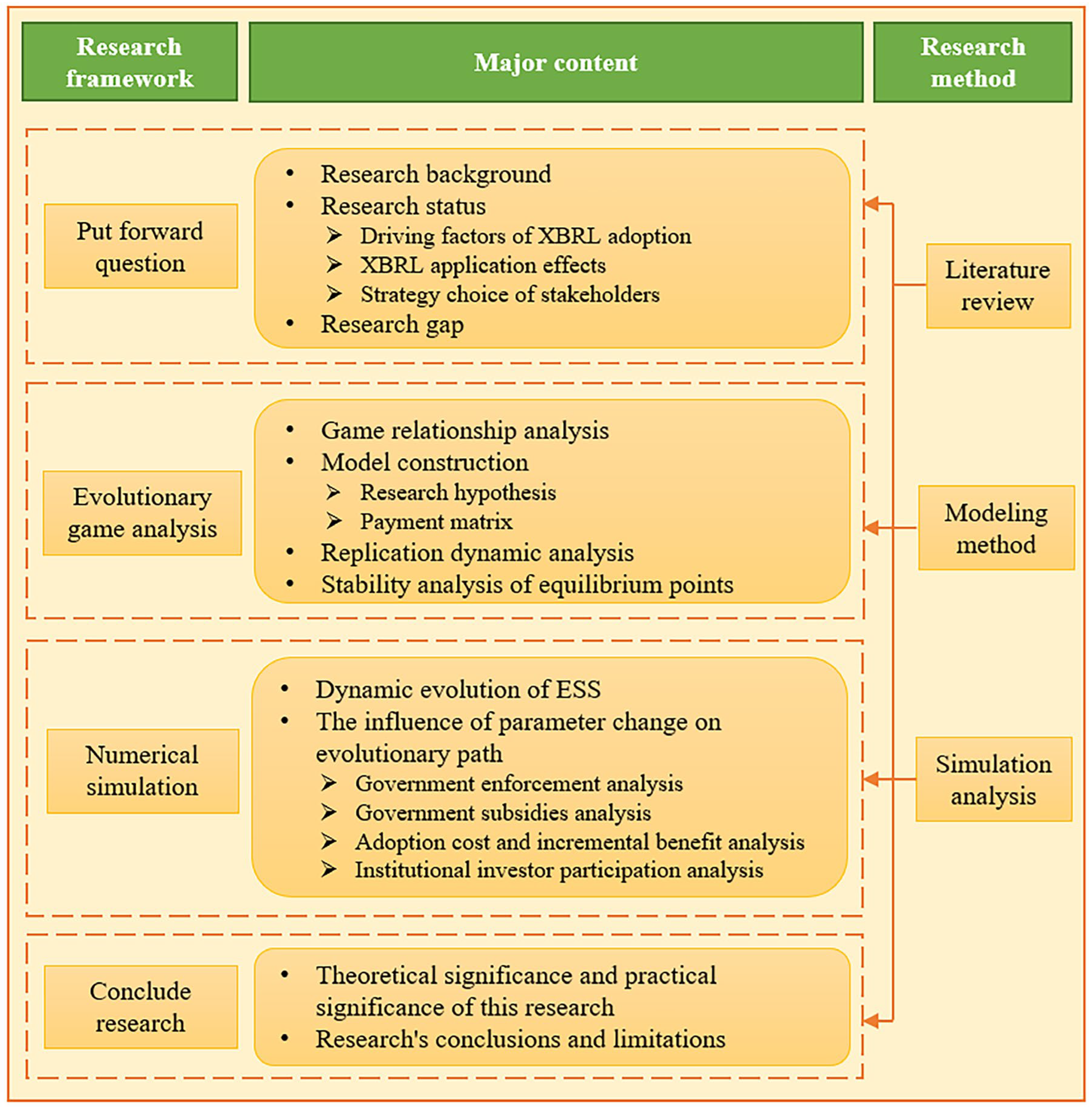

Extensible Business Reporting Language Technology Adoption and Diffusion—A Tripartite Evolutionary Game Perspective

Abstract

1. Introduction

1.1. Background of the Work

1.2. Motivation of the Work

1.3. Contributions of the Work

2. Literature Review

2.1. Driving Factors of XBRL Adoption

2.2. XBRL Application Effects

2.3. Strategy Choice of Stakeholders

2.4. Literature Review Summary

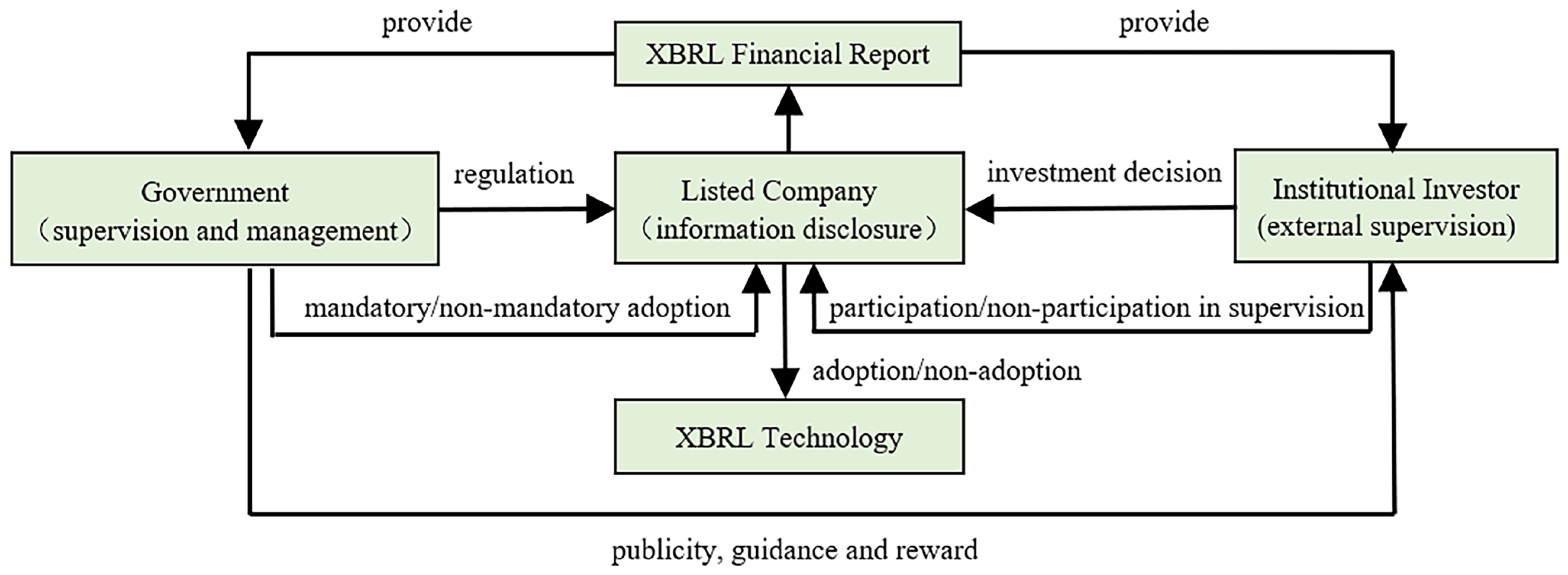

3. Model Construction

3.1. Relationship Definition

3.2. Basic Assumptions

3.3. Model Establishment

3.4. Dynamic Replication Analysis

3.4.1. Dynamic Replication Analysis of Governments

3.4.2. Replication Dynamic Analysis of Listed Enterprises

3.4.3. Replication Dynamic Analysis of Institutional Investors

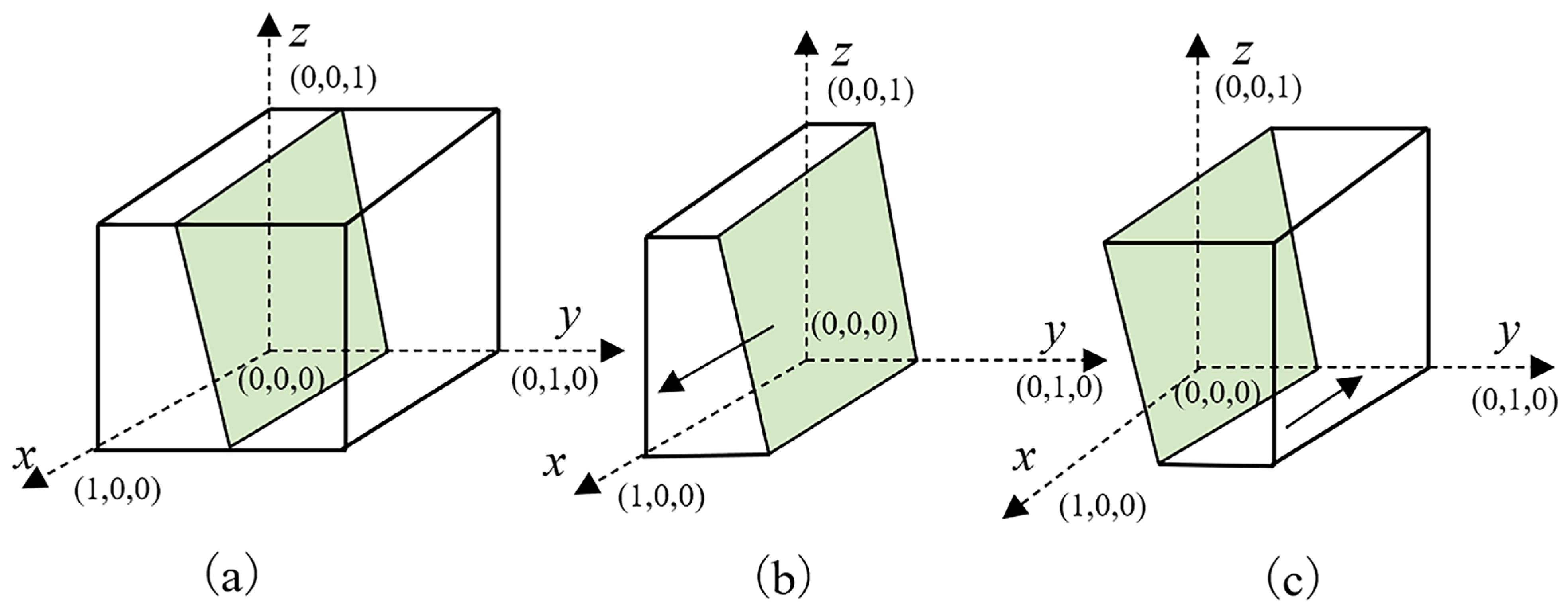

3.5. Stability Analysis of Equilibrium Points

4. Numerical Simulation and Results

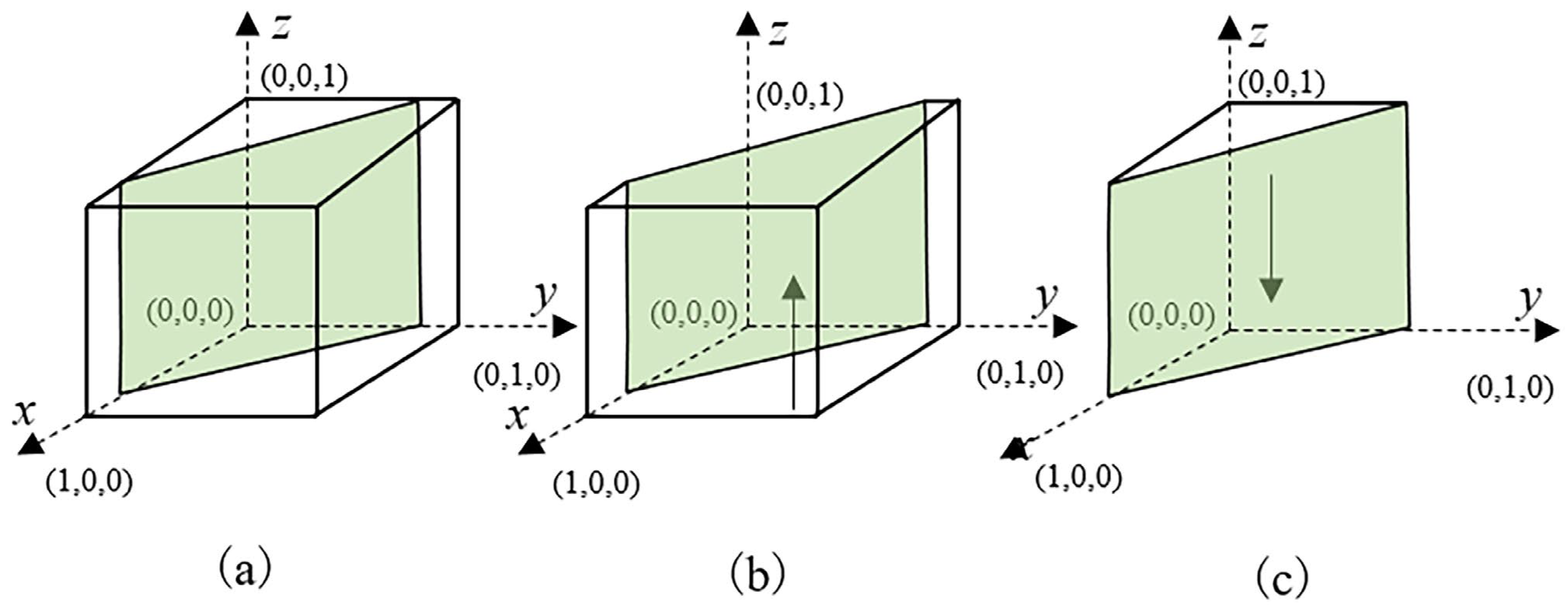

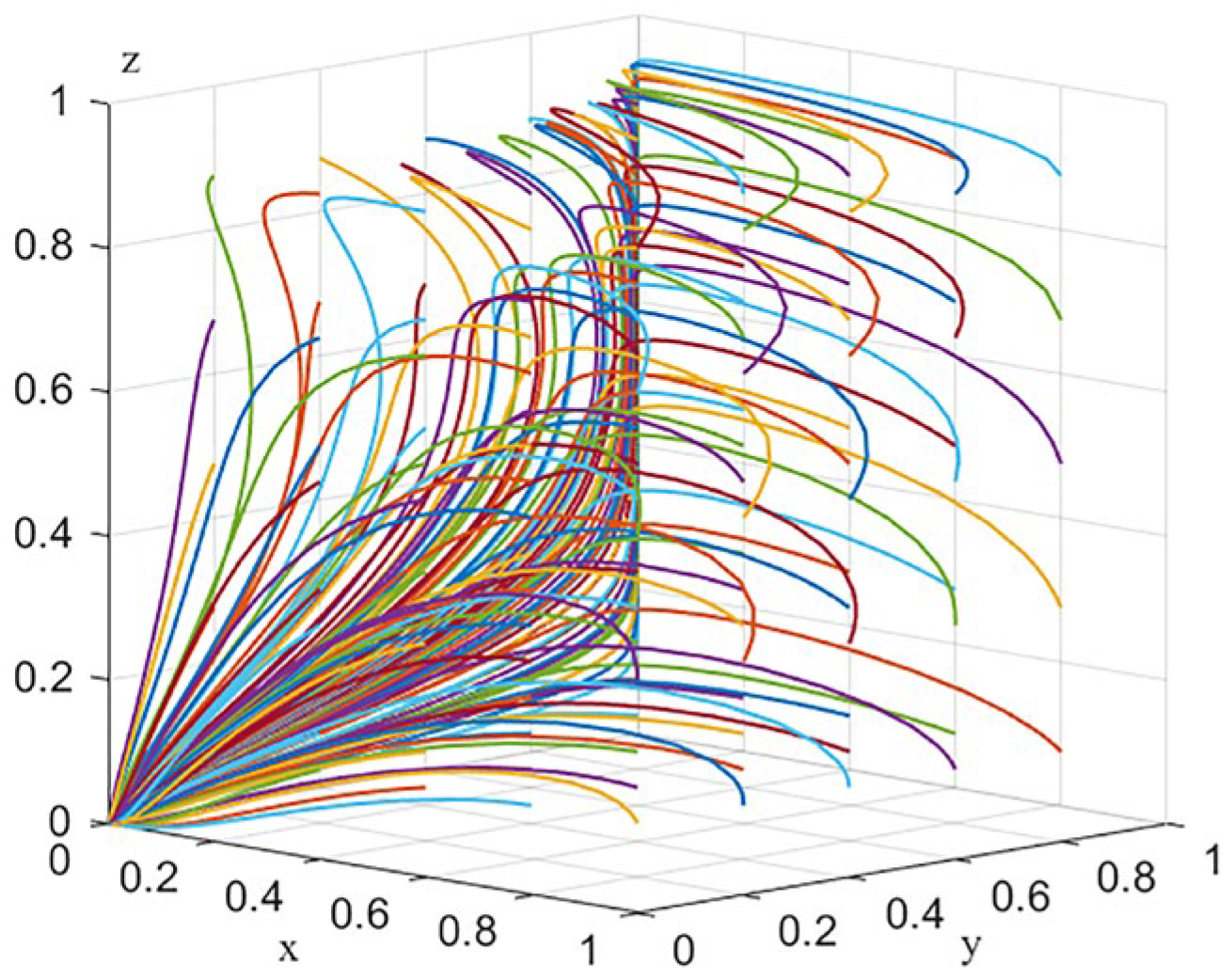

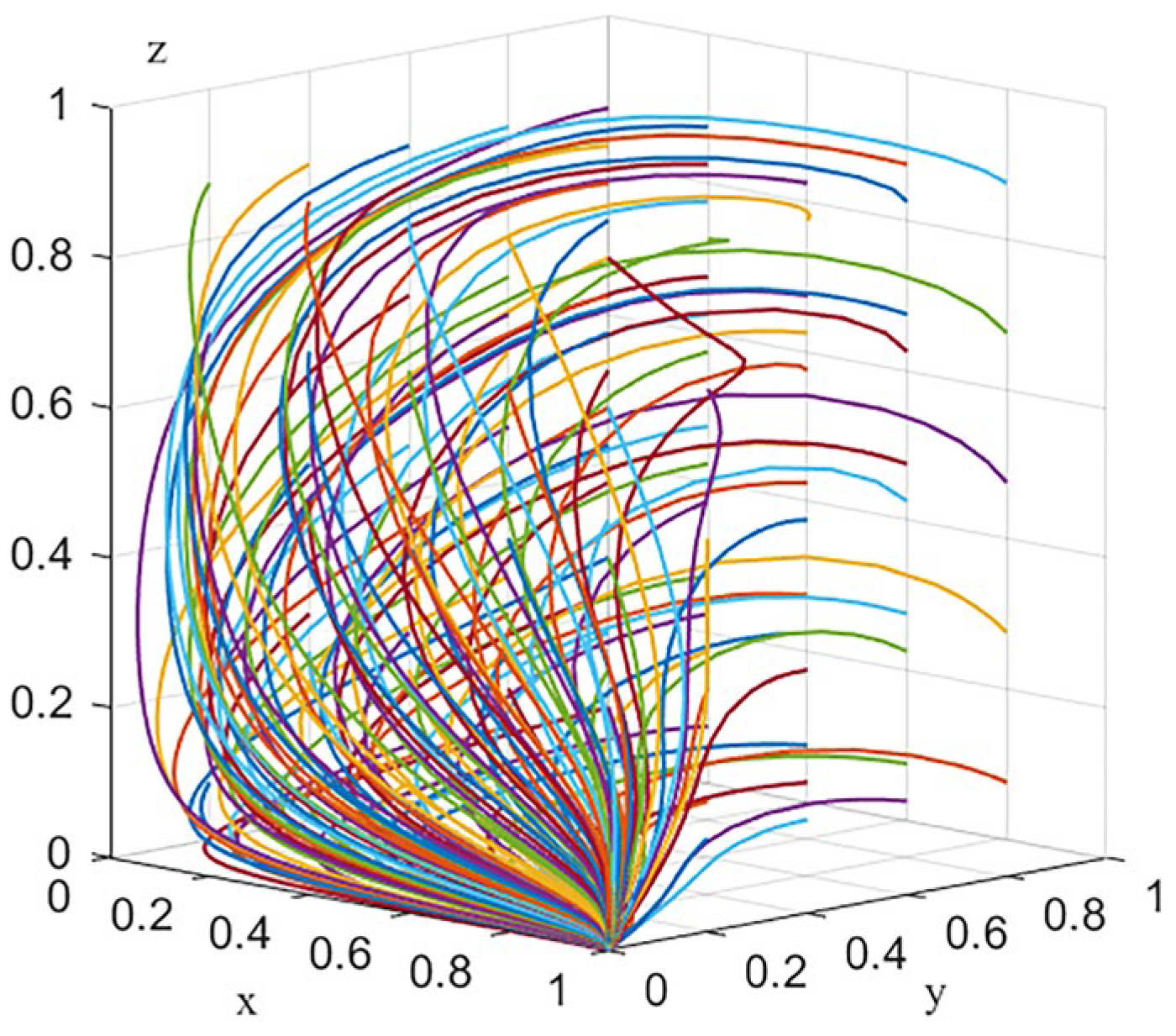

4.1. The Dynamic Evolution of ESS

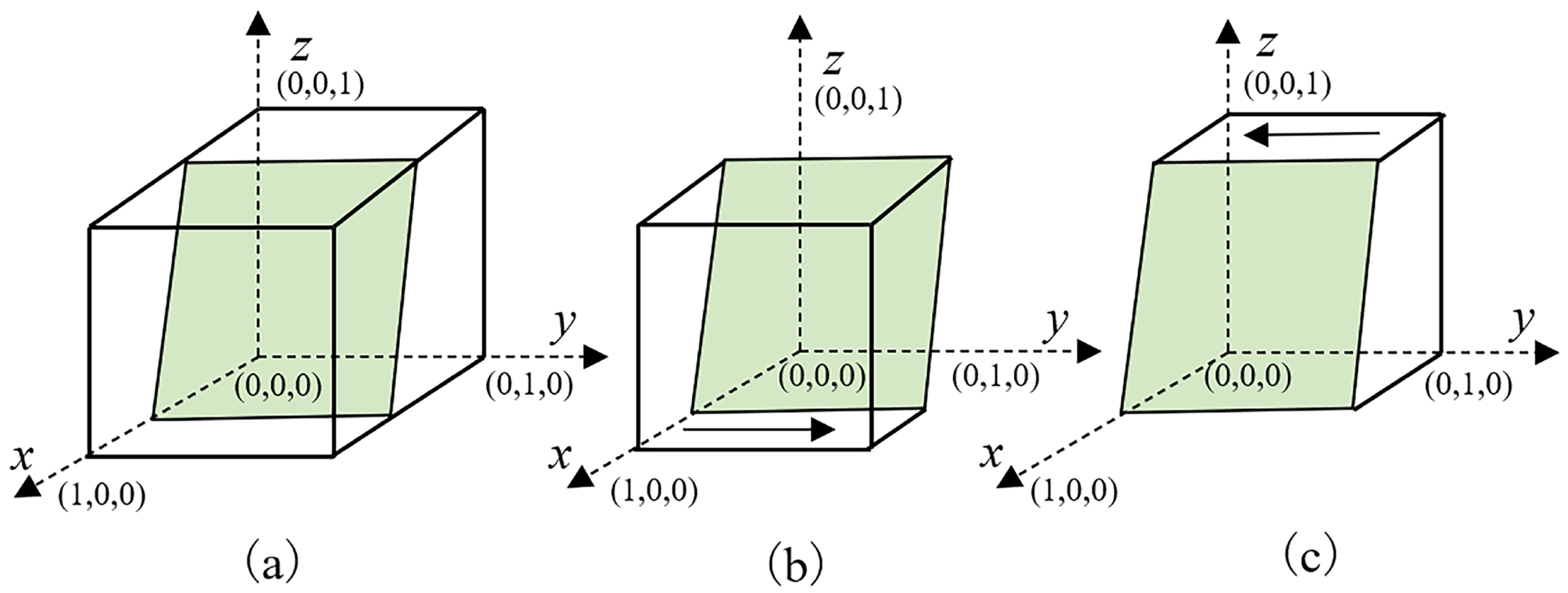

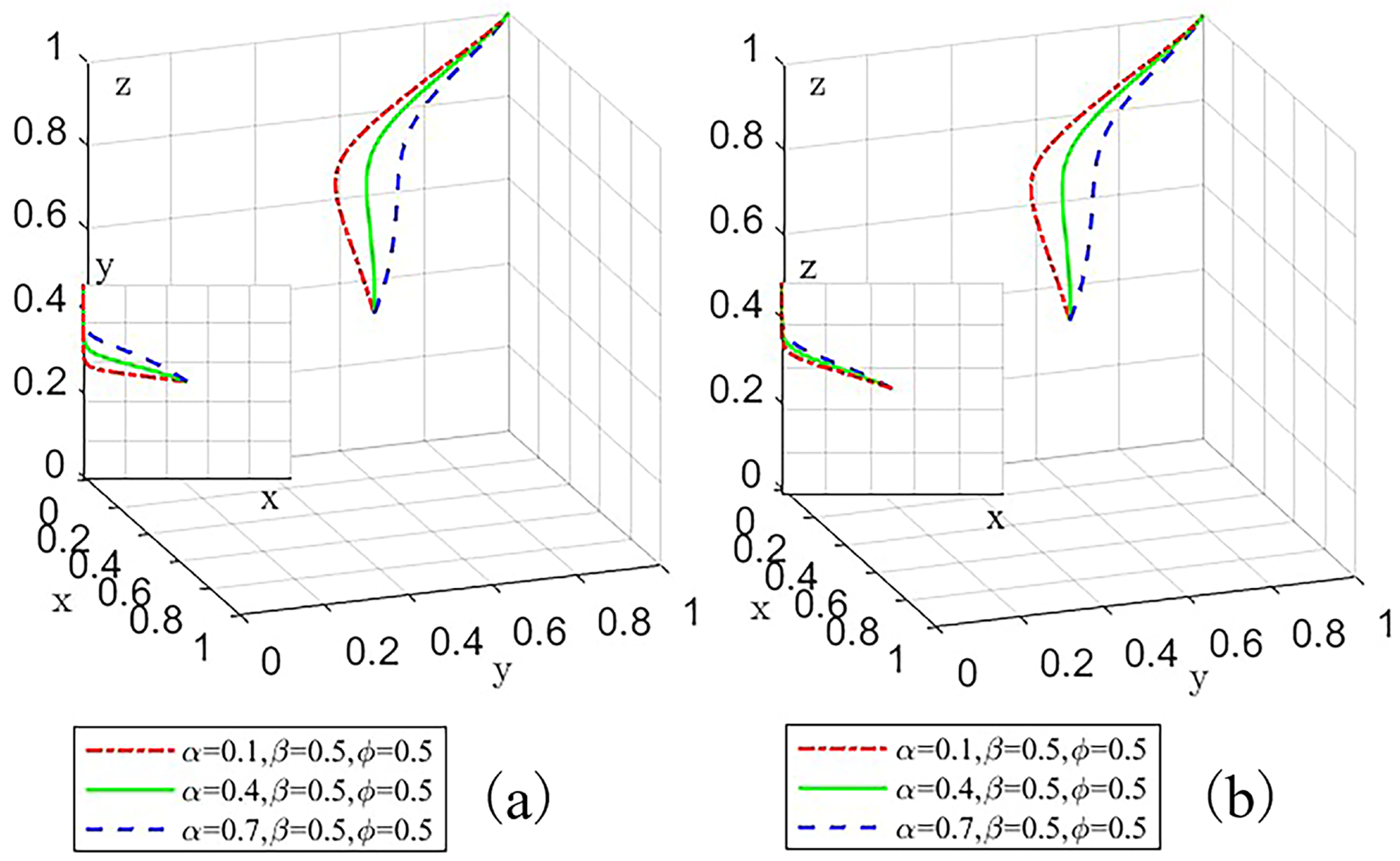

4.2. Government Enforcement Analysis

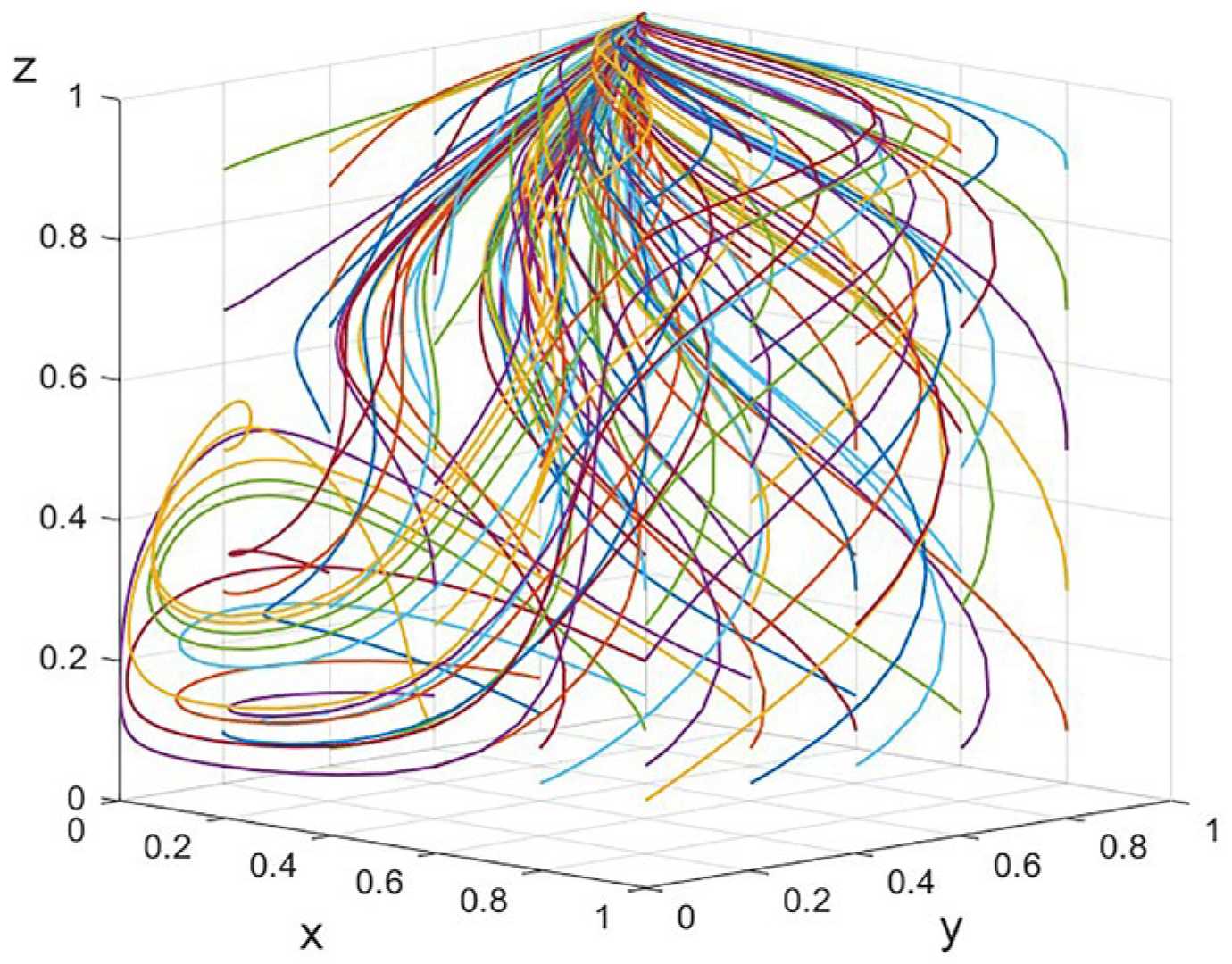

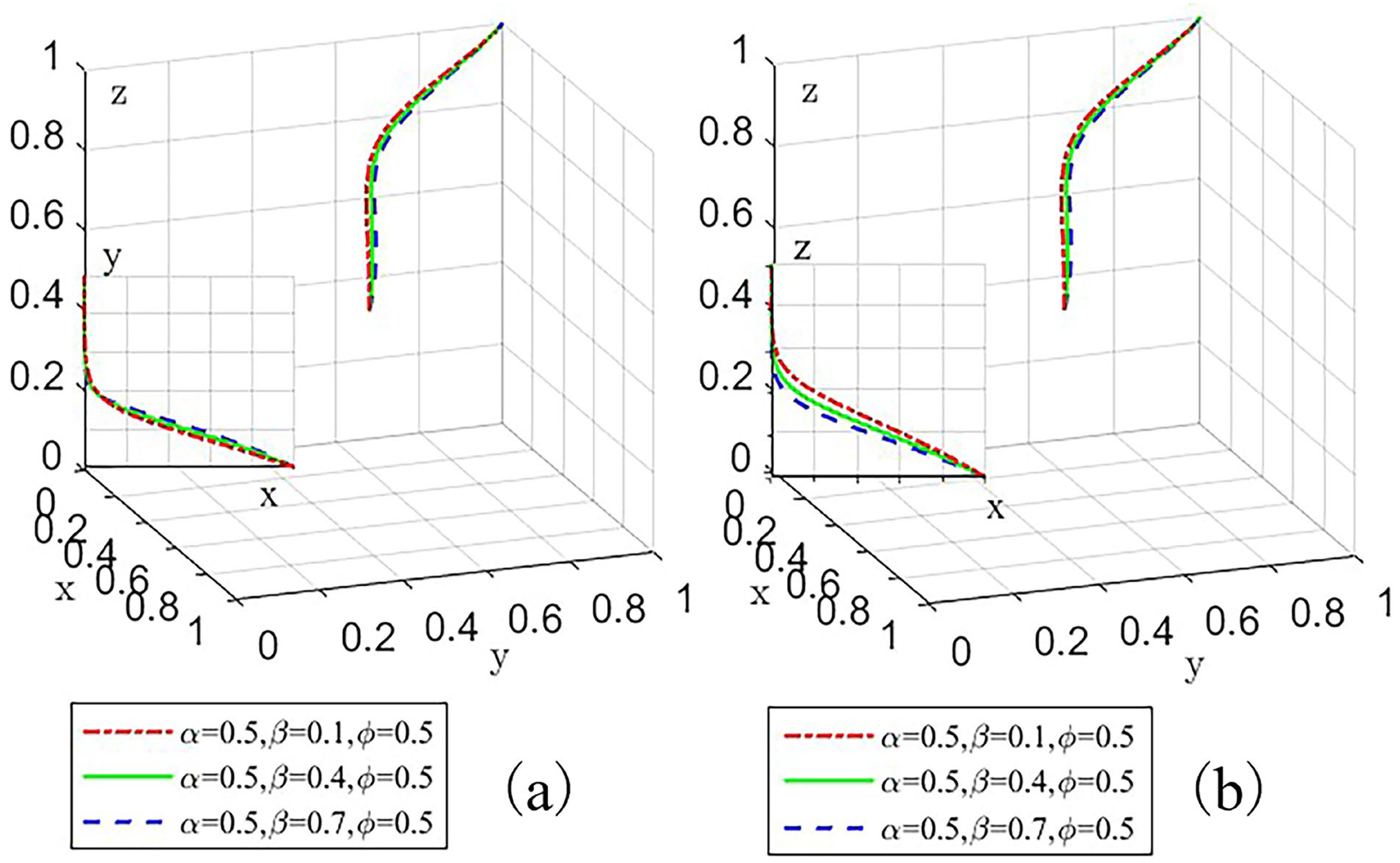

4.3. Government Subsidies Analysis

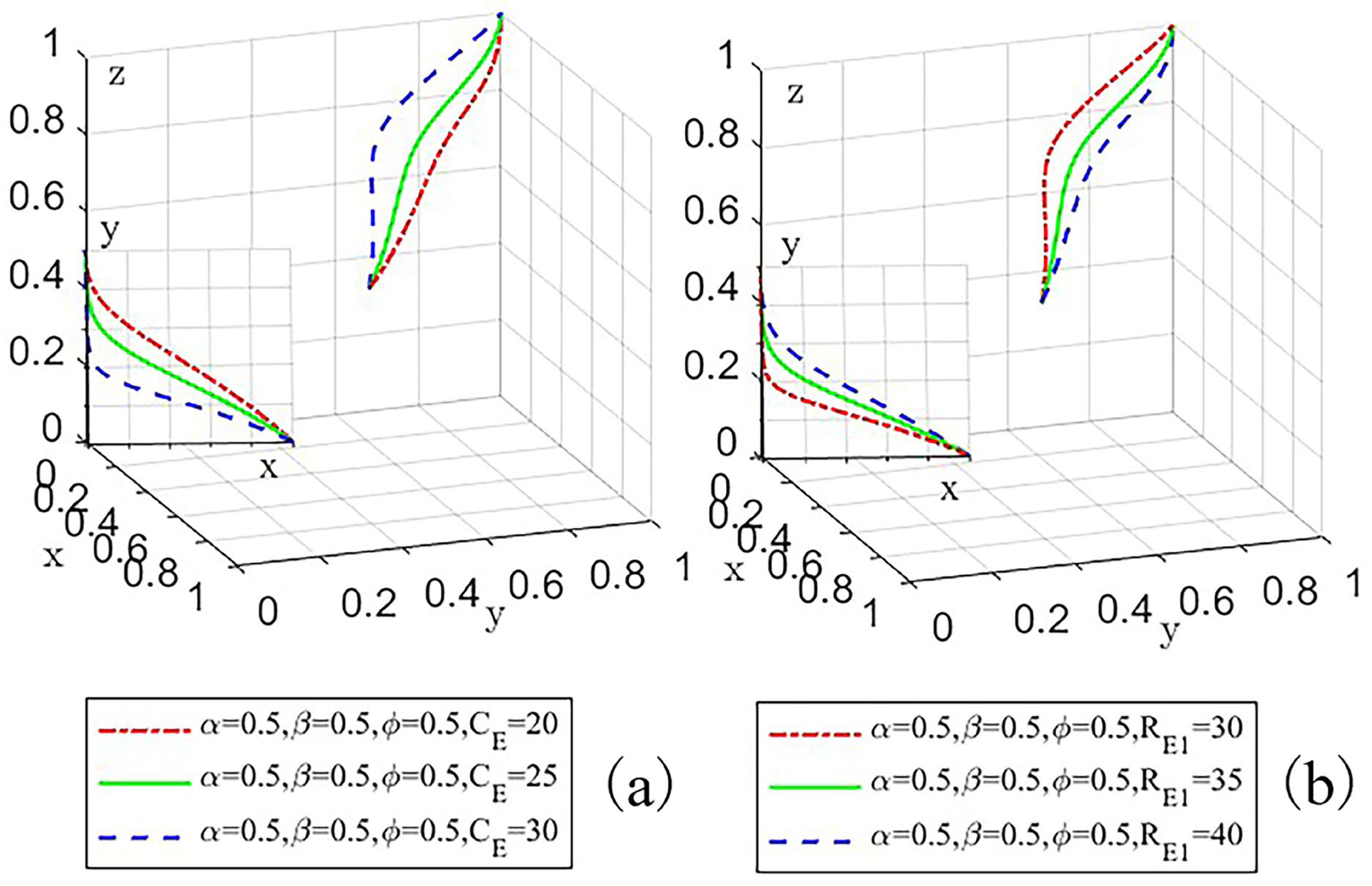

4.4. Adoption Cost and Incremental Benefit Analysis

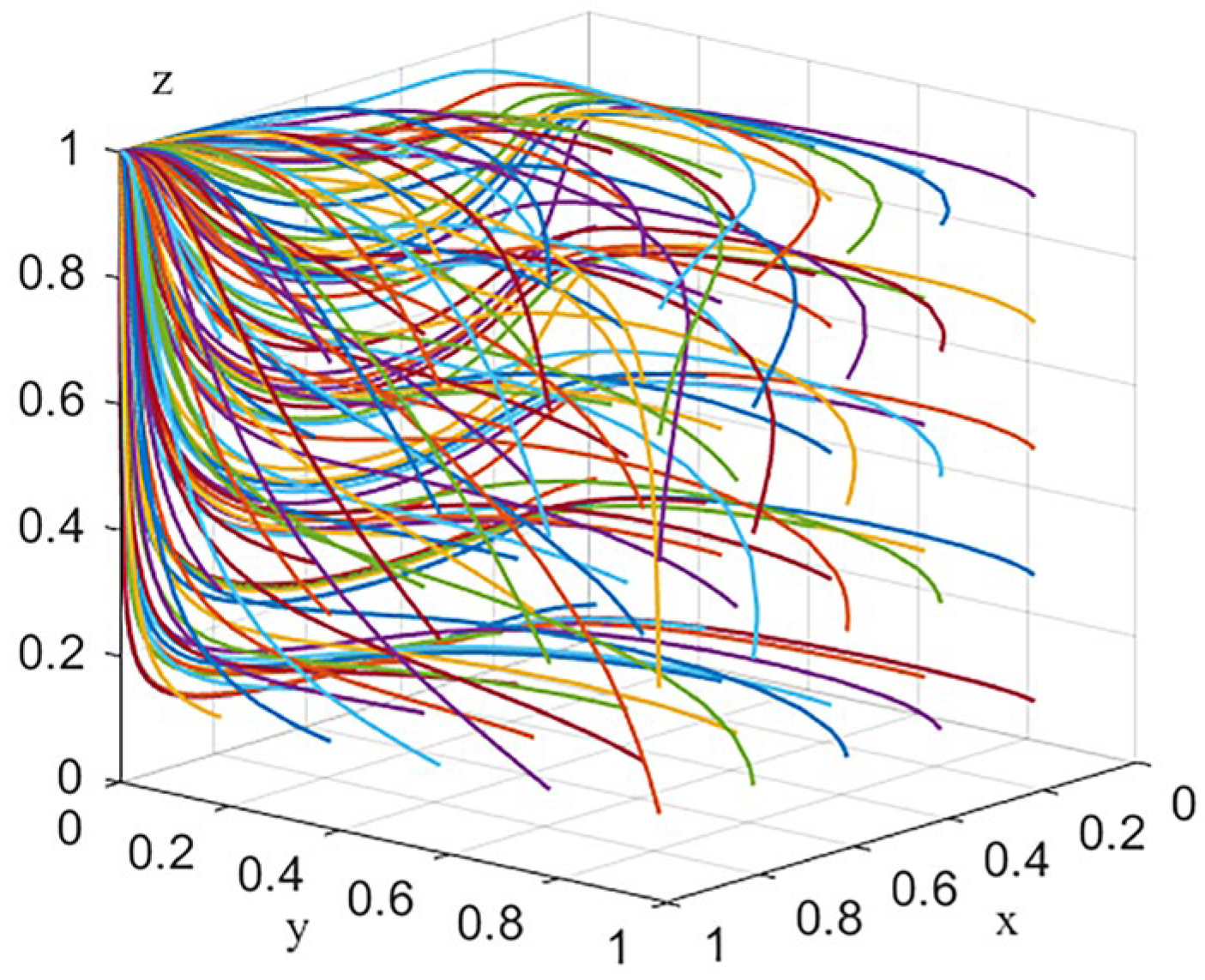

4.5. Institutional Investor Participation Analysis

5. Discussion

5.1. Relation to Earlier Research

5.2. Contributions and Suggestions

6. Conclusions and Limitations

6.1. Conclusions

6.2. Limitations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Bartolacci, F.; Caputo, A.; Fradeani, A.; Soverchia, M. Twenty years of XBRL: What we know and where we are going. Meditari Account. Res. 2020, 29, 1113–1145. [Google Scholar] [CrossRef]

- Borgi, H. XBRL technology adoption and consequences: A synthesis of theories and suggestions of future research. J. Account. Manag. Inf. Syst. 2022, 21, 220–235. [Google Scholar] [CrossRef]

- Ping, W. Data mining and XBRL integration in management accounting information based on artificial intelligence. J. Intell. Fuzzy Syst. 2021, 40, 6755–6766. [Google Scholar] [CrossRef]

- Blankespoor, E. The impact of information processing costs on firm disclosure choice: Evidence from the XBRL mandate. J. Account. Res. 2019, 57, 919–967. [Google Scholar] [CrossRef]

- Huang, Y.; Shan, Y.G.; Yang, J.W. Information processing costs and stock price informativeness: Evidence from the XBRL mandate. Aust. J. Manag. 2021, 46, 110–131. [Google Scholar] [CrossRef]

- Aksoy, M.; Yilmaz, M.K.; Topcu, N.; Uysal, Ö. The impact of ownership structure, board attributes and XBRL mandate on timeliness of financial reporting: Evidence from Turkey. J. Appl. Account. Res. 2021, 22, 706–731. [Google Scholar] [CrossRef]

- Li, X.; Zhu, H.; Zuo, L. Reporting technologies and textual readability: Evidence from the XBRL mandate. Inf. Syst. Res. 2021, 32, 1025–1042. [Google Scholar] [CrossRef]

- Licheng, L.; Qin, L. Financial Innovation in the Background of Digital Economy-summary of the main viewpoints of the 18th National Accounting Informatization Academic Annual Conference. Account. Res. J. 2019, 10, 95–97. [Google Scholar] [CrossRef]

- Song, X.; Ding, Z.; Liu, C.; Zhang, Q. The Utilization Ratio and Interoperability of Corporate-Level XBRL Classification Standard Elements in China. Comput. Intell. Neurosci. 2022, 2022, 4897908. [Google Scholar] [CrossRef]

- Zhongsheng, W.; Qin, L. International XBRL Application Experience and Enlightenment to my country’s Promotion of XBRL Cause. Mod. Manag. 2016, 36, 53–55. [Google Scholar] [CrossRef]

- Ming, L.; Haifeng, Q.; Fanghui, J. Task-related top management team faultline, mixed-ownership structure and innovation performance in state-owned companies. Sci. Res. Manag. 2018, 39, 26–33. [Google Scholar] [CrossRef]

- Xingmei, X.; Xinkai, Z. Government Control, Institutional Investors, and Financial Restatement—Empirical evidence based on “patching” of annual reports of listed companies in China. Jianghan Trib. 2016, 6, 60–66. [Google Scholar] [CrossRef]

- Lixia, Z. Listed company annual report disclosure of existing problems and countermeasures. Financ. Account. 2019, 13, 77–78. [Google Scholar] [CrossRef]

- Hong, C.; Wenhua, W.; Yaodan, H.; Lifu, L. Front-line regulation of stock exchanges and corporate debt financing: Evidence based on financial reporting Inquiry Letters. Financ. Regul. Res. 2021, 2, 86–102. [Google Scholar] [CrossRef]

- Longbin, L.; Xiaoping, H.; Bo, Y. Research on the effectiveness of securities market regulation to reduce the re-violation of enterprises. Financ. Regul. Res. 2022, 5, 19–39. [Google Scholar] [CrossRef]

- Yan, H. The Information Demands of Investors and Media Coverage: A Quasi-natural Experiment Based on Margin Trading. J. Shanghai Univ. Financ. Econ. 2022, 24, 94–107. [Google Scholar] [CrossRef]

- Xianming, Z.; Tianxi, Z.; Xiaodong, S. Game Analysis of Financial Information Standard Based on XBRL. Chin. J. Manag. 2011, 8, 273. [Google Scholar] [CrossRef]

- Gang, R.; Zhongsheng, W. Game Study on XBRL Financial Information Disclosure. Gov. Financ. 2019, 22, 12529–12538. [Google Scholar]

- Zhongsheng, W.; Qin, L. Market Competition, Government Behavior and XBRL Technology Diffusion. Account. Res. 2015, 8, 19–23. [Google Scholar] [CrossRef]

- Ding, P.; Yong, X. Supervision Strategy of XBRL Technology Adoption from the Perspective of Evolutionary Game. Oper. Res. Manag. Sci. 2021, 30, 172. [Google Scholar] [CrossRef]

- Yonghao, X.; Xin, X.; Feifei, Z. The “Large-Volume Trading Anomaly” in China’s A-Share Market. J. Manag. World 2022, 38, 120. [Google Scholar] [CrossRef]

- Rostami, M.; Nayeri, M.D. Investigation on XBRL adoption based on TOE model. Br. J. Econ. Manag. Trade 2015, 7, 269–278. [Google Scholar] [CrossRef]

- Baby, A.; Kannammal, A. Network Path Analysis for developing an enhanced TAM model: A user-centric e-learning perspective. Comput. Hum. Behav. 2020, 107, 106081. [Google Scholar] [CrossRef]

- Pinsker, R.E.; Felden, C. Professional role and normative pressure: The case of voluntary XBRL adoption in Germany. J. Emerg. Technol. Account. 2016, 13, 95–118. [Google Scholar] [CrossRef]

- Jinping, G.; Huiqin, Z. Research on the impact of financial presentation Innovation on the cost of corporate equity capital. Hubei Soc. Sci. 2016, 8, 81–87. [Google Scholar] [CrossRef]

- Jinping, G.; Yan, W.; Jing, F. Key Factors of the Innovation Diffusion of XBRL Financial Reporting. Res. Financ. Econ. Issues 2016, 1, 85–92. [Google Scholar] [CrossRef]

- Ansary, M.E.; Oubrich, M.; Orlando, B.; Fiano, F. The determinants of XBRL adoption: A meta-analysis. Int. J. Manag. Financ. Account. 2020, 12, 1–24. [Google Scholar] [CrossRef]

- Borgi, H.; Tawiah, V. Determinants of eXtensible business reporting language adoption: An institutional perspective. Int. J. Account. Inf. Manag. 2022, 30, 352–371. [Google Scholar] [CrossRef]

- Zhou, J. Does one size fit all? Evidence on XBRL adoption and 10-K filing lag. Account. Financ. 2020, 60, 3183–3213. [Google Scholar] [CrossRef]

- Bani-Khalid, T.; El-Dalabeeh, A.; Al-Adamat, A. The effect of XBRL adoption on information symmetry in companies’ financial reports through knowledge management: Perceptions of employees of the Jordan securities commission. Accounting 2021, 7, 629–634. [Google Scholar] [CrossRef]

- Ruan, L.; Liu, H.; Tsai, S.-B. XBRL adoption and capital market information efficiency. J. Glob. Inf. Manag. 2021, 29, 1–18. [Google Scholar] [CrossRef]

- Chen, G.; Kim, J.-B.; Lim, J.-H.; Zhou, J. XBRL adoption and bank loan contracting: Early evidence. J. Inf. Syst. 2018, 32, 47–69. [Google Scholar] [CrossRef]

- Chong, D.; Shi, H.; Fu, L.; Ji, H.; Yan, G. The impact of XBRL on information asymmetry: Evidence from loan contracting. J. Manag. Anal. 2017, 4, 145–158. [Google Scholar] [CrossRef]

- Imhof, M.J.; Seavey, S.E.; Smith, D.B. Comparability and cost of equity capital. Account. Horiz. 2017, 31, 125–138. [Google Scholar] [CrossRef]

- Rahwani, N.R.; Sadewa, M.M.; Qalbiah, N.; Mukhlisah, N.; Nikmah, N. XBRL based corporate tax filing in Indonesia. Procedia Comput. Sci. 2019, 161, 133–141. [Google Scholar] [CrossRef]

- Hsieh, T.-S.; Wang, Z.; Abdolmohammadi, M. Does XBRL disclosure management solution influence earnings release efficiency and earnings management? Int. J. Account. Inf. Manag. 2019, 27, 74–95. [Google Scholar] [CrossRef]

- Birt, J.L.; Muthusamy, K.; Bir, P. XBRL and the qualitative characteristics of useful financial information. Account. Res. J. 2017, 30, 107–126. [Google Scholar] [CrossRef]

- Ra, C.-W.; Lee, H.-Y. XBRL adoption, information asymmetry, cost of capital, and reporting lags. iBusiness 2018, 10, 93. [Google Scholar] [CrossRef]

- Sassi, W.; Othman, H.B.; Hussainey, K. The impact of mandatory adoption of XBRL on firm’s stock liquidity: A cross-country study. J. Financ. Report. Account. 2021, 19, 299–324. [Google Scholar] [CrossRef]

- Xu, Z.; Cheng, Y.; Yao, S. Tripartite evolutionary game model for public health emergencies. Discret. Dyn. Nat. Soc. 2021, 2021, 6693597. [Google Scholar] [CrossRef]

- Zhou, Y.; Rahman, M.M.; Khanam, R.; Taylor, B.R. The impact of penalty and subsidy mechanisms on the decisions of the government, businesses, and consumers during COVID-19—Tripartite evolutionary game theory analysis. Oper. Res. Perspect. 2022, 9, 100255. [Google Scholar] [CrossRef]

- Chu, Z.; Bian, C.; Yang, J. How can public participation improve environmental governance in China? A policy simulation approach with multi-player evolutionary game. Environ. Impact Assess. Rev. 2022, 95, 106782. [Google Scholar] [CrossRef]

- Chu, Z.; Bian, C.; Yang, J. From fabrication to consolidation of China’s political blue-sky: How can environmental regulations shape sustainable air pollution governance? Environ. Policy Gov. 2023, 33, 31–43. [Google Scholar] [CrossRef]

- Wei’an, L.; Yin, M. A tripartite evolutionary game study on green governance in China’s coating industry. Environ. Sci. Pollut. Res. 2022, 29, 61161–61177. [Google Scholar] [CrossRef] [PubMed]

- Zhou, K.; Wang, Q.; Tang, J. Evolutionary game analysis of environmental pollution control under the government regulation. Sci. Rep. 2022, 12, 474. [Google Scholar] [CrossRef]

- Zhu, Y.; Niu, L.; Zhao, Z.; Li, J. The tripartite evolution game of environmental governance under the intervention of central government. Sustainability 2022, 14, 6034. [Google Scholar] [CrossRef]

- Yang, J.; Wang, Y.; Mao, J.; Wang, D. Exploring the dilemma and influencing factors of ecological transformation of resource-based cities in China: Perspective on a tripartite evolutionary game. Environ. Sci. Pollut. Res. 2022, 29, 41386–41408. [Google Scholar] [CrossRef]

- Teng, Y.; Lin, P.-W.; Chen, X.-L.; Wang, J.-L. An analysis of the behavioral decisions of governments, village collectives, and farmers under rural waste sorting. Environ. Impact Assess. Rev. 2022, 95, 106780. [Google Scholar] [CrossRef]

- Jiang, X.; Sun, H.; Lu, K.; Lyu, S.; Skitmore, M. Using evolutionary game theory to study construction safety supervisory mechanism in China. Eng. Constr. Archit. Manag. 2023, 30, 514–537. [Google Scholar] [CrossRef]

- Li, X.; Li, Q.; Du, Y.; Fan, Y.; Chen, X.; Shen, F.; Xu, Y. A Novel Tripartite Evolutionary Game Model for Misinformation Propagation in Social Networks. Secur. Commun. Netw. 2022, 2022, 1136144. [Google Scholar] [CrossRef]

- Peng, X.; Wang, F.; Wang, J.; Qian, C. Research on food safety control based on evolutionary game method from the perspective of the food supply chain. Sustainability 2022, 14, 8122. [Google Scholar] [CrossRef]

- Gao, L.-H.; Cai, D.; Zhao, Y.; Yan, H. A tripartite evolutionary game for marine economy green development with consumer participation. Environ. Dev. Sustain. 2022, 1–32. [Google Scholar] [CrossRef]

- Jiang, S.; Wei, X.; Jia, J.; Ma, G. Toward sustaining the development of green residential buildings in China: A tripartite evolutionary game analysis. Build. Environ. 2022, 223, 109466. [Google Scholar] [CrossRef]

- Chen, L.; Bai, X.; Chen, B.; Wang, J. Incentives for green and low-carbon technological innovation of enterprises under environmental regulation: From the perspective of evolutionary game. Front. Energy Res. 2022, 9, 817. [Google Scholar] [CrossRef]

- Yi, L.; Hiroatsu, F. Incentives for innovation in robotics and automated construction: Based on a tripartite evolutionary game analysis. Sustainability 2022, 14, 2475. [Google Scholar] [CrossRef]

| Parameters | Meanings |

|---|---|

| Government benefits when listed enterprises do not adopt XBRL technology. | |

| Incremental benefits are gained from the increased efficiency of government regulation when listed enterprises adopt XBRL technology. | |

| The maximum fine that a listed enterprise is required to pay when they choose non-adoption while the government chooses the mandatory strategy. | |

| Maximum government subsidy for listed enterprises that adopt XBRL technology. | |

| . | |

| The cost of promoting and guiding listed enterprises to adopt XBRL technology when the government chooses a mandatory strategy. | |

| When the government adopts a mandatory strategy, the reward it gives to the institutional investors for their participation in monitoring work. | |

| Net benefits when listed enterprises do not adopt XBRL technology. | |

| The maximum external reputation damage is caused by dissatisfied institutional investors when the listed enterprises choose a non-adoption strategy. | |

| Incremental benefits from the adoption of XBRL by listed enterprises in the context of institutional investor participation. | |

| . | |

| The cost of adopting XBRL to listed enterprises. | |

| The overall improved information environment was brought about when listed enterprises adopted XBRL technology. | |

| Incremental benefits for institutional investors using XBRL formatted financial reporting. | |

| Losses to institutional investors when listed enterprises do not adopt XBRL technology. | |

| The monitoring costs involved in the diffusion of XBRL technology for institutional investors. | |

| . |

| Parties Involved in the Game | Listed Enterprises | Institutional Investors | ||

| Participation () | Non-participation () | |||

| Government | Mandatory () | Adoption | ||

| Non-Adoption () | ||||

| Voluntary () | Adoption () | |||

| Non-adoption () | ||||

| Equilibrium Points | Eigenvalue | Eigenvalue | Eigenvalue | Stability Condition |

| ① | ||||

| ② | ||||

| ③ | ||||

| — | ||||

| ④ | ||||

| ⑤ | ||||

| — | ||||

| — |

| Equilibrium Point | Eigenvalue | ||||

| ① | ② | ③ | ④ | ⑤ | |

| Case | |||||||||||||

| Case 1 | 0.5 | 0.5 | 0.6 | 20 | 20 | 15 | 15 | 20 | 20 | 30 | 15 | 30 | 10 |

| Case 2 | 0.7 | 0.5 | 0.6 | 20 | 22 | 15 | 10 | 20 | 20 | 40 | 35 | 30 | 10 |

| Case 3 | 0.9 | 0.5 | 0.5 | 30 | 20 | 15 | 15 | 5 | 20 | 30 | 15 | 30 | 10 |

| Case 4 | 0.8 | 0.1 | 0.4 | 40 | 10 | 10 | 18 | 20 | 10 | 15 | 10 | 55 | 10 |

| Case 5 | 0.6 | 0.2 | 0.7 | 40 | 10 | 10 | 10 | 20 | 10 | 18 | 10 | 40 | 10 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Pan, D.; Ji, Y. Extensible Business Reporting Language Technology Adoption and Diffusion—A Tripartite Evolutionary Game Perspective. Systems 2023, 11, 197. https://doi.org/10.3390/systems11040197

Pan D, Ji Y. Extensible Business Reporting Language Technology Adoption and Diffusion—A Tripartite Evolutionary Game Perspective. Systems. 2023; 11(4):197. https://doi.org/10.3390/systems11040197

Chicago/Turabian StylePan, Ding, and Yali Ji. 2023. "Extensible Business Reporting Language Technology Adoption and Diffusion—A Tripartite Evolutionary Game Perspective" Systems 11, no. 4: 197. https://doi.org/10.3390/systems11040197

APA StylePan, D., & Ji, Y. (2023). Extensible Business Reporting Language Technology Adoption and Diffusion—A Tripartite Evolutionary Game Perspective. Systems, 11(4), 197. https://doi.org/10.3390/systems11040197