Commodity Pricing and Replenishment Decision Strategy Based on the Seasonal ARIMA Model

Abstract

:1. Introduction

2. Preparation for Modeling

2.1. Modeling Assumptions and Data Pre-Processing Methods

- Categorization: All single products were grouped into six distinct categories: floral leaf, cauliflower, aquatic rhizome, solanaceous, chili, and edible mushroom.

- Missing Data Handling: Due to discontinuities in the recorded data, we employed window mean or regression methods to fill in the gaps in the data time points.

- Outlier Identification: We identified outlier data and addressed it using techniques such as moving averages and direct deletion.

- Data Standardization: The data were standardized, scaling it to a zero-mean homoscedastic interval to ensure dimensionless features across multiple data points.

2.2. Relationship between Cost-Plus Pricing and Other Influential Factors

2.2.1. Cost-Plus Pricing

- (1)

- Total fixed cost W is calculated as the product of unit selling price a and the quantity of sale d, while the total variable cost R is determined by multiplying the attrition rate s by the quantity of sale d:W = a × d, R = s × d

- (2)

- The unit cost C is obtained by summing the total fixed cost W and the total variable cost R:C = W + R

- (3)

- The markup rate Q is the quotient of unit cost and sales quantity d multiplied by the difference between selling price and purchase price divided by the sum of the quotient and 1 of the purchase price:

- (4)

- Cost-plus pricing P is:P = C × (1 + Q)

- (5)

- Substituting Equations (2) and (3) into Equation (4), we obtain the final Cost-plus pricing P as:

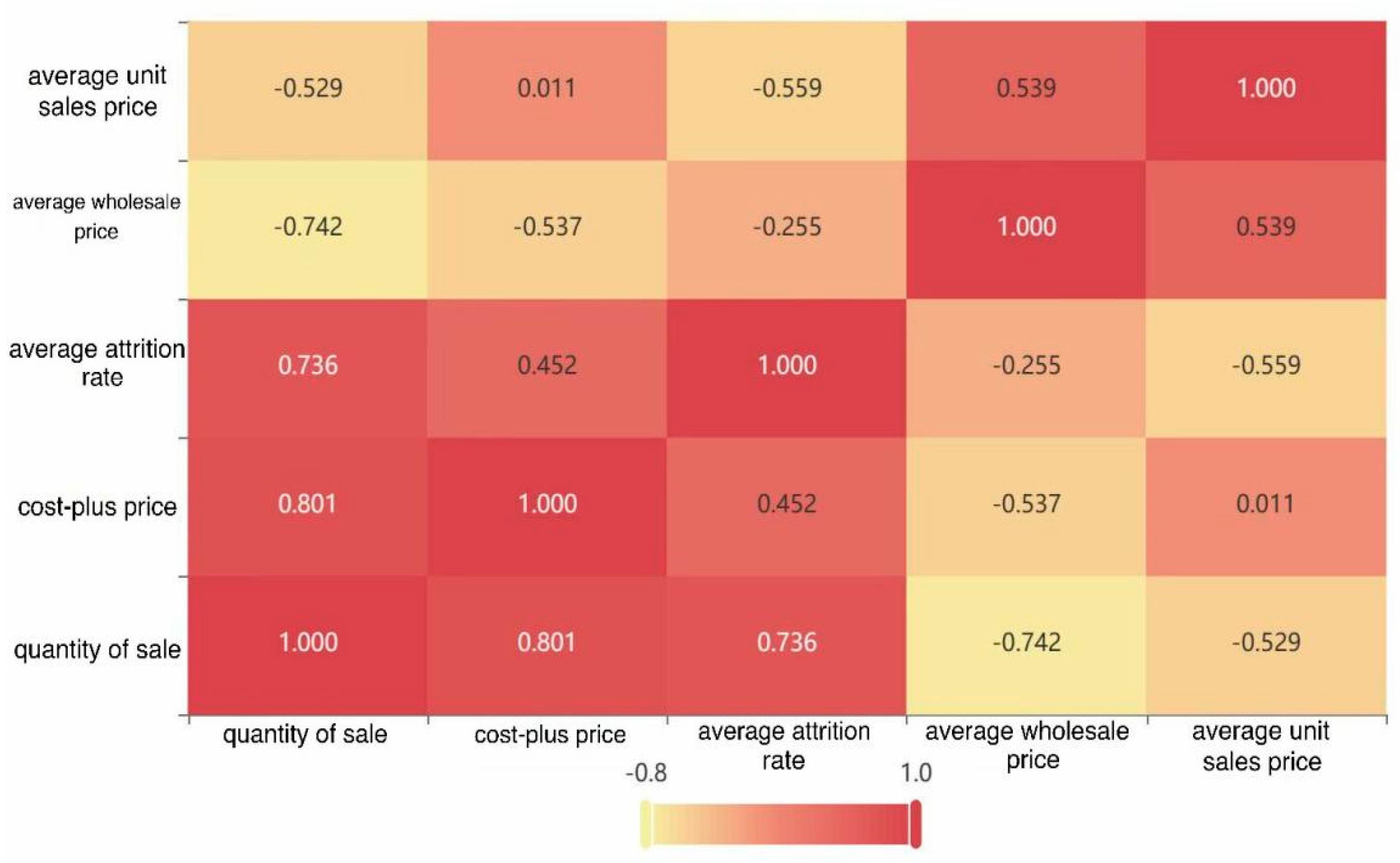

2.2.2. Pearson Correlation Analysis

- Covariance of samples:

- Standard deviation of samples:

- Pearson correlation coefficient of samples:

3. Establishment of a Model

3.1. Prediction of the Replenishment Quantity in Categories

- (1)

- At first, we calculate the total sales volume of each category from 1 July to 7 July in 2020, 2021, and 2022 and draw the sales timing charts for them. Then, we decompose the time series into trend data, seasonal data, and random data to preliminarily judge the seasonal effect of the data.

- (2)

- To prove the stationarity of time series, we did an ADF test on six categories. If p < 0.05, the series is stationary. If the original time series does not satisfy stationarity, it will be differentiated and seasonally differentiated until the series satisfies stationarity.

- (3)

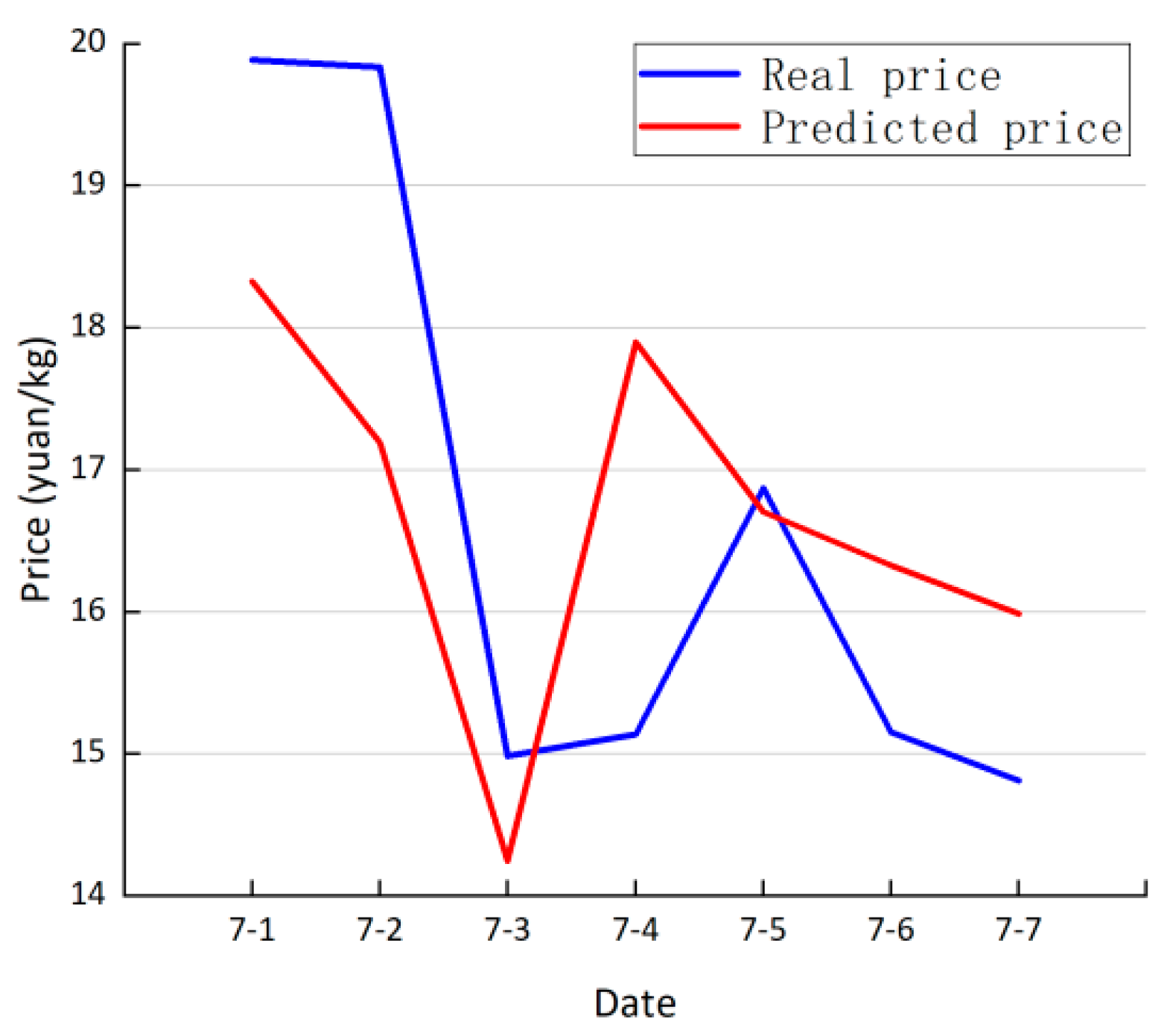

- According to the results of the ADF test, the optimal difference can be found. Then, we established the ACF (auto-correlation function), which describes the linear correlation between time series observations and their past observations. The calculation formula is as follows:Here, k represents the number of lag periods and represents the sequence value. To conduct a more comprehensive analysis, we eliminated interference and examined the Partial Autocorrelation Function (PACF) of the differenced data. The method for analyzing key parameters and the legend entry are identical to those used for the ACF. To reflect the degree of correlation between variables, we draw an autocorrelation chart of final differential data and a partial autocorrelation chart of final differential data. And in order to make the predicted values more visible, we also draw the time series prediction chart.

- (4)

- Solving the models, we obtain the replenishment quantity of six categories in seven days, which can make the income of the supermarket maximal.

3.2. Prediction of Pricing Strategy in Categories

3.3. Prediction of Pricing and Replenishment Strategies for a Single Product

- Single product display quantity constraint: the replenishment quantity of each vegetable single product should meet the conditions of the minimum display quantity of 2.5 kg:

- Restriction on the total number of salable items: In the development of the replenishment plan for the single item, the total number of salable items should be controlled between 27 and 33:

- Supermarket capacity constraint: Due to the limited sales space of supermarket products, the replenishment volume of single items on July 1 should be less than the maximum sales volume of single items (vegetables) in supermarkets from 24 to 30 June:

- Equation constraint: Sales volume and commodity cost plus pricing meet:

- Objective function:

- Constraint conditions:

4. Results and Analysis

4.1. Prediction of the Replenishment Quantity in Categories

4.2. Prediction of Pricing Strategy in Categories

4.3. Prediction of Pricing and Replenishment Strategies for a Single Product

5. Prospects and Suggestions

- (1)

- Consumer return tracking data

- Opinion: Conduct market survey questionnaires during consumers’ shopping check-out to gather feedback on their satisfaction with the shopping experience, related needs for commodity categories, and other relevant information. This data can assist supermarkets in making real-time adjustments to replenishment and pricing decisions.

- Reason: Consumer feedback can directly reflect the quality of service, product availability, product quality, and pricing decisions. Addressing these aspects can lead to improved business strategies for fresh supermarkets, attracting more customers, and creating a positive cycle for dynamic adjustments to replenishment and pricing.

- (2)

- Commodity consumption rate data

- Opinion: Collect comprehensive data on the attrition rates of vegetable commodities, considering various real-world factors that may affect consumption.

- Reason: Idealized consumption rates may not account for factors like residents’ inability to purchase vegetables on certain days or the absence of discounts. Preparing for unexpected situations by improving data on commodity attrition rates will aid supermarkets in adapting replenishment and pricing strategies under special circumstances.

- (3)

- Market demand data

- Opinion: Actively research market demand for vegetable commodities through surveys and interviews, collecting detailed data on consumer needs.

- Reason: Detailed market demand data can reveal specific consumer requirements for various vegetable categories. This information can significantly influence replenishment and pricing decisions, enabling supermarkets to respond to consumer needs by adjusting the quantity and pricing of goods.

- (4)

- Peer competition data

- Opinion: Gather information on promotional activities conducted by neighboring fresh food supermarkets and compile it into peer competition data.

- Reason: Nearby fresh food supermarkets often compete with each other for customers, leading to potential price wars on vegetable commodities. Price adjustments can affect sales volumes, impacting supermarket profits. Collecting peer competition data can help supermarkets make informed decisions on replenishment and pricing.

- (5)

- Weather data

- Opinion: Monitor and collect local weather forecasts for the upcoming week and organize this data.

- Reason: Weather conditions significantly influence the sales of vegetable commodities. Temperature changes can affect storage cycles and pricing, while precipitation can impact customer traffic and goods transportation. Given the unpredictability of weather, having access to weather data allows supermarkets to adjust replenishment and pricing decisions to mitigate economic losses.

- (6)

- Supply chain data

- Opinion: Gain insights into supply chain information, including inventory levels, supplier reliability, delivery times, and transportation times, and consolidate it into comprehensive supply chain data.

- Reason: Supply chain information plays a pivotal role in replenishment and pricing decisions. Inventory levels determine the extent of replenishment and pricing adjustments, while supplier reliability affects the timeliness of fresh supply. Integrating supply chain data enables supermarkets to fine-tune their replenishment and pricing strategies for vegetable goods.

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Correction Statement

References

- Chen, J.; Dan, B. Fresh agricultural product supply chain coordination under the physical loss-controlling. Eng.-Theory Pract. Syst. 2009, 29, 54–62. [Google Scholar]

- Emanuele, F.; Andrea, M.; Giuseppe, N.D. Vanilla-option-pricing: Pricing and market calibration for options on energy commodities. Softw. Impacts 2020, 6, 100043. [Google Scholar]

- Guo, L. Cross-border e-commerce platform for commodity automatic pricing model based on deep learning. Electron. Commer. Res. 2022, 22, 1–20. [Google Scholar] [CrossRef]

- Chen, J.; Ewald, C.; Ouyang, R.; Westgaard, S.; Xiao, X. Pricing commodity futures and determining risk premia in a three factor model with stochastic volatility: The case of Brent crude oil. Ann. Oper. Res. 2021, 313, 29–46. [Google Scholar] [CrossRef]

- Crosby, J.; Frau, C. Jumps in commodity prices: New approaches for pricing plain vanilla options. Energy Econ. 2022, 114, 106302. [Google Scholar] [CrossRef]

- Liang, X.; Wang, N.; Zhang, M.; Jiang, B. Bi-objective multi-period vehicle routing for perishable goods delivery considering customer satisfaction. Expert Syst. Appl. 2023, 220, 119712. [Google Scholar] [CrossRef]

- Reza, M.A.; Rashed, S.; Hassan, M.S.H. Optimizing the sales level of perishable goods in a two-echelon green supply chain under uncertainty in manufacturing cost and price. J. Ind. Prod. Eng. 2022, 39, 581–596. [Google Scholar]

- Zhao, S.; Li, W. Block chain-based traceability system adoption decision in the dual-channel perishable goods market under different pricing policies. Int. J. Prod. Res. 2023, 61, 4548–4574. [Google Scholar] [CrossRef]

- Zhao, H.; Wang, X. Basic pricing model of perishable goods by electric businesses under group buying in cooperation mode between merchants and group buying platform. J. Shenyang Univ. Technol. (Soc. Sci. Ed.) 2018, 11, 544–548. [Google Scholar]

- Zhang, X.; Mo, N. Ordering and Pricing Strategy of Perishable Goods Inventory Based on Weibull Function and Price Discount. J. Chongqing Norm. Univ. (Nat. Sci.) 2019, 37, 1–5. [Google Scholar]

- Guo, S. Dynamic Pricing of Perishable Goods with Consideration of Consumer Returns. Master’s Thesis, Nanjing University of Science and Technology, Nanjing, China, 2022. [Google Scholar]

- Young, H.C. Optimal pricing and ordering policies for perishable commodities. Eur. J. Oper. Res. 2003, 144, 68–82. [Google Scholar]

- Elmaghraby, W.; Gulcu, A.; Keskinocak, P. Designing opyimal preannounced markdowns in the presence of rational customers with multiunit demands. Manuf. Serv. Oper. Manag. 2008, 10, 126–148. [Google Scholar] [CrossRef]

- Aviv, Y.; Pazgal, A. Optimal pricing of seasonal products in the presence of forward looking consumers. Manuf. Serv. Oper. Manag. 2008, 10, 339–359. [Google Scholar] [CrossRef]

- Maihami, R.; Nakhai, K. Joint control of inventory and its pricing for noninstantaneously deteriorating items under permissible delay in payments and partial backlogging. Math. Comput. Model. 2012, 55, 1722–1733. [Google Scholar] [CrossRef]

- Wang, Y. Cost-plus pricing from KFC. Econ. Res. Guide 2011, 17, 1673-291X (2011) 17-0158-02. [Google Scholar]

- Cleophas, T.J.; Zwinderman, A.H. Bayesian Pearson Correlation Analysis. In Modern Bayesian Statistics in Clinical Research; Springer: Cham, Switzerland, 2018. [Google Scholar]

- Dimri, T.; Ahmad, S.; Sharif, M. Time series analysis of climate variables using seasonal ARIMA approach. J. Earth Syst. Sci. 2020, 129, 149. [Google Scholar] [CrossRef]

- Khashei, M.; Bijari, M.; Hejazi, S.R. Combining seasonal ARIMA models with computational intelligence techniques for time series forecasting. Soft Comput. 2012, 16, 1091–1105. [Google Scholar] [CrossRef]

- John, R.C.S. Applied linear regression. J. Qual. Technol. 1981, 13, 218–219. [Google Scholar] [CrossRef]

- Flatman, R.J.; Badrick, T.C. Linear regression. Aust. J. Med. Sci. 1992, 13, 13–17. [Google Scholar]

- Cornejo-Acosta, J.A.; García-Díaz, J.; Pérez-Sansalvador, J.C.; Segura, C. Compact Integer Programs for Depot-Free Multiple Traveling Salesperson Problems. Mathematics 2023, 11, 3014. [Google Scholar] [CrossRef]

- Wang, S.; Cheng, J.; Zhu, B. Optimal operation of a single unit in a pumping station based on a combination of orthogonal experiment and 0-1 integer programming algorithm. Water Supply 2022, 22, 7905–7915. [Google Scholar] [CrossRef]

| Variable | Series | t | p | AIC | Critical Value | ||

|---|---|---|---|---|---|---|---|

| 1% | 5% | 10% | |||||

| Aquatic rhizomes category | Primitive series | 1.738 | 0.998 | 86.390 | −4.138 | −3.155 | −2.714 |

| First-order difference | −1.640 | 0.462 | 88.892 | −4.138 | −3.155 | −2.714 | |

| 1st order difference–1st order seasonal difference | −4.611 | 0.000 | 70.786 | −4.138 | −3.155 | −2.714 | |

| Date | Floral Leaf | Cauliflower | Aquatic Rhizome | Solanaceous | Chili | Edible Mushroom |

|---|---|---|---|---|---|---|

| 1 | 126.495 | 28.897 | 30.068 | 17.421 | 39.874 | 43.257 |

| 2 | 171.263 | 55.851 | 43.649 | 18.477 | 39.874 | 43.257 |

| 3 | 164.640 | 47.944 | 78.855 | 33.370 | 39.874 | 43.257 |

| 4 | 92.573 | 27.955 | 35.201 | 8.804 | 39.874 | 43.257 |

| 5 | 109.178 | 42.640 | 49.490 | 8.526 | 39.874 | 43.257 |

| 6 | 140.429 | 31.186 | 54.000 | 0.040 | 39.874 | 43.257 |

| 7 | 110.012 | 50.962 | 58.048 | 5.604 | 39.874 | 43.257 |

| Unstandardized Coeffient | Standardized Coefficient | t | p | VIF | R2 | Adjust R2 | F | ||

|---|---|---|---|---|---|---|---|---|---|

| B | Standard Error | Beta | |||||||

| Constant | 19.588 | 1.935 | - | 10.123 | 0.000 | - | 0.35 | 0.22 | F = 2.693 p = 0.162 |

| Sales Volume | −0.084 | 0.051 | −0.592 | −1.641 | 0.162 | 1 | |||

| Dependent variable: cost-plus pricing | |||||||||

| Date | Floral Leaf | Cauliflower | Aquatic Rhizome | Solanaceous | Chili | Edible Mushroom |

|---|---|---|---|---|---|---|

| 1 | 5.70 | 9.54 | 17.06 | 7.02 | 12.58 | 11.47 |

| 2 | 5.66 | 8.82 | 15.92 | 7.04 | 12.58 | 11.47 |

| 3 | 5.66 | 9.03 | 12.96 | 7.18 | 12.58 | 11.47 |

| 4 | 5.74 | 9.57 | 16.63 | 6.94 | 12.58 | 11.47 |

| 5 | 5.72 | 9.17 | 15.43 | 6.94 | 12.58 | 11.47 |

| 6 | 5.69 | 9.48 | 15.05 | 6.85 | 12.58 | 11.47 |

| 7 | 5.72 | 8.95 | 14.71 | 6.91 | 12.58 | 11.47 |

| Single Product | Replenishment Volume (kg) | Pricing (CNY/kg) | Single Product | Replenishment Volume (kg) | Pricing (CNY/kg) |

|---|---|---|---|---|---|

| Xixia Mushroom (1) | 6.57 | 24.19 | Yunnan lettuce (portion) | 58.00 | 4.91 |

| Shanghai Cole | 7.04 | 8.16 | Basella rubra | 9.59 | 5.19 |

| Flowering cabbage | 4.11 | 7.94 | Spinach (portion) | 15.00 | 7.21 |

| Yunnan romaine vegetable (portion) | 26.00 | 4.48 | Branch Jiang green stalk scattered flowers | 11.19 | 46.42 |

| Green eggplant (1) | 7.10 | 7.40 | Cordyceps flower (portion) | 4.00 | 11.18 |

| Broccoli | 10.74 | 13.47 | Spinach | 3.25 | 17.87 |

| Lotus root (1) | 7.66 | 14.92 | Tall Melon (1) | 3.95 | 12.80 |

| Screw pepper (portion) | 19.00 | 102.14 | Millet pepper (portion) | 33.00 | 5.92 |

| Ginger, Garlic, millet and pepper Combo (small) | 9.00 | 38.87 | Green and Red Hangzhou Pepper combination (portion) | 4.00 | 20.03 |

| Baby Chinese cabbage | 19.00 | 6.27 | Mushroom bisporus (box) | 13.00 | 66.75 |

| Crab Mushroom and White Jade Mushroom Double combination (box) | 3.95 | 74.65 | Flammulina mushrooms (box) | 26.00 | 45.17 |

| Screw pepper | 8.47 | 11.44 | Honghu lotus root belt | 4.74 | 146.88 |

| Water caltrop | 3.40 | 28.48 | Sweet potato tips | 7.06 | 5.12 |

| Chrysanthemum | 3.68 | 16.47 | Sea mushrooms (bag) | 13.00 | 32.06 |

| Small Green Vegetables (1) | 7.81 | 5.31 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liu, J.; Liu, B. Commodity Pricing and Replenishment Decision Strategy Based on the Seasonal ARIMA Model. Mathematics 2023, 11, 4921. https://doi.org/10.3390/math11244921

Liu J, Liu B. Commodity Pricing and Replenishment Decision Strategy Based on the Seasonal ARIMA Model. Mathematics. 2023; 11(24):4921. https://doi.org/10.3390/math11244921

Chicago/Turabian StyleLiu, Jiaying, and Bin Liu. 2023. "Commodity Pricing and Replenishment Decision Strategy Based on the Seasonal ARIMA Model" Mathematics 11, no. 24: 4921. https://doi.org/10.3390/math11244921

APA StyleLiu, J., & Liu, B. (2023). Commodity Pricing and Replenishment Decision Strategy Based on the Seasonal ARIMA Model. Mathematics, 11(24), 4921. https://doi.org/10.3390/math11244921