1. Introduction

In this paper we aim to make forecasts, at different moments of time (3, 6, 9, and 12 months), of DAX, S&P 500, and SHANGHAI Composite stock indexes values for 2020, using geometric Brownian motion (GBM), but in which drift and diffusion are determined by considering two states of the economic situation weighted with their probabilities of occurrence. We chose to make the forecasts for 2020, as this year was characterized by the onset of the health crisis (COVID-19 pandemic) but also by a probability of a financial crisis. In addition, the real data of the indices from 2020 allowed us to test the forecast models: GBM and modified geometric Brownian motion (mGBM) at different time intervals of 3, 6, 9, and 12 months. In fact, if investors would not consider the occurrence of a possible financial crisis, the data used to build the differential equation (GBM) is limited in practice to the year 2019. This period does not contain a financial crisis in the data, as no such event took place during this period and, as a result, although GBM may well capture the future evolution of stock indexes, some nuanced aspects may have been lost sight of in a closer analysis of these evolutions (we found that year 2019 is the same year when many of the stock indexes on the markets examined were historically high, in line with Flitter [

1], Wearden [

2], and Carlson [

3]). Therefore, if we consider several economic conjunctures, then this situation could change. In this sense, the states of the economic conjunctures can be considered as non-crisis and financial crisis, and their probabilities of occurrence are determined as follows: if the probability of a crisis is known, the probability of non-crisis is given by the difference between 1: the probability of a crisis. The question that arises is how can we, in a financial crisis situation, know the probability of occurrence of the financial crisis, the expected returns, and the risks of investors (returns volatility)?

A complementary direction of the study is the determination of discrete and differential Shannon entropy, to measure market uncertainty. We consider this approach necessary because, based on the results obtained, we can observe whether there are differences regarding the degree of uncertainty between the analysis periods considered in the paper, the financial crisis period (2008), and the non-financial crisis period (2019). We consider this complementary approach useful, as it is known that there is a link between the efficiency of markets and their entropy [

4] and this may provide additional arguments regarding the use of GBM to make forecasts if in both periods the degree of uncertainty is approximately the same level (a premise of the efficiency of financial markets is that the price of securities has a random evolution—random walk).

Therefore, our paper supports the idea of using GBM for forecasting, and, according to Wilmott in his work “Paul Wilmott introduces quantitative finance” [

5], “The widely accepted model for equities, currencies, commodities, and indexes is dS = µS dt + σS dB. It is a continuous-time model of an asset price […] and the foundation of so much finance theory”.

In GBM, constant drift and diffusion coefficients are used, but GBM models can also be used in the cases in which the volatility (necessary in the measurement of the coefficient of diffusion) is stochastic. Numerical solutions can be used through a Monte Carlo simulation in the absence of an analytical solution. In addition, Monte Carlo simulation can be used when there are stochastic diffusion processes with jumps, in which the price of financial security does not fluctuate continuously and regularly (it varies by jumping in a discontinuous way).

The GBM, which we can also call the classic GBM, has proven to be a very useful forecasting tool in finance. However, this tool is less useful in case of a future financial crisis in the financial markets. One solution in this regard would be the following: if we know the probability of a crisis and the expected return, respectively, the risks of investors (return volatility) in a crisis and the coefficients of drift and diffusion can be rewritten to capture it in the differential equation.

Regarding expected returns and volatility in the financial crisis situation, we can consider that their values may be those recorded in 2008, a period that characterizes such a situation well (2008 is our benchmark in the article regarding what we can empirically understand by a financial crisis). Summarizing, we can say that the periods of analysis considered for determining the coefficients of drift and diffusion that characterize the two states of the economic situation in the form of a mix are 2019 (for the non-financial crisis period) and 2008 (for financial crisis period), to make forecasts for 2020. We emphasize that, in our analysis, for the two periods mentioned above, we work with sizes such as the average log-return and the standard deviation of the log-returns, and these can be largely considered representative to characterize the expected returns by the investors and return volatilities in non-crisis and financial crisis situations.

Regarding the likelihood of a financial crisis or economic recession, it is worth noting that these probabilities can be known because of current research increasingly active in this field of study. Thus, in 2019 many researchers, including Nobel laureates (e.g., Robert Engle [

6,

7]), were concerned about measuring the likelihood of a financial crisis in the US market or in other mature markets. In addition, on 14 October 2019, Bloomberg published a model used to detect the US recession whose result is given by the probability of the US recession calculated for the next 12 months in the future.

Therefore, knowing the appearance probabilities of the two states of the economic conjuncture and knowing the numerical characteristics (average log-return and the standard deviation of the log-returns) corresponding to these states, a rewriting of the GBM model can be performed, referred to as the mGBM model, in which drift and diffusion are calculated considering these states in the form of a mix. The result is a GBM that can better capture the evolution of stock indexes, given the fact that in the construction of drift and diffusion, a possible future financial crisis can also be considered.

That being said, for the present research, we will work with two scenarios regarding the evolution of DAX, S&P 500, and SHANGHAI Composite stock indexes: Scenario A, in which the probability of the financial crisis appearance is zero (in which case the GBM is, in fact, the classical one—GBM), and Scenario B, in which there is a probability of appearance of the financial crisis (in which case the GBM is a modified one—mGBM), as in

Figure 1.

We also highlight that the solutions generated by the equation of GBM can be determined both analytically and numerically by GBM using Monte Carlo simulation. We opt for the second option because, on the one hand, we consider it more useful because of the possibility of a graphical representation of possible paths. On the other hand, alternative values for the stock market index (10,000 values) can be obtained by simulation at different times (3, 6, 9, and 12 months). Based on these values, the number higher than the value from the date of analysis can be later determined (30 or 31 of December, the closing date of the stock market). This last fact makes possible the determination of the likelihood that the stock market index will be higher in future than its value at the date of analysis, and so we can capture some nuanced aspects of the analysis of simulated data regarding the forecasts.

That being said, the article is further structured as follows: the literature review,

Section 2, presents the most important conceptual approaches; research methodology is described in the third part; the empiric findings and discussions are described in the fourth section of the paper; the conclusions of the study are outlined in the final part of the article.

4. Empirical Results and Discussions

In the following, considering the elements described in the methodology, we forecast the values of the major stock indexes of the three capital markets: DAX—German Stock Exchange (U.E.), S&P 500—New York Stock Exchange (U.S.), and SHANGHAI Composite—SHANGHAI Stock Exchange (Asia). We will also measure the degree of uncertainty of the analyzed markets through Shannon entropy, using discrete and continuous distribution.

Based on the methodology, in our empirical approaches we consider the following:

Log-returns are intraday.

The analysis period and the forecast period are considered at the level of a stock exchange year (252 days).

The period through which we characterize the conjuncture of a financial crisis is 2008, and the period through which we characterize the conjuncture of non-financial crisis is 2019.

The forecasts are made for 2020, at 3, 6, 9, and 12 months.

The data is taken from Thomson’s Reuters’ Eikon Refinitiv platform [

65].

4.1. Probability of the Financial Crisis

In our study, we consider the probability of the financial crisis to be at least equal to the probability of the economic recession (given by Bloomberg in early January 2020 for the next 12 months, see

Figure 2) for the following reasons: financial crises do not necessarily determine an installation of an economic recession, their causes being both of a financial nature and a psychological, behavioral nature. Thus, during periods of economic recession, consumption is affected, companies’ earnings are uncertain, inflation can rise, and erode the value of earnings, a state of panic and caution sets in, and investors usually seek to invest in “refuge” assets, and for these mentioned reasons, the period of economic recession also overlaps with a period of a market collapse, financial crisis.

What we cannot know exactly is whether the above recession probability is the measure of a recession comparable to the 2008 recession (the period that characterizes the financial crisis in our analyses). However, as recessionary probability models evolve, we will have a better measure of them. Thus, if we knew the probabilities of the occurrence of different types of recessions, then we would also know the probabilities corresponding to the different types of financial crises. It would be better to know the probabilities of financial crisis corresponding to different types of financial crises, but there may be such scientific concerns in the future given the importance of their knowledge in economic processes. In this context, the methodology proposed by us may better capture the future evolution of stock market indexes.

That being said, we consider that the probability of occurrence of the financial crisis on the US market (considered the mature market) is similar to the probability of occurrence on the other analyzed markets (German and Asian markets), because they are also considered mature markets. In addition, another way in which we can technically capture this aspect of similarity is by calculating the Granger causality through which we can highlight the existence of such a link. In this sense, we analyzed the time series during the financial crisis (2008) of these stock market indexes on account of the Granger causality presented in

Appendix A,

Table A1. If the obtained results confirm that a US financial crisis Granger-causes the other markets (German and Asian markets) to change, we can conclude that the appearance on the US market of a probability of financial crisis is found to affect the probability of crisis on other markets.

To not distort the analysis, only common daily trading prices in 2008 were used for the three indexes analyzed.

For the F-test result of the Granger causality not to be distorted, we must make sure that the analyzed series are stationary. In this sense, we applied the ADF test; the results obtained are presented in

Appendix A,

Table A2.

The results of the ADF test confirm that the series are stationary, and the results obtained on Granger causality are not distorted.

According to Granger causality test, we obtained the following for lag 1:

S&P 500 Granger-cause DAX (p-value = 0.00000000002; p-value < 0.05).

S&P 500 Granger-cause SHANGHAI Composite (p-value = 0.0104; p-value < 0.05).

The Granger causality test proves that the reciprocal is not valid, S&P 500 is not Granger caused either by DAX (p-value = 0.5533) or SHANGHAI Composite (p-value = 0.2403).

According to Granger causality test, we obtained the following for lag 2:

S&P 500 Granger-cause DAX (p-value = 0.00000000008; p-value < 0.05).

S&P 500 Granger-cause SHANGHAI Composite (p-value = 0.0450; p-value < 0.05).

The Granger causality test proves that the reciprocal is not valid, S&P 500 is not Granger-caused either by DAX (p-value = 0.7820) or SHANGHAI Composite (p-value = 0.1301).

As a result, the S&P 500 Granger-caused DAX and SHANGHAI Composite on both lag 1 and lag 2, but the reciprocal is not valid, which means that the probability of the financial crisis on the US market is transmitted to other mature markets (DAX and SHANGHAI Composite).

4.2. Forecasts on Scenarios (A and B) and Graphical Representation

Based on the GBM with Monte Carlo simulation, we estimated the tolerance intervals in which the values of the stock market indexes will be over 3 months, 6 months, 9 months, and 1 year, with tolerance levels of 95% and 75% from the date of analysis (30 or 31 of December 2019, depending on each index) on two Scenarios (A and B), see

Appendix A Table A3,

Table A4 and

Table A5.

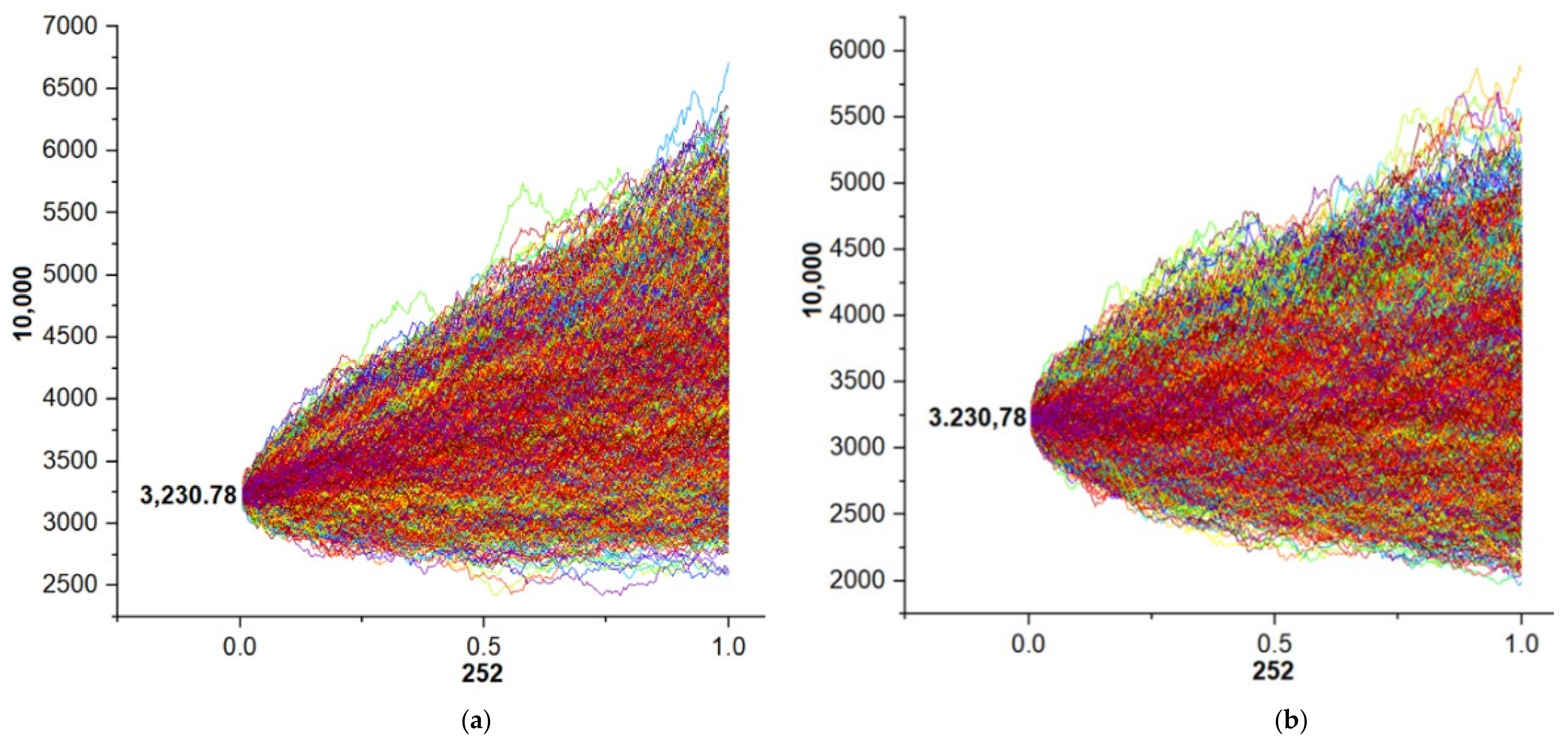

Possible paths have been taken in two scenarios:

Scenario A, in which the probability of a financial crisis is 0 per cent (GBM).

Scenario B, in which the probability of a financial crisis is: 28 per cent (mGBM).

For each stock market index examined, 10,000 potential paths were taken for the next year. In other words, for each stock market index using GBM models with Monte Carlo simulation, 10,000 alternative simulations (see Brătian [

66] for dataset) of the index were computed for each stock market day from the next year 2020 (see

Appendix A,

Figure A1,

Figure A2 and

Figure A3). In these figures there is a graphic representation of GBM models of 10,000 possible paths: (a) Scenario A; (b) Scenario B.

For simulations obtained by applying GBM and mGBM models at 3 months, 6 months, 9 months, and 12 months, we determined the probability that the values of the indexes will be higher than their corresponding values at the date of analysis (30 or 31 of December 2019, depending on each index) on the two scenarios mentioned above (see

Appendix A,

Table A3,

Table A4 and

Table A5).

4.3. Testing the GBM vs. mGBM Models

In the following we will proceed to test the results obtained from the application of GBM and mGBM models by the following methods presented below.

4.3.1. Using Tolerance Intervals with Different Tolerance Levels

The table below shows the situation with the real values of the three indexes analyzed (DAX, S&P 500, and SHANGHAI Composite) observed on these markets at 3, 6, 9, and 12 months, see

Table 1.

At 3 months, for tolerance level 95% and 75%, tolerance intervals on Scenarios A and B do not contain the real value, which means that the probability of the financial crisis is higher than 28%, but the tolerance interval values in Scenario B generated by mGBM are closer to the actual value compared to the tolerance interval values in Scenario A generated by GBM.

At 6 months, for tolerance level 95%, the real values are contained in tolerance intervals for both Scenario A and Scenario B, but for tolerance level 75%, the real value is contained only by tolerance intervals from Scenario B generated by mGBM.

At 9 and 12 months, for tolerance level 95%, the real values are contained in tolerance intervals for both Scenario A and Scenario B, but for tolerance level 75%, the real value is contained only by tolerance intervals from Scenario B generated by mGBM for DAX, and for S&P 500, the real values are contained in both Scenarios A and B for a tolerance level of 75%.

At 3, 6, 9, and 12 months, the expected index values in Scenario B generated by mGBM are closer to the real values (the expected index value for S&P 500 at 9 months is identical to the real value at 9 months) than expected index values in Scenario A generated by GBM.

At 3 months, for tolerance level 95%, the real values are contained in tolerance intervals for both Scenario A and Scenario B, but for tolerance level 75%, the real value is contained only by tolerance intervals from Scenario B generated by mGBM. At 3 months, the expected index value in Scenario B generated by mGBM is closer to the real value than the expected index value in Scenario A generated by GBM.

At 6 months, for tolerance level 95%, the real values are contained in tolerance intervals for both Scenario A and Scenario B, but for tolerance level 75%, the real value is contained only by tolerance intervals from Scenario A generated by GBM.

At 9 months, for tolerance level 95%, the real values are contained in tolerance intervals for both Scenario A and Scenario B,, but for tolerance level 75%, the real value is contained only by tolerance intervals from Scenario A generated by GBM.

At 12 months, for both tolerance levels of 95% and 75%, the real values are contained only in Scenario A generated by GBM.

At 6, 9, and 12 months, the expected index value in Scenario A generated by GBM is closer to real values than the expected index value in Scenario B generated by mGBM; at 3 months, the real value is closed to the expected index value which can be found in Scenario B generated by mGBM.

In conclusion, the real values of the DAX and S&P 500 stock indexes are confirmed at 3, 6, 9, and 12 months on Scenario B generated by mGBM, and for SHANGHAI Composite, the real values are confirmed at 3 months on Scenario B generated by mGBM, and at 6, 9, and 12 months the real values are confirmed on Scenario A generated by GBM.

4.3.2. Probability That the Forecasted Value of the Stock Market Indexes Will Be Higher Than the Value from the Analysis Date (30 or 31 of December 2019)

In

Table 2 below, we present the closing prices at the date of the analysis. From the forecasted results in

Table A3,

Table A4 and

Table A5 from

Appendix A, it can be seen the probability that these prices will be higher at 3, 6, 9, and 12 months, based on the simulations performed on the two Scenarios A and B.

What we can observe is that for Scenario A generated by GBM, the probability that the index values will be higher than the closing price is much higher compared to Scenario B generated by mGBM. As a result, the mGBM model better captures the real situation (see

Table 1) recorded for DAX and S&P 500 given the real results of these indexes at 3, 6, 9, and 12 months, but it is not capturing the real situation for SHANGHAI Composite for which the real situation is better captured by the GBM model, except for the values at 3 months.

4.3.3. Robustness Testing

To test the robustness of the GBM model compared to the robustness of the mGBM model we used mean average percentage error (MAPE).

MAPE is calculated according to Equation (27), and its values can be interpreted according to

Table 3.

MAPE was used in the following two forms:

The smallest MAPE for Scenario A, respectively, the smallest MAPE for Scenario B [

67]. In this sense, from the 10,000 simulations, the simulation with the smallest MAPE on each scenario, at 12 months, is chosen (see

Table 4).

The average of MAPE for scenario A, respectively the average of MAPE for Scenario B. In this sense, the average of MAPE is calculated for the 10,000 simulations, on each scenario, at 12 months (see

Table 4).

At = actual value; St = simulated value.

Based on the results obtained after testing, we can conclude the following:

4.3.4. Measuring the Degree of Market Uncertainty through Shannon Entropy

Regarding the uncertainty of the markets, calculated using the discrete Shannon entropy and the Shannon differential entropy and whose results are found in

Table 5, we can make the following remarks:

Using a discrete distribution for the periods considered during the financial crisis and the non-financial crisis, the degree of uncertainty of the markets examined is the same with minor variations. This means that, regardless of the economic situation (crisis or non-crisis), the uncertainty in the markets is roughly the same.

Using continuous distribution for periods considered to be a financial crisis and a non-financial crisis, it is found that the degree of uncertainty in the markets examined varies significantly from the situation discussed above. We note that, in the situation of the financial crisis, the degree of uncertainty in the markets examined is significantly higher than in the situation of the non-financial crisis.

We find a high level of entropy in the analyzed markets both in the crisis period and in the period of non-financial crisis, and, given the fact that there is a direct link between market efficiency and their entropy (high entropy—high efficiency; low entropy—low efficiency), it can be deduced that the analyzed markets are information-efficient, and in this case, the use of GBM for forecasting is justified, as the prices have a random evolution (random walk). In the case of the DAX—German Stock Exchange (U.E.) and S&P 500—New York Stock Exchange (U.S.) stock indices, discreet and differential entropy do not differ in the crisis and non-crisis scenarios; there are insignificant differences in the case of SHANGHAI Composite—Shanghai Stock Exchange (Asia).

5. Conclusions

The GBM proved to be a suitable model for making forecasts of stock market index values, as it describes their future evolution quite well. However, the model proposed by us (mGBM), in which drift and diffusion are determined by considering two states of the economic situation weighted with their probabilities of occurrence, brings some contributions through which some subtle nuances that better describe the future evolution of stock indexes (confirms for two indexes out of three analyzed—DAX, S&P 500, and for SHANGHAI Composite partially confirms at 3 months) are captured. Thus, in general, on account of the analyzed stock market indexes, the model proposed by us better describes the future trajectories of these indexes. We consider these aspects important, because, based on such a model, investors have the possibility of a better understanding of the forecasting process when the probability of a financial crisis appears on the markets.

However, what cannot be very well captured are the temporary shocks on the capital markets, as shown in this case by the shock generated by the COVID-19 pandemic in March, as seen in

Figure 3,

Figure 4 and

Figure 5.

The forecasts for 2020 are supported by the fact that the actual data for this year are compared with the forecast data, and, consequently, the results can be considered verisimilar.

The limitations of this study come from the fact that, in this paper, we model the behavior of random variables, but the factors that generate their effects are unknown. Through quantitative finance, we do not research the structural reasons for the price evolution of a financial security, but instead we use the stochastic calculation to obtain its corresponding value. The analysis of the causes that can justify these results is the topic of behavioral finance, which can analyze the behavior of investors and describe the state of the economy at various times. Another limitation comes from the fact that the results of the analysis are presented on only three stock indices (DAX, S&P 500, and SHANGHAI Composite) associated with large economies, and the results could be different in emerging markets. This aspect will be the subject of future research that will contain analysis of several stock indices from different markets, both mature and emerging.