FinTech Companies: A Bibliometric Analysis †

Abstract

:1. Introduction

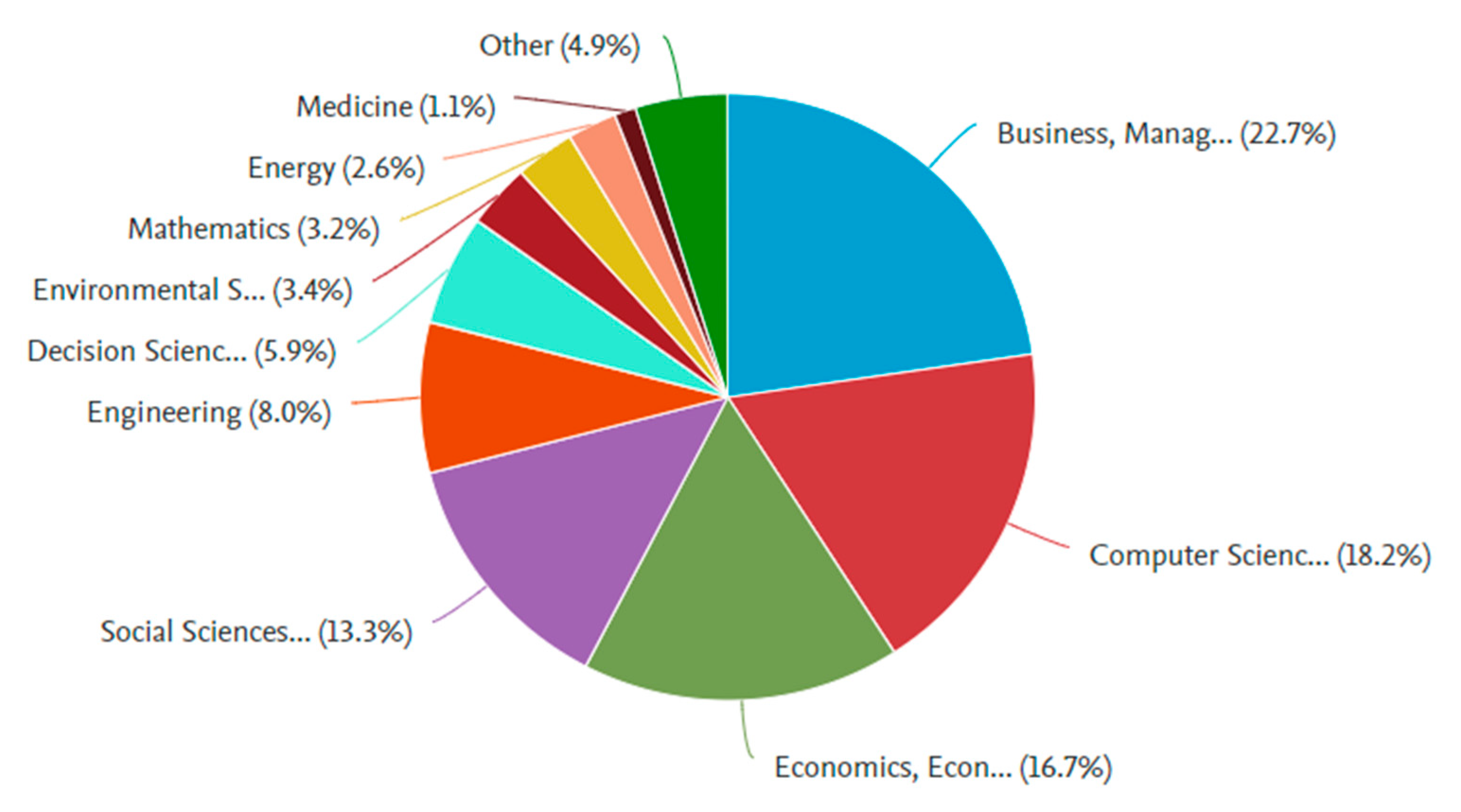

2. Research Method

Research Questions

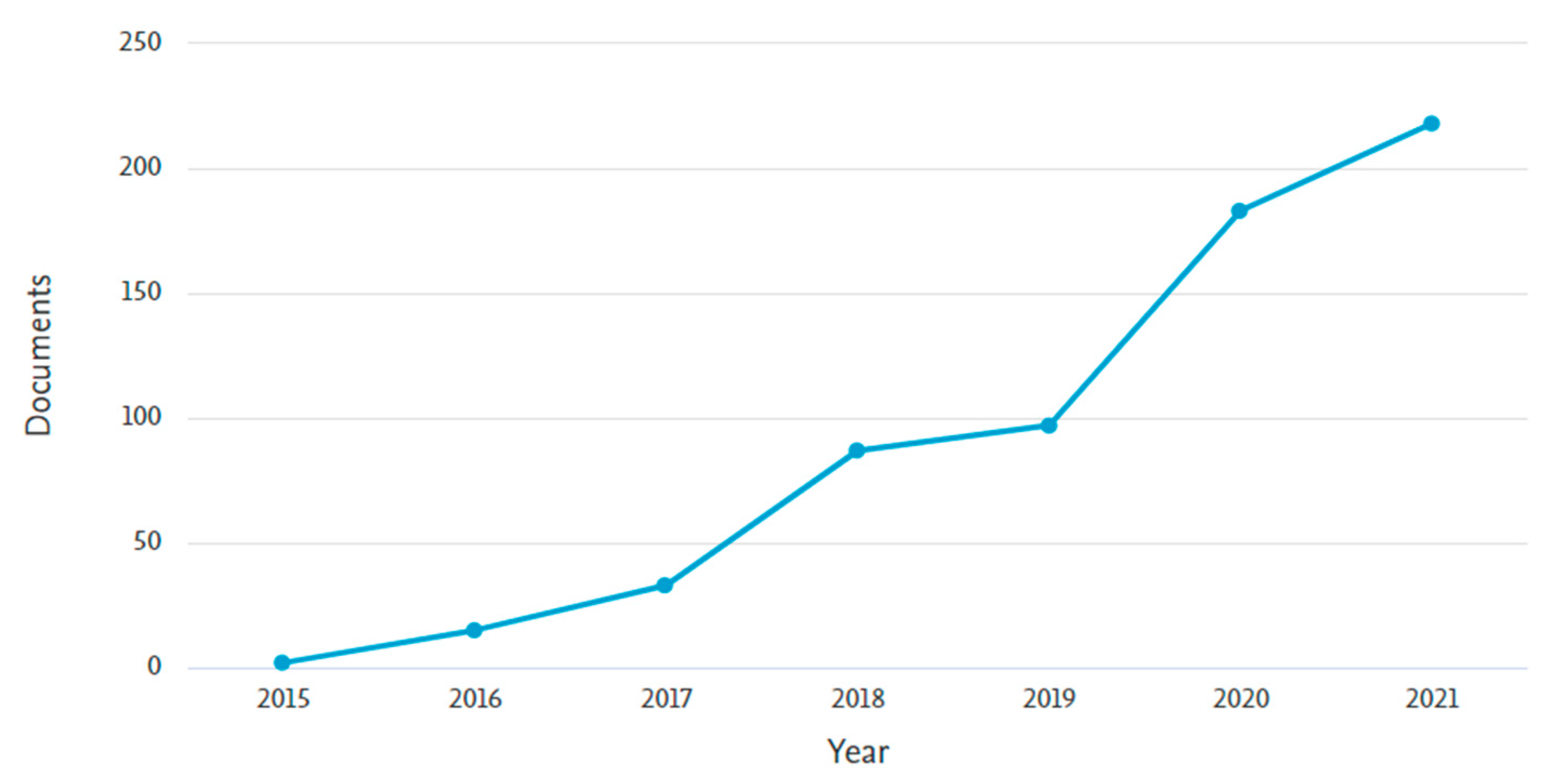

- RQ1. How has the literature developed between 2015 and 2021?

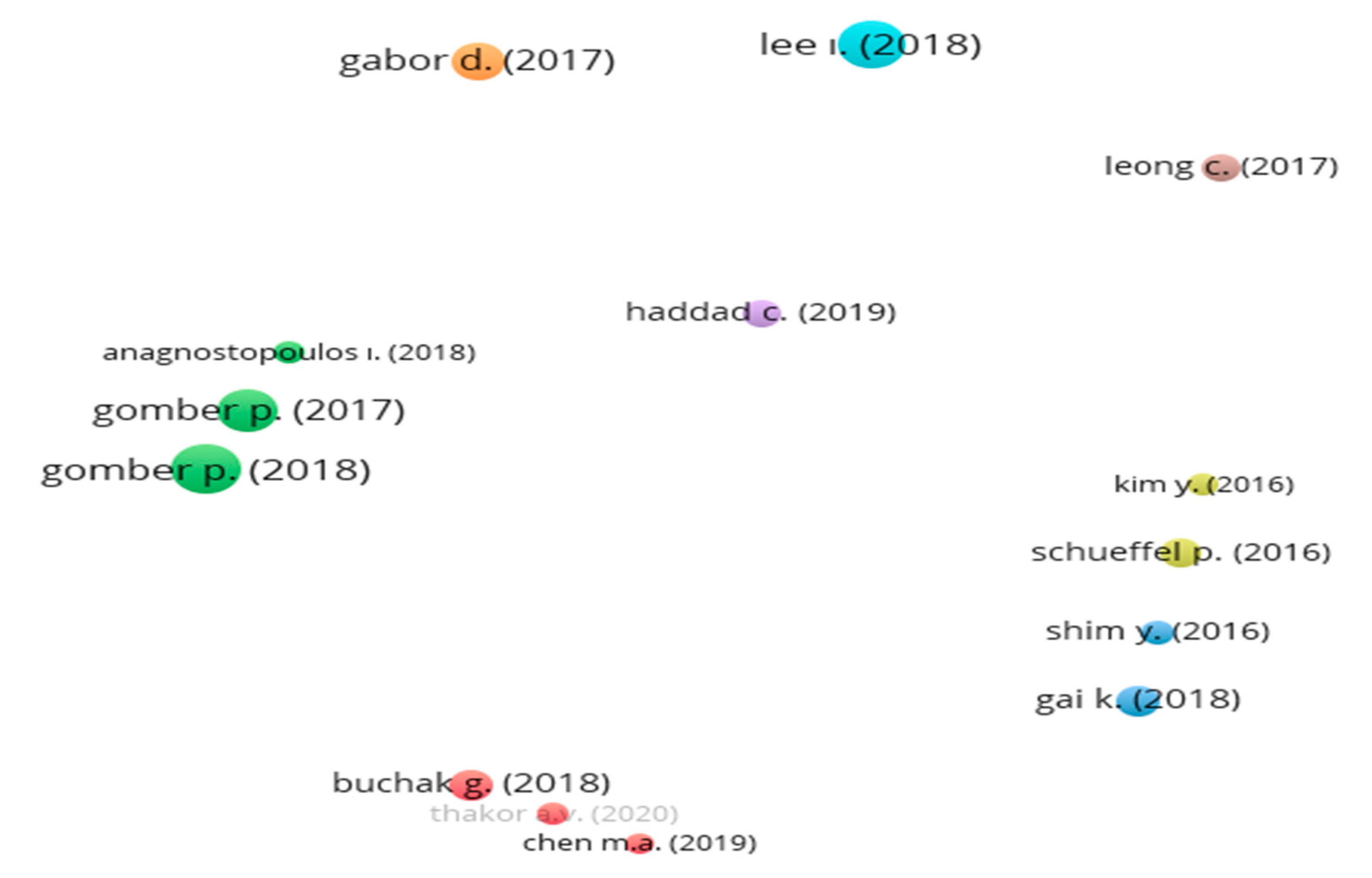

- RQ1.1. What are the most influential studies and authors?

- RQ1.2. What are the main studies in FinTech?

- RQ1.3. What are the distributions and impacts of publications over time?

- RQ2. What are the important topics in the FinTech literature?

- RQ3. Are the results compatible with Lotka’s Law?

- RQ4. Are the results compatible with Bradford’s Law?

3. Sampling and Methodology

Bibliometric Analysis

4. Findings

4.1. Author Influence

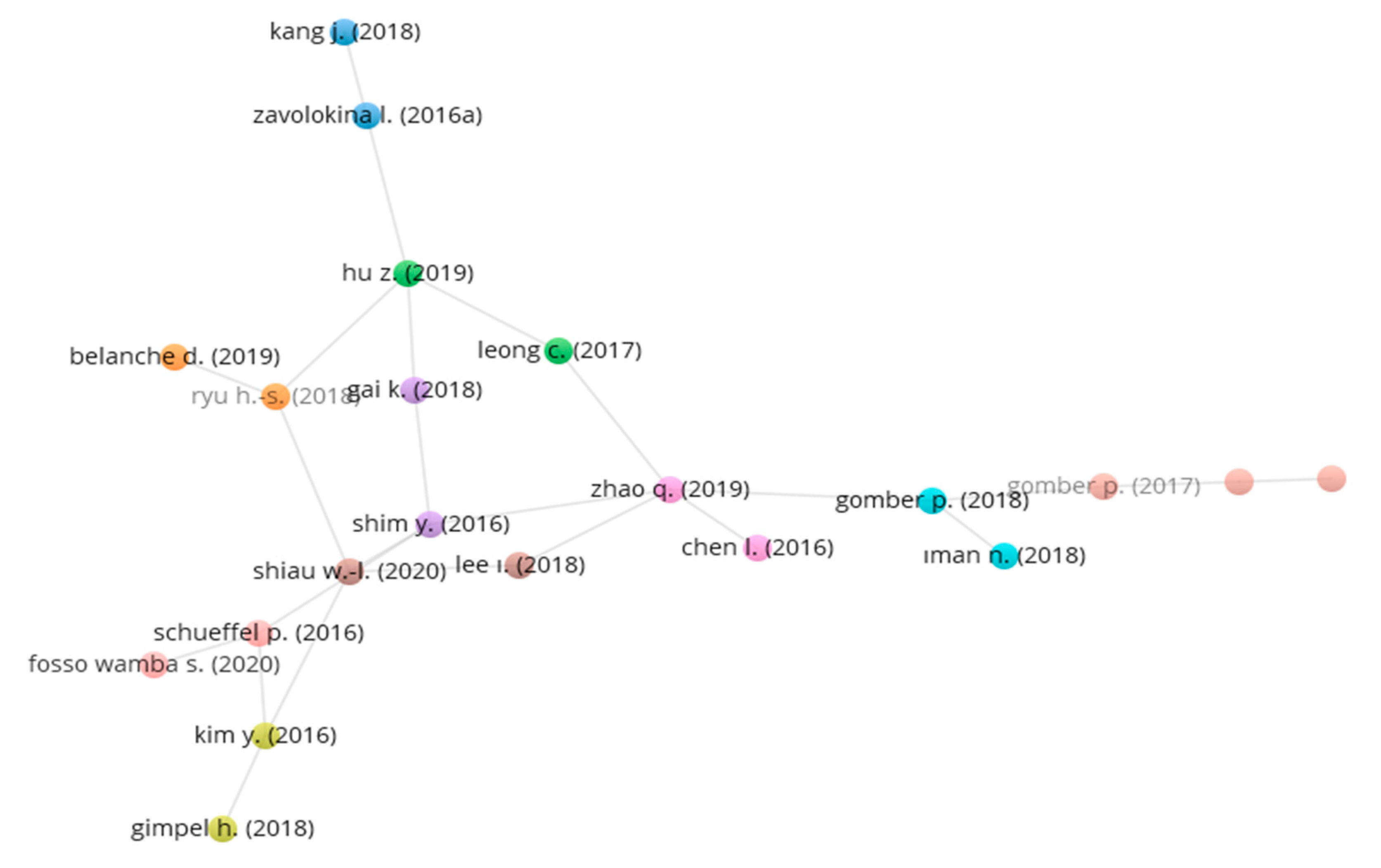

4.2. Centrality of Publications

4.3. Centrality of Keywords

4.4. Lotka’s Law

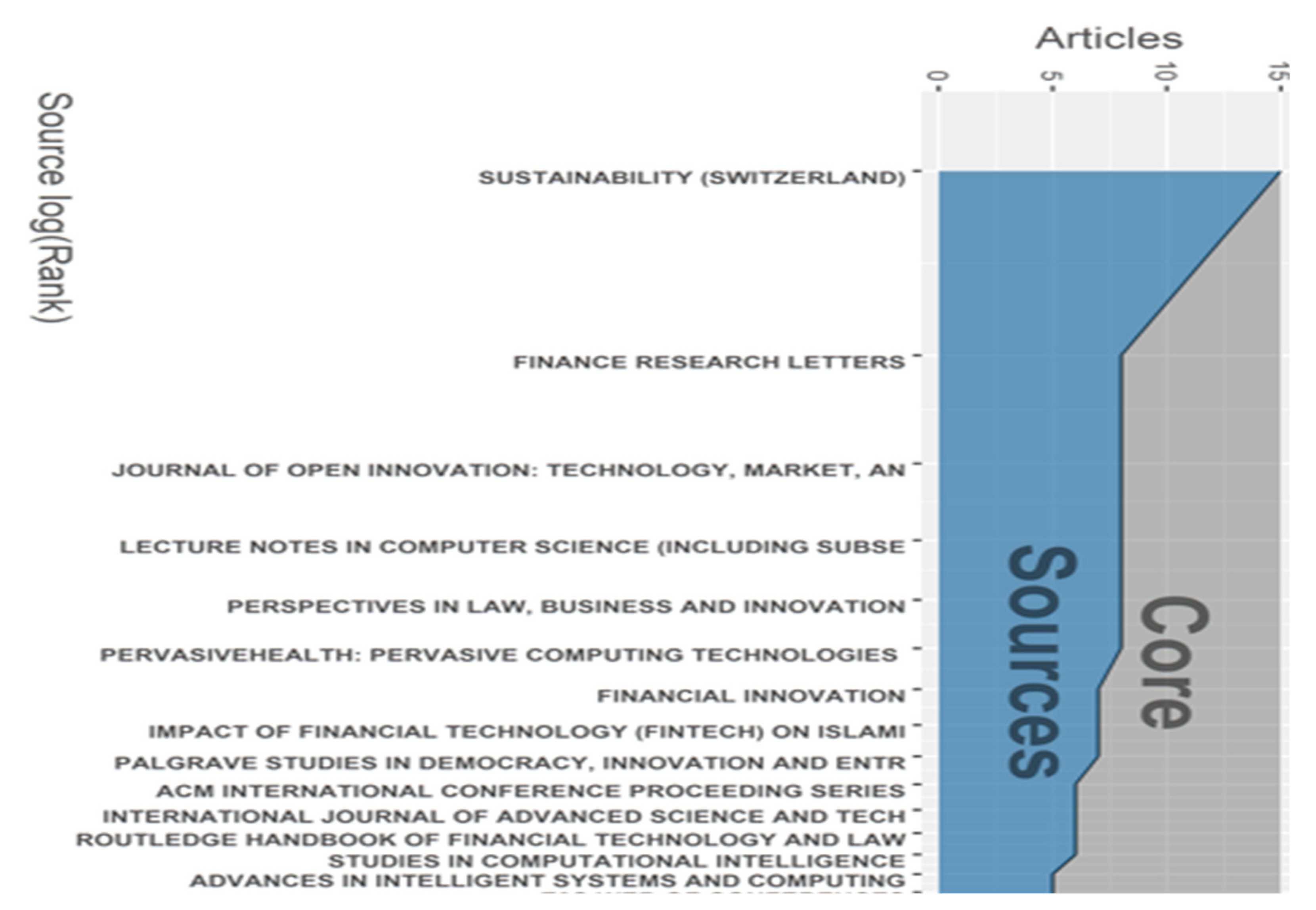

4.5. Bradford’s Law

5. Results and Discussion

- RQ1. How has the literature developed over time?

- RQ1.1. What are the most influential studies and authors?

- RQ1.2. What are the main studies in FinTech?

- RQ1.3. What are the distributions and effects of publications over time?

- RQ2. What are the important topics in the FinTech literature?

- RQ3. Are the results compatible with Lotka’s Law?

- RQ4. Are the results compatible with Bradford’s Law?

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Al-Ajlouni, Ahmed Taha, and Monir Suliaman Al-Hakim. 2018. Financial Technology in Banking Industry: Challenges and Opportunities. International Conference on Economics and Administrative Sciences ICEAS2018. Available online: https://www.researchgate.net/publication/331303690_Financial_Technology_in_Banking_Industry_Challenges_and_Opportunities (accessed on 18 December 2021).

- Albort-Morant, Gema, and Domingo Ribeiro-Soriano. 2016. A bibliometric analysis of international impact of business incubators. Journal of Business Research 69: 1775–79. [Google Scholar] [CrossRef]

- Ante, Lennart, Philipp Sandner, and Ingo Fiedler. 2018. Blockchain-Based ICOs: Pure Hype or the Dawn of a New Era of Startup Financing? Journal of Financial Risk and Management 11: 80. [Google Scholar] [CrossRef] [Green Version]

- Arner, Douglas W., Janos Barberis, and Ross P. Buckley. 2016. The Evolution of Fintech: A New Post-Crisis Paradigm? Available online: https://doi.org/10.2139/ssrn.2676553 (accessed on 18 December 2021).

- Arner, Douglas W., Jànos Barberis, and Ross P. Buckley. 2017. FinTech and RegTech in a Nutshell, and the Future in a Sandbox. Available online: https://doi.org/10.2139/ssrn.3088303 (accessed on 18 December 2021).

- Berkmen, Pelin, Kimberly Beaton, Dmitry Gershenson, Javier Arze del Granado, Kotaro Ishi, Marie Kim, Emanuel Kopp, and V. Marina. 2019. Fintech in Latin America and the Caribbean: Stocktaking. IMF Working Paper(WP/19/71). Available online: https://www.elibrary.imf.org/downloadpdf/journals/001/2019/071/article-A000-en.xml (accessed on 18 December 2021).

- Blasco-Carreras, Cristina, Gema Albort-Morant, and Belén Ribeiro-Navarrete. 2015. Impacto internacional del crowdsourcing como nuevo topic de interés en el campo científico del emprendimiento: Análisis bibliométrico del periodo 2008–2015. Universitas: Gestão e TI 5. [Google Scholar] [CrossRef] [Green Version]

- Blažun Vošner, Helena, Samo Bobek, Simona Sternad Zabukovšek, and Peter Kokol. 2017. Openness and information technology: A bibliometric analysis of literature production. Kybernetes 46: 750–66. [Google Scholar] [CrossRef]

- Bradford, Samuel C. 1985. Sources of information on specific subjects. Journal of Information Science—Lecture Notes in Computer Science 10: 17–180. First published 1929. [Google Scholar] [CrossRef]

- Buchak, Greg, Gregor Matvos, Tomasz Piskorski, and Amit Seru. 2018. Fintech, regulatory arbitrage, and the rise of shadow banks. Journal of Financial Economics 130: 453–83. [Google Scholar] [CrossRef]

- Cadavid Higuita, Lorena, Gabriel Awad, and Carlos Jaime Franco Cardona. 2012. A Bibliometric Analysis of a Modeled Field for Disseminating İnnovation. Estudios Gerenciales, 213–36. Available online: http://www.scielo.org.co/scielo.php?pid=S0123-59232012000500012&script=sci_arttext&tlng=pt (accessed on 18 December 2021). [CrossRef] [Green Version]

- Cancino, Christian A., Ariel I. La Paz, Juan C. Salazar-Elena, and José Guimón. 2017. Most Influential Journals and Authors in Digital Business Research: A Bibliometric Analysis. CONF-IRM 2017 Proceedings. Available online: https://aisel.aisnet.org/confirm2017/20/ (accessed on 18 December 2021).

- Cao, Shuyan, Yanan Cao, Xiaoyu Wang, and Yanqiao Lu. 2017. A Review of Researches on Blockchain. WHICEB 2017 Proceedings. Available online: https://aisel.aisnet.org/whiceb2017/57/ (accessed on 18 December 2021).

- Dabbagh, Mohammad, Mehdi Sookhak, and Nader Sohrabi Safa. 2019. The Evolution of Blockchain: A Bibliometric Study. IEEE Access 7: 19212–21. [Google Scholar] [CrossRef]

- Dorfleitner, Gregor, Lars Hornuf, Matthias Schmitt, and Martina Weber. 2017. Definition of FinTech and Description of the FinTech Industry. In FinTech in Germany. Berlin: Springer, pp. 5–10. [Google Scholar] [CrossRef]

- Dospinescu, Octavian, Bogdan Anastasiei, and Nicoleta Dospinescu. 2019. Key Factors Determining the Expected Benefit of Customers When Using Bank Cards: An Analysis on Millennials and Generation Z in Romania. Symmetry 11: 1449. [Google Scholar] [CrossRef] [Green Version]

- Dospinescu, Octavian, Nicoleta Dospinescu, and Daniela-Tatiana Agheorghiesei. 2021. FinTech Services and Factors Determining the Expected Benefits of Users: Evidence in Romania for Millennials and Generation Z. E&M Economics and Management 24: 101–18. [Google Scholar] [CrossRef]

- Dugast, Jérôme, and Thierry Foucault. 2018. Data abundance and asset price informativeness. Journal of Financial Economics 130: 367–91. [Google Scholar] [CrossRef]

- Fairthorne, Robert A. 1969. Empirical Hyperbolic Distributions (Bradford-Zipf-Mandelbrot) for Bibliometric Description and Prediction. Journal of Documentation 25: 319–43. [Google Scholar] [CrossRef]

- Freeman, Linton C. 1979. Centrality in social networks conceptual clarification. Social Networks 1: 215239. [Google Scholar] [CrossRef] [Green Version]

- Gabor, Daniela, and Sally Brooks. 2017. The Digital Revolution in Financial Inclusion: International Development in the FinTech Era. New Political Economy 22: 423–36. [Google Scholar] [CrossRef]

- Gai, Keke, Meikang Qiu, and Xiaotong Sun. 2018. A Survey on FinTech. A Journal of Network and Computer Applications 83: 262–73. [Google Scholar] [CrossRef]

- Gomber, Peter, Jascha-Alexander Koch, and Michael Siering. 2017. Digital Finance and FinTech: Current research and future research directions. Journal of Business Economics 87: 537–80. [Google Scholar] [CrossRef]

- Gomber, Peter, Robert J. Kauffman, Chris Parker, and Bruce W. Weber. 2018. On the Fintech Revolution: Interpreting the Forces of Innovation, Disruption, and Transformation in Financial Services. Journal of Management Information Systems 35: 220–65. [Google Scholar] [CrossRef]

- Gozman, Daniel, and Leslie Willcocks. 2019. The emerging Cloud Dilemma: Balancing innovation with cross-border privacy and outsourcing regulations. Journal of Business Research 97: 235–56. [Google Scholar] [CrossRef]

- Haddad, Christian, and Lars Hornuf. 2019. The emergence of the global fintech market: Economic and technological determinants. Small Business Economics 53: 81–105. [Google Scholar] [CrossRef] [Green Version]

- History of the Basel Committee. 2019. History of the Basel Committee. Retrieved from Bank of International Settlements. Available online: https://www.bis.org/bcbs/history.htm (accessed on 18 December 2021).

- Hochstein, Marc. 2015. Fintech (the Word, That Is) Evolves. American Banker. Available online: https://www.americanbanker.com/opinion/fintech-the-word-that-is-evolves (accessed on 18 December 2021).

- Hu, Zhongqing, Shuai Ding, Shizheng Li, Luting Chen, and Shanlin Yang. 2019. Adoption Intention of Fintech Services for Bank Users: An Empirical Examination with an Extended Technology Acceptance Model. Symmetry 11: 340. [Google Scholar] [CrossRef] [Green Version]

- Ji, Fen, and Ai Tia. 2021. The effect of blockchain on business intelligence efficiency of banks. Kybernetes. [Google Scholar] [CrossRef]

- Kaplan, Steven N., and Josh Lerner. 2016. Venture Capital Data: Opportunities and Challenges. NBER Working Paper Series; Chicago: University of Chicago Press. [Google Scholar] [CrossRef]

- Karafiloski, Elena, and Anastas Mishev. 2017. Blockchain Solutions for Big Data Challenges: A Literature Review. Paper presented at the IEEE Eurocon 2017—17th International Conference, Ohrid, Macedonia, July 6–8; pp. 763–68. [Google Scholar] [CrossRef]

- Kim, Seoyoung, Atulya Sarin, and Daljeet Virdi. 2018. Crypto-Assets Unencrypted. Journal of Investment Management 16: 99–129. [Google Scholar] [CrossRef] [Green Version]

- Kotarba, Marcin. 2016. New factors inducing changes in the retail banking customer relationship management (CRM) and their exploration by the fintech. Foundations of Management 8: 69–78. [Google Scholar] [CrossRef] [Green Version]

- Kumari, Anita, and Anil Kumar Sharma. 2017. Infrastructure financing and development: A bibliometric review. International Journal of Critical Infrastructure Protection, 49–65. [Google Scholar] [CrossRef]

- Lee, In, and Yong Jae Shin. 2018. Fintech: Ecosystem, business models, investment decisions, and challenges. Business Horizons 61: 35–46. [Google Scholar] [CrossRef]

- Lee, Tae-heon, and Hee-Woong Kim. 2015. An Exploratory Study on Fintech Industry in Korea. Paper presented at the 2nd International Conference on Innovative Engineering Technologies (ICIET’2015), Bangkok, Thailand, August 7–8. [Google Scholar]

- Leong, Carmen, Barney Tan, Xiao Xiao, Felix Ter Chian Tan, and Yuan Sun. 2017. Nurturing a FinTech ecosystem: The case of a youth microloan startup. International Journal of Information Management, 92–97. [Google Scholar] [CrossRef]

- Liu, John. 2016. Bitcoin literature: A co-word analysis. Paper presented at the 6th Economics & Finance Conference, OECD, Paris, France, September 6; Paris: International Institute of Social and Economic Sciences, pp. 262–72. [Google Scholar]

- Lotka, Alfred J. 1926. The frequency distribution of scientific productivity. Journal of the Washington Academy of Sciences 16: 317–23. Available online: https://www.jstor.org/stable/pdf/24529203.pdf (accessed on 18 December 2021).

- Martínez-Climent, Carla, Ana Zorio-Grima, and Domingo Ribeiro-Soriano. 2018. Financial return crowdfunding: Literature review and bibliometric analysis. International Entrepreneurship and Management Journal 14: 527–53. [Google Scholar] [CrossRef]

- Merediz-Solà, Ignasi, and Aurelio F. Bariviera. 2019. A bibliometric analysis of bitcoin scientific production. Research in International Business and Finance 50: 294–305. [Google Scholar] [CrossRef] [Green Version]

- Milian, Eduardo Z., Mauro de M. Spinola, and Marly M. de Carvalho. 2019. Fintechs: A literature review and research agenda. Electronic Commerce Research and Applications 34: 100833. [Google Scholar] [CrossRef]

- Mora, Higinio, Mario R. Morales-Morales, Francisco A. Pujol-López, and Rafael Mollá-Sirvent. 2021. Social cryptocurrencies as model for enhancing sustainable development. Kybernetes 50: 2883–916. [Google Scholar] [CrossRef]

- Nicoletti, B. 2017. The Future of FinTech, Integrating Finance, and Technology in Financial Services. New York: Palgrave Macmillian. [Google Scholar] [CrossRef]

- Rogowski, Wojciech. 2017. The Dawn of Robo-Advisors. E-MENTOR, 53–63. Available online: http://www.e-mentor.edu.pl/eng/article/index/number/71/id/1315/ (accessed on 18 December 2021). [CrossRef]

- Schueffel, Patrick. 2016. Taming the beast: A scientific definition of fintech. Journal of Innovation Management 4: 32–54. [Google Scholar] [CrossRef]

- Shim, Yongwoon, and Dong-Hee Shin. 2016. Analyzing China’s Fintech Industry from the Perspective of Actor-Network Theory. Telecommunications Policy 40: 168–81. [Google Scholar] [CrossRef]

- Standage, Tom. 2013. The Victorian Internet: The Remarkable Story of the Telegraph and the Nineteenth Century’s On-line Pioneers, 2nd ed. Revised edition 25 February 2014. New York: Bloomsbury USA. [Google Scholar]

- Stoeckli, Emanuel, Christian Dremel, and Falk Uebernickel. 2018. Exploring characteristics and transformational capabilities of InsurTech innovations to understand insurance value creation in a digital world. Electronic Markets 28: 287–305. [Google Scholar] [CrossRef] [Green Version]

- Wasserman, Stanley, and Katherine Faust. 1994. Social Network Analysis: Methods and Applications. Cambridge: Cambridge University Press, p. 116. [Google Scholar] [CrossRef]

- Wu, P. 2017. Fintech Trends Relationships Research: A Bibliometric Citation Meta-Analysis. Paper presented at the 17th International Conference on Electronic Business ICEB, Dubai, United Arab Emirates, December 4–8; pp. 99–105. [Google Scholar]

- Yan, Tan Choon, Paul Schulte, and David Lee Kuo Chuen. 2018a. InsurTec15h and FinTech: Banking and Insurance Enablement. In Handbook of Blockchain, Digital Finance, and Inclusion, vol 1: Cryptocurrency, Fintech, Insurtech, and Regulation. Cambridge: Academic Press, pp. 249–81. [Google Scholar] [CrossRef]

- Yan, Yan, Zhewen Liao, and Xiaosong Chen. 2018b. Fixed-income securities: Bibliometric review with network analysis. In Scientometrics. Berlin: Springer, pp. 1615–40. [Google Scholar] [CrossRef]

- Zalan, Tatiana, and Elissar Toufaily. 2017. The Promise of Fintech in Emerging Markets: Not as Disruptive. Contemporary Economics 11. Available online: https://www.econstor.eu/bitstream/10419/195501/1/1029213224.pdf (accessed on 18 December 2021).

- Zheng, Zibin, Shaoan Xie, Hong-Ning Dai, Xiangping Chen, and Huaimin Wang. 2018. Blockchain challenges and opportunities: A survey. International Journal of Web and Grid Services (IJWGS) 14: 352–75. [Google Scholar] [CrossRef]

| No | University | TP | TC | CPP | h-Index |

|---|---|---|---|---|---|

| 1 | Bina Nusantara University | 16 | 30 | 1.88 | 3 |

| 2 | Amity University | 11 | 8 | 0.72 | 2 |

| 3 | The University of Sydney | 10 | 181 | 18.1 | 3 |

| 4 | UNSW Sydney | 9 | 191 | 21.2 | 4 |

| 5 | Ahlia University | 9 | 18 | 2 | 3 |

| 6 | Soongsil University | 8 | 110 | 13.75 | 3 |

| 7 | Universitas Indonesia | 8 | 12 | 1.5 | 2 |

| 8 | Singapore Management University | 7 | 244 | 34.85 | 4 |

| 9 | Universidad Anáhuac México | 7 | 0 | 0 | 0 |

| 10 | Kingdom University | 6 | 55 | 9.17 | 4 |

| No | Journals | TP | TC | CPP | h-İndex |

|---|---|---|---|---|---|

| 1 | Sustainability Switzerland | 15 | 96 | 6.4 | 5 |

| 2 | Lecture Notes in Computer Science including subseries | 8 | 40 | 5 | 1 |

| 3 | Journal of Open Innovation: Technology, Market, and Complexity | 8 | 33 | 4.12 | 3 |

| 4 | Finance Research Letters | 8 | 32 | 4 | 2 |

| 5 | Perspectives In Law, Business and Innovation | 8 | 0 | 0 | 0 |

| 6 | Financial Innovation | 7 | 107 | 15.28 | 4 |

| 7 | Impact Of Financial Technology (Fintech) on Islamic Finance and Financial Stability | 7 | 6 | 0.86 | 2 |

| 8 | Palgrave Studies in Democracy, Innovation, and Entrepreneurship for Growth | 7 | 0 | 0 | 0 |

| 9 | ACM International Conference Proceeding Series | 6 | 20 | 3.3 | 3 |

| 10 | Industrial Management and Data Systems | 5 | 166 | 33.2 | 4 |

| No | Countries | TP | TC | CPP | h-Index |

|---|---|---|---|---|---|

| 1 | China | 87 | 745 | 8.56 | 13 |

| 2 | United States | 84 | 1415 | 16.84 | 18 |

| 3 | United Kingdom | 67 | 615 | 9.18 | 12 |

| 4 | Indonesia | 49 | 137 | 2.79 | 7 |

| 5 | South Korea | 41 | 673 | 16.41 | 12 |

| 6 | Australia | 41 | 416 | 10.14 | 8 |

| 7 | India | 36 | 57 | 1.58 | 4 |

| 8 | Germany | 31 | 762 | 24.58 | 10 |

| 9 | Malaysia | 25 | 87 | 3.48 | 6 |

| 10 | Singapore | 21 | 287 | 13.6 | 7 |

| No | Authors | TP | TC | CPP | h-Index | Self-Citations |

|---|---|---|---|---|---|---|

| 1 | Rabbani, M.R. | 6 | 55 | 9.16 | 4 | 26 |

| 2 | Tan, B. | 5 | 105 | 21 | 2 | 9 |

| 3 | Wójcik, D. | 5 | 19 | 3.8 | 3 | 5 |

| 4 | Muthukannan, P. | 5 | 8 | 1.6 | 2 | 1 |

| 5 | Hornuf, L. | 4 | 156 | 39 | 3 | 9 |

| 6 | Jagtiani, J. | 4 | 89 | 22.25 | 3 | 3 |

| 7 | Gozman, D. | 4 | 65 | 16.25 | 2 | 6 |

| 8 | Wonglimpiyarat, J. | 4 | 52 | 13 | 3 | 0 |

| 9 | Khan, S. | 4 | 42 | 10.5 | 3 | 22 |

| 10 | Ashta, A. | 4 | 39 | 9.75 | 3 | 9 |

| Publications/Year | <2017 | % | 2017 | % | 2018 | % | 2019 | % | 2020 | % | 2021 | % | Total | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | Gomber et al. (2018) | 0 | 0% | 0 | 0% | 8 | 3% | 43 | 20% | 62 | 29% | 101 | 47% | 214 |

| 2 | Lee and Shin (2018) | 0 | 0% | 0 | 0% | 7 | 3% | 30 | 14% | 82 | 40% | 85 | 41% | 204 |

| 3 | Gomber et al. (2017) | 0 | 0% | 1 | 5% | 19 | 11% | 31 | 17% | 58 | 33% | 65 | 37% | 174 |

| 4 | Gabor and Brooks (2017) | 0 | 0% | 7 | 4% | 19 | 13% | 28 | 19% | 33 | 22% | 59 | 40% | 146 |

| 5 | Buchak et al. (2018) | 0 | 0% | 0 | 0% | 1 | 1% | 15 | 13% | 30 | 25% | 71 | 60% | 117 |

| 6 | Gai et al. (2018) | 0 | 0% | 0 | 0% | 9 | 8% | 32 | 28% | 32 | 28% | 40 | 35% | 113 |

| 7 | Schueffel (2016) | 0 | 0% | 3 | 3% | 16 | 15% | 16 | 15% | 34 | 33% | 34 | 33% | 103 |

| 8 | Leong et al. (2017) | 0 | 0% | 2 | 2% | 9 | 9% | 21 | 21% | 34 | 35% | 32 | 33% | 98 |

| 9 | Haddad and Hornuf (2019) | 0 | 0% | 0 | 0% | 0 | 0% | 6 | 6% | 34 | 36% | 54 | 57% | 94 |

| 10 | Shim and Shin (2016) | 1 | 1% | 5 | 6% | 10 | 12% | 18 | 22% | 22 | 28% | 24 | 30% | 79 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tepe, G.; Geyikci, U.B.; Sancak, F.M. FinTech Companies: A Bibliometric Analysis. Int. J. Financial Stud. 2022, 10, 2. https://doi.org/10.3390/ijfs10010002

Tepe G, Geyikci UB, Sancak FM. FinTech Companies: A Bibliometric Analysis. International Journal of Financial Studies. 2022; 10(1):2. https://doi.org/10.3390/ijfs10010002

Chicago/Turabian StyleTepe, Gencay, Umut Burak Geyikci, and Fatih Mehmet Sancak. 2022. "FinTech Companies: A Bibliometric Analysis" International Journal of Financial Studies 10, no. 1: 2. https://doi.org/10.3390/ijfs10010002

APA StyleTepe, G., Geyikci, U. B., & Sancak, F. M. (2022). FinTech Companies: A Bibliometric Analysis. International Journal of Financial Studies, 10(1), 2. https://doi.org/10.3390/ijfs10010002