Heterogeneous Spillover Networks and Spatial–Temporal Dynamics of Systemic Risk Transmission: Evidence from G20 Financial Risk Stress Index

Abstract

1. Introduction

2. Literature Review

3. Research Methods and Model Construction

3.1. Measurement of Risk Method in Global Financial Markets

3.2. Analysis Model of Risk Transmission in Global Financial Markets

3.3. Analysis Model of Global Financial Market Correlation

3.3.1. Time-Varying Characteristic Analysis Model of Global Financial Market Correlation

3.3.2. Analysis Model of Global Financial Market Correlation Space Characteristics

4. Results

4.1. Global Financial Market Risk Index Analysis

4.2. Analysis of Fluctuation Spillover Effects and Correlation Network in Global Financial Markets

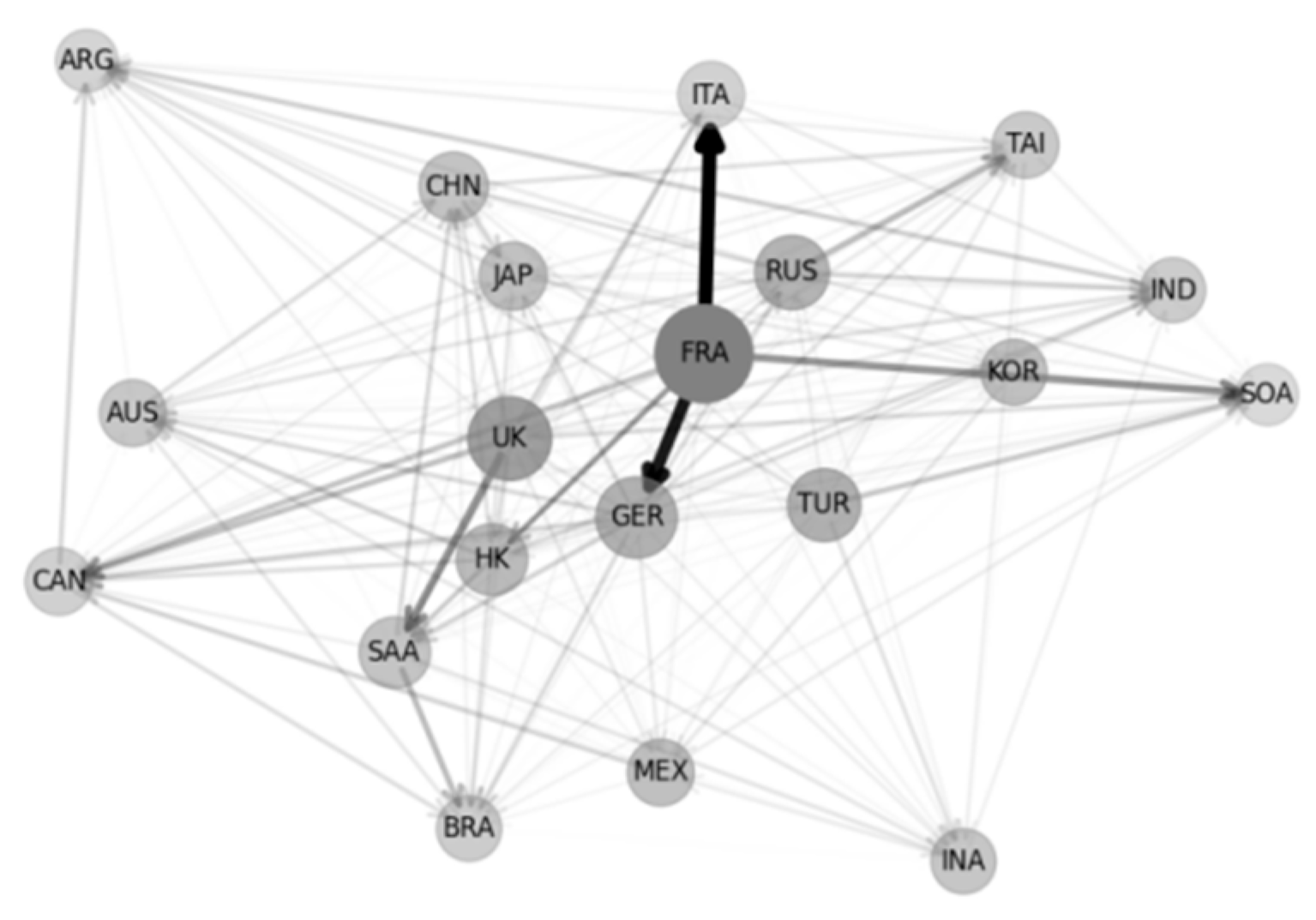

4.2.1. Analysis of the Overall Fluctuation Spillover Effect of the Financial Market and the Correlation Network

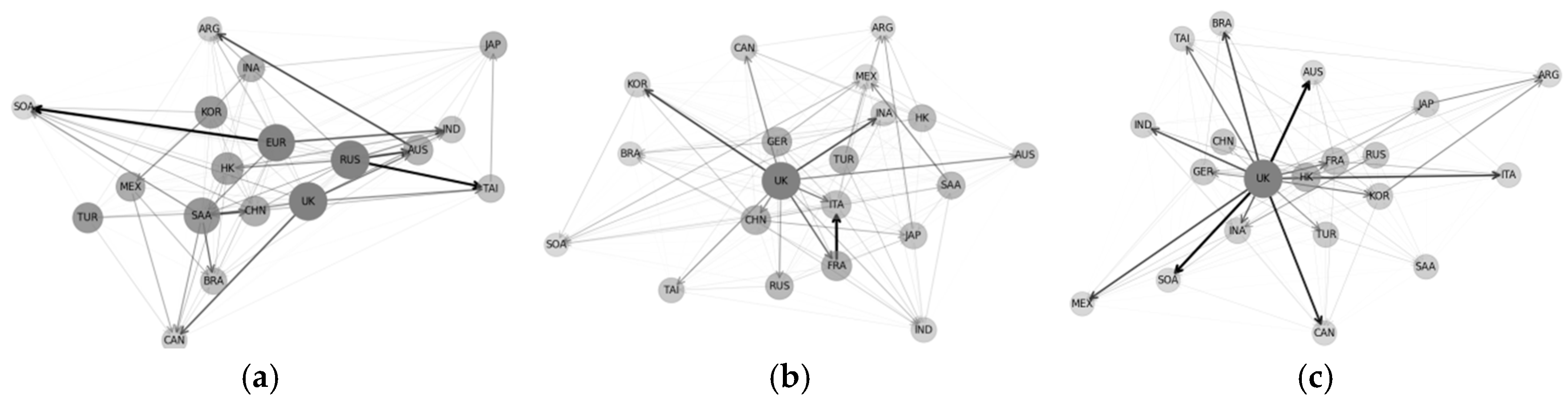

4.2.2. Market Volatility Spillover Effect and Correlation Network Analysis

4.2.3. Cross-Market Volatility Spillover Effects and Correlation Network Analysis

4.3. The Spatial and Temporal Characteristics of Risk Correlation in the Global Financial Markets

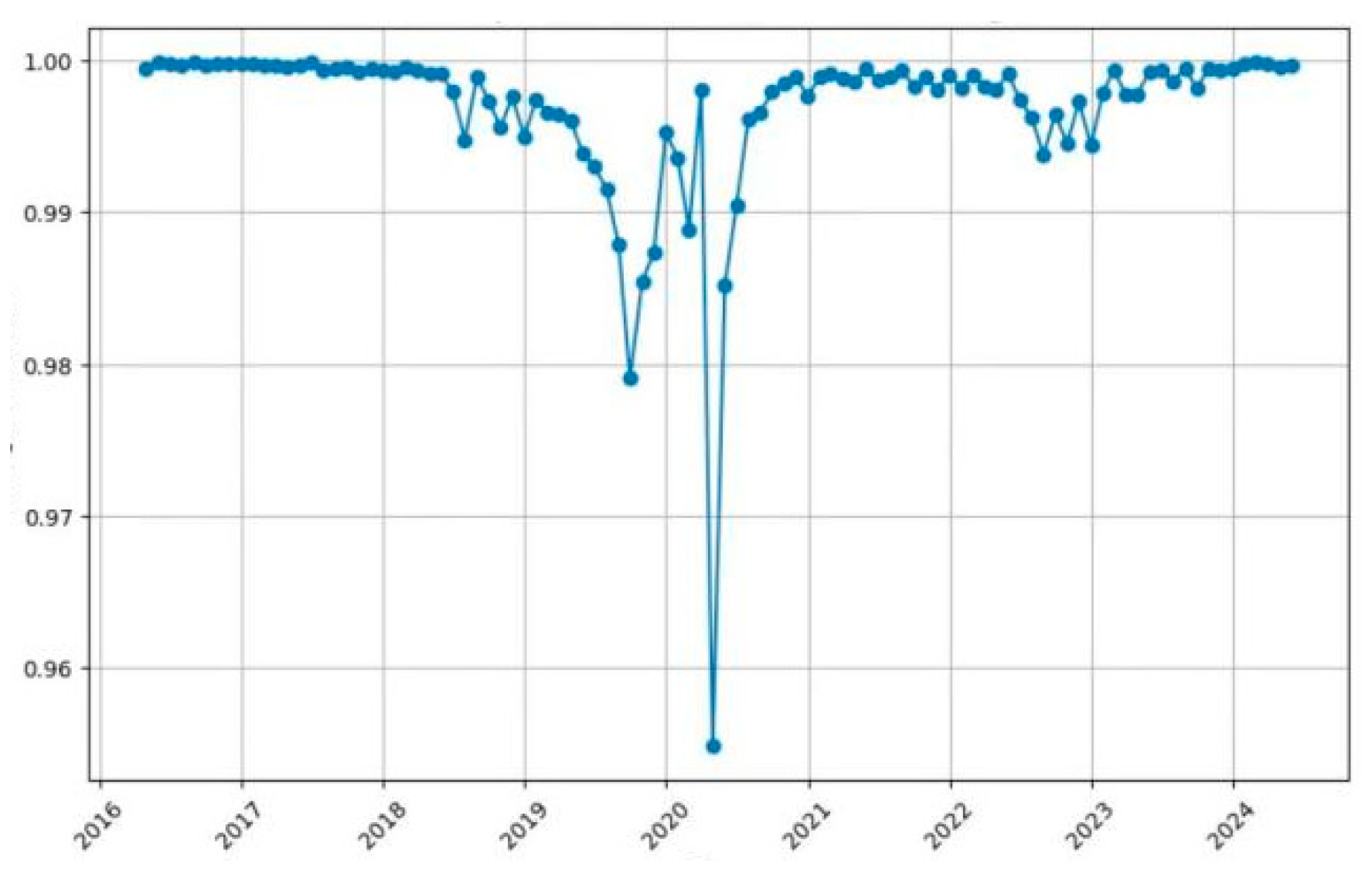

4.3.1. The Time-Varying Characteristics of the Global Financial Market Correlation

4.3.2. Spatial Characteristics of the Global Financial Market Correlation

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Panazan, O.; Gheorghe, C. Impact of geopolitical risk on G7 financial markets: A comparative wavelet analysis between 2014 and 2022. Mathematics 2024, 12, 370. [Google Scholar] [CrossRef]

- Yang, Z.H.; Chen, Y.T.; Zhang, P.S. Research on the cross-market contagion of tail risks in stock and foreign exchange markets. J. Manag. Sci. China 2020, 23, 54–77. [Google Scholar]

- Illing, M.; Liu, Y. An Index of Financial Stress for Canada (Bank of Canada Working Paper 2003-14); Bank of Canada: Ottawa, ON, Canada, 2003. [Google Scholar]

- Stiglitz, J.E. Risk and Global Economic Architecture: Why Full Financial Integration May Be Undesirable. Am. Econ. Rev. 2010, 100, 388–392. [Google Scholar] [CrossRef]

- Allen, F.; Gale, D. Financial Contagion. J. Political Econ. 2000, 108, 1–33. [Google Scholar] [CrossRef]

- Baker, M.; Wurgler, J. Investor Sentiment and the Cross-Section of Stock Returns. J. Financ. 2006, 61, 1645–1680. [Google Scholar] [CrossRef]

- Engle, R.F. Dynamic Conditional Correlation: A Simple Class of Multivariate GARCH Models. J. Bus. Econ. Stat. 2002, 20, 339–350. [Google Scholar] [CrossRef]

- Forbes, K.J.; Rigobon, R. No Contagion, Only Interdependence: Measuring Stock Market Comovements. J. Financ. 2002, 57, 2223–2261. [Google Scholar] [CrossRef]

- Patton, A.J. Modelling Asymmetric Exchange Rate Dependence. Int. Econ. Rev. 2006, 47, 527–556. [Google Scholar] [CrossRef]

- Cai, J.; Cheung, Y.L.; Wong, M.C.S. What Moves the Gold Market? J. Futur. Mark. Futures Options Other Deriv. Prod. 2009, 29, 491–507. [Google Scholar] [CrossRef]

- Dixon, L.; Clouse, C.; McCulloch, J. The Relationship Between Financial Market Liquidity and International Transmission of Financial Shocks. J. Int. Money Financ. 2017, 74, 227–242. [Google Scholar]

- Bekaert, G.; Harvey, C.R.; Lundblad, C. Financial Openness and Productivity. World Dev. 2014, 52, 31–50. [Google Scholar]

- Dungey, M.; Fry, R.; González-Hermosillo, B.; Martin, V.L. Empirical Modeling of Contagion: A Review of Methodologies. Quant. Financ. 2005, 5, 9–24. [Google Scholar] [CrossRef]

- Billio, M.; Getmansky, M.; Lo, A.W.; Pelizzon, L. Econometric Measures of Connectedness and Systemic Risk in the Finance and Insurance Sectors. J. Financ. Econ. 2012, 104, 535–559. [Google Scholar] [CrossRef]

- Bollerslev, T. Generalized Autoregressive Conditional Heteroskedasticity. J. Econom. 1986, 31, 307–327. [Google Scholar] [CrossRef]

- Brunnermeier, M.K.; Crocket, A.; Goodhart, C.; Persaud, A.D.; Shin, H. The Fundamental Principles of Financial Regulation; International Center for Monetary and Banking Studies: Geneva, Switzerland, 2009. [Google Scholar]

- Diebold, F.X.; Yilmaz, K. Measuring Financial Asset Return and Volatility Spillovers, with Application to Global Equity Markets. Econ. J. 2009, 119, 158–171. [Google Scholar] [CrossRef]

- Lanne, M.; Saikkonen, P. Noncausal Vector Autoregression. J. Appl. Econom. 2011, 26, 636–664. [Google Scholar]

- Caporin, M.; McAleer, M.; Zekaite, Z. Exchange Rate Volatility and Risk Spillovers in Global Financial Markets. Int. Rev. Econ. Financ. 2018, 56, 56–77. [Google Scholar]

- Caporin, M.; Pelizzon, L.; Ravazzolo, F.; Rigobon, R. Measuring Sovereign Contagion in Europe. J. Financ. Stab. 2018, 34, 150–181. [Google Scholar] [CrossRef]

- Lau, W.Y.; Go, Y.H. Dynamic causality between stock return and exchange rate: Is stock—Oriented hypothesis more relevant in Malaysia? Asia—Pac. Financ. Mark. 2018, 25, 137–157. [Google Scholar] [CrossRef]

- Maitra, D.; Dawar, V. Return and volatility spillover among commodity futures, stock market and exchange rate: Evidence from India. Glob. Bus. Rev. 2019, 20, 214–237. [Google Scholar] [CrossRef]

- Zhao, Y.P.; Qin, L.S.; Huang, Y.X. Research on the risk spillover effect of global foreign exchange market pressure: Based on spillover index and network topology analysis. World Econ. Study 2020, 8, 3–16+135. [Google Scholar]

- Xiao, Y.X.; Li, X.Y. Research on the spillover effect between the foreign exchange market and the stock market—Analysis based on the W-VAR-MGARCH-BEKK model. South China Financ. 2014, 2, 59–64. [Google Scholar]

- Li, L.; Wang, B.; Hao, D.P. Central Bank’s Exchange Rate Communication and Stock Market Volatility. Financ. Forum 2019, 24, 52–66+80. [Google Scholar]

- Yu, B.; Guan, C.; Dai, S.G. Research on the linkage of financial markets across the Taiwan Strait and in Hong Kong—Based on the six—Element asymmetric VAR—BEKK—MVGARCH model. Asia—Pac. Econ. Rev. 2019, 4, 136–142. [Google Scholar]

- Zhou, B.C.; Zhang, H.; Cao, Q. Industry heterogeneity of the volatility spillover effect between RMB exchange rate and stock market. Tax. Econ. 2021, 5, 55–61. [Google Scholar]

- Chen, G.J.; Xu, D.X.; Chen, J. Analysis of the volatility spillover effect between China’s stock market and foreign exchange market. J. Quant. Tech. Econ. 2009, 26, 109–119. [Google Scholar]

- He, C.Y.; Liu, L.; Xu, X.Y. Foreign exchange market intervention, exchange rate changes and stock price volatility—Theoretical model and empirical research based on investor heterogeneity. Econ. Res. J. 2013, 48, 29–42+97. [Google Scholar]

- Chen, Y.; Chen, L.N.; Lin, L.D. Research on the volatility spillover effect between RMB exchange rate and stock market. Manag. Sci. 2009, 22, 104–112. [Google Scholar]

- Sachs, J.; Tornell, A.; Velasco, A. Financial Crises in Emerging Markets: The Lessons from 1995; Brookings Papers on Economic Activity; National Bureau of Economic Research: Cambridge, MA, USA, 1996; Volume 27, pp. 147–216. [Google Scholar]

- Wang, C.L.; Hu, L. Research on early warning of China’s financial risks based on Markov regime switching model. J. Financ. Res. 2014, 40, 99–114. [Google Scholar]

- Balakrishnan, R.; Danninger, S.; Elekdag, S.; Tytell, I. The Transmission of Financial Stress from Advanced to Emerging Economies (IMF Working Paper No. WP/09/133); International Monetary Fund: Washington, DC, USA, 2009. [Google Scholar]

- Jiang, W.; Yu, Q.L. Carbon emissions and economic growth in China: Based on mixed frequency VAR analysis. Renew. Sustain. Energy Rev. 2023, 183, 113500. [Google Scholar] [CrossRef]

- Dong, J.; Li, C. Structure characteristics and influencing factors of China’s carbon emission spatial correlation network: A study based on the dimension of urban agglomerations. Sci. Total Environ. 2022, 853, 158613. [Google Scholar] [CrossRef] [PubMed]

- Liu, D.; Zeng, X.; Su, B.; Wang, W.; Sun, K.; Sadia, U.H. A social network analysis regarding electricity consumption and economic growth in China. J. Clean. Prod. 2020, 274, 122973. [Google Scholar] [CrossRef]

- Mitze, T.; Strotebeck, F. Centrality and get-richer mechanisms in interregional knowledge networks. Reg. Stud. 2018, 52, 1477–1489. [Google Scholar] [CrossRef]

- Antonakakis, N.; Chatziantoniou, I.; Gabauer, D. Refined Measures of Dynamic Connectedness based on Time-Varying Parameter Vector Autoregressions. J. Risk Financ. Manag. 2020, 13, 84. [Google Scholar] [CrossRef]

- Alrweili, H.; Ben-Salha, O. Dynamic asymmetric volatility spillover and connectedness network analysis among sectoral renewable energy stocks. Mathematics 2024, 12, 1816. [Google Scholar] [CrossRef]

- Tian, Y.; Wu, Y. Systemic financial risk forecasting: A novel approach with IGSA—RBFNN. Mathematics 2024, 12, 1610. [Google Scholar] [CrossRef]

- Zhao, X.J.; Zhang, W.G.; Liu, Y.J. Volatility spillovers and risk contagion paths with capital flows across multiple financial markets in China. Emerg. Mark. Financ. Trade 2018, 56, 731–749. [Google Scholar] [CrossRef]

| RANK | Country | NET | RATE | OUT | IN | GROSS | E | RANK | Country | NET | RATE | OUT | IN | GROSS | E |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | FRA | 187.26 | 44.25 | 223.40 | 36.13 | 259.53 | 72.16 | 11 | SAA | −13.01 | 3.07 | 55.95 | 68.96 | 124.91 | 10.41 |

| 2 | UK | 98.14 | 23.19 | 142.74 | 44.60 | 187.34 | 52.39 | 12 | INA | −19.04 | 4.50 | 33.69 | 52.74 | 86.43 | 22.03 |

| 3 | TUR | 47.20 | 11.15 | 74.57 | 27.37 | 101.94 | 46.30 | 13 | AUS | −22.75 | 5.38 | 47.83 | 70.58 | 118.41 | 19.21 |

| 4 | GER | 41.31 | 9.76 | 123.11 | 81.80 | 204.91 | 20.16 | 14 | TAI | −28.41 | 6.71 | 45.12 | 73.53 | 118.65 | 23.94 |

| 5 | RUS | 37.26 | 8.81 | 85.11 | 47.84 | 132.95 | 28.03 | 15 | BRA | −37.07 | 8.76 | 28.96 | 66.02 | 94.98 | 39.02 |

| 6 | HK | 12.01 | 2.84 | 83.97 | 71.96 | 155.93 | 7.70 | 16 | IND | −38.80 | 9.17 | 36.45 | 75.25 | 111.71 | 34.73 |

| 7 | KOR | −2.62 | 0.62 | 45.45 | 48.07 | 93.53 | 2.80 | 17 | CAN | −49.57 | 11.71 | 44.64 | 94.21 | 138.85 | 35.70 |

| 8 | MEX | −2.81 | 0.66 | 55.38 | 58.20 | 113.58 | 2.48 | 18 | ITA | −53.11 | 12.55 | 45.18 | 98.28 | 143.46 | 37.02 |

| 9 | JAP | −5.68 | 1.34 | 61.33 | 67.01 | 128.33 | 4.42 | 19 | ARG | −60.60 | 14.32 | 11.21 | 71.81 | 83.03 | 72.99 |

| 10 | CHN | −11.71 | 2.77 | 66.39 | 78.09 | 144.48 | 8.10 | 20 | SOA | −78.02 | 18.44 | 11.19 | 89.21 | 100.39 | 77.72 |

| Category | Total Overflow Index | Country | UK | EUR | RUS | TUR | SAA | CHN | HK | TAI | ||

| FRA | GER | ITA | ||||||||||

| money market | 52.81 | NET | 78.53 | 72.02 | 74.98 | 32.62 | 37.52 | −3.89 | 16.43 | −37.9 | ||

| RATE | 22.75 | 20.87 | 21.72 | 9.45 | 10.87 | 1.13 | 4.76 | 10.98 | ||||

| exchange market | 70 | NET | 202.38 | 50.52 | 46.04 | −1.24 | 25.71 | 45.48 | 21.7 | 36.37 | 20.82 | −15.44 |

| RATE | 45.07 | 11.25 | 10.25 | 0.28 | 5.73 | 10.13 | 4.83 | 8.1 | 4.64 | 3.44 | ||

| stock market | 77.05 | NET | 408.55 | 36.25 | 8.41 | −50.87 | 22.42 | 0.55 | −18.65 | 20.28 | 97.34 | −44.37 |

| RATE | 68.8 | 6.1 | 1.42 | 8.57 | 3.77 | 0.09 | 3.14 | 3.42 | 16.39 | 7.47 | ||

| Category | Total Overflow Index | Country | JAP | KOR | IND | INA | AUS | CAN | MEX | BRA | ARG | SOA |

| money market | 52.81 | NET | −10.57 | 30.8 | −42.46 | −7.37 | −14.13 | −57.57 | 2.25 | −34.91 | −57.26 | −79.09 |

| RATE | 3.06 | 8.92 | 12.3 | 2.14 | 4.09 | 16.68 | 0.65 | 10.11 | 16.59 | 22.92 | ||

| exchange market | 70 | NET | −13.23 | −43.78 | −47.47 | −35.39 | −25.41 | −20.52 | −58.65 | −60.06 | −55.76 | −72.07 |

| RATE | 2.95 | 9.75 | 10.57 | 7.88 | 5.66 | 4.57 | 13.06 | 13.37 | 12.42 | 16.05 | ||

| stock market | 77.05 | NET | −9.57 | −10.49 | −34.84 | −21.11 | −70.02 | −62.35 | −69.28 | −52.81 | −76.69 | −72.74 |

| RATE | 1.61 | 1.77 | 5.87 | 3.56 | 11.79 | 10.5 | 11.67 | 8.89 | 12.91 | 12.25 | ||

| Rank | Market | NET | RATE | OUT | IN | GROSS | E | Rank | Market | NET | RATE | OUT | IN | GROSS | E |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | C_EUR | 59.03 | 13.95 | 95.51 | 36.49 | 259.53 | 44.72 | 12 | E_UK | −2.65 | 0.63 | 46.27 | 48.92 | 95.19 | 2.78 |

| 2 | S_UK | 45.38 | 10.72 | 102.55 | 57.17 | 187.34 | 28.41 | 13 | E_GER | −4.71 | 1.11 | 40.35 | 45.06 | 85.41 | 5.51 |

| 3 | C_JAP | 35.96 | 8.50 | 68.98 | 33.03 | 101.94 | 35.25 | 14 | E_JAP | −5.27 | 1.24 | 71.22 | 76.49 | 147.70 | 3.57 |

| 4 | C_CHN | 29.49 | 6.97 | 79.67 | 50.18 | 204.91 | 22.71 | 15 | E_RUS | −8.48 | 2.00 | 65.22 | 73.70 | 138.92 | 6.10 |

| 5 | C_UK | 20.20 | 4.77 | 69.00 | 48.80 | 132.95 | 17.15 | 16 | S_RUS | −15.63 | 3.69 | 51.81 | 67.44 | 119.25 | 13.11 |

| 6 | E_HK | 17.15 | 4.05 | 53.58 | 36.43 | 155.93 | 19.05 | 17 | E_CHN | −30.52 | 7.21 | 48.84 | 79.37 | 128.21 | 23.81 |

| 7 | E_FRA | 11.45 | 2.71 | 72.82 | 61.36 | 93.53 | 8.54 | 18 | S_HK | −35.71 | 8.44 | 46.56 | 82.27 | 128.83 | 27.72 |

| 8 | C_HK | 9.65 | 2.28 | 66.14 | 56.50 | 113.58 | 7.87 | 19 | S_JAP | −36.65 | 8.66 | 27.49 | 64.14 | 91.63 | 40.00 |

| 9 | C_RUS | 8.93 | 2.11 | 64.34 | 55.41 | 128.33 | 7.46 | 20 | E_KOR | −46.61 | 11.01 | 34.25 | 80.86 | 115.11 | 40.49 |

| 10 | S_CHN | 5.57 | 1.32 | 43.70 | 38.12 | 144.48 | 6.81 | 21 | S_KOR | −59.01 | 13.94 | 29.27 | 88.28 | 117.55 | 50.20 |

| 11 | C_KOR | 2.44 | 0.58 | 50.75 | 48.32 | 99.07 | 2.46 |

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|---|---|---|---|

| FRM | −0.135 *** | −0.134 *** | −0.135 *** | −0.136 *** | −0.136 *** | −0.134 *** | −0.131 *** | −0.136 *** | −0.133 *** |

| CRM | −0.115 *** | −0.045 | −0.074 | −0.068 | −0.075 | −0.062 | −0.042 | −0.095 ** | −0.071 |

| ERM | −0.067 ** | −0.069 ** | −0.066 | −0.076 | −0.096 ** | −0.089 * | −0.101 ** | −0.015 * | −0.083 |

| SRM | −0.078 | −0.081 * | −0.077 | −0.079 | −0.081 * | −0.081 * | −0.082 * | −0.082 * | −0.085 * |

| 2016 | H-H | L-H | L-L | H-L | 2018 | H-H | L-H | L-L | H-L |

|---|---|---|---|---|---|---|---|---|---|

| FRI | CHN ** | TAI *** | FRI | CHN ** | TAI *** | ||||

| CRI | JAP ** | TAI *** | MEX ** | CRI | GER ** ITA * | CHN *** | |||

| ERI | TAI *** | CHN *** | ERI | ||||||

| SRI | ARG *** | SRI | ARG *** | ||||||

| 2021 | H-H | L-H | L-L | H-L | 2024 | H-H | L-H | L-L | H-L |

| FRI | CHN ** | TAI *** | FRI | CHN ** | TAI *** | ||||

| CRI | BRA *** KOR * | ITA * | CHN *** | CRI | JAP ** | ||||

| ERI | ERI | RUS * | MEX ** | ||||||

| SRI | ARG *** | SRI | ARG *** |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, X.; Zhang, J.; Chen, X.; Zhang, H.; Wong, C.U.I.; Chan, T. Heterogeneous Spillover Networks and Spatial–Temporal Dynamics of Systemic Risk Transmission: Evidence from G20 Financial Risk Stress Index. Mathematics 2025, 13, 1353. https://doi.org/10.3390/math13081353

Wang X, Zhang J, Chen X, Zhang H, Wong CUI, Chan T. Heterogeneous Spillover Networks and Spatial–Temporal Dynamics of Systemic Risk Transmission: Evidence from G20 Financial Risk Stress Index. Mathematics. 2025; 13(8):1353. https://doi.org/10.3390/math13081353

Chicago/Turabian StyleWang, Xing, Jiahui Zhang, Xiaolong Chen, Hongfeng Zhang, Cora Un In Wong, and Thomas Chan. 2025. "Heterogeneous Spillover Networks and Spatial–Temporal Dynamics of Systemic Risk Transmission: Evidence from G20 Financial Risk Stress Index" Mathematics 13, no. 8: 1353. https://doi.org/10.3390/math13081353

APA StyleWang, X., Zhang, J., Chen, X., Zhang, H., Wong, C. U. I., & Chan, T. (2025). Heterogeneous Spillover Networks and Spatial–Temporal Dynamics of Systemic Risk Transmission: Evidence from G20 Financial Risk Stress Index. Mathematics, 13(8), 1353. https://doi.org/10.3390/math13081353