumer groups for milk powder in China (children and senior citizens in urban areas) have been growing. The population group aged between 0–14 has increased by 2.05% between 2010 and 2015, and the population group aged over 65 has increased by 38.54% between 2006 and 2015 (Data estimated by using data from National Bureau of Statistics of China). (b) The increase in milk demand is greater than the growth of domestic milk production [

18]. As China’s national statistics illustrate, milk production has increased by 17.58%, while the urban population increased by 32.30% between 2006 and 2015. (c) E-commerce platforms in China such as Alibaba, Tmall and JD with overseas shopping channels have facilitated a change in the shopping habits among Chinese consumers and enable households in every part of China to buy imported products online, which has greatly boosted foreign milk powder imports [

8,

19], and (d) Shattered consumer confidence following severe food safety incidents (such as the 2008 milk scandal incident) has resulted in a tendency for Chinese consumers (especially urban consumers) to prefer imported products [

8,

20,

21].

New Zealand is the dominant player in the Chinese SMP market accounting for 57.3% of China’s total dairy import [

9]. The dairy sector has been the largest goods export sector in New Zealand and has been on an upward trend over the past two decades [

22] and the 2008 bilateral China-New Zealand Free Trade Agreement (FTA) gradually reduces tariffs on dairy products to zero with milk powders phased out by 2019. Favourable trade policies, ongoing development of a global network by the New Zealand Dairy Board, and Fonterra subsidiaries overseas make the dairy sector more competitive in its export markets [

23]. Chinese SMP imports from New Zealand have grown rapidly since 2008, reaching a peak in 2014, following which the level of imports dropped, mainly due to high SMP stocks in China.

Compared to New Zealand, Ireland is a much smaller player in the Chinese SMP market. The market share of Irish SMP in the Chinese market accounts for 2.26% of China’s total SMP imports by value in 2016 (Estimated by using the data from UN Comtrade). As a member of the European Union having access to the corresponding favourable trade policies, traditionally Irish dairy export commodities were mainly destined for the UK and other European markets. In 2016, Ireland’s SMP value of exports to China only accounted for 5.72% of its total exports. However, with the abolition of EU milk quotas in 2016, Ireland is expected to see a 50% milk production increase by 2020. Meanwhile, Brexit imposes a great level of uncertainty and risk in the UK market. As an export-oriented country with more than 80% of its dairy products exported overseas, rapid expansion to alternative international market destinations is crucial to the Irish dairy industry. Under such a situation, China has become an increasingly important strategic market for Ireland with fast growth in market share since 2012 [

1,

14].

Nowadays, New Zealand’s dominant position in China’s dairy import market is likely to be challenged by dairy exporters from the EU through intensified market competition. The fast-changing international landscape has demanded a better understanding of spatial price dynamics in this key international market.

3. Methodology, Empirical Model, and Data

Price dynamics and transmission between two geographically separated exporters in a specific market can display various patterns due to different levels of market integration [

24,

25,

26], market scenarios [

27], and policy uncertainty [

28]. Over the years spatial price dynamics and transmission for food commodities have been extensively explored in the literature, with different econometric models being developed and applied to empirical studies: Abdulai [

27] utilizes threshold cointegrating models to reveal asymmetric market signals transmission and responses between central and local maize markets. The switching regime VECM model employed by Goodwin and Piggott [

26] investigates price linkages among different corn and soybean regional markets in North Carolina, the US. Non-parametric regressions and non-linear threshold models have been compared to estimate asymmetric price adjustments in spatially separate pig markets within the EU [

29]. Nonlinear autoregressive distributed lag model, as well as nonparametric kernel-based and time-varying copulas, are employed to assess asymmetric spatial price linkages and market integration and co-movement of monthly SMP prices among the US, the EU and Oceania markets [

24,

30]. Despite plenty of time series applications, the studies on the dairy industry spatially are relatively rare.

This section explains relevant methodologies including both the linear and non-linear cointegration models, including the error correction model, and four types of threshold models [

31,

32,

33], and how they are employed in our study to empirically address SMP export price transmission dynamics for Ireland and New Zealand.

3.1. Linear Cointegration Analysis

The Granger-Engle cointegration model named after Engle and Granger [

32] is a two-step procedure for cointegration analysis to solve the problem of spurious regression. The way of detecting the cointegrating relationship is to first establish a long-run equilibrium equation and then to test the stationarity of the residuals derived from the acquired equation.

Step 1: The Granger-Engle long-run equilibrium equation for two variables could be constructed as Equation (1), whose parameters can be estimated by OLS regression.

where

is the vector of driving time series variable,

is the vector of another time series variable,

and

are coefficients,

is the error term.

Step 2: An Augmented Dicken-Fuller (ADF) test [

34] was performed on the residuals

to determine whether the residuals are stationary. If so, then the two nonstationary variables of I (1) can be regarded as cointegrated. To be more specifical, the number of lags was selected by Akaike Information Criterion (AIC), Bayesian Information Criterion (BIC), or Ljung–Box Q test to ensure that there is no serial correlation in the regression residuals, that is, the residuals

in Equation (2) could be considered as white noise. Therefore, if the null hypothesis of ρ = 0 is rejected, it can be concluded that

and

are integrated.

where

is the coefficient of residuals,

is the coefficient vector of residual differences in different lag orders,

is a white noise with zero mean and constant variance, which is identically and independently distributed, ∆ is the first difference indicator,

is the estimated residuals and p represents the lag orders.

3.2. Non-Linear Cointegration Analysis

The threshold autoregressive (TAR) model proposed by Tong [

33] facilitates the capture of the “deep” movements in a series and investigate whether troughs in the series are more persistent than peaks or vice versa. Therefore, the TAR approach was employed to uncover the SMP export price relationships among the average world and regional markets or different exporters in the same market. In addition, asymmetries in price adjustments to positive or negative deviations can be obtained through the TAR model.

Alternatively, Momentum-Threshold Autoregressive (M-TAR) model could capture the attempt to mitigate or eliminate large changes in a series.

Equation (2) can be written in an alternative specification as

where

is the coefficient of positive deviation, and

is the coefficient of negative deviation,

is the Heaviside indicator function that can be set as following equations:

and τ is the value of the threshold,

is the identically and independently distributed white noise with mean zero and constant variance. If the Heaviside indicator depends on the level of

as indicated in Equation (4), then Equation (3) is the representation form of the Threshold Autoregressive Model (TAR). If the Heaviside indicator relies on the previous period’s change in

as Equation (5), then Equation (3) is the representation form of M-TAR Model. If

, a negative realization of

decays faster than the positive one, then the increases tend to persist, whereas decreases are sharper and more significant, thereby tending to revert rapidly towards equilibrium. This pattern would be reversed if

[

31,

35].

3.3. Asymmetric Error Correction Model with Threshold Cointegration

Provided that there is only one cointegrating relationship in the form of Equation (1), the Asymmetric Error-correction Models with Threshold cointegration can be constructed as the following specifications.

where

and

are driving price and dependent price in first difference respectively,

is the coefficient of positive deviations of vector X for Equation (6),

is the coefficient of negative deviations of vector X for Equation (6),

is the coefficient of positive deviations of vector Y for Equation (6),

is the coefficient of negative deviations of vector Y for Equation (6),

is the coefficient of positive deviations of vector X for Equation (7),

is the coefficient of positive deviations of vector X for Equation (7),

is the coefficient of positive deviations of vector X for Equation (7),

is the coefficient of negative deviations of vector Y for Equation (7);

and

are intercepts,

and

are the coefficients of positive and negative Error-Correction terms, respectively, and

is the error term. The subscribes t and j indicate time and lags, respectively. In Equations (6) and (7), the positive and the negative variables were subjects to the following example Equations:

The error correction term E defined as and , reveals possible asymmetric prices in response to positive and negative deviations from the long-term equilibrium, along with the impact of threshold cointegration. It is the Heaviside indicator in Equations (4) and (5). As X represents the driving force and the long-term disequilibrium is measured as the difference between X and Y, thus the signs of the coefficients for error correction terms should be δX+ > 0, δX− > 0 and δY+ < 0, δY− < 0. The maximum lags j is selected by AIC statistics and Ljung-Box Q test.

3.4. Empirical Models and Hypothesis

Considering that China has been a global leader in milk powder imports, especially those from New Zealand, and with Ireland trying to expand its dairy market share and market returns in China, three relationships based on our assumptions of export prices were studied in this paper.

First, the relationship between export prices from Ireland in global markets,, and prices in the Chinese market, , with the latter as the driving force, was analysed, namely and . The correlation of the two price series was estimated to be 0.75.

Second, export prices from New Zealand to the Chinese market, , was assumed to be the driving force of New Zealand’s export prices in the global markets, . Therefore, in this case: and . The correlation of the two price series was estimated as 0.52.

Finally, the third relationship was estimated between export prices in the Chinese market from New Zealand, , and from Ireland, , in which, the price of New Zealand was designated as the driving force, i.e., and . The correlation of the two price series was 0.87.

The first two relationships were to identify the dominant position of export destination and market integration between a specific market, i.e., China and the global market, and the third relationship was estimated to identify price leadership between a dominant player (New Zealand) and a new player (Ireland) in the Chinese market.

3.5. Data and Software

As mentioned above, three pairs of SMP export price relationships were explored in the study, including prices set by Ireland in the Chinese market and in the global market, the prices set by New Zealand in the Chinese market and in the global market, and the prices of Ireland and New Zealand in the Chinese market. Trade data for New Zealand was extracted from the UN Comtrade and trade data for Ireland was extracted from Eurostat due to a large amount of missing data for Ireland in the UN Comtrade dataset. The commodity of Skim Milk Powder (SMP) was classified according to the Harmonises System classification at 6 digits of detail (HS6) as HS 040210 (Milk and Cream in Solid Forms, of A Fat Content by Weight ≤1.5%.).

Monthly data from January 2010 to December 2016 was used for this study. The export price from New Zealand in US dollars was calculated using the equation: , where is the total export value in US dollars and is the total export weight in kilogram. While the export prices from Ireland in US dollars was calculated using the equation: , where is the total export value in euro, is the total export weight in kilogram, and is the exchange rate for the conversion of one euro to the US dollars extracted from International Financial Statistics (IFS), h symbolizes the destinations for export, namely, China and the world. All the export values are FOB (free-on-board) values.

In this study, the software R studio was used for statistical analysis and Microsoft Excel for the depiction of figures. Specifically, the R package apt created by Sun [

36] was applied for the analysis.

3.6. Descriptive Statistics and the Unit Root Test Results for the Price Series

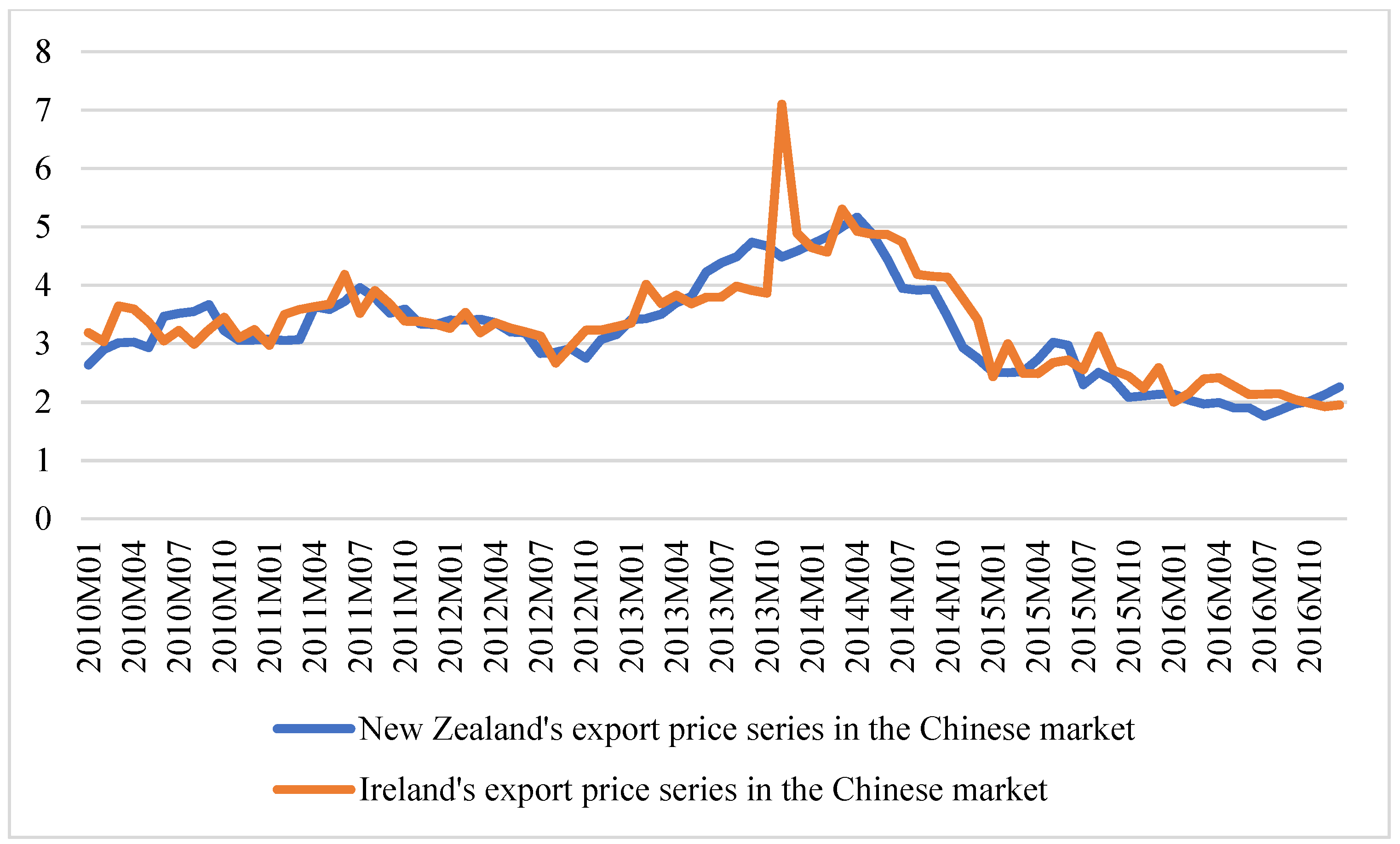

The descriptive statistics of price series from January 2010 to December 2016 used in this study are outlined in

Table 1 and the time series are plotted in

Figure 1.

From January 2010 to December 2016, Ireland’s average export prices globally and in Chinese markets were 2.927 US dollars per kilogram and 3.340 US dollars per kilogram, respectively; while New Zealand’s average export prices were 2.861 US dollars per kilogram and 3.217 US dollars per kilogram, respectively. Generally, according to the descriptive statistics, export prices for the Chinese market are higher than for the global market, and also export prices from Ireland are higher than from New Zealand. It is probably because New Zealand and China have a free trade agreement that substantially lowers tariff duty rates to 1.7%, while China’s most favored nation (MFN) tariffs for SMP is 10% (Data source: WTO Tariff Download Facility).

As depicted in

Figure 1,

Figure 2 and

Figure 3, the export prices for both the countries were much more stable before 2013 and displayed a co-movement pattern over time, after which they have obvious spikes and troughs with large fluctuations in the years 2013 to 2015. The main reasons behind these price fluctuations analysed by Bord Bia Report [

14,

37,

38] are: (a) A cold wet spring in Europe and the worst drought in New Zealand for 75 years, along with weak production in China resulted in low dairy supply in 2013. (b) The demand from China remained high in 2013, resulting in intensive stock building in 2013 and early 2014. (c) In 2014, domestic production was higher than expected while China’s economic growth slowed down. (d) High retail prices in late 2013 and early 2014 reduced import demand both in the Chinese and global markets and the oil price fell. However, fluctuations have died down since 2015 with prices dropping to low levels. Overall, as illustrated in

Figure 1, export prices from Ireland and New Zealand appear to have a co-movement pattern and Ireland’s export prices follow New Zealand’s price changes with greater fluctuations. Thus, New Zealand, to a certain degree, may have been the price leading country for SMP exports both in global and in Chinese markets.

To analyse the price series using proper time series models. The first step is to test the stationarity of all series. The Augmented Dicken-Fuller (ADF) and Phillips-Perron (PP) united root tests were conducted for the price series outlined in

Table 2.

The hypothesis of non-stationarity couldn’t be rejected at the 10% level, while it could be rejected at the 1% level for the first-differenced form. All the price series are non-stationary and are one-order integrated. Therefore, accessing cointegration relationships could be processed to figure out whether the two countries’ prices could have long-run relationships.

5. Empirical Results of the Cross-Country Price Relationship in the Chinese Market

In this section, the empirical results of the cross-country price transmission in the Chinese market are analysed.

Table 7 outlines the results for the Engle-Granger and threshold cointegration tests based on Equations (2) and (3) in

Section 3.1 for the Ireland-New Zealand price relationship in the Chinese Market. Both Equations (2) and (3) are based on the error of Equation (1)

, where

is the vector of New Zealand’s export price in the Chinese market,

, and

is the vector of Ireland’s export price in the Chinese market,

.

5.1. Engle-Granger Cointegration Analysis for New Zealand-Ireland Export Price Relationship

The linear relationship of export prices of Ireland and New Zealand to China was estimated. The coefficient was 0.9034 which was significant at the level of 1%. The relationship was shown in Equation (12). The result for the ADF test was −0.8538, implying that the hypothesis for stationarity was rejected at the significance level of 1%. Therefore, the export prices of New Zealand and Ireland are cointegrated and the long-run regression relationship is as Equation (12).

5.2. Non-Linear Threshold Cointegration Analysis for New Zealand-Ireland Export Price Relationship

The nonlinear cointegration is also estimated using the above mentioned four threshold models. Different lags ranging from 1 to 12 were performed to select the best lag. According to the AIC statistics, the best lag for the models was 0.

In the relationship of export prices of New Zealand and Ireland in the Chinese market, the consistent MTAR is the best fit with the lowest AIC and BIC statistics for the four models. Focusing on the results of consistent MTAR estimation, the hypothesis of symmetric adjustment can be rejected at the 10% significance level. Moreover, the two prices have a cointegrating relationship because no cointegration hypothesis can be rejected at the significance level of 1%. The estimates of coefficients of adjustments to positive and negative shocks are −0.951 and −0.49 respectively. Both estimates are significant at the level of 5%. Therefore, the above-threshold deviations from long-run equilibrium due to increases in Irish prices or decreases in New Zealand’s prices could be corrected at a rate of 95.1% per month, while below-threshold deviations due to decreases in Irish prices or increases in New Zealand’s prices could be corrected at a rate of 49% per month. In the long-term, the convergence for above-threshold deviations is very fast requiring only one month to return to long-run equilibrium, while it would take two months for below-threshold deviations to converge to long-run equilibrium. Therefore, the SMP export of two geographically separated countries are well integrated, and the adjustments of price changes are rapid yet a bit asymmetric. This is consistent with the conclusion of studies several studies where a strong and an increasing degree of overall price co-movement and statistically significant probabilities for joint price crashes and booms were found in the international SMP market, with the EU and Oceania have been the regions with the highest degree of integration [

24]; and the dominant pattern of transmission of skim milk powder, in the long run, is asymmetric involving positive price stocks to be transmitted with higher intensity compared to negative prices shocks [

30].

New Zealand has been the price leader in the Chinese SMP import market, and Irish export prices respond more rapidly to decreases than to increases in New Zealand’s export prices. The reason behind the asymmetric price adjustment could be that New Zealand has been dominating China’s SMP import market and has obtained a large SMP market share in China. Ireland, as a small player with no price advantage in China’s SMP import market, could be greatly constrained by the price pressure from New Zealand. Ireland is forced to reduce its price quickly when New Zealand prices decrease and are unable to keep up with increases New Zealand’s export prices in the Chinese market, implying that Irish SMP may lack competitiveness in terms of price due to the homogeneous attributes of SMP as a commodity. Additionally, Irish exporters’ lack of tracking the price movement of New Zealand’s export prices and a clear understanding of the price relationship between the export prices of New Zealand and Ireland in the Chinese market might explain the inferior position of Irish SMP export prices as well.

5.3. Error Correction Model Results Analysis

The consistent MTAR model was the best fit for export price relationship between New Zealand and Ireland. The estimated results of the asymmetric error correction model with consistent MTAR are reported in

Table 8.

In the ECM-C-MTAR estimations, two coefficients (i.e., and ) were significant at the level of 10% for the New Zealand price equation, and two coefficients (i.e., and ) were significant at the significance level of 1% for the Ireland price equation. Moreover, the squared R statistic was only 0.1 for the New Zealand equation and 0.472 for the Ireland equation. The F statistics of the model fitness were 1.392 and 11.19 for New Zealand and Ireland equations, respectively. The AIC and BIC statistics of the New Zealand equation are much lower than those for Ireland. To sum up, the AECM-C-MTAR fits better for Ireland.

The coefficients of the error correction term and in the equation of Ireland were significant for positive and negative deviations, and the point estimations are −1.09 and −0.596, respectively. Thus, it could be concluded that the price of Ireland adjusts faster to positive than negative deviations from long-run equilibrium in the short run. In the equation of New Zealand, the point estimate for the coefficient of the positive error correction term is 0.208 and is significant at the level of 5%. The point estimate of the negative error correction term was 0.02 but was not significant at the 10% level. It could still be concluded that the price of New Zealand converges faster to long-run equilibrium for positive deviations in the short run.

6. Discussions

The export of skim milk powder is of vital importance to both New Zealand and Ireland, although in comparison, the SMP export volumes and values differ greatly. New Zealand has dominated Chinese imports SMP over the past decade thanks to its large production scale, early access to the Chinese market, superior trade policies and a strong brand image based on the country of origin of milk and dairy products. Nevertheless, the boom in imported milk powder has threatened the domestic dairy industry in China which triggers some ongoing negotiation on new cooperation modes and policies (such as multinational cooperation of domestic “star” dairy brands, increasing taxes on online imported products, stricter labelling requirements, etc.) between domestic milk powder brands and foreign exporters.

Several potential directions might be interesting for future research. Firstly, advanced models such as the global vector autoregressive model can be implemented to conduct the spatial price transmission of dairy products with other influential factors (e.g., exchange rate, energy prices, upstream raw material prices, policy changes, etc.) to addresses the complexity and dynamics of dairy export markets following market shocks. Secondly, export prices of different dairy products from different dairy export countries can be incorporate into analysis to figure out the interlinkage of products and global market integration. Thirdly, a well-designed theoretical model with mathematic deviations to reflect the variable causal relationship might be considered and incorporated into time series models in the future.

Several limitations need to be addressed. Firstly, this paper only analyses the export prices of SMP for New Zealand and Ireland, it would be better if the other comparable countries in the EU, such as Denmark, Germany and France are also put into the analysis with Ireland and New Zealand, to improve the understanding of market competition and entry barriers in the Chinese market. Secondly, limitations in economic theoretical supports and rigorous economic analysis probably weaken the economic implications of this study. Thirdly, time spans should be expanded to study whether the conclusions can be consistent with different time spans applied.

7. Conclusions

In this study, the price dynamics of Ireland and New Zealand, including three price transmission relationships, were explored, and several meaningful conclusions are drawn from this research.

- (1)

The asymmetries exist in the price transmission of the three price pairs, namely, export prices of Ireland in the world and the Chinese markets, export prices of New Zealand in the world and the Chinese markets and export prices of New Zealand and Ireland in the Chinese market, though displayed in different patterns. This is consistent with the previous studies on asymmetries of SMP price transmissions that the dominant pattern of transmission of SMP, in the long run, is asymmetric involving positive price stocks to be transmitted with higher intensity compared to negative prices shocks [

30].

- (2)

In the long term, the SMP export of two geographically separated countries in the Chinese market are well integrated as the adjustments of price changes are rapid. New Zealand has been the price leader in the Chinese SMP imported market, and the export prices of Ireland responds more rapidly to decreases than to increases of the export prices of New Zealand. This is consistent with the trade pattern of the two countries and the conclusions of positive asymmetry found in the majority of spatial price studies [

41], also consistent with other studies on price leadership that show dominated players in a market usually plays as price leaders [

42].

- (3)

The threshold cointegration analysis reveals that in the long-term positive deviations of the price spread between prices of the Chinese market and the global markets take lesser time to be fully digested than negative deviations for Ireland, yet takes longer time to be fully digested than negative deviations for New Zealand. Similarly, in the short term, the error correction model reveals the price adjustment paths in the global market for both Ireland and New Zealand were asymmetric. So, for own-country price transmission, Ireland and New Zealand displays opposite asymmetry directions. This can be explained by a previous study by Abdulai [

27] that prices in local markets respond more rapidly to price increases in the central market. New Zealand mainly exports its SMP to the Chinese market, the Chinese market can be regarded as the central market for New Zealand. Ireland’s SMP export destinations are more diversified, so there is no central market for Ireland.

Therefore, this study has several policy implications for international dairy trade patterns and for new entrants and small players to expand their share in the Chinese market. Dairy exporting countries that aim to expand market share in the Chinese market should explore new selling points and cooperation modes to turn the challenges into new opportunities to expand the scale of SMP exports to China, and market returns. The following advice is proposed: (1) Instead of competing directly in the SMP export with New Zealand in the Chinese market, Ireland or other similar new entrants to the Chinese dairy market should focus more on high value-added and high-end products, such as infant milk formula, sports nutritious products and packaged dairy products. (2) It is necessary to closer cooperation with Chinese companies to provide ingredients to China’s domestic dairy producing companies to expand market share. (3) New entrants should continue to build the image for its sustainable, high-end and unique dairy sector in the Chinese market to create differentiation to its dairy products. (4) The export price of New Zealand could be an effective price signal for Ireland and other SMP exporting countries to adjust its SMP price and export pattern in advance.