A New Continuous-Discrete Fuzzy Model and Its Application in Finance

Abstract

1. Introduction

2. Preliminaries

- (i)

- u is normal, that is, there exists such that .

- (ii)

- u is fuzzy convex, that is, , for any and .

- (iii)

- u is upper semicontinuous.

- (iv)

- is compact.

- (i)

- For all sufficiently small, the H-differences exist and the limits (in the metric D)or

- (ii)

- For all sufficiently small, the H-differences exist and the limits (in the metric D)

- (i)

- If F is (i)-differentiable, then and are differentiable functions and we have

- (ii)

- If F is (ii)-differentiable, then and are differentiable functions and we have

- (a)

- The fuzzy mapping f is continuous on ;

- (b)

- The fuzzy mapping f satisfies Lipschitz condition

3. General Mixed Continuous-Discrete Fuzzy Model

4. Linear Fuzzy Differential-Difference Equations

- (i)

- (ii)

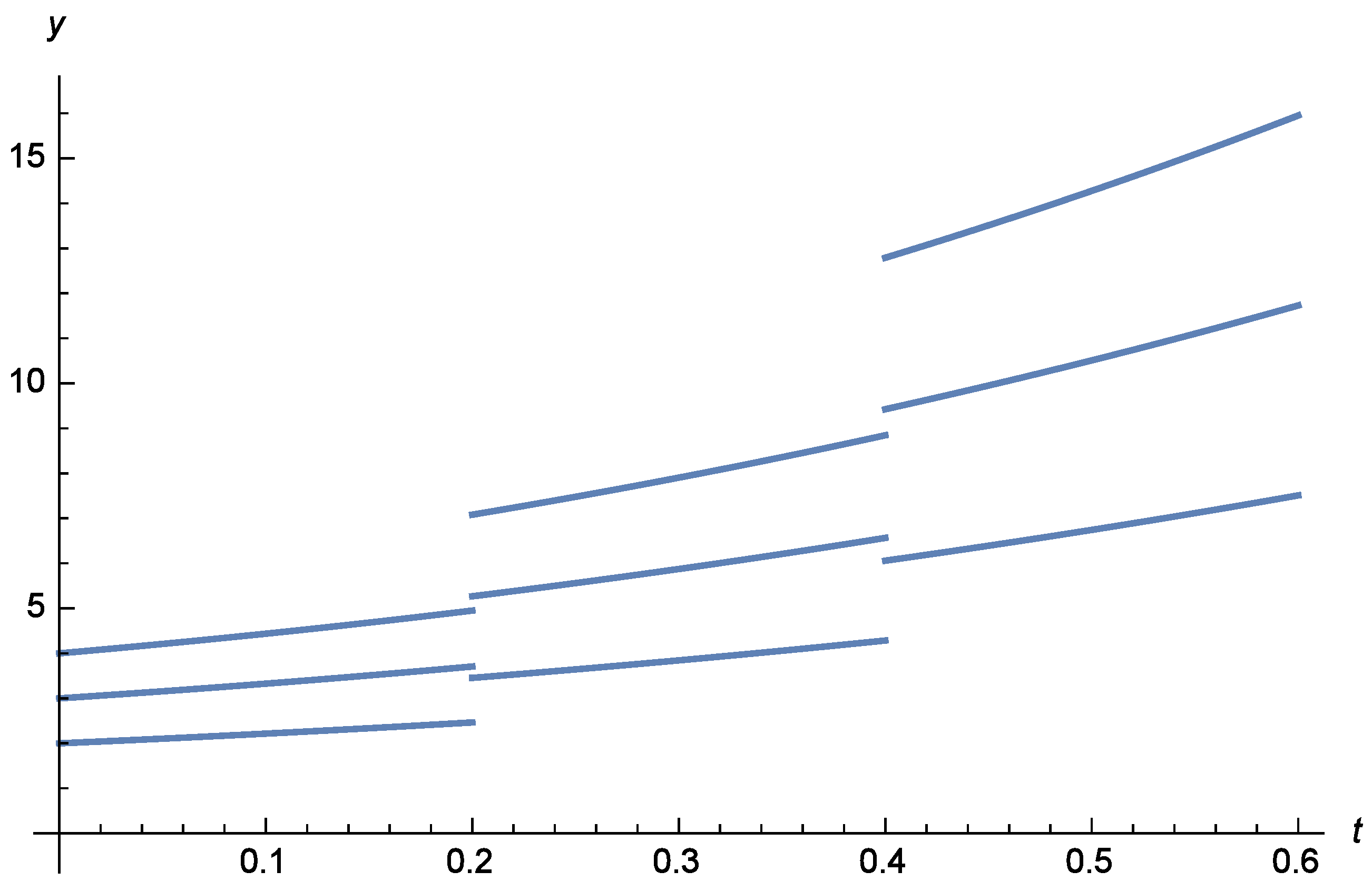

5. Application: Time Value of Money

- Case I. Simple Interest: Chrysasif et al. [4] considered a simple capitalization problem. Let us assume that an amount of money is deposited in a bank account to obtain the interest. Then, the future value of this investment consists of the initial value of deposit P, namely the principal, plus all the interest earned during the period of investment. The authors considered the case when the interest is received only by the principal. This motivates the following fuzzy difference equation of simple interest [4]where I is the rate of interest and

- Case II. Periodic Compounding: Let us assume that an amount of money P is deposited in a bank account to receive interest at a constant rate Here, in contrast to the case of simple interest, we assume that the interest earned will be added to the initial principal periodically. Consequently, the interest will be received not only by the principal, but also by all the interest earned so far. This motivates the following fuzzy difference equation [4]The authors of Reference [4] have studied the compound interest problem considering a new factor which is added into the equation, denoting the deposits realized during the life of the accountIt is natural to use fuzzy number for the extra deposits because we do not know certainly the number of deposits that the customer will make during the period of investment.

- Case III. Continuous Compounding: In this case, the rate of growth of the deposit is proportional to the current wealth. In the periodic compounding, if we consider limit case as we get , which is the solution of the following Cauchy problem [24]This is known as the continuous compounding, where the corresponding growth factor is .

6. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Chakraverty, S.; Tapaswini, S.; Behera, D. Fuzzy Differential Equations and Applications for Engineers and Scientists; Taylor& Francis: Oxfordshire, UK, 2016. [Google Scholar]

- Bede, B. Mathematics of Fuzzy Sets and Fuzzy Logic; Springer: London, UK, 2013. [Google Scholar]

- Chalco-Cano, Y.; Román-Flores, H. On new solutions of fuzzy differential equations. Chaos Solitons Fractals 2008, 38, 112–119. [Google Scholar] [CrossRef]

- Chrysafis, K.A.; Papadopoulos, B.K.; Papaschinopoulos, G. Papaschinopoulos, On the fuzzy difference equations of finance. Fuzzy Sets Syst. 2008, 159, 3259–3270. [Google Scholar] [CrossRef]

- Khastan, A. New solutions for first order linear fuzzy difference equations. J. Comput. Appl. Math. 2017, 312, 156–166. [Google Scholar] [CrossRef]

- Papaschinopoulos, G.; Papadopoulos, B.K. On the fuzzy difference equation xn+1 = A + . Fuzzy Sets Syst. 2002, 129, 73–81. [Google Scholar] [CrossRef]

- Villamizar-Roa, E.J.; Angulo-Castillo, V.; Chalco-Cano, Y. Existence of solutions to fuzzy differential equations with generalized Hukuhara derivative via contractive-like mapping principles. Fuzzy Sets Systems 2015, 265, 24–38. [Google Scholar] [CrossRef]

- Bede, B.; Rudas, I.J.; Bencsik, A.L. First order linear fuzzy differential equations under generalized differentiability. Inform. Sci. 2007, 177, 1648–1662. [Google Scholar] [CrossRef]

- Deeba, E.Y.; de Korvin, A. Analysis by fuzzy difference equations of a model of CO2 level in the blood. Appl. Math. Lett. 1999, 12, 33–40. [Google Scholar] [CrossRef]

- Kaleva, O. Fuzzy differential equations. Fuzzy Sets Syst. 1987, 24, 301–317. [Google Scholar] [CrossRef]

- Papaschinopoulos, G.; Stefanidou, G. Boundedness and asymptotic behaviour of the solutions of a fuzzy difference equation. Fuzzy Sets Syst. 2003, 140, 523–539. [Google Scholar] [CrossRef]

- Rodríguez-López, R. On the existence of solutions to periodic boundary value problems for fuzzy linear differential equations. Fuzzy Sets Syst. 2013, 219, 1–26. [Google Scholar] [CrossRef]

- Buckley, J.J. The fuzzy mathematics of finance. Fuzzy Sets Syst. 1987, 21, 257–273. [Google Scholar] [CrossRef]

- Córdova, J.D.; Molina, E.C.; López, P.N. Fuzzy logic and financial risk. A proposed classification of financial risk to the cooperative sector. Contaduría Adm. 2017, 62, 1687–1703. [Google Scholar] [CrossRef]

- Kwapisz, M. On difference equations arising in mathematics of finance. Nonlinear Anal. Theory Methods Appl. 1997, 30, 1207–1218. [Google Scholar] [CrossRef]

- Diamond, P.; Kloeden, P. Metric Spaces of Fuzzy Sets; World Scientific: Singapore, 1994. [Google Scholar]

- Gasilov, N.; Amrahov, S.E.; Fatullayev, A.G. Solution of linear differential equations with fuzzy boundary values. Fuzzy Sets Syst. 2014, 257, 169–183. [Google Scholar] [CrossRef]

- Nieto, J.J.; Rodríguez-López, R.; Franco, D. Linear first order fuzzy differential equations. Int. J. Uncertain. Fuzziness Knowl.-Based Syst. 2006, 14, 687–709. [Google Scholar] [CrossRef]

- Nieto, J.J.; Rodríguez-López, R.; Georgiou, D.N. Fuzzy differential systems under generalized metric spaces approach. Dyn. Syst. Appl. 2008, 17, 1–24. [Google Scholar]

- Khastan, A.; Rodríguez-López, R. On the solutions to first order linear fuzzy differential equations. Fuzzy Sets Syst. 2016, 295, 114–135. [Google Scholar] [CrossRef]

- Papaschinopoulos, G.; Papadopoulos, B.K. On the fuzzy difference equation xn+1 = A + . Soft Comput. 2002, 6, 456–461. [Google Scholar] [CrossRef]

- Lakshmikantham, V.; Trigiante, D. Theory of Difference Equations: Numerical Methods and Applications; Academic Press: New York, NY, USA, 1988. [Google Scholar]

- Kacprzyk, J.; Fedrizzi, M. Fuzzy Regression Analysis; Physica-Verlag: Heidelberg, Germany, 1992. [Google Scholar]

- Capinski, M.; Zastawniak, T. Mathematics for Finance: An Introduction to Financial Engineering; Springer: London, UK, 2003. [Google Scholar]

- Dong, N.P.; Long, H.V.; Khastan, A. Optimal control of a fractional order model for granular SEIR epidemic model. Commun. Nonlinear Sci. Numer. Simulat. 2020, 88, 105312. [Google Scholar] [CrossRef]

- Mazandarani, M.; Kamyad, A.V. Modified fractional Euler method for solving fuzzy fractional initial value problem. Commun. Nonlinear Sci. Numer. Simul. 2013, 18, 12–21. [Google Scholar] [CrossRef]

- Mazandarani, M.; Zhao, Y. Fuzzy Bang-Bang control problem under granular differentiability. J. Franklin Inst. 2018, 355, 4931–4951. [Google Scholar] [CrossRef]

- Son, N.T.K.; Dong, N.P.; Son, L.H.; Abdel-Basset, M.; Manogaran, G.; Long, H.V. On the stabilizability for a class of linear time-invariant systems under uncertainty. Circ. Syst. Signal Process. 2020, 39, 919–960. [Google Scholar] [CrossRef]

- Son, N.T.K.; Dong, N.P.; Long, H.V.; Son, L.H.; Khastan, A. Linear quadratic regulator problem governed by granular neutrosophic fractional differential equations. ISA Trans. 2019, 97, 296–316. [Google Scholar] [CrossRef] [PubMed]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Long, H.V.; Jebreen, H.B.; Chalco-Cano, Y. A New Continuous-Discrete Fuzzy Model and Its Application in Finance. Mathematics 2020, 8, 1808. https://doi.org/10.3390/math8101808

Long HV, Jebreen HB, Chalco-Cano Y. A New Continuous-Discrete Fuzzy Model and Its Application in Finance. Mathematics. 2020; 8(10):1808. https://doi.org/10.3390/math8101808

Chicago/Turabian StyleLong, Hoang Viet, Haifa Bin Jebreen, and Y. Chalco-Cano. 2020. "A New Continuous-Discrete Fuzzy Model and Its Application in Finance" Mathematics 8, no. 10: 1808. https://doi.org/10.3390/math8101808

APA StyleLong, H. V., Jebreen, H. B., & Chalco-Cano, Y. (2020). A New Continuous-Discrete Fuzzy Model and Its Application in Finance. Mathematics, 8(10), 1808. https://doi.org/10.3390/math8101808