Assessing Blockchain Investments through the Learning Option: An Application to the Automotive and Aerospace Industry

Abstract

:1. Introduction

2. The Blockchain Technology and the Automotive and Aerospace Industry

3. Investing While Discovering: The Learning Option

3.1. Nomenclature

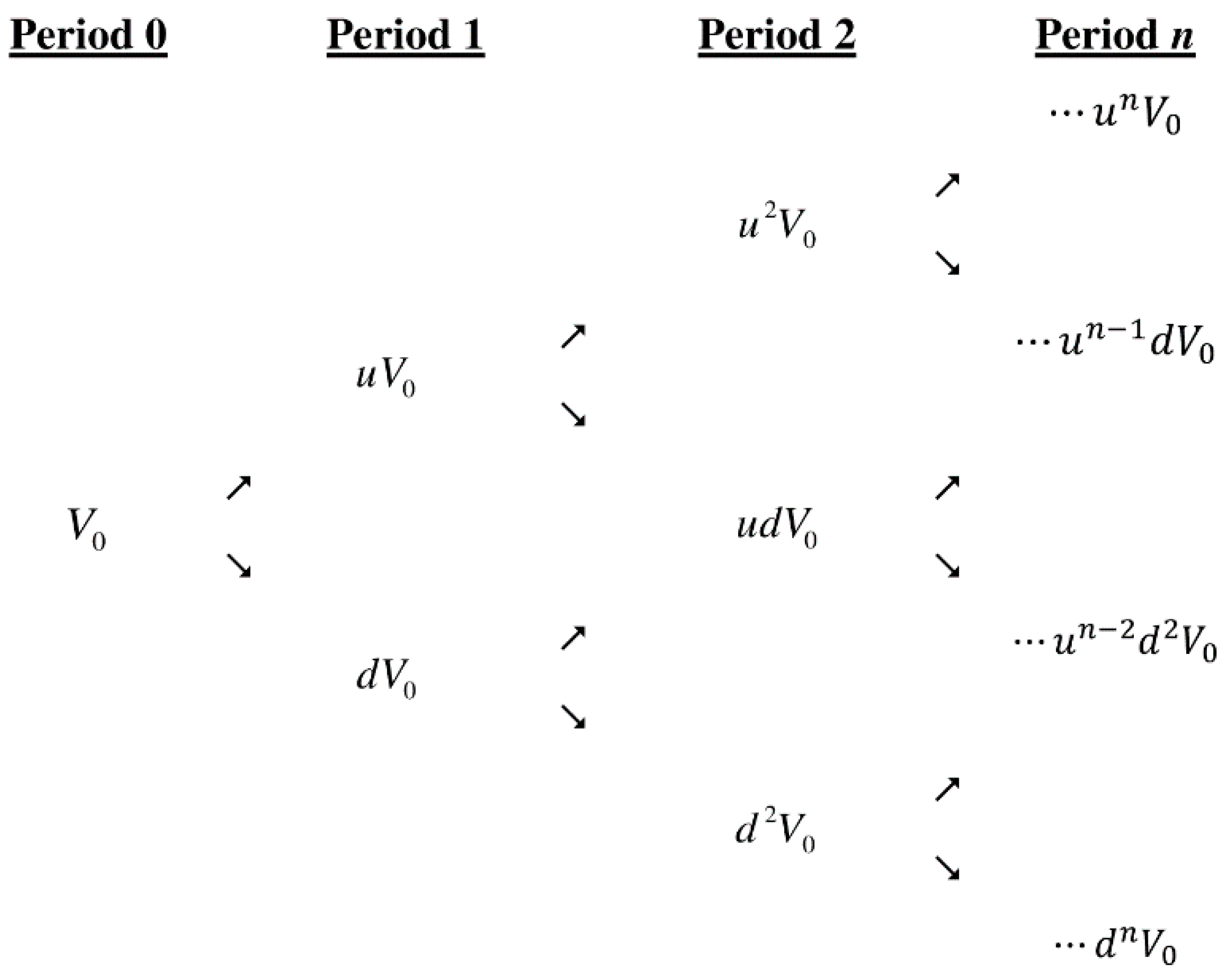

3.2. Valuing the Learning Investment

- ,

- ,

- .

- In the first interval, , the value of the initial investment is lower than the project value in the worst scenario (it is multiplied by the factor d), discounted until moment 0. In this way, it is advisable to invest in the project. Specifically, the project value is given by the difference between the incremented present value of the future cash flows, x, as a consequence of investing in the option to learn and the total investment (the initial investment to carry out the project and the investment to carry out the learning option).

- In the second interval, , the value of the initial total investment is in an intermediate position between the present value of the cash flow in the less favorable situation and in the most favorable one.

- In the last interval, , the initial investment is higher than the present value of the cash flow in the best scenario; thus, it is not recommended to carry out the investment.

4. Application of the Option and Main Results

- -

- The upper factor of cash-flow fluctuation is = 1.029.

- -

- The lower factor of cash-flow fluctuation is d 0.971.

- -

- The probability of occurrence of the profitable scenario is as follows:

- -

- The probability of occurrence of the nonprofitable scenario is q = .

- -

- The increment in the present value of cash flows (calculated from Equation (A1) in Appendix A and considering that the value of xmax = 1.14, given that the revaluation potential to S&P 500 equities in 2020 is 14% [43] (consulted on 16 January 2020)) is as follows:

5. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

- when , it means that, when there is no investment to learn, the present value of the future cash flows does not change.

- when , it means that the profits derived from an initial investment in the learning option are not unlimited; there is a maximum value of x beyond which the present value of the future cash flows stops growing.

Appendix B

| k | Learning Option Value (see Equation (4)) | |||

|---|---|---|---|---|

| 1 | 4.436 | 15.977 | 14.003 | 0.155 |

| 2 | 4.436 | 15.241 | 14.003 | 0.155 |

| 3 | 4.436 | 14.538 | 14.003 | 0.155 |

| 4 | 4.436 | 13.869 | 14.003 | 0.155 |

| 5 | 4.436 | 13.229 | 14.003 | 0.155 |

| 6 | 4.436 | 12.620 | 14.003 | 0.155 |

| 7 | 4.436 | 12.038 | 14.003 | 0.155 |

| 8 | 4.436 | 11.484 | 14.003 | 0.155 |

| 9 | 4.436 | 10.955 | 14.003 | 0.155 |

| 10 | 4.436 | 10.450 | 14.003 | 0.155 |

References

- Trașcă, D.L.; Ștefan, G.M.; Sahlian, D.N.; Hoinaru, R.; Șerban-Oprescu, G.-L. Digitalization and Business Activity. The Struggle to Catch up in CEE Countries. Sustainability 2019, 11, 2204. [Google Scholar] [CrossRef] [Green Version]

- Lee, I.; Shin, Y.J. Fintech: Ecosystem, business models, investment decisions, and challenges. Bus. Horiz. 2018, 61, 35–46. [Google Scholar] [CrossRef]

- Tarifa-Fernández, J.; Casado-Belmonte, M.P.; Martínez-Romero, M.J. Perspective and Challenges of Blockchain Technology in the Accountability of Financial Information. In Architectures and Frameworks for Developing and Applying Blockchain Technology; IGI Global: Hershey, PA, USA, 2019; pp. 45–68. [Google Scholar]

- Nowiński, W.; Kozma, M. How can blockchain technology disrupt the existing business models? Entrep. Bus. Econ. Rev. 2017, 5, 173–188. [Google Scholar] [CrossRef]

- Cowan, K.R.; Daim, T.U. Review of technology acquisition and adoption research in the energy sector. Technol. Soc. 2011, 33, 183–199. [Google Scholar] [CrossRef]

- Benaroch, M.; Kauffman, R.J. A Case for Using Real Options Pricing Analysis to Evaluate Information Technology Project Investments. Inf. Syst. Res. 1999, 10, 70–86. [Google Scholar] [CrossRef] [Green Version]

- Kauffman, R.J.; Li, X. Technology competition and optimal investment timing: A real options perspective. IEEE Trans. Eng. Manag. 2005, 52, 15–29. [Google Scholar] [CrossRef] [Green Version]

- McGrath, R.G.; MacMillan, I.C. Assessing technology projects using real options reasoning. Res. Technol. Manag. 2000, 43, 35–49. [Google Scholar] [CrossRef]

- Carlsson, C.; Fullér, R. A fuzzy approach to real option valuation. Fuzzy Sets Syst. 2003, 139, 297–312. [Google Scholar] [CrossRef] [Green Version]

- Lander, D.M.; Pinches, G.E. Challenges to the practical implementation of modeling and valuing real options. Q. Rev. Econ. Financ. 1998, 38, 537–567. [Google Scholar] [CrossRef]

- Morreale, A.; Mittone, L.; Vu, T.T.T.; Collan, M. To wait or not to wait? Use of the flexibility to postpone investment decisions in theory and in practice. Sustainability 2020, 12, 3451. [Google Scholar] [CrossRef] [Green Version]

- Shi, P.; Yan, B.; Zhao, J. Appropriate timing for SMEs to introduce an Internet-based online channel under uncertain operating costs: A real options analysis. Electron. Commer. Res. 2020, 20, 969–999. [Google Scholar] [CrossRef]

- Schneider, R.; Imai, J. Valuing Investments in Digital Transformation of Business Models. Int. J. Real Options Strategy 2019, 7, 1–26. [Google Scholar] [CrossRef]

- Attaran, M.; Gunasekaran, A. Blockchain-enabled technology: The emerging technology set to reshape and decentralise many industries. Int. J. Appl. Decis. Sci. 2019, 12, 424–444. [Google Scholar] [CrossRef]

- Favato, G.; Vecchiato, R. Embedding real options in scenario planning: A new methodological approach. Technol. Forecast. Soc. Chang. 2017, 124, 135–149. [Google Scholar] [CrossRef] [Green Version]

- Rimba, P.; Tran, A.B.; Weber, I.; Staples, M.; Ponomarev, A.; Xu, X. Comparing Blockchain and Cloud Services for Business Process Execution. In Proceedings of the 2017 IEEE International Conference on Software Architecture, Gothenburg, Sweden, 3–7 April 2017; Institute of Electrical and Electronics Engineers Inc.: Piscataway, NJ, USA, 2017; pp. 257–260. [Google Scholar]

- Viriyasitavat, W.; Da Xu, L.; Bi, Z.; Sapsomboon, A. Blockchain-based business process management (BPM) framework for service composition in industry 4.0. J. Intell. Manuf. 2020, 31, 1737–1748. [Google Scholar] [CrossRef]

- Konstantinidis, I.; Siaminos, G.; Timplalexis, C.; Zervas, P.; Peristeras, V.; Decker, S. Blockchain for business applications: A systematic literature review. In The Lecture Notes in Business Information Processing; Springer: Cham, Switzerland, 2018; Volume 320, pp. 384–399. [Google Scholar]

- Wang, J.; Wu, P.; Wang, X.; Shou, W. The outlook of blockchain technology for construction engineering management. Front. Eng. Manag. 2017, 4, 67. [Google Scholar] [CrossRef] [Green Version]

- Subramanian, N.; Chaudhuri, A.; Kayıkcı, Y.; Subramanian, N.; Chaudhuri, A.; Kayıkcı, Y. Information System Evolution and Blockchain. In Blockchain and Supply Chain Logistics; Springer: Cham, Switzerland, 2020; pp. 1–9. [Google Scholar]

- Association, A.I. Blockchain in Aerospace and Defense. Establishing an Industry Approach to Blockchain Governance, Standards, and Participation; Aerospace Industries Association: Arlington, VA, USA, 2019. [Google Scholar]

- Schmidt, J.; Gelle, M.; Gottlieb, C. Driving Trust: Distributed Ledger for Supply Chain; Accenture Consulting: Chicago, IL, USA, 2020. [Google Scholar]

- Aaronson, M.; Caffrey, H.; Won, S.; Ahlquist, J. Getting Real about Blockchain in Aerospace and Defence; The Boston Consulting Group: Boston, MA, USA, 2018. [Google Scholar]

- Consulting, A. Blockchain in Aerospace and Defense. Capturing Growth and Efficiency through a Rapidly Emerging Technology; Accenture Consulting: Chicago, IL, USA, 2017. [Google Scholar]

- Gilain, A.; Le Masson, P.; Weil, B. The hidden feat behind development cost escalation—How engineering design enables functional expansion in the aerospace industry. In Proceedings of the International Conference on Engineering Design, ICED; Cambridge University Press: Cambridge, UK, 2019; Volume 1, pp. 3011–3020. [Google Scholar]

- Adner, R.; Levinthal, D.A. What Is Not a Real Option: Considering Boundaries for the Application of Real Options to Business Strategy. Acad. Manag. Rev. 2004, 29, 74. [Google Scholar] [CrossRef] [Green Version]

- Martzoukos, S.H. Real Options with Random Controls and the Value of Learning. Ann. Oper. Res. 2000, 99, 305–323. [Google Scholar] [CrossRef]

- McCardle, K.F. Information Acquisition and the Adoption of New Technology. Manag. Sci. 1985, 31, 1372–1389. [Google Scholar] [CrossRef]

- Goswami, S.; Teo, H.; Chan, H. Real options from RFID adoption: The role of institutions and managerial mindfulness. In Proceedings of the International Conference on Information Systems, ICIS 2008, Paris, France, 14–17 December 2008. [Google Scholar]

- Krychowski, C.; Quelin, B. How Can Real Options Help Define Optimal Timing in Business Model Dynamics? An Application to the Mobile Telecommunications Industry. 2014. Available online: https://www.strategie-aims.com/events/conferences/24-xxiiieme-conference-de-l-aims/communications/3276-how-can-real-options-help-define-optimal-timing-in-business-model-dynamics-an-application-to-the-mobile-telecommunications-industry/download (accessed on 12 September 2020).

- Copeland, T.E.; Keenan, P.T. Making real options real. McKinsey Q. 1998, 3, 128–141. [Google Scholar]

- Turvey, C.G. Mycogen as a Case Study in Real Options. Rev. Agric. Econ. 2001, 23, 243–264. [Google Scholar] [CrossRef]

- Childs, P.D.; Triantis, A.J. Dynamic R&D investment policies. Manag. Sci. 1999, 45, 1359–1377. [Google Scholar]

- Brach, M. Real Options in Practice; John Wiley & Sons, Inc.: Hoboken, NJ, USA, 2003. [Google Scholar]

- Plaza Gonzalez, C.; Sánchez Pérez, A.M. Opciones reales para la valoración del proceso de internacionalización de Mercadona. In XX Reunión de Economía Mundial; Editorial Universidad de Almería: Almería, Spain, 2018. [Google Scholar]

- Cruz Rambaud, S.; Sanchez Perez, A.M. An assessment of the option to reduce the investment in a project by the binomial pricing model. Eng. Econ. 2017, 28, 514–523. [Google Scholar] [CrossRef]

- Sarkar, S. On the investment-uncertainty relationship in a real options model. J. Econ. Dyn. Control 2000, 24, 219–225. [Google Scholar] [CrossRef]

- Dikos, G. Real options econometrics for aggregate tanker investment decisions. Int. J. Ocean Syst. Manag. 2008, 1, 31–44. [Google Scholar] [CrossRef]

- Sahaym, A.; Treviño, L.J.; Steensma, H.K. The influence of managerial discretion, innovation and uncertainty on export intensity: A real options perspective. Int. Bus. Rev. 2012, 21, 1131–1147. [Google Scholar] [CrossRef]

- Research, B. Blockchain in Automotive and Aerospace & Aviation Market: Focus on Key Application and Types of Blockchain—Analysis and Forecast, 2019–2029. 2019. Available online: https://www.prnewswire.com/news-releases/blockchain-in-automotive-and-aerospace--aviation-market-focus-on-key-application-and-types-of-blockchain--analysis-and-forecast-2019-2029-300867422.html (accessed on 10 January 2020).

- Dow Jones Today|DJIA Index Live—Investing.com. Available online: https://www.investing.com/indices/us-30 (accessed on 22 July 2020).

- Daily Treasury Yield Curve Rates. Available online: https://www.treasury.gov/resource-center/data-chart-center/interest-rates/pages/TextView.aspx?data=yieldYear&year=2020 (accessed on 15 January 2020).

- Previsión S&P 500 Para 2020|Blog Bankinter. Available online: https://www.bankinter.com/blog/mercados/prevision-sp500 (accessed on 16 January 2020).

| Symbol | Description |

|---|---|

| Present value of the project with the learning option | |

| Investment necessary to carry out the learning option at the present moment | |

| Investment necessary to carry out the project at the present moment | |

| Total investment (valued at the present moment), i.e., | |

| Value of future cash flows at moment k | |

| Probability density function of the value of the future cash flows | |

| Risk-free interest rate | |

| u | Upper factor of cash-flow fluctuation |

| Lower factor of cash-flow fluctuation | |

| Project value at moment k + 1 in the favorable scenario | |

| Project value at moment k + 1 in the unfavorable scenario | |

| Probability of occurrence of the favorable scenario | |

| Probability of occurrence of the unfavorable scenario | |

| Project volatility | |

| x | Percentage increment of the present value of the future cash flows as a consequence of investing in the learning option (see Appendix A) |

| xmax | Potential (maximum) revaluation of a project (its value is greater than 1) |

| n | Time horizon of the option to learn |

| m | Total time horizon of the project |

| Variables | Value | Source |

|---|---|---|

| Project value in year 10 | V10 = $20 billion | BIS Research (2019) [40] |

| Learning investment | IL = $1.53683 billion | |

| Initial investment | I0 = $2.900 billion | |

| Learning option time horizon | n = 1 year | |

| Total time horizon | m = 10 years | |

| Volatility | σ = 8.36% | 1 year change in S&P 500 information technology index (consulted on 22 July 2019) [41] |

| Risk-free interest rate | rf = 1.79% | United States 10 year bond (consulted on 15th January 2020) [42] |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sánchez Pérez, A.M.; Tarifa Fernández, J.; Cruz Rambaud, S. Assessing Blockchain Investments through the Learning Option: An Application to the Automotive and Aerospace Industry. Mathematics 2020, 8, 2213. https://doi.org/10.3390/math8122213

Sánchez Pérez AM, Tarifa Fernández J, Cruz Rambaud S. Assessing Blockchain Investments through the Learning Option: An Application to the Automotive and Aerospace Industry. Mathematics. 2020; 8(12):2213. https://doi.org/10.3390/math8122213

Chicago/Turabian StyleSánchez Pérez, Ana María, Jorge Tarifa Fernández, and Salvador Cruz Rambaud. 2020. "Assessing Blockchain Investments through the Learning Option: An Application to the Automotive and Aerospace Industry" Mathematics 8, no. 12: 2213. https://doi.org/10.3390/math8122213