This section explains the data set and the experimental process in detail. Next, we present the findings, results and discussion. And finally, we evaluate the conclusions of the application.

4.1. Data Set and Experimental Process

Following the main purpose of the study, we measured the FP (financial performance) of most traded 24 companies (banks are excluded) which have the highest market value in the BIST-30 index, in Turkey, by MCDM methods. These companies were chosen as decision alternatives, and 6 different performance types were chosen as decision criteria. The period of the study con-sists of a total of 10 quarters between 2019 and 2021: 2019/06 (Q1), 2019/09 (Q2), 2019/12 (Q3), 2020/03 (Q4), 2020/06 (Q5), 2020/09 (Q6), 2020/12 (Q7), 2021/03 (Q8), 2021/06 (Q9), 2021/09 (Q10). FPs of the companies were calculated separately for each quarter base period. First of all, the FPs of the companies were calculated by using seven MCDM methods for each period. After that, the FP MCDM scores of the companies were compared both in terms of correlation coefficient with Stock Return (SR), namely percentage change in price, and SD (Standard deviation). Thus, objective findings were revealed regarding the capacity, tendency, character or importance of each MCDM method for each period. These findings showed that we can compare MCDM methods depending on the highest performance success for decision makers who want to evaluate the performance of companies under certain criteria and constraints. We would also like to point out that the FINNET commercial data software is used to obtain companies’ FP performance indicators and share price data.

Figure 1 displays the diagram of the study.

The experimental process of this study is as follows:

Step 1: Data Matrix Preparation

First of all, the obtained performance values are placed in the decision matrix in order to calculate the MCDMs. Here, six different ratios are considered as a measure of FP. The decision matrix is formed with these initial data obtained during the calculation of the MCDM results.

Step 2: Weighting Calculation Procedure

Since the equal weighting method was preferred, it was applied to all criteria. This study, it is mainly aimed to compare MCDM methods objectively. In the MCDM procedure, the selection of the weighting procedure (such as normalization, threshold value, preference function selection) is a separate issue in itself. And this is not the subject of this study. In this study, we emphasize that our focus is the MCDM comparison, by choosing the equal weighting method, which is a non-judgmental technique.

Step 3: MCDM Calculation Procedure

Microsoft Excel program was used to execute MCDM process steps. In this study, a total of 70 different MCDM rankings were produced for 10 base periods by using seven different MCDM scores belonging to 24 companies. In other words, 70 different MCDM scores were calculated for a company (this number is 1680 for all companies). This shows that the study is quite comprehensive. Thus, according to alternative MCDM results, we can make more reliable and valid judgments for 10 base periods compared to one period.

Step 4: Evaluation of MCDM Ranking Results

To understand which of the MCDM rankings produce superior results, we evaluated Spearman Correlation (RHO). Secondly, we suggested SD analysis with a structured procedure similar to objective weighting techniques. This process was done in the Excel program.

Step 5: Evaluation of Analysis Results as Superiority and Comparison Functions in MCDM Methods.

MCDM methods were compared according to RHO and SD analyzes and average performance values of sequences produced by MCDMs. As a result of separate calculations for both criteria, we suggested that the method with the best averages might be more important or appropriate.

Considering the fact that an MCDM model is primarily designed to represent reality [

16], it is appropriate to base the share price of companies as a reference. In addition, MCDM methods come into play as a decision support element in a decision-making problem where there is uncertainty. In this context, the formal information content of MCDMs calculated by SD can be suggested as a criterion for the hierarchical ranking of MCDMs.

4.2. Findings and Results

There are over a hundred MCDM methods, and they all claim to offer the best solution. However, today there is still no consensus on the selection of the best MCDM method. These methods obviously have different computational procedures and they produce different sorting results in most cases. This makes us think that they can produce a unique distribution or have a different character, far from a coincidence. In this study, exploratory research of the specific capacity of MCDM methods was revealed. The SD objective procedure helped us in determining the specific characteristics of MCDM scores. Secondly, the RHO coefficient level, which expresses the FP-SR (stock return or percentage change in share price) correlation, was suggested as another confirmatory criterion. The results of this recommendation are shown in the tables below.

Table 4 shows the MCDM methods preferred in this study and the references based on the calculation stages. In this study, first of all, the performance criteria values, which are displayed in

Table 5, were used to evaluate companies’ financial performances. An example initial decision matrix is shown below. This decision matrix contains raw data that has not yet been normalized.

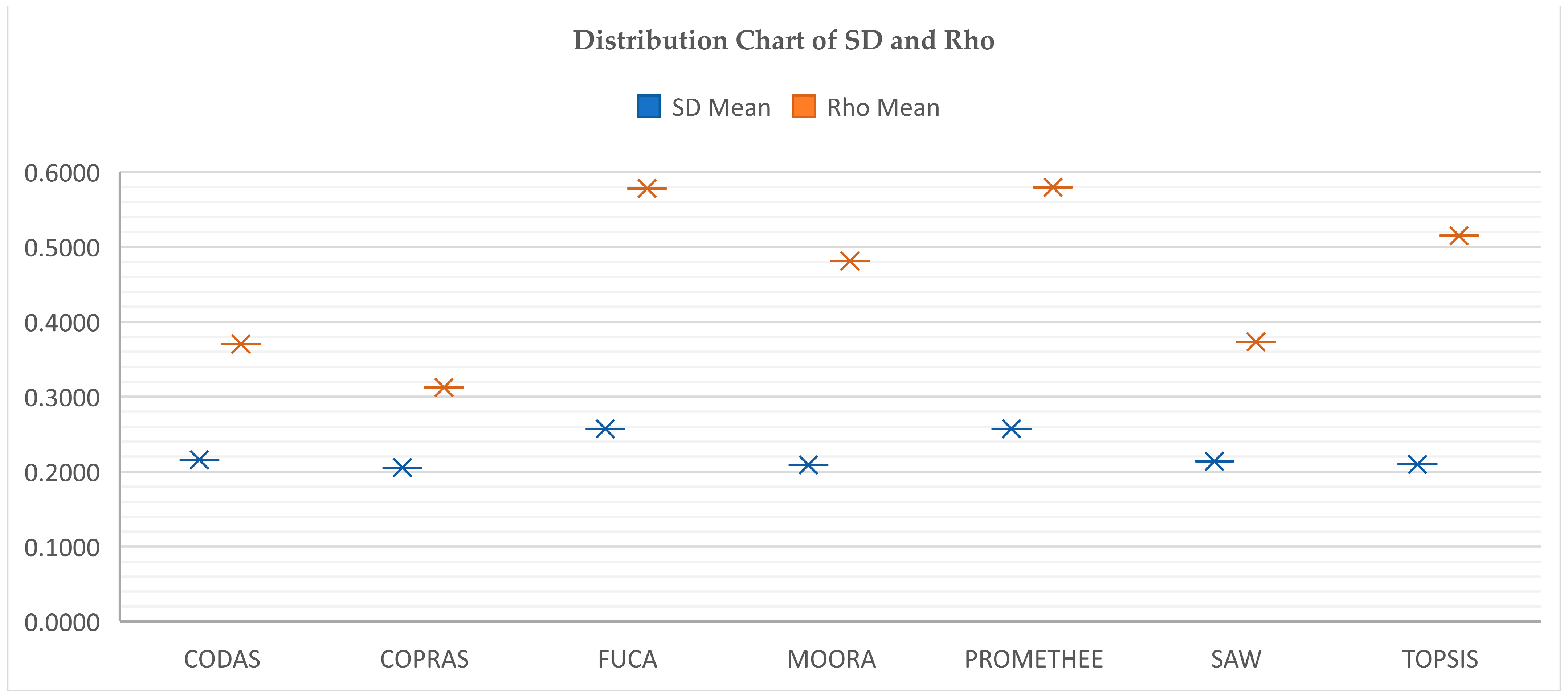

We analyzed a period of 10 quarters in total. We clearly discovered that PROMETHEE II and FUCA were predominantly better for both benchmarks (SD and Rho), which is displayedin the following tables and figures.

Table 6 below shows the specific final scores produced by the 7 MCDM methods examined in the study for the 2021/09 quarter selected as the sample base period.

Table 6 shows that the scores produced by some MCDM methods are in the range of 0–1, some in the range of −1–0, and some have a high positive-negative distribution. This may give us a clue about the characteristics of MCDM methods. In this sense, the standard deviation of the normalized score value of the MCDM scores in question will give us an idea about their determinant aspects. It is clear that the technique used in the calculation steps has an effect on the distribution of the final scores of the MCDM methods. Whether a method is subject to the Outranking or value/utility school, the type of normalization used, the preference function, or the threshold value affects the distribution of results differently. In addition, some methods such as TOPSIS care about ideal values (PIS-NIS), and this distance-based approach also directly affects the results and score distribution.

In this study, we primarily use the SD criterion to compare seven MCDM methods. The final and specific scores produced by the MCDM methods have been normalized to justify comparison. In the next step, the SD value of the scores of each MCDM method was obtained. And the final findings are displayed in

Table 7. Dominantly, PROMETHEE II and FUCA methods produced the highest SD values compared to other MCDM methods. The 10-quartile SD averages are: FUCA 0.257096854; PROMETHEE 0.257061822; CODAS 0.21565885; SAW 0.213692925; TOPSIS 0.209506837; MOORA 0.208981241; COPRAS 0.205142873. FUCA and PROMETHEE-2 methods produced the highest mean SD value at almost the same level. It is seen that COPRAS is in the last place in terms of mean SD value. So FUCA and PROMETHEE are stable while producing high SD value and COPRAS producing low SD value.

Table 8 shows the comparative rankings of the MCDM methods depending on SD values. It can be said that PROMETHEE-2 and FUCA methods produced almost the same results.

Table 8 can be interpreted as follows: These two methods achieved a clear advantage over other MCDM methods by achieving 9 first places in 10 cases in terms of SD value. Although PROMETHEE&FUCA and COPRAS were uniquely stable in their success positions, it can be said that CODAS, SAW, TOPSIS and MOORA methods showed less stable performance among themselves in an intermediate gray zone, similar to each other.

In this study, we use the Rho criterion as a secondary validation criterion to compare seven MCDM methods. The final and specific scores produced by these methods were calculated as the Spearman correlation (Rho) with stock returns to justify the comparison. That is, the Rho value of the scores of each MCDM method was obtained for each base period. And the final findings are shown in

Table 9. Compared to other MCDM methods, PROMETHEE II and FUCA methods predominantly produced the highest Rho values. The correlation coefficient produced by MCDM methods (10-quartile means) with return on stock was PROMETHEE 0.5796, FUCA 0.5781; TOPSIS 0.515; MOORA 0.4811; SAW 0.3734; CODAS 0.3701; COPRAS is 0.3122. PROMETHEE and FUCA methods produced the highest mean Rho values at almost the same level as the SD benchmark. Likewise, the COPRAS method has the lowest Rho’s, as in the case of SD criterion. Other MCDM methods similarly maintained their positions in the same gray area. But their positions among themselves differ from the previous situation (especially for CODAS).

Table 10 shows the comparative rankings of the MCDM methods depending on the Rho values. It can be said that PROMETHEE-2 and FUCA methods produce very similar results. The results points out that these two methods achieved a clear advantage over other MCDM methods by winning 7 times out of 10 cases. Although PROMETHEE&FUCA and COPRAS were uniquely stable in their success positions, it can be said that CODAS, SAW, TOPSIS, and MOORA methods showed less stable performance among themselves in an intermediate gray zone, similar to each other.

Table 11 may be helpful to further clarify the picture. Both SD and Rho benchmarks are shown here. Accordingly, it is understood that the large number of MCDM methods that are used in the study is beneficial. If the PROMETHEE, FUCA and COPRAS methods were not present in this study, it would obviously be difficult to evaluate the results. Because the performance of these methods is either too high or too low. Other methods, CODAS, MOORA, TOPSIS and SAW, showed relatively different performances for the two proposed comparison methods. This actually gives an idea of why the SD benchmark was rarely used before. The reason for this is that the results produced by these methods are very close to each other. Thus, this would be a difficult road for researchers looking for consistency in comparison.

Figure 2 below is the Performance Radar Graph of MCDMs based on SD benchmark. Here it can be better seen that the PROMETHEE&FUCA duo produces a predominantly higher SD.

Figure 3 Below is the performance radar graph of the MCDMs based on the Rho benchmark. It can be better seen here that the PROMETHEE&FUCA duo often produces a higher Rho.

It can be seen from the scatter plot (

Figure 4) below that the PROMETHEE&FUCA pair usually produces higher Rho and SD.

Results in the tables show that PROMETHEE II and FUCA methods are more appropriate methods for financial performance measurement compared to other five methods. These two methods produced a common performance, so we can assume them as equivalent of each other. They produced a higher correlation with the stock market price, which is a real-life example. Moreover, the distribution of their final scores corresponds to a wider range. And that means they produce a higher SD value. In other words, since the amount of objective information of PROMETHEE-2 and FUCA is higher, it can be said that they are more important methods compared to others.

As it is clearly seen in the figures above, it is clear that the scores produced by PROMETHEE and FUCA methods give better results than other MCDM methods. Thus, in this case, there is very strong evidence that MCDM methods produce a characteristic sequence. In other words, MCDM methods can show a unique and consistent tendency. SD values and average values of RHO coefficients based on the relationship between share price and FP for the 10 quarters between 2019 and 2021 show remarkable and unique results. Accordingly, the SD score results show that PROMETHEE and FUCA produce more valuable information content compared to other methods. In addition, these results provide conclusive evidence that they better capture real life.

According to Zaidan et al. (2017), a SD value close to zero indicates that the data value is closer to the cluster mean [

18]. A higher SD value means that the data is spread over a wider range of values. Thus, a MCDM with a higher SD has better ranking scores in essentially comparing alternatives. Because there is a more comprehensive and wider distribution, this allows an easier comparison between alternatives. On the other hand, the scores of the method with a low SD value are closer to the mean. This proximity reduces the tolerance to allow comparison between alternatives. The situation is somewhat similar to the difference between return on stocks and return on interest. The first is risky, has a wide distribution, but its returns are higher. The risk and dispersion of the latter are zero, and the return is usually small and stable. Thus, in general, it can be said that the SD value is a criterion for “value” or “significance”, as seen in many real-life examples.

Moreover, perhaps most importantly, these results show that MCDM methods have unique characteristics in terms of SD. Indeed, in the context of SD, the results show that both MCDM methods have certain objective tendencies, patterns, or capacities over the 10 quarters, consistently. In other words, the fact that MCDM methods consistently and often have higher or lower SD capacity for a given problem also facilitates the comparability of the methods. It can even be said that one side may be superior to the comparison in a way, if only the SD tendency of MCDM methods is based.

As a matter of fact, it can even be argued that a MCDM method is superior among other MCDM methods, borrowing the idea or theory underlying objective weighting methods. Because according to the SD weighting approach, a column with a higher SD value is considered more important because it has a higher information content [

19].

The above results contain quite satisfactory and consistent information about the MCDM comparison. On the other hand, it should be taken into account that normalization types can affect SD results. In future studies, it may also be recommended to calculate SD scores for different types of normalization.

4.3. Discussion

As it is known, as a hypothetical approach, the methods used in the objective estimation of the importance of rankings (for example, SD as a statistical technique) are based on an assumption in terms of information content determination. Accordingly, for objective weight estimation methods, the larger the difference between the values of the items in the column, the more valuable the information contained in the criterion (indicator). In other words, the weight of a criterion is higher in direct proportion to the information content [

30]. In fact, formally, the SD approach can be used to discover the information content of the final scores produced by MCDM methods [

18], this approach is more clearly and boldly demonstrated in this study. No study has been found in the literature showing this approach with such clarity before. Although there is no rational obstacle in calculating the SDs of the normalized final scores of the MCDM methods, there might surely be some reservations for interpreting the results. In this study, the SDs of the methods were calculated first and then interpreted as an evaluation element in the comparison of MCDM scores. This innovative and adapted approach can be an easy, reassuring and objective alternative for decision makers who are struggling with the difficulties and uncertainties in choosing an appropriate MCDM method, an old and chronic problem that we discuss in this study.

In fact, comparing the characteristic performances of MCDM methods is an interesting and difficult subject. Considering that MCDM methods produce different scores, it would not be correct to directly compare them over raw scores. Normalized score should be used to ensure comparability of final scores of MCDM techniques [

18]. SD has rarely been used to evaluate normalized MCDM scores. On the other hand, Zaidan et al. (2017) partially used the SD method for MCDM comparison. However, we do not find another example of this in the literature [

18]. In this study, one more step was taken and it was clearly shown that the information content of MCDM methods can be measured according to the SD value and some valuable tendency, pattern or capacity signs can be captured with these measurement results.

In this study, we adopted another objective criterion confirming the real life SD criterion to provide highly consistent, characteristic and distinctive results. There are some studies that have recently tried this new approach and achieved positive results. These studies, which measure financial performance on the basis of MCDM, indicate that there is a natural and special MCDM evaluation solution in this field [

17,

28]. Accordingly, we benefit from satisfactory and significant correlations between share price and MCDM-based financial performance rankings. In this study, we observed that some MCDM methods such as PROMETHEE&FUCA provide these correlations to a higher degree. In other words, it has been clearly seen that some MCDM methods better capture or model real-life situations. Thus, we strengthened our argument by using these two objective mechanisms at the same time, which confirm each other, for the first time, to reveal the hidden capacities of MCDM methods.

The findings and results of our study open a new door to interesting and original discussions. We list them as follows:

Unconventionally, the SD procedure was used in this study for MCDM outputs (ranking results) rather than inputs (criteria). Normally, when criteria are used for weighting purposes, different criteria may be more important in different base periods. That means the weights are often changing. In this study, the SD that we used in the comparison of MCDM information contents provided very consistent results. The comparative performance success of MCDM methods in base periods is the same. In other words, PROMETHEE&FUCA clearly outperformed the other methods in terms of both SD and Rho criteria.

In order to solve problem scenarios and limitations of the study, we can compare information contents of MCDM methods. And this again reveals the greater capacity and the importance of the PROMETHEE&FUCA methods. Although the other methods has score levels close to PROMETHEE&FUCA as a characteristic tendency, it still maintains its place even in sensitive measures.

Our results show that PROMETHEE&FUCA might be more efficient than other methods. It is also noteworthy that PROMETHEE&FUCA can also work without normalization, similar to some outranking methods.

The most important finding of this study is the strong evidence about the scores of the methods having objective characteristics. In other words, a MCDM data as a set contains patterns that indicate certain capacity, and this means originality and superiority. Thus, the selection of a more appropriate and efficient MCDM method was discussed and some solutions were proposed with objective criteria in this study.

Random selection of any MCDM method may affect the decision to be taken. In this study, FP measurement was made. Comparing and measuring FP can be a good decision support system element for companies’ financial information users. For example, with this refined information, company owners can learn their success positions accurately compared to their competitors. Lenders can extend loans to companies that are able to pay their debts. Stock investors can use FP information regarding fundamental analysis in choosing the best stock.

Table 12 below lists the companies with the best FP according to the PROMETHEE&FUCA and other methods. Accordingly, when a random method is chosen, a different “best” alternative can be chosen. This will influence the strategic decisions made by decision makers. In other words, based on the findings in this study, we can say that the random choosing the best MCDM method may adversely affect the decisions. We discuss the automatic determination of a MCDM method based on real life and higher information content criteria. In the table below, it is clearly seen that the best performing companies have changed in some quarters according to MCDM methods.

The explanations we have listed below are what the study aims or does not aim; or sets clear boundaries about what it measures and what it does not:

Since the choice of preference function belongs to the decision maker, we used the commonly used usual type preference function for PROMETHEE II. This type of function is the only preference function that does not impose the “threshold value” on the decision maker. Thus, we minimized the subjective intervention authority of the decision maker, which is an important factor in comparability. According to the results of the study, PROMETHEE II that was calculated with the usual type preference function was more successful.

Other methods and PROMETHEE&FUCA are based on completely different principles (the schools of utility/value and outranking), and it is true that PROMETHEE is a much more sophisticated approach. On the other hand, since SAW has a simpler methodology, it can be argued that these results may not actually be normal or surprising anyway. By comparing an additional MCDM method, namely FUCA, and presenting it in the table below, we justify that this is a prejudice and underestimating claim. FUCA method comes first among the methods that have the simplest methodology among more than 100 methods. In this study, we compared the results of the more complex PROMETHEE II with the simpler FUCA method. According to the results obtained, although these methods have different methodologies and complexity, interestingly, they produced close to above 99% similar results. In other words, they produced almost the same performance according to both SD and rho criteria. These results show that methodological complexity cannot be a direct criterion for comparing the final scores of MCDM methods. In fact, this shows that what is valuable can sometimes be simple (see

Table 13 and

Table 14).

With these benchmarks, it is hard to claim which of the methods is the absolute better fit. But the findings from the study do contain some interesting and valuable indications of tendencies, patterns or capacities regarding SD and rho criteria. It is worth emphasizing that this study is not about methodological “inputs” but rather the “outputs”, which are the final results of MCDM methods. With the decision analytics approach, objective and consistent information about the performance of the result scores of MCDM methods was discovered through the historical data of the companies. For example, although the PROMETHEE II method is a sophisticated method, the information that it provides is the same ranking result as the FUCA method, which is one of the simplest methods. Understanding this with methodological formulas is a relatively difficult task, and no previous study in the literature was able to identify this finding.

The relationship between stock returns and MCDM results has been emphasized in few studies in the literature [

17,

28]. These studies states that this relationship changes according to MCDM methods. This was confirmed this study with PROMETHEE II/FUCA and other methods in this study. In addition, there are certain constraints in the studies on the type of financial performance measurement, such as the period, number of firms, country, sector and criteria, and this approach has been confirmed by changing these. Therefore, this is important if the same or different methods confirm the model in question even though the constraints have changed. In addition, this study showed that this proposed approach yielded predominantly parallel results with the SD criterion. Thus, for the first time, a dual authentication mechanism was tested and verified in this study.

The purpose of this study has nothing to do with “portfolio selection”, although the concepts of “return on shares”, which refers to price changes, are frequently mentioned in this article. However, this should be understood as evaluating the correlation between a MCDM type and stock return in terms of MCDM capacity. There is no choice recommendation regarding investing in a stock. Here, an alternative solution proposal has been proposed based on the findings obtained by data analytics to a methodological deadlock regarding MCDM comparison.

Basically, if the normalized score array of an MCDM method shows a higher standard deviation, it is of course difficult to assume that one method is absolutely better than the other. However, if the results consistently indicate higher values for some MCDM methods, at least for this problem scenario, we consider it appropriate to discuss whether this may be considered a tendency, capacity or a sign of conformity.

The design of this research was carried out by Zaidan et al. (2017)’s SD approach and Baydaş et al. (2022)’s Rho approach. In other words, this research further enhanced the context by using a dual verification mechanism. In addition, in parallel with the findings of Baydaş et al. (2022), PROMETHEE and FUCA were the most successful methods in this study. On the other hand, it was observed that some MCDM methods produced higher SD, similar to the approach in the study of Zaidan et al. (2017).