Abstract

Earth’s climate cannot be ignored any longer. Policies are vital in order to mitigate the negative effects of climate change. The energy crisis created by the Russo-Ukrainian war in Europe and COVID-19 pandemic affected the EU and its member states. The focus is more than ever on its energy policies and independence. The EU revised the energy strategy in response to the regional conflict, and it sped up all the processes for energetic independence from other countries outside of the EU. This benefited the climate change policies the most, as all the measures involved reducing energy consumption and increasing renewables, thus contributing to reducing greenhouse gas emissions. As a member state of the EU, Romania is committed to complying with EU regulations. With a high degree of energy independence compared with the other EU members, Romania plans to become a regional energy provider and modernize the energy infrastructure internally as a response to the regional conflict. The measures that the EU and Romania implemented after the conflict started in 2022 have come to fruition, and the effects are becoming visible a year later. This study aims to study the energy strategy of Romania in correlation with the EU strategy in the turbulent period of pandemics and conflict between 2019 and 2023, with the latest available data.

1. Introduction

The effects of dependence on fossil fuels: pollution, economic constraints, greenhouse gases (GHG), global warming, and anthropogenic disturbances on planet Earth, cannot be denied anymore. The average annual global temperature has already risen by 1 °C, and the target is to keep it below 1.5 °C in the years to come. Exceeding the average temperature by 1.5 °C will have a huge impact on humanity: extreme weather, sea level rise, worsening health, poverty for millions of people worldwide, food scarcity, loss of biodiversity, and even species extinction, with humans included. Coal is the largest contributor to the global temperature increase. Oil and natural gas account for a third and a fifth, respectively, of the world‘s total carbon emissions [1].

The disruptions created by the COVID-19 pandemic and the Russo-Ukrainian war risk undoing previous efforts to mitigate climate change. Environmental change and air contamination must be dialed back and diminished by implementing sustainable and renewable solutions to produce energy. Energetic security for a nation means a secure supply and stable prices. Energy comes from three main sources: fossil fuels, nuclear energy, and renewable energy [2]. The use of renewable energy sources has been encouraged by the European Union (EU) for a long time, creating benefits for all its member states [3]. Romania is the first EU member state to achieve the renewable energy targets, five years ahead of the deadline set for 2020 [4]. Energy strategy can be viewed as the political issue of our time, as geopolitics impact energy prices, imports, exports, and policies. It is connected to environmental change and energy security, and, more predominant in recent years, is a poverty generator and highly debated issue, including different factors and conflicting points of view. Thus, the best energy policies will assure an advantage in the future if implemented correctly.

At the start of 2022, a new regional conflict started in Europe. The energy market was fragile and unstable in the post-pandemic years, and the conflict added another layer of risk on top of that, basically triggering a world energy crisis and creating volatile markets and prices. From the total gas imports in the EU in 2020, 41% represented gas imported from Russia [5]. In 2021, the EU imported from Russia 35% of its natural gas and 27% of its oil [6]. As the conflict represented a serious threat for all of Europe, it represented the start of a policy shift in the EU regarding the energy strategy. The European Union set up a new plan for the energy strategy with the target of removing the energy dependency [7] and pressing on towards energetic independence in the future, focusing more than before on renewable energy sources. Romania has always pursued energy independence in order to secure its future and to self-sustain. Due to its history, Romanians fear being controlled from the exterior. This is so embedded in the Romanian mentality that today in Romania, the household ownership rate is the highest in the world at 95.3%, according to Eurostat [8], and Romania is the only country in the world that once paid all of its debts [9]. Romania represents one of the most focused EU member states on energy independence and security for itself and for all EU members.

The Romanian energy generation systems are relying on a mostly old infrastructure and quite low efficiencies [10], inherited from the past century. At the same time, Romania has a unique potential for using renewable energy from multiple sources due to its geolocation, having access to mountains, hills, plains, and seashore. Since it became a member state of the EU in 2007, it started shily to integrate renewable energy into the energy generation [11], to restructure the energy generation system [12], and to rethink the coal share in the energy mix in Romania [13]. Moreover, renewable energy usage is on the rise, with hydro power having the highest share [14], but it has a significant negative impact on aquatic biodiversity [15]. Wind energy has huge potential, especially at the Black Sea shore [16]. Solar energy from photovoltaics benefit from a lot of attention and increase in demand, both from the government and the entire population [17]. Considering all this, the Romanian government established the Romanian Energy Strategy (RES) that has been updated over the years, and it resembles the energy plan for the upcoming decades. At present, Romania’s government desires to become a regional energy pillar for the EU in south-eastern Europe.

As the Russo-Ukrainian war is not showing any sign of ending soon and the pandemic disturbances still reverberate worldwide, this study analyses the combined impact of pandemic and regional conflict on the energy sector in Romania as an EU member state. It also analyses the policies in the EU and Romania regarding energy security on the road ahead and, most importantly, the Romanian Energy Strategy as an EU member state from eastern Europe that is also a bordering country to the Russo-Ukrainian war.

European energy markets have changed drastically since the conflict started. The topic of this review paper is to analyze how Romania’s energy policies were impacted since 2020 because of the conflict in combination with the pandemic. The perspective of this review is from an Eastern Europe country that is part of EU and NATO and also borders the regional conflict.

The questions that this review paper aims to address are as follows:

- what impact the pandemic and regional conflict had on climate and energy policies in the EU;

- what impact the pandemic and regional conflict had on climate and energy policies in Romania as an EU Eastern European country;

- what was the Romanian energy strategy before this and how did it change after the conflict started;

- what is the current state in the EU and Romania regarding energy production and energy consumption;

- what is the potential that Romania has for greener energy;

- how much does the buildings sector, being the largest energy consumer in the EU and Romania, impact the energy policies, and what is its current state regarding both energy production for buildings and energy consumption for buildings.

2. Methods and Procedures

This study presents the evolution of energy strategy and policies in Romania in the past decade. Since the ongoing conflict and pandemic heavily impacted the energy markets in EU and in Romania, policies benefitted from a lot more attention and got a speed boost compared with past decades. Our study is not a review for the published literature regarding energy strategies for the EU but is focused on the topic of the EU and Romania’s energy strategy changes due to the pandemic and ongoing conflict. This issue is of high relevance because Romania is an EU member that is bordering a nation in conflict, which brought up regional energy stress. The structure of this review article starts setting the tone for what the pandemic and especially the regional conflict actually means for the EU and for the EU Eastern Region. Afterwards, it analyses the impact that both the conflict and the pandemic subsequently had on climate strategy and energy policies in both the EU and Romania. It addresses and proves the impact by comparing present and past views and policies regarding energy on all levels. After studying the impact, the next step was to analyze the energy state of affairs in both the EU and Romania regarding all its forms and niches. Due to the buildings sector being the largest energy consuming sector in the EU and Romania, this review delves further into how this sector has been impacted by energy policy changes because of the ongoing conflict and pandemic.

This work aims to bring forth the rapid energy policy changes and the struggles that have been caused by this unfortunate series of events since 2020 onwards in Eastern Europe. The intended value of this review article consists in the desire to be the first work that presents the overall energy impact on an Eastern European EU country caused by the conflict and pandemic, specifically Romania.

3. Regional Conflict and Pandemic Impact on Climate Strategy and Energy Policy

Amid the COVID-19 pandemic, the Russo-Ukrainian war started in Europe. As the world suffered from the COVID-19 disturbances in both economic and social areas [18], the conflict only amplified its consequences. The situation is even worse in the European Union, mainly because of energy imports from Russia [19]. In the world energy markets, Russia is in the first countries for oil, gas, and coal exports [20]. Given these unprecedented times, prices are soaring globally [21]. The gas price in Europe rose from 20 to 80 €/MWh and it also influenced the electricity prices [19]. Inflation is on the rise, with no sign of stabilizing any time soon [22].

The coronavirus disease of 2019 caused the loss of over 6.48 million people [23]. When the conflict started on 24 February, Russia reported 132,998 COVID-19 cases and Ukraine, 25,789 COVID-19 cases, while in refugee-hosting countries, the cases summed up to 57,753 [24]. As the world’s efforts focused on ending the pandemic, which currently has no definitive treatment, the Russo-Ukrainian war threatens to undo all efforts, especially in the European Union. All this disturbance caused the focus to shift away from global efforts to reduce global warming and climate change’s effects. For the European Union, it intensified the target to accelerate the implementation of energy policies, especially with a focus on renewable energy.

In March 2023, the EU agreed to increase the usage of renewable energy sources in a continuous effort to remove energy dependency in regards to the regional conflict [25]. The EU is determined to continue its process towards clean energy, and it confirms yet again, in this period of global uncertainty, that it has the grit needed to be the world’s climate change leader [26] with regards to policies, strategies, and actual implementation of measures that are meant to save the planet from becoming inhabitable for humans in the future.

3.1. Impact in the European Union

The European Union was on course to further decarbonize the European economy by 2050 and mitigate climate change just before the pandemic started in 2019 [27]. Although the pandemic halted efforts for a time, the regional conflict reminded us of a dire, unresolved problem: the EU’s dependency on energy. As the North Atlantic Treaty Organization (NATO) found renewal because of the conflict, the EU finds renewal and common ground for its energy policies in order to achieve its energy security. The EU has a leading role regarding the global climate change threat. After more than two decades of negotiations, the agreement regarding climate change, the Paris Agreement, was adopted in 2015. Its focus is to continue the struggle to keep the global mean temperature increase under 2 °C and try to find ways to limit it to 1.5 °C [28]. This translates to the need to reduce greenhouse gas emissions into the Earth’s atmosphere without a negative impact on the economy.

Even before the Russo-Ukrainian conflict started, the EU had been actively pursuing combating climate change for a couple of decades, targeting

- reducing GHG emissions by 40% until 2030 compared with 1990 levels.;

- increasing the energy consumption from renewable energy sources up to 32% until 2030;

- improving the energy efficiency of the EU’s final energy consumption by 32.5% until 2030.

In 2023, the EU pressed on again, changing the targets that were in place and increasing the established levels yet again. Changes that the EU repeatedly confirmed were made as a response to the energy threat created by the ongoing conflict. In 2023, the EU revised the Climate Law [29] that is part of the European Green Deal (EGD) [30] and all other connected legislation such as Fit for 55 [31], REPowerEU [32], and others. The targets set for 2030 as a response to the energy crisis are the following [33]:

- reduce GHG emissions by 55% until 2030 compared with 1990 levels;

- increase the energy consumption from renewable energy sources up to 45% until 2030;

- improve the energy efficiency of the EU’s final energy consumption by 42.5% until 2030.

The long-term EU thresholds for 2040 and 2050 changed over time as well. Earlier targets were to reduce GHG emissions by up to 60% until 2040 and up to 80–95% by 2050 [29]. In 2023, the EU increased the percentages once again, in concordance with the new 2030 thresholds set in motion by the conflict. The new objective is to reduce GHG emissions by up to 95% until 2040 and reach zero net emissions by 2050 [34].

Since the regional conflict started on 24 February 2022, the EU has started to speed up its efforts towards a renewable energy transition. This rapid shift turned out to be the right path as Russia switched off the main gas pipeline to Europe due to economic sanctions in September 2022 [35]. Facing a dire situation, the EU was heavily dependent on Russian fossil fuels, according to Ursula von der Leyen, the President of the European Commission [36], and thus the EU launched the REPowerEU strategy in order to turn its energetic focus on more energy production and less energy imports.

The REPowerEU strategy [32] was finished earlier than originally planned. It targets eliminating Russian energy imports by 2027. Its three major focuses are as follows:

- to save energy;

- to produce clean energy from renewable sources;

- to diversify the energy supplies.

This plan introduced policies that succeeded in reducing Russian fossil fuel dependency, saving 20% of the energy consumption in the EU, introducing a gas price cap and a global oil price cap, and doubling renewables [36]. The success can be seen in the sheer numbers, as Russian gas accounted for 8% of all pipeline gas imported into the EU in September 2022, compared to 41% of imports from Russia in August 2021 [36]. This is a success for the EU climate and energy strategy going forward, as the EU managed to advance renewable energy development and energy independence faster than ever before. The European Union voted in 2022 in favor of classifying nuclear sources of energy and natural gas as “green” sources of energy [37], with the target of helping the financial markets and finally bringing the gas price down [38]. This will go into effect in the EU taxonomy rule book in 2023, unless 20 of the 27 member states reject it [39]. Although rejection is very unlikely to happen, the measure received a lot of backlash, especially from climate change activists, as a fossil fuel will only truly be a fossil fuel. Policies can change how it is financially considered, but it has the same impact on GHG emissions as before it was considered “green”. As for renewables in the EU, Solar Power Europe reported that in 2022, the EU’s installed photovoltaics were up by 47% compared to 2021, from 28.1 GW to 41.4 GW [40]. The chances that followed the Russo-Ukrainian conflict can clearly be seen in 2022, as from the total EU energy mix, wind and solar generated 22% of the electricity in 2022, overtaking gas with approximately 2.5% for the first time [41]. Also, nine EU countries generated more than half of their electricity demand from renewable sources in 2022 [41]. Although the data for 2023 are not yet available, it is estimated that fossil fuel usage in the EU will register a 20% drop in 2023 compared to 2022 [42].

The fight against climate change always faces the same issue: the choice between effectiveness and popularity [43]. It is difficult to implement effective taxes to reduce GHG emissions due to public resistance, political trust and efficacy, and fossil fuel dependence [44]. In 1990, Finland was the world’s first country to implement a carbon tax. Since then, 19 European countries have followed their model [45]. Moreover, since 2005, the EU has successfully implemented “the largest trading system of emission allowances worldwide” [46].

There are two different ways in which the carbon emitted in the Earth’s atmosphere is taxed. Both are in place and function together at the moment in the EU and are the following:

- the carbon tax;

- the EU ETS (Emission Trading System).

Compared to the ETS, the carbon tax sets a price directly on carbon by having a tax rate on GHG emissions or the carbon content of fossil fuels. It is also different because the emission reduction from the carbon tax is not pre-defined, but the price of carbon is [47]. The EU ETS carbon market sets a cap on the total GHG emitted annually and allows trade between emitters for the emissions allowances, meaning that it directly sets a price on GHG emissions [47]. The EU ETS is specific to companies, and it stimulates emissions reduction in two ways: either by reducing emissions through renewable energy use or by buying emissions allowances. The EU ETS does not tax GHG emissions from individual owners in any form or from any transport fuels [48].

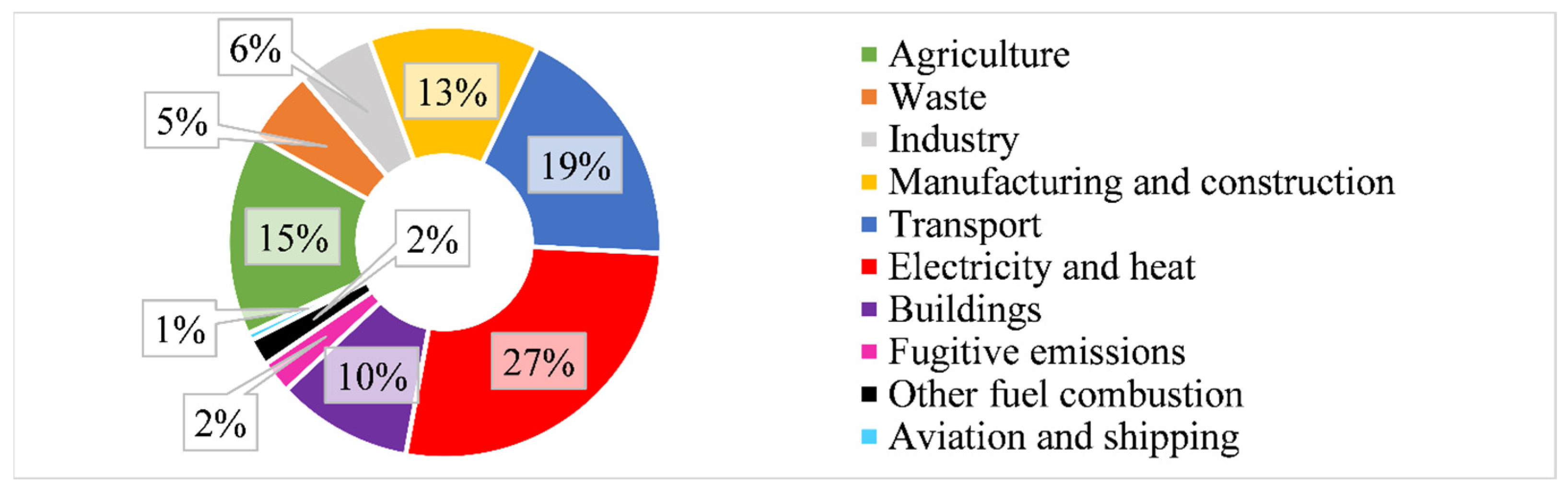

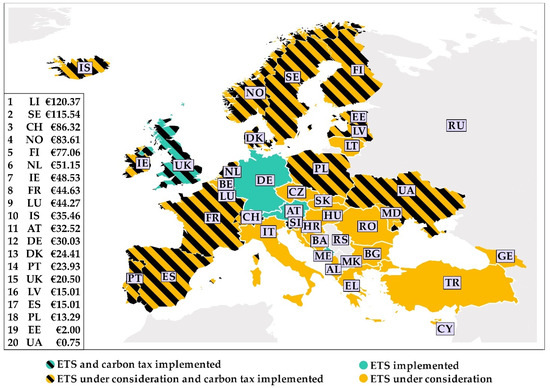

Currently, only a couple of countries in Europe have a tax on carbon, compared with the countries under the EU ETS, as seen in Figure 1. The EU has started the procedure to implement a carbon tax for all EU members. In accordance with this, Romania will also comply with EU regulations and implement the carbon tax until 2027, as the EU plans to do.

Figure 1.

Europe countries by ETS and carbon tax regulations as of March 31, 2023. Carbon tax rates per metric ton of CO2. Prices for carbon tax were converted using the EUR-USD currency conversion rate as of 31 March 2023. The authors created this figure with data from the World Bank’s “Carbon Pricing Dashboard” [49].

Historically, EU energy policies shifted back and forth from national to supranational authorities or were shared competences, as mentioned in the Treaty on the Functioning of the European Union (TFEU) [50]. The Russo-Ukrainian conflict reopened this problem: should energy policy be regulated by each member state or solely by the EU? Although in the past the power returned to national governments [51], today, EU leaders are not willing to take decisive actions for their countries and rely on EU policies [19]. The EU struggles to find the best course of action to achieve its energy security. As the conflict continues and post-pandemic recovery is ongoing, the future of EU energy security remains unknown. What is really an accepted fact for all EU members is the need to secure an energy future without relying on Russian imports.

3.2. Impact in Romania as a European Union Member

“Beyond the destruction caused by the conflict, Europe is also in an energy crisis. All European states are looking for solutions to reduce their dependence on gas and crude oil imports from Russia. In this context, Romania will have to take concrete, rational steps towards ensuring energy independence”, claimed the Romanian environment secretary [52].

In accordance with EU policies, Romania also targets energy independence in response to the Russo-Ukrainian conflict. In 2021, 45% of the primary energy consumption in Romania was provided by imports, according to the National Institute of Statistics [53], and it relies only on Russian imports for 29% of its gas consumption. In 2022, 47% of the primary energy consumption was provided by imports, but the amount of money Romania paid for Russian imports dropped by 51% compared to 2021. Considering that in 2022 the gas prices were a lot higher than in 2022, it is estimated that in 2022 Romania relied on Russian imports for only 8–14% of its gas consumption.

Romanian energy legislation is based on and closely adapted from EU regulatory legislation. For this reason, the EU approach to energy legislation is important in order to understand Romanian energy legislation. The Romanian Energy Strategy [54] (RES) was developed in concordance with the EU Clean Energy for All Europeans package, representing the fourth energy package that implements the Paris Agreement of 2015 [28]. Moreover, RES is corelated with the REPowerEU plan; the Fit for 55 packages; the European Green Deal; the EU Energy Performance of Buildings Directive (EPBD); the Effort Sharing Regulation (ESR); the Energy Efficiency Directive (EED), Directive 2003/87/EC, also known as the Emissions Trading System Directive (ETSD); and the Renewable Energy Directive (RED), all of which are energy-related policies. RES’s purpose is the sustainable growth of the energetic sector in Romania between 2020 and 2030, with a 2050 perspective. It establishes targets for the reduction of GHG emissions, the increase in renewable energy sources, the increase in energy efficiency in all sectors, and the implementation of the European Green Deal. The RES considers the implementation of national objectives in order to

- reduce the emissions from ETS sectors up to 43.9% compared with 2005 levels and 2% from non-ETS sectors compared with 2005 levels;

- increase to 30.7% the energy from renewable sources from the final energy consumption;

- reduce the final energy consumption by 40.4% compared with the 2007 projection.

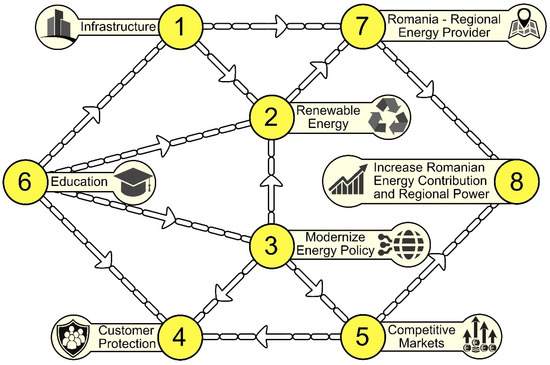

The RES establishes eight objectives, designed to complement each other, that need to be simultaneously implemented and accomplished in relation to the technological, economic, and geopolitical contexts and are presented in Table 1. RES targets infrastructure, policy, and education. While energy education represents the base for all the objectives, the infrastructure objectives rely on the policy objectives for implementation, and the final target of increasing Romania’s regional power relies on all of them working together. Figure 2 provides a block diagram to easily understand the connection between all objectives, each of which has a table number and a clear description of its target. Observing the diagram, the RES structure provides a clear view of what the Romanian government plans to do: increase education, develop infrastructure, reform policy, and have an impact on a regional level.

Table 1.

Romanian Energy Strategy objectives [1].

Figure 2.

The block diagram of the Romanian Energy Strategy objectives based on their interconnectivity. The authors created this figure with data from the RES.

The first objective targets finishing the Romanian electrification. At the moment, only 90% of residential consumers are connected to the national electrical system. Although electrical energy is used the most in Romania, the consumption per capita is 2.4 times lower than the EU average. As for natural gas, only 44% of Romanian households are connected to the national gas system. This objective also targets rapidly increasing the development of the national electrical and gas systems in order to reach all consumers and also increase their transport capacities. Following the start of the conflict, with the intent of becoming a regional energy provider, Romania intensified the effort to strengthen its electrical and gas systems, especially the high-capacity transport, with the target of being able to export as soon as possible higher energy quantities.

The second objective states that renewable energy will play a vital role in Romania’s decarbonization. At the end of 2022, the Romanian government will have already started a program titled “The National Recovery and Resilience Plan” (NRRP), which targets renewable energy, replacing coal as fuel, nuclear energy, cogeneration, bio-fuels, and energetic infrastructure modernization. To approach this, Romania intends to use so-called “transitional energy sources”, such as natural gas, hydrogen, and nuclear energy, to be able to move towards 100 percent renewable energy in the future. It targets developing a national strategy for hydrogen production and the infrastructure to use it as another source of energy, as multiple countries in Europe and North America are researching [55]. The NRRP also targets the building sector, with the goal of lowering their energy consumption. This process started a long time ago in Romania, but now it is even more intensified with the emphasis on using renewable energy sources for every building, either new or already built.

The third objective acknowledges the need for transparent, fair, and stable policies from the government. Thus, it targets improving the implementation and regulation of all energy measures and creating a stable environment for all parties involved in energy extraction, production, transport, and final use.

The fourth objective targets protecting the final consumer. As the government understands that the final consumer is affected by the end price, it seeks to eliminate the possibilities for high fluctuations in price. It also supports the first objective target of providing accessibility to all consumers of energy.

The fifth objective targets guaranteeing safe and stable energy markets. For a prosperous energy economy, the government wants to assure competitive and fair markets for all energy sub-sectors.

The sixth objective targets increasing the number of qualified workers on all the energy jobs, as the Romanian government knows that the actual qualified workforce is getting old, and the current education system needs to be improved. In the long run, the success of all the objectives in the RES will be directly influenced by the qualified workforce that will implement, maintain, and improve the energy sector.

The seventh objective represents the boldest objective for Romania yet, as it wants to develop all the energy sectors with the purpose of becoming a regional energy provider. This objective represents an extended vision of the first objective, over the country’s borders, towards its neighbors, and especially towards the EU. In the past years, with all the disorder from the pandemic and conflict, the government acknowledged the strategic geolocation of Romania and was committed to becoming the EU’s south-east anchor in the energy sector.

The eight objectives represent all the development visions of all the other objectives, as Romania participates in an ongoing process of integration in the EU energy markets. Romania has the primary energy sources required, but they need to be sustainable, taking into account the impact on the environment and following the EU regulation on climate change.

The European energy crisis basically had its roots in the fact that the main transit route for natural gas, through Ukraine, was lost. Europe found itself in a new reality, which in turn caused prices to skyrocket. Romania was one of the first countries in the EU to adopt measures intended to lower the effects of the energy crisis, with the target of stabilizing electricity, gas, and fuel prices from production, transport, and the final consumer. While the EU searched elsewhere for gas supplies, like increasing the import of gas from Azerbaijan from 8 bcm in 2021 to 11.4 bcm in 2022 [56], Romania intends to strengthen its regional energy security foothold. For this, Romania plans in its Energy Strategy to renew, expand, and consolidate both its national electrical and gas systems. Romania understands that energy source and route diversification is an important step towards national and European energy independence and towards reducing its dependency on Russian energy.

The actual steps Romania is taking towards energy independence have already started. From the electrical point of view, it plans to finish more than ten projects for the electrical systems by 2030 [54]. Most of them are projects to increase the electrical power lines’ capacities inside Romania. At the end of 2022, Romania successfully finished Romanian–Bulgarian interconnections from Stupina (RO) to Varna (BG) and from Rahman (RO) to Dobrudja (BG). Another important interstate project is the power line connection between Suceava (RO) and Bălți (MD). It is a project on the REPowerEU plan, and the Romanian part of the power line will be funded by the EU [57].

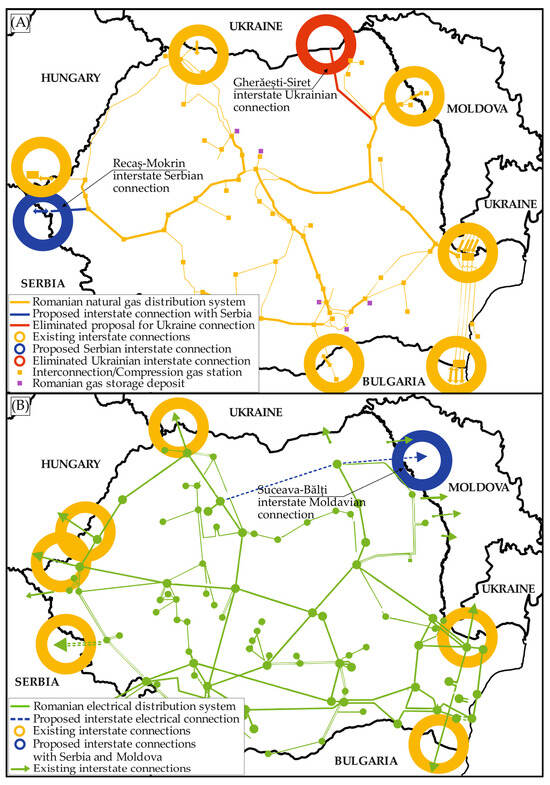

For the natural gas system, Romania plans to consolidate all its national transport pipelines. As for the plans with its neighbors, the main objective is to implement the second phase of the BRUA project. BRUA stands for Bulgaria–Romania–Hungary–Austria, which is needed in order to create another pipeline for gas imports from Azerbaijan and the Middle East for Europe. Moreover, Romania has another important objective for developing the Southern Gas Transmission Corridor for transporting gas from the Black Sea shore [58]. Romania’s projects for new interstate connections for electrical energy (ENTSO-E) and gas (ENTSO-G) are represented in Figure 3 alongside the national electrical and gas system distribution in Romania as of 2023.

Figure 3.

Romania’s interstate connections in a project for electrical energy and natural gas. (A) ENTSO-G Romania’s proposed connections; (B) ENTSO-E Romania’s proposed connections. The authors created this figure with data from the Romanian Energy Strategy [31] and the National Natural Gas Transport System Development Plan [59].

As Ukraine and Moldova were recently successfully connected to the European Network of Transmission System Operators for Electricity (ENTSO-E), Romania’s efforts to become a regional provider continue. Romania has ongoing projects to build two new nuclear reactors at Cernavodă Nuclear Power Plant to increase the export of electrical energy until 2030 [60] and also to interconnect the electrical energy system with Moldova and Ukraine via back-to-back stations [54].

Moreover, with the new offshore exploration law (Romanian Law No. 157/2022 [61]), Romania will start to tap into important quantities of oil reserves in the Black Sea. Originally, in 2018, the law only covered the offshore oil reserves, but in May 2022, the law was changed to also include the onshore oil reserves. In 2023, new reserves of oil and natural gas were discovered in the south of Romania, estimated to be approximately 30 boe (barrels of oil equivalent) [62]. By the end of 2026, Romania will also extract natural gases from the Black Sea, which are estimated to be more than its annual consumption [63].

In the near future, Romania will have more oil resources than it consumes. It will export to neighboring countries, with Moldova having a high priority according to Romanian policy if the present trend continues. Plans set in motion by the REPowerEU and RES prove to have been successful since the start of the conflict, not because of the actual planning itself but because of the speed with which measures are set in motion.

4. Energy in the European Union and Romania

Energy is the key to human evolution. It is an indicator of how well, how fast, and how sustainable a country, a group of countries, a continent, or the whole planet Earth is developing. For understanding today’s world policies, understanding energy is mandatory. Energy is neither created nor destroyed; it is only transformed and transferred from one form to another. Energy is economically regarded from two major points of view:

- Energy production (or primary energy consumption), which is energy obtained from another source, in a form that can be used for human needs;

- Energy consumption (or final energy consumption), which is energy in a specific form, used by humans for specific purposes.

The European Union has been setting its target to reduce energy consumption for decades now. Since joining the EU in 2007, Romania has also agreed to comply with the same energy policy as the EU. The 2012 Energy Efficiency Directive set the first rules and obligations for reducing energy consumption. It set targets for 2020 and 2030 energy consumption levels. Overall, the primary energy consumption in the EU should be only 1023 Mtoe (million metric tons of oil equivalent) by 2030. Consequently, the final energy consumption in the EU should be only 787 Mtoe by 2030 [64].

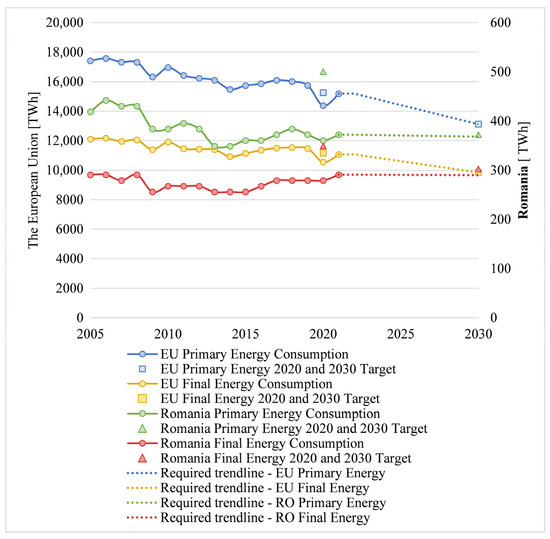

Figure 4 presents both the primary and final energy consumption, in TWh, for the EU (left vertical axis) and Romania (right vertical axis) since 2005 to 2021. In the EU, both energy consumption and production are on a downward trend. In Romania, the downward trend is seen mostly in primary energy consumption as the Romanian state industry gradually shut down after the 1989 civil revolution. The final energy consumption, on the other hand, remained steady, and it has even increased in the last few years, mostly because the country is developing more and more, thus increasing the final energy need. Interestingly, the 2020 target set by EED has seemingly not been reached by the ongoing trend but by a sudden drop in energy consumption compared to 2019, and that was the result of the COVID-19 lockdown in the first two quarters of 2020. The data are available only up to 2021 at this moment.

Figure 4.

Primary and final energy consumption in the EU and Romania since 2005 to 2021, with targets for 2020 and 2030 [65].

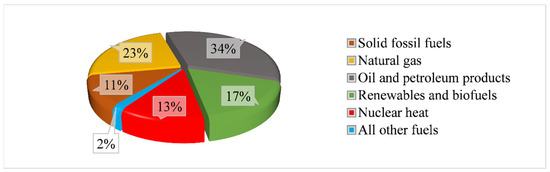

4.1. Energy in the European Union

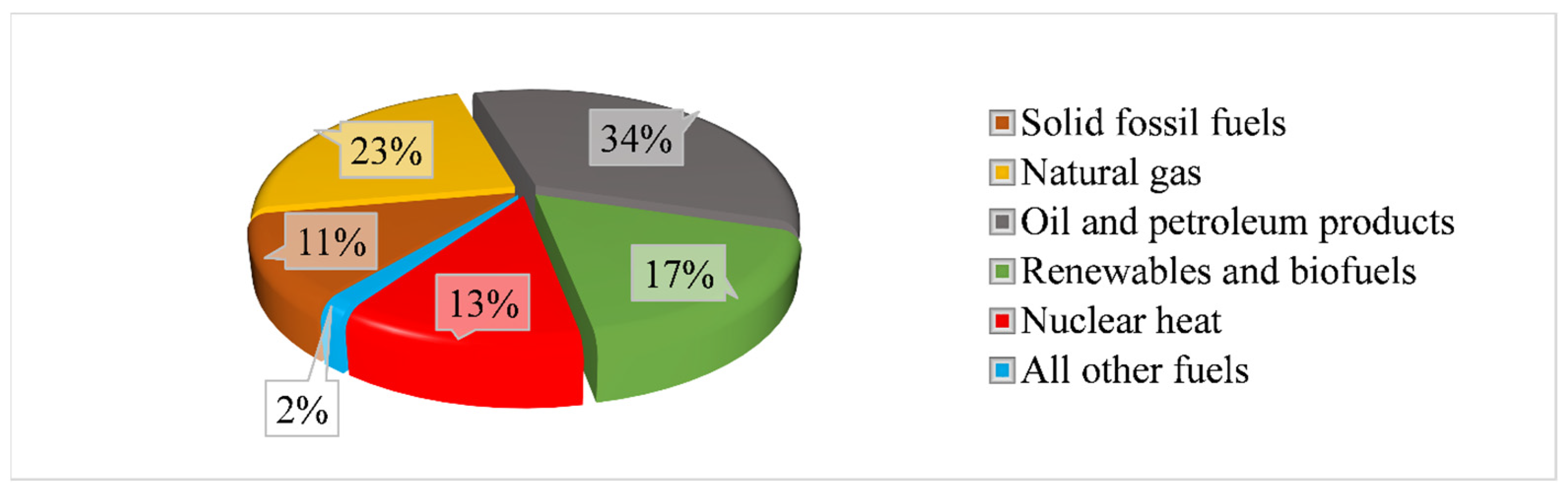

The EU target to increase the renewable share in energy production processes is well known. The latest available data, from 2021, about energy production in the EU is represented in Figure 5. The total energy production in 2021 increased by 6% compared to 2020 [66]. The share of renewables and biofuels as a source of energy was 17% in 2021, the same as in 2020. Oil, petroleum products, solid fossil fuels, and natural gas (all being fossil fuels) continue to contribute to a massive share of 68% in 2021, similar to 2020. Although the EU is a world leader when it comes to renewable energy policies and strategies, it still has a long road ahead to reach the desired threshold of 42.5% [33].

Figure 5.

Energy production (primary energy consumption) from sources in the EU in 2021, in percentages based on terajoules [66].

Approximate 23% of the total energy production in the EU comes from natural gas. In 2021, 45% of the total natural gas was imported from Russia into EU [67]. The energy strategy that the EU started with the REPowerEU plan and continued as a result of the Russo-Ukrainian war, contributed to the decrease in energy imports from Russia, as Table 2 presents, which was an astounding 90% in March 2023 compared with the average monthly figure from 2019 to 2022 [68].

Table 2.

European Union energy imports from Russia in million metric tons [69].

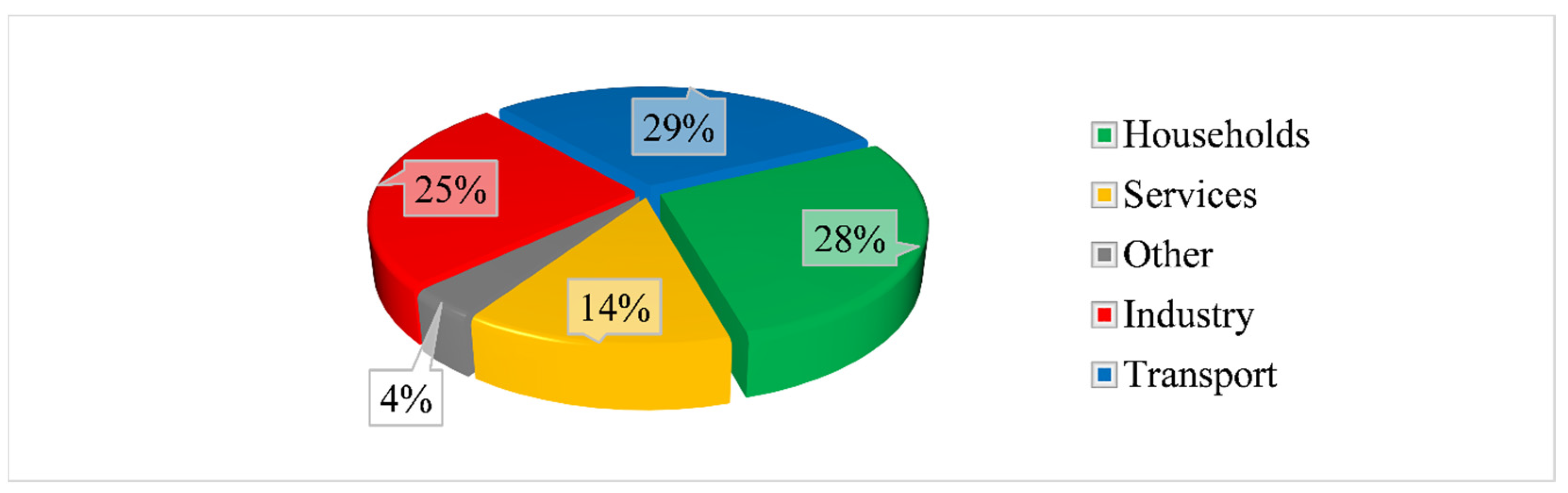

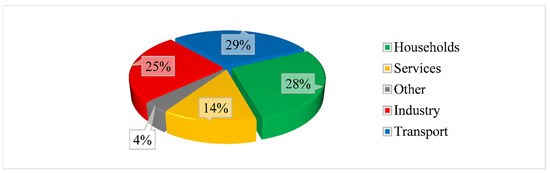

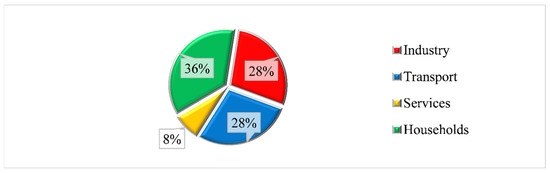

In the EU, around 40% of the total energy consumption comes from buildings and services [54], and since 2007, it has increased by approximately 5% for households and 2.4% for services. Industry accounts for approximately 25% of the energy consumption, as seen in Figure 6, and it fell by 12.4% in 2021 compared to 2007 [66]. Transport sector energy consumption was on the rise until 2019, compared with 1990 levels. International aviation skyrocketed by 90.9%, while rail and inland waterway levels dropped by around 30% and 23.5%, respectively. In 2018, the transport sector’s shares of energy consumption were 33.9% and 25.4% of total GHG emissions, respectively [70]. In 2021, energy consumption decreased by 29%, and GHG emissions dropped by 10%. This high decrease was caused by COVID-19, which halted almost all transport in 2020, but it is on the rise again.

Figure 6.

Energy consumption (final energy consumption) by sectors in EU in 2021, in percentages, based on terajoules [66].

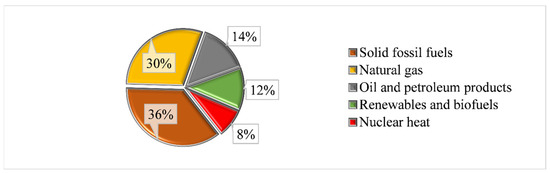

4.2. Energy in Romania

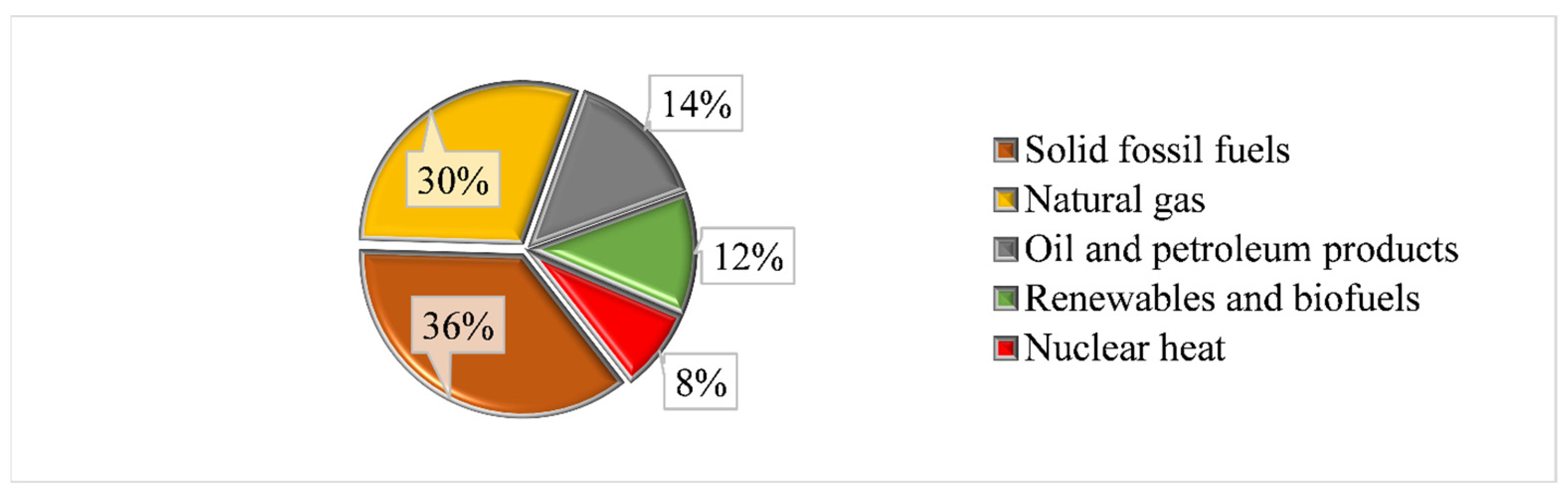

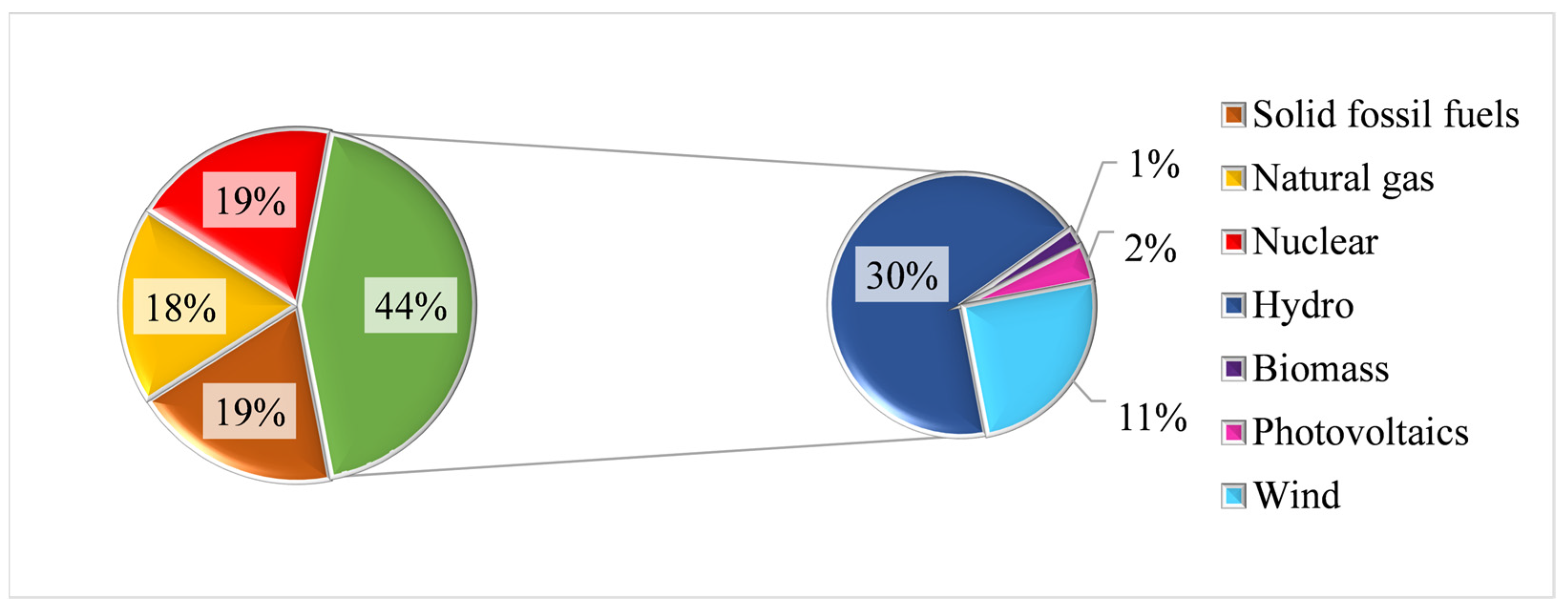

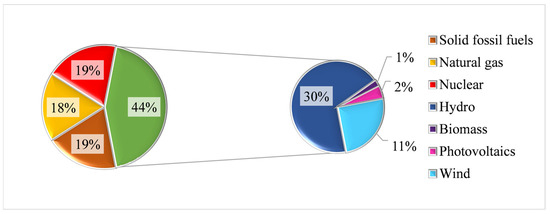

Romania aligns itself with EU regulations and is a strong supporter of the EU energy strategy. The Romanian energy production mix is presented in Figure 7. Compared to the EU, the energy production mix in Romania has some interesting differences. In percentages, Romania used 20% less oil and petroleum products than the EU average in 2021, 5% less nuclear heat, and 5% less renewable energy and biofuels. On the other hand, it used 25% more solid fossil fuels, both coal and wood, especially for urban and residential heating, and 7% more natural gas. The renewable energy production is quite low in Romania overall, but from the total electricity mix in Romania for 2021 (Figure 8), 44% of the electricity was generated from renewable sources, which is higher than the EU’s 37% in 2021 [71].

Figure 7.

Energy production (primary energy consumption) from sources in Romania in 2021, in percentages [72].

Figure 8.

Electricity production mix (primary energy consumption for electricity generation) from sources in Romania in 2021, in percentages [73].

From the total 36% of solid fossil fuels, only 19% are used for electricity generation, and from the total 30% of natural gas, only 18% are used for electricity generation; the rest are used for heating buildings. This means that 29% of the energy production in Romania comes from heating buildings with wood and natural gas. This represents one of the more important problems that the Romanian government addresses in the RES and intends to solve in the following decade.

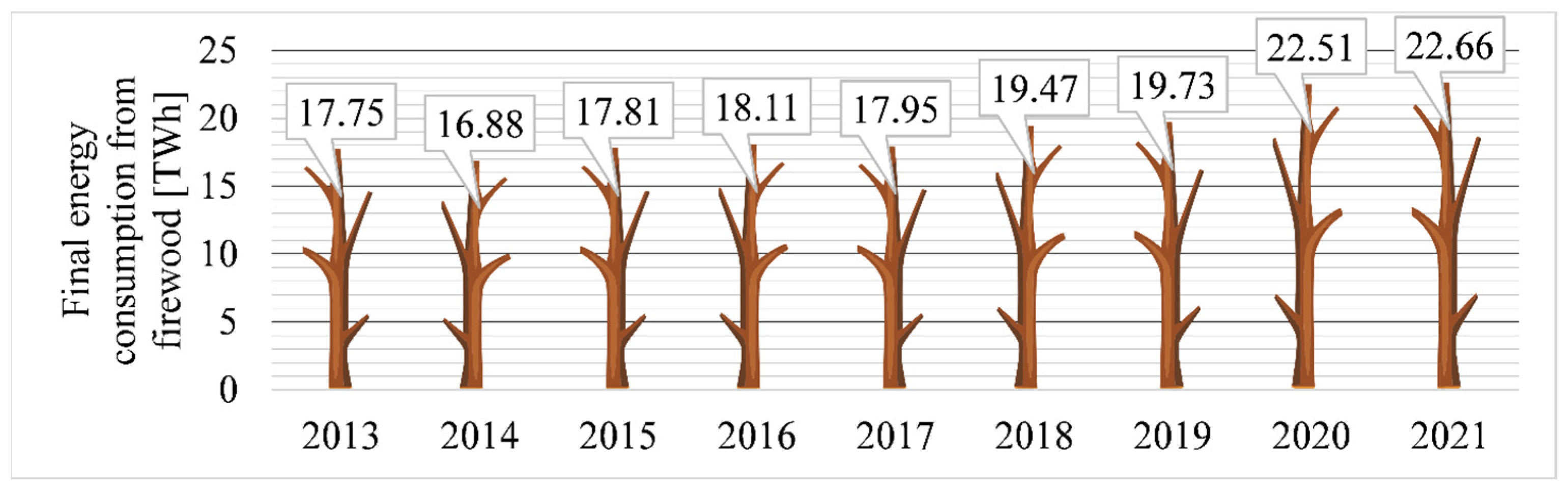

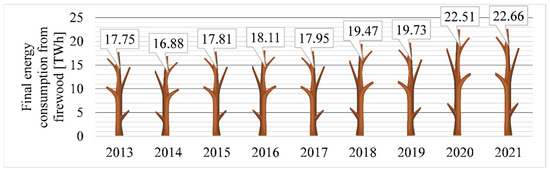

As of December 2022, the total number of households in Romania was estimated at 9.65 million [74]. According to RES, approximately 3.5 million households are currently heated with firewood; approximately 2.5 million with natural gas; 1.2 million from district heating; and the rest with tar, diesel, liquefied gas, or electricity. Officially, 36.27% of the Romanian population heat with firewood; 25.91% with natural gas; 12.44% from district heating; and 25.39% with tar, diesel, liquefied gas, or electricity. In Figure 9, the official firewood consumption from 2013 to 2021 is presented, which corresponds with the estimated firewood required to heat 3.5 million households. Data for 2022 are not yet available.

Figure 9.

Energy consumption from firewood for heating households in Romania with data registered by the National Institute of Statistics [75].

Firewood is cheaper than natural gas, and it is used only in rural households. The rural households share is 44.56% (4.3 million), and they are mostly heated with firewood. This comes into contradiction with the official number of households heated with firewood and the share that tar, diesel, liquefied gas, or electricity have, but it is not a mistake. This disparity exists due to illegally harvesting timber for domestic heating purposes, especially in rural areas, which is a common occurrence in Romania. For a long time now, governments have been unable to stop it, even though the forestry code was modified in 2020 and again in 2023 to drastically increase the punishment, even including imprisonment [76]. Currently, it is impossible to know for sure how much firewood is used in Romania as an energy source. The official data only cover a part of it.

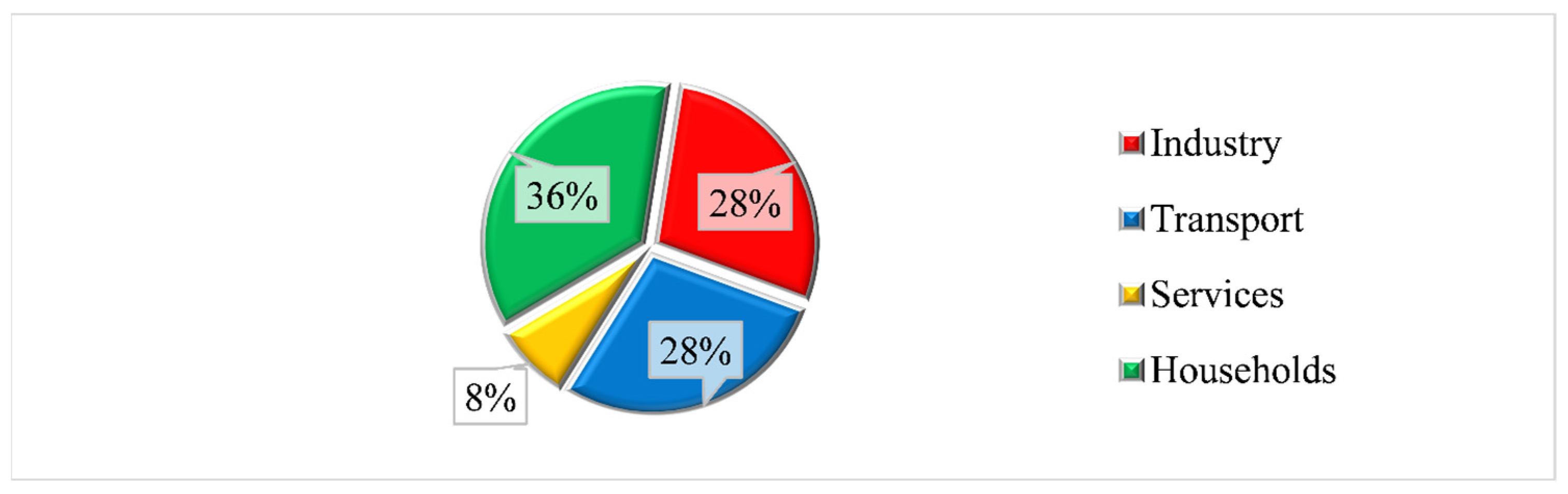

In Romania, of the total energy consumption, 44% comes from the buildings and services sector, as presented in Figure 10. This is higher than the EU average by approximately 4%. Although Romania received considerable financial support from the EU and the government is actively implementing measures to meet the EU’s climate change effort requirements, this is a difficult affair considering Romania’s economy and corruption state [77]. Industry energy consumption is a little bit higher than the EU average, by 3%, and the transport sector has more or less the same share of the total final energy consumption.

Figure 10.

Energy consumption (final energy consumption) by sectors in Romania in 2021, excluding energy production, in percentages, based on Mtoe [78].

The current geopolitical status has opened doors to opportunities, but short-term solutions could represent steps backward in achieving decarbonization and sustainable development. Thus, Romania has considered increasing coal mine production capacities, despite commitments to reduce GHG emissions [79]. The greatest opportunity right now is to accelerate the transition to green energy. By producing more energy from renewable energy sources, it is expected to see both the consumption of fossil fuels and energy prices decline. The Romanian government needs to focus on financing innovative technology, energy-efficient technology, and renewable energy sources in order to realize these objectives, which are all encompassed in the RES objectives as presented in Figure 2.

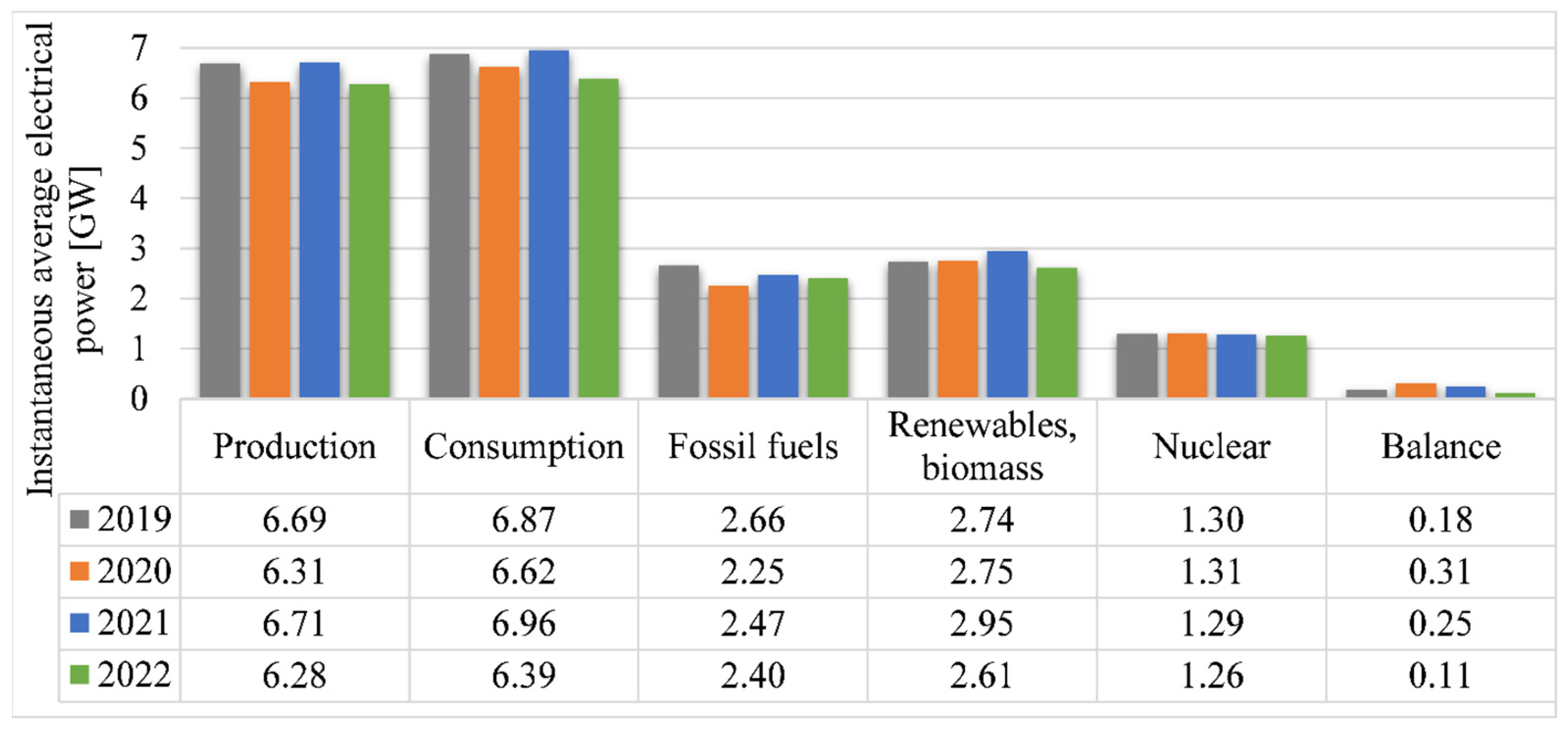

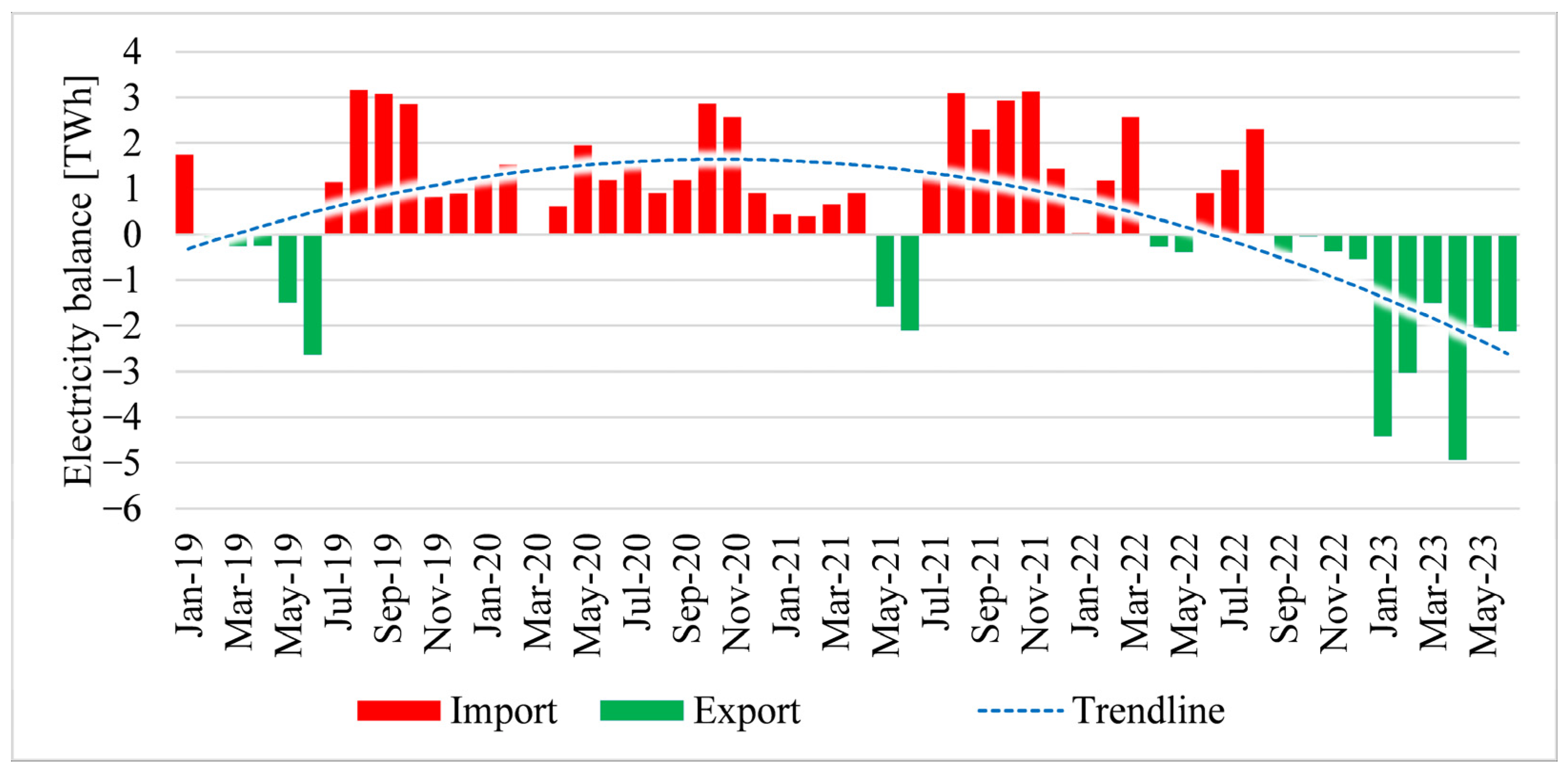

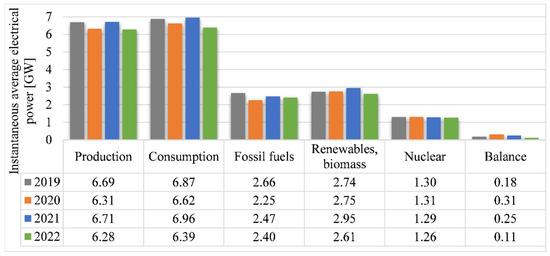

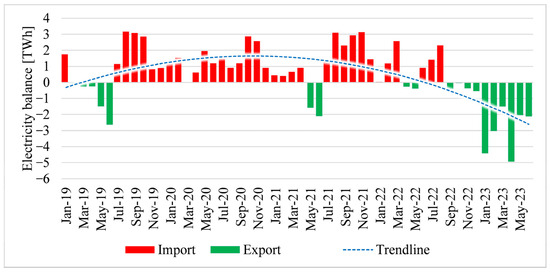

In Figure 11, data from 2019 to 2022 are presented [80] for the average instantaneous electricity consumption, production divided by energy sources (fossil fuels, renewables, and nuclear), and the balance of imported and exported electrical energy. Positive values mean imported energy; negative values correspond to exported energy. Although Romania has a total installed capacity in electricity production of 18.3 GWh [81], the average instantaneous production is only a third of the total capacity. This fact is reflected in the positive balance (imported energy) for 2019 to 2022. Despite a balanced mix of production sources, Romania was a net importer of electricity in 2021 and 2022 for the third and fourth years in a row. Net imports were approximately 40% higher than in 2019, the year that is used as a baseline since it was not affected by the pandemic. Importantly, in 2021, for the third year in a row, Romania failed to produce electricity for self-usage at a competitive price, despite having one of the finest energy mixes in the European Union. The issue for 2021 is that there has not been any net import of electricity to stimulate economic development. According to the National Institute of Statistics, in 2021, the economy consumed 2.3% less energy than in 2019. The negative 90 MWh difference in electricity consumption in the economy in 2021 compared to 2019 may be attributable to a drop-in activity rather than miraculous energy saving measures. In 2022, the imported electricity more than halved compared to 2021, as Romania was a net exported for 6 months of 2022. In Figure 12, data up to June 2023 for the imported and exported electrical energy in Romania are represented. It is important to note that after the start of the Russo-Ukrainian conflict in 2022, Romania began to export electrical energy to its neighbors. As the conflict was a big incentive to start applying what the RES stated, related to the REPowerEU plan, by the end of 2022, Romania started to export a lot more electrical energy than ever before. The trendline direction points toward further increases, which is exactly what Romania is planning.

Figure 11.

Instantaneous average electrical power in Romania between 2019 and 2022, representing production, consumption, fossil fuels, renewables, biomass, nuclear, and the balance of imported and exported electrical power [80].

Figure 12.

Monthly average imported and exported electricity since January 2019 to May 2023 in Romania according to Transelectrica [73].

Besides electrical energy production and consumption, natural gas and wood are used for heating and industry. As natural gas imports from Russia in Europe are in a volatile state, Romania benefits from a semi-independence status compared with other EU states [82]. In the past three years, of the total natural gas consumption, only 24.09% has been imported. Even if, officially, in Romania, the dependence on Russian gas is considered at 10%, the reality is that it is between 20 and 30%. This is explained by the fact that Romania imports natural gas from companies that also buy it from Gazprom (an energy company in Russia, the biggest natural gas company in the world [83]), basically buying Russian gas from intermediary companies, as the head of the Intelligent Energy Association in Romania stated [82].

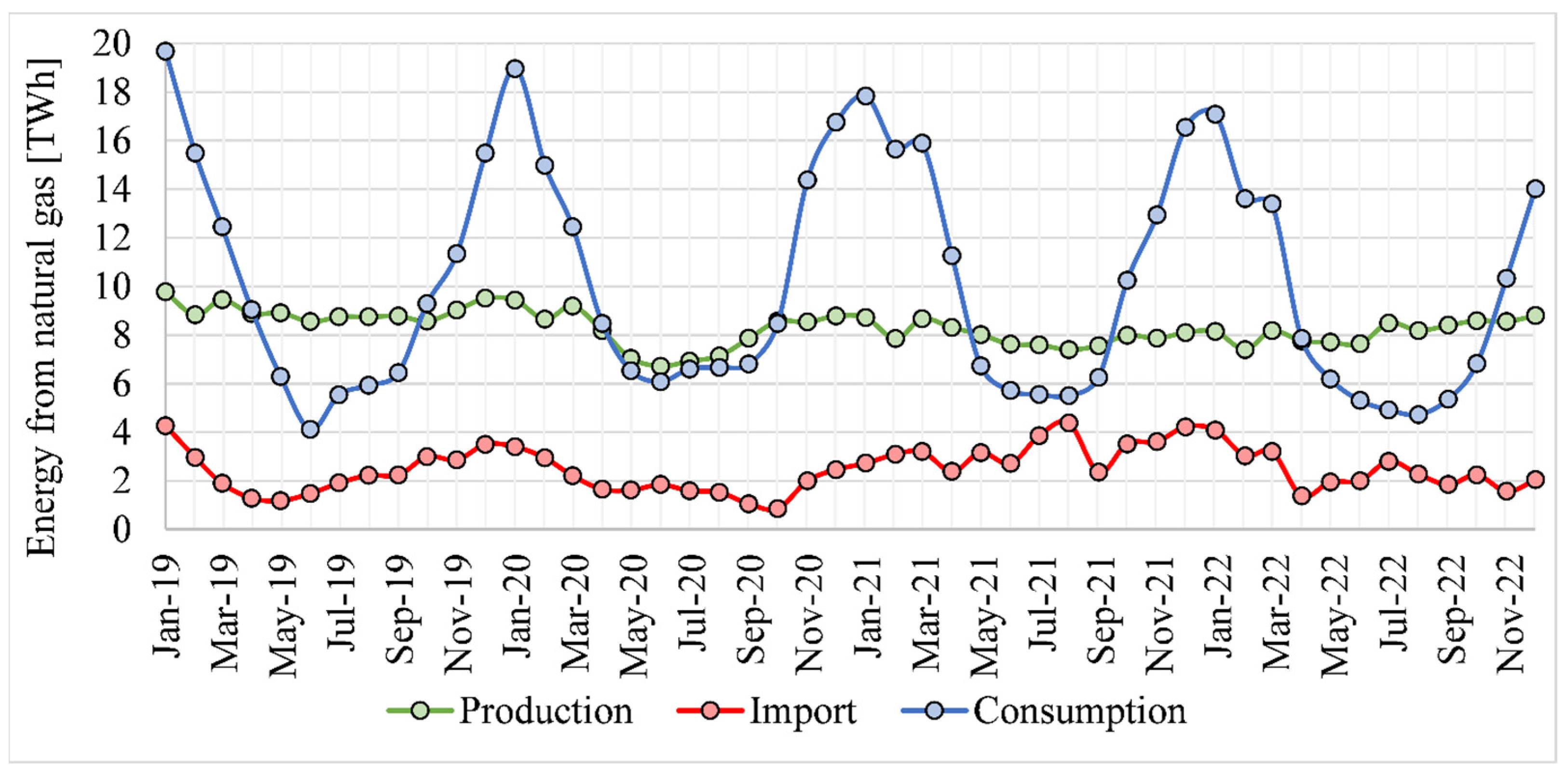

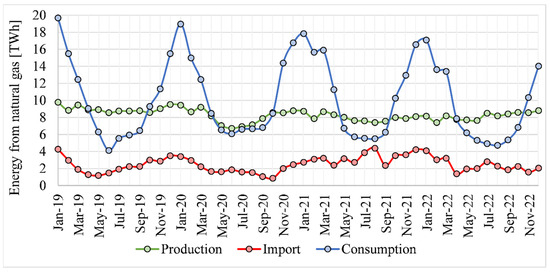

The increase in gas prices has resulted in a general renewal for coal in electricity generation at the beginning of 2021, but its share is smaller than it was in 2019. In 2021, both natural gas and coal had a share of 37.6%, down from 40.1% in 2019 [84]. Figure 13 presents the data collected by the National Energy Regulatory Authority in Romania regarding energy production and consumption from natural gas as a source. Natural gas consumption was on the rise, with 7.48% more in 2021 than in 2019, but in 2022 it decreased by 9.46% compared with 2019. On the other hand, the production of energy from internal natural gas is decreasing, reaching 11.21% less energy production in 2021 than in 2019. In 2022 it increased compared with 2021 by 2.24%. Natural gas imports have seen an increase in 2021, with 36.2% more than in 2019 and 69.4% more than in 2020, but a decrease by 1.29% was registered in 2022 compared to 2019.

Figure 13.

Energy production, consumption, and import from natural gas between 2019 and 2022 in Romania, with data from the National Energy Regulatory Authority [85].

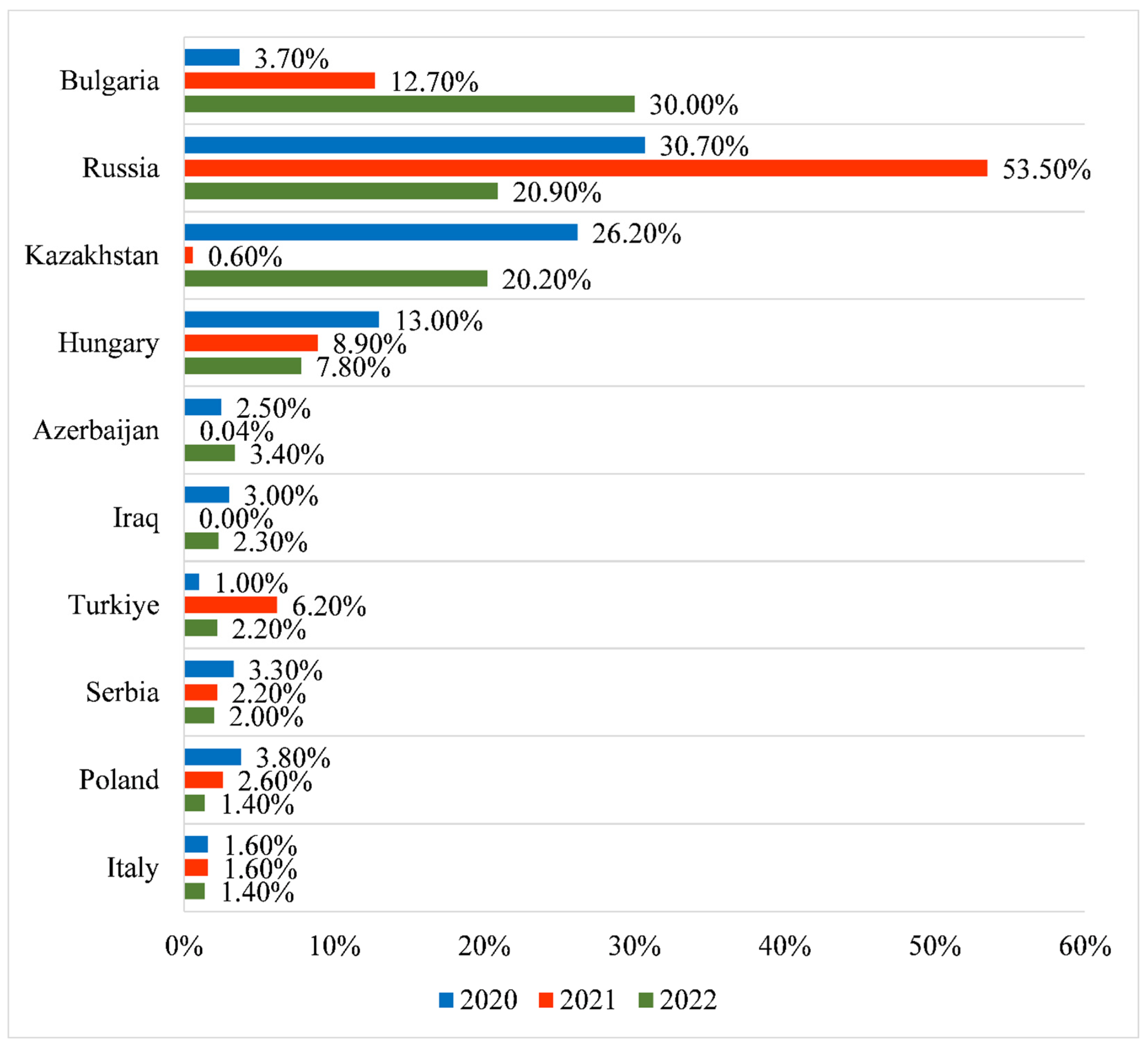

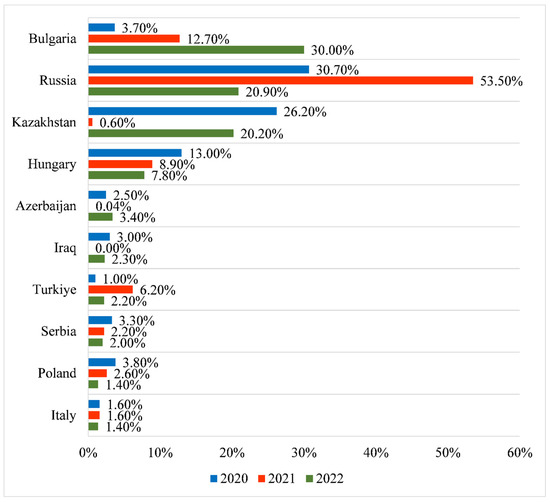

Romania’s dependency rate on imports fluctuated over the years. It peaked at 31.46% in 2007 and got as low as 16.66% in 2014 [86]. Since 2014, it continued to rise and reached 31.65% in 2021 [86]. For 2022, there are no data available at the moment, but there are data about the imported energy share in Romania by country, as Figure 14 presents. Although it does not offer information about the energy dependency rate, it presents the energy imported for 2020–2022. Compared to 2021, before the start of the conflict, in 2022, Romania reduced the energy imports from Russia from 53.50% to 20.90% and made up for it with imports from mostly Bulgaria and Kazakhstan, while also increasing by small amounts the energy from other countries that had a lower share.

Figure 14.

Imported energy share in Romania, by country, in 2020, 2021, and 2022 [87].

4.3. Romania’s Potential for Greener Electricity Production

Romania is in a unique position in the present political and economic climate, with the Black Sea serving as a significant asset that might hasten the switch to renewable energy. The Romanian Black Sea coast has huge potential for wind energy production, being able to install wind power plants with a capacity of up to 72,000 MW [88]. By 2030, Romania is expected to install more wind energy capacity of approximately 2302 MW and more solar energy (photovoltaic) capacity of approximately 3692 MW as part of the National Energy and Climate Plan, both of which are strategically important to the country’s energy system. According to Global Data [89], Romania’s photovoltaic capacity is predicted to quadruple between 2021 and 2030, rising from 1.39 GW in 2020 to 4.25 GW in 2030.

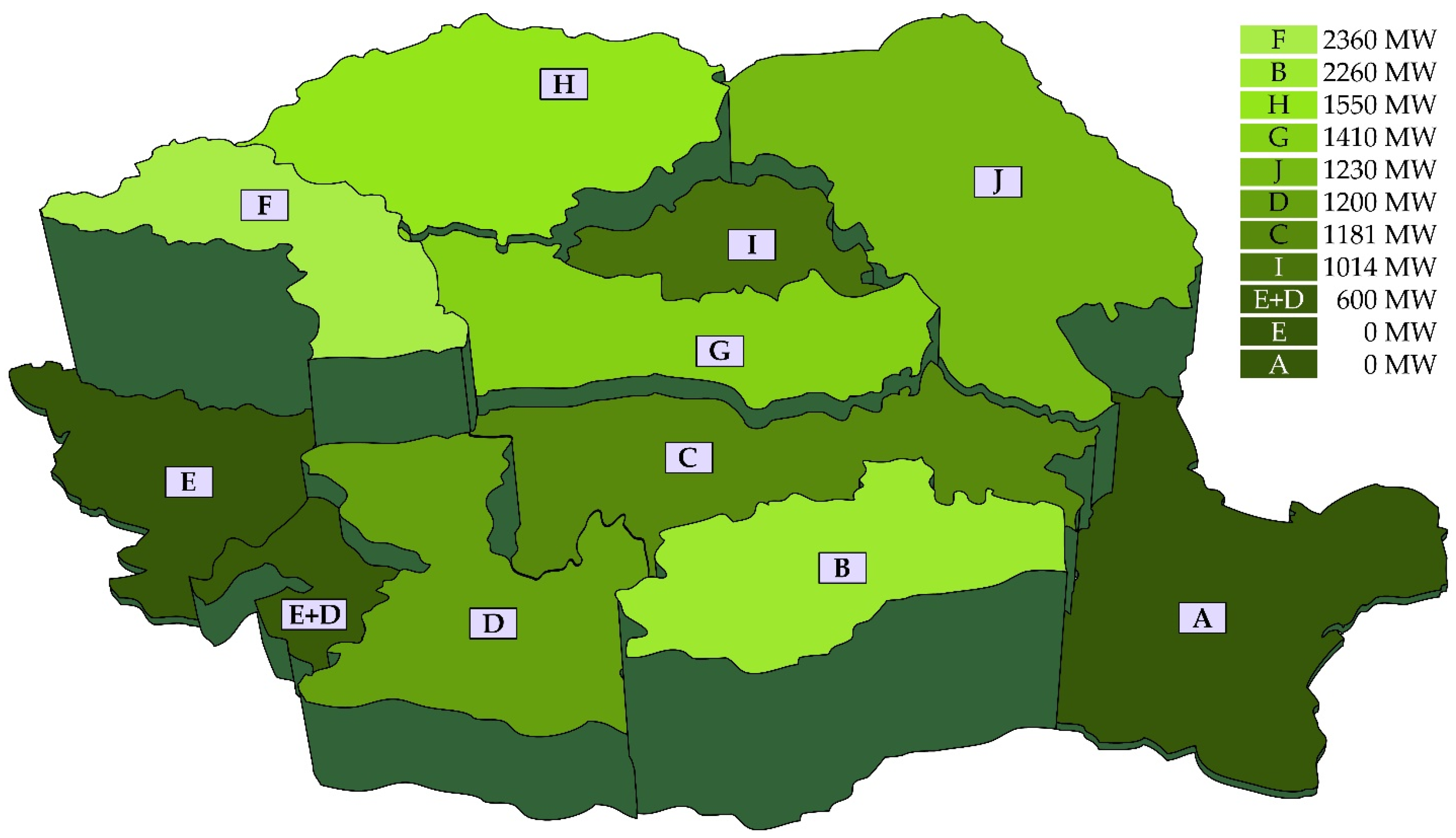

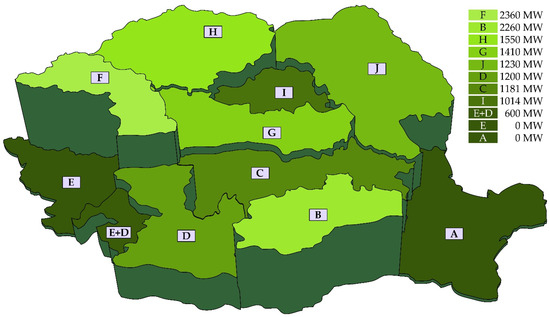

For a long time, it was impossible to introduce electrical energy back into the national electrical system in Romania. This all changed recently, as the laws and regulations have been slowly changed to allow for electrical energy decentralization. In the present, besides being an electricity consumer or an electricity producer, there is the possibility of being a “prosumer”. The term “prosumer” was introduced worldwide in 2018, in the International Standards [90], and it refers to an entity that is both an electricity consumer and a producer. This is something that the Romanian people have demanded for ages, and as soon as the regulations were modified, a lot of people opted to become prosumers. At the moment, a prosumer can introduce back into the electrical system the same amount of electrical energy that it can consume from the system, limited by the physical connection and the contract. Besides this, there is a limit of 400 kW electrical power that can be introduced back into the electrical system for prosumers [91]. The surplus of energy produced needs to be consumed locally and cannot be introduced back into the electrical system. The limitations set for the electricity introduced back into the national electrical system are in place due to the fact that the system does not have the capacity to sustain more energy. As of 2023, the available capacities, by region in Romania are presented in Figure 15. Two regions in Romania have zero connection capacities, and no other prosumers are allowed to connect there.

Figure 15.

The available connection capacities for introducing electricity into the national electrical system in Romania, by regions, in 2023 [92].

Moreover, the government started the “Green House” program in 2019 and it is still ongoing, which incentivizes residential households to install photovoltaic capacities. The government supports financially up to EUR 4000 and a maximum of 90% of the total price to install photovoltaic systems of at least 3 kW [93]. Another government program exists for small and medium companies to install photovoltaic capacity between 27 kW and 100 kW as a prosumer and to have hybrid plug-in electrical car charging stations of at least 22 kW [94]. The financial support from the government for this program is up to EUR 100,000 per eligible company. In 2022, the total accepted projects were 1642, with a cumulative installed capacity of 84,467 kW [94]. In 2023, the total accepted projects were 1878, with a cumulative installed capacity of 93,655 kW [95]. This indicates the Romanian people’s desire to invest in renewable energy.

With approximately 30% of the country’s total electricity production, hydropower is a significant part of Romania’s energy mix. Long-term output from renewable sources would be guaranteed through the renovation of existing electrical power plants. A complex renovation program is necessary to ensure that hydropower remains a key component of the country’s energy output since a sizable portion of hydropower plants are approaching the end of their initial life cycle [96].

Nuclear energy has gained more attention in light of the EU’s ecological taxonomy, and the European Commission has categorized it as sustainable energy. Nuclear energy is on Romania’s agenda, whether it is an intermediate step in the green transition or not. As nuclear energy accounts for almost 20% of the electricity production, the renovation of unit 1 of the Cernavodă nuclear power plant (the only nuclear power plant in Romania) by 2030, as well as the construction of future nuclear units 3 and 4, demonstrate the will to invest in nuclear energy in Romania. It is still a viable option for diversification and, eventually, energy independence. Moreover, the development of a small modular nuclear reactor in Romania, expected to be finished by 2030, indicates that nuclear energy is a national focus and is not considered to be removed yet.

To increase the development of energy infrastructure and renewable energy use, the European Union launched a renewable energy support program worth EUR 672.5 billion, called the Recovery and Resilience Plan. It is designed to reduce the economic and social consequences of the pandemic [97]. Although it was planned with the pandemic in mind, by the time the financial support actually arrived at each member state, it had a new importance: reducing the energy burden from Russian imports in the context of the ongoing conflict. Romania’s share of this EU plan is EUR 29.2 billion. This plan was set in motion in 2021 by the EU, and the program became available at the start of 2023 in Romania. The Romanian government appears to be relying on it to improve the country’s renewable energy development and make this financial support count for reaching targets set in RES. As the country seeks to incorporate renewable energy sources into the national electrical system, this will also present opportunities for transmission and distribution infrastructure companies. The rapid expansion of solar PV capacity will assist Romania in increasing its energy production. As a result, moving away from electricity imports, which were high in 2019 and 2020 [98], to electricity exports is ongoing, as Figure 12 presents. Capitalizing on this energy potential is critical in the context of Romania’s target of gradually eliminating coal-based energy by 2032.

5. Buildings Sector

Buildings and their dependencies have the highest impact on energy and greenhouse gases in the European Union. Therefore, the EU recognizes this issue, and for decades it has focused a lot of effort on it. In 2002, the first version of the Energy Performance of Buildings Directive was published, and since then, it has received several revisions that focused on the building’s energy efficiency, either by reducing the GHG emissions further or increasing the share of renewable energy sources and everything related to that [99]. Today the research is focused on switching fossil fuels with renewable energy directly or indirectly through advances in the technology used by equipment that access the renewable energy sources [100]. Furthermore, important research on improving the building construction materials or adjusting building elements to help mitigate the energy consumption [101] is also an ongoing process.

5.1. Buildings in the European Union

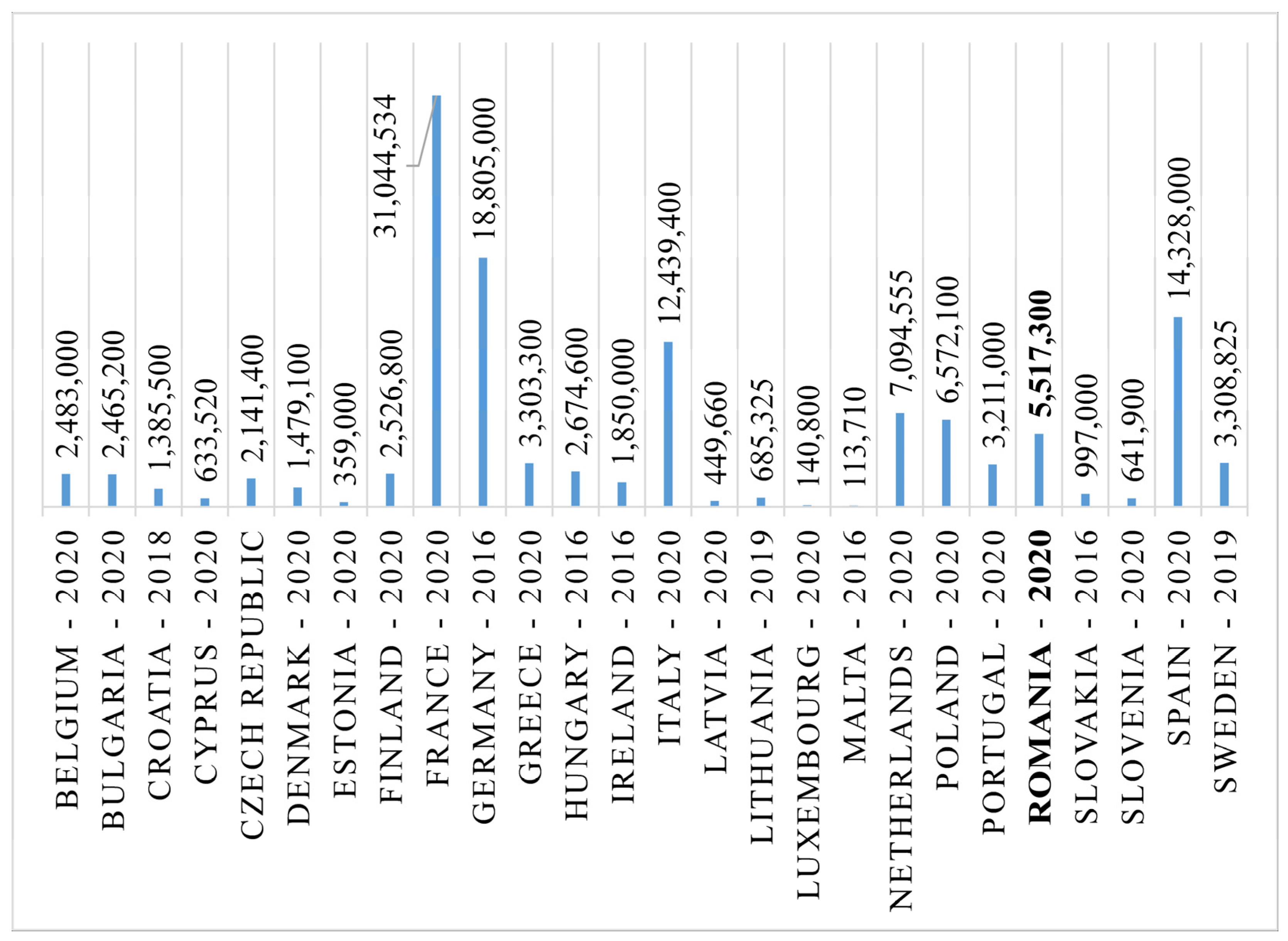

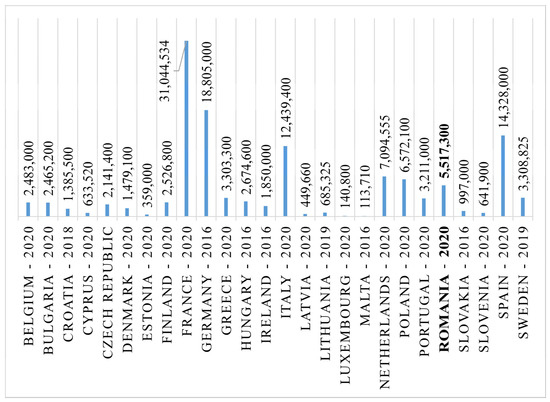

The European Union’s surface area is home to approximately 126.65 million buildings, both residential and non-residential [102]. Figure 16 presents the building numbers by member state. The highest number of buildings are found in France, Germany, Italy, and Spain, which are mostly the biggest countries by land area in the EU.

Figure 16.

Buildings number in the EU by member state from the latest available data [100].

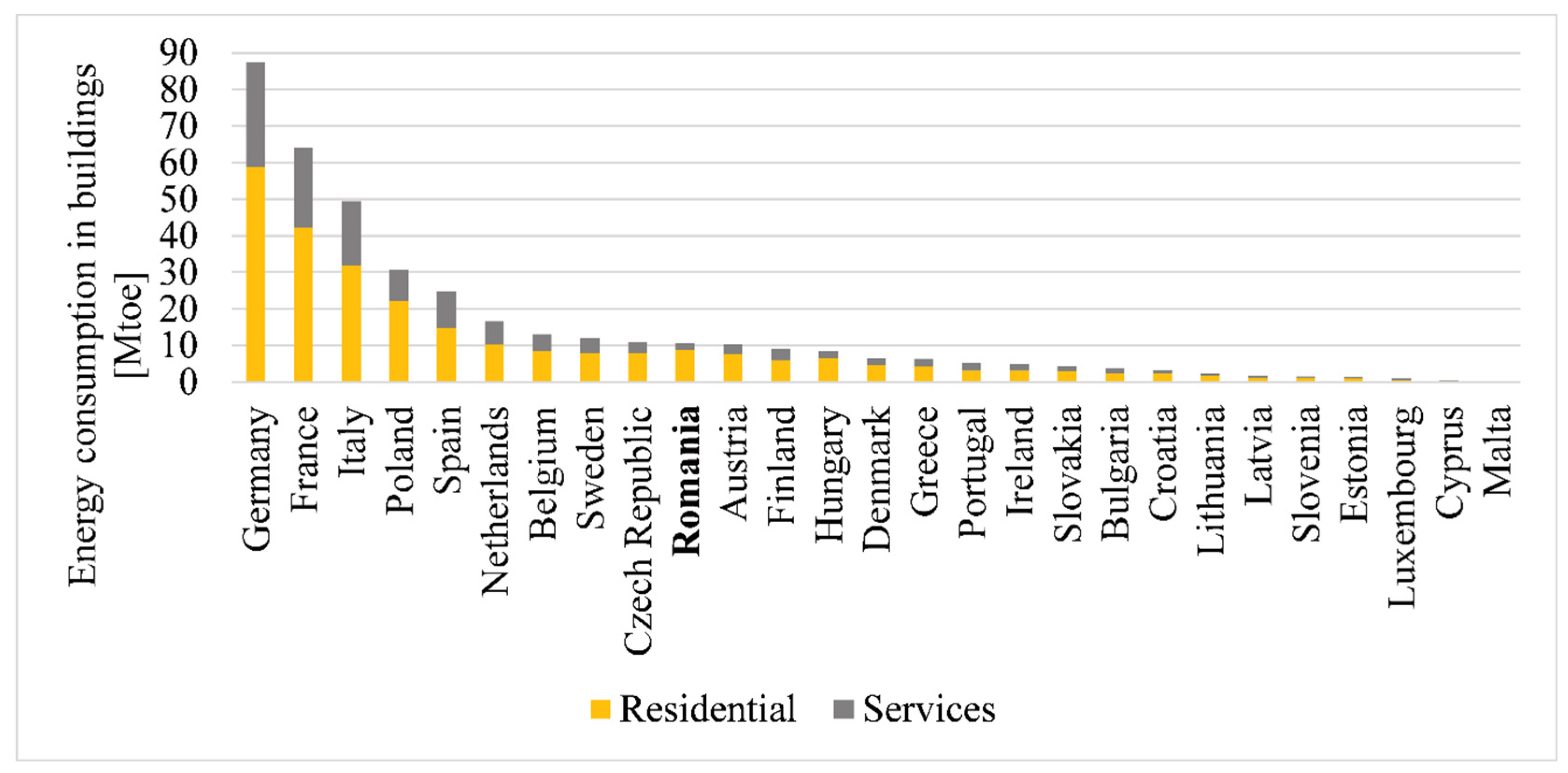

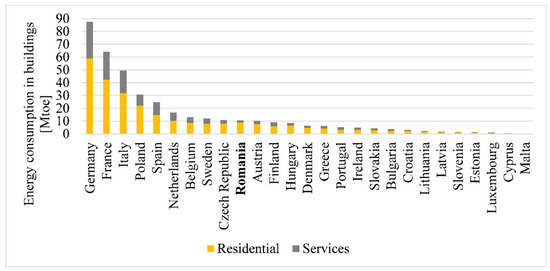

Figure 17 presents the energy consumption in buildings, both residential and service buildings, in the EU in 2021. Although the second-largest country by buildings, Germany, is the highest energy consumer for buildings in the EU, followed by France and Italy, actually, the energy used in Germany (87.53 Mtoe) for buildings is higher than the consumption from all the countries from Romania onwards combined (81.73 Mtoe).

Figure 17.

Energy consumption for buildings in the EU by member state for 2021 [100].

As efforts to reduce energy consumption and GHG emissions from buildings until 2030 in the context of the regional conflict continues, in 2023, the European Parliament adopted new requirements for buildings [103] as part of the Energy Performance of Buildings Directive:

- all new buildings must be zero-emission buildings from 2028;

- all new public buildings must be zero-emission buildings from 2026;

- all new buildings need to have solar technology from 2028;

- all residential buildings that need renovation need to have solar technology from 2032;

- residential buildings need to reach class E by 2030 and class D by 2033;

- non-residential and public buildings need to achieve class E by 2027 and class D by 2030;

- fossil fuel in new heating systems will be totally eliminated by 2035.

In the EU, buildings represent the single largest energy consumer sector if we consider all sub-sectors that are connected to buildings. In the present, approximately 35% of the buildings in the EU are over 50 years old, and approximately 75% of the buildings are not energy efficient [104]. Moreover, only 1% of the buildings in the EU are renovated every year, which is not sufficient at all and needs to be accelerated. The target is to eliminate the G and F classes entirely by renovating all G residential buildings by 2030 and non-residential buildings by 2027, and by renovating all F residential buildings by 2033 and non-residential buildings by 2030 [105].

5.2. Buildings in Romania

In Romania, the constructed surface area is 493,000,000 m2, with residential structures accounting for 86%. Single-family households dominate the 8.1 million housing units, accounting for 61% of them. Rural regions share approximately 47.5% of all residences. Individual (single-family) residences account for 95% of housing units in rural regions. Romania has a significant heritage of buildings built with a limited amount of thermal insulation because, prior to the 1973 energy crisis, there were no restrictions regarding thermal insulation. Thus, all the buildings older than that are no longer in line with the current energy standards. The Energy Performance Certificate (EPC) is a great tool for centralizing information about the energetic behavior of buildings. It was introduced in 2007 in Romania at the request of the European Union, based on EPBD from 2002 [106]. Although there is no statistic in Romania yet regarding the number of buildings by their energy class, it is generally accepted that most of the buildings in Romania are in energy classes C and D [107].

From the total energy consumption in the buildings sector, 81% represent residential consumption, and only 19% represent consumption in services such as schools, hospitals, commercial buildings, or other non-residential buildings [108]. All the energy consumed in buildings in Romania is thermal energy (for heating, cooling, ventilation, and domestic hot water) and electrical energy (for lighting, electrical appliances, and thermal energy production). The leading share of energy in the residential building sector is energy used for space heating, representing 78% of the total energy consumption in buildings, while cooling only represents approximately 1% [109].

At present, 1.2 million buildings are connected to district heating, and 92% of them are connected to combined heat and power (CHP) plants. The number of residential buildings connected to state district heating constantly dropped after 1990. Approximately 50% of the buildings connected to the state district heating system are in the capital city of Bucharest. District heating systems in Romania are old, with heat and water leakage everywhere and immense functioning issues, requiring rapid and major investment for their modernization. The primary resources used in CHP in Romania are gas (51%), tar (26%), coal (20%), and the rest from other sources [110].

A share of 2.5 million buildings use natural gas for heating and domestic hot water from individual systems (gas boilers). Approximately 3.5 million buildings use solid fuel, and the remaining buildings are heated with liquid fuel or electrical energy [54]. Solid fuel is used in rural areas, where buildings are partially and intermittently heated. The most commonly used solid fuel in Romania for heating is firewood, which is burned in low-efficiency terracotta stoves and offers low thermal comfort levels. Biomass legislation in Romania is unclear, and it is uncertain if firewood is considered a biomass fuel or not. However, national reports for biomass fuel usage include firewood. Although the highest share of residential heating represents firewood, the equipment used provides an incomplete and inefficient burn and leads to emissions of carbon dioxide that contribute to GHG emissions.

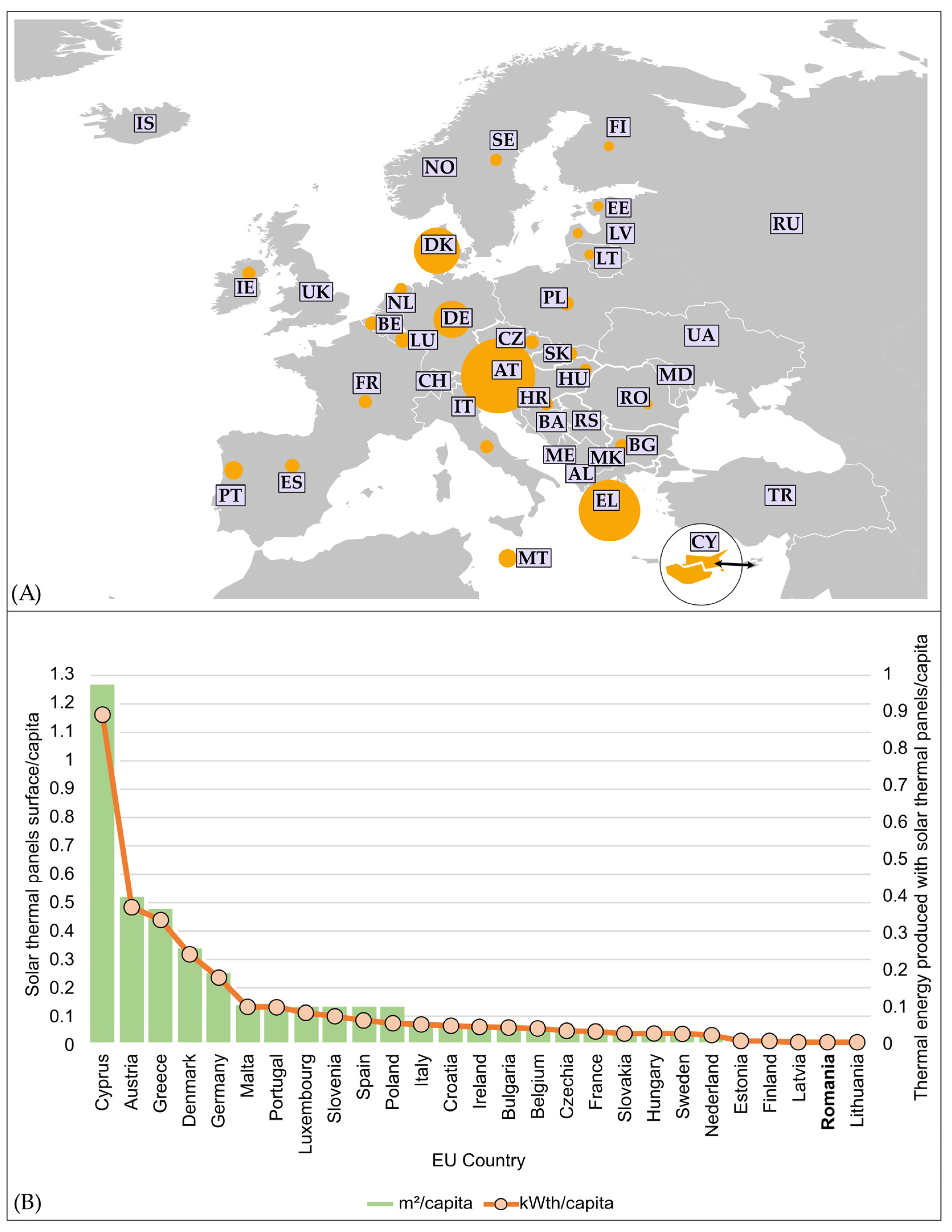

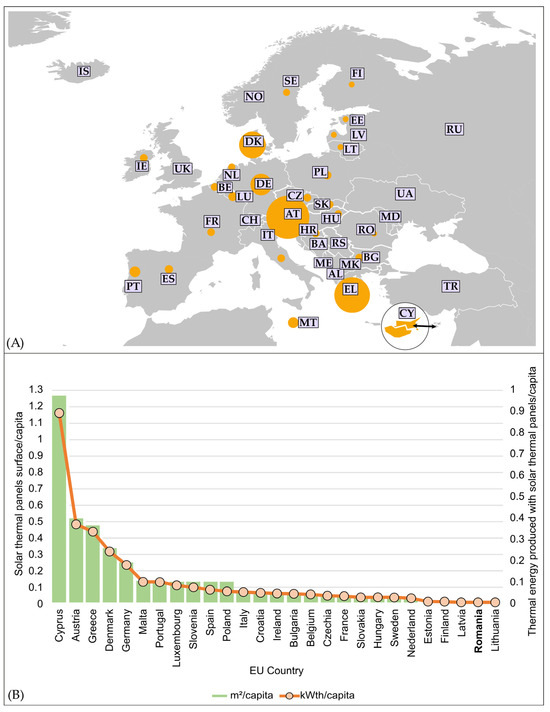

Heat pumps and solar thermal panels’ usage for thermal energy production in buildings is low due to high investment costs and low population purchasing power. The use of solar thermal panels has been on the rise lately. In 2021, a total of 15,960 m2 were installed, summing up to a total surface of 234,870 m2 of solar thermal panels [111], a growth of 12% since 2016. In Romania, the solar thermal panel surface per capita is only 0.012 m2/capita, one of the lowest in the EU (Figure 18), with the mean in the EU being 0.128 m2/capita. Heat pumps have been installed mainly in new buildings, and their total share is very low.

Figure 18.

The solar thermal panel area per capita and the thermal energy production from them in EU countries: (A) countries’ shares on a map; (B) countries’ shares on a chart. The authors created this figure with data from EurObserv’ER [109].

The use of photovoltaic solar panels for electrical energy production in residential and non-residential buildings was insignificant for years, but in the past few years, this has slowly begun to change. In the residential sector, solar photovoltaic panels were used mainly in buildings that were unable to connect to the national electrical distribution system. With the significant increase in electrical energy prices due to both the COVID-19 pandemic and the Russo-Ukrainian war, the installation of photovoltaic panels in non-residential buildings has significantly increased. The new legislation allowing prosumers contributed to this. The impact of this is not yet observable, but there will be data available in the years to come.

Romanian authorities are taking timid steps toward reducing the energy consumption of buildings. The Romanian people are usually skeptical about changes, and every new measure is received with a degree of backlash. Therefore, implementing new regulations takes time and effort. In 2020, the Romanian law nr. 372/2005 was revised, and it states that all buildings built after 31 December 2020 must be nearly Zero Energy Buildings (nZEB). Also, it states that all new buildings owned by the state that are built after 31 December 2018 must be nZEB. The same law mentions that since the start of 2021, all new buildings have the obligation to ensure at least 30% of their energy consumption comes from renewable sources that can be produced within a 30 km radius of the building’s GPS coordinates. This sounds really good on paper, but the reality is not the same. Most buildings are equipped with few solar panels and are avoiding this law’s requirements.

Nevertheless, the Romanian government is working on a law to eliminate the use of individual gas boilers for all new apartment buildings in an effort to reduce GHG emissions from natural gas. The allowed solutions must be centralized, either district heating, renewable energy sources, or a centralized gas boiler for the entire building. Although the law is not in force at the moment, two counties in Romania already have municipal laws in force for this aspect.

Approximately 54% of the residential buildings were built before 1970 in Romania, and over 90% before 1989. All of them are characterized by low energy efficiency, with energy consumption of 180–400 kWh/m2/year [110]. The existing households in Romania have a high possibility for energy efficiency improvement, energy consumption reduction, and also renewable energy source usage. To widely implement the required measures, more support and subsidy policies from the government are needed. The main target needs to first of all encourage energy consumption reduction with the increase in the thermal insulation degree in buildings and, secondly, the utilization of systems that tap into renewable energy sources. All measures already implemented in this regard, including the support program for solar photovoltaic panels for individual households, have been a real success. This confirms the special interest of household owners in reducing their energy consumption and utilizing renewable energy if they have government support. The main obstacle is represented by the high investment cost of implementing such measures.

6. Discussion

Energy has become the most important currency on Earth today. It has such a big impact on everyday human life that everything revolves around the capacity to extract, harness, and exploit it. It remains to be seen what effect it will have on Earth—its salvation or its destruction. The downside of energy is the GHG emissions that are introduced into the atmosphere from all energetic activities on the planet. Reducing GHG emissions has always been the main focus of the EU, but after the conflict started, it helped speed up this process by turning even more to renewable energy to eliminate Russian imports energy dependency of the EU.

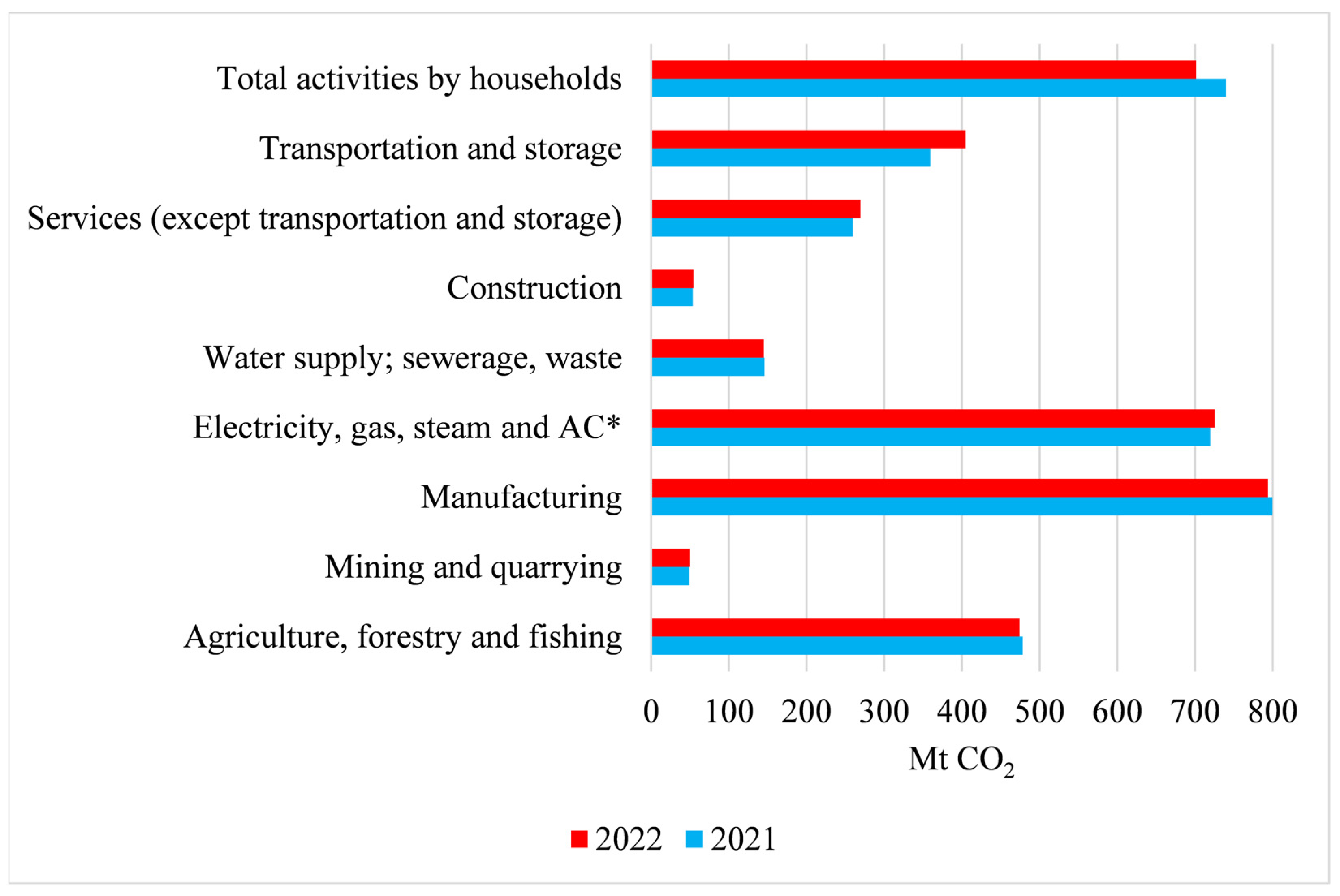

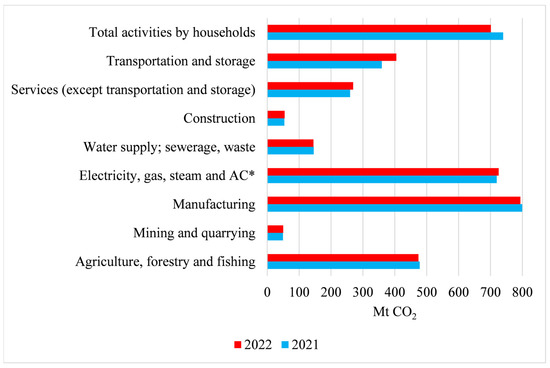

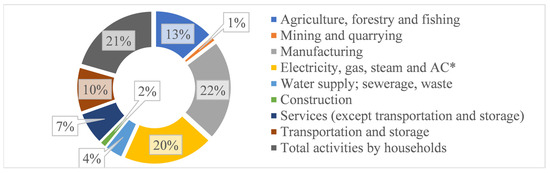

The GHG emission amounts by sector in the EU are presented in Figure 19 for 2021 and 2022. From the total GHG emissions, the highest share accounts for combined buildings (households and services), industry, and energy production, reaching approximately 70%. For this reason, a lot of attention is directed towards these interconnected sectors, and the EU is actively pursuing the member states to comply with the accepted regulations. Moreover, when considering that 40% of energy production is used for buildings and that all industry activities are basically based inside buildings as well, the EU’s focus on everything related to buildings makes sense since these interconnected sectors contribute to most of the GHG emissions in the EU.

Figure 19.

GHG emissions from sectors in 2021 and 2022 in EU [112]; *AC—air conditioning.

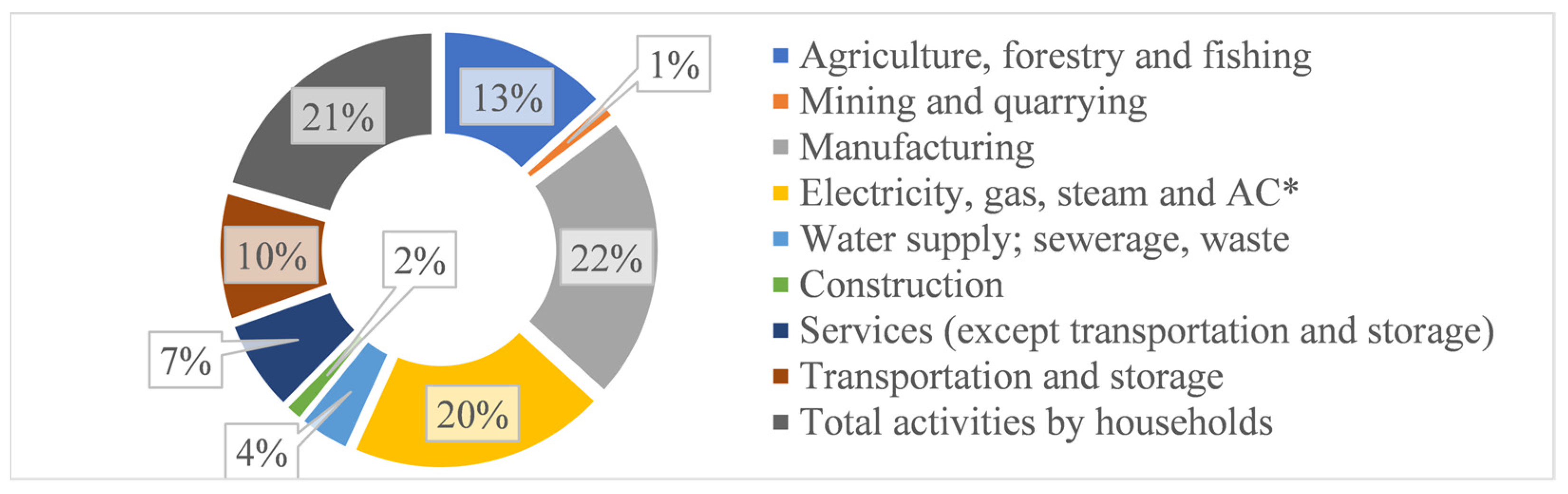

Figure 20 presents the GHG emissions in percentages for sectors in 2022, with the latest data that are available. Except for agriculture (which is underreported [113]), forestry, fishing, and transportation, every other sector is related to buildings, as in building construction (construction), building use (households, services, water, sewerage, and waste), building energy consumption (electricity, gas, steam, AC, mining, and quarrying), or building activities (manufacturing). The combined EU regulations that are part of the decarbonization strategy proved to be effective over time, as the total GHG emissions decreased by 35% for the buildings sector from 2005 to 2020 [114]. With the current decreasing trend, it is now hard to estimate if the EU will be able to reach the new emission reduction target of 55% until 2030. The previous target of 40% compared to 1990 levels had a lot more chance of becoming true. The EU is definitely determined to stick to the new 55% compared to 1990 levels, and previous achievements give the EU credibility, at least for the moment.

Figure 20.

GHG emissions by sectors in 2022 in EU [112]; *AC—air conditioning.

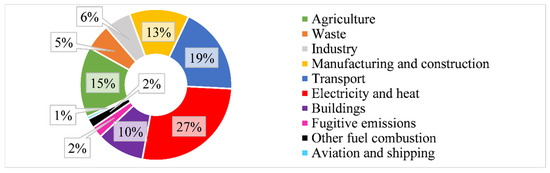

In order to understand the Romanian energy strategy, the EU energy strategy must be understood. Romanian policies and energy measures align with EU regulations. Nonetheless, in recent years, Romania’s focus has increased substantially in regards to climate change and is committed to fulfilling EU energy thresholds established for 2050. Also, Romania is determined to transform itself into a regional energy provider. Due to the recent regional security threat in mind, this process has been accelerated with new projects for interstate electrical and gas connections. However, Romania still needs to focus on its internal energy needs; system modernization; access to energy for the entire population; resolving firewood theft, especially in isolated rural areas, etc. Figure 21 presents the GHG emissions in Romania for 2019, according to the latest available data. Unlike the EU average, buildings’ GHG share is approximately 10%. The highest GHG emissions are coming from electricity and heat production; hence, the majority of the RES objectives focus on improving the energetic infrastructure in Romania.

Figure 21.

GHG emissions by sectors in 2019 in Romania [115].

Today, over 30% of electrical energy in Romania is produced from hydropower, which is reliable and, more importantly, considered a renewable energy source. Most of the hydropower plants in Romania were built during the past century with the mindset of energetic independence. Because of this heritage, Romania was the first country to achieve EU targets regarding the share of renewables [4], being ahead of other EU states. As Romania exports electrical energy on an increasing trend and imports only 20–30% of natural gas for energy on a decreasing trend, it is in a state of energy independence that most EU members are not. Combined with EU and NATO membership, Romania’s national security and energetic independence in the region have never, historically, been so high.

7. Conclusions and Policy Implications

As humanity became more industrial and highly interconnected, energy started to represent an uncontested asset with climate change implications that can damage our planet in our desire for conflict and conquest when used only as a political tool. Due to energy prices’ rapid increase recently due to COVID-19 and Russo-Ukrainian war implications, interest in renewable energy sources for households gained momentum. Stimulated by the EU, the Romanian government has focused on energy reforms and a strategy for the future. The new offshore law that will allow resources to be extracted from the Black Sea bed, together with multiple internal energy system modernization projects for electrical and gas production and distribution and interstate connection projects, sets up a prolific vision regarding Romania’s energy independence and regional power.

As a member state of the EU, Romania shares an interest in climate change. The energy strategy is a topic that has always been important for Romania due to its geographical position and natural resources. Romania is determined to implement and follow EU energy regulatory measures for climate change. Romania’s energy strategy focuses on energy independence and becoming a regional energy provider, along with energy access to the entire population and energy infrastructure modernization. Government measures that had been implemented to limit the increase in energy prices in Romania had positive results in the short run but were not a sustainable solution in the long run. The effective solution for this is to offer governmental programs that focus on energy efficiency in all sectors and follow the objectives of the Romanian Energy Strategy.

Energy policy changes that resulted as a consequence of the post-pandemic and Russo-Ukrainian conflict in Romania are related to the EU changes:

- reduce the GHG emissions by 55% until 2030, 95% until 2040, and 100% by 2050;

- reduce the emissions from ETS sectors up to 43.9% and 2% from non ETS sectors;

- increase the primary energy consumption from renewables up to 45% until 2030;

- improve the energy efficiency for the EU’s final energy consumption by 42.5% until 2030;

- increase to 30.7% the energy from renewable sources from the final energy consumption;

- reduce the final energy consumption by 40.4% compared with the 2007 projection;

- all new buildings must be zero-emission buildings from 2026 and 2028 onwards;

- all new buildings need to have solar technology from 2028;

- all residential buildings that need renovation need to have solar technology from 2032;

- residential buildings need to reach class E by 2030 and class D by 2033;

- non-residential and public buildings need to achieve class E by 2027 and class D by 2030;

- fossil fuel in new heating systems will be totally eliminated by 2035;

- revise the Romanian Energy Strategy in 2022 with the regional power provider in mind;

- start the Recovery and Resilience plan, funded by the EU, to help with post-pandemic and regional conflict effects on energy.

The results of the policy changes had the following effect after the start of the regional conflict:

- EU saved 20% of energy consumption in 2022;

- Russian gas imports in EU dropped to 8% in September 2022 compared to August 2021;

- EU photovoltaics capacity increased to 47% in 2022 compared to 2021;

- electricity generated from renewables in EU increased to 22%, overtaking natural gas for the first time by 2.5%;

- it is estimated that fossil fuel usage in EU will register a 20% drop in 2023 compared to 2022;

- energy imports from Russia decreased with 90% in March 2023 compared with the monthly figures from 2019 to 2022 in the EU;

- energy imports from Russia decreased from 53.50% in 2021 to 20.90% in 2022 in Romania;

- Romania ended the import trend and exported electrical energy since July 2022 each consecutive month, with efforts to become a regional provider.

Author Contributions

Conceptualization, A.-M.B. and A.-I.B.; methodology, A.-M.B. and G.N.; software, A.-I.B. and A.-M.B.; validation, G.D. and G.N.; formal analysis, G.N., O.-M.T., and G.D.; investigation, A.-I.B. and A.-M.B.; data curation, A.-I.B. and G.D.; writing—original draft preparation, A.-M.B., G.N., A.-I.B., and G.D.; writing—review and editing, A.-M.B., O.-M.T., G.N., and A.-I.B.; visualization, A.-M.B. and G.N.; supervision, G.N. and O.-M.T.; project administration, G.N. and G.D. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

The data presented in this study are available on request from the corresponding author. The data are not publicly available due to privacy issues.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Han, Y.; Jin, B.; Qi, X.; Zhou, H. Influential Factors and Spatiotemporal Characteristics of Carbon Intensity on Industrial Sectors in China. Int. J. Environ. Res. Public Health 2021, 18, 2914. [Google Scholar] [CrossRef]

- Cîrstea, S.D.; Martis, C.S.; Cîrstea, A.; Constantinescu-Dobra, A.; Fülöp, M.T. Current Situation and Future Perspectives of the Romanian Renewable Energy. Energies 2018, 11, 3289. [Google Scholar] [CrossRef]

- Busch, H.; Ruggiero, S.; Isakovic, A.; Hansen, T. Policy Challenges to Community Energy in the EU: A Systematic Review of the Scientific Literature. Renew. Sustain. Energy Rev. 2021, 151, 111535. [Google Scholar] [CrossRef]

- World Energy Council. Romania ahead of Europe on Renewable Targets. Available online: https://www.worldenergy.org/news-views/entry/romania-ahead-of-europe-on-renewable-targets (accessed on 17 May 2023).

- Al-Saidi, M. White Knight or Partner of Choice? The Ukraine War and the Role of the Middle East in the Energy Security of Europe. Energy Strateg. Rev. 2023, 49, 101116. [Google Scholar] [CrossRef]

- Xin, B.; Zhang, M. Evolutionary Game on International Energy Trade under the Russia-Ukraine Conflict. Energy Econ. 2023, 125, 106827. [Google Scholar] [CrossRef]

- Vezzoni, R. Green Growth for Whom, How and Why? The REPowerEU Plan and the Inconsistencies of European Union Energy Policy. Energy Res. Soc. Sci. 2023, 101, 103134. [Google Scholar] [CrossRef]

- EUROSTAT. Available online: https://appsso.eurostat.ec.europa.eu/nui/submitViewTableAction.do (accessed on 7 September 2022).

- Bertsch, G.; Elliott-Gower, S. The Impact of Governments on East-West Economic Relations; Palgrave Macmillan: London, UK, 1991; ISBN 978-1-349-12419-0. [Google Scholar]

- Koltsaklis, N.E.; Dagoumas, A.S.; Seritan, G.; Porumb, R. Energy Transition in the South East Europe: The Case of the Romanian Power System. Energy Rep. 2020, 6, 2376–2393. [Google Scholar] [CrossRef]

- Colesca, S.E.; Ciocoiu, C.N. An Overview of the Romanian Renewable Energy Sector. Renew. Sustain. Energy Rev. 2013, 24, 149–158. [Google Scholar] [CrossRef]

- Popovici, V. 2010 Power Generation Sector Restructuring in Romania—A Critical Assessment. Energy Policy 2011, 39, 1845–1856. [Google Scholar] [CrossRef]

- Anastasiu, N.; Simionescu, B.C.; Popa, M.E.; Mihai, M.; Rusu, R.D.; Predeanu, G. Romanian Coal Reserves and Strategic Trends. Int. J. Coal Geol. 2018, 198, 177–182. [Google Scholar] [CrossRef]

- Năstase, G.; Şerban, A.; Florentina Năstase, A.; Dragomir, G.; Ionuţ Brezeanu, A.; Fani Iordan, N. Hydropower Development in Romania. A Review from Its Beginnings to the Present. Renew. Sustain. Energy Rev. 2017, 80, 297–312. [Google Scholar] [CrossRef]

- Costea, G.; Pusch, M.T.; Bănăduc, D.; Cosmoiu, D.; Curtean-Bănăduc, A. A Review of Hydropower Plants in Romania: Distribution, Current Knowledge, and Their Effects on Fish in Headwater Streams. Renew. Sustain. Energy Rev. 2021, 145, 111003. [Google Scholar] [CrossRef]

- Dragomir, G.; Şerban, A.; NǍstase, G.; Brezeanu, A.I. Wind Energy in Romania: A Review from 2009 to 2016. Renew. Sustain. Energy Rev. 2016, 64, 129–143. [Google Scholar] [CrossRef]

- Năstase, G.; Șerban, A.; Dragomir, G.; Brezeanu, A.I.; Bucur, I. Photovoltaic Development in Romania. Reviewing What Has Been Done. Renew. Sustain. Energy Rev. 2018, 94, 523–535. [Google Scholar] [CrossRef]

- Zakeri, B.; Paulavets, K.; Barreto-Gomez, L.; Echeverri, L.G.; Pachauri, S.; Boza-Kiss, B.; Zimm, C.; Rogelj, J.; Creutzig, F.; Ürge-Vorsatz, D.; et al. Pandemic, War, and Global Energy Transitions. Energies 2022, 15, 6114. [Google Scholar] [CrossRef]

- Osička, J.; Černoch, F. European Energy Politics after Ukraine: The Road Ahead. Energy Res. Soc. Sci. 2022, 91, 102757. [Google Scholar] [CrossRef]

- Umar, M.; Riaz, Y.; Yousaf, I. Impact of Russian-Ukraine War on Clean Energy, Conventional Energy, and Metal Markets: Evidence from Event Study Approach. Resour. Policy 2022, 79, 102966. [Google Scholar] [CrossRef]

- Wang, Y.; Bouri, E.; Fareed, Z.; Dai, Y. Geopolitical Risk and the Systemic Risk in the Commodity Markets under the War in Ukraine. Financ. Res. Lett. 2022, 49, 103066. [Google Scholar] [CrossRef]

- Aharon, D.Y.; Qadan, M. Infection, Invasion, and Inflation: Recent Lessons. Financ. Res. Lett. 2022, 50, 103307. [Google Scholar] [CrossRef]

- World Health Organization. Available online: https://covid19.who.int/ (accessed on 7 September 2022).

- Dhawan, M.; Choudhary, O.P.; Priyanka; Saied, A.A. Russo-Ukrainian War amid the COVID-19 Pandemic: Global Impact and Containment Strategy. Int. J. Surg. 2022, 102, 106675. [Google Scholar] [CrossRef]

- European Parliment News. Renewable Energy: MEPs Strike Deal with Council to Boost Use of Green Energy. Available online: https://www.europarl.europa.eu/news/en/press-room/20230327IPR78523/renewable-energy-meps-strike-deal-with-council-to-boost-use-of-green-energy (accessed on 7 July 2023).

- Röck, M.; Baldereschi, E.; Verellen, E.; Passer, A.; Sala, S.; Allacker, K. Environmental Modelling of Building Stocks—An Integrated Review of Life Cycle-Based Assessment Models to Support EU Policy Making. Renew. Sustain. Energy Rev. 2021, 151, 111550. [Google Scholar] [CrossRef]

- Mišík, M.; Oravcová, V. Ex Ante Governance in the European Union: Energy and Climate Policy as a ‘Test Run’ for the Post-Pandemic Recovery. Energy Policy 2022, 167, 113076. [Google Scholar] [CrossRef]