The State of Grain Trade between China and Russia: Analysis of Growth Effect and Its Influencing Factors

Abstract

:1. Introduction

1.1. Research Background

1.2. Related Research

1.2.1. Research on Agricultural Product Trade between China and Russia

1.2.2. Revision: Relevant Research on Growth Effects and Their Influencing Factors

2. Research Methods and Data Description

2.1. Research Methods

2.1.1. H–K Measure Method

2.1.2. Model Building

Ternary Margins (Export)

The Size of the Agricultural Economy (AGDPR)

Food Productivity (PR)

Trade Cost (COST)

Economic Shocks (WD)

2.2. Data Description

3. Current Situation of Bilateral Grain Product Export Trade between China and Russia

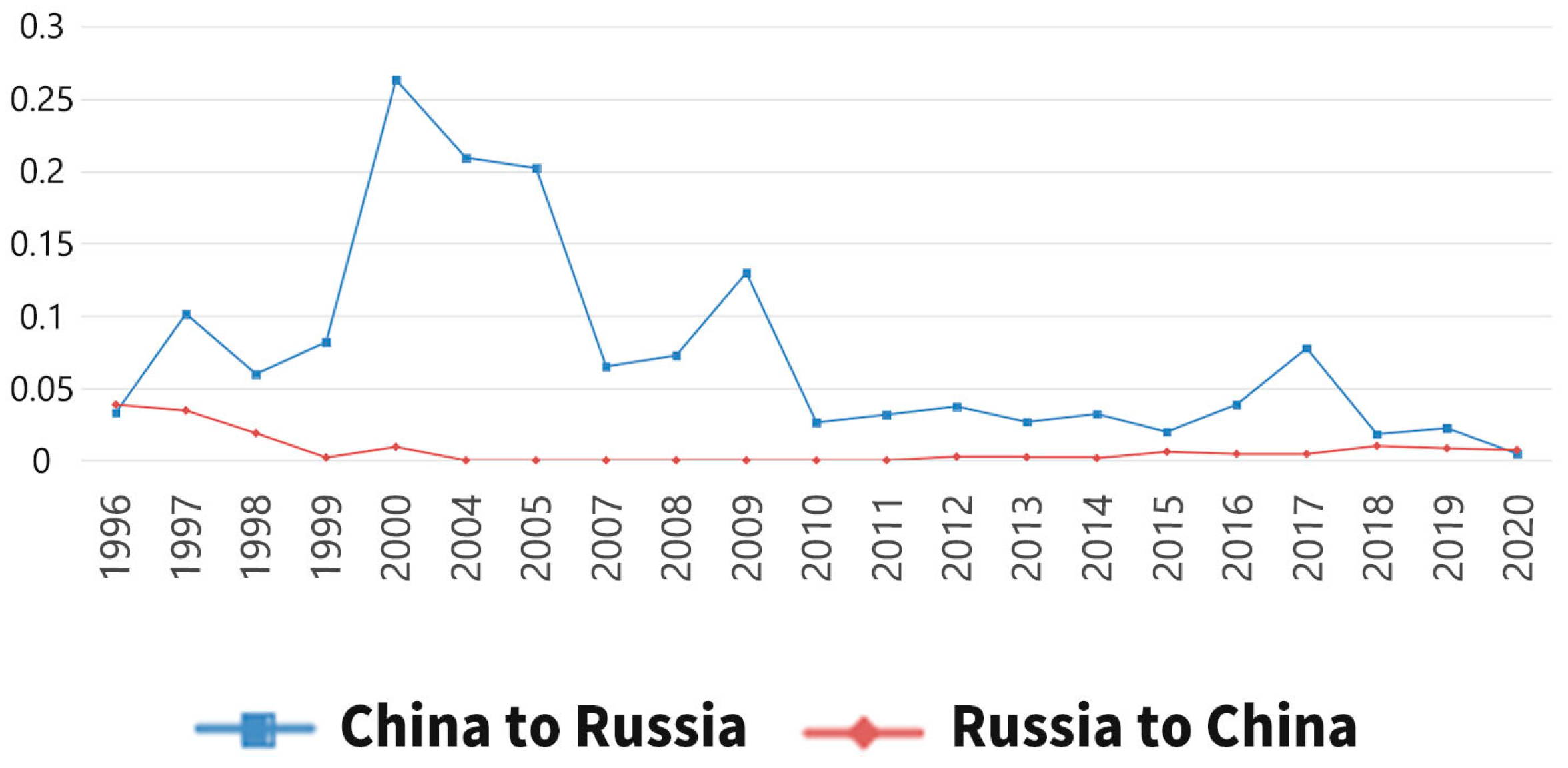

3.1. Export Trade Size of Bilateral Grain Products between China and Russia

3.2. Structure of Bilateral Grain Product Export Trade between China and Russia

4. Marginal Decomposition of Bilateral Grain Product Export Trade between Russia and China

4.1. Overall Margin

4.1.1. Intensive Margin

4.1.2. Extensive Margin

4.1.3. Quantity Margin

4.1.4. Price Margin

4.2. Phase Analysis

5. Factors Influencing the Ternary Margin Value of Bilateral Grain Product Exports between China and Russia

5.1. Factors Influencing the Quantity Margin of Bilateral Grain Product Exports between China and Russia

5.2. Factors Influencing the Price Margin of Bilateral Grain Product Exports between China and Russia

5.3. Factors Influencing the Extensive Margin of Bilateral Grain Product Exports between China and Russia

6. Conclusions and Implications

6.1. Conclusions

6.2. Implications

6.2.1. Optimizing the Trade Policies of Both Countries and Improving the Quality of Trade Development

6.2.2. Building Cross-Border Cooperative Parks and Creating the Whole Industrial Chain Layout

6.2.3. Building a Financial Service System and Supporting the Development of Cooperative Enterprises

6.2.4. Strengthening Infrastructure Construction and Achieving Interconnectivity in Agricultural Cooperation between China and Russia

Author Contributions

Funding

Institutional Review Board Statement

Data Availability Statement

Conflicts of Interest

References

- Tang, B. Agricultural Product Trade between China and BRICS Countries: Comparative Advantages and Cooperation Potential. Issues Agric. Econ. 2012, 33, 67–76. [Google Scholar]

- Xu, X.; Liu, J. Analysis of the development trend and influencing factors of com plementary fruit and vegetable trade between China and Russia. Prices Mon. 2021, 1, 54–63. [Google Scholar]

- Zhu, X.; Tao, Y.; Wu, T. Impact of U.S.-China Trade Friction on China-Russia Soybean Trade. Theory Res. 2020, 6, 8–11. [Google Scholar]

- Tong, G.; Shi, L. Empirical analysis of agricultural trade between China and Russia based on intra-industry. Issues Agric. Econ. 2017, 38, 89–100. [Google Scholar]

- Zhang, G. Current situation and characteristics of agricultural trade between China and Russia. J. Eurasian Econ. 2010, 4, 30–33. [Google Scholar]

- Wang, R.; Wang, Y. Research on the import trade of agricultural products between China and the countries along the Silk Road Economic Belt. Economist 2017, 4, 97–104. [Google Scholar]

- Yang, F.; Ding, J. The problems and countermeasures of Chinese agricultural products exported to Russia market. Pract. Foreign Econ. Relat. Trade 2015, 3, 47–49. [Google Scholar]

- Fang, L. Analysis of the influencing factors and countermeasures for the further expansion of agricultural product trade between China and Russia. Pract. Foreign Econ. Relat. Trade 2018, 6, 21–24. [Google Scholar]

- Sun, H.; Tong, G. The Impact of Russian Green Trade Barriers on Sino Russian Agricultural Product Trade. Jiangxi Soc. Sci. 2019, 39, 77–85. [Google Scholar]

- Wang, J.; Dai, C.; Zhou, M.; Liu, Z. Research on global grain trade network pattern and its influencing factors. J. Nat. Resour. 2021, 36, 1545–1556. [Google Scholar] [CrossRef]

- Duan, J.; Nie, C.; Wang, Y.; Yan, D.; Xiong, W. Research on Global Grain Trade Network Pattern and Its Driving Factors. Sustainability 2022, 14, 245. [Google Scholar] [CrossRef]

- Constantin, M.; Sapena, J.; Apetrei, A.; Pătărlăgeanu, S.R. Deliver Smart, Not More! Building Economically Sustainable Competitiveness on the Ground of High Agri-Food Trade Specialization in the EU. Foods 2023, 12, 232. [Google Scholar] [CrossRef] [PubMed]

- Ma, J.; Li, M.; Li, X. The evolution of international grain trade pattern based on complex network and entropy. Int. J. Mod. Phys. Comput. 2023, 34, 2. [Google Scholar] [CrossRef]

- Bu, X.; Shi, G.; Dong, S. Pattern of Grain Production Potential and Development Potential in China–Mongolia–Russia Economic Corridor. Sustainability 2022, 14, 10102. [Google Scholar] [CrossRef]

- Maslova, V.; Zaruk, N.; Fuchs, C.; Avdeev, M. Competitiveness of Agricultural Products in the Eurasian Economic Union. Agriculture 2019, 9, 61. [Google Scholar] [CrossRef]

- Du, R.; Chen, Y.; Dong, G.; Tian, L.; Zhang, J.; Zhang, N. Optimization and Benefit Analysis of Grain Trade in Belt and Road Countries. Entropy 2022, 24, 1667. [Google Scholar] [CrossRef]

- Duan, J.; Yong, X.U.; Jiang, H. Trade vulnerability assessment in the grain-importing countries: A case study of China. PLoS ONE 2021, 16, e0257987. [Google Scholar] [CrossRef]

- Peters, G.P.; Hertwich, E.G. Pollution embodied in trade: The Norwegian case. Glob. Environ. Chang. 2006, 16, 379–387. [Google Scholar] [CrossRef]

- Ferreira, F.H.G. Distributions in Motion: Economic Growth, Inequality, and Poverty Dynamics; World Bank eLibrary: Geneva, Switzerland, 2010. [Google Scholar]

- Dollar, D. Outward-Oriented Developing Economies Really Do Grow More Rapidly: Evidence from 95 LDCs, 1976–1985. Econ. Dev. Cult. Chang. 1992, 40, 523–544. [Google Scholar] [CrossRef]

- Sachs, J.; Warner, A. Economic Reform and the Progress of Global Integration. Harv. Inst. Econ. Res. Work. Pap. 1995, 35, 1–118. [Google Scholar] [CrossRef]

- Edwards, S. Openness, Productivity and Growth: What do We Really Know? Econ. J. 1998, 108, 383–398. [Google Scholar] [CrossRef]

- Harrison, A.; Hanson, G. Who gains from trade reform? Some remaining puzzles. J. Dev. Econ. 1999, 59, 125–154. [Google Scholar] [CrossRef]

- Rodríguez, F.; Rodrik, D. Trade Policy and Economic Growth: A Skeptic’s Guide to the Cross-National Evidence. NBER Macroecon. Annu. 2000, 15, 261–338. [Google Scholar] [CrossRef]

- Konstantakopoulou, I. New evidence on the Export-led-growth hypothesis in the Southern Euro-zone countries (1960–2014). Econ. Bull. 2016, 36, 429–439. [Google Scholar]

- Wang, Q.; Zhang, F. The effects of trade openness on decoupling carbon emissions from economic growth—Evidence from 182 countries. J. Clean. Prod. 2020, 279, 123838. [Google Scholar] [CrossRef]

- Bernard, A.B.; Jensen, J.B.; Redding, S.J.; Schott, P.K. The Margins of US Trade. Am. Econ. Rev. 2009, 99, 487–493. [Google Scholar] [CrossRef]

- Shi, B. The Ternary Margin of China’s Export Growth. China Econ. Q. 2010, 9, 1311–1330. [Google Scholar]

- Zhang, S.; Wang, S. A ternary marginal analysis of China’s vegetable export growth to ASEAN. J. Huazhong Agric. Univ. (Soc. Sci. Ed.) 2016, 1, 85–90+130–131. [Google Scholar]

- Zheng, Y.; Ding, C.; Ma, J. Ternary marginal analysis of bilateral agricultural exports between China and Russia under the background of “One Belt and One Road”. Mod. Econ. Res. 2018, 10, 73–80. [Google Scholar]

- Liu, H.; Zhu, Z. Ternary Marginal Analysis of China-Vietnam Agricultural Trade in the Context of “One Belt, One Road”. World Agric. 2019, 9, 89–95+103+135. [Google Scholar]

- Amurgo-Pacheco, A.; Piérola, M.D. Patterns of Export Diversification in Developing Countries: Intensive and Extensive Margins; HEI Working Paper; 2008; pp. 1–34. [Google Scholar]

- Yang, F.; Ding, J. Expand China’s Agricultural Exports to Five Central Asian Countries under the”One Belt, One Road”Strategy: Based on Three Margins. J. East China Univ. Sci. Technol. (Soc. Sci. Ed.) 2016, 31, 84–92. [Google Scholar]

- Sun, Z.; Li, X. The trade margins of Chinese agricultural exports to ASEAN and their determinants. J. Integr. Agric. 2018, 17, 2356–2367. [Google Scholar] [CrossRef]

- Hummels, D.; Klenow, P.J. The Variety and Quality of a Nation’s Exports. Am. Econ. Rev. 2005, 95, 704–723. [Google Scholar] [CrossRef]

- Chaney, T. Distorted Gravity: The Intensive and Extensive Margins of International Trade. Am. Econ. Rev. 2008, 98, 1707–1721. [Google Scholar] [CrossRef]

- Qian, X.; Xiong, P. The Binary Margin of China’s Export Growth and Its Determinants. Econ. Res. J. 2010, 45, 65–79. [Google Scholar]

- Sun, Z.; Li, X. Puzzle of China’s Grain Trade Deficit: Variety, Price or Quantity. J. Int. Trade 2018, 9, 9–24. [Google Scholar]

| Year | China–Russia Value of Exports | Russia–China Value of Exports | Total Grain Trade between China and Russia | Grain Trade Balance between China and Russia | Surplus Country |

|---|---|---|---|---|---|

| 1996 | 600.06 | 1699.11 | 2299.17 | 1099.05 | Russia |

| 1997 | 1561.63 | 1794.93 | 3356.56 | 233.30 | Russia |

| 1998 | 775.35 | 1422.20 | 2197.55 | 646.86 | Russia |

| 1999 | 5693.57 | 177.76 | 5871.33 | 5515.80 | China |

| 2000 | 5871.58 | 830.30 | 6701.88 | 5041.28 | China |

| 2001 | 1854.96 | 222.31 | 2077.27 | 1632.64 | China |

| 2002 | 5255.09 | 1.08 | 5256.17 | 5254.01 | China |

| 2003 | 7421.77 | 16.78 | 7438.54 | 7404.99 | China |

| 2004 | 4047.53 | 3.91 | 4051.45 | 4043.62 | China |

| 2005 | 4883.75 | 4.06 | 4887.80 | 4879.69 | China |

| 2006 | 6236.99 | 18.75 | 6255.74 | 6218.25 | China |

| 2007 | 1338.21 | 37.06 | 1375.27 | 1301.15 | China |

| 2008 | 2521.36 | 103.45 | 2624.81 | 2417.91 | China |

| 2009 | 2363.48 | 52.86 | 2416.33 | 2310.62 | China |

| 2010 | 2044.81 | 22.19 | 2067.00 | 2022.62 | China |

| 2011 | 3720.18 | 92.76 | 3812.95 | 3627.42 | China |

| 2012 | 2211.72 | 2335.01 | 4546.74 | 123.29 | Russia |

| 2013 | 2522.26 | 1809.86 | 4332.12 | 712.39 | China |

| 2014 | 4984.11 | 2676.09 | 7660.20 | 2308.02 | China |

| 2015 | 3445.02 | 13,092.54 | 16,537.57 | 9647.5204 | Russia |

| 2016 | 2336.34 | 13,229.08 | 15,565.41 | 10,892.739 | Russia |

| 2017 | 3607.96 | 14,453.78 | 18,061.74 | 10,845.823 | Russia |

| 2018 | 2615.56 | 26,353.86 | 28,969.42 | 23,738.295 | Russia |

| 2019 | 2314.99 | 23,585.90 | 25,900.88 | 21,270.907 | Russia |

| 2020 | 500.56 | 28,407.00 | 28,907.56 | 27,906.435 | Russia |

| Trade Direction | 1996 | *** | 2019 | 2020 | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Commodity Code | Export Volume | Proportion | *** | Commodity Code | Export Volume | Proportion | Commodity Code | Export Volume | Proportion | |

| China–Russia exports | 070190 Fresh and cold non-seed potatoes | 1108.51 | 51.09 | *** | 070190 | 3905.52 | 76.28 | 100630 | 2178.06 | 73.47 |

| 100630 Milled rice | 915.54 | 42.87 | *** | 100630 | 968.22 | 18.91 | 070190 | 103.97 | 11.70 | |

| 100510 Seed corn | 102.38 | 4.79 | *** | 120100 | 86.22 | 1.68 | 071022 Frozen common beans | 58.61 | 6.60 | |

| Russia–China exports | 120100 Soybeans | 6890.18 | 97.81 | *** | 120100 | 71256.99 | 81.56 | 120100 | 69316.24 | 73.02 |

| 100400 Oats | 154.44 | 2.19 | *** | 100590 Non-seed corn | 6524.98 | 7.47 | 100590 | 13768.4 | 14.50 | |

| *** | 100190 Other wheat and mixed wheat | 5843.10 | 6.69 | 100110 Durum wheat | 4244.76 | 4.47 | ||||

| Trade Direction | Phase | Contribution Rate % | ||||

|---|---|---|---|---|---|---|

| R | IM | EM | P | X | ||

| China exports to Russia | 1996–2001 | 100.00 | 97.27 | 2.73 | 122.28 | −25.02 |

| 2002–2008 | 100.00 | 84.97 | 15.03 | 80 | 4.97 | |

| 2009–2014 | 100.00 | 225.69 | −125.69 | 268.75 | −43.06 | |

| 2015–2020 | 100.00 | 102.11 | −2.11 | 85.43 | 16.67 | |

| Russia exports to China | 1996–2001 | 100.00 | 241.43 | −141.43 | 168.57 | 72.86 |

| 2002–2008 | 100.00 | 89.85 | 10.15 | 110.05 | −20.2 | |

| 2009–2014 | 100.00 | 100.44 | −0.44 | 116.3 | −15.86 | |

| 2015–2020 | 100.00 | 77.18 | 22.82 | 21.25 | 55.93 | |

| Explanatory Variable | Quantity Margin | Price Margin | Extensive Margin |

|---|---|---|---|

| Agricultural economic size | −0.029 *** (−2.937) | 0.166 ** (2.504) | 0.114 ** (2.532) |

| Grain productivity | 0.365 *** (2.742) | −2.677 *** (−2.887) | −1.383 ** (−2.254) |

| Trade cost | 0.125 (1.135) | 4.47 * (1.939) | 0.37 (0.364) |

| Economic shock | 0.008 (1.523) | −0.259 *** (−3.11) | 0.013 (0.394) |

| Constant term | −0.213 ** (−1.968) | 0.763 (0.847) | 1.295 * (1.959) |

| Observation number | 50 | 50 | 50 |

| R2 | 0.464 | 0.723 | 0.726 |

| F | 4.977 *** | 15.038 *** | 15.210 *** |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Fu, J.; Tong, G. The State of Grain Trade between China and Russia: Analysis of Growth Effect and Its Influencing Factors. Agriculture 2023, 13, 1407. https://doi.org/10.3390/agriculture13071407

Fu J, Tong G. The State of Grain Trade between China and Russia: Analysis of Growth Effect and Its Influencing Factors. Agriculture. 2023; 13(7):1407. https://doi.org/10.3390/agriculture13071407

Chicago/Turabian StyleFu, Jing, and Guangji Tong. 2023. "The State of Grain Trade between China and Russia: Analysis of Growth Effect and Its Influencing Factors" Agriculture 13, no. 7: 1407. https://doi.org/10.3390/agriculture13071407