Does a New Electric Vehicle Manufacturer Have the Incentive for Battery Life Investment? A Study Based on the Game Framework

Abstract

:1. Introduction

- An investigation of the optimal strategies for battery life investments among electric vehicle manufacturers.

- An analysis of the impact of battery investment coefficients on electric vehicle manufacturers.

- A study and analysis of static and dynamic game behaviours.

- The study and control of the chaotic phenomenon in the dynamic game process.

2. Literature Review

2.1. Investment in Battery Life

2.2. Duopoly Game and Complexity

3. The Model

3.1. Notation and Model Construction

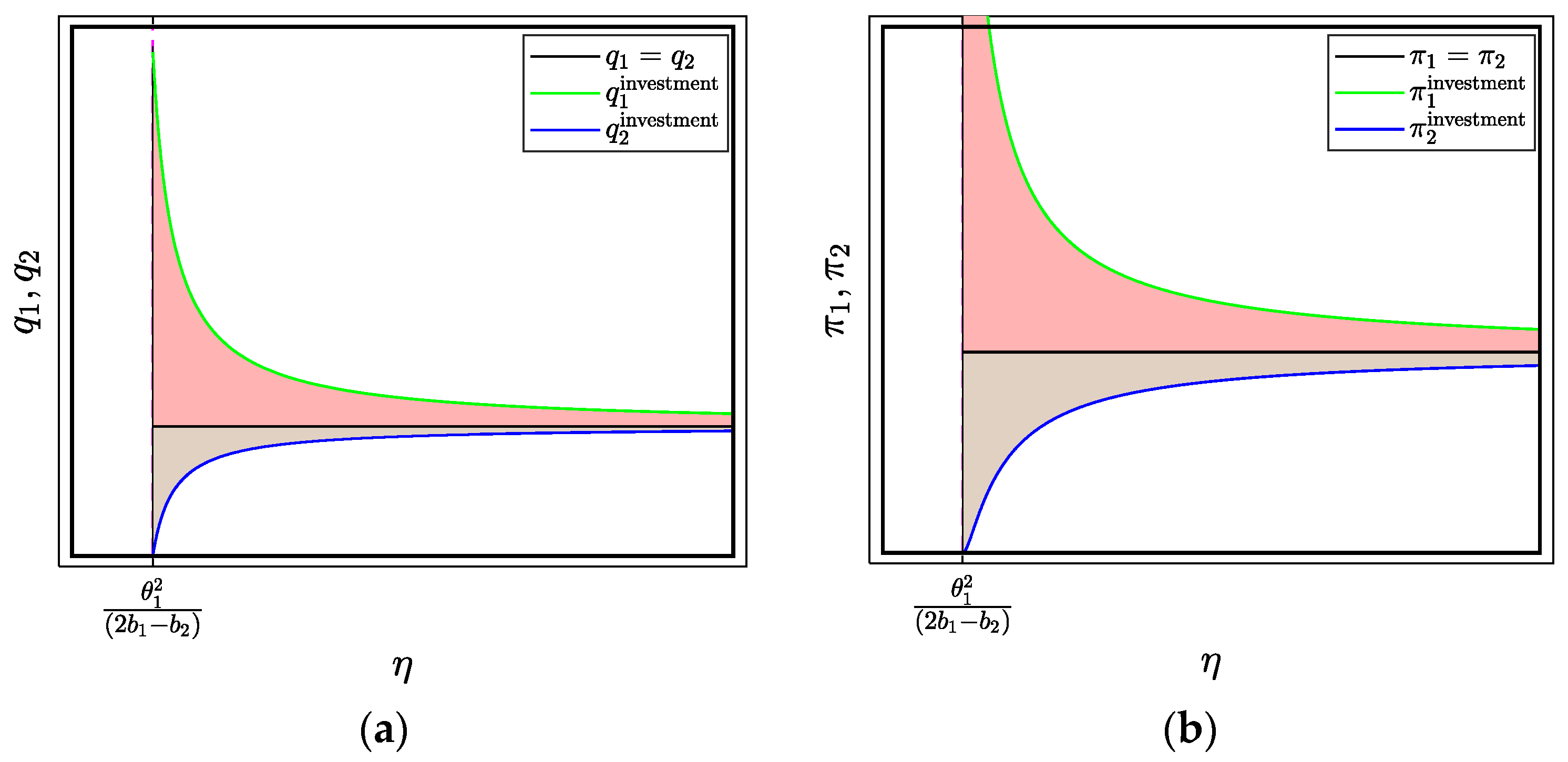

3.2. One Manufacturer Invests in Battery Life

- (1)

- With , we haveor , as is greater than zero, so we have .

- (2)

- Based on (1), we know that is greater than zero, so is greater than zero too, and greater than zero as well.

- (3)

- With we haveor , as we know that , so we only need to find is positive, so we can obtain , as , and so we finally have .

4. Dynamic Game Model Analysis

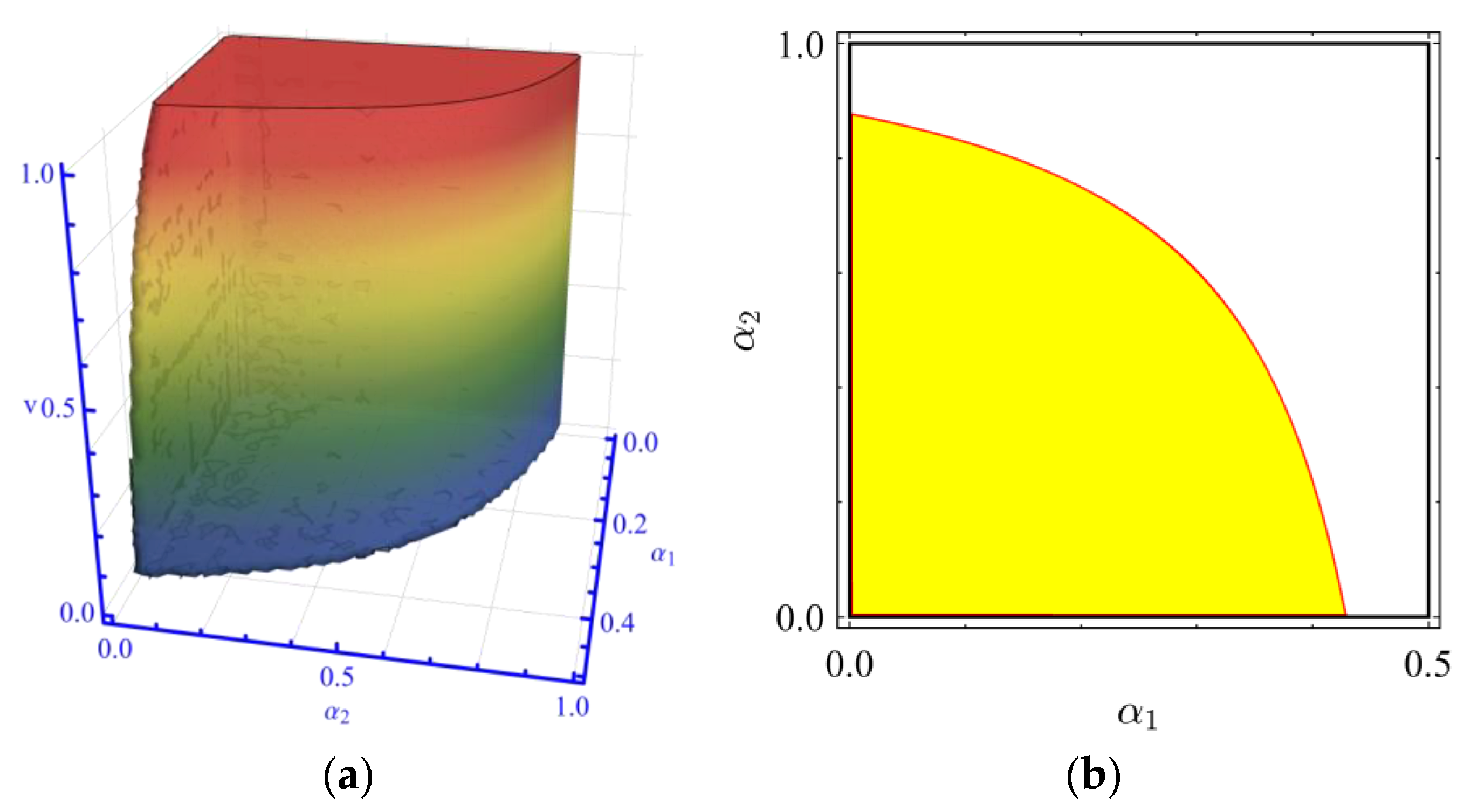

4.1. Equilibrium Points and Local Stability Analysis

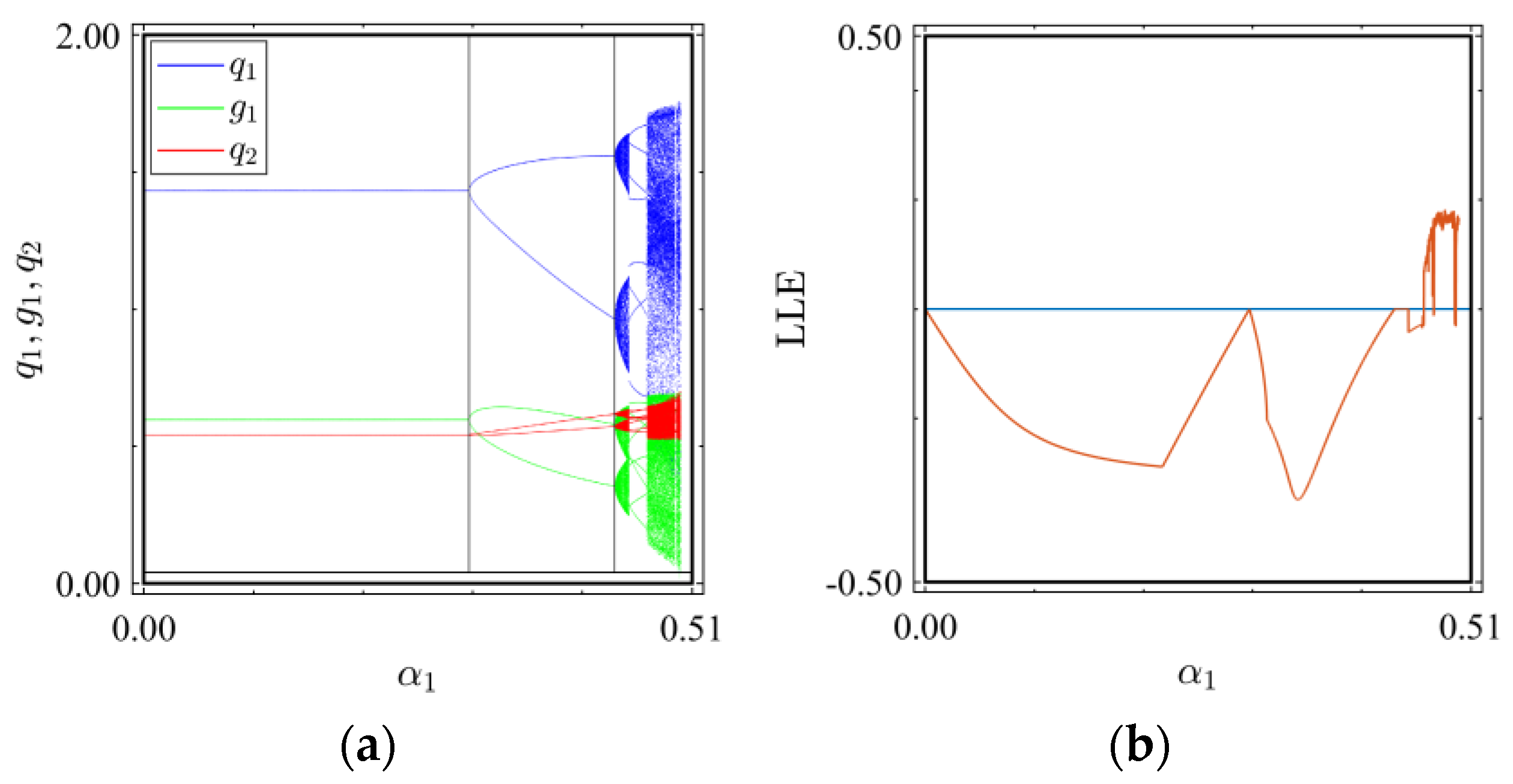

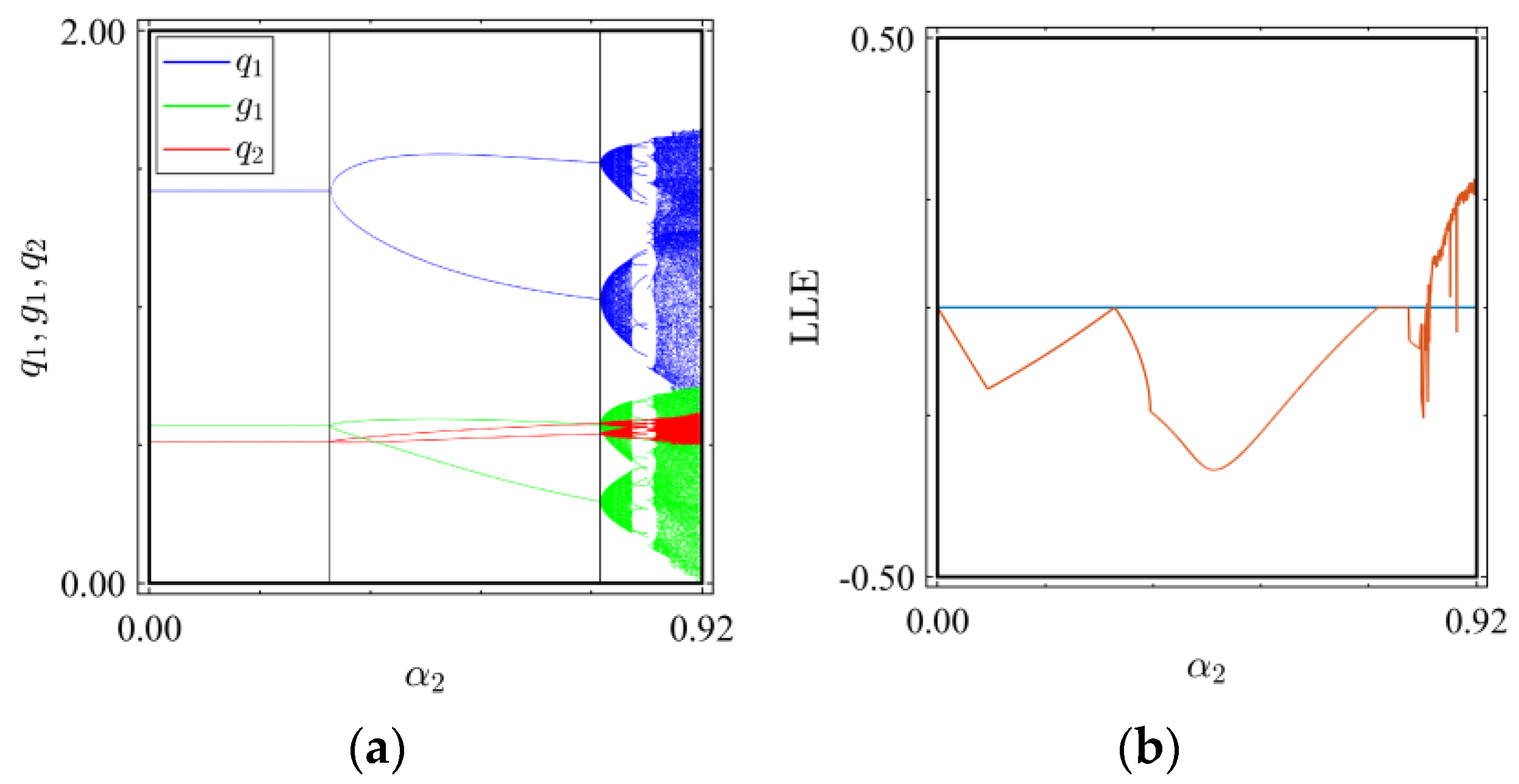

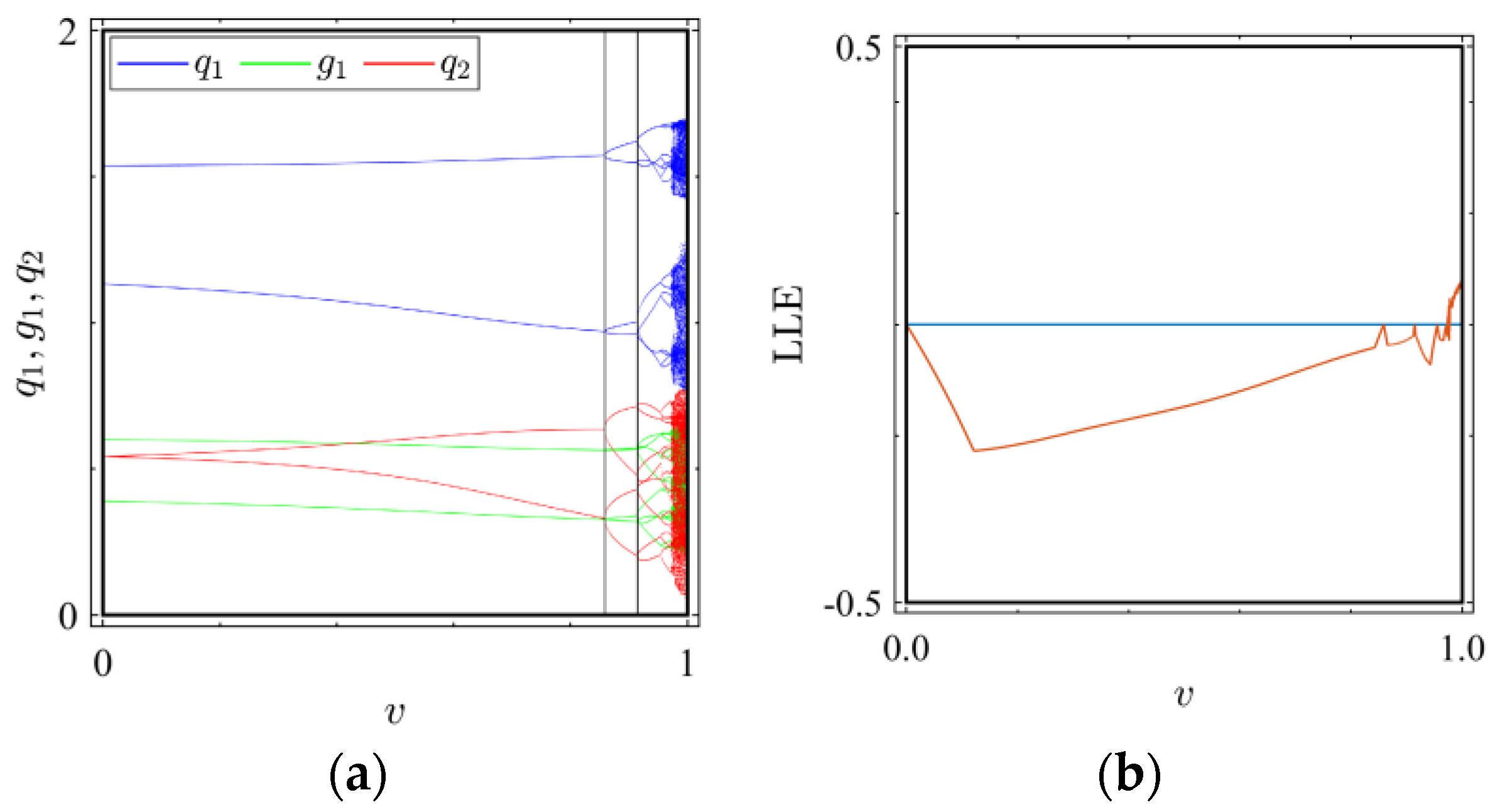

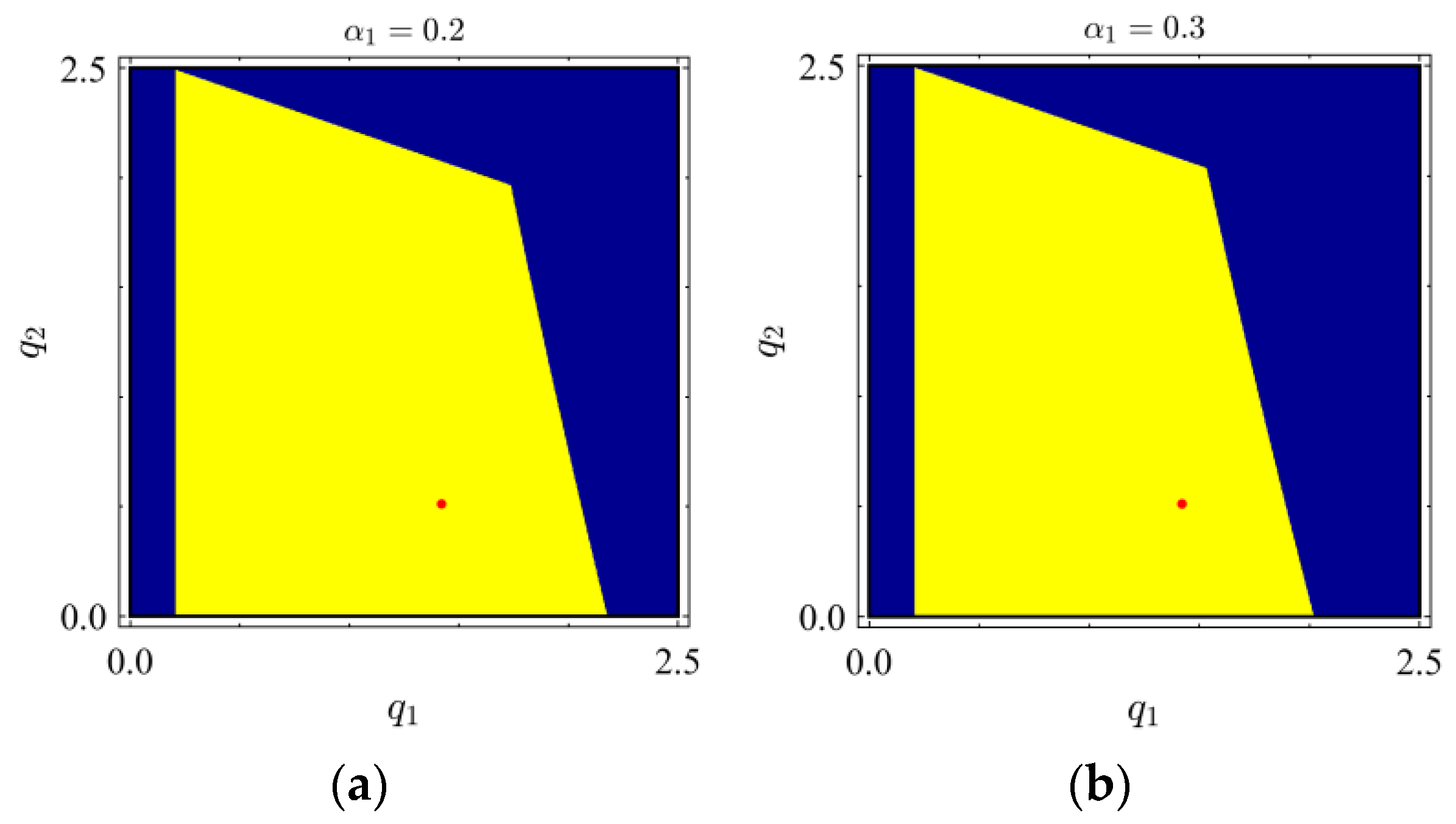

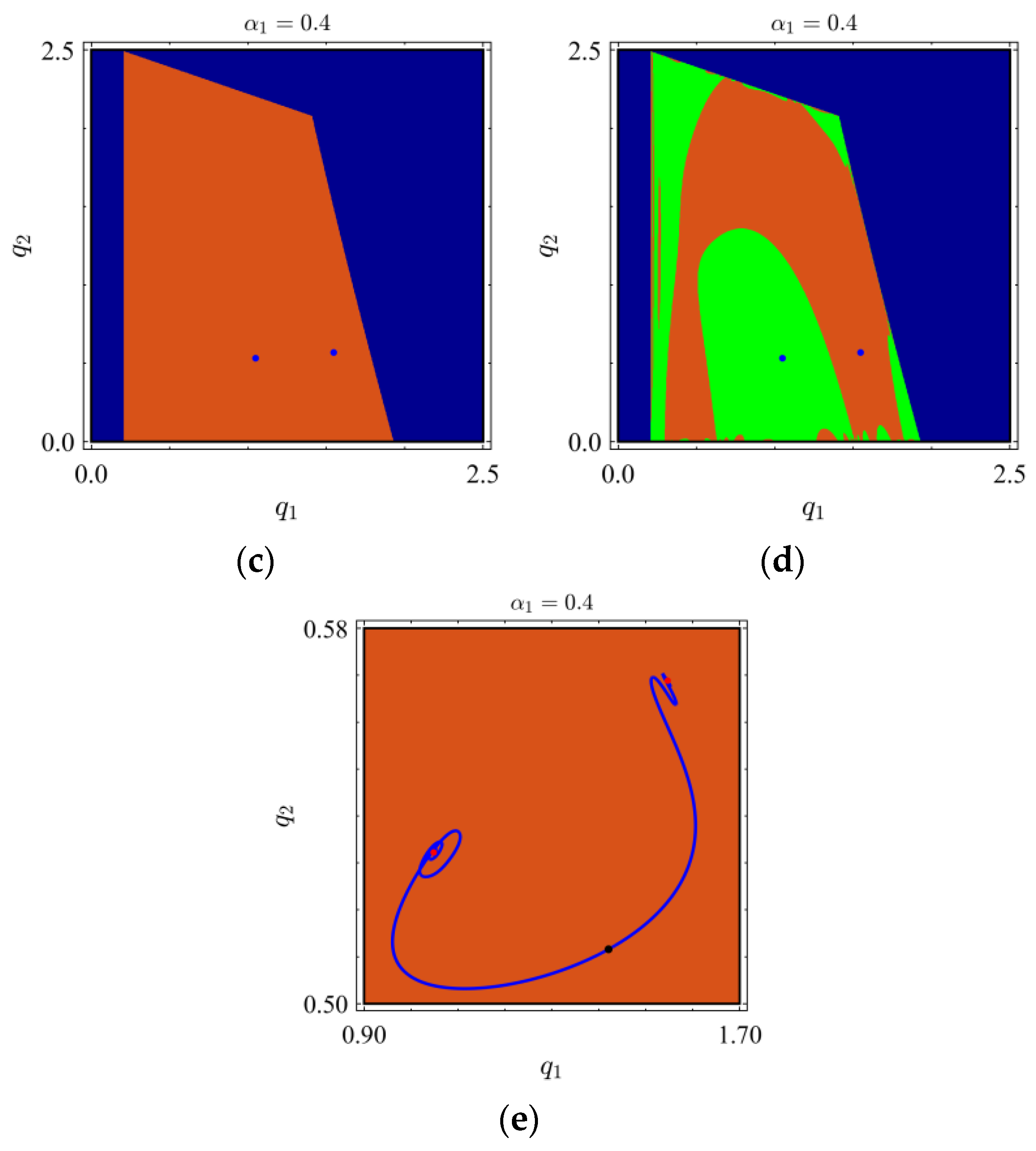

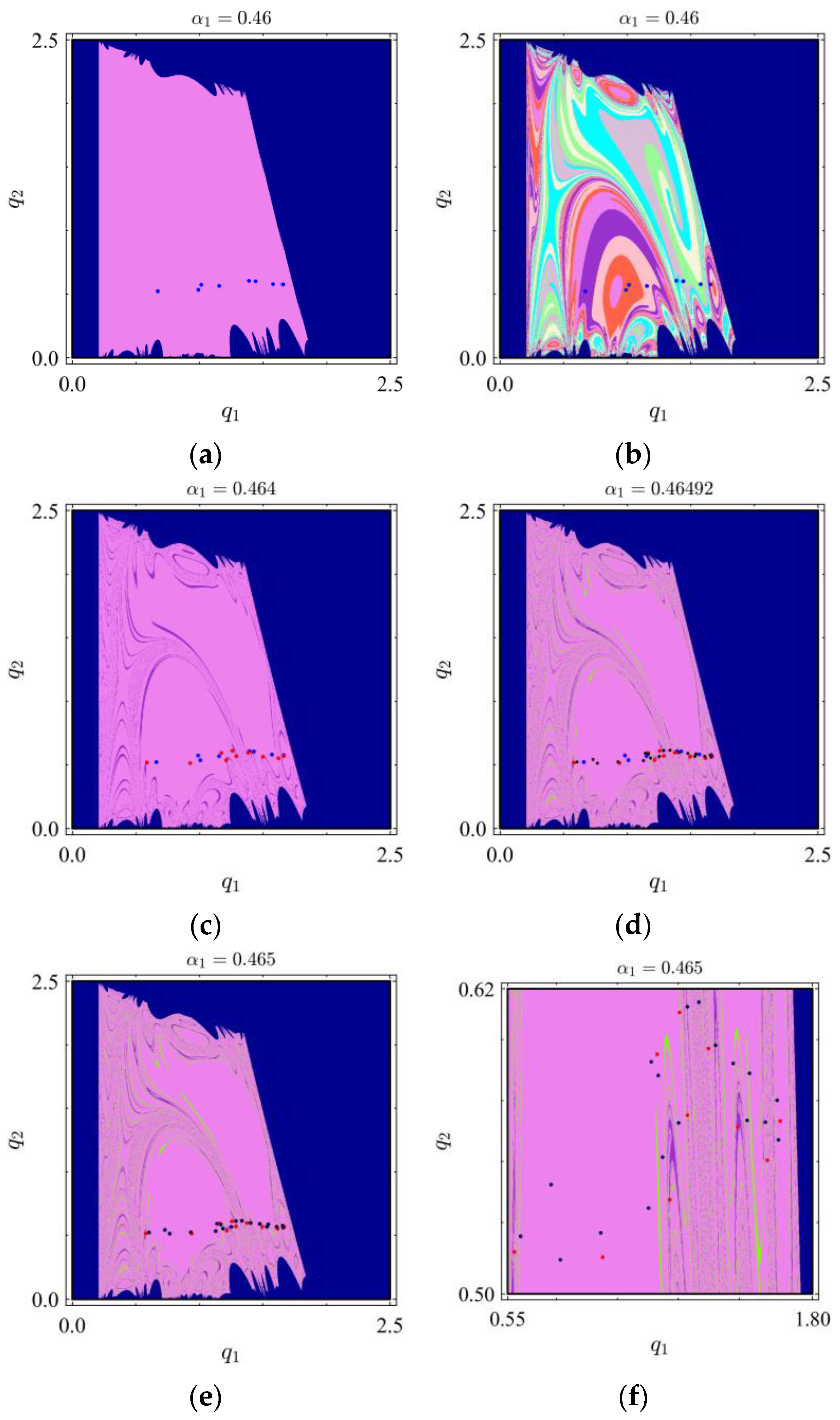

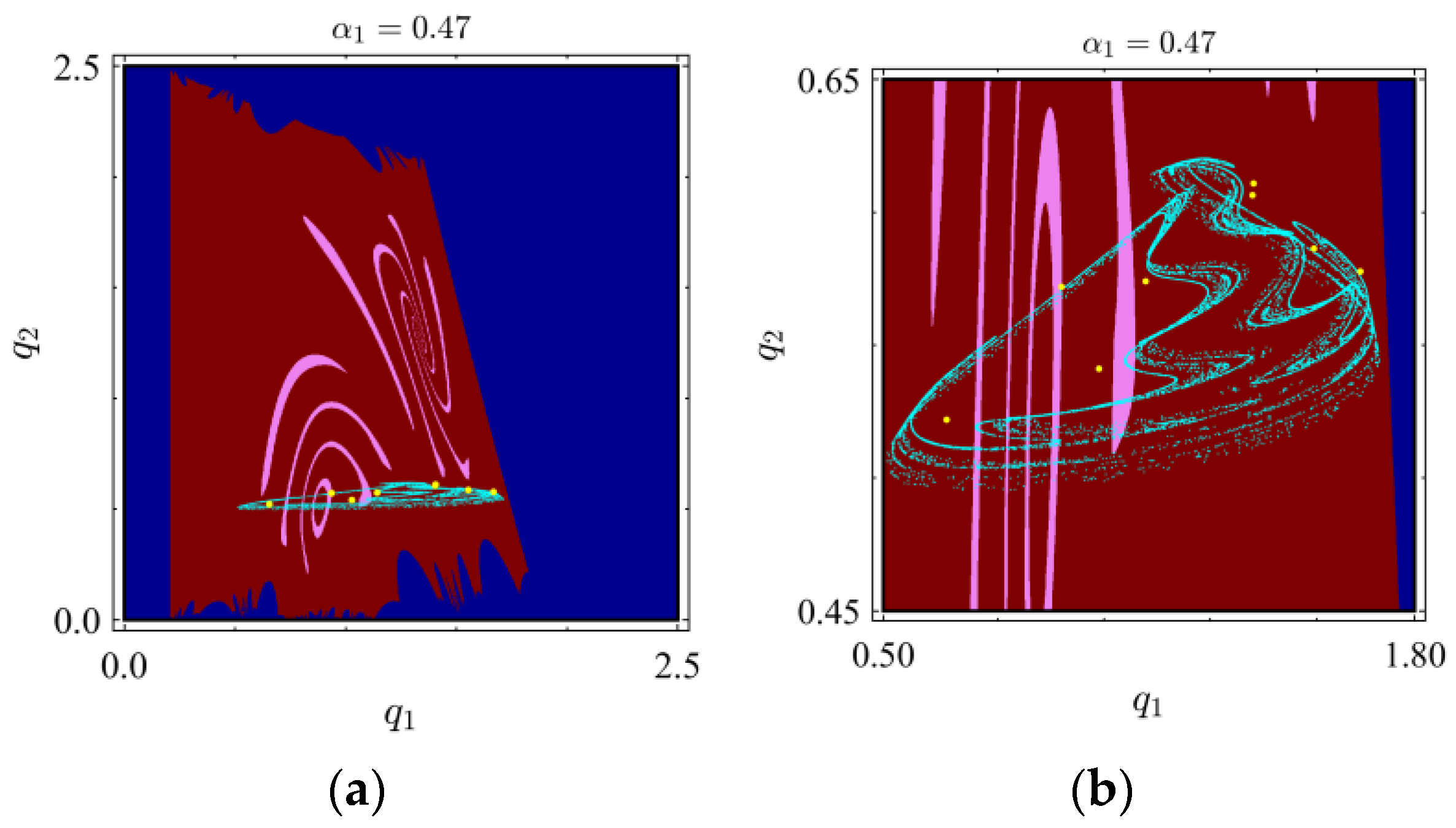

4.2. Global Bifurcation and Attractors

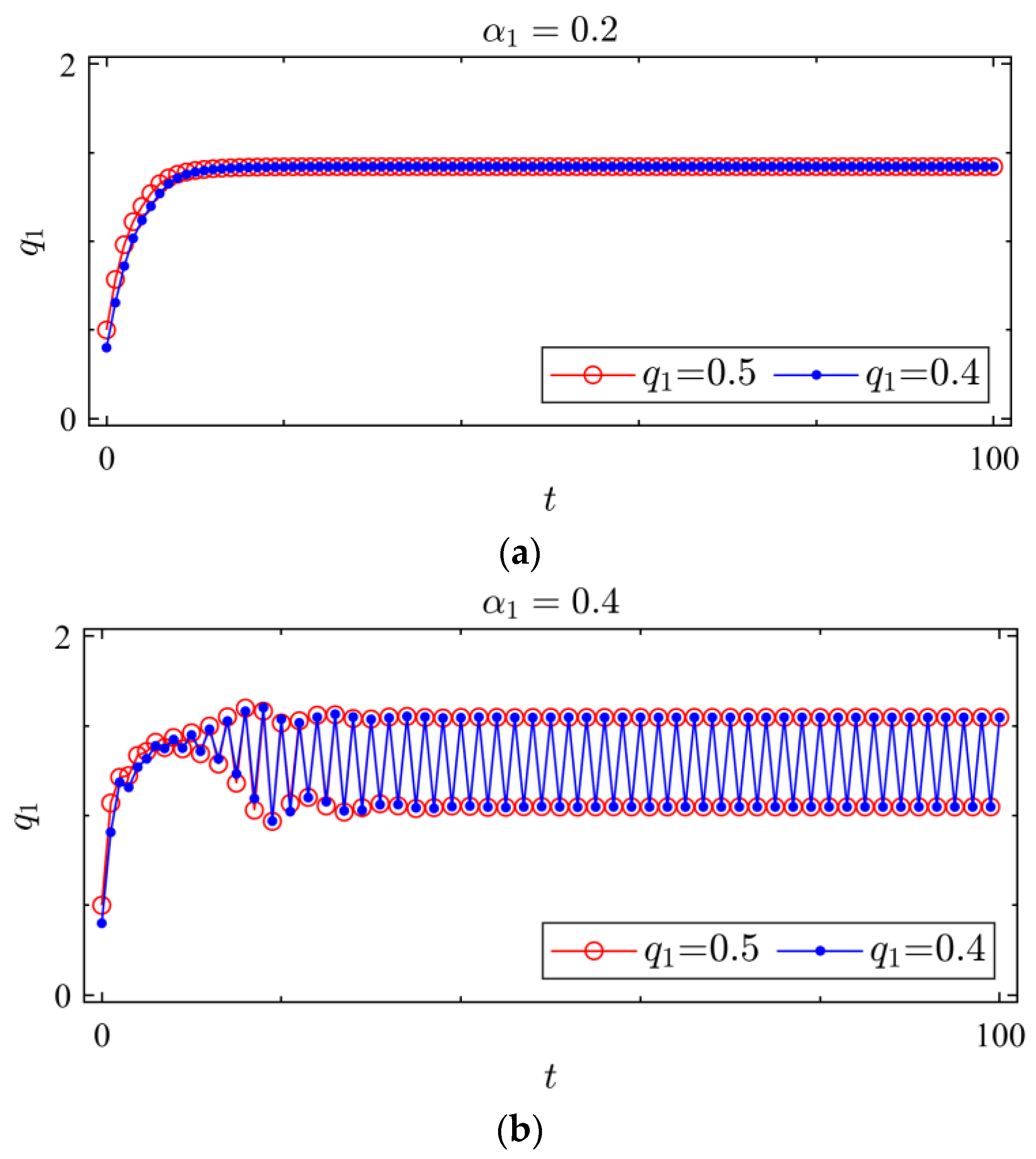

4.3. Sensitivity Analysis

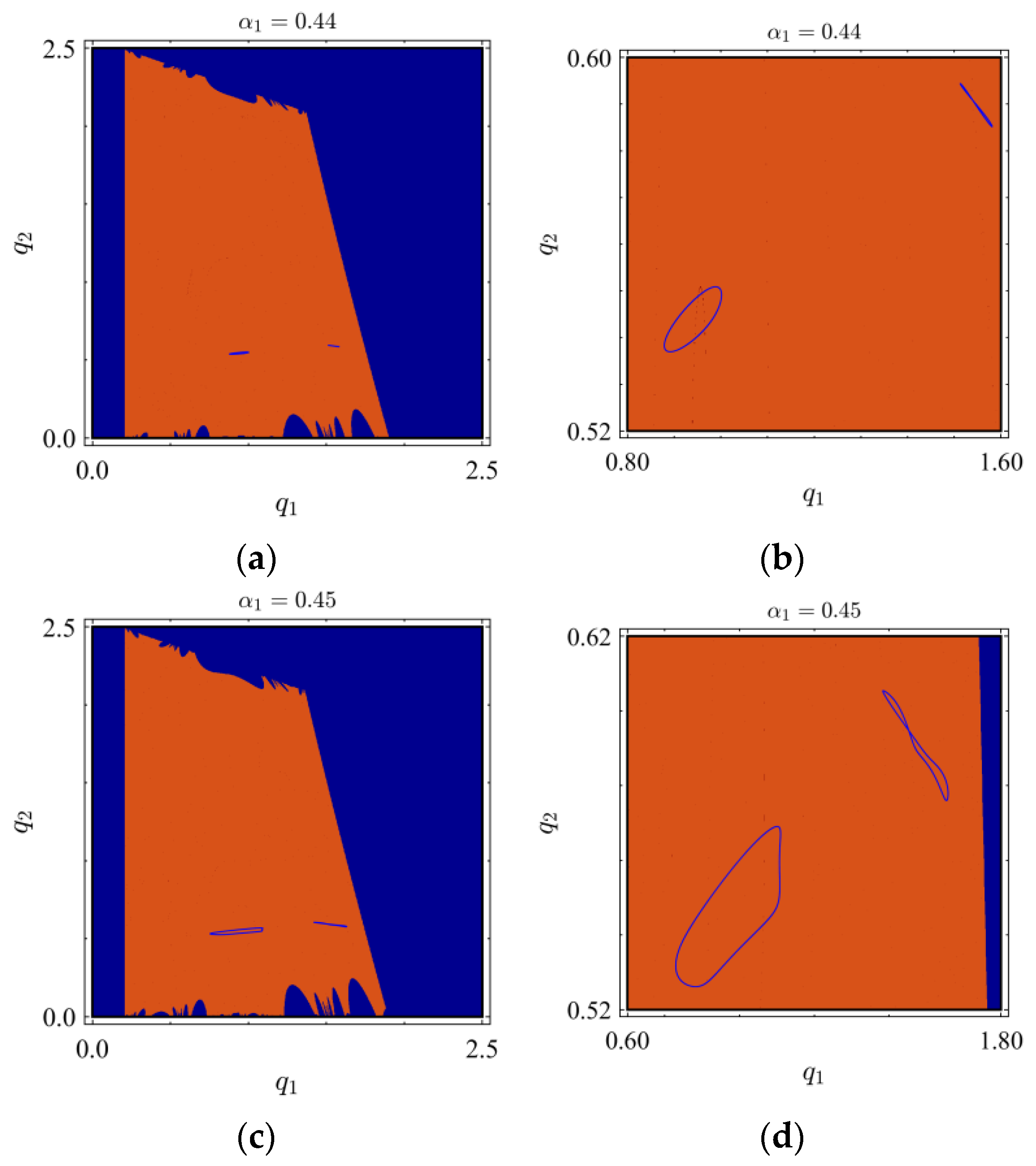

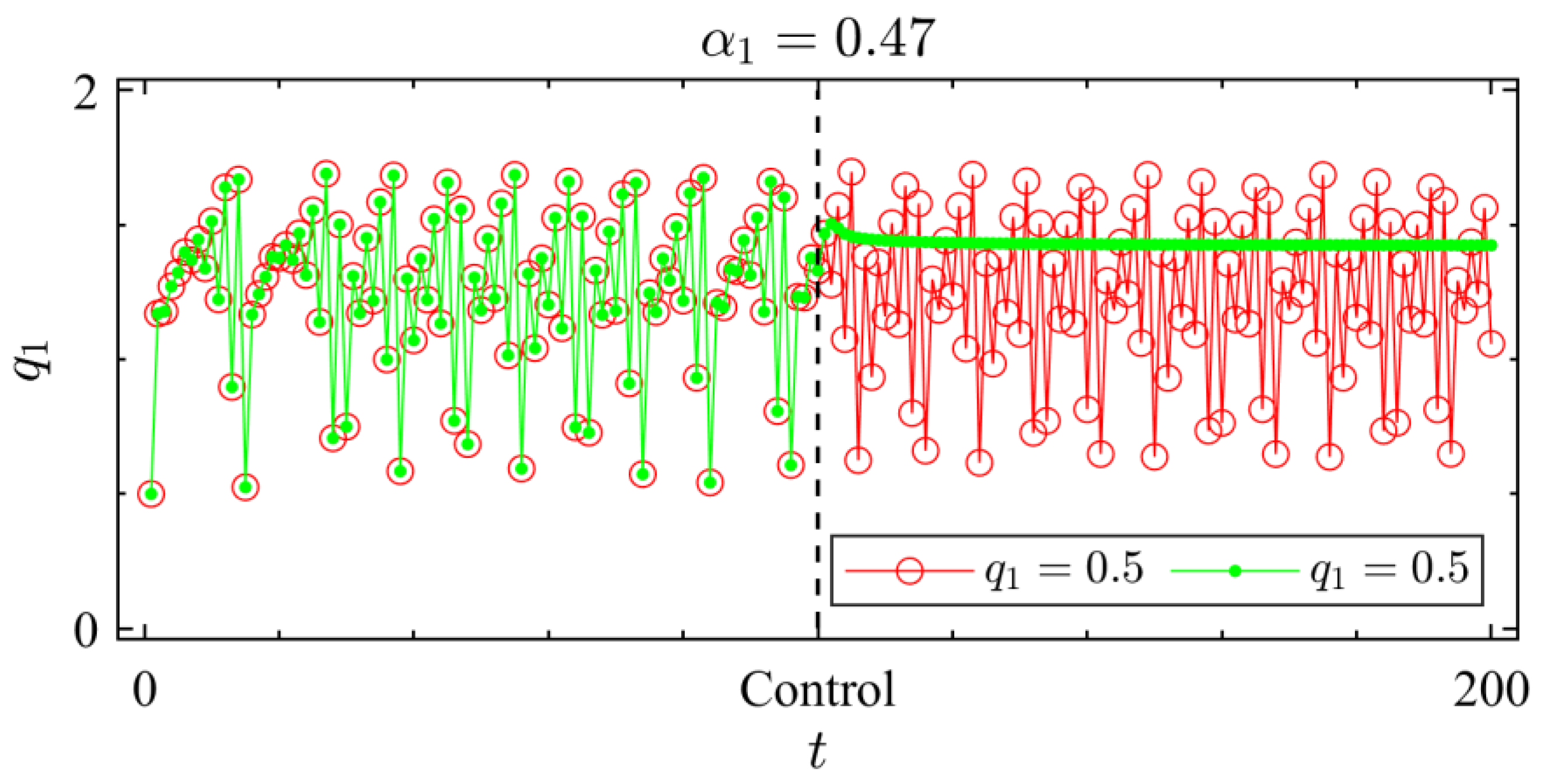

4.4. Chaos Control

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Ma, J.; Hou, Y.; Wang, Z.; Yang, W. Pricing strategy and coordination of automobile manufacturers based on government intervention and carbon emission reduction. Energy Policy 2021, 148, 111919. [Google Scholar] [CrossRef]

- Ma, J.; Hou, Y.; Yang, W.; Tian, Y. A time-based pricing game in a competitive vehicle market regarding the intervention of carbon emission reduction. Energy Policy 2020, 142, 111440. [Google Scholar] [CrossRef]

- Ma, J.; Si, F.; Zhang, Q.; Huijiang. Evolution delayed decision game based on carbon emission and capacity sharing in the Chinese market. Int. J. Prod. Res. 2022. [Google Scholar] [CrossRef]

- Ma, J.; Xu, T. Optimal Strategy of Investing in Solar Energy for Meeting the Renewable Portfolio Standard Re-quirement. J. Oper. Res. Soc. 2022, 74, 181–194. [Google Scholar] [CrossRef]

- Ma, J.; Zhu, L.; Guo, Y. Strategies and stability study for a triopoly game considering product recovery based on closed loop supply chain. Oper. Res. 2021, 21, 2261–2282. [Google Scholar] [CrossRef]

- Binshuo, B.; Junhai, M.; Mark, G. Short- and long-term repeated game behaviours of two parallel supply chains based on government subsidy in the vehicle market. Int. J. Prod. Res. 2020, 58, 7507–7530. [Google Scholar]

- Xu, T.; Ma, J. Feed-in tariff or tax-rebate regulation? Dynamic decision model for the solar photovoltaic supply chain. Appl. Math. Model. 2021, 89, 1106–1123. [Google Scholar] [CrossRef]

- Ma, J.; Xie, L. The stability analysis of the dynamic pricing strategy for bundling goods: A comparison between simulta-neous and sequential pricing mechanism. Nonlinear Dyn. 2019, 95, 1147–1164. [Google Scholar] [CrossRef]

- Zhu, Y.; Xia, C.; Chen, Z. Nash Equilibrium in Iterated Multiplayer Games Under Asynchronous Best-Response Dynamics. IEEE Trans. Autom. Control. 2023. [Google Scholar] [CrossRef]

- Ma, J. Nonlinear Analysis Methods for Complex Economic and Financial Systems; Beijing Science Press: Beijing, China, 2021; Volume 6. [Google Scholar]

- Dong, C.; Liu, Q.; Shen, B. To be or not to be green? Strategic investment for green product development in a supply chain. Transp. Res. Part E Logist. Transp. Rev. 2019, 131, 193–227. [Google Scholar] [CrossRef]

- Zheng, Y.; Zhang, G.; Zhang, W. A Duopoly Manufacturers’ Game Model Considering Green Technology Investment under a Cap-and-Trade System. Sustainability 2018, 10, 705. [Google Scholar] [CrossRef]

- Sun, H.; Wan, Y.; Zhang, L.; Zhou, Z. Evolutionary game of the green investment in a two-echelon supply chain under a government subsidy mechanism. J. Clean. Prod. 2019, 235, 1315–1326. [Google Scholar] [CrossRef]

- Li, Z.; Pan, Y.; Yang, W.; Ma, J.; Zhou, M. Effects of government subsidies on green technology investment and green mar-keting coordination of supply chain under the cap-and-trade mechanism. Energy Econ. 2021, 101, 105426. [Google Scholar] [CrossRef]

- Liu, L.; Wang, Z.; Zhang, Z. Matching-Game Approach for Green Technology Investment Strategies in a Supply Chain under Environmental Regulations. Sustain. Prod. Consum. 2021, 28, 371–390. [Google Scholar] [CrossRef]

- Li, C.; Liu, Q.; Zhou, P.; Huang, H. Optimal innovation investment: The role of subsidy schemes and supply chain channel power structure. Comput. Ind. Eng. 2021, 157, 107291. [Google Scholar] [CrossRef]

- Li, Z.; Yang, W.; Liu, X.; Taimoor, H. Coordination strategies in dual-channel supply chain considering innovation investment and different game ability. Kybernetes 2020, 49, 1581–1603. [Google Scholar] [CrossRef]

- Zhang, L.; Wang, J.; You, J. Consumer environmental awareness and channel coordination with two substitutable products. Eur. J. Oper. Res. 2015, 241, 63–73. [Google Scholar] [CrossRef]

- Hong, Z.; Wang, H.; Yu, Y. Green product pricing with non-green product reference. Transp. Res. Part E Logist. Transp. Rev. 2018, 115, 1–15. [Google Scholar] [CrossRef]

- Chen, J.-Y.; Dimitrov, S.; Pun, H. The impact of government subsidy on supply Chains’ sustainability innovation. Omega 2019, 86, 42–58. [Google Scholar] [CrossRef]

- Ueda, M. Effect of information asymmetry in Cournot duopoly game with bounded rationality. Appl. Math. Comput. 2019, 362, 124535. [Google Scholar] [CrossRef]

- Yang, X.; Peng, Y.; Xiao, Y.; Wu, X. Nonlinear dynamics of a duopoly Stackelberg game with marginal costs. Chaos Solitons Fractals 2019, 123, 185–191. [Google Scholar] [CrossRef]

- Lou, W.; Ma, J. Complexity of sales effort and carbon emission reduction effort in a two-parallel household appliance supply chain model. Appl. Math. Model. 2018, 64, 398–425. [Google Scholar] [CrossRef]

- Elsadany, A.A.; Awad, A.M. Dynamics and chaos control of a duopolistic Bertrand competitions under environmental taxes. Ann. Oper. Res. 2019, 274, 211–240. [Google Scholar] [CrossRef]

- Zhou, J.; Zhou, W.; Chu, T.; Chang, Y.-X.; Huang, M.-J. Bifurcation, intermittent chaos and multi-stability in a two-stage Cournot game with R&D spillover and product differentiation. Appl. Math. Comput. 2019, 341, 358–378. [Google Scholar] [CrossRef]

- Askar, S.; Al-Khedhairi, A. Dynamic investigations in a duopoly game with price competition based on relative profit and profit maximization. J. Comput. Appl. Math. 2020, 367, 112464. [Google Scholar] [CrossRef]

- Wu, F.; Ma, J. The equilibrium, complexity analysis and control in epiphytic supply chain with product horizontal diversification. Nonlinear Dyn. 2018, 93, 2145–2158. [Google Scholar] [CrossRef]

- Wang, H.; Ma, J. Complexity analysis of a Cournot–Bertrand duopoly game with different expectations. Nonlinear Dyn. 2014, 78, 2759–2768. [Google Scholar] [CrossRef]

- Ma, J.; Sun, L. Complex dynamics of a MC–MS pricing model for a risk-averse supply chain with after-sale investment. Commun. Nonlinear Sci. Numer. Simul. 2015, 26, 108–122. [Google Scholar] [CrossRef]

- Nobakhti, E.; Khaki-Sedigh, A.; Vasegh, N. Control of Multichaotic Systems Using the Extended OGY Method. Int. J. Bifurc. Chaos 2015, 25, 1550096. [Google Scholar] [CrossRef]

- Chen, D.; Ignatius, J.; Sun, D.; Zhan, S.-L.; Zhou, C.; Marra, M.; Demirbag, M. Reverse logistics pricing strategy for a green supply chain: A view of customers’ environmental awareness. Int. J. Prod. Econ. 2019, 217, 197–210. [Google Scholar] [CrossRef]

- Martín-Herrán, G.; Sigué, S.P. An integrative framework of cooperative advertising: Should manufacturers continuously support retailer advertising? J. Bus. Res. 2017, 70, 67–73. [Google Scholar] [CrossRef]

- Martín-Herrán, G.; Sigué, S.P. Retailer and manufacturer advertising scheduling in a marketing channel. J. Bus. Res. 2017, 78, 93–100. [Google Scholar] [CrossRef]

- Ma, J.; Sun, L. Complexity analysis about nonlinear mixed oligopolies game based on production cooperation. IEEE Trans. Control. Syst. Technol. 2018, 26, 1532–1539. [Google Scholar] [CrossRef]

- Zhu, Y.; Zhang, Z.; Xia, C.; Chen, Z. Equilibrium analysis and incentive-based control of the anticoordinating networked game dynamics. Automatica 2023, 147, 110707. [Google Scholar] [CrossRef]

- Zhu, Y.; Xia, C.-Y.; Wang, Z.; Chen, Z. Networked Decision-Making Dynamics Based on Fair, Extortionate and Generous Strategies in Iterated Public Goods Games. IEEE Trans. Netw. Sci. Eng. 2022, 9, 2450–2462. [Google Scholar] [CrossRef]

| Notation | Explanation |

|---|---|

| Parameters | |

| Positive constant | |

| Positive constant which stands for the impact of sales on the price of their own quantity, , , , and | |

| Constant marginal cost of manufacturer 1 and manufacturer 2, , , | |

| Coefficient of the battery life level, | |

| Coefficient of the investment cost function, | |

| Decision variables | |

| Quantity of manufacturer 1 and manufacturer 2, , | |

| Battery life level of the electric vehicle; it is up to the manufacturer to implement investment in battery technology, | |

| Others | |

| Profit of manufacturer 1 and manufacturer 2, | |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, Z.; Li, X.; Liang, W.; Ma, J. Does a New Electric Vehicle Manufacturer Have the Incentive for Battery Life Investment? A Study Based on the Game Framework. Mathematics 2023, 11, 3551. https://doi.org/10.3390/math11163551

Wang Z, Li X, Liang W, Ma J. Does a New Electric Vehicle Manufacturer Have the Incentive for Battery Life Investment? A Study Based on the Game Framework. Mathematics. 2023; 11(16):3551. https://doi.org/10.3390/math11163551

Chicago/Turabian StyleWang, Zongxian, Xiao Li, Weihua Liang, and Junhai Ma. 2023. "Does a New Electric Vehicle Manufacturer Have the Incentive for Battery Life Investment? A Study Based on the Game Framework" Mathematics 11, no. 16: 3551. https://doi.org/10.3390/math11163551