1. Introduction

Since the beginning of the 21st century Brazil is a reference in the biofuel production, with particular emphasises in the ethanol commodity. The Brazilian ethanol production began growing in the 1970’s, and continued increasing while the oil prices were significantly rising in the London and New York stock exchanges in the mid of 2000’s. Following this trend, the USA advanced in the ethanol production from corn that was subsequently approved by the Energy Policy of Act, or simply, the Energy Bill, in mid 2005 [

1].

Those efforts boosted the USA ethanol production to overcome that of Brazilian in 2006. However, that same year was marked by an important discovery in the history of the Brazilian fuel market. Indeed, the pre-salt layer located in the Santos basin, on the southeastern coast of Brazil, was detected and became one of the most prolific petroleum systems in the world. In a short time after the findings, considerable investments in the oil sector start occurred and, the gasoline production gained the attention of government, companies and investors, resulting in a cutting off on the ethanol investment. As a consequence, after an initial surge of 76 ethanol plants constructed in the period 2007–2010, at least 26 ethanol plants were shut down during 2011–2014, on the state of Sao Paulo [

2].

One of the strategies of Brazil’s sugarcane crop season for 2011–2012 was the commercial compromise with the USA. The deal included the exportation of Brazil’s ethanol from sugarcane to the USA since that guaranteed a premium for this biofuel [

3]. On the other hand, Brazil imported corn-based ethanol from the USA, due to a sugarcane crop shortfall that resulted in an increase of the biofuel prices for consumers.

A strategy for recovering the ethanol production in 2011–2012 included the reduction of taxes for the ethanol sector and the increased amount of ethanol in the blend with gasoline, going from 20% to 25%. [

4]. Simultaneously, the government offered to sugarcane producers interest-free subsidized loans in order to recover the earlier production state. This strategy brought results to the sector, since in the crop season of 2014 the ethanol production reached a record of 28.6 billion liters [

5]. However, this also reflected by lowering the prices of sugar in the international market, which is usually the alternative option when producing ethanol from plants. A third strategy was to control the fuel prices in the internal market, which was later proved to be the reason for inadequate conditions in the market competition [

6]. Indeed, by avoiding (artificially) the gasoline prices to fluctuate relative to the international market prices, lower costs for ethanol in the domestic market were forced, guaranteeing competitivity vis a vis the values spent with gasoline [

7].

The following years (2015–2017) brought instability to the sector, since Brazil faced an economic recession and, besides, a presidential impeachment process took place leading not only to a lower consumption of ethanol in the internal market, but also to a decrease of light vehicles sales and unemployment [

8,

9].

In recent years, the Brazilian energy sector is recovering, and an optimistic scenario emerged, where the internal prices are again linked to those of the international market. Furthermore, a new investment cycle was recently announced for the sector until 2030, in the scope of the Renovabio program [

10]. Also, the current mandatory blending of ethanol in gasoline reached 27%, but with a perspective of increasing to 30% by 2022 and 40% by 2030 [

11].

Brazil is also an important player when it comes to agricultural commodities [

12,

13]. The country is recognized as one of the major exporters of agricultural products, primarily as a result of its strong performance in the sector. According to the Food and Agriculture Organization of the United Nations (FAO), Brazilian agriculture products contributed to about 4% of the country’s gross domestic product (GDP) [FAO Statistical Yearbook 2016,

http://www.fao.org/faostat/en/, acessed June 17, 2019]. In fact, one can see exported products influencing this margin, such as the sugarcane and its derivatives (ethanol and sugar), soybean, coffee, beef, orange juice, and corn. Most of these products are negotiated in the Brazilian Stock Exchange, B3 S.A. It is important to highlight that the country’s agricultural area is increasing each year, requiring, therefore, agricultural machinery and equipment that lead to a significant impact on the energy expenditure.

The price volatility of the Brazilian ethanol is primarily influenced by the following market factors [

14]: (i) the amount of sugarcane production; (ii) the percentage of sugarcane available for the production of ethanol; (iii) the consumer income; (iv) the number of the light commercial fleet vehicles; and (v) the price of the gasoline, directly influencing the ethanol prices in result to the blend of the two fuels.

Janda and Kristoufek [

11] reviewed the literature in the scope of time series analysis of price transmission from food to energy commodities and vice versa. They concluded that, due to policy-induced trade barriers, there is not sufficient evidence of an integrated international biofuel market, including major producers, such as the US, European and Brazilian markets. Fowowe [

15], Reboredo [

16], Nazlioglu and Soytas [

17] found some weak and almost neutral price transmission between the agricultural commodities and the energy prices. On the other hand, for different agricultural commodities, time periods and regions, several researchers [

18,

19,

20,

21,

22,

23,

24,

25,

26,

27,

28,

29,

30,

31,

32,

33,

34] found significant evidences that the crude oil prices influence those commodities, such as for the cases of the soybean, corn, wheat, rice and sugar. Similarly, several of other studies [

35,

36,

37,

38,

39,

40,

41,

42,

43,

44] explored the ethanol relationship with agricultural commodities. It was found that, in general, ethanol prices dynamics are affected by sugar prices in Brazil. Besides, Capitani et al. [

37] verified that there is weak linkage between the ethanol and the international prices.

The standard approach in most of these studies requires analyzing a plethora of variables. The need to understand the relationships between a large number of variables makes multivariate analysis a laborious task due to the sheer bulk of data. Indeed, all variables are considered simultaneously and their effects are not interpreted separately. In turn, bivariate analysis allows the association, correlation and analysis of two variables and, if properly applied, provides solid and useful information. One should note that is not sufficient to observe a set of variables and to apply multivariate techniques, because, if they are not linked together, one has to the bivariate analysis to obtain more significative information.

Several researchers applied different tools and concepts such as, error correction models (ECM), vector error correction models (VECM) and cointegration for studying the agricultural and energy commodities [

8,

9,

15,

24,

33,

34,

36,

43,

44,

45,

46,

47,

48,

49,

50,

51,

52,

53,

54,

55,

56,

57,

58,

59,

60,

61,

62,

63,

64,

65,

66,

67,

68]. Mattos et al. [

9] discussed the price transmission for the future markets of agricultural commodities using VECM. They evaluated the impact on the price transmission in the futures prices of the Chicago Mercantile Exchange and the Brazilian Stock Exchange in the spot prices of the corn in the Brazilian internal market. Mallory et al. [

62] explored the topic and analyzed long-term relations between the ethanol, corn and natural gas in the USA.

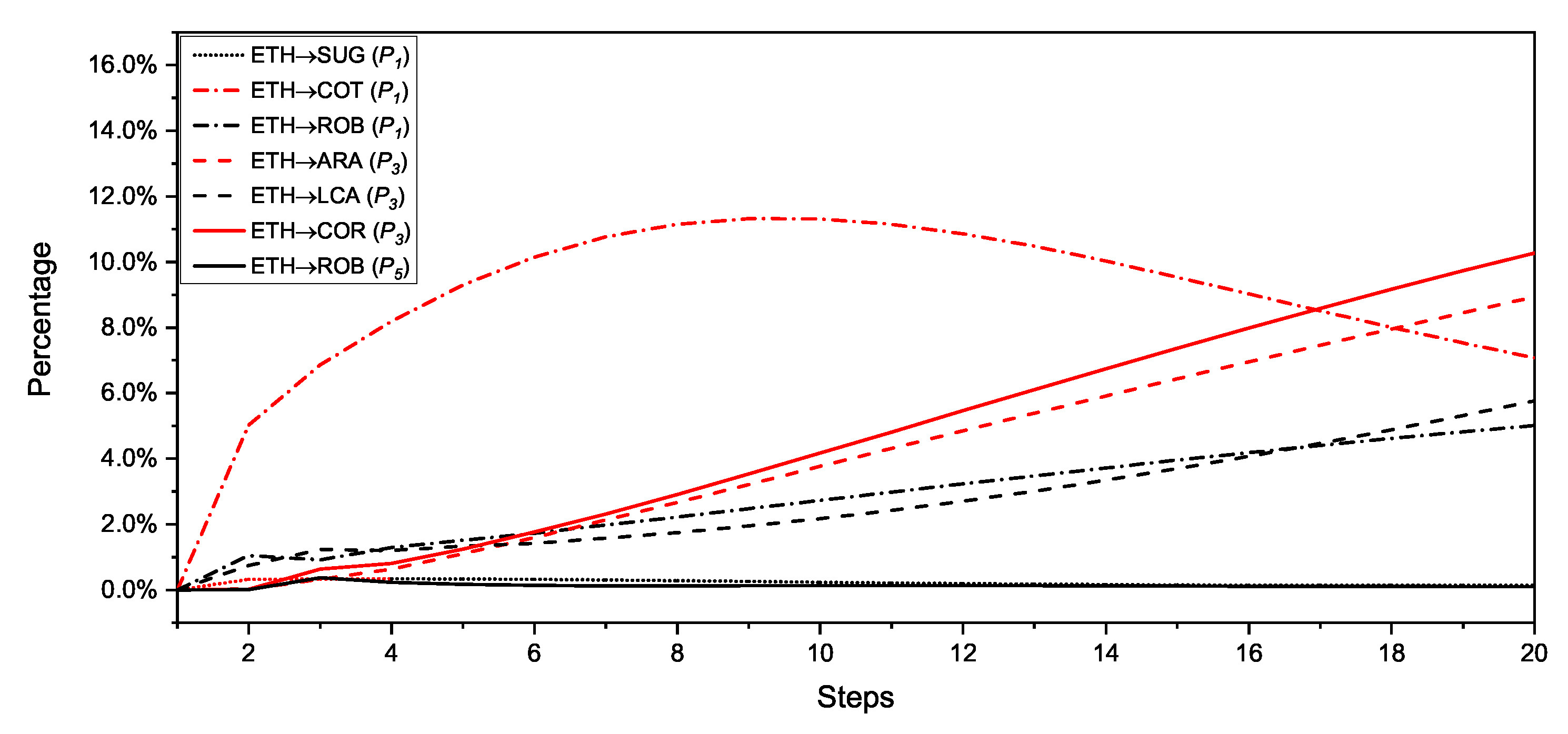

The main goal of this work is to investigate the bilateral price relationship between the Brazilian ethanol (ETH) and each one of the major Brazilian agricultural commodities. For this purpose, we adopt several mathematical tools, namely the Bai-Perron test of structural changes, the Johansen cointegration test and the bivariate VECM exploited by the orthogonal impulse response (OIR) and the forecast error variance decomposition (FEVD).

This paper is organized as follows. In

Section 2, the time series (TS) are presented and the adopted methods are introduced. In

Section 3, the results are discussed. Finally, in

Section 4, the main conclusions are outlined.

2. Data and Methodology

We consider the spot prices of the ETH and seven important commodities in the Brazilian agricultural GDP, such as the sugar (SUG), cotton (COT), live cattle (LCA), Arabica coffee (ARA), Robusta coffee (ROB), corn (COR) and soybean (SOY). The work aims to measure the impact of ethanol prices against agricultural commodities and vice versa. Such evaluation is possible using multivariate models that are described in the follow-up of this paper.

The data were obtained from the Center for Advanced Studies on Applied Economics/University of Sao Paulo (CEPEA/USP) and the CEPEA methodology for the daily pricing of these products can be found in its website

www.cepea.esalq.usp.br. We adopt daily spot prices TS for the ethanol and the seven agricultural commodities for a time interval between January 2011 and December 2018.

Bearing in mind that during this period many changes occurred in the Brazilian energy sector, we evaluate the presence of breakpoints in the prices of the ethanol TS by means of the Bai–Perron algorithm [

69]. The main idea consists in obtaining the optimal number

b of breakpoints in the TS using an information criterion, namely the Bayesian information criterion (BIC).

The Bai–Perron algorithm is a dynamic method that estimates multiple structural changes (i.e., breakpoints) as global minimizers of the residual sum of squares in a given TS [

69]. This technique tests the deviations from stability in the linear regression model by assuming the existence of

b breakpoints, and that the coefficients vary from one regression to the other. Therefore, we have

time sub-intervals and each

i-th regression model can be described as [

69,

70,

71]

where the index

i represents the time interval index for

intervals,

is the observed independent variable,

is the vector of coefficients, and

stands for the disturbance. Therefore, the algorithm estimates the breakpoints by minimizing the residual sum of squares of the equation. The estimated breakpoint values

of the ethanol TS are listed in

Table 1 for five tested options (denoted A to E).

As stated in [

69], the Schwarz criterion, or simply the BIC, was applied for structural break inference by Yao [

72]. The BIC value is defined as

, where

is the log-likelihood of the model,

k is the number of independent parameters and

m is the number of the TS values (e.g., the number of samples). Thus, the criterion represents the statistics that maximizes the chance of identifying the best fitting model to the TS. Then, the model with the lowest BIC value is chosen as the best model [

73]. This is commonly applied for selecting the model dimension by estimating the number of breaks. Therefore, for the ethanol TS breakpoints, we obtained from the algorithm five possible options A-E, where A and E are the minimum and maximum values corresponding to one BP and five BP, respectively. The BIC values and the estimated

b values

are listed in

Table 1.

From

Table 1 we verify that

is the optimal number of breakpoints in the TS since the BIC shows a slightly lower value. By other words,

leads to the best fitting and involves five sub-periods denoted as

to

in the follow-up. Therefore, we have: (i)

from January/2011 to May/2012, (ii)

from May/2012 to November/2013, (iii)

from November/2013 to September/2015, (iv)

from September/2015 to October/2017, and (v)

from October/2017 to December/2018. The TS of the eight commodities and the corresponding sub-periods are illustrated in

Figure 1.

Costa and Burnquist [

74] listed different factors that help to understand the four breakpoints in option D. Concerning

, we observe a peak price for the ethanol at the beginning of this period. After, the price tends to reduce pointing the first breakpoint found. During

the price is maintaining lower than at the beginning of

achieving the lowest price at the end of the

. This was due to the price control politics in the energy sector of Brazil influencing directly the ethanol prices. Besides, the gradual decreasing of the so-called “Contribution of Intervention in the Economic Domain tax” for gasoline, completely removed at the end of 2012, also affected the ethanol price that became less competitive in the domestic market. Nonetheless, in the final of

the price increased again leading to another breakpoint. The sub-period

ended in September of 2015 when the ethanol prices were skyrocketing due to the corruption scandals in Brazil’s energy state firm Petrobras that affected the whole sector and produced another breakpoint. The last breakpoint is due to the new pricing policy adopted by Petrobras in the sector. For this reason, ethanol prices may again fluctuate more freely in the internal market.

2.1. Cointegration of Time Series

The cointegration relation between two TS was firstly introduced by Granger [

75]. Later, Engle and Granger [

76] explored an error correction model. A simple way for explaining a cointegration relation was proposed by Murray [

77] under the title “the metaphor of the drunk and her dog”. In order to investigate the price transmission process among the ethanol and other agricultural commodities, the cointegration hypothesis is considered. The process of adjustment was pointed by Murray [

77] as the error correction model.

For non-stationary TS, the distance between two series can be stationary, since the adjustment occurs for each step. In this case, the TS are said to be cointegrated of order zero. For a cointegration process to be presented in two TS, both must have the same integration order

n, where

n is the number of times that a non-stationary TS needs to be differentiate in order to become stationary [

77]. Therefore, considering the error correction terms

c and

d one can write

where

t stands for the discrete-time sampling instants,

and

are the cointegrated variables,

and

are the white noise stationary steps and

is the cointegration relation between the variables

x and

y.

Aaron Smith and Robin Harrison [

78] formulated an extension of the original metaphor by exploring the multiple cointegration with 3 or more cointegrated variables, with the work entitled “A drunk, her dog and a boyfriend: an illustration of multiple cointegration and error correction”.

Often, we observe some confusion between the terms “cointegration” and “correlation”. Alexander [

79] points that a cointegration process takes into account both the concepts of integration and stationarity, while that is not considered in a correlation measure. Additionally, the correlation calculates a linear association between two TS. The cointegration of two or more TS can be studied, while a correlation is simply a coefficient in the range [

]. However, a cointegration process cannot be quantified, since, instead, it is identified.

In this work, we evaluate the cointegration process among the 7 agricultural commodities prices, namely the sugar, cotton, live cattle, corn, soybean, Arabica coffee and Robusta coffee, with respect to the ethanol prices. The cointegration is calculated using the Johansen test, and the VECM model is estimated when the cointegration between a particular commodity with respect to the ethanol is verified.

The Johansen Test for Cointegration

Johansen [

80] proposed a statistical test to determine the cointegration relation between two TS. It is known that the cointegration process is directly linked to the VECM since the test is based on the matrix coefficients

and

that compose the model. The

parameters are related to the long-run equilibrium. The

parameters (so-called “speed adjustment parameters”) are related to how fast the series tends to return the equilibrium after some perturbation. We can determine how many steps are required for the series to come back to the equilibrium by using the relation

.

The Johansen test [

81,

82] is applied to verify if the rank (

r) of the matrix

is equal to zero (null hypothesis). If

this implicates a the non-existence of the error correction term (ECT). Otherwise, if

, then the null hypothesis is rejected and there is a cointegration relation between the analyzed TS. Johansen proposed two possibles tests, namely, the Max-Eigen and the Trace tests, that are based on the assumption of a pure unit root. In contrast to the method for cointegration validation of Engle-Granger [

76], the test purposed by Johansen allows the study of more than one cointegration relation among the variables. For this reason, the Johansen test was applied in this work in view of analyzing possible cointegration processes involving the prices of agricultural commodities versus the ethanol.

2.2. The Vector Error Correction Model

The ECM was introduced by Sargan [

83]. Later the idea was employed by Davidson [

84], evolving toward the VECM methodology. The VECM is based on the generalized vector autoregression (VAR), that allows an adjustment of a regression model between multiple variables to evaluate its relationship.

Let us consider

and

as two non-cointegrated and stationary TS. Then, the approach from the VAR(

j) model is possible as [

85,

86]

where

and

are the equation autoregressive terms of

and

, respectively, and

and

denote white-noise disturbances. On the other hand, if the TS were not initialy stationary, then we had the VAR(

j) in the differences

given by [

85,

86]:

If a cointegration process was found among two or more TS, then the ECT can be implemented and the VAR model becomes a VECM. Note that for implementing the VECM it was not needed that both TS are stationary. Indeed, once the

values are calculated from the ECT modeling they are adjusted, so that a stationary ECT is returned, and then applied in the regression equation. Thus, the ECT is expressed in the VECM as

, for each price equation, where

represents the equilibrium equation between the prices. A VECM is expressed as [

9,

46,

87,

88]