The Impact of Crop Insurance on Fertilizer Use: Evidence from Grain Producers in China

Abstract

1. Introduction

2. Theoretical Mechanism and Policy Background

2.1. Theoretical Mechanism

2.2. Crop Insurance in China

2.3. Heterogeneity in Farm Size

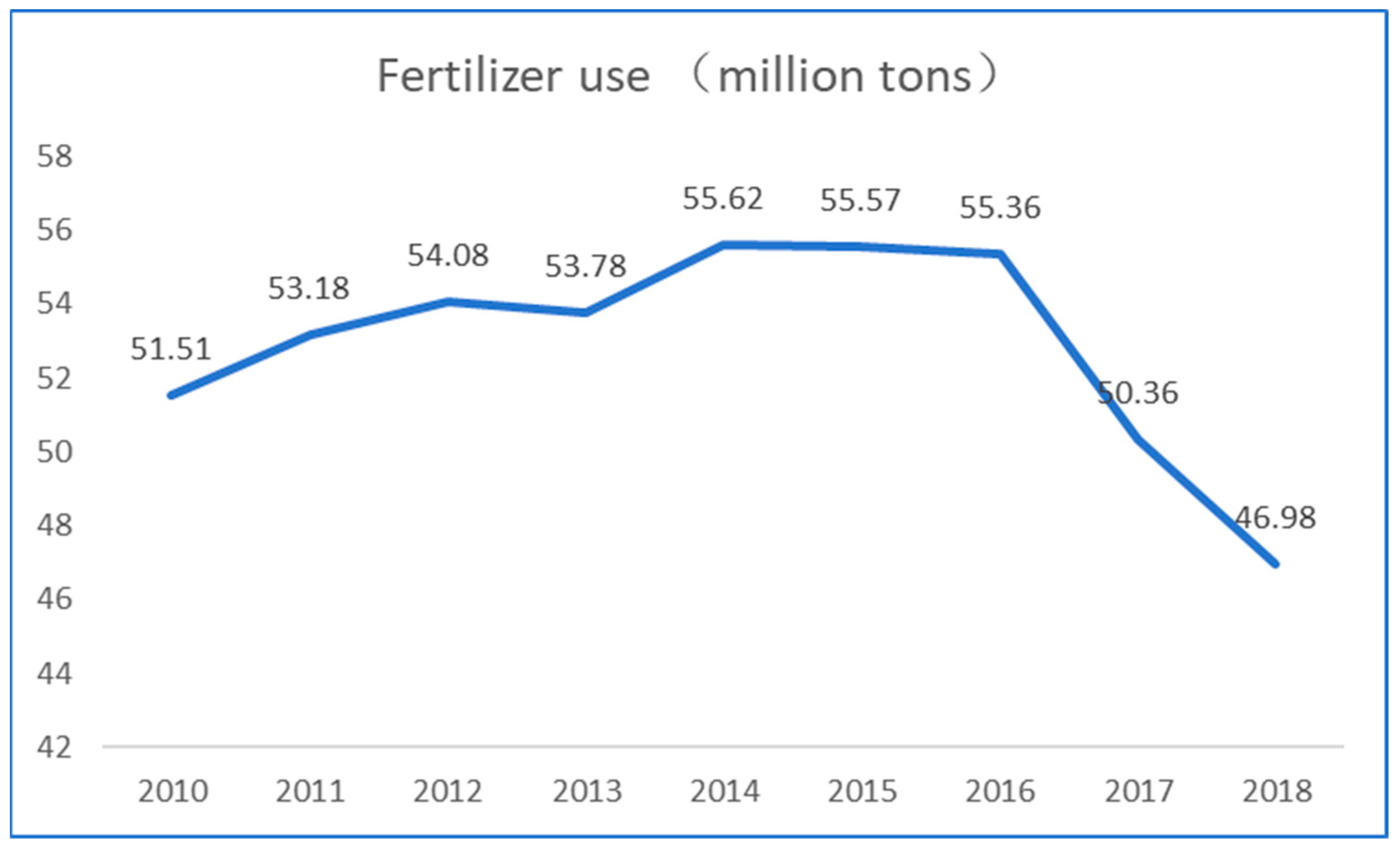

2.4. Chemical Fertilizer Use in China

3. Model and Data

3.1. Model and Variables

3.2. Endogeneity and Estimation Strategy

3.2.1. Endogenity of Insurance Decision

3.2.2. Instrumental Variable Estimation

3.3. Data Source and Description

4. Estimation Results

4.1. The Impact of Crop Insurance on Fertilizer Use

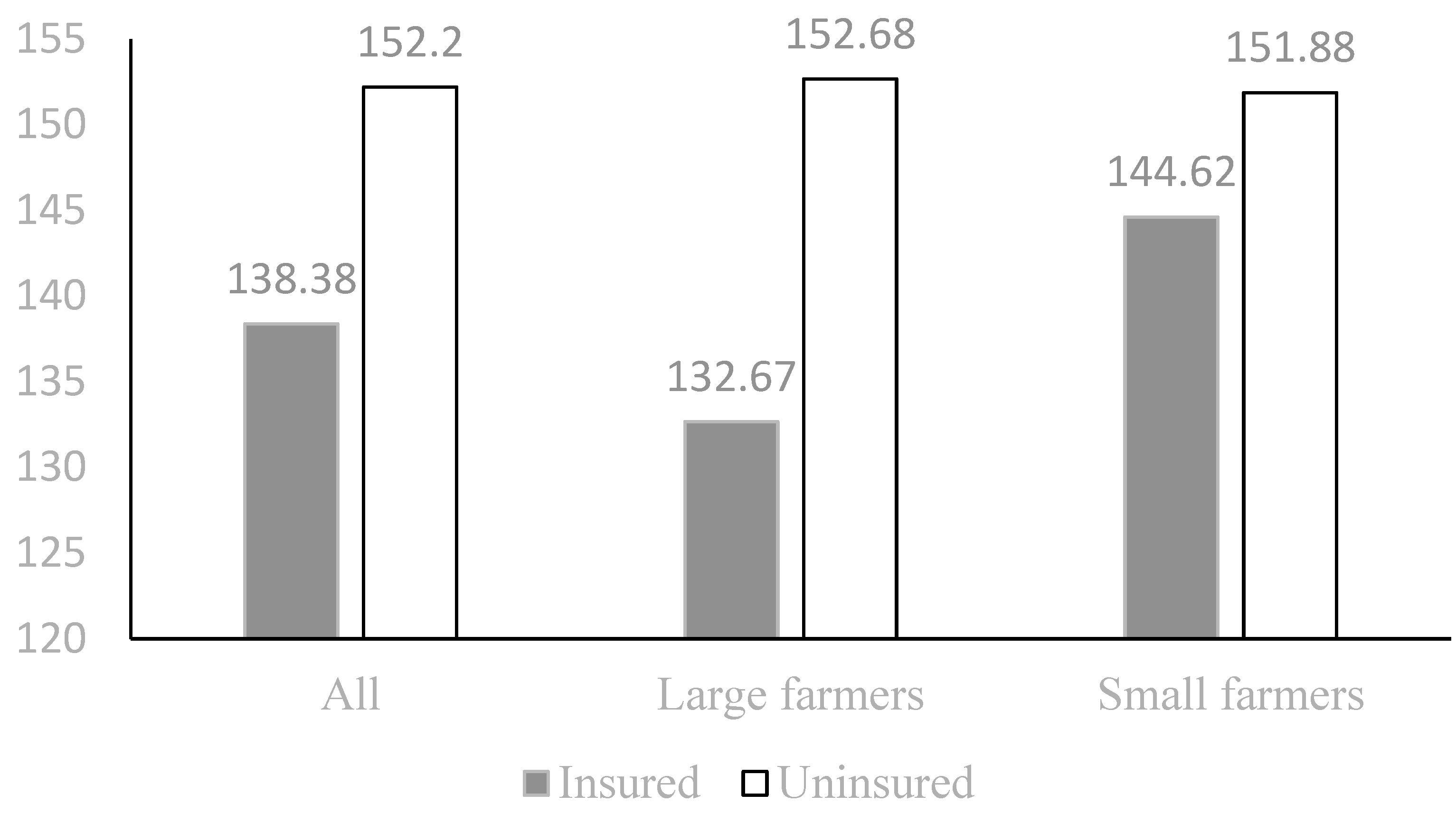

4.2. The Impact of Crop Insurance on Fertilizer Use among Farms of Different Scales

4.3. Robustness Checks

4.3.1. Different Estimation Methods

4.3.2. Fertilizer Quantity as an Independent Variable

5. Conclusions and Discussion

Author Contributions

Funding

Institutional Review Board Statement

Data Availability Statement

Conflicts of Interest

References

- Atafar, Z.; Mesdaghinia, A.; Nouri, J.; Homaee, M.; Yunesian, M.; Ahmadimoghaddam, M.; Mahvi, A.H. Effect of fertilizer application on soil heavy metal concentration. Environ. Monit. Assess. 2010, 160, 83–89. [Google Scholar] [CrossRef]

- Gai, X.; Liu, H.; Liu, J.; Zhai, L.; Yang, B.; Wu, S.; Ren, T.; Lei, Q.; Wang, H. Longterm benefits of combining chemical fertilizer and manure applications on crop yields and soil carbon and nitrogen stocks in North China Plain. Agric. Water Manag. 2018, 208, 384–392. [Google Scholar] [CrossRef]

- Yuan, F.; Tang, K.; Shi, Q. Does Internet use reduce chemical fertilizer use? Evidence from rural households in China. Environ. Sci. Pollut. Res. 2021, 28, 6005–6017. [Google Scholar] [CrossRef]

- Wu, H.; MacDonald, G.K.; Galloway, J.N.; Zhang, L.; Gao, L.; Yang, L.; Yang, J.; Li, X.; Li, H.; Yang, T. The influence of crop and chemical fertilizer combinations on greenhouse gas emissions: A partial life-cycle assessment of fertilizer production and use in China. Resour. Conserv. Recycl. 2021, 168, 105303. [Google Scholar] [CrossRef]

- Zhang, Z.S.; Chen, J.; Liu, T.Q.; Cao, C.G.; Li, C.F. Effects of nitrogen fertilizer sources and tillage practices on greenhouse gas emissions in paddy fields of central China. Atmos. Environ. 2016, 144, 274–281. [Google Scholar] [CrossRef]

- Jin, S.; Zhou, F. Zero Growth of Chemical Fertilizer and Pesticide Use: China’s Objectives, Progress and Challenges. J. Resour. Ecol. 2018, 9, 50–58. [Google Scholar]

- Pope, R.D.; Kramer, R.A. Production Uncertainty and Factor Demands for the Competitive Firm. South. Econ. J. 1979, 46, 489–501. [Google Scholar] [CrossRef]

- Horowitz, J.K.; Lichtenberg, E. Crop Insurance, Moral Hazard and chemical use in agriculture. Am. J. Agric. Econ. 1993, 75, 926–935. [Google Scholar] [CrossRef]

- Babcock, B.A.; Hennessy, D.A. Input Demand under Yield and Revenue Insurance. Am. J. Agric. Econ. 1996, 78, 416–427. [Google Scholar] [CrossRef]

- Smith, V.H.; Goodwin, B.K. Crop Insurance, Moral Hazard and Agricultural Chemistry Use. Am. J. Agric. Econ. 1996, 78, 428–438. [Google Scholar] [CrossRef]

- Mishra, A.K.; Wesley Nimon, R.; El-Osta, H.S. Is moral hazard good for the environment? Revenue insurance and chemical input use. J. Environ. Manag. 2005, 74, 11–50. [Google Scholar] [CrossRef] [PubMed]

- Leathers, H.D.; Quiggin, J.C. Interactions between Agricultural and Resource Policy: The Importance of Attitudes toward Risk. Am. J. Agric. Econ. 1991, 3, 757–764. [Google Scholar] [CrossRef]

- Regmi, M.; Briggeman, B.C.; Featherstone, A.M. Effects of crop insurance on farm input use: Evidence from Kansas farm data. Agric. Resour. Econ. Rev. 2022, 51, 361–379. [Google Scholar] [CrossRef]

- Wu, J.J. Crop Insurance, Acreage Decisions, and Nonpoint-Source Pollution. Am. J. Agric. Econ. 1999, 81, 305–320. [Google Scholar] [CrossRef]

- Chang, H.H.; Mishra, A.K. Chemical usage in production agriculture: Do crop insurance and off-farm work play a part? J. Environ. Manag. 2012, 105, 76–82. [Google Scholar] [CrossRef] [PubMed]

- Weber, J.G.; Key, N.; O’Donoghue, E. Does federal crop insurance make environmental externalities from agriculture worse? J. Assoc. Environ. Resour. Econ. 2016, 3, 707–742. [Google Scholar] [CrossRef]

- Quiggin, J.C.; Karagiannis, G.; Stanton, J. Crop insurance and crop production: An empirical study of moral hazard and adverse selection. Aust. J. Agric. Econ. 1993, 37, 95–113. [Google Scholar] [CrossRef]

- Liang, Y.; Coble, K.H. A Cost Function Analysis of Crop Insurance Moral Hazard and Agricultural Chemical Use. Agric. Appl. Econ. Assoc. 2009, 49485. [Google Scholar] [CrossRef]

- Enjolras, G.; Aubert, M. How does crop insurance influence pesticide use? Evidence from French farms. Rev. Agric. Food Environ. Stud. 2020, 101, 461–485. [Google Scholar] [CrossRef]

- Goodwin, B.; Vandeveer, M.L.; Deal, J.L. An Empirical Analysis of Acreage Effects of Participation in the Federal Crop Insurance Pregame. Am. J. Agric. Econ. 2004, 86, 1058–1077. [Google Scholar] [CrossRef]

- Li, H.; Yuan, K.; Cao, A. The role of crop insurance in reducing pesticide use: Evidence from rice farmers in China. J. Environ. Manag. 2022, 306, 114–456. [Google Scholar] [CrossRef] [PubMed]

- Si, C.; Li, Y.; Jiang, W. Effect of Insurance Subsidies on Agricultural Land-Use. Int. J. Env. Res Public Health 2023, 20, 1493. [Google Scholar] [CrossRef] [PubMed]

- Zhong, F.; Ning, M.; Xing, L. Does crop insurance influence agrochemical uses under current Chinese situations? A case study in the Manasi watershed, Xinjiang. Agric. Econ. 2007, 36, 103–112. [Google Scholar] [CrossRef]

- Munshi, K. Social learning in a heterogeneous population: Technology diffusion in the Indian Green Revolution. J. Dev. Econ. 2004, 73, 185–213. [Google Scholar] [CrossRef]

- Maddala, G.S. Limited Dependent and Qualitative Variables in Econometrics; Cambridge University Press: Cambridge, UK, 1983. [Google Scholar]

- Hausman, J. Specification Tests in Econometrics. Econometrica 1978, 46, 1251–1271. [Google Scholar] [CrossRef]

- Angrist, J.D.; Pischke, J.-S. Mostly Harmless Econometrics: An Empiricist’s Companion; Princeton University Press: Princeton, NJ, USA, 2009. [Google Scholar]

- Jacoby, H.G.; Li, G.; Rozelle, S. Hazards of Expropriation: Tenure Insecurity and Investment in Rural China. Am. Econ. Rev. 2002, 92, 1420–1447. [Google Scholar] [CrossRef]

| Variables | Unit | Mean | SD | Min | Max | |

|---|---|---|---|---|---|---|

| Dependent Variables | Log fertilizer expenditure | RMB/mu | 4.855 | 0.622 | 0 | 6.89 |

| Log fertilizer quantity | kg/mu | 1.73 | 0.598 | 0 | 2.53 | |

| Independent Variables | Insured or not | 1 = yes 0 = no | 0.364 | 0.481 | 0 | 1 |

| Plot quality | 1 = good 2 = Medium 3 = Bad | 1.624 | 0.642 | 1 | 3 | |

| Rented in | 1 = yes 0 = no | 0.425 | 0.494 | 0 | 1 | |

| Manure | 1 = yes 0 = no | 0.320 | 0.467 | 0 | 1 | |

| Plot size | Mu | 18.49 | 75.39 | 0.1 | 1750 | |

| Farming years | Years | 31.87 | 13.70 | 0 | 67 | |

| Crop type | 1 = Corn 0 = rice | 0.533 | 0.499 | 0 | 1 | |

| Gender | 1 = Male 0 = Female | 0.965 | 0.183 | 0 | 1 | |

| Education | years | 6.791 | 3.071 | 0 | 16 | |

| Rate of non-farm labor | % | 0.411 | 0.337 | 0 | 1 | |

| Large farmer or not | 1 = year 0 = no | 0.439 | 0.497 | 0 | 1 | |

| Instrumental Variables | Village participation rate | % | 48.67 | 39.38 | 0 | 100 |

| Implemented in town or not | 1 = yes 0 = no | 0.847 | 0.361 | 0 | 1 | |

| Premium rate | % | 0.015 | 0.027 | 0 | 0.333 |

| OLS | IV | |||||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | ||

| Insured or not | 0.0344 | −0.392 *** | −0.141 * | −0.125 | −0.193 | −0.172 |

| (0.0316) | (0.0799) | (0.0799) | (0.0786) | (0.138) | (0.117) | |

| Plot quality | ||||||

| Medium | 0.0540 * | 0.0538 * | 0.0688 ** | 0.0434 | 0.0514 | |

| (0.0319) | (0.0308) | (0.0318) | (0.0311) | (0.0321) | ||

| Bad | 0.0858 * | 0.0896 * | 0.0986 * | 0.0783 | 0.0823 | |

| (0.0507) | (0.0511) | (0.0512) | (0.0507) | (0.0510) | ||

| Property right | −0.00392 | −0.0132 | −0.0120 | −0.00524 | −0.00727 | |

| (0.0307) | (0.0306) | (0.0318) | (0.0293) | (0.0309) | ||

| Manure | 0.0347 | −0.0111 | −0.00395 | 0.0264 | 0.0274 | |

| (0.0345) | (0.0332) | (0.0330) | (0.0353) | (0.0352) | ||

| Plot size | −0.0004 | 0.0006 | 0.0003 | 0.00003 | 0.00004 | |

| (0.00021) | (0.00021) | (0.0002) | (0.00022) | (0.00021) | ||

| Crop type | 0.298 *** | 0.262 *** | 0.282 *** | 0.314 *** | 0.313 *** | |

| (0.0549) | (0.0330) | (0.0359) | (0.0558) | (0.0566) | ||

| Farming years | 0.000343 | 0.000350 | −0.000113 | |||

| (0.00112) | (0.00109) | (0.00116) | ||||

| Gender | 0.165 | 0.232 * | 0.144 | |||

| (0.114) | (0.123) | (0.116) | ||||

| Education | −0.00721 | −0.00244 | −0.00750 * | |||

| (0.00448) | (0.00482) | (0.00455) | ||||

| Large farmer or not | −0.00616 | 0.0153 | 0.0193 | |||

| (0.0287) | (0.0305) | (0.0306) | ||||

| Rate of non-farm labor | 0.115 ** | 0.156 *** | 0.0997 ** | |||

| (0.0452) | (0.0483) | (0.0447) | ||||

| County dummy | Yes | No | No | No | Yes | Yes |

| Constant | 4.367 *** | 4.998 *** | 4.744 *** | 4.427 *** | 4.548 *** | 4.401 *** |

| (0.156) | (0.0313) | (0.0483) | (0.150) | (0.0969) | (0.159) | |

| Observations | 1707 | 1707 | 1707 | 1707 | 1707 | 1707 |

| R2 | 0.150 | 0.048 | 0.051 | 0.065 | 0.121 | 0.130 |

| Prob > chi2 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| F value in first stage | - | 407.45 | 63.81 | 45.93 | 44.77 | 42.12 |

| Over-identification test | - | 0.11 | 0.67 | 0.75 | 0.62 | 0.69 |

| Dependent Variables | Large-Scale Farmers | Small-Scale Farmers |

|---|---|---|

| Insured or not | −0.279 * | −0.102 |

| (0.147) | (0.283) | |

| Plot quality | ||

| Medium | 0.0182 | 0.0720 |

| (0.0447) | (0.0493) | |

| Bad | 0.152 * | 0.0180 |

| (0.0826) | (0.0716) | |

| Property right | 0.0166 | −0.0185 |

| (0.0435) | (0.0450) | |

| Manure | 0.00001 | −0.0023 |

| (0.00024) | (0.0019) | |

| Plot size | 0.184 *** | 0.405 *** |

| (0.0699) | (0.0833) | |

| Crop type | −0.110 * | 0.132 *** |

| (0.0604) | (0.0425) | |

| Farming years | −0.00115 | −0.000357 |

| (0.00169) | (0.00167) | |

| Gender | 0.0829 | 0.283 * |

| (0.199) | (0.151) | |

| Education | −0.000265 | −0.0195 *** |

| (0.00681) | (0.00669) | |

| Large farmer or not | −0.00421 | 0.175 *** |

| (0.0652) | (0.0625) | |

| Rate of non-farm labor | — | — |

| County dummy | Yes | Yes |

| Constant | 4.553 *** | 4.366 *** |

| (0.284) | (0.189) | |

| Observations | 751 | 956 |

| R2 | 0.133 | 0.173 |

| Prob > chi2 | 0.000 | 0.000 |

| All | Large-Scale Farmers | Small-Scale Farmers | ||

|---|---|---|---|---|

| (1) | (2) | (3) | ||

| Two-stage estimation | Insured or not | −0.155 | −0.282 * | −0.105 |

| (0.124) | (0.151) | (0.292) | ||

| Observations | 1707 | 751 | 956 | |

| R2 | 0.150 | 0.160 | 0.186 | |

| Prob > F | 0.000 | 0.000 | 0.000 | |

| Bootstrap-S.E.-adjusted two-stage estimation | Insured or not | −0.155 | −0.282 * | −0.105 |

| (0.125) | (0.147) | (0.290) | ||

| Observations | 1707 | 751 | 956 | |

| R2 | 0.150 | 0.160 | 0.186 | |

| Prob > F | 0.000 | 0.000 | 0.000 | |

| Fertilizer quantity as the dependent variable | Insured or not | −0.120 | −0.314 ** | 0.0504 |

| (0.107) | (0.158) | (0.266) | ||

| Observations | 1707 | 751 | 956 | |

| R2 | 0.138 | 0.133 | 0.204 | |

| Prob > F | 0.000 | 0.000 | 0.000 | |

| Controls | Plot | Yes | Yes | Yes |

| Farm | Yes | Yes | Yes | |

| County dummy | Yes | Yes | Yes |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, C.; Lyu, K.; Zhang, C. The Impact of Crop Insurance on Fertilizer Use: Evidence from Grain Producers in China. Agriculture 2024, 14, 420. https://doi.org/10.3390/agriculture14030420

Zhang C, Lyu K, Zhang C. The Impact of Crop Insurance on Fertilizer Use: Evidence from Grain Producers in China. Agriculture. 2024; 14(3):420. https://doi.org/10.3390/agriculture14030420

Chicago/Turabian StyleZhang, Chongshang, Kaiyu Lyu, and Chi Zhang. 2024. "The Impact of Crop Insurance on Fertilizer Use: Evidence from Grain Producers in China" Agriculture 14, no. 3: 420. https://doi.org/10.3390/agriculture14030420

APA StyleZhang, C., Lyu, K., & Zhang, C. (2024). The Impact of Crop Insurance on Fertilizer Use: Evidence from Grain Producers in China. Agriculture, 14(3), 420. https://doi.org/10.3390/agriculture14030420