Continuous Wavelet Transform of Time-Frequency Analysis Technique to Capture the Dynamic Hedging Ability of Precious Metals

Abstract

:1. Introduction

2. Materials and Methods

2.1. Theoretical Mechanism

2.2. Empirical Technique

2.2.1. The Form of CWT

2.2.2. Wavelet Coherence

2.2.3. Wavelet Partial Coherence and Phase-Difference

2.3. Data

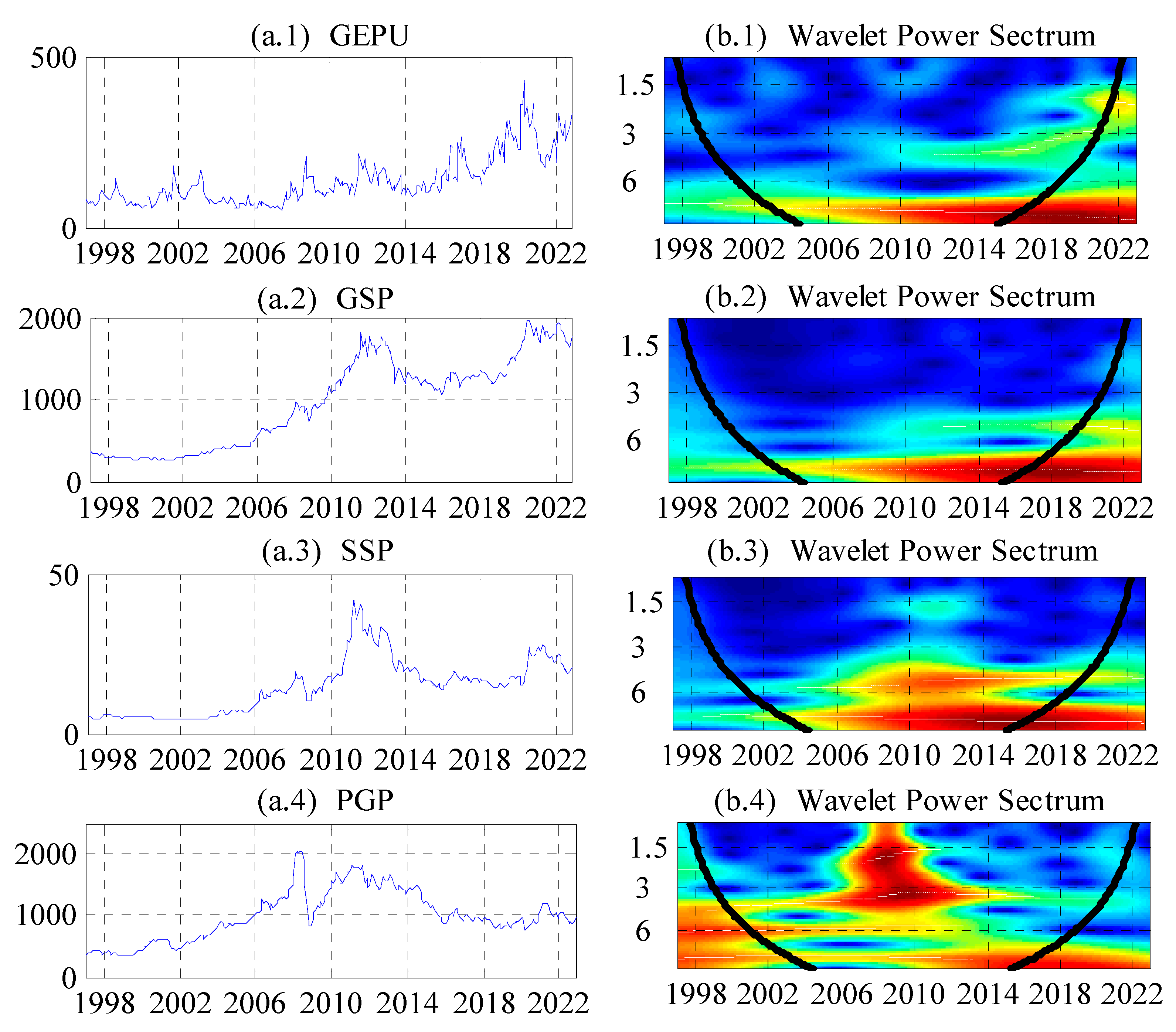

3. Results

3.1. Descriptive Statistics

3.2. The Correlation between GEPU and GSP

3.3. The Correlation between GEPU and SSP

3.4. The Correlation between GEPU and PSP

4. Discussion

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Qin, M.; Su, C.W.; Umar, M.; Lobonţ, O.R.; Manta, A.G. Are climate and geopolitics the challenges to sustainable development? Novel evidence from the global supply chain. Econ. Anal. Polic. 2023, 77, 748–763. [Google Scholar] [CrossRef]

- Davis, S.J. An Index of Global Economic Policy Uncertainty; NBER Working Papers 22740; National Bureau of Economic Research, Inc.: Cambridge, MA, USA, 2016. [Google Scholar]

- Qin, M.; Su, C.W.; Xiao, Y.D.; Zhang, S. Should gold be held under global economic policy uncertainty? J. Bus. Econ. Manag. 2020, 21, 725–742. [Google Scholar] [CrossRef] [Green Version]

- Su, C.W.; Liu, F.Y.; Qin, M.; Chnag, T.Y. Is a consumer loan a catalyst for confidence? Ekon. Istraz. Econ. Res. 2022, 1–22. [Google Scholar] [CrossRef]

- Su, C.W.; Pang, L.D.; Umar, M.; Lobonţ, O.R.; Moldovan, N.C. Does gold’s hedging uncertainty aura fade away? Resour. Policy 2022, 77, 102726. [Google Scholar] [CrossRef]

- Han, Y.W.; Li, J. The impact of global economic policy uncertainty on portfolio optimization: A Black–Litterman approach. Int. Rev. Financ. Anal. 2023, 86, 102476. [Google Scholar] [CrossRef]

- Qin, M.; Su, C.W.; Tao, R. BitCoin: A new basket for eggs? Econ. Model. 2021, 94, 896–907. [Google Scholar] [CrossRef]

- Kamal, J.B.; Wohar, M.; Kamal, K.B. Do gold, oil, equities, and currencies hedge economic policy uncertainty and geopolitical risks during covid crisis? Resour. Policy 2022, 78, 102920. [Google Scholar] [CrossRef]

- Cheng, S.; Zhang, Z.Y.; Cao, Y. Can precious metals hedge geopolitical risk? Fresh sight using wavelet coherence analysis. Resour. Policy 2022, 79, 102972. [Google Scholar] [CrossRef]

- Gençyürek, A.G.; Ekinci, R. Safe-haven and hedging roles of precious metals for BRICS and Turkey. Borsa Istanb. Rev. 2022, in press. [CrossRef]

- Su, C.W.; Qin, M.; Tao, R.; Zhang, X.Y. Is the status of gold threatened by bitcoin? Ekon. Istraz. Econ. Res. 2020, 33, 420–437. [Google Scholar] [CrossRef]

- Qin, M.; Su, C.W.; Qi, X.Z.; Hao, L.N. Should gold be stored in chaotic eras? Ekon. Istraz. Econ. Res. 2020, 33, 224–242. [Google Scholar] [CrossRef] [Green Version]

- Qin, M.; Su, C.W.; Pirtea, M.G.; Peculea, A.D. The essential role of Russian geopolitics: A fresh perception into the gold market. Resour. Policy 2023, 81, 103310. [Google Scholar] [CrossRef]

- Qin, M.; Su, C.W.; Tao, R.; Umar, M. Is factionalism a push for gold price? Resour. Policy 2020, 67, 101679. [Google Scholar] [CrossRef]

- Chiang, T.C. The effects of economic uncertainty, geopolitical risk and pandemic upheaval on gold prices. Resour. Policy 2022, 76, 102546. [Google Scholar] [CrossRef]

- Cui, M.Y.; Wong, W.K.; Wisetsri, W.; Mabrouk, F.; Muda, I.; Li, Z.Y.; Hassan, M. Do oil, gold and metallic price volatilities prove gold as a safe haven during COVID-19 pandemic? Novel evidence from COVID-19 data. Resour. Policy 2023, 80, 103133. [Google Scholar] [CrossRef]

- Sami, J. Has the long-run relationship between gold and silver prices really disappeared? Evidence from an emerging market. Resour. Policy 2021, 74, 102292. [Google Scholar] [CrossRef]

- McCown, J.R.; Shaw, R. Investment potential and risk hedging characteristics of platinum group metals. Q. Rev. Econ. Financ. 2017, 63, 328–337. [Google Scholar] [CrossRef]

- Dibooglu, S.; Cevik, E.I.; Gillman, M. Gold, silver, and the US dollar as harbingers of financial calm and distress. Q. Rev. Econ. Financ. 2022, 86, 200–210. [Google Scholar] [CrossRef]

- Chen, J.Y.; Wang, Y.L.; Ren, X.H. Asymmetric effect of financial stress on China’s precious metals market: Evidence from a quantile-on-quantile regression. Res. Int. Bus. Financ. 2023, 64, 101831. [Google Scholar] [CrossRef]

- Wei, Y.; Wang, Y.Z.; Lucey, B.M.; Vigne, S.A. Cryptocurrency uncertainty and volatility forecasting of precious metal futures markets. J. Commod. Mark. 2023, 29, 100305. [Google Scholar] [CrossRef]

- Pierdzioch, C.; Risse, M.; Rohloff, S. Are precious metals a hedge against exchange-rate movements? An empirical exploration using bayesian additive regression trees. N. Am. J. Econ. Financ. 2016, 38, 27–38. [Google Scholar] [CrossRef]

- Salisu, A.A.; Gupta, R.; Nel, J.; Bouri, E. The (Asymmetric) effect of El Niño and La Niña on gold and silver prices in a GVAR model. Resour. Policy 2022, 78, 102897. [Google Scholar] [CrossRef]

- Shahzad, U.; Mohammed, K.S.; Tiwari, S.; Nakonieczny, J.; Nesterowicz, R. Connectedness between geopolitical risk, financial instability indices and precious metals markets: Novel findings from Russia Ukraine conflict perspective. Resour. Policy 2023, 80, 103190. [Google Scholar] [CrossRef]

- Mensi, W.; Ali, S.R.M.; Vo, X.V.; Kang, S.H. Multiscale dependence, spillovers, and connectedness between precious metals and currency markets: A hedge and safe-haven analysis. Resour. Policy 2022, 77, 102752. [Google Scholar] [CrossRef]

- Su, Y.D.; Khaskheli, A.; Raza, S.A.; Yousufi, S.Q. How COVID-19 influences prices of oil and precious metals: Comparison between data extracted from online searching trends and actual events. Resour. Policy 2022, 78, 102916. [Google Scholar]

- Mensi, W.; Aslan, A.; Vo, X.V.; Kang, S.H. Time-frequency spillovers and connectedness between precious metals, oil futures and financial markets: Hedge and safe haven implications. Int. Rev. Econ. Financ. 2023, 83, 219–232. [Google Scholar] [CrossRef]

- Jiang, Y.H.; Fu, Y.Y.; Ruan, W.H. Risk spillovers and portfolio management between precious metal and BRICS stock markets. Phys. A. 2019, 534, 120993. [Google Scholar] [CrossRef]

- Erdoğan, S.; Gedikli, A.; Çevik, E.İ.; Erdoğan, F.; Çevik, E. Precious metals as safe-haven for clean energy stock investment: Evidence from nonparametric Granger causality in distribution test. Resour. Policy 2022, 79, 102945. [Google Scholar] [CrossRef]

- Sephton, P.S. Revisiting the inflation-hedging properties of precious metals in Africa. Resour. Policy 2022, 77, 102735. [Google Scholar] [CrossRef]

- Mokni, K.; Al-Shboul, M.; Assaf, A. Economic policy uncertainty and dynamic spillover among precious metals under market conditions: Does COVID-19 have any effects? Resour. Policy 2021, 74, 102238. [Google Scholar] [CrossRef]

- Ahmed, R.; Chaudhry, S.M.; Kumpamool, C.; Benjasak, C. Tail risk, systemic risk and spillover risk of crude oil and precious metals. Energ. Econ. 2022, 112, 106063. [Google Scholar] [CrossRef]

- Das, D.; Bhatia, V.; Kumar, S.B.; Basu, S. Do precious metals hedge crude oil volatility jumps? Int. Rev. Econ. Financ 2022, 83, 102257. [Google Scholar] [CrossRef]

- Huang, J.; Cao, Y.; Zhong, P.S. Searching for a safe haven to crude oil: Green bond or precious metals? Financ. Res. Lett. 2022, 50, 103303. [Google Scholar] [CrossRef]

- Khaskheli, A.; Zhang, H.Y.; Raza, S.A.; Khan, K.A. Assessing the influence of news indicator on volatility of precious metals prices through GARCH-MIDAS model: A comparative study of pre and during COVID-19 period. Resour. Policy 2022, 79, 102951. [Google Scholar] [CrossRef]

- Yıldırım, D.Ç.; Esen, Ö.; Ertuğrul, H.M. Impact of the COVID-19 pandemic on return and risk transmission between oil and precious metals: Evidence from DCC-GARCH model. Resour. Policy 2022, 79, 102939. [Google Scholar] [CrossRef]

- Frimpong, S.; Gyamfi, E.N.; Ishaq, Z.; Agyei, S.K.; Agyapong, D.; Adam, A.M. Can global economic policy uncertainty drive the interdependence of agricultural commodity prices? Evidence from partial wavelet coherence analysis. Complexity 2021, 2021, 8848424. [Google Scholar] [CrossRef]

- Agyei, S.K.; Bossman, A.; Asafo-Adjei, E.; Asiamah, O.; Adela, V.; Adorm-Takyi, C. Exchange rate, COVID-19, and stock returns in Africa: Insights from time-frequency domain. Discret. Dyn. Nat. Soc. 2022, 2022, 4372808. [Google Scholar] [CrossRef]

- Cifarelli, G.; Paladino, G. Oil price dynamics and speculation: A multivariate financial approach. Energ. Econ. 2010, 32, 363–372. [Google Scholar] [CrossRef]

- Sharpe, W.F. Capital asset prices: A theory of market equilibrium under conditions of risk. J. Financ. 1964, 19, 425–442. [Google Scholar]

- Aguiar-Conraria, L.; Soares, M.J. Oil and the macroeconomy: Using wavelets to analyze old issues. Empir. Econ. 2011, 40, 645–655. [Google Scholar] [CrossRef]

- Crowley, P. An intuitive guide to wavelets for economists. J. Econ. Surv. 2007, 21, 207–267. [Google Scholar] [CrossRef]

- Torrence, C.; Compo, G.P. A practical guide to wavelet analysis. B. Am. Meteorol. Soc. 1998, 79, 61–78. [Google Scholar] [CrossRef]

- Torrence, C.; Webster, P.J. Interdecadal changes in the ENSO-Monsoon System. J. Climate 1999, 12, 2679–2690. [Google Scholar] [CrossRef]

- Grinsted, A.; Moore, J.C.; Jevrejeva, S. Application of the cross wavelet transform and wavelet coherence to geophysical time series. Nonlinear Proc. Geoph. 2004, 11, 561–566. [Google Scholar] [CrossRef]

- Caldara, D.; Iacoviello, M. Measuring Geopolitical Risk; Working Paper; Board of Governors of the Federal Reserve Board: Washington, DC, USA, 2021. [Google Scholar]

- Qin, M.; Su, C.W.; Zhong, Y.F.; Song, Y.R.; Oana-Ramona, L. Sustainable finance and renewable energy: Promoters of carbon neutrality in the United States. J. Environ. Manag. 2022, 324, 116390. [Google Scholar] [CrossRef]

- Zheng, H.D.; Ding, Y.J.; Wen, Q.; Liu, B.; Zhang, S.G. Separation and purification of platinum group metals from aqueous solution: Recent developments and industrial applications. Resour. Conserv. Recy. 2021, 167, 105417. [Google Scholar] [CrossRef]

| GEPU | GSP | SSP | PSP | GPR | USDI | |

|---|---|---|---|---|---|---|

| Observations | 311 | 311 | 311 | 311 | 311 | 311 |

| Mean | 135.363 | 958.761 | 14.650 | 993.464 | 100.228 | 92.296 |

| Median | 113.204 | 1061.900 | 14.940 | 947.410 | 89.140 | 93.040 |

| Maximum | 430.259 | 1964.900 | 41.970 | 2052.450 | 512.530 | 120.240 |

| Minimum | 48.877 | 254.800 | 4.120 | 342.600 | 39.050 | 71.840 |

| Standard Deviation | 72.499 | 543.567 | 8.640 | 413.234 | 51.782 | 10.990 |

| Skewness | 1.312 | 0.099 | 0.659 | 0.342 | 4.259 | 0.342 |

| Kurtosis | 4.316 | 1.605 | 2.908 | 2.436 | 29.342 | 2.605 |

| Jarque-Bera | 111.654 *** | 25.704 *** | 22.624 *** | 10.187 *** | 9932.029 *** | 8.078 ** |

| Probability | 0.000 | 0.000 | 0.000 | 0.006 | 0.000 | 0.018 |

| Variables | Terms of Correlations | Time Periods | Lead-Lag Relations |

|---|---|---|---|

| GEPU—GSP | Long term | 1997 | Synchronous (+) |

| 1998–2000 | GSP leads GEPU (+) | ||

| 2011–2022 | GEPU leads GSP (+) | ||

| Medium term | 1997 | GSP leads GEPU (+) | |

| Short term | 2011 | GSP leads GEPU (+) | |

| 2008, 2020 | GEPU leads GSP (+) | ||

| GEPU—SSP | Long term | 2006–2008, 2013–2015 | GEPU leads SSP (+) |

| Medium term | 2017 | GEPU leads SSP (+) | |

| Short term | 2017–2022 | GEPU leads SSP (+) | |

| GEPU—PSP | Long term | 2007–2009 | PSP leads GEPU (+) |

| 2014–2015 | GEPU leads PSP (+) | ||

| Medium term | 2008–2009, 2010–2013 | PSP leads GEPU (+) | |

| 2017 | GEPU leads PSP (+) | ||

| Short term | 2016–2017 | GEPU leads PSP (+) | |

| 2018–2022 | PSP leads GEPU (−) |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Su, C.-W.; Wang, K.-H.; Lobonţ, O.-R.; Qin, M. Continuous Wavelet Transform of Time-Frequency Analysis Technique to Capture the Dynamic Hedging Ability of Precious Metals. Mathematics 2023, 11, 1186. https://doi.org/10.3390/math11051186

Su C-W, Wang K-H, Lobonţ O-R, Qin M. Continuous Wavelet Transform of Time-Frequency Analysis Technique to Capture the Dynamic Hedging Ability of Precious Metals. Mathematics. 2023; 11(5):1186. https://doi.org/10.3390/math11051186

Chicago/Turabian StyleSu, Chi-Wei, Kai-Hua Wang, Oana-Ramona Lobonţ, and Meng Qin. 2023. "Continuous Wavelet Transform of Time-Frequency Analysis Technique to Capture the Dynamic Hedging Ability of Precious Metals" Mathematics 11, no. 5: 1186. https://doi.org/10.3390/math11051186