A Closed-Form Pricing Formula for Log-Return Variance Swaps under Stochastic Volatility and Stochastic Interest Rate

Abstract

:1. Introduction

2. Pricing Variance Swaps and Our Model

2.1. CIR–Heston Hybrid Model

- (1)

- , and .

- (2)

- To ensure the value of and are always positive, we set , .

- (3)

- All the parameters are denoted under the risk-neutral measure .

2.2. Variance Swaps

2.3. Measure Transformation

2.4. Pricing Formula for Variance Swaps

3. The Approximate Formula

4. Numerical Analysis

4.1. Monte Carlo Simulations

4.2. Reliability of Approximate Formula

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

Appendix B

Appendix C

References

- Carr, P.; Lee, R. Volatility derivatives. Annu. Rev. Financ. Econ. 2009, 1, 319–339. [Google Scholar] [CrossRef] [Green Version]

- Grünbichler, A.; Longstaff, F.A. Valuing futures and options on volatility. J. Bank. Financ. 1996, 20, 985–1001. [Google Scholar] [CrossRef]

- Howison, S.; Rafailidis, A.; Rasmussen, H. On the pricing and hedging of volatility derivatives. Appl. Math. Financ. 2004, 11, 317–346. [Google Scholar] [CrossRef] [Green Version]

- Heston, S.; Nandi, S. Derivatives on Volatility: Some Simple Solutions Based on Observables. SSRN Electron. J. 2000. [Google Scholar] [CrossRef] [Green Version]

- Elliott, R.J.; Siu, T.K.; Chan, L. Pricing volatility swaps under Heston’s stochastic volatility model with regime switching. Appl. Math. Financ. 2007, 14, 41–62. [Google Scholar] [CrossRef]

- Swishchuk, A. Modeling and pricing of variance swaps for stochastic volatilities with delay. WILMOTT Mag. 2005, 19, 63–73. [Google Scholar]

- Swishchuk, A. Modeling and pricing of variance swaps for multi-factor stochastic volatilities with delay. Can. Appl. Math. Q. 2006, 14, 439–467. [Google Scholar]

- Habtemicael, S.; SenGupta, I. Pricing variance and volatility swaps for Barndorff-Nielsen and Shephard process driven financial markets. Int. J. Financ. Eng. 2016, 3, 1650027. [Google Scholar] [CrossRef]

- Issaka, A.; SenGupta, I. Analysis of variance based instruments for Ornstein-Uhlenbeck type models: Swap and price index. Ann. Financ. 2017, 13, 401–434. [Google Scholar] [CrossRef]

- SenGupta, I.; Wilson, W.; Nganje, W. Barndorff-Nielsen and Shephard model: Oil hedging with variance swap and option. Math. Financ. Econ. 2019, 13, 209–226. [Google Scholar] [CrossRef]

- Jarrow, R.; Kchia, Y.; Larsson, M.; Protter, P. Discretely sampled variance and volatility swaps versus their continuous approximations. Financ. Stoch. 2013, 17, 305–324. [Google Scholar] [CrossRef] [Green Version]

- Farnoosh, R.; Sobhani, A.; Rezazadeh, H.; Beheshti, M.H. Numerical method for discrete double barrier option pricing with time-dependent parameters. Comput. Math. Appl. 2015, 70, 2006–2013. [Google Scholar] [CrossRef]

- Farnoosh, R.; Sobhani, A.; Beheshti, M.H. Efficient and fast numerical method for pricing discrete double barrier option by projection method. Comput. Math. Appl. 2017, 73, 1539–1545. [Google Scholar] [CrossRef]

- Lian, G.; Zhu, S.P.; Elliott, R.J.; Cui, Z. Semi-analytical valuation for discrete barrier options under time-dependent lévy processes. J. Bank. Financ. 2017, 75, 167–183. [Google Scholar] [CrossRef]

- Little, T.; Pant, V. A finite-difference method for the valuation of variance swaps. J. Comput. Financ. 2001, 5, 81–101. [Google Scholar] [CrossRef]

- Heston, S.L. A closed-form solution for options with stochastic volatility with applications to bond and currency options. Rev. Financ. Stud. 1993, 6, 327–343. [Google Scholar] [CrossRef] [Green Version]

- Michael, A. Kouritzin, Explicit Heston solutions and stochastic approximation for path-dependent option pricing. Int. J. Theor. Appl. Financ. 2018, 21, 1850006. [Google Scholar]

- Zhu, S.P.; Lian, G.H. A closed-form exact solution for pricing variance swaps with stochastic volatility. Math. Financ. 2011, 21, 233–256. [Google Scholar]

- Zhu, S.P.; Lian, G.H. Analytically pricing volatility swaps under stochastic volatility. J. Comput. Appl. Math. 2015, 288, 332–340. [Google Scholar] [CrossRef]

- Zhang, L.W. A closed-form pricing formula for variance swaps with mean-reverting Gaussian volatility. ANZIAM J. 2014, 55, 362–382. [Google Scholar]

- Broadie, M.; Jain, A. The effect of jumps and discrete sampling on volatility and variance swaps. Int. J. Theor. Appl. Financ. 2008, 11, 761–797. [Google Scholar] [CrossRef]

- Liu, W.Y.; Zhu, S.P. Pricing variance swaps under the Hawkes jump-diffusion process. J. Futur. Mark. 2019, 39, 635–655. [Google Scholar] [CrossRef]

- Kim, J.H.; Yoon, J.H.; Yu, S.H. Multiscale stochastic volatility with the Hull-CWhite rate of interest. J. Futur. Mark. 2014, 34, 819–837. [Google Scholar] [CrossRef]

- Cao, J.; Lian, G.; Roslan, T.R.N. Pricing variance swaps under stochastic volatility and stochastic interest rate. Appl. Math. Comput. 2016, 277, 72–81. [Google Scholar] [CrossRef] [Green Version]

- Cox, J.C.; Ingersoll, J.E., Jr.; Ross, S.A. A theory of the term structure of interest rates. Econometrica 1985, 53, 385–407. [Google Scholar] [CrossRef]

- Cao, J.; Roslan, T.R.N.; Zhang, W. The valuation of variance swaps under stochastic volatility, stodwastic interest rate and full correlation structure. Korean Math. Soc. 2020, 57, 1167–1186. [Google Scholar]

- Han, Y.; Zhao, L. A closed-form pricing formula for variance swaps under MRG-Vasicek model. Comput. Appl. Math. 2019, 38, 142. [Google Scholar] [CrossRef]

- Xu, D.X.; Yang, B.Z.; Kang, J.H.; Huang, N.J. Variance and volatility swaps valuations with the stochastic liquidity risk. Phys. A Stat. Mech. Its Appl. 2021, 566, 125679. [Google Scholar] [CrossRef]

- He, X.J.; Zhu, S.P. How should a local regime-switching model be calibrated? J. Econom. Dyn. Control 2017, 78, 149–163. [Google Scholar] [CrossRef] [Green Version]

- He, X.J.; Zhu, S.P. On full calibration of hybrid local volatility and regime-switching models. J. Futur. Mark. 2018, 38, 586–606. [Google Scholar] [CrossRef]

- Zhu, S.P.; Lian, G.H. On the valuation of variance swaps with stochastic volatility. Appl. Math. Comput. 2012, 219, 1654–1669. [Google Scholar] [CrossRef]

- Bernard, C.; Cui, Z. Prices and asymptotics for discrete variance swaps. Appl. Math. Financ. 2014, 21, 140–173. [Google Scholar] [CrossRef] [Green Version]

- Zhu, S.P.; Lian, G.H. Pricing forward-start variance swaps with stochastic volatility. Appl. Math. Comput. 2015, 250, 920–933. [Google Scholar] [CrossRef]

- Cao, J.P.; Fang, Y.B. An analytical approach for variance swaps with an Ornstein-Uhlenbeck process. Aust. N. Z. Ind. Appl. Math. J. 2017, 59, 83–102. [Google Scholar]

- Sanae, R. Analytically pricing variance swaps in commodity derivative markets under stochastic convenience yields. Commun. Math. Sci. 2021, 19, 111–146. [Google Scholar]

- Larissa, B.; Maran, R.M.; Ioan, B.; Anca, N.; Mircea-Iosif, R.; Horia, T.; Gheorghe, F.; Ema Speranta, M.; Dan, M.I. Adjusted Net Savings of CEE and Baltic Nations in the Context of Sustainable Economic Growth: A Panel Data Analysis. Risk Financ. Manag. 2020, 13, 234. [Google Scholar] [CrossRef]

- Brigo, D.; Mercurio, F. Interest Rate Models-Theory and Practice: With Smile, Inflation and Credit; Springer Science and Business Media: Berlin/Heidelberg, Germany, 2007. [Google Scholar]

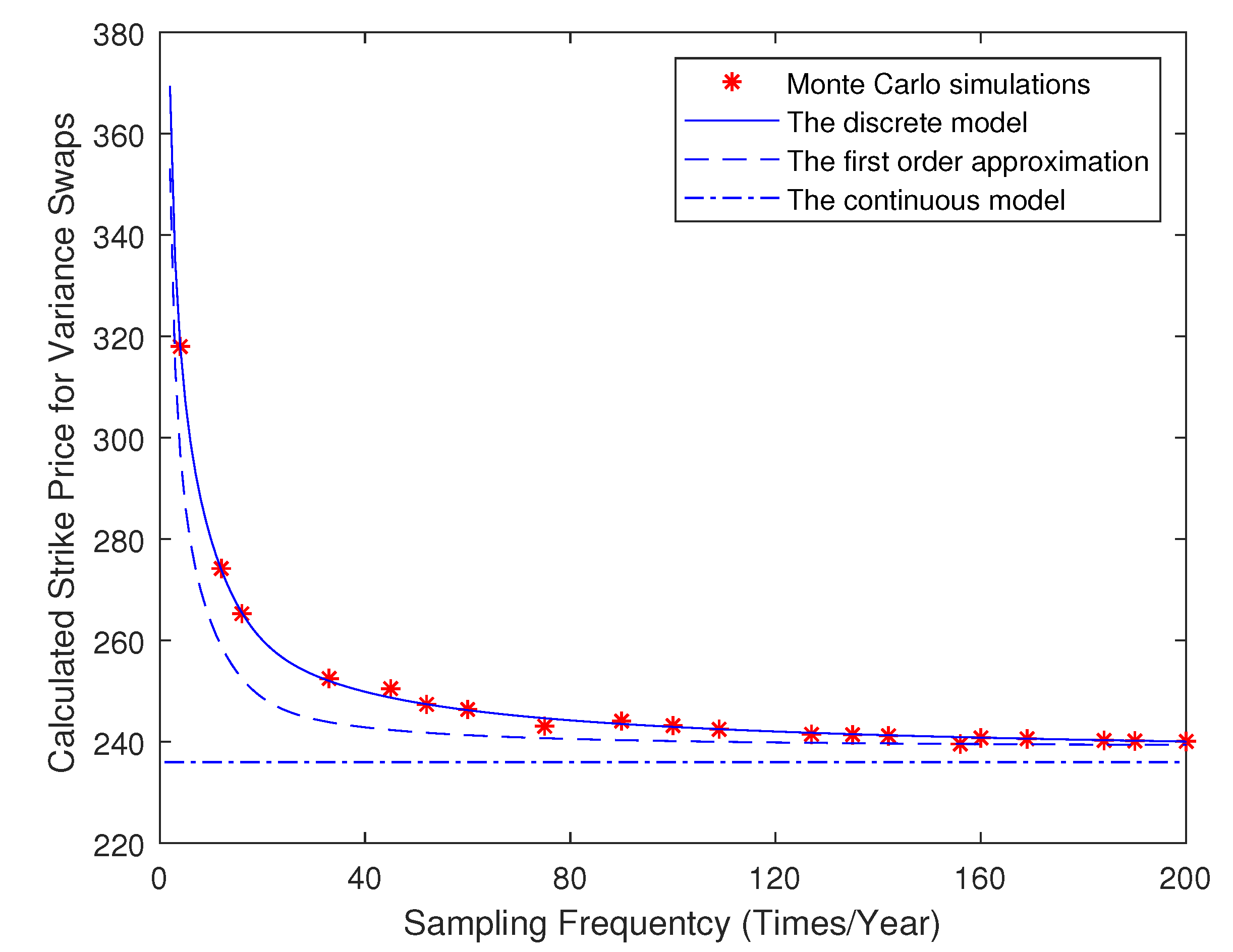

| Sampling Frequency | Monte Carlo | Discrete | First Order | Continuous |

|---|---|---|---|---|

| Quarterly (N = 4) | 318.11 | 318.13 | 296.82 | 236.31 |

| Monthly (N = 12) | 274.24 | 274.02 | 258.91 | 236.31 |

| Fortnightly(N = 16) | 265.33 | 265.55 | 252.53 | 236.31 |

| Weekly (N = 52) | 247.43 | 247.48 | 241.80 | 236.31 |

| Daily (N = 252) | 240.14 | 240.12 | 239.45 | 236.31 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Mao, C.; Liu, G.; Wang, Y. A Closed-Form Pricing Formula for Log-Return Variance Swaps under Stochastic Volatility and Stochastic Interest Rate. Mathematics 2022, 10, 5. https://doi.org/10.3390/math10010005

Mao C, Liu G, Wang Y. A Closed-Form Pricing Formula for Log-Return Variance Swaps under Stochastic Volatility and Stochastic Interest Rate. Mathematics. 2022; 10(1):5. https://doi.org/10.3390/math10010005

Chicago/Turabian StyleMao, Chen, Guanqi Liu, and Yuwen Wang. 2022. "A Closed-Form Pricing Formula for Log-Return Variance Swaps under Stochastic Volatility and Stochastic Interest Rate" Mathematics 10, no. 1: 5. https://doi.org/10.3390/math10010005

APA StyleMao, C., Liu, G., & Wang, Y. (2022). A Closed-Form Pricing Formula for Log-Return Variance Swaps under Stochastic Volatility and Stochastic Interest Rate. Mathematics, 10(1), 5. https://doi.org/10.3390/math10010005