1. Introduction

A prolonged economic stagnation and unemployment have been calling for innovation and entrepreneurship globally in pursuance of a new engine of economic growth, drawing a great deal of attention in start-ups and new ventures. Accordingly, the number of startups and the magnitude of venture capital investment have been consistently increasing. However, many startups cannot manage through the ‘death-valley’ curve because even though they successfully obtain seed capital in the initial phase of developing ideas and technology, many of them fail to raise additional capital in the phase of launching the product and bringing it to market. For example, the 1-year survival rate of technology-based startups and small businesses in South Korea is 78.5%, followed by 40.4% for 3-year, 26.9% for 5-year, and 15.8% for 10-year (Korea Institute of Start-up and Entrepreneurship Development 2018).

Crowdfunding, which refers to companies’ efforts to fund their ventures by drawing contributions directly from a large number of individuals, has been emerging as a new method of funding new ventures. In the US, the Jumpstart Our Business Startups (JOBS) Act passed in 2012 legalized equity-based crowdfunding, as the amendment of the Financial Investment Services and Capital Markets Act in 2015 and enforcement of it in 2016 did in South Korea. Equity-based crowdfunding has only begun to gain traction in the US for accredited investors in 2014 and became legal for non-accredited investors in 2016.

Prior research on crowdfunding has focused on studying the motivation of entrepreneurs and investors in their participation in crowdfunding, determinants of successful crowdfunding, or making policy implications regarding how to encourage crowdfunding. Prior studies have used various terms to refer to people who request funds and people who give money in crowdfunding, including founders, creators, entrepreneurs, and borrowers for people who request funds, and funders, backers, investors, and lenders for people who give money. In this study, as we focus on equity-based crowdfunding, we use entrepreneurs and investors to refer to the two participating parties in crowdfunding and use borrowers and lenders on necessary occasions. In terms of the types of crowdfunding, the majority of prior studies has examined reward-based and lending-based crowdfunding, and research on equity-based crowdfunding is sparse [

1].

Therefore, a call for empirical research on how financing through crowdfunding affects firm performance and employment has been raised, to add to the prior literature that has mainly focused on the motivation of participants in crowdfunding and determinants of successful crowdfunding [

2]. Furthermore, an in-depth analysis of investor protection corresponding to the emergence of equity-based crowdfunding is becoming necessary, as well as further examination of information asymmetry arising [

1].

In general, investors of crowdfunding projects make their investment choices only from information made available by entrepreneurs, while venture capital firms and angel investor groups conduct the due diligence process to evaluate new ventures before making their investment choices. In this environment in which there are limited information and insufficient evaluation, prior research has shown that herding behavior among investors becomes more salient [

3,

4,

5]. This herding behavior can decrease the risk of uncertainty if the investment decision is made through the wisdom of crowds, but the presence of free-riding among investors can increase the risk of investments associated with herding [

6,

7]. Therefore, before making investments through crowdfunding, it is important to examine whether there is a difference in firm performance and employment outcomes between companies that financed their ventures successfully through crowdfunding and companies that did not. Also, it would be beneficial to investigate what information made available by entrepreneurs is meaningful in making investment choices and whether there is enough information provided to reduce information asymmetry.

This study aims to identify the difference in firm performance and employment outcomes between successful and failed capital procurement through equity-based crowdfunding. More specifically, we first examine whether there is a significant difference in the survival rate between companies with successful crowdfunding and companies with failed crowdfunding. Secondly, we investigate how the financial performance of companies with successful crowdfunding is different from the performance of companies with failed crowdfunding. Third, we examine whether there is a difference in employment outcomes between companies that succeeded in crowdfunding and companies that failed. Lastly, by investigating the difference in firm performance and employment outcomes according to the results of equity-based crowdfunding investment, we attempt to provide some evidence for investors to evaluate the validity of investments and for policymakers to evaluate their support in crowdfunding as a new channel of financing new ventures and provide insights to investors and policymakers.

2. Literature Review

2.1. Crowdfunding

Crowdfunding refers to the efforts by companies to fund their ventures by drawing contributions from an undefined, large group of individuals using the internet when they develop a product or service. Prior research has provided various definitions of crowdfunding; a method in which companies propose their business model and get funds from many unknown investors [

8]; a method in which companies draw contributions directly from individuals without financial intermediaries [

9]; a method in which companies make an open call through the internet for donations or for contributions which get rewarded in the future with some form of compensation such as a product, money, or voting rights [

10]; and a method of financing in which entrepreneurial individuals or companies draw contributions from undefined public through the internet [

11].

Crowdfunding projects can be classified into four different categories based on the purpose and method of funding: donation-based, reward-based, lending-based, and equity-based crowdfunding [

12]. The donation-based crowdfunding is philanthropic as the investors of projects do not expect any reward or compensation. Under the reward-based crowdfunding, a number of investors fund the projects and get compensated in some forms other than monetary compensation, and this type of crowdfunding has been widely used in projects related to performances, music, films, education, and environment. Under the lending-based crowdfunding model, individuals and businesses can borrow small amounts of money through the internet, and investors participate in funding expecting to get promised interest on the loans. Online microcredit and peer-to-peer lending are examples of this lending-based crowdfunding. The equity-based crowdfunding has been used for new businesses and startups with small capital and resembles angel investor funding, and investors participating in the equity-based crowdfunding expect a share in the future cash flows or equity proportionate to the level of funding provided [

1].

Table 1 provides forms of crowdfunding based on the purpose and method.

2.1.1. Motivation for Crowdfunding

Prior research on crowdfunding has mainly focused on the motivation of participants in crowdfunding and determinants of successful crowdfunding. Prior studies investigating the motivation of entrepreneurs (i.e., borrowers) participating in crowdfunding have provided multiple explanations, including raising funds [

13,

14], validating the ability to succeed the projects [

14], getting social proof through successful experiences of others [

14], and expanding awareness of their crowdfunding projects through social media [

14].

Studies investigating investors’ (i.e., lenders) motivations in participating in crowdfunding have documented both external motivations such as getting rewards and increasing profits through getting interests and internal motivations such as helping others, contributing to projects that are considered important for the society, getting satisfaction when the goals are achieved, and finding joy in participating in innovative activities [

14,

15,

16,

17].

2.1.2. Determinants of Successful Crowdfunding

Prior research on the determinants of successful crowdfunding has examined characteristics of entrepreneurs and investors, the relationship between entrepreneurs and investors, and characteristics of projects [

1]. Prior studies on the characteristics of entrepreneurs and their association with successful crowdfunding have investigated social capital such as the size of online and offline networks [

18,

19,

20,

21] and the past experiences of entrepreneurs in launching projects or supporting projects [

22].

Prior research investigating how the characteristics of investors affect successful crowdfunding has focused on investor behaviors, including herding behavior among investors. This stream of research includes studies documenting evidence of herding among investors by analyzing investment patterns and studies exploring collective intelligence as a determinant of herding behavior [

3,

5,

23,

24]. Herding behavior occurs when one person’s decision is greatly impacted by others’ choices. As crowdfunding involves information asymmetry between entrepreneurs and investors, the likelihood of investors to follow other investors’ behavior observed in the platform, instead of relying on their own judgment, increases. Therefore, herding behavior is salient in a crowdfunding setting. This herding behavior then results in the concentration of funds on projects that are already well-funded. Specifically, Agrawal et al. [

3], using the linear probability model, find that projects with more accumulated funds attract more investors, and Zhang and Liu [

5] show that herding in crowdfunding can be viewed as rational herding as they find a lower likelihood of failure in crowdfunding projects associated with bigger herding. In contrast, there are studies showing no evidence of herding in crowdfunding. Burch et al. [

25] find that herding behavior is salient in equity-based and lending-based crowdfunding projects, but there is no herding present in donation-based crowdfunding projects, rather the opposite, as investors are more likely to choose the projects that are not well-funded.

Meanwhile, prior literature has also examined how the characteristics of projects affect the success of donation-based and equity-based crowdfunding, by looking at factors such as the purpose of projects, the size of funding goals, and the duration of the campaign. Kuppuswamy and Bayus [

4] find that successful crowdfunding projects are smaller in terms of the size of funding goals and have a shorter duration. Also, phrases such as “most popular”, “recently launched”, and “ending soon” attracted more investors. The number of updates by entrepreneurs in the crowdfunding platform is also found to contribute to achieving the goal, suggesting that regular feedback is important to receive funds. Mollick [

26] indicates that a shorter duration, a higher number of videos included in the project explanation, and a faster update of progress increases the likelihood of success. Yum et al. [

24] argue that in the case of lending-based crowdfunding, the number of applications for funding in the past can affect the likelihood of project success.

Using the data from 140 companies that participated in equity-based crowdfunding, Ahlers et al. [

27] examine how factors such as a trading status, a receipt of government awards, a patent status, transparency in disclosures, and the board organization affect the success of crowdfunding. The results indicate that the number of board members is positively associated with the magnitude of funds and that no disclosure of financial information reduces the magnitude of funds. Also, companies trying to sell more shares took longer to receive the funds, and companies with more transparent financial information reached the goal faster [

27,

28,

29]. However, the study finds no evidence in the effect of having patents, receiving government awards, and external recognition on the success [

27].

Table 2 provides prior research on the determinants of successful crowdfunding.

2.2. Crowdfunding and Firm Performance

In their empirical analysis of crowdfunding success and firm performance, Kim and Jeong [

35] find that prior financial performance does not affect the success of crowdfunding and companies with successful crowdfunding had higher growth and increased revenues.

Prior studies have also examined companies’ subsequent financing activities after crowdfunding. In their study on companies using reward-based crowdfunding, Roma et al. [

36] find that getting larger funds through crowdfunding helps to attract professional investors for subsequent investments after crowdfunding, although this evidence is only present when there is a patent or social network involved. Another study using an equity-based crowdfunding setting shows that firm age, a CEO age, and trademarks can affect the survival of a company and its financing activities after crowdfunding [

37].

Ryu et al. [

38] suggest that there is no significant difference in companies’ ability to get subsequent funding from venture capitalists between companies that funded their capital through crowdfunding and companies getting funds through angel investors.

Using Kickstarter as a crowdfunding platform to study, Kuppuswammy et al. [

39] find that the success of crowdfunding has a positive impact on the advertisement of the company, establishment of a partnership with other businesses, and receipt of additional external financing after the end of the campaign. In this study, Kuppuswammy et al. [

39] argue that crowdfunding can play a role of ‘concept proof’ as it can prove market potential of the ideas and help to reduce the risk of financing when banks, venture capitalists, and angel investors hesitate to fund the projects in the phase of developing ideas.

Crowdfund Capital Advisors (CCA) conducted a survey to companies with successful crowdfunding, in North America, Europe, and Africa from June 2012 to June 2013. According to their report [

40], there was an average of 24% increase in quarterly revenues, while companies with successful equity-based crowdfunding showed a 351% increase in their revenues. In terms of attracting venture capitalists, 28% of companies with crowdfunding success got funds from angel investors or venture capitalists in three months after crowdfunding, and 43% of companies with crowdfunding success discussed investment options with institutional investors. CCA states that professional investors recognized companies with successful crowdfunding as companies that passed a market test [

40]. However, there is a study that suggests the opposite, as the existence of many small shareholders can impose difficulty on the management of the firm, which leads professional investors such as angel investors and venture capitalists to avoid crowdfunding companies [

2].

2.3. Crowdfunding and Employment Outcomes

In his book ‘The General Theory of Employment, Interest, and Money’, Keynes [

41] identifies insufficient aggregate demand as a reason for unemployment and suggests that a solution to unemployment and depression is to increase aggregate demand, while insufficient aggregate demand occurs when there is not enough investment. The Keynes’ theory of employment has been recognized as an important theory in the market economy and has been used in policies encouraging startups, investments in new technology for new product and service, and expansion of government spending.

Research on the size and age of companies and their impact on employment has also been conducted consistently, and they generally suggest that small and medium-sized businesses create more jobs than large companies. Birch [

42] provides empirical evidence that small businesses create most of the jobs in the U.S., especially new jobs. This finding has been used to support policies supporting small and medium-sized businesses, while some researchers have presented an objection to it. Davidsson and Delmar [

43] argue that there is no systematic relationship between the size of companies and employment growth, and Haltiwanger et al. [

44] find that, when controlling for firm age, there is no systematic inverse relationship between firm size and net growth rates.

From the analysis of crowdfunding in the U.S. and European countries, Chun [

2] suggests that startups and new businesses are the ones contributing to net job creation and argues that increasing the number of startups and their survival and growth rate is important to reduce unemployment and promote economic growth. Furthermore, the study suggests that financing is an important factor for the growth of startups and new businesses, and equity-based crowdfunding can be an innovative way to fund their ventures. Also, crowdfunding in this setting is considered to attract funds from venture capitalists and angel investors. Consistent with this notion, Chun [

2] further suggests that equity-based crowdfunding can be a new method to finance ventures and new businesses in South Korea, resulting in increases in the number of startups and their survival and growth rate and contributing to net job creation. Along with this suggestion, Chun [

2] raised a need for research on how equity-based crowdfunding can affect employment outcomes.

Meanwhile, Pozzi and Rocchelli [

45] find that companies with successful crowdfunding are accompanied by increases in their revenues and the number of employees, and CCA [

40] showed that 39% of companies with successful equity-based crowdfunding hire an average of 2.2 people as new employees after crowdfunding and 48% of companies stated that they would consider crowdfunding when they hire new employees [

2].

3. Research Design

3.1. Methodological Approach

Although there has been growing research on crowdfunding, empirical evidence on the effect of equity-based crowdfunding on outcomes such as firm performance and employment is sparse.

To investigate the difference in firm performance and employment outcomes according to the results of equity-based crowdfunding investment, this study compares firm performance and employment outcomes of companies with successful crowdfunding and companies with failed crowdfunding and tests whether there is a significant difference. We draw the variables necessary to analyze the survival rate, financial performance, and employment outcomes of companies from prior research.

This study employs data from companies that participated in equity-based crowdfunding in South Korea. Currently, the law restricts participants in equity-based crowdfunding to small and medium-sized businesses with a firm age of less than seven years. Through crowdfunding, these companies who are in their early stage and in a desperate need of funds are expected to increase the likelihood of survival, improve financial performance, such as growth and profitability, and increase employment. Especially, we expect that the difference in the survival rate and employment outcomes will be more significant than the profitability in our analysis, between companies with crowdfunding success and companies with crowdfunding failure, as companies in our sample are in their beginning stage.

Therefore, we empirically analyze the difference in the survival rate, firm performance, and employment outcomes by comparing companies with successful equity-based crowdfunding and companies with failed equity-based crowdfunding.

3.2. Hypotheses

3.2.1. Firm Survival Rate

In their study on reward-based crowdfunding and firm performance, Mollick et al. [

46] find that successful projects survive for one to four more years after the end of the campaign, have increased revenues, and hire an average of 2.2 people additionally. Consistently, Chun [

2] argue that increasing the number of startups and the survival and growth rate of startups is important to reduce unemployment and promote economic growth. Chun [

2] also suggests that raising capital is a critical factor for the growth of startups and new businesses and equity-based crowdfunding can be an effective and innovative way for startups and new businesses to raise capital. This new financing resource is also projected to contribute to increasing the number of startups and their survival rate. This suggestion from prior research, therefore, raises a need for empirical research on the relationship between raising capital through crowdfunding and the survival rate of companies using crowdfunding. Accordingly, we evaluate the validity of this argument by testing the following hypothesis.

H1. There is a significant difference in the survival rate between companies with successful crowdfunding and companies with failed crowdfunding.

3.2.2. Financial Performance

Prior research investigating the financial performance of companies with successful crowdfunding is as follows. Schoonhoven et al. [

47] find that financial performance of ventures increases as they have more funds to use or more options for financing. Kim and Jeong [

35] provide empirical evidence that there is a significant improvement in the company size and revenues when companies have a successful crowdfunding, and Pozzi and Rocchelli [

45] show that companies with successful reward-based crowdfunding are associated with increased revenues. Consistently, CCA [

40] show that revenues greatly increase for companies with crowdfunding success.

In terms of subsequent investments from professional investors after crowdfunding, Roma et al. [

36] find that in a reward-based crowdfunding setting, pledging a higher amount of money from crowdfunding is helpful in attracting professional investors and consequently in securing subsequent funding. Furthermore, CCA [

40] show that companies with crowdfunding success have more active discussions with venture capitalists and angel investors regarding subsequent investments. On the contrary, Chun [

2] argue that the difficulties involved in crowdfunding projects due to the presence of many small shareholders can lead professional investors such as venture capitalists and angel investors to avoid funding companies with successful crowdfunding. Also, Ryu et al. [

38] suggest that in terms of getting subsequent funding from venture capitalists, there is no significant difference in companies funded through crowdfunding and companies funded through angel investors. Based on prior research, we state our hypotheses as follows.

H2. There is a significant difference in the sales growth rate between companies with successful crowdfunding and companies with failed crowdfunding.

H3. There is a significant difference in the profitability growth between companies with successful crowdfunding and companies with failed crowdfunding.

3.2.3. Employment Outcomes

Extant research has examined initial funding for startups and their employment outcomes. Birch [

42], using the U.S. data, provide empirical evidence that small businesses create the most jobs and that most of the new jobs are created by small businesses. However, Davidson and Delmar [

43] argue that there is no systematic relationship between firm size and employment growth rates.

Pozzi and Rocchelli [

45] document evidence of an increase in the number of employees for companies with successful crowdfunding in their study on reward-based crowdfunding, and the survey from CAA [

40] also shows that 39% of companies with successful equity-based crowdfunding hire an average of 2.2 employees after crowdfunding and that 48% of companies answered that they would consider crowdfunding when they hire new employees.

Chun [

2] suggests that companies inducing net job creation are startups and new businesses and that raising capital is an important factor for startups and new businesses to grow. For this purpose, Chun [

2] suggests that equity-based crowdfunding can be an effective and innovative way to fund their ventures, consequently attracting venture capitalists and angel investors. Therefore, Chun [

2] emphasizes a need for empirical evidence on crowdfunding and its impact on employment outcomes. In this study, we test the following hypothesis to provide empirical evidence on crowdfunding and employment outcomes.

H4. There is a significant difference in the absolute employment growth between companies with successful crowdfunding and companies with failed crowdfunding.

H5. There is a significant difference in the employment growth rate between companies with successful crowdfunding and companies with failed crowdfunding.

3.3. Measurement of Variables

To examine the relationship between raising capital through crowdfunding and firm performance and employment outcomes, we measured the following variables based on prior research.

The growth of companies is measured using growth rates of several factors such as sales, employment, assets, capital, and profits [

43,

48,

49,

50,

51,

52,

53,

54]. Especially, sales and employment reflect both the short-term and long-term changes of companies and can be a more objective measure of growth [

43,

55,

56]. The relative growth is usually measured as a percentage growth rate [

42,

57], and this study uses both absolute and relative growth measures.

In this study, we use a success of crowdfunding as an independent variable and use the firm’s survival rate, sales growth rate, profitability growth, absolute employment growth, and employment growth rate as dependent variables.

Table 3 provides definitions of variables.

4. Research Data

This study employs 228 projects from 218 companies (111 successes and 117 failures), this data from all equity-based crowdfunding projects completed in South Korea in 2016. Except for an analysis of the survival rate, we exclude 83 projects (20 successes and 63 failures) including SPC and companies without financial information due to the closure of business and use 145 projects (91 successes and 54 failures) as a sample for our analyses. We obtain data on the business closure, financial and employment information from Korea Enterprise Data, funding archives from Korea Securities Depository, and proprietary data provided for research from Financial Services Commission and conduct an empirical analysis.

We perform the difference analysis between companies with successful crowdfunding and companies with failed crowdfunding.

Table 4 provides a summary of funding results, types of equity, industry, and firm age for the projects included in our sample.

5. Empirical Analysis and Findings

Findings from our analyses are as follows.

5.1. Descriptive Statistics

5.1.1. Survival Rate

Table 5 provides descriptive statistics of the survival rate for companies with successful crowdfunding and companies with failed crowdfunding. The survival rate is checked for closures as of 31 October 2018.

The survival rate of companies, which is used to evaluate whether a company can be a going concern, is higher for companies with successful crowdfunding (86.5%) than for companies with failed crowdfunding (82.9%). Also, compared to the expected survivals, the actual number of survived firms among companies with successful crowdfunding was higher (94 expected and 96 actual). For companies with failed crowdfunding, the actual number of survivals (97 companies) was lower than the expected (99 companies). Although there is no big difference, we observe that the survival rate of companies with crowdfunding success is higher than the survival rate of companies with crowdfunding failure.

5.1.2. Financial Performance

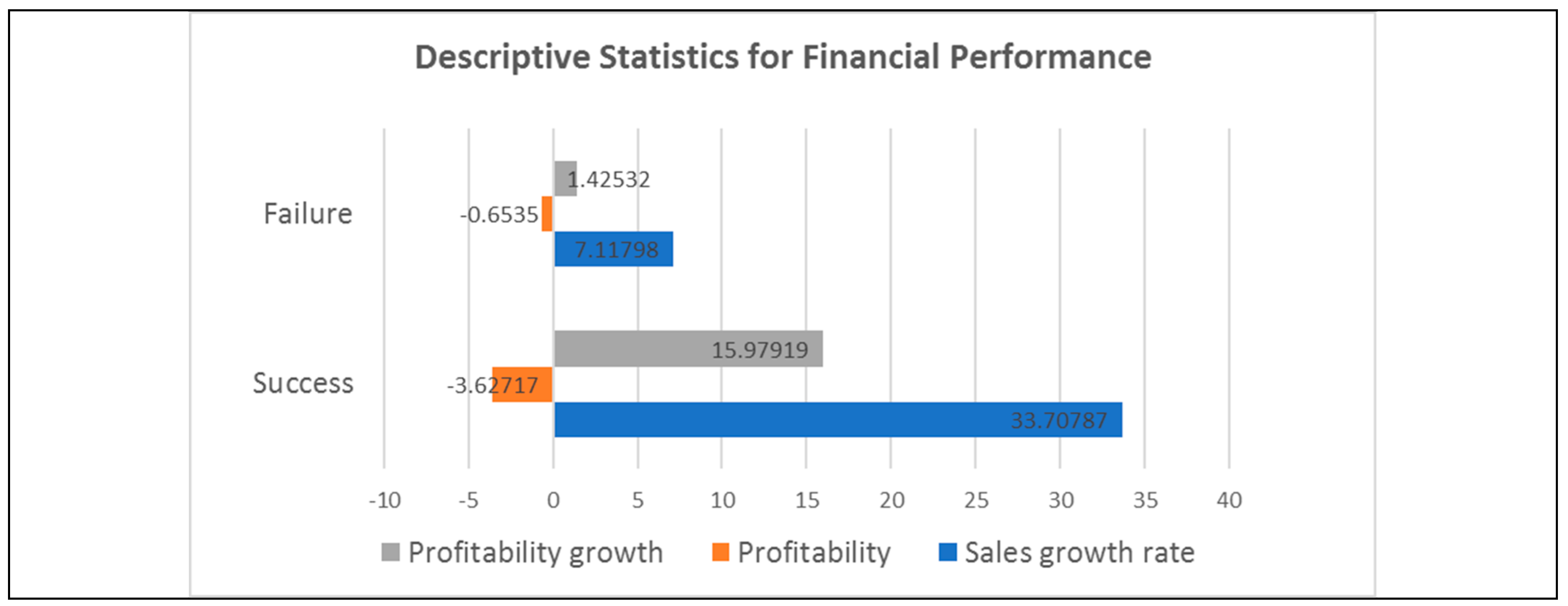

Table 6 provides descriptive statistics of the sales growth rate (the sales increase rate from 2015 to 2017), profitability (profitability in 2017), and profitability growth (the profitability increase rate from 2015 to 2017).

First, the sales growth rate was higher for companies with successful crowdfunding (33.70787) than companies with failed crowdfunding (7.11798). Although the profitability was lower for companies with successful crowdfunding (−3.66887) than for companies with failed crowdfunding (−0.65350), the profitability growth was higher for companies with crowdfunding success (15.47230) than for failed companies (1.34614). Therefore, we document that the sales growth rate and profitability growth of companies that successfully raised capital through crowdfunding is relatively higher. The number of firms in descriptive statistics differs from the total number of samples because the denominator is zero in the ratio of sales growth rate, profitability, and profitability growth.

Figure 1 shows a bar chart of descriptive statistics for financial performance between companies with successful crowdfunding and companies with failed crowdfunding.

5.1.3. Employment Outcomes

Table 7 provides descriptive statistics of absolute employment growth (a change in the number of employees from the time of funding to 2017) and employment growth rate (a percentage increase rate in the number of employees from the time of funding to 2017).

In terms of absolute employment growth, companies with successful crowdfunding showed a higher mean (0.91) than companies with failed crowdfunding (−1.52). Also, the employment growth rate was higher for companies with successful crowdfunding (24.760) than companies with failed crowdfunding (−7.940). In summary, these results show that companies with successful crowdfunding projects had an increase in employment, while failed companies had a decrease in employment.

Figure 2 shows a bar chart of descriptive statistics for employment outcomes between companies with successful crowdfunding and companies with failed crowdfunding.

We test whether this difference observed in descriptive statistics is significant using the difference analysis.

5.2. Difference Analysis

5.2.1. Difference Analysis for Survival Rate

We perform a chi-squared test to determine whether there is a significant difference in the survival rate between companies with successful crowdfunding and companies with failed crowdfunding. Although the survival rate was higher for companies with successful crowdfunding than companies with failed crowdfunding in descriptive statistics, the results from a chi-squared test show a

p-value of 0.453, rejecting H1 at a significance level of 0.05. Therefore, there is no significant difference in the survival rate between companies with successful crowdfunding and companies with failed crowdfunding.

Table 8 provides chi-square test for survival rate.

5.2.2. Difference Analysis for Financial Performance

We perform a t-test to determine whether there is a significant difference in financial performance between companies with successful crowdfunding and companies with failed crowdfunding. The results indicate that there is no significant difference in all measures of financial performance (i.e., the sales growth rate, and profitability growth) between companies that had successful crowdfunding projects and companies that had failed crowdfunding projects.

Table 9 provides

t-test for financial performance.

Although the sales growth rate was higher for companies with successful crowdfunding than companies with failed crowdfunding in descriptive statistics, the t-test rejects H2 at the 5% significance level (p-value = 0.424). Therefore, there is no significant difference in the sales growth rate between the two groups.

Descriptive statistics show higher profitability growth for companies with successful crowdfunding compared to companies with failed crowdfunding. However, the t-test results in the p-value of 0.250, rejecting H3 at the 5% significance level. Therefore, there is no significant difference in the profitability growth between the two groups.

5.2.3. Difference Analysis for Employment Outcomes

We perform the

t-test to compare employment outcomes of companies with successful crowdfunding and companies with failed crowdfunding. The results show that there is a significant difference in the absolute employment growth and the employment growth rate between companies with crowdfunding success and companies with crowdfunding failure, suggesting that companies with successful crowdfunding contribute to job creation.

Table 10 provides

t-test for employment outcomes.

We measure absolute employment growth as a change in the number of employees between the time of funding and 2017. As shown in

Table 10, the

t-test yields a

p-value of 0.012, supporting H4 at the 5% significance level. Therefore, we document that there is a significant difference in the increase in employment between companies with successful crowdfunding and companies with failed crowdfunding.

The employment growth rate is measured by using the difference in the number of employees between the time of funding and 2017 as a numerator and the number of employees at the time of funding as a denominator. The t-test shows a p-value of 0.003, supporting H5 at the 5% significance level.

Figure 3 shows a boxplot of comparing employment outcomes between companies with successful crowdfunding and companies with failed crowdfunding.

This result shows that there is a significant difference in the employment growth rate between companies with successful crowdfunding and companies with failed crowdfunding.

Table 11 provides a summary of results from hypothesis testing.

6. Discussion

Hypothesis 1–3 are rejected. There is no significant difference in the survival rate, sales growth rate, and profitability growth between the between companies with successful crowdfunding and companies with failed crowdfunding. However, hypothesis 4 and 5 are supported. There is a significant difference in the absolute employment growth, employment growth rate between companies with successful crowdfunding and companies with failed crowdfunding.

From the descriptive statistics, raising capital through equity-based crowdfunding seems to contribute to the external growth of startups by increasing the survival rate, sales, and employment. Although the profitability was a little lower for companies with successful crowdfunding compared to companies with failed crowdfunding, it suggests that companies with successful crowdfunding pay more attention to the growth rather than to the profitability given they are in the early stage.

From the difference analysis, the difference in the survival rate, sales growth and profitability growth between successful crowdfunding and failed crowdfunding documented is found to be insignificant from the difference analysis. However, companies with successful crowdfunding show significantly higher employment growth.

This study aimed to identify differences in short-term corporate performance and employment growth between the two groups according to the success and failure of financing through equity-based crowdfunding for companies within 7 years of new business formation. We find that the characteristics of these firms that are conducting or verifying new projects through financing are similar to those of prior studies results confirming the short-term effects of entrepreneurial activities or new business activities on economic performance and employment growth.

Prior study in relation to this; In a study of Lee [

58] that identified the logical relationship between entrepreneurial activities and economic growth, it was found that new firms had no immediate impact on economic growth, but had a positive impact on economic growth over a period of about two years. One year or less, the causal relationship is not established.

Fritsch and Mueller [

59,

60,

61,

62] found that start-ups themselves cause a direct effect in the short-term that directly leads to an increase in employment. Fritsch and Schroeter [

63] found that start-up rates are positive for current and one-year employment growth in an empirical study that examines the effects of new business formation on employment growth.

The results of this study which deal with the capital procurement of entrepreneurs within 7 years of new business formation by equity-based crowdfunding and the results of the study of the effects of new business formation on economic growth and employment growth are similar within a short period of time within a year. We interpret that the results of this study are due to the use of capital in the early-stage companies is concentrated on research and development rather than increasing sales, which is a characteristic of the early-stage companies in terms of the growth stages. In addition, it is interpreted that the direct effect of employment growth is also found in the start-up firms that raise capital through equity-based crowdfunding, as the result of the prior study that the new business formation induces direct effects of employment.

7. Conclusions

This study provides the following implications. In this study, we show that equity-based crowdfunding has a positive impact on companies’ employment growth, supporting the validity of policies encouraging equity-based crowdfunding. The results of this study suggest that equity-based crowdfunding can be one short-term solution to be an adequate source of funds for startup companies that need to expand their R&D and hire new employees. Also, this result suggests that equity-based crowdfunding can be one short-term solution to reduce the risk of startup companies and to improve social employment outcomes.

Equity-based crowdfunding is an investment action that acquires the stock of a company, and it is important for investors to confirm the corporate performance that is subject to investment. However, from the investors’ perspective, the study does not provide clear evidence indicating a positive effect of equity-based crowdfunding on firm growth and profitability. This lack of evidence raises a concern that the crowdfunding market can become a lemon market in the long-term if the risk of unverifiability of financial performance does not decrease because the early-stage companies need consistent investments to survive. This implies that investors need to be more considerate when they participate in crowdfunding. Although there is a positive side of crowdfunding, such as reducing risk through the wisdom of crowds, crowdfunding also involves herding behavior and free-riding among investors, which can increase the risk.

In order to activate the equity-based crowdfunding, it is necessary for the investors to confirm the more robust financial growth of the investing company or to provide more objective and reliable information than the one-sided information provided by the investee company.

Therefore, to reduce the risk of investors participating in equity-based crowdfunding and support the scale-up of growth-stage firms, we suggest expanding the scope of equity-based crowdfunding projects to the growth-stage company that can identify objective and reliable financial performance, instead of restricting it to the early-stage companies within 7 years of new business formation. Also, to encourage equity-based crowdfunding, we suggest policymakers consider allowing professional investors to publish analyst reports for these start-up companies so that investors can objectively evaluate the value of the firm, such as growth or profitability, for companies seeking to raise capital through equity-based crowdfunding.

Currently, many governments subsidize companies with successful crowdfunding through matching funds, connecting to low-interest rate loans, and supporting interest expenses. We propose that there is a need for reinforcing the due diligence process to evaluate potential values of companies participating in crowdfunding and monitoring of them to make more effective use of these governmental policies and encourage the market participation in crowdfunding. We recommend an expansion of roles of crowdfunding platform facilitators and involvement of firm evaluation institutions or professional startup institutions with authority and capability in the crowdfunding market.

Although this study provides empirical evidence on the difference in firm performance and employment outcomes according to the results of equity-based crowdfunding investment and makes useful implications for academics, market participants, and regulators, the study also has limitations, including the short sample period. Usually, meaningful events data for Angel investments take an average of 6 years. Globally, because of the short history of equity-based crowdfunding, there is not enough data on the performance of companies attempting to raise money through equity-based crowdfunding. However, we believe that collecting data and conducting small-scale research is necessary for the decision-making of investors and policymakers, although there is not enough data in the equity-based crowdfunding. We also think it is necessary for follow-up study and follow-up researchers who deal with equity-based crowdfunding.

This study was studied using corporate financial information up to 2017. Because the company’s financial information is reported on a yearly basis, and corporate information in 2018 is updated after June 2019, there is a limit to data collection. One year of corporate data alone may not be enough to judge a company’s performance after equity-based crowdfunding.

However, it is significant in that it is the result of empirical research that has been conducted on all companies participating in the equity-based crowdfunding project conducted in Korea for one year in 2016. In this study, we find that the characteristics of these firms that are conducting or verifying new projects through equity-based crowdfunding financing are similar to those of prior studies’ results confirming the short-term effects of entrepreneurial activities or new business activities on economic performance and employment growth. In particular, it is very meaningful to confirm that the direct effect of employment growth is also found in start-up firms that raise capital through equity-based crowdfunding.

This study compares the differences in corporate performance between successful and unsuccessful companies in equity-based crowdfunding. If sufficient data are subsequently available, further research on the effect of equity-based crowdfunding on the corporate’s performance, such as regression analysis, is needed.

Future research could provide additional insights by analyzing long-term firm performance after crowdfunding.