The Predictive Power of Social Media Sentiment: Evidence from Cryptocurrencies and Stock Markets Using NLP and Stochastic ANNs

Abstract

1. Introduction

2. Related Work

| An Annotated Bibliography on Stock Predictions Using Neural Networks and Data from Social Networks | |||

|---|---|---|---|

| Authors | Type of Prediction | Performance Measures | Sets of Data |

| Albariqi and Winarko (2020) [49] | 2-days to 60-days prices | Accuracy: 81.3%, precision: 81%, recall: 94.7% | 1300 observations (August 2010–October 2017) |

| Atsalakis, Atsalaki, Pasiouras and Zopounidis (2019) [50] | Price movements | RMSE: 0.376, MSE: 0.0014, MAE: 0.0307 | 2201 daily closing prices from September 2011 to October 2017 |

| Charandabi and Kamyar (2021), [30] | Actual price, short-term prediction | Accuracy: 50% | August 2015 to June 2019 |

| Charandabi and Kamyar (2021), [30] | Price movement | Accuracy: 58%–63% | 2 years observations |

| Derbentsev, Datsenko, Stepanenko and Bezkorovainyi (2019) [51] | 5 to 30 days price movement | RMSE: 0.04–0.08 | Daily closing prices from January 2017 to March 2019 |

| Hitam, Ismail and Saeed (2019) [52] | Cryptocurrency daily prices | Accuracy: 78.9% | OHLC (open/high/low/closing) daily prices from 2013 to 2018 |

| Khedr, Arif, El-Bannany, Alhashmi and Sreedharan (2021) [35] | Survey of previous contributions from 2010 to 2020 | — | — |

| Li and Dai (2021) [42] | 3 days ahead price prediction | Precision: 64%; Recall 81%; F1 69% | Bitcoin historical prices, macroeconomic indicators, and investor attention. Data from December 2016 to August 2018 |

| Mahboubeh and Heidari (2020) [53] | 5 days ahead forecasting | average MAPE: 1.14% | 5 days and 6 months historical series. |

| Madan, Saluja, Shaurya, Zhao (2015) [54] | Price movements | Accuracy: 98.7% for daily data; 8%to 50% for high frequency data (10 s and 10 min timeframes) | Daily prices and 26 additional features, gathered from Blockchain Info |

| Nayak (2022) [55] | Daily, weekly, monthly closing prices | MAPE: 0.031%; MSE: 0.01893; UT: 0.052; ARV 0.016, | Data from September 2014 to December 2020 |

| Pant, Neupane, Poudel, Pokhrel, and Lama (2018) [43] | Next day’s price | Accuracy for sentiment classification 81.39% and 77.62% for overall RNN | Data from January 2015 to December 2017 (2585 positive, 1669 negative and 3200 irrelevant tweets). |

| Poongodi, Vijayakumar and Chilamkurti (2020) [36] | Daily closing price | Accuracy: 49% | Hourly-based analysis from April 2013 to July 2017 |

| Pratama, Nugroho and Sukiyono (2020) [56] | Daily closing price | MSE: 1118.008; MAPE: 0.761%; MAD: 26.364 | Daily closing price, starting from April 2013 to February 2019 |

| Radityo, Munajat and Budi (2017) [57] | Next day closing price | MAPE: 1.883% for hybrid method between backpropagation and genetic (GABPNN) | BTC prices from October 2013 to April 2017 (1278 observations), OHLC prices and volumes |

| Serafini, Yi, Zhang, Brambilla, Wang, Hu and Li (2020) [38] | Next day weighted value | ARIMAX-MSE: 0.0003; RNN-MSE: 0.0014 | Data from April 2017 to October 2019, BTC volumes, weighted prices, sentiment and Tweets volumes. |

| Tandon, Revankar, Palivela and Parihar (2021) [58] | Next time step price | Accuracy: 96%; RMSE: 0.0395 | 1-min spaced BTC data from January 2012 to March 2021, OHLC prices, volumes, chosen currencies, weighted Bitcoin prices, Tweets by Elon Musk about cryptocurrencies from 2009 until 2021 |

| Valencia, Gómez-Espinosa and Valdés-Aguirre (2019) [37] | Daily price movements | precision: 76%; accuracy: 72% | 80-days data, hourly and daily granularity. The dataset contains OHLC prices, transaction volumes, and social data retrieved from Twitter |

| Zhang, Dai, Zhou, Mondal, Martínez García and Wang (2021) [59] | Daily closing price, price movements | RMSE: 0.097; 95.2% on ETH | Daily closing prices from July 2017 to July 2020 |

3. Data and Methodology

3.1. Data Retrieval, Sentiment Analysis, and Financial Stock Trends

3.2. BERT and roBERTa Models

3.3. Neural Networks

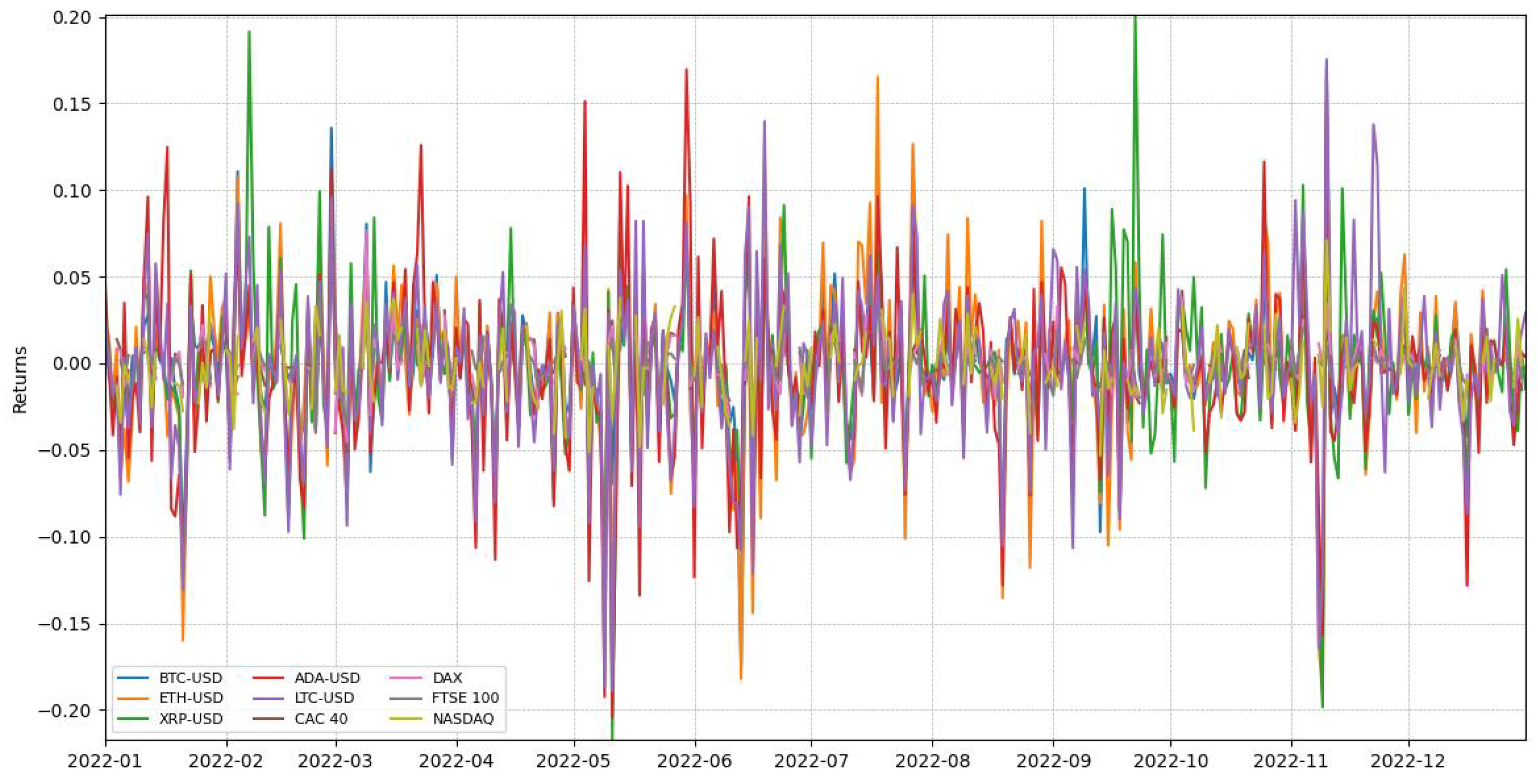

3.4. Data

3.5. Data Preprocessing

- Removal and replacement: remove the input features including more than of missing or anomalous values, such as not available (N/A) data due to delisting or other corporate operations; then, replace missing values, if any, with a rule of thumb, such as the average value of the variable over time or by propagating the last available observation forward to the next available;

- Normalization: the normalization step is necessary, especially for neural networks, to facilitate the convergence of the training algorithm towards a global optimum and thereby obtain stable parameters for the model. Hence, let be the value before normalization of a generic input feature at time t, and let be its normalized value. The relationship between the two can be stated as follows:where , such that the condition is satisfied. For problems in which the features might potentially contain negative values, ref. [77] proposed a different formulation:

3.6. Training and Test Set

4. Results

4.1. Results with Historical Stock Market Data

4.2. Results with Stocks and Twitter Historical Data

- Learning rate: ;

- Learning algorithm: Adam;

- Batch Size: 128;

- Hidden Layer 1 Node Size: ;

- Hidden Layer 2 Node Size: ;

- Dropout: ;

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Nakamoto, S. Bitcoin: A peer-to-peer electronic cash system. Decentralized Bus. Rev. 2008. [Google Scholar]

- Lyócsa, Š.; Molnár, P.; Plíhal, T.; Širaňová, M. Impact of macroeconomic news, regulation and hacking exchange markets on the volatility of bitcoin. J. Econ. Dyn. Control 2020, 119, 103980. [Google Scholar] [CrossRef]

- Jalal, R.N.U.D.; Alon, I.; Paltrinieri, A. A bibliometric review of cryptocurrencies as a financial asset. Technol. Anal. Strateg. Manag. 2021, 1–16. [Google Scholar] [CrossRef]

- Nghiem, H.; Muric, G.; Morstatter, F.; Ferrara, E. Detecting cryptocurrency pump-and-dump frauds using market and social signals. Expert Syst. Appl. 2021, 182, 115284. [Google Scholar] [CrossRef]

- Hamrick, J.; Rouhi, F.; Mukherjee, A.; Feder, A.; Gandal, N.; Moore, T.; Vasek, M. An examination of the cryptocurrency pump-and-dump ecosystem. Inf. Process. Manag. 2021, 58, 102506. [Google Scholar] [CrossRef]

- Li, S.; Huang, Y. Do cryptocurrencies increase the systemic risk of the global financial market? China World Econ. 2020, 28, 122–143. [Google Scholar] [CrossRef]

- Bouri, E.; Molnár, P.; Azzi, G.; Roubaud, D.; Hagfors, L.I. On the hedge and safe haven properties of Bitcoin: Is it really more than a diversifier? Financ. Res. Lett. 2017, 20, 192–198. [Google Scholar] [CrossRef]

- Shahzad, S.J.H.; Bouri, E.; Roubaud, D.; Kristoufek, L.; Lucey, B. Is Bitcoin a better safe-haven investment than gold and commodities? Int. Rev. Financ. Anal. 2019, 63, 322–330. [Google Scholar] [CrossRef]

- Corbet, S.; Meegan, A.; Larkin, C.; Lucey, B.; Yarovaya, L. Exploring the dynamic relationships between cryptocurrencies and other financial assets. Econ. Lett. 2018, 165, 28–34. [Google Scholar] [CrossRef]

- Huang, Y.; Duan, K.; Mishra, T. Is Bitcoin really more than a diversifier? A pre-and post-COVID-19 analysis. Financ. Res. Lett. 2021, 43, 102016. [Google Scholar] [CrossRef]

- Bouri, E.; Jalkh, N.; Molnár, P.; Roubaud, D. Bitcoin for energy commodities before and after the December 2013 crash: Diversifier, hedge or safe haven? Appl. Econ. 2017, 49, 5063–5073. [Google Scholar] [CrossRef]

- Baur, D.G.; Lucey, B.M. Is gold a hedge or a safe haven? An analysis of stocks, bonds and gold. Financ. Rev. 2010, 45, 217–229. [Google Scholar] [CrossRef]

- Cheah, E.T.; Fry, J. Speculative bubbles in Bitcoin markets? An empirical investigation into the fundamental value of Bitcoin. Econ. Lett. 2015, 130, 32–36. [Google Scholar] [CrossRef]

- Baur, D.G.; Dimpfl, T. Asymmetric volatility in cryptocurrencies. Econ. Lett. 2018, 173, 148–151. [Google Scholar] [CrossRef]

- Baur, D.G.; Hong, K.; Lee, A.D. Bitcoin: Medium of exchange or speculative assets? J. Int. Financ. Mark. Institutions Money 2018, 54, 177–189. [Google Scholar] [CrossRef]

- Lee, D.K.C.; Guo, L.; Wang, Y. Cryptocurrency: A new investment opportunity? J. Altern. Investments 2017, 20, 16–40. [Google Scholar]

- Morillon, T.G.; Chacon, R.G. Dissecting the stock to flow model for Bitcoin. Stud. Econ. Financ. 2022, 39, 506–523. [Google Scholar] [CrossRef]

- Yiying, W.; Yeze, Z. Cryptocurrency Price Analysis with Artificial Intelligence. In Proceedings of the 2019 5th International Conference on Information Management (ICIM), Cambridge, UK, 24–27 March 2019; pp. 97–101. [Google Scholar]

- Jay, P.; Kalariya, V.; Parmar, P.; Tanwar, S.; Kumar, N.; Alazab, M. Stochastic Neural Networks for Cryptocurrency Price Prediction. IEEE Access 2020, 8, 82804–82818. [Google Scholar] [CrossRef]

- Abraham, J.; Higdon, D.; Nelson, J.; Ibarra, J. Cryptocurrency price prediction using tweet volumes and sentiment analysis. SMU Data Sci. Rev. 2018, 1, 1. [Google Scholar]

- Lamon, C.; Nielsen, E.; Redondo, E. Cryptocurrency Price Prediction Using News and Social Media Sentiment. SMU Data Sci. Rev. 2017, 1, 1–22. [Google Scholar]

- Phillips, R.C.; Gorse, D. Predicting cryptocurrency price bubbles using social media data and epidemic modelling. In Proceedings of the 2017 IEEE Symposium Series on Computational Intelligence (SSCI), Honolulu, HI, USA, 27 November–1 December 2017; pp. 1–7. [Google Scholar] [CrossRef]

- Khuntia, S.; Pattanayak, J. Adaptive market hypothesis and evolving predictability of bitcoin. Econ. Lett. 2018, 167, 26–28. [Google Scholar] [CrossRef]

- Bouri, E.; Lau, C.K.M.; Lucey, B.; Roubaud, D. Trading volume and the predictability of return and volatility in the cryptocurrency market. Financ. Res. Lett. 2019, 29, 340–346. [Google Scholar] [CrossRef]

- Eom, C.; Kaizoji, T.; Kang, S.H.; Pichl, L. Bitcoin and investor sentiment: Statistical characteristics and predictability. Phys. A Stat. Mech. Its Appl. 2019, 514, 511–521. [Google Scholar] [CrossRef]

- Guégan, D.; Renault, T. Does investor sentiment on social media provide robust information for Bitcoin returns predictability? Financ. Res. Lett. 2021, 38, 101494. [Google Scholar] [CrossRef]

- Cheah, J.E.T.; Luo, D.; Zhang, Z.; Sung, M.C. Predictability of bitcoin returns. Eur. J. Financ. 2022, 28, 66–85. [Google Scholar] [CrossRef]

- Wen, Z.; Bouri, E.; Xu, Y.; Zhao, Y. Intraday return predictability in the cryptocurrency markets: Momentum, reversal, or both. N. Am. J. Econ. Financ. 2022, 62, 101733. [Google Scholar] [CrossRef]

- Gu, S.; Kelly, B.; Xiu, D. Empirical asset pricing via machine learning. Rev. Financ. Stud. 2020, 33, 2223–2273. [Google Scholar] [CrossRef]

- Charandabi, S.E.; Kamyar, K. Prediction of Cryptocurrency Price Index Using Artificial Neural Networks: A Survey of the Literature. Eur. J. Bus. Manag. Res. 2021, 6, 17–20. [Google Scholar] [CrossRef]

- Cybenko, G. Approximation by superpositions of a sigmoidal function. Math. Control. Signals Syst. 1989, 2, 303–314. [Google Scholar] [CrossRef]

- Devlin, J.; Chang, M.W.; Lee, K.; Toutanova, K. BERT: Pre-training of Deep Bidirectional Transformers for Language Understanding. arXiv 2019, arXiv:1810.04805. [Google Scholar]

- Nannen, V.; Eiben, A.E. Efficient relevance estimation and value calibration of evolutionary algorithm parameters. In Proceedings of the 2007 IEEE Congress on Evolutionary Computation, Singapore, 25–28 September 2007; pp. 103–110. [Google Scholar]

- Montero, E.; Riff, M.C.; Neveu, B. A beginner’s guide to tuning methods. Appl. Soft Comput. 2014, 17, 39–51. [Google Scholar] [CrossRef]

- Khedr, A.M.; Arif, I.; El-Bannany, M.; Alhashmi, S.M.; Sreedharan, M. Cryptocurrency price prediction using traditional statistical and machine-learning techniques: A survey. Intell. Syst. Account. Financ. Manag. 2021, 28, 3–34. [Google Scholar] [CrossRef]

- Poongodi, M.; Vijayakumar, V.; Chilamkurti, N. Bitcoin price prediction using ARIMA model. Int. J. Internet Technol. Secur. Trans. 2020, 10, 396–406. [Google Scholar] [CrossRef]

- Valencia, F.; Gómez-Espinosa, A.; Valdés-Aguirre, B. Price Movement Prediction of Cryptocurrencies Using Sentiment Analysis and Machine Learning. Entropy 2019, 21, 589. [Google Scholar] [CrossRef] [PubMed]

- Serafini, G.; Yi, P.; Zhang, Q.; Brambilla, M.; Wang, J.; Hu, Y.; Li, B. Sentiment-Driven Price Prediction of the Bitcoin based on Statistical and Deep Learning Approaches. In Proceedings of the 2020 International Joint Conference on Neural Networks (IJCNN), Glasgow, UK, 19–24 July 2020; pp. 1–8. [Google Scholar] [CrossRef]

- Murray, K.; Rossi, A.; Carraro, D.; Visentin, A. On Forecasting Cryptocurrency Prices: A Comparison of Machine Learning, Deep Learning, and Ensembles. Forecasting 2023, 5, 196–209. [Google Scholar] [CrossRef]

- Patel, M.M.; Tanwar, S.; Gupta, R.; Kumar, N. A deep learning-based cryptocurrency price prediction scheme for financial institutions. J. Inf. Secur. Appl. 2020, 55, 102583. [Google Scholar] [CrossRef]

- Fischer, T.; Krauss, C. Deep learning with long short-term memory networks for financial market predictions. Eur. J. Oper. Res. 2018, 270, 654–669. [Google Scholar] [CrossRef]

- Li, Y.; Dai, W. Bitcoin price forecasting method based on CNN-LSTM hybrid neural network model. J. Eng. 2020, 2020, 344–347. [Google Scholar] [CrossRef]

- Pant, D.R.; Neupane, P.; Poudel, A.; Pokhrel, A.K.; Lama, B.K. Recurrent Neural Network Based Bitcoin Price Prediction by Twitter Sentiment Analysis. In Proceedings of the 2018 IEEE 3rd International Conference on Computing, Communication and Security (ICCCS), Kathmandu, Nepal, 25–27 October 2018; pp. 128–132. [Google Scholar] [CrossRef]

- Wołk, K. Advanced social media sentiment analysis for short-term cryptocurrency price prediction. Expert Syst. 2020, 37, e12493. [Google Scholar] [CrossRef]

- Parekh, R.; Patel, N.P.; Thakkar, N.; Gupta, R.; Tanwar, S.; Sharma, G.; Davidson, I.E.; Sharma, R. DL-GuesS: Deep learning and sentiment analysis-based cryptocurrency price prediction. IEEE Access 2022, 10, 35398–35409. [Google Scholar] [CrossRef]

- Inamdar, A.; Bhagtani, A.; Bhatt, S.; Shetty, P.M. Predicting cryptocurrency value using sentiment analysis. In Proceedings of the 2019 International Conference on Intelligent Computing and Control Systems (ICCS), Madurai, India, 15–17 May 2019; pp. 932–934. [Google Scholar]

- Li, T.R.; Chamrajnagar, A.S.; Fong, X.R.; Rizik, N.R.; Fu, F. Sentiment-based prediction of alternative cryptocurrency price fluctuations using gradient boosting tree model. Front. Phys. 2019, 7, 98. [Google Scholar] [CrossRef]

- Linardatos, P.; Kotsiantis, S. Bitcoin price prediction combining data and text mining. In Advances in Integrations of Intelligent Methods; Springer: Singapore, 2020; pp. 49–63. [Google Scholar]

- Albariqi, R.; Winarko, E. Prediction of Bitcoin Price Change using Neural Networks. In Proceedings of the 2020 International Conference on Smart Technology and Applications (ICoSTA), Surabaya, Indonesia, 20–20 February 2020; pp. 1–4. [Google Scholar] [CrossRef]

- Atsalakis, G.S.; Atsalaki, I.G.; Pasiouras, F.; Zopounidis, C. Bitcoin price forecasting with neuro-fuzzy techniques. Eur. J. Oper. Res. 2019, 276, 770–780. [Google Scholar] [CrossRef]

- Derbentsev, V.; Datsenko, N.; Stepanenko, O.; Bezkorovainyi, V. Forecasting cryptocurrency prices time series using machine learning approach. SHS Web Conf. 2019, 65, 02001. [Google Scholar] [CrossRef]

- Hitam, N.A.; Ismail, A.R.; Saeed, F. An Optimized Support Vector Machine (SVM) based on Particle Swarm Optimization (PSO) for Cryptocurrency Forecasting. Procedia Comput. Sci. 2019, 163, 427–433. [Google Scholar] [CrossRef]

- Faghih Mohammadi Jalali, M.; Heidari, H. Predicting changes in Bitcoin price using grey system theory. Financ. Innov. 2020, 6, 13. [Google Scholar] [CrossRef]

- Madan, I.; Saluja, S.; Zhao, A. Automated Bitcoin Trading via Machine Learning Algorithms. 2015, Volume 20. Available online: http://cs229.stanford.edu/proj2014/Isaac%20Madan (accessed on 29 July 2023).

- Nayak, S.C. Bitcoin closing price movement prediction with optimal functional link neural networks. Evol. Intell. 2022, 15, 1825–1839. [Google Scholar] [CrossRef]

- Pratama, A.R.; Nugroho, S.; Sukiyono, K. Cryptocurrency Forecasting using α-Sutte Indicator, ARIMA, and Long Short-Term Memory. In Proceedings of the 1st International Conference on Statistics and Analytics, Bogor, Indonesia, 2–3 August 2019. [Google Scholar]

- Radityo, A.; Munajat, Q.; Budi, I. Prediction of Bitcoin exchange rate to American dollar using artificial neural network methods. In Proceedings of the 2017 International Conference on Advanced Computer Science and Information Systems (ICACSIS), Bali, Indonesia, 28–29 October 2017; pp. 433–438. [Google Scholar] [CrossRef]

- Tandon, C.; Revankar, S.; Palivela, H.; Parihar, S.S. How can we predict the impact of the social media messages on the value of cryptocurrency? Insights from big data analytics. Int. J. Inf. Manag. Data Insights 2021, 1, 100035. [Google Scholar] [CrossRef]

- Zhang, Z.; Dai, H.N.; Zhou, J.; Mondal, S.K.; García, M.M.; Wang, H. Forecasting cryptocurrency price using convolutional neural networks with weighted and attentive memory channels. Expert Syst. Appl. 2021, 183, 115378. [Google Scholar] [CrossRef]

- Bathina, K.; ten Thij, M.; Bollen, J. Quantifying societal emotional resilience to natural disasters from geo-located social media content. PLoS ONE 2022, 6, 0269315. [Google Scholar] [CrossRef]

- Jang, S.M.; Hart, P.S. Polarized frames on “climate change” and “global warming” across countries and states: Evidence from Twitter big data. Glob. Environ. Chang. 2015, 32, 11–17. [Google Scholar] [CrossRef]

- Yu, Y.; Wang, X. World Cup 2014 in the Twitter World: A big data analysis of sentiments in US sports fans’ tweets. Comput. Hum. Behav. 2015, 48, 392–400. [Google Scholar] [CrossRef]

- Öztürk, N.; Ayvaz, S. Sentiment analysis on Twitter: A text mining approach to the Syrian refugee crisis. Telemat. Inform. 2018, 35, 136–147. [Google Scholar] [CrossRef]

- Mellado, C.; Hallin, D.; Cárcamo, L.; Alfaro, R.; Jackson, D.; Humanes, M.L.; Márquez-Ramírez, M.; Mick, J.; Mothes, C.; I-Hsuan LIN, C.; et al. Sourcing pandemic news: A cross-national computational analysis of mainstream media coverage of COVID-19 on Facebook, Twitter, and Instagram. Digit. J. 2021, 9, 1261–1285. [Google Scholar] [CrossRef]

- Basari, A.S.H.; Hussin, B.; Ananta, I.G.P.; Zeniarja, J. Opinion Mining of Movie Review using Hybrid Method of Support Vector Machine and Particle Swarm Optimization. Procedia Eng. 2013, 53, 453–462. [Google Scholar] [CrossRef]

- Tripathy, A.; Agrawal, A.; Rath, S.K. Classification of sentiment reviews using n-gram machine learning approach. Expert Syst. Appl. 2016, 57, 117–126. [Google Scholar] [CrossRef]

- Ibrahim, A.F.; Hassaballah, M.; Ali, A.A.; Nam, Y.; Ibrahim, I.A. COVID19 Outbreak: A Hierarchical Framework for User Sentiment Analysis. Comput. Mater. Contin. 2022, 70, 2507–2524. [Google Scholar] [CrossRef]

- Rehman, A.U.; Malik, A.K.; Raza, B.; Ali, W. A Hybrid CNN-LSTM Model for Improving Accuracy of Movie Reviews Sentiment Analysis. Multimed. Tools Appl. 2019, 78, 26597–26613. [Google Scholar] [CrossRef]

- Dashtipour, K.; Gogate, M.; Adeel, A.; Larijani, H.; Hussain, A. Sentiment Analysis of Persian Movie Reviews Using Deep Learning. Entropy 2021, 23, 596. [Google Scholar] [CrossRef]

- Dang, C.N.; Moreno-García, M.N.; De la Prieta, F. Using Hybrid Deep Learning Models of Sentiment Analysis and Item Genres in Recommender Systems for Streaming Services. Electronics 2021, 10, 2459. [Google Scholar] [CrossRef]

- Jaidka, K.; Ahmed, S.; Skoric, M.; Hilbert, M. Predicting elections from social media: A three-country, three-method comparative study. Asian J. Commun. 2019, 29, 252–273. [Google Scholar] [CrossRef]

- Radford, A.; Narasimhan, K.; Salimans, T.; Sutskever, I. Improving Language Understanding with Unsupervised Learning; Technical Report; OpenAI, 2018. [Google Scholar]

- Howard, J.; Ruder, S. Universal Language Model Fine-tuning for Text Classification. arXiv 2018, arXiv:1801.06146. [Google Scholar]

- Liu, Y.; Ott, M.; Goyal, N.; Du, J.; Joshi, M.; Chen, D.; Levy, O.; Lewis, M.; Zettlemoyer, L.; Stoyanov, V. RoBERTa: A Robustly Optimized BERT Pretraining Approach. arXiv 2019, arXiv:1907.11692. [Google Scholar]

- Hoseinzade, E.; Haratizadeh, S. CNNpred: CNN-based stock market prediction using a diverse set of variables. Expert Syst. Appl. 2019, 129, 273–285. [Google Scholar] [CrossRef]

- Coqueret, G.; Guida, T. Machine Learning for Factor Investing: R Version; CRC Press: Boca Raton, FL, USA, 2020. [Google Scholar]

- Angelini, E.; Di Tollo, G.; Roli, A. A neural network approach for credit risk evaluation. Q. Rev. Econ. Financ. 2008, 48, 733–755. [Google Scholar] [CrossRef]

- Di Tollo, G.; Tanev, S.; Ma, Z. Neural networks to model the innovativeness perception of co-creative firms. Expert Syst. Appl. 2012, 39, 12719–12726. [Google Scholar] [CrossRef]

- di Tollo, G.; Tanev, S.; Liotta, G.; De March, D. Using online textual data, principal component analysis and artificial neural networks to study business and innovation practices in technology-driven firms. Comput. Ind. 2015, 74, 16–28. [Google Scholar] [CrossRef]

- Gilli, M.; Këllezi, E. A global optimization heuristic for portfolio choice with VaR and expected shortfall. In Computational Methods in Decision-Making, Economics and Finance; Springer: Boston, MA, USA, 2002; pp. 167–183. [Google Scholar]

- Dimpfl, T.; Peter, F.J. Nothing but noise? Price discovery across cryptocurrency exchanges. J. Financ. Mark. 2021, 54, 100584. [Google Scholar] [CrossRef]

- Diebold, F.X.; Mariano, R.S. Com paring predictive accu racy. J. Bus. Econ. Stat. 1995, 13, 253–263. [Google Scholar]

- Pesaran, M.H.; Timmermann, A. A simple nonparametric test of predictive performance. J. Bus. Econ. Stat. 1992, 10, 461–465. [Google Scholar]

- Andria, J.; di Tollo, G.; Pesenti, R. Fuzzy multi-criteria decision-making: An entropy-based approach to assess tourism sustainability. Tour. Econ. 2021, 27, 168–186. [Google Scholar] [CrossRef]

- di Tollo, G.; Stützle, T.; Birattari, M. A metaheuristic multi-criteria optimisation approach to portfolio selection. J. Appl. Oper. Res. 2014, 6, 222–242. [Google Scholar]

| Accuracy of Prediction | ||||||

|---|---|---|---|---|---|---|

| Index | CAC40 | DAX | FTSE 100 | Nasdaq | Nikkei | Crypto |

| 1 January 2006–1 January 2007 | Min 0.6888; Max 0.9629; Mean 0.8295; Md 0.826; Std 0.0595 | Min 0.7608; Max 0.9565; Mean 0.8440; Md 0.8478; Std 0.0512 | Min 0.6592; Max 0.9295; Mean 0.8298; Md 0.8444; Std 0.0571 | Min 0.6888; Max 0.9333; Mean 0.8130; Md 0.8222; Std 0.0584 | Min 0.5832; Max 0.9125; Mean 0.8020; Md 0.8538; Std 0.1942 | N/A |

| 1 January 2009–1 January 2010 | Min 0.6304; Max 0.9347; Mean 0.8135; Md 0.8222; Std 0.0651 | Min 0.7555; Max 0.9777; Mean 0.8444; Md 0.8444; Std 0.0485 | Min 0.6666; Max 0.9333; Mean 0.8153; Md 0.8; Std 0.0669 | Min 0.6666; Max 0.9555; Mean 0.8227; Md 0.8222; Std 0.0693 | Min 0.6172; Max 0.8931; Mean 0.8305; Md 0.8231; Std 0.1874 | N/A |

| Accuracy of Prediction (Historical + roBERTa) | ||||||

|---|---|---|---|---|---|---|

| Index | CAC40 | DAX | FTSE 100 | Nasdaq | Nikkei | Crypto |

| 1 January 2022–1 January 2023 | Min 0.6895; Max 0.9333; Mean 0.8594; Md 0.8222; Std 0.0543 | Min 0.5914; Max 0.9749; Mean 0.8688; Md 0.8222; Std 0.0814 | Min 0.6818; Max 0.9845; Mean 0.8329; Md 0.8181; Std 0.0596 | Min 0.7538; Max 0.9755; Mean 0.8269; Md 0.8222; Std 0.0561 | Min 0.7193; Max 0.9830; Mean 0.8512; Md 0.8411; Std 0.1142 | Min 0.6919; Max 0.9902; Mean 0.8748; Md 0.8358; Std 0.0901 |

| Accuracy of prediction (Historical only) | ||||||

| Index | CAC40 | DAX | FTSE 100 | Nasdaq | Nikkei | Crypto |

| 1 January 2022–1 January 2023 | Min 0.6729; Max 0.9281; Mean 0.8601; Md 0.8521; Std 0.0371 | Min 0.4810; Max 0.9813; Mean 0.8891; Md 0.8061; Std 0.0946 | Min 0.6740; Max 0.9799; Mean 0.8254; Md 0.8265; Std 0.0691 | Min 0.6901; Max 0.9691; Mean 0.8311; Md 0.8319; Std 0.0496 | Min 0.6410; Max 0.9577; Mean 0.8619; Md 0.8781; Std 0.1529 | Min 0.7003; Max 0.9893; Mean 0.8634; Md 0.8427; Std 0.103 |

| Accuracy of Prediction (Historical + roBERTa) | ||||||

|---|---|---|---|---|---|---|

| Index | CAC40 | DAX | FTSE 100 | Nasdaq | Nikkei | Crypto |

| 1 January 2022–1 January 2023 | Min 0.4910; Max 0.7513; Mean 0.6812; Md 0.7219; Std 0.1281 | Min 0.6518; Max 0.9821; Mean 0.7192; Md 0.7391; Std 0.1828 | Min 0.6035; Max 0.9719; Mean 0.7911; Md 0.7501; Std 0.1288 | Min 0.7813; Max 0.8251; Mean 0.7913; Md 0.9691; Std 0.1932 | Min 0.7321; Max 0.9041; Mean 0.8126; Md 0.8520; Std 0.1315 | Min 0.4710; Max 0.9271; Mean 0.8102; Md 0.8261; Std 0.1527 |

| Accuracy of prediction (Historical only) | ||||||

| Index | CAC40 | DAX | FTSE 100 | NASDAQ | NIKKEI | Crypto |

| 1 January 2022–1 January 2023 | Min 0.4152; Max 0.8517; Mean 0.7201; Md 0.7001; Std 0.2613 | Min 0.6315; Max 0.7814; Mean 0.5813; Md 0.5728; Std 0.2104 | Min 0.5744; Max 0.8939; Mean 0.6041; Md 0.6521; Std 0.2115 | Min 0.7001; Max 0.9153; Mean 0.8411; Md 0.8355; Std 0.1643 | Min 0.4931; Max 0.7512; Mean 0.6915; Md 0.7115; Std 0.3204 | Min 0.5192; Max 0.8925; Mean 0.8255; Md 0.8192; Std 0.2514 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

di Tollo, G.; Andria, J.; Filograsso, G. The Predictive Power of Social Media Sentiment: Evidence from Cryptocurrencies and Stock Markets Using NLP and Stochastic ANNs. Mathematics 2023, 11, 3441. https://doi.org/10.3390/math11163441

di Tollo G, Andria J, Filograsso G. The Predictive Power of Social Media Sentiment: Evidence from Cryptocurrencies and Stock Markets Using NLP and Stochastic ANNs. Mathematics. 2023; 11(16):3441. https://doi.org/10.3390/math11163441

Chicago/Turabian Styledi Tollo, Giacomo, Joseph Andria, and Gianni Filograsso. 2023. "The Predictive Power of Social Media Sentiment: Evidence from Cryptocurrencies and Stock Markets Using NLP and Stochastic ANNs" Mathematics 11, no. 16: 3441. https://doi.org/10.3390/math11163441

APA Styledi Tollo, G., Andria, J., & Filograsso, G. (2023). The Predictive Power of Social Media Sentiment: Evidence from Cryptocurrencies and Stock Markets Using NLP and Stochastic ANNs. Mathematics, 11(16), 3441. https://doi.org/10.3390/math11163441