1. Introduction

Accounting developed from the double-entry bookkeeping principle that appeared in Venice in the middle-ages that has developed over time and its scope increased during the Industrial Revolution. Modern accounting is one of the most important areas of the economy and is widespread in our lives today, so modern businesses and economies without accounting cannot be imagined [

1]. Financial accounting provides information on accounting transactions or events occurring in a company through financial statements, so that users or stakeholders of accounting information can make economic decisions. Investors also need corporate accounting information to make decisions about whether to invest in a particular company or, if already invested, when to close the investment. Managerial accounting provides the information necessary for decision-making by managers within a company. Because managerial accounting provides information according to the needs of the company’s management, there is no set standard or format, and information is provided whenever necessary. Managerial accounting provides information necessary for the aggregation and analysis of cost data, budget management, and special decision-making for corporate decision-making and internal control. Tax accounting refers to the process of measuring corporate profits as taxable income in accordance with the provisions of the tax law. Tax accounting provides information for the legitimate tax revenues of government tax authorities. In other words, the reason why accounting is necessary in modern society is that it provides useful information for economic decision-making necessary in modern society, reports on trusteeship responsibilities received from stakeholders, provides useful information for company management’s decision-making, and provides information related to legitimate tax revenues to the tax authorities.

Due to its importance, many previous studies have conducted research to analyze trends in the field of accounting (e.g., [

2,

3,

4]). Melnyk, Trachova, Kolesnikova, Demchuk, and Golub [

4] investigated trends in financial accounting through studies of the literature and surveys. In the past, the performance of technical accounting functions for regulation and governance was the trend of accounting, and now the trend of accounting has changed due to the spread of global business and digital technology. Rezaee, Szendi, Shum, and Elmore [

3] identified trends in managerial accounting through the use of a questionnaire survey. The trend in managerial accounting has shifted from traditional techniques appropriate for their more labor-oriented manufacturing to the integration of accounting controls with strategic measures and the use of non-financial performance measures. However, most of these studies are conducted from the academic point of view, and research on a practitioners’ view in practice is lacking. In addition, existing studies have focused on interpretation through surveys [

4,

5,

6]. Moreover, they do not reflect the effects of automation and efficiency of accounting work due to the recent development of ICT and information systems. In other words, they have been focusing on the trend of the development of theory rather than the trend related to practical accounting and accounting information systems. As such, there is a gap between academia and practitioners, and accordingly, it is necessary to find out about the accounting information systems that are being developed in the actual business field. Recently, the advancement of ICT and information systems has made accounting activity more efficient, and the productivity of accounting tasks has increased. The use of technologies, such as blockchain, is mainly used to reduce human errors in accounting, increase efficiency, and increase transparency and reliability [

7].

Therefore, the research objective of this paper is to quantitatively investigate the developmental trends in accounting information systems using business method patents. To this end, this study has two research questions. First, in which areas or functions of the AIS field are patents and new technologies being applied? Second, what kinds of patents dominate the AIS field and are at the center of development? As a result, it is possible to understand the development trend of AIS, and in the future, to understand the direction of its development. Patents as a useful technical and law document have been widely adopted for various research purposes [

8,

9,

10,

11,

12]. In particular, business method patents are about a software-based practical system, and so are suitable data for analyzing business- and management-related information systems. In particular, some characteristics, such as high volume, clear classifications, and many knowledge flows, make the business method patents a more valuable and useful data source. To consider the characteristics of business method patents, this paper adopted a knowledge persistence-based main path analysis. Knowledge persistence-based main path analysis can dramatically reduce the network complexity without omission of the dominant knowledge flows and show the knowledge interrelationships among sub-domains. The empirical results show that accounting information system patents were developed along with the software patent of knowledge injected from the outside. Software patents were cited during the development of accounting information system patents, and the two technologies developed together in response to changes in the business environment and needs. Another empirical result is that the accounting information systems can be divided into four sub-domains: bookkeeping and accounting system, taxation system, user customization system, and protection system. Overall, tax accounting is affected by bookkeeping and accounting systems and user customization system. Accounting and taxation systems have developed from the basic accounting/tax processing techniques in the early stages to various types of accounting/tax processing for global companies, and the corporate tax calculation of the accounting period in the later years.

The remainder of this paper is structured as follows:

Section 2 provides a review of the literature.

Section 3 and

Section 4 explain the details of the data and method. The developmental trends of accounting information systems are presented in

Section 5. The last section presents the discussions and conclusion.

5. Results

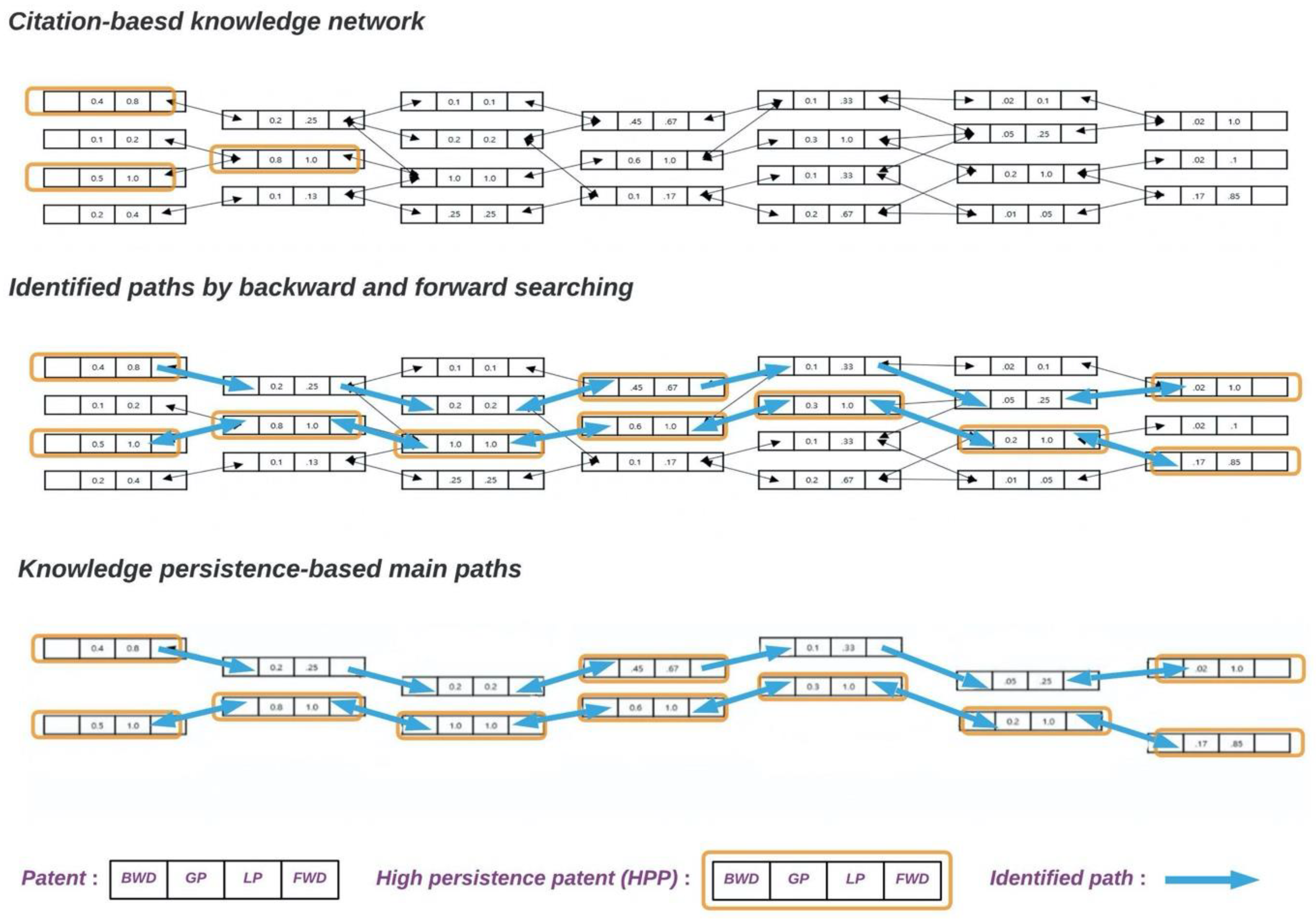

The KP-based main paths for the accounting information systems are shown in

Figure 2. The network is drawn by using Gephi (

www.gephi.org accessed on 15 September 2022) and the Event graph layout plug-in is used to arrange patents by a layer order. Based on the threshold values for determining the dominant knowledge patents (GP ≥ 0.3 or LP ≥ 0.8), 39 patents out of all patents (4816) related to accounting information systems were selected, and a total of 67 patents were on the main paths (see

Appendix A). To find sub-domains under the accounting information systems, experts in accounting qualitatively analyzed the textual sections (abstract and description) and technical definitions of the classifications of patents on the main paths and defined four sub-domains. The representative names for the sub-domains are bookkeeping and accounting system, taxation system, user customization system, and protection system.

The accounting domain can be broadly classified into three types: financial accounting, managerial accounting, and tax accounting [

38]. Among these, managerial accounting is normally used by the administrators of the company for internal control and is not regulated externally. Managerial accounting is a management technique used to make decisions within an organization, unlike other types of accounting where there are no rules to follow (e.g., Activity-Based Costing and Balanced Scorecard). The purpose of financial accounting is to share accurate financial information to external users (shareholders, creditors, employees, and business partners). Financial accounting is regulated by national or international rules. On the other hand, the purpose of tax accounting is to describe the business process in such a way that income tax criteria can be appropriately assessed. The tax system requires some certainty that may not be appropriate for financial accounting standards to function in accordance with tax law. In many western countries, tax regulations have historically been more detailed than accounting regulations. This situation led to tax regulations being more important than accounting regulations [

39]. Patents related to managerial accounting were not shown in the main path network, and the four sub-domains are related to financial accounting and tax accounting. In particular, the number of patents related to tax accounting accounted for the majority. Patents related to tax accounting were affected by patents related to bookkeeping and accounting systems and user customization systems, but did not affect other sub-domains.

Figure 2 shows the categorized sub-domains of accounting information systems and their trajectories.

As mentioned earlier, for analyzing and understanding the injected knowledge from outside, it is explained which software patents affect accounting information systems patents and which they are cited in. Through this, it is possible to know the characteristics of software patents that have influenced the chronological development process of accounting information systems patents and the history of changes in these software patents. In order to find out the software patents that have influenced the accounting information systems patents, first, the types of software patents that are frequently cited and influenced by all accounting information systems’ patents including those not on the main paths, as well as those on the main paths, are described. First of all, with the exception of CPC sub-group G06Q, which includes business management patents, the patents of which CPC sub-groups have affected accounting information systems’ patents are identified. This result is shown in

Figure 3. Meanwhile, for the analysis of software patents, the analysis was focused on the CPC sub-group G06F, which had the most influence on accounting information systems patents on the main paths.

Figure 4 shows the evolution of sub-classification of G06F codes of software patents that affected accounting information systems according to year. The vertical axis coverage represents the share of CPC code that affected accounting information systems’ patents.

As can be seen in

Figure 3, the software patent that had the greatest influence on accounting information systems’ patents from the 1990s to the present is G60F16 of the CPC code. These analysis results are similar when analyzing only the software patents that affected the accounting information systems’ patents on the main paths.

Figure 5 shows the sub-classification of G06F codes of software patents that have influenced patents on the main paths by year.

A common trend in

Figure 4 and

Figure 5 is that before the 1990s, G06F7 and G06F15 mainly influenced accounting information systems’ patents, and from the 1990s, G06F16 had a dominant influence on accounting information systems’ patents. As mentioned earlier, the CPC codes of the software patents that affected accounting information systems’ patents from the 1970s to the 1990s are G06F7 and G06F15. G06F7 is to sort, select, merge, or compare data, or to perform functional evaluation by calculation. This software technology supports and improves accounting information systems as a technology that affects the acquisition, comparative analysis, calculation, and evaluation of accounting information. Meanwhile, G06F15 relates to adaptation to a specific application, and is related to the patent for portable checkbook-balance calculating devices or electronic calculating apparatus related to accounting. As such, early software patents were technologies related to basic accounting information acquisition, comparative analysis, and accounting processing calculations. On the other hand, the CPC code of software patents that have influenced accounting information systems’ patents from the 1990s to the present is G06F16. G06F16 relates to data format conversion from or to a database and retrieval of media data incorporating multiple media types. These techniques were used to organize and rearrange accounting information. In response to various format changes, accounting information can be displayed at the right time and place, and accounting information can be retrieved from image or audio information. In other words, from the 1990s, software technology that enables the acquisition of accounting information from more complex and diverse sources, and technology that allows the obtained information to be transformed into a format suitable for various purposes, such as taxation and decision-making, and used for various purposes, have been developed together with accounting information systems. In summary, the software patents that influenced the accounting information systems’ patents can be divided into pre-1990s and post-1990s characteristics. Prior to the 1990s, software patents related to the storage and processing of basic accounting information, such as financial documents calculators, were mainly cited. However, since the 1990s, software patents for automatic conversion and arrangement of formats and advanced software systems related to accounting information systems’ patents, such as acquisition of more complex and diverse accounting information and fusion of tax and accounting information, have been cited and influenced.

The development process of accounting information systems’ patents affected by the injected knowledge from outside discussed earlier is divided into four sub-domains and explained.

Bookkeeping and accounting system: The bookkeeping and accounting system sub-domain can be divided into the accounting processing and accounting information extractions. First, trajectories for the accounting processing show the development from a simple accounting calculation and storage technique to a more advanced financial management technique. The basis of accounting is to accurately account for all possible information. In the early days, techniques related to the basics of this accounting process were developed. Nodes #43, #55, #118, and #293 are about techniques that enable calculation, storage, and perform functions of accounting information, which is the basis of accounting. The node #43 is an electronic checkbook technique, including a dedicated microprocessor that stores information every day, even when not otherwise in use, that continues to perform a specific function. It also keeps handwritten records and includes techniques to check direct deposit slips for errors. The node #55 is a check calculator technique, which supports storage and remembers deposit balance information and check number information. The node #118 is an automatic reconciliation technique, which compares data stored in old memory with data stored in new memory, identifies inconsistencies, and automatically corrects existing data sets to match new data if desired. The node #293 is an automatic accounting processing technique that standardizes and formalizes business management tasks and performs accounting procedures for transaction data much more automatically in real time. Automatic accounting processing technology enables automatic accounting processing without accounting knowledge. In addition, errors that occur in the accounting process are automatically controlled. Meanwhile, these early accounting information system patents were influenced by the aforementioned software patents. Software patents US4075702 and US4224675, which are patents of G06F15, influenced nodes #43 and #55, which are dominant knowledge patents among accounting information systems’ patents in the late 1970s. Software patent US 4075702 (electronic calculating apparatus and wallet enclosure) is cited for the accounting information systems’ patent node #43, and US 4224675 (portable checkbook-balance calculating device) is cited for the accounting information systems’ patent node #55. As such, for the accounting information systems’ patent related to simple accounting processing and information storage technology in the early days, the software patents were also patents related to the storage and calculation of accounting information for accounting processing.

These early accounting techniques evolved into more advanced financial management techniques. According to Shortridge and Smith [

40], the accounting paradigm shifted from emphasizing transactions, historical costs, and the reliability of accounting information to emphasizing economic events, fair value, the relevance of accounting information, and information relevant to globalization. Kanakriyah [

41] suggests that the accounting information system supports budgeting or costing systems that collect, analyze, process, and convert data into useful information. Node #984 is a technique that helps budget management based on accounting information. For budget management, this technique maintains account balances for budget-related transactions. For multi-corporate management, node #2462 includes a technique that is linked to the accounting of two or more individual companies in a multi-company group. The multi-company accounting system automatically reconciles the balances to balance the amounts owed to each of the individual companies to specify the outstanding balances for each company. Node #4035 is a technique that integrates the characteristics of a segmented market with an accounting system. This technique integrates the profitability and accounting data for each market segment. Users can define characteristics of market segments and link the characteristics by adding structure to the documents when generating financial documents that include profit and loss (P&L) and balance accounts. On the other hand, these latter accounting information system patents were influenced by software patents. Software patents US7756907 (computer systems and methods for visualizing data) and US7783591 (automated processing of financial documents) are cited for node #2462, which is from the mid to late 2000s. These software patents are patents required for the implementation of accounting information processing in node #2462, which is a patent for responding to changes in the business environment. It can be seen that accounting information system patents have been influenced by software patents both in the earlier and later periods.

On the other hand, the paths for the accounting information extraction are about techniques that extract accounting information from images. From the 1970s, the qualitative nature of the representational faithfulness of accounting information began to be emphasized. This means that the interpretation of individual accounts is important rather than simply showing accounting information. For this, not only accounting numbers but also various information surrounding accounting transactions are needed and interpreted together with accounting numbers. Node #40 is a technique that separates and records accounting information along with the images for the documents involved in transactions. Software patents US3988571 (document reject reentry) and US4027142 (automated processing of financial documents) in the G06F7 code, which is a technique related to obtaining accounting information, influenced node #40. Nodes #932, #4538, and #4755, which have been further developed since then, are techniques for extracting accounting information from images, which store and analyze images, convert images to text, analyze data, extract accounting data, and put data into accounting reports. The technique in node #932 analyzes images on receipts, converts images to text, analyzes data, extracts expense data, and puts data into expense reports. It also displays receipt images side by side with cost data. In addition, the stored images are encrypted to prevent tampering, preserving the integrity of the receipt image. Node #4538 is a technique that acquires image and numeric data. Numerical data is automatically extracted, organized, and saved in the defined format for reporting. After saving, the numerical data of images or reports can be retrieved. Node #4755 is a technique that performs analytical processing of the image to determine the receipt image. To summarize the bookkeeping and accounting system sub-domain, the basic accounting calculation and storage technique in the early stage were mainly related to accounting processing. These techniques were aimed at enabling calculation, storage, and performing functions of accounting information, which is the basis of accounting, and accurate accounting and reducing errors. It has since evolved into more advanced financial management techniques. This is the technique of accounting information system which supports budgeting or costing systems that collect, analyze, process, and convert data into useful information. On the other hand, not only accounting numbers but also various information surrounding accounting transactions have steadily developed with increasing importance. However, the main paths in this sub-domain continue until the 1990s, and after that, it is not the main paths. This means that the techniques for collecting or storing sufficient information and accurate bookkeeping, which are the basics of accounting, were all developed at the beginning of the development process, and after that, it was only a description of the scalability of accounting information. In addition, since the accounting process does not require advanced technology and is calculated when necessary information is accurately entered without errors to comply with accounting regulations, the importance of technology development seems to have decreased after the development of basic technologies.

Taxation system: The developmental trajectories for the taxation system sub-domain overall shows the developments in a tax return technology. Tax return is a very important issue for corporations, governments, and stakeholders, and tax calculation is the last thing to be calculated after tax accounting based on financial accounting data. The amount of corporate tax payable is calculated by adding tax adjustment work to each account balance in accounting. In addition, tax may occur whenever an economic event occurs, and the amount of tax to be paid for the current period is determined after the close of each fiscal year. Companies are required to consistently make tax-related calculations, bookkeeping, and payments throughout the fiscal year, all of which are associated with the most important corporate tax return. The early development of the taxation system is related to basic tax calculation and transaction tax payment. After that, it leads to the development of techniques necessary for calculating and paying corporate tax according to various business situations. Nodes #106, #252, and #187 are early progresses of an automated corporate profit and consumption tax processing system, a point-of-sale tax collection system, and an automated taxable transaction reporting or collection system. Node #106 is a technique for automatically processing payroll, corporate profits, and consumption tax. This technique stores tax deposit information related to tax deposits. It also allows banks to automatically transfer tax deposits from each depositor’s account to their bank account. Node #252 is an automatic transaction tax filing or collection technology. A point-of-sale terminal networked to a central computer enters and stores data on taxable transactions and stores the taxes accrued on the transactions. All collected data generate a report that reflects the transaction tax payable. These reports are then sent to tax authorities or other tax authorities, such as the federal government. Node #187 is a technique that collects and remits taxes in real time at a point-of-sale location. This technique periodically transfers the collected tax amount to the tax authority bank. After the development of this initial transaction-specific tax system, node #164, a withholding tax system, was invented. Node #164 is a technique that automatically transfers withholding tax to an appropriate withholding account. These withholding amounts are delivered to the treasury and/or other collection agencies on a daily basis. A series of barcodes is also printed on the check to identify a specific withholding account. This technique, based partly on node #105, is an account balance management technique in the bookkeeping and accounting system sub-domain. Node #105 is an automated ledger account maintenance technique that provides the up-to-date balances of all ledger accounts whenever data related to a completed transaction are entered. The ledger account records and transaction records are provided to ensure a high level of resistance to tampering with data and provide traceability to all entries and postings. It develops, from these withholding tax technologies, to nodes #389 and #546, which are related to tax payment. Node #389 is a technique for collecting tax revenue and recovering currently unrecovered tax revenues by storing data representing sales transactions in which sellers do not collect specified taxes. This technique supports updating the tax due notice to reflect the tax payment shown on it, and automatically remit the appropriate income to the tax authority once the tax due notice has been paid. Node #546 is a technique that automates tax forms. Node #546 allows tax forms to be first retrieved from a database and then formatted to the retrieved tax-related forms. A formatted tax-related form is sent to the governmental entity. Software patents US5535322 (data processing system with improved work flow system and method) and US5911776 (automatic format conversion system and publishing methodology for multi-user network) in the G06F16, which allows data to be converted to multiple formats, are cited for node #546. After that, node #1878 is invented, citing node #445, which is a user customization convenience technique of the user customization system sub-domain. Node #1878 is a technique for identifying tax documents to customize tax return preparation. This system enables users to identify tax documents relevant to a taxpayer’s situation and prepare an appropriate tax return. Node #2586 is a technique that involves generating a partially completed tax return based on basic user information without needing to obtain other user inputs. Software patents US4553261 (document and data handling and retrieval system) and US7636886 (system and method for grouping and organizing pages of an electronic document into pre-defined categories) are cited to implement this important technique. Both techniques were directly or indirectly influenced by the early technologies of nodes #106, #252, and #187. After that, the most recent developmental paths led to the tax return systems, such as nodes #3875, #3956, and #3735. Node #3878 is a technique that improves user retention of tax return preparation systems by personalizing the tax return preparation interview. Node #3735 is a technique that provides personalized answers to tax-related questions received from users of electronic tax return preparation systems. Node #3956 is a technique related to an electronic interview method that supports preparing tax return. As such, the developmental paths related to the tax system have led from the calculation of corporate tax and transaction tax to the technology related to tax return.

To summarize the taxation system sub-domain, the early development of the taxation system is related to basic tax calculation and transaction tax payment. Since then, taxation systems have developed with a focus on the tax return systems. The development of accounting systems is shorter and less numerous than the development of tax systems. Taxation systems, which are more rigid than accounting rules, are further developed. In addition, since tax payments and refunds are related to the inflow/outflow of a company’s wealth, the interest of the company, government, and other stakeholders will be higher than other accounting information systems. For this reason, tax-related systems have been steadily developing over a longer period of time. On the other hand, one company’s share of tax-related patent rights is high, unlike other sub-domain technologies. A company called INTUIT INC. owns 15 tax-related patents (

Table 3), concentrated since 2010, accounting for 88% of tax-related patents issued after 2010. INTUIT INC. is a financial services software company, specializing in accounting and tax software. INTUIT INC.’s platform holds around 80% of the accounting software market share. The fact that the financial software group, not the general company, holds many tax-related patents reflects the reality that most companies handle accounting/tax affairs with external software rather than in-house systems.

User customization system: The developmental trajectories for the user customization system show a relatively short development period on the main paths. The user customization system sub-domain has continued in the direction of creating and managing user information. Nodes #204 and #288 are techniques that generate, maintain, process, and analyze data about individual users. Specifically, these techniques generate claims for users and prepare reports on user data. This creates billing for individual users. Based on the knowledge from these techniques, node #284, a consumer-based bill management and payment technique that supports receiving, analyzing, managing, and paying electronic bills, was invented. Node #445 is a technique that allows users to temporarily store information and to retrieve it later. When the user accesses it, the user can download the previously stored information and integrate the information automatically.

Protection system: The developmental paths of this sub-domain are toward protection of an accounting system and stored information and have a relatively short knowledge generation. Node #78 is an encrypted computer software security and charging technology. The user’s computer is provided with a hardware security module and a billing module, and the security program accesses the application and records information about the billing in the billing module. Node #279, which cites node #78, is a technique for secure transaction management and protection of electronic rights. This technique ensures that information is only accessed and used in an authorized manner and helps maintain the integrity, availability, or confidentiality of information. Node #4650 is a cryptographic mechanism technology for confidential/secure communication for verifying or authenticating a user’s identity or authority, while allowing customization of service plan proposals or other controls.

6. Conclusions and Discussion

This paper quantitatively analyzed developmental trajectories in the accounting information systems along with the injected knowledge from outside. The business method patents related to the accounting information systems were used as analytic data, and main path analysis was adopted to investigate developmental trends. Since the business method patents have a great number of knowledge flows and knowledge interrelationships within the domain, this paper adopted the knowledge persistence-based main path analysis, which can dramatically minimize the network complexity without omitting the dominant knowledge patents and clearly show the knowledge interrelationships among sub-domains.

This study confirmed that accounting information system patents have been mainly developed in four sub-areas: bookkeeping and accounting system, taxation system, user customization system, and protection system. The empirical results show that the accounting information systems domain has developed from the basic accounting/tax processing technology in the early stages and developed various types of accounting/tax processing for global companies, and the corporate tax calculation of the accounting period in the later years. First, the bookkeeping and accounting system has continuously evolved over time. This sub-domain shows the paradigm shift from the initial basic accounting calculation and storage technique to scalability to accounting techniques and other functions in more complex situations. Although the accounting process does not require advanced technology and the importance of technology development seems to have decreased, it is likely to develop again according to changes in the business environment or the birth of new types of transactions. Second, the user customization system and protection system have been creating knowledge for a relatively short period of time., and the trajectories were simple and constant. These technologies are not directly related to accounting, but rather for the accessibility and convenience of users and the safety of the system, so they will be developed for the same purpose in the future. Third, the taxation system has been creating knowledge for a relatively long period of time.. This sub-domain has developed from the initial basic tax calculation and transaction tax payment to corporate tax-related tax return. Since tax payments and refunds are related to the inflow/outflow of a company’s wealth, the interest of the company, the government, and other stakeholders will be higher than other subdomains. For this reason, this technology is likely to continue to evolve with a focus on tax returns. As mentioned earlier, the development of accounting information systems has been developed to meet the needs of society according to the changes in the business environment (globalization, development of ICT technology, etc.) that require new technologies. As various types of accounting events appear, accounting techniques have been developed accordingly. Accounting technologies are required in order for the accounting information system to incorporate the new necessary accounting theories and laws in the rapidly changing business environment. In other words, accounting technologies in business method patents are tools that connect the real world with the accounting system. By studying the development trend of accounting technology patents, changes in the business environment surrounding accounting can be confirmed, and changes in the future business environment and the direction of development of accounting technology required in practice can be predicted accordingly. The bookkeeping and accounting system technology will be further subdivided to cope with more complex/various transaction types in the future. In addition, there will be more extensions to use the stored accounting information for various purposes. The technology to combine information from all areas of management, including accounting, will be developed for business decision-making, such as profitability analysis by transaction and strategic positioning. Moreover, the taxation system technology will eventually develop technologies that deal with various types of tax issues for corporate tax return. Techniques for dealing with differences in tax laws between countries of multinational corporations due to globalization, or techniques for new environmental laws, can also be developed. The user customization system and protection system are expected to develop into an advanced technology for its original purpose without major change in the development direction of the existing technology.

As can be seen from the results, patents related to accounting information systems have been mainly developed in bookkeeping and accounting systems and taxation systems. Companies must disclose accurate accounting information in compliance with IFRS regulations to enable fair comparison of companies’ financial status and business performance, and they should perform tax accounting in accordance with the government’s tax laws. Companies use not only the software they created in-house, but some of the dominant enterprise resource planning (ERP), including the accounting and tax software programs used primarily by many external companies. In other words, accounting and taxation are highly dependent on the technology of external software and can be affected by the patented technology of external ERP software companies (i.e., SAP, Intuit inc). According to [

42], the most important and practical information technology to interact with accounting was the ERP system, and companies increasingly relied on ERP systems designed to enhance tax-related capabilities [

43]. For this reason, it seems that many patents have been developed in these two sub-domains. Meanwhile, according to [

44], the state of accounting information systems can be divided into four stages: Stage 1 broken systems; Stage 2 financial reporting-driven systems; Stage 3 customized and stand-alone systems; and Stage 4 integrated systems.

Table 4 shows the four-stage model of accounting information systems.

As evident in

Appendix A, there is a clear indication of the growing complexity of those patents, signifying the moves/advancement of corporate business information systems from Stage 1 to Stage 4, also from financial accounting-oriented systems to more complex ERP systems. Based on this model, patents related to accounting information systems are expected to be further developed from a practical standpoint for the establishment of fully linked databases and systems, and integration of accounting processing and production, customer, cost, operation, and strategic control.

On the other hand, business innovation needs to be grounded in practice and continuous development between technological-push and demand-pull sides of an innovation. In order to respond to changes in the business environment and for more effective and efficient business activities, support for technology such as patents is absolutely necessary. The voice of the demand for innovation in practice and the development of technological innovation, such as patents, leads to the development of management innovation. Management innovation can be achieved by developing patents that support such innovation with interest and development, not only by innovation suppliers, such as INTUIT INC., but also by innovation demanders, such as general companies.

In addition, emerging technologies, such as artificial intelligence, big data, and block chain technologies, are having an impact on accounting fields, such as taxation, costing, and auditing. Because accounting is data-driven, big data can help deliver greater value [

45]. Big data can also be used for customs policy establishment and performance auditing [

46]. Meanwhile, block chain can be used by customs authorities for tax control purposes. It also allows for real-time decision-making and ensures transparent and secure exchange of cost information [

47]. Moreover, artificial intelligence supports internal control and decision making in an organization [

48]. Accordingly, practitioners’ job responsibilities are rapidly changing due to the development of these emerging technologies. These emerging technologies will significantly impact the AIS and the skills required of specialists in AIS. As a result, future AIS-related patents will develop with direct and indirect connection with these emerging technologies. Patents that support emerging technologies or help their users will be further developed, and AIS technology patents may arise in a completely new direction through emerging technologies.

We believe that the result of this study can be a useful lesson for public policy makers seeking to support innovation development by encouraging closer working relationships between suppliers and demanders of innovation. When it becomes possible to understand and predict not only new technologies directly related to patents, but also the fields to which the new technologies are applied, it is possible to focus on politically nurturing specific fields and formulating policies to support the application of new technologies. Furthermore, as mentioned earlier, patents related to AIS technology will be combined with artificial intelligence, block chain, and big data technologies. All of these new technologies are based on data storage, management, and utilization [

49]. Therefore, policy regulation standards for personal information, one of the core data, need to be clearer. In addition, the establishment of a data library can be promoted by establishing a system to open secure public and private data. Meanwhile, new technologies, such as big data, data analytics, and artificial intelligence, can pose a threat to accounting professionals. Accounting experts must move away from the traditional accounting field of the past and perform data interpretation and analyst roles with data utilization and analytical skills using new technologies [

45]. To this end, it is necessary to improve corporate regulations and accounting regulations for the use of new technologies, and in particular, a new accounting education course may be newly established in preparation for the impact on the accounting industry. To become a winner in the Fourth Industrial Revolution, many new technologies need to be applied to a wide range of fields.

There are several important contributions to this study. First, to understand the development trend by applying the knowledge persistence-based main path approach used in several studies of new technology development trends to accounting information systems, which is one of the novel fields in the social science field. Existing studies have drawn the results of applying the approach to new technologies that are directly related. However, this study applies the approach to the AIS field rather than any specific technology, analyzing which patents used in the AIS field dominate or are at the center of development. As a result, it is possible to understand the development trend of AIS, and in the future, to understand the direction of its development. Second, this study identifies the underlying mechanisms of AIS development. It can be seen that AIS has developed along with IT, and that the theoretical aspects of academia and the practical aspects of practitioners have been developed at the same time. The development of managerially useful theories is also that practical patents or technologies that actual practitioners apply to their work are absolutely necessary. In the course of the success of AIS and other social science theories or technologies, there may be several trial and error stages depending on the gap between theory and practice. A stage of trial and error is necessary through continuous communication between academia and practitioners. The fact that the development of science and technology is absolutely necessary to realize the value of a theory means that the development of social science and science are inseparable. Third, by using fact-oriented data, patents that practitioners actually acquire and use, it is possible to find out the object developmental trajectory in the practical AIS field closer to reality. As mentioned earlier, most of the research on the development of AIS is conducted from an academic point of view through a survey of opinions or reviews of the literature on journal articles, and studies on the perspective of practical practitioners are lacking. According to [

50], it is necessary to place more effort into understand the management practice itself that practitioners need. This study drew more realistic results by studying patents acquired and used by actual companies from the perspective of practitioners. Finally, the approach used in this study can be used in other emerging technologies that influence accounting research, such as artificial intelligence, big data, cloud computing, block chain, and the Internet of things. Several studies claim that artificial intelligence, big data, and block chain technologies are having an impact on accounting fields such as taxation, costing, and auditing, and research in these fields is active (i.e., [

46,

47,

48,

51]). In addition to understanding the development trend of the technology through research on patents related to artificial intelligence, it is possible to predict the future direction of the Fourth Industrial Revolution through research on how this technology is used in which fields of social sciences. This study may not be new in methodological terms. However, this study is the first step in applying the existing knowledge persistence-based main path approach to the field of social science. Through this study, it is possible to know the areas that need to be modified/added when using this approach in future social science research. In this regard, this study is not a study simply applying the knowledge persistence-based main path approach to a new field, but rather a study for methodological development for cross-disciplinary application of the approach.

However, some issues should be improved or considered for further research. First, this paper collected the business method patents related to the accounting information systems and considered knowledge flows occurred within the collected patent set, i.e., target domain. However, considering that the accounting information systems are basically a software-based system, and so they are closely related to computer and software technologies, it seems to be a good strategy to add the ICT-related patents to the patent set. By adding ICT-related patents to research data, the technical basis of accounting information systems can be analyzed. Second, sub-domains under the accounting information systems were qualitatively identified by the accounting experts. However, it costs too much money and time to use the knowledge or expertise of domain experts. An automated approach for identifying sub-domains under the patent set can make the task more efficient. Third, to analyze and interpret the main paths, domain experts read all patents on the main paths to understand major knowledge trajectories and identify what specific knowledge is transferred to later patents. Expert’s work can be more efficient if patent textual information is summarized and provided for qualitative analysis. Therefore, further research will apply NLP (natural language processing) for representing each patent and so better understanding of the knowledge combination process. Moreover, some methodological limitations can be improved based on the findings: (1) the number of average citations is larger (at least two times) than other general technical fields; (2) the year ranges of forward citations of patents are relatively short; (3) Lack of analysis of knowledge interactions with other technical fields, particularly software technologies, and internal interactions with other subdomains of AIS. For further improvement of the KP-based main path approach for social science studies, more focus should be placed on citation weighting for each knowledge flow. For citation weight measurement, the similarity between the citing and cited patent can be one possible way. In general, patent citations, patent texts (usually in the abstract section), and patent classifications have been widely used for a patent similarity measurement in technical fields. However, patent citation information cannot be used for patent citation weighting, and patent texts of social science fields, including AIS, usually consists of general systematic expressions and do not clearly include keywords which can clearly distinguish technical or functional differences. Therefore, the patent classification-based approach seems to be the proper way for citation weighting in social science fields. In addition, the backward-forward searching algorithm for tracing/finding potential main paths can be improved for application in social science fields. Compared to technical fields, social science-related patents have more knowledge flows, but a shorter range of forward citations, and this can create relatively high KP values, but they can be similar values from the layer perspective. However, this can cause multiple selections in the backward-forward searching process and the generated main path network can be more complex. To solve this potential problem, further research should focus on the prevention of the multi-selection issue, and the consideration of both time and layers for rearranging knowledge networks can be one possible strategy.

In the future, not only AIS, but also in many social science fields, a phenomenon of convergence of various new technologies will occur. Therefore, methodological diversity will be further deepened in social science research, and cross-disciplinary research will increase. As more and more social science research focuses on science, many social science researchers will have to make efforts to go beyond the limits of the existing traditional social science research methodologies.