Breaking Down the Barriers to Innovation Quality: The Impact of Digital Transformation

Abstract

1. Introduction

2. Literature Review and Hypothesis Development

2.1. Literature Review

2.1.1. Digital Transformation

2.1.2. Innovation Quality

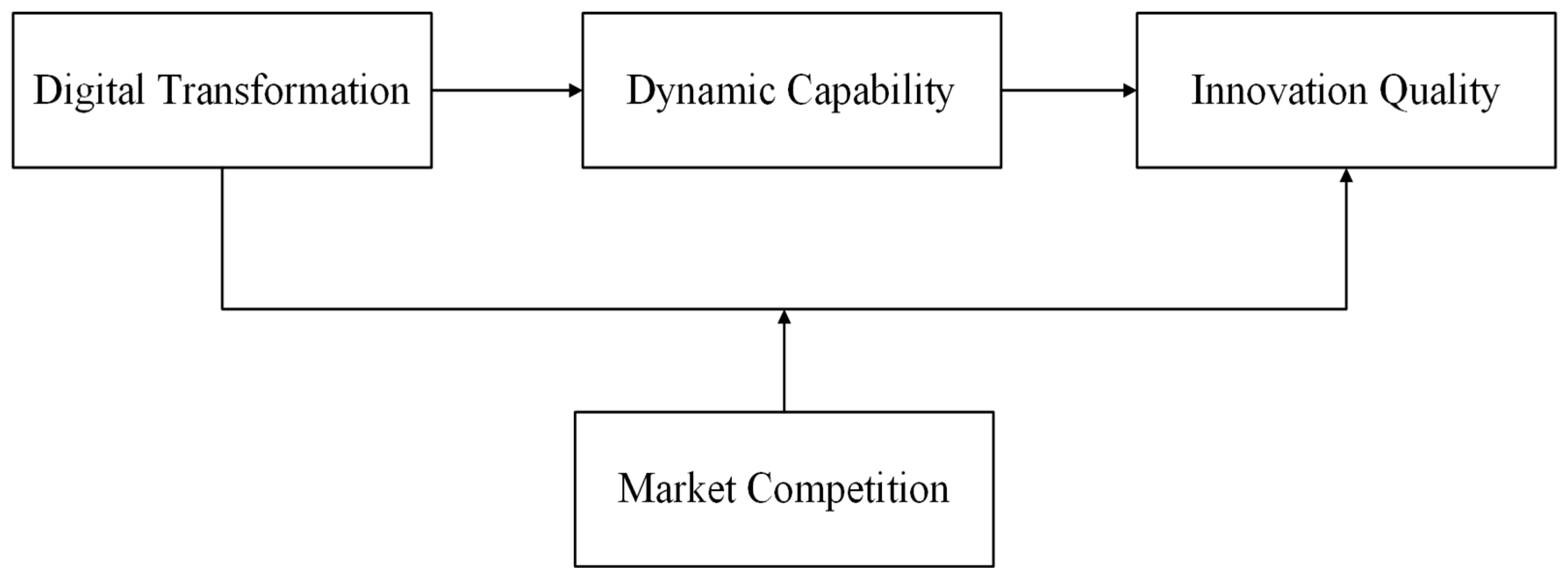

2.2. Hypothesis Development

2.2.1. Digital Transformation and Innovation Quality

2.2.2. Moderating Effect of Market Competition

2.2.3. Mediating Role of Dynamic Capability

3. Data and Methods

3.1. Sample and Data

3.2. Variables and Measurements

3.3. Model Specification

4. Results

4.1. Descriptive Statistics

4.2. Regression Analysis

4.3. Robustness Checks

4.3.1. Instrumental Variable Estimate

4.3.2. PSM-DID

4.4. Mechanism Results

4.5. Additional Analysis

5. Discussion

6. Implications, Limitations, and Future Research

6.1. Theoretical Implications

6.2. Practical Implications

6.3. Limitations and Future Research

Supplementary Materials

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Nambisan, S.; Wright, M.; Feldman, M. The digital transformation of innovation and entrepreneurship: Progress, challenges and key themes. Res. Policy 2019, 48, 103773. [Google Scholar] [CrossRef]

- Niu, Y.; Wen, W.; Wang, S.; Li, S. Breaking barriers to innovation: The power of digital transformation. Financ. Res. Lett. 2023, 51, 103457. [Google Scholar] [CrossRef]

- Troise, C.; Corvello, V.; Ghobadian, A.; O’Regan, N. How can SMEs successfully navigate VUCA environment: The role of agility in the digital transformation era. Technol. Forecast. Soc. Change 2022, 174, 121227. [Google Scholar] [CrossRef]

- Wu, J.; Wang, C.; Hong, J.; Piperopoulos, P.; Zhuo, S. Internationalization and innovation performance of emerging market enterprises: The role of host-country institutional development. J. World Bus. 2016, 51, 251–263. [Google Scholar] [CrossRef]

- Peng, Y.; Tao, C. Can digital transformation promote enterprise performance? —From the perspective of public policy and innovation. J. Innov. Knowl. 2022, 7, 100198. [Google Scholar] [CrossRef]

- Chaithanapat, P.; Punnakitikashem, P.; Oo, N.C.K.K.; Rakthin, S. Relationships among knowledge-oriented leadership, customer knowledge management, innovation quality and firm performance in SMEs. J. Innov. Knowl. 2022, 7, 100162. [Google Scholar] [CrossRef]

- Yu, L.; Zhao, D.; Xue, Z.; Gao, Y. Research on the use of digital finance and the adoption of green control techniques by family farms in China. Technol. Soc. 2020, 62, 101323. [Google Scholar] [CrossRef]

- Wang, C.L.; Ahmed, P.K. Dynamic capabilities: A review and research agenda. Int. J. Manag. Rev. 2007, 9, 31–51. [Google Scholar] [CrossRef]

- Rialti, R.; Marzi, G.; Ciappei, C.; Busso, D. Big data and dynamic capabilities: A bibliometric analysis and systematic literature review. Manag. Decis. 2019, 57, 2052–2068. [Google Scholar] [CrossRef]

- Zhang, J.; Li, H.; Zhao, H. The Impact of Digital Transformation on Organizational Resilience: The Role of Innovation Capability and Agile Response. Systems 2025, 13, 75. [Google Scholar] [CrossRef]

- Fang, S.; Qin, Y. Social Identification in Open Innovation Projects: Role of Knowledge Collaboration and Resource Interdependence. Systems 2025, 13, 129. [Google Scholar] [CrossRef]

- Schulze, A.; Brusoni, S. How dynamic capabilities change ordinary capabilities: Reconnecting attention control and problem-solving. Strategy Manag. J. 2022, 43, 2447–2477. [Google Scholar] [CrossRef]

- Cannas, R. Exploring digital transformation and dynamic capabilities in agrifood SMEs. J. Small Bus. Manag. 2023, 61, 1611–1637. [Google Scholar] [CrossRef]

- Chin, T.; Wang, W.; Yang, M.; Duan, Y.; Chen, Y. The moderating effect of managerial discretion on blockchain technology and the firms’ innovation quality: Evidence from Chinese manufacturing firms. Int. J. Prod. Econ. 2021, 240, 108219. [Google Scholar] [CrossRef]

- Bresciani, S.; Huarng, K.-H.; Malhotra, A.; Ferraris, A. Digital transformation as a springboard for product, process and business model innovation. J. Bus. Res. 2021, 128, 204–210. [Google Scholar] [CrossRef]

- Li, M.; Liu, Y.; Feng, R. How Can China’s Autonomous Vehicle Companies Use Digital Empowerment to Improve Innovation Quality?—The Role of Digital Platform Capabilities and Boundary-Spanning Search. Systems 2025, 13, 45. [Google Scholar] [CrossRef]

- Vial, G. Understanding digital transformation: A review and a research agenda. J. Strateg. Inf. Syst. 2019, 28, 118–144. [Google Scholar] [CrossRef]

- Günther, W.A.; Mehrizi, M.H.R.; Huysman, M.; Feldberg, F. Debating big data: A literature review on realizing value from big data. J. Strategy Inf. Syst. 2017, 26, 191–209. [Google Scholar] [CrossRef]

- Caputo, A.; Pizzi, S.; Pellegrini, M.M.; Dabić, M. Digitalization and business models: Where are we going? A science map of the field. J. Bus. Res. 2021, 123, 489–501. [Google Scholar] [CrossRef]

- Nasiri, M.; Saunila, M.; Ukko, J. Digital orientation, digital maturity, and digital intensity: Determinants of financial success in digital transformation settings. Int. J. Oper. Prod. Manag. 2022, 42, 274–298. [Google Scholar] [CrossRef]

- Jafari-Sadeghi, V.; Garcia-Perez, A.; Candelo, E.; Couturier, J. Exploring the impact of digital transformation on technology entrepreneurship and technological market expansion: The role of technology readiness, exploration and exploitation. J. Bus. Res. 2021, 124, 100–111. [Google Scholar] [CrossRef]

- Zhang, X.; Gao, C.; Zhang, S. The niche evolution of cross-boundary innovation for Chinese SMEs in the context of digital transformation—Case study based on dynamic capability. Technol. Soc. 2022, 68, 101870. [Google Scholar] [CrossRef]

- Haner, U.-E. Innovation quality—A conceptual framework. Int. J. Prod. Econ. 2002, 80, 31–37. [Google Scholar] [CrossRef]

- Lahiri, N. Geographic distribution of R&D activity: How does it affect innovation quality? Acad. Manag. J. 2010, 53, 1194–1209. [Google Scholar] [CrossRef]

- Duan, Y.; Wang, K.; Chang, H.; Liu, W.; Xie, C. The moderating effect of organizational knowledge utilization on top management team’s social capital and the innovation quality of high-tech firms. J. Knowl. Manag. 2024, 28, 3104–3128. [Google Scholar] [CrossRef]

- Jin, P.; Mangla, S.K.; Song, M. The power of innovation diffusion: How patent transfer affects urban innovation quality. J. Bus. Res. 2022, 145, 414–425. [Google Scholar] [CrossRef]

- Jun, W.; Nasir, M.H.; Yousaf, Z.; Khattak, A.; Yasir, M.; Javed, A.; Shirazi, S.H. Innovation performance in digital economy: Does digital platform capability, improvisation capability and organizational readiness really matter? Eur. J. Innov. Manag. 2022, 25, 1309–1327. [Google Scholar] [CrossRef]

- Ates, A.; Acur, N. Making obsolescence obsolete: Execution of digital transformation in a high-tech manufacturing SME. J. Bus. Res. 2022, 152, 336–348. [Google Scholar] [CrossRef]

- Verhoef, P.C.; Broekhuizen, T.; Bart, Y.; Bhattacharya, A.; Dong, J.Q.; Fabian, N.; Haenlein, M. Digital transformation: A multidisciplinary reflection and research agenda. J. Bus. Res. 2021, 122, 889–901. [Google Scholar] [CrossRef]

- Khurana, I.; Dutta, D.K.; Ghura, A.S. SMEs and digital transformation during a crisis: The emergence of resilience as a second-order dynamic capability in an entrepreneurial ecosystem. J. Bus. Res. 2022, 150, 623–641. [Google Scholar] [CrossRef]

- Yoon, T.J. Quality Information Disclosure and Patient Reallocation in the Healthcare Industry: Evidence from Cardiac Surgery Report Cards. Mark. Sci. 2020, 39, 636–662. [Google Scholar] [CrossRef]

- Li, J.; Pan, Y.; Yang, Y.; Tse, C.H. Digital platform attention and international sales: An attention-based view. J. Int. Bus. Stud. 2022, 53, 1817–1835. [Google Scholar] [CrossRef]

- Neumeyer, X.; Santos, S.C.; Morris, M.H. Overcoming Barriers to Technology Adoption When Fostering Entrepreneurship Among the Poor: The Role of Technology and Digital Literacy. IEEE Trans. Eng. Manag. 2021, 68, 1605–1618. [Google Scholar] [CrossRef]

- Laursen, K.; Masciarelli, F.; Prencipe, A. Trapped or spurred by the home region? The effects of potential social capital on involvement in foreign markets for goods and technology. J. Int. Bus. Stud. 2012, 43, 783–807. [Google Scholar] [CrossRef]

- Kettunen, J.; Grushka-Cockayne, Y.; Degraeve, Z.; De Reyck, B. New product development flexibility in a competitive environment. Eur. J. Oper. Res. 2015, 244, 892–904. [Google Scholar] [CrossRef]

- Chen, Y.; Visnjic, I.; Parida, V.; Zhang, Z. On the road to digital servitization—The (dis)continuous interplay between business model and digital technology. Int. J. Oper. Prod. Manag. 2021, 41, 694–722. [Google Scholar] [CrossRef]

- Teece, D.J. Business models and dynamic capabilities. Long Range Plan. 2018, 51, 40–49. [Google Scholar] [CrossRef]

- Teece, D.J. Explicating dynamic capabilities: The nature and microfoundations of (sustainable) enterprise performance. Strategy Manag. J. 2007, 28, 1319–1350. [Google Scholar] [CrossRef]

- Liu, M.; Li, C.; Wang, S.; Li, Q. Digital transformation, risk-taking, and innovation: Evidence from data on listed enterprises in China. J. Innov. Knowl. 2023, 8, 100332. [Google Scholar] [CrossRef]

- Lemma, T.T.; Negash, M.; Mlilo, M.; Lulseged, A. Institutional ownership, product market competition, and earnings management: Some evidence from international data. J. Bus. Res. 2018, 90, 151–163. [Google Scholar] [CrossRef]

- Michailova, S.; Zhan, W. Dynamic capabilities and innovation in MNC subsidiaries. J. World Bus. 2015, 50, 576–583. [Google Scholar] [CrossRef]

- Ciampi, F.; Marzi, G.; Demi, S.; Faraoni, M. The big data-business strategy interconnection: A grand challenge for knowledge management. A review and future perspectives. J. Knowl. Manag. 2020, 24, 1157–1176. [Google Scholar] [CrossRef]

- Chen, N.; Sun, D.; Chen, J. Digital transformation, labour share, and industrial heterogeneity. J. Innov. Knowl. 2022, 7, 100173. [Google Scholar] [CrossRef]

- Liu, C.; Zhang, W.; Zhu, X. Does Digital Transformation Promote Enterprise Development? Evidence From Chinese a-Share Listed Enterprises. J. Organ. End User Comput. 2022, 34, 1–18. [Google Scholar] [CrossRef]

- Hassan, M.K.; Hasan, B.; Halim, Z.A.; Maroney, N.; Rashid, M. Exploring the dynamic spillover of cryptocurrency environmental attention across the commodities, green bonds, and environment-related stocks. N. Am. J. Econ. Financ. 2022, 61, 101700. [Google Scholar] [CrossRef]

- Singh, J. Distributed R&D, cross-regional knowledge integration and quality of innovative output. Res. Policy 2008, 37, 77–96. [Google Scholar] [CrossRef]

- Liu, S.; Du, J.; Zhang, W.; Tian, X.; Kou, G. Innovation quantity or quality? The role of political connections. Emerg. Mark. Rev. 2021, 48, 100819. [Google Scholar] [CrossRef]

- Xie, Z.; Li, J. Exporting and innovating among emerging market firms: The moderating role of institutional development. J. Int. Bus. Stud. 2018, 49, 222–245. [Google Scholar] [CrossRef]

- Nadkarni, S.; Narayanan, V.K. Strategic schemas, strategic flexibility, and firm performance: The moderating role of industry clockspeed. Strateg. Manag. J. 2007, 28, 243–270. [Google Scholar] [CrossRef]

- Zahra, S.A.; George, G. Absorptive capacity: A review, reconceptualization, and extension. Acad. Manag. Rev. 2002, 27, 185–203. [Google Scholar] [CrossRef]

- Duchek, S. Capturing Absorptive Capacity: A Critical Review and Future Prospects. Schmalenbach Bus. Rev. 2013, 65, 312–329. [Google Scholar] [CrossRef]

- Gupta, A.K. Innovation dimensions and firm performance synergy in the emerging market: A perspective from Dynamic Capability Theory & Signaling Theory. Technol. Soc. 2021, 64, 101512. [Google Scholar] [CrossRef]

- Duan, X.; Jin, Z.-M. Positioning decisions within strategic groups the influences of strategic distance, diversification and media visibility. Manag. Decis. 2014, 52, 1858–1887. [Google Scholar] [CrossRef]

- Yang, Y.; Jiang, Y.; Chen, X. Does buyers’ financial slack promote or inhibit suppliers’ circular economy performance? Ind. Mark. Manag. 2021, 99, 111–122. [Google Scholar] [CrossRef]

- Chen, Z.; Cui, R.; Tang, C.; Wang, Z. Can digital literacy improve individuals’ incomes and narrow the income gap? Technol. Forecast. Soc. Chang. 2024, 203, 123332. [Google Scholar] [CrossRef]

- McGuinness, P.B.; Vieito, J.P.; Wang, M. The role of board gender and foreign ownership in the CSR performance of Chinese listed firms. J. Corp. Finance 2017, 42, 75–99. [Google Scholar] [CrossRef]

- Tang, Y.; Geng, B. Digital finance development level and corporate debt financing cost. Finance Res. Lett. 2023, 60, 104825. [Google Scholar] [CrossRef]

- Duarte, J.; Siegel, S.; Young, L. Trust and Credit: The Role of Appearance in Peer-to-peer Lending. Rev. Financial Stud. 2012, 25, 2455–2483. [Google Scholar] [CrossRef]

- Zhu, S.; Lv, K.; Cheng, Y. The Impact of Digital Technology Innovation on Firm Performance: Based on the Corporate Digital Responsibility Perspective. Bus. Ethic- Environ. Responsib. 2025, 2, 12785. [Google Scholar] [CrossRef]

- Wang, S.; Zhang, H. Digital Transformation and Innovation Performance in Small- and Medium-Sized Enterprises: A Systems Perspective on the Interplay of Digital Adoption, Digital Drive, and Digital Culture. Systems 2025, 13, 43. [Google Scholar] [CrossRef]

- Ma, B.; Li, H. Antitrust laws, market competition and corporate green innovation. Int. Rev. Econ. Financ. 2025, 97, 103768. [Google Scholar] [CrossRef]

- Mehrabi, S.; Mahdad, M.; Bijman, J.; Cholez, C.; Mesa, J.C.P.; Giagnocavo, C. Microfoundations of dynamic capabilities enabling scaling pathways of sustainability-oriented innovation business models. Bus. Strategy Environ. 2025, 34, 849–871. [Google Scholar] [CrossRef]

- Yu, R.; Chen, Y.; Jin, Y.; Zhang, S. Evaluating the Impact of Digital Transformation on Urban Innovation Resilience. Systems 2025, 13, 8. [Google Scholar] [CrossRef]

| Variable | Mean | Std. Dev | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) |

|---|---|---|---|---|---|---|---|---|---|---|

| IQ | 2.312 | 1.500 | 1 | |||||||

| DT | 1.276 | 1.341 | 0.066 *** | 1 | ||||||

| MC | −0.039 | 0.080 | 0.01 | −0.173 *** | 1 | |||||

| Size | 7.909 | 1.224 | 0.413 *** | 0.038 *** | −0.050 *** | 1 | ||||

| OwnC | 3.463 | 0.456 | 0.034 *** | −0.124 *** | −0.014 * | 0.163 *** | 1 | |||

| ROE | 0.090 | 0.074 | −0.031 *** | 0.031 *** | 0.00 | 0.122 *** | 0.077 *** | 1 | ||

| DFL | 1.388 | 0.987 | 0.063 *** | −0.106 *** | 0.036 *** | 0.118 *** | −0.027 *** | −0.289 *** | 1 | |

| RGR | 0.302 | 4.085 | −0.01 | 0.016 ** | 0.00 | 0.019 ** | 0.00 | 0.040 *** | −0.01 | 1 |

| Age | 10.660 | 7.104 | 0.206 *** | 0.00 | 0.01 | 0.358 *** | −0.055 *** | −0.024 *** | 0.146 *** | 0.014 * |

| (1) IQ | (2) IQ | (3) IQ | |

|---|---|---|---|

| DT | 0.044 *** (5.25) | 0.043 *** (5.11) | |

| Size | 0.299 *** (20.38) | 0.293 *** (19.97) | 0.308 *** (21.10) |

| OwnC | −0.203 *** (−6.37) | −0.198 *** (−6.21) | −0.209 *** (−6.53) |

| ROE | −0.613 *** (−6.10) | −0.594 *** (−5.91) | −0.608 *** (−6.03) |

| DFL | 0.0230 *** (3.15) | 0.022 *** (3.06) | 0.023 *** (3.18) |

| RGR | −0.006 *** (−2.59) | −0.006 ** (−2.56) | −0.006 ** (−2.54) |

| Age | 0.051 *** (7.85) | 0.049 *** (7.65) | 0.055 *** (8.62) |

| MC | 0.650 *** (4.57) | ||

| DT×MC | 0.264 *** (3.87) | ||

| Cons | −1.494 *** (−8.14) | −1.429 *** (−7.76) | −1.543 *** (−8.41) |

| Industry FE | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes |

| N | 17216 | 17216 | 17216 |

| R2 | 0.392 | 0.390 | 0.385 |

| Variables | First Stage | Second Stage | PSM-DID | ||

|---|---|---|---|---|---|

| (1) (DT) | (2) (DT) | (3) (IQ) | (4) (IQ) | (5) (IQ) | |

| L1.DT | 0.417 *** (42.83) | ||||

| DP | 0.051 *** (3.58) | ||||

| DT | 0.132 *** (3.46) | 4.117 *** (3.41) | |||

| TREAT × POST | 0.180 *** (5.90) | ||||

| Controls (Same as Table 2) | YES | YES | YES | YES | YES |

| Industry FE | YES | YES | YES | YES | |

| Year FE | YES | YES | YES | YES | |

| Underidentification test | 1727.169 *** | 1727.169 *** | 1727.169 *** | 11.605 *** | |

| N | 10516 | 10516 | 10516 | 14956 | 15110 |

| R2 | 0.0582 | 0.125 | 0.0582 | 0.125 | 0.004 |

| Variables | (1) IQ | (2) DC | (3) IQ |

|---|---|---|---|

| DT | 0.027 * (1.94) | 0.267 *** (2.99) | 0.026 * (1.83) |

| Size | 0.345 *** (11.06) | −0.458 ** (−2.30) | 0.348 *** (11.15) |

| OwnC | −0.170 *** (−2.89) | 0.421 (1.12) | −0.172 *** (−2.93) |

| ROE | −0.509 *** (−3.08) | −9.635 *** (−9.16) | −0.452 *** (−2.72) |

| DFL | 0.019 (1.46) | −0.166 ** (−2.06) | 0.020 (1.54) |

| RGR | −0.007 (−1.61) | 0.006 (0.21) | −0.007 (−1.62) |

| Age | −0.139 *** (−2.99) | −0.049 (−0.17) | −0.138 *** (−2.99) |

| DC | 0.006 *** (2.92) | ||

| N | 8643 | 8643 | 8643 |

| R2 | 0.064 | 0.125 | 0.065 |

| Type | Estimated Value | Standard Error | Z | p | LLCI | ULCI |

|---|---|---|---|---|---|---|

| Indirect effect | 0.060 | 0.005 | 12.49 | 0.000 | 0.051 | 0.070 |

| Direct effect | −0.013 | 0.013 | 2.49 | 0.316 | −0.037 | 0.012 |

| Variables | The Mediation Effect of CEF | The Mediation Effect of FC | ||||

|---|---|---|---|---|---|---|

| (1) IQ | (2) CEF | (3) IQ | (4) IQ | (5) FC | (6) IQ | |

| DT | 0.036 *** (4.08) | −0.001 (−0.35) | 0.036 *** (4.07) | 0.036 *** (4.08) | −0.011 *** (−7.26) | 0.030 *** (3.41) |

| CEF | −1.904 *** (−4.66) | |||||

| FC | −0.553 *** (−10.52) | |||||

| Controls (Same as Table 2) | Yes | Yes | Yes | Yes | Yes | Yes |

| N | 15,892 | 15,892 | 15,892 | 15,892 | 15,892 | 15,892 |

| R2 | 0.393 | 0.187 | 0.394 | 0.393 | 0.622 | 0.403 |

| Indirect effect | −0.035 ** | −0.001 * | ||||

| Sobel test | 48.472% | 1.659% | ||||

| Hypothesis | Contents of the Hypothesis | Result |

|---|---|---|

| H1 | Digital transformation→Innovation quality. | Supported |

| H2 | Market competition positively moderates the relationship between digital transformation and innovation quality. | Supported |

| H3 | Digital transformation→Dynamic capability. | Supported |

| H4 | Dynamic capability mediates the gap between digital transformation and innovation quality. | Supported |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Meng, M.; Fan, S.; Lei, J.; Feng, Y. Breaking Down the Barriers to Innovation Quality: The Impact of Digital Transformation. Systems 2025, 13, 295. https://doi.org/10.3390/systems13040295

Meng M, Fan S, Lei J, Feng Y. Breaking Down the Barriers to Innovation Quality: The Impact of Digital Transformation. Systems. 2025; 13(4):295. https://doi.org/10.3390/systems13040295

Chicago/Turabian StyleMeng, Mengmeng, Siyao Fan, Jiasu Lei, and Yinbo Feng. 2025. "Breaking Down the Barriers to Innovation Quality: The Impact of Digital Transformation" Systems 13, no. 4: 295. https://doi.org/10.3390/systems13040295

APA StyleMeng, M., Fan, S., Lei, J., & Feng, Y. (2025). Breaking Down the Barriers to Innovation Quality: The Impact of Digital Transformation. Systems, 13(4), 295. https://doi.org/10.3390/systems13040295