Abstract

The minimum wage has become a standard measure in the economic and social policies of countries all over the world. The primary objective of this measure is to guarantee that workers receive a minimum wage that allows them to lead a decent life, thereby reducing inequality and poverty. However, studies on the minimum wage have not focused on assessing the effects on these dimensions but only on employment. The objective of this study is to address this research gap by analysing the effects of minimum wage increases on income inequality and poverty. To this end, firstly, a systematic review of the empirical analyses was conducted using the PRISMA methodology, with a view to ensuring that all empirical evidence was available. Secondly, the Spanish case was examined. The significant increase in minimum wage in Spain in 2019 (21.3% in real terms) presents an invaluable opportunity to utilise this event as a natural experiment to generate new evidence. A difference-in-differences approach was employed to assess the impact of this phenomenon in the period 2018–2019 with microdata from European Statistics on Income and Living Conditions (EU-SILC for Spain). In doing so, two basic scientific contributions were made. The first one, a systematic, exhaustive, and up-to-date literature review (up to June 2024), as there is, to our knowledge, no recent systematic review of this relationship (minimum wage vs. inequality). The available evidence indicates a clear inverse relationship between the minimum wage and inequalities and poverty. The second one, regarding the Spanish case, there has been a dearth of scientific studies on this subject. Thus, this paper provides new scientific evidence demonstrating that a significant increase in the minimum wage can significantly improve the income of low-wage earners, thereby reducing income inequality and in-work poverty. Furthermore, there is evidence of a spillover effect towards income groups closer to the treatment group.

Keywords:

minimum wage; MW; inequality; poverty; systematic review; PRISMA; difference-in-differences; Spain 1. Introduction

The minimum wage (MW) has been a subject of interest to researchers, politicians, trade unions, and the general public since the beginning of the 20th century. Indeed, there were significant protests and strikes from the late 19th and early 20th century against the low wages paid to workers and in favour of guaranteeing by law a fair wage that would at least allow a minimally decent life for workers and their families. Since that time, governments in countries across the globe have implemented MW regulations.1 Indeed, the MW has become a standard measure in the economic and social policy of every country in the world (according to the International Labour Organization (ILO), at least 90% of ILO member countries have a national minimum wage and the rest, at least, a regional or local minimum wage). The proportion of the labour force directly or indirectly affected by the MW is estimated to be between 20% and 30% (Belman and Wolfson 2014). This encompasses not only those who earn the MW but also those who earn more through the so-called “spillover effect” and even workers in the informal sector through the so-called “lighthouse effect”. The resurgence of this measure in recent decades is also related to the growing concern of governments about rising inequality and poverty in both rich and developing countries. The consequences of this effect are significant, with social and political instability being notable. Inequality and poverty are arguably the most important economic and social problems in the world, in addition to environmental concerns.

The minimum wage is defined as “the minimum sum payable to a worker for work performed or services rendered, within a given period, whether calculated on the basis of time or output, which may not be reduced either by individual or collective agreement, which is guaranteed by law and which may be fixed in such a way as to cover the minimum needs of the worker and his or her family, in the light of national economic and social condition” (ILO 2014). The aims and objectives of the minimum wage are typically described in the regulations that govern the measure. The overarching objective is social justice, which is determined by each individual receiving fair economic compensation for their work. This compensation should, at a minimum, allow the individual to live in dignity. The mere existence of workers who are paid less than a decent living wage (in-work poverty) is an undesirable situation, not only because it leads to social injustice but also because the dumping effect in turn impacts the companies that do pay a fair wage. The amount of the MW has been the subject of intense debate. The question of defining what is meant by “a decent standard of living” is therefore of great importance. In Europe, the concept of a “decent standard of living” is defined in the European Social Charter (ESC) article 4, with the interpretation of the Committee of Social Rights (ECSR) serving to guarantee its fulfilment. This threshold was established in 1998 at 60% of the average net salary of each country, with non-compliance being defined as occurring at 50% of the net salary.2

Despite these clear objectives, the scientific discussion in Economics focused on the controversy throughout the 20th century as to whether a rise in minimum wages could distort the so-called “competitive labour market” and lead to a reduction in employment that would cause the disappearance of any improvement for workers, according to the model of perfect competition elaborated by (Stigler 1946). It should be noted that this theory is based on theoretical assumptions that are far detached from reality.

The existing literature on the effects of MW increase on inequality and poverty is limited, particularly in terms of empirical analyses. Thus, the present contribution aims to address this gap in the literature. To this end, two objectives were set: firstly, to carry out a systematic, exhaustive, and unbiased review of the empirical analyses on this issue; and secondly, to analyse a specific case that provides new evidence on the subject (the Spanish case), given that from 2019 onwards there has been an important change in the minimum wage policy in Spain, which includes a very significant increase in its amount (21.3% in real terms). At the same time, empirical studies on the impact of the MW on inequality and poverty in Spain are almost non-existent; to date, there have been only a few institutional technical reports on the subject.

For this purpose, the methodology applied was twofold. First, a systematic literature review was conducted using the PRISMA methodology (already used in previous studies (De Paz-Báñez et al. 2020) to enable the collection of all empirical studies on the effect of the MW on inequality and poverty in an exhaustive and unbiased manner. Given the existence of other reviews on the subject, although not systematic or up to date, the results of these reviews were collected and complemented with an exhaustive analysis of the latest years (2020–2024), for which there is no literature review to our knowledge (for a summary of the application specifications for this case, see Appendix A). Secondly, the Spanish case in 2019 was treated as a natural experiment using the difference-in-differences methodology, applying an OLS regression analysis, in the period 2018–2019 with microdata from European Statistics on Income and Living Conditions (EU-SILC for Spain). The aim of this study was to see whether a substantial increase in the MW, as occurred in Spain in 2019, would have a significant effect on income inequality, especially in the bottom tail of the distribution, as indicated in some of the literature, or whether, on the contrary, this effect would be masked by other undesirable effects, as indicated in other studies on the subject (see point 2). Such an effect was clearly in favour of the first option.

Thus, in this article, two new basic scientific contributions are made: an exhaustive, current, unbiased literature review, given that there is to our knowledge no comprehensive review of this relationship—MW vs. inequality—up to 2024, which allowed us to establish the state of the art so far; and, secondly, new empirical evidence is provided to show that a large increase in MW can greatly improve the lives of low-wage workers without side effects that interfere with this positive effect, the negative effects on employment being small or non-existent.

In what follows, first, the systematic review of the effect of the MW changes on inequality and poverty is presented, focusing on the empirical analyses (Section 2), followed by a summary of the specificities of the Spanish case (Section 3). Then, the empirical analysis is carried out to determine the effects of the large increase in 2019 on the income inequality of the affected workers (Section 4). In Section 5, the results are discussed, followed by an analysis of their practical implications (Section 6) and by the conclusions.

2. Systematic Review of Empirical Studies on the Effects of MW on Inequality and Poverty

Until the end of the 1980s, there was a scarcity of empirical studies in the field of economics, and they played a marginal role, dependent on theoretical studies. They served only to confirm some predictions of the theories or to estimate parameters of a theoretical model that was taken as true.

The most commonly used method was time series regression. From the beginning of the 1990s, the number of empirical analyses began to increase, and the role of these studies changed, taking on a more prominent character and a different objective: to check whether the theories in use were correct or not, whether there was sufficient empirical evidence to support them, or, on the contrary, whether they should be refuted and a new theory or model be sought or the existing one modified. Empirical studies ceased to be a mere adjunct to theory and became an essential part of scientific work, based on the assumption that a theory is scientific only because of empirical evidence (according to Popperian approaches). Since then, the methodology applied to these studies has become more sophisticated, with the predominance of natural and laboratory experiments with a control group, in order to be able to rule out the possibility that the changes are caused by any of the many other variables involved, which may have varied in the process and go beyond the mere correlation between variables. In fact, most of the empirical studies carried out in the field of economic sciences in recent decades have totally or partially refuted some of those theories.

In the specific case of MW, an important change occurred with the work by Card and Krueger at the beginning of the 1990s, giving rise to what has been called the New Minimum Wage Research (NMWR) (Belman and Wolfson 2014). The change in MW research since then, particularly in methodological terms, has meant that everything that was previously known, or thought to be known, about the subject had to be reconsidered. This major change has occurred not only in the promotion and greater weight given to empirical work, but especially in the strategies and designs of empirical research (Card and Krueger 2016). Thus, in recent decades, a large number of theoretical and empirical studies have been produced with varying results. See, for example, the literature reviews and meta-analyses by (Allegretto et al. 2017; Belman and Wolfson 2014; Brown et al. 1982; Brown 1999; Dube 2019a; Neumark and Wascher 2008; Neumark et al. 2014; Neumark and Shirley 2022). However, the vast majority of these studies have focused on the effect of the minimum wage on employment.

2.1. Systematic Review Up to 2019

Studies on the impact of the MW on inequality and poverty are scarce, despite this effect being the main objective of the measure. The work that is usually considered to be the first to have carried out an empirical analysis of the impact of the MW on household income is that by (Gramlich et al. 1976), which reflects a major controversy between economists and politicians and between traditional economists and what he calls “radicals”. However, it was not until the early 1990s that more systematic studies were developed. The book by Card and Krueger (1995) provided a comprehensive review of previous studies on the subject and concluded that increases in the minimum wage had led to a reduction in wage inequality and an increase in the earnings of low-income workers and families. Despite the controversial nature of this claim, given that the opposite was believed at the time, subsequent studies have since confirmed this conclusion.

Indeed, since then, the impact of minimum wages on the wage distribution has been the subject of a number of empirical studies, focusing mainly on the US. Perhaps the most cited one is the study by DiNardo et al. (1996) who, for the period 1973–1988, concluded that the real decline in the MW was the source of a quarter of the increase in inequality in the US during that period. Freeman (1996) conducted a comprehensive review of the effects on wage distribution and concluded that minimum wages could help to improve the welfare of the lowest paid and to limit wage inequality. Lee (1999) concluded that minimum wages had relatively large effects on the distribution of wages, due in part to the “spillover effect” on workers paid above the MW. Autor et al. (2016) assessed the impact of federal minimum wages on the US wage distribution over the period 1979–2012 and found that the minimum wage did indeed reduce inequality at the bottom of the distribution, although the effects are smaller today than in the 1980s. They argued that Lee (1999)’s findings overstated the effect of the minimum wage, but still found evidence of spillover effects and considered them to have a significant impact on wage inequality. Both studies attributed the increased inequality in the United States to the depreciation of the value of the minimum wage. In the UK, Dickens et al. (2012) concluded that the introduction of the national minimum wage had had a strong effect at the bottom tail of UK wages, raising workers’ wages to the 35th percentile of the overall wage distribution.

There has also been research on the impact of minimum wages on family income and poverty. Dube (2019b) found thirteen studies relating minimum wages to poverty rates and also provided his own estimates. The average elasticity poverty rates of each group analysed in these studies with respect to the minimum wage was −0.18. Although the poverty rate is arguably a “fuzzy” criterion for assessing the distributional effects of minimum wages, these studies confirm that minimum wages have a poverty-reducing effect.

But perhaps the most comprehensive review on MW is provided by Belman and Wolfson (2014), with an analysis of more than 200 articles, mainly from the period 2000–2014, focusing on the most developed Western countries. They found few studies measuring the impact of the MW on inequality and poverty (specifically, 8 studies on the impact on the wage distribution and 19 on poverty). If anything, they found evidence of a reduction in inequality at the bottom of the distribution, although the evidence on poverty was less clear.

In developing countries, on the other hand, the evidence is similar, despite the weight of the informal sector and greater non-compliance with MW regulations. Studies have been carried out both when the minimum wage has risen and when it has fallen. For instance, in Mexico, (Bosch and Manacorda 2010) analysed the impact of the minimum wage on inequality between 1989 and 2001, when the Mexican minimum wage fell by around 50 per cent in relation to median earnings. Their analysis suggests that “a decrease in the real minimum wage leads to an increase in the 50/10 percentile gap of 1.4 p.p. a year and a rise in the 90–50 percentile gap of 1.8 p.p.” (p. 146). The erosion of the real value of minimum wages is “fully responsible for the observed increase in inequality at the bottom of the distribution” (pp. 143–44).

2.2. Systematic Review from 2020 to 2024

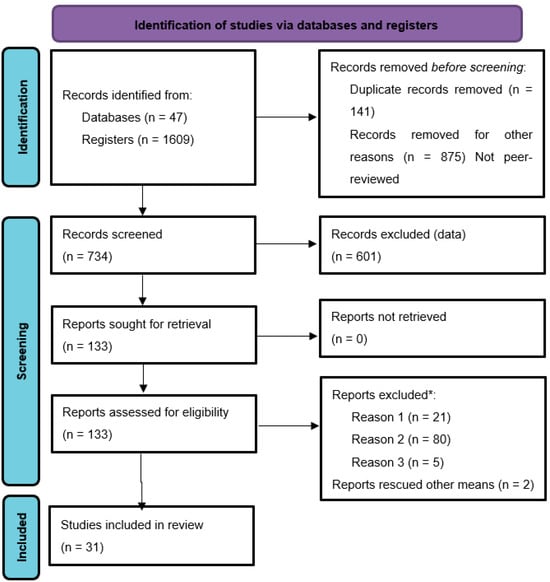

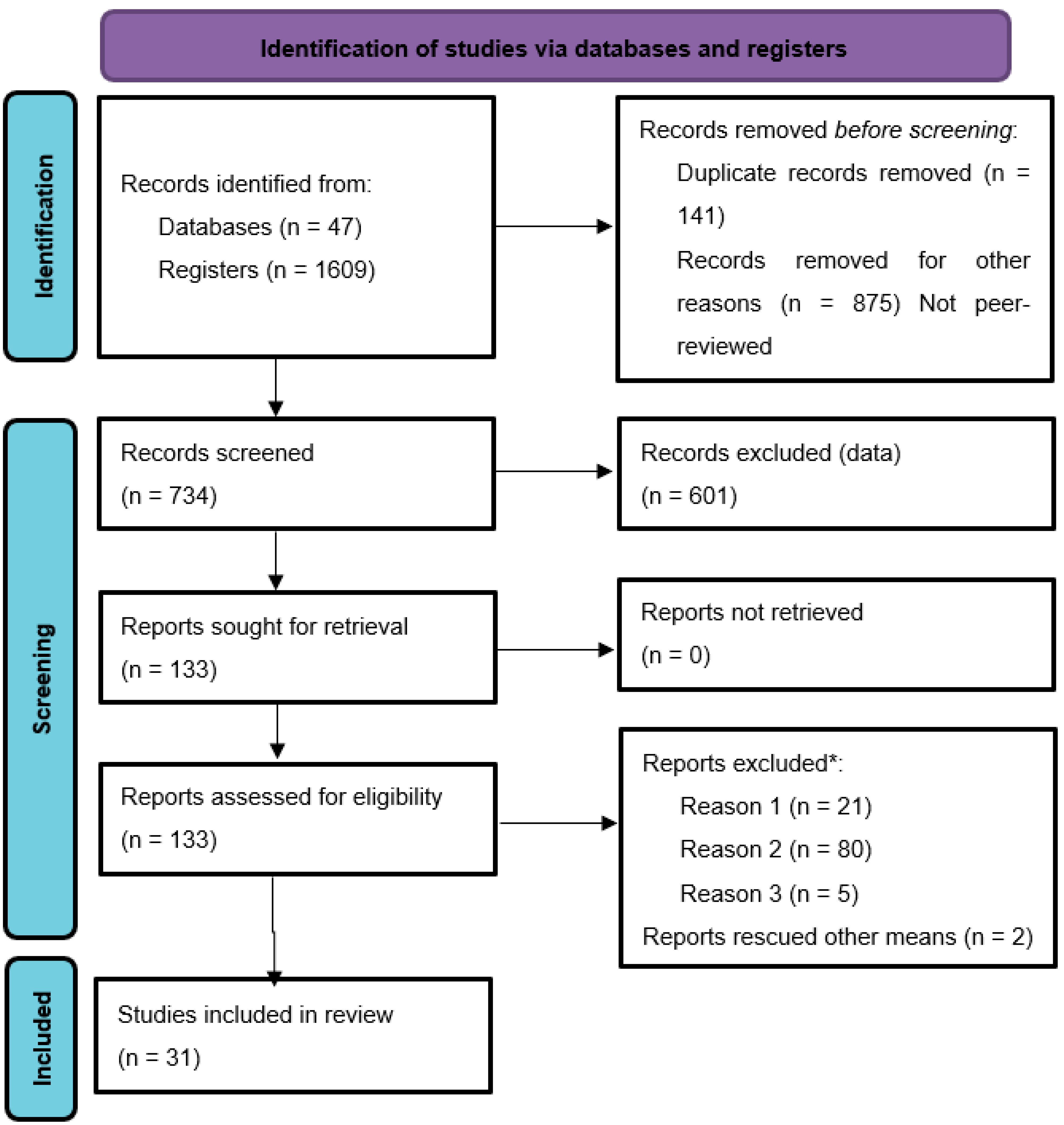

With the studies outlined above, especially those by (Belman and Wolfson 2014; Dube 2019a, 2019b), there are sufficient literature reviews to provide insight into the evidence on the influence of changes in the MW on inequality and poverty up to 2019. However, to the best of our knowledge, no further reviews exist, hence the need to conduct a comprehensive review from that date onwards.3 The PRISMA method was used as described in Appendix A. A large number of databases were searched, in particular ProQuest (47) and Columbus-UHU (140). The first search yielded more than 1600 documents, which were screened to include only peer-reviewed empirical scientific analyses from any country in the world, published at least in abstract form in English or Spanish. After screening, a total of 31 articles published between 2020 and 2024 (June) were selected and reviewed in summary form (Appendix B, Table A1).

All studies focused on changes in the MW in the years up to 2020. The countries studied were mainly the USA (6), Germany (5), Turkey (4), and Brazil (3). The remaining articles involved 8 other countries, and 4 other articles covered wider regions. It is noteworthy that no articles were found for Spain, which increases the importance of this article.4

Most research analysed the general impact of the minimum wage on wage and/or income inequality (14). However, some studies focused on more specific aspects such as: the indirect effects of the MW; the relationship between income inequality and social variables; effects on higher incomes; on the middle class; impact on gender inequality; on racial inequality; effects on formal and informal wages; on negotiated wages; and general effects on the labour market. Most of them sourced data from official agency surveys (19), either labour (6) or household living conditions surveys (9). Another 5 used administrative data.

The methodology of analysis varied widely. Some of them were descriptive (3) or applied time series regression (12). The problem encountered in these studies was that the results were prospective or defined as mere correlations between variables. Others applied simulation (5) or modelling (2), which are exploratory exercises based on sometimes unrealistic models. Only nine of them employed causal methodology with clear differentiation between treatment and control groups. Specifically, they applied the difference-in-differences methodology.

The results of more descriptive research comparing wage distributions (3) suggest that there is an inverse relationship between MW and wage and/or income inequality, especially for certain disadvantaged groups. (Cho and Yang 2021), for Korea over the period 2010 to 2020, found that MW reduced the gender pay gap.5 Also, Laporšek et al. (2021), in Slovenia, where the minimum wage increased by 22.9% in 2010, showed that the effect was greater for women, young people, and workers with lower educational attainment or low employment status.6 Beccaria et al. (2020), comparing the evolution of MW levels with those agreed in collective bargaining in Argentina, concluded that MW did not have a differential impact on the remuneration of the lower categories of each agreement.

Through simulation (5), (Long 2022), using a synthetic control approach in the absence of a direct control group, obtained different results for the US state of Seattle. Estimating the impact on the Gini and Atkinson indices for different values of the minimum wage, the results suggest that the ability of firms to replace low-skilled workers can offset wage gains, leaving income inequality unchanged. Backhaus and Müller (2023) found that neither in-work poverty nor overall disposable income inequality decreased after the introduction of the minimum wage in Germany, despite the fact that the minimum wage reform had a significant impact on the lower tail of the wage distribution. Although non-compliance affected, the main reason cited by the authors was that minimum wage earners were spread across the income distribution and not concentrated in low-income households. In the same vein, Alinaghi et al. (2020), for the New Zealand case, suggested that minimum wage policy did not appear to be particularly targeted, largely because many low-wage workers were secondary wage earners in higher-income households, while many low-income households had no wage earners at all. Grünberger et al. (2021) applying EUROMOD for 21 EU countries suggested that MW increases could significantly reduce in-work poverty, wage inequality, and the wage gap between men and women. (Engbom and Moser 2022), using an equilibrium model of the Brazilian labour market, found that the increase in MW accounted for 45 per cent of the large decrease in income inequality between 1996 and 2012. The model would predict significant spillover effects in higher incomes. At the same time, the impact of the minimum wage on employment and production was mitigated by the reallocation of workers to more productive firms.

Using time series regression (Cho and Yang 2021; Tamkoç and Torul 2020) estimate a correlation coefficient of 0.54 between the time evolution of the MW and that of the Gini index in Turkey, where estimates of wage, income, and consumption inequality show declining time trends over the 2002–2016 period, coinciding with the rapid growth of the minimum wage during this period. Engelhardt and Purcell 2021 found that the MW reduces inequality in the bottom quartile of the income distribution, and especially in the bottom decile; Sefil-Tansever and Yılmaz (2024) and Bakis and Polat (2023) also found reduction income disparities and a spillover effect in the case of Turkey. In the latter article, they found that the MW significantly reduced income disparities, especially among formal workers at the lower and upper ends of the wage distribution, and they also found evidence of a certain lighthouse effect: the minimum wage seemed to have an equalising influence on the wage structure of workers in the informal sector. Herrero-Olarte and Sosa (2020) found a correlation in Latin American countries, but with a small impact on the relationship between the increase in the MW and the increase in the lowest wages. Saboia et al. (2021), for the case of Brazil, estimated a significant effect of the MW on low and middle levels of labour income, with the largest effect between the third and seventh decile, thus improving the country’s income distribution. However, other studies found no effect of the MW on earnings in the first two deciles of the distribution, an effect attributed to labour in-formality concentrated at the bottom of the wage distribution. Herrero-Olarte (2022) estimated an insignificant impact on the poorest decile in Ecuador and a larger positive impact on the lower-middle deciles. This result is confirmed in Herrero-Olarte (2023), who deepened the analysis of the lighthouse effect, which he considers to be the main factor in reducing in-work poverty and inequality.

Joe and Moon (2020), using data from OECD countries, confirmed the existence of a correlation between minimum wage increases and a reduction in wage inequality at the bottom of the wage distribution, while having little effect at the top of the wage distribution. The estimated effect is larger for women than for men, which is consistent with the fact that the proportion of workers who are directly affected by changes in the minimum wage is higher among women than among men. They also found that the minimum wage had little effect on wage inequality at the upper end of the wage distribution.

As regards indirect effects, Chao et al. (2022) found that a 1% increase in the minimum wage led to a reduction in the Gini coefficient of about 0.025 in the short run (without a business exit effect) and 0.031 in the long run (with a business exit effect). In other words, about one-third of the reduction in the Gini coefficient in the long run is due to the indirect effect of minimum wages through the business exit channel. Fortin et al. (2021) also found correlations between the decrease in the MW and the increase in inequality. Indirect (spillover) effects substantially increased the impact of decreased real minimum wage on increased inequality in the US over the period 1979–1988.

Finally, in South Africa, following a sharp 52% increase in the minimum wage in 2013, in an economy where 90% of agricultural workers were paid below the new minimum wage level prior to the implementation date, Bassier and Ranchhod (2024) suggest that compliance decreased as the gap between the minimum wage and the pre-implementation wage increased. They estimated that agricultural workers experienced an average wage increase of 9% as a result of the MW policy.

Some studies used statistical modelling to analyse causal relationships (DiNardo et al. 1996). Sari and Purwono (2021) applied cointegration and long-run structural vector autoregression (SVAR) in the Indonesian context. While focusing on modelling the relationship between income inequality and social variables, they concluded that increasing the minimum wage can reduce income inequality and morbidity, and increase education and per capita income. (Bükey 2022) used the ARDL (Autoregressive Distributed Lag) method in the Turkish case and found that a 1% increase in the minimum wage reduced the Gini coefficient by 0.061%, while a 1% increase in private sector wages increased the Gini coefficient by 0.051%. This finding suggests that minimum wage policies play an important role in reducing inequality, even though wage increases in the private sector may increase inequality. They find a bidirectional causal relationship both from the minimum wage to private sector wages and from private sector wages to the minimum wage. It can therefore be said that there is a spiral effect between the minimum wage and the overall wage level in the private sector.

Only nine articles (see Table 1) provided empirical evidence on the causal relationship between MW and its effects found using the difference-in-differences approach with a control group. Only one of them used treatment and control groups with wage thresholds: Burauel et al. (2020) assigned workers with wages below the MW (EUR 8.5/h) to the treatment group, while the control group had wages between EUR 8.5 and EUR 10/h. Derenoncourt and Montialoux (2021) used treatment intensity before and after 1967, which is their reference year. The rest used the identification strategy proposed by Card and Krueger (1992) based on regional differences in relative treatment intensity.

Table 1.

Synthesis of results of the systematic review: articles with treatment and control groups (DiD).

As regards the results observed through causal analyses, the most studied case is that of Germany, following the introduction of the MW in 2015 (see Dütsch et al. 2024). A total of four studies were found in the German context: (Bossler and Schank 2023; Burauel et al. 2020; Caliendo et al. 2023; Ohlert 2023).

All these studies confirm significant increases in hourly wages in almost all contexts, ranging from 3.9% to 6.7% for employees earning less than EUR 8.50 per hour before the introduction of the minimum wage. Caliendo et al. (2023) estimated a treatment effect for the first quintile of around 9% in 2015 and 21% between 2016 and 2018. The causal analysis by Burauel et al. (2020) found an MW-induced wage increase of 6.5%, which resulted in a 6.6 percentage point increase in the wage situation of low-paid workers in terms of gross monthly earnings, despite the high level of non-compliance found across the study. The positive impact is more pronounced for marginal workers’ wages, with an increase of 15.5% compared to 7.8% for regular full-time jobs. With regard to territorial disparities, Bossler and Schank (2023) confirmed that the minimum wage reduced wage inequality in East and West Germany and also led to a convergence of the wage differential between East and West. The results demonstrated that monthly wages increased significantly at the lower end of the wage distribution and up to the median. The results indicated that a minimum wage increase led to a 12% increase in monthly wages at the 5th percentile, a 21% increase at the 20th percentile, and a 2% increase at the 50th percentile of the unconditional wage distribution. Conversely, the effect was zero beyond the median. Ohlert (2023) employed a difference-in-differences analysis at the firm level to investigate the impact of the statutory minimum wage on gender inequalities, specifically the wage gap, working time gap, and income gap. The results show a reduction of up to 3.6 percentage points in the average wage gap between men and women. In terms of gross earnings, in firms affected by the minimum wage, the gap was reduced by up to 6.1 percentage points for all employees and by up to 4.6 percentage points more for low-paid employees. Finally, they identified adjustments in the working hours of women and men in the low-wage sector, which resulted in a reduction in the working hours gap between the genders. In Brazil, Sotomayor (2021) revealed a significant reduction in poverty levels across successive increments of the MW. On average, poverty and income inequality decreased by 2.8% and 2.4%, respectively. Yet, the effects of the MW on poverty levels appear to diminish over time. However, the authors highlighted that some standard errors were considerable and cautioned against the potential risk of bias due to the presence of autocorrelation and heteroskedasticity in the majority of the time series. In the case of Colombia, Pérez (2020) employed city-industry blocks with high and low MW incidence as treatment and control groups to analyse the difference in impact on the formal and informal sectors. The study revealed that the wage increase induced in the formal sector amounted to 3%, a figure that was higher than that observed in the informal sector.

M. Frank (2021) aimed to identify the possible causal relationship between the sustained decline in real US minimum wage over the three decades preceding the Great Recession of 2007 and the real increase in the incomes of the richest. During these years, the income shares of the richest 1% in the US increased by more than 150% (from 9.3% to 23.5%). Over the same period, the real federal minimum wage fell by around 35% (from $8.92 to $5.76 in 2011). An inverse relationship between minimum wage laws and top income shares is found, but the results are not robust against small changes in the specification of the econometric model or in the inequality indicators used. Derenoncourt and Montialoux (2021) also in the case of the US, concluded that the expansion of the MW in 1967 could explain more than 20% of the reduction in the racial income gap during the civil rights era. Finally, they estimated the effect of the minimum wage increases implemented by 10 states in 2014 and 2015 at the business level. Using the control group states where the MW increase had not occurred versus those that had substantially increased minimum wages, Forsythe found results that indicated a decline in wage inequality at the business level. This spillover effect was observed to spread the wage increase upwards, with no evidence of changes in occupational organisation.

As a summary of the analysis of the studies so far, it can be stated that the MW is an effective measure to reduce inequality in the lower tail of the income distribution. The empirical evidence over the last five years is clear on the existence of this causal relationship, adding to the evidence accumulated in previous years. Specifically, the nine articles in this review show how the MW induces a rise in wages in the lower tail of the distribution, thus reducing wage inequality, with spillover effects to higher wages (Bossler and Schank 2023; Forsythe 2023) and also to marginal workers (Burauel et al. 2020), an effect that in more informal economies can spill over into informal employment (Pérez 2020). There is also causal evidence that this decline in inequality contributes to the reduction in the gender (Ohlert 2023) and race (Derenoncourt and Montialoux 2021) gap, as these workers are at the lower tail of the wage distribution. Reduced inequality is also detected by pre-2020 work and by recently published descriptive and regression studies (Autor et al. 2016; Backhaus and Müller 2023; Bakis and Polat 2023; Belman and Wolfson 2014; Dickens et al. 2012; Card and Krueger 1995; Chao et al. 2022; Engelhardt and Purcell 2021; Freeman 1996; Grünberger et al. 2021; Joe and Moon 2020; Lee 1999; Saboia et al. 2021; Sari and Purwono 2021; Sefil-Tansever and Yılmaz 2024; Tamkoç and Torul 2020). Moreover, the decrease in real MW is a cause of increased inequality as shown by Frank, M. in the case of the US (Frank 2021), thereby confirming previous results (Autor et al. 2016; DiNardo et al. 1996; Lee 1999) and for Mexico and recent results showing the existence of correlation (Fortin et al. 2021).

The evidence is therefore quite compelling, only contradicted by a simulation exercise in the US state of Seattle (Long 2022).

The MW also shows, at least in the German case with a nationwide MW, potential to contribute to the reduction in territorial disparities, as shown in (Bossler and Schank 2023), or to contribute to increasing the allocation efficiency of workers (Dustmann et al. 2022). These effects identified through the causal analysis, which are not directly related to the main objective of the measure, represent an interesting element to be further explored.

The impact of the minimum wage on poverty remains much less explored. We rely primarily on the evidence already cited above (Belman and Wolfson 2014; Dube 2019b), and more recently there is clear evidence for the case of Brazil (Sotomayor 2021), where the minimum wage contributed significantly to poverty reduction, and for the case of South Africa (Bassier and Ranchhod 2024).

From the empirical literature reviewed, it is possible to derive some important elements that condition the intensity and duration of the impact of the MW on inequality, as well as its effectiveness as a poverty reduction measure.

Firstly, it is important to consider the level of MW in relative terms. Minimum wages well below median or average wages have little or no impact on the wage distribution and hence on inequality, and vice versa. In (Bassier and Ranchhod 2024; Laporšek et al. 2021; Tamkoç and Torul 2020), there is evidence of the effectiveness of large increases in the MW in economies where the MW was well below the median or average wage. Also related to the amount, but in this case relative to the wage distribution as a whole, is the percentage of workers affected by the increase or decrease in the MW—also considering spillover and lighthouse effects. Depending on the quantile in the wage distribution, a greater number of workers will be affected.

Secondly, the degree of compliance with regulations and the size of the informal economy are assessed. In the EU, (Eurofound 2024) estimates an average non-compliance in 2018 of 1.3% or 6.93% depending on the data source used (for Spain: 0.98% or 11.6%, respectively); in the same line, Burauel et al. (2020) also indicate a high level of non-compliance in Germany. A high degree of non-compliance and/or a high degree of informality means that the influence of the MW is not concentrated in the first deciles, if it is in the first deciles that both phenomena are concentrated. Several recent studies have found negative correlations with respect to the impact on inequality, that is, the MW reduces inequality, in Turkey, Brazil, Ecuador, and South Africa (Bakis and Polat 2023; Saboia et al. 2021; Herrero-Olarte 2022, 2023; Bassier and Ranchhod 2024), and in a group of South American countries (Herrero-Olarte and Sosa 2020).

Thirdly, the institutional architecture of the labour market should be considered. The collective bargaining model, the existence of national or territorial MW, or different amounts per category or collective, etc. condition both the degree of coverage of the group directly affected and the extension to groups with wages close to the MW (spillover and lighthouse effects) and even to higher wages.

Finally, the effectiveness of the measure in meeting the challenge of poverty reduction is conditioned, in addition to the above circumstances, by the following: the MW threshold in relation to the poverty rate; the percentage of people living in poverty or at risk of poverty who are economically active, either working or in search of employment; the extent to which the MW is complemented by other measures with the same objective of reducing inequality and eradicating poverty, e.g., social transfers; the distributional position of the workers concerned in the income and wealth distribution, i.e., whether or not they are concentrated in low-income households; and the company’s response, which has been little studied in the literature, but which will also determine the profile of the workers affected, as a possible reallocation of workers to more productive activities or substitution of workers may alter the composition of the group of workers affected by the measure.

3. The Spanish Case

In Spain, the national minimum wage is applicable to all workers regardless of age, branch of activity, type of working day, type of contract, or territory. Article 35 of the Spanish Constitution of 1978 establishes the right of everyone to receive remuneration for their productive work sufficient to satisfy their needs and those of their families. The basic norm that regulates labour relations in Spain, the Workers’ Statute of 1980, establishes and defines the characteristics of the interprofessional minimum wage in its article 27.

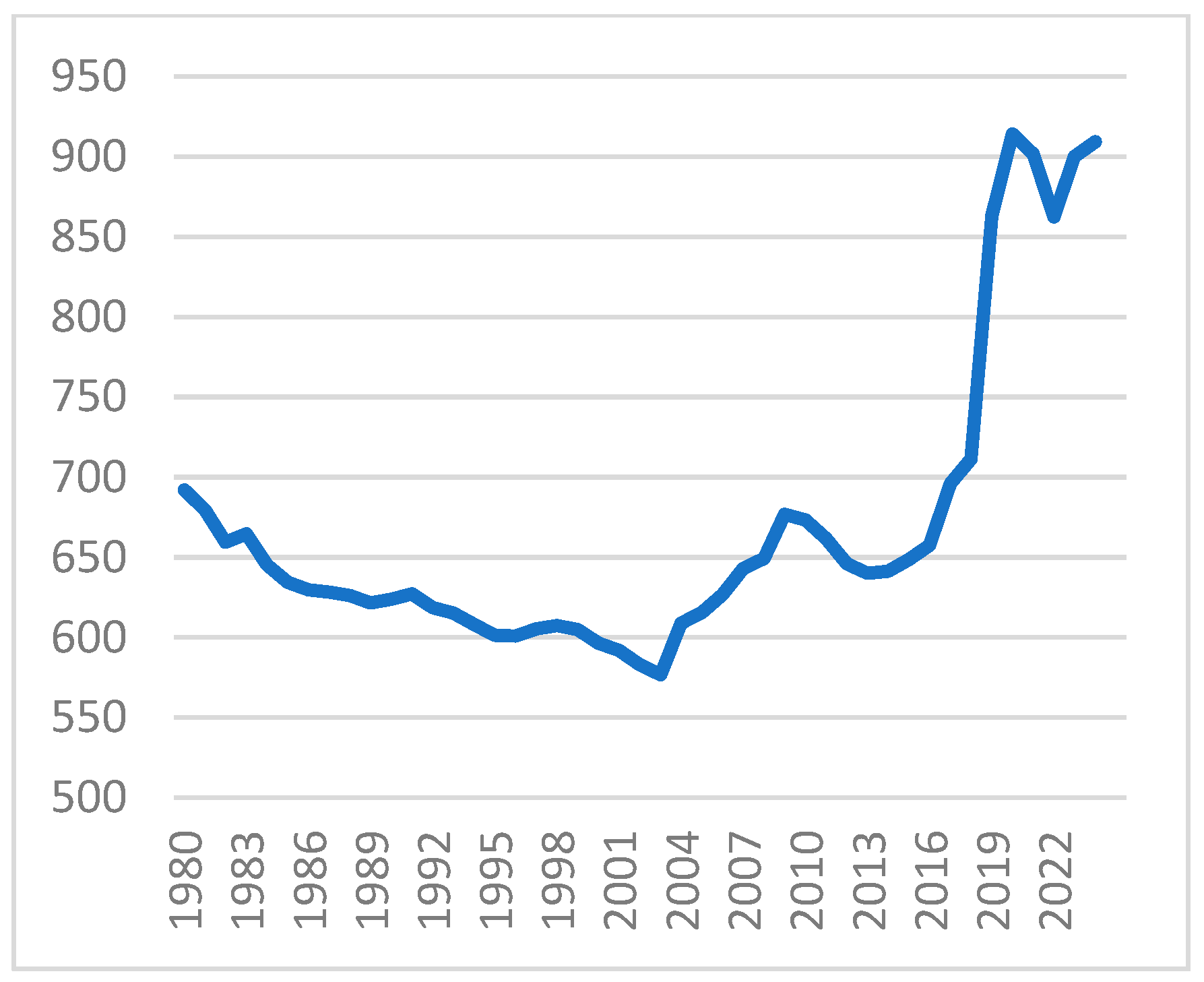

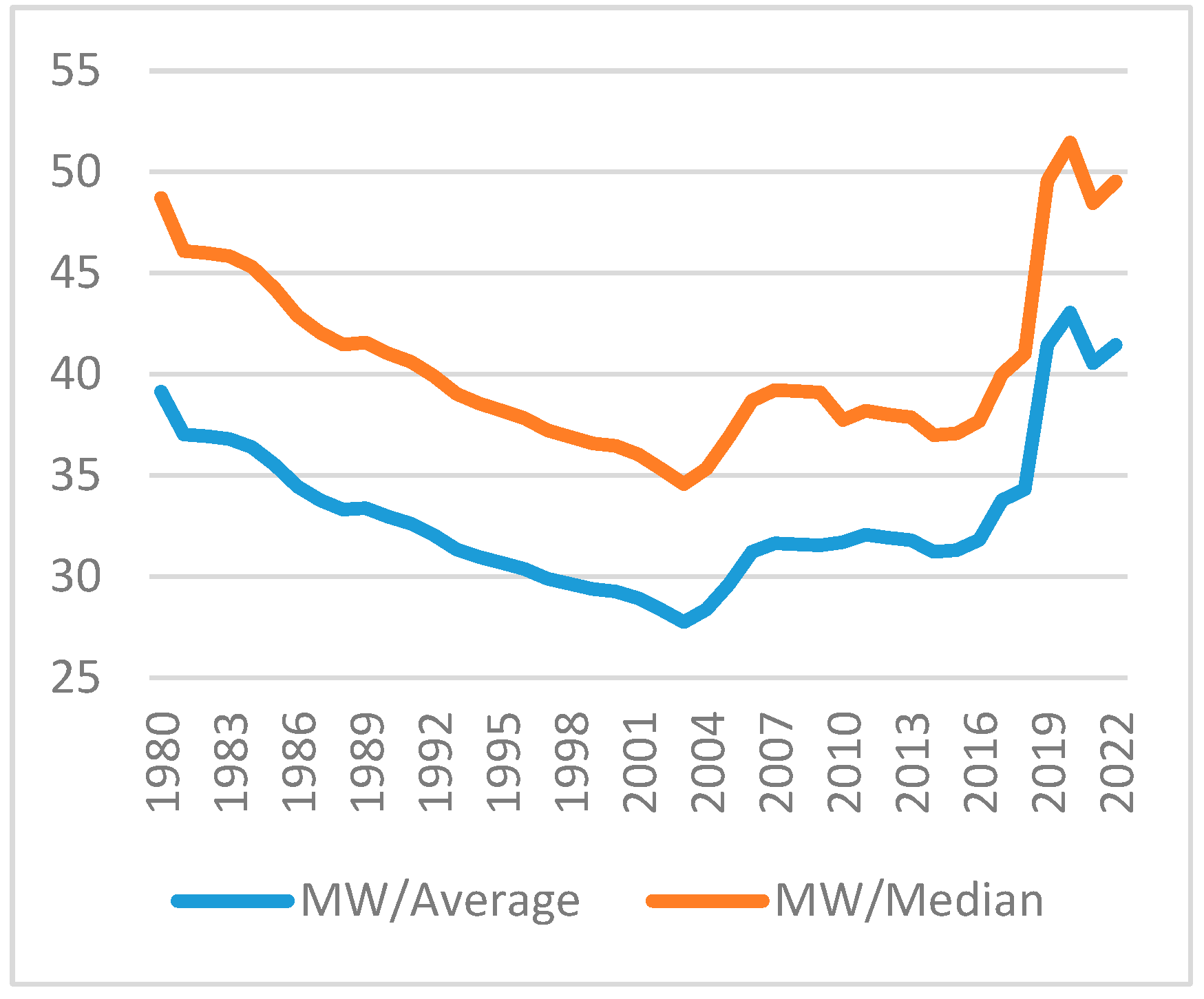

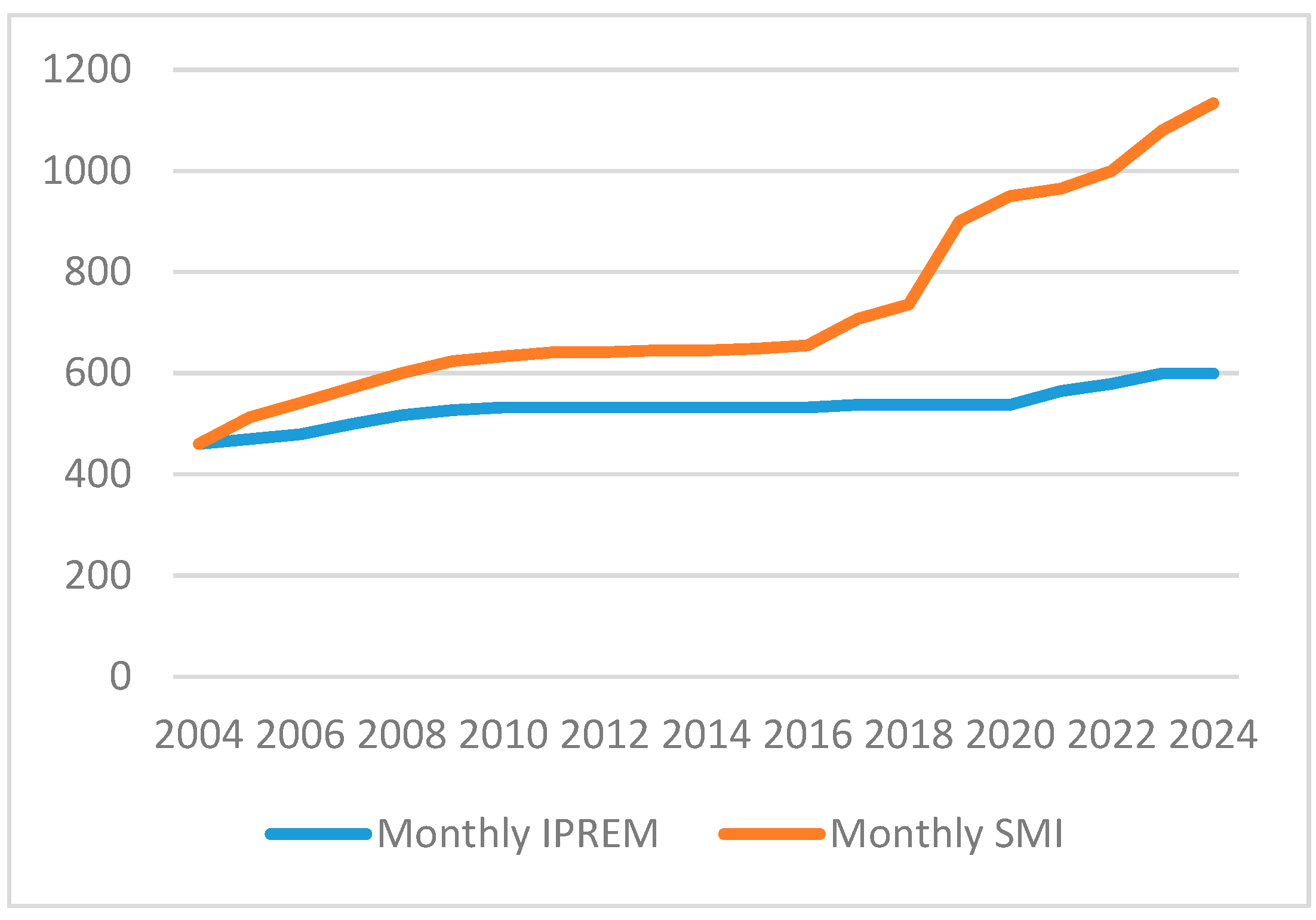

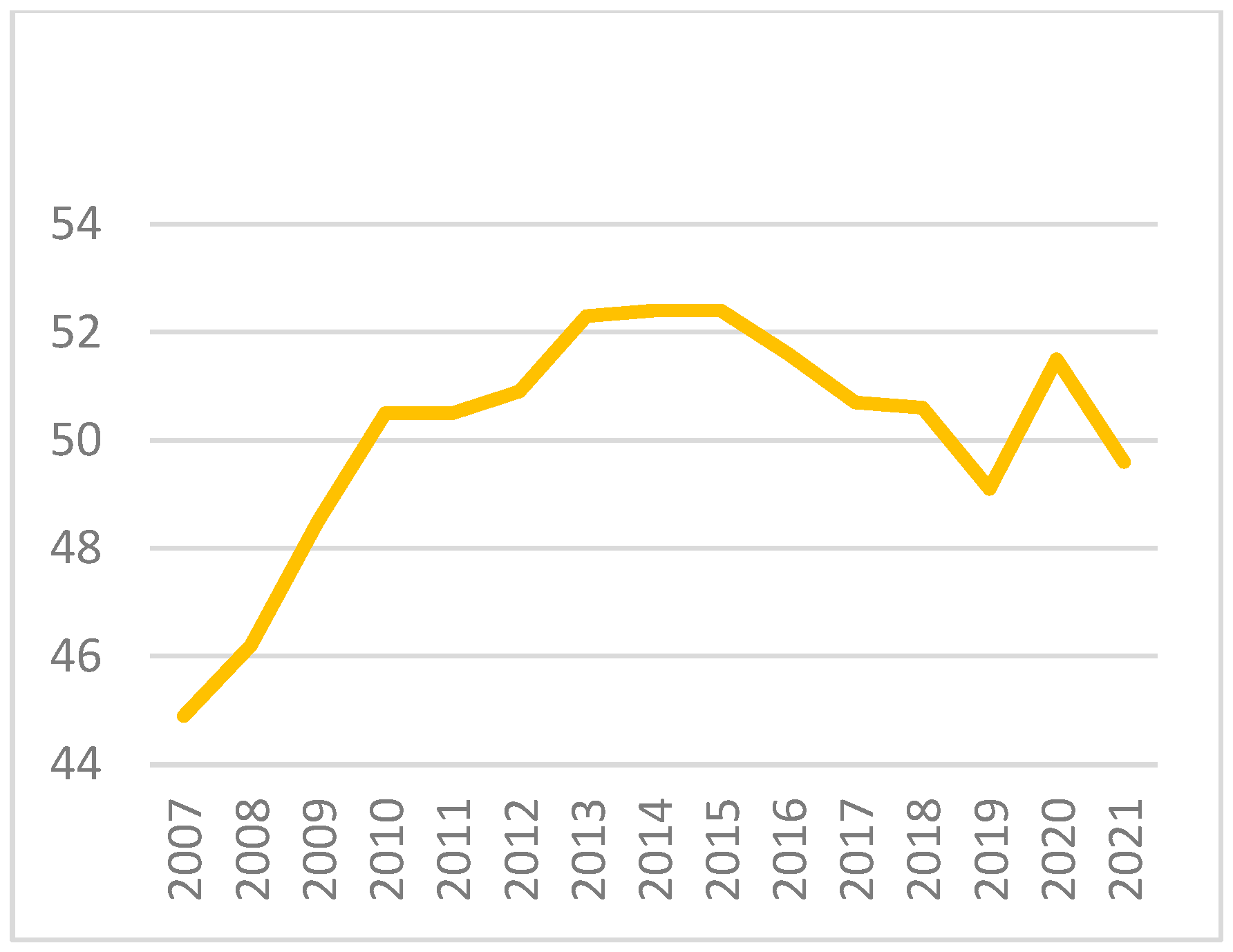

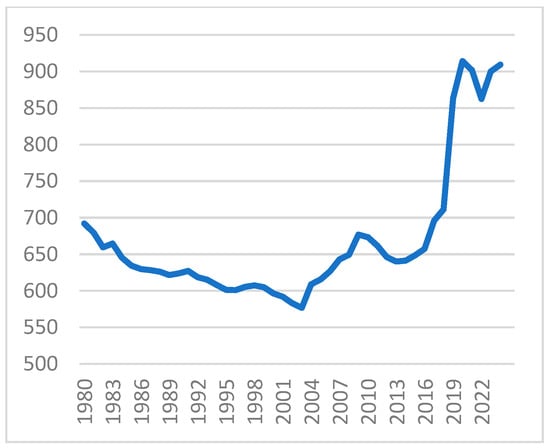

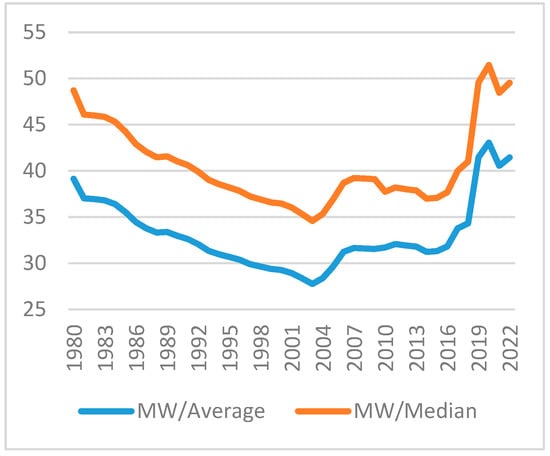

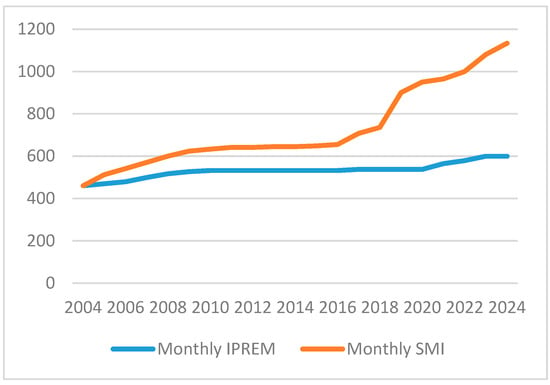

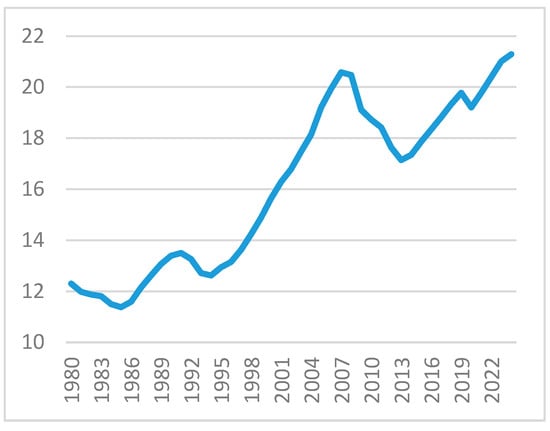

Despite the objectives set out in this regulation, from 1980 to 2004, the MW continued to fall in constant terms and in relation to the average and median wage (see Figure 1 and Figure 2). In addition, the minimum wage set was far below the real wages paid by firms, so that it affected a very limited, almost non-existent, group of workers (Llopis et al. 2011). Inflation control was the priority objective at this stage, which meant that the MW lost even more purchasing power. It was not until 2004 that the adaptation of the regulations to the European Social Charter began to be taken seriously. In fact, in 2004, the government set the target of reaching 60% of the average wage and drew up a plan to achieve it gradually by 2012. To this end, a growth path of the MW above the expected inflation rate was initiated, only to be interrupted by the 2008 crisis. In fact, from 2009 onwards, the minimum wage policy was clearly abandoned until 2017, when it began to grow again, allowing for the recovery of part of the purchasing power lost over the previous decade. However, the MW remained far from the wages actually paid, so it was more useful for calculating social benefits than as a wage floor. But even this ceased to be true, given that in 2004 the MW was no longer used as the basis for these social benefits, and the public indicator of multiple effects income (IPREM, for its acronym in Spanish) was created for this purpose, which from then on grew considerably less than the MW (see Figure 3).

Figure 1.

Evolution of monthly minimum wage (14 payments) (in euros, as of 2015) INE. Source: self-elaborated with data from the INE and the OECD.

Figure 2.

MW in relation to average and median gross wage equivalent to full-time (OECD). Source: self-elaborated with data from the INE and the OECD. Source: self-elaborated with data from the INE and the OECD.

Figure 3.

SMI vs. IPREM (in euros). Source: self-elaborated with data from the INE.

The big change occurred from 2019 onwards, when the government resumed its objective of reaching an MW representing 60% of the average wage through a determined policy with a continuous increase path. This began with a strong increase in 2019 (22.3%) and was followed by other more modest increases once the COVID-19 crisis was overcome. This substantial increase in the MW led to its application to a significant proportion of the population. Thus, the change in the minimum wage policy in Spain has allowed for an analysis of the case as a natural experiment, with the objective of accumulating empirical evidence on the effects of large MW increases that could be useful for other similar interventions in other countries.

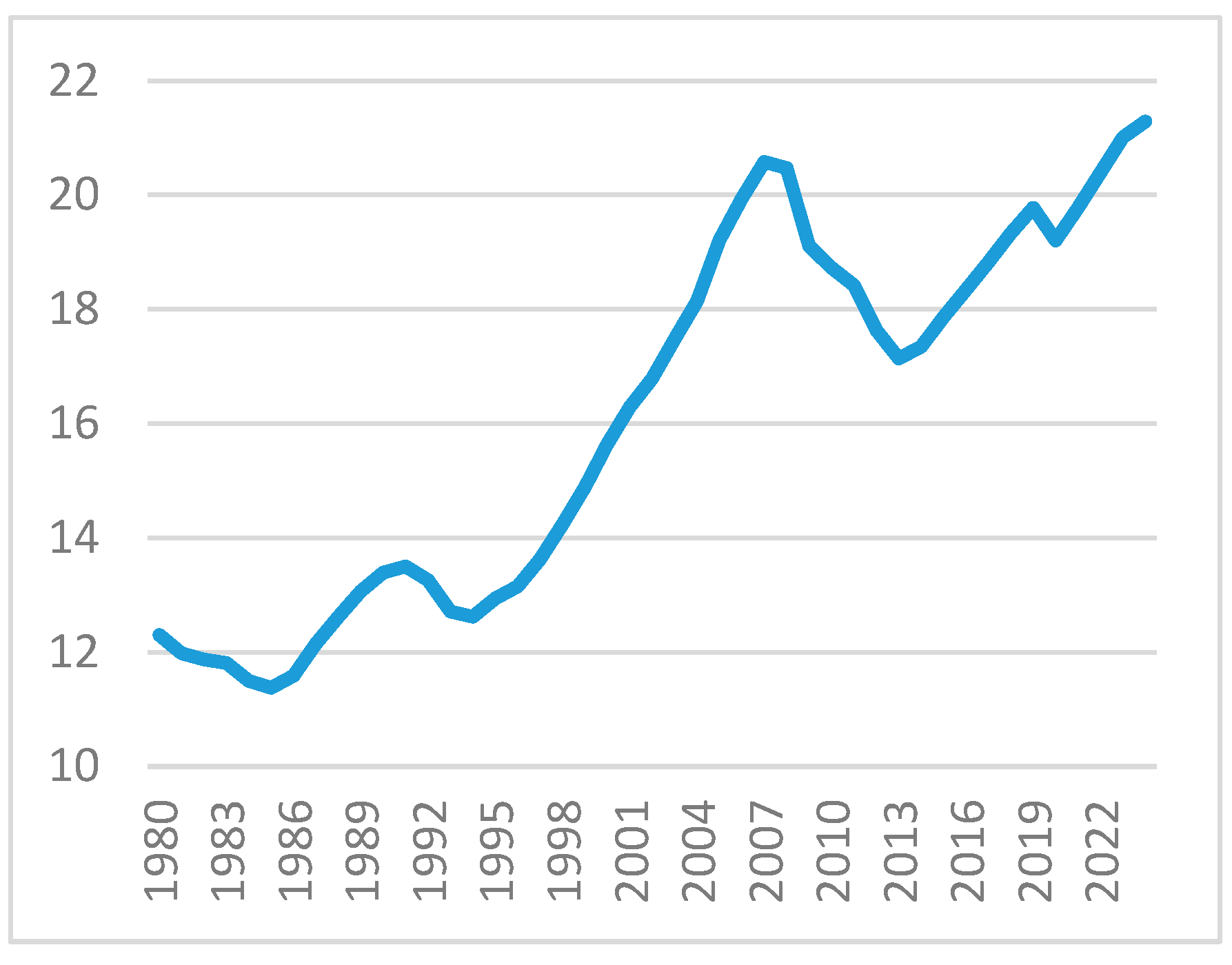

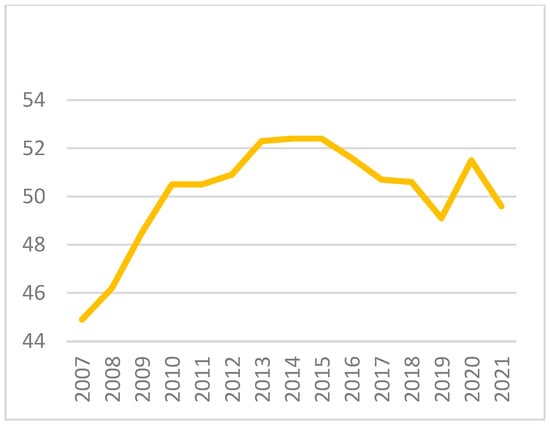

As can be seen in Figure 4 and Figure 5, the relationship of this MW evolution with inequality and employment seems clear in aggregate terms. It seems that the increase in MW in 2019 did not reduce employment, but it did reduce inequality,7 even in the long run once the 2020 pandemic crisis had been overcome.

Figure 4.

Number of employees (in millions). Source: self-elaborated with data from the INE.

Figure 5.

Gini index (market income) %, Spain, 2007–2021. Source: self-elaborated with data from the INE and the OECD.

Despite the great opportunity that this change represents for Spain, there are few scientific studies on the case. This contrasts with the large number of studies that have been carried out in the German context (see the review by Dütsch et al. (2024)), in addition to dozens of studies for the US. Moreover, almost all empirical studies focus, at the international level, on the effect on employment and only a few deal with the effect on inequality and poverty; moreover, they are all grey literature.8 So, as far as is known, this is the first scientific article on the effect of the large MW increase on inequality and poverty in Spain from 2019 onwards.

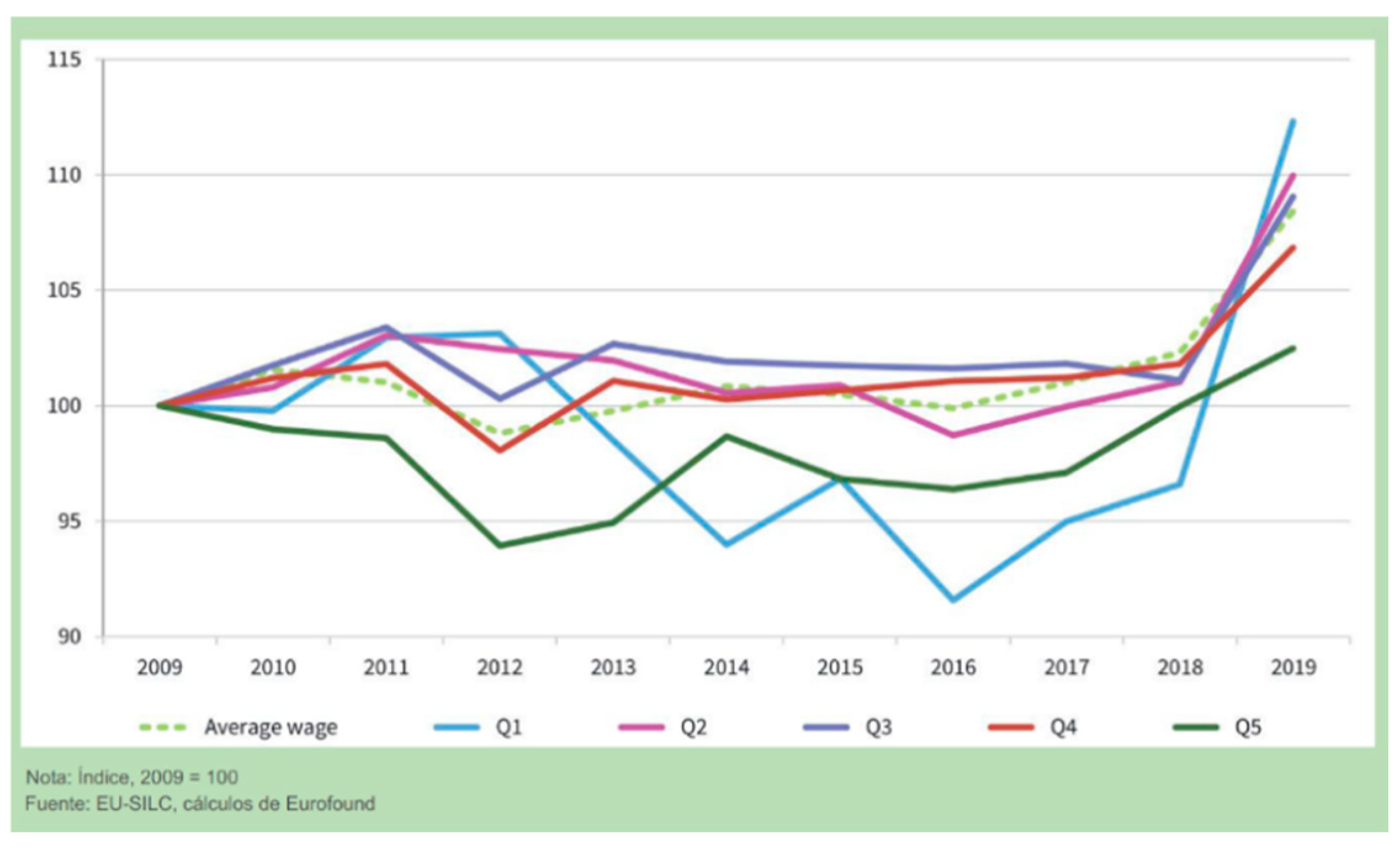

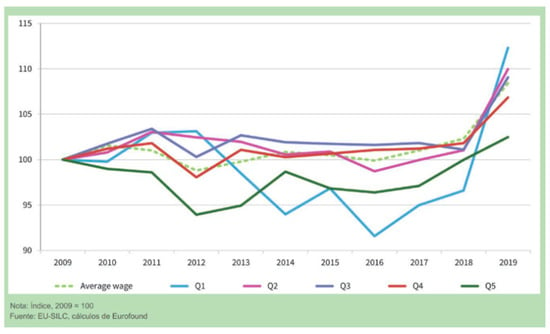

As an illustrative example, Figure 6 shows the evolution of average wages by quintile based on the Eurofound Technical Survey. Research on the impact of the 22.3% increase in the minimum wage in Spain in 2019, conducted for this report (Eurofound 2022), found that Spain recorded the largest reduction in wage inequality among EU27 Member States in 2019. Moreover, the lowest-paid workers (Q1) experienced a greater increase in wages in 2019, and those in the quintiles just above them (Q2 and Q3) also experienced growth, exceeding that of the highest earners (Q4 and Q5). This suggests that the large MW increase in 2019 may have contributed to a reduction in inequality at the bottom of the distribution. However, as previously stated, these results are merely exploratory and require further analysis to transition from correlation to causation, as will be demonstrated in the following section.

Figure 6.

Evolution of average wages by wage quintile. Spain, 2009–2019 (Eurofound 2022).

4. An Analysis of the Impact of the MW on Income Inequality: In Spain, for the 2019 Increase

The 2019 minimum wage increase in Spain represented a unique event in the country’s democratic history. According to estimates by the National Statistics Institute (INE, for its acronym in Spanish), in 2018, 14.1% of the Spanish population had an annual income equal to or below the minimum wage, while in 2019 this percentage increased to 18.18%. This meant that more than 2 million people were directly affected by this wage increase. This historic milestone offers a unique opportunity to explore, through a quasi-experiment, the causal impact of the minimum wage increase on the income of the population, which is essential to better understand the economic and social implications of this measure.

Thus, the aim of this section is to study the causal effect of the increase in the minimum wage on the distribution of gross annual income in Spain in the most recent period. In particular, this section aims to analyse the effects of the large increase in the MW in 2019, an increase of 22.3%. The objective is to study not only the effect that the MW increase may have had on the group of people with a gross annual income equal to or lower than the 2019 MW, but also the spillover effect, as the minimum wage may act as a benchmark that guides other wage increases in the rest of the income distribution.

To carry out this analysis, data from the microdata files of the annual Living Conditions Survey (SILC) carried out by the Spanish National Statistics Institute were used. This survey belongs to the set of harmonised statistics for the countries of the European Union. Its main purpose is to collect statistical information, comparable at the European level, on income and social exclusion (European Statistics on Income and Living Conditions, EU-SILC). Although the SILC is targeted at households, it also provides information at the individual level. Indeed, a distinctive feature of this study is that the effect of the increase in the minimum wage is analysed at the individual level rather than at the household level, in contrast to most previous studies that have focused on household income. This is due to the fact that household income is influenced by a multitude of factors, including household composition and sources of additional income, which may obscure the specific impact of wages. In contrast, an analysis at the individual level allows for a more precise identification of the groups that have been most affected by the increase in the minimum wage, such as women, young people, and immigrants. Moreover, the availability and reliability of individual income data in the Living Conditions Survey facilitates this type of analysis.

The microdata files (both longitudinal and cross-sectional) offer information on personal characteristics such as age, gender, marital status, mode of cohabitation, or level of studies, as well as on work activity: type of working day, number of hours worked in a regular week, type of occupation, or economic activity of the company for which the person works, among other variables. The data are gathered through questionnaires, although in the case of certain variables, such as income, the final data are constructed by combining the information provided by the informant with information from administrative records (mainly from tax or social security sources). This method provides detailed information on the majority of income components, which are compulsory sources of recording. Furthermore, it indirectly contributes to reducing the non-response rate for this type of variable, which is typically very high. As for the reference period used for data collection in the survey, although most of the data refer to the year in which the survey was carried out, the data relating to income and its components refer to the calendar year prior to the date of the survey.

The Living Conditions Survey (SILC-Spain) is an annual survey covering approximately 13,000 households and 35,000 individuals. Starting in 2019, a process of sampling expansion was initiated, which was consolidated in 2022. This significant increase in the sample will allow for greater precision and generalisability of the results in the long term. Currently, the latest available longitudinal data needed to carry out this study refer to the period 2019–2022. However, as the sample is renewed by one quarter each year and the process of sampling expansion started in 2019, the sample could not be sufficiently representative over the whole period of analysis, and therefore the quasi-experiment is restricted to the years 2019–2020 (referring to income relative to the years 2018–2019). In any case, the 2019–2020 two-year period is sufficiently distinctive, given the significant increase in the minimum wage in Spain during this period and the absence of academic studies that have empirically analysed this increase in the minimum wage in the most recent phase. We analysed only the short term, not including data from 2021 due to the distortion caused by the COVID-19 pandemic in that data.

The target population focuses on the active workforce, aged 16–64 years, employed and full-time, i.e., those who have worked, in a regular week, 35 or more hours per week. By selecting this population group, the variability that may exist in the sample owing to people with low incomes due to part-time or sporadic work is excluded. This target population, full-time employees without self-employment, is widely used in the literature (Bossler and Schank 2023; Ohlert 2023; Pérez 2020) and allows for a more accurate and representative analysis of the impact that the increase in the minimum wage may have had.

To assess the causal impact of the minimum wage (MW) increase on income among the target population, an ordinary least squares multiple linear regression model following a difference-in-differences (DiD) approach is used. This method is particularly suitable for this study because of its ability to exclude, under the parallel trends assumption, the effect that possible confounding variables may have on the causal effect of the treatment (in this case, MW increase). In addition, DiD allows controlling for parallel trends in population income before 2019, which in turn enables identifying the causal effect of the MW increase more precisely. In the systematic review of the academic literature provided above, since 2020 only nine studies have carried out an empirical analysis based on DiD for the relationship between MW and inequality and poverty (Bossler and Schank 2023; Burauel et al. 2020; Caliendo et al. 2023; Derenoncourt and Montialoux 2021; Forsythe 2023; Frank 2021; Ohlert 2023; Pérez 2020; Sotomayor 2021), none in the case of Spain.

As a quasi-experiment, treatment and control groups can be identified using criteria other than randomisation, such as an eligibility cut-off. The reference income intervals used to construct the treatment and control groups are shown in the table below (Table 2).9

Table 2.

Gross income limits for the composition of treatment and control groups.

This study involves three treatment groups and one control group. Treatment group 1 consists of all employed persons, belonging to the target population, who in the year 2019 had a gross income equal to or below the minimum wage of the year 2019 (12,600 euros). Treatment group 2 consists of those persons who in 2019 had a gross annual income above the annual minimum wage but whose gross annual income was two-thirds lower than the median income of the total population in 2019. Treatment group 3 is made up of those persons who in 2019 had a gross annual income between two-thirds and 1.5 times the median income in 2019. The control group consists of all persons who in 2019 had a gross annual income of more than 1.5 times the median income in the same year.

In addition, to minimise the impact of atypical values on the accuracy and reliability of the model, the sample was refined. Persons with null or missing annual gross income and 3% of persons with very low or very high gross income were removed. This percentage has been set at around 50% of the average income for treatment group 1 in each year of analysis, which is a common value in the literature (Caliendo et al. 2023). This filtering has been done to ensure that the sample is representative and not influenced by biased values. The final sample for analysis consists of persons with gross annual income between 3% and 97% of the gross income distribution of the total population. The table below summarises the size of each group involved in the DiD analysis (Table 3).

Table 3.

Basic data of the sample.

Compliance with assumptions and reliability analysis. The validity and reliability of DiD results depend on several key assumptions, including parallel trends, absence of confounders, and stability of the treatment and control groups (Vicens Otero 2008). These assumptions are critical to ensuring that treatment effect estimates are accurate and not influenced by external factors.

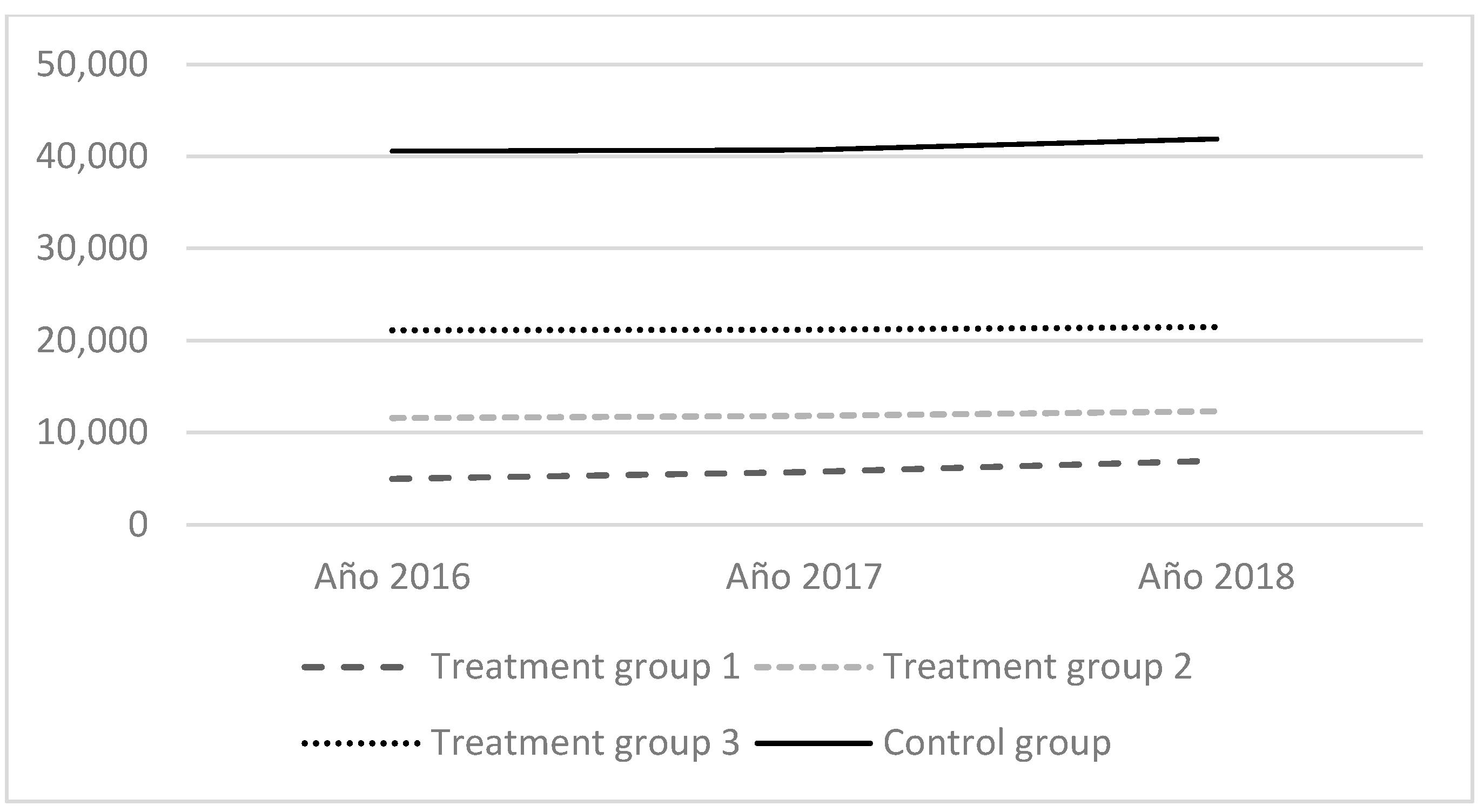

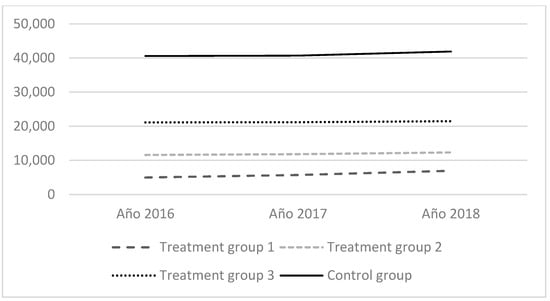

Notably, the parallel trends assumption implies that, in the absence of treatment, the difference between the treatment and control groups would have remained constant over time. Figure 7 reflects the trends for the three treatment groups and the control group in the three years prior to the 2019 MW increase.

Figure 7.

Parallel trends assumption. Change in gross income for treatment and control groups, 2016–2018. Source. Self-elaborated based on microdata from the Living Conditions Survey (SILC). Cross-sectional database.

The assumption of the absence of confounding factors implies the absence of variables that affect both the treatment and the outcome variable. To test this assumption, additional explanatory variables have been included in the modelling, and the results remain robust. The results do not change significantly when new variables are included, indicating that the model is not influenced by external factors. Furthermore, the standard error hardly changes, the standardised coefficients do not change significantly, and the R2 increases slightly, suggesting that the model is influenced by the treatment variable and not by other variables.

The assumption of group stability implies that the composition of the treatment and control groups does not change over time. If the treatment and control groups change, it is possible that the observed differences between the groups could be caused by other factors unrelated to the increase in MW. For instance, if the demographic composition of the treatment group changes during the analysed time period, this could influence the dependent variable and make the differences between the groups larger than they actually are as a result of the increase in MW. In the present case, individuals were carefully selected based on their income situation in 2019 and were in the same situation in 2018, which reduces the possibility of significant changes in the treatment and control groups during the period analysed.

Equally important is to verify that the control group is significantly away from the descriptive values of the treatment groups in terms of the variable of analysis (income). The control group here is composed of full-time employed people with a significantly higher income level than the treatment groups, with incomes above 1.5 times the median income of the year 2019. To ensure that this assumption is met, several econometric tests were carried out using different control groups. First, the control group included all individuals who did not belong to treatment groups 1 or 2. Second, the control group included individuals with an income above two-thirds of the median income in 2019. In all cases, the results show a positive causal effect of the 2019 minimum wage increase on the gross income of individuals in treatment groups 1 and 2 in relation to the control group (see Table 4). Moreover, the relationships between the independent variables and the dependent variable did not change. However, a certain degree of autocorrelation was found in the residuals, with values for the Durbin–Watson indicator above 1 but below 1.5. To overcome this problem, the control group is the one furthest away from treatment groups 1, 2, and 3, i.e., those with high incomes of more than 1.5 times the median income in 2019. This guarantees that all assumptions are met and, more importantly, the R2 has increased significantly to values above 0.9, as shown in Table 4 and Table 5.

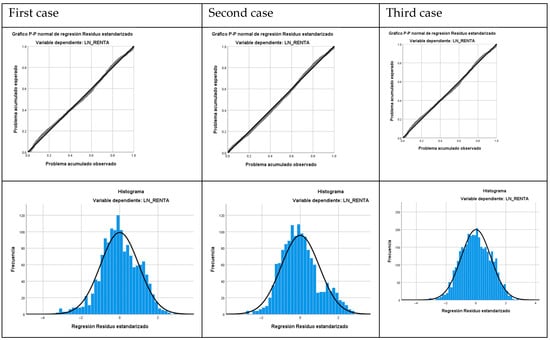

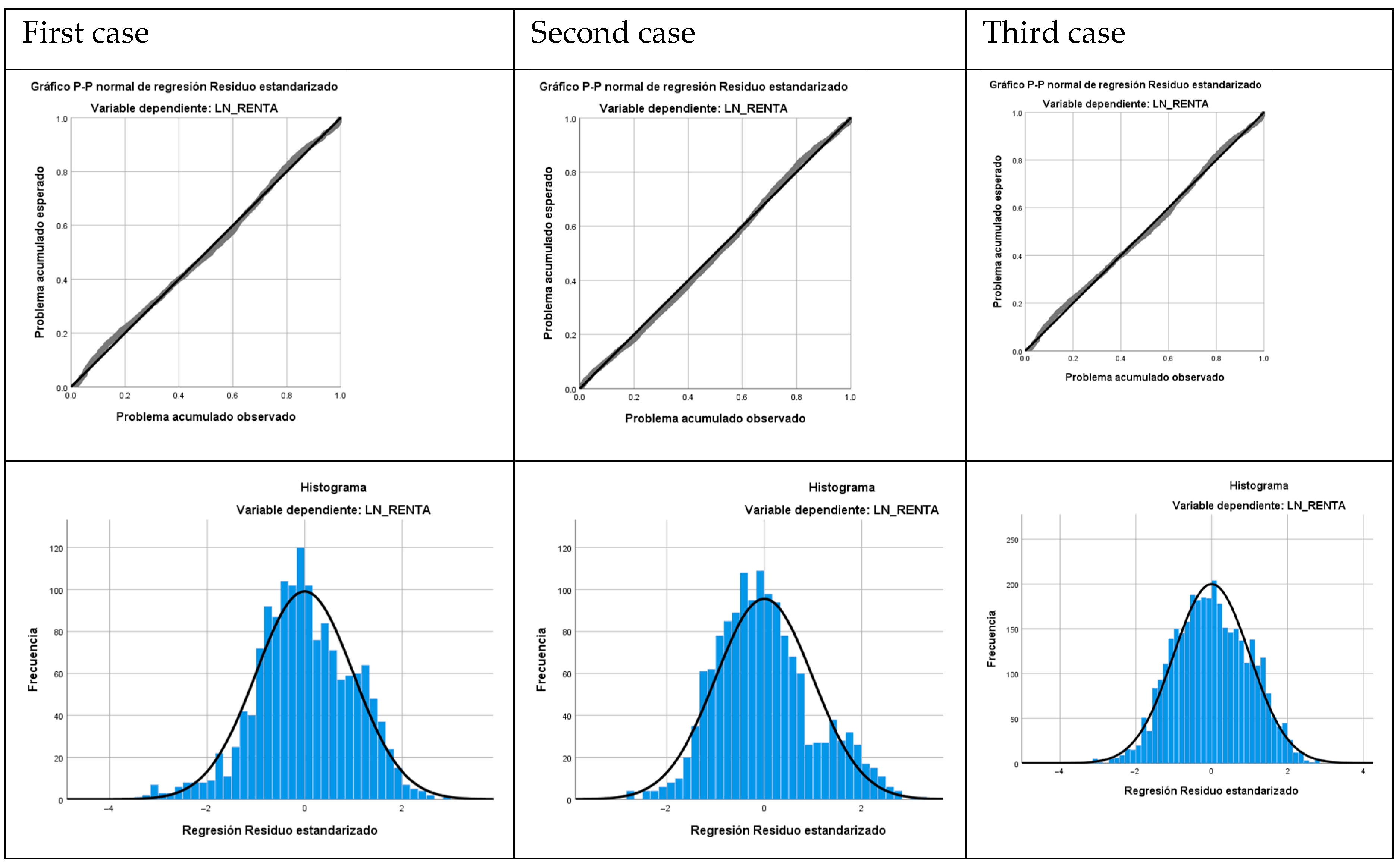

Finally, compliance with the assumptions of the regression analysis was verified using the SPSS version 25.0 statistical package. In particular, the linearity of the relationship between the variables and the independence of the errors were checked using the Durbin–Watson test that takes values between 1.5 and 2.5, which guarantees the independence of the errors (included in Table 4, Table 5 and Table 6), as well as the normality of the residuals, the homoscedasticity using the Breusch–Pagan test, and the absence of collinearity using the VIF test, which takes values below 3.3, which guarantees the absence of collinearity. No indicators have been observed to suggest the need to apply a different multiple linear regression model, such as the generalised linear model or a more robust corrector (in Appendix C, Figure A2, the normal p–p plots and scatter plots are included).

Multiple Regression Model

The impact of the MW increase on income was analysed using an ordinary least squares model following the DiD approach for the years 2018–2019. This model considers that in January 2019, there was an increase in the MW of 22.3%.

The following ordinary least squares income equation is estimated:

where Y is the logarithm of each individual’s gross annual income; X1 is a time variable that takes the value 1 in 2019 and 0 in 2018; X2 is also a dichotomous variable that takes the value 1 if the individual belongs to treatment group 1 (or treatment groups 2 or 3, respectively), and 0 if they belong to the control group; X3 is the year and treatment interaction variable that takes the value 1 when the observation belongs to an individual in treatment group 1 (or treatment groups 2 or 3, respectively) and to the year 2019, and 0 otherwise. represents other explanatory variables included in the model (gender, mode of cohabitation, and tertiary education). Different studies, as seen in Section 2, show that the effect of the wage increase is different among certain more disadvantaged groups and according to their level of education, as in the case of women (Cho and Yang 2021; Laporšek et al. 2021) or single-parent families (Alinaghi et al. 2020).

The parameter is the constant term of the model, and parameters , are the coefficients of the independent variables that measure the magnitude of the effect that each of the independent variables has on the dependent variable, i.e., annual income. The parameter represents the change in income between 2018 and 2019. The discriminates between two groups based on the income threshold set and the comparison with the control group defined by a certain income level listed in Table 2. The most interesting coefficients are the parameters that, in each model, record the difference between the income of the treatment group before and after the 2019 increase, i.e., the differential effect of the MW increase on the income of individuals in the treatment groups.

In a semilogarithmic model with dichotomous variables, such as the one we are concerned with here, the coefficients of the independent variables are not interpreted as continuous percentage changes but as changes in state. Dichotomous variables indicate the presence or absence of a specific characteristic, such as membership in a certain treatment group, a specific year, or the interaction between year and membership in the treatment group, represented, in our study, by the coefficients β1, β2, and β3, respectively. Consequently, the coefficients associated with these dichotomous independent variables reflect the change in the logarithm of annual income when the dichotomous variables change from 0 to 1.

To interpret the percentage effect, we mainly follow the conversions proposed by Halvorsen and Palmquist (1980), Kennedy (1981), and Giles (1982). Halvorsen and Palmquist (1980) provide a solid theoretical basis for the interpretation of coefficients of dichotomous variables in semilogarithmic models. The formula is as follows:

where β is the coefficient of the corresponding dichotomous variable.

Kennedy (1981) expands on Halvorsen and Palmquist’s interpretation by noting that this interpretation is correct only under certain conditions and proposes an additional adjustment that takes into account the variance of the coefficient estimator, improving the precision of the interpretation. Thus, Kennedy’s correction (1981) includes an additional term to account for this omission. The corrected formula (introducing the variance) is as follows:

where β is the coefficient of the corresponding dichotomous variable and σ2 is the variance of the β estimator.

Giles (1982) provides an unbiased estimation of the percentage effect of the dummy variables. He adjusts the formulation of Halvorsen and Palmquist (1980), but with a different approach to ensure that the estimation is unbiased. The validation is performed through Monte Carlo simulations. Although Kennedy and Giles address the same problem, Giles’ formula is distinguished by its focus on bias correction and validation through simulations, providing a more accurate and unbiased estimation of the effect of dummy variables in semilogarithmic models (Van Garderen and Shah 2002).

In our case, the variations between both approaches are minimal, as can be seen in Table A2 of Appendix C.

This regression model is then applied to three cases:

- Case 1: The variable X2 takes on a value of 1 when the person has a gross annual income equal to or below the 2019 minimum wage (i.e., belongs to treatment group 1) and a value of 0 when the person belongs to the control group (persons with a gross annual income equal to or above 1.5 times the median income in 2019).

- Case 2: The variable X2 takes on a value of 1 when the person has a gross annual income above the 2019 minimum wage but equal to or below two-thirds of the 2019 median income (treatment group 2), and a value of 0 when the person belongs to the control group, i.e., with an income equal to or above 1.5 times the 2019 median income.

- Case 3: The variable X2 takes on a value of 1 when the person has a gross annual income of more than two-thirds and less than 1.5 times the median income in 2019 (treatment group 3), and a value of 0 when the person belongs to the control group.

Case 1.

Effects of the MW increase on the income of individuals with gross annual incomes equal to or below the minimum wage (treatment group 1).

The results of the model using Equation (1) are shown in Table 4. The dependent variable is the logarithm of the individual’s annual income. The explanatory variables refer to the characteristics of the individuals in the sample. The “gender” variable takes on a value of 1 if the person is a woman and 0 if the person is a man. The “mode of cohabitation” variable takes on a value of 1 if the person lives alone and 0 if the person lives with a partner. The “level of education” variable is given a value of 1 if the person has tertiary education and 0 otherwise.

Table 4.

Results of the estimates of the effect of the MW increase on treatment group 1.

Table 4.

Results of the estimates of the effect of the MW increase on treatment group 1.

| Model (1) | Model (2) | |

|---|---|---|

| Year | 0.021 ** (0.014) | 0.020 ** (0.013) |

| Treatment 1 | −1.062 *** (0.016) | −1.024 *** (0.017) |

| Treatment 1 × year | 0.187 *** (0.022) | 0.188 *** (0.022) |

| Gender | −0.023 *** (0.011) | |

| Living as a couple | −0.035 *** (0.012) | |

| Level of education | 0.062 *** (0.012) | |

| Adjusted R2 (a) | 0.913 | 0.917 |

| Durbin–Watson | 1.854 | |

| Standard error | 0.20812 | 0.20349 |

Source. Self-elaborated based on longitudinal SILC data from the INE. Years 2018–2019. Note. Non-standardised errors in brackets. Significance level *** p < 0.01; ** p < 0.05. N treatment group 1: 316; N control: 473. (a): Adjusted R2 and R2 barely vary by a hundredth of a cent.

Model (1) includes as independent variables year (X1), treatment 1 (X2), and the interaction between the two (X3). In model (2), dichotomous explanatory variables have been added: gender, mode of cohabitation in the household, and having tertiary education or not. Despite adding these variables, the model remains significant at 99%, and the adjusted R2 increases by four hundredths. In addition, the standard error of the residuals decreases, indicating an improvement in the fit. Again, as in model (1), the adjusted R2 value is almost identical to the uncorrected value, reflecting the goodness of fit of the model.

The following results were observed:

- The income of individuals with a gross annual income equal to or below the MW was 64.1% to 65.5% lower than the income of the highest gross income group, the control group.

- The gross annual income of all individuals (regardless of whether they belong to treatment group 1 or the control group) increased by around 2% in real terms after the 2019 minimum wage increase.

- The increase in the minimum wage led to an increase of 20.5% to 20.7% in the income of those with an income at or below the minimum wage.

Similarly, model (2), in which explanatory variables are introduced, observes a differential in women’s income compared with men’s; women’s income is lower than men’s, just as the income of people living alone is lower than that of those usually living with a partner. The influence of educational level on wages is also evident in this study, with income being higher if the person has tertiary education (with a beta of 0.062).

Case 2.

Effects of the MW increase on the incomes of low-income individuals (treatment group 2).

In this second case, the model—Equation (1)—was applied by introducing treatment variable 2 as a treatment variable, which represents 11.1% of the total number of people in the target population (see Table 3).

In this case, the effect of the 2019 MW increase on the income of treatment group 2, which consists of those with an income below two-thirds of the median but above the 2019 minimum wage, is examined. The same model is applied as in the previous case (first case), with the difference that treatment 2 variable is added, which has a value of 1 if the person belongs to treatment group 2 and a value of 0 if the person belongs to the control group (with incomes above 1.5 times the median income).

The year and interaction variables are included in the model in a similar way to that explained in the previous section.

Table 5 reflects the results obtained.

Table 5.

Results of the estimates of the effect of the MW increase on treatment group 2.

Table 5.

Results of the estimates of the effect of the MW increase on treatment group 2.

| Model (1) | Model (2) | |

|---|---|---|

| Year | 0.031 *** (0.010) | 0.030 *** (0.010) |

| Treatment 2 | −0.982 *** (0.012) | −0.954 *** (0.012) |

| Treatment 2 × year | 0.036 ** (0.017) | 0.037 ** (0.016) |

| Gender | −0.019 ** (0.008) | |

| Living as a couple | −0.024 *** (0.009) | |

| Level of education | 0.052 *** (0.009) | |

| Adjusted R2 (a) | 0.926 | 0.928 |

| Standard error | 0.14959 | 0.14732 |

| Durbin–Watson | 1.937 | |

Source. Self-elaborated based on longitudinal SILC data from the INE. Years 2018–2019. Note. Non-standardised errors in brackets. Significance level *** p < 0.01; ** p < 0.05. N treatment group 2: 260; N control: 473. (a): Adjusted R2 and R2 barely vary by a hundredth of a cent.

The following results were observed:

- The income of individuals belonging to this treatment group was between 61.5% and 62.6%% lower than the income of the highest income group.

- The income of individuals (in both treatment and control groups) increased by around 3% between 2018 and 2019.

- The income of the group of people in treatment group 2 increased by between 3.7% and 3.8% between 2018 and 2019. This is a smaller increase than for the group of people with incomes below the minimum wage, but significant for such low-income levels (considering the income thresholds for the groups shown in Table 2).

Case 3.

Effects of the MW increase on the income of middle-income individuals (treatment group 3).

In this third case, the same model is applied, but using as the treatment population those individuals with average annual gross incomes, i.e., above two-thirds of the median income in 2019 but below those of the control group, which are above 1.5 times the median income in 2019.

The model remains significant, and the results are reflected in the Table 6.

Table 6.

Results of the estimates of the effect of the MW increase on treatment group 3.

Table 6.

Results of the estimates of the effect of the MW increase on treatment group 3.

| Model (1) | Model (2) | |

|---|---|---|

| Year | 0.041 ** (0.015) | 0.039 ** (0.014) |

| Treatment 3 | −0.786 *** (0.012) | −0.731 *** (0.012) |

| Treatment 3 × year | 0.019 (0.017) | 0.018 (0.016) |

| Gender | −0.063 ** (0.008) | |

| Living as a couple | −0.034 *** (0.009) | |

| Level of education | 0.182 *** (0.008) | |

| Adjusted R2 (a) | 0.607 | 0.636 |

| Standard error | 0.22425 | 0.21582 |

| Durbin–Watson | 1.969 | |

Source. Self-elaborated based on longitudinal SILC data from the INE. Years 2018–2019. Note. Non-standardised errors in brackets. Significance level *** p < 0.01; ** p <0.05. N treatment group 3: 1297; N control: 473. (a): Adjusted R2 and R2 barely vary by a hundredth of a cent.

The results in Table 6 indicate that, although the model remains significant, the interaction variable “treatment 3-year” is no longer significant in any of models (1) and (2). No collinearity or heteroskedasticity effects are observed, but changes in the partial and semi-partial correlations of the interaction variables “treatment 3 × year” and income have been detected. In particular, it is observed that the partial and semi-partial correlations of these variables decrease compared to the values obtained in the models applied in the first two case studies. This may indicate that other variables not included in the model are influencing the variations in gross annual income in this third case, something not observed in the other two cases.

Yet, there are certain important trends to note:

- The gross annual income of people with medium-high incomes stood at between 51.9% and 54.3% of the income of the control group. Thus, the analysis of β2 coefficients shows, in the different scenarios, the large difference in income between all groups and the high-income group.

- The income of individuals (in both treatment 3 group and control group) increased by around 4% between 2018 and 2019.

- The differences between the genders were more pronounced the higher the income level.

- Individuals living with a partner had higher incomes than those living alone.

- In higher income groups, tertiary education had a greater impact on income than in lower income groups.

5. Discussion of the Results

Firstly, it is important to note that all the necessary tests to check the robustness of the data and that the result has been very positive have been carried out. The model behaves robustly and is not very sensitive to variations in the definition of the treatment and control groups. Therefore, the results obtained can be considered solid and robust.

The results of this study suggest that the increase in the minimum wage in Spain in 2019 had a positive impact on the increase in gross annual incomes of the wage-earning population aged 16–64. In particular, it can be observed that the 22.3% increase in the MW in Spain in 2019 led to a significant reduction in inequality, not only for the population directly affected (treatment group 1) but also for the population not directly affected, especially the population group with wages just above the MW (treatment group 2). The effect in higher income groups (treatment group 3), although similar, is not significant.

Result 1: Using the difference-in-differences analysis based on longitudinal data from the Living Conditions Survey, the increase in income between 2018 and 2019 for the group of people with incomes equal to or below the MW was between 20.5% and 20.7% (Appendix C, Table A2). This suggests that the increase in the minimum wage in 2019 had a significant impact on the income of this population group. Compared to other studies, such as that by Burauel et al. (2020) in Germany, an increase in hourly wages of 6.47 percentage points was also found for the group of people earning less than the minimum wage before the reform. The impact in Spain even seems to be more substantial. However, it is important to consider that the economic and employment contexts vary significantly between the two countries, which may influence the results.

Result 2: The increase in income from 2018 to 2019 induced by the increase in the MW for the group of people with an income between the annual minimum wage and two thirds of the median income distribution (i.e., with a gross annual income between EUR 12,600 and EUR 16,444.80) was between 3.6% and 3.8%. In this sense, Bossler and Schank (2023) found that the implementation of the minimum wage in Germany had an impact on monthly wages up to the 50th percentile; on their part, Caliendo et al. (2023) observed this effect up to the second quintile. The evidence found in the present study therefore shows a spillover effect towards the income groups closest to the lowest group, indicating that the increase in the minimum wage has a positive impact on the income of workers earning just above the new minimum wage. These findings are consistent with the results of previous studies, such as that by Dickens et al. (2012) or the one by Joe and Moon (2020), who found more pronounced effects of the MW increase at the bottom of the income distribution. The empirical literature confirming positive minimum wage effects that reach all the way to the bottom half of the income distribution is extensive (see Dickens and Manning 2004; DiNardo et al. 1996; Lee 1999; Card and DiNardo 2002; Autor et al. 2008).

In addition to the significant income effects for individuals with annual incomes below the MW, another key finding of this study is that the impact is also felt, albeit to a lesser degree, by those with gross incomes above MW. This suggests that the increase in the minimum wage in 2019 did not only benefit those closest to the poverty line but also had a widespread impact on income distribution.

This result reflects the existence of a “contagion zone” around the minimum wage level, where wages close to the MW tend to adjust as well. This “spillover effect” has been extensively studied in the literature, as can be seen in (Bakis and Polat 2023; Belman and Wolfson 2014; Fortin et al. 2021; Sefil-Tansever and Yılmaz 2024). Studies such as the one by Autor et al. (2016) found evidence of this spillover effect, showing that increases in the minimum wage had a positive impact on the wages of workers earning slightly above the new minimum. This effect is also observed in Lee (1999), who also found that the impact of this increase on income diminished with increasing levels of the income distribution, as is the case in the present study with treatment group 3.

Result 3: There are no effects on middle and high incomes. Although these effects have not been explored in depth, as this was not the aim of this study, the results do not reflect effects beyond two-thirds of the median. There is not much empirical evidence on this issue, though. Autor et al. (2016) identified spillover effects on individuals in the top half of the income distribution.

Impact on Inequality

In Spain, the Gini Index (market income) has already shown an increase from 0.506 in 2018 to 0.491 in 2019, reflecting a significant fall in inequality this year. In the same period, the average income of the lowest income group (treatment group 1) increased by 29% compared to an increase in the average income of the highest income group (control group 1) of 7%.

In Germany, Bossler and Schank (2023) estimated a significant reduction in the variation of log wages, which fell by 14.7% after the introduction of the minimum wage and would have fallen by only 8.7% without such reform. According to Burauel et al. (2020), the impact of the MW was much smaller (6.7 points) than in Spain.

Regarding gender inequality, the differences in gross annual income between men and women are significant in all the income groups analysed. The differences are greater in the extreme groups, with low income and with medium-high income (as reflected in Table A3 of Appendix C). In this sense, and given that there are more women than men with incomes below the annual minimum wage, an increase in minimum wages can make a significant contribution to narrowing the gender gap. In this sense, the present study coincides with that by Autor et al. (2016) and Caliendo et al. (2023). The simulation model by Grünberger et al. (2021) also suggests that MW increases can reduce the gap between men and women. Ohlert (2023) clearly identified this causal relationship. The results from the Ohlert study suggest two main pathways of the impact of the minimum wage on gender inequalities: more women than men benefit from the minimum wage also (Caliendo et al. 2023) and there exist different adjustments in working hours for women and men in the low-wage sector. The results presented here are consistent with the limited accumulated evidence: given the strong income growth quantified at the tail of the distribution and the higher presence of women in this group, a significant impact on the distributional gap between women and men can be inferred.

In relation to the form of cohabitation, higher income levels are also observed when people live as a couple than when they live alone. In any case, this aspect would require a more specific study taking into account different groups.

The findings indicate that educational level also has an influential role to play. In fact, those with lower levels of education will be more affected by the MW increase. The income of people with a tertiary education level is higher than the income of people with other lower levels of education (as reflected in Table A3 of Appendix C). Finally, it seems that the lighthouse effect, i.e., the effect on the informal economy, is also intuited, at least in cases where, according to the SILC, the workers earn less than the minimum wage despite working full time, as can be seen in the figures in Appendix C. However, this aspect requires further analysis to be verified.

6. Practical Implications