Stability Analysis of Innovation Collaboration between Commercial Banks and Fintech Companies

Abstract

:1. Introduction

2. Literature Review

2.1. Motivations for Banks and Fintechs to Engage in Collaboration

2.2. Stability of Collaboration between Banks and Fintechs

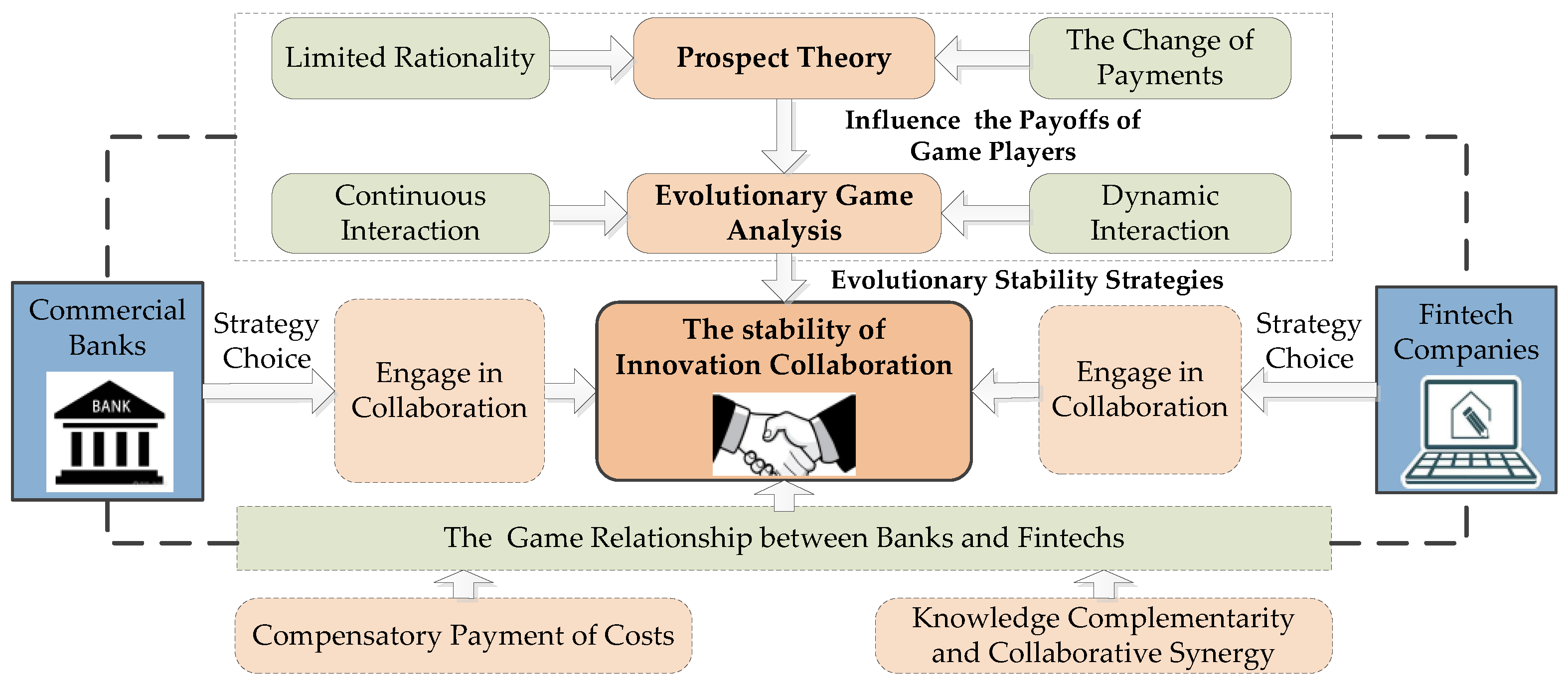

- Establishing the evolutionary game relationship between banks and fintechs, this study examines the change process of collaboration stability in the context of China’s rapidly growing fintech market and the construction of a new fintech ecosystem.

- This study considers the bounded rationality of collaborating partners. It can effectively enhance the science of analysis by introducing prospect theory into the decision analysis of banks and fintechs.

- This study uses scenario simulation analysis to analyze which factors influence the stability of collaboration qualitatively. The simulation results suggest recommendations for banks and fintechs to forge a stable and effective partnership.

3. Methodology Adoption and Model Construction

3.1. Application Analysis of Evolutionary Game Theory and Prospect Theory

3.2. Model Assumption

- Game player B represents banks, while game player F represents fintechs.

- In the game process, the banks’ strategy can be expressed as {collaboration, competition}. If the probability that banks adopt the collaboration strategy is denoted by x(x ∈ [0,1]), then the probability that the banks select the competition strategy is (1 − x). Correspondingly, the fintechs’ strategy set is {collaboration, competition}. Assuming the probability that fintechs select collaboration is y(y ∈ [0,1]), the probability that fintechs choose competition strategy is (1 − y).

- The rights and obligations of game players are equal. When the banks or fintechs choose to collaborate, they will have to spend resources to maintain collaborative relationships, but they will also have the right to share some of the technology, knowledge, and customer resources; when the banks or fintechs not to collaborate, they will also lose the right to obtain external resources.

- Differences in partners’ concerns about short-term and long-term benefits and costs. Due to the greater uncertainty surrounding long-term benefits and costs, assessments of these factors rely more heavily on decision-makers’ perceptions compared to short-term considerations.

- In accordance with prospect theory, the value of the reference point in the value function is set to 0. Furthermore, the perceived utility of long-term profits and losses is substituted by the deviation of profits or losses from this reference point.

3.3. Long-Term Payoffs Based on Prospect Theory

3.4. Payoff Matrix of the Evolutionary Game Model

4. Stability Analysis

4.1. Model Description

4.2. Game Theory Model Solving and Analysis

4.2.1. Asymptotic Stability Analysis of the Banks

4.2.2. Asymptotic Stability Analysis of the Fintechs

4.2.3. Analysis of Strategic Stability of Both Sides of Game

4.2.4. Analysis of Factors Influencing Collaborative Stability

5. Case Study and Simulation Results

5.1. Effect Analysis of the Overall Long-Term Benefits (π)

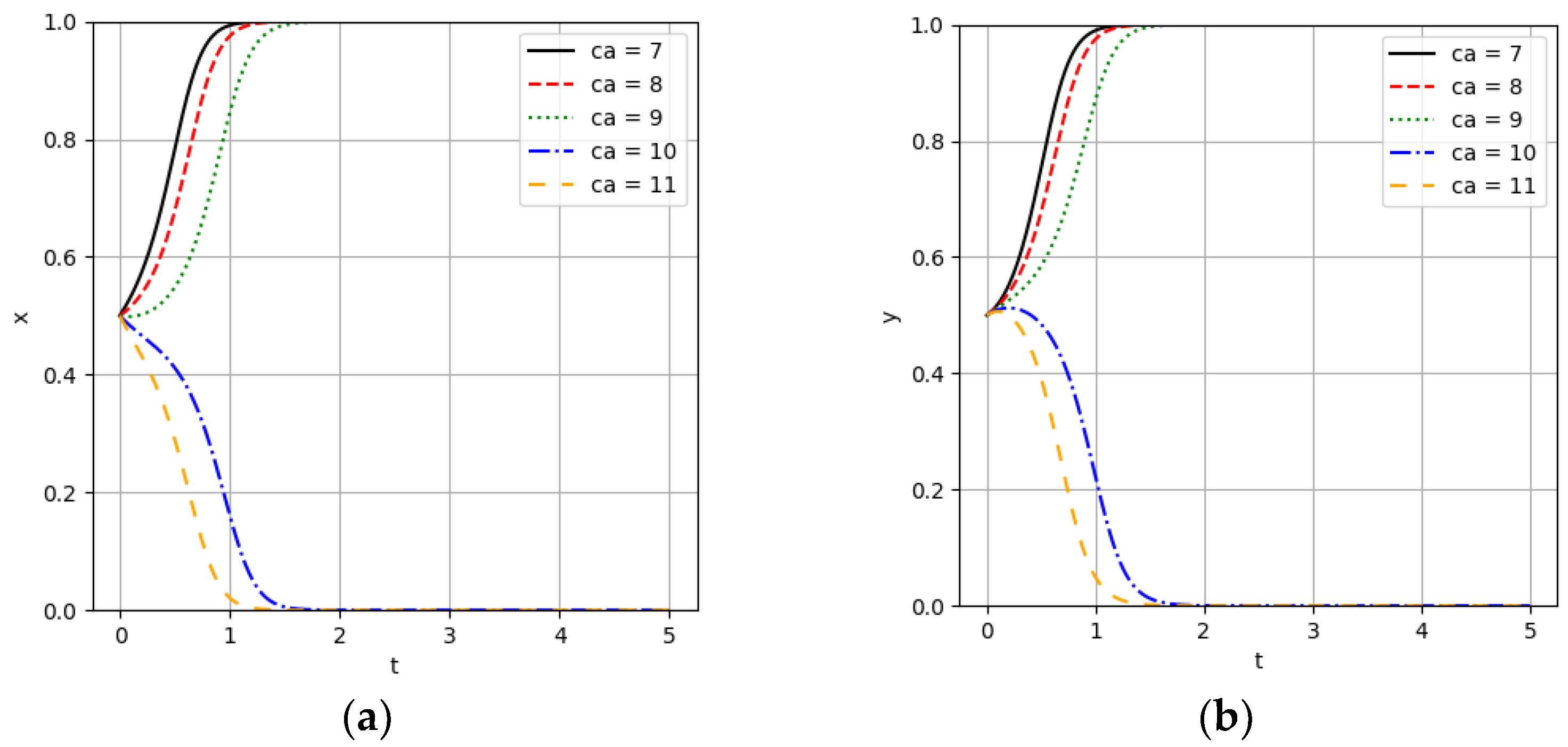

5.2. Effect Analysis of the Long-Term Costs (Ca and Cb)

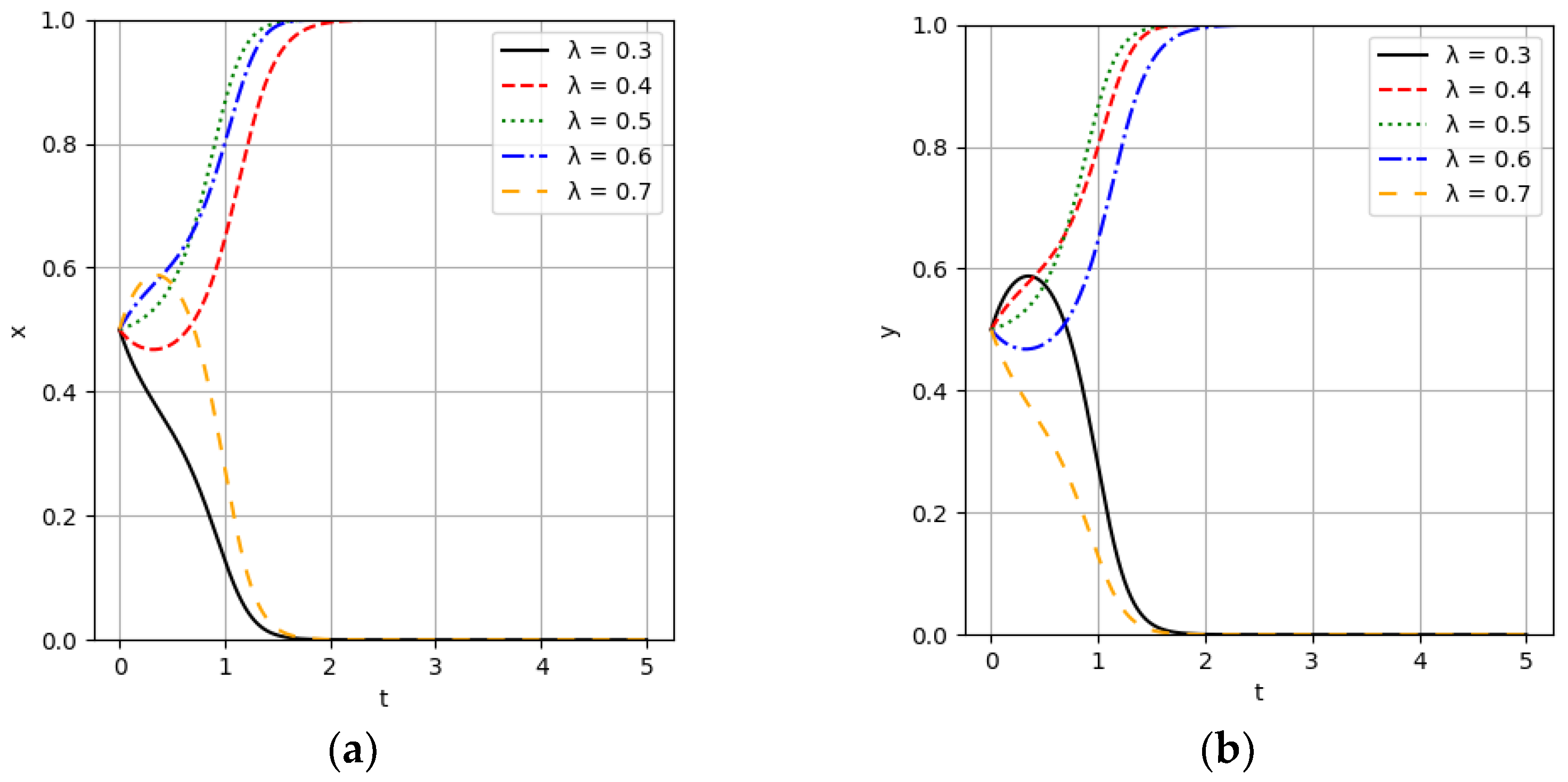

5.3. Effect Analysis of the Collaboration Benefit Distribution Coefficient (λ)

5.4. Effect Analysis of Knowledge Complementarity Coefficient (β)

5.5. Effect Analysis of Collaboration Synergy Coefficient (θ)

5.6. Effect Analysis of the Profit Sensitivity of Banks and Fintechs (α)

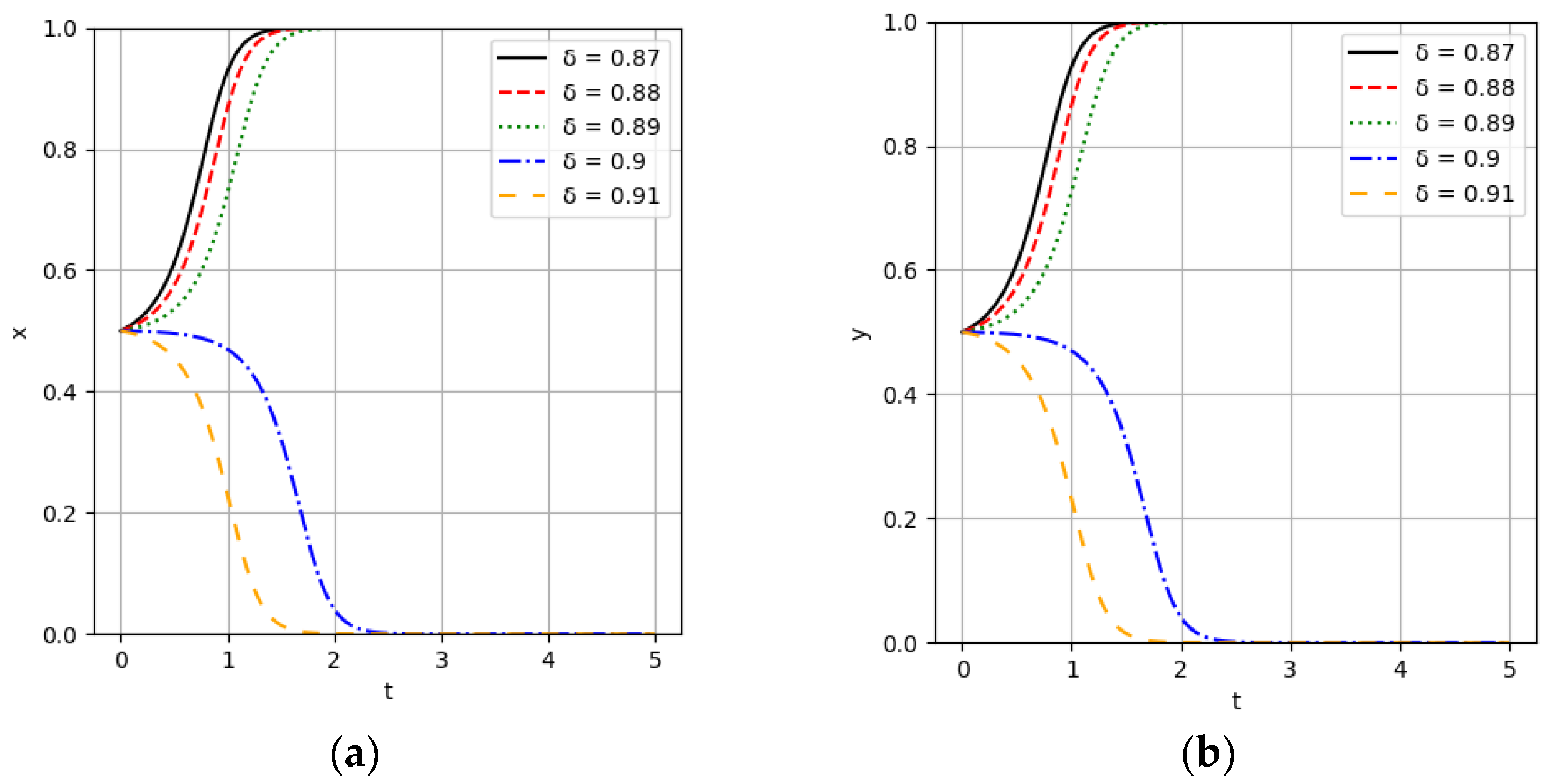

5.7. Effect Analysis of the Sensitivity of Banks and Fintech Companies to Losses (δ)

6. Conclusions and Implications

6.1. Conclusions

6.2. Implications

6.3. Limitations and Future Research

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Zhao, J.; Li, X.; Yu, C.H.; Lee, C.C. Riding the FinTech innovation wave: FinTech, patents and bank performance. J. Int. Money Financ. 2022, 122, 102552. [Google Scholar] [CrossRef]

- Merello, P.; Barberá, A.; De la Poza, E. Is the sustainability profile of FinTech companies a key driver of their value? Technol. Forecast. Soc. Chang. 2022, 174, 121290. [Google Scholar] [CrossRef]

- Xu, Y.; Bao, H. FinTech regulation: Evolutionary game model, numerical simulation, and recommendations. Expert Syst. Appl. 2023, 211, 118327. [Google Scholar] [CrossRef]

- Boot, A.; Hoffmann, P.; Laeven, L.; Ratnovski, L. Fintech: What’s old, what’s new? J. Financ. Stabil. 2021, 53, 100836. [Google Scholar] [CrossRef]

- Cheng, M.; Qu, Y. Does bank FinTech reduce credit risk? Evidence from China. Pac.-Basin Financ. J. 2020, 63, 101398. [Google Scholar] [CrossRef]

- Wang, Y.; Sui, X.; Zhang, Q. Can fintech improve the efficiency of commercial banks?—An analysis based on big data. Res. Int. Bus. Financ. 2021, 55, 101338. [Google Scholar] [CrossRef]

- Chen, X.; You, X.; Chang, V. FinTech and commercial banks’ performance in China: A leap forward or survival of the fittest? Technol. Forecast. Soc. 2021, 166, 120645. [Google Scholar] [CrossRef]

- Lee, C.C.; Ni, W.; Zhang, X. FinTech development and commercial bank efficiency in China. Glob. Financ. J. 2023, 57, 100850. [Google Scholar] [CrossRef]

- Drasch, B.J.; Schweizer, A.; Urbach, N. Integrating the “troublemakers”: A taxonomy for cooperation between banks and fintechs. J. Econ. Bus. 2018, 100, 26–42. [Google Scholar] [CrossRef]

- Muthukannan, P.; Tan, B.; Gozman, D.; Johnson, L. The emergence of a fintech ecosystem: A case study of the Vizag Fintech Valley in India. Inf. Manag. 2020, 57, 103385. [Google Scholar] [CrossRef]

- National Internet Finance Association of China (NIFA). 2021 Chief Insight Report on China’s FinTech Enterprises. Available online: https://www.nifa.org.cn/nifa/2955675/2955761/2998236/index.html (accessed on 25 July 2021).

- Acar, O.; Çıtak, Y.E. Fintech integration process suggestion for banks. Procedia Comput. Sci. 2019, 158, 971–978. [Google Scholar] [CrossRef]

- Li, J.; Li, J.; Zhu, X.; Yao, Y.; Casu, B. Risk spillovers between FinTech and traditional financial institutions: Evidence from the US. Int. Rev. Financ. Anal. 2020, 71, 101544. [Google Scholar] [CrossRef]

- Lai, C.; Li, R.; Gao, X. Bank competition with technological innovation based on evolutionary games. Int. Rev. Econ. Financ. 2024, 89, 742–759. [Google Scholar] [CrossRef]

- Haddad, C.; Hornuf, L. How do fintech start-ups affect financial institutions’ performance and default risk? Eur. J. Financ. 2023, 29, 1761–1792. [Google Scholar] [CrossRef]

- Hornuf, L.; Klus, M.F.; Lohwasser, T.S.; Schwienbacher, A. How do banks interact with fintech startups? Small Bus. Econ. 2021, 57, 1505–1526. [Google Scholar] [CrossRef]

- Fang, Y.; Ye, L.; Wen, G.; Wang, R. Do commercial banks benefit from bank-fintech strategic collaboration? Evidence from Chinese city banks. Int. J. e-Collab. 2022, 18, 1–18. [Google Scholar] [CrossRef]

- Gomber, P.; Koch, J.A.; Siering, M. Digital finance and fintech: Current research and future research directions. J. Bus. Econ. 2017, 87, 537–580. [Google Scholar] [CrossRef]

- Najaf, K.; Schinckus, C.; Yoong, L.C. VaR and market value of fintech companies: An analysis and evidence from global data. Manag. Financ. 2021, 47, 915–936. [Google Scholar] [CrossRef]

- Cheng, M.; Zhao, H.; Zhou, M. Foreign strategic investors, state ownership, and non-interest activities: Evidence from China. J. Financ. Stab. 2020, 50, 100779. [Google Scholar] [CrossRef]

- Lu, M.; Gao, Y.; Wan, Q. Research on evolutionary game of collaborative innovation in supply chain under digitization background. Math. Probl. Eng. 2021, 2021, 3511472. [Google Scholar] [CrossRef]

- Riikkinen, M.; Pihlajamaa, M. Achieving a strategic fit in fintech collaboration–A case study of Nordea Bank. J. Bus. Res. 2022, 152, 461–472. [Google Scholar] [CrossRef]

- Elia, G.; Stefanelli, V.; Ferilli, G.B. Investigating the role of Fintech in the banking industry: What do we know? Eur. J. Innov. Manag. 2023, 26, 1365–1393. [Google Scholar] [CrossRef]

- Akhtar, Q.; Nosheen, S. The impact of fintech and banks M&A on acquirer’s performance: A strategic win or loss? Borsa Istanb. Rev. 2022, 22, 1195–1208. [Google Scholar] [CrossRef]

- Hoang, Y.H.; Nguyen, N.T.H.; Vu, N.B.; Nguyen, D.T.T.; Tran, L.H.T. Toward successful bank-fintech partnerships: Perspectives from service providers in an emerging economy. Asian Soc. Sci. 2021, 17, 19–24. [Google Scholar] [CrossRef]

- Luo, Y.; Li, C.; Luo, B. Research on evolutionary mechanism of competition between third-party payment institutions and commercial banks based on double-layer network. Chin. J. Manag. Sci. 2023, 31, 238–247. [Google Scholar] [CrossRef]

- Ye, L.; Fang, Y. Evolutionary game analysis on firms and banks’ behavioral strategies: Impact of environmental governance on interest rate setting. Environ. Impact Assess. Rev. 2021, 86, 106501. [Google Scholar] [CrossRef]

- Shen, J.; Gao, X.; He, W.; Sun, F.; Zhang, Z.; Kong, Y.; Wan, Z.; Zhang, X.; Li, Z.; Wang, J.; et al. Prospect theory in an evolutionary game: Construction of watershed ecological compensation system in Taihu Lake Basin. J. Clean. Prod. 2021, 291, 125929. [Google Scholar] [CrossRef]

- Tversky, A.; Kahneman, D. Advances in prospect theory: Cumulative representation of uncertainty. J. Risk Uncertain. 1992, 5, 297–323. [Google Scholar] [CrossRef]

- Dong, J.; Jiang, Y.; Liu, D.; Dou, X.; Liu, Y.; Peng, S. Promoting dynamic pricing implementation considering policy incentives and electricity retailers’ behaviors: An evolutionary game model based on prospect theory. Energy Policy 2022, 167, 113059. [Google Scholar] [CrossRef]

- Bank of Nanjing. Annual Report of Bank of Nanjing for 2018. Available online: https://www.njcb.com.cn/njcbmobile/2019-04/30/article_2023081810211070606.html. (accessed on 30 April 2019).

| Core Methods and Research Objects | Definitions |

|---|---|

| Prospect Theory | Prospect theory describes how people make decisions under uncertainty, highlighting that individuals value gains and losses differently. Unlike traditional utility theory, prospect theory accounts for psychological biases, such as loss aversion and framing effects, influencing choices based on perceived probabilities rather than actual outcomes. |

| Evolutionary Game Method | The evolutionary game method studies strategic interactions among agents whose strategies evolve over time based on their success. Unlike classical game theory, which assumes rational decision-making, this approach models how strategies can change due to adaptation and natural selection, providing insights into the dynamics of collaboration and competition in biological and social systems. |

| Innovation Collaboration between Banks and Fintechs | Innovation collaboration between banks and fintechs involves partnerships where banks leverage fintechs’ technology to enhance their services, while fintechs gain access to banks’ resources and customer bases. This collaboration fosters innovation in financial products and services, improves customer experience, and accelerates digital transformation, benefiting both parties and driving industry growth. |

| Research Gaps | Methodology |

|---|---|

| Existing research predominantly analyzes the collaborative relationship between banks and fintech companies from a static perspective. | This study employs evolutionary game theory to construct a co-operative game model, analyzing the relationship between banks and fintechs from a dynamic evolutionary perspective. |

| Existing research usually assumes collaborators are entirely rational and seek to maximize benefits. | Applying prospect theory to incorporate bounded rationality in the analysis of collaborator behavior. |

| Only some studies have thoroughly considered the specific characteristics of cooperative games that differ from non-co-operative games. | A comprehensive sensitivity analysis of the factors influencing the stability of collaboration is conducted using simulation methods |

| Categories | Parameters | Definitions |

|---|---|---|

| Parameters regarding the costs and benefits of banks | I1 | Interest income |

| S1 | Fee and commission income | |

| D1 | Short-term collaboration income | |

| ΔL1 | Perceived income of long-term collaboration | |

| C1 | Short-term collaboration cost | |

| ΔE1 | Perceived costs of long-term collaboration | |

| Parameters regarding the costs and benefits of fintechs | I2 | Sales and service income |

| S2 | Technology service income | |

| D2 | Short-term collaboration income | |

| ΔL2 | Perceived income of long-term collaboration | |

| C2 | Short-term collaboration cost | |

| ΔE2 | Perceived costs of long-term collaboration | |

| Parameters regarding collaboration | β | Complementarity of knowledge and technology between the parties |

| θ | Synergies in the collaboration process | |

| Parameters regarding the value perception based on prospect theory | pi | The objective probability of a decision event occurring |

| Δx | The perceived value | |

| α | The degree of convexity of the power function of the value of the gains | |

| δ | The degree of convexity of the power function of the value of the losses | |

| Ca | The long-term cost of collaboration of banks | |

| Cb | The long-term cost of collaboration of fintechs |

| Fintech Companies (F) | |||

|---|---|---|---|

| Collaboration (y) | Competition (1 − y) | ||

| Banks (B) | Collaboration (x) | I1 + S1 + βD1 + θβD1 + βΔL1 + θβΔL1 − C1 − |ΔE1| I2 + S2 + βD2 + θβD2 + βΔL2 + θβΔL2 − C2 − |ΔE2| | I1 + S1 + βD1 + θβD1 − C1 − |ΔE1| I2 + S2 + βD2 + θβD2 + βΔL2 − C2 |

| Competition (1 − x) | I1 + S1 + βD1 + θβD1 + βΔL1 − C1 I2 + S2 + βD2 + θβD2 − C2 − |ΔE2| | I1 + S1 + βD1 + θβD1 I2 + S2 + βD2 + θβD2 | |

| Equilibrium Points | det(G) | tr(G) |

|---|---|---|

| Z1(0,0) | (C1 + |ΔE1|)(C2 + |ΔE2|) | −(C1 + |ΔE1| + C2 + |ΔE2|) |

| Z2(0,1) | (θβΔL1 − |ΔE1|)(C2+|ΔE2|) | (θβΔL1 − |ΔE1|) + (C2 + |ΔE2|) |

| Z3(1,0) | (C1 + |ΔE1|)(θβΔL2 − |ΔE2|) | (C1 + |ΔE1|) + (θβΔL2 − |ΔE2|) |

| Z4(1,1) | (θβΔL1 − |ΔE1|)(θβΔL2 − |ΔE2|) | −(θβΔL1 − |ΔE1|) − (θβΔL2 − |ΔE2|) |

| Z0(x*,y*) | (C1 + |ΔE1|)(C2 + |ΔE2|)(θβΔL1 − |ΔE1|)(θβΔL2 − |ΔE2|) | 0 |

| Equilibrium Points | det(G) | tr(G) | Result |

|---|---|---|---|

| Z0(0,0) | + | − | ESS |

| Z1(1,0) | + | + | Instability |

| Z2(0,1) | + | + | Instability |

| Z3(1,1) | + | − | ESS |

| Zo(x*,y*) | + | 0 | Saddle point |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Fang, Y.; Wen, G. Stability Analysis of Innovation Collaboration between Commercial Banks and Fintech Companies. Mathematics 2024, 12, 2724. https://doi.org/10.3390/math12172724

Fang Y, Wen G. Stability Analysis of Innovation Collaboration between Commercial Banks and Fintech Companies. Mathematics. 2024; 12(17):2724. https://doi.org/10.3390/math12172724

Chicago/Turabian StyleFang, Ying, and Guofeng Wen. 2024. "Stability Analysis of Innovation Collaboration between Commercial Banks and Fintech Companies" Mathematics 12, no. 17: 2724. https://doi.org/10.3390/math12172724

APA StyleFang, Y., & Wen, G. (2024). Stability Analysis of Innovation Collaboration between Commercial Banks and Fintech Companies. Mathematics, 12(17), 2724. https://doi.org/10.3390/math12172724