Toxic Asset Subsidies and the Early Redemption of TALF Loans

Abstract

:1. Introduction

2. Relevant Literature

2.1. Theory Papers on the Government’s Toxic Asset Programs

2.2. Empirical Studies on CMBS

3. Data

| Data Item | Mean | Median | Minimum | Maximum | Standard Deviation |

|---|---|---|---|---|---|

| Loan Date | 11/15/09 | 10/29/09 | 7/24/09 | 3/29/10 | 71.91 |

| Subsidy at LD | 33.87% | 34.61% | 21.40% | 45.19% | 6.19% |

| Subsidy at RD | −11.14% | −8.80% | −21.70% | 6.43% | 4.95% |

| TALF Spread LD | 1.35% | 1.37% | 1.05% | 1.53% | 0.13% |

| TALF Spread RD | 2.44% | 2.37% | 1.09% | 3.95% | 0.62% |

| CMBX AAA Credit Spread LD | 2.58% | 2.41% | 1.44% | 4.12% | 0.79% |

| CMBX AAA Credit Spread RD | 1.36% | 1.28% | 0.83% | 3.13% | 0.49% |

| CMBX AAA Credit Spread RD minus LD | −1.22% | −1.08% | −2.76% | 0.10% | 0.68% |

| 60-Day Volatility at LD | 12.49% | 13.86% | 4.60% | 19.10% | 4.02% |

| 30-Day Volatility at LD | 9.16% | 6.05% | 4.44% | 19.63% | 5.73% |

| 60-Day Volatility at RD | 4.03% | 3.23% | 3.22% | 19.13% | 1.68% |

| 30-Day Volatility at RD | 3.83% | 3.36% | 3.09% | 19.67% | 1.49% |

| TALF Interest Rate | 3.33% | 3.54% | 2.72% | 3.87% | 0.44% |

| Years to Maturity at RD | 3.37 | 3.98 | 1.82 | 4.99 | 1.04 |

| Years to Maturity at LD | 4.11 | 5.00 | 3.00 | 5.01 | 0.99 |

| Loan Amount (millions) | $17.6 | $14.9 | $10.0 | $80.3 | $8.1 |

| Assets Purchased (millions) | $20.9 | $17.9 | $11.8 | $94.5 | $9.6 |

| Loan-to-Value Ratio | 84.3% | 84.8% | 78.9% | 85.6% | 1.2% |

| Loan-to-Value Ratio | 84.3% | 84.8% | 78.9% | 85.6% | 1.2% |

| Tranche Rank | 2.83 | 2.00 | 1.00 | 7.00 | 1.05 |

| 2005 Vintage Dummy | 0.233 | 0.000 | 0.000 | 1.000 | 0.423 |

| 2006 Vintage Dummy | 0.319 | 0.000 | 0.000 | 1.000 | 0.467 |

| 2007 Vintage Dummy | 0.343 | 0.000 | 0.000 | 1.000 | 0.475 |

| Buyer Dummy Arrowpoint | 0.058 | 0.000 | 0.000 | 1.000 | 0.234 |

| Buyer Dummy Blackrock | 0.137 | 0.000 | 0.000 | 1.000 | 0.344 |

| Buyer Dummy DMR | 0.070 | 0.000 | 0.000 | 1.000 | 0.255 |

| Buyer Dummy Ladder | 0.111 | 0.000 | 0.000 | 1.000 | 0.314 |

| Buyer Dummy PIMCO | 0.080 | 0.000 | 0.000 | 1.000 | 0.272 |

| Issuer Dummy Bank of America | 0.080 | 0.000 | 0.000 | 1.000 | 0.272 |

| Issuer Dummy Bear Stearns | 0.096 | 0.000 | 0.000 | 1.000 | 0.295 |

| Issuer Dummy Citigroup | 0.017 | 0.000 | 0.000 | 1.000 | 0.131 |

| Issuer Dummy Credit Suisse | 0.058 | 0.000 | 0.000 | 1.000 | 0.234 |

| Issuer Dummy Goldman Sachs | 0.064 | 0.000 | 0.000 | 1.000 | 0.245 |

| Issuer Dummy JPMorgan | 0.152 | 0.000 | 0.000 | 1.000 | 0.359 |

| Issuer Dummy Lehman Brothers/UBS | 0.077 | 0.000 | 0.000 | 1.000 | 0.267 |

| Issuer Dummy Merril Lynch | 0.052 | 0.000 | 0.000 | 1.000 | 0.223 |

| Issuer Dummy Morgan Stanley | 0.070 | 0.000 | 0.000 | 1.000 | 0.255 |

| Issuer Dummy Wachovia | 0.130 | 0.000 | 0.000 | 1.000 | 0.336 |

| S&P Rated Dummy | 0.729 | 1.000 | 0.000 | 1.000 | 0.445 |

| Moody’s Rated Dummy | 0.767 | 1.000 | 0.000 | 1.000 | 0.423 |

| Moody’s or S&P Rated Dummy | 0.959 | 1.000 | 0.000 | 1.000 | 0.198 |

| Number of Observations | 686 | ||||

| Total Loans Funded (millions) | $12,069 | ||||

| Total Assets Purchased (millions) | $14,316 |

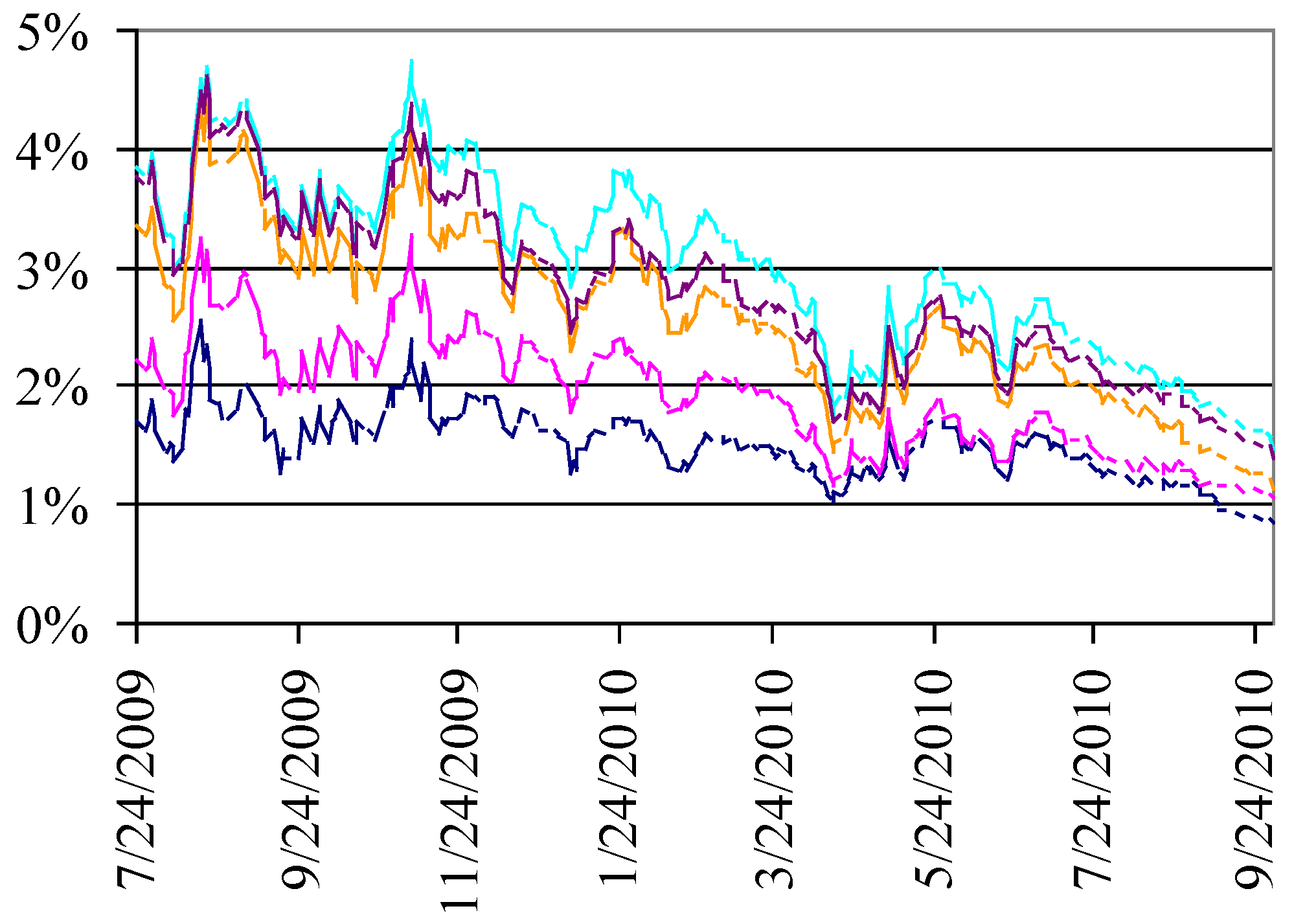

| Difference in Average Credit Spread between Vintages | ||||||

|---|---|---|---|---|---|---|

| Vintage | Average Spread | (1) | (2) | (3) | (4) | (5) |

| (1) 2006-1 | 1.51% | NA | −0.40% | −1.08% | −1.51% | −1.29% |

| t-statistic | −12.05 | −23.73 | −32.04 | −27.72 | ||

| p-value | 0.000 | 0.000 | 0.000 | 0.000 | ||

| (2) 2006-2 | 1.91% | NA | −0.68% | −1.11% | −0.89% | |

| t-statistic | −13.29 | −21.14 | −17.08 | |||

| p-value | 0.000 | 0.000 | 0.000 | |||

| (3) 2007-1 | 2.58% | NA | −0.43% | −0.21% | ||

| t-statistic | −7.11 | −3.45 | ||||

| p-value | 0.000 | 0.001 | ||||

| (4) 2007-2 | 3.02% | NA | 0.23% | |||

| t-statistic | 3.65 | |||||

| p-value | 0.000 | |||||

| (5) 2008-1 | 2.79% | NA | ||||

| t-statistic | ||||||

| p-value | ||||||

4. A Theoretical Model of TALF Loans

| Hypothesis | Loan Date (LD) | Redemption Date (RD) | Difference (LD)—(RD) | p-Value | Hypothesized Difference |

|---|---|---|---|---|---|

| (H3) Subsidy | 34.72% | −10.44% | 45.16% | 0.000 | positive |

| (H4) TALF Spread in % | 1.36% | 2.13% | −0.77% | 0.000 | negative |

| (H5) 60-Day Volatility | 12.58% | 4.85% | 7.73% | 0.000 | positive |

| (H5) 30-Day Volatility | 9.36% | 4.32% | 5.04% | 0.000 | positive |

| Number of Observations | 338 | ||||

5. Predicting Early TALF CMBS Redemptions

5.1. Two-Tailed t-Tests of Factors Associated with Early TALF CMBS Loan Redemptions

| Panel A | |||||

| Data Item | (A) Repaid | (B) Outstanding | Difference (A)–(B) | T-Statistic | p-Value |

| Loan Date | 10/28/09 | 12/4/09 | −36.85 | −6.94 | 0.000 |

| Subsidy LD | 34.72% | 33.06% | 1.66% | 3.55 | 0.000 |

| Subsidy RD | −10.44% | −11.81% | 1.37% | 3.65 | 0.000 |

| TALF Loan Spread over Treasuries at LD | 1.36% | 1.34% | 0.02% | 1.58 | 0.115 |

| TALF Loan Spread over Treasuries at RD | 2.13% | 2.73% | −0.60% | −14.58 | 0.000 |

| CMBX AAA Credit Spread LD | 2.56% | 2.60% | −0.04% | −9.44 | 0.000 |

| CMBX AAA Credit Spread RD | 1.66% | 1.07% | 0.58% | −41.15 | 0.000 |

| CMBX AAA Credit Spread RD minus LD | −0.91% | −1.53% | 0.62% | very large | 0.000 |

| 60-Day Volatility at LD | 12.58% | 12.40% | 0.17% | 0.56 | 0.574 |

| 30-Day Volatility at LD | 9.36% | 8.98% | 0.38% | 0.87 | 0.385 |

| 60-Day Volatility at RD | 4.85% | 3.23% | 1.62% | 14.36 | 0.000 |

| 30-Day Volatility at RD | 4.32% | 3.36% | 0.97% | 8.97 | 0.000 |

| Interest Rate in % | 3.51 | 3.16 | 0.36 | 11.70 | 0.000 |

| Years to Maturity at RD | 3.82 | 2.94 | 0.88 | 12.23 | 0.000 |

| Years to Maturity at LD | 4.46 | 3.76 | 0.70 | 9.87 | 0.000 |

| Loan Amount (millions) | $17.5 | $17.7 | −0.12 | −0.11 | 0.916 |

| Assets Purchased (millions) | $20.9 | $20.9 | 0.03 | 0.05 | 0.964 |

| Loan-to-Value Ratio | 83.9% | 84.6% | −0.68% | −7.96 | 0.000 |

| Tranche Rank | 3.012 | 2.647 | 0.365 | 4.55 | 0.000 |

| Number of Observations | 338 | 348 | |||

| Total Loans Funded (millions) | $5926 | $6142 | |||

| Total Assets Purchased (millions) | $7059 | $7257 | |||

| Panel B | |||||

| Data Item | (A) Repaid | (B) Outstanding | Difference (A)–(B) | T-Statistic | p-Value |

| 2005 Vintage Dummy | 0.210 | 0.256 | −0.046 | −1.41 | 0.158 |

| 2006 Vintage Dummy | 0.393 | 0.247 | 0.146 | 4.16 | 0.000 |

| 2007 Vintage Dummy | 0.269 | 0.414 | −0.145 | −4.03 | 0.000 |

| Buyer Dummy Arrowpoint | 0.044 | 0.072 | −0.027 | −1.53 | 0.125 |

| Buyer Dummy Blackrock | 0.266 | 0.011 | 0.255 | 10.43 | 0.000 |

| Buyer Dummy DMR | 0.000 | 0.138 | −0.138 | −7.34 | 0.000 |

| Buyer Dummy Ladder | 0.000 | 0.218 | −0.218 | −9.70 | 0.000 |

| Buyer Dummy PIMCO | 0.139 | 0.023 | 0.116 | 5.72 | 0.000 |

| Issuer Dummy BAC | 0.077 | 0.083 | −0.006 | −0.31 | 0.758 |

| Issuer Dummy Bear Stearns | 0.077 | 0.115 | −0.038 | −1.69 | 0.092 |

| Issuer Dummy Citigroup | 0.021 | 0.014 | 0.006 | 0.63 | 0.527 |

| Issuer Dummy Credit Suisse | 0.059 | 0.057 | 0.002 | 0.09 | 0.924 |

| Issuer Dummy Goldman Sachs | 0.080 | 0.049 | 0.031 | 1.66 | 0.097 |

| Issuer Dummy JPMorgan | 0.175 | 0.129 | 0.045 | 1.65 | 0.099 |

| Issuer Dummy Lehman Brothers/UBS | 0.056 | 0.098 | −0.041 | −2.04 | 0.042 |

| Issuer Dummy Merril Lynch | 0.062 | 0.043 | 0.019 | 1.12 | 0.265 |

| Issuer Dummy Morgan Stanley | 0.062 | 0.078 | −0.015 | −0.79 | 0.428 |

| Issuer Dummy Wachovia | 0.130 | 0.129 | 0.001 | 0.03 | 0.973 |

| S&P Rated Dummy | 0.713 | 0.744 | −0.031 | 0.92 | 0.358 |

| Moody’s Rated Dummy | 0.772 | 0.761 | 0.011 | 0.33 | 0.741 |

| Moody’s or S&P Rated Dummy | 0.962 | 0.957 | 0.005 | 0.31 | 0.759 |

| Number of Observations | 338 | 348 | |||

| Total Loans Funded (millions) | $5926 | $6142 | |||

| Total Assets Purchased (millions) | $7059 | $7257 | |||

5.2. Logistic Regressions of Factors Associated with Early TALF CMBS Loan Redemptions

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | |

|---|---|---|---|---|---|

| Subsidy at LD | 10.451 | 11.344 | 39.033 | 50.110 | 10.273 |

| 0.000 | 0.000 | 0.001 | 0.000 | 0.000 | |

| TALF Loan Spread at LD in % | 736.491 | 476.117 | 380.475 | 396.781 | 357.930 |

| 0.000 | 0.002 | 0.000 | 0.001 | 0.000 | |

| Change in CMBX from LD to RD | 260.741 | 270.079 | 254.022 | 243.825 | 248.688 |

| 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | |

| 60-Day Volatility at LD | −52.888 | −72.010 | |||

| 0.083 | 0.000 | ||||

| 30-Day Volatility at LD | −13.691 | −12.591 | −12.160 | ||

| 0.000 | 0.001 | 0.000 | |||

| Assets Purchased (millions) | 0.000 | 0.005 | −0.002 | 0.007 | 0.014 |

| 0.986 | 0.695 | 0.865 | 0.540 | 0.235 | |

| Loan-to-Value Ratio | −38.417 | −36.311 | −0.220 | −5.995 | −52.820 |

| 0.004 | 0.013 | 0.990 | 0.711 | 0.000 | |

| Tranche Rank | −0.713 | −0.617 | −0.613 | −0.370 | |

| 0.000 | 0.000 | 0.000 | 0.011 | ||

| 2005 Vintage Dummy | −2.797 | −2.741 | −2.805 | −2.898 | |

| 0.000 | 0.000 | 0.000 | 0.000 | ||

| 2006 Vintage Dummy | −2.165 | −2.174 | −2.489 | −2.672 | |

| 0.000 | 0.000 | 0.000 | 0.000 | ||

| 2007 Vintage Dummy | −2.350 | −2.312 | −2.648 | −2.777 | |

| 0.000 | 0.000 | 0.000 | 0.000 | ||

| Buyer Dummy Arrowpoint | −0.691 | −0.754 | −0.483 | ||

| 0.141 | 0.148 | 0.800 | |||

| Buyer Dummy Blackrock | 3.632 | 3.488 | 3.086 | 3.424 | 4.092 |

| 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | |

| Buyer Dummy DMR | −21.717 | −21.310 | −20.852 | ||

| 0.997 | 0.997 | 0.997 | |||

| Buyer Dummy Ladder | −20.945 | −20.811 | −21.148 | ||

| 0.996 | 0.996 | 0.996 | |||

| Buyer Dummy PIMCO | 1.707 | 2.123 | 2.435 | 2.752 | 2.412 |

| 0.001 | 0.000 | 0.000 | 0.000 | 0.000 | |

| Intercept | 25.310 | 28.109 | −5.060 | −2.901 | 42.509 |

| 0.026 | 0.024 | 0.751 | 0.848 | 0.000 | |

| Number of Observations | 686 | 664 | 664 | 664 | 664 |

| Number of Obs. Where Y = 1 | 327 | 327 | 327 | 327 | 327 |

| Number of Obs. Where Y = 0 | 337 | 337 | 337 | 337 | 337 |

| Correct Predictions | 83.40% | 88.7% | 87.5% | 85.7% | 87.0% |

| Psuedo R-squared | 0.532 | 0.569 | 0.567 | 0.517 | 0.511 |

6. Conclusions

Funding

Informed Consent Statement

Conflicts of Interest

| 1 | According to Wilson (2011), there were two other components of the U.S. government’s toxic asset purchase plans. Those other two programs were the Legacy Securities Program (LSP) run by the U.S. Treasury and the Legacy Loans Program (LLP) run by the Federal Deposit Insurance Corporation (FDIC). The legacy securities program has financed the purchase of CMBS, but primarily it has financed the purchase of residential mortgage securities. Only 18 percent, or $3.4 billion, of the $19.3 billion of securities purchased through the LSP by 30 September 2010, consisted of CMBS. See U.S. Treasury, 20 October 2010, “Legacy Securities Public-Private Investment Program, Program Update, 30 September 2010,” U.S. Treasury, Office of Financial Stability, Available online: http://www.financialstability.gov/docs/External%20Report%20-%2009-10%20vFinal.pdf (accessed on 9 January 2011). Unlike the Federal Reserve’s TALF program, the U.S. Treasury has not released any data on the actual CMBS and Residential Mortgage Backed Securities (RMBS) purchased with the LSP by the start of 2011. |

| 2 | Sarah Mulholland, 4 January 2011, “Wall Street Preparing $4 Billion of Commercial-Mortgage Bonds,” Bloomberg, Available online: http://www.bloomberg.com/news/print/2011-01-04/wall-street-banks-preparing-4-billion-of-commercial-mortgage-bond-sales.html (accessed on 9 January 2011). |

| 3 | |

| 4 | See Exhibits 19 and 21 of CRE Finance Council, 14 January 2011, Compendium of Statistics, Available online: http://www.crefc.org/uploadedFiles/CMSA_Site_Home/Industry_Resources/Research/Industry_Statistics/CMSA_Compendium.pdf (accessed on 16 January 2011). |

| 5 | See Craig Torres and Scott Lanman, 1 December 2010, “Fed Emergency Borrowers Ranged From GE to McDonald’s,” Bloomberg, Available online: http://www.bloomberg.com/news/print/2010-12-01/fed-crisis-borrowers-ranged-from-bank-of-america-to-mcdonald-s.html (22 February 2012); and Board of Governors of the Federal Reserve System, 1 December 2010, “Press Release: Federal Reserve releases detailed information about transactions conducted to stabilize markets during the recent financial crisis,” Federal Reserve, Available online: http://www.federalreserve.gov/newsevents/press/monetary/20101201a.htm (accessed on 2 January 2011). |

| 6 | This is a similar finding to Ambrose and Sanders (2003) who find that prepayments on CMBS are more likely to occur when the spread between the coupon rate on the mortgage and current interest rates widens. |

| 7 | See U.S. Treasury, 20 October 2010, “Legacy Securities Public-Private Investment Program, Program Update, 30 September 2010”, U.S. Treasury, Office of Financial Stability, Available online: http://www.financialstability.gov/docs/External%20Report%20-%2009-10%20vFinal.pdf (accessed on 9 January 2011). |

References

- Agarwal, Sumit, Jacqueline Barrett, Crystal Cun, and Mariacristina De Nardi. 2010. The Asset-Backed Securities Markets, the Crisis, and TALF. Federal Reserve Bank of Chicago Economic Perspectives 34: 101–15. [Google Scholar]

- Ambrose, Brent W., and Anthony B. Sanders. 2003. Commercial Mortgage-backed Securities: Prepayment and Default. Journal of Real Estate Finance and Economics 26: 179–96. [Google Scholar] [CrossRef]

- An, Xudong, Yongheng Deng, and Anthony B. Sanders. 2008. Subordination Levels in Structured Financing. In The Handbook of Financial Intermediation and Banking. Edited by Arnoud Boot and Anjan Thakor. New York: Elsevier, New York: North Holland Press. [Google Scholar]

- An, Xudong, Yongheng Deng, and Stuart Gabriel. 2009. Value Creation through Securitization: Evidence from the CMBS market. Journal of Real Estate Finance and Economics 38: 302–26. [Google Scholar] [CrossRef]

- An, Xudong, Yongheng Deng, and Stuart Gabriel. 2011. Asymmetric Information, Adverse Selection, and the Pricing of CMBS. Journal of Financial Economics 100: 304–25. [Google Scholar] [CrossRef]

- Ashcraft, Adam, Allen Malz, and Zoltan Pozsar. 2012. The Federal Reserve’s Term Asset-Backed Lending Facility. Federal Reserve Bank of New York Economic Policy Review 18: 29–66. [Google Scholar]

- Ashcraft, Adam, Nicolae Garleanu, and Lasse H. Pedersen. 2010. Two Monetary Tools: Interest Rates and Haircuts. NBER Macroeconomics Annual 25: 143–80. [Google Scholar] [CrossRef] [Green Version]

- Bhansali, Vineer, and Mark B. Wise. 2009. How Valuable Are the TALF Puts? Journal of Fixed Income 19: 71–75. [Google Scholar] [CrossRef]

- Black, Fischer, and Myron Scholes. 1973. The Pricing of Options and Corporate Liabilities. Journal of Political Economy 81: 637–54. [Google Scholar] [CrossRef] [Green Version]

- Campbell, Sean, Daniel Covitz, William Nelson, and Karen Pence. 2011. Securitization Markets and Central Banking: An Evaluation of the Term Asset-Backed Securities Loan Facility. Journal of Monetary Economics 58: 518–31. [Google Scholar] [CrossRef] [Green Version]

- Caviness, Elizabeth, Asani Sarkar, Ankur Goyal, and Woojung Park. 2021. The Term Asset-Backed Securities Loan Facility. In Federal Reserve Bank of New York Staff Reports No. 979. New York: Office of Senator Carl Levin, Chairman Senate Permanent Subcommittee on Investigations. [Google Scholar]

- Covitz, Daniel M., Ralf R. Meisenzahl, and Karen M. Pence. 2021. Incentives and Tradeoffs in Designing a Crisis Liquidity Facility with Nonbank Counterparties: Lessons from the Term Asset-Backed Securities Loan Facility. Working Paper. Available online: http://www.ralfmeisenzahl.com/uploads/7/6/8/1/76818505/talf_paper_march_2021_final.pdf (accessed on 1 February 2022).

- Gaballo, Gaetano, and Ramon Marimon. 2022. Breaking the Spell with Credit-Easing: Self-Confirming Credit Crises in Competitive Search Economies. Social Science Research Network Working Paper. Available online: https://ssrn.com/abstract=2736082 (accessed on 8 February 2022).

- Johnston, Jack, and John Dinardo. 1997. Econometric Methods, 4th ed. New York: McGraw-Hill. [Google Scholar]

- Krugman, Paul. 2009. Geithner Plan Arithmetic. Conscience of a Liberal Blog. New York Times. March 23. Available online: http://krugman.blogs.nytimes.com/2009/03/23/geithner-plan-arithmetic/ (accessed on 9 May 2009).

- Levin, Carl. 2010. Press Release, April 22, 2010: Senate Subcommittee Holds Third Hearing on Wall Street and the Financial Crisis: The Role of Credit Rating Agencies. In Office of Senator Carl Levin, Chairman Senate Permanent Subcommittee on Investigations. Available online: http://levin.senate.gov/newsroom/release.cfm?id=324129 (accessed on 15 January 2011).

- Mizrach, Bruce, and Christopher J. Neely. 2020. Supporting Small Borrowers: ABS Markets and the TALF. Economic Synopses Federal Reserve Bank of St. Louis 20: 1–4. [Google Scholar] [CrossRef]

- Pavlov, Andrei D., and Susan M. Wachter. 2002. Robbing the Bank: Non-recourse Lending and Asset Prices. Journal of Real Estate Finance and Economics 28: 147–60. [Google Scholar] [CrossRef]

- Pavlov, Andrei D., and Susan M. Wachter. 2009a. Mortgage Put Options and Real Estate Markets. Journal of Real Estate Finance and Economics 38: 89–103. [Google Scholar] [CrossRef] [Green Version]

- Pavlov, Andrei D., and Susan M. Wachter. 2009b. Systemic Risk and Market Institutions. Yale Journal on Regulation 26: 445–55. [Google Scholar]

- Rhee, June. 2020. The Term Asset-Backed Securities Loan Facility (TALF) (U.S. GFC). Journal of Financial Crises 2: 281–306. [Google Scholar]

- Stiglitz, Joseph. 2009. Obama’s Ersatz Capitalism. New York Times. April 1. Available online: http://www.nytimes.com/2009/04/01/opinion/01stiglitz.html (accessed on 18 April 2009).

- Titman, Sheridan, and Sergey Tsyplakov. 2010. Originator Performance, CMBS Deals and Yield Spreads of Commercial Mortgages. Review of Financial Studies 23: 3558–94. [Google Scholar] [CrossRef]

- Titman, Sheridan, Stathis Tompaidis, and Sergey Tsyplakov. 2005. Determinants of Credit Spreads in Commercial Mortgages. Real Estate Economics 33: 711–38. [Google Scholar] [CrossRef] [Green Version]

- Todd, Alan, and Yuriko Iwai. 2006. An Introduction to the CMBX.NA Index and Single-Name CMBS CDS. CMBS World 8: 29–37. [Google Scholar]

- Wilson, Linus. 2010a. The Put Problem with Buying Toxic Assets. Applied Financial Economics 20: 31–35. [Google Scholar] [CrossRef]

- Wilson, Linus. 2010b. Slicing the Toxic Pizza, an Analysis of FDIC’s Legacy Loans Program for Receivership Assets. International Journal of Monetary Economics and Finance 3: 300–309. [Google Scholar] [CrossRef]

- Wilson, Linus. 2011. A Binomial Model of Geithner’s Toxic Asset Plan. Journal of Economics and Business 65: 349–71. [Google Scholar] [CrossRef]

- Wilson, Linus, and Wendy Yan Wu. 2012. Escaping TARP. Journal of Financial Stability 8: 32–42. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wilson, L. Toxic Asset Subsidies and the Early Redemption of TALF Loans. Int. J. Financial Stud. 2022, 10, 23. https://doi.org/10.3390/ijfs10020023

Wilson L. Toxic Asset Subsidies and the Early Redemption of TALF Loans. International Journal of Financial Studies. 2022; 10(2):23. https://doi.org/10.3390/ijfs10020023

Chicago/Turabian StyleWilson, Linus. 2022. "Toxic Asset Subsidies and the Early Redemption of TALF Loans" International Journal of Financial Studies 10, no. 2: 23. https://doi.org/10.3390/ijfs10020023

APA StyleWilson, L. (2022). Toxic Asset Subsidies and the Early Redemption of TALF Loans. International Journal of Financial Studies, 10(2), 23. https://doi.org/10.3390/ijfs10020023