Do Financial Crises Matter for Nonlinear Exchange Rate and Stock Market Cointegration? A Heterogeneous Nonlinear Panel Data Model with PMG Approach

Abstract

:1. Introduction

2. Literature Review

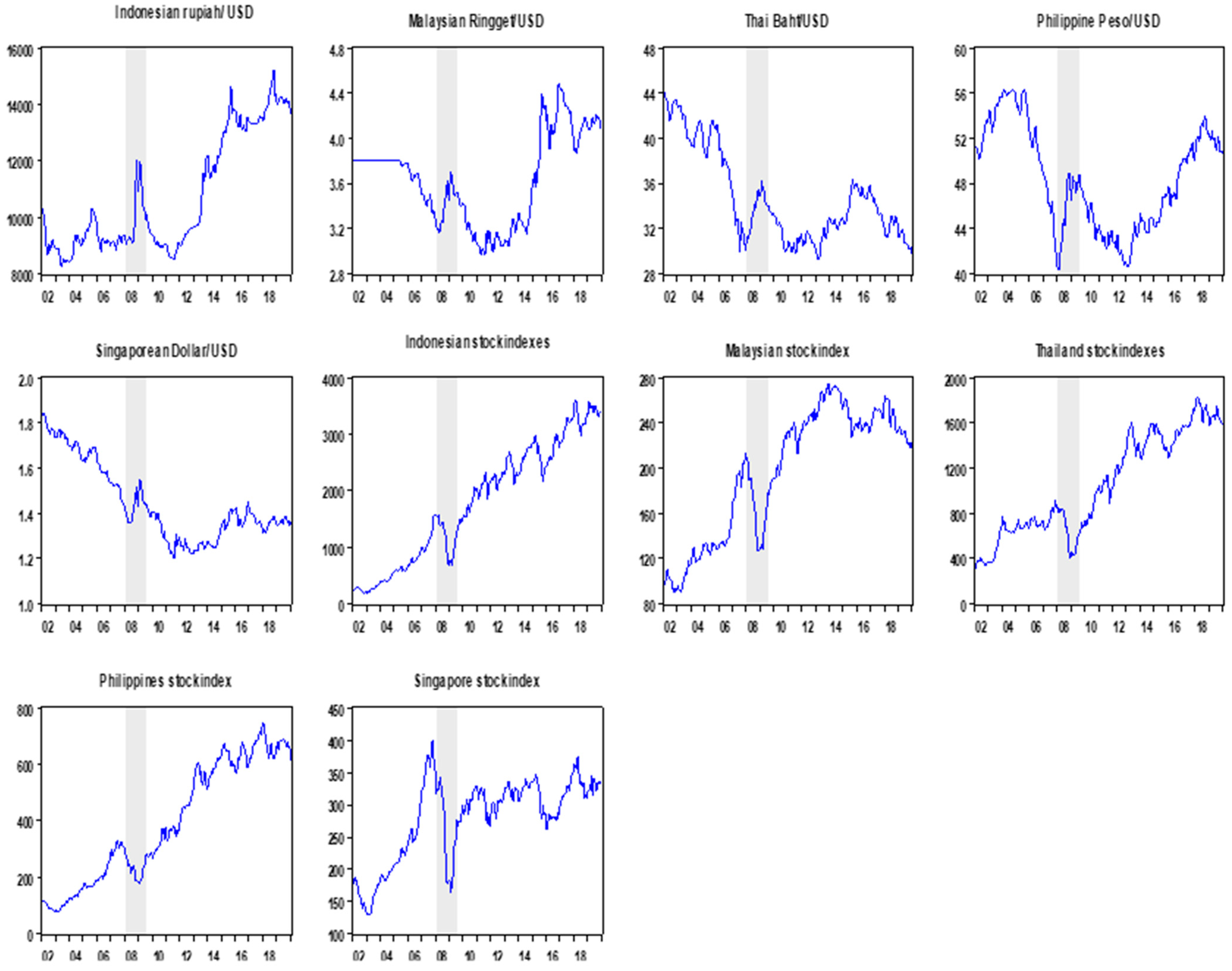

3. Methodology and Data

3.1. Econometric Estimation

3.2. Cross-Sectional Dependence Test by Pesaran (2004) and Cross-Sectional Augmented IPS Unit Root Test by Pesaran (2007)

3.3. Symmetrical PARDL Modeling Approach

3.4. Asymmetrical PARDL Modeling with the PMG Approach

3.5. Granger Causation

4. Results and Discussions

5. Conclusions and Future Research Directions

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Adjasi, Charles K. D. 2009. Macroeconomic uncertainty and conditional stock-price volatility in frontier African markets: Evidence from Ghana. The Journal of Risk Finance 10: 333–49. [Google Scholar] [CrossRef]

- Agyire-Tettey, Kwame F., and Anthony Kyereboah-Coleman. 2008. Impact of macroeconomic indicators on stock market performance: The case of the Ghana Stock Exchange. The Journal of Risk Finance 9: 365–78. [Google Scholar] [CrossRef]

- Aktürk, Halit. 2016. Do stock returns provide a good hedge against inflation? An empirical assessment using Turkish data during periods of structural change. International Review of Economics & Finance 45: 230–246. [Google Scholar] [CrossRef] [Green Version]

- Al-hajj, Ekhlas, Usama Al-Mulali, and Sakiru Adebola Solarin. 2018. Oil price shocks and stock returns nexus for Malaysia: Fresh evidence from nonlinear ARDL test. Energy Reports 4: 624–37. [Google Scholar] [CrossRef]

- Andriansyah, Andriansyah, and George Messinis. 2019. Stock Prices, Exchange Rates and Portfolio Equity Flows: A Toda-Yamamoto Panel Causality Test. Journal of Economic Studies 46: 399–421. [Google Scholar] [CrossRef]

- Anisak, N., and A. Mohamad. 2019. Foreign Exchange Exposure of Indonesian Listed Firms. Global Business Review 21: 918–36. [Google Scholar] [CrossRef]

- Delgado, Nancy Areli Bermudez, Estefanía Bermudez Delgado, and Eduardo Saucedo. 2018. The relationship between oil prices, the stock market and the exchange rate: Evidence from Mexico. The North American Journal of Economics and Finance 45: 266–75. [Google Scholar] [CrossRef]

- Arif, Billah Dar, Aasif Shah, Niyati Bhanja, and Amaresh Samantaraya. 2014. The relationship between stock prices and exchange rates in Asian markets: A wavelet based correlation and quantile regression approach. South Asian Journal of Global Business Research 3: 209–24. [Google Scholar] [CrossRef]

- Asad, Muzaffar, Mosab I. Tabash, Umaid A. Sheikh, Mesfer Mubarak Al-Muhanadi, and Zahid Ahmad. 2020. Gold-oil-exchange rate volatility, Bombay stock exchange and global financial contagion 2008: Application of NARDL model with dynamic multipliers for evidences beyond symmetry. Cogent Business and Management 7. [Google Scholar] [CrossRef]

- Athukorala, Prema-chandra, and Aekapol Chongvilaivan. 2010. The Global Financial Crisis and Asian Economies: Impacts and Trade Policy Responses. ASEAN Economic Bulletin 27: 1–4. Available online: http://www.jstor.org/stable/41317106 (accessed on 1 October 2019). [CrossRef]

- Bahmani-Oskooee, Mohsen, and Sujata Saha. 2015. On the relation between stock prices and exchange rates: A review article. Journal of Economic Studies 42: 707–32. [Google Scholar] [CrossRef]

- Bahmani-Oskooee, Mohsen, and Sujata Saha. 2016. Do exchange rate changes have symmetric or asymmetric effects on stock prices? Global Finance Journal 31: 57–72. [Google Scholar] [CrossRef] [Green Version]

- Bai, Shuming, and Kai S. Koong. 2018. Oil prices, stock returns, and exchange rates: Empirical evidence from China and the United States. The North American Journal of Economics and Finance 44: 12–33. [Google Scholar] [CrossRef]

- Baz, Khan, Deyi Xu, Gideon M. K. Ampofo, Imad Ali, Imran Khan, Jinhua Cheng, and Hashmat Ali. 2019. Energy consumption and economic growth nexus: New evidence from Pakistan using asymmetric analysis. Energy 189: 116254. [Google Scholar] [CrossRef]

- BenSaïda, Ahmed, Sabri Boubaker, and Nguyen Duc Khuong. 2018. The shifting dependence dynamics between the G7 stock markets. Quantitative Finance 18: 801–12. [Google Scholar] [CrossRef]

- Blau, Benjamin M. 2018. Exchange rate volatility and the stability of stock prices. International Review of Economics & Finance 58: 299–311. [Google Scholar] [CrossRef]

- Boubaker, Sabri, and Jamel Jouini. 2014. Linkages between emerging and developed equity markets: Empirical evidence in the PMG framework. The North American Journal of Economics and Finance 29: 322–35. [Google Scholar] [CrossRef]

- Boubaker, Sabri, John W. Goodell, Dharen Kumar Pandey, and Vineeta Kumari. 2022. Heterogeneous impacts of wars on global equity markets: Evidence from the invasion of Ukraine. Finance Research Letters 48: 102934. [Google Scholar] [CrossRef]

- Brem, Alexander, Petra Nylund, and Eric Viardot. 2020. The impact of the 2008 financial crisis on innovation: A dominant design perspective. Journal of Business Research 110: 360–9. [Google Scholar] [CrossRef]

- Broock, William A., J. A. Scheinkman, W. D. Dechert, and B. LeBaron. 1996. A test for independence based on the correlation dimension. Econometric Reviews 15: 197–235. [Google Scholar] [CrossRef]

- Camilleri, Silvio John, Nicolanne Scicluna, and Ye Bai. 2019. Do stock markets lead or lag macroeconomic variables? Evidence from select European countries. The North American Journal of Economics and Finance 48: 170–86. [Google Scholar] [CrossRef]

- Chang, Bisharat Hussain, Muhammad Saeed Meo, Qasim Raza Syed, and Zahida Abro. 2019. Dynamic analysis of the relationship between stock prices and macroeconomic variables: An empirical study of Pakistan stock exchange. South Asian Journal of Business Studies 8: 229–45. [Google Scholar] [CrossRef]

- Charfeddine, Lanouar, and Karim Barkat. 2020. Short- and long-run asymmetric effect of oil prices and oil and gas revenues on the real GDP and economic diversification in oil-dependent economy. Energy Economics 86: 104680. [Google Scholar] [CrossRef]

- Chen, Shiu-Sheng. 2009. Predicting the bear stock market: Macroeconomic variables as leading indicators. Journal of Banking & Finance 33: 211–23. [Google Scholar] [CrossRef]

- Chiu, Ching-wai Jeremy, Richard D. F. Harris, Evarist Stoja, and Michael Chin. 2018. Financial market Volatility, macroeconomic fundamentals and investor Sentiment. Journal of Banking & Finance 92: 130–45. [Google Scholar] [CrossRef]

- Chkir, Imed, Khaled Guesmi, A. Ben Brayek, and Kamel Naoui. 2020. Modelling the nonlinear relationship between oil prices, stock markets, and exchange rates in oil-exporting and oil-importing countries. Research in International Business and Finance 54: 101274. [Google Scholar] [CrossRef]

- Choi, In. 2001. Unit root tests for panel data. Journal of International Money and Finance 20: 249–72. Available online: https://econpapers.repec.org/RePEc:eee:jimfin:v:20:y:2001:i:2:p:249-272 (accessed on 5 October 2019). [CrossRef]

- Demirguc-Kunt, Asli, Alvaro Pedraza, and Claudia Ruiz-Ortega. 2021. Banking Sector Performance During the COVID-19 Crisis. Journal of Banking & Finance 133: 106305. [Google Scholar]

- Dumitrescu, Elena-Ivona, and Christophe Hurlin. 2012. Testing for Granger non-causality in heterogeneous panels. Economic Modelling 29: 1450–60. [Google Scholar] [CrossRef] [Green Version]

- Fidrmuc, Jarko, and Iikka Korhonen. 2010. The impact of the global financial crisis on business cycles in Asian emerging economies. Journal of Asian Economics 21: 293–303. [Google Scholar] [CrossRef] [Green Version]

- Ghulam, A. 2018. Conditional volatility nexus between stock markets and macroeconomic variables. Journal of Economic Studies 45: 77–99. [Google Scholar] [CrossRef] [Green Version]

- Granger, Clive, and Gawon Yoon. 2002. Hidden Cointegration. Available online: https://econpapers.repec.org/RePEc:ecj:ac2002:92 (accessed on 27 October 2022).

- Hadri, Kaddour. 2000. Testing for stationarity in heterogeneous panel data. The Econometrics Journal 3: 148–61. [Google Scholar] [CrossRef]

- Hatemi-J, Abdulnasser. 2012. Asymmetric causality tests with an application. Empirical Economics 43: 447–56. [Google Scholar] [CrossRef]

- Ho, Sin-Yu. 2018. Macroeconomic determinants of stock market development in South Africa. International Journal of Emerging Markets 14: 322–42. [Google Scholar] [CrossRef]

- Hung, Ngo Thai. 2019. Spillover Effects Between Stock Prices and Exchange Rates for the Central and Eastern European Countries. Global Business Review 23: 259–86. [Google Scholar] [CrossRef]

- Jain, Anshul, and Pratap Chandra Biswal. 2016. Dynamic linkages among oil price, gold price, exchange rate, and stock market in India. Resources Policy 49: 179–185. [Google Scholar] [CrossRef]

- Jung, Young Cheol, Anupam Das, and Adian McFarlane. 2020. The asymmetric relationship between the oil price and the US-Canada exchange rate. The Quarterly Review of Economics and Finance 76: 198–206. [Google Scholar] [CrossRef]

- Kassouri, Yacouba, and Halil Altıntaş. 2020. Threshold cointegration, nonlinearity, and frequency domain causality relationship between stock price and Turkish Lira. Research in International Business and Finance 52: 101097. [Google Scholar] [CrossRef]

- Keat, Heng Swee. 2009. The Global Financial Crisis: Impact on Asia and Policy Challenges Ahead. San Francisco: Federal Reserve Bank, pp. 268–75. [Google Scholar]

- Keswani, Sarika, and Bharti Wadhwa. 2018. An Empirical Analysis on Association Between Selected Macroeconomic Variables and Stock Market in the Context of BSE. The Indian Economic Journal 66: 170–89. [Google Scholar] [CrossRef]

- Kumar, Manish. 2013. Returns and volatility spillover between stock prices and exchange rates: Empirical evidence from IBSA countries. International Journal of Emerging Markets 8: 108–28. [Google Scholar] [CrossRef]

- Kumar, Satish. 2019. Asymmetric impact of oil prices on exchange rate and stock prices. The Quarterly Review of Economics and Finance 72: 41–51. [Google Scholar] [CrossRef]

- Levin, Andrew, Chien-Fu Lin, and James Chia-Shang Chu. 2002. Unit root tests in panel data: Asymptotic and finite-sample properties. Journal of Econometrics 108: 1–24. Available online: https://econpapers.repec.org/RePEc:eee:econom:v:108:y:2002:i:1:p:1-24 (accessed on 1 July 2019). [CrossRef]

- Liang, Chin Chia, Carol Troy, and Ellen Rouyer. 2020. U.S. uncertainty and Asian stock prices: Evidence from the asymmetric NARDL model. The North American Journal of Economics and Finance 51: 101046. [Google Scholar] [CrossRef]

- Mahapatra, Smita, and Saumitra N. Bhaduri. 2019. Dynamics of the impact of currency fluctuations on stock markets in India: Assessing the pricing of exchange rate risks. Borsa Istanbul Review 19: 15–23. [Google Scholar] [CrossRef]

- Makin, Anthony J. 2019. Lessons for macroeconomic policy from the Global Financial Crisis. Economic Analysis and Policy 64: 13–25. [Google Scholar] [CrossRef]

- Mazuruse, Peter. 2014. Canonical correlation analysis: Macroeconomic variables versus stock returns. Journal of Financial Economic Policy 6: 179–96. [Google Scholar] [CrossRef]

- Mohamed Dahir, Ahmed, Fauziah Mahat, Nazrul H. Ab Razak, and A. N. Bany-Ariffin. 2018. Revisiting the dynamic relationship between exchange rates and stock prices in BRICS countries: A wavelet analysis. Borsa Istanbul Review 18: 101–13. [Google Scholar] [CrossRef]

- Mollick, Andre, and Khoa H. Nguyen. 2015. U.S. oil company stock returns and currency fluctuations. Managerial Finance 41: 974–94. [Google Scholar] [CrossRef]

- Neveen, Ahmed. 2018. The effect of the financial crisis on the dynamic relation between foreign exchange and stock returns: Empirical evidence from MENA region. Journal of Economic Studies 45: 994–1031. [Google Scholar] [CrossRef]

- Othman, Anwar Hasan Abdullah, Syed Musa Alhabshi, and Razali Haron. 2019. The effect of symmetric and asymmetric information on volatility structure of crypto-currency markets: A case study of bitcoin currency. Journal of Financial Economic Policy 11: 432–50. [Google Scholar] [CrossRef]

- Park, Cyn-Young, and Kwanho Shin. 2020. Contagion through National and Regional Exposures to Foreign Banks during the Global Financial Crisis. Journal of Financial Stability 46: 100721. [Google Scholar] [CrossRef]

- Pesaran, M. Hashem. 2004. General Diagnostic Tests for Cross Section Dependence in Panels. Cambridge Working Papers in Economics No. 0435. Cambridge: University of Cambridge, Faculty of Economics. [Google Scholar]

- Pesaran, M. Hashem. 2006. Estimation and Inference in Large Heterogeneous Panels with a Multifactor Error Structure. Econometrica 74: 967–1012. [Google Scholar] [CrossRef] [Green Version]

- Pesaran, M. Hashem. 2007. A simple panel unit root test in the presence of cross-section dependence. Journal of Applied Econometrics 22: 265–312. [Google Scholar] [CrossRef] [Green Version]

- Pesaran, M. Hashem, Yongcheol Shin, and Richard J. Smith. 2001. Bounds testing approaches to the analysis of level relationships. Journal of Applied Econometrics 16: 289–326. [Google Scholar] [CrossRef]

- Pesaran, M. Hashem, Yongcheol Shin, and Richard P. Smith. 1999. Pooled Mean Group Estimation of Dynamic Heterogeneous Panels. Journal of the American Statistical Association 94: 621–34. [Google Scholar] [CrossRef]

- Rajesh, S. 2019. Dynamism between selected macroeconomic determinants and electricity consumption in India. International Journal of Social Economics 46: 805–21. [Google Scholar] [CrossRef]

- Rasiah, Rajah, Kee Cheok Cheong, and Richard Doner. 2014. Southeast Asia and the Asian and Global Financial Crises. Journal of Contemporary Asia 44: 572–80. [Google Scholar] [CrossRef]

- Reddy, Y. V., and A. Sebastin. 2008. Interaction between forex and stock markets in India: An entropy approach. Vikalpa 33: 27–46. [Google Scholar] [CrossRef] [Green Version]

- Rehman, Mobeen U. 2017. Dynamics of Co-movements among Implied Volatility, Policy Uncertainty and Market Performance. Global Business Review 18: 1478–87. [Google Scholar] [CrossRef]

- Rillo, Aladdin D. 2009. ASEAN ECONOMIES: Challenges and Responses Amid the Crisis. Southeast Asian Affairs 2009: 17–27. Available online: http://www.jstor.org/stable/27913375 (accessed on 1 May 2019). [CrossRef]

- Roubaud, David, and Mohamed Arouri. 2018. Oil prices, exchange rates and stock markets under uncertainty and regime-switching. Finance Research Letters 27: 28–33. [Google Scholar] [CrossRef]

- Salvatore, Capasso. 2019. The long-run interrelationship between exchange rate and interest rate: The case of Mexico. Journal of Economic Studies 46: 1380–97. [Google Scholar] [CrossRef]

- Shahbaz, Muhammad. 2013. Linkages between inflation, economic growth and terrorism in Pakistan. Economic Modelling 32: 496–506. [Google Scholar] [CrossRef]

- Shahzad, Syed Jawad Hussain, Shahzad Mohd Nor, Roman Ferrer, and Shawkat Hammoudeh. 2017. Asymmetric determinants of CDS spreads: U.S. industry-level evidence through the NARDL approach. Economic Modelling 60: 211–30. [Google Scholar] [CrossRef]

- Shakil, Mohammad Hassan, Mashiyat Tasnia, and Buerhan Saiti. 2018. Is gold a hedge or a safe haven? An application of ARDL approach. Journal of Economics, Finance and Administrative Science 23: 60–76. [Google Scholar] [CrossRef] [Green Version]

- Sheikh, Umaid A., Mosab I. Tabash, and Muzaffar Asad. 2020a. Global Financial Crisis in Effecting Asymmetrical Co-integration between Exchange Rate and Stock Indexes of South Asian Region: Application of Panel Data NARDL and ARDL Modelling Approach with Asymmetrical Granger Causality. Cogent Business & Management 7: 1843309. [Google Scholar] [CrossRef]

- Sheikh, Umaid A., Muzaffar Asad, Aqeel Israr, Mosab I. Tabash, and Zahid Ahmed. 2020b. Symmetrical cointegrating relationship between money supply, interest rates, consumer price index, terroristic disruptions, and Karachi stock exchange: Does global financial crisis matter? Cogent Economics and Finance 8: 1838689. [Google Scholar] [CrossRef]

- Sheikh, Umaid A., Muzaffar Asad, Zahid Ahmed, and U. Mukhtar. 2020c. Asymmetrical relationship between oil prices, gold prices, exchange rate, and stock prices during global financial crisis 2008: Evidence from Pakistan. Cogent Economics and Finance 8: 1757802. [Google Scholar] [CrossRef]

- Shin, Yongcheol, Byungchul Yu, and Matthew Greenwood-Nimmo. 2013. Modelling Asymmetric Cointegration and Dynamic Multipliers in a Nonlinear ARDL Framework. New York: Springer. [Google Scholar] [CrossRef] [Green Version]

- Shiva, Atul, and Monica Sethi. 2015. Understanding Dynamic Relationship among Gold Price, Exchange Rate and Stock Markets: Evidence in Indian Context. Global Business Review 16: 93S–111S. [Google Scholar] [CrossRef]

- Sikhosana, Ayanda, and Goodness C. Aye. 2018. Asymmetric volatility transmission between the real exchange rate and stock returns in South Africa. Economic Analysis and Policy 60: 1–8. [Google Scholar] [CrossRef] [Green Version]

- Simbolon, Lentina, and Purwanto. 2018. The Influence of Macroeconomic Factors on Stock Price: The Case of Real Estate and Property Companies. Global Tensions in Financial Markets 34: 2–19. [Google Scholar] [CrossRef]

- Singhal, Shelly, Sangita Choudhary, and Pratap Chandra Biswal. 2019. Return and volatility linkages among International crude oil price, gold price, exchange rate and stock markets: Evidence from Mexico. Resources Policy 60: 255–61. [Google Scholar] [CrossRef]

- Tabash, Mosab I., Umaid A. Sheikh, and Muzaffar Asad. 2020. Market miracles: Resilience of Karachi stock exchange index against terrorism in Pakistan. Cogent Economics & Finance 8: 1821998. [Google Scholar]

- Taufeeq, Ajaz. 2017. Stock prices, exchange rate and interest rate: Evidence beyond symmetry. Journal of Financial Economic Policy 9: 2–19. [Google Scholar] [CrossRef]

- Tiwari, Aviral Kumar, and Phouphet Kyophilavong. 2017. Exchange Rates and International Reserves in India: A Frequency Domain Analysis. South Asia Economic Journal 18: 76–93. [Google Scholar] [CrossRef]

- Toda, Hiro Y., and Taku Yamamoto. 1995. Statistical inference in vector autoregressions with possibly integrated processes. Journal of Econometrics 66: 225–50. [Google Scholar] [CrossRef]

- Tuna, Gülfen. 2018. Interaction between precious metals price and Islamic stock markets. International Journal of Islamic and Middle Eastern Finance and Management 12: 96–114. [Google Scholar] [CrossRef]

- Umar, Muhammad, and Gang Sun. 2015. Country risk, stock prices, and the exchange rate of the renminbi. Journal of Financial Economic Policy 7: 366–76. [Google Scholar] [CrossRef]

- Vezos, Panayiotis, and N. Lael Joseph. 2006. The sensitivity of US banks’ stock returns to interest rate and exchange rate changes. Managerial Finance 32: 182–99. [Google Scholar] [CrossRef]

- Wei, Yu, Songkun Qin, Xiafei Li, Sha Zhu, and Guiwu Wei. 2019. Oil price fluctuation, stock market and macroeconomic fundamentals: Evidence from China before and after the financial crisis. Finance Research Letters 30: 23–9. [Google Scholar] [CrossRef]

- Wong, Hock Tsen. 2017. Real exchange rate returns and real stock price returns. International Review of Economics & Finance 49: 340–352. [Google Scholar] [CrossRef]

- Xie, Zixiong, Shyh-Wei Chen, and An-Chi Wu. 2020. The foreign exchange and stock market nexus: New international evidence. International Review of Economics & Finance 67: 240–266. [Google Scholar] [CrossRef]

- Zhang, Tianding, Tianwen Du, and Jie Li. 2019. The impact of China’s macroeconomic determinants on commodity prices. Finance Research Letters 36: 101323. [Google Scholar] [CrossRef]

- Zhang, Jia-Bing, Ya-Chun Gao, and Shi-Min Cai. 2020. The hierarchical structure of stock market in times of global financial crisis. Physica A: Statistical Mechanics and Its Applications 542: 123452. [Google Scholar] [CrossRef]

| Descriptive Statistics | Pre-Economic Crisis | Post-Economic Crisis | Complete Sample Duration | |||

|---|---|---|---|---|---|---|

| Stock Indexes | Exchange Rate | Stock Indexes | Exchange Rate | Stock Indexes | Exchange Rate | |

| Mean | 348.35 | 1848.5 | 1025.75 | 2383.54 | 741.65 | 2166.36 |

| Median | 231.15 | 39.9 | 600.72 | 32.24 | 339.31 | 33.23 |

| Maximum | 1576.20 | 10,315 | 3599.71 | 15,202.43 | 3599.71 | 15,202.50 |

| Minimum | 78.16 | 1.41 | 190.05 | 1.21 | 78.16 | 1.203 |

| Std.dev | 277.74 | 3660 | 942.14 | 4823.6 | 801.37 | 4388.282 |

| Skewness | 1.53 | 1.51 | 1.122 | 1.63 | 1.77 | 1.67 |

| Kurtosis | 5.50 | 3.31 | 3.08 | 3.86 | 5.39 | 4.09 |

| Jorque-berra | 238.34 | 140.65 | 127.1302 | 288.5 | 827.71 | 560.63 |

| Probability | 0.000 *** | 0.000 *** | 0.0000 *** | 0.0000 * | 0.000 *** | 0.0000 ** |

| Sum | 127,148.9 | 674,715.0 | 620,557.5 | 1,442,227.4 | 804,696.0 | 2,350,500 |

| Sum.sq.dev | 28,080,759 | 48,092,138 | 5.36 × 108 | 1.44 × 1010 | 6.98 × 108 | 2.09 × 1010 |

| Observation | 365 | 365 | 605 | 605 | 1085 | 1085 |

| Coefficient of Variation | Pre-2008 Recession | Post-2008 Recession | Overall Sampling Duration | |||

|---|---|---|---|---|---|---|

| Indexes | Exchange Rate | Indexes | Exchange Rate | Indexes | Exchange Rate | |

| COV | 0.79 | 1.98 | 0.91 | 2.02 | 1.081 | 2.03 |

| Nonlinearity Confirmatory Test Dimensions | January 2002 to January 2008 | January 2010 to January 2020 | January 2002 to January 2020 | |||

|---|---|---|---|---|---|---|

| Stock Indexes | Exchange Rate | Stock Indexes | Exchange Rate | Stock Indexes | Exchange Rate | |

| M = 2 | 0.192 *** | 0.179 *** | 0.181 *** | 0.199 *** | 0.199 *** | 0.196 *** |

| M = 3 | 0.32 *** | 0.311 *** | 0.317 *** | 0.339 *** | 0.330 *** | 0.32 *** |

| M = 4 | 0.41 *** | 0.412 *** | 0.41 *** | 0.429 *** | 0.41 *** | 0.41 *** |

| M = 5 | 0.47 *** | 0.497 *** | 0.48 *** | 0.501 *** | 0.49 *** | 0.50 *** |

| M = 6 | 0.51 *** | 0.521 *** | 0.52 *** | 0.55 *** | 0.49 *** | 0.40 *** |

| Multiple CD Tests | Pre-Economic Recessionary Regime | Post-Economic Recessionary Regime | When Overall Sampling Duration Is Considered (January 2002–January 2020) | |||

|---|---|---|---|---|---|---|

| Indexes | Exchange Rate | Indexes | Exchange | Indexes | Exchange | |

| Rate | Rate | |||||

| Breusch Pagan LM test | 586.19 *** | 318.3 *** | 488.47 *** | 619.6 *** | 1661.5 *** | 735.22 *** |

| Pesaran scaled LM test | 128.84 *** | 68.9 *** | 106.99 *** | 136.2 *** | 369.3 *** | 162.16 *** |

| Bias-corrected scaled LM test | 128.80 *** | 68.8 *** | 106.97 *** | 136.3 *** | 369.20 *** | 162.15 *** |

| Pesaran CD test | 24.09 *** | 13.43 *** | 20.69 *** | 24.26 *** | 40.55 *** | 18.25 *** |

| Variable | CS-Augmented IPS Unit Root Test by Pesaran (2007) | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| AT Level | After Taking 1st Difference | Order of Integration | |||||||

| CIPS-1 | CIPS-2 | CIPS-3 | Critical Value @5% | CIPS1 | CIPS2 | CIPS3 | Critical Value @5% | ||

| Pre-2008 | |||||||||

| Indexes | −0.9 | −1.21 | −1.3 | −1.77 | −5.65 | −6.78 | −7.71 | −1.77 | I(1) |

| ER | −1.1 | −1.31 | −1.78 | −1.72 | −5.10 | −7.79 | −9.10 | −1.72 | I(1) |

| Post-2008 | |||||||||

| Indexes | −1.4 | −1.65 | −1.91 | −1.98 | −8.09 | −14.87 | −21.87 | −1.98 | I(1) |

| ER | −1.9 | −2.03 | −2.12 | −2.10 | −7.98 | −8.10 | −10.3 | −2.10 | I(1) |

| Complete sample | |||||||||

| Indexes | −1.9 | −2.01 | −2.13 | −2.21 | −12.87 | −17.76 | −17.10 | −2.21 | I(1) |

| ER | −1.1 | −1.5 | −1.87 | −2.03 | −14.55 | −14.98 | −16.33 | −2.03 | I(1) |

| Variables | Pre-economic Recessionary Regime (January 2002–January 2008) | |||||||

|---|---|---|---|---|---|---|---|---|

| Panel-Based ARDL Model with PMG | Panel-Based NARDL Model with PMG | |||||||

| Coeff. | Std.Error | t-Value | Prob. Value | Coeff. | Std.Error | t.Value | Prob. Value | |

| Long-term results | ||||||||

| log(Indexes) | ||||||||

| log(ER) | 0.001 | 0.0008 | 1.47 | 0.14 | ||||

| Linear ECT(-1) | −0.008 | 0.010 | −0.84 | 0.39 | ||||

| ER+ | −0.0006 *** | 0.00023 | −2.80 | 0.0054 | ||||

| ER− | 0.00035 ** | 0.00015 | 2.251 | 0.025 | ||||

| Nonlinear ECT(-1) | −0.137 *** | 0.027 | −5.04 | 0.001 | ||||

| Short-term results | ||||||||

| ∆log(indexes) | ||||||||

| ∆log(ER) | −0.128 | 0.10 | −1.22 | 0.22 | ||||

| ∆log(ER(-1)) | 0.07 | 0.10 | 0.71 | 0.47 | ||||

| ∆ER+ | −0.180 | 0.14 | −1.26 | 0.20 | ||||

| ∆ER− | −0.13 * | 0.081 | −1.67 | 0.09 | ||||

| Housman test | 1.32 | |||||||

| Hsiao test of Heterogeneity | 6021 *** | |||||||

| Wald test statistics for short-term asymmetries | ||||||||

Indexes | −1.48 | |||||||

| Wald test statistics for long-term asymmetries | ||||||||

Indexes | −3.87 *** | |||||||

| Variables | Post-Economic Recessionary Regime (January 2010–January 2020) | |||||||

|---|---|---|---|---|---|---|---|---|

| Panel-Based ARDL Model with PMG | Panel-Based NARDL Model with PMG | |||||||

| Coeff. | Std.Error | t-Value | Prob. Value | Coeff. | Std.Error | t.Value | Prob. Value | |

| Long-term results | ||||||||

| log(Indexes) | ||||||||

| log(ER) | −0.27 | 0.21 | −1.28 | 0.20 | ||||

| Linear ECT(-1) | −0.28 | 0.19 | −1.47 | 0.15 | ||||

| ER− | 0.30 | 0.25 | 1.22 | 0.22 | ||||

| ER+ | −0.24 | 0.19 | −1.23 | 0.21 | ||||

| Nonlinear ECT(-1) | −0.27 | 0.189 | −1.423 | 0.16 | ||||

| Short-term results | ||||||||

| ∆log(indexes) | ||||||||

| ∆log(ER) | −0.67 ** | 0.28 | −2.35 | 0.018 | ||||

| ∆ER+ | −0.028 * | 0.01 | −1.91 | 0.055 | ||||

| ∆ER− | 0.0188 ** | 0.0082 | 2.27 | 0.023 | ||||

| Housman test | 1.58 | |||||||

| Hsiao test of Heterogeneity | 6991.4 | |||||||

| Wald test statistics for short-term asymmetries | ||||||||

ER | −6.44 *** | |||||||

| Wald test statistics for long-term asymmetries | ||||||||

ER | −1.65 | |||||||

| Variables | Whole Sample Duration from January 2002 to January 2020 | |||||||

|---|---|---|---|---|---|---|---|---|

| Panel-Based ARDL Model with PMG | Panel-Based NARDL Model with PMG | |||||||

| Coeff. | Std.Error | t-Value | Prob. Value | Coeff. | Std.Error | t.Value | Prob. Value | |

| Long-term results | ||||||||

| log(Indexes) | ||||||||

| log(ER) | −1.69 *** | 0.46 | −3.69 | 0.0001 | ||||

| Linear ECT(-1) | −0.01 * | 0.009 | −1.80 | 0.07 | ||||

| ER+ | −0.0025 | 0.01 | −0.18 | 0.85 | ||||

| ER− | −0.030 ** | 0.012 | −2.42 | 0.01 | ||||

| Nonlinear ECT(-1) | −0.0266 ** | 0.0094 | −2.82 | 0.015 | ||||

| Short-term results | ||||||||

| dlog(indexes) | ||||||||

| dlog(ER) | 0.039 ** | 0.017 | 2.27 | 0.0233 | ||||

| ER+ | −0.21 | 0.16 | −1.28 | 0.199 | ||||

| ER− | −0.28 | 0.23 | −1.24 | 0.219 | ||||

| Housman test | 1.65 | |||||||

| Hsiao test of Heterogeneity | 7612.6 *** | |||||||

| Wald test statistics for short-term asymmetries | ||||||||

Indexes | −1.23 | |||||||

| Wald test statistics for long-term asymmetries | ||||||||

Indexes | −6.76 *** | |||||||

| Alternative Hypothesis: | Obs | F-Statistic | Prob. |

|---|---|---|---|

| For the pre–health crisis → | 365 | 21.0280 | 1 × 10−09 |

| → | 60.8820 | 9 × 10−26 | |

| → | 365 | 0.73857 | 0.4780 |

| → Stock Index | 65.6672 | 1 × 10−27 | |

| Stock Index → | 365 | 14.1874 | 8 × 10−07 |

| → Stock Index | 50.9847 | 7 × 10−22 | |

| For the time frame of post-economic contraction | |||

| → | 685 | 25.5925 | 4 × 10−11 |

| → | 1.78974 | 0.1686 | |

| 685 | 4.36121 | 0.0135 | |

| → Stock Index | 9.54244 | 9 × 10−05 | |

| Stock Index → | 685 | 0.49253 | 0.6115 |

| → Stock Index | 6.72552 | 0.0014 | |

| For the whole sample time frame → | 1085 | 3.44961 | 0.0324 |

| → | 44.7696 | 8 × 10−19 | |

| 1085 | 11.3404 | 1 × 10−05 | |

| → Stock Index | 30.3243 | 3 × 10−13 | |

| Stock Index | 1085 | 4.22969 | 0.0150 |

| → Stock Index | 36.0304 | 2 × 10−15 | |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tabash, M.I.; Sheikh, U.A.; Matar, A.; Ahmed, A.; Tran, D.K. Do Financial Crises Matter for Nonlinear Exchange Rate and Stock Market Cointegration? A Heterogeneous Nonlinear Panel Data Model with PMG Approach. Int. J. Financial Stud. 2023, 11, 7. https://doi.org/10.3390/ijfs11010007

Tabash MI, Sheikh UA, Matar A, Ahmed A, Tran DK. Do Financial Crises Matter for Nonlinear Exchange Rate and Stock Market Cointegration? A Heterogeneous Nonlinear Panel Data Model with PMG Approach. International Journal of Financial Studies. 2023; 11(1):7. https://doi.org/10.3390/ijfs11010007

Chicago/Turabian StyleTabash, Mosab I., Umaid A. Sheikh, Ali Matar, Adel Ahmed, and Dang Khoa Tran. 2023. "Do Financial Crises Matter for Nonlinear Exchange Rate and Stock Market Cointegration? A Heterogeneous Nonlinear Panel Data Model with PMG Approach" International Journal of Financial Studies 11, no. 1: 7. https://doi.org/10.3390/ijfs11010007

APA StyleTabash, M. I., Sheikh, U. A., Matar, A., Ahmed, A., & Tran, D. K. (2023). Do Financial Crises Matter for Nonlinear Exchange Rate and Stock Market Cointegration? A Heterogeneous Nonlinear Panel Data Model with PMG Approach. International Journal of Financial Studies, 11(1), 7. https://doi.org/10.3390/ijfs11010007