Analysis of the Spatio-Temporal Evolution, Influencing Factors, and Spillover Effects of the Urban–Rural Income Gap in Chongqing Municipality, China

Abstract

1. Introduction

2. Literature Review

3. Materials and Methods

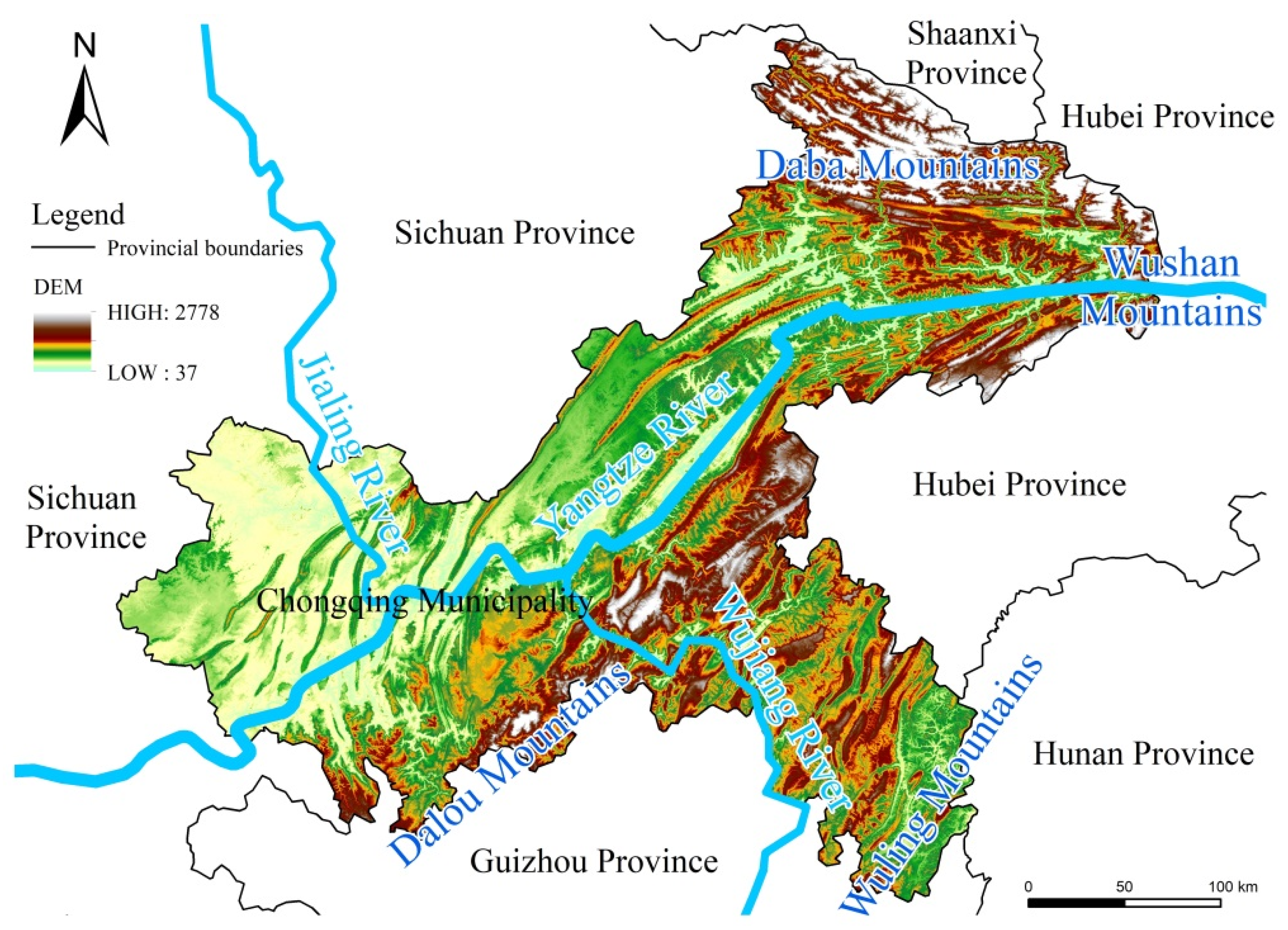

3.1. Overview of the Study Area

3.2. Research Methods of Spatial Econometrics

3.3. Indicator System

4. Results

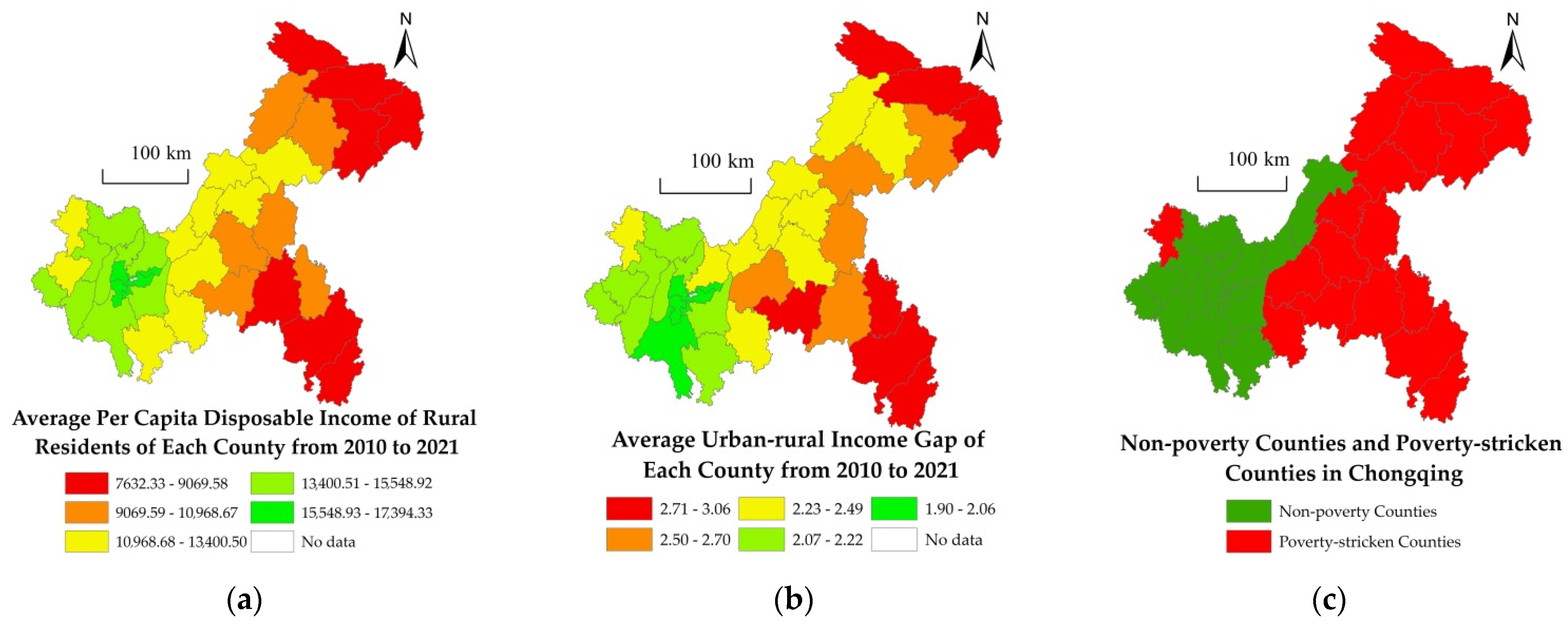

4.1. Analysis of the Spatial Pattern of the Urban–Rural Income Gap

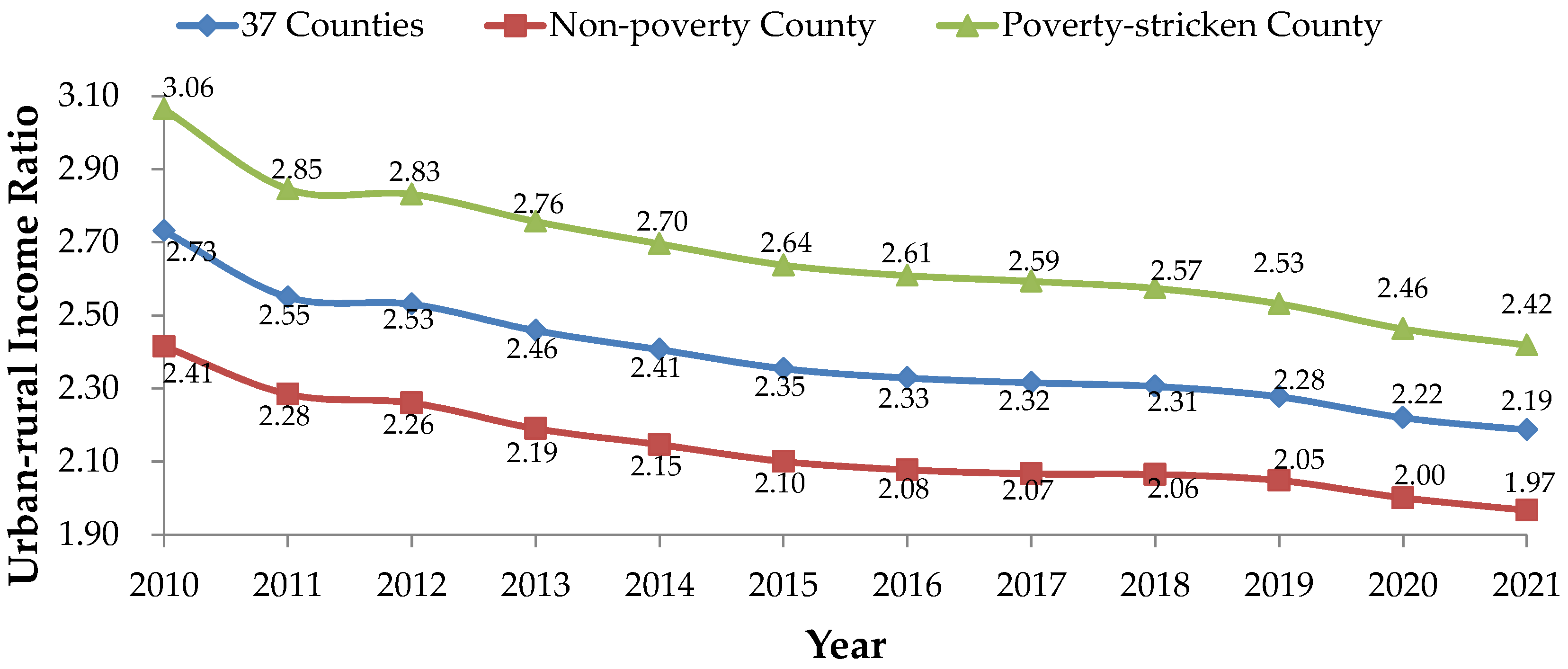

4.2. Analysis of the Spatio-Temporal Evolution of the Urban–Rural Income Gap

4.3. Analysis of the Influencing Factors of the Urban–Rural Income Gap

- (1)

- Fixed assets investment level (X9). The SAR model passed the 10% significance level, and with a value of −0.0042. It shows that the improvement of fixed assets investment can significantly reduce the URIG. In addition, the estimated SARARSARAR and SEM results are also very similar, at −0.0038 and −0.0045, respectively. The experimental findings of the SEM also passed the 10% significance level test, indicating the robustness of the model. While the calculation of investment in fixed assets does not include farmers’ investments, increased investment in fixed assets may also benefit rural residents. Meanwhile, increased investment in fixed assets helps urban residents to increase their incomes. It also boosts rural incomes, and increased investment in fixed assets contributes to better urban and rural integration. It can mitigate the URIG to some degree.

- (2)

- Per capita public financial expenditure (X10). The SAR regression results passed the 10% significance test, with a value of −0.0065, indicating that the improvement in per capita public expenditure can substantially reduce the URIG. Furthermore, the estimated results of the SARARSARAR and the SEM are also very similar, at −0.0063 and −0.0075, respectively, and the experimental output of the SARARSARAR passed the 10% significance level test. The experimental output of SEM also passed the 5% significance test, indicating the robustness of the model. There are various kinds of public financial expenditure, not only for urban construction, but also for rural development. Especially over the past few years, with the implementation of China’s TPA policies, the total amount and proportion of public financial investment in rural areas have also increased. With the growth in per capita public spending, the income level of the rural population can be improved; this has somewhat alleviated the rural–urban income gap.

- (3)

- Proportion of rural employees (X11). The SAR passed the 1% significance test, with an estimation of −0.0005, indicating that growth in the proportion of rural employees can notably decrease the URIG. Furthermore, the estimated outcome of the SARAR and the SEM are essentially the same, both with values of −0.0005, and the regression results of the SARAR and the SEM passed the 1% significance test, indicating the robustness of the models. This is because the increase in the proportion of rural employees shows that the general labor force is large and the employment rate is relatively high. Rural incomes will rise, mitigating the URIG.

- (4)

- Proportion of grain sown (X12). The SAR regression results passed the 1% significance test, with a coefficient of 0.0006, indicating that the growth in the proportion of grain planting can expand the URIG significantly. Moreover, the regression results of the SARAR and the SEM are also very similar, with values of 0.0007 and 0.0006, respectively; the SARAR estimates and the SEM passed the test for significance at 1%, indicating the robustness of the models. In China, the price of grain is generally low, and the sale of cash crops such as vegetables, fruits, and other high-value-added crops are more conducive to improving rural residents’ income. The growth ratio of grain sown indicates that the proportion of cash crops planted on this land is relatively low and the planting structure is relatively simple, which will further limit the growth of the rural residents’ income level; this is detrimental to the narrowing of the URIG.

- (5)

- Amount of agricultural fertilizer applied per unit area (X13). The SAR model regression results passed the 5% significance level test, with a value of −0.0067, indicating that the increase in agricultural fertilizer application per unit area can significantly reduce the URIG. Furthermore, the estimated outcomes of the SARAR and SEM are also very similar, with values of −0.0070 and −0.0064, respectively, and the estimated outputs of the SARAR and the SEM passed the 5% significance level test, demonstrating the models’ robustness. The amount of agricultural fertilizer used per unit area is a reflection of the scale and high yields of agricultural products in a region. The improvement in the quantity of agricultural manure applied per unit area indicates that agricultural products are grown on a large scale in the area and have high yields. Consequently, rural incomes will rise, reducing the URIG.

- (6)

- Proportion of real estate development investment (X15). SAR passed the 1% significance level test, indicating that the increase in the proportion of real estate development investment can significantly decrease the URIG. Moreover, the estimated outputs of SARAR and the SEM are also basically the same, both with values of −0.0003; the SARAR and SEM models’ experimental outputs also passed the 1% significance level test, demonstrating their robustness. While increasing the proportion of investment in property development will significantly improve a region’s level of urbanization, the investment in real estate development will also attract more rural residents to work in cities, to some degree, which has the function of improving the income level of rural residents; it can therefore reduce the URIG to some degree. However, due to the significant differences between impoverished and non-poverty-stricken counties in Chongqing, further classification and discussion are needed to analyze the actual effect of this indicator.

- (7)

- Population density (X17). The SAR passed the 1% significance test, and its estimated factor was 0.0575, indicating that increases in population density are not conducive to a reduction of the URIG. Furthermore, the estimated results of the SARAR and the SEM are also very similar, 0.0598 and 0.0574, respectively, and the regression results from both the SARAR and SEM passed the 1% significance test, indicating that the model is robust. This is due to Chongqing being a municipality that incorporates “big cities, big rural areas, big mountainous areas, big reservoir areas, and ethnic minority areas”. As population density increases, these natural characteristics can lead to resource scarcity and the widening of dual urban–rural differences and further increasing urban and rural residents’ income gap. Therefore, increasing population density is not conducive to reducing the URIG.

- (1)

- Fixed asset investment level (X9). The 1% significance level test was passed by the regression results of the SAR using a sample of non-poverty-stricken counties. In addition, the estimated results from the corresponding SARAR model and SEM model passed the 1% level of significance test, and their estimated coefficients were similar to those of the SAR model, demonstrating both the robustness of the model and that the level of fixed asset investment is a significant factor affecting the URIG in counties without poverty. The estimated results of the SEM with poverty-stricken counties as samples are not significant, and the estimated coefficient is −0.0042. The estimated results of the corresponding SARAR and SAR models are also not significant, and their estimated coefficients are relatively similar to those of the SAR model, at −0.0042 and −0.0035, respectively, demonstrating the robustness of the model. Still, the level of investment in fixed assets has little impact on URIG in poor counties. The above results suggest that improved investment in fixed assets can substantially reduce the URIG in counties without poverty, but the effect on poverty-stricken counties is relatively modest. The poor economic foundations of poverty-stricken counties prevent the increase in fixed assets investment from promoting rural and urban development. In addition, its small contribution to the development of these regions renders its effect relatively insignificant. On the contrary, the fixed assets investment of non-poverty-stricken counties is generally large, and the funds invested in rural construction are also sufficient. This greater investment in fixed assets is more conducive to promoting integrated urban and rural development in non-poverty-stricken counties.

- (2)

- Per capita public financial expenditure (X10). The regression results of SAR, which used non-poverty-stricken counties as samples, are not significant, and its estimated coefficient is −0.0041. The experimental output of the corresponding SARAR and the SEM models are also not significant, and their estimated coefficients are relatively similar to those of the SAR model, which are −0.0040 and −0.0038, respectively, demonstrating the robustness of the model, but that public finance spending per capita is not a significant factor influencing the URIG in counties without poverty. The 10% significance level test was passed by the estimated findings of SEM when poverty-stricken counties were used as the sample, and its regression coefficient was −0.0076. The estimated results of the corresponding SARAR and SAR were relatively similar, at −0.0075 and −0.0058, respectively, indicating both that the model was robust and that increases in public finance spending per capita might affect the URIG of poverty-stricken counties to some degree. The above results show that increases in public financial spending per capita can reduce the URIG in poverty-stricken counties to some degree, but the impact on non-poverty-stricken counties is small due to poverty-stricken counties’ spending on poverty alleviation and rural income. The proportion of financial expenditure for rural construction has also increased further. Poverty-stricken counties can reduce the URIG by increasing per capita public financial spending. On the contrary, for non-poverty-stricken counties, the proportion of per capita public financial expenditure for rural construction is low, and its role still needs to be improved.

- (3)

- Proportion of rural employees (X11). Regression results from the SAR model when non-poverty-stricken counties were taken as the sample passed the 1% significance test, with the estimated coefficient set at −0.0005. The SARAR and SEM estimates also passed the 1% significance test, and the estimated coefficients are basically in line with those of the SAR model, with values of −0.0005; this demonstrates the model’s robustness and indicates that the proportion of rural employees is a significant factor affecting the URIG in non-poverty-stricken counties. The estimated results of the SEM model when taking poverty-stricken counties as samples are insignificant, and its estimated coefficient is 0.0000. The estimated results of the corresponding SARAR model and SAR model are also insignificant. The estimated coefficients are basically consistent with the SAR model, both being 0.0000, indicating the robustness of the model; however, the proportion of rural employees has a small impact on the URIG in counties affected by poverty. The preceding statistics show that adding more rural workers in non-poverty-stricken counties reduces the URIG, but the impact on poverty-stricken counties is not pronounced. The economic baseline of poor counties is generally weak, the level of income obtained through employment is low, and the contribution of the increase in the proportion of rural employees to the income increase of rural residents in poor counties is still limited. In contrast, there are many jobs and opportunities in non-poverty-stricken counties, and the income earned through employment is generally very high. To further reduce the URIG, an increase in the share of rural employees is more conducive to the promotion of non-poverty-stricken counties.

- (4)

- Proportion of grain sown (X12). The significance level test of 5% was passed, and the regression coefficient is 0.0005 when the SAR model results are sampled from non-poverty-stricken counties. In addition, the corresponding estimated results from the SARAR model and SEM model passed tests at the 5% and 1% levels of significance, respectively. The estimated coefficients are essentially consistent with those of the SAR model, both being 0.0005, indicating that the model is robust, and that the URIG in counties without poverty is influenced by grain planting. The SEM model using poverty-stricken counties as a sample passed the 10% significance level and had a regression coefficient of 0.0005. The estimated coefficients of the corresponding SARAR and SAR models were relatively similar to those of the SAR model, with values of 0.0005 and 0.0004, respectively, indicating that the model was robust to the intervention and demonstrating that the grain planting ratio affected the URIG of poverty-stricken counties to some degree. The aforementioned results show that increasing grain cultivation suppresses the URIG in both poverty-stricken and non-poverty areas at a similar level.

- (5)

- Proportion of real estate development investment (X15). The regression coefficient of the SAR model with non-poverty-stricken counties as samples was −0.0002, passing the 1% significance test. The regression results of SARAR and SEM passed the 5% significance level test, and the regression coefficients were −0.0002, similar to those of the SAR model; this shows the model’s robustness and indicates that the proportion of investment in property development was a significant factor affecting the URIG in non-poverty-stricken counties. The estimated results of SEM, when taking the poverty-stricken counties as the sample, were not significant, and its estimated coefficient is −0.0002. Similarly, the estimated results from the corresponding SARAR and the SAR are insignificant, and their estimated coefficients are relatively similar to those of the SAR, at −0.0002 and −0.0001, respectively, indicating the robustness of the model, but also that the proportion of investment in property development has a weak effect on the URIG in poverty-stricken counties. The above findings indicate that the increase in the proportion of investment in real estate development can significantly reduce the URIG in non-poverty-stricken counties, but its influence on poverty-stricken counties is modest. It could be that the economic foundation of non-poverty-stricken counties is generally good, and the investment in real estate development is large, meaning that it can more effectively absorb rural labor and further promote the increase in employment and income in rural labor. On the contrary, the economic foundation of poverty-stricken counties is relatively weak, as is their real estate development, so the resulting income increase is also relatively weak.

4.4. Analysis of the Spatial Spillover Effect of the Factors Influencing the Urban–Rural Income Gap

- (1)

- Development level of secondary industry (X2). Taking non-poverty-stricken counties as the sample, 0.0658 is the spillover effect’s estimated outcome; it successfully passed the 10% significance level test, indicating that the improvement of the secondary industry development level in non-poverty-stricken counties works to restrain the decrease in the URIG in nearby counties. The estimated spillover effect of the sample of poverty-stricken counties is −0.0900, and it passes the 1% significance level test, indicating that an increase in the secondary industry’s level of development in poverty-stricken counties has facilitated the lowering of the URIG in the surrounding counties to a significant degree. It is possible that the economic conditions of non-poverty-stricken counties are generally relatively more economically advanced; the growth of secondary industry is conducive to the progress of urbanization and industrialization. The urban population in non-poverty-stricken counties is large, the rural population is generally small, and the absorption of agricultural workforce is insufficient, which leads to the growing URIG in the surrounding counties. Hence, an overall adverse spillover effect appears. However, the economic conditions in poverty-stricken counties are generally weak. Although the development of the secondary industry has boosted industrialization and urbanization to a great extent, it has also absorbed a larger rural labor force. In addition, the rural population in poverty-stricken counties is generally large, and the level of urbanization is also low. This effect of absorbing the labor force is more obvious than that of urbanization, thus promoting the amount of income in rural areas. It has further narrowed the URIG, showing a beneficial spillover effect.

- (2)

- Fixed assets investment level (X9). The spillover effect of the sample of non-poverty-stricken counties is estimated to be 0.0847, and it passed the test for significance at 1%, indicating that the improvement of investments in fixed assets in non-poverty-stricken counties has a restraining impact on the lowering of the URIG in surrounding counties. The spillover effect of the sample of poverty-stricken counties is estimated to be −0.0199, and it passed the test for significance at 10%, demonstrating that the improvement of investments in fixed assets in poverty-stricken counties has facilitated the narrowing of the URIG in surrounding counties. It is possible that the level of fixed assets investment in non-poverty-stricken counties is generally superior to that in poverty-stricken counties. High-intensity fixed assets investment not only contributes to the integration of rural and urban development in the region, but also promotes connections with the surrounding areas. The urbanization level of non-poverty-stricken counties is generally high, the economic level is relatively highly developed, and the urban population accounts for a large proportion of the total population. With the improvement of fixed assets investment, more urban residents benefit. Therefore, the increase in fixed assets investment will more obviously stimulate growth in the urban population in surrounding areas, thus making the URIG appear to be widened, showing an adverse spillover effect. For poverty-stricken counties, the urbanization rate is generally low, and the proportion of the rural population is relatively high. Rural residents benefit more from investments in fixed assets. Therefore, the growth in investments in fixed assets will drive an increase in rural residents’ income in the surrounding areas, thus lowering the URIG and showing a spillover effect.

- (3)

- Proportion of grain sown (X12). The estimated spillover effect of non-poverty-stricken counties was 0.0018, and it passed the test for significance at 10%. The estimated result of the spillover effect of poverty-stricken counties is 0.0031, and the 5% significance level test was passed. These outcomes show that the proportional increase in grain sown in non-poverty-stricken and poverty-stricken counties has a restraining impact on reducing the URIG in the surrounding counties, and the effect in poverty-stricken counties is more widespread. In China, the price of grain is generally low, and the sale of cash crops such as vegetables, fruits, and other high-value-added crops are more beneficial to rural residents’ incomes. The share increase in grain sown demonstrates that the proportion of cash crops planted on these lands is relatively low and that the planting structure is relatively simple; this will further limit the growth of rural residents’ incomes, which is not just unfavorable for the reduction of the local URIG, but also has adverse spillover effects on the surrounding areas. More importantly, poverty-stricken counties have a weak foundation of development, a weak economic foundation, and generally low incomes for rural residents. The increase in the proportion of grain planting has a more profound impact on rural residents’ incomes in these areas and the surrounding poor areas, which is significantly disadvantageous to the growth in rural residents’ incomes, and thus has a more adverse impact on the surrounding areas.

- (4)

- Proportion of real estate development investment (X15). Taking non-poverty-stricken counties as the sample, the spillover effect is projected to have a result of 0.0013 and was determined to be significant at 5%, demonstrating that the growth in the proportion of real estate development investment in non-poverty-stricken counties has a restraining effect on the reduction of the URIG in surrounding counties. The estimated spillover effect of the sample of poverty-stricken counties is −0.0009. It passed the 10% significance level test, demonstrating that the growth in the proportion of real estate development investment in poverty-stricken counties has significantly promoted the narrowing of the URIG in the surrounding counties. The reason for this may be that the level of investment in real estate development in non-impoverishes counties is generally higher than that in areas plagued by poverty, and the level of urbanization is higher. With the increasing proportion of investment in the construction of real estate, the region’s degree of urbanization has been further improved, and the labor force in the surrounding areas has also been absorbed. Due to the high level of urbanization and the large urban population in counties where there is no poverty, the growth in the proportion of investment in the development of real estate will be more helpful in absorbing the surrounding urban labor force and promoting urban residents’ income in the surrounding areas, thus widening the URIG, leading to a negative spillover effect. For poverty-stricken counties, the urbanization rate is generally low, and there are generally more rural residents. Rural residents benefit more from investment in the construction of real estate. Therefore, the increasing investment level in actual estate development will drive growth in the rural residents’ earnings in the surrounding areas, narrowing the URIG, and showing a beneficial spillover effect.

- (5)

- Population density (X17). Using counties without poverty as the sample, the estimated outcome of the spillover impact is 0.7159, and it was determined to be significant at 1%, indicating that the increase in population density in non-poverty-stricken counties has a restraining impact on the reduction of the URIG in surrounding counties. The estimated spillover effect of the sample of poverty-stricken counties was −0.8795, and it passed the test for significance at 1%, demonstrating that the rise in the population density in poverty-stricken counties significantly boosted the decrease in the URIG in the surrounding counties. It is possible that the change in the population density index has the opposite spillover effect on non-poverty-stricken counties, and poverty-stricken counties are intimately connected to the immigration and emigration of people. The economic conditions of non-poverty-stricken counties are generally good, and the population is relatively dense. With the advancement of urbanization, there will be a continuous flow of people moving into these non-poverty-stricken counties. The population concentration will further support an increase in the level of urbanization and an increase in urban residents’ income, which will not only widen the local URIG, but also have an unintended impact on the URIG in the surrounding areas. The economic conditions of poverty-stricken counties are generally weak, and the population is relatively small and often accompanied by the characteristics of net population outflow; meanwhile, the net outflow of this part of the population from poverty-stricken counties comprises more metropolitan dwellers, and the outflow of this population is conducive to higher migrant income. Therefore, the reduction of population density will lead to the widening of the URIG in surrounding regions.

5. Discussion

6. Conclusions

- (1)

- Income ratios in urban and rural Chongqing show spatial self-relevance and positive agglomeration, with lower ratios in the west and higher ratios in the north-east and south. In addition, the URIG in Chongqing is closely related to the PCDI of rural residents, showing a very obvious negative correlation; it also showed the trend of “poverty-stricken counties > non-poverty-stricken counties”.

- (2)

- In general, the URIG in all counties of Chongqing has shown a declining annual trend. Although the URIG in poverty-stricken counties is generally high, the ratio of decline is slightly higher than that in non-poverty-stricken counties.

- (3)

- The outcomes of our analysis of the influencing factors reveal that the level of fixed assets investment, the per capita spending of public funds, the proportion of rural employees, the proportion of grain sowing, the amount of agricultural fertilizer applied per unit area, the proportion of real estate development investment, and population density variables are important factors of the URIG in Chongqing. The raise of the level of fixed assets investment, per capita public spending of public funds, the proportion of rural employees, the amount of agricultural fertilizer applied per unit area, and the proportion of investment in real estate development can considerably narrow the URIG. Meanwhile, increases in the proportion of grain sowing and population density have a notable inhibitory impact on narrowing the URIG. Furthermore, the effects of the aforementioned causes obviously differ for poverty-stricken and non-poverty-stricken counties.

- (4)

- The relevant factors’ spillover effects demonstrate that there are obvious spillover effects of the level of secondary industry development, the fixed assets investment level, the proportion of real estate development investment, and population density in constraining the narrowing of the URIG in non-poverty-stricken counties, but they also have obvious spillover impacts such as promoting the narrowing of the URIG in non-poverty-stricken counties. The proportion of grain sown clearly has a detrimental spillover effect in constraining the narrowing of the URIG, and non-poverty-stricken counties have a greater impact.

Author Contributions

Funding

Institutional Review Board Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Year | Moran’s I | Z Statistics | p Values | Geary’s C | Z Statistics | p Values |

|---|---|---|---|---|---|---|

| 2010 | 0.336 *** | 12.996 | 0.000 | 0.642 *** | −10.582 | 0.000 |

| 2011 | 0.327 *** | 12.649 | 0.000 | 0.637 *** | −10.803 | 0.000 |

| 2012 | 0.326 *** | 12.620 | 0.000 | 0.639 *** | −10.649 | 0.000 |

| 2013 | 0.325 *** | 12.573 | 0.000 | 0.639 *** | −10.738 | 0.000 |

| 2014 | 0.325 *** | 12.580 | 0.000 | 0.640 *** | −10.730 | 0.000 |

| 2015 | 0.325 *** | 12.597 | 0.000 | 0.640 *** | −10.712 | 0.000 |

| 2016 | 0.326 *** | 12.624 | 0.000 | 0.636 *** | −10.869 | 0.000 |

| 2017 | 0.326 *** | 12.626 | 0.000 | 0.635 *** | −10.921 | 0.000 |

| 2018 | 0.321 *** | 12.444 | 0.000 | 0.640 *** | −10.687 | 0.000 |

| 2019 | 0.312 *** | 12.148 | 0.000 | 0.645 *** | −10.397 | 0.000 |

| 2020 | 0.307 *** | 11.981 | 0.000 | 0.648 *** | −10.285 | 0.000 |

| 2021 | 0.308 *** | 12.012 | 0.000 | 0.647 *** | −10.338 | 0.000 |

| Annual Average | 0.324 *** | 12.540 | 0.000 | 0.639 *** | −10.706 | 0.000 |

References

- Yang, R.Y.; Zhong, C.B.; Yang, Z.S.; Yang, S.Q. Can the Targeted Poverty Alleviation Policy Really Increase the Income of Rural Residents? An Empirical Test Based on 129 Counties in Yunnan Province. Nankai Econ. Stud. 2023, 39, 8. [Google Scholar]

- Yang, R.Y.; Yang, Z.S. Can the Sorghum Planting Industry in Less-Favoured Areas Promote the Income Increase of Farmers? An Empirical Study of Survey Data from 901 Samples in Luquan County. Agriculture 2022, 12, 2107. [Google Scholar] [CrossRef]

- Ma, X.; Wang, F.R.; Chen, J.D.; Zhang, Y. The income gap between urban and rural residents in China: Since 1978. Comput. Econ. 2018, 52, 1153–1174. [Google Scholar] [CrossRef]

- Yang, R.Y.; Zhong, C.B.; Yang, Z.S.; Wu, Q.J. Analysis on the Effect of the Targeted Poverty Alleviation Policy on Narrowing the Urban-Rural Income Gap: An Empirical Test Based on 124 Counties in Yunnan Province. Sustainability 2022, 14, 12560. [Google Scholar] [CrossRef]

- Sicular, T.; Yue, X.; Gustafsson, B.; Li, S. The urban-rural income gap and inequality in China. Rev. Income Wealth 2007, 53, 93–126. [Google Scholar] [CrossRef]

- Li, S.; Luo, C.L. Re-estimating the income gap between urban and rural households in China. J. Peking Univ. Philos. Soc. Sci. 2007, 44, 111–120. [Google Scholar]

- National Bureau of Statistics of the People’s Republic of China. China Statistical Yearbook 2021, 1st ed.; China Statistics Press: Beijing, China, 2021. [Google Scholar]

- Guo, Y.; Li, J.J.; Du, Z.X. Trends of urban-rural income gap: International experience and its implications for China. World Agric. 2022, 6, 5–17. [Google Scholar]

- Yang, Z.S.; Yang, R.Y.; Liu, F.L. Spatio-temporal evolution and influencing factors of urban–rural income gap in Yunnan province based on poverty classification. Geogr. Res. 2021, 40, 2252–2271. [Google Scholar]

- Xinhua News Agency. Premier Li Keqiang Attended the Press Conference and Answered Questions from Chinese and Foreign Journalists. Available online: http://www.gov.cn/premier/2020-05/29/content_5515798.htm#allContent (accessed on 29 May 2020).

- Ge, D.Z.; Long, H.L. Rural spatial governance and urban-rural integration development. Acta Geogr. Sin. 2020, 75, 1272–1286. [Google Scholar]

- Zhao, X.L. Five characteristics in the change of income gap in China. Econ. Rev. J. 2004, 20, 16–18. [Google Scholar]

- He, R.W. Urban-rural integration and rural revitalization: Theory, mechanism and implementation. Geogr. Res. 2018, 37, 2127–2140. [Google Scholar]

- Zhang, Y.N.; Long, H.L.; Ma, L.; Tu, S.S.; Chen, K.Q. Research progress of urban-rural relations and its implications for rural revitalization. Geogr. Res. 2019, 38, 578–594. [Google Scholar]

- Li, Y.H.; Yan, J.Y.; Song, C.Y. Rural revitalization and sustainable development: Typical case analysis and its enlightenments. Geogr. Res. 2019, 38, 595–604. [Google Scholar]

- Molero-Simarro, R. Inequality in China revisited. The effect of functional distribution of income on urban top incomes, the urban–rural gap and the Gini index, 1978–2015. China Econ. Rev 2017, 42, 101–117. [Google Scholar] [CrossRef]

- Colin, C. Conditions of Economic Progress, 1st ed.; Macmillan: London, UK, 1940. [Google Scholar]

- David, R. The Principles of Political Economy and Taxation, 1st ed.; Dover Publications: New York, NY, USA, 2004. [Google Scholar]

- Kuznets, S. Economic growth and income inequality. Am. Econ. Rev. 1955, 45, 42–48. [Google Scholar]

- Adelman, I.; Morris, C.T. Economic Growth and Social Equality in Development Country, 1st ed.; Stanford University Press: Palo Alto, CA, USA, 1973. [Google Scholar]

- Ahiuwalia, M. Inequality, poverty and development. J. Dev. Econ. 1976, 3, 307–342. [Google Scholar] [CrossRef]

- Anand, S.; Kanbur, S.M.R. Inequality and development: A critique. J. Dev. Econ. 1993, 41, 19–43. [Google Scholar] [CrossRef]

- Tunali, C.B.; Yilanci, V. Are per papita incomes of MENA countries converging or diverging? Stat. Mech. Its Appl. 2010, 21, 4855–4862. [Google Scholar] [CrossRef]

- Roland, B. Inequality and growth. NBER Macroecon. Annu. 1996, 11, 11–92. [Google Scholar]

- Klaus, D.; Lyn, S. New ways of looking at old issues: Inequality and growth. J. Dev. Econ. 1998, 57, 259–287. [Google Scholar]

- Piketty, T. The dynamics of the wealth distribution and the interest rate with credit rationing. Rev. Econ. Stud. 1997, 64, 173–189. [Google Scholar] [CrossRef]

- Fei, J.C.H.; Ranis, G.; Kuo, S.W.Y. Growth with Equality; Oxford University Press: London, UK, 1979. [Google Scholar]

- Fields, G.S. Decomposing LDC Inequalities. Oxf. Econ. Pap. New Ser. 1979, 31, 437–459. [Google Scholar] [CrossRef]

- Liu, J.X.; Li, X.Q.; Liu, S.T.; Rahman, S.; Sriboonchitta, S. Addressing Rural–Urban Income Gap in China through Farmers’ Education and Agricultural Productivity Growth via Mediation and Interaction Effects. Agriculture 2022, 12, 1920. [Google Scholar] [CrossRef]

- Wang, S.P.; Ouyang, Z.G. The threshold effect of China’s urban-rural income inequality on real economic growth. Soc. Sci. China 2008, 29, 54–66+205. [Google Scholar]

- Castello, A.; Domenech, R. Human capital inequality and economic growth: Some new evidence. Econ. J. 2002, 112, 187–200. [Google Scholar] [CrossRef]

- Knowles, S. Inequality and economic growth: The empirical relationship reconsidered in the light of comparable data. J. Dev. Stud. 2005, 41, 135–159. [Google Scholar] [CrossRef]

- Li, H.; Zou, H. Income inequality is not harmful for growth: Theory and evidence. Rev. Dev. Econ. 1998, 2, 318–334. [Google Scholar] [CrossRef]

- Forbes, K.J. A reassessment of the relationship between inequality and growth. Am. Econ. Rev. 2000, 90, 869–887. [Google Scholar] [CrossRef]

- Li, Y.Y.; Wang, C. Can centralized fiscal reform narrow the gap between urban and rural areas?—Evidence based on a quasi-natural experiment of “the village-finance-supervised-by-county”. Manag. World 2020, 36, 113–130. [Google Scholar]

- Wen, T.; Ran, G.H.; Xiong, D.P. Financial development and the income growth of farmer in China. Econ. Res. J. 2005, 51, 30–43. [Google Scholar]

- Zhang, S.H.; Liu, J. Is the targeted poverty-relief policy narrowing the income gap between the urban and rural areas?—An empirical study based on spatial panel data. J. Xinjiang Univ. Philos. Humanit. Soc. Sci. 2018, 46, 1–9. [Google Scholar]

- Liu, M.H.; Li, J.W.; Li, Q. Impact of targeted poverty alleviation on the urban-rural household income gap—A case study of shanxi province. Chin. J. Agric. Resour. Reg. Plan. 2020, 41, 228–237. [Google Scholar]

- Wan, H.Y.; Li, S. The effects of household registration system discrimination on urban-rural income inequality in China. Econ. Res. J. 2013, 48, 43–55. [Google Scholar]

- Zou, C.; Liu, J.; Liu, B.; Zheng, X.; Fang, Y. Evaluating poverty alleviation by relocation under the link policy: A case study from Tongyu County, Jilin Province in China. Sustainability 2019, 11, 5061. [Google Scholar] [CrossRef]

- Li, G. A Study on the Relationship between industrial structure and urban-rural income gap in the Yangtze River Economic Belt: An empirical test based on panel data. Inq. Into Econ. Issues 2019, 40, 72–77. [Google Scholar]

- Cheng, Y.H. China’s overall gini coefficient since reform and its decomposition by rural and urban areas since reform and opening-up. Soc. Sci. China 2007, 28, 45–60+205. [Google Scholar]

- Pan, J.H. Spatiotemporal pattern of urban-rural income gap of prefecture level cities or above in China. Econ. Geogr. 2014, 34, 60–67. [Google Scholar]

- Sun, X.Y.; Xu, Y.; Liu, Y.H. Residents’ income disparity and spatial difference in China. Econ. Geogr. 2015, 35, 18–25, 42. [Google Scholar]

- Chen, F.; Yu, T.H.; Wang, H.P. Analysis on the degree of urban-rural income polarization and its changes of temporal-spatial characteristics in central China. Hum. Geogr. 2012, 27, 104–109. [Google Scholar]

- Ding, Z.W.; Zhang, G.S.; Wang, F.Z. Spatial-temporal differentiation of urban-rural income in Central Plains Region at different scales. Geogr. Res. 2015, 34, 131–148. [Google Scholar]

- Zuo, Y.H. The study of reason for urban-rural Income gap in China: Based on the angel of income sources. Econ. Probl. 2011, 33, 40–43. [Google Scholar]

- Sun, J.S.; Huang, Q.H. Study on main influencing factors and contribution rate of income gap between urban and rural residents of China: Based on the data analysis of 6937 residents questionnaires from 31 provinces. Econ. Theory Bus. Manag. 2013, 33, 5–16. [Google Scholar]

- Wu, X.L.; Liu, Z.Y. The factors that affect the income gap between urban and rural areas of china: Based on the provincincial Panel Data from 2002 to 2011. Mod. Econ. Sci. 2014, 36, 46–54, 125–126. [Google Scholar]

- Li, J.J.; Mi, W.B.; Song, Y.Y.; Zhou, R.R.; Yang, R. Spatial-temporal differentiation and factors of urban-rural income gap in Ningxia. Res. Agric. Mod. 2016, 37, 785–793. [Google Scholar]

- Jiang, X.J.; Yang, Q.S.; Zhang, Y.; Wang, X.Y.; Liu, J.; Liu, J. Spatiotemporal differentiation and influencing factors of urban-rural income gap in northeast China based on multi-scale. Mod. Urban Res. 2019, 26, 109–118. [Google Scholar]

- Song, J. An empirical analysis on the influencing factors of urban-rural income gap in Hebei province. China Econ. Trade Her. 2019, 3, 92–94. [Google Scholar]

- Wang, N.; Wang, X. Analysis on the causes of the urban-rural income gap widening year by year in Yunnan province. Econ. Trade 2018, 4, 61+63. [Google Scholar]

- Brief Introduction of Chongqing. Available online: https://www.cq.gov.cn/zjcq/sqgk/cqsq/202302/t20230210_11593093.html (accessed on 10 February 2023).

- The Main Data of the Seventh National Population Census in Chongqing. Available online: http://tjj.cq.gov.cn/zwgk_233/fdzdgknr/tjxx/sjjd_55469/202105/t20210513_9277447.html (accessed on 13 May 2021).

- Survey Office in Chongqing, National Bureau of Statistics of the People’s Republic of China, Chongqing Municipal Bureau of Statistics. Chongqing Survey Yearbook 2022, 1st ed.; China Statistics Press: Beijing, China, 2022. [Google Scholar]

- Yang, R.Y.; Zhong, C.B. Analysis on Spatio-Temporal Evolution and Influencing Factors of Air Quality Index (AQI) in China. Toxics 2022, 10, 712. [Google Scholar] [CrossRef]

- Moran, P. Notes on Continuous Stochastic Phenomena. Biometrika 1950, 37, 17–23. [Google Scholar] [CrossRef]

- Elhorst, J.P. Spatial Econometrics: From Cross-Sectional Data to Spatial Panels, 1st ed.; Springer: Berlin/Heidelberg, Germany, 2014. [Google Scholar]

- Wang, D. Has Electronic Commerce Growth Narrowed the Urban–Rural Income Gap? The Intermediary Effect of the Technological Innovation. Sustainability 2023, 15, 6339. [Google Scholar] [CrossRef]

- Chen, T.W.; Zhang, Z.B. Can the Low-Carbon Transition Impact the Urban–Rural Income Gap? Empirical Evidence from the Low-Carbon City Pilot Policy. Sustainability 2023, 15, 5726. [Google Scholar] [CrossRef]

- Liu, P.J.; Zhang, Y.T.; Zhou, S.Q. Has Digital Financial Inclusion Narrowed the Urban–Rural Income Gap? A Study of the Spatial Influence Mechanism Based on Data from China. Sustainability 2023, 15, 3548. [Google Scholar] [CrossRef]

- Xiong, M.Z.; Li, W.Q.; Teo, B.S.X.; Othman, J. Can China’s Digital Inclusive Finance Alleviate Rural Poverty? An Empirical Analysis from the Perspective of Regional Economic Development and an Income Gap. Sustainability 2022, 14, 16984. [Google Scholar] [CrossRef]

- Zhang, S.H.; Sun, Y.; Yu, X.Z.; Zhang, Y.F. Geographical Indication, Agricultural Products Export and Urban–Rural Income Gap. Agriculture 2023, 13, 378. [Google Scholar] [CrossRef]

- Loewenstein, W.; Bender, D. Labor Market Failure, Capital Accumulation, Growth and Poverty Dynamics in Partially Formalised Economies: Why Developing Countries’ Growth Patterns are Different. SSRN Ecectrinic J. 2017. [Google Scholar] [CrossRef]

- Sadik-Zada, E.R. Distributional Bargaining and the Speed of Structural Change in the Petroleum Exporting Labor Surplus Economies. Eur. J. Dev. Res. 2020, 32, 51–98. [Google Scholar] [CrossRef]

- Sadik-Zada, E.R. Natural resources, technological progress, and economic modernization. Rev. Dev. Econ. 2021, 25, 381–404. [Google Scholar] [CrossRef]

- Harun, M.; Che, M.; Jalil, A. Public expenditure expansion and inter-ethnic and rural-urban income disparity. Procedia Econ. Financ. 2012, 1, 296–303. [Google Scholar] [CrossRef]

- Bauer, J. The internet and income inequality: Socio-economic challenges in a hyperconnected society. Telecommun. Policy 2018, 42, 333–343. [Google Scholar] [CrossRef]

- Yang, R.Y.; Zhong, C.B. Land Suitability Evaluation of Sorghum Planting in Luquan County of Jinsha River Dry and Hot Valley Based on the Perspective of Sustainable Development of Characteristic Poverty Alleviation Industry. Agriculture 2022, 12, 1852. [Google Scholar] [CrossRef]

| Dimension | Variables | Computing Method | Name | Unit |

|---|---|---|---|---|

| Industrial Structure | Development level of primary industry | ln (primary industry output value/rural registered residence population) | X1 | CNY/person |

| Development level of secondary industry | ln (output value of secondary industry/urban registered residence population) | X2 | CNY/person | |

| Development level of tertiary industry | ln (output value of tertiary industry/total population) | X3 | CNY/person | |

| Development level of agriculture, forestry, animal husbandry, and fisheries | ln (total output value of agriculture, forestry, animal husbandry and fisheries/rural registered residence population) | X4 | CNY/person | |

| Proportion of the output value of secondary and tertiary industries | Secondary and tertiary industries’ output value/GDP × 100% | X5 | % | |

| Economic and Social | Night light brightness | ln (night light + 0.01) | X6 | None |

| Economic development level | ln (GDP/total population) | X7 | CNY/person | |

| Per capita grain output | ln (total grain output/total population) | X8 | kg/person | |

| Investment Expenditure | Fixed assets investment level | ln (total fixed assets investment/total population) | X9 | CNY/person |

| Per capita public financial expenditure | ln (public finance expenditure/total population) | X10 | CNY/person | |

| Rural Development | Proportion of rural employees | Total number of rural employees/total population × 100% | X11 | % |

| Agriculture Status | Proportion of grain sown | Grain planting area/farm plants planting area × 100% | X12 | % |

| Amount of agricultural fertilizer used per unit area | ln (amount of agricultural fertilizer used/planting area of farm plants) | X13 | kg/m2 | |

| Urban Construction | Minimum living security ratio of urban residents | Minimum living security number of urban residents/urban registered residence population × 100% | X14 | % |

| Proportion of real estate development investment | Investment in real estate development/GDP × 100% | X15 | % | |

| Population Structure | Urbanization rate | Urban registered residence population/total population × 100% | X16 | % |

| Population density | ln (total population/land area) | X17 | person/km2 |

| Items | Influence Factors of the Urban–Rural Income Gap | |||

|---|---|---|---|---|

| (1) FE | (2) SARAR | (3) SAR | (4) SEM | |

| Development Level of Primary Industry (X1) | 0.0001 (0.0075) | 0.0011 (0.0031) | 0.0011 (0.0031) | 0.0010 (0.0031) |

| Development Level of Secondary Industry (X2) | 0.0035 (0.0057) | 0.0029 (0.0037) | 0.0029 (0.0037) | 0.0032 (0.0038) |

| Proportion of the Output Value of the Secondary and Tertiary Industries (X5) | 0.0001 (0.0007) | 0.0001 (0.0003) | 0.0001 (0.0003) | 0.0001 (0.0003) |

| Per Capita Grain Output (X8) | −0.0020 (0.0019) | −0.0013 (0.0015) | −0.0011 (0.0014) | −0.0010 (0.0015) |

| Fixed Assets Investment Level (X9) | −0.0029 (0.0045) | −0.0039 (0.0025) | −0.0042 * (0.0024) | −0.0045 * (0.0025) |

| Per Capita Public Financial Expenditure (X10) | −0.0066 (0.0059) | −0.0063 * (0.0037) | −0.0065 * (0.0036) | −0.0075 ** (0.0037) |

| Proportion of Rural Employees (X11) | −0.0005 * (0.0003) | −0.0005 *** (0.0002) | −0.0005 *** (0.0002) | −0.0005 *** (0.0002) |

| Proportion of Grain Sown (X12) | 0.0008 *** (0.0002) | 0.0007 *** (0.0002) | 0.0006 *** (0.0001) | 0.0006 *** (0.0002) |

| Amount of Agricultural Fertilizer Used Per Unit Area (X13) | −0.0073 * (0.0043) | −0.0070 ** (0.0032) | −0.0067 ** (0.0032) | −0.0064 ** (0.0032) |

| Minimum Living Security Ratio of Urban Residents (X14) | 0.0863 (0.0907) | 0.0269 (0.0566) | 0.0205 (0.0553) | 0.0268 (0.0583) |

| Proportion of Real Estate Development Investment (X15) | −0.0004 *** (0.0001) | −0.0003 *** (0.0001) | −0.0003 *** (0.0001) | −0.0003 *** (0.0001) |

| Population Density (X17) | 0.0756 ** (0.0320) | 0.0598 *** (0.0175) | 0.0575 *** (0.0170) | 0.0574 *** (0.0176) |

| Parameter ρ | — | 0.6065 *** (0.1039) | 0.5942 *** (0.0942) | — |

| Parameter λ | — | −0.0011 (0.2428) | — | 0.5231 *** (0.1214) |

| LR Test: Individual Effect | 608.89 *** (0.0000) | 36.80 *** (0.0002) | 37.37 *** (0.0002) | 78.46 *** (0.0002) |

| LR Test: Time Effect | 1516.27 *** (0.0000) | 1460.16 *** (0.0000) | 1492.09 *** (0.0000) | 1526.76 *** (0.0000) |

| Hausman Test | 598.53 *** (0.0000) | — | 611.42 *** (0.0000) | 72.48 *** (0.0000) |

| Individual Effect | Yes | Yes | Yes | Yes |

| Time Effect | Yes | Yes | Yes | Yes |

| FE/RE | FE | FE | FE | FE |

| Within R2/R2 | 0.9820 | 0.1187 | 0.1523 | 0.1730 |

| Sample Size | 444 | 444 | 444 | 444 |

| Items | Non-Poverty-Stricken Counties | Poverty-Stricken Counties | ||||||

|---|---|---|---|---|---|---|---|---|

| (1) FE | (2) SARAR | (3) SAR | (4) SEM | (1) FE | (2) SARAR | (3) SAR | (4) SEM | |

| Development Level of Primary Industry (X1) | 0.0025 (0.0064) | 0.0022 (0.0032) | 0.0023 (0.0033) | 0.0022 (0.0033) | 0.0074 (0.0217) | 0.0053 (0.0118) | 0.0071 (0.0115) | 0.0047 (0.0117) |

| Development Level of Secondary Industry (X2) | 0.0006 (0.0067) | 0.0014 (0.0048) | 0.0008 (0.0047) | 0.0016 (0.0048) | −0.0019 (0.0112) | −0.0039 (0.0064) | −0.0024 (0.0061) | −0.0044 (0.0064) |

| Proportion of the Output Value of Secondary and Tertiary Industries (X5) | −0.0006 (0.0008) | −0.0007 (0.0006) | −0.0006 (0.0006) | −0.0007 (0.0006) | 0.0006 (0.0009) | 0.0007 * (0.0004) | 0.0007 * (0.0004) | 0.0007 * (0.0004) |

| Per Capita Grain Output (X8) | 0.0011 (0.0021) | 0.0009 (0.0016) | 0.0011 (0.0015) | 0.0008 (0.0016) | −0.0285 (0.0316) | −0.0255 (0.0173) | −0.0262 (0.0169) | −0.0259 (0.0174) |

| Fixed Assets Investment Level (X9) | −0.0190 *** (0.0064) | −0.0182 *** (0.0042) | −0.0191 *** (0.0040) | −0.0180 *** (0.0041) | −0.0031 (0.0050) | −0.0042 (0.0031) | −0.0035 (0.0031) | −0.0042 (0.0031) |

| Per Capita Public Financial Expenditure (X10) | −0.0041 (0.0060) | −0.0040 (0.0047) | −0.0041 (0.0047) | −0.0038 (0.0048) | −0.0050 (0.0111) | −0.0075 (0.0062) | −0.0058 (0.0059) | −0.0076 * (0.0043) |

| Proportion of Rural Employees (X11) | −0.0005 ** (0.0002) | −0.0005 *** (0.0002) | −0.0005 *** (0.0002) | −0.0005 *** (0.0002) | 0.0001 (0.0005) | 0.0000 (0.0003) | 0.0000 (0.0003) | 0.0000 (0.0003) |

| Proportion of Grain Sown (X12) | 0.0004 (0.0003) | 0.0005** (0.0002) | 0.0004** (0.0002) | 0.0005 *** (0.0002) | 0.0004 (0.0006) | 0.0005 (0.0003) | 0.0004 (0.0003) | 0.0005 * (0.0003) |

| Amount of Agricultural Fertilizer Used Per Unit Area (X13) | −0.0052 (0.0042) | −0.0054 (0.0036) | −0.0051 (0.0035) | −0.0055 (0.0036) | −0.0020 (0.0153) | −0.0008 (0.0107) | −0.0012 (0.0104) | −0.0010 (0.0107) |

| Minimum Living Security Ratio of Urban Residents (X14) | −0.0218 (0.2018) | −0.0429 (0.1577) | −0.0291 (0.1550) | −0.0540 (0.1590) | −0.1196 (0.0892) | −0.1074 * (0.0646) | −0.1124 * (0.0636) | −0.1089 * (0.0647) |

| Proportion of Real Estate Development Investment (X15) | −0.0002 * (0.0001) | −0.0002 ** (0.0001) | −0.0002 *** (0.0001) | −0.0002** (0.0001) | −0.0001 (0.0003) | −0.0002 (0.0002) | −0.0001 (0.0001) | −0.0002 (0.0002) |

| Population Density (X17) | 0.0119 (0.0214) | 0.0156 (0.0189) | 0.0136 (0.0186) | 0.0166 (0.0191) | 0.1292 (0.2303) | 0.1051 (0.0723) | 0.1254 * (0.0726) | 0.1007 (0.0713) |

| Parameter ρ | — | −0.0808 (0.3795) | −0.1545 (0.2250) | — | — | −0.1681 (0.2883) | −0.4167 * (0.2351) | — |

| Parameter λ | — | −0.2508 (0.4165) | — | −0.3592 (0.2557) | — | −0.4894 (0.3910) | — | −0.6370 * (0.3310) |

| LR Test: Individual Effect | 842.57 *** (0.0000) | 59.87 *** (0.0000) | 58.96 *** (0.0000) | 98.16 *** (0.0000) | 603.74 *** (0.0000) | 64.83 *** (0.0000) | 65.65 *** (0.0000) | 104.81 *** (0.0000) |

| LR Test: Time Effect | 476.31 *** (0.0000) | 607.90 *** (0.0000) | 609.71 *** (0.0000) | 623.30 *** (0.0000) | 631.49 *** (0.0000) | 709.52 *** (0.0000) | 719.72 *** (0.0000) | 711.52 *** (0.0000) |

| Individual Effect | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Time Effect | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| FE/RE | FE | FE | FE | FE | FE | FE | FE | FE |

| Within R2/R2 | 0.9826 | 0.5938 | 0.6093 | 0.5974 | 0.9892 | 0.2703 | 0.0392 | 0.4391 |

| Sample Size | 228 | 228 | 228 | 228 | 228 | 228 | 228 | 228 |

| Items | Non-Poverty-Stricken Counties | Poverty-Stricken Counties | ||||

|---|---|---|---|---|---|---|

| Direct | Indirect | Total | Direct | Indirect | Total | |

| Development Level of Primary Industry (X1) | 0.0031 (0.0032) | −0.0098 (0.0149) | −0.0067 (0.0156) | 0.0017 (0.0116) | −0.1081 *** (0.0388) | −0.1064 *** (0.0393) |

| Development Level of Secondary Industry (X2) | 0.0025 (0.0046) | 0.0658 * (0.0343) | 0.0683 * (0.0361) | −0.0070 (0.0061) | −0.0900 *** (0.0335) | −0.0970 *** (0.0351) |

| Proportion of the Output Value of Secondary and Tertiary Industries (X5) | 0.0003 (0.0005) | −0.0039 (0.0040) | −0.0036 (0.0042) | 0.0004 (0.0004) | 0.0024 (0.0018) | 0.0029 (0.0018) |

| Per Capita Grain Output (X8) | 0.0023 (0.0014) | −0.0071 (0.0066) | −0.0049 (0.0070) | −0.0423 ** (0.0167) | −0.0537 (0.0555) | −0.0961 * (0.0566) |

| Fixed Assets Investment Level (X9) | −0.0121 *** (0.0045) | 0.0847 *** (0.0318) | 0.0726 ** (0.0334) | −0.0049 * (0.0028) | −0.0199* (0.0102) | −0.0247 ** (0.0098) |

| Per Capita Public Financial Expenditure (X10) | 0.0004 (0.0046) | 0.0017 (0.0352) | 0.0021 (0.0371) | −0.0018 (0.0060) | −0.0257 (0.0264) | −0.0275 (0.0284) |

| Proportion of Rural Employees (X11) | −0.0005 *** (0.0002) | −0.0017 (0.0014) | −0.0022 (0.0015) | 0.0003 (0.0003) | −0.0003 (0.0014) | −0.0001 (0.0014) |

| Proportion of Grain Sown (X12) | 0.0003 (0.0002) | 0.0018 * (0.0010) | 0.0021 * (0.0011) | 0.0005 * (0.0003) | 0.0031 ** (0.0014) | 0.0037 ** (0.0015) |

| Amount of Agricultural Fertilizer Used Per Unit Area (X13) | −0.0075 ** (0.0034) | −0.0208 (0.0201) | −0.0283 (0.0212) | −0.0114 (0.0107) | 0.0063 (0.0387) | −0.0052 (0.0407) |

| Minimum Living Security Ratio of Urban Residents (X14) | −0.0289 (0.1594) | −1.2950 (1.2054) | −1.3238 (1.2837) | −0.1929 *** (0.0621) | 0.0936 (0.2438) | −0.0993 (0.2487) |

| Proportion of Real Estate Development Investment (X15) | −0.0001 (0.0001) | 0.0013 ** (0.0006) | 0.0012 * (0.0006) | 0.0000 (0.0001) | −0.0009 * (0.0005) | −0.0009 ** (0.0005) |

| Population Density (X17) | 0.0792 *** (0.0287) | 0.7159 *** (0.2746) | 0.7951 *** (0.2970) | 0.2886 *** (0.0980) | −0.8795 *** (0.2846) | −0.5908 ** (0.2376) |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yang, S.; Yang, Z.; Yang, R.; Cai, X. Analysis of the Spatio-Temporal Evolution, Influencing Factors, and Spillover Effects of the Urban–Rural Income Gap in Chongqing Municipality, China. Agriculture 2023, 13, 907. https://doi.org/10.3390/agriculture13040907

Yang S, Yang Z, Yang R, Cai X. Analysis of the Spatio-Temporal Evolution, Influencing Factors, and Spillover Effects of the Urban–Rural Income Gap in Chongqing Municipality, China. Agriculture. 2023; 13(4):907. https://doi.org/10.3390/agriculture13040907

Chicago/Turabian StyleYang, Shiqin, Zisheng Yang, Renyi Yang, and Xueli Cai. 2023. "Analysis of the Spatio-Temporal Evolution, Influencing Factors, and Spillover Effects of the Urban–Rural Income Gap in Chongqing Municipality, China" Agriculture 13, no. 4: 907. https://doi.org/10.3390/agriculture13040907

APA StyleYang, S., Yang, Z., Yang, R., & Cai, X. (2023). Analysis of the Spatio-Temporal Evolution, Influencing Factors, and Spillover Effects of the Urban–Rural Income Gap in Chongqing Municipality, China. Agriculture, 13(4), 907. https://doi.org/10.3390/agriculture13040907