1. Introduction

As an important leverage to financial policy, the short-term interest rate is not only a bridge between micro economy and macro economy but also an important approach to studying the return of risky assets and securities prices. The term structures of the short-term interest rate will affect securities pricing through the transmission mechanism, and then have an important impact on financial derivative securities and income securities (López et al. [

1]). Therefore, the research on short-term interest rate models has important theoretical and practical significance.

The dynamic change process of the short-term interest rate can be described through different parameter forms in the univariate continuous time model defined as follows:

where

is a Brownian motion,

and

are the drift function and diffusion function, respectively, representing the instantaneous mean and variance of the process. For example, Vasicek [

2] introduced the Ornstein–Uhlenbeck process to describe the change trend of the interest rate. Cox et al. [

3] established the CIR model, which solved the problem of a negative value in the Vasicek model, and Chan et al. [

4] proposed the CKLS model in the same model frame. In the three models above, the drift function is assumed to be a linear form. Although a linear setting can reflect the mean reversion of the interest rate, abnormal empirical conclusions will appear when the interest rate sample data contain large shocks. Aït-Sahalia [

5] and Bali and Wu [

6] assumed the nonlinear drift function form of multi-order positive power and first-order negative power to effectively capture the nonlinear effect of interest rate. In this paper, we no longer limit the specific form of the unknown coefficients of the interest rate model and adopt the general functional form of state variable.

With the development of money markets and the intensification of volatility, scholars have found that the short-term interest rate shows the distribution characteristics of peak, thick tail and skewness, and sometimes the fluctuation is obvious (Piazzesi [

7], Das [

8]). Johannes [

9] mentioned that the diffusion models induced interest rate increments that were approximately normal over short time intervals while the increments of actual data were very non-normal. Thus, the continuous stochastic models have been insufficient to accurately describe the change process of short-term interest rate. By adding Poisson jump to the continuous stochastic model to describe the dynamics of uncertain and discontinuous variables, it can not only explain the peak and thick tail phenomena of the data but also allow some unexpected jumps in the changes of variables. Johannes [

9] found that the jump diffusion model could effectively describe the excessive peak phenomenon of the interest rate. Pan et al. [

10] and Kong and Yi [

11] found that introducing jump behavior into the interest rate process could better simulate the change process of real data. In this paper, the jump diffusion model defined as follows is used to describe the dynamic behavior of the short-term interest rate:

It is usually assumed that

is a compound Poisson process with a finite number of jumps, that is,

where

denotes the size of the jump, and

is a Poisson process with intensity

For the parameter estimation, the data distribution is usually assumed to follow a specific model and then determine the unknown parameters in the model, which indicates that there is often a significant gap between the parametric models and actual models. To compensate for the above shortcomings, Rosenblatt [

12] and Parzen [

13] proposed a nonparametric estimation approach that does not utilize prior knowledge about data distribution and does not impose any assumptions to data distribution. It is a method of studying data distribution characteristics from the perspective of the data sample itself, and therefore has received high attention in the fields of statistical theory and application. Compared with the parameter estimation, the nonparametric methods do not need to assume a specific function form for the drift function and possess the characteristics of more accuracy, robustness and flexibility. Johannes [

9], Bandi and Nguyen [

14] gave nonparametric estimation for the coefficients of the jump diffusion model based on the infinitesimal conditional moments. Based on the symmetric kernel function, Mancini and Renò [

15] proposed a nonparametric threshold estimation method for the jump diffusion model and made an empirical study on the US short-term interest rate.

The interest rate data in China, especially the nominal interest rate, are usually non-negative; if the boundary correction is not made for the region close to or far from the origin, there may be large errors in the Nadaraya–Watson estimation (NW estimation) based on the symmetric kernel. Chen [

16] and Scaillet [

17] used the gamma asymmetric kernel for boundary correction. The gamma asymmetric kernel can be regarded as a combination of the variable bandwidth and boundary correction method. Firstly, the shape of asymmetric kernel will change with the smoothing position, and this adaptive smoothing is realized by a single smoothing parameter. Secondly, the order of the variance of the kernel density estimation obtained by the gamma kernel function is

which means that as the point

x gets farther, the variance of the gamma kernel estimation will become smaller to achieve the effect of boundary correction.

The existing estimators for the drift coefficient in the diffusion model with jumps involve jump components and possess larger boundary errors. How to effectively estimate the drift function is an important issue that faces challenges and has theoretical significance. Gamma kernel estimation can effectively solve the boundary effect of Gaussian kernel estimation. Additionally, when there is a jump in the data, the Gaussian kernel estimation will possess a large deviation, and the threshold function can ensure the unbiasedness of nonparametric estimation. Based on the work in Chen [

16] and Mancini and Renò [

15], in this paper, the nonparametric approach to the unknown drift coefficient in the jump diffusion process of interest rate is considered by combining the gamma asymmetric kernel and threshold function. Furthermore, the central limit theorems for the corresponding estimator in null recurrent and positive recurrent cases have been proven under wild conditions. Moreover, the better finite property of the gamma asymmetric kernel threshold estimator is verified by the Monte Carlo numerical simulation experiment and empirical analysis of the SHIBOR and LIBOR data.

The structure of the paper is organized as follows.

Section 2 introduces the nonparametric estimator for the drift function in the jump diffusion model and the central limit theorem of the corresponding estimator.

Section 3 verifies the finite sample property of the estimator through the Monte Carlo numerical simulation experiment.

Section 4 applies the estimator to the empirical analysis of SHIBOR and LIBOR.

Section 5 concludes.

Section 6 contains detailed proofs for the main results.

2. Drift Nonparametric Estimation and Main Result

Considering that the interest rate

is often non-negative, it is not reasonable to construct nonparametric estimation based on symmetric kernel for the drift function without boundary correction. In this paper, we will adopt nonparametric estimation using the gamma asymmetric kernel for the unknown drift function to correct the boundary bias. The gamma asymmetric kernel is defined as follows:

where

and

is the smoothing parameter. Since the gamma kernel function is distributed in

, the nonparametric estimation based on the gamma kernel might correct boundary bias for non-negative variables compared with the estimation constructed with the Gaussian symmetric kernel of Mancini and Renò [

15].

Similar to the nonparametric estimation constructed with the Gaussian kernel function of Mancini and Renò [

15], the Nadaraya–Watson estimator

based on the gamma asymmetric kernel for the unknown drift function

is constructed as follows:

where

are the discrete sampling observations for the process

in (

2),

is the sampling interval, and

is the threshold function.

The following technical assumptions are imposed for the central limit theorems throughout the paper. The range of the process is assumed as with

Assumption 1. For model (

2),

the non-negative jump intensity is bounded, and the drift coefficient and strictly positive diffusion coefficient are progressively measurable processes with càdlàg paths and twice-continuously differentiable. Additionally, they satisfy the conditions of local Lipschitz continuity and linear growth: There exist some positive constants such that for , where

Moreover, there exists some positive constant C such that Assumption 2. The process in model (

2)

is Harris recurrent. Assumption 3. The local time for model (2) satisfies the following condition:as Assumption 4. The sampling interval the threshold function and the smoothing parameter satisfy the following conditions:

, → 0 and

as and for all visited xbut where Remark 1. Jacod and Shiryaev [

18] mentioned that the stochastic differential Equation (

2) has a unique strong solution on

if Assumption 1 holds. A unique invariant measure

with

exists under Assumption 2. Furthermore, a time-invariant probability measure

exists for process

under the condition of the positive Harris recurrent assumption. Eisenbaum and Kaspi [

19] and Wang and Zhou [

20] adopted the same assumption as that in Assumption 3. The asymptotic relationships between the smoothing parameter

and the sampling interval

in Assumption 4 are similar to those of Mancini and Renò [

15] and Gospodinov and Hirukawa [

21].

The statistical large sample property of the nonparametric gamma kernel threshold estimator is obtained by letting n, and in the following theorem.

Theorem 1. (null recurrent case).

In model (2)

, under Assumptions 1–4, for the interior x if “”,for the boundary x if “”, Theorem 2. (positive recurrent case).

Under Assumptions 1 and 2 with positive Harris recurrent condition, Assumption 3 and then, for the interior for the boundary Remark 2. Theorem 2 can be deduced by Theorem 1 easily with property (

5) as follows:

under the positive recurrent condition.

Remark 3. The asymptotic normality of the Nadaraya–Watson nonparametric estimator based on the Gaussian symmetric kernel for the unknown drift function

is obtained by Mancini and Renò [

15] under mild assumptions:

where

and

Two main differences exist between the result of Mancini and Renò [

15] and Theorem 1 in this paper. Firstly, compared with the result of Mancini and Renò [

15], the convergence rate of the gamma asymmetric threshold nonparametric estimator proposed in this paper varies with the location of the point

for example “interior

x” and “boundary

x”. Secondly, the variance of the gamma asymmetric kernel threshold estimator is inversely proportional to the design

x for “interior

x”, which indicates that Estimator (

4) is resistant to sparse design point

One can refer to Song et al. [

22] for more theoretical details.

3. Monte Carlo Numerical Simulation for Finite Sample Property

In this section, we perform the Monte Carlo simulation experiment to compare the finite sample properties of three nonparametric estimators for the unknown drift function, which are the Gaussian symmetric kernel estimation (naive estimator), Gaussian symmetric kernel threshold estimation denoted as NW, and gamma asymmetric kernel threshold estimation denoted as AS.

Here, we mainly consider the nonparametric estimation for the drift coefficient in the jump–diffusion model defined as

where the values of the drift and diffusion coefficients coincide with those in Aït-Sahalia et al. [

23], that is,

represents the compound Poisson jump process, the jump intensity

follows the Poisson distribution with

and the jump amplitude

follows the normal distribution

Assuming that

one sample path of

in model (

7) generated by the Euler–Maruyama scheme is shown in

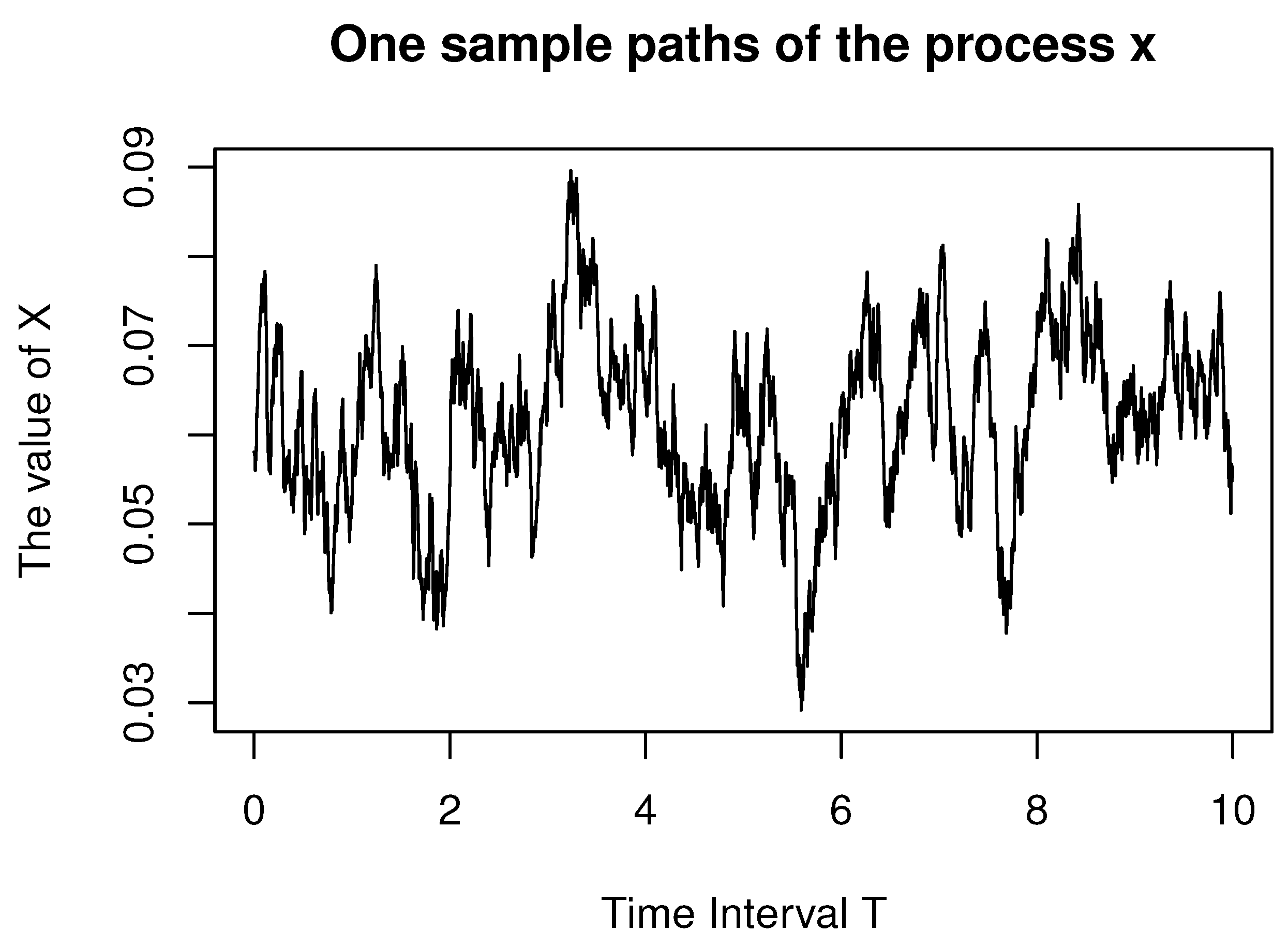

Figure 1. It can be seen that the sample track presents the large fluctuation characteristic, and there exists an obvious jump phenomenon.

Next, nonparametric Gaussian kernel estimation, Gaussian kernel threshold estimation and gamma kernel threshold estimation are used to estimate the unknown drift coefficient. Throughout this section, the Gaussian symmetric kernel function used here is

and the bandwidths of the Gaussian symmetric kernel estimator and gamma asymmetric kernel estimator are

and

, respectively, where

is the standard deviation of the sample data. The threshold function is

where

is the conditional standard deviation of sample difference sequences

based on the GARCH model.

Figure 2 depicts the true value of the drift function and the estimated values based on the three estimators. It can be found that the gamma kernel threshold estimator possesses the smaller estimation bias for the drift coefficient than the Gaussian kernel estimator and Gaussian kernel threshold estimator, showing the boundary correction effect and the bias reduction.

Furthermore, the overall finite-sample performance among nonparametric Gaussian kernel estimation, Gaussian kernel threshold estimation and gamma kernel threshold estimation for the unknown drift function is compared through the following three measures considered by Fan et al. [

24] under various jump intensities and jump amplitudes.

Measure 1: absolute mean error (AME):

Measure 2: root mean square error (RMSE):

Measure 3: relative ideal mean absolute deviation error (RIMADE):

where

is the nonparametric estimator of

are chosen uniformly to cover the range of the sample path of

and

N represents the number of observed values. The smaller the values of the above measures, the better the estimation results. The results are shown in

Table 1 and

Table 2. Compared with naive Gaussian kernel estimation, the biases of the non-parametric threshold estimation, such as Gaussian kernel threshold estimation and gamma kernel threshold estimation, are smaller, indicating that the threshold function can reduce the estimation bias by de-jumping. The bias of the gamma kernel threshold estimation is the smallest, which shows that the asymmetric kernel threshold method can reduce the overall estimation error. Additionally, it can be found in

Table 1 that the estimation biases of the three estimators increase with the jump intensity

which may be caused by the increasing number of jumps in time

Moreover, it is found in

Table 2 that with the increase in jump amplitude

the biases of the three estimators also increase, which is related to the larger jump amplitude.

In order to illustrate the normality of the gamma kernel threshold estimator, the QQ figures of the gamma kernel threshold estimators for the drift coefficient at 0.04, 0.06 and 0.08 are plotted. As shown in

Figure 3, it can be found that the gamma kernel threshold estimators of the drift coefficients at different points approximately follow the normal distribution, which indicates that the gamma kernel estimator has asymptotic normality.

4. Empirical Analysis

In this section, the nonparametric gamma kernel threshold estimator proposed in this paper is applied to the one-month term short rates of SHIBOR and LIBOR from January 2009 to December 2020, which contains 2996 data respectively. Note that the theoretical result in this paper is mainly based on the assumption that the data are Harris recurrent. In order to keep up with the theoretical assumptions, the data selection for the empirical analysis in this section is daily one-month term of SHIBOR and LIBOR data as only an example, which is nonstationary based on the Dickey–Fuller test. One can refer to the source of the data used here in the public domain:

https://www.shibor.org/shibor/dataservices/ (accessed on 1 January 2021). The data from January 2009 to December 2019 are selected as the training set, and three estimators, including traditional Gaussian kernel estimation, Gaussian kernel threshold estimation and gamma kernel threshold estimation, are used to estimate the drift coefficients of SHIBOR and LIBOR from January 2020 to December 2020. Note that since SHIBOR and LIBOR are the simple interests, they should be converted into continuous compound interests when conducting empirical analysis. Due to the fact that SHIBOR is quoted as a percentage of the annual rate (360 days a year), it is firstly necessary to convert SHIBOR into the form of an actual rate calculated over 365 days. The transformation form is defined as follows:

Then it needs to be transformed into a form of continuous compound interests, which is

where

m is the number of times compounded in a year, which is equal to 12,

R is the simple interest, and

is the compound interest. There exist jumps for these empirical data according to the LM test proposed by Lee and Mykland [

25], which indicates the effectiveness of the jump–diffusion model (

2) to describe the empirical data.

The nonparametric estimation curves for the drift function of SHIBOR and LIBOR based on the Gaussian kernel method, Gaussian kernel threshold method and gamma kernel threshold method are shown in

Figure 4. From the figure, it is seen that the estimation values of the Gaussian kernel threshold method and gamma kernel threshold method for the drift coefficients of SHIBOR and LIBOR data are relatively close, while the estimation values of the Gaussian kernel method are far from the two, which are greatly affected by the jumps. It indicates that the threshold function can effectively eliminate the influence of the jump.

In order to compare the finite-sample estimation performance of the three estimators, the measures AME, RMSE and RIMADE are calculated. Considering that the true drift coefficient of empirical data cannot be obtained similarly to those in the Monte Carlo simulation study, the numerical value calculated by

is used as the proxy of the true drift coefficient. The results are shown in

Table 3. It can be demonstrated from

Table 3 that for the SHIBOR and LIBOR data, the estimation bias of gamma kernel threshold method is the smallest, followed by Gaussian kernel threshold estimation, and the estimation bias of traditional Gaussian kernel estimation method is the largest, which indicates the effectiveness of the nonparametric estimator constructed with the gamma kernel threshold method proposed in this paper.

6. Discussion

Here, we address the potential criticisms of the proposed method and provide a discussion of the theoretical limitations of the method and a discussion of the practical implications of the findings.

Theoretically, only the pointwise convergence, such as the asymptotic normality of the estimators, is considered in this paper, which indicates that the results of the central limit theorem in this paper vary with position. Additionally, the theoretical results are only proved for the diffusion model with finite jumps, not including the infinite jumps.

Practically, the research method in this paper is only applicable to non-negative short-term interest rate data, and is not applicable to negative interest rate data. Moreover, the practical application of the research method still need to be further explored, which is currently only applied to the daily one-month term of SHIBOR and LIBOR data.

7. Conclusions and Extension

Gamma kernel estimation can effectively solve the boundary effect of Gaussian kernel estimation. Additionally, when there is a jump in the data, the Gaussian kernel estimation will possess a large deviation, and the threshold function can ensure the unbiasedness of nonparametric estimation. Hence, a modified nonparametric estimation for the drift function in the jump diffusion process of the interest rate is constructed by combining the asymmetric gamma kernel function and threshold function.

Theoretically, the central limit theorem of the underlying estimator is proved. Practically, the better finite sample performance of the gamma kernel threshold estimation is verified through Monte Carlo numerical simulation experiment and empirical analysis of the SHIBOR and LIBOR data (note that the findings mentioned for both SHIBOR and LIBOR are the same). By comparing the three estimations—Gaussian kernel estimation, Gaussian kernel threshold estimation and gamma kernel threshold estimation—it is shown that the gamma kernel threshold estimation has better robustness and smaller error, which effectively improves the Gaussian kernel estimator of Mancini and Renò [

15]. So, the gamma kernel threshold estimation proposed in this paper provides a more asymptotic unbiased estimator for the drift function in diffusion models with jumps, which has important theoretical and practical significance.

Only the pointwise convergence, such as the asymptotic normality of the estimators, is considered in this paper, which might be the limitation. In the future, we will study the uniform consistency result for the underlying estimator.