Abstract

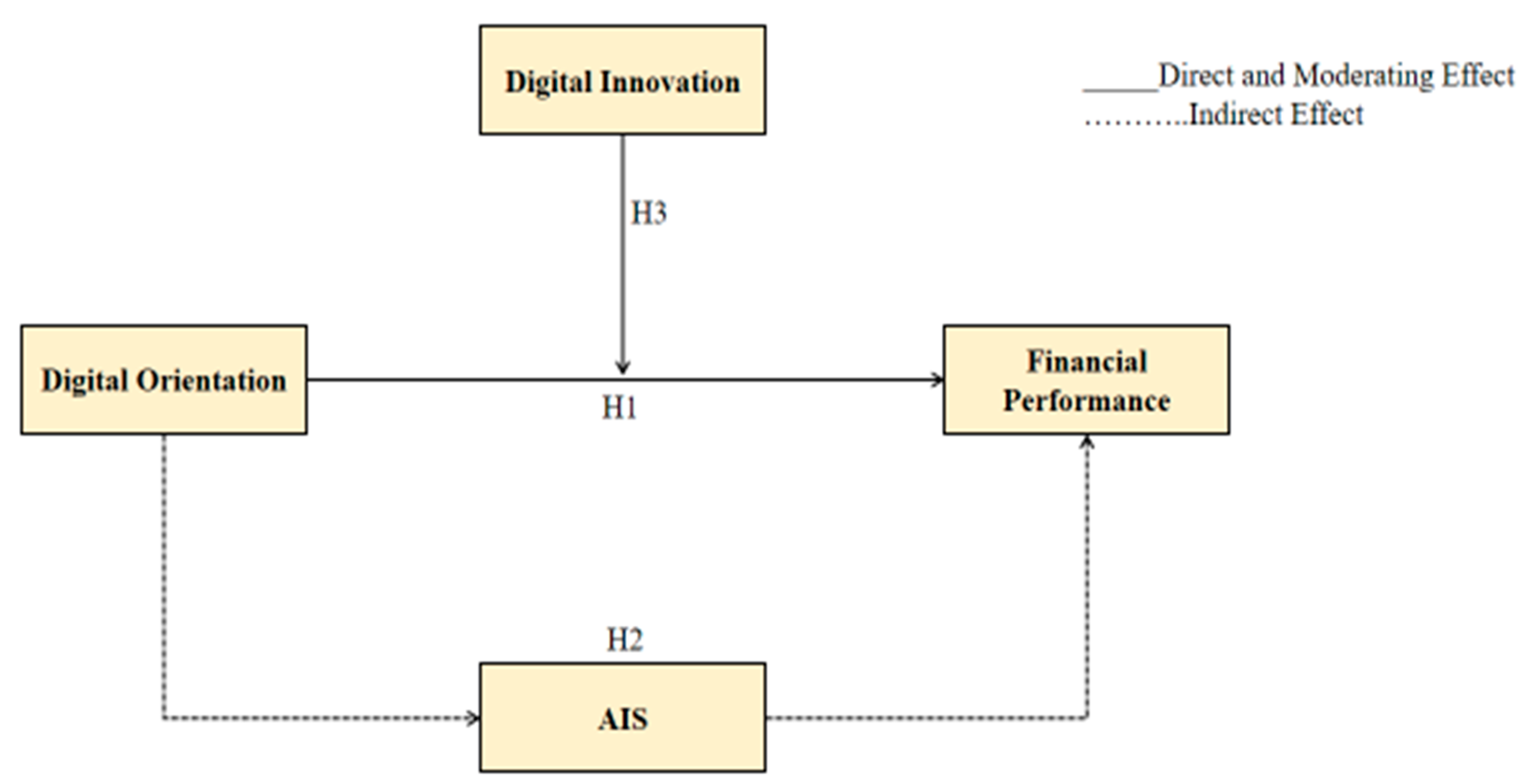

Nowadays, many businesses recognize the importance of digitization as a strategic advantage to maintain competitiveness. As a result, current research aims to investigate three significant factors that influence digital transformation: digital innovation (DI), digital orientation (DO), and the accounting information system (AIS). These factors are supposed to impact the financial success and performance of firms. The objective of this study is to examine the positive association between digital orientation and financial performance (FP) and to explore how the AIS mediates this relationship. Additionally, this paper investigates the moderating role of digital innovation in the relationship between digital orientation and financial performance. To collect data, a quantitative method was employed using a random sampling technique. Data were collected via a questionnaire survey from small and medium-sized enterprises (SMEs) in China, with a sample size of 550. Structural equation modeling (SEM) and a bootstrapping technique with 5000 iterations were used to test the study hypotheses. The findings of this study indicate a positive link between digital orientation and the financial performance of organizations. Furthermore, the results confirm that the AIS acts as a mediator between digital orientation and financial performance. The outcomes also demonstrate that digital innovation plays a moderating role in the relationship between DO and financial performance. This paper contributes to the existing literature on digital transformation by providing a deeper understanding of the aforementioned antecedents of the digital revolution (DO, AIS, and financial performance) and how they should be integrated within digitalization settings to achieve financial performance.

1. Introduction

In the contemporary era, the ubiquitous diffusion of digital transformation and the fast pace of digitalization has confirmed that not all industries or businesses are safe from the impacts of digital transformation [1]. Therefore, it is indispensable to recognize how to rapidly act in response to the challenges encountered as a result of the latest digital technologies and how to use opportunities presented by a technological revolution that actualizes improved financial performance [2]. As many prior scholars have demonstrated, digital orientation is not restricted to just digital conversions, firms could not exploit the complete benefits of digital change with only a few common practice updates [3]. Alternatively, digitalization requires intentional continuous efforts, including the comprehensive planning of the digital transformation atmosphere [4]. Accordingly, businesses towards continuous and enduring financial performance from digital orientation require implementing strategic approaches that frequently state structural changes, technology use, and adjustments in the value creation that supports the improvement of financial performance as significant dimensions [5]. Digital orientation is critical for an organization’s commitment and directness to use digital technologies, as digitalization creates value by introducing novel patterns of doing business which lead to improved financial performance [6]. Digital orientation refers to commitment and directness to implement digital technologies after the implementation of digital initiatives to increase financial success in an organization [7]. Moreover, adjustments in value creation characterize a major factor in the transformation strategies, presenting impacts of the diverse tactics of creating value which supports working effectively in dynamic settings and better digitalization areas and increase financial performance [8]. For the management of an internal control structure in an organization, an accounting information system is required because it concerns decision-making issues and helps manage the communication of data and information control [9]. AIS is an application or machine which, at what time integrated with the information technology (IT) field, is intended to aid in managing and controlling the topics linked to firms’ financial successes [10]. However, stunning advancements in technology have unlocked possibilities of using and generating accounting information systems from a strategic perspective [11]. Digital orientation is the firm’s aptitude to function competently and deal with greater size of operations within a dynamic environment; it is a prominent aspect that can speed up a firm’s financial performance [12]. Additionally, due to the challenges of the digital revolution and implementation of strategic options such as AIS, achieving the firm’s goals is challenging and needs constant and technical efforts, which ensures financially successful performance [13]. The accounting information system is essential for all enterprises, whether profit oriented or not, but requires maintaining AIS. Digital orientation is the systematic approach of ensuring that the readiness required to constantly adapt advantages of the AIS could be assessed via influences on upgrading the decision-making practices, quality of internal controls, and financial performance evaluations and enabling firm transactions with persistent digital transformation [14]. Digital orientation is vital in technological transformation strategies as its practical determination governs development, implementation, and advancement in technology [15].

An accounting information system comprises interconnected elements designed to collect raw data and information and transform them into useful financial data for reporting to decision makers, thereby enhancing financial performance [16]. Digital innovation supports corporate strategies that improve financial performance and foster a more adaptable and flexible business culture to navigate constant changes in a dynamic environment [17]. Digital innovation involves the application of digital technologies to streamline processes and enhance efficiency in addressing existing challenges. It acts as a catalyst, creating a virtuous cycle that leads to improved financial performance [18]. Digital transformation is reflected innovative application, financial performance and sustainability of the company and creates a climate of business growth and profit gain [19,20] However, there is a lack of awareness regarding strategic options that can contribute to the financial success of firms engaged in digital transformation [21]. Previous research has explored various determinants of digital transformation, such as the digital economy [22], information system success [23], and digital marketing [24]. To validate the approach chosen for this paper, it is argued that, until now, the relationship between DO, AIS, and digital innovation has been examined individually without considering all these variables simultaneously. This study recognizes three significant and distinct antecedents of digital transformation: digital orientation, AIS, and digital innovation. It addresses the question of how enterprises integrate these components to achieve financial success. The primary objectives of this study are to explore the following three questions:

- How does digital orientation positively influence financial performance?

- How does the accounting information system mediate this relationship?

- What is the moderating role of digital innovation in the relationship between digital orientation and financial performance?

This research framework builds upon digital transformation and strategic management literature, providing guidance for investigating the antecedents of digitalization and how these elements can be leveraged to achieve high financial performance. Therefore, this paper focuses on SMEs, as they often face resource constraints with regard to implementing digital transformation at the structural level. The structure of this paper is as follows: Section 1 provides an introduction to the study variables and a comprehensive explanation of the research topic; theoretical hypotheses are then developed, and a research model is presented; Section 4 describes the methodology and measurements of the study constructs; subsequently, the result findings and analysis are discussed along with discussion and conclusions in the last section.

2. Literature Review and Substantiation of Hypotheses

Digital orientation includes methodologies and accounting techniques to manage and record economic transactions. However, digital innovation supports tracking transactions and internal reporting with innovative applications of IT that lead toward enhancement in financial performance [19]. Although recognized potentials of digital transformation, many firms’ failures in accomplishing better financial performance phenomena indicate a necessity for enhanced understanding and expertise of digital transformation to gain financial advantages, specifically net and operating profit [20].

2.1. Digital Orientation and Financial Performance

Digital orientation provides strategic directions in a manner that diminishes every loss of concentration opportunity and working problem, which guide toward improved financial performance in an enterprise [25]. Digital orientation could provide ease in handling operating challenges as it is the commitment to utilize advanced digital technologies which assist enterprises in adopting discriminate technical solutions rapidly and complement novel digital objects to the current solutions, thus attaining financial performance [26]. Furthermore, digital orientation plays a significant role in overcoming working complications, yielding high financial performance with optimization, self-sufficiency, and monitoring; it also generates values with the adoption of digitalization in an organization [27]. Digital orientation providing a strategic path to firms via the digital revolution is related to improved financial performance. Although the impacts of technological change on customary financial performance indicators cannot constantly be determined, thus interpreting the digital orientation is useful [28]. For example, Apple’s company success could be measured using the transitional indicator, for instance, the number of profit-generated apps and the extent of consumer satisfaction at specific times they used their products [29]. Recently, most businesses have implemented similar perspectives regarding the great potential of digital transformation for accomplishing success [30]. Moreover, various studies have ratified that the latest technological orientation could pave the way to efficient and functional modifications, direct toward operative and financial performance effectiveness, and provide competitive benefits and cost proficiency with monitoring and optimizing practices [31]. However, a higher level of failures in a digital investment indicates a low level of perceiving the digital revolution turning into economic outcomes [27,32]. In addition, numerous benefits of the digital orientation belong to novel patterns of functioning, predominantly in customer collaborations and innovative approaches to generating value via digitalized systems which lead to the achievement of effective financial performance in an organization [33]. However, various organizations use the latest digital technologies to improve prevailing operating tactics and strategies, disclosing they cannot obtain the complete benefits of the technical transformation [34]. Nevertheless, different performers engaged in the digital orientation face troubles and challenges in the achievement of financial performance via digital transformation [35].

H1.

Digital orientation is directly linked with financial performance.

2.2. Mediating Role of AIS

The accounting information system is a set of resources, for instance, people, machinery, and tools, intended to change financial data into information and data which are used by several decision makers [36]. Firms that have a digital orientation are likely to be additionally committed to using the latest digital technologies. Furthermore, firms use diverse digital initiatives to enable their business objectives, i.e., financial performance. These initiatives can be indicators of AIS implementation which might link to different operations in an organization [37]. AIS is the collection of organized activities, technologies, and documents planned to gather data, manage, and communicate information to different inner and outer stakeholders within an enterprise [38]. Digital orientation reflects an organization’s ability to get involved in further areas of technological transformation, like the adoption of AIS in its present capacity, which leads toward enhanced financial performance [39]. However, digital orientation needs more than just the adaptation of accounting information systems and the implementation of advanced technologies to determine the altering strategies, administrative structure, and employee culture that benefit stakeholders [40]. Reasonably, digital orientation is systematic adjustments to sustainable financial performance and digital change. Moreover, a firm’s digital orientation could affect its financial success because these firms frequently have strong and effective governance and clear vision, which support directing digitalization investments in line with business objectives [41,42]. Digital orientation assists in the adoption of AIS, which is the system used for gathering, recording, managing, and communicating data and generating valuable information for stakeholders and decision makers that lead to high financial performance [42]. Furthermore, the digital orientation role in supporting digital transformation has been considered from different perspectives. Firms involved in using advanced technologies and developing competencies to succeed in such digitalization are more likely to have improved financial performance [36].

H2.

AIS mediates the relationship between digital orientation and financial performance.

2.3. Digital Innovation Moderates

Digitalization has brought exceptional challenges and great opportunities for societal, ecological, and economic structures [33]. At the organizational level, digital innovation becomes very significant for firms, particularly those having a digital orientation to deal with challenges following future sustainability attitudes, which support the enhancement of financial performance [18]. Digital orientation provides the foundation for directions and the success of managerial actions, which boosts corporate value considerably and affects financial performance [8]. Digital orientation helps address data insufficiency, access accurate information, and utilize digital innovation resources to build technical conditions for the growth of sustainable financial performance in an organization [17]. Hence, this study explores that digital orientation relies on digital innovation for sustainable financial performance. Digital orientation involves the creative performance and behavior of an organization for the implementation of novel practices and methods, in turn, to resolve present challenges via the latest digital innovation, which keeps them proactive in the use of resources and degree of innovation that leads toward improved financial performance [28]. Digital orientation is a tactical plan under the digital revolution, which needs constant digital innovation developments to offer specific solutions with dynamic transformation in strategies, plans, and policies that guide organizations to enhanced financial performance [43]. Digital innovation is the creative use of advanced digital technologies to achieve the objectives of the firm value chain and boost efficiency by integrating the operational thinking of viable innovation into research and development, marketing, and production designing, which leads to enhanced financial performance [3,44].

H3.

Digital innovation plays a role in moderating the relationship between digital orientation and financial performance.

Current research will test the following model (Figure 1).

Figure 1.

Theoretical framework.

3. Research Methodology

This study was quantitative in nature, and the survey was conducted via questionnaires. In this study, the analysis unit is SMEs in China. After COVID-19, Chinese SMEs rapidly modified their conventional patterns, and changes and new development and advancements have been taking place unprecedentedly. For the selection of SMEs for data collection, we focused on firms that involve the implementation of IT projects and strategic planning related to the investments in the reorganization of the machinery, technology, services, practices, and broad plans concerning app installations and software. Digital transformation and financial success are obtained via multi-factor policies that sustain training sessions specified for workers and customers in SMEs of China concerning the utilization of digital knowledge or AIS and the accomplishment of IT objectives in SMEs. We choose respondents using a random-sampling technique from SMEs of four different territories. Data were collected from owners, managers, CEOs, and administration that match with appropriate profile prerequisites, like participating in different kinds of IT project executions and having comprehensive knowledge and inclusive expertise about AIS, which affect their firms’ financial performances, and were chosen as a respondent to the questionnaire. This study questionnaire was distributed with the assistance of two research assistants via e-mail to participants. A total of 550 questionnaires were distributed among survey participants, in which just 383 responses were completed and fulfilled the study requirements and thus were further useable for the analysis. Data collection practices took one and a half months and had a return rate of 69.63%.

Structural Equation Modeling (SEM), a sophisticated econometric technique, is an appropriate method for examining the interactions between DO, accounting information system (AIS), digital innovation, and economic success because it permits the evaluation of complex linkages and latent elements. The authors may evaluate the direct and indirect links within their theoretical structure and capture the concurrent impacts of numerous factors via SEM. Additionally, SEM offers the chance to assess measurement approaches and examine the reliability and accuracy of the constructs that were used in this study, improving the robustness and integrity of the analysis. To ensure the accuracy and consistency of the items in the questionnaire, the standardized items for measuring the study variables (digital orientation, AIS, digital innovation, and financial performance) were adapted from prior studies. These items were then reviewed and tested by experts and academics.

The questionnaire consisted of two sections. Section 1 focused on demographic details, such as education, gender, position, and field experience. Section 2 included items for all the study variables.

A five-point Likert scale was used for all the items, ranging from 0 = strongly disagree to 5 = strongly agree.

3.1. Digital Orientation

To measure digital orientation, 4-item scale adapted from a previous study [45] was used. This scale assessed the organization’s capabilities and strategies that promote digital transformation and provide competitive advantages. An example item from this scale is “New digital technology is readily accepted in our organization”.

3.2. Accounting Information System

The measurement of AIS was performed using a 6-item scale adapted from the work of a previous study [46]. This scale focused on the practices that generate financial data and information about recognizable economic units. An example item from this scale is “The data storage contributes to the integrity of the financial reporting process”.

3.3. Financial Performance

Financial performance was measured using a 4-item scale adapted from another study [46]. This scale evaluates an enterprise’s financial position based on equity, revenue, assets, profitability, and liabilities. An example item from this scale is “The satisfaction of various stakeholder groups is instrumental for the organization”.

3.4. Digital Innovation

Digital innovation was measured using an 8-item scale adapted from previous research [47]. This scale evaluated the success of digital transformation, revenue growth, and employee productivity using advanced digital technologies. An example item from this scale is “The satisfaction of various stakeholder groups is instrumental for the organization”.

4. Results

4.1. Analysis

We conducted a confirmatory factor analysis (CFA) to assess the variables of DO, accounting information systems, digital innovation, and financial performance. Our hypothesized four-factor model was found to be the best fit for the data, and three alternative models were rejected. The fit indices, including χ2 = 1065.42, DF = 435, χ2/df = 2.449, CFI = 0.93, GFI = 0.92, and RMSEA = 0.05, indicated an overall good fit for the model. The model’s fitness was verified according to the criteria established by Anderson and Gerbing [48].

4.2. Reliability and Validity

To evaluate the reliability and validity of the measurement instruments, we utilized SPSS 18.0 and structural equation modeling. Table 1 presents the results for convergent validity, average variance extracted (AVE), and Cronbach’s alpha. Following the approach proposed by Fornell and Larcker (1981) [49], we examined the discriminant validity. The results in Table 1 confirmed that all values met the required criteria: convergent reliability (CR) and average variance extracted (AVE) were higher than the suggested cutoffs (CR > 0.70, AVE > 0.50), and CR was greater than AVE. Additionally, Cronbach’s alpha exceeded 0.60, indicating satisfactory internal consistency for the measured constructs.

Table 1.

Discriminant validity of the constructs.

4.3. Descriptive Statistics

The results of correlation, mean, and standard deviation are presented in Table 2. We examined the variance inflation factor (VIF) scores to assess the presence of multi-collinearity. The VIF scores were found to be below the accepted threshold of 1.00, indicating the absence of significant multi-collinearity issues.

Table 2.

Correlation matrix and descriptive statistics.

4.4. Hypothesis Testing

To test the hypothesis regarding the relationship between digital orientation and financial performance, we conducted an SEM analysis. The results presented in Table 3 indicate a significant and positive relationship between digital orientation and financial performance (β = 0.34 **, p < 0.01). Based on these findings, we accept the hypothesis that digital orientation has a positive and significant effect on financial performance. Nowadays, financial performance is based on technological orientation because technological tools and applications help perform operations efficiently. Hence, H1 was accepted.

Table 3.

Digital orientation to financial performance.

Table 4 presents the indirect effect of accounting information systems as a mediator between digital orientation and financial performance. Accounting information systems encompass a collection of resources designed to transform financial data into information for various stakeholders. The results of the analysis indicated that the accounting information system acts as a mediator (Beta = 0.18, Lower = 0.2458 to Upper = 0.3672). Therefore, H2 was supported, suggesting that the relationship between digital orientation and financial performance is mediated via the accounting information system.

Table 4.

Indirect effect of AIS between digital orientation and financial performance.

Table 5 displays the moderation effect of digital innovation on the direct relationship between digital orientation and financial performance. This study investigates the reliance of digital orientation on digital innovation for achieving sustainable financial performance. The results demonstrate that digital innovation has a positive and significant moderating role in the relationship between digital orientation and financial performance (β = 0.32 **, p < 0.01). As a result, H3 is supported, indicating that digital innovation plays an influential role in the association between digital orientation and financial performance.

Table 5.

Hierarchal regression results for moderating effect of digital innovation.

5. Discussion

The primary objective of this study is to investigate the determinants of digital transformation that influence financial performance, focusing on digital orientation, accounting information systems (AIS), and digital innovation. To summarize the comprehensive theoretical model, this research proposes three hypotheses and discusses their theoretical and practical implications. H1 suggests a direct relationship between digital orientation and financial performance. By examining SMEs with a digital orientation, this study aims to understand how they leverage the latest technologies to improve their financial performance. This research H1 presents a direct relationship between digital orientation and financial performance. This study provides an understanding of how representative groups of SMEs with digital orientation implement the latest technologies to achieve improved financial performance. The results are consistent with prior studies; digital orientation provides strategic directions in a manner that diminishes every loss of concentrated opportunity and working problems which leads to improved financial performance in an enterprise [25]. Digital orientation could provide ease in handling operating challenges as it is committed to utilizing advanced digital technologies that assist enterprises in adopting discriminate technical solutions rapidly and complement novel digital objects to the current solutions, thus attaining financial performance [26]. Although digital orientation plays a critical role in the attainment of high financial performance, previous studies provide little attention to the association that exists between digital orientation and financial performance. However, SMEs with higher digital orientation capabilities obtain advantages from unprecedented revolutions happening within information technology. The outcomes demonstrate that DO is positively and significantly linked with financial performance. Furthermore, H2 proposes that AIS mediates the relationship between digital orientation and financial performance. SMEs with high digital orientation tend to depart from conventional methods and embrace advanced tools such as AIS extensively to drive financial success. This finding is consistent with previous research suggesting that firms with a digital orientation are likely to be additionally committed to using the latest digital technologies. Furthermore, firms use diverse digital initiatives to enable their business objectives, i.e., financial performance. These initiatives can be indicators of AIS implementation which might link to different operations in an organization [37]. AIS is the collection of organized activities, technologies, and documents planned to gather data, manage, and communicate information to different inner and outer stakeholders within an enterprise [38]. Digital orientation reflects an organization’s ability to get involved in further areas of technological transformation like the adoption of AIS in its present capacity which leads to enhanced financial performance [39]. Therefore, we hypothesize that AIS mediates the relationship between digital orientation and financial performance.

Hypothesis 3 (H3) proposes that digital innovation moderates the linkage between digital orientation and financial performance. This study supports previous findings that digital orientation provides the foundation for directions and the success of managerial actions, which boosts corporate value considerably and affects financial performance [8]. As mentioned earlier, digital orientation helps address data insufficiency, access accurate information, and utilize digital innovation resources to build technical conditions for the growth of sustainable financial performance in an organization [17,50]. Hence, this study explores that digital orientation relies on digital innovation for sustainable financial performance. The outcomes confirm conclusions relating to SMEs’ financial performance in the H3. The results confirm that digital innovation strengthens the relationship between digital orientation and financial performance among SMEs.

In summary, this study makes significant contributions to the existing literature and supports all the indirect and direct hypotheses. By examining the role of digital orientation, AIS, and digital innovation, this research enhances our understanding of the determinants of financial performance in the context of digital transformation.

5.1. Theoretical Implications

This study contributes to the theoretical understanding of digital transformation at the organizational level by exploring the factors that influence financial performance. The finding that a company’s digital orientation is positively related to financial performance supports the notion that organizations prioritizing and embracing digital activities are likely to experience improved financial outcomes. This underscores the importance of fostering a digital mindset and culture within businesses. This study also emphasizes the significance of efficient information management and integration, as evidenced by the role of accounting information systems (AIS) as an intermediary in the relationship between digital orientation and financial performance. This suggests that the development and effective utilization of a robust AIS, which facilitates data-driven decision making and provides accurate financial information, can enhance the translation of a digital perspective into improved financial performance. Furthermore, this study highlights the need for continuous technological development and adaptation by investigating digital innovation as a mediator between technological orientations and financial success. It suggests that organizations with a high degree of digital innovation may experience amplified benefits from a digital orientation in terms of financial performance. To maximize the impact of digital orientation on economic outcomes, organizations should foster an environment of innovation and embrace emerging technologies. Additionally, this study encourages future researchers to explore other variables that could influence financial performance in empirical models. By investigating the relationships among various antecedents and their impact on financial performance, this study provides a deeper understanding of the determinants of financial performance and digital transformation that have received limited attention in the existing literature.

5.2. Practical Implications

This study also provides guidance for management, researchers, and policymakers to choose different actions for organizing and managing digital transformations. First of all, management must recognize digital orientation, AIS, and digital innovation as strategic components of digitalization. Subsequent effects on financial success are understood via combined implications of all these variables. Secondly, practitioners need to evaluate these constructs consecutively and in combination to measure their present significance and prominence and to select economic choices that boost financial performance. Thirdly, management should consider the significant mediation of AIS when measuring financial performance in the current digital world. Assuming that AIS is an incessant approach that includes practices and proficiency will support management to prepare its organization to face swift challenges and develop proper value in the dynamic environment. Thus, management must realize that a definite level of AIS is required to accomplish high financial performance from a digital orientation. Meanwhile, the influence of these selected technologies rises in parallel with the level of the AIS. Lastly, managers must recall that relating digital transformation instantaneously to various emergent business parts might jeopardize the mechanisms of businesses and would not add to the financial performance of enterprises. In many cases, this tactic can even decline profit. Instead, management must focus on selectivity and the necessity for vibrant visualization domains and opportunities when digitalizing. It means proceeding with continuous activities of implementing digital technologies together decisively and consistently.

5.3. Limitations and Further Research

This study has several restrictions that offer opportunities for future directions. Firstly, in this study, for data collection, a quantitative method and random sampling technique were used. However, further studies should be required to evaluate the consistency of the results via cross-sectional and qualitative methods. Secondly, this study’s sample size is smaller, so its findings are applicable only to the SME sector. Therefore, in the future, a large sample size should be used to test this empirical model for the generalization of results in other sectors. Lastly, in this study, we used AIS as a mediator and digital innovation as a moderator that affects the financial performance of SMEs in China. This study suggests that more research should also be conducted to assess other independent variables and their combined effects on various performance outcomes. A comparison of different digital transformation profiles would also shed light on how they contribute to enhanced performance.

6. Conclusions

Based on the understanding provided in the literature relating to digital transformation and strategic organization, this research model tested three significant antecedents of digital transformation, namely digital orientation, AIS, and digital innovation, and determined that these variables influence the financial performance of SMEs.

The connection between AIS and financial performance lies in how AIS affects various aspects of financial management, leading to improved financial performance. The following are some key points to consider:

- Data Accuracy and Reliability: AIS helps ensure accurate and reliable financial data by automating data entry and reducing the risk of human errors. Accurate financial information is essential for making informed business decisions, setting financial goals, and assessing financial performance accurately.

- Timely Financial Reporting: AIS facilitates the timely generation of financial reports, such as balance sheets, income statements, and cash flow statements. Timely financial reporting provides management with up-to-date information to evaluate the financial health of the organization, identify areas of improvement, and take necessary corrective actions.

- Streamlined Financial Processes: AIS automates various financial processes, such as recording transactions, generating invoices, processing payments, and reconciling accounts. By streamlining these processes, AIS enhances operational efficiency, reduces manual workloads, and minimizes the likelihood of errors. This, in turn, improves overall financial performance.

- Decision Support: AIS generates financial information and reports that help management make strategic and operational decisions. For instance, AIS can provide real-time insights into revenue, expenses, profitability, and cash flow, enabling managers to identify profitable product lines, cost-saving opportunities, and potential financial risks. Informed decision making based on accurate financial information can positively impact financial performance.

- Compliance and Risk Management: AIS assists in ensuring compliance with financial regulations and reporting standards. It helps maintain proper internal controls, identify potential fraud or irregularities, and mitigate financial risks. Compliance and risk management measures supported by AIS contribute to maintaining financial stability and protecting the organization’s performance.

- Enhanced Financial Analysis: AIS provides tools and capabilities for financial analysis, including financial ratios, trend analysis, and variance analysis. These analytical capabilities enable deeper insights into financial performance, profitability, liquidity, and efficiency. By analyzing financial data more effectively, organizations can identify areas for improvement and take action to enhance financial performance.

Overall, AIS plays a crucial role in managing financial information effectively, improving data accuracy, streamlining processes, supporting decision making, ensuring compliance, and enhancing financial analysis. By leveraging the capabilities of AIS, organizations can optimize their financial performance, increase profitability, and achieve their financial goals. This study’s addition of the interconnections is a unique contribution to the prior mainly bilateral studies on associations between DO, AIS, and digital innovation.

Author Contributions

Conceptualization, R.H.B. and A.G.; methodology, Z.Y. and V.R.; software, Z.Y. and A.A.N.; validation, A.G. and A.A.N.; formal analysis, Z.Y. and V.R.; investigation, R.H.B. and V.R.; resources, R.H.B. and A.A.N.; data curation, R.H.B. and V.R.; writing—original draft preparation, R.H.B., Z.Y. and A.A.N.; writing—review and editing, A.G., V.R. and A.A.N.; visualization, Z.Y and V.R.; supervision, A.G. and A.A.N.; project administration, A.G. and A.A.N.; funding acquisition, R.H.B. and V.R.; All authors have read and agreed to the published version of the manuscript.

Funding

Researchers Supporting Project number (RSP2023R87), King Saud University, Riyadh, Saudi Arabia.

Institutional Review Board Statement

This study was conducted following the guidelines of Declaration-of-Helsinki. It is approved by the Ethics Committee of HU. Ref: HUDNo. 547-098.

Informed Consent Statement

Informed consent was obtained from participants involved in this research.

Data Availability Statement

Data will be provided on request.

Acknowledgments

Researchers Supporting Project number (RSP2023R87), King Saud University, Riyadh, Saudi Arabia.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Parviainen, P.; Tihinen, M.; Kääriäinen, J.; Teppola, S. Tackling the digitalization challenge: How to benefit from digitalization in practice. Int. J. Inf. Syst. Proj. Manag. 2017, 5, 63–77. [Google Scholar] [CrossRef]

- Abou-Foul, M.; Ruiz-Alba, J.L.; Soares, A. The impact of digitalization and servitization on the financial performance of a firm: An empirical analysis. Prod. Plan. Control 2021, 32, 975–989. [Google Scholar] [CrossRef]

- Quinton, S.; Canhoto, A.; Molinillo, S.; Pera, R.; Budhathoki, T. Conceptualising a digital orientation: Antecedents of supporting SME performance in the digital economy. J. Strat. Mark. 2018, 26, 427–439. [Google Scholar] [CrossRef]

- Almeida, F.; Santos, J.D.; Monteiro, J.A. The Challenges and Opportunities in the Digitalization of Companies in a Post-COVID-19 World. IEEE Eng. Manag. Rev. 2020, 48, 97–103. [Google Scholar] [CrossRef]

- Molina-Azorín, J.F.; Claver-Cortés, E.; López-Gamero, M.D.; Tarí, J.J. Green management and financial performance: A literature review. Manag. Decis. 2009, 47, 1080–1100. [Google Scholar] [CrossRef]

- Nasiri, M.; Saunila, M.; Ukko, J. Digital orientation, digital maturity, and digital intensity: Determinants of financial success in digital transformation settings. Int. J. Oper. Prod. Manag. 2022, 42, 274–298. [Google Scholar] [CrossRef]

- Rupeika-Apoga, R.; Petrovska, K.; Bule, L. The Effect of Digital Orientation and Digital Capability on Digital Transformation of SMEs during the COVID-19 Pandemic. J. Theor. Appl. Electron. Commer. Res. 2022, 17, 669–685. [Google Scholar] [CrossRef]

- Kindermann, B.; Beutel, S.; de Lomana, G.G.; Strese, S.; Bendig, D.; Brettel, M. Digital orientation: Conceptualization and operationalization of a new strategic orientation. Eur. Manag. J. 2021, 39, 645–657. [Google Scholar] [CrossRef]

- Al-Hiyari, A.; Al-Mashregy, M.H.H.; Mat, N.K.; Alekam, J.E. Factors that affect accounting information system implementation and accounting information quality: A survey in University Utara Malaysia. Am. J. Econ. 2013, 3, 27–31. [Google Scholar]

- Fitrios, R. Factors that influence accounting information system implementation and accounting information quality. Int. J. Sci. Technol. Res. 2016, 5, 192–198. [Google Scholar]

- Gofwan, H. Effect of Accounting Information System on Financial Performance of Firms: A Review of Literature; 2nd Departmental Seminar Series with the Theme–History of Accounting Thoughts: A Methodological Approach; Department of Accounting (Bingham University): Karu, Asarawa State, Nigeria, 2022; Volume 2, pp. 57–60. [Google Scholar]

- Bendig, D.; Schulz, C.; Theis, L.; Raff, S. Digital orientation and environmental performance in times of technological change. Technol. Forecast. Soc. Chang. 2023, 188, 122272. [Google Scholar] [CrossRef]

- Thennakoon, S.T.M.M.; Rajeshwaran, N. Accounting information system and financial performance: Empirical evidence on Sri Lankan firms. Int. J. Account. Bus. Financ. 2022, 8, 15–32. [Google Scholar] [CrossRef]

- Astuti, W.A.; Augustine, Y. The Effect of Digital Technology and Agility On Company Performance with Management Accounting System as Mediation. Int. J. Res. Appl. Technol. 2022, 2, 11–29. [Google Scholar] [CrossRef]

- Salehi, M.; Rostami, V.; Mogadam, A. Usefulness of Accounting Information System in Emerging Economy: Empirical Evidence of Iran. Int. J. Econ. Financ. 2010, 2, 186–195. [Google Scholar] [CrossRef]

- Spilnyk, I.; Brukhanskyi, R.; Yaroshchuk, O. Accounting and Financial Reporting System in the Digital Economy. In Proceedings of the 2020 10th International Conference on Advanced Computer Information Technologies (ACIT), Deggendorf, Germany, 16–18 September 2020; pp. 581–584. [Google Scholar]

- Hinings, B.; Gegenhuber, T.; Greenwood, R. Digital innovation and transformation: An institutional perspective. Inf. Organ. 2018, 28, 52–61. [Google Scholar] [CrossRef]

- Scott, S.V.; Van Reenen, J.; Zachariadis, M. The long-term effect of digital innovation on bank performance: An empirical study of SWIFT adoption in financial services. Res. Policy 2017, 46, 984–1004. [Google Scholar] [CrossRef]

- Arias-Pérez, J.; Vélez-Jaramillo, J. Ignoring the three-way interaction of digital orientation, Not-invented-here syndrome and employee’s artificial intelligence awareness in digital innovation performance: A recipe for failure. Technol. Forecast. Soc. Chang. 2022, 174, 121305. [Google Scholar] [CrossRef]

- Ionascu, I.; Ionascu, M.; Nechita, E.; Sacarin, M.; Minu, M. Digital Transformation, Financial Performance and Sustainability: Evidence for European Union Listed Companies. Amfiteatru Econ. 2022, 24, 94–109. [Google Scholar] [CrossRef]

- Fabian, N.E.; Broekhuizen, T.; Nguyen, D.K. Digital transformation and financial performance: Do digital specialists unlock the profit potential of new digital business models for SMEs? In Managing Digital Transformation; Routledge: London, UK, 2021; pp. 240–258. [Google Scholar]

- Abd Razak, S.N.A.; Noor, W.N.B.W.M.; Jusoh, Y.H.M. Embracing Digital Economy: Drivers, Barriers and Factors Affecting Digital Transformation of Accounting Professionals. Int. J. Adv. Res. Econ. Financ. 2021, 3, 63–71. [Google Scholar]

- Tungpantong, C.; Nilsook, P.; Wannapiroon, P. A Conceptual Framework of Factors for Information Systems Success to Digital Transformation in Higher Education Institutions. In Proceedings of the 2021 9th International Conference on Information and Education Technology (ICIET), Okayama, Japan, 27–29 March 2021; pp. 57–62. [Google Scholar] [CrossRef]

- Melović, B.; Jocović, M.; Dabić, M.; Vulić, T.B.; Dudic, B. The impact of digital transformation and digital marketing on the brand promotion, positioning and electronic business in Montenegro. Technol. Soc. 2020, 63, 101425. [Google Scholar] [CrossRef]

- Rosamartina, S.; Giustina, S.; Domenico, D.F.; Pasquale, D.V.; Angeloantonio, R. Digital reputation and firm performance: The moderating role of firm orientation towards sustainable development goals (SDGs). J. Bus. Res. 2022, 152, 315–325. [Google Scholar] [CrossRef]

- Abbu, H.R.; Gopalakrishna, P. Synergistic effects of market orientation implementation and internalization on firm performance: Direct marketing service provider industry. J. Bus. Res. 2021, 125, 851–863. [Google Scholar] [CrossRef]

- Ivashchenko, A.; Britchenko, I.; Dyba, M.; Polishchuk, Y.; Sybirianska, Y.; Vasylyshen, Y. Fintech platforms in sme’s financing: Eu experience and ways of their application in Ukraine. Invest. Manag. Financ. Innov. 2018, 15, 83–96. [Google Scholar] [CrossRef]

- Kim, G.; Shin, B.; Kim, K.K.; Lee, H.G. IT capabilities, process-oriented dynamic capabilities, and firm financial performance. J. Assoc. Inf. Syst. 2011, 12, 1. [Google Scholar] [CrossRef]

- Ikramuddin, I.; Matriadi, F.; Iis, E.Y.; Mariyudi, M. Marketing Performance Development: Application of the Concept of Digital Marketing and Market Orientation Strategy in the Msme Sector. Int. J. Educ. Rev. Law Soc. Sci. (IJERLAS) 2021, 1, 181–190. [Google Scholar] [CrossRef]

- Liu, J.; Zhou, K.; Zhang, Y.; Tang, F. The Effect of Financial Digital Transformation on Financial Performance: The Intermediary Effect of Information Symmetry and Operating Costs. Sustainability 2023, 15, 5059. [Google Scholar] [CrossRef]

- Payne, E.H.M.; Dahl, A.J.; Peltier, J. Digital servitization value co-creation framework for AI services: A research agenda for digital transformation in financial service ecosystems. J. Res. Interact. Mark. 2021, 15, 200–222. [Google Scholar] [CrossRef]

- Scardovi, C. Digital Transformation in Financial Services; Springer International Publishing: Cham, Switzerland, 2017; Volume 236. [Google Scholar]

- Shen, L.; Zhang, X.; Liu, H. Digital technology adoption, digital dynamic capability, and digital transformation performance of textile industry: Moderating role of digital innovation orientation. Manag. Decis. Econ. 2022, 43, 2038–2054. [Google Scholar] [CrossRef]

- Fang, M.; Liu, F.; Xiao, S.; Park, K. Hedging the bet on digital transformation in strategic supply chain management: A theoretical integration and an empirical test. Int. J. Phys. Distrib. Logist. Manag. 2023. ahead-of-print. [Google Scholar] [CrossRef]

- Niemand, T.; Rigtering, J.C.; Kallmünzer, A.; Kraus, S.; Maalaoui, A. Digitalization in the financial industry: A contingency approach of entrepreneurial orientation and strategic vision on digitalization. Eur. Manag. J. 2021, 39, 317–326. [Google Scholar] [CrossRef]

- Saleh, Q.Y.; Al-Nimer, M.B. The mediating role of the management accounting information system in the relationship between innovation strategy and financial performance in the Jordanian industrial companies. Cogent Bus. Manag. 2022, 9, 2135206. [Google Scholar] [CrossRef]

- Hutahayan, B. The mediating role of human capital and management accounting information system in the relationship between innovation strategy and internal process performance and the impact on corporate financial performance. Benchmarking Int. J. 2020, 27, 1289–1318. [Google Scholar] [CrossRef]

- Ironkwe, U.; Nwaiwu, J. Accounting Information System on Financial and Non-Financial Measures of Companies in Nigeria. Int. J. Adv. Acad. Res.|Bus. Dev. Manag. 2018, 4, 39–55. [Google Scholar]

- Ali, B.J.; Bakar, R.; Omar, W.A.W. The critical success factors of accounting information system (AIS) and it’s impact on organisational performance of Jordanian commercial banks. Int. J. Econ. Commer. Manag. 2016, 4, 658–677. [Google Scholar]

- Rehm, S.-V. Accounting Information Systems and how to prepare for Digital Transformation. In The Routledge Companion to Accounting Information Systems; Routledge: London, UK, 2017; pp. 69–80. [Google Scholar] [CrossRef]

- Chen, Y.; Hu, X. The Empowerment and Subversion of Financial Technology to Accounting Information System. In Proceedings of the 2nd International Conference on Internet, Education and Information Technology (IEIT 2022), Online, 27 December 2022; pp. 33–38. [Google Scholar] [CrossRef]

- Zhavoronok, A.; Popelo, O.; Shchur, R.; Ostrovska, N.; Kordzaia, N. The Role of Digital Technologies in the Transformation of Regional Models of Households’ Financial Behavior in the Conditions of the National Innovative Economy Development. Ingénierie des Systèmes d’Information 2022, 27, 613–620. [Google Scholar] [CrossRef]

- Asmuni, I. Reliability Implementation of Accounting Information Systems in Improving Small and Medium Enterprises Financial Performance. Test Eng. Manag. 2020, 83, 798–811. Available online: https://www.researchgate.net/publication/341423378_Reliability_Implementation_of_Accounting_Information_Systems_in_Improving_Small_and_Medium_Enterprises_Financial_Performance (accessed on 20 March 2023).

- Chmutova, I.; Simon Kuznets Kharkiv National University of Economics; Vovk, V.; Bezrodna, O. Analytical tools to implement integrated bank financial management technologies. Econ. Ann.-XXI 2017, 163, 95–99. [Google Scholar] [CrossRef]

- Khin, S.; Ho, T.C. Digital technology, digital capability and organizational performance: A mediating role of digital innovation. Int. J. Innov. Sci. 2018, 11, 177–195. [Google Scholar] [CrossRef]

- Soudani, S.N. The Usefulness of an Accounting Information System for Effective Organizational Performance. Int. J. Econ. Financ. 2012, 4, 136–145. [Google Scholar] [CrossRef]

- Xu, G.; Hou, G.; Zhang, J. Digital Sustainable Entrepreneurship: A Digital Capability Perspective through Digital Innovation Orientation for Social and Environmental Value Creation. Sustainability 2022, 14, 11222. [Google Scholar] [CrossRef]

- Anderson, J.C.; Gerbing, D.W. Structural equation modeling in practice: A review and recommended two-step approach. Psychol. Bull. 1988, 103, 411. [Google Scholar] [CrossRef]

- Fornell, C.; Larcker, D.F. Structural equation models with unobservable variables and measurement error: Algebra and statistics. J. Mark. Res. 1981, 18, 382–388. [Google Scholar] [CrossRef]

- Zhao, L.; Liu, Z.; Vuong, T.H.G.; Nguyen, H.M.; Radu, F.; Tăbîrcă, A.I.; Wu, Y.-C. Determinants of Financial Sustainability in Chinese Firms: A Quantile Regression Approach. Sustainability 2022, 14, 1555. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).