Modeling Synchronization Risk among Sustainable Exchange Trade Funds: A Statistical and Network Analysis Approach

Abstract

1. Introduction

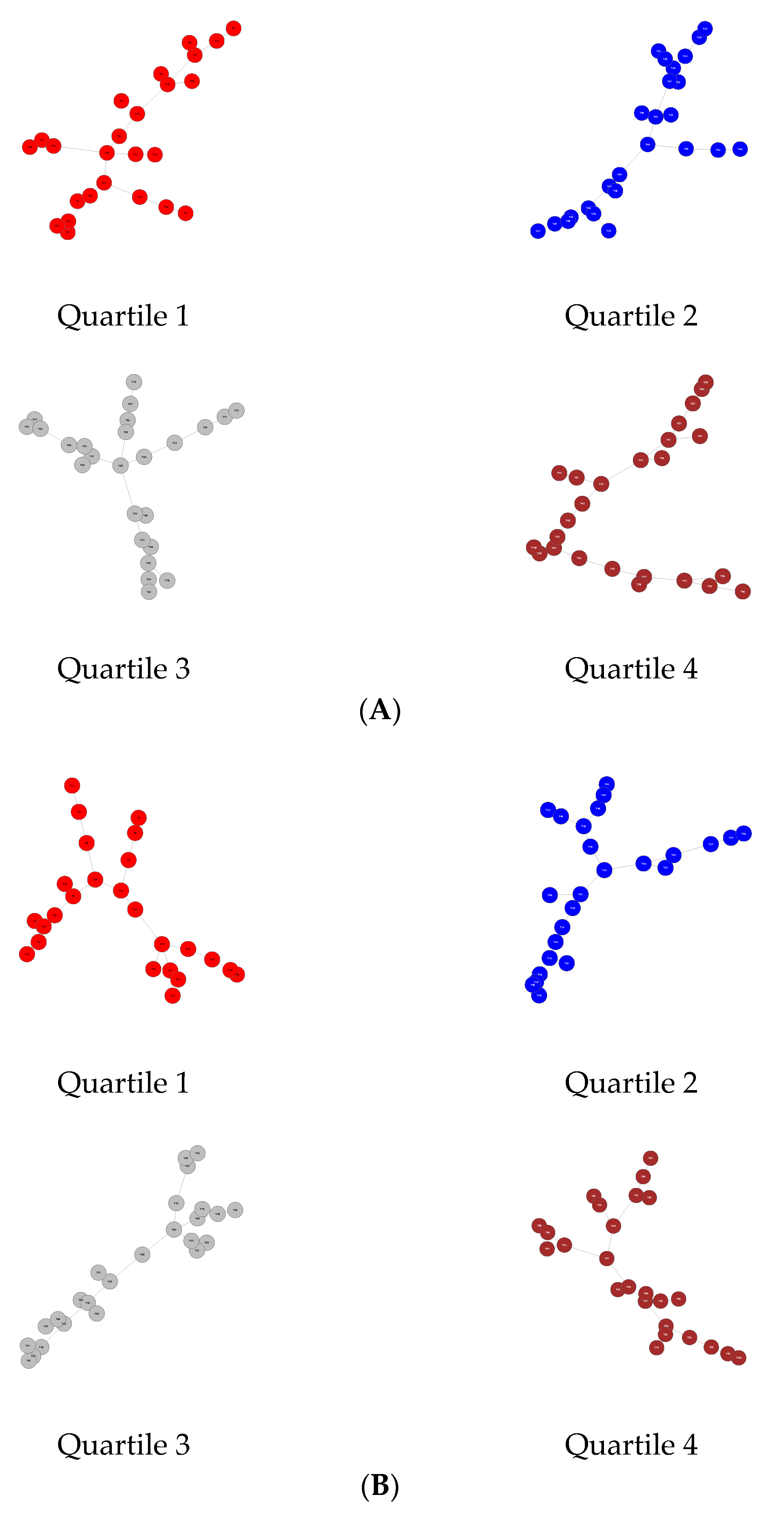

- We use 100 global equity ETF equivalents at 80% of the global amount under management in this industry and classify these ETFs according to their ESG score in four quartiles. Specifically, we used the 2021 ESG score to rank the ETFs from the top ESG score to the bottom ESG score (ESG score for ETFs has been available since 2021 and is updated quarterly. Nevertheless, none of the ETFs included in this study changed quarterly between 2021 and 2022).

- We built the ETF asset correlation network for each quartile to measure the ETFs’ synchronization of returns over time.

- We apply econometric modeling to study the statistical significance of the CBOE Volatility Index’s (VIX) influence on this synchronization phenomenon.

- We present a new approach to the influence of ESG on the performance of financial assets, complementing the studies that study profitability and risk. Indeed, we focus on systemic or contagion risk, using the synchronization of financial markets as a proxy for the potential danger of contagion of adverse shocks to investment portfolios.

- Using ETFs has two advantages: (i) ETFs allow us to work with their market return and systemic risk, allowing us to study changes in the value perceived in the fundamentals of each asset in the fund and changes in the market sentiment regarding the ETF. (ii) ETFs today are the investment vehicle with the most significant expansion in the financial market regarding assets under management. According to official figures from Statista, by 2022, the 2010 AUM went from USD 1.3 billion to USD 7.7 billion.

- We apply financial network methodologies to improve the aggregate understanding of a complex phenomenon such as synchronization and its impact on a highly relevant financial asset class that rapidly adopts ESG standards on its investment policies.

2. Theoretical Background

2.1. Network Methods and Financial Markets

2.2. Systemic Risk and Financial Markets Synchronization

2.3. Influence of ESG on Market Synchronization

3. Materials and Methods

3.1. Measuring Stock Market Synchronization with MSTL

3.2. Measuring the Shape of the Network

3.3. Econometrics Models and Evaluation

3.4. Spillovers Analysis

4. Results

4.1. Univariate Results

4.2. Multivariate Results

4.3. Robustness Analysis

4.4. Instabilities and Connectedness Analysis

5. Discussion

6. Conclusions

- For investors, to reduce the risk of synchronization in the face of adverse shocks, it is recommended to invest in ETFs with a high ESG score.

- For regulators to encourage the ESG information to promote a better decision-making process.

- For investment managers, our evidence illustrates another alternative to managing portfolio risk based on the ESG score of funds.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Conflicts of Interest

Appendix A. Comparative Analysis of the Theoretical and Empirical Financial Networks Literature

| Main Themes | Authors | Year | Application | Main Results |

| Stability & fragility of financial systems | Kiyotaki, N.; Moore, J. [28] | 1997 | Dynamic models of spillovers between lenders and borrowers. | The dynamic interaction between credit limits and asset prices is a powerful transmission mechanism by which the effects of shocks persist, amplify, and spill over to other sectors. |

| Allen, F.; Gale, D. [29] | 1997 | Analysis of the behavior of financial markets when dealing with no diversifiable risks and the presence of intermediaries. | In an economy with intermediaries and no financial markets, accumulating reserves of safe assets allows returns to be smoothed, the non-diversifiable risk to be eliminated, and an ex ante Pareto improvement comparedwith the allocation in the market equilibrium to be achieved. | |

| D. Acemoglu, A. Ozdaglar, and A. Tahbaz-Salehi [76] | 2015 | Study of stability and financial contagion among financial networks of interbank liabilities. | A densely connected financial network enhances financial stability. Nevertheless, beyond a certain point, dense interconnections serve as a mechanism for the propagation of shocks, leading to a more fragile financial system. Moreover, the same factors contributing to resilience under certain conditions may function as significant sources of systemic risk under others. | |

| Networks of financial assets | Mantegna, R.N. [34] | 1999 | Graph analysis of the topological structures of financial stock markets. | There is a hierarchical arrangement of stocks traded in a financial market. The topological space is a subdominant ultrametric space associated with a graph connecting the stocks of the portfolio analyzed. The hierarchical tree of the subdominant ultrametric space associated with the graph provides a meaningful economic taxonomy. |

| Mantegna, R.N.; Stanley, H.E.; Chriss, N.A. [37] | 2000 | Applications to financial markets of power-law distributions, correlations, scaling, unpredictable time series and random processes. | The behavior of complex systems such as financial markets could be explained by applying mathematical and physics techniques. | |

| Albert, R.; Jeong, H.; Barabási, A.L. [30] | 2000 | Analysis of the robustness of complex systems under the occurrence of errors. | All redundant systems do not share error tolerance: it is displayed only by a class of non-homogeneously wired networks. Error tolerance depends on selecting and removing a few nodes that play a vital role in maintaining the network’s connectivity. | |

| Bernard, P.; Ahmed, K.; Pierre, C.J.; Nouredine, Z.; Zekri, L. [31] | 2008 | Study of the propagation of wildfire using small-world models. | Forest fire patterns are fractal, and that critical exponents are universal, which suggests that the propagation/non-propagation transition is a second-order transition. Universality tells us that the characteristic critical behavior of propagation in real systems can be extracted from the simplest network model. | |

| Haldane, A.G. [32] | 2013 | Discussion of the behavior under stress of a complex and adaptive network of financial institutions and assets. | Financial markets as a complex adaptive system allow considering some of the lessons from other network disciplines (ecology, epidemiology, biology, and engineering) into the financial sphere. In addition, network approaches provide a different view of the structural vulnerabilities built up in the financial system over the past decade and suggest ways of improving its robustness in the period ahead. | |

| Nikolaus Hautsch, Julia Schaumburg, Melanie Schienle [77] | 2015 | Using network interdependence between firms’ tail risk exposures to estimate the measure of financial companies’ contribution to systemic risk. | Results reveal many relevant risk spillover channels and determine companies’ systemic importance in the U.S. financial system. Monitoring companies’ systemic importance and enabling transparent macroprudential supervision is crucial for financial stability. | |

| Haldane, A.G. [32] | 2012 | Discussion regarding the modeling of risks in financial markets. | Modern finance is complex. Regulation of modern finance is almost certainly too complex. That configuration spells trouble. Because complexity generates uncertainty, not risk, it requires a regulatory response grounded in simplicity, not complexity. | |

| Eberhard, J., Lavin, J. F., & Montecinos-Pearce, A. [35] | 2017 | Analysis of the structure of brokers’ transaction network of stocks. | Changes in the networks of transactions are correlated with variables that describe economic–financial environments. In addition, changes in the brokers’ transaction network structure are associated with a greater probability of positive shocks of more than two standard deviations in the stock exchange index return and total traded stock volume. | |

| Lavin, J.F.; Valle, M.A.; Magner, N.S. [6] | 2019 | Study of the topology and connectivity structure of mutual funds and stocks Applying bipartite network methods. | Changes in the bipartite network between stocks and funds and its one-mode projection are correlated with variables related to funds’ investment strategies and industry-specific variables. Consequently, these elements are a new source of potential disturbance in the financial network conformed by stocks and mutual funds. | |

| Lavin, J.F.; Valle, M.A.; Magner, N.S. [8] | 2021 | Modeling synchronization in stock markets using correlation-based network methods. | Global stock synchronization is dynamic over time, its minimums coincide with significant financial shocks, and it shrinks to its minimum levels, indicating that the returns of global markets are moving in a synchronized way. Moreover, it is a significant and positive factor in regional synchronization. Regional markets react heterogeneously to global synchronization shocks, suggesting that local and global factors are synchronization sources. | |

| Portfolio selection & risk management | Onnela, J.P.; Chakraborti, A.; Kaski, K.; Kertész, J.; Kanto, A. [36] | 2003 | Applying asset trees to reflect the economic taxonomy of stock correlations and portfolio diversification. | The diversification dimension of portfolio optimization results in the fact that the assets of the classic Markowitz portfolio are located on the outer leaves of the asset tree formed by the stocks (nodes) and their respective distances (correlations). |

| Diebold, F. & Yılmaz, K. [70] | 2014 | Using variance decomposition estimations as natural and insightful measures of connectedness among financial firms. | Variance decompositions define weighted, directed networks so that connectedness measures are intimately related to key measures of connectedness used in the network literature. | |

| Výrost, T., Lyócsa, Š., & Baumöhl, E. [40] | 2019 | Analysis of portfolio optimization techniques based on network-based models and centrality measures of stocks.1 | Network-based asset allocation strategies improve key portfolio return characteristics in an out-of-sample framework, most notably, risk and left-tail risk-adjusted returns. Resolving portfolio model selection uncertainties further improves risk–return characteristics | |

| Integration of financial markets & Forecasting models | Q. Ji, E. Bouri, and D. Roubaud [78] | 2019 | Analysis of information flow among U.S. equities, strategic commodities (oil and gold), and BRICS equities using dynamic networks models. | The integration structure of an information transmission network is unstable and changes over time. The impact patterns of events are dissimilar—some events impact the local market only, whereas others have a global impact. |

| Gao, H. L., & Mei, D.C. [38] | 2019 | Study of the dynamics of correlation structures between U.S. and Asian stock markets. | Non-linear effects dominate stronger dependencies between all indices after the 2008 financial crisis. The synchronicity decreases for significant variations of firm specifics. The 2008 global financial crisis spread rapidly to Asian markets compared with several other financial crises or crashes. China’s stock and U.S. markets exhibit a lack of interdependence during the 2008 financial crisis. | |

| Magner, N.S., Lavin, J.F., Valle, M.A., Hardy, N. [39] | 2020 | Applying network-based models to forecasting the implied volatility of stock markets. | The length of the minimum spanning tree is relevant to forecast volatility in European and Asian stock markets, improving forecasting models’ performance. In addition, the evidence from this work establishes a road map to deepen the understanding of how financial networks can improve the quality of prediction of financial variables. The latter is crucial during financial shocks, where uncertainty and volatility skyrocket. | |

| Magner N, Lavin JF, Valle M, Hardy N. [74] | 2021 | Analysis of the use of the implied stock market’s volatility indices’ predictive power on synchronizing global equity indices returns. | An increase in the markets’ volatility expectations, captured by the implied volatility indices, is a good Granger predictor of an increase in the synchronization of stock market returns in the following month. |

Appendix B. Comparative Analysis of Theoretical and Empirical Financial Performance and the ESG Literature

| Main Themes | Authors | Year | Application | Main Results |

| Neutral impacts of ESG on financial performance | Bauer, R., Koedijk, K., & Otten, R. [54] | 2015 | Study the effect of ESG level on mutual funds returns | Mutual funds with high ESG levels have no better performance than lower-ESG-level mutual funds. |

| Mill G. [53] | 2006 | Examines the financial performance of a UK unit trust that was initially “conventional” and later adopted socially responsible investment (SRI) principles (ethical investment principles). | Mean risk-adjusted performance is unchanged by the switch to SRI, with no evidence of over-or under-performance relative to the benchmark market index by any of the four funds. | |

| Hamilton, Sally, Hoje Jo, and Meir Statman. [79] | 1993 | Compare the mutual funds’ financial performance between socially responsible and conventional mutual funds | Socially responsible mutual funds do not earn statistically significant excess returns, and the performance of such mutual funds is not statistically different from the performance of conventional mutual funds. | |

| Statman, M., & Glushkov, D. [80] | 2009 | Study the stock returns of companies with high scores on social responsibility characteristics and shun stocks of companies associated with tobacco, alcohol, gambling, firearms, and military or nuclear operations. | Authors find evidence consistent with the “no effect” hypothesis, whereby the expected returns of socially responsible stocks are approximately equal to the expected returns of conventional stocks. | |

| Aw, E. N. W., LaPerla, S. J., & Sivin, G. Y. [81] | 2017 | Study portfolios that outperform a benchmark while allowing investors to embrace ESG. | Top-quintile (most compliant) stocks ranked by ESG score underperform the out-sample research universe. | |

| Positive impacts of ESG on financial performance | Statman, Meir. [82] | 2000 | Using an index of socially responsibility named “Domini Social Index” to compare the financial performance of the SRI and conventional mutual funds. | The Domini Social Index performed better than the S&P 500 Index, but the differences between their risk-adjusted returns are not statistically significant. |

| Serafeim, G. [83] | 2020 | Study the “public sentiment influences investor views” about the value of company sustainability activities. | The valuation premium for strong sustainability performance increases as a function of positive momentum in public sentiment. An ESG factor long (short) on companies with superior (inferior) sustainability performance and negative (positive) ESG sentiment momentum delivered significant positive alpha. | |

| Konar, S., & Cohen, M. A. [84] | 2001 | Study the market value of firms in the S&P 500 to objective measures of their environmental performance. | [84] Ad environmental performance is negatively correlated with the intangible asset value of firms. Specifically, a 10% reduction in emissions of toxic chemicals results in a USD 34 million increase in market value (this magnitude varies across industries). | |

| Durán-Santomil, P., Otero-González, L., Correia-Domingues, R. H., & Reboredo, J. C. [85] | 2019 | Study the effects of socially responsible investments (SRI) on European equity fund performance. | Sustainability scores impacted positively on financial performance considering returns and risk. | |

| de Franco, C. [86] | 2020 | Study USA, Asia-Pacific, and Europe portfolios based on this measure of controversy from environmental, social and governance (ESG) data. | Portfolios that excluded highly controversial stocks outperform their benchmarks, except for the Asia-Pacific zone. | |

| Bauer, R., Koedijk, K., & Otten, R. [54] | 2005 | Using German, UK, and U.S. ethical mutual funds the study and explore their financial risk. | Ethical funds are typically less exposed to market return variability; they are small and more growth-oriented compared with conventional funds. | |

| Impact of ESG on financial risk | De, I., & Clayman, M. R. [57] | 2015 | Examine the relationship between the ESG ratings of a company and its stock returns, volatility, and risk-adjusted returns in the post-2008 financial crisis era. | There is a negative relationship between ESG and volatility in greater depth, given the well-documented low-volatility anomaly (outperformance of low-volatility stocks). Both (high) ESG rating and (low) volatility positively impact stock returns, but the ESG effect is independent of the low-volatility effect. |

| Nofsinger, J., & Varma, A. [59] | 2014 | Investigate the performance of SRI funds during crisis and non-crisis periods to empirically test the hypothesis that SRI funds dampen downside risk for investors during poor economic conditions | Compared with conventional mutual funds, socially responsible mutual funds outperform during market crises. | |

| Becchetti, L., Ciciretti, R., & Hasan, I. [61] | 2015 | Investigate the nexus between idiosyncratic volatility and corporate social responsibility. | Idiosyncratic volatility (IV) is negatively correlated with corporate social responsibility (CSR-specific stakeholder risk factor). | |

| Boitan, I. A. [62] | 2020 | Study the synchronization between the price return provided by sustainability indices calculated for various geographic regions. | Sustainability indices, which include companies from Europe, Japan, U.S., World developed countries, and World best-in-class, exhibit more correlation price returns than conventional assets. | |

| Ielasi, F., & Rossolini, M. [60] | 2019 | Compare the risk-adjusted performance of sustainability-themed funds with other categories of mutual funds | Sustainable funds are better than other thematic funds in overcoming financially turbulent periods and currently benefit from SRI regulation and disclosure. | |

| Cerqueti, R., Ciciretti, R., Dalò, A., & Nicolosi, M. [58] | 2020 | Compare funds highly ranked in Environmental Social and Governance (ESG) aspects with those with a poor ESG compliance using network analysis. | SRI funds have a better resilience against shock events by observing that the stability of the structure of the SRI fund network varies less in the face of a highly negative event | |

| Renneboog, L., ter Horst, J., & Zhang, C. [87] | 2011 | Study the money flows into and out of socially responsible investment (SRI) funds around the world. | SRI money flows are less related to past fund returns. Ethical money is less sensitive to past negative returns than are conventional fund flows, especially when SRI funds primarily use negative or Sin/Ethical screens |

References

- Governance, OECD Investment. The Integration of Environmental, Social and Governance Factors; OECD: Paris, France, 2017. [Google Scholar]

- Raddant, M.; Kenett, D.Y. Interconnectedness in the Global Financial Market. J. Int. Money Financ. 2021, 110, 102280. [Google Scholar] [CrossRef]

- Bury, T. A Statistical Physics Perspective on Criticality in Financial Markets. J. Stat. Mech. Theory Exp. 2013, 2013, P11004. [Google Scholar] [CrossRef]

- Statista. Statista Dossier on Exchange Traded Funds around the World; Statista: Hamburg, Germany, 2021. [Google Scholar]

- Diebold, F.X.; Yılmaz, K. Financial and Macroeconomic Connectedness: A Network Approach to Measurement and Monitoring; Oxford University Press: New York, NY, USA, 2015; ISBN 0199338302. [Google Scholar]

- Lavin, J.F.; Valle, M.A.; Magner, N.S. A Network-Based Approach to Study Returns Synchronization of Stocks: The Case of Global Equity Markets. Complexity 2021, 2021, 7676457. [Google Scholar] [CrossRef]

- Lahrech, A.; Sylwester, K. US and Latin American Stock Market Linkages. J. Int. Money Financ. 2011, 30, 1341–1357. [Google Scholar] [CrossRef]

- Lavin, J.F.; Valle, M.A.; Magner, N.S. Modeling Overlapped Mutual Funds’ Portfolios: A Bipartite Network Approach. Complexity 2019, 2019, 1565698. [Google Scholar] [CrossRef]

- Hartzmark, S.M.; Sussman, A.B. Do Investors Value Sustainability? A Natural Experiment Examining Ranking and Fund Flows. J. Financ. 2019, 74, 2789–2837. [Google Scholar] [CrossRef]

- Matallín-Sáez, J.C.; Soler-Domínguez, A.; Navarro-Montoliu, S.; de Mingo-López, D.V. Investor Behavior and the Demand for Conventional and Socially Responsible Mutual Funds. Corp. Soc. Responsib. Environ. Manag. 2021, 29, 46–59. [Google Scholar] [CrossRef]

- Weber, M.; Camerer, C.F. The Disposition Effect in Securities Trading: An Experimental Analysis. J. Econ. Behav. Organ. 1998, 33, 167–184. [Google Scholar] [CrossRef]

- Batrancea, L.M. An Econometric Approach on Performance, Assets, and Liabilities in a Sample of Banks from Europe, Israel, United States of America, and Canada. Mathematics 2021, 9, 3178. [Google Scholar] [CrossRef]

- Matos, P. ESG and Responsible Institutional Investing around the World a Critical Review; CFA Institute Research Fundation: Charlottesville, VA, USA, 2020. [Google Scholar]

- King, M.A.; Sentana, E.; Wadhwani, S. Volatiltiy and Links between National Stock Markets; National Bureau of Economic Research: Cambridge, MA, USA, 1990. [Google Scholar]

- Hamao, Y.; Masulis, R.W.; Ng, V. Correlations in Price Changes and Volatility across International Stock Markets. Rev. Financ. Stud. 1990, 3, 281–307. [Google Scholar] [CrossRef]

- Lin, W.-L.; Engle, R.F.; Ito, T. Do Bulls and Bears Move across Borders? International Transmission of Stock Returns and Volatility. Rev. Financ. Stud. 1994, 7, 507–538. [Google Scholar] [CrossRef]

- Wongswan, J. Transmission of Information across International Equity Markets. Rev. Financ. Stud. 2006, 19, 1157–1189. [Google Scholar] [CrossRef]

- Page, S.; Panariello, R.A. When Diversification Fails. Financ. Anal. J. 2018, 74, 19–32. [Google Scholar] [CrossRef]

- Libich, J.; Lenten, L. Hero or Villain? The Financial System in the 21st Century. J. Econ. Surv. 2021, 36, 3–40. [Google Scholar] [CrossRef]

- Finucane, M.L.; Alhakami, A.; Slovic, P.; Johnson, S.M. The Affect Heuristic in Judgments of Risks and Benefits. J. Behav. Decis. Mak. 2000, 13, 1–17. [Google Scholar] [CrossRef]

- Chernev, A.; Blair, S. Doing Well by Doing Good: The Benevolent Halo of Corporate Social Responsibility. J. Consum. Res. 2015, 41, 1412–1425. [Google Scholar] [CrossRef]

- Gneezy, U.; Potters, J. An Experiment on Risk Taking and Evaluation Periods. Q. J. Econ. 1997, 112, 631–645. [Google Scholar] [CrossRef]

- Haws, K.L.; Winterich, K.P.; Naylor, R.W. Seeing the World through GREEN-tinted Glasses: Green Consumption Values and Responses to Environmentally Friendly Products. J. Consum. Psychol. 2014, 24, 336–354. [Google Scholar] [CrossRef]

- Rahal, R.-M.; Fiedler, S. Cognitive and Affective Processes of Prosociality. Curr. Opin. Psychol. 2022, 44, 309–314. [Google Scholar] [CrossRef]

- Andreoni, J. Impure Altruism and Donations to Public Goods: A Theory of Warm-Glow Giving. Econ. J. 1990, 100, 464–477. [Google Scholar] [CrossRef]

- White, K.; Habib, R.; Hardisty, D.J. How to SHIFT Consumer Behaviors to be More Sustainable: A Literature Review and Guiding Framework. J. Mark. 2019, 83, 22–49. [Google Scholar] [CrossRef]

- Trudel, R. Sustainable Consumer Behavior. Consum. Psychol. Rev. 2019, 2, 85–96. [Google Scholar] [CrossRef]

- Kiyotaki, N.; Moore, J. Credit Chains. J. Political Econ. 1997, 105, 211–248. [Google Scholar] [CrossRef]

- Allen, F.; Gale, D. Financial Markets, Intermediaries, and Intertemporal Smoothing. J. Political Econ. 1997, 105, 523–546. [Google Scholar] [CrossRef]

- Albert, R.; Jeong, H.; Barabási, A.L. Error and Attack Tolerance of Complex Networks. Nature 2000, 406, 378–382. [Google Scholar] [CrossRef]

- Bernard, P.; Ahmed, K.; Pierre, C.J.; Nouredine, Z.; Zekri, L. Universal Scaling of Forest Fire Propagation. arXiv 2008, arXiv:08053365. [Google Scholar]

- Haldane, A.G. Rethinking the financial network. In Fragile Stabilität—Stabile Fragilität; Springer: Wiesbaden, Germany, 2013; pp. 243–278. ISBN 978-3-658-02247-1/978-3-658-02248-8. [Google Scholar]

- Haldane, A.G.; Madouros, V. The Dog and the Frisbee. Rev. Econ. Inst. 2012, 14, 13–56. [Google Scholar]

- Mantegna, R.N. Hierarchical Structure in Financial Markets. Eur. Phys. J. B 1999, 11, 193–197. [Google Scholar] [CrossRef]

- Eberhard, J.; Lavin, J.F.; Montecinos-Pearce, A. A Network-Based Dynamic Analysis in an Equity Stock Market. Complexity 2017, 2017, 3979836. [Google Scholar] [CrossRef]

- Onnela, J.P.; Chakraborti, A.; Kaski, K.; Kertész, J.; Kanto, A. Dynamics of Market Correlations: Taxonomy and Portfolio Analysis. Phys. Rev. E Stat. Phys. Plasmas Fluids Relat. Interdiscip. Top. 2003, 68, 056110. [Google Scholar] [CrossRef]

- Mantegna, R.N.; Stanley, H.E.; Chriss, N.A. An Introduction to Econophysics: Correlations and Complexity in Finance. Phys. Today 2000. [Google Scholar] [CrossRef]

- Gao, H.L.; Mei, D.C. The Correlation Structure in the International Stock Markets during Global Financial Crisis. Phys. A Stat. Mech. Its Appl. 2019, 534, 122056. [Google Scholar] [CrossRef]

- Magner, N.S.; Lavin, J.F.; Valle, M.A.; Hardy, N. The Volatility Forecasting Power of Financial Network Analysis. Complexity 2020, 2020, 7051402. [Google Scholar] [CrossRef]

- Výrost, T.; Lyócsa, Š.; Baumöhl, E. Network-Based Asset Allocation Strategies. N. Am. J. Econ. Financ. 2019, 47, 516–536. [Google Scholar] [CrossRef]

- De Bandt, O.; Hartmann, P. What Is Systemic Risk Today? Risk Meas. Syst. Risk 1998, 37–84. [Google Scholar]

- de Souza, S.R.S.; Silva, T.C.; Tabak, B.M.; Guerra, S.M. Evaluating Systemic Risk Using Bank Default Probabilities in Financial Networks. J. Econ. Dyn. Control 2016, 66, 54–75. [Google Scholar] [CrossRef]

- Balcı, M.A.; Batrancea, L.M.; Akgüller, Ö.; Nichita, A. Coarse Graining on Financial Correlation Networks. Mathematics 2022, 10, 2118. [Google Scholar] [CrossRef]

- Balcı, M.A.; Akgüller, Ö.; Can Güzel, S. Hierarchies in Communities of UK Stock Market from the Perspective of Brexit. J. Appl. Stat. 2021, 48, 2607–2625. [Google Scholar] [CrossRef]

- Bekaert, G.; Harvey, C.R.; Ng, A. Market Integration and Contagion*. J. Bus. 2005, 78, 39–69. [Google Scholar] [CrossRef]

- Song, D.M.; Tumminello, M.; Zhou, W.X.; Mantegna, R.N. Evolution of Worldwide Stock Markets, Correlation Structure, and Correlation-Based Graphs. Phys. Rev. E Stat. Nonlinear Soft Matter Phys. 2011. [Google Scholar] [CrossRef]

- Guo, N.-Z.; Tu, A.H. Stock Market Synchronization and Institutional Distance. Financ. Res. Lett. 2021, 42, 101934. [Google Scholar] [CrossRef]

- Watts, D.J.; Strogatz, S.H. Collective Dynamics of ’small-World9 Networks. Nature 1998. [Google Scholar] [CrossRef] [PubMed]

- Martinez-Jaramillo, S.; Carmona, C.U.; Kenett, D.Y. Interconnectedness and Financial Stability. J. Risk Manag. Financ. Inst. 2019, 12, 168–183. [Google Scholar]

- Lewis, A.; Juravle, C. Morals, Markets and Sustainable Investments: A Qualitative Study of ‘Champions’. J. Bus. Ethics 2010, 93, 483–494. [Google Scholar] [CrossRef]

- Cerqueti, R.; Ciciretti, R.; Dalò, A.; Nicolosi, M. The Resilience of the Socially Responsible Investment Networks; Elsevier: Amsterdam, The Netherlands, 2020. [Google Scholar]

- Kreander, N.; Gray, R.H.; Power, D.M.; Sinclair, C.D. Evaluating the Performance of Ethical and Non-ethical Funds: A Matched Pair Analysis. J. Bus. Financ. Account. 2005, 32, 1465–1493. [Google Scholar] [CrossRef]

- Mill, G.A. The Financial Performance of a Socially Responsible Investment over Time and a Possible Link with Corporate Social Responsibility. J. Bus. Ethics 2006, 63, 131–148. [Google Scholar] [CrossRef]

- Bauer, R.; Koedijk, K.; Otten, R. International Evidence on Ethical Mutual Fund Performance and Investment Style. J. Bank. Financ. 2005, 29, 1751–1767. [Google Scholar] [CrossRef]

- Mallin, C.A.; Saadouni, B.; Briston, R.J. The Financial Performance of Ethical Investment Funds. J. Bus. Financ. Account. 1995, 22, 483. [Google Scholar] [CrossRef]

- Kuhnen, C.M. Business networks, corporate governance, and contracting in the mutual fund industry. J. Financ. 2009, 64, 2185–2220. [Google Scholar] [CrossRef]

- De, I.; Clayman, M.R. The Benefits of Socially Responsible Investing: An Active Manager’s Perspective. J. Invest. 2015, 24, 49–72. [Google Scholar] [CrossRef]

- Becchetti, L.; Ciciretti, R.; Dalò, A. Fishing the corporate social responsibility risk factors. J. Financ. Stab. 2018, 37, 25–48. [Google Scholar] [CrossRef]

- Nofsinger, J.; Varma, A. Socially Responsible Funds and Market Crises. J. Bank. Financ. 2014, 48, 180–193. [Google Scholar] [CrossRef]

- Ielasi, F.; Rossolini, M. Responsible or Thematic? The True Nature of Sustainability-Themed Mutual Funds. Sustainability 2019, 11, 3304. [Google Scholar] [CrossRef]

- Becchetti, L.; Ciciretti, R.; Hasan, I. Corporate Social Responsibility, Stakeholder Risk, and Idiosyncratic Volatility. J. Corp. Financ. 2015, 35, 297–309. [Google Scholar] [CrossRef]

- Boitan, I.A. Sustainable Stock Market Indices: A Comparative Assessment of Performance. J. Res. Emerg. Mark. 2020, 2, 7–14. [Google Scholar] [CrossRef]

- Cormen, T.H.; Leiserson, C.E.; Rivest, R.L.; Stein, C. Introduction to Algorithms; MIT Press: Cambridge, MA, USA, 2009; ISBN 0262533057. [Google Scholar]

- Stam, C.J.; Tewarie, P.; Van Dellen, E.; Van Straaten, E.C.W.; Hillebrand, A.; Van Mieghem, P. The Trees and the Forest: Characterization of Complex Brain Networks with Minimum Spanning Trees. Int. J. Psychophysiol. 2014, 92, 129–138. [Google Scholar] [CrossRef] [PubMed]

- Newey, W.K.; West, K.D. Hypothesis Testing with Efficient Method of Moments Estimation. Int. Econ. Rev. 1987, 28, 777–787. [Google Scholar] [CrossRef]

- Newey, W.K.; West, K.D. Automatic Lag Selection in Covariance Matrix Estimation. Rev. Econ. Stud. 1994, 61, 631–653. [Google Scholar] [CrossRef]

- Timmermann, A. Elusive Return Predictability. Int. J. Forecast. 2008, 24, 1–18. [Google Scholar] [CrossRef]

- Bai, J.; Perron, P. Estimating and Testing Linear Models with Multiple Structural Changes. Econometrica 1998, 66, 47. [Google Scholar] [CrossRef]

- Diebold, F.X.; Yilmaz, K. Better to Give than to Receive: Predictive Directional Measurement of Volatility Spillovers. Int. J. Forecast. 2012, 28, 57–66. [Google Scholar] [CrossRef]

- Diebold, F.X.; Yilmaz, K. On the Network Topology of Variance Decompositions: Measuring the Connectedness of Financial Firms. J. Econom. 2014, 182, 119–134. [Google Scholar] [CrossRef]

- Valle, M.A.; Lavín, J.F.; Magner, N.S. Equity Market Description under High and Low Volatility Regimes Using Maximum Entropy Pairwise Distribution. Entropy 2021, 23, 1307. [Google Scholar] [CrossRef] [PubMed]

- Xia, J.J. A Model of Synchronization for Self-Organized Crowding Behavior. arXiv 2016, arXiv:1612.01132. [Google Scholar] [CrossRef]

- Slovic, P.; Finucane, M.L.; Peters, E.; MacGregor, D.G. Risk as analysis and risk as feelings: Some thoughts about affect, reason, risk and rationality. In The Feeling of Risk; Routledge: London, UK, 2013; pp. 49–64. ISBN 1849776679. [Google Scholar]

- Magner, N.; Lavin, J.F.; Valle, M.; Hardy, N. The Predictive Power of Stock Market’s Expectations Volatility: A Financial Synchronization Phenomenon. PLoS ONE 2021, 16, e0250846. [Google Scholar]

- Barberis, N. Psychology-Based Models of Asset Prices and Trading Volume. Handb. Behav. Econ. Appl. Found. 2018, 1, 79–175. [Google Scholar] [CrossRef]

- Acemoglu, D.; Ozdaglar, A.; Tahbaz-Salehi, A. Systemic risk and stability in financial networks. Am. Econ. Rev. 2015, 105, 564–608. [Google Scholar] [CrossRef]

- Hautsch, N.; Schaumburg, J.; Schienle, M. Financial network systemic risk contributions. Rev. Financ. 2015, 19, 685–738. [Google Scholar] [CrossRef]

- Ji, Q.; Bouri, E.; Roubaud, D.; Kristoufek, L. Information interdependence among energy, cryptocurrency and major commodity markets. Energy Econ. 2019, 81, 1042–1055. [Google Scholar] [CrossRef]

- Hamilton, S.; Jo, H.; Statman, M. Doing well while doing good? The investment performance of socially responsible mutual funds. Financ. Anal. J. 1993, 49, 62–66. [Google Scholar] [CrossRef]

- Statman, M.; Glushkov, D. The wages of social responsibility. Financ. Anal. J. 2009, 65, 33–46. [Google Scholar] [CrossRef]

- Aw, E.N.; LaPerla, S.J.; Sivin, G.Y. A morality tale of ESG: Assessing socially responsible investing. J. Wealth Manag. 2017, 19, 14–23. [Google Scholar] [CrossRef]

- Statman, M. Socially responsible mutual funds (corrected). Financ. Anal. J. 2000, 56, 30–39. [Google Scholar] [CrossRef]

- Grewal, J.; Serafeim, G. Research on corporate sustainability: Review and directions for future research. Found. Trends® Account 2020, 14, 73–127. [Google Scholar] [CrossRef]

- Konar, S.; Cohen, M.A. Does the Market Value Environmental Performance? Rev. Econ. Stat. 2001, 83, 281–289. [Google Scholar] [CrossRef]

- Durán-Santomil, P.; Otero-González, L.; Correia-Domingues, R.H.; Reboredo, J.C. Does sustainability score impact mutual fund performance? Sustainability 2019, 11, 2972. [Google Scholar] [CrossRef]

- De Franco, C. Esg controversies and their impact on performance. J. Invest. 2020, 29, 33–45. [Google Scholar] [CrossRef]

- Renneboog, L.; Ter Horst, J.; Zhang, C. Is ethical money financially smart? Nonfinancial attributes and money flows of socially responsible investment funds. J. Financ. Intermediation 2011, 20, 562–588. [Google Scholar] [CrossRef]

| Q2 | Q3 | Q4 | ||

|---|---|---|---|---|

| Panel A: MSTL | ||||

| Q1 | All period | 0.939 *** | −0.875 *** | −0.214 ** |

| 2017M01–2018M01 | 1.176 *** | −1.441 *** | −0.835 *** | |

| 2020M03–2021M03 | 0.977 *** | −0.509 ** | 0.271 * | |

| Q2 | All period | −1.815 *** | −1.154 *** | |

| 2017M01–2018M01 | −2.620 *** | −2.011 *** | ||

| 2020M03–2021M03 | −1.487 *** | −0.705 *** | ||

| Q3 | All period | 0.661 *** | ||

| 2017M01–2018M01 | 0.608 *** | |||

| 2020M03–2021M03 | 0.781 *** | |||

| Panel B: Diameter | ||||

| Q1 | All period | 0.144 *** | −0.264 *** | −0.023 |

| 2017M01–2018M01 | 0.093 | −0.689 *** | −0.575 ** | |

| 2020M03–2021M03 | 0.449 ** | 0.147 | 0.361 ** | |

| Q2 | All period | −0.408 *** | −0.167 *** | |

| 2017M01–2018M01 | −0.783 ** | −0.669 ** | ||

| 2020M03–2021M03 | −0.302 ** | −0.087 | ||

| Q3 | All period | 0.241 *** | ||

| 2017M01–2018M01 | 0.114 | |||

| 2020M03–2021M03 | 0.213 * | |||

| Panel C: Mean Strength | ||||

| Q1 | All period | 0.039 *** | −0.036 *** | −0.009 *** |

| 2017M01–2018M01 | 0.049 *** | −0.060 *** | −0.025 *** | |

| 2020M03–2021M03 | 0.041 *** | −0.021 ** | 0.011 * | |

| Q2 | All period | −0.075 *** | −0.048 *** | |

| 2017M01–2018M01 | −0.109 *** | −0.082 *** | ||

| 2020M03–2021M03 | −0.061 *** | −0.029 *** | ||

| Q3 | All period | 0.028 *** | ||

| 2017M01–2018M01 | 0.025 *** | |||

| 2020M03–2021M03 | 0.032 *** | |||

| Panel A | Panel B | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) | |

| Q1 (Lowest ESG) | Q2 | Q3 | Q4 (Highest ESG) | All Sample | Q1 (Lowest ESG) | Q2 | Q3 | Q4 (Highest ESG) | All Sample | |

| VMSTL | DIAMETER | |||||||||

| VIX | −0.100 *** | −0.011 | −0.011 | 0.057 * | −0.511 *** | −0.411 ** | −0.068 | −0.269 * | −0.207 | −1.179 *** |

| (0.035) | (0.021) | (0.021) | (0.033) | (0.075) | (0.163) | (0.183) | (0.152) | (0.157) | (0.311) | |

| Z(−1) | −0.083 *** | −0.094 *** | −0.094 *** | −0.041 | −0.431 *** | 0.125 | −0.062 | 0.031 | 0.121 ** | 0.278 *** |

| (0.027) | (0.014) | (0.014) | (0.036) | (0.065) | (0.060) | (0.077) | (0.070) | (0.050) | (0.100) | |

| Z(−2) | −0.035 | −0.024 | −0.024 | −0.048 | −0.170 ** | 0.039 | 0.079 | 0.099 * | 0.094 | −0.010 |

| (0.022) | (0.015) | (0.015) | (0.044) | (0.069) | (0.063) | (0.075) | (0.058) | (0.058) | (0.089) | |

| Z(−3) | −0.037 ** | −0.024 ** | −0.024 ** | 0.001 | 0.012 | −0.114 ** | −0.082 | 0.074 | −0.029 | 0.148 ** |

| (0.017) | (0.010) | (0.010) | (0.029) | (0.070) | (0.051) | (0.066) | (0.065) | (0.057) | (0.070) | |

| VMSTL_ALL | 0.893 *** | 0.905 *** | 0.905 *** | 1.030 *** | ||||||

| (0.033) | (0.014) | (0.014) | (0.036) | |||||||

| DIAMETER_ALL | 0.471 *** | 0.385 *** | 0.465 *** | 0.563 *** | ||||||

| (0.044) | (0.031) | (0.069) | (0.079) | |||||||

| C | 0.001 | −0.001 | −0.001 | 0.000 | 0.000 | 0.419 * | 0.930 *** | 0.272 | −0.320 | 2.544 *** |

| (0.002) | (0.001) | (0.001) | (0.004) | (0.003) | (0.249) | (0.328) | (0.223) | (0.300) | (0.636) | |

| Adj R2 | 0.905 | 0.913 | 0.913 | 0.930 | 0.375 | 0.517 | 0.508 | 0.576 | 0.675 | 0.088 |

| F-stat | 198.167 | 218.753 | 218.753 | 278.451 | 16.575 | 23.444 | 22.642 | 29.485 | 44.620 | 3.539 |

| Prob(F-stat) | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.010 |

| Panel A | Panel B | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) | |

| Q1 (Lowest ESG) | Q2 | Q3 | Q4 (Highest ESG) | All Sample | Q1 (Lowest ESG) | Q2 | Q3 | Q4 (Highest ESG) | All Sample | |

| STRENGTH | VPMFGL | |||||||||

| VIX | −0.785 ** | −0.086 | −0.111 | 0.375 | −18.385 *** | −0.143 *** | −0.042 | −0.040 | 0.051 * | −0.525 *** |

| (0.322) | (0.260) | (0.228) | (0.278) | (3.560) | (0.029) | (0.055) | (0.030) | (0.028) | (0.044) | |

| Z(−1) | 0.054 * | −0.013 | −0.017 | 0.058 | 0.406 *** | −0.093 *** | −0.087 *** | −0.068 ** | −0.039 | −0.425 *** |

| (0.027) | (0.038) | (0.023) | (0.037) | (0.091) | (0.023) | (0.022) | (0.031) | (0.042) | (0.039) | |

| Z(−2) | 0.006 | −0.016 | 0.038 | 0.016 | 0.102 | −0.021 | −0.010 | −0.008 | −0.034 | −0.178 *** |

| (0.019) | (0.029) | (0.027) | (0.030) | (0.072) | (0.025 | (0.027) | (0.030) | (0.050) | (0.038) | |

| Z(−3) | 0.004 | −0.020 | 0.018 | 0.067 | 0.059 | −0.033 * | −0.022 | −0.011 | −0.001 | 0.014 |

| (0.022) | (0.031) | (0.025) | (0.020) | (0.089) | (0.019) | (0.019) | (0.030) | (0.029) | (0.038) | |

| STRENGTH_ALL | 0.224 *** | 0.183 *** | 0.218 *** | 0.233 *** | ||||||

| (0.011) | (0.008) | (0.007) | (0.013) | |||||||

| VPMFGL_ALL | 0.875 *** | 0.928 *** | 0.954 *** | 1.037 *** | ||||||

| (0.032) | (0.040) | (0.031) | (0.044) | |||||||

| C | −0.035 | 0.719 | 0.268 | −1.589 | 20.388 *** | 0.001 | 0.000 | 0.002 | 0.000 | 0.000 |

| (0.667) | (0.468) | (0.549) | (0.620) | (2.680) | (0.003) | (0.002) | (0.003) | (0.004) | (0.002) | |

| Adjusted R-squared | 0.916 | 0.913 | 0.928 | 0.894 | 0.225 | 0.906 | 0.916 | 0.948 | 0.923 | 0.376 |

| F-statistic | 230.620 | 222.303 | 272.771 | 177.606 | 8.637 | 200.814 | 229.260 | 380.946 | 250.408 | 16.666 |

| Prob(F-statistic) | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Q1 (Lowest ESG) | Q2 | Q3 | Q4 (Highest ESG) | |

| VMSTL | ||||

| Regime 1 | ||||

| VIX | −0.087 *** | 0.114 | 0.200 ** | −0.013 |

| (0.017) | (0.118) | (0.076) | 0.077 | |

| Time period (T1) | 2013M02–2015M08 | 2013M02–2015M06 | 2013M02–2015M05 | 2013M02–2015M01 |

| Regime 2 | ||||

| VIX | 0.031 | −0.077 *** | 0.048 | −0.049 |

| (0.028) | (0.024) | (0.039) | 0.099 | |

| Time period (T2) | 2015M09–2016M11 | 2015M07–2016M11 | 2015M06–2016M10 | 2015M02–2016M04 |

| Regime 3 | ||||

| VIX | −0.519 *** | −0.198 * | −0.156 *** | 0.14 |

| (0.053) | (0.103) | (0.052) | 0.131 | |

| Time period (T3) | 2016M12–2018M05 | 2016M12–2018M10 | 2016M11–2019M01 | 2016M05–2017M07 |

| Regime 4 | ||||

| VIX | −0.09 | 0.118 * | −0.039 | 0.445 *** |

| (0.069) | (0.060) | (0.056) | 0.081 | |

| Time period (T4) | 2018M06–2019M08 | 2018M11–2021M10 | 2019M02–2021M10 | 2017M08–2018M10 |

| Regime 5 | ||||

| VIX | −0.142 *** | 0.105 | ||

| (0.049) | 0.093 | |||

| Time period (T5) | 2019M09–2021M10 | 2018M11–2020M01 | ||

| Regime 6 | ||||

| VIX | 0.005 | |||

| 0.039 | ||||

| Time period (T6) | 2020M02–2021M10 | |||

| Adj R2 | 0.910 | 0.927 | 0.958 | 0.947 |

| F-statis | 37.402 | 58.621 | 103.625 | 54.516 |

| Prob(F-stats) | 0.000 | 0.000 | 0.000 | 0.000 |

| Panel A–VMSTL | Q1 | Q2 | Q3 | Q4 | VIX | From Others |

|---|---|---|---|---|---|---|

| Q1 | 25.5 | 21.9 | 21.3 | 19.5 | 11.8 | 74.5 |

| Q2 | 22.0 | 25.7 | 22.5 | 20.1 | 9.6 | 74.3 |

| Q3 | 21.1 | 22.2 | 25.3 | 21.8 | 9.5 | 74.7 |

| Q4 | 20.4 | 21.0 | 23.1 | 26.8 | 8.7 | 73.2 |

| VIX | 18.2 | 14.7 | 14.8 | 12.8 | 39.4 | 60.6 |

| Contribution to others | 81.8 | 79.8 | 81.7 | 74.3 | 39.7 | 357.3 |

| Contribution including own | 107.3 | 105.5 | 107.0 | 101.1 | 79.1 | 71.5% |

| Panel B–VPMFG | Q1 | Q2 | Q3 | Q4 | VIX | From Others |

| Q1 | 25.3 | 22.6 | 21.4 | 19.7 | 11.0 | 74.7 |

| Q2 | 22.2 | 25.6 | 22.2 | 20.8 | 9.2 | 74.4 |

| Q3 | 21.1 | 22.1 | 25.2 | 22.5 | 9.1 | 74.8 |

| Q4 | 20.2 | 21.3 | 22.9 | 27.4 | 8.2 | 72.6 |

| VIX | 18.3 | 15.4 | 15.5 | 12.4 | 38.4 | 61.6 |

| Contribution to others | 81.9 | 81.4 | 81.9 | 75.5 | 37.4 | 358.1 |

| Contribution including own | 107.2 | 107.0 | 107.2 | 102.9 | 75.8 | 71.6% |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Magner, N.; Lavín, J.F.; Valle, M.A. Modeling Synchronization Risk among Sustainable Exchange Trade Funds: A Statistical and Network Analysis Approach. Mathematics 2022, 10, 3598. https://doi.org/10.3390/math10193598

Magner N, Lavín JF, Valle MA. Modeling Synchronization Risk among Sustainable Exchange Trade Funds: A Statistical and Network Analysis Approach. Mathematics. 2022; 10(19):3598. https://doi.org/10.3390/math10193598

Chicago/Turabian StyleMagner, Nicolás, Jaime F. Lavín, and Mauricio A. Valle. 2022. "Modeling Synchronization Risk among Sustainable Exchange Trade Funds: A Statistical and Network Analysis Approach" Mathematics 10, no. 19: 3598. https://doi.org/10.3390/math10193598

APA StyleMagner, N., Lavín, J. F., & Valle, M. A. (2022). Modeling Synchronization Risk among Sustainable Exchange Trade Funds: A Statistical and Network Analysis Approach. Mathematics, 10(19), 3598. https://doi.org/10.3390/math10193598