Abstract

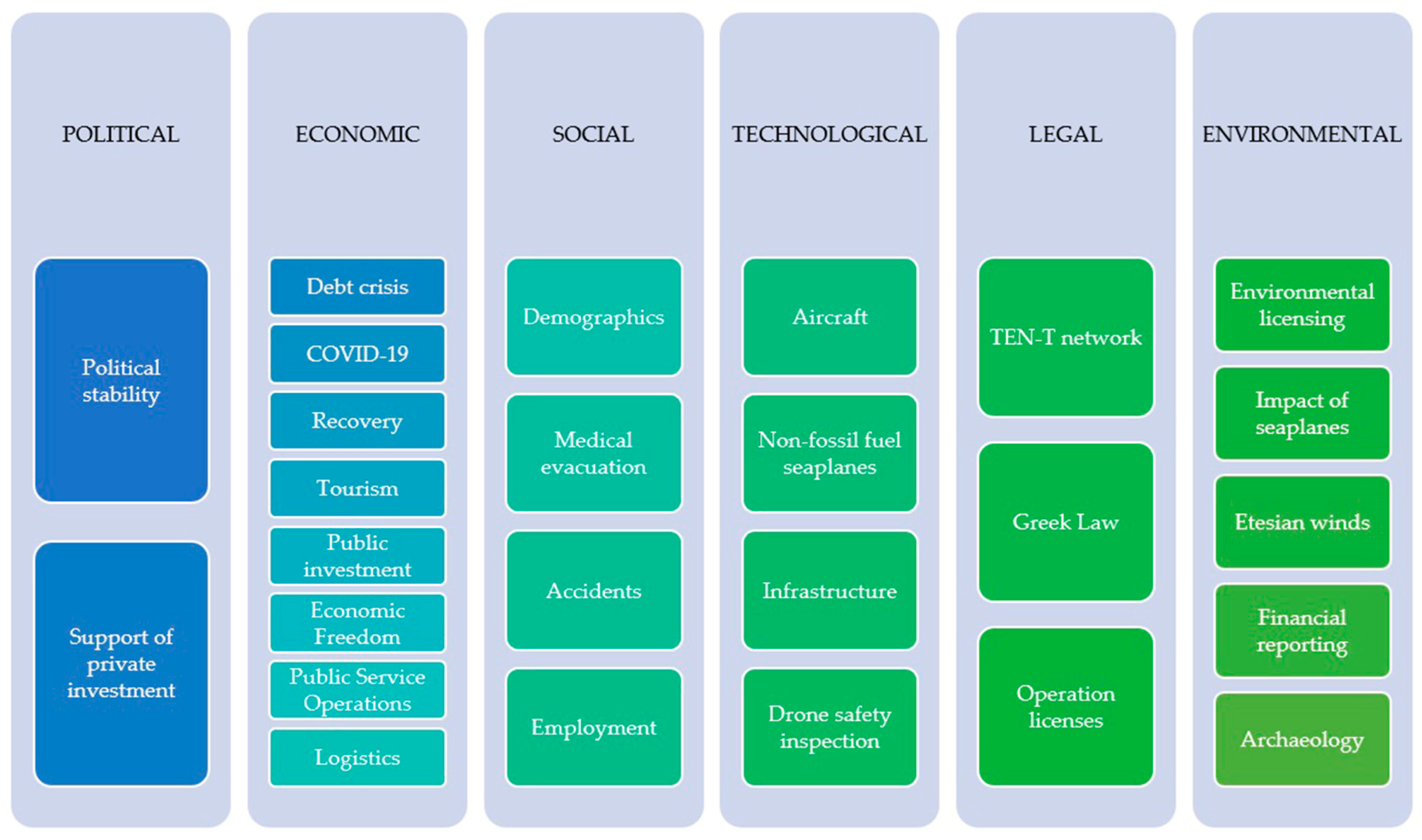

Seaplane operations connect remote areas, promote tourism, and provide unique transportation solutions. After many years of preparations, commercial seaplane operations on a network of 100 water airports and 200 waterways in Greece are about to commence. The network can serve the needs of 1.6 million permanent residents of the Greek islands, the inhabitants of the mainland, and over 35 million annual tourists. This paper aims to conduct a PESTLE (Political, Economic, Social, Technological, Legal, and Environmental) analysis to identify the factors that have delayed operations and those that will affect the success of future operations. As such, 26 factors are examined. It was found that the Greek debt crisis and the COVID-19 pandemic were impediments to operations. The potential of using electric seaplanes is discussed. Recent developments in using drone inspection capabilities for aviation safety are examined. Management strategies for the Etesian winds and other environmental issues are presented. Overall, seaplane operations have enormous potential, while the Greek economic recovery provides favorable conditions for completing the project. The critical issue determining success is executing a multi-faceted business model to ensure seaplane operations’ financial viability. The network can act in synergy with other modes of transportation to help achieve social cohesion, improve tourism services, and foster economic development.

1. Introduction

According to a recent market analysis, the size of the global seaplane market in 2023 is valued at USD 348.54 million [1]. This figure is projected to grow to USD 844.56 million by 2030, representing a Compound Annual Growth Rate (CAGR) of 10.33% over the forecast period from 2023 to 2030. The expansion of the global seaplanes market can be attributed to several critical factors, including increased orders for luxury flying boats, a growing focus among transportation companies on acquiring aircraft to lower air transportation costs, and a rising demand for amphibious planes.

Seaplane operators worldwide are vital in connecting remote areas, promoting tourism, and providing unique transportation solutions in regions with significant water bodies. The following list of operators (Table 1) showcases the versatility of seaplane travel and its growing significance in the aviation industry, from promoting tourism in the Maldives and Australia to providing crucial connectivity for Canadians and Americans. The number of seaplanes per airline has been attained from the CIRIUM database and seaplane operators [2].

Table 1.

Global seaplane operators.

In Asia, Trans Maldivian Airways (TMA) is one of the largest seaplane operators globally, with a fleet of 63 aircraft. It primarily serves the Maldives, providing essential connectivity between the capital, Malé, and various resort islands. The key routes are Malé to various luxury resort islands. TMA holds the record for the largest seaplane fleet in the world and has significantly contributed to Maldive’s tourism industry by offering convenient transfers for tourists.

Seawings (Dubai) is a luxury seaplane operator with nine-seater seaplanes and offers scenic flights and private charters in the United Arab Emirates. The company focuses on providing high-end travel experiences. The key routes are scenic flights over Dubai, Abu Dhabi, and other iconic UAE landmarks. Seawings has become synonymous with luxury seaplane tours in the UAE, providing unique aerial views of the region’s architectural marvels.

In North America, Harbour Air Seaplanes (Canada) is North America’s largest seaplane airline, with around a 40 aircraft fleet operating in the Pacific Northwest. The company is known for its sustainability initiatives and efforts to develop the world’s first fully electric commercial seaplane. Harbour Air conducted the first successful flight of a fully electric seaplane in 2019. The key routes are Vancouver to Victoria, Vancouver to Whistler, and other destinations along the coast of British Columbia.

Kenmore Air (Seattle, US), with a fleet of over 20 aircraft, operates seaplane and landplane flights in the Pacific Northwest, offering scheduled and charter services. The key routes are Seattle to the San Juan Islands, Seattle to Victoria, and various destinations in British Columbia. Kenmore Air is known for its scenic flights and has been a staple in the Pacific Northwest’s air travel industry for decades.

Air Whitsunday, a charter airline in Australia, specializes in operating a fleet of seaplanes. In addition to providing transportation services, the company offers scenic tours, allowing passengers to explore the stunning landscapes of the Whitsunday Islands and the Great Barrier Reef from the air. Their seaplanes provide unique access to remote locations, enhancing the travel experience with breathtaking aerial views.

Seaplanes in Greece are also becoming increasingly significant in modern times. They are set to play an essential role in improving connectivity in Greece, particularly for its many islands. While challenges must be addressed, the potential benefits for tourism and inter-island transport are substantial.

With over 170 inhabited islands and a coastline of 13,676 km [3], the Greek archipelago faces limited transportation options, especially during off-peak seasons when ferry services are reduced. Seaplanes offer a flexible alternative, reaching even the most remote islands where traditional airports and ferry terminals are impractical. They improve accessibility for residents and enhance the travel experience for tourists with quicker, scenic routes.

Seaplanes also align with Greece’s sustainable tourism goals, minimizing infrastructure needs and preserving natural landscapes. Despite logistical challenges, the Greek government and private investors are committed to expanding seaplane operations, aiming to establish a network of seaports across famous and lesser-known islands, making seaplanes a crucial part of Greece’s transport network.

Hellenic Seaplanes SA, established in 2013 and based in Athens, is currently focused on developing water airport infrastructure. The airline plans to launch scheduled seaplane flights, offering faster transportation between the Greek Islands, mainland Greece, and coastal cities. It will also provide aviation services like maintenance, training, charter, sightseeing flights, and private cargo operations. Hellenic Seaplanes conducted its first trial flight from Lavrio in 2024 [4].

Greek Water Airports was founded to engage in the construction, licensing, and operation of water airports. From the start of its operations, the company led a pioneering business venture with enormous growth potential in Greece. It has licensed the first four seaplane bases in Greece (Corfu, Paxos, Patras, Rethymno) and has undertaken the licensing of 64 additional water airports.

Grecian Air Seaplanes is a new seaplane operator based in Greece. The company mainly focuses on connecting the Greek islands with mainland Greece. In the long term, the airline aims to expand its route network to include other island regions of Greece. In addition to scheduled passenger flights, the airline will also offer private charter flights, tours, and medical flights.

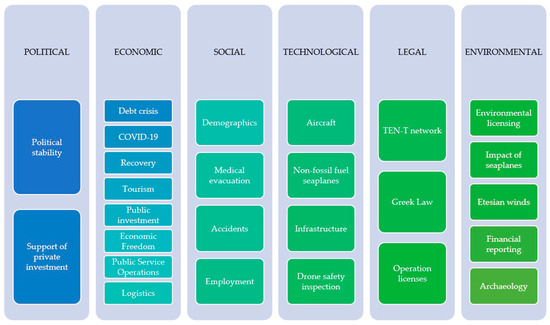

Considering the geography of Greece, it is almost paradoxical that it does not have an extensive seaplane operation network. Several seaplane operators have been trying to establish a transportation network and start commercial operations for over a decade. Numerous water airports have been constructed, and several test flights have been performed over the last two years. At this point, commercial operations are expected to commence in 2025. The research question is to discover why this undertaking has taken so long, what factors have affected development, and what factors will be critical in the first years of operations. A PESTLE (Political, Economic, Social, Technological, Legal, and Environmental) analysis is the best methodology to answer these questions.

2. Literature Review

2.1. General Outlook

After Greece’s exit from austerity programs, many entrepreneurs have been actively looking to capitalize on the country’s distinctive morphological and topological characteristics. Whether it is the country’s picturesque landscapes, its rich cultural heritage, or its strategic geographical location, several factors make Greece an attractive destination for business ventures. Many entrepreneurs are exploring innovative ways to leverage these unique features to create new opportunities and drive regional economic growth.

Recent studies have shown great interest in developing and using seaplane bases and their potential impact on other transportation modes and the local economy. Kafasis [5] showed that seaplanes may provide a flexible alternative that promotes interconnectivity and enhances accessibility to remote areas, especially after the introduction of Law 4568/2018, which establishes the legal framework for seaplanes’ licensing, operation, and use. Another study by Andrade et al. [6] indicated that seaplanes are a unique form of transportation that offers great flexibility in terms of infrastructure. Unlike traditional planes, seaplanes can operate on both land and water, making them an excellent choice for regions with both types of surfaces. This feature is particularly advantageous in areas where sea and air connectivity are the only options.

Seaplanes utilize natural water bodies, minimizing the environmental impact associated with the buildings and maintenance of large airports, making them an increasingly sustainable and practical mode of transportation in various parts of the world. This is especially true in the Maldives, a nation comprising 1200 islands and islets in the heart of the Indian Ocean near the equator. With limited land available for construction, including runways, seaplanes have emerged as the ideal option for transportation in this region. Favro et al. [7] explored the importance and role of air transport in tourism development in Croatia. Their research concluded that having seaplane connections to each island can boost tourism by promoting a positive image of the destination and impressing guests. Specifically, the paper proposed that connecting islands and the coast with seaplanes to enrich tourism offers excellent economic and environmental development potential. However, they noted that some seaplane companies had suspended their operations due to financial difficulties and regulatory challenges. Iliopoulou et al. [8] investigated the design of a seaplane network connecting the Greek islands with the mainland. They developed a multi-objective capacitated vehicle routing model with simultaneous pickups and deliveries, trip duration limits, and intermediate passenger accommodation. Results showed that the algorithm generates routes serving neighboring islands and fully satisfies local ridership between them. Roukounis et al. [9] applied multi-criteria decision analysis (MCDA) to evaluate different areas for water airport allocation.

The European Commission launched the Future Seaplane Traffic (FUSETRA) project due to the projected increase of over 5% in air traffic each year. FUSETRA’s mission was to thoroughly examine the current state of seaplane travel, identifying its strengths and weaknesses. The challenges of expanding airport capacities and constructing new ones and the vast stretches of shorelines across Europe’s seas, lakes, and rivers were also significant. The ultimate goal was to generate comprehensive concepts and requirements for a cutting-edge seaplane transportation system, focusing on “improving passenger choice in air transportation” and developing new and innovative vehicles. This process involved extensive research into present-day practices and future-oriented traffic system concepts, emphasizing seamless integration into sea, air, and land transportation networks [10]. FUSETRA has developed comprehensive information, analysis, and requirements for reviving European seaplane operations. The results of FUSETRA’s work will directly impact the strategy for addressing future regulatory issues. Since the regulatory process requires interdisciplinary cooperation between sea and air authorities and between local and European Commission authorities, FUSETRA’s work is crucial for successfully renewing European seaplane operations. In the case of Greece, FUSETRA’s focus on regulatory cooperation is crucial since effectively integrating seaplane services requires collaboration between maritime and aviation authorities.

Additionally, the FUSETRA project concluded that regional development in Europe, a critical factor in the continent’s progress, is currently hindered by the limited mobility in less accessible areas and many new member states. However, the potential for development in these regions can be unlocked with the introduction of seaplane technology, a promising solution that can significantly enhance mobility and foster growth. By increasing seaplane traffic in Europe, broader societal implications can be achieved in various areas: seaplane traffic opens new possibilities for point-to-point connection to new destinations with substantially reduced travel time from door to door. Increasing the individual daily action radius from 100 km to more than 500 km will benefit most of the population. A broader seaplane network will improve first aid care, especially in low-accessible areas. Not only inhabitants in low-populated regions of the northern European countries but also smaller islands in the Mediterranean and Atlantic will benefit from off-shore platforms and damaged ships. Research and rescue operations in maritime environments are classical seaplane missions [10].

2.2. Socioeconomic Development and Connectivity of Remote Regions

Remote regions and sparsely populated areas face significant challenges regarding their socioeconomic development. Residents must incur higher transportation costs while benefiting from fewer social services and fewer options in education and health care. Population sparsity is measured with population density—usually lower than 8 or 12.5 inhabitants per square kilometer. In Greece’s case, the islands we are examining for seaplane transport are remote regions, but only a few can be considered sparsely populated.

According to a briefing from the European Parliament, the general lack of connections to and from other regions constitutes a significant problem for insular territories. The accessibility to most islands is problematic and can be characterized by infrequent transport. Some of the smaller and least developed islands suffer from population decline and aging as younger people look for better job prospects inland or abroad. On the other hand, islands with a strong tourist economy have managed to reverse this trend and sustain a younger population [11,12]. Indeed, in some remote areas, local economies are often built around activities that deal with landscapes and the natural, historical, and cultural heritage. Tourism-related businesses attract staffing from other regions, mainly for seasonal jobs [13].

Greece exhibits all the symptoms of depopulation, leading to labor shortages, declining economic productivity, and increasing demands on the health and welfare system. By understanding the causes and far-reaching implications of this phenomenon, policymakers can develop effective strategies to address it. Insular/remote areas can be revitalized through socioeconomic improvements, infrastructure investments, and policies directly impacting these communities. Improving transportation infrastructure and Internet access in rural areas can amplify accessibility and connectivity [14]. Sectors of interventions in areas with geographic specificities mainly concern physical and digital connectivity, better access to public services, and promoting renewable energy [15].

Regarding islands, connectivity is attained primarily through maritime and air transport. At the same time, there are significant accessibility challenges, mostly with other regions rather than with central economic and administrative centers. For example, while there are connections between the port of Piraeus and Athens International Airport with many islands in the Cyclades, there are fewer options to travel between these islands. At this point, seaplanes are ideal for offering more mobility and connectivity alternatives. Finally, regarding decision-making, the European Union’s use of Regional Development and Cohesion policies is most appropriate for such interventions.

2.3. Advanced and Regional Air Mobility

The vision for Advanced Air Mobility (AAM) is to help emerging aviation markets safely develop an air transportation system that moves people and cargo between places underserved by aviation [16]. AAM is a pioneering aviation undertaking transforming urban and regional transportation through electrified vertical takeoff and landing aircraft [17]. These aircraft can take off and land in confined areas and are, therefore, particularly suitable for densely populated areas, reducing the need for large, centralized airports. AAM is committed to offering more accessible and cost-effective transportation solutions while mitigating ground traffic congestion, noise pollution, and ecological repercussions. By integrating urban vertiports, AAM intends to increase connectivity and operational efficiency. AAM is the new face of mobility, supported by technology advancement, strategic route planning, and major investments.

Regional Air Mobility (RAM) is a redesign of regional transportation enabled by using novel aircraft and existing airport infrastructure to efficiently, affordably, and flexibly connect travelers. RAM operations have been designed for aircraft carrying fewer than 20 passengers or the equivalent weight in cargo, operating on existing runways from underutilized regional airports. This approach not only increases access for communities that have been marginalized but also helps to alleviate traffic congestion at major aviation hubs. RAM provides a ground-breaking and scalable solution for future transportation needs by facilitating technologies such as community-compatible aircraft, autonomous systems, and an operational ecosystem [18]. As RAM regards transporting passengers aboard small aircraft over short distances, operational challenges include low passenger volumes, competing transportation modes, and high operating costs [19].

Both AAM and RAM are based on some key underlying concepts and principles: (a) on-demand transportation by flexible and adaptable services that are tailored to users’ needs; (b) improved connectivity, accessibility, and mobility of remote and underserved areas; (c) integration with existing transportations systems; and (d) foresight regarding the potential of electric propulsion.

All these principles are very relevant to seaplane operations in Greece. Seaplanes can be easily reconfigured to provide chartered flights, transfer to resorts, cargo, or medical evacuation services. They operate in underserved regions of the Greek islands, particularly in the off-season. Generally, operations rely on small aircraft exploiting existing infrastructure; seaplanes can take off and land from water runways and minor coastal ports without major airports. The seaplane network is integrated with the TEN-T transport system and other modes of transportation, such as airlines and ferries. It can help reduce congestion at significant aviation facilities and facilitate tourism and economic development by connecting islands and coastal urban areas. The potential for using electric propulsion is always open once the technology becomes available.

2.4. PESTLE Analysis

PESTLE analysis is a framework used to evaluate the external macro-environmental factors affecting a business or investment decision and is crucial in financial feasibility studies. PESTLE analysis examines six key factors: Political, Economic, Social, Technological, Legal, and Environmental. Each factor provides valuable insights into the external forces shaping an investment opportunity.

Mohandoss and Muthuraman [20] employed PESTLE analysis to examine the internal and external factors affecting the aviation industry in Oman Air, Sultanate of Oman. Another instance of a PESTLE analysis was conducted by Nataraja and Al-Aali [21] to investigate the strategies and competitive advantages of Emirates Airlines that led to its outstanding performance when the airline industry globally suffered multibillion-dollar losses in 2009. Pınar [22] conducted a study analyzing the effects of the COVID-19 pandemic on the aviation industry using PESTLE analysis. The study concluded that strategies should be implemented to prepare and recover the aviation industry for future pandemics. Such strategies should include promoting restructured travel packages, low-cost flights, and popular routes. Furthermore, emphasis should be placed on energy efficiency and environmental sustainability. A recent study by Serfointein and Govender [23] sheds light on stakeholders’ views regarding the PESTLE framework’s influence on the macro-environment of commercial flight operations in South Africa. The study concludes that to remain competitive, it is necessary to continuously monitor and have a comprehensive understanding of the potential impacts of the macro-environment. Pauna [24] conducted a PESTLE analysis of Tarom Romanian National Airline. The analysis revealed that there are more opportunities than threats for the company. Based on this, Tarom can consider revising its economic and marketing policies to explore new markets.

Zahari and Romli [25] analyzed suborbital flight operations using PESTLE to find the implications for a nation. They found that while the prospects might seem positive, many significant challenges must be addressed, such as high cost, poor regulatory clarity, jurisdictional concern, competition for market share with traditional tourism, and environmental impact effects. Though there are opportunities for suborbital flight operations, establishing solid policies and regulations to overcome these impediments is a prerequisite for making the industry sustainable.

In a study by Bimo et al. [26], PESTLE-SWOT analysis combined external environmental factors with internal strengths and weaknesses to provide a comprehensive strategic assessment for decision-making. In the case of Indonesia’s military amphibious aircraft acquisition, this method highlighted significant strengths, such as favorable diplomatic relations with Russia, the availability of low-interest credit facilities, and operational familiarity with the specific aircraft. The opportunities include enhanced defense cooperation, better connectivity of remote areas, and advancements in the domestic defense industry. Some weaknesses include limitations on budget allocations for defense and weak maintenance infrastructure.

Beyond aerospace, in a study by Christodoulou and Cullinane [27], PESTLE analysis was used to identify the Political, Economic, Social, Technological, Legal, and Environmental factors that can influence the adoption and successful implementation of a port energy management system. A study by Guno et al. [28] used the Philippines as a case to apply PESTLE analysis in determining the factors that affect the adoption of electric vehicles (EVs) in the public transport system. The study considered the viewpoints of various transport stakeholders. The survey results showed that economic and technological factors are the main hindrances to adopting electric public transport. Finally, Van Hung [29] applied PESTLE analysis to examine the pros and cons of the Kra Canal project in Vietnam.

2.5. SWOT Analysis

SWOT analysis is a strategic planning tool used to identify and evaluate the Strengths, Weaknesses, Opportunities, and Threats of an organization, project, or business venture. In the context of the seaplane business in Greece, a SWOT analysis by Andrade et al. [6] concluded that a market for seaplane in Greece is ready to be explored. Boldizsár and Kővári [30] applied SWOT analysis to evaluate strategic considerations for enhancing a nation’s military aircraft fleet. Specifically, they highlight strengths such as the speed and efficiency of air transport and recent acquisitions, but also weaknesses in high operational costs, limited range, and outdated equipment. The opportunities range from fleet modernization driven by NATO requirements to the potential revenues available from more considerable transport capabilities. The threats include safety risks from aging aircraft and labor shortages.

While SWOT and PESTLE analyses are valuable tools for strategic planning, offering different perspectives. SWOT focuses on internal and external factors specific to an organization. At the same time, PESTLE provides a comprehensive view of the external macro-environment, identifying factors that are sometimes out of the investor’s control. Combining both analyses can provide a robust framework for understanding the factors influencing a business and formulating effective strategies.

2.6. Summary

The literature review has examined Greece’s potential to benefit from its geographical and cultural assets by developing a seaplane transport network. Seaplanes can reach more challenging areas in terms of accessibility and contribute positively to economic development. Seaplanes provide a unique opportunity to increase the regional and inter-regional connectivity of the Greek islands. Seaplane operations in Greece are aligned with the future vision of aviation as set by AAM and RAM. However, they do not rely on emerging technologies and can immediately provide a community-friendly and geography-specific solution for Greece’s transportation challenges. PESTLE analysis, which has been used in aviation and other undertakings, is the most appropriate tool to gain insight into broader factors influencing seaplane adaption in Greece and strategic future opportunities.

3. Methodology

3.1. PESTLE Analysis Process

The research was conducted in several stages. First, a literature review was conducted to identify the main issues regarding the seaplane industry in Greece and the international experience. The literature review included journal articles, industry reports, newspaper articles, and aviation websites. The critical elements of the PESTLE analysis were identified, and a detailed questionnaire was prepared. Following this, a series of structured interviews were conducted with aviation industry experts. After the interviews, the components of the PESTLE analysis were refined, and an additional literature review was carried out.

3.2. Political

3.2.1. Political Stability in Greece

Political stability is one of the most critical factors in attracting private investment since it provides investors with a predictable and secure environment [31]. In the past decade, there has been a significant change in Greece’s political landscape. During the recession that began in 2009, Greece experienced substantial political instability, including frequent changes in government, austerity measures, and social unrest. However, a significant shift toward more political stability has been observed since the early 2020s.

This improved stability has been vital in attracting investments, including in the seaplane industry. Greece’s commitment to a stable environment has created favorable conditions for long-term projects like seaplane infrastructure, boosting connectivity across the islands and supporting economic growth through tourism.

3.2.2. Support of Private Investment in Greece

Private investment plays a vital role in driving economic development, and the Greek government has taken proactive steps to attract foreign and domestic investors to the country. Several initiatives have been undertaken to support private investment, such as tax incentives, simplified licensing procedures, and establishing investment-friendly regulatory frameworks. Some key initiatives include an investment incentive law that offers tax relief and grants, fast-tracking procedures to expedite investment approvals, and a strategic investment program targeting large-scale projects with strategic importance.

According to the U.S. Department of State’s Investment Climate Statements [32], the Greek government has also implemented several reforms starting in 2022 to improve the investment climate. In addition to fiscal consolidation and structural reforms, the government enhances transparency and reduces bureaucracy. The current administration strongly emphasizes maintaining a stable political environment conducive to economic growth and investment.

As a sequence of the initiatives mentioned above and as a strategic response to gaining a competitive edge in the aviation market and boosting tourism, the Greek government has actively encouraged the establishment of long-term partnerships between the private sector and public authorities for seaplane operations. These collaborations foster a sustainable and robust seaplane industry, ensuring that infrastructure development and service provision align with national tourism goals and the broader economic growth strategy.

3.3. Economic

3.3.1. Greek Debt Crisis

In 2010, 2012, and 2015, Greece was forced to seek bailout loans from international creditors due to the debt crisis. In return, the country had to comply with strict austerity measures and privatize public assets. On 11 August 2015, Greece announced it would receive EUR 86 billion in the third bailout package, subject to further austerity measures. The austerity measures in Greece included deep cuts to wages and pensions, tax hikes, and spending reductions on public services. These led to severe economic hardship, with a deep recession and unemployment exceeding 27%. However, the recent economic recovery has fostered renewed investor confidence, which supports long-term projects such as the development of seaplane infrastructure.

3.3.2. COVID-19 and the Aviation Sector in Greece

The aviation sector, a critical component of Greece’s economy due to its dependence on tourism, faced severe disruptions during the COVID-19 pandemic as travel restrictions and lockdowns led to a sharp decline in passenger numbers. Greece, which relies heavily on international tourism for economic growth, experienced a contraction in GDP during this period, with the aviation industry bearing a significant brunt of the downturn. The COVID-19 pandemic exacerbated pre-existing economic challenges in Greece, where recovery from the financial crises of the previous decade was still ongoing. However, as the global economy began to recover and vaccination rates increased, the aviation industry in Greece showed signs of gradual recovery. Government interventions and European Union support significantly aided this recovery, reassuring stakeholders about the sector’s stability. The pandemic underscored the sensitivity of aviation to macroeconomic shocks. It highlighted the need for strategic resilience in industries reliant on global mobility and tourism, emphasizing the importance of long-term planning and adaptability in crises. The persistent uncertainty and economic instability during the COVID-19 pandemic created an environment unsuitable for significant new investments in the aviation sector, such as seaplane operations.

3.3.3. Economic Recovery

By the end of 2023, The Economist magazine recognized Greece for its best economic performance, securing the top spot on the list of 35 countries [33]. Multiple rating agencies have granted Greece an investment-grade status, making 2023 an incredibly successful year for the country. Greece is now looking forward to an even more promising 2024.

Greece’s real GDP experienced a growth rate of 2.2% in 2023, slightly lower than the figures projected in the Autumn Economic Forecast for Greece [34]. Despite a substantial decrease in consumption growth rates, it remained one of the primary growth drivers in the previous year. In addition, investment played a significant role in contributing to the economy’s growth, thanks to the successful implementation of the Recovery and Resilience Plan (RRP) and the robust construction activity, which were key drivers of economic growth. However, the slower-than-expected recovery of Greece’s key trade partners in the EU influenced export growth, although net exports still contributed positively. Looking ahead, economic growth is expected to remain at 2.3% in 2024 and 2025, with actual consumption expanding at similar rates as in 2023. Investment is expected to increase significantly as the RRP implementation gains speed, but this may result in higher import demand, reducing the contribution of net exports in 2024-25. This positive outlook for economic growth in the coming years, driven by the RRP and robust construction activity, should instill optimism about Greece’s future.

3.3.4. Tourism on the Rise

Based on the Greece Tourism Report—Q2 [35], Greece’s tourism industry is expected to experience positive growth in the coming years. The report predicts that in 2024, there will be an increase in the number of tourists visiting Greece, with arrival levels strengthening throughout the year. The country is also expected to fully recover to pre-pandemic (2019) arrival levels by 2023. As we move into the medium term (2024–2028), arrivals are projected to continue to grow, driven by an increasing number of flight networks. In addition, the report suggests that international tourism receipts will rise, boosted by travel and hospitality spending supported by easing inflationary pressures (Table 2).

Table 2.

Key forecasts (Greece 2021–2028).

3.3.5. Public Investment

The “National Strategic Reference Framework 2021–2027” (NSRF 2021–2027) reflects Greece’s new development strategies in alignment with the priorities of the European Commission for the coming years. A total of EUR 26.2 billion will be made available for Greece in the next seven years, of which EUR 20.9 billion will be allocated from European Union Support and EUR 5.3 billion to the National Contribution. Overall, the investment program reflects and prioritizes strengthening the economy’s productive potential, infrastructure, and human skills and enhancing social protection. At the same time, Greece has the National Development Program 2021–2025, which supports national investments in digital transformation, sustainable development, social development, infrastructure, tourism, and agriculture.

Following the COVID-19 pandemic, a new tool is available for public investments. NextGenerationEU is a comprehensive recovery and resilience program launched by the European Parliament and the Council of Europe in December 2021 [36]. The centerpiece of NextGenerationEU is the Recovery and Resilience Facility (RRF)—an instrument providing grants and loans to support reforms and investments in the EU member states. Within this context, the National Recovery and Resilience Plan “Greece 2.0”, approved by ECOFIN on 13 July 2021, includes 106 investments and 68 reforms and is expected to mobilize many investments in Greece by 2026 [37]. The current budget is EUR 36 billion [38].

The favorable economic environment in Greece, bolstered by the NSRF, the National Development Program, and “Greece 2.0”, creates a prime opportunity for investments in many emerging sectors. This alignment between national investment strategies and the seaplane sector underscores the potential for growth and innovation in Greece’s transportation infrastructure.

3.3.6. Index of Economic Freedom

The Index of Economic Freedom (IEF) is an annual guide published by the Heritage Foundation in Washington. The IEF measures the principles of economic freedom that fuel prosperity and progress in societies. It covers 12 freedoms—from property rights to financial freedom—in 184 countries. Greece’s economic freedom score is 55.1, making its economy the 113th freest in the 2024 Index of Economic Freedom. Greece is ranked 42nd out of 44 European countries, and its economy is considered “mostly unfree”. The country’s economic freedom score is lower than the world and regional averages. The Greek economy has been rebounding following structural reforms and the stabilization of the banking sector. However, institutional competitiveness remains challenging, the public sector still consumes a high percentage of GDP, and the rigid labor market impedes job growth. Unemployment and public debt remain high. Tourism and shipping are Greece’s most important and promising industries [39].

Regarding foreign investors seeking to invest in seaplane operations, the low value of IEF in Greece requires further analysis. As seen in Table 3, government spending and fiscal health have a detrimental effect on Greece’s IEF score. However, the other ten freedoms that have good scores are very encouraging. Finally, the correlation between seaplane operations and the tourism industry, which is doing well, is also very positive.

Table 3.

The 12 freedoms of the Index of Economic Freedom [39].

3.3.7. Public Service Operations

Member states of the European Union may opt to impose Public Service Obligations (PSOs) to maintain appropriate scheduled air services on routes vital for the economic development of remote regions. In all cases, they must respect the conditions and requirements in Articles 16–18 of Regulation 1008/2008 of the European Parliament and of the Council of 24 September 2008 on common rules for the operation of air services in the Community. If no air carrier is interested in operating the route on which the obligations have been imposed, the member state concerned may restrict the access to the route to a single air carrier and compensate its operational losses resulting from the PSO. The operator’s selection must be made by public tender at the European community level. Hence, all impositions, modifications, and abolitions of PSOs and the corresponding calls for tenders must be announced in the Official Journal of the European Union [40].

Regarding seaplanes, the Greek government may tender PSOs for new routes in remote islands. A public tender process will be held in all cases where operators must compete. This may help operators maintain financial viability in periods of low demand. However, caution is necessary so as not to overburden the state budget.

3.3.8. Logistics and Supply Chains

Unique difficulties are associated with managing supply chains on islands in Greece, including port congestion, seasonality, and infrastructural constraints that call for innovative logistics solutions [41]. Regarding the production and distribution of goods, seaplanes have a minor role in the supply chain since most operations will continue primarily through maritime transport. In some cases, they can provide low-volume but high-added-value cargo services. Their benefits are focused primarily on passengers by providing more options and extended mobility.

There are some issues regarding logistics and the supply chain during the construction and operation of water airports. In the construction phase, materials must be transferred to the islands, in most cases by ferry boats. In the operation phase, aviation fuel supply is a critical issue. In some locations, the delivery of aviation fuel is straightforward, i.e., Air BP, Shell, and EKO have about 25 jet fuel distribution centers on the mainland and many islands in Greece. For example, the existing distribution center can service the refueling of the water airport in Corfu. Regarding short trips, such as the Corfu-Paxoi itinerary, provisions can be made so seaplanes have enough fuel for their return journey. Hence, some water airports (like Corfu) will operate as regional hubs. Of course, a challenge arises in creating new distribution networks on islands that do not have land airports. Inadvertently, examining this issue highlights that jet fuel distribution networks are rendered obsolete by using electric seaplanes. However, battery charging facilities will need to be installed.

3.4. Social

3.4.1. Demographics

Greece is the southernmost of the countries on the Balkan Peninsula. The country’s development has been greatly influenced by geography. While the many mountains have restricted internal communications, the sea has opened up broader horizons. The total land area of Greece (one-fifth of which is made up of the Greek islands) is comparable in size to England. Greece has over 2000 islands, of which about 170 are inhabited [42]. According to the 2021 population census, the total population of Greece is 10.5 million. Approximately 15% of the population (1.6 mil.) live on islands. These inhabitants are distributed approximately in Crete (625,000), South Aegean (328,000), North Aegean (195,000), Ionian Islands (204,000), and Evoia 200,000 [43]. Greece faces a major demographic challenge since many young people migrate abroad or to the capital (Athens), seeking better employment and financial opportunities. At the same time, the islands’ economies are mainly dependent on tourism. As such, there are significant seasonal fluctuations in the population to cover the needs of the tourism industry. Overall, while the islands are one of the most fascinating and beautiful parts of Greece, offering development opportunities, there are significant difficulties in transportation, connectivity, and mobility.

3.4.2. Emergency Air Medical Evacuation

Access to healthcare is a significant problem in smaller islands, which have limited facilities and rely on medical professionals’ visits. In some cases, it is imperative to ensure medical evacuation to the mainland, which has more well-staffed hospitals. To this extent, several public authorities and private companies in Greece offer air medical evacuation (medevac) services. Public sector organizations primarily manage public air medical evacuations and are often part of the national healthcare and emergency response framework. Here are the main public entities involved in air medical evacuations:

Hellenic National Center for Emergency Care (EKAV) is Greece’s primary public emergency medical service provider. It operates a fleet of air ambulances, including helicopters and fixed-wing aircraft, for medical evacuation and transport. It also provides air medical evacuations for emergencies, including critical care transport from remote or inaccessible areas to specialized medical facilities.

Hellenic Air Force: It often assists in medical evacuations, especially in severe emergencies or disasters. It has specialized units and aircraft equipped for medical evacuation missions and provides air transport for critical patients, especially when civilian resources are insufficient or unavailable.

Hellenic Coast Guard: It is responsible for maritime safety and often assists with medical evacuations from ships or remote islands. They utilize helicopters and vessels equipped for medical emergencies to transport patients to mainland medical facilities, which are private sector companies.

Greece’s private medical evacuation companies play a vital role in the healthcare system by providing essential air and ground transport services for patients in critical conditions. Several private medical evacuation companies offer specialized services for air medical transport. They operate with high standards of medical care, advanced technology, and experienced personnel, ensuring the safety and well-being of patients during medical evacuations. Here are some of the notable private medical evacuation companies operating in Greece: MedEvac Greece, EuroAmbulance, Athens Assistance, Air Intersalonica H.A.T.T.C.S.A., Greek FlyingDoctors, and Greek Air Ambulance Network (GAAN). They all specialize in air ambulance services, offering rapid and efficient patient transport across Greece and beyond. They provide medical evacuations, patient transfers, and repatriation services. Their aircraft are outfitted with the latest medical equipment, and they have experienced medical staff to provide high-quality care during flights.

This robust infrastructure for emergency air medical evacuation in Greece, supported by public and private entities, highlights the country’s advanced capabilities in aviation services. This well-established framework also provides a strong foundation for the emerging seaplane industry. As seaplanes begin to operate in Greece, they can complement the existing air medical evacuation services, particularly in reaching remote islands and hard-to-access areas. Integrating seaplanes into the national transportation network could enhance the efficiency and reach of medical evacuations.

3.4.3. Accidents

Ison [44] sought to comprehensively analyze historical seaplane accident data in the United States. The study aimed to assess and analyze all historical National Transportation Safety Board accident reports since 1982. Considering the distinctive nature of seaplane operations and the safety implications, coupled with the lack of recent and comprehensive seaplane safety data, the need for an in-depth and thorough inquiry into seaplane safety was evident. Accident event sequences showed higher accidents during takeoffs among seaplanes. However, a comparison of the estimated seaplane accident rate per 100.000 h vs. that of non-seaplanes was similar. Additionally, between 1982 and 2021, considerable gains in seaplane safety were noted, with decreases in total and fatal accidents. In summary, seaplane operations have consistently become safer over time.

Xiao et al. [45] developed a practical Bayesian network (BN) model for risk assessment of seaplane operation. The safety risk factors were classified into four categories: pilot, aircraft, environment, and management. After that, a seaplane risk evaluation system was created with 18 indicators. It is found that the four most critical risk factors of seaplane operation are mental barriers, mechanical failure, visibility, and improper emergency disposal. Guo et al. [46] highlighted the importance of coordinating maritime and civil aviation authorities to improve safety management. MacDonald et al. [47] reviewed seaplane water accident investigations by the Transportation Safety Board of Canada (TSB) between 1995 and 2019. Drowning and being trapped within the cabin was the principal cause of death (54%). Over 50% of seaplanes inverted and sank, resulting in the highest percentage of fatalities. Loss of control in landing and other landing problems were the principal causes of accidents.

According to the Aircraft Owners and Pilots Association (AOPA), “Seaplane Accident Analysis Report 2008–2022”, seaplane accidents, while few, represent an area of general aviation where targeted focus on training can reduce the number of occurrences. A look at the defining events for seaplanes reveals that abnormal runway contact (ARC) causes the most seaplane accidents, followed by loss of control in flight (LOC-I), system component failure-power plant (SCF-PP) and loss of control on ground (LOC-G). The AOPA Air Safety Institute has developed some recommendations to mitigate accidents [48]. These are the following:

- Encourage seaplane pilot participation in the FAA activity survey;

- Encourage seaplane-specific training at seasonal intervals using the ASI Focused Flight Review program’s seaplane profile;

- Accentuate the importance of seasonal proficiency and “rusty” starts to season;

- Improve stick and rudder skills, with emphasis on seaplane-specific configurations (e.g., maneuverability on floats versus wheels and low-speed control);

- Install angle of attack indicators;

- Broaden installation of gear warning/alerting systems designed for land and water operations;

- Encourage all seaplane pilots to participate in the Seaplane Pilots Association’s “Positive rate, gear up” campaign;

- Conduct seaplane-specific decision-making training focusing on wind and water conditions and stabilized approaches.

3.4.4. Employment

The creation of employment opportunities in the Greek islands related to the operation of seaplanes is a critical issue for the economy. The water airports will require ground personnel, aircraft maintenance personnel, infrastructure personnel, baggage loading and control, aircraft security, infrastructure security, cleaning staff, and refueling staff. The planned network of water airports can create 2000 direct and 5000 indirect jobs [49]. The direct jobs concern the staff in the operation of the water airports and the seaplane airlines. The indirect jobs regard the staff in hotels, restaurants, and other tourism-related services. Overall, this will be a significant boost to the Greek economy.

3.5. Technological

3.5.1. Selected Aircraft

The Greek seaplane operators have selected the Cessna Caravan and the DH-6 Twin Otter for their flight operations. The Cessna Caravan is a rugged and flexible aircraft manufactured by Textron Aviation (Figure 1). Its powerful single turboprop engine delivers a rare combination of high performance, low operating costs, and the ability to adapt to various missions. The DHC-6 Twin Otter is manufactured by Viking Air (De Havilland Canada). It has a rugged airframe and is a twin-engine seaplane propelled by Pratt & Whitney technology, which increases the payload range and decreases operating costs. The specifications of both seaplanes are listed in Table 4.

Figure 1.

Cessna Caravan amphibian seaplane.

Table 4.

Basic specification of selected seaplanes.

We note that some other legacy seaplanes have piston engines and, therefore, in some cases, require leaded fuel, namely ‘avgas’. In the case of Greece, the selected aircraft that use turboprop Pratt & Whitney PT6A series engines, which are gas turbines, run on kerosene, which does not contain lead. In recent developments, some of these engines can also run on a blend of kerosene and 50% sustainable aviation fuel (SAF) [52]. Recently, researchers examined the PT6A-61A engine experimental operation in an aviation test bench using mixtures of JETA-1 and biodiesel [53]. Overall, significant ongoing research aims to shift to 100% SAF. In the future, this research and the efficient configuration of fuel supply chains will allow the deployment of SAF to achieve decarbonization in the aviation industry [54,55].

Recently, Hellenic Seaplanes announced that they had signed a Memorandum of Understanding (MoU) with Norwegian-based Elfly group, which is a pioneer in developing electric seaplanes. Under the agreement, Hellenic Seaplanes has made a commitment to purchase 10 electric-powered Noemi 9-seater aircraft from 2028. Naturally, Hellenic Seaplanes will continue its operations with Cessna and DHC-6 seaplanes.

3.5.2. Non-Fossil Fuel Seaplanes

Reducing greenhouse gas emissions has emerged as a priority for civil transport aviation. Hybrid-electric propulsion is a promising technological solution that will address the environmental impact of transport aviation shortly [56]. The electrification of the propulsion system has opened the door to a new paradigm of propulsion system configurations and novel aircraft designs, which had never been envisioned before [57]. Su-ungkavatin et al. [58] conducted an in-depth review of alternative technologies for sustainable aviation, which were classified into four main categories, namely (i) biofuels, (ii) electro fuels, (iii) electric (battery-based), and (iv) hydrogen aviation. Their motivation stemmed from climate neutrality becoming a long-term competitiveness asset within the aviation industry, as demonstrated by the several innovations and targets set within that sector. Ambitious timelines are set, involving essential investment decisions within a 5-year time horizon. Yao et al. [59] recognized that there has been a growing need for vehicles with air-water amphibious capacities in recent years for both military and civil applications. As a result, the hybrid aquatic–aerial vehicle (HAAV), which integrates the locomotion capacity of aerial vehicles and underwater vehicles, is facing a vast developing opportunity, and plenty of related technologies have emerged. After reviewing technological advances, they believe promising solutions for aquatic–aerial locomotion will inspire more practical studies in the HAAV field.

Sziroczak et al. [60] introduced a new conceptual design methodology adapted to developing new small aircraft supported by hybrid-electric propulsion systems. They highlight the low specific energy of the available battery technologies. In particular, the specific energy of kerosene is about 30 times greater than the specific energy of available batteries. One kg of kerosene contains about 11.94 KWh energy, whereas the specific energy of today’s batteries is about 400 Wh/kg. They conclude that hybrid-electric propulsion is the most likely answer to reaching reduced emission goals. Finally, Wang et al. [61] proposed a coupled energy efficiency optimization method for the takeoff phase of an electric seaplane’s electric propulsion unit (EPU). The efficiency and energy consumption of the propeller at different stages were calculated, identifying the points of highest efficiency. These angles were then validated through experiments with an RX1E-S electric seaplane, proving the method’s effectiveness and accuracy.

In April 2024, North America’s largest seaplane airline, Harbour Air, announced signing a Letter of Intent (LOI) with magniX, an electric aviation propulsion company, to purchase 50 magni650 electric engines. This is a significant milestone toward the electrification of Harbour Air’s fleet. The initial goal is to install the magni650 on the DHC-2 Beaver. After the maiden flight of the world’s first electric commercial aircraft in 2019, Harbour Air has operated 78 successful test flights with its prototype. Harbour Air’s ambitious timeline targets the commercial certification of its first electric aircraft by 2026. Adopting electric aviation technology will open the path for cleaner, quieter, more efficient, and more sustainable aviation [62].

Besides seaplanes, there is significant progress in de-carbonization in other aircraft. At a simulated 27,500 feet inside an altitude chamber at NASA’s Electric Aircraft Testbed (NEAT) facility, engineers at magniX recently demonstrated the capabilities of a battery-powered engine that could help turn hybrid electric flight into a reality. This milestone, completed in April 2024, marks the end of the first phase in a series of altitude tests at the facility under NASA’s Electrified Powertrain Flight Demonstration (EPFD) project. The initial round of tests investigated the effects of temperature and high voltage on the electric engine operating at flight levels. MagniX is retrofitting a De Havilland Dash 7 aircraft with a new hybrid electric propulsion system that combines traditional turbo-propellor engines with electric motors. This prototype vehicle will demonstrate fuel burn and emission reductions in regional aircraft carrying up to 50 passengers. After flight tests are completed, magniX will modify the aircraft in preparation for hybrid electric flight tests planned for 2026 [63].

3.5.3. Infrastructure

Greece’s seaplane transportation network requires significant infrastructure investments regarding flight operation, maintenance, and training. In terms of operation, there are three types of water airports, as outlined below [5]:

- One docking position applies to small areas with a modest population, which may have other water airports nearby and are not visited by many travelers;

- Hub-type, which provides up to six docking positions, aims to connect areas with a larger population and more visitors;

- Metropolitan-type, capable of accommodating up to twelve seaplanes. This type of water airport usually exists in the capitals of big islands and prefectures. They incorporate infrastructure necessary for seaplanes’ safe operation, including refueling facilities, waiting lounges, and arrival and departure gates.

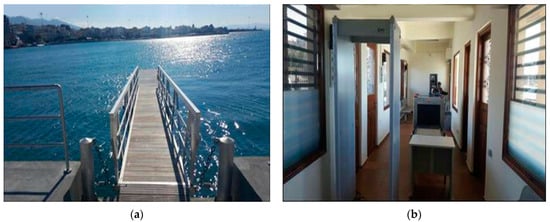

Figure 2a,b show the interior and exterior of Skyros water airport. The water airport facilitates all standard airport operations, i.e., check-in, security check, and a waiting area. It is a significant challenge to facilitate all these operations in a limited space. Usually, water airports are constructed within the proximity of an existing port to utilize other infrastructure. Figure 3a,b show Patra water airport.

Figure 2.

Skyros water airport: (a) exterior and (b) interior.

Figure 3.

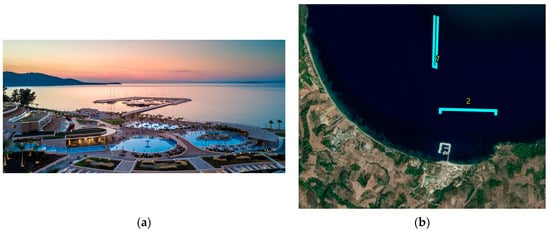

Patra water airport: (a) exterior and (b) interior.

Besides water airports, seaplanes can operate on waterways, which are essentially a group of committed seaplane landing areas. According to Greek Law, aircraft are allowed six pairs of takeoff and water landing (alighting) daily on a waterway. However, the incoming flight must have originated from an airport or water airport. The significant advantage of waterways is that they do not require the infrastructure of a water airport. Hence, their licensing procedure is simple and can be set up quickly. They usually serve hotels, resorts, or areas with difficult access. Figure 4 shows a 5-star hotel in Kassandra, Halkidiki. The two water landing areas are near the small marina and far from the beach. They each have a length of 650 m and a width of 20 m. Their precise geographical coordinates are defined in their licensing decision.

Figure 4.

Miraggio 5-star Thermal Spa Resort in Kassandra, Halkidiki: (a) hotel and marina; (b) aerial view of alighting/takeoff areas relative to hotel and marina.

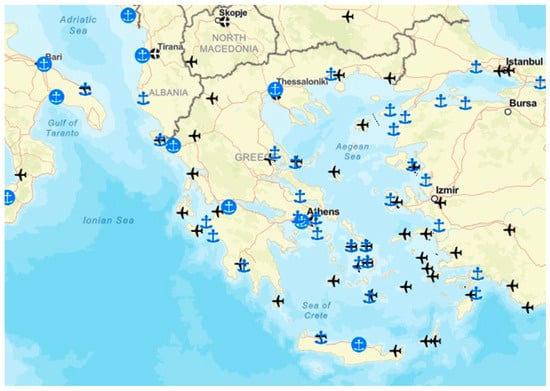

When completed, the entire seaplane transport network over the 13 administrative regions of Greece and Mount Athos will comprise 100 water airports (Table A1) and 200 waterways (Table A2). At the moment, nine water airports are constructed, eleven have been licensed, and the rest are still being licensed. Similarly, 18 waterways have been licensed, and the rest are obtaining their licenses. Two metropolitan-type water airports will be set up in Athens and Thessaloniki later as the fleet of seaplanes increases. There are three water airports at lakes: Vegoritida, Taka, and Pamvotida (Ioannina). The other water airports are on the coastal area of the mainland and, of course, the islands. Figure 5 shows the complete water airport network that is under development.

Figure 5.

Seaplane transport network—water airports.

Additionally, maintenance hangars are necessary. At the moment, Hellenic Seaplanes plans to have two hangars: one in Chalkida (area of 4000 m2), which can accommodate three seaplanes, and one in Kyllini (area of 3000 m2), which can accommodate two seaplanes. Regular maintenance is required according to national regulations and the requirements set by the seaplane manufacturers.

As the network of water airports increases, so will the required number of pilots. Creating a pilot academy in Greece to train a new generation of seaplane pilots would be sensible. This would require cooperation with certified seaplane pilot trainers.

3.5.4. Water Airport Safety Inspection by Drones

The safe operation of water airports is of utmost importance. The 5D AeroSafe project is a research program funded by the European Union. Its main objective is to apply innovative technologies to maximize aviation safety by offering drone inspection capabilities for airports and air navigation systems of civil aviation, as well as a unique solution for water airports. Utilizing drone technologies and artificial intelligence techniques, the final product will be an integrated water airport management system that will maximize the safety of seaplane landing and takeoff, reduce the administrative costs of water airport operation, and provide water airport operators with a comprehensive situational awareness tool. Airbus coordinates the project consortium, while the Greek companies Future Intelligence, Greek Water Airports, and Hellenic Mediterranean University are heavily involved. ENAC from France, ITWL from Poland, Vicomtech from Spain, Airmap from Germany, and Ferrovial from Spain are consortium members. EUROCONTROL participates as a consultant and observer in the consortium. The consortium is in close collaboration with the Hellenic Civil Aviation Authority (HCAA) to define the necessary regulatory procedures to ensure that all conditions are met for the successful execution of the pilots. The project’s developments are anticipated to significantly contribute to the safety of water airports and airport operations while expanding the field of emerging and innovative services in air navigation. The HCAA will cooperate with EASA to establish the necessary legislative framework for the safe operation of drones [64,65].

In July 2023, in the port of Lavrio, Greece, Pilot 2A was held, which concerned water airport inspection. The demonstration presented the capabilities of the system designed as part of the 5D-AeroSafe project. The software application allows the creation of mission scenarios sent to the UAV, which in turn carries out the mission automatically according to the plan. The UAV can identify unwanted objects in the water, which may affect the seaplane operation [66]. Greek Water Airports (GWA) specializes in designing, constructing, and managing water airports. Participating in the 5D-Aerosafe project will allow it to adopt the solution in time for water airport management and operations [67]. Figure 6 illustrates four seaplane landing areas (with red lines) in the Lavrio water airport. Before every seaplane alighting, the drone is sent on a specific mission to assess safety.

Figure 6.

Indicative water airport alighting areas for drone safety inspection.

3.6. Legal

3.6.1. Trans-European Transport Network

The Trans-European Transport Network (TEN-T) policy has traditionally been based on Regulation (EU) No 1315/2013 of the European Parliament and of the Council of 11 December 2013 as revised in 2014, 2016, 2017, 2019, 2023, and 2024. The regulation identifies projects of common interest and specifies the requirements to be complied with for managing the infrastructure of the Trans-European Transport Network. In terms of mode of transport, it focuses on inland waterways, conventional rail, high-speed rail, roads, ports, airports, and rail-road terminals. The regulation establishes guidelines for developing a Trans-European Transport Network comprising a dual-layer structure consisting of comprehensive and core networks, the latter being established based on the comprehensive network. The comprehensive network shall comprise all existing and planned transport infrastructures of the Trans-European Transport Network identified in the regulation. The core network shall consist of those parts of the comprehensive network with the highest strategic importance. Regarding Greece, Annex II of the regulation lists all nodes of the core and comprehensive networks, particularly of airports and maritime ports. Very recently, Regulation (EU) 2024/1679 replaced 1315/2013.

Interestingly, the regulation does not refer to water airport infrastructure or seaplane operations in Greece or the rest of Europe. This indicates that policymakers do not view seaplanes as a significant contributor to the TEN-T network. Overall, there is a significant gap in the legal framework regarding the transportation planning policy for new seaplane operations.

The spatial planning of the location of water airports must consider the core and comprehensive TEN-T network. Figure 7 shows the core and comprehensive TEN-T network regarding ports and airports in Greece from the TENtec interactive GIS map website (Regulation 1315/2013). Greece has 20 comprehensive ports and five core ports: Athens (Piraeus), Patra, Igoumenitsa, Thessaloniki, and Heraklion. Greece has 35 comprehensive airports and three core airports in Athens, Thessaloniki, and Heraklion. On the one hand, when water airports are near the core and comprehensive network infrastructure, a high degree of intermodality is achieved. On the other hand, when water airports are in a location other than the core and comprehensive network, they enhance connectivity by extending the European transport network. The transport network has five layers: core network, comprehensive network, other ports and airports, water airports, and waterways.

Figure 7.

Core and comprehensive TEN-T ports and airports in Greece and neighboring countries [68]–Regulation 1315/2013. A circle indicates a core node.

3.6.2. Greek Laws Regarding Water Airports and Waterways

In 2013, the Greek government introduced the first law regarding waterway operations. Law 4146/18-4-2013 established the initial guidelines for seaplane terminal operations in Greece and stated that licenses for waterway operations would have no time limit.

Later, law 4568/2018 replaced the previous law to simplify water airport licensing. The law set the framework for licensing, operating, and utilizing water airports, including rules for safe seaplane operation. It contained additional sections covering matters of traffic responsibility and the distribution of duties between governmental and privately owned entities. The law also accounted for international flights operated by seaplanes.

A second revision of the original law in Greece (Law 4663/2020) introduced the reactivation of seaplanes in harbors and lakes [69]. Law 4663/2020 contains relevant information on the operation of maritime airports, environmental requirements, flight conditions, and general provisions. This law complements and amends Law 4568/2018, which had already provided some consistency to the projects, making it a crucial foundation for developing seaplane projects. Under this law, the Ministry of Infrastructure and Transport launched a new era in the field of waterways. The main issues of the latest law are presented below.

Information about waterway licenses: Article 1 of the law introduces three types of licenses: a “license for establishment”, a “license for operation”, and an “establishment and operation license” to expedite the process for waterway projects. Public bodies needing funding for infrastructure can use a procurement procedure to operate waterways. Establishing watercourses may be considered within strategic investments, provided the conditions outlined in Law 4608/2019 (Article 66) are met. The law redefines the “establishment license”, eliminating the need for equipment manufacturing and enabling immediate issuance. This encourages infrastructure development and attracts investors [70].

The law allows licenses for individuals, expanding opportunities for private investors. Licensing is regulated by joint ministerial orders, with additional requirements for tourist development areas and ports. Environmental approvals are necessary, depending on the status of the water airport. License durations vary: “establishment license” and “uno actu license” are indefinite with valid environmental approvals, while the “operation license” matches waterway contract durations, which are at least five years.

Location: The law allows for the establishment and operation of waterways in tourist development areas, accommodations, and ports, boosting tourism.

License transfer and concession: All three types of licenses are eligible for transfer to individuals or legal entities who meet the specified criteria detailed in the pertinent legislation governing license acquisition. Moreover, holders of a “license for establishment and operation” possess the authority to entrust the operation of waterway facilities and services to suitable individuals or legal entities following the provisions explicitly articulated in Article 12.

Waterway operating fees and staff training: Each aircraft company must pay a fee per departing passenger, capped at EUR 10, along with applicable stamp duty remitted to the Greek State (Article 19). Furthermore, personnel training is conducted by the Civil Aviation Authority and other certified internal or external entities, as outlined in Article 20.

Waterways: The law outlines the procedures for approving and operating waterways in Greece, involving the navy, air force, Civil Aviation Authority (CAA), and the Hellenic Coastguard. Applications must include nautical charts, and approved areas are marked for public use. Operation rules cover environmental protection, international flight restrictions, flight times, and passenger safety. Pilots must notify port authorities, avoid risky maneuvers near people or boats, and ensure security checks for passengers and cargo. Pilots are also responsible for safety and compliance, limiting daily aircraft movements and violation penalties.

3.6.3. Licenses Required for Commercial Operations

The Hellenic Civil Aviation Authority (HCAA) is responsible for regulating and overseeing all aspects of civil aviation, including the operation of seaplanes. The HCAA ensures that seaplane operations adhere to national and international safety standards and regulations. One of its primary responsibilities includes issuing licenses and certifications for pilots, air traffic controllers, maintenance engineers, other aviation professionals, and airlines and aircraft. After licensing, operators are subject to continuous oversight by HCAA. They are audited regularly for competence and adequacy of resources in areas such as compliance monitoring, management and organizational structure, crew training, flight planning, flight inspections, ground operations, and many others. Before commercial operation, seaplane operators must hold three licenses: an Aircraft Maintenance License (AML), an Air Operator Certificate (AOC), and an Air Carrier Operating License (ACOL).

To obtain an EASA Part-66 AML, an applicant must demonstrate knowledge and experience in maintenance activities. An AOC is a certification granted by a national aviation authority to an aircraft operator to allow it to use aircraft for commercial purposes [71]. The specific requirements and regulations for obtaining an AOC can vary by country, but generally, they cover similar aspects of safety, maintenance, and operations. This AOC is issued according to Commission Regulation (EU) No 1139/2018 as amended and its implementing rules. Finally, operators must also hold a valid Air Carrier Operating License issued by the HCAA under Regulation (EC) No 1008/2008 as amended. In Greece, all three license applications are submitted to the HCAA.

Besides the technical requirements, attaining licenses also requires a detailed business plan that proves the operator can meet its actual and potential obligations established under realistic assumptions for 24 months from the start of operations. Furthermore, it should demonstrate that it can operate for three months from the start of operations without attaining any income. The business plan must include a projected balance sheet, including a profit-and-loss account, for three years. The project expenditures and income figures must be well documented.

3.7. Environmental

3.7.1. Framework for Environmental Licensing

Water airports must ensure environmental licensing as part of attaining an operation license. Greek Law 4014/2011 outlines the procedures regarding environmental licensing. Projects are distinguished into two categories: A—regarding projects likely to impact the environment significantly, requiring an Environmental Impact Assessment (EIA) study and an Environmental Terms Approval Decision; and B—projects with localized and insignificant environmental impacts. In some cases, the environmental licensing of a category A water airport is studied relative to the pre-existing environmental terms of the port in which it is established. A joint ministerial decision (Government Gazette 3497B 31 July 2021) was recently issued regarding the Standard Environmental Commitments (SEC) of category B water airports to address the significance of advancing environmental licensing regarding seaplanes. Table 5 summarizes such SEC conditions. Most of the water airports are considered category B projects. In all cases, the government agency granting environmental licensing must seek the opinion of the relevant archaeological agency.

Table 5.

Standard environmental commitments in water airports.

We highlight the importance of continuously monitoring SEC during operations to avoid negative social impacts. For example, licensing legislation emphasizes monitoring noise levels during operation. Measurements must be taken at least twice a year (in the summer period or time of peak demand) during the course of 24 h. Measurements are taken at sensitive points like schools, medical centers, infrastructure, and residencies. Specifically, the following indices are monitored, ,, , and . The highest allowable noise level is 70 dB(A) on the index. If this level is exceeded, noise protection actions will be enforced, including restrictions on the number of movements of seaplanes.

3.7.2. Environmental Impact of Seaplanes

A five-year study by the U.S. Army Corps of Engineers, who are responsible for the waterways in the U.S.A., on the environmental impact of seaplanes found no adverse effects on air, water, or soil quality, nor wildlife, fisheries, or hydrology. Seaplanes are favorable as their operations do not disturb marine life. A seaplane’s propeller is entirely above the water and thus does not disturb sediments or marine life or contribute to marine noise pollution. Seaplanes generate no more than a 2–3-inch wake—not enough to be a factor in shoreline erosion. Unlike other watercraft, seaplanes do not discharge pollutants like oil, fuel, or sewage into the water and are not treated with toxic paints. Seaplanes do not discharge gallons of fuel and oil into the water as many other powered watercraft do. Unlike boats, the exhaust from a seaplane’s engine is discharged into the air well above the water’s surface, where it can dissipate without impacting water quality. Seaplanes do not discharge the contents of chemical toilets overboard. Also, seaplane aviation fuel does not contain the toxic additive MTBE found in automotive and marine fuels [72,73,74]. Finally, considering their low environmental impacts, seaplanes are one of the few forms of transport allowed on the Great Barrier Reef [75], a very sensitive marine ecosystem.

Greece could leverage seaplanes to enhance connectivity between its islands while preserving the natural beauty and marine ecosystems central to its tourism industry. Seaplanes’ ability to operate without disturbing marine life aligns well with Greece’s need for sustainable transportation options supporting environmental conservation and economic development.

3.7.3. Etesian Winds

The Etesian winds (annual winds), also called Meltemi, blow between the northwest and northeast in the Aegean Sea in the summer. They represent a crucial climatic element in the eastern Mediterranean during summer and early autumn. The Etesians result from a low-pressure system that stretches from Anatolia to northwest India and is formed by intense heating of the region. This peak in August when the mean wind speed is around 8 ms−1 and the maximum values mean between 15 ms−1 and 17 ms−1 in the southern Aegean [76,77,78].

One of the critical challenges for seaplane operations is the Etesian winds in the Aegean Sea, which peak during the highest passenger travel demand period. To address this, seaplane operators can implement a range of strategies. These include designing water airports as wind-resistant as possible, allowing for takeoff, and alighting at high wind speeds from multiple directions. Alternatively, islands could have two water airports at opposite ends, ensuring one is always operational. Sometimes, a waterway could be used instead of a water airport. Moreover, amphibious seaplanes could land on land airfields to avoid disrupting scheduled flights in extreme situations.

3.7.4. Integrated Reporting for Sustainability

Influenced by the COVID-19 pandemic, geopolitical tensions, and military conflicts, the global landscape significantly impacts airports’ economic development and consumer behavior [79]. This research reports that these factors have increased consumer expectations, which has led to increased competition in the airport industry and the demand for better services. In this environment, customer satisfaction is essential and is measured using models such as SERVQUAL, SKYTRAX, and Kano [79,80]. As a valuable tool for comprehensively assessing social, financial, and environmental indicators, integrated reporting (IR) assists airport managers in redesigning Key Performance Indicators (KPIs) and enhancing business transparency. This approach aligns with the need for multi-criteria decision-making in sustainability and business development.

Uzule [81] examined airports in Northeastern Europe as they used IR to report on annual performance and sustainability. The adoption of IR is limited, but an increasing emphasis on sustainability indicates a shift toward reporting focused on sustainability issues. Projects like the construction of Riga Airport City illustrate how stakeholders’ demands and evolving industry trends drive this transition. Airport infrastructure investments and sustainable development are prominent components of national development plans, such as Latvia’s Sustainable Development Strategy until 2030. Through initiatives such as RailBaltic, Baltic airports can become more competitive and accessible, leading to greater regional integration and connectivity.

For the seaplane industry in Greece, which is on the brink of significant growth, embracing IR can provide a competitive edge by offering a comprehensive view of operations that includes financial, environmental, social, and governance factors. As such, IR can help seaplane operators enhance transparency, improve stakeholder engagement, and ensure sustainable business practices. This approach meets rising consumer demands and strengthens the seaplane industry’s competitiveness and resilience in the rapidly changing market, promising an exciting future.

3.7.5. Archaeological Issues