Dynamic Optimal Control Strategy of CCUS Technology Innovation in Coal Power Stations Under Environmental Protection Tax

Abstract

:1. The Presentation of the Issue

- (1)

- Does imposing an environmental protection tax effectively stimulate technological innovation in coal power stations to curb carbon emissions?

- (2)

- How should the environmental protection tax be adjusted to influence technological advancements in coal power stations?

- (3)

- How does investment in CCUS technology innovation fluctuate across different scenarios?

2. Theories and Hypotheses

2.1. CCUS Technology in Coal Power Stations

2.2. Environmental Tax and CCUS Technology

- (1)

- It examines the impact of environmental taxes on technological innovation and how these taxes influence electricity pricing.

- (2)

- The learning-by-doing effect, which enhances efficiency, is introduced into technological innovation, reflected in the dynamic model of technology.

- (3)

- It examines and contrasts CCUS technology investments in coal power plants under both profit maximization and social welfare maximization, providing insights to support investment decision-making in the industry.

3. Research Design

4. Research Results

4.1. Optimal Decision Behavior Under Profit Maximization

4.1.1. Optimality Conditions and Properties

4.1.2. Steady-State Analysis

4.2. Optimal Decision-Making Behavior Under Social Welfare Maximization

4.2.1. Optimality Conditions and Properties

4.2.2. Steady-State Analysis

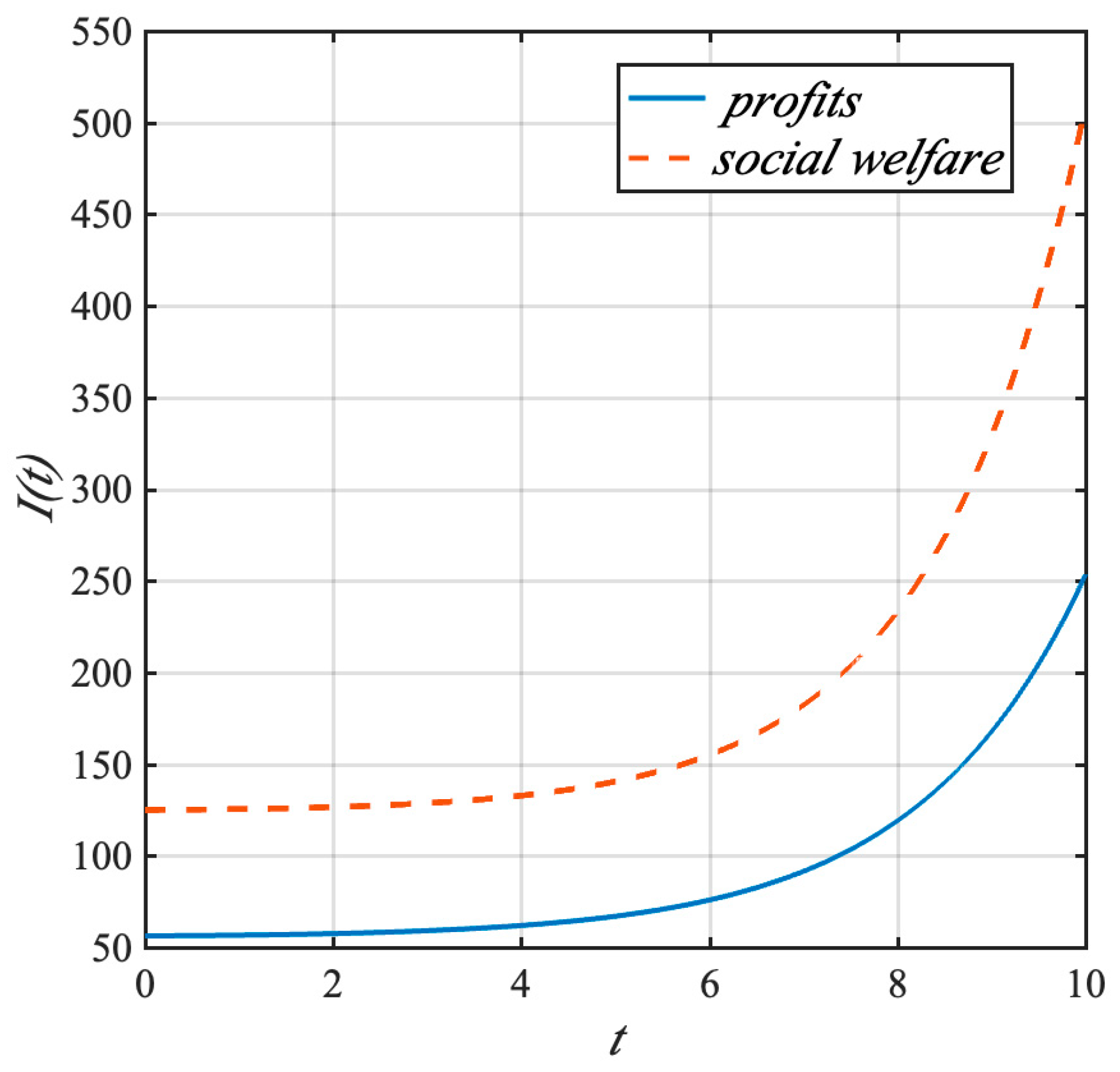

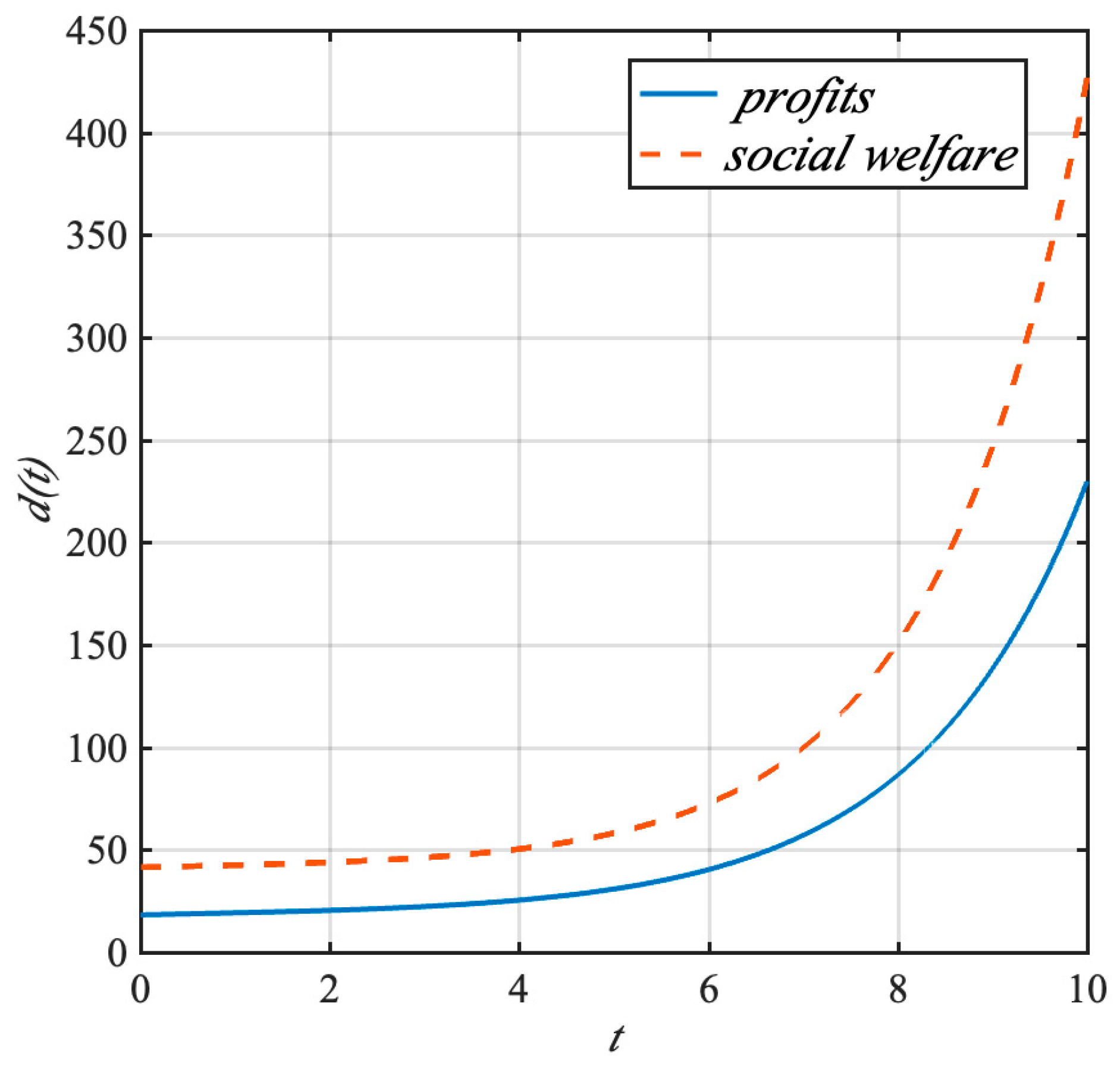

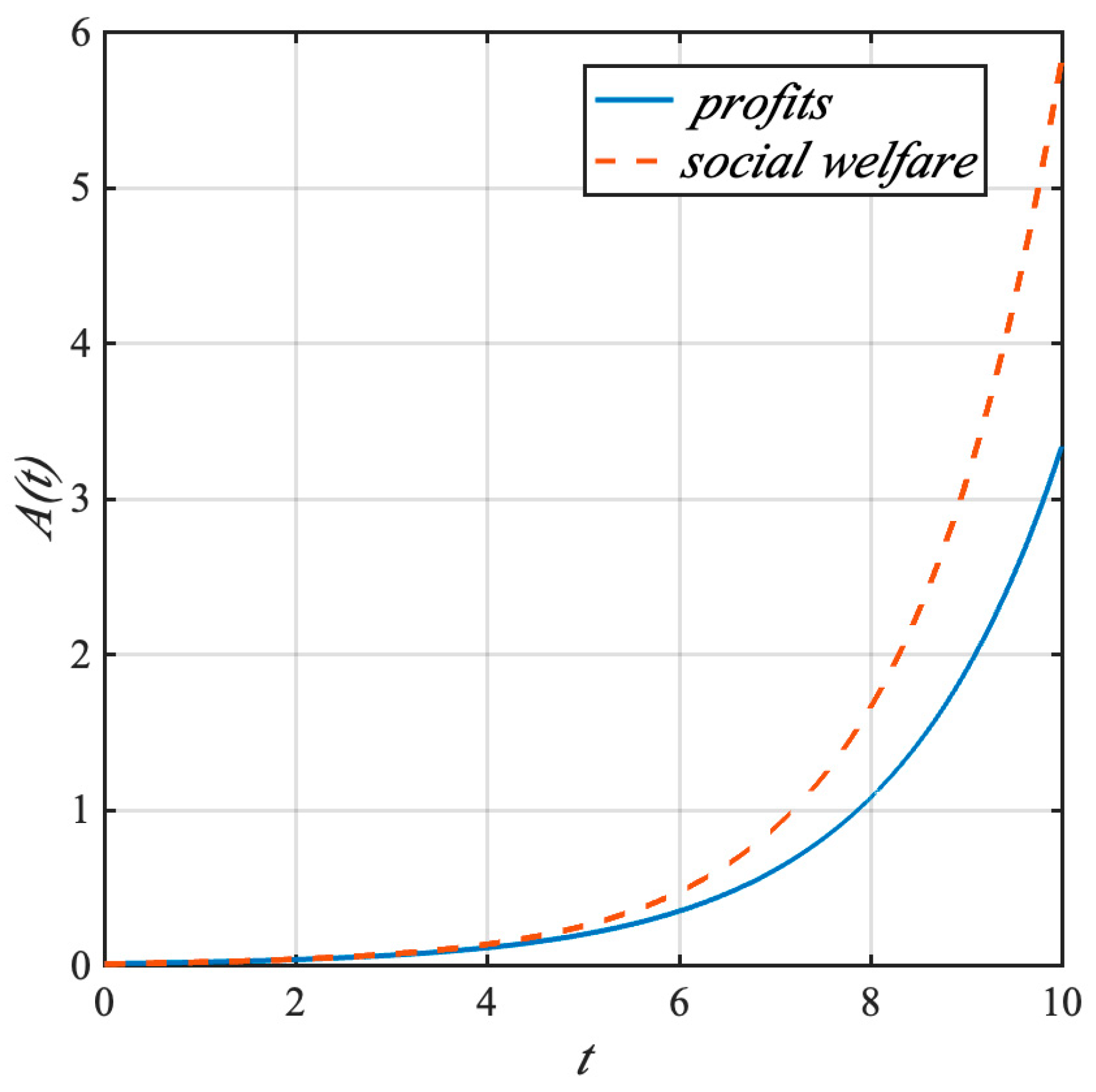

4.3. Numerical Simulation

5. Discussion of Results

- (1)

- The dynamic system demonstrates saddle-path stability characteristics under both profit-driven optimization and social welfare maximization frameworks, contingent upon specific operational thresholds. When , the equilibrium solution manifests unique saddle-path convergence properties. Stability analysis reveals that this dynamic equilibrium is highly sensitive to three critical factors: the temporal discount factor, technological obsolescence rate, and knowledge depreciation coefficient. The temporal discount factor reflects the time value of money and future benefits, which has a significant impact on the investment decisions and operating strategies of thermal power plants. A higher discount factor may lead to a greater emphasis on short-term profits, while a lower discount factor may encourage more long-term investment in CCUS technologies. The technological obsolescence rate indicates the speed at which CCUS technologies become outdated. As new and more efficient CCUS technologies emerge, the existing technologies may lose their competitiveness, which will affect the investment and operation of thermal power plants. The knowledge depreciation coefficient represents the rate at which the knowledge related to CCUS technologies becomes outdated. With the continuous development of science and technology, the knowledge and skills required for CCUS operation and maintenance may need to be updated in a timely manner. Otherwise, it will affect the performance and cost-effectiveness of CCUS systems.

- (2)

- The allocation of resources toward CCUS technology for coal power plants is greater under social welfare maximization compared to profit maximization. This is because, under the social welfare maximization framework, the focus is not only on the economic benefits of thermal power plants but also on the overall social and environmental benefits. Therefore, more resources will be allocated to CCUS technology to reduce carbon emissions and improve air quality, even if it may reduce the short-term profitability of thermal power plants. Government initiatives are more effective in advancing CCUS technology than the efforts of coal power plants alone. Governments can provide various forms of support, such as financial subsidies, tax incentives, and policy guidance, to encourage thermal power plants to adopt CCUS technologies. In addition, governments can also coordinate the efforts of different stakeholders, such as research institutions, equipment manufacturers, and power grid companies, to jointly promote the development and application of CCUS technologies.

- (3)

- Under social welfare maximization, CCUS technology innovation, knowledge accumulation, and the overall cleanliness of coal power stations exceed the levels achieved under profit-driven decision-making by coal power plants. This is because, under the social welfare maximization framework, there is a greater incentive to invest in R&D and innovation of CCUS technologies to improve their performance and reduce costs. At the same time, the accumulation of knowledge and experience in the application of CCUS technologies will also be more valued, which will promote the continuous improvement of the overall cleanliness of coal power stations.

- (4)

- Environmental protection tax will not only affect the investment in CCUS technological innovation of coal power stations but also affect the price of electricity. The static environmental protection tax cannot well reflect its impact, so the government should reasonably set the dynamic environmental protection tax to promote the CCUS technology innovation of coal-fired power plants. A dynamic environmental protection tax can better adapt to the changes in the cost and benefits of CCUS technologies and the market conditions of the power industry. By adjusting the tax rate in a timely manner, the government can encourage thermal power plants to continuously invest in CCUS technological innovation and improve their environmental performance.

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

Appendix B

Appendix C

Appendix D

Appendix E

Appendix F

References

- Ahmed, S.; Bibi, S.S.; Irshad, M.; Asif, M.; Khan, M.K.; Kim, J. Synthesis of long-chain paraffins over bimetallic Na–Fe0.9Mg0.1Ox by direct CO2 hydrogenation. Top. Catal. 2024, 67, 363–376. [Google Scholar] [CrossRef]

- Ahmed, S.; Irshad, M.; Yoon, W.; Karanwal, N.; Sugiarto, J.R.; Khan, M.K.; Kim, S.K.; Kim, J. Evaluation of MgO as a promoter for the hydrogenation of CO2 to long-chain hydrocarbons over Fe-based catalysts. Appl. Catal. B Environ. 2023, 338, 123052. [Google Scholar] [CrossRef]

- Rennert, K.; Errickson, F.; Prest, B.C.; Rennels, L.; Newell, R.G.; Pizer, W.; Kingdon, C.; Wingenroth, J.; Cooke, R.; Parthum, B. Comprehensive evidence implies a higher social cost of CO2. Nature 2022, 610, 687–692. [Google Scholar] [CrossRef] [PubMed]

- Han, J.; Li, J.; Tang, X.; Wang, L.; Yang, X.; Ge, Z.; Yuan, F. Coal-fired power plant CCUS project comprehensive benefit evaluation and forecasting model study. J. Clean. Prod. 2023, 385, 135657. [Google Scholar] [CrossRef]

- Sun, L.; Li, X.; Su, C.; Wang, X.; Yuan, X. Analysis of dynamic strategies for decision-making on retrofitting carbon capture, utilization, and storage technology in coal-fired power plants. Appl. Therm. Eng. 2025, 264, 125371. [Google Scholar] [CrossRef]

- Budinis, S.; Krevor, S.; Mac Dowell, N.; Brandon, N.; Hawkes, A. An assessment of CCS costs, barriers and potential. Energy Strategy Rev. 2018, 22, 61–81. [Google Scholar] [CrossRef]

- Edenhofer, O.; Knopf, B.; Barker, T.; Baumstark, L.; Bellevrat, E.; Chateau, B.; Criqui, P.; Isaac, M.; Kitous, A.; Kypreos, S. The economics of low stabilization: Model comparison of mitigation strategies and costs. Energy J. 2010, 31, 31,11–48. [Google Scholar] [CrossRef]

- Durmaz, T. The economics of CCS: Why have CCS technologies not had an international breakthrough? Renew. Sustain. Energy Rev. 2018, 95, 328–340. [Google Scholar] [CrossRef]

- Davoodi, S.; Al-Shargabi, M.; Wood, D.A.; Rukavishnikov, V.S.; Minaev, K.M. Review of technological progress in carbon dioxide capture, storage, and utilization. Gas. Sci. Eng. 2023, 117, 205070. [Google Scholar] [CrossRef]

- Singh, U.; Colosi, L.M. The case for estimating carbon return on investment (CROI) for CCUS platforms. Appl. Energy 2021, 285, 116394. [Google Scholar] [CrossRef]

- Wang, X.; Tang, R.; Meng, M.; Su, T. Research on CCUS business model and policy incentives for coal-fired power plants in China. Int. J. Greenh. Gas. Control 2023, 125, 103871. [Google Scholar] [CrossRef]

- Niazvand, F.; Kharrati, S.; Khosravi, F.; Rastgou, A. Scenario-based assessment for optimal planning of multi-carrier hub-energy system under dual uncertainties and various scheduling by considering CCUS technology. Sustain. Energy Technol. Assess. 2021, 46, 101300. [Google Scholar] [CrossRef]

- Fan, J.-L.; Li, Z.; Li, K.; Zhang, X. Modelling plant-level abatement costs and effects of incentive policies for coal-fired power generation retrofitted with CCUS. Energy Policy 2022, 165, 112959. [Google Scholar] [CrossRef]

- Liu, M.; Zhang, Y.; Lan, H.; Huang, F.; Liang, X.; Xia, C. Assessing the cost reduction potential of CCUS cluster projects of coal-fired plants in Guangdong Province in China. Front. Earth Sci. 2023, 17, 844–855. [Google Scholar] [CrossRef]

- Szolgayova, J.; Fuss, S.; Obersteiner, M. Assessing the effects of CO2 price caps on electricity investments—A real options analysis. Energy Policy 2008, 36, 3974–3981. [Google Scholar] [CrossRef]

- Heydari, S.; Ovenden, N.; Siddiqui, A. Real options analysis of investment in carbon capture and sequestration technology. Comput. Manag. Sci. 2012, 9, 109–138. [Google Scholar] [CrossRef]

- Zhou, W.; Zhu, B.; Fuss, S.; Szolgayová, J.; Obersteiner, M.; Fei, W. Uncertainty modeling of CCS investment strategy in China’s power sector. Appl. Energy 2010, 87, 2392–2400. [Google Scholar] [CrossRef]

- Gustafsson, K.; Sadegh-Vaziri, R.; Grönkvist, S.; Levihn, F.; Sundberg, C. BECCS with combined heat and power: Assessing the energy penalty. Int. J. Greenh. Gas Control 2021, 110, 103434. [Google Scholar] [CrossRef]

- Picciano, P.; Aguilar, F.X.; Burtraw, D.; Mirzaee, A. Environmental and socio-economic implications of woody biomass co-firing at coal-fired power plants. Resour. Energy Econ. 2022, 68, 101296. [Google Scholar] [CrossRef]

- Tan, Z.; Zeng, X.; Lin, B. How do multiple policy incentives influence investors’ decisions on biomass co-firing combined with carbon capture and storage retrofit projects for coal-fired power plants? Energy 2023, 278, 127822. [Google Scholar] [CrossRef]

- Bowen, F. Barriers to carbon capture and storage may not be obvious. Nature 2010, 464, 160. [Google Scholar] [CrossRef] [PubMed]

- Jewell, J.; Vinichenko, V.; Nacke, L.; Cherp, A. Prospects for powering past coal. Nat. Clim. Change 2019, 9, 592–597. [Google Scholar] [CrossRef]

- Wei, N.; Jiao, Z.; Ellett, K.; Ku, A.Y.; Liu, S.; Middleton, R.; Li, X. Decarbonizing the coal-fired power sector in China via carbon capture, geological utilization, and storage technology. Environ. Sci. Technol. 2021, 55, 13164–13173. [Google Scholar] [CrossRef]

- Zhu, L.; Fan, Y. A real options–based CCS investment evaluation model: Case study of China’s power generation sector. Appl. Energy 2011, 88, 4320–4333. [Google Scholar] [CrossRef]

- Chen, H.; Zhang, Y.; Gutman, I. A kernel-based clustering method for gene selection with gene expression data. J. Biomed. Inform. 2016, 62, 12–20. [Google Scholar] [CrossRef]

- Pilorgé, H.; McQueen, N.; Maynard, D.; Psarras, P.; He, J.; Rufael, T.; Wilcox, J. Cost analysis of carbon capture and sequestration of process emissions from the US industrial sector. Environ. Sci. Technol. 2020, 54, 7524–7532. [Google Scholar] [CrossRef] [PubMed]

- Amiri-Pebdani, S.; Alinaghian, M.; Khosroshahi, H. Pricing in competitive energy supply chains considering government interventions to support CCS under cap-and-trade regulations: A game-theoretic approach. Energy Policy 2023, 179, 113630. [Google Scholar] [CrossRef]

- Baiardi, D.; Menegatti, M. Pigouvian tax, abatement policies and uncertainty on the environment. J. Econ. 2011, 103, 221–251. [Google Scholar] [CrossRef]

- Fang, G.; Chen, G.; Yang, K.; Yin, W.; Tian, L. Can green tax policy promote China’s energy transformation?—A nonlinear analysis from production and consumption perspectives. Energy 2023, 269, 126818. [Google Scholar] [CrossRef]

- Yeung, D.W. Dynamically consistent collaborative environmental management with production technique choices. Ann. Oper. Res. 2014, 220, 181–204. [Google Scholar] [CrossRef]

- Yeung, D.W.; Petrosyan, L.A. A cooperative dynamic environmental game of subgame consistent clean technology development. Int. Game Theory Rev. 2016, 18, 1640008. [Google Scholar] [CrossRef]

- Siedschlag, I.; Yan, W. Firms’ green investments: What factors matter? J. Clean. Prod. 2021, 310, 127554. [Google Scholar] [CrossRef]

- Osorio, A.; Zhang, M. Using contests to design emission tax mechanisms. Sustain. Prod. Consum. 2022, 31, 762–776. [Google Scholar] [CrossRef]

- Cheng, B.; Qiu, B.; Chan, K.C.; Zhang, H. Does a green tax impact a heavy-polluting firm’s green investments? Appl. Econ. 2022, 54, 189–205. [Google Scholar] [CrossRef]

- Wang, Y.; Yu, L. Can the current environmental tax rate promote green technology innovation?-Evidence from China’s resource-based industries. J. Clean. Prod. 2021, 278, 123443. [Google Scholar] [CrossRef]

- Milliman, S.R.; Prince, R. Firm incentives to promote technological change in pollution control. J. Environ. Econ. Manag. 1989, 17, 247–265. [Google Scholar] [CrossRef]

- Hattori, K. Optimal combination of innovation and environmental policies under technology licensing. Econ. Model. 2017, 64, 601–609. [Google Scholar] [CrossRef]

- Kemp, R.; Pontoglio, S. The innovation effects of environmental policy instruments—A typical case of the blind men and the elephant? Ecol. Econ. 2011, 72, 28–36. [Google Scholar] [CrossRef]

- Li, S.; Pan, X. A dynamic general equilibrium model of pollution abatement under learning by doing. Econ. Lett. 2014, 122, 285–288. [Google Scholar] [CrossRef]

- Yi, Y.; Wei, Z.; Fu, C. An optimal combination of emissions tax and green innovation subsidies for polluting oligopolies. J. Clean. Prod. 2021, 284, 124693. [Google Scholar] [CrossRef]

- Arrow, K.J. The economic implications of learning by doing. Rev. Econ. Stud. 1962, 29, 155–173. [Google Scholar] [CrossRef]

- Guo, G.; Li, S. A dynamic analysis of a monopolist’s quality improvement, process innovation and goodwill. J. Ind. Manag. Optim. 2023, 19, 1714. [Google Scholar] [CrossRef]

- Menanteau, P.; Finon, D.; Lamy, M.-L. Prices versus quantities: Choosing policies for promoting the development of renewable energy. Energy Policy 2003, 31, 799–812. [Google Scholar] [CrossRef]

- Li, S.; Fu, T. Abatement technology innovation, worker productivity and firm profitability: A dynamic analysis. Energy Econ. 2022, 115, 106369. [Google Scholar] [CrossRef]

- Su, C.; Deng, J.; Li, X.; Huang, W.; Wang, C.; Wang, X. Investment in enhancing resilience safety of chemical parks under blockchain technology: From the perspective of dynamic reward and punishment mechanisms. J. Loss Prev. Proc. 2025, 94, 105523. [Google Scholar] [CrossRef]

| 10 | 0.01 | 0.65 | 0.18 | 0.37 | 0.30 | 0.03 | 0.01 | 0.55 | 0.20 | 0.12 | 0.10 | 0.40 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Su, C.; Zha, X.; Ma, J.; Li, B.; Wang, X. Dynamic Optimal Control Strategy of CCUS Technology Innovation in Coal Power Stations Under Environmental Protection Tax. Systems 2025, 13, 193. https://doi.org/10.3390/systems13030193

Su C, Zha X, Ma J, Li B, Wang X. Dynamic Optimal Control Strategy of CCUS Technology Innovation in Coal Power Stations Under Environmental Protection Tax. Systems. 2025; 13(3):193. https://doi.org/10.3390/systems13030193

Chicago/Turabian StyleSu, Chang, Xinxin Zha, Jiayi Ma, Boying Li, and Xinping Wang. 2025. "Dynamic Optimal Control Strategy of CCUS Technology Innovation in Coal Power Stations Under Environmental Protection Tax" Systems 13, no. 3: 193. https://doi.org/10.3390/systems13030193

APA StyleSu, C., Zha, X., Ma, J., Li, B., & Wang, X. (2025). Dynamic Optimal Control Strategy of CCUS Technology Innovation in Coal Power Stations Under Environmental Protection Tax. Systems, 13(3), 193. https://doi.org/10.3390/systems13030193