Research on the Impact of Digital Green Finance on Agricultural Green Total Factor Productivity: Evidence from China

Abstract

:1. Introduction

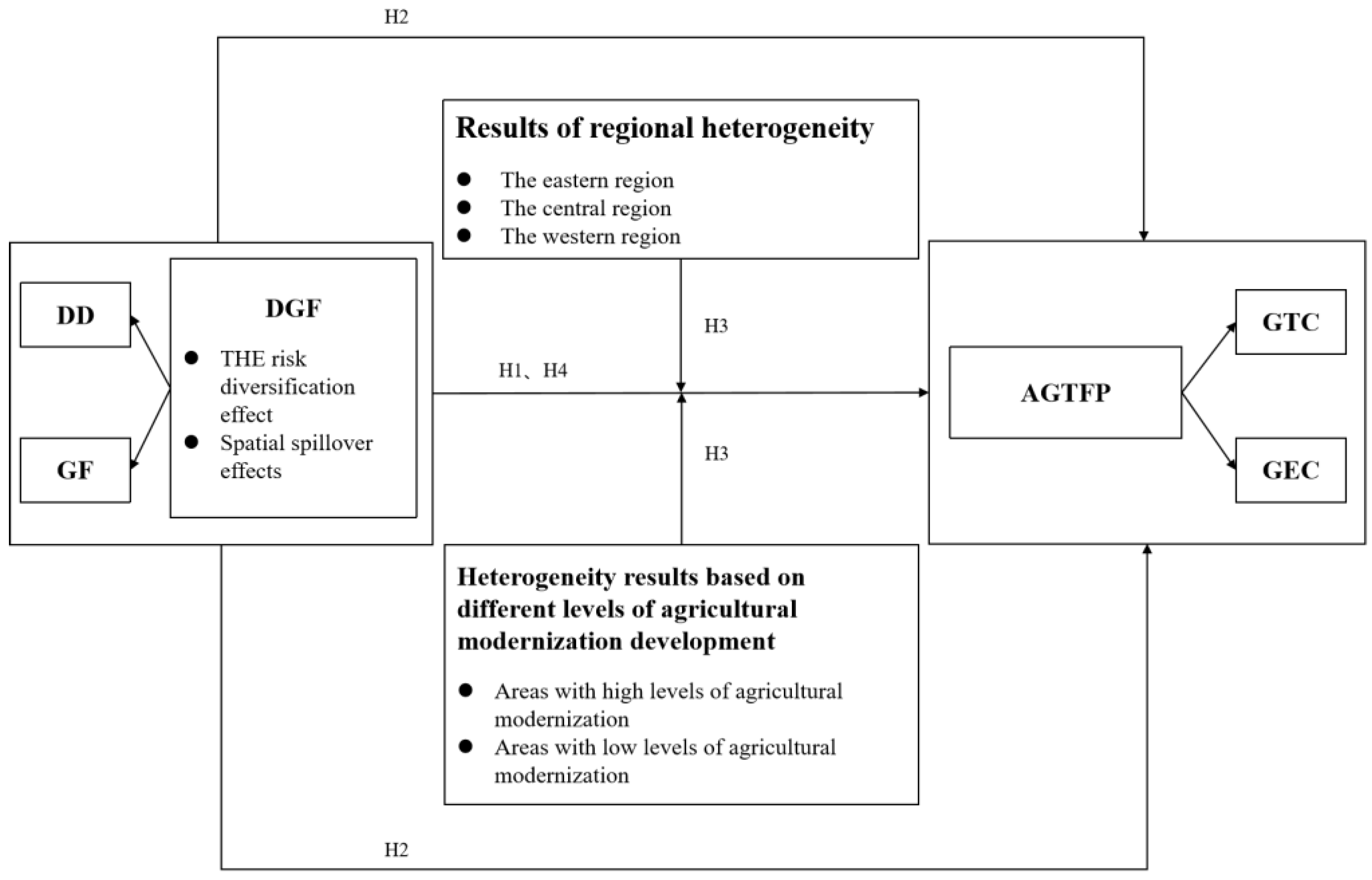

2. Theoretical Framework and Research Hypothesis

2.1. Theoretical Framework of DGF on AGTFP

2.2. The Direct Effect of DGF on AGTFP

2.3. The Impact Mechanism of DGF on AGTFP

2.4. Spatial Heterogeneity of DGF on AGTFP

2.5. Spatial Spillover Effects of DGF on AGTFP

3. Research Design

3.1. Methods

3.1.1. Panel Data Model

3.1.2. Quantile Model

3.1.3. Spatial Econometric Model

3.2. Measurement of Main Variables

3.2.1. Measurement of DGF

3.2.2. Measurement of AGTFP

3.2.3. Control Variables

3.3. Data Source and Descriptive Statistics

4. Empirical Results and Analysis

4.1. Baseline Effect Analysis

4.1.1. Baseline Regression Results

4.1.2. Impact Mechanism Analysis

4.2. Heterogeneity Analysis

4.3. Spatial Spillover Effect Analysis

4.3.1. Spatial Autocorrelation Analysis

4.3.2. Selection of Spatial Econometric Models

4.3.3. Spatial Regression Results Analysis

4.4. Robustness Test

5. Discussion

6. Conclusions and Policy Implications

6.1. Conclusions

6.2. Policy Implications

7. Limitations

Author Contributions

Funding

Institutional Review Board Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Yu, X. Promoting Agriculture Green Development to realize the great rejuvenation of the Chinese nation. Front. Agric. Sci. Eng. 2020, 7, 119–120. [Google Scholar] [CrossRef]

- Wang, B.; Liu, G. Energy Conservation and Emission Reduction and China’s Green Economic Growth—Based on a Total Factor Productivity Perspective. China Ind. Econ. 2015, 57–69. [Google Scholar] [CrossRef]

- Fang, Y.; Shao, Z. Whether Green Finance Can Effectively Moderate the Green Technology Innovation Effect of Heterogeneous Environmental Regulation. Int. J. Environ. Res. Public Health 2022, 19, 3646. [Google Scholar] [CrossRef] [PubMed]

- Wang, L.; Tang, J.; Tang, M.; Su, M.; Guo, L. Scale of operation, financial support, and agricultural green total factor productivity: Evidence from China. Int. J. Environ. Res. Public Health 2022, 19, 9043. [Google Scholar] [CrossRef] [PubMed]

- Jiakui, C.; Abbas, J.; Najam, H.; Liu, J.; Abbas, J. Green technological innovation, green finance, and financial development and their role in green total factor productivity: Empirical insights from China. J. Clean. Prod. 2023, 382, 135131. [Google Scholar] [CrossRef]

- Cheng, Z.; Kai, Z.; Zhu, S. Does green finance regulation improve renewable energy utilization? Evidence from energy consumption efficiency. Renew. Energy 2023, 208, 63–75. [Google Scholar] [CrossRef]

- Lan, J.; Wei, Y.; Guo, J.; Li, Q.; Liu, Z. The effect of green finance on industrial pollution emissions: Evidence from China. Res. Policy 2023, 80, 103156. [Google Scholar] [CrossRef]

- Huang, Y.; Chen, C.; Lei, L.; Zhang, Y. Impacts of green finance on green innovation: A spatial and nonlinear perspective. J. Clean. Prod. 2022, 365, 132548. [Google Scholar] [CrossRef]

- Lee, C.-C.; Lee, C.-C. How does green finance affect green total factor productivity? Evidence from China. Energy Econ. 2022, 107, 105863. [Google Scholar] [CrossRef]

- Wang, H.; Cui, H.; Zhao, Q. Effect of green technology innovation on green total factor productivity in China: Evidence from spatial durbin model analysis. J. Clean. Prod. 2021, 288, 125624. [Google Scholar] [CrossRef]

- Liu, Y.; Lei, J.; Zhang, Y. A study on the sustainable relationship among the green finance, environment regulation and green-total-factor productivity in China. Sustainability 2021, 13, 11926. [Google Scholar] [CrossRef]

- Kong, Q.; Shen, C.; Li, R.; Wong, Z. High-speed railway opening and urban green productivity in the post-COVID-19: Evidence from green finance. Glob. Financ. J. 2021, 49, 100645. [Google Scholar] [CrossRef] [PubMed]

- Li, H.; Lin, Q.; Wang, Y.; Mao, S. Can Digital Finance Improve China’s Agricultural Green Total Factor Productivity? Agriculture 2023, 13, 1429. [Google Scholar] [CrossRef]

- Ren, X.; Zeng, G.; Gozgor, G. How does digital finance affect industrial structure upgrading? Evidence from Chinese prefecture-level cities. J. Environ. Manag. 2023, 330, 117125. [Google Scholar] [CrossRef] [PubMed]

- Li, X.; Shao, X.; Chang, T.; Albu, L.L. Does digital finance promote the green innovation of China’s listed companies? Energy Econ. 2022, 114, 106254. [Google Scholar] [CrossRef]

- Lin, B.; Ma, R. How does digital finance influence green technology innovation in China? Evidence from the financing constraints perspective. J. Environ. Manag. 2022, 320, 115833. [Google Scholar] [CrossRef] [PubMed]

- Sun, Y.; Tang, X. The impact of digital inclusive finance on sustainable economic growth in China. Financ. Res. Lett. 2022, 50, 103234. [Google Scholar] [CrossRef]

- Hu, J. Synergistic effect of pollution reduction and carbon emission mitigation in the digital economy. J. Environ. Manag. 2023, 337, 117755. [Google Scholar] [CrossRef] [PubMed]

- Du, M.; Hou, Y.; Zhou, Q.; Ren, S. Going green in China: How does digital finance affect environmental pollution? Mechanism discussion and empirical test. Environ. Sci. Pollut. Res. 2022, 29, 89996–90010. [Google Scholar] [CrossRef]

- Ozili, P.K. Digital finance, green finance and social finance: Is there a link? Financ. Internet Q. 2021, 17, 1–7. [Google Scholar] [CrossRef]

- Liu, Y.; Luan, L.; Wu, W.; Zhang, Z.; Hsu, Y. Can digital financial inclusion promote China’s economic growth? Int. Rev. Financ. Anal. 2021, 78, 101889. [Google Scholar] [CrossRef]

- Ahmad, M.; Majeed, A.; Khan, M.A.; Sohaib, M.; Shehzad, K. Digital financial inclusion and economic growth: Provincial data analysis of China. China Econ. J. 2021, 14, 291–310. [Google Scholar] [CrossRef]

- Liu, Y.; Chen, L. The impact of digital finance on green innovation: Resource effect and information effect. Environ. Sci. Pollut. Res. 2022, 29, 86771–86795. [Google Scholar] [CrossRef] [PubMed]

- Yang, C.; Masron, T.A. Impact of digital finance on energy efficiency in the context of green sustainable development. Sustainability 2022, 14, 11250. [Google Scholar] [CrossRef]

- Cao, S.; Nie, L.; Sun, H.; Sun, W.; Taghizadeh-Hesary, F. Digital finance, green technological innovation and energy-environmental performance: Evidence from China’s regional economies. J. Clean. Prod. 2021, 327, 129458. [Google Scholar] [CrossRef]

- Qin, L.; Liu, S.; Wang, Y.; Gu, H.; Shen, T. Spatial coupling coordination and interactive response between green finance and green total factor productivity: Geographical analysis based on Chinese provinces, 2010–2020. Environ. Sci. Pollut. Res. 2024, 31, 20001–20016. [Google Scholar] [CrossRef]

- Laurett, R.; Paço, A.; Mainardes, E.W. Antecedents and consequences of sustainable development in agriculture and the moderator role of the barriers: Proposal and test of a structural model. J. Rural Stud. 2021, 86, 270–281. [Google Scholar] [CrossRef]

- Liu, D.; Zhu, X.; Wang, Y. China’s agricultural green total factor productivity based on carbon emission: An analysis of evolution trend and influencing factors. J. Clean. Prod. 2021, 278, 123692. [Google Scholar] [CrossRef]

- Sheng, Y.; Tian, X.; Qiao, W.; Peng, C. Measuring agricultural total factor productivity in China: Pattern and drivers over the period of 1978–2016. Aust. J. Agric. Resour. Econ. 2020, 64, 82–103. [Google Scholar] [CrossRef]

- Liu, J.; Dong, C.; Liu, S.; Rahman, S.; Sriboonchitta, S. Sources of total-factor productivity and efficiency changes in China’s agriculture. Agriculture 2020, 10, 279. [Google Scholar] [CrossRef]

- Qin, L.; Liu, S.; Hou, Y.; Zhang, Y.; Wu, D.; Yan, D. The spatial spillover effect and mediating effect of green credit on agricultural carbon emissions: Evidence from China. Front. Earth Sci. 2023, 10, 1037776. [Google Scholar] [CrossRef]

- Guo, J.; Zhang, K.; Liu, K. Exploring the mechanism of the impact of green finance and digital economy on China’s green total factor productivity. Int. J. Environ. Res. Public Health 2022, 19, 16303. [Google Scholar] [CrossRef]

- Li, G.; Jia, X.; Khan, A.A.; Khan, S.U.; Ali, M.A.S.; Luo, J. Does green finance promote agricultural green total factor productivity? Considering green credit, green investment, green securities, and carbon finance in China. Environ. Sci. Pollut. Res. 2023, 30, 36663–36679. [Google Scholar] [CrossRef]

- Hu, Y.; Liu, C.; Peng, J. Financial inclusion and agricultural total factor productivity growth in China. Econ. Model. 2021, 96, 68–82. [Google Scholar] [CrossRef]

- Shen, Z.; Wang, S.; Boussemart, J.-P.; Hao, Y. Digital transition and green growth in Chinese agriculture. Technol. Forecast. Soc. Change 2022, 181, 121742. [Google Scholar] [CrossRef]

- Chen, T.; Rizwan, M.; Abbas, A. Exploring the role of agricultural services in production efficiency in Chinese agriculture: A case of the socialized agricultural service system. Land 2022, 11, 347. [Google Scholar] [CrossRef]

- Zhou, X.; Chen, T.; Zhang, B. Research on the impact of digital agriculture development on agricultural green total factor productivity. Land 2023, 12, 195. [Google Scholar] [CrossRef]

- Liu, X.; Wang, X.; Yu, W. Opportunity or Challenge? Research on the Influence of Digital Finance on Digital Transformation of Agribusiness. Sustainability 2023, 15, 1072. [Google Scholar] [CrossRef]

- Zhu, Y.; Zhang, J. Can Green Finance Contribute to the Construction of Rural Ecological Civilization? J. Southwest Univ. Soc. Sci. Ed. 2023, 49, 103–115. [Google Scholar] [CrossRef]

- Wen, T.; He, Q. Pushing Forward Rural Revitalization on All Fronts and Deepening Rural Financial Reform and Innovation: The Logical Conversion, Breakthroughs and Path Selection. Chin. Rural Econ. 2023, 93–114. [Google Scholar] [CrossRef]

- Ding, Q.; Huang, J.; Chen, J. Does digital finance matter for corporate green investment? Evidence from heavily polluting industries in China. Energy Econ. 2023, 117, 106476. [Google Scholar] [CrossRef]

- Zhang, S.; Wu, Z.; Wang, Y.; Hao, Y. Fostering green development with green finance: An empirical study on the environmental effect of green credit policy in China. J. Environ. Manag. 2021, 296, 113159. [Google Scholar] [CrossRef] [PubMed]

- Zheng, W.; Zhang, L.; Hu, J. Green credit, carbon emission and high quality development of green economy in China. Energy Rep. 2022, 8, 12215–12226. [Google Scholar] [CrossRef]

- Lv, C.; Fan, J.; Lee, C.-C. Can green credit policies improve corporate green production efficiency? J. Clean. Prod. 2023, 397, 136573. [Google Scholar] [CrossRef]

- Hong, M.; Li, Z.; Drakeford, B. Do the green credit guidelines affect corporate green technology innovation? Empirical research from China. Int. J. Environ. Res. Public Health 2021, 18, 1682. [Google Scholar] [CrossRef] [PubMed]

- Zhang, M.; Liu, Y. Influence of digital finance and green technology innovation on China’s carbon emission efficiency: Empirical analysis based on spatial metrology. Sci. Total Environ. 2022, 838, 156463. [Google Scholar] [CrossRef]

- Xu, J.; She, S.; Gao, P.; Sun, Y. Role of green finance in resource efficiency and green economic growth. Resour. Policy 2023, 81, 103349. [Google Scholar] [CrossRef]

- Ouyang, H.; Guan, C.; Yu, B. Green finance, natural resources, and economic growth: Theory analysis and empirical research. Resour. Policy 2023, 83, 103604. [Google Scholar] [CrossRef]

- Li, Y.; Zhou, H. Study on the Spatial Effect and Heterogeneity of Green Finance Development on the Transformation and Upgrading of Industrial Structure: Interpretation Based on spatial Durbin Model. J. Southwest Univ. Nat. Sci. Ed. 2023, 45, 164–174. [Google Scholar] [CrossRef]

- Ma, D.; Zhu, Q. Innovation in emerging economies: Research on the digital economy driving high-quality green development. J. Bus. Res. 2022, 145, 801–813. [Google Scholar] [CrossRef]

- Li, Z.; Chen, H.; Mo, B. Can digital finance promote urban innovation? Evidence from China. Borsa Istanb. Rev. 2023, 23, 285–296. [Google Scholar] [CrossRef]

- Chen, C.; Ye, A. Heterogeneous effects of ICT across multiple economic development in Chinese cities: A spatial quantile regression model. Sustainability 2021, 13, 954. [Google Scholar] [CrossRef]

- Lv, C.; Bian, B.; Lee, C.-C.; He, Z. Regional gap and the trend of green finance development in China. Energy Econ. 2021, 102, 105476. [Google Scholar] [CrossRef]

- Qiang, C.; Xu, W. Green Finance Have an Effect on the Economic High-Quality Development from the perspective of Space. Jianghan Trib. 2022, 6, 21–28. [Google Scholar] [CrossRef]

- Wang, B.; Wang, Y.; Cheng, X.; Wang, J. Green finance, energy structure, and environmental pollution: Evidence from a spatial econometric approach. Environ. Sci. Pollut. Res. 2023, 30, 72867–72883. [Google Scholar] [CrossRef]

- Lijun, M.; Ye, A. Influence and spatial spillover effects of the digital economy on the high-quality development of the tourism industry. Prog. Geogr. 2023, 42, 2296–2308. [Google Scholar]

- Li, T.; Lin, H. Regional Green Finance, Space Spillovers and High-quality Economic Development. Inq. Into Econ. Issues 2023, 4, 157–174. [Google Scholar]

- Xie, D.; Hu, S.; Bao, Y. Can Green Finance Improve China’s Urban Green Total Factor Productivity: Based on Data from 285 Cities in China. J. China Univ. Geosci. Soc. Sci. Ed. 2023, 23, 122–137. [Google Scholar] [CrossRef]

- Dong, R.; Wang, S.; Baloch, M.A. Do green finance and green innovation foster environmental sustainability in China? Evidence from a quantile autoregressive-distributed lag model. Environ. Dev. Sustain. 2023, 1–23. [Google Scholar] [CrossRef]

- Xu, G.; Chang, H.; Yang, H.; Schwarz, P. The influence of finance on China’s green development: An empirical study based on quantile regression with province-level panel data. Environ. Sci. Pollut. Res. 2022, 29, 71033–71046. [Google Scholar] [CrossRef]

- Qin, L.; Liu, S.; Wang, Y.; Gu, H.; Shen, T. Regional differences, dynamic evolution, and spatial–temporal convergence of green finance development level in China. Environ. Sci. Pollut. Res. 2024, 31, 16342–16358. [Google Scholar] [CrossRef] [PubMed]

- Guo, F.; Wang, J.; Wang, F.; Kong, T.; Zhang, X.; Cheng, Z. Measuring China’s Digital Financial Inclusion: Index Compilation and Spatial Characteristics. China Econ. Q. 2020, 19, 1401–1418. [Google Scholar] [CrossRef]

- Shen, Y.; Guo, X.; Zhang, X. Digital financial inclusion, land transfer, and agricultural green total factor productivity. Sustainability 2023, 15, 6436. [Google Scholar] [CrossRef]

- Ma, J.; Meng, H.; Shao, D.; Zhu, Y. Green Finance, Inclusive Finance and Green Agriculture Development. Financ. Forum 2021, 26, 3–8+20. [Google Scholar] [CrossRef]

- Zhang, T. Can green finance policies affect corporate financing? Evidence from China’s green finance innovation and reform pilot zones. J. Clean. Prod. 2023, 419, 138289. [Google Scholar] [CrossRef]

- Li, X.; Liu, Y.; Song, T. Calculation of the Green Development Index. Soc. Sci. China 2014, 6, 69–95+207–208. [Google Scholar]

- Wang, F.; Du, L.; Tian, M. Does agricultural credit input promote agricultural green total factor productivity? Evidence from spatial panel data of 30 provinces in China. Int. J. Environ. Res. Public Health 2022, 20, 529. [Google Scholar] [CrossRef] [PubMed]

- Yang, Y.; Ma, H.; Wu, G. Agricultural green total factor productivity under the distortion of the factor market in China. Sustainability 2022, 14, 9309. [Google Scholar] [CrossRef]

- Yin, Z.; Sun, X.; Xing, M. Research on the impact of green finance development on green total factor productivity. Stat. Decis. 2021, 37, 139–144. [Google Scholar]

- Gao, Q.; Cheng, C.; Sun, G.; Li, J. The impact of digital inclusive finance on agricultural green total factor productivity: Evidence from China. Front. Ecol. Evol. 2022, 10, 905644. [Google Scholar] [CrossRef]

- Fang, L.; Hu, R.; Mao, H.; Chen, S. How crop insurance influences agricultural green total factor productivity: Evidence from Chinese farmers. J. Clean. Prod. 2021, 321, 128977. [Google Scholar] [CrossRef]

- Zeng, Z.; Yan, J.; Zhang, D.L.; Liao, S.W. The Assistance of Digital Economy to the Revitalization of Rural China. In Proceedings of the 4th International Conference on Social Sciences and Economic Development (ICSSED), AEIC Acad Exchange Informat Ctr, Wuhan, China, 15–17 March 2019; pp. 702–704. [Google Scholar]

- Yu, H.J.; Zhu, Q. Impact and mechanism of digital economy on China’s carbon emissions: From the perspective of spatial heterogeneity. Environ. Sci. Pollut. Res. 2023, 30, 9642–9657. [Google Scholar] [CrossRef] [PubMed]

- Yu, Z.; Liu, S.; Zhu, Z. Has the digital economy reduced carbon emissions?: Analysis based on panel data of 278 cities in China. Int. J. Environ. Res. Public Health 2022, 19, 11814. [Google Scholar] [CrossRef] [PubMed]

- Yu, H.Y.; Wang, J.C.; Xu, J.J.; Ding, B.H. Does digital economy agglomeration promote green economy efficiency? A spatial spillover and spatial heterogeneity perspective. Environ. Dev. Sustain. 2024. [Google Scholar] [CrossRef]

| Primary Indicator | Secondary Indicator | Metric Weights | Indicator Description |

|---|---|---|---|

| Degree of digitalization (41.41%) | Mobile | 20.58% | Proportion of mobile payments |

| Percentage of mobile payment amount | |||

| Affordable | 10.27% | Average loan interest rate of small and micro-operators | |

| Average personal loan interest rate | |||

| Credit transformation | 3.93% | Proportion of the number of Huabei payments | |

| Proportion of the payment amount of Huabei | |||

| Proportion of the number of sesame credit-free deposits | |||

| Proportion of sesame credit-free deposit amount | |||

| Facilitation | 6.63% | Proportion of the number of QR code payments made by users | |

| The proportion of the amount paid by the user’s QR code | |||

| Green finance (58.59%) | Green credit | 29.29% | Proportion of interest expenses in high-energy-consuming industries |

| Green credit balances | |||

| Green securities | 14.65% | Proportion of market value of environmental protection enterprises | |

| Proportion of market value of high-energy-consuming industries | |||

| Green insurance | 8.79% | Ratio of agricultural insurance scale | |

| Agricultural insurance loss ratio | |||

| Green investment | 5.86% | Proportion of investment in environmental pollution control | |

| Proportion of public expenditure on energy conservation and environmental protection |

| Variable Type | Variable | Indicator Description |

|---|---|---|

| Input variables | Labor input | Number of people employed in agriculture |

| Land input | Total sown area | |

| Energy inputs | Total power of agricultural machinery | |

| Water inputs | ||

| Agricultural inputs | Reduced amount of chemical fertilizer application | |

| Pesticide application rate | ||

| The amount of agricultural film used | ||

| Desired output variables | Gross Domestic Product | Gross agricultural output |

| Undesired output variables | Carbon emissions | Carbon emissions from agricultural production |

| Variable | Sample Size | Mean | Standard Deviation | Min | Max | VIF |

|---|---|---|---|---|---|---|

| AGTFP | 300 | 0.411 | 0.343 | 0.01 | 1.902 | —— |

| DGF | 300 | −0.688 | 0.312 | −1.995 | −0.0471 | 2.40 |

| UL | 300 | 0.59 | 0.122 | 0.35 | 0.896 | 3.02 |

| MD | 300 | 0.648 | 0.239 | 0.112 | 1.335 | 1.12 |

| HUM | 300 | 2.045 | 0.0778 | 1.766 | 2.275 | 1.72 |

| DA | 300 | 5.168 | 1.637 | 0 | 7.888 | 2.08 |

| FS | 300 | 6.521 | 0.706 | 4.519 | 7.902 | 1.84 |

| (1) | (2) | (3) | (4) | (5) | |

|---|---|---|---|---|---|

| AGTFP | AGTFP | AGTFP (0.1) | AGTFP (0.5) | AGTFP (0.9) | |

| DGF | 0.152 *** | 0.200 *** | 0.127 *** | 0.266 *** | 0.348 *** |

| [0.054] | (0.043) | (0.041) | (0.052) | (0.056) | |

| UL | 0.382 * | −3.432 *** | 0.0213 | 1.284 ** | 1.920 |

| [0.197] | (0.435) | (0.090) | (0.633) | (1.343) | |

| MD | 0.0363 | −0.0788 | −0.145 | 0.229 * | −0.0229 |

| [0.065] | (0.066) | (0.092) | (0.137) | (0.073) | |

| HUM | −0.0856 | −0.0666 | −0.0156 | −0.315 | −0.749 |

| [0.256] | (0.300) | (0.215) | (0.734) | (0.841) | |

| DA | −0.111 *** | −0.0528 *** | −0.0774 *** | −0.0503 ** | −0.115 *** |

| [0.011] | (0.009) | (0.007) | (0.020) | (0.039) | |

| FS | 0.355 *** | 0.177 *** | 0.309 *** | 0.455 ** | 0.370 *** |

| [0.022] | (0.057) | (0.028) | (0.214) | (0.111) | |

| _cons | −1.296 ** | 1.519 ** | |||

| [0.538] | (0.730) | ||||

| Province fixed | NO | YES | YES | YES | YES |

| Year fixed | NO | YES | YES | YES | YES |

| N | 300 | 300 | 300 | 300 | 300 |

| adj. R2 | 0.9004 |

| (1) | (2) | |

|---|---|---|

| AGTFP | AGTFP | |

| DD | 0.0466 | |

| (0.039) | ||

| GF | 0.285 *** | |

| (0.062) | ||

| UL | −3.483 *** | −3.364 *** |

| (0.469) | (0.437) | |

| MD | −0.0997 | −0.0882 |

| (0.069) | (0.066) | |

| HUM | 0.0838 | −0.0854 |

| (0.311) | (0.301) | |

| DA | −0.0501 *** | −0.0531 *** |

| (0.009) | (0.009) | |

| FS | 0.208 *** | 0.191 *** |

| (0.059) | (0.057) | |

| _cons | 0.672 | 1.530 ** |

| (0.800) | (0.732) | |

| Province fixed | YES | YES |

| Year fixed | YES | YES |

| N | 300 | 300 |

| adj. R2 | 0.8926 | 0.9001 |

| (1) | (2) | |

|---|---|---|

| GTC | GEC | |

| DGF | −0.103 | 0.303 *** |

| (0.063) | (0.072) | |

| UL | 0.837 | −4.269 *** |

| (0.639) | (0.726) | |

| MD | −0.0140 | −0.0658 |

| (0.097) | (0.111) | |

| HUM | 1.047 ** | −1.113 ** |

| (0.441) | (0.501) | |

| DA | −0.0273 ** | −0.0256 * |

| (0.013) | (0.015) | |

| FS | 0.0417 | 0.135 |

| (0.084) | (0.095) | |

| _cons | −2.754 ** | 4.272 *** |

| (1.074) | (1.219) | |

| Province fixed | YES | YES |

| Year fixed | YES | YES |

| N | 300 | 300 |

| adj. R2 | 0.8539 | 0.1901 |

| (1) | (2) | (3) | |

|---|---|---|---|

| AGTFP (The Eastern Region) | AGTFP (The Central Region) | AGTFP (The Western Region) | |

| DGF | 0.262 *** | 0.105 *** | 0.149 ** |

| [0.086] | [0.037] | [0.066] | |

| UL | −3.721 *** | 5.465 *** | 4.278 *** |

| [0.885] | [0.664] | [0.982] | |

| MD | −0.0824 | −0.0260 | −0.282 * |

| [0.117] | [0.039] | [0.167] | |

| HUM | −0.538 | −0.140 | 0.350 |

| [0.456] | [0.294] | [0.362] | |

| DA | −0.0388 ** | 0.00129 | −0.0205 |

| [0.016] | [0.008] | [0.018] | |

| FS | 0.387 *** | 0.206 *** | −0.113 |

| [0.104] | [0.067] | [0.115] | |

| _cons | 2.102 | −3.685 *** | −1.379 |

| [1.343] | [0.894] | [1.174] | |

| Province fixed | YES | YES | YES |

| Year fixed | YES | YES | YES |

| N | 110 | 90 | 100 |

| adj. R2 | 0.9342 | 0.9807 | 0.9292 |

| (1) | (2) | |

|---|---|---|

| AGTFP (Areas with High Levels of Agricultural Modernization) | AGTFP (Areas with Low Levels of Agricultural Modernization) | |

| DGF | 0.344 *** | 0.0981 ** |

| [0.098] | [0.046] | |

| UL | −4.623 *** | 1.373 |

| [1.196] | [0.865] | |

| MD | −0.269 | −0.00810 |

| [0.187] | [0.052] | |

| HUM | −0.757 | −0.0299 |

| [0.510] | [0.320] | |

| DA | −0.0739 *** | −0.0221 ** |

| [0.021] | [0.010] | |

| FS | 0.320 ** | −0.0422 |

| [0.135] | [0.082] | |

| _cons | 3.955 ** | 0.196 |

| [1.536] | [0.976] | |

| Province fixed | YES | YES |

| Year fixed | YES | YES |

| N | 100 | 200 |

| adj. R2 | 0.9136 | 0.9424 |

| Year | W1 | W2 | ||||

|---|---|---|---|---|---|---|

| Moran’s I | Z | p | Moran’s I | Z | p | |

| 2011 | 0.079 | 3.329 | 0.000 | 0.474 | 3.298 | 0.000 |

| 2012 | 0.064 | 2.814 | 0.002 | 0.437 | 2.957 | 0.002 |

| 2013 | 0.055 | 2.579 | 0.005 | 0.430 | 2.955 | 0.002 |

| 2014 | 0.057 | 2.632 | 0.040 | 0.293 | 2.080 | 0.019 |

| 2015 | 0.056 | 2.576 | 0.005 | 0.386 | 2.644 | 0.004 |

| 2016 | 0.080 | 3.202 | 0.001 | 0.429 | 2.840 | 0.002 |

| 2017 | 0.064 | 2.738 | 0.003 | 0.383 | 2.556 | 0.005 |

| 2018 | 0.116 | 4.235 | 0.000 | 0.515 | 3.400 | 0.000 |

| 2019 | 0.095 | 3.658 | 0.000 | 0.473 | 3.150 | 0.001 |

| 2020 | 0.098 | 3.748 | 0.000 | 0.504 | 3.345 | 0.000 |

| Year | W1 | W2 | ||||

|---|---|---|---|---|---|---|

| Moran’s I | Z | p | Moran’s I | Z | p | |

| 2011 | 0.054 | 2.623 | 0.004 | 0.370 | 2.621 | 0.004 |

| 2012 | 0.060 | 2.729 | 0.003 | 0.481 | 3.275 | 0.001 |

| 2013 | 0.053 | 2.581 | 0.005 | 0.457 | 3.195 | 0.001 |

| 2014 | 0.042 | 2.264 | 0.012 | 0.365 | 2.591 | 0.005 |

| 2015 | 0.064 | 2.927 | 0.002 | 0.484 | 3.411 | 0.000 |

| 2016 | 0.058 | 2.759 | 0.003 | 0.424 | 3.017 | 0.001 |

| 2017 | 0.059 | 2.913 | 0.002 | 0.450 | 3.308 | 0.000 |

| 2018 | 0.059 | 2.902 | 0.002 | 0.440 | 3.258 | 0.001 |

| 2019 | 0.045 | 2.461 | 0.007 | 0.411 | 3.049 | 0.001 |

| 2020 | 0.030 | 1.893 | 0.029 | 0.328 | 2.351 | 0.009 |

| The Type of Inspection | Statistics | p-Value |

|---|---|---|

| LM-Lag | 4.207 | 0.040 |

| Robust LM-Lag | 8.631 | 0.003 |

| LM-Error | 38.446 | 0.000 |

| Robust LM-Error | 42.870 | 0.000 |

| LR-SAR | 16.480 | 0.011 |

| LR-SEM | 26.620 | 0.000 |

| Wald-SAR | 16.770 | 0.010 |

| Wald-SEM | 27.560 | 0.000 |

| Hausman | 23.930 | 0.000 |

| (1) | (2) | (3) | |

|---|---|---|---|

| AGTFP (SAR) | AGTFP (SEM) | AGTFP (SDM) | |

| DGF | 0.172 *** | 0.174 *** | 0.150 *** |

| (0.038) | (0.039) | (0.038) | |

| UL | −3.042 *** | −3.211 *** | −2.237 *** |

| (0.390) | (0.429) | (0.490) | |

| MD | −0.0215 | −0.0104 | 0.0255 |

| (0.059) | (0.065) | (0.061) | |

| HUM | −0.00481 | −0.0422 | 0.167 |

| (0.264) | (0.265) | (0.263) | |

| DA | −0.0471 *** | −0.0499 *** | −0.0412 *** |

| (0.008) | (0.008) | (0.008) | |

| FS | 0.144 *** | 0.153 *** | 0.146 *** |

| (0.050) | (0.052) | (0.053) | |

| W× DGF | 0.0898 * | ||

| (0.054) | |||

| W × UL | −2.070 ** | ||

| (0.804) | |||

| W × MD | −0.168 ** | ||

| (0.066) | |||

| W × HUM | −0.0165 | ||

| (0.393) | |||

| W × DA | −0.0166 | ||

| (0.012) | |||

| W × FS | 0.0413 | ||

| (0.090) | |||

| rho | 0.269 *** | 0.225 *** | |

| (0.056) | (0.060) | ||

| lambda | 0.217 *** | ||

| (0.065) | |||

| Province fixed | YES | YES | YES |

| Year fixed | YES | YES | YES |

| N | 300 | 300 | 300 |

| sigma2_e | 0.00747 *** | 0.00781 *** | 0.00713 *** |

| (0.001) | (0.001) | (0.001) | |

| Log-L | 304.5509 | 299.4805 | 312.7888 |

| (1) | (2) | (3) | |

|---|---|---|---|

| AGTFP (Direct Effects) | AGTFP (Indirect Effects) | AGTFP (Total Effect) | |

| DGF | 0.162 *** | 0.147 ** | 0.310 *** |

| (0.040) | (0.067) | (0.085) | |

| UL | −2.491 *** | −3.095 *** | −5.587 *** |

| (0.445) | (0.906) | (0.878) | |

| MD | 0.0174 | −0.189 ** | −0.171 * |

| (0.058) | (0.075) | (0.095) | |

| HUM | 0.162 | 0.0351 | 0.197 |

| (0.265) | (0.476) | (0.610) | |

| DA | −0.0434 *** | −0.0311 ** | −0.0745 *** |

| (0.008) | (0.013) | (0.015) | |

| FS | 0.154 *** | 0.0965 | 0.251 * |

| (0.053) | (0.111) | (0.134) | |

| Province fixed | YES | YES | YES |

| Year fixed | YES | YES | YES |

| (1) | (2) | |

|---|---|---|

| AGTFP (Tail Reduction) | AGTFP (One Lag Period) | |

| DGF | 0.175 *** | |

| [0.051] | ||

| L.DGF | 0.150 *** | |

| [0.053] | ||

| UL | −3.361 *** | −3.259 *** |

| [0.448] | [0.508] | |

| MD | −0.0796 | −0.0239 |

| [0.067] | [0.071] | |

| HUM | −0.00857 | 0.000333 |

| [0.305] | [0.314] | |

| DA | −0.0528 *** | −0.0509 *** |

| [0.009] | [0.009] | |

| FS | 0.191 *** | 0.154 ** |

| [0.058] | [0.060] | |

| _cons | 1.245 * | 1.386 * |

| [0.738] | [0.782] | |

| Province fixed | YES | YES |

| Year fixed | YES | YES |

| N | 300 | 270 |

| adj. R2 | 0.8966 | 0.8868 |

| (1) | (2) | (3) | |

|---|---|---|---|

| AGTFP (One Lag Period) | AGTFP (Tail Reduction) | AGTFP (Replace the Adjacency Weight Matrix) | |

| L.DGF | 0.121 *** | ||

| (0.046) | |||

| DGF | 0.119 *** | 0.179 *** | |

| (0.045) | (0.038) | ||

| UL | −2.032 *** | −2.178 *** | −2.836 *** |

| (0.557) | (0.498) | (0.444) | |

| MD | 0.0639 | 0.0341 | −0.0465 |

| (0.065) | (0.062) | (0.059) | |

| HUM | 0.311 | 0.242 | 0.115 |

| (0.275) | (0.266) | (0.264) | |

| DA | −0.0397 *** | −0.0403 *** | −0.0465 *** |

| (0.009) | (0.008) | (0.008) | |

| FS | 0.114 ** | 0.164 *** | 0.146 *** |

| (0.056) | (0.053) | (0.051) | |

| rho | 0.174 *** | 0.238 *** | 0.256 *** |

| (0.065) | (0.059) | (0.067) | |

| sigma2_e | 0.00690 *** | 0.00730 *** | 0.00724 *** |

| (0.001) | (0.001) | (0.001) | |

| Province fixed | YES | YES | YES |

| Year fixed | YES | YES | YES |

| N | 270 | 300 | 300 |

| LOG-L | 287.1557 | 308.8637 | 311.2108 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Qin, L.; Zhang, Y.; Wang, Y.; Pan, X.; Xu, Z. Research on the Impact of Digital Green Finance on Agricultural Green Total Factor Productivity: Evidence from China. Agriculture 2024, 14, 1151. https://doi.org/10.3390/agriculture14071151

Qin L, Zhang Y, Wang Y, Pan X, Xu Z. Research on the Impact of Digital Green Finance on Agricultural Green Total Factor Productivity: Evidence from China. Agriculture. 2024; 14(7):1151. https://doi.org/10.3390/agriculture14071151

Chicago/Turabian StyleQin, Lingui, Yan Zhang, Yige Wang, Xinning Pan, and Zhe Xu. 2024. "Research on the Impact of Digital Green Finance on Agricultural Green Total Factor Productivity: Evidence from China" Agriculture 14, no. 7: 1151. https://doi.org/10.3390/agriculture14071151