1. Introduction

Hurricanes and flood-related events cause more direct economic damage than any other type of natural disaster. From a global perspective, recent damage estimates of USD 5 billion for the single month of June (2016) (

http://thoughtleadership.aonbenfield.com/Documents/20160706-ab-analytics-if-june-global-recap2.pdf). In the United States, those damages total more than USD 1 trillion in damages since 1980 [

1]. On average, direct flood losses have risen from USD 4 billion annually in the 1980’s to roughly USD 17 billion annually from 2010 to 2018 [

2]. Increasing development of flood-prone areas is a key driver of rising [

3,

4,

5] and climate change is expected to exacerbate losses even further [

6,

7,

8,

9]. In both the international and U.S. cases, the current and future expectations around flood risk and damages make the need for readily available impact assessment tools that can be created at scale and the use of publicly available data and transparent methods imperative. One such global flood hazard model [

10] is the base model from which this current impact assessment is built and is created with completely open and transparent modeling methodologies.

Despite flooding’s tremendous impact on US properties and communities, current estimates of expected damages are lacking due to the fact that flood risk in many parts of the US is unidentified or underestimated (e.g., [

11,

12,

13,

14]). With respect to unidentified risk, two-thirds of the nation’s 3.5 million stream miles and 46 percent of its shoreline have not yet been mapped by the Federal Emergency Management Agency (FEMA)—the agency responsible for identifying the nation’s flood risk [

11]. While much land area has yet to be mapped, FEMA reports that more than 98% of the US population lives in a community in which FEMA has studied and mapped flood hazards [

15]. However, not all studies are comprehensive, and not all maps use the most recent data or are of the highest quality. Indeed, FEMA maps have a number of well-documented limitations and may underestimate risk for certain properties and communities [

16]. Wing et al. [

13] find that current FEMA maps only identify 33% of the US population that is at risk of flooding in the 1% annual-chance event (also known as the 100-year flood). Furthermore, FEMA only considers two types of floods (the 1% and 0.2% annual-chance events) in their mapping process, despite the fact that flood damages arise from a full spectrum of possible flood events whose depths and impacts vary by return period [

17]. Additionally, FEMA does not characterize flood risk at the individual parcel level, which limits the amount of information they can provide about a property’s flood risk. To FEMA’s credit, their maps are created with the primary driver being regulatory and safety uses by local and federal government officials and not as a property level risk tool. This difference accounts for much of the gap identified by Wing and colleagues [

13]. In terms of economic flood risk, there are a number of proprietary and “black box” flood models that are often used in the estimation of mortgage risk, insurance rates, and larger portfolio analyses.

Not having accurate and comprehensive, publicly available estimates of annual flood damages or average annual losses (AAL) is a critical oversight, because they enable improved risk management and more cost-effective hazard mitigation planning at every level, with accessibility open to individual property owners as well as smaller communities that may not have the ability to purchase the for-profit models currently seen as “state-of-the-art” in this space. A more readily available version of these data would provide actionable information to homeowners and renters about the flood damage a property is likely to experience, allowing them to make more informed decisions about risk reduction investments and flood insurance coverage. Nationally, such estimates influence whether and to what extent Congress allocates funds for hazard mitigation programs and major infrastructure projects aimed at reducing flood risk. At the state and local level, they enable more accurate cost-benefit analyses, which are a primary factor in whether these projects receive public funding. Indeed, annual flood damage estimates are used in cost-benefit analyses that help to determine how billions of federal, state, and local dollars are spent every year.

While insurers, reinsurers, and catastrophe modeling firms have extensive experience estimating AALs for a range of hazards, there are fewer high-precision estimates available in the academic literature or public domain. There are a number of global models that provide estimates of expected flood damages, though the methods tend to rely on coarse data and methods which lack relevance at the property level (e.g., [

18,

19]). While some studies have attempted to quantify flood damages using a statistical approach, they have often focused on estimating property damages (or insurance claims) arising from individual storms or on expected damages from the 1% annual chance flood (100-year flood). These studies have also tended to focus on a limited geographic area such as a county or Census tract [

20,

21,

22,

23,

24,

25]. The limited literature on AALs is partly due to the fact that the private firms’ risk identification and damage calculation methods are commercially privileged. In one study, Czajkowski et al. [

26] used proprietary flood damage curves and a proprietary flood model from CoreLogic and Swiss Re to estimate AALs for individual properties in two Texas counties. However, AAL studies more frequently use publicly available flood risk tools, such as the Hazus-MH Flood Model or FEMA’s Risk Map products in combination with US Army Corps of Engineers depth–damage functions, to estimate AALs.

The Hazus-MH Flood Model is a GIS-based tool developed by FEMA that couples flood hazard data with a damage model that relates flood depths to property damage. Hazus is publicly available and widely used by researchers and state and local governments to estimate future (avoided) flood damages and in conducting cost-benefit analyses for proposed flood risk-reduction projects. Researchers have relied on Hazus to estimate avoided flood damages associated with both grey and green infrastructure projects [

27,

28,

29]. By default, Hazus provides aggregated damage data based on the building inventory composition in a Census block. However, some studies have combined Hazus depth data with data from local tax assessors and other datasets to carry out parcel-level analyses (e.g., [

30]). In recent studies, researchers have examined AALs on a broader scale. Wobus et al. [

6] examine how riverine flood damages across 376 US watersheds are expected to change in response to rising global temperatures. They find that expected annual damages are 5 to 7 times higher than damages expected from the 1% annual chance event and that a significant share of the losses attributable to a more comprehensive evaluation of flood risk.

In addition to the literature summarized here, two recent studies lay the groundwork for this analysis. Wing et al. [

31] address several of the aforementioned limits to estimating flood losses. Using a 30-m resolution model, the authors generate flood hazard estimates for the entire contiguous US. Combining these depths with asset and population data, they find that the US population exposed to flooding in the 1% annual chance event is roughly 3 times higher than prior estimates. Applying US Army Corps of Engineers (USACE) depth–damage functions, they find that expected flood losses from the 1% annual chance event in all locations would total approximately USD 1.2 trillion. Though they do not account for changes in climate conditions, they find that population and GDP growth alone will significantly increase flood exposure over time. In a separate analysis, Quinn et al. [

32] address spatial dependence issues characteristic of many flood damage estimates. Rather than assume flood frequencies are uniform across wide areas, the authors model more realistic spatial flooding patterns, allowing them to estimate the total annual losses that may occur in extreme flooding years. The authors simulate 1000 years of flooding, including more than 63,000 events, in the coterminous US, and use the results to estimate total economic losses associated with each event. Their results indicate that there is a 1% probability of annual fluvial flood damages exceeding USD 78 billion in any given year and a 0.1% chance of losses exceeding USD 136 billion. This recent literature begs the question of what the estimated loss now, and in the future, when considering a full loss–probability curve (i.e., more dynamic representation of loss than the 1–100 year layer allows for) and an accounting of that loss into the future using agreed upon environmental change inputs.

This study builds upon this literature by taking advantage of newly available parcel-level flood risk information from the First Street Foundation Flood Model [

33], including the integration of a first-of-its-kind national database of over 100,000 unique flood adaptation measures to calculate average annual losses (AAL) for residential properties. First Street data provide parcel-level flood risk information for the four major flood types (tidal, pluvial, fluvial, and surge) at six explicitly modeled return periods and account for the risk-mitigating effects of levees, dams, open spaces, and other adaptation measures. Such data, and especially their open methodology, have not previously existed at the property level and allow for new insights in the area of AAL analysis using a higher quality of flood risk information than that derived from other open sources such as FEMA maps or the Hazus-MH model. Armed with more comprehensive estimates of expected flood damages and greater knowledge of the impact of risk-reduction measures, decision makers at every level of government can better identify the locations and measures that would be most beneficial in reducing flood risk, and more effectively manage residual risk through insurance and other risk transfer mechanisms.

2. Application: Estimating AAL, New Jersey (2020 and 2050)

As an application of the EIA tool and the integrated economic damage assessment, this illustration makes use of publicly available depth–damage-functions in combination with an “open methods” flood risk assessment tool developed by the First Street Foundation and a series academic partners [

33,

34] for a single state in the US, New Jersey. The state New Jersey is the most densely populated state in the US and one that is subject to substantial flood risk from both coastal and inland sources, making it a good application site to illustrate the utility of the EIA tool. With nearly 1800 miles of coastline, New Jersey’s economy and way of life are closely tied to its shoreline areas and therefore quite vulnerable to the impacts of flooding. In 2012, Hurricane Sandy made very clear that communities up and down the New Jersey coast are susceptible to devastating storm surge. However, residents throughout the state face risk from tidal, fluvial, and pluvial flooding as well. Due to rising sea levels, tidal flood risk across the state has more than doubled since 1980 [

35]. Inland areas such as the Raritan River region are particularly vulnerable to rainfall and riverine flooding.

Over the next several decades, the state’s flood risk is expected to increase as sea levels and temperatures continue to climb. According to the First Street Foundation Flood Model (the primary source of data for this analysis), there are currently 385,400 New Jersey properties at risk of flooding in the 1% annual chance flood, a number that is projected to increase by 19% over the next 30 years [

36]. At a broader level, the First Street Model estimates that roughly 515,000 New Jersey properties are currently at risk of any flooding (calculated as a flood depth of 1 cm or more to the building in the 0.2% annual chance flood) and another 100,000 will be at risk over the next 30 years. Among these, more than 15,000 face a 99% chance of flooding at least once over that time span.

3. Data and Methodology

Data for this analysis come from a combination of public and non-public sources. On the public side, this project makes use of property-level building characteristics from county assessor offices in the state of New Jersey combined with the microsoft/mapbox building footprint database (

https://github.com/Microsoft/USBuildingFootprints). The property data have been standardized and made available through a third party provider to ensure that attributes are consistent and meaningful across counties. Where those data are not available, we use publicly available, block-level, National Structures Inventory (

https://github.com/HydrologicEngineeringCenter/NSI) data from the USACE to estimate local building codes and dwelling types at the Census block level to ensure the ability to capture the “likely” building characteristics. We also use a combination of USACE and Federal Insurance Administration (FIA) depth–damage functions created within the HAZUS (

https://msc.fema.gov/portal/resources/hazus) framework. Using these property characteristics and damage functions, this application compares deterministic flood hazard layers created at two different time periods (2020 and 2050) and six different return periods (2-year, 5-year, 20-year, 100-year, 250-year, and 500-year).

3.1. Flood Hazard Layer Data

The First Street Foundation Flood Model was developed in partnership with Fathom (Wing et al. 2017; First Street Foundation, 2020a; Bates et al.,

under review) and provides the hazard layers with 3 m resolution at various return period intervals including 2-year, 5-year, 20-year, 100-year, 250-year, and 500-year flood events in 2020 and 2050. The max (cm) flooding depth for each property is sampled at the perimeter of the building footprint boundary or at the property parcel centroid where no building footprint exists. In this study, we focus on the properties that have a non-zero depth value at median of iterative simulation under RCP 4.5 scenario to estimate flood risk in current (2020) and future (2050) environmental conditions. The flood model takes into account changing environmental factors including Sea Level Rise, increasing cyclonic intensity, higher probabilities of cyclone landfall locations at higher latitudes, shifting precipitation patterns, and shifts in river discharge. The coastal component of the model employs the GeoClaw software [

37] to simulate geophysical variables including storm surge and tidal flooding. GeoCLAW solves the 2D depth-averaged shallow water equations on an adaptive mesh scheme, running at a very low resolution by default, and then increases in resolution in areas near the storm, based on the storm intensity and proximity parameters. The output of the model is a time series of total static water levels throughout the storms that is incorporated into the national flood model. Finally, the combination of coastal and inland flooding estimates is based on boundary conditions that are representative of distinct return period magnitudes and the marginal distributions of the flood driving processes within each boundary layer. The details on development and combination of different hazard risk layers are beyond the scope of this paper (for full summary see [

33,

34]).

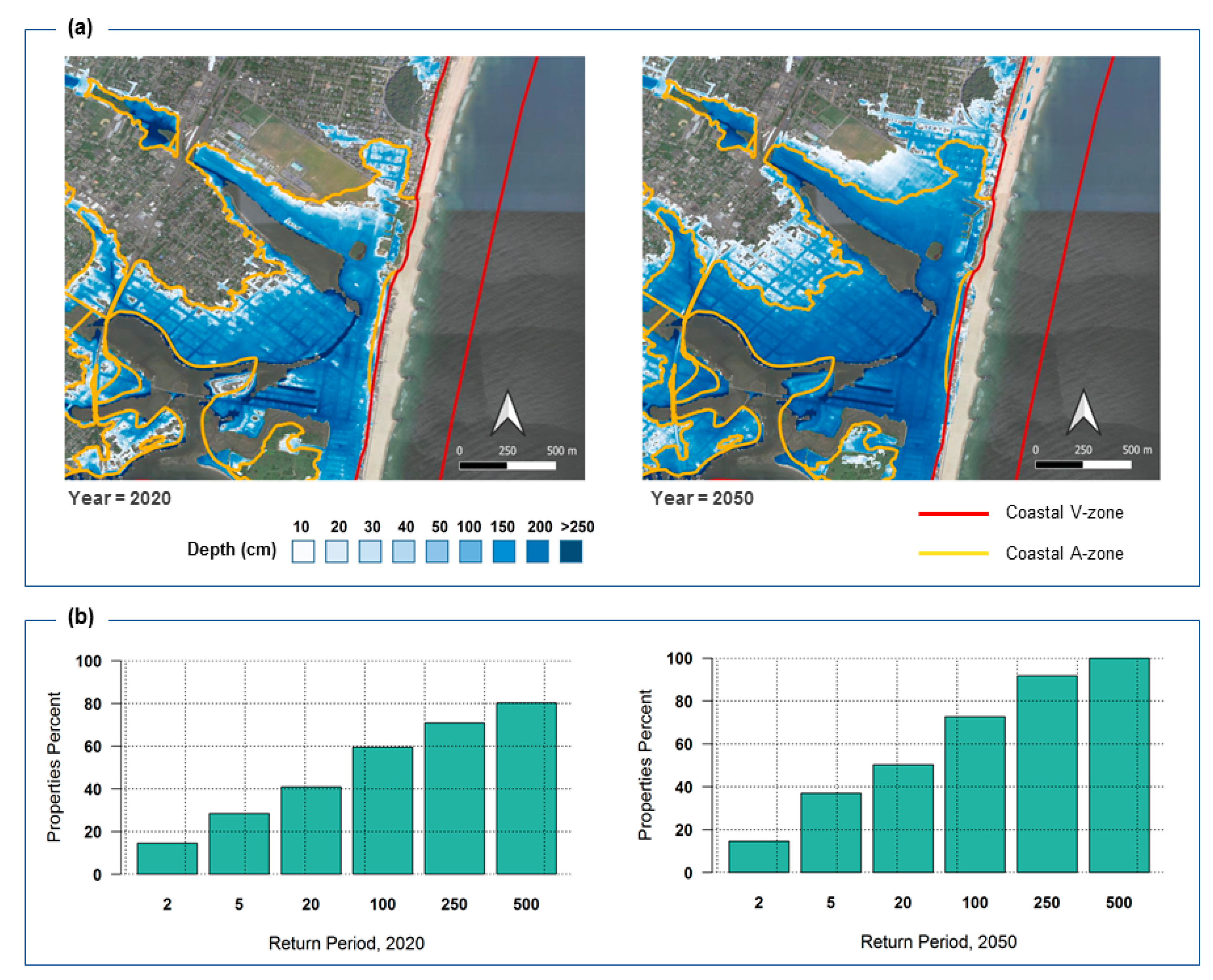

Figure 1 shows the flooding under the 100-year scenario across a small area in Ocean County, NJ. The maps in Panel-a represent the extent and depth of flooding in 2020 and 2050, while the bar charts in Panel-b indicate the percentage of properties impacted by flooding in different return period scenarios. The yellow line on the maps indicates the FEMA Coastal A-zone boundary, while the red line delineates the Coastal V-zone.

The flood extent maps indicate that projected risk of flooding from a 100-year event in 2020 aligns very well with the Coastal A zone boundary in 2020. This alignment is the evidence of proper risk identification as the Coastal A zone was originally perceived as the primary level of the 100-years floodplain boundary [

38] designated in the FEMA special flood hazard area. When environmental change is taken into account, Panel-b indicates that in 2050 the water inside Coastal-A zone gets deeper in previously flooded areas and even moves well beyond the flood zone boundary outside of the FEMA designated zone. The sample figure shows no significant flooding over the 100-years scenario inside the Coastal V-zone. Additionally, the 30-year projection indicates that only a small area floods inside the V-zone. Of note here is that

Figure 1 is employed to present the dynamic of the flooding extent over 30-years in a small excerpt of the data. However, the spatial variability within and beyond coastal zones cannot be generalized for the entire region. Comparing the percent of the impacted properties in the 100-year scenario shows that the number of affected properties rises by 15% over the 30 year period. Similarly, under the 500-year scenario, the number of impacted properties increases about 20% over the same time period.

3.2. Property Assessor Data

The property assessor data provide the general information for the more than 3,600,000 properties in the state of New Jersey that we identified as having a risk of flooding. This dataset contains more than 300 attributes. Of primary importance to this project is the geographic location of property, the market value (market value is defined as the amount a typical, well-informed purchaser would be willing to pay for a property), automated valuation model (AVM) value (AVM value is a statistical calculation model to estimate the current value of a property derived from our parcel provider’s Automated Valuation Model), number of stories and unit, structure data and the foundation type. The

Figure 2a represents the visualization of the property data points that were identified as being at risk of flood in our analysis. As one can see, these are primarily clustered in areas close to the coast, along waterways, or in relatively low-lying areas per their elevation profile.

3.3. National Structures Inventory Database

The National Structure Inventory (NSI) is a system of databases containing structure inventories at different spatial coverage and quality levels. The NSI database provides a series of attributes required for flood hazard estimates. We applied NSI data to impute the missing attributes for each property, based on the most common values from the belonging census block. The census block is the smallest geographic enumeration area in the US Census geography catalog and generally captures sub-neighborhood spatial geographies in which building codes, housing characteristics, and population demographics are highly homogeneous. These properties were then used in aggregation to identify the most likely characteristics of buildings in that block with regards to the presence of a basement (foundation type) and the structure information. In the case that this information was missing from the property assessor data, the imputed most likely foundation type and structure information were linked via the NSI’s census block spatial linkage of the individual property to the census geography.

3.4. TIGER/Line Demographic Data

This dataset (

https://www.census.gov/geographies/mapping-files/time-series/geo/tiger-line-file.html) contains a unique geography entity code that links to the different levels of demographic data hierarchy. We used Tiger polygons to identify the census block boundary code for each property, using geospatial intersection.

Figure 2b illustrates the relationship between properties and U.S. Census blocks. The properties (represented by dots) and the blocks (represented by rectangular polygons) highlight the high resolution associated with the aggregation of point data to the block level. Even the most densely populated blocks have only dozens of property points and some have single digit counts. By assigning the foundation type (basement/or no basement) and the structure type to the missing property level data file using the “most likely” characteristic at the census block, this imputation procedure minimizes the likelihood of assigning incorrect data to the properties based on local building codes and the homogeneity of properties within such a small spatial scale.

3.5. Depth–Damage Functions

The depth damage analysis is based on the HAZUS-MH methodology [

39], a national GIS-based model developed for FEMA to estimate the physical, economic, and social impacts of natural disasters (i.e., earthquake, hurricane, flood, and tsunami). HAZUS can support deterministic hydraulic analysis (e.g., FIT and HEC-RAS) and generate a flood surface elevation from the digital elevation model. It can also generate probabilistic scenarios of flood inundation maps across different return periods [

40]. For running depth–damage function, the HAZUS application relies on a set of depth–damage curves, collected from a variety of sources including the Federal Insurance and Mitigation Administration (FIMA), the U.S. Army Corps of Engineers (USACE), and the USACE Institute for Water Resources (USACE-IWR). These curves are compiled for the USACE Chicago, Galveston, New Orleans, New York, Philadelphia, St. Paul, and Wilmington Districts [

41,

42]. They supply a range of damage functions for different occupancy classes at Riverine, Coastal-A, and Coastal-V zones.

In the current study, we apply HAZUS depth–damage functions to pre-defined flood surface level at each property. We use these estimates to calculate an annual expected loss from flooding. Our application of the depth–damage functions has four steps:

(1) Specify Occupancy Code (SpCode): each property has a specific code that is based on the number of stories, the occupancy class of the building, and whether it has a basement or not. The depth damage functions use these codes to relate flooding depth to structural and contents damages for each property. Originally, HAZAUS uses the general building stock by census block. For each census block, HAZUS inventory consists of the number of square feet of buildings by specific occupancy type, specific foundation, and the average height of the first floor above grade by foundation type. The aggregated loss for each census block is then calculated from the partial percentage of each group. However, in our analysis, we apply the unique depth–damage function outside of the HAZUS framework directly to our parcel-level data. Moreover, our economic loss is limited to structural damage of residential buildings and does not include contents inside the home.

(2) Structural Value of Properties: Due to the fact that the damage function is based on a percentage loss output, values of the structure were required for the final calculations. Our property’s structural values were adopted from reported AVM values in the assessor data file provided by our 3rd party standardizer, which took the disparate information from multiple county assessor offices and cleaned it to be used consistently in analysis. These values were not available for about 35 percent of the property points and required imputation in places where these data were not available. To impute the missing data, we took two steps:

(a) We used existing structure value information to best estimate the missing AVM values. This required the training of a linear regression model on the properties that have both a Market Value and AVM values available, using the former as a predictor and the latter as predictand. Next, we employed the model to fill AVM values for those properties that have only market values.

(b) To complete AVMs for the remainder of properties that have neither Market Value nor AVM values, we applied a Regression-Based Inverse Distance Weighting (IDW) model. The IDW interpolation model created a raster layer of AVM predicted values across the study area which could be directly sampled by the point location of the properties missing the AVM. As a rule of thumb, this interpolation technique works very well in densely populated areas, and less well in areas that are sparsely populated [

43]. This is further illustrated in

Figure 2b where the underlying spatial gradient is associated with the interpolated AVM values. For those properties missing AVM values, we simply sample the underlying spatial interpolation and assign that value for damage estimation.

(3) Depth–damage Function (DDF): Default damage function estimates the percentage of damage relative to the depth of flooding. These functions operate between −4 feet to 24 feet. Here, a negative depth refers to inundation level in the basement. To obtain the value within each interval, the function runs a linear interpolation between beginning and end of the interval. DDFs include curves to quantify the damage for both structure and content of the building. The expected loss only considers the properties that are at coastal and riverine flood zones. Under pluvial scenarios, buildings could be flooded by severe, concentrated rainfall coupled with inadequate local drainage systems. However, HAZUS methodology does not account for failure of local storm water drainage systems, and their resulting damages to the building. Additionally, the HAZUS methodology and the applied depth–damage curves are focused only on standing water that does not recede quickly; a condition which is more likely to be associated with fluvial and storm surge flooding (that may or may not be coupled with rainfall). As such, we are removing pluvial-only flood risk from our damage estimations to ensure that the damage curves are only applied in the capacity that they were designed to be implemented.

Figure 3 illustrates the damage functions for Coastal A, Coastal V, and Riverine flood events with the curves representing the percent of damage given the depth of water for properties in each of these zones. The shape of the curves is primarily driven by the type of event that is likely to affect the properties, including storm surge for Coastal Zones and fluvial inundation for the Riverine zone.

The Depth–Damage function results estimate the percent damage relative to the depth of floodwater as measured from the top of the first finished floor. For the first floor elevation value in each property, we applied HAZUS default data originally allotted through frequency analysis of census block [

39]. This value varies by type of foundation and flood scheme information.

(4) Aggregate Annualized Loss (AAL): We estimate structural damage to the properties for 2-year, 5-year, 20-year, 100-year, 250-year, and 500-year flood events. The expected annualized loss (AL) in each year is the sum of the probabilities that relate to each flood magnitude multiplied by the damage. As shown in

Figure 3, we assume the loss in each probability bin is uniform. In the absence of a reliable estimate on the entire distribution of damages, this assumption is an easy compromise to obtain the foreseen loss for discrete flood events [

30,

44].

where

L and

P show the loss and probability, respectively, and

i is the numerator for different return period scenarios. These annualized losses are visually represented by the development of the loss–probability curve illustrated below in

Figure 3, which is represented by the triangular probability distribution formed by the specific probability layers included in this analysis.

3.6. Study Sample

In this study, we focused on properties in the state of New Jersey that are either in the coastal or riverine flood risk zones per the most spatially expansive, and lowest probability event included in this analysis (500 year event). Based on the FEMA flood zones boundaries, about 200,304 properties are at the risk of coastal flooding, while the remaining are identified with riverine flood schemes. Prior to running flood damage functions, the outlying property values are removed from given observations at 99% confidence interval. Outlying property values are related to values that were outside of the three standard deviations and did not align with reality. For example, some values were extremely low, and others extremely high. Those were removed from the estimation process to ensure they did not overly influence our ability to predict home values accurately. The results of this study are based on the remainder of properties (n = 283,435).

Table 1 categorizes the number of investigated properties by different groups of building class, and the impacted flood scenarios by flood start year. The focus on the start of the flood experience is important in that it gives us the ability to implement the appropriate flood hazard layers. The year and return period identify the first occurrence of flooding in the properties. The majority of residential properties at risk are single family buildings followed by multi-dwelling and manufactured housing. Notably, almost all the properties that start to flood in 2050 are impacted only by 100-year or a lower probability scenario. That does not imply that none of the properties flood in the higher probability scenarios, but it means 2 and 5 return periods in 2050 are not uniquely the first episode of flooding for any of the properties. In contrast, a relatively high number of properties begin to flood under different return period scenarios in 2020—the start year of our analysis.

Furthermore,

Figure 4 presents the number of properties within each group of specific building codes (SpCode) and flood type scenarios. As mentioned earlier, the SpCode is a unique key formed based on the number of stories, the class of occupancy, and the foundation, helping to identify the corresponding depth–damage function. As shown in

Figure 3, the R11N and R12N groups (single-family properties with one and two stories and no basement) constitute more than half of the total properties in the dataset. Among those properties at risk, the majority of these groups are located in Coastal A and Riverine flood zones. In contrast, a small number of the investigated properties are located in the FEMA coastal-V zone. According to

Figure 4, the third frequent group of studied properties is a two-story single-family with a basement (R12B)—evenly distributed in Riverine and Coastal-A flood zones.

4. Results

The results of the AAL analysis on residential properties at risk is summarized in

Table 2. Generally, the Coastal A-zone manifests the highest flooding damage in 2020 and is expected to increase by about 42.3% in 2050. The contribution of other flood schemes (Riverine and Coastal V-zone) to the total expected annual loss is ten times smaller than the share of Coastal A-zone. Nevertheless, Coastal V-zone properties face the highest rate of increase in expected losses over the 30 year period. For the entire state, the average expected loss for properties at risk rises from USD 5481 in 2020 to USD 7772 in 2050. The 41.4% increase in average flood damage for all properties in the study is associated with an additional USD 657 million worth of housing value at risk. Additionally, ancillary analyses using zip code level National Flood Insurance Program claims (~40 years worth of data) 9994 zipcode–year combinations in which claims were paid out in relation to damage from flooding events in the state of New Jersey. The mean value of those payouts over those respective time periods is USD 5540 which aligns very closely with our estimated 2020 AAL of USD 5482 in 2020.

Moreover,

Table 3 illustrates the total expected loss inside and outside of FEMA designated Special Flood Hazard Area (SFHA) simply as a way of capturing our expected loss estimates against FEMA’s current 1–100 flood zone layer, a designation that mandates flood insurance for homeowners. More generically, the SFHA boundaries distinguish high flooding risk regions (inside the SFHA) from the low to moderate risk regions (outside the SFHA). Generally, the expected loss in the high-risk flooding hazard area is about 9~10 times higher than the area with low to moderate risk of flooding. Over time, the expected loss outside and inside the hazard area grows about 32% (~USD 31 million) and 42% (~USD 618 million), respectively.

To put these numbers into context, average flood insurance claims paid for three out of ten most significant events that impacted the state of New Jersey—including Superstorm Sandy, Hurricane Ivan and Hurricane Irene—are USD 66,517, USD 57,097 and USD 30,369, respectively (please see the National Flood Insurance Program for claims and statistics at

https://www.fema.gov/policy-claim-statistics-flood-insurance). These numbers are just for context, but are useful in thinking about the probability of these types of more extreme events and the calculated annual loss estimates. The average paid loss associated with these major events is 4 to 10 times higher than average expected loss for the investigated properties in our 2050 estimates of average loss (USD 7772).

The correlation between the flood start (using it as a metric for hazard intensity) and the average expected loss in the properties at risk is presented in

Table 4. In the table, one can see the average AAL (as an average of the values obtained for 2020 and 2050) as well as average AVM property value versus the first occurrence of flooding. Generally, the association of an earlier flood start and lower return period scenarios with higher flood intensity and significant flooding damage is intuitive. For instance, the average expected loss for the properties that only flood at a 500-year scenario in 2050 is about USD 12. For the properties which initiate flooding at a 2-year return period in 2020, the damages rise to USD 25,369.

Table 3 also shows that the average property values do not necessarily modulate the variability of AAL values for different flood occurrences. The properties which only flood in 2050 at 250-years or lower probability scenarios, constitute the highest property values among different groups but only indicate USD 93 USD expected loss. This low expectation is due to the fact that flood risk is both very low (1in 250 and 1in 500 year risk only) and does not exist in the current climate (2020 environmental conditions). As mentioned in

Table 1, none of the properties start flooding at the 2 or 5 year return period, in 2050. Thus, we removed those scenarios from

Table 4.

Figure 5 presents the spatial distribution of expected loss due to the structural damage, aggregated across different counties in New Jersey. The maps provide the results of the analysis of average property values, the average of the expected loss in 2020 and 2050, and the percent of average expected loss for each spatial unit. The table below the maps provides the details on the manifested numbers. Generally, the average expected loss among different counties ranges from USD 3000 to USD 15,000. In both absolute and relative terms, Ocean and Warren county present the highest expected damage over 30-years. Both of these counties are perceived as relatively low or median in terms of aggregated property values among other counties, but exceed more than 4% of structural damage for the residential buildings. Notably, Cape May and Hudson county—which present the highest average property value—are among the lower exposed counties.

At the level of individual structures, the average expected loss follows a unimodal, non-symmetric, highly skewed distribution (see

Figure 6). While more than half of the properties show an expected loss of USD 1000 or less, at the lower frequency the distribution, expected losses can reach USD 30,000 annually. The disproportionate number of lower damages in the expected loss spectrum describes the nature of flood hazard intensity where the higher probability events are expected to leave a lower damage and footprint. On the other hand, the heavy-tailed frequency modulated by a small number of extremely large values can be due to the presence of high inundation and high property values in the data. Either or both could impact the damage skewness and control the outliers in the output.

Additionally, the breakdown of average annualized loss across different groups of SpCode in

Figure 7 follows the frequency pattern discussed earlier in

Figure 4. Occupancy types (SpCode) R11N, R12B, and R12N constitute the highest frequency of properties and place among the top exposed SpCode groups. The intra-variability of the values in each group shows the dominant impact of the FEMA Coastal A-zone in the entire state. However, while the riverine flooding schemes indicate around 10% of the impacted properties in each group, its proportion of total expected loss is lower than 5% of the total damage.

To assess how the combined impact of sea level rise, tidal flooding, and the increased potential for tropical cyclone activity from the warming seas and atmosphere would affect structural damage in New Jersey, we quantified the trends in expected loss over 30 years.

Figure 8 illustrates the projected change in total expected loss of each county from 2020 to 2050. The numbers are reported as the total average AAL in million USD. Accordingly, Ocean county shows the most significant response to environmental changes over three decades, with total average AAL spiking at nearly USD 300 million. Cape May and Atlantic follow Ocean county with a USD 150 million and a USD 80 million increase in expected loss, respectively. As we discussed in

Figure 5, in terms of the average annual loss value, Cape May is among the lower risk counties. However, considering the change in exposure from 2020 to 2050, Cape May emerges as the second most affected county in the state. Additionally, we evaluated the change in expected flooding loss over 30 years at the parcel level.

Figure 9 presents the range of values for different counties. Similar to the change in total values, the median of properties’ change in annual loss indicates a higher exposure in Ocean, Cape May, and Atlantic counties. These counties also show a higher deviation in parcel-level expected loss, covering a wider range of values from near zero to USD 3000.

While the analysis of frequency/magnitude is a reliable tool for evaluating flood risk and relating that to the damage, considering the vulnerability components helps to understand the severity of the impact on the exposed population or assets. On the significance of this interaction,

Figure 10 provides a granular illustration of flood risk estimation and the associated exposure of population and properties in New Jersey. The bubbles in the figure identify the average expected loss versus the average housing value aggregated over each county. The size and color of each bubble indicate the share of each county in relation to the total number of properties and total population in the entire state, respectively. It is clear from the figure that the variability of expected loss is not an artifact of the property value. For instance, Ocean county, with the highest expected damage, is considered average in terms of property value. In contrast, Hudson county presents the highest property value but ranks among the lowest flood risk counties of New Jersey. The majority of counties with a low and medium share of properties (less than 10%) indicate a low property value and low expected loss. Conversely, Ocean county, with high property and population percent, show the highest expected loss, distinctively characterized by a high level of exposure. Similarly, Warren ranked second in flood risk, but identified with a considerably low population and share of the state’s properties. On the same note, Bergen county contains the highest proportion of the population with a relatively low percentage of properties and has relatively low flood risk (with less than USD 5000 average expected loss).

5. Discussion and Conclusions

The EIA detailed in the preceding sections is the product of the ability to combine economic damage indicators with new high precision input data. While the results are only for the state of New Jersey, their implications indicate that they are both reliable (as validated by a comparison to historic NFIP and IA claims over the lifetime of the programs in the state) and consistent, which set the foundation for a larger scale national level analysis. The high level of reliability was identified via historic observation from the lifetime payouts of NFIP and IA claims based on damage and depth relationships. As evidence, the average yearly payout for NFIP claims over the ~40 years of NFIP claims program in the state of NJ found that, on average, the total payout divided by the number of claims was about USD 5540 per year, per claim. This equates to a real-world expectation of annual loss from flood in the state of New Jersey over this time period. Our calculations found that the estimated payout in 2020 was actually about USD 5481. This is a remarkably close approximation of estimated annualized loss over given the six explicitly modeled return period events and the estimated inundation from each at each property in the state. It is reasonable for the observed value to be a little higher in that there have been multiple large events over the relatively short time periods in which the NFIP coverage has been available (Sandy, Ivan, and Irene, for example), but the close approximation lends itself as validation for both the underlying hazard layers and the applied damage functions.

Additionally, the ability to extend the EIA by understanding the economic implications of the changing environment adds another level of sophistication to the assessment tool. By relying on the IPCC’s RPC 4.5 future forecasts along with NASA’s CMIP5 Global Climate Models, we were able to estimate the same six hazard layers with depths associated with the same specific return periods in the year 2050. This estimation proved significant, in that the AAL increased from USD 5482 in 2020 to USD 7772 in 2050. That is over USD 2000 an increase over the time period of estimated loss to flooding per home that experiences flood risk, or about USD 650 million more in aggregate annual loss to flooding, moving from USD 1.55 billion expected losses in 2020 to USD 2.2 billion in 2050. Of course, these results are subject to change. Here we have implemented the RCP 4.5 future forecasts; however, there is already evidence that the 4.5 curve may be too low of a future estimation. If that is the case, then the estimated increases could change dramatically upwards. On the other hand, if the forecast is relatively accurate in the future and these types of assessment tools are used for policy making, informing decisions, and resource allocations, then we may see human adaptation in the form of built protections and smarter development in a way that minimizes the expected growth of loss associated with these environmental changes. Either way, having a high precision and reliable set of estimates at the property level helps to quantify current impact and plan for future conditions.

Finally, the public nature of this assessment tool is empowering to both policymakers and homeowners. There are certainly high precision tools that exist in practice, but generally in a closed proprietary form. Having an assessment tool with open methods, made from open data, with results open to the public, makes resourcing and planning tools for individuals, organizations, and smaller communities available in such a way that has not been easily accessible in the way of resilience planning, floodplain management, and resource allocation for community infrastructure programs with an eye towards the changing environment and maximizing the return on program spending. For example, it allows state/federal agencies to prioritize spending based on changes in expected losses over the next 30 years, which in some cases may underscore the urgency of flood risk reduction projects with a real quantifiable cost and return on the investment.

The public nature of the model results, methodology and the data inputs also mean that we already have the tools to perform these analyses nationwide at our disposal. Publicly available cost benefit analyses with transparent methodologies can be put in the hands of local communities, rather than relying on expensive and opaque engineering consultancies. The only other publicly available nationwide flood risk assessment tool that exists today is the FEMA SFHA. The FEMA models alone cannot perform this kind of analysis, as they were developed specifically with the floodplain manager in mind and with human safety in emergencies at the forefront of many of the modeling decisions. As such, the SFHAs have been created as two dimensional (no depth) categorically limiting zones (in or out of the SFHA) and without the same resolution in regards to magnitude (only 1–100 or 1–500 year zones). In contrast, the flood hazard tool here has varying return periods (ranging from 1–2 to the 1–500 year zones) with depths attached to each of those hazard layers and forecasting into the future. In fact, a simple overlay with SFHA’s shows that about 7% of our estimated aggregate damages in New Jersey in 2020 (USD 95 million) fall outside of the FEMA identified SFHA. The remaining USD 1.5 billion fall within the FEMA SFHA, but the USD 95 million is significant in that these are homeowners that are outside of federally mandated insurance zones, but are still likely to incur damage from flood events. This % remains relatively stable into 2050, where about USD 126.5 million in estimated aggregate damages fall outside of the current SFHA, and about USD 2.1 billion currently delineated within the SFHA. This additional precision on time, magnitude, vertical resolution, and horizontal resolution allow for a set of damage estimates specifically designed for the property level and with data driven evidence of reliability based on historical observation of damage payouts.