Testing the Efficient Market Hypothesis and the Model-Data Paradox of Chaos on Top Currencies from the Foreign Exchange Market (FOREX)

Abstract

1. Introduction

2. A Brief Exploratory Statistical Analysis of the Dataset Considered

2.1. Descriptive Analysis of the Main Macroeconomic News and Indicators Used for Top Three Economic Regions

2.1.1. Descriptive Analysis of the United States by Each Macroeconomic New

- Trade balance (Figure 1a). The US trade balance is notable for its consistently negative value, and very significantly so. It started the period at −60 B, and in 2009, a small upward trend began, reaching a peak value of −26 B. From then on, a downward–lateral trend began until the end of 2020. At this stage, the values were between −50 B and −35 B. At the beginning of 2020, the downward trend accelerated, with values reaching −109.8 B. Currently, it seems that exports have recovered some ground, as it is around −50 B. Regarding the forecast value, two phases can be observed. The first was observed until the end of 2017, in which the forecast value was much more erratic and conservative with respect to the current value, and another phase was observed from then until now, in which the forecast value very accurately anticipates the movement of the current data.

- Unemployment rate (Figure 1b). We can see that the unemployment rate reached its second highest value (within our study period) in 2010. We can note that since then, it was on a downward trend until 2020. Then, with the impact of the pandemic crisis in 2020, the market came to a screeching halt, with unemployment rates climbing to close to 15%. We can see that there is a small difference between the current figure and the one expected by the market (with the exception of 2020, a year in which uncertainty played a major role in the markets). The current and forecast values are quite similar throughout the series; therefore, it seems that this series will not generate any information surprises. Later, we see whether this is the case or not.

- Gross Domestic Product (GDP) [Figure 1c]. The US Gross Domestic Product has been a very stable value, except for during the 2008 crisis, until the arrival of the pandemic in March 2020. From then on, there was a steep fall to −32.9% (the forecast value was expected to fall to −34.5%). Subsequently, it recovered by the same magnitude to 33.1% (and its forecast value of 32%). We can say that the fall in GDP caused by the COVID-19 crisis has fully recovered.

- Retail sales (Figure 1d). The expected value is somewhat more cautious than the actual value, causing information surprises, as we explained. These differences are more marked with increases in volatility, i.e., during the pandemic, as there was a very aggressive reduction in retail sales, with a decrease of more than 16%, and with its consequent rebound effect in the following periods. The pre-2020 values show a very tight range, with values between −3% and +3%.

- Industrial Production Index (IPI) (Figure 1e). The US Industrial Production Index has taken very marked ranges of values in the different crises we have lived through. In 2008, the value fell below −2.5%, while the market expected a much smaller fall, closer to −1%. During the pandemic, we observed a much more marked fall in industrial production, with the value dropping to −11.2%. In this case, the forecast data did predict the magnitude of the impact accurately, predicting a value of −11.3% over the same period. It should be noted that in the two periods of decline noted above, the industrial production data did not recover as easily as they did when this decline was generated. The forecast value is in a much more conservative range than the current value, with the exception of the COVID-19 period, where it correctly anticipated the abrupt market movement.

- Consumer Price Index (CPI) [Figure 1f]. The average value of US inflation stands at almost 2.3%. From 2010 to 2020, inflation was contained between 2 and 4 percent. With the advent of the pandemic, it initially dropped to almost 0.0%, but then it spiked to reach values above 9.0%. As in the case of the unemployment rate, the current and forecast values are quite similar throughout the series; therefore, it seems that this series will not generate any information surprises either.

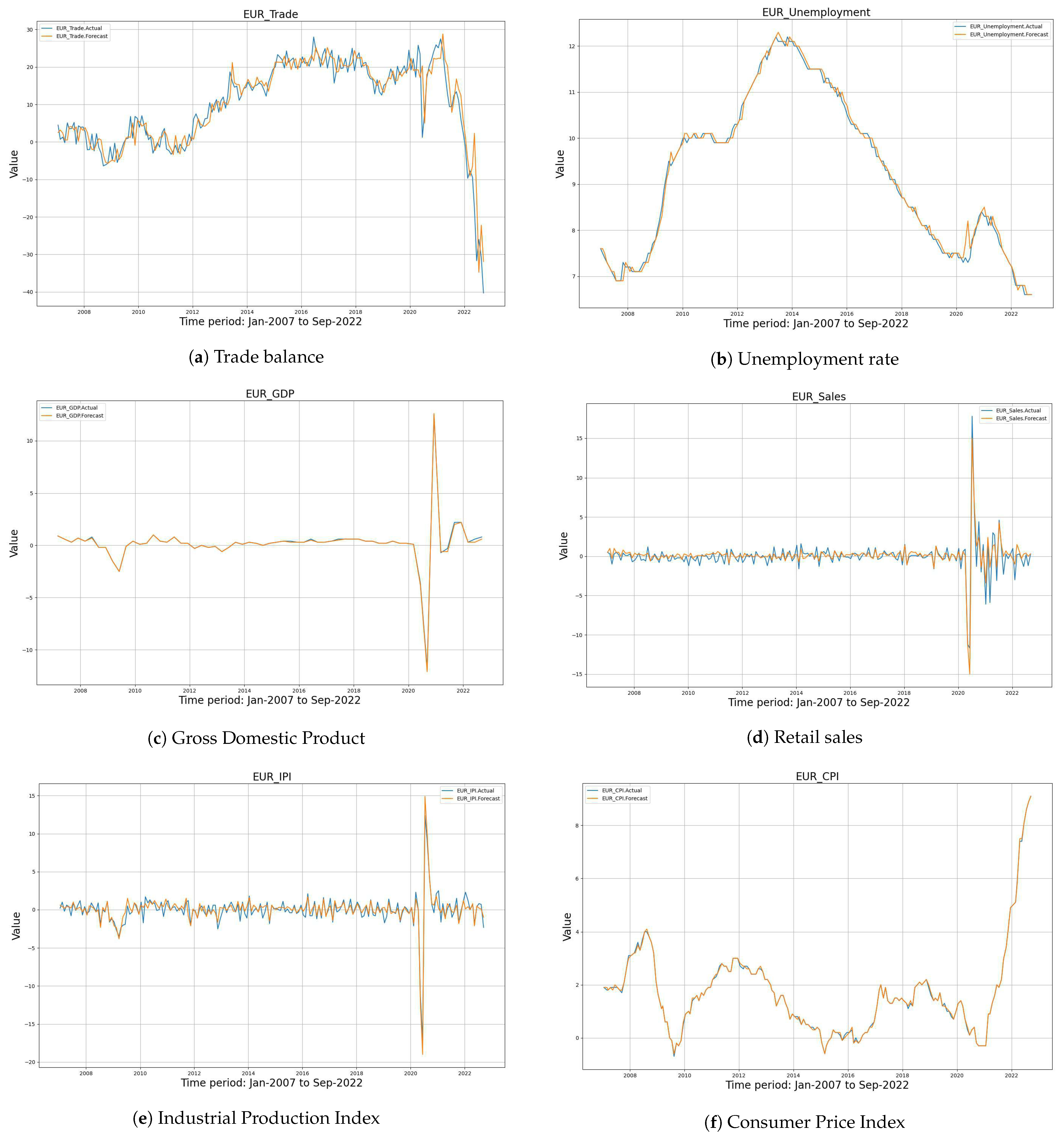

2.1.2. Descriptive Analysis of Europe by Each Macroeconomic New

- Trade balance (Figure 2a). The European trade balance has been in positive territory for most of the time period studied, with peak balances of 28 B and the forecast being 28.8 B. Since that peak, it began on a downward trend that does not seem to be over yet. Currently, the minimum value is at −40.3 B, while the expected value was −34.8 B. In general terms, we can say that the forecast value has been more optimistic than the current value, as its average value is 10.28 B, while the current value is 9.91 B.

- Unemployment rate (Figure 2b). The maximum peak of European unemployment was reached in 2013, with values above 12%. Since then, the unemployment rate had been declining steadily until the arrival of COVID-19 in 2020, after which, the unemployment rate has risen somewhat steadily from 7.5% to almost 8.5%. In this period of time, it is worth noting that the market expected a considerably higher unemployment rate than the current value, although throughout our study period, we can observe that the forecast values are quite close to the current value.

- Gross Domestic Product (GDP) (Figure 2c). We can see that the current and forecast data practically coincide over the whole period. It is worth highlighting the fall in GDP during the 2008 crisis, and the much greater fall in 2020 with the onset of the pandemic. Europe was on the verge of recovering the totality of the previous fall due to COVID-19, as this fall was −11.8%, and the subsequent recovery was 12.5%. The current figure has an average value of 0.19%, while the forecast figure is 0.17%.

- Retail sales (Figure 2d). European retail sales had a fairly narrow range of values until 2020, varying between +2% and −2%. In March 2020, due to the COVID-19 pandemic, negative values soared, and it is particularly striking that the market expected a value of −15%, but fortunately for the economy, this value did not exceed 11.7%. For the rest of the values in the series, we can see that the forecast takes much more conservative values than the real value.

- Industrial Production Index (IPI) (Figure 2e). The European industrial production index notably has an average value over the whole period of −0.043%. The forecast value anticipated the magnitude of the current value in most cases, including the two recent crises in 2008 and 2020. It is worth noting that in 2020, the forecast value exceeded both the positive and negative expectations of the indicator, as it estimated a fall in industrial production of −19%, with the actual figure being −17.1%. The same happened when the indicator recovered, as the forecast figure peaked at 14.9%, although the actual value did not exceed 12.4%.

- Consumer Price Index (CPI) (Figure 2f). The European Central Bank has a target inflation rate of 2.71%. The truth is that, even with the recent sharp rise in prices, the average value of inflation is 1.71%. It is worth noting that year-on-year inflation is currently at 9.1%, becoming negative (within our study period) in 2009, 2015, and 2021. The forecast value is very much in line with the current value.

2.1.3. Descriptive Analysis of the United Kingdom by Each Macroeconomic New

- Trade balance (Figure 3a). The UK trade balance has been negative throughout the period, with the only notable moment of positive balance being at the beginning of 2020. Thereafter, the volatility of the data increased considerably. At the beginning of 2022, the trade balance reached its minimum value of −26.5 B. It should be noted that the forecast value is much more moderate than the actual value, especially in periods where volatility increases, as the expected data do not match the actual value.

- Unemployment rate (Figure 3b). We can observe an upward trend starting in mid-2008, which was sustained until 2013, when the unemployment rate began to fall until 2020, when the economy was damaged by the arrival of the COVID-19 pandemic, with its consequent increase in the unemployment rate throughout the year. It is currently beginning a downward trend, with values below 4%. We can see this indicator has very similar real and expected values, with the exception at the beginning of the pandemic, where the market expected a much higher rise in unemployment than the real increase.

- Gross Domestic Product (GDP) (Figure 3c). The forecast figure tracks the current figure fairly closely over the whole period; therefore, it seems likely that there will be no significant information surprises. It is worth noting that the UK fell some way short of recovering from its full fall in 2020 due to the pandemic, which was −19.8%, and the subsequent recovery was 16%.

- Retail sales (Figure 3d). We see in the graph how the predicted data are always more conservative than the actual data, indicating that analysts expected (for both positive and negative values) lower values than the actual data. We can see that before the pandemic, retail sales were very limited between −5% and 5%, but this ceased to be the case with the arrival of the COVID-19 pandemic, during which, sales initially fell to −18.1%, largely recovering in the following months after this fall, with values close to 8%. We can see that the predicted value of retail sales is below the actual value, even during the pandemic and in the following years.

- Industrial Production Index (IPI) (Figure 3e). It is striking that with the arrival of the pandemic in 2020 and the consequent fall in the British consumer price index, the forecast value estimated a much smaller fall than what actually occurred. The figure was an estimated 15 percent, compared with the actual figure of just over 20 percent. However, the predicted value of the rise did coincide with the actual value, being 9.2% and 9.3%, respectively. Once again, we can see that the fall was much more abrupt than the subsequent recovery, and the forecast values are much more moderate than the actual values, generating real information surprises.

- Consumer Price Index (CPI) (Figure 3f). The minimum inflation value was recorded during 2015, while temporary upward peaks were reached in 2009 and late 2011. Currently, UK prices have been rising at a frenetic pace from 2021 to the present, reaching increases of 10%. We can see that the dispersion between the current and forecast data is very low. This indicates that the data expected by analysts are very similar, if not the same as the actual data that appears later, which is likely to have little or no effect on the currency market as there are not many information surprises in the data. We examine this in this paper.To conclude this section, we compare the results of the three economic regions analysed. Europe stands out as the only one with a positive average balance of trade. At the same time, it has the highest average unemployment rate, the lowest average GDP growth rate, and a negative average retail sales balance. In terms of industrial production, it stands out for having achieved the highest value among the three regions, although it has a negative average value (close to zero). Regarding the United States, it has the most negative trade balance of the three regions and the highest and the lowest unemployment rate and GDP of the three regions, respectively. In terms of the consumer price index, the United States stands out for having the lowest average value. Finally, the UK stands out for having the lowest unemployment rate compared with the other geographical areas. It also had the lowest value for retail sales and industrial production during the pandemic and the highest value for inflation in both absolute and average terms.

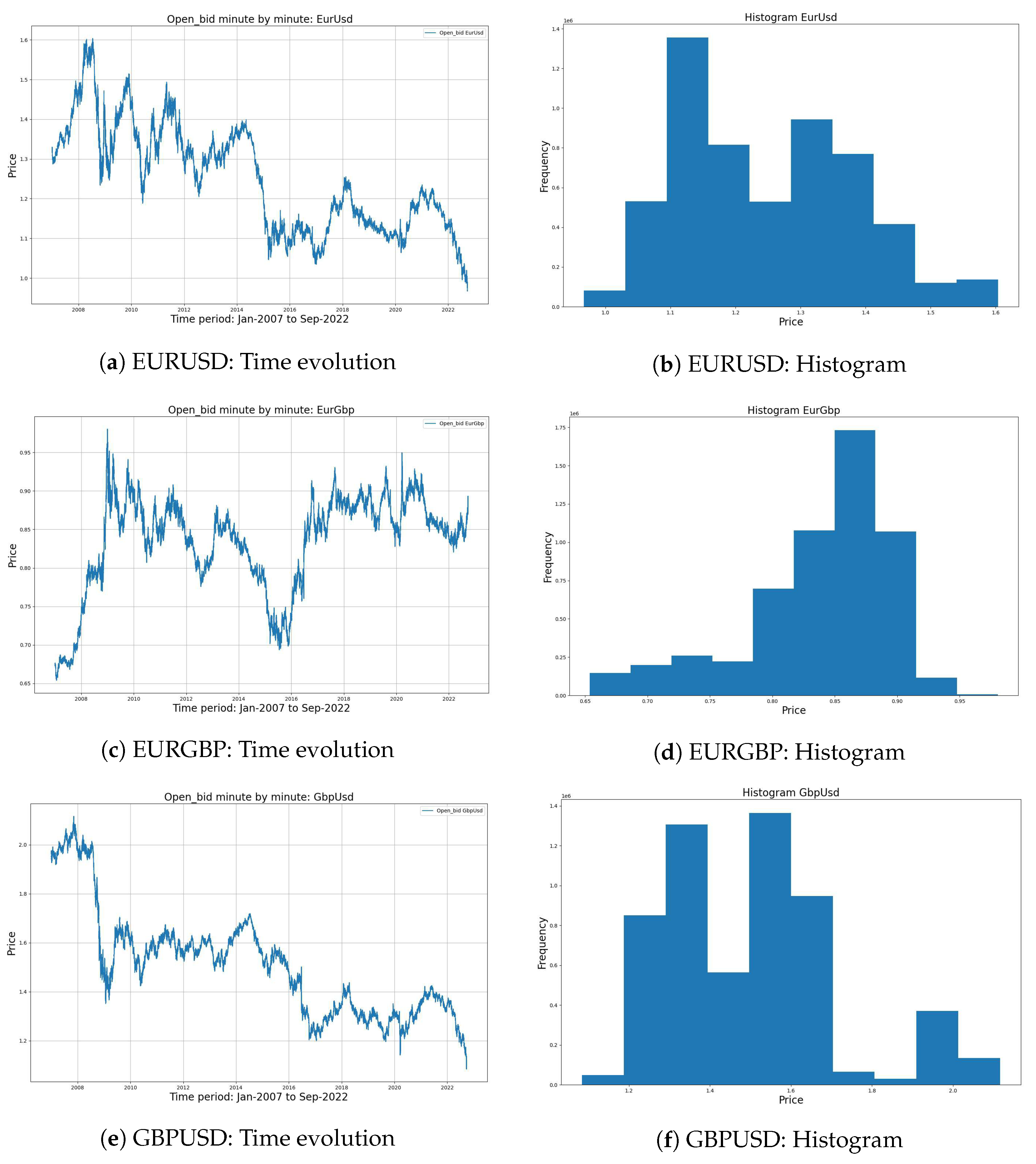

2.2. Descriptive Analysis of the Top Currencies Rates Used from the Foreign Exchange Market

3. Methodology

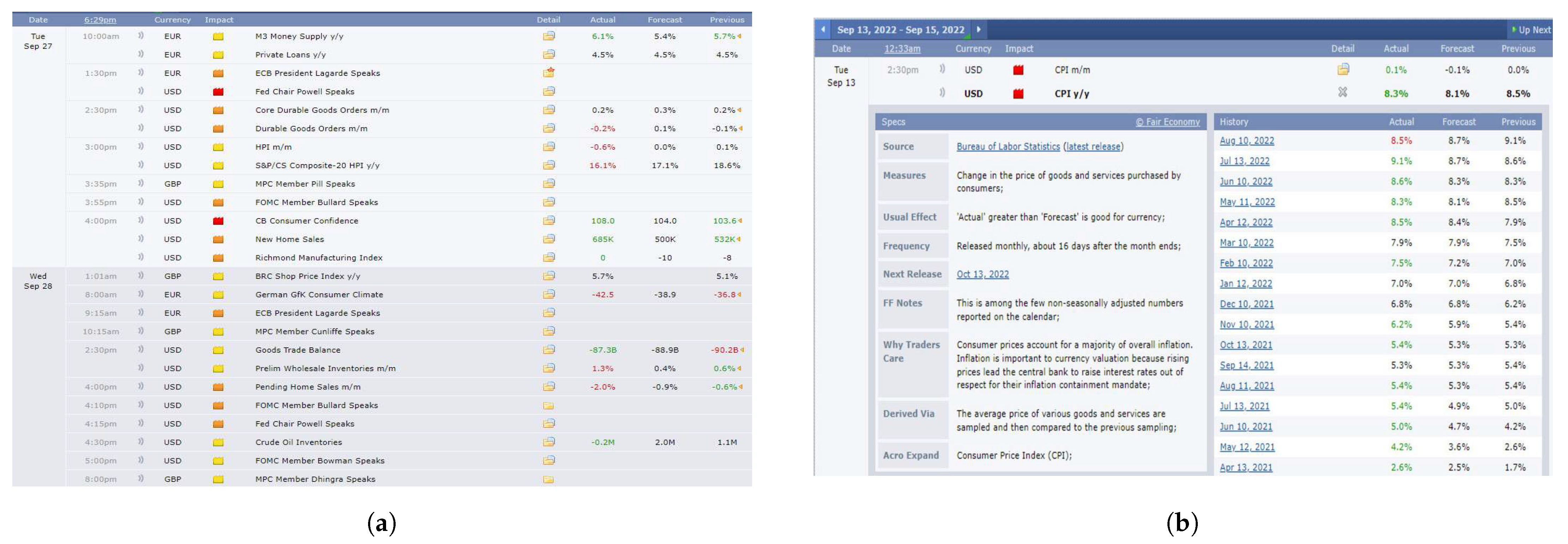

3.1. How Can the Efficient Market Hypothesis Be Tested through the Correlation between the Information Surprises and Market Movements?

- Previous: These data are revisions of the current data of the previous month, i.e., the macroeconomic data published the previous month are revised and updated to account for any modifications, as often, due to the acceleration of the publication of data, some data are left unchecked.

- Forecast: These data are expected by economic analysts based on surveys of financial organisations, such as Reuters and Bloomberg.

- Actual: These are the actual data published. They express the evolution of the economy over the last month in the case of monthly news. The difference between these data and the consensus will determine the direction of the fluctuation of the currency market, at least in the short term.

3.2. How Can the Paradox of Chaos Be Tested through the Estimation of the Lyapunov Exponent Considering Different Time Frequencies in the Financial Series Used?

4. Results and Discussion

4.1. Analysing Correlations between Information Surprises and Market Movements in Europe, the United States, and the United Kingdom to Test the Efficient Market Hypothesis

- Trade balance: If the trade balance data are higher than expected, it will be a sign that a higher demand for US dollars is needed to pay for exports, which will increase the price of that currency.

- Gross Domestic Product: A higher than expected figure is a sign that the US economy is in better economic health, indicating a strengthening currency.

- Retail sales: Higher than expected retail sales indicate stronger domestic demand, a sign of greater confidence and economic strength in the country.

- Industrial Production Index: A higher than expected figure indicates stronger manufacturing strength in the country. This should be reflected in an appreciating and stronger currency.

- Consumer Price Index: Higher than expected inflation will indicate strong economic activity and the possible future need to raise interest rates to reduce inflation. Higher interest rates in the country will lead to higher foreign investment in the country, which will lead to higher demand for the currency, with consequent appreciation.

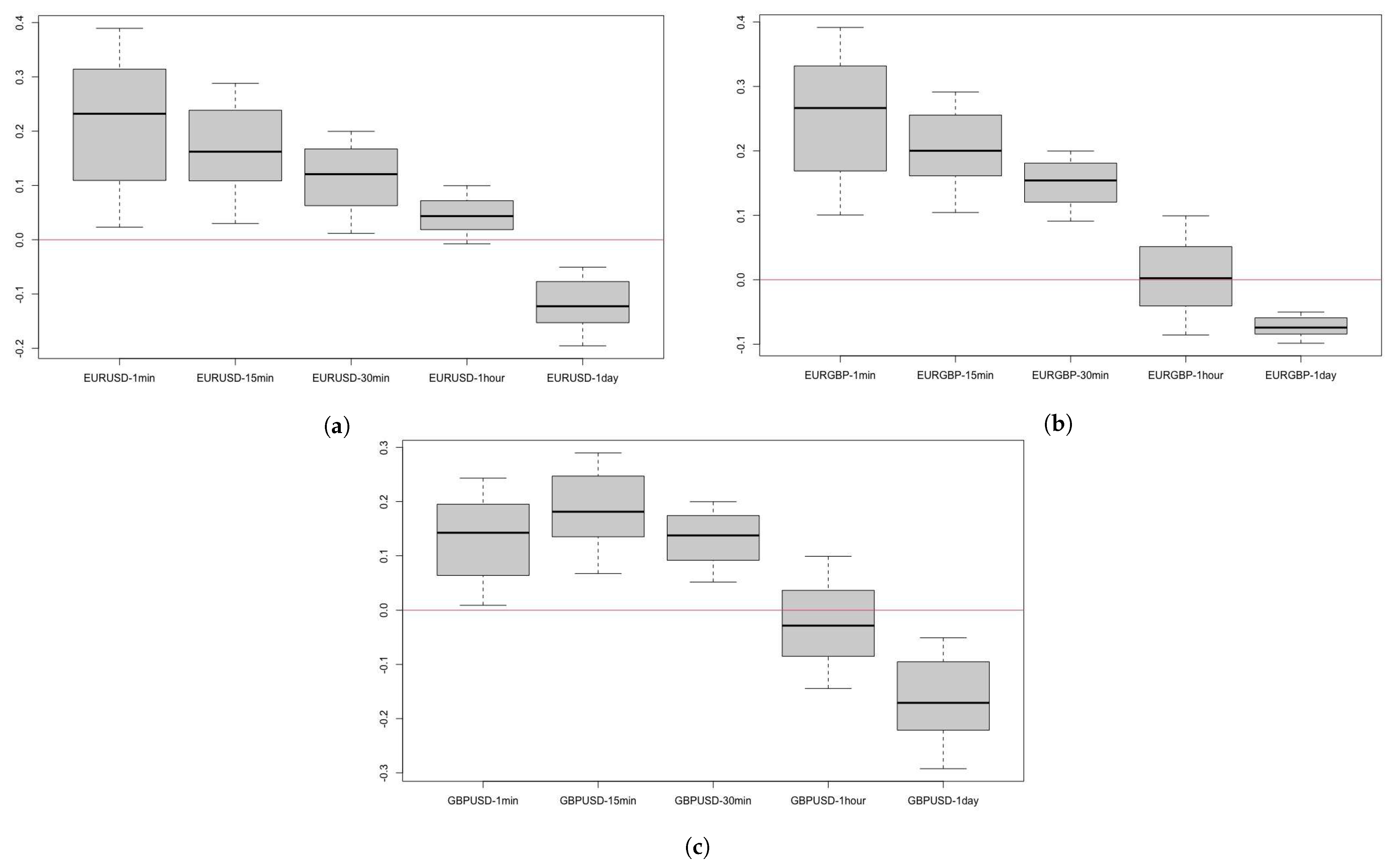

4.2. Analysing Possible Chaotic Behaviour by Estimating Lyapunov Exponents in the EURUSD, EURGBP, and GBPUSD Exchange Rates to Test the Paradox of Chaos

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Frankel, J.A.; Froot, K.A. Chartists, fundamentalists, and trading in the foreign exchange market. Am. Econ. Rev. 1990, 80, 181–185. [Google Scholar]

- Sarno, L.; Taylor, M.P. The Microstructure of the Foreign-Exchange Market: A Selective Survey of the Literature; International Economics Section, Department of Economics: Princeton, NJ, USA, 2001; Volume 89. [Google Scholar]

- Taylor, M.P.; Allen, H. The use of technical analysis in the foreign exchange market. J. Int. Money Financ. 1992, 11, 304–314. [Google Scholar] [CrossRef]

- Archer, M.D.; Bickford, J.L. The Forex Chartist Companion: A Visual Approach to Technical Analysis; John Wiley & Sons: Hoboken, NJ, USA, 2007; Volume 297. [Google Scholar]

- Murphy, J.J. The Visual Investor: How to Spot Market Trends; John Wiley & Sons: Hoboken, NJ, USA, 2009. [Google Scholar]

- Allahyari Soeini, R.; Niroomand, A.; Kheyrmand Parizi, A. Using fibonacci numbers to forecast the stock market. Int. J. Manag. Sci. Eng. Manag. 2012, 7, 268–279. [Google Scholar] [CrossRef]

- Fernández, R.M.; Crespo, D.M.P. Forecasting the future trend of the EUR/USD exchange rate, using advanced technical analysis tools. Cent. Sur 2022, 6, 75–97. [Google Scholar]

- Dieci, R.; Westerhoff, F. Heterogeneous speculators, endogenous fluctuations and interacting markets: A model of stock prices and exchange rates. J. Econ. Dyn. Control 2010, 34, 743–764. [Google Scholar] [CrossRef]

- Abouloula, K.; Ou-Yassine, A.; Krit, S.d. Pattern to build a robust trend indicator for automated trading. In Expert Systems in Finance; Routledge: Oxfordshire, UK, 2019; pp. 217–235. [Google Scholar]

- Rosillo, R.; De la Fuente, D.; Brugos, J.A.L. Technical analysis and the Spanish stock exchange: Testing the RSI, MACD, momentum and stochastic rules using Spanish market companies. Appl. Econ. 2013, 45, 1541–1550. [Google Scholar] [CrossRef]

- Gontis, V.; Kononovicius, A. The consentaneous model of the financial markets exhibiting spurious nature of long-range memory. Phys. A Stat. Mech. Its Appl. 2018, 505, 1075–1083. [Google Scholar] [CrossRef]

- Yaohao, P.; Albuquerque, P.H.M. Non-linear interactions and exchange rate prediction: Empirical evidence using support vector regression. Appl. Math. Financ. 2019, 26, 69–100. [Google Scholar] [CrossRef]

- Tsantekidis, A.; Tefas, A. Transferring trading strategy knowledge to deep learning models. Knowl. Inf. Syst. 2021, 63, 87–104. [Google Scholar] [CrossRef]

- Warin, T.; Stojkov, A. Machine Learning in Finance: A Metadata-Based Systematic Review of the Literature. J. Risk Financ. Manag. 2021, 14, 302. [Google Scholar] [CrossRef]

- Kadiri, E.; Alabi, O. Importance of Technical and Fundamental Analysis in the Foreign Exchange Market. Br. J. Econ. Manag. Trade 2015, 5, 181–194. [Google Scholar] [CrossRef] [PubMed]

- Dornbusch, R. Purchasing Power Parity; National Bureau of Economic Research Cambridge: Cambridge, MA, USA, 1985. [Google Scholar]

- Keynes, J.M. The general theory of employment. Q. J. Econ. 1937, 51, 209–223. [Google Scholar] [CrossRef]

- Kaltwasser, P.R. Uncertainty about fundamentals and herding behavior in the FOREX market. Phys. A Stat. Mech. Its Appl. 2010, 389, 1215–1222. [Google Scholar] [CrossRef]

- Prat, G.; Uctum, R. Expectation formation in the foreign exchange market: A time-varying heterogeneity approach using survey data. Appl. Econ. 2015, 47, 3673–3695. [Google Scholar] [CrossRef]

- Boutouria, N.; Hamad, S.B.; Medhioub, I. Investor Behaviour Heterogeneity in the Options Market: Chartists vs. Fundamentalists in the French Market. J. Econ. Bus. 2020, 3, 917–923. [Google Scholar] [CrossRef]

- Zhang, Q.; Li, Z. Time-varying risk attitude and the foreign exchange market behavior. Res. Int. Bus. Financ. 2021, 57, 101394. [Google Scholar] [CrossRef]

- Fama, E.F. Efficient Capital Markets: A Review of Theory and Empirical Work. J. Financ. 1970, 25, 383–417. [Google Scholar] [CrossRef]

- Gürkaynak, R.S.; Wright, J.H. Identification and Inference Using Event Studies. Manch. Sch. 2013, 81, 48–65. [Google Scholar] [CrossRef]

- Scotti, C. Surprise and uncertainty indexes: Real-time aggregation of real-activity macro-surprises. J. Monet. Econ. 2016, 82, 1–19. [Google Scholar] [CrossRef]

- Altavilla, C.; Giannone, D.; Modugno, M. Low frequency effects of macroeconomic news on government bond yields. J. Monet. Econ. 2017, 92, 31–46. [Google Scholar] [CrossRef]

- Caruso, A. Macroeconomic news and market reaction: Surprise indexes meet nowcasting. Int. J. Forecast. 2019, 35, 1725–1734. [Google Scholar] [CrossRef]

- Kahneman, D.; Tversky, A. Prospect theory: An analysis of decision under risk. In Handbook of the Fundamentals of Financial Decision Making: Part I; World Scientific: Singapore, 2013; pp. 99–127. [Google Scholar]

- Taleb, N.N. Black swans and the domains of statistics. Am. Stat. 2007, 61, 198–200. [Google Scholar] [CrossRef]

- Ullah, A.; Zhao, X.; Amin, A.; Syed, A.A.; Riaz, A. Impact of COVID-19 and economic policy uncertainty on China’s stock market returns: Evidence from quantile-on-quantile and causality-in-quantiles approaches. Environ. Sci. Pollut. Res. 2022; online ahead of print. [Google Scholar] [CrossRef]

- Brock, W.; Hommes, C.; Schumacher, J.; Hey, C.; Hanzon, B.; Praagman, C. Models of complexity in economics and finance. In System Dynamics in Economic and Financial Models; Wiley: New York, NY, USA, 1997; pp. 3–41. [Google Scholar]

- Day, R.H.; Huang, W. Bulls, bears and market sheep. J. Econ. Behav. Organ. 1990, 14, 299–329. [Google Scholar] [CrossRef]

- De Grauwe, P.; Dewachter, H. A chaotic model of the exchange rate: The role of fundamentalists and chartists. Open Econ. Rev. 1993, 4, 351–379. [Google Scholar] [CrossRef]

- Carles, P.G. Estudios de la dinámica de un modelo estocástico para un mercado financiero con distintos tipos de agentes. Stud. Carande Rev. Cienc. Soc. Jurídicas 1999, 4, 163–176. [Google Scholar]

- Díaz, A. La Economía de la Complejidad: Economía Dinámica Caótica; McGraw-Hill: New York, NY, USA, 1994. [Google Scholar]

- Shone, R. Economic Dynamics: Phase Diagrams and Their Economic Application; Cambridge University Press: Cambridge, UK, 2002. [Google Scholar]

- Faggini, M. Chaotic time series analysis in economics: Balance and perspectives. Chaos 2014, 24, 042101. [Google Scholar] [CrossRef]

- Fernández-Díaz, A. Chaos Theory: Current and Future Research and Applications; McGraw-Hill/Interamericana de España SL: Madrid, Spain, 2019. [Google Scholar]

- Sprott, J.C.; Elhadj, Z. World Scientific Series on Nonlinear Science. In Frontiers in the Study of Chaotic Dynamical Systems with Open Problems; Series B; World Scientific: Singapore, 2011; Volume 16. [Google Scholar]

- BenSaïda, A.; Litimi, H. High level chaos in the exchange and index markets. Chaos Solitons Fractals 2013, 54, 90–95. [Google Scholar] [CrossRef]

- Bruno, B.; Faggini, M.; Parziale, A. Complexity modelling in economics: The state of the art. Econ. Thoughts 2016, 5, 29–43. [Google Scholar]

- Lahmiri, S. Investigating existence of chaos in short and long term dynamics of Moroccan exchange rates. Physics A 2017, 465, 655–661. [Google Scholar] [CrossRef]

- Vamvakaris, M.D.; Pantelous, A.A.; Zuev, K.M. Time series analysis of SP 500 index: A horizontal visibility graph approach. Physics A 2018, 497, 41–51. [Google Scholar] [CrossRef]

- BenSaïda, A. Noisy chaos in intraday financial data: Evidence from the American index. Appl. Math. Comput. 2014, 226, 258–265. [Google Scholar] [CrossRef]

- Anagnostidis, P.; Emmanouilides, C.J. Nonlinearity in high-frequency stock returns: Evidence from the Athens Stock Exchange. Physics A 2015, 421, 473–487. [Google Scholar] [CrossRef]

- Aslan, A.; Sensoy, A. Intraday efficiency-frequency nexus in the cryptocurrency markets. Financ. Res. Lett. 2019, 35, 101298. [Google Scholar] [CrossRef]

- Lo, M.; Lee, C.F. A reexamination of the market efficiency hypothesis: Evidence from an electronic intra-day, inter-dealer FX market. Q. Rev. Econ. Financ. 2006, 46, 565–585. [Google Scholar] [CrossRef]

- Leone, V.; Kwabi, F. High frequency trading, price discovery and market efficiency in the FTSE100. Econ. Lett. 2019, 181, 174–177. [Google Scholar] [CrossRef]

- Sandubete, J.E.; Escot, L. Chaotic signals inside some tick-by-tick financial time series. Chaos Solitons Fractals 2020, 137, 109852. [Google Scholar] [CrossRef]

- Ullah, A.; Zhao, X.; Kamal, M.A.; Zheng, J. Modeling the relationship between military spending and stock market development (a) symmetrically in China: An empirical analysis via the NARDL approach. Phys. A Stat. Mech. Its Appl. 2020, 554, 124106. [Google Scholar] [CrossRef]

- Ullah, A.; Zhao, X.; Kamal, M.A.; Riaz, A.; Zheng, B. Exploring asymmetric relationship between Islamic banking development and economic growth in Pakistan: Fresh evidence from a non-linear ARDL approach. Int. J. Financ. Econ. 2021, 26, 6168–6187. [Google Scholar] [CrossRef]

- Syed, A.A.; Kamal, M.A.; Ullah, A.; Grima, S. An Asymmetric Analysis of the Influence That Economic Policy Uncertainty, Institutional Quality, and Corruption Level Have on India’s Digital Banking Services and Banking Stability. Sustainability 2022, 14, 3238. [Google Scholar] [CrossRef]

- Pearce, D.K.; Solakoglu, M.N. Macroeconomic news and exchange rates. J. Int. Financ. Mark. Inst. Money 2007, 17, 307–325. [Google Scholar] [CrossRef]

- Love, R.; Payne, R. Macroeconomic news, order flows, and exchange rates. J. Financ. Quant. Anal. 2008, 43, 467–488. [Google Scholar] [CrossRef]

- Beleña, L. La Hipótesis de Mercado Eficiente y Las Sorpresas de Información en las Noticias Macroeconómicas Estadounidenses para Predecir a Corto Plazo la Cotización del Tipo de Cambio Euro-Dólar; Facultad de Estudios Estadísticos (UCM): Madrid, Spain, 2015. [Google Scholar]

- Engels, J.M.; Diehr, P. Imputation of missing longitudinal data: A comparison of methods. J. Clin. Epidemiol. 2003, 56, 968–976. [Google Scholar] [CrossRef] [PubMed]

- Makovskỳ, P. Modern approaches to efficient market hypothesis of FOREX–the central European case. Procedia Econ. Financ. 2014, 14, 397–406. [Google Scholar] [CrossRef][Green Version]

- Mele, M. On the Inefficient Markets Hypothesis: Arbitrage on the Forex Market. Int. J. Econ. 2015, 9, 111–122. [Google Scholar]

- Firoj, M.; Khanom, S. Efficient market hypothesis: Foreign exchange market of Bangladesh. Int. J. Econ. Financ. Issues 2018, 8, 99. [Google Scholar]

- Lee, N.; Choi, W.; Pae, Y. Market efficiency in foreign exchange market. Econ. Lett. 2021, 205, 109931. [Google Scholar] [CrossRef]

- Ball, R.; Brown, P. An empirical evaluation of accounting income numbers. J. Account. Res. 1968, 6, 159–178. [Google Scholar] [CrossRef]

- Peterson, P.P. Event studies: A review of issues and methodology. Q. J. Bus. Econ. 1989, 28, 36–66. [Google Scholar]

- Kothari, S.P.; Warner, J.B. Econometrics of event studies. In Handbook of Empirical Corporate Finance; Elsevier: Amsterdam, The Netherlands, 2007; pp. 3–36. [Google Scholar]

- Corrado, C.J. Event studies: A methodology review. Account. Financ. 2011, 51, 207–234. [Google Scholar] [CrossRef]

- Croushore, D.; Stark, T. A real-time data set for macroeconomists. J. Econom. 2001, 105, 111–130. [Google Scholar] [CrossRef]

- Bradley, E.; Kantz, H. Nonlinear time-series analysis revisited. Chaos 2015, 25, 097610. [Google Scholar] [CrossRef] [PubMed]

- Tang, L.; Lv, H.; Yang, F.; Yu, L. Complexity testing techniques for time series data: A comprehensive literature review. Chaos Solitons Fractals 2015, 81, 117–135. [Google Scholar] [CrossRef]

- Devaney, R. An Introduction to Chaotic Dynamical Systems; Chapman and Hall/CRC Press: London, UK, 2021. [Google Scholar]

- Lyapunov, A. The General Problem of the Stability of Motion, Kharkov (1892); Academic Press: New York, NY, USA, 1966. [Google Scholar]

- Alligood, K.T.; Sauer, T.D.; Yorke, J.A. Chaos: An Introduction to Dynamical Systems; Springer: New York, NY, USA, 1996. [Google Scholar]

- Giannerini, S.; Rosa, R. Assessing chaos in time series: Statistical aspects and perspectives. Stud. Nonlinear Dyn. Econom. 2004, 8, 1–11. [Google Scholar] [CrossRef]

- Ruelle, D.; Takens, F. On the nature of turbulence. Commun. Math. Phys. 1971, 20, 167–192. [Google Scholar] [CrossRef]

- Mañé, R. On the dimension of the compact invariant sets of certain non-linear maps. In Dynamical Systems and Turbulence, Lecture Notes in Mathematics; Springer: Berlin/Heidelberg, Germany, 1981; pp. 230–242. [Google Scholar]

- Sauer, T.; Yorke, J.A.; Casdagli, M. Embedology. J. Stat. Phys. 1991, 65, 579–616. [Google Scholar] [CrossRef]

- Broer, H.; Takens, F. Reconstruction and time series analysis. In Dynamical Systems and Chaos; Springer: Berlin/Heidelberg, Germany, 2011; pp. 205–242. [Google Scholar]

- Gencay, R.; Dechert, W. An algorithm for the n Lyapunov exponents of an n-dimensional unknown dynamical system. Physics D 1992, 59, 142–157. [Google Scholar] [CrossRef]

- Eckmann, J.P.; Ruelle, D. Ergodic theory of chaos and strange attractors. Rev. Mod. Phys. 1985, 57, 617–656. [Google Scholar] [CrossRef]

- Sano, M.; Sawada, Y. Measurement of the Lyapunov spectrum from a chaotic time series. Phys. Rev. Lett. 1985, 55, 1082. [Google Scholar] [CrossRef]

- Eckmann, J.P.; Kamphorst, S.O.; Ruelle, D.; Ciliberto, S. Liapunov exponents from time series. Phys. Rev. A 1986, 34, 4971–4979. [Google Scholar] [CrossRef]

- Gencay, R. A statistical framework for testing chaotic dynamics via Lyapunov exponents. Physics D 1996, 89, 261–266. [Google Scholar] [CrossRef]

- Shintani, M.; Linton, O. Is there chaos in the world economy? A nonparametric test using consistent standard errors. Int. Econ. Rev. 2003, 44, 331–357. [Google Scholar] [CrossRef]

- McCaffrey, D.F.; Ellner, S.; Gallant, A.R.; Nychka, D.W. Estimating the Lyapunov Exponent of a Chaotic System with Nonparametric Regression. J. Am. Stat. Assoc. 1992, 87, 682–695. [Google Scholar] [CrossRef]

- Dechert, W.D.; Gencay, R. Lyapunov exponents as a nonparametric diagnostic for stability analysis. J. Appl. Econ. 1992, 7, S41–S60. [Google Scholar] [CrossRef]

- Shintani, M.; Linton, O. Nonparametric neural network estimation of Lyapunov exponents and a direct test for chaos. J. Econ. 2004, 120, 1–33. [Google Scholar] [CrossRef]

- Ellner, S.; Gallant, A.; McCaffrey, D.; Nychka, D. Convergence rates and data requirements for Jacobian-based estimates of Lyapunov exponents from data. Phys. Lett. A 1991, 153, 357–363. [Google Scholar] [CrossRef]

- Nychka, D.; Ellner, S.; Gallant, A.R.; McCaffrey, D. Finding Chaos in Noisy Systems. J. R. Stat. Soc. Ser. B Stat. Methodol. 1992, 54, 399–426. [Google Scholar] [CrossRef]

- Whang, Y.J.; Linton, O. The asymptotic distribution of nonparametric estimates of the Lyapunov exponent for stochastic time series. J. Econ. 1999, 91, 1–42. [Google Scholar] [CrossRef]

- Andrews, D.W.K. Heteroskedasticity and Autocorrelation Consistent Covariance Matrix Estimation. Econometrica 1991, 59, 817–858. [Google Scholar] [CrossRef]

- Égert, B.; Kočenda, E. The impact of macro news and central bank communication on emerging European forex markets. Econ. Syst. 2014, 38, 73–88. [Google Scholar] [CrossRef]

- Kočenda, E.; Moravcová, M. Intraday effect of news on emerging European forex markets: An event study analysis. Econ. Syst. 2018, 42, 597–615. [Google Scholar] [CrossRef]

- Sandubete, J.E.; Escot, L. DChaos: An R Package for Chaotic Time Series Analysis. R J. 2021, 13, 232–252. [Google Scholar] [CrossRef]

| Topic | Currency | Macroeconomic New | Frequency | No. Obs |

|---|---|---|---|---|

| Employment | USD | Unemployment rate | Monthly | 189 |

| EUR | Unemployment rate | Monthly | 190 | |

| GBP | Unemployment rate | Monthly | 189 | |

| Trade balance | USD | Trade balance | Monthly | 189 |

| EUR | Trade balance | Monthly | 187 | |

| GBP | Goods trade balance | Monthly | 189 | |

| Economic activity | USD | Advance Gross Domestic Product | Quarterly | 63 |

| EUR | Revised Gross Domestic Product | Quarterly | 63 | |

| GBP | Final Gross Domestic Product | Quarterly | 63 | |

| USD | Retail sales | Monthly | 189 | |

| EUR | Retail sales | Monthly | 189 | |

| GBP | Retail sales | Monthly | 189 | |

| USD | Industrial Production Index | Monthly | 189 | |

| EUR | Industrial Production Index | Monthly | 189 | |

| GBP | Industrial Production Index | Monthly | 189 | |

| Price Index | USD | Consumer Price Index | Monthly | 189 |

| EUR | Consumer Price Index | Monthly | 189 | |

| GBP | Consumer Price Index | Monthly | 189 |

| Currency | No. Obs | Mean | Stand. Dev. | Min | Max | Kurtosis | Skewness |

|---|---|---|---|---|---|---|---|

| EURUSD | 8,238,061 | 1.248645 | 0.134039 | 0.966964 | 1.603625 | −0.794841 | 0.347385 |

| EURGBP | 8,238,061 | 0.834787 | 0.060808 | 0.657782 | 0.980500 | 0.417404 | −1.027335 |

| GBPUSD | 8,238,061 | 1.505842 | 0.215475 | 1.084358 | 2.116291 | 0.216963 | 0.815237 |

| _Trade | _Unemp | _GDP | _Sales | _IPI | _CPI | |

|---|---|---|---|---|---|---|

| -Dif15m | 0.0583 | 0.0036 | −0.0747 | 0.0608 | −0.0295 | 0.0639 |

| (0.4810) | (0.0035) * | (0.7010) | (0.4147) | (0.7020) | (0.3884) | |

| -Dif30m | 0.0226 | 0.009 | 0.0601 | 0.0422 | −0.073 | 0.0091 |

| (0.7757) | (0.9020) | (0.5227) | (0.5688) | (0.3657) | (0.9105) | |

| -Dif60m | −0.0204 | 0.0414 | −0.0114 | 0.0503 | −0.0823 | 0.0231 |

| (0.7984) | (0.5731) | (0.8719) | (0.5029) | (0.3221) | (0.7578) | |

| -Dif15m | −0.0495 | 0.029 | −0.153 | −0.0122 | 0.0163 | 0.037 |

| (0.5053) | (0.6930) | (0.2598) | (0.8705) | (0.8316) | (0.6189) | |

| -Dif30m | −0.0303 | 0.0245 | 0.1069 | −0.0347 | −0.1083 | 0.0348 |

| (0.8478) | (0.7386) | (0.6882) | (0.6444) | (0.1263) | (0.6419) | |

| -Dif60m | −0.0001 | 0.0322 | 0.192 | −0.0633 | −0.1151 | 0.0791 |

| (0.8815) | (0.6609) | (0.1792) | (0.3932) | (0.1089) | (0.2843) | |

| -Dif15m | 0.0886 | −0.0267 | 0.0845 | 0.051 | −0.0696 | 0.0024 |

| (0.2329) | (0.7159) | (0.4175) | (0.4954) | (0.3588) | (0.9758) | |

| -Dif30m | 0.0169 | −0.0178 | −0.0088 | 0.0705 | 0.0022 | −0.0408 |

| (0.8202) | (0.8084) | (0.6403) | (0.3427) | (0.8853) | (0.5780) | |

| -Dif60m | −0.0286 | 0.007 | −0.1698 | 0.0899 | 0.0267 | −0.0568 |

| (0.7003) | (0.9235) | (0.2063) | (0.2263) | (0.6298) | (0.4396) | |

| -Dif15m | −0.0727 | 0.0856 | −0.3296 | −0.0584 | −0.1721 | −0.2116 |

| (0.3206) | (0.2417) | (0.0147) * | (0.4054) | (0.0162) * | (0.0037) * | |

| -Dif30m | −0.0937 | 0.0708 | −0.1756 | −0.1025 | −0.0734 | −0.1981 |

| (0.2026) | (0.3420) | (0.2495) | (0.1517) | (0.3131) | (0.0066) * | |

| -Dif60m | −0.0322 | 0.0441 | −0.0975 | −0.1377 | 0.0417 | −0.1867 |

| (0.6644) | (0.5552) | (0.5661) | (0.0593) | (0.5716) | (0.0106) * | |

| -Dif15m | −0.1473 | 0.0645 | −0.0349 | −0.1791 | −0.0522 | 0.0329 |

| (0.0443) * | (0.3837) | (0.8424) | (0.0136) * | (0.4812) | (0.6558) | |

| -Dif30m | −0.1537 | 0.0786 | 0.0531 | −0.1048 | −0.0484 | 0.0343 |

| (0.0358) * | (0.2847) | (0.5449) | (0.1542) | (0.5029) | (0.6418) | |

| -Dif60m | −0.1373 | 0.0896 | 0.0465 | −0.1063 | 0.0594 | 0.0259 |

| (0.0615) | (0.2222) | (0.7343) | (0.1455) | (0.4237) | (0.7786) | |

| -Dif15m | 0.0142 | 0.0673 | −0.3388 | 0.0262 | −0.1547 | −0.2529 |

| (0.8521) | (0.3567) | (0.0118) * | (0.7442) | (0.0298) | (0.0004) * | |

| -Dif30m | 0.0266 | 0.0394 | −0.2462 | −0.0632 | −0.0369 | −0.2479 |

| (0.7173) | (0.5899) | (0.0769) | (0.3681) | (0.6147) | (0.0006) * | |

| -Dif60m | 0.0815 | −0.0014 | −0.1396 | −0.0981 | −0.0129 | −0.2379 |

| (0.2672) | (0.9711) | (0.3862) | (0.1811) | (0.8623) | (0.0010) * | |

| _Trade | _Unemp | _GDP | _Sales | _IPI | _CPI | |

| -Dif15m | 0.0642 | −0.0123 | 0.1059 | −0.1052 | −0.0834 | −0.2134 |

| (0.3380) | (0.9517) | (0.4161) | (0.1521) | (0.2397) | (0.0032) * | |

| -Dif30m | 0.0592 | 0.0783 | 0.0502 | −0.0822 | −0.0936 | −0.2615 |

| (0.4355) | (0.2635) | (0.7039) | (0.2676) | (0.2075) | (0.0002) * | |

| -Dif60m | 0.1414 | 0.0833 | 0.063 | −0.0423 | −0.1498 | −0.2149 |

| (0.0937) | (0.2482) | (0.6039) | (0.5935) | (0.0508) * | (0.0025) * | |

| -Dif15m | −0.0039 | 0.1882 | −0.1013 | −0.3641 | −0.3202 | 0.3406 |

| (0.9685) | (0.0136) * | (0.4649) | (0.0001) * | (0.0001) * | (0.0001) * | |

| -Dif30m | 0.0165 | 0.1975 | −0.0995 | −0.3289 | −0.2632 | 0.2481 |

| (0.8733) | (0.0084) * | (0.4701) | (0.0001) * | (0.0002) * | (0.0005) * | |

| -Dif60m | 0.0529 | 0.137 | −0.2551 | −0.2711 | −0.2136 | 0.1559 |

| (0.5671) | (0.0742) | (0.0473) * | (0.0001) * | (0.007) * | (0.0345) * | |

| -Dif15m | 0.0723 | −0.157 | 0.1443 | 0.3206 | 0.2517 | −0.4474 |

| (0.3044) | (0.0428) * | (0.2800) | (0.0001) * | (0.0005) * | (0.0001) * | |

| -Dif30m | 0.0534 | −0.1246 | 0.1461 | 0.2753 | 0.1822 | −0.4101 |

| (0.4486) | (0.1040) | (0.2796) | (0.0001) * | (0.0127) * | (0.0001) * | |

| -Dif60m | 0.0773 | −0.0631 | 0.2895 | 0.266 | 0.0764 | −0.2895 |

| (0.3406) | (0.4312) | (0.0218) * | (0.0002) * | (0.2741) | (0.0001) * |

| -1m | [9,1,6] | 0.20437 | 0.21658 | 0.21571 | 0.23997 |

| () * | () * | () * | () * | ||

| -15m | [7,1,3] | 0.14892 | 0.15218 | 0.15844 | 0.18127 |

| () * | () * | () * | () * | ||

| -30m | [8,1,10] | 0.10881 | 0.11293 | 0.11477 | 0.12673 |

| () * | () * | () * | () * | ||

| -1h | [8,1,4] | 0.04167 | 0.04922 | 0.04471 | 0.05593 |

| () * | () * | () * | () * | ||

| -1d | [8,1,3] | −0.12621 | −0.12993 | −0.12618 | −0.13057 |

| (0.2406) | (0.2481) | (0.2402) | (0.2467) | ||

| -1m | [9,1,2] | 0.25176 | 0.26492 | 0.26381 | 0.28308 |

| () * | () * | () * | () * | ||

| -15m | [7,1,5] | 0.16933 | 0.17836 | 0.17391 | 0.19923 |

| () * | () * | () * | () * | ||

| -30m | [8,1,8] | 0.15002 | 0.15271 | 0.15883 | 0.16640 |

| () * | () * | () * | () * | ||

| -1h | [7,1,9] | 0.000974 | 0.00109 | 0.00101 | 0.00124 |

| (0.0493) | (0.0410) | (0.0405) | (0.0421) | ||

| -1d | [8,1,1] | −0.06211 | −0.06455 | −0.06372 | −0.07530 |

| (0.1399) | (0.1468) | (0.1429) | (0.1582) | ||

| -1m | [7,1,6] | 0.13965 | 0.14663 | 0.14419 | 0.15117 |

| () * | () * | () * | () * | ||

| -15m | [10,1,3] | 0.16005 | 0.17708 | 0.17391 | 0.18194 |

| () * | () * | () * | () * | ||

| -30m | [8,1,9] | 0.12806 | 0.13507 | 0.13956 | 0.14987 |

| () * | () * | () * | () * | ||

| -1h | [8,1,9] | −0.03056 | −0.03702 | −0.03301 | −0.04197 |

| (0.0677) | (0.0759) | (0.0703) | (0.0882) | ||

| -1d | [9,1,5] | −0.15907 | −0.16020 | −0.16341 | −0.17022 |

| (0.25919) | (0.26220) | (0.26608) | (0.2717) |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sandubete, J.E.; Beleña, L.; García-Villalobos, J.C. Testing the Efficient Market Hypothesis and the Model-Data Paradox of Chaos on Top Currencies from the Foreign Exchange Market (FOREX). Mathematics 2023, 11, 286. https://doi.org/10.3390/math11020286

Sandubete JE, Beleña L, García-Villalobos JC. Testing the Efficient Market Hypothesis and the Model-Data Paradox of Chaos on Top Currencies from the Foreign Exchange Market (FOREX). Mathematics. 2023; 11(2):286. https://doi.org/10.3390/math11020286

Chicago/Turabian StyleSandubete, Julio E., León Beleña, and Juan Carlos García-Villalobos. 2023. "Testing the Efficient Market Hypothesis and the Model-Data Paradox of Chaos on Top Currencies from the Foreign Exchange Market (FOREX)" Mathematics 11, no. 2: 286. https://doi.org/10.3390/math11020286

APA StyleSandubete, J. E., Beleña, L., & García-Villalobos, J. C. (2023). Testing the Efficient Market Hypothesis and the Model-Data Paradox of Chaos on Top Currencies from the Foreign Exchange Market (FOREX). Mathematics, 11(2), 286. https://doi.org/10.3390/math11020286