Exploring the Impact of Digital Transformation on Non-Financial Performance in Central and Eastern European Countries

Abstract

1. Introduction

2. Theoretical Background

2.1. Research Theme 1: Digital Transformation—A Mediating Role Between Competitive Pressure and Company Performance, an Important Element in Restructuring Activities for Value Creation, and a Solution for Sustainable Development—Particularities During the COVID-19 Pandemic

2.2. Research Theme 2: The Impact of Digital Transformation on Non-Financial Performance

2.3. Research Theme 3: New Business Models and the Involvement of Information Technology (IT) Solutions to Promote Sustainable Development

3. Research Hypotheses, Data, and Methodology

3.1. Research Hypotheses

3.2. Data and Methodology

3.2.1. Data

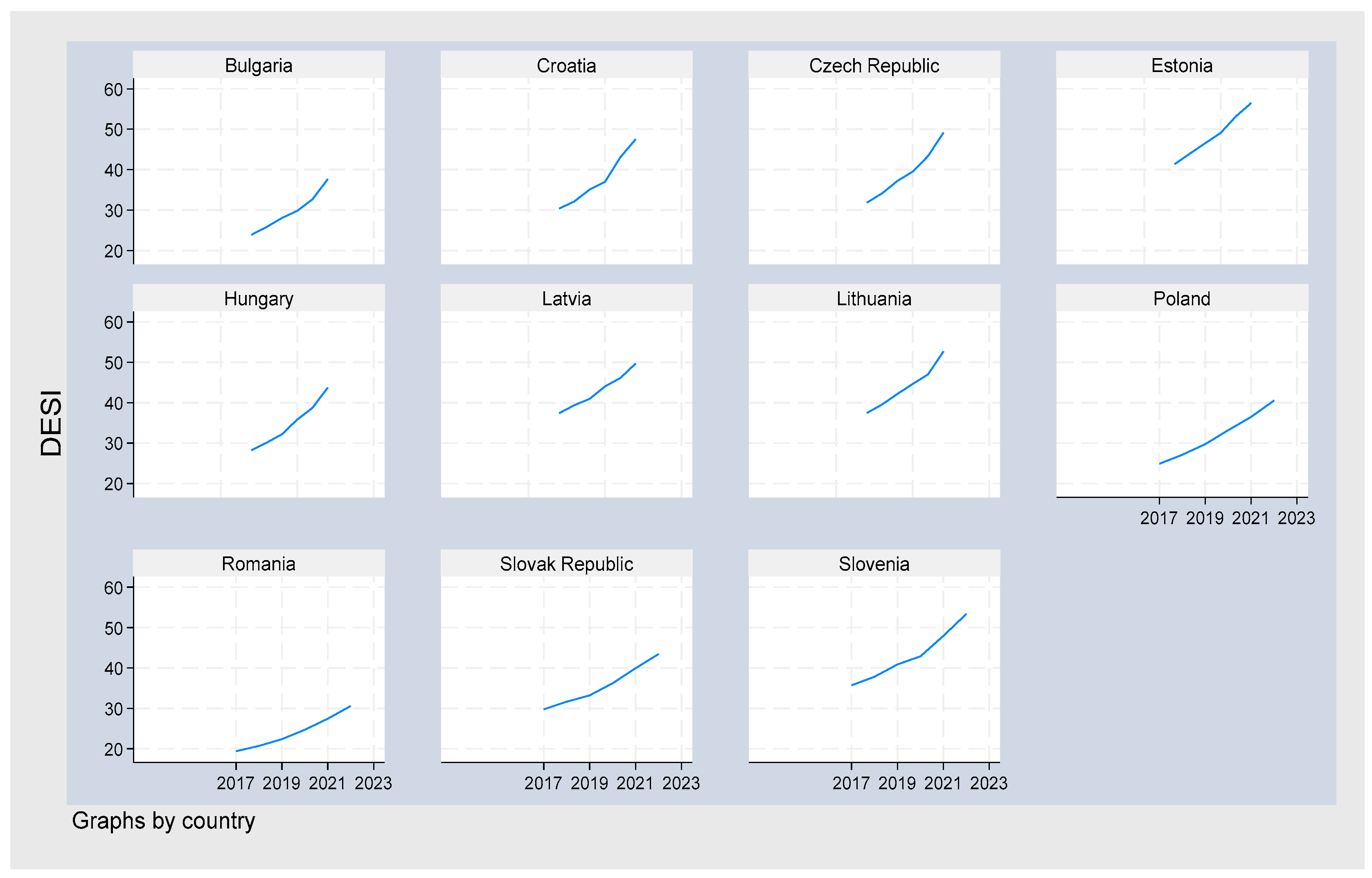

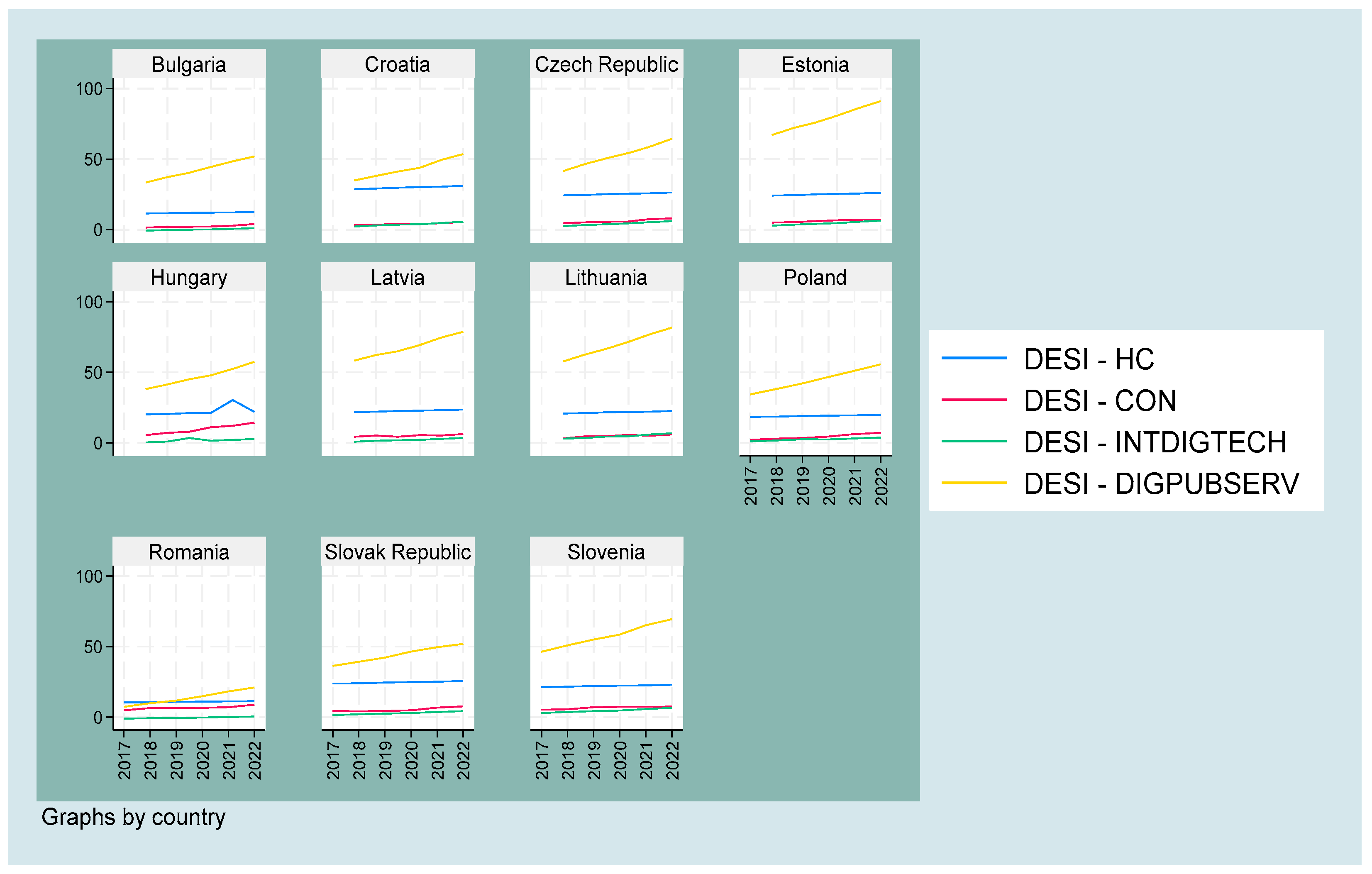

- Digital transformations: Digital Economy and Society Index (desi); DESI—human capital (desihc); DESI—connectivity (desicon); DESI—integration of digital technology (desiintdigtech); DESI—digital public services (desidigpubserv);

- Sustainable economic performance indicators (environmental, social, and governance data—ESG): environmental—CO2 emissions (CO2EM) and renewable energy consumption (renergcons); social—ratio of female-to-male labor force participation rate (labforfm) and unemployment (unempl); governance—regulatory quality: estimate (RQ.EST) (regq) and government effectiveness: estimate (goveffect);

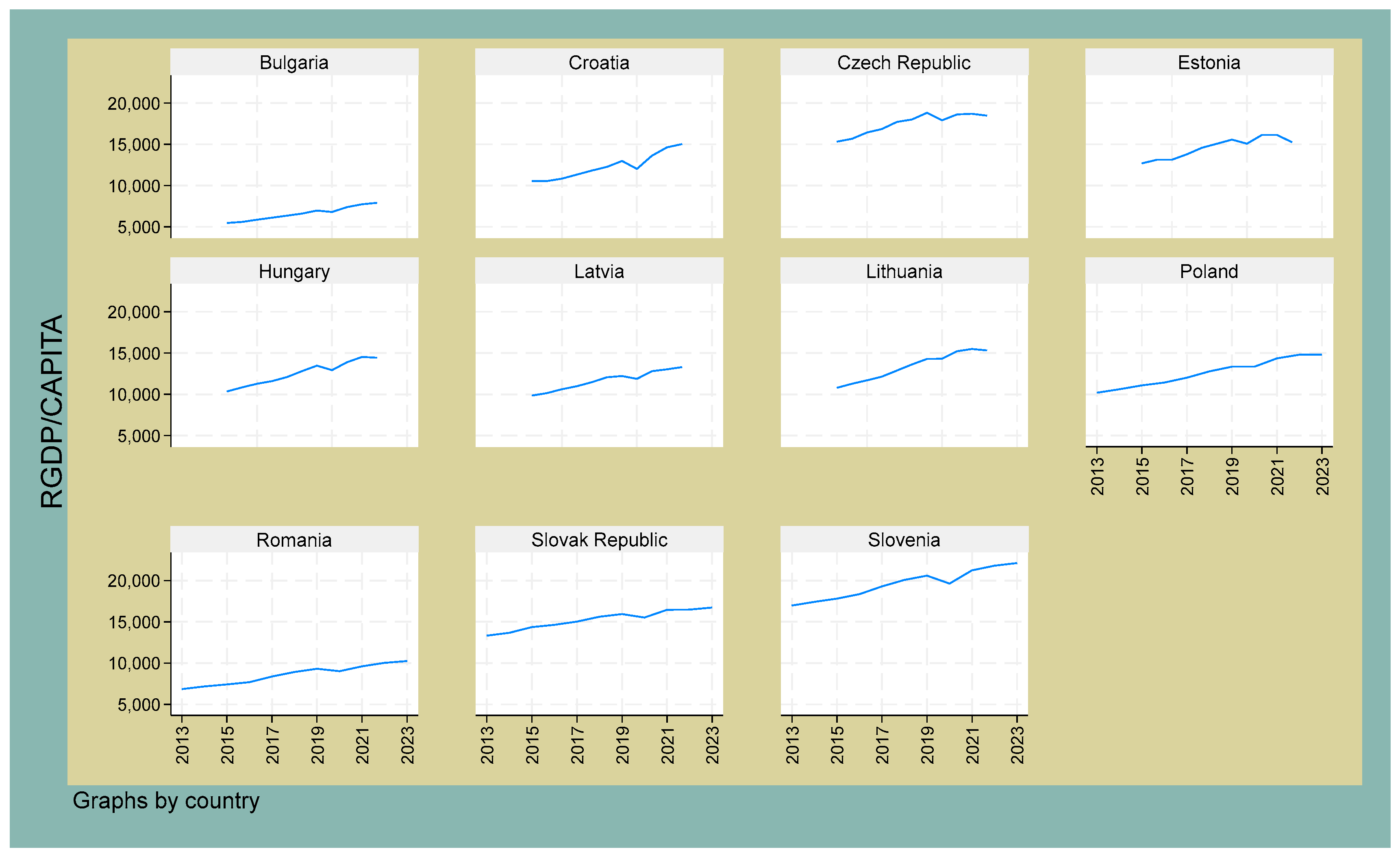

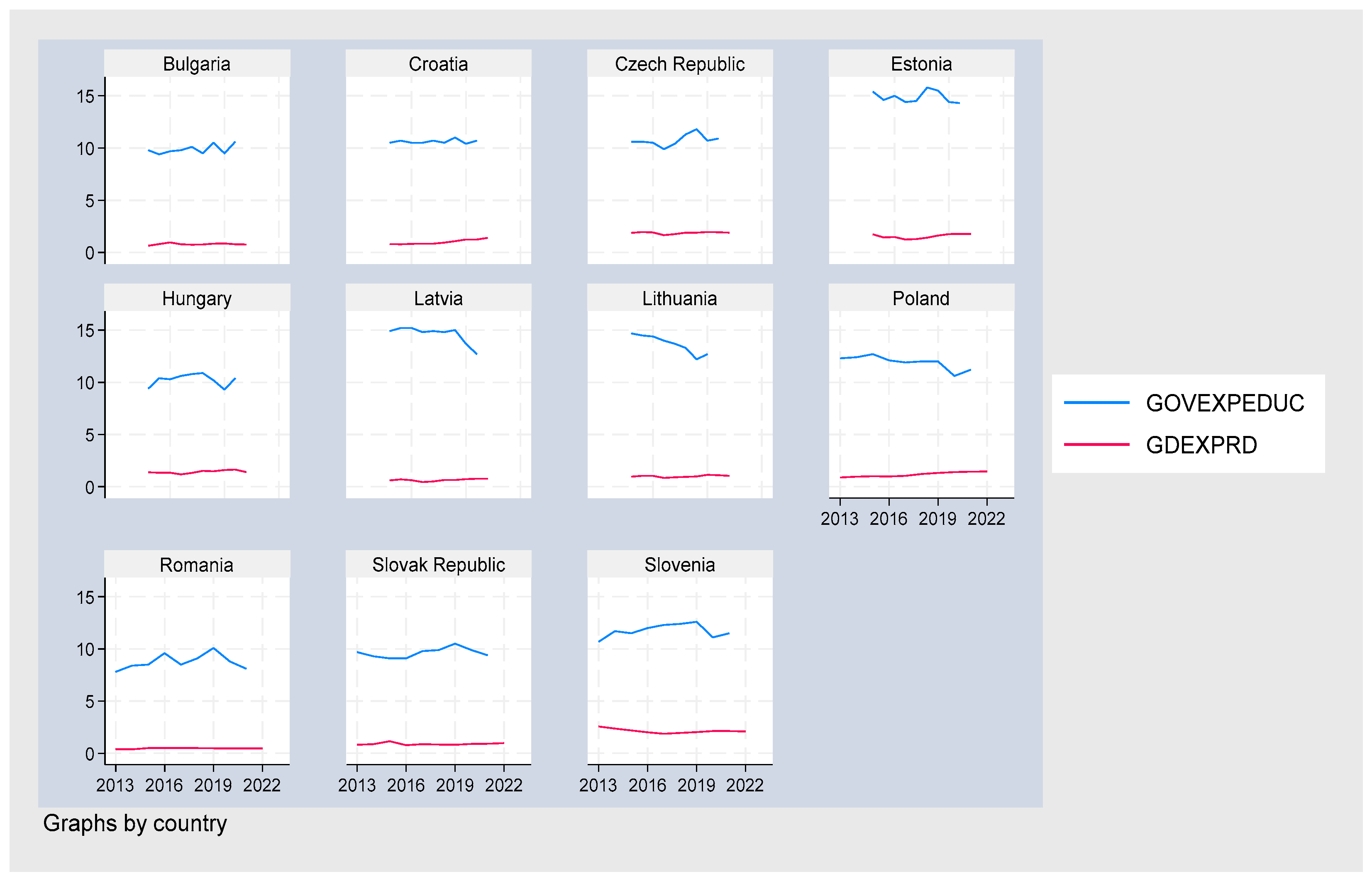

- In order to capture a more accurate estimation of the relationship between variables [91] and to reduce omitted variable bias [92], we have included control variables in our dataset, namely: real GDP per capita (rgdpcapita), government expenditure on education (govexpeduc), and gross domestic expenditure on R&D (gdexprd). Control variables contribute to the specification of the model, allowing for a more nuanced understanding of the dynamics of the data, which is crucial in capturing both time-invariant and time-varying effects [93]. By controlling various factors, the findings are more robust and applicable to broader contexts, thus enhancing the external validity of the results [94].

- Connectivity: This dimension assesses the availability and quality of broadband services. It includes indicators such as the penetration of fixed broadband subscriptions, mobile broadband subscriptions, and the coverage and speed of network connections. Key aspects are the infrastructure quality, including the adoption of very high-capacity networks (e.g., fiber-optic connections).

- Human Capital: This dimension evaluates the skills and education of the population concerning digital technologies. It includes indicators like the level of digital skills among the population, the percentage of individuals with basic digital skills, and the number of ICT specialists in the workforce. This dimension reflects how well people can engage with digital technologies, which is crucial for the digital economy.

- Integration of Digital Technology: This dimension looks at how businesses integrate digital technologies into their operations. Key indicators include the adoption of technologies such as cloud services, big data, and social media, alongside the digitalization of businesses’ processes. This aspect is important for understanding how well businesses are leveraging digital tools to enhance productivity and competitiveness.

- Digital Public Services: This dimension assesses the digitalization of public services. It includes indicators related to e-government services such as online public services, open data availability, and the use of digital tools in government interactions with citizens. It reflects how well governments are utilizing digital technologies to provide services and engage with citizens.

- Environmental:

- −

- CO2 Emissions (CO2EM)—This indicator measures the total amount of carbon dioxide (CO2) emissions produced by a specific country, typically expressed in metric tons per capita (as in our study) or as a total number of emissions. CO2 emissions are a crucial metric for assessing a country’s environmental impact, particularly in the context of climate change. Tracking this metric helps governments and organizations identify trends, develop policies aimed at reducing carbon footprints, and promote sustainable practices.

- −

- Renewable Energy Consumption (renergcons)—This refers to the use of energy derived from renewable resources that are naturally replenished over time (solar, wind, hydroelectric, biomass, and geothermal energy). The World Bank tracks renewable energy consumption to evaluate the transition towards sustainable energy systems, reduce dependence on fossil fuels, and mitigate climate change impacts. It reflects a country’s commitment to increasing the share of clean energy in its total energy consumption, promoting environmental sustainability and energy security (calculated as % of total final energy consumption).

- Social:

- −

- Ratio of Female-to-Male Labor Force Participation Rate (labforfm)—This ratio compares the labor force participation rate of women to that of men. It is calculated by dividing the female labor force participation rate by the male labor force participation rate. Gender parity in labor force participation is a core aspect of social equity and development. A higher ratio indicates a more equitable labor market where women have opportunities comparable to those of men. This metric is crucial as it helps assess how inclusive a country’s economy is, the status of gender equality, and the role of women in the workforce which can impact economic growth, social stability, and overall well-being.

- −

- Unemployment (unempl)—The total number of people who are actively seeking employment but are unable to find work. It includes individuals who are without jobs, available for work, and have made specific efforts to find employment within, typically, the last four weeks (calculated as % of total labor force).

- Governance:

- −

- Regulatory Quality: Estimate (RQ.EST) (regq)—This governance indicator reflects the ability of the government to formulate and implement sound policies and regulations that allow and promote private sector development. It is typically assessed through a combination of quantitative and qualitative measures. High regulatory quality is essential for providing a favorable business environment, ensuring fair competition, and protecting the rights of citizens and investors. It influences economic performance, investment levels, and overall governance. Strong regulatory frameworks help create stability, transparency, and rule of law, which are vital for sustainable economic growth and social development.

- −

- Government Effectiveness: Estimate (goveffect)—This is a key governance indicator measured by the World Bank, reflecting the quality of public services, the capacity of civil service, and the degree of independence from political pressures. It also encompasses the effectiveness of policy formulation and implementation, as well as the credibility of the government’s commitment to such policies. The World Bank defines government effectiveness as “the quality of public services, the quality of the civil service and its independence from political pressures, the quality of policy formulation and implementation, and the credibility of the government’s commitment to such policies” [95]. The effectiveness of government is critical for economic development as it influences investment, economic growth, and public trust in institutions [96]. High government effectiveness is associated with better service delivery, enhanced business environments, and improved overall societal welfare.

- Control variables:

- −

- Real GDP per capita (rgdpcapita)—This is an economic metric, extracted from the Eurostat database, that measures the average economic output per person in a specific region, adjusted for inflation. It reflects the value of all goods and services produced in a country (gross domestic product, GDP) divided by the population, providing a clearer picture of economic performance and living standards over time. Eurostat calculates real GDP per capita using purchasing power standards (PPS), which accounts for differences in price levels between countries, allowing for more accurate cross-country comparisons [90]. This measure is crucial for assessing economic conditions and trends across European Union member states.

- −

- Government Expenditure on Education (govexpeduc)—This refers to the financial resources allocated by governments to support educational institutions and programs. This expenditure can include funding for primary, secondary, and tertiary education, as well as vocational training and adult education. It encompasses salaries for educators, infrastructure development, educational materials, and other related costs [89]. In our analysis, we considered government expenditure on education expressed as a percentage of total government expenditure (from World Bank estimates). The proportion of government expenditure allocated to education serves as an indicator of the priority assigned by a government to the educational sector in comparison to other public investments. Variations in government structures and budget allocations can influence how education is funded. Additionally, it reflects the government’s commitment to the development of human capital (countries with younger populations may spend more on education in relation to other sectors such as health or social security and vice versa).

- −

- Gross Domestic Expenditure on R&D (gdexprd)—This indicator measures gross domestic expenditure on research and development (GERD) as a percentage of the gross domestic product (GDP)—also called R&D intensity, extracted from the Eurostat database for our research [97]. Expressing R&D expenditure as a percentage of GDP relates it to the size of the economy. This allows for a more meaningful comparison between countries with different economic scales. A small country may have high R&D spending per capita, but if its economy is smaller, the percentage of GDP might be a better indicator of the country’s commitment to R&D. The data are collected through national statistical offices and is crucial for assessing a country’s innovation capacity and investment in knowledge creation.

3.2.2. Research Methodology

- −

- For the environmental dimension:CO2EMit = β0 + β1DESIit + β2RGDPCAPITAit + β3GOVEXPEDUCit + β4GDEXPRDit + εitCO2EMit = β0 + β1DESIHCit + β2DESICONit + β3DESIINTDIGTECHit + β4DESIDIGPUBSERVit + β5RGDPCAPITAit + β6GOVEXPEDUCit + β7GDEXPRDit + εitRENERGCONSit = β0 + β1DESIit + β2RGDPCAPITAit + β3GOVEXPEDUCit + β4GDEXPRDit + εitRENERGCONSit = β0 + β1DESIHCit + β2DESICONit + β3DESIINTDIGTECHit + β4DESIDIGPUBSERVit + β5RGDPCAPITAit + β6GOVEXPEDUCit + β7GDEXPRDit + εit

- −

- For the social dimension:LABFORFMit = β0 + β1DESIit + β2RGDPCAPITAit + β3GOVEXPEDUCit + β4GDEXPRDit + εitLABFORFMit = β0 + β1DESIHCit + β2DESICONit + β3DESIINTDIGTECHit + β4DESIDIGPUBSERVit + β5RGDPCAPITAit + β6GOVEXPEDUCit + β7GDEXPRDit + εitUNEMPLit = β0 + β1DESIit + β2RGDPCAPITAit + β3GOVEXPEDUCit + β4GDEXPRDit + εitUNEMPLit = β0 + β1DESIHCit + β2DESICONit + β3DESIINTDIGTECHit + β4DESIDIGPUBSERVit + β5RGDPCAPITAit + β6GOVEXPEDUCit + β7GDEXPRDit + εit

- −

- For the governance dimension:REGQit = β0 + β1DESIit + β2RGDPCAPITAit + β3GOVEXPEDUCit + β4GDEXPRDit + εitREGQit = β0 + β1DESIHCit + β2DESICONit + β3DESIINTDIGTECHit + β4DESIDIGPUBSERVit + β5RGDPCAPITAit + β6GOVEXPEDUCit + β7GDEXPRDit + εitGOVEFFECTit = β0 + β1DESIit + β2RGDPCAPITAit + β3GOVEXPEDUCit + β4GDEXPRDit + εitGOVEFFECTit = β0 + β1DESIHCit + β2DESICONit + β3DESIINTDIGTECHit + β4DESIDIGPUBSERVit + β5RGDPCAPITAit + β6GOVEXPEDUCit + β7GDEXPRDit + εit

4. Results

5. Discussion

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

| Environmental | Social | Governance | ||||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| CO2EM | RENERGCONS | LABFORFM | UNEMPL | REGQ | GOVEFEECT | |

| DESI | 2.67 | 3.29 | 2.67 | 2.67 | 2.67 | 2.67 |

| RGDPCAPITA | 3.27 | 3.21 | 3.27 | 3.27 | 3.27 | 3.27 |

| GOVEXPEDUC | 1.86 | 2.42 | 1.86 | 1.86 | 1.86 | 1.86 |

| GDEXPRD | 2.81 | 2.78 | 2.81 | 2.81 | 2.81 | 2.81 |

| Environmental | Social | Governance | ||||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| CO2EM | RENERGCONS | LABFORFM | UNEMPL | REGQ | GOVEFEECT | |

| DESIHC | 2.42 | 2.76 | 2.42 | 2.42 | 2.42 | 2.42 |

| DESICON | 1.37 | 1.28 | 1.37 | 1.37 | 1.37 | 1.37 |

| DESIINTDIGTECH | 7.17 | 6.91 | 7.17 | 7.17 | 7.17 | 7.17 |

| DESIDIGPUBSERV | 5.96 | 6.18 | 5.96 | 5.96 | 5.96 | 5.96 |

| RGDPCAPITA | 5.10 | 5.21 | 5.10 | 5.10 | 5.10 | 5.10 |

| GOVEXPEDUC | 3.41 | 3.71 | 3.41 | 3.41 | 3.41 | 3.41 |

| GDEXPRD | 3.16 | 3.27 | 3.16 | 3.16 | 3.16 | 3.16 |

References

- Vial, G. Understanding Digital Transformation: A Review and a Research Agenda. J. Strateg. Inf. Syst. 2019, 28, 118–144. [Google Scholar] [CrossRef]

- Nadkarni, S.; Prügl, R. Digital Transformation: A Review, Synthesis and Opportunities for Future Research. Manag. Rev. Q 2021, 71, 233–341. [Google Scholar] [CrossRef]

- Dąbrowska, J.; Almpanopoulou, A.; Brem, A.; Chesbrough, H.; Cucino, V.; Di Minin, A.; Giones, F.; Hakala, H.; Marullo, C.; Mention, A.; et al. Digital Transformation, for Better or Worse: A Critical Multi-level Research Agenda. R D Manag. 2022, 52, 930–954. [Google Scholar] [CrossRef]

- Zhao, X. The Impact of Digital Transformation Strategy of Manufacturing Enterprises on Digital Innovation Performance. Int. Bus. Econ. Stud. 2024, 6, 77. [Google Scholar] [CrossRef]

- Papathomas, A.; Konteos, G. Financial Institutions Digital Transformation: The Stages of the Journey and Business Metrics to Follow. J. Financ. Serv. Mark. 2024, 29, 590–606. [Google Scholar] [CrossRef]

- Teng, X.; Wu, Z.; Yang, F. Research on the Relationship between Digital Transformation and Performance of SMEs. Sustainability 2022, 14, 6012. [Google Scholar] [CrossRef]

- Manny, L.; Duygan, M.; Fischer, M.; Rieckermann, J. Barriers to the Digital Transformation of Infrastructure Sectors. Policy Sci. 2021, 54, 943–983. [Google Scholar] [CrossRef]

- Aguilar, J.; Fuentes, J.; Montoya, E.; Hoyos, W.; Benito, D. Explainability Analysis of the Evaluation Model of the Level of Digital Transformation in MSMEs Based on Fuzzy Cognitive Maps: Explainability Analysis on Fuzzy Cognitive Maps. CLEI Electron. J. 2024, 27, 1–28. [Google Scholar] [CrossRef]

- Ubiparipović, B.; Matković, P.; Pavlićević, V. Key Activities of Digital Business Transformation Process. Strateg. Manag. 2023, 28, 33–40. [Google Scholar] [CrossRef]

- Korachi, Z.; Bounabat, B. General Approach for Formulating a Digital Transformation Strategy. J. Comput. Sci. 2020, 16, 493–507. [Google Scholar] [CrossRef]

- Warner, K.S.R.; Wäger, M. Building Dynamic Capabilities for Digital Transformation: An Ongoing Process of Strategic Renewal. Long Range Plan. 2019, 52, 326–349. [Google Scholar] [CrossRef]

- Nazari, Z.; Musilek, P. Impact of Digital Transformation on the Energy Sector: A Review. Algorithms 2023, 16, 211. [Google Scholar] [CrossRef]

- Czakon, W.; Mania, K.; Jedynak, M.; Kuźniarska, A.; Choiński, M.; Dabić, M. Who Are We? Analyzing the Digital Identities of Organizations through the Lens of Micro-Interactions on Social Media. Technol. Forecast. Soc. Chang. 2024, 198, 123012. [Google Scholar] [CrossRef]

- Jedynak, M.; Czakon, W.; Kuźniarska, A.; Mania, K. Digital Transformation of Organizations: What Do We Know and Where to Go Next? J. Organ. Chang. Manag. 2021, 34, 629–652. [Google Scholar] [CrossRef]

- Li, Y.; Fei, G.Z. Network Embeddedness, Digital Transformation, and Enterprise Performance—The Moderating Effect of Top Managerial Cognition. Front. Psychol. 2023, 14, 1098974. [Google Scholar] [CrossRef]

- Olczyk, M.; Kuc-Czarnecka, M. Digital Transformation and Economic Growth—DESI Improvement and Implementation. Technol. Econ. Dev. Econ. 2022, 28, 775–803. [Google Scholar] [CrossRef]

- Kovács, T.Z.; Bittner, B.; Szilárd, A.; Nábrádi, A. Digital Transformation of Human Capital in the Eu According to the DESI Index. Issues Inf. Syst. 2022, 23, 293–311. [Google Scholar] [CrossRef]

- European Commision. DESI Dashboard for the Digital Decade (2023 Onwards); European Commision: Brussels, Belgium, 2023. [Google Scholar]

- Vyshnevskyi, O.; Stashkevych, I.; Shubna, O.; Barkova, S. Economic Growth in the Conditions of Digitalization in the EU Countries. Stud. Appl. Econ. 2021, 38, 1–9. [Google Scholar] [CrossRef]

- Nagy, S. Digital Economy and Society. A Cross Country Comparison of Hungary and Ukraine. arXiv 2019, arXiv:1901.00283. [Google Scholar] [CrossRef]

- Moroz, M. The Level of Development of the Digital Economy in Poland and Selected European Countries: A Comparative Analysis. Found. Manag. 2017, 9, 175–190. [Google Scholar] [CrossRef]

- Baumgartner, C.; Hartl, E.; Hess, T. New Workplace, New Mindset: Empirical Case Studies on the Interplay Between Digital Workplace and Organizational Culture. In Innovation Through Information Systems; Ahlemann, F., Schütte, R., Stieglitz, S., Eds.; Lecture Notes in Information Systems and Organisation; Springer International Publishing: Cham, Switzerland, 2021; Volume 48, pp. 91–107. ISBN 978-3-030-86799-7. [Google Scholar]

- Neely, A. (Ed.) Business Performance Measurement: Unifying Theory and Integrating Practice, 2nd ed.; Cambridge University Press: Cambridge, UK, 2007; ISBN 978-0-521-85511-2. [Google Scholar]

- Najmi, M.; Rigas, J.; Fan, I. A Framework to Review Performance Measurement Systems. Bus. Process Manag. J. 2005, 11, 109–122. [Google Scholar] [CrossRef]

- Dai, C.; Fang, J. Digital Transformation and Non-Financial Performance in Manufacturing. Sustainability 2024, 16, 5099. [Google Scholar] [CrossRef]

- Hoque, Z. Linking Environmental Uncertainty to Non-Financial Performance Measures and Performance: A Research Note. Br. Account. Rev. 2005, 37, 471–481. [Google Scholar] [CrossRef]

- Kaplan, R.S.; Norton, D.P. Transforming the Balanced Scorecard from Performance Measurement to Strategic Management: Part I. Account. Horiz. 2001, 15, 87–104. [Google Scholar] [CrossRef]

- Van Veen-Dirks, P.; Wijn, M. Strategic Control: Meshing Critical Success Factors with the Balanced Scorecard. Long Range Plan. 2002, 35, 407–427. [Google Scholar] [CrossRef]

- Lim, S.; Matolcsy, Z.; Chow, D. The Association between Board Composition and Different Types of Voluntary Disclosure. Eur. Account. Rev. 2007, 16, 555–583. [Google Scholar] [CrossRef]

- Abidin, S.; Al Jaffri Saad, R.; Mohd Muhaiyuddin, N.M. Evaluating Corporate Reporting on the Internet: The Case of Zakat Institutions in Malaysia. J. Pengur. 2014, 42, 19–29. [Google Scholar] [CrossRef]

- Krasodomska, J.; Cho, C.H. Corporate Social Responsibility Disclosure: Perspectives from Sell-Side and Buy-Side Financial Analysts. Sustain. Account. Manag. Policy J. 2017, 8, 2–19. [Google Scholar] [CrossRef]

- Arvidsson, S. Disclosure of Non-financial Information in the Annual Report: A Management-team Perspective. J. Intellect. Cap. 2011, 12, 277–300. [Google Scholar] [CrossRef]

- Tarquinio, L.; Posadas, S.C. Exploring the Term “Non-Financial Information”: An Academics’ View. Meditari Account. Res. 2020, 28, 727–749. [Google Scholar] [CrossRef]

- Oladimeji, M.S.; Eze, B.U.; Akanni, K.A. Business Eco System and Micro, Small and Medium Enterprises (Msmes) Performance in Nigeria. Int. J. Entrep. Knowl. 2018, 6, 76–86. [Google Scholar] [CrossRef]

- Kumar, N.; Ganguly, K.K. Non-Financial e-Procurement Performance Measures: Their Interdependence and Impact on Production Cost. Int. J. Product. Perform. Manag. 2020, 70, 41–64. [Google Scholar] [CrossRef]

- Cho, M.; Ibrahim, S. Non-Financial Performance Measures and Pay-Performance Sensitivity. J. Financ. Report. Account. 2022, 20, 185–214. [Google Scholar] [CrossRef]

- Wicaksono, H.; Muchtar, S. The Effect of Dividend Policy and Environmental Social Governance on Company Performance with Moderation of Good Corporate Governance in IDX LQ45 Companies. Neraca Keuang. J. Ilm. Akunt. Keuang. 2024, 19, 182–192. [Google Scholar] [CrossRef]

- Karami, M.; Ghiasvand, A.; Hematfar, M. Identifying Financial and Non-Financial Metrics Affecting Companies’ Sustainability Performance: A Thematic Analysis Approach. Int. J. Innov. Manag. Organ. Behav. 2023, 3, 1–9. [Google Scholar] [CrossRef]

- Schönherr, N.; Findler, F.; Martinuzzi, A. Exploring the Interface of CSR and the Sustainable Development Goals. Transnatl. Corp. 2017, 24, 33–47. [Google Scholar] [CrossRef]

- Delgado-Ceballos, J.; Ortiz-De-Mandojana, N.; Antolín-López, R.; Montiel, I. Connecting the Sustainable Development Goals to Firm-Level Sustainability and ESG Factors: The Need for Double Materiality. BRQ Bus. Res. Q. 2023, 26, 2–10. [Google Scholar] [CrossRef]

- Khalid, F.; Sun, J.; Huang, G.; Su, C.-Y. Environmental, Social and Governance Performance of Chinese Multinationals: A Comparison of State- and Non-State-Owned Enterprises. Sustainability 2021, 13, 4020. [Google Scholar] [CrossRef]

- Albu, C.-N.; Albu, N.; Dumitru, M.; Fota, M.-S.; Guşe, R.G. Sustainability Reporting in Central and Eastern European Countries. In Research Handbook on Sustainability Reporting; Rimmel, G., Aras, G., Baboukardos, D., Krasodomska, J., Nielsen, C., Schiemann, F., Eds.; Edward Elgar Publishing: Gloucestershire, UK, 2024; pp. 400–417. ISBN 978-1-03-531626-7. [Google Scholar]

- David, L.K.; Wang, J.; David, V. Economic and Governance Dimensions of ESG Performance: A Comparative Study in the Developing and European Countries. J. Dev. Areas 2024, 58, 221–240. [Google Scholar] [CrossRef]

- Siwiec, K.; Karkowska, R. Relationship between ESG and Financial Performance of Companies in the Central and Eastern European Region. Cent. Eur. Econ. J. 2024, 11, 178–199. [Google Scholar] [CrossRef]

- Radu, O.-M.; Dragomir, V.D.; Ionescu-Feleagă, L. The Conceptual Link between Country Competitiveness and Corporate ESG Performance. Proc. Int. Conf. Bus. Excell. 2023, 17, 763–775. [Google Scholar] [CrossRef]

- Zumente, I.; Lāce, N. Are We There yet? The Evaluation of ESG Impact on Corporate Financial Performance in CEE. In Proceedings of the 12th International Scientific Conference, Vilnius, Lithuania, 12–13 May 2022; Vilnius Gediminas Technical University: Vilnius, Lithuania, 2022. [Google Scholar]

- Dagilienė, L.; Bruneckienė, J.; Jucevičius, R.; Lukauskas, M. Exploring Smart Economic Development and Competitiveness in Central and Eastern European Countries. Compet. Rev. 2020, 30, 485–505. [Google Scholar] [CrossRef]

- Brodny, J.; Tutak, M. The Level of Digitization of Small, Medium and Large Enterprises in the Central and Eastern European Countries and Its Relationship with Economic Parameters. J. Open Innov. Technol. Mark. Complex. 2022, 8, 113. [Google Scholar] [CrossRef]

- Novak, J.; Purta, M.; Marciniak, T.; Ignatowicz, K.; Rozenbaum, K.; Yearwood, K. The Rise of Digital Challengers How Digitization Can Become the Next Growth Engine for Central and Eastern Europe; Digital McKinsey, McKinsey & Company: New York, NY, USA, 2018. [Google Scholar]

- Kahrović, E.; Avdović, A. Impact of Digital Technologies on Business Performance in Serbia. Manag. J. Sustain. Bus. Manag. Solut. Emerg. Econ. 2023, 28, 37. [Google Scholar] [CrossRef]

- Katz, R.; Koutroumpis, P.; Martin Callorda, F. Using a Digitization Index to Measure the Economic and Social Impact of Digital Agendas. Info 2014, 16, 32–44. [Google Scholar] [CrossRef]

- Cieślik, E. The Cross-Sectoral Technological Interdependencies of Central and Eastern Europe in the Era of Industry 4.0 and Chinese Digital Silk Road. Acta Sci. Pol. Oeconomia 2023, 22, 19–31. [Google Scholar] [CrossRef]

- Yang, P.; Hao, X.; Wang, L.; Zhang, S.; Yang, L. Moving toward Sustainable Development: The Influence of Digital Transformation on Corporate ESG Performance. Kybernetes 2024, 53, 669–687. [Google Scholar] [CrossRef]

- Esamah, A.; Aujirapongpan, S.; Rakangthong, N.K.; Imjai, N. Agile Leadership and Digital Transformation in Savings Cooperative Limited: Impact on Sustainable Performance Amidst COVID-19. J. Hum. Earth Future 2023, 4, 36–53. [Google Scholar] [CrossRef]

- Liu, Q.; Wan, H.; Yu, H. Digital Transformation and Corporate Performance: The Moderating Role of Corporate Culture. Acad. J. Manag. Soc. Sci. 2023, 3, 90–93. [Google Scholar] [CrossRef]

- Paiola, M.; Gebauer, H. Internet of Things Technologies, Digital Servitization and Business Model Innovation in BtoB Manufacturing Firms. Ind. Mark. Manag. 2020, 89, 245–264. [Google Scholar] [CrossRef]

- Tronvoll, B.; Sklyar, A.; Sörhammar, D.; Kowalkowski, C. Transformational Shifts through Digital Servitization. Ind. Mark. Manag. 2020, 89, 293–305. [Google Scholar] [CrossRef]

- Aldowaish, A.; Kokuryo, J.; Almazyad, O.; Goi, H.C. How to Manage Conflicts in the Process of ESG Integration? A Case of a Japanese Firm. Sustainability 2024, 16, 3391. [Google Scholar] [CrossRef]

- Trantopoulos, K.; Von Krogh, G.; Wallin, M.W.; Woerter, M. External Knowledge and Information Technology: Implications for Process Innovation Performance. MIS Q. 2017, 41, 287–300. [Google Scholar] [CrossRef]

- Kraus, S.; Durst, S.; Ferreira, J.J.; Veiga, P.; Kailer, N.; Weinmann, A. Digital Transformation in Business and Management Research: An Overview of the Current Status Quo. Int. J. Inf. Manag. 2022, 63, 102466. [Google Scholar] [CrossRef]

- Chen, J.-S.; Khiêm, M.Đ.; Tsou, H.-T. Digital Organisational Restructuring on Business Value Creation in SMEs during the COVID-19 Pandemic. Technol. Anal. Strateg. Manag. 2024, 36, 4036–4051. [Google Scholar] [CrossRef]

- Bai, C.; Quayson, M.; Sarkis, J. COVID-19 Pandemic Digitization Lessons for Sustainable Development of Micro-and Small- Enterprises. Sustain. Prod. Consum. 2021, 27, 1989–2001. [Google Scholar] [CrossRef]

- Nicolescu, O.; Nicolescu, C. Stakeholder Management and Social Responsibility: Concepts, Approaches and Tools in the Covid Context, 1st ed.; Routledge: New York, NY, USA, 2021; ISBN 978-1-00-321770-1. [Google Scholar]

- Wang, J. Digital Transformation, Environmental Regulation and Enterprises’ ESG Performance: Evidence from China. Corp. Soc. Responsib. Environ. Manag. 2024, 32, 1567–1582. [Google Scholar] [CrossRef]

- Li, Y.; Zheng, Y.; Li, X.; Mu, Z. The Impact of Digital Transformation on ESG Performance. Int. Rev. Econ. Financ. 2024, 96, 103686. [Google Scholar] [CrossRef]

- He, X.; Chen, W. Digital Transformation and Environmental, Social, and Governance Performance from a Human Capital Perspective. Sustainability 2024, 16, 4737. [Google Scholar] [CrossRef]

- Wang, D.; Xia, X. The Impact of Digital Transformation on Firms’ Value: Examining the Role of ESG Performance and the Effect of Information Interaction. Bus. Process Manag. J. 2024, 30, 1236–1265. [Google Scholar] [CrossRef]

- Kim, D.; Cho, K. Digital Transformation Characteristics of the Semiconductor Industry Ecosystem. Sustainability 2022, 15, 483. [Google Scholar] [CrossRef]

- Liu, N.; Xu, Q.; Gao, M. Digital Transformation and Tourism Listed Firm Performance in COVID-19 Shock. Financ. Res. Lett. 2024, 63, 105398. [Google Scholar] [CrossRef]

- Bocken, N.M.P.; Short, S.W.; Rana, P.; Evans, S. A Literature and Practice Review to Develop Sustainable Business Model Archetypes. J. Clean. Prod. 2014, 65, 42–56. [Google Scholar] [CrossRef]

- Magableh, K.N.Y.; Kannan, S.; Hmoud, A.Y.R. Innovation Business Model: Adoption of Blockchain Technology and Big Data Analytics. Sustainability 2024, 16, 5921. [Google Scholar] [CrossRef]

- Kohtamäki, M.; Leminen, S.; Parida, V. Conceptualizing Digital Business Models (DBM): Framing the Interplay between Digitalization and Business Models. Technovation 2024, 133, 103013. [Google Scholar] [CrossRef]

- Guo, Y.-M.; Huang, Z.-L.; Guo, J.; Li, H.; Guo, X.-R.; Nkeli, M.J. Bibliometric Analysis on Smart Cities Research. Sustainability 2019, 11, 3606. [Google Scholar] [CrossRef]

- Zupic, I.; Čater, T. Bibliometric Methods in Management and Organization. Organ. Res. Methods 2015, 18, 429–472. [Google Scholar] [CrossRef]

- Adams, J. The Rise of Research Networks. Nature 2012, 490, 335–336. [Google Scholar] [CrossRef]

- Glänzel, W.; Schubert, A. Analysing Scientific Networks Through Co-Authorship. In Handbook of Quantitative Science and Technology Research; Moed, H.F., Glänzel, W., Ulrich, S., Eds.; Kluwer Academic Publishers: Dordrecht, The Netherlands, 2005; pp. 257–276. ISBN 978-1-4020-2702-4. [Google Scholar]

- Habib, R.; Afzal, M.T. Sections-Based Bibliographic Coupling for Research Paper Recommendation. Scientometrics 2019, 119, 643–656. [Google Scholar] [CrossRef]

- Vogel, B.; Reichard, R.J.; Batistič, S.; Černe, M. A Bibliometric Review of the Leadership Development Field: How We Got Here, Where We Are, and Where We Are Headed. Leadersh. Q. 2021, 32, 101381. [Google Scholar] [CrossRef]

- Esses, D.; Csete, M.S.; Németh, B. Sustainability and Digital Transformation in the Visegrad Group of Central European Countries. Sustainability 2021, 13, 5833. [Google Scholar] [CrossRef]

- El Hilali, W.; El Manouar, A.; Janati Idrissi, M.A. Reaching Sustainability during a Digital Transformation: A PLS Approach. Int. J. Innov. Sci. 2020, 12, 52–79. [Google Scholar] [CrossRef]

- Feroz, A.K.; Zo, H.; Chiravuri, A. Digital Transformation and Environmental Sustainability: A Review and Research Agenda. Sustainability 2021, 13, 1530. [Google Scholar] [CrossRef]

- Hurduzeu, G.; Lupu, I.; Lupu, R.; Filip, R.I. The Interplay between Digitalization and Competitiveness: Evidence from European Countries. Societies 2022, 12, 157. [Google Scholar] [CrossRef]

- Zolkover, A.; Petrunenko, I.; Iastremska, O.; Stashkevych, O.; Mehdizade, M.M. Benefits and Risks of Digital Business Transformation: The Example of Eastern Europe Countries. J. East. Eur. Cent. Asian Res. 2022, 9, 344–356. [Google Scholar] [CrossRef]

- Wozniak-Jechorek, B. Examining the European Transition: Central Eastern European Countries Two Decades Post-EU Accession. Rev. Econ. Políticas Públicas 2024, 12, 48–60. [Google Scholar] [CrossRef]

- Istenič, S.P.; Kozina, J. Participatory Planning in a Post-Socialist Urban Context: Experience from Five Cities in Central and Eastern Europe. In Participatory Research and Planning in Practice; Nared, J., Bole, D., Eds.; The Urban Book Series; Springer International Publishing: Cham, Switzerland, 2020; pp. 31–50. ISBN 978-3-030-28013-0. [Google Scholar]

- Meyer-Sahling, J.; Van Stolk, C. A Case of Partial Convergence: The Europeanization of Central Government in Central and Eastern Europe. Public Adm. 2015, 93, 230–247. [Google Scholar] [CrossRef]

- Wang, Q.; Wang, H.; Feng, G.; Chang, C. Impact of Digital Transformation on Performance of Environment, Social, and Governance: Empirical Evidence from China. Bus. Ethics Environ. Responsib. 2023, 32, 1373–1388. [Google Scholar] [CrossRef]

- Li, H.; Xu, J. Impact of Digital Government on Digital Transformation of Enterprises from the Perspective of Urban Economic Sustainable Development. Sustainability 2024, 16, 2667. [Google Scholar] [CrossRef]

- World Bank. World Development Indicators; World Bank: Washington, DC, USA, 2021. [Google Scholar]

- European Commission. Eurostat—Statistics Explained; European Commision: Brussels, Belgium, 2022. [Google Scholar]

- Baltagi, B.H. Econometric Analysis of Panel Data, 3rd ed.; J. Wiley & Sons: Chichester, UK; Hoboken, NJ, USA, 2005; ISBN 978-0-470-01456-1. [Google Scholar]

- Wooldridge, J.M. Econometric Analysis of Cross Section and Panel Data, 2nd ed.; MIT Press: Cambridge, MA, USA; London, UK, 2010; ISBN 978-0-262-23258-6. [Google Scholar]

- Hsiao, C. Panel Data Analysis—Advantages and Challenges. TEST 2007, 16, 1–22. [Google Scholar] [CrossRef]

- Angrist, J.D.; Pischke, J.-S. Mostly Harmless Econometrics: An Empiricist’s Companion; Princeton University Press: Princeton, NJ, USA; Oxford, UK, 2009; ISBN 978-0-691-12035-5. [Google Scholar]

- World Bank. Worldwide Governance Indicators; World Bank: Washington, DC, USA, 2021. [Google Scholar]

- Kaufmann, D.; Kraay, A.; Mastruzz, M. “Governance Matters VIII: Aggregate and Individual Governance Indicators 1996–2008” Policy Research Working Paper 4978; The World Bank: Washington, DC, USA, 2009. [Google Scholar]

- Eurostat. Research and Development (R&D) Statistics; Eurostat: Luxembourg, 2022. [Google Scholar]

- Noja, G.G.; Cristea, M.; Panait, M.; Trif, S.M.; Ponea, C. Ștefan The Impact of Energy Innovations and Environmental Performance on the Sustainable Development of the EU Countries in a Globalized Digital Economy. Front. Environ. Sci. 2022, 10, 934404. [Google Scholar] [CrossRef]

- Ali, S.; Dogan, E.; Chen, F.; Khan, Z. International Trade and Environmental Performance in Top ten-emitters Countries: The Role of eco-innovation and Renewable Energy Consumption. Sustain. Dev. 2021, 29, 378–387. [Google Scholar] [CrossRef]

- Doran, N.M.; Bădîrcea, R.M.; Manta, A.G. Digitization and Financial Performance of Banking Sectors Facing COVID-19 Challenges in Central and Eastern European Countries. Electronics 2022, 11, 3483. [Google Scholar] [CrossRef]

- Huber, P.J. Robust Estimation of a Location Parameter. Ann. Math. Statist. 1964, 35, 73–101. [Google Scholar] [CrossRef]

- Davies, L.; Gather, U. The Identification of Multiple Outliers. J. Am. Stat. Assoc. 1993, 88, 782–792. [Google Scholar] [CrossRef]

- Rousseeuw, P.J.; Leroy, A.M. Robust Regression and Outlier Detection; Wiley Series in Probability and Mathematical Statistics; Wiley: New York, NY, USA, 1987; ISBN 978-0-471-85233-9. [Google Scholar]

- European Environment Agency (EEA). Renewable Energy in Latvia; European Environment Agency (EEA): Copenhagen, Denmark, 2021. [Google Scholar]

- Levin, A.; Lin, C.-F.; James Chu, C.-S. Unit Root Tests in Panel Data: Asymptotic and Finite-Sample Properties. J. Econom. 2002, 108, 1–24. [Google Scholar] [CrossRef]

- Ladu, M.G.; Meleddu, M. Is There Any Relationship between Energy and TFP (Total Factor Productivity)? A Panel Cointegration Approach for Italian Regions. Energy 2014, 75, 560–567. [Google Scholar] [CrossRef]

- Harris, R.D.F.; Tzavalis, E. Inference for Unit Roots in Dynamic Panels Where the Time Dimension Is Fixed. J. Econom. 1999, 91, 201–226. [Google Scholar] [CrossRef]

- Jiang, H.; Chen, Z.; Liang, Y.; Zhao, W.; Liu, D.; Chen, Z. The Impact of Industrial Structure Upgrading and Digital Economy Integration on China’s Urban Carbon Emissions. Front. Ecol. Evol. 2023, 11, 1231855. [Google Scholar] [CrossRef]

- Yu, Z.; Liu, S.; Zhu, Z. Has the Digital Economy Reduced Carbon Emissions?: Analysis Based on Panel Data of 278 Cities in China. Int. J. Environ. Res. Public Health 2022, 19, 11814. [Google Scholar] [CrossRef]

- Xu, X.; Huang, N.; Wang, S. Digital Economy Enables Low-Carbon Agricultural Development in Liaoning Province under the “Double Carbon” Goal. Adv. Econ. Dev. Manag. Res. 2024, 1, 154. [Google Scholar] [CrossRef]

- Vuksanović Herceg, I.; Kuč, V.; Mijušković, V.M.; Herceg, T. Challenges and Driving Forces for Industry 4.0 Implementation. Sustainability 2020, 12, 4208. [Google Scholar] [CrossRef]

- Mokeeva, T.; Yurko, K. Using Digital Tools in Government Procurement Analysis: Detecting Suspicious Purchases with Control Indicators. Int. J. Technol. 2023, 14, 1821. [Google Scholar] [CrossRef]

- Van Tonder, C.; Hasanefendic, S.; Bossink, B.; Schachtebeck, C.; Nieuwenhuizen, C. Internal Organizational Factors Driving Digital Transformation for Business Model Innovation in SMEs. J. Bus. Models 2023, 11, 86–109. [Google Scholar] [CrossRef]

- Güler, M.; Büyüközkan, G. A Survey of Digital Government: Science Mapping Approach, Application Areas, and Future Directions. Systems 2023, 11, 563. [Google Scholar] [CrossRef]

- Ionescu-Feleagă, L.; Ionescu, B.-. Ștefan; Stoica, O.C. The Link between Digitization and the Sustainable Development in European Union Countries. Electronics 2023, 12, 961. [Google Scholar] [CrossRef]

- Stalmachova, K.; Chinoracky, R.; Strenitzerova, M. Changes in Business Models Caused by Digital Transformation and the COVID-19 Pandemic and Possibilities of Their Measurement—Case Study. Sustainability 2021, 14, 127. [Google Scholar] [CrossRef]

- Gao, F.; Lin, C.; Zhai, H. Digital Transformation, Corporate Innovation, and International Strategy: Empirical Evidence from Listed Companies in China. Sustainability 2022, 14, 8137. [Google Scholar] [CrossRef]

- Li, N.; Liu, Z.; Zhang, X. A Study on the Impact of Dynamic Visitor Demand on the Digital Transformation of Enterprises—Considerations Based on the Regional Innovation Environment and the Level of Big Data. Sustainability 2022, 15, 261. [Google Scholar] [CrossRef]

- Wang, D. The Long-Term Impact of Digital Transformation on Businesses: The Lagging Effect of Digitalisation. 2023. Available online: https://ssrn.com/abstract=4591187 (accessed on 10 December 2024).

| Concept | Approach/Definition | Sources |

|---|---|---|

| Digital transformation | The process of leveraging (emerging) digital technologies to meet consumer needs/empower enterprises. | [4,5,6,7] |

| A comprehensive rethinking of organizational strategies and structures. | [8,9,10,11] | |

| The process of triggering major changes in enterprise organizational characteristics and reconstructing the organizational structure, behavior, and operating system through the combined application of information technology (IT), computing, communication, and connection technologies. | [6,12] | |

| A profound socioeconomic change that spans across multiple levels, including individuals, organizations, ecosystems, and, ultimately, societies. | [3,13,14,15] |

| Concept | Approach/Definition | Sources |

|---|---|---|

| Non-financial performance | A firm’s long-term success in customer satisfaction, internal business process efficiency, innovation, and employee satisfaction. | [26,27,28] |

| The company’s social accountability. | [29,30,31] | |

| The companies’ intellectual capital. | [32,33] |

| Keywords | Occurrences | Links | Total Link Strength |

|---|---|---|---|

| digital transformation | 934 | 261 | 5947 |

| performance | 595 | 259 | 4052 |

| innovation | 431 | 254 | 3009 |

| impact | 349 | 255 | 2443 |

| dynamic capabilities | 280 | 236 | 2268 |

| management | 285 | 250 | 2136 |

| firm performance | 260 | 246 | 1987 |

| technology | 202 | 230 | 1499 |

| big data | 152 | 218 | 1228 |

| strategy | 156 | 199 | 1179 |

| SDG | Number of Articles |

|---|---|

| 09 Industry Innovation and Infrastructure | 784 |

| 12 Responsible Consumption and Production | 202 |

| 04 Quality Education | 66 |

| 08 Decent Work and Economic Growth | 57 |

| 13 Climate Action | 45 |

| 01 No Poverty | 41 |

| 03 Good Health and Well-Being | 19 |

| 11 Sustainable Cities and Communities | 19 |

| 10 Reduced Inequality | 10 |

| 02 Zero Hunger | 8 |

| 07 Affordable and Clean Energy | 5 |

| 05 Gender Equality | 3 |

| 15 Life on Land | 2 |

| 16 Peace and Justice Strong Institutions | 1 |

| 14 Life Below Water | 1 |

| Variable | n | Mean | Standard Deviation | Minimum | Maximum |

|---|---|---|---|---|---|

| CO2EM | 110 | 6.0212 | 2.4146 | 3.56 | 14.3 |

| renergcons | 88 | 23.0284 | 8.9954 | 10.7 | 43.8 |

| labforfm | 121 | 78.6422 | 4.4188 | 66.4 | 86.1 |

| unempl | 121 | 6.8050 | 3.0406 | 2 | 17.3 |

| regq | 110 | 0.8709 | 0.3713 | 0.2 | 1.7 |

| goveffect | 110 | 0.6573 | 0.4167 | −0.3 | 1.3 |

| desi | 66 | 37.4159 | 8.5628 | 19.4 | 56.51 |

| desihc | 66 | 21.4633 | 5.5741 | 10.46 | 31.12 |

| desicon | 66 | 5.6101 | 2.2536 | 1.51 | 14.31 |

| desiintdigtech | 66 | 2.8057 | 2.0021 | −1.07 | 6.88 |

| desidigpubserv | 66 | 51.1747 | 18.2394 | 7.41 | 91.18 |

| rgdpcapita | 121 | 13,155.29 | 3743.506 | 5470 | 22,130 |

| govexpeduc | 98 | 11.4959 | 2.0548 | 7.8 | 15.8 |

| gdexprd | 110 | 1.1734 | 0.5169 | 0.30 | 2.56 |

| Variable | Adjusted t-Stat | z-Value | p-Value | |

|---|---|---|---|---|

| Levin-Lin-Chu | Harris-Tzavalis | Levin-Lin-Chu | Harris-Tzavalis | |

| CO2EM | −2.3175 | −1.8432 | 0.0102 | 0.0695 |

| renergcons | −0.9193 | 1.5627 | 0.0790 | 0.0409 |

| labforfm | −0.6657 | 1.8288 | 0.0528 | 0.0964 |

| unempl | −5.9977 | 1.3736 | 0.0000 | 0.0457 |

| regq | −1.1220 | −2.2924 | 0.1309 | 0.0109 |

| goveffect | −3.5944 | −1.1876 | 0.0002 | 0.1175 |

| desi | 11.3405 | 5.1165 | 0.0000 | 0.0600 |

| desihc | −1.8428 | −3.9020 | 0.0327 | 0.0000 |

| desicon | −9.6298 | 3.0466 | 0.0000 | 0.0988 |

| desiintdigtech | 1.2648 | 2.4050 | 0.0977 | 0.0819 |

| desidigpubserv | 22.8473 | 3.7016 | 0.1300 | 0.0499 |

| rgdpcapita | −2.5007 | 2.0308 | 0.0062 | 0.0789 |

| govexpeduc | −1.89 | −4.5680 | 0.0543 | 0.0319 |

| gdexprd | −3.5730 | −3.6087 | 0.0002 | 0.0514 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) | (11) | (12) | (13) | (14) |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (1) CO2EM | 1.000 | |||||||||||||

| (2) RENERGCONS | −0.366 *** | 1.000 | ||||||||||||

| (3) LABFORFM | 0.049 | 0.483 *** | 1.000 | |||||||||||

| (4) UNEMPL | −0.320 *** | 0.308 *** | 0.179 ** | 1.000 | ||||||||||

| (5) REGQ | 0.534 *** | 0.176 * | 0.371 *** | −0.155 * | 1.000 | |||||||||

| (6) GOVEFEECT | 0.346 *** | 0.268 ** | 0.581 *** | 0.073 | 0.722 *** | 1.000 | ||||||||

| (7) DESI | 0.144 | 0.543 *** | 0.707 *** | 0.134 | 0.616 *** | 0.724 *** | 1.000 | |||||||

| (8) DESIHC | 0.164 | 0.243 | 0.432 *** | 0.257 ** | 0.414 *** | 0.677 *** | 0.612 *** | 1.000 | ||||||

| (9) DESICON | −0.050 | −0.025 | −0.087 | −0.308 ** | −0.017 | 0.150 | 0.369 *** | 0.198 | 1.000 | |||||

| (10) DESIINTDIGTECH | 0.259 ** | 0.212 | 0.616 *** | 0.018 | 0.557 *** | 0.746 *** | 0.869 *** | 0.718 *** | 0.277 ** | 1.000 | ||||

| (11) DESIDIGPUBSERV | 0.218 * | 0.504 *** | 0.769 *** | 0.151 | 0.749 *** | 0.771 *** | 0.923 *** | 0.534 *** | 0.172 | 0.754 *** | 1.000 | |||

| (12) RGDPCAPITA | 0.396 *** | −0.124 | 0.393 *** | −0.325 *** | 0.374 *** | 0.705 *** | 0.604 *** | 0.642 *** | 0.380 *** | 0.788 *** | 0.483 *** | 1.000 | ||

| (13) GOVEXPEDUC | 0.252 ** | 0.579 *** | 0.599 *** | 0.069 | 0.729 *** | 0.700 *** | 0.662 *** | 0.357 *** | −0.050 | 0.428 *** | 0.785 *** | 0.227 ** | 1.000 | |

| (14) GDEXPRD | 0.544 *** | −0.297 *** | 0.296 *** | −0.330 *** | 0.269 *** | 0.565 *** | 0.489 *** | 0.491 *** | 0.371 *** | 0.662 *** | 0.435 *** | 0.785 *** | 0.136 | 1.000 |

| Environmental | Social | Governance | ||||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| CO2EM | RENERGCONS | LABFORFM | UNEMPL | REGQ | GOVEFEECT | |

| DESI | −0.122 * (0.0461) | 0.987 *** (0.208) | 0.324 ** (0.102) | 0.155 *** (0.0362) | 0.00525 (0.00667) | 0.00932 (0.00466) |

| RGDPCAPITA | 0.000102 (0.000105) | −0.000516 (0.000405) | 0.000290 (0.000233) | 0.0000667 (0.0000826) | 0.0000304 (0.000015) | 0.0000554 *** (0.0000106) |

| GOVEXPEDUC | 0.217 (0.155) | 1.119 (0.663) | 0.496 (0.344) | −0.0230 (0.122) | 0.120 *** (0.0224) | 0.116 *** (0.0157) |

| GDEXPRD | 2.452 ** (0.724) | −10.68 *** (2.824) | −2.020 (1.603) | −3.172 *** (0.568) | −0.0270 (0.105) | 0.0496 (0.0731) |

| _cons | 3.271 * (1.397) | −3.567 (5.272) | 59.44 *** (3.095) | 2.937 * (1.096) | −1.079 *** (0.202) | −1.842 *** (0.141) |

| R2 | 0.417 | 0.718 | 0.506 | 0.556 | 0.665 | 0.881 |

| Woolridge test | F(1,10) = 4.524 Prob > F = 0.071 | F(1,10) = 4.115 Prob > F = 0.08 | F(1,10) = 8.395 Prob > F = 0.045 | F(1,10) = 1.507 Prob > F = 0.81 | F(1,10) = 5.53 Prob > F = 0.67 | F(1,10) = 3.458 Prob > F = 0.087 |

| Environmental | Social | Governance | ||||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| CO2EM | RENERGCONS | LABFORFM | UNEMPL | REGQ | GOVEFEECT | |

| DESIHC | −0.0386 (0.0531) | 0.199 (0.266) | −0.0851 (0.117) | 0.118 * (0.0491) | −0.0273 *** (0.00479) | 0.0107 (0.00553) |

| DESICON | −0.404 *** (0.111) | 1.238 * (0.545) | −0.774 ** (0.245) | −0.0617 (0.103) | −0.0292 ** (0.0100) | −0.0164 (0.0116) |

| DESIINTDIGTECH | −0.496 (0.287) | 3.658 ** (1.343) | 0.0126 (0.632) | 0.182 (0.266) | −0.0411 (0.0259) | −0.0363 (0.0299) |

| DESIDIGPUBSERV | 0.0175 (0.0270) | −0.0673 (0.127) | 0.217 *** (0.0596) | 0.0403 (0.0250) | 0.00977 *** (0.00244) | 0.00837 ** (0.00281) |

| RGDPCAPITA | 0.000261 * (0.000117) | −0.00146 * (0.000539) | 0.000475 (0.000257) | 0.0000140 (0.000108) | 0.0000967 *** (0.000011) | 0.0000598 *** (0.0000121) |

| GOVEXPEDUC | −0.177 (0.186) | 3.102 *** (0.855) | −0.254 (0.411) | −0.0955 (0.173) | 0.0753 *** (0.0168) | 0.0790 *** (0.0194) |

| GDEXPRD | 2.718 *** (0.681) | −10.04 ** (3.196) | −1.801 (1.500) | −3.380 *** (0.630) | 0.0245 (0.0614) | 0.0584 (0.0708) |

| _cons | 4.197 * (1.765) | 4.010 (8.247) | 72.12 *** (3.889) | 5.709 ** (1.633) | −0.921 *** (0.159) | −1.617 *** (0.184) |

| R2 | 0.543 | 0.713 | 0.621 | 0.589 | 0.922 | 0.906 |

| Woolridge test | F(1,10) = 4.167 | F(1,10) = 3.412 | F(1,10) = 2.949 | F(1,10) = 2.369 | F(1,10) = 1.198 | F(1,10) = 2.049 |

| Prob > F = 0.06 | Prob > F = 0.0945 | Prob > F = 0.079 | Prob > F = 0.057 | Prob > F = 0.093 | Prob > F = 0.117 | |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Buglea, A.; Cișmașu, I.D.; Gligor, D.A.G.; Jurcuț, C.N. Exploring the Impact of Digital Transformation on Non-Financial Performance in Central and Eastern European Countries. Electronics 2025, 14, 1226. https://doi.org/10.3390/electronics14061226

Buglea A, Cișmașu ID, Gligor DAG, Jurcuț CN. Exploring the Impact of Digital Transformation on Non-Financial Performance in Central and Eastern European Countries. Electronics. 2025; 14(6):1226. https://doi.org/10.3390/electronics14061226

Chicago/Turabian StyleBuglea, Alexandru, Irina Daniela Cișmașu, Delia Anca Gabriela Gligor, and Cecilia Nicoleta Jurcuț. 2025. "Exploring the Impact of Digital Transformation on Non-Financial Performance in Central and Eastern European Countries" Electronics 14, no. 6: 1226. https://doi.org/10.3390/electronics14061226

APA StyleBuglea, A., Cișmașu, I. D., Gligor, D. A. G., & Jurcuț, C. N. (2025). Exploring the Impact of Digital Transformation on Non-Financial Performance in Central and Eastern European Countries. Electronics, 14(6), 1226. https://doi.org/10.3390/electronics14061226