Profiting on the Stock Market in Pandemic Times: Study of COVID-19 Effects on CESEE Stock Markets

Abstract

:1. Introduction

2. Related Literature Review

3. Methodology and Data Description

3.1. Event Study Methodology

3.2. Robustness Checking

3.3. Data Description

- Event 1: WHO declared Public Health Emergency of International Concern (PHEIC) regarding COVID-19 on 30 January 2020;

- Event 2: WHO announced the name “COVID-19”;

- Event 3: First person to be infected in the country;

- Event 4: WHO officially declared the pandemic on 11 March 2020;

- Event 5: Official first lockdown date of the economy.

4. Empirical Results

4.1. Main Analysis: ESM Estimation Results

4.2. Robustness Checking: GARCH Estimation Results

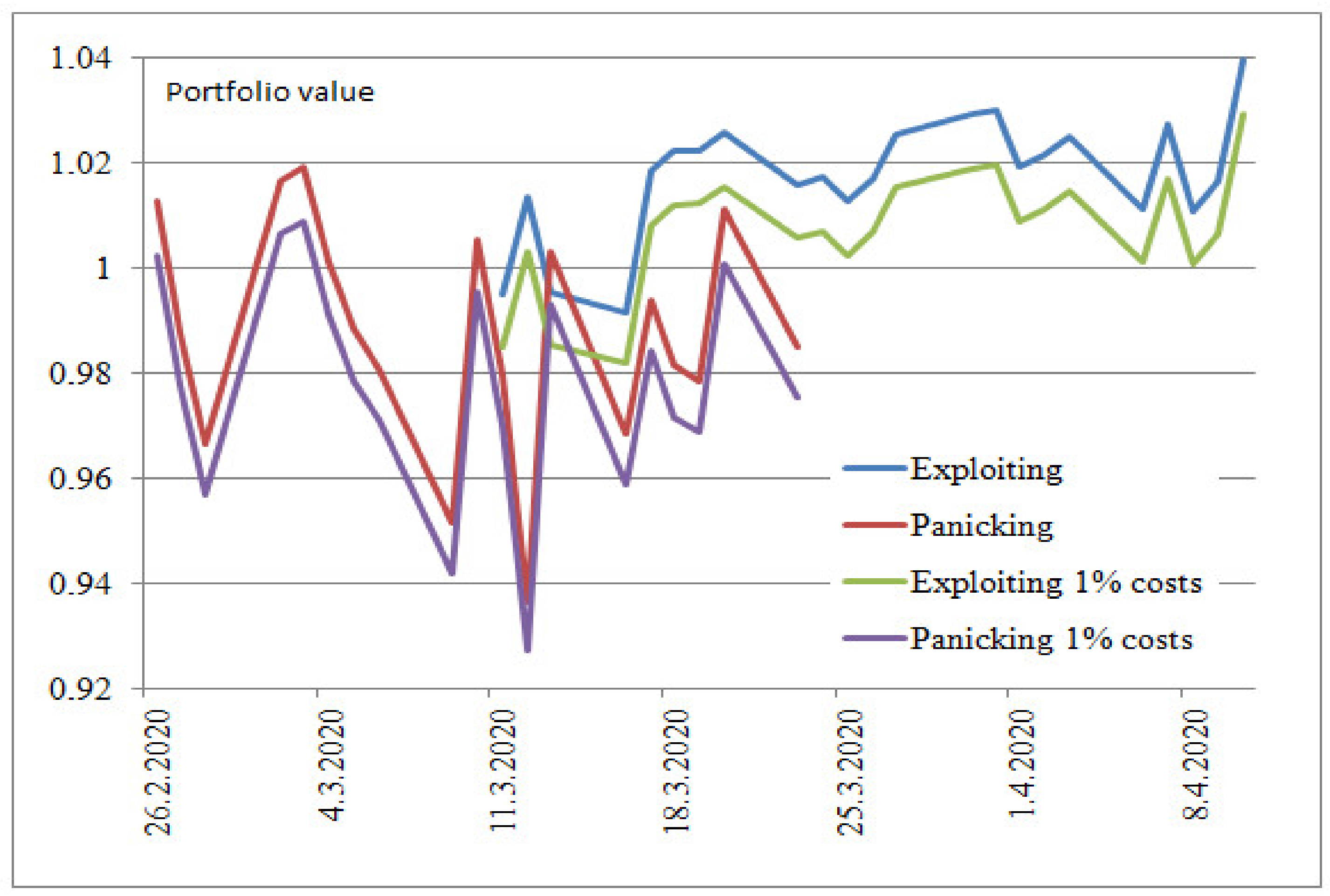

4.3. Trading Simulation Results

5. Conclusions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Zhang, D.; Hu, M.; Ji, Q. Financial Markets under the Global Pandemic of COVID-19. Financ. Res. Lett. 2020, 36, 101528. [Google Scholar] [CrossRef]

- Barro, R.J.; Ursua, J.F.; Weng, J. The Coronavirus and the Great Influenza Pandemic: Lessons from the “Spanish Flu” for the Coronavirus’s Potential Effects on Mortality and Economic Activity; Working Papers No. w26866; National Bureau of Economic Research: Cambridge, MA, USA, 2020. [Google Scholar] [CrossRef]

- He, P.; Sun, Y.; Zhang, Y.; Li, T. COVID–19′s Impact on Stock Prices Across Different Sectors—An Event Study Based on the Chinese Stock Market. Emerg. Mark. Financ. Trade 2020, 56, 2198–2212. [Google Scholar] [CrossRef]

- Ashraf, B.N. Stock markets’ reaction to COVID-19: Cases or fatalities? Res. Int. Bus. Financ. 2020, 54, 101249. [Google Scholar] [CrossRef]

- Al-Awadhi, A.; Alsafi, K.; Al-Awadhi, A.; Alhammadi, S. Death and contagious infectious disease: Impact of the COVID-19 virus on stock market returns. J. Behav. Exp. Financ. 2020, 27, 100326. [Google Scholar] [CrossRef]

- Mazur, M.; Dang, M.; Vega, M. COVID-19 and the march 2020 stock market crash. Evidence from S&P1500. Finance Res. Lett. 2020, 38, 101690. [Google Scholar]

- Harvey, C.; Liu, Y.; Zhu, H. … and the Cross-Section of Expected Returns. Rev. Financ. Stud. 2015, 29, 5–68. [Google Scholar] [CrossRef] [Green Version]

- Donadelli, M.; Kizys, R.; Riedel, M. Dangerous infectious diseases: Bad news for Main Street, good news for Wall Street? J. Financ. Mark. 2017, 35, 84–103. [Google Scholar] [CrossRef]

- Hanna, D.; Yiping, H. The impact of SARS on Asian Economies. Asian Econ. Pap. 2004, 3, 102–112. [Google Scholar] [CrossRef]

- Smith, R.D.; Keogh-Brown, M.R.; Barnett, T. Estimating the economic impact of pandemic influenza: An application of the computable general equilibrium model to the UK. Soc. Sci. Med. 2011, 73, 235–244. [Google Scholar] [CrossRef]

- Haacker, M. The Impact of HIV/AIDS on Government Finance and Public Services; International Monetary Fund: Washington, DC, USA, 2004. [Google Scholar]

- Bloom, D.E.; Cadarette, D.; Sevilla, J.P. Epidemics and economics: New and resurgent infectious diseases can have far-reaching economic repercussions. Financ. Dev. 2018, 55, 46–49. [Google Scholar]

- Kahneman, D.; Tversky, A. Prospect theory: An analysis of decision under risk. Econometrica 1979, 47, 263–291. [Google Scholar] [CrossRef] [Green Version]

- Shefrin, H.; Statman, M. The disposition to sell winners too early and ride losers too long: Theory and evidence. J. Financ. 1985, 40, 777–790. [Google Scholar] [CrossRef]

- De Long, J.B.; Shleifer, A.; Summers, L.H.; Waldmann, R.J. Noise trader risk in financial markets. J. Political Econ. 1990, 98, 703–738. [Google Scholar] [CrossRef]

- Lee, C.; Shleifer, A.; Thaler, R.H. Investor sentiment and the closed-end fund puzzle. J. Financ. 1991, 46, 75–109. [Google Scholar] [CrossRef]

- Shleifer, A. Inefficient Markets: An Introduction to Behavioral Finance; Oxford University Press: New York, NY, USA, 1999. [Google Scholar]

- Škrinjarić, T.; Golubić, Z.L.; Orlović, Z. Empirical analysis of dynamic spillovers between exchange rate return, return volatility and investor sentiment. Studies in Economics and Finance. Stud. Econ. Finance 2020, 38, 86–113. [Google Scholar] [CrossRef]

- Baker, M.; Wurgler, J. Investor Sentiment and the Cross-Section of Stock Returns. J. Financ. 2006, 61, 1645–1680. [Google Scholar] [CrossRef] [Green Version]

- Baker, M.; Wurgler, J. Investor sentiment in the stock market. J. Econ. Perspect. 2007, 21, 129–152. [Google Scholar] [CrossRef] [Green Version]

- Chiang, T.C. Financial risk, uncertainty and expected returns: Evidence from Chinese equity markets. China Financ. Rev. Int. 2019, 9, 425–454. [Google Scholar] [CrossRef]

- Krugman, P. Crashing Economy, Rising Stocks: What’s Going On? New York Times. 30 April 2020. Available online: https://www.nytimes.com/2020/04/30/opinion/economy-stock-market-coronavirus.html (accessed on 20 January 2021).

- Malkiel, B.; Shiller, R. Does Covid-19 Prove the Stock Market Is Inefficient? A Wealth of Common Sense. 11 May 2020. Available online: https://awealthofcommonsense.com/2020/05/does-covid-19-prove-the-stock-market-is-inefficient/ (accessed on 20 January 2021).

- Baek, S.; Mohanty, S.K.; Glambosky, M. COVID-19 and stock market volatility: An industry level analysis. Financ. Res. Lett. 2020, 37, 101748. [Google Scholar] [CrossRef]

- Bouri, E.; Demirer, R.; Gupta, R.; Pierdzioch, C. Infectious Diseases, Market Uncertainty and Oil Market Volatility. Energies 2020, 13, 4090. [Google Scholar] [CrossRef]

- Li, Y.; Liang, C.; Ma, F.; Wang, J. The role of the IDEMV in predicting European stock market volatility during the COVID-19 pandemic. Financ. Res. Lett. 2020, 36, 101749. [Google Scholar] [CrossRef]

- Haroon, O.; Rizvi, S.A.R. COVID-19: Media coverage and financial markets behavior-A sectoral inquiry. J. Behav. Exp. Financ. 2020, 27, 100343. [Google Scholar] [CrossRef]

- Ali, M.; Alaam, N.; Rizvi, S.A.R. Coronavirus (COVID-19)—An epdicemic or pandemic for financial markets. J. Behav. Exp. Financ. 2020, 27, 100341. [Google Scholar] [CrossRef] [PubMed]

- Rojas, F.; Jiang, X.; Montenovo, L.; Simon, K.I.; Weinberg, B.A.; Wing, C. Is the Cure Worse than the Problem Itself? Immediate Labor Market Effects of COVID-19 Case Rates and School Closures in the U.S.; NBER Working Paper No. 27127; National Bureau of Economic Research: Cambridge, MA, USA, 2020. [Google Scholar]

- Haddad, V.; Moreira, A.; Muir, T. When Selling Becomes Viral: Disruptions in Debt Markets in the COVID-19 Crisis and the Fed’s Response; NBER Working Paper No. 27168; National Bureau of Economic Research: Cambridge, MA, USA, 2020. [Google Scholar]

- Jordà, Ò.; Singh, S.R.; Taylor, A.M. Longer-Run Economic Consequences of Pandemics; CEPR Discussion Paper DP14543; CEPR: London, UK, 2020. [Google Scholar]

- Goodell, J.W. COVID-19 and finance: Agendas for future research. Financ. Res. Lett. 2020, 35, 101512. [Google Scholar] [CrossRef]

- Sharif, A.; Aloui, C.; Yarovaya, L. COVID-19 pandemic, oil prices, stock market and policy uncertainty nexus in the US economy: Fresh evidence from the wavelet-based approach. Int. Rev. Financ. Anal. 2020, 70, 101496. [Google Scholar] [CrossRef]

- Yarovaya, L.; Matkovskyy, R.; Jalan, A. The Effects of a ‘Black Swan’ Event (COVID-19) on Herding Behavior in Cryptocurrency Markets: Evidence from Cryptocurrency USD, EUR, JPY and KRW Markets. SSRN, 29 April 2020. Available online: https://ssrn.com/abstract=3586511 (accessed on 20 January 2021).

- Škrinjarić, T. Stock Market Reactions to Brexit: Case of Selected CEE and SEE Stock Markets. Int. J. Financ. Stud. 2019, 7, 1. [Google Scholar] [CrossRef] [Green Version]

- Trenca, I.; Petria, I.; Pece, A.M. Empirical inquiry of gregarious behavior: Evidence from European emerging markets. Rev. Econ. 2015, 67, 143–160. [Google Scholar]

- Baele, L.; Bekaert, G.; Schäfer, L. An Anatomy of Central and Eastern European Equity Markets; Columbia Business School: New York, NY, USA, 2015; pp. 15–71. [Google Scholar]

- Golab, A.; Allen, D.E.; Powell, R. Aspects of Volatility and Correlations in European Emerging Economies. In Emerging Markets and Sovereign Risk; Finch, N., Ed.; Palgrave Macmillan: London, UK, 2015. [Google Scholar]

- Burch, T.R.; Emery, D.R.; Fuerst, M.E. Who Moves Markets in a Sudden Marketwide Crisis? Evidence from 9/11. J. Financ. Quant. Anal. 2016, 51, 463–487. [Google Scholar] [CrossRef]

- Vidović, J. Investigation of stock illiquidity on Central and South East European markets in naïve portfolio framework. Ekon. Misao I Praksa 2013, 2, 537–550. [Google Scholar]

- Heyden, K.J.; Heyden, T. Market Reactions to the Arrival and Containment of COVID-19: An Event Study. Finance Research Letters, Forthcoming; SSRN: Rochester, NY, USA, 2020. [Google Scholar]

- Verma, S.; Gustafsson, A. Investigating the emerging COVID-19 research trends in the field of business and management: A bibliometric analysis approach. J. Bus. Res. 2020, 118, 253–261. [Google Scholar] [CrossRef]

- Aristovnik, A.; Ravšelj, D.; Umek, L. A Bibliometric Analysis of COVID-19 across Science and Social Science Research Landscape. Sustainability 2020, 12, 9132. [Google Scholar] [CrossRef]

- Arslan, H.M.; Bilal, C.S.; Bashir, M.F.; Naseer, K. Contemporary research on spillover effects of COVID-19 in stock markets. A systematic and bibliometric review. In Proceedings of the 3rd International Electronic Conference on Environmental Research and Public Health—Public Health Issues in the Context of the COVID-19 Pandemic session Health Economics, Online, 11–25 January 2020. [Google Scholar]

- Baker, S.R.; Bloom, N.; Davis, S.J.; Kost, K.; Sammon, M.; Viratyosin, T. The Unprecedented Stock Market Reaction to COVID-19. 2020. Available online: https://www.policyuncertainty.com/media/StockMarkets_COVID.pdf-24-03-2020 (accessed on 20 January 2021).

- Baker, S.; Bloom, N.; Davis, S.J.; Terry, S.J. COVID-Induced Economic Uncertainty. 2020. Available online: http://www.policyuncertainty.com/media/COVID-Induced%20.pdf (accessed on 20 January 2021).

- Liu, H.; Manzoor, A.; Wang, C.; Zhang, L.; Manzoor, Z. The COVID-19 outbreak and affected countries stock markets response. Int. J. Environ. Res. Public Health 2020, 17, 2800. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Huo, X.; Qiu, Z. How Does China’s Stock Market React to the Announcement of the COVID-19 Pandemic Lockdown? (Working Paper). 2020. Available online: https://ssrn.com/abstract=3594062 (accessed on 20 January 2021).

- Chaudhary, R.; Bakhski, P.; Gupta, H. Volatility in International Stock Markets: An Empirical Study during COVID-19. J. Risk Financ. Manag. 2020, 13, 208. [Google Scholar] [CrossRef]

- Ahmed, A.D.; Huo, R. Volatility transmissions across international oil market, commodity futures and stock markets: Empirical evidence from China. Energy Econ. 2020, 93, 104741. [Google Scholar] [CrossRef]

- Sansa, N.A. The impact of the COVID-19 on the financial markets: Evidence from China and USA. Electron. Res. J. Soc. Sci. Hum. 2020, 2, 29–39. [Google Scholar] [CrossRef]

- Corbet, S.; Hou, G.; Yang, H.; Lucey, B.M.; Oxley, L. Aye Corona! The contagion effects of being named corona during the COVID-19 pandemic. Financ. Res. Lett. 2020, 38, 101591. [Google Scholar] [CrossRef]

- Hassan, S.M.; Riveros Gavilanes, J.M. First to React Is the Last to Forgive: Evidence from the Stock Market Impact of COVID 19. J. Risk Financ. Manag. 2021, 14, 1–25. [Google Scholar]

- Bahrini, F.; Filfilan, A. Impact of the novel coronavirus on stock market returns: Evidence from GCC countries. Quant. Financ. Econ. 2020, 4, 640–652. [Google Scholar] [CrossRef]

- Papadamou, S.; Fassas, A.P.; Kenourgis, D.; Dimitriou, D. Direct and Indirect Effects of COVID-19 Pandemic on Implied Stock Market Volatility: Evidence from Panel Data Analysis; MPRA Paper No. 100020; MPRA: Munich, Germany, 2020; Available online: https://mpra.ub.uni-muenchen.de/100020/ (accessed on 20 January 2021).

- Bai, L.; Wei, Y.; Wei, G.; Li, X.; Zhang, S. Infectious disease pandemic and permanent volatility of international stock markets: A long-term perspective. Financ. Res. Lett. 2021, 40, 101709. [Google Scholar] [CrossRef]

- Nippani, S.; Washer, K. SARS: A Non-Event for Affected Countries’ Stock Markets? Appl. Financ. Econ. 2004, 14, 1105–1110. [Google Scholar] [CrossRef]

- Wang, Y.-H.; Yang, F.-J.; Chen, L.-J. An investor’s perspective on infectious diseases and their influence on market behavior. J. Bus. Econ. Manag. 2013, 14 (Suppl. 1), S112–S127. [Google Scholar] [CrossRef] [Green Version]

- Chen, M.-H.; Jang, S.C.S.; Kim, W.G. The Impact of the SARS Outbreak on Taiwanese Hotel Stock Performance: An Event-study Approach. Int. J. Hosp. Manag. 2007, 26, 200–212. [Google Scholar] [CrossRef]

- Del Giudice, A.; Paltrinieri, A. The impact of the Arab Spring and the Ebola outbreak on African equity mutual fund investor decisions. Res. Int. Bus. Financ. 2017, 41, 600–612. [Google Scholar] [CrossRef]

- Intellinews. 2020. Available online: https://www.intellinews.com/central-southeast-europe-stock-markets-jump-in-anticipation-of-covid-free-future-197421/ (accessed on 20 January 2021).

- Ari, A.; Bartolini, D.; Boranova, V.; di Bella, G.; Dybczak, K.; Honjo, K.; Huidrom, R.; Jobst, A.; Jovanovic, N.; Ozturk, E.; et al. Infrastructure in Central, Eastern, and Southeastern Europe: Benchmarking, Macroeconomic Impact, and Policy Issues; IMF eLibrary: New Brunswick, NJ, USA, 2020. [Google Scholar]

- Global Impact Investing Network. The Impact Investing Market in the COVID-19 Context. An Overview. Response, Recovery, and Resilience Investment Coalition. 2020. Available online: https://thegiin.org/assets/The%20Impact%20Investing%20Market%20in%20the%20COVID19%20Context_An%20Overview.pdf (accessed on 20 January 2021).

- Longin, F.; Solnik, B. Is the Correlation in International Equity Returns Constant: 1960–1990? J. Int. Money Financ. 1995, 14, 3–26. [Google Scholar] [CrossRef]

- Longin, F.; Solnik, B. Correlation Structure of International Equity Markets During Extremely Volatile Periods. J. Financ. 2001, 56, 649–676. [Google Scholar] [CrossRef]

- Erb, C.; Campbell, H.; Viskanta, T. Forecasting International Equity Correlations. Financ. Anal. J. 1994, 50, 32–45. [Google Scholar] [CrossRef]

- De Santis, G.; Gerard, B. International Asset Pricing and Portfolio Diversification with Time-Varying Risk. J. Financ. 1997, 52, 1881–1912. [Google Scholar] [CrossRef]

- Davidson, W.N.; Chandy, P.R.; Cross, M. Large losses, risk management and stock returns in the airline industry. J. Risk Insur. 1987, 54, 162–172. [Google Scholar] [CrossRef]

- Bradford, B.M.; Robinson, H.D. Abnormal returns, risk, and financial statement data: The case of the Iraqi invasion of Kuwait. J. Econ. Bus. 1997, 49, 193–204. [Google Scholar] [CrossRef] [Green Version]

- Pantzalis, C.; Stangeland, D.A.; Turtle, H.J. Political elections and the resolution of uncertainty: The international evidence. J. Bank. Financ. 2000, 24, 1575–1604. [Google Scholar] [CrossRef]

- Ramchander, S.; Schwebach, R.G.; Staking, K. The informational relevance of corporate social responsibility: Evidence from DS400 index reconstitutions. Strateg. Manag. 2012, 33, 303–314. [Google Scholar] [CrossRef]

- Škrinjarić, T.; Orlović, Z. Effects of economic and political events on stock returns: Event study of Agrokor case in Croatia. Croat. Econ. Surv. 2019, 21, 47–86. [Google Scholar] [CrossRef]

- Brown, S.; Warner, J. Measuring security price performance. J. Financ. Econ. 1980, 8, 205–258. [Google Scholar] [CrossRef]

- Brown, S.; Warner, J. Using daily stock returns: The case of event studies. J. Financ. Econ. 1985, 14, 3–31. [Google Scholar] [CrossRef]

- MacKinlay, C. Event Studies in Economics and Finance. J. Econ. Lit. 1997, 35, 13–39. [Google Scholar]

- Binder, J. The event study methodology since 1969. Rev. Quant. Financ. Account. 1998, 11, 111–137. [Google Scholar] [CrossRef]

- Topcu, M.; Gulal, O.S. The Impact of COVID-19 on emerging stock markets. Financ. Res. Lett. 2020, 36, 101691. [Google Scholar] [CrossRef]

- Czech, K.; Wielechowski, M.; Kotyza, P.; Benešova, I.; Laputkova, A. Shaking Stability: COVID-19 Impact on the Visegrad Group Countries’ Financial Markets. Sustainability 2020, 12, 6282. [Google Scholar] [CrossRef]

- White, H. A heteroskedasticity-Consistent Covariance Matrix Estimator and a Direct Test for Heteroskedasticity. Econometrica 1980, 48, 718–838. [Google Scholar] [CrossRef]

- Newey, W.; West, K. A Simple, Positive Semi-definite, Heteroskedasticity and Autocorrelation Consistent Covariance Matrix. Econometrica 1987, 55, 703–708. [Google Scholar] [CrossRef]

- Holler, J. Event-study methodology and statistical significance. 2014, Germany: O1WIR Publisher for Economics, Computer Science and Law.

- Armitage, S. Event Study Methods and Evidence on Their Performance. J. Econ. Surv. 1995, 9, 25–52. [Google Scholar] [CrossRef]

- Park, N. A guide to using event study methods in multi-country settings. Strateg. Manag. J. 2004, 25, 655–668. [Google Scholar] [CrossRef]

- Singh, B.; Dhall, R.; Narang, S.; Rawat, S. The Outbreak of COVID-19 and Stock Market Responses: An Event Study and Panel Data Analysis for G-20 Countries. Glob. Bus. Rev. 2020, 1–26. [Google Scholar] [CrossRef]

- Kothari, S.P.; Warner, J.B. Econometrics of event studies. In Handbook of Corporate Finance: Empirical Corporate Finance; Eckbo, B.E., Ed.; Elsevier: Amsterdam, The Netherlands, 2007; Volume 1, pp. 3–36. [Google Scholar]

- Sheskin, D.J. Handbook of Parametric and Nonparametric Statistical Procedures, 4th ed.; CRC Press: Boca Raton, FL, USA, 2004. [Google Scholar]

- Fama, E.; Fisher, L.; Jensen, M.; Roll, R. The adjustment of stock prices to new information. Int. Econ. Rev. 1969, 10, 1–21. [Google Scholar] [CrossRef]

- Benzid, L.; Chebbi, K. The Impact of COVID-19 on Exchange Rate Volatility: Evidence Through GARCH Model. SSRN, 28 May 2020. Available online: https://ssrn.com/abstract=3612141 (accessed on 28 May 2020).

- OECD. 2018. Available online: https://stats.oecd.org/glossary/detail.asp?ID=303 (accessed on 20 January 2021).

- OECD. 2018. Available online: https://www.oecd.org/south-east-europe/economies/ (accessed on 20 January 2021).

- Investing. 2021. Available online: https://www.investing.com (accessed on 20 January 2021).

- Eurostat. 2021. Available online: https://ec.europa.eu/eurostat/data/database (accessed on 20 January 2021).

- WHO. 2020. Available online: https://www.who.int/news/item/27-04-2020-who-timeline---covid-19 (accessed on 20 January 2021).

- WHO. 2020. Available online: https://www.who.int/emergencies/diseases/novel-coronavirus-2019/interactive-timeline#event-29 (accessed on 20 January 2021).

- Ru, H.; Yang, E.; Zou, K. What Do We Learn from SARS-CoV-1 to SARS-CoV-2: Evidence from Global Stock Markets; SSRN Working Paper; SSRN: Rochester, NY, USA, 2020. [Google Scholar]

- Capelle-Blancard, G.; Desroziers, A. The stock market is not the economy? Insights from the COVID-19 crisis. Covid Economics: Vetted and Real-Time Papers. CEPR Covid Econ. 2020, 28, 20–70. [Google Scholar]

- Škrinjarić, T. Stock market stability on selected CEE and SEE markets: A quantile regression approach. Post-Communist Econ. 2019, 32, 352–375. [Google Scholar] [CrossRef]

- Ferreira, P. What guides Central and Eastern European stock markets? A view from detrended methodologies. Post Communist Econ. 2018, 30, 805–819. [Google Scholar] [CrossRef]

- Égert, B.; Kočenda, E. Interdependence between Eastern and Western European stock markets: Evidence from intraday data. Econ. Syst. 2007, 31, 184–203. [Google Scholar] [CrossRef]

- Zouaoui, M.; Nouyrigat, G.; Beer, F. How Does Investor Sentiment Affect Stock Market Crises? Evidence from Panel Data. Financ. Rev. 2011, 46, 723–747. [Google Scholar] [CrossRef] [Green Version]

- Pochea, M.-M.; Filip, A.-M.; Pece, A.-M. Herding Behavior in CEE Stock Markets Under Asymmetric Conditions: A Quantile Regression Analysis. J. Behav. Financ. 2017, 18, 400–416. [Google Scholar] [CrossRef]

- Hofstede, G. Culture’s Consequences: Comparing Values, Behaviors, Institutions, and Organizations Across Nations; Sage Publication: Beverly Hills, CA, USA, 2001. [Google Scholar]

- Johnston, R.B.; Nedelescu, O.M. The impact of terrorism on financial markets. J. Financ. Crime 2006, 13, 7–25. [Google Scholar] [CrossRef]

- Ding, W.; Levine, R.; Lin, C.; Xie, W. Corporate Immunity to the COVID-19 Pandemic; NBER Working Paper No. 27055; National Bureau of Economic Research: Cambridge, MA, USA, 2020. [Google Scholar] [CrossRef]

- Fahlenbrach, R.; Rageth, K.; Stulz, R.M. How Valuable is Financial Flexibility when Revenue Stops? Evidence from the COVID-19 Crisis; NBER Working Papers 27106; National Bureau of Economic Research: Cambridge, MA, USA, 2020. [Google Scholar]

- Landier, A.; Thesmar, D. Earnings Expectations in the COVID Crisis; NBER Working Paper No. 27160; National Bureau of Economic Research: Cambridge, MA, USA, 2020. [Google Scholar]

- Geert, B.; Campbell, H.; Ng, A. Market integration and contagion. J. Bus. 2005, 78, 39–70. [Google Scholar]

- King, M.A.; Wadhwani, S. Transmission of volatility between stock markets. Rev. Financ. Stud. 1990, 3, 5–33. [Google Scholar] [CrossRef]

- Hon, M.T.; Strauss, J.; Yong, S.-K. Contagion in financial markets after September 11: Myth or reality? J. Financ. Res. 2004, 27, 95–114. [Google Scholar] [CrossRef]

- Park, C.-Y.; Kwanho, S. Contagion through National and Regional Exposures to Foreign Banks during the Global Financial Crisis. J. Financ. Stab. 2020, 46, 100721. [Google Scholar] [CrossRef]

- Bashir, U.; Yu, Y.; Hussain, M.; Zebende, G. Do foreign exchange and equity markets co-move in Latin American region? Detrended cross-correlation approach. Physica A 2016, 462, 889–897. [Google Scholar] [CrossRef] [Green Version]

- Huthaifa, A.; Canepa, A. Evidence of Stock Market Contagion during the COVID-19 Pandemic: A Wavelet-Copula-GARCH Approach. J. Risk Financ. Manag. 2021, 14, 329. [Google Scholar] [CrossRef]

- Vidyamurthy, G. Pairs Trading: Quantitative Methods and Analysis; John Wiley & Sons: Hoboken, NJ, USA, 2004. [Google Scholar]

- Elliott, R.J.; van der Hoek, J.; Malcolm, W.P. Pairs trading. Quant. Financ. 2005, 5, 271–276. [Google Scholar] [CrossRef]

- Liu, B.; Chang, L.-B.; Geman, H. Intraday pairs trading strategies on high frequency data: The case of oil companies. Quant. Financ. 2017, 17, 87–100. [Google Scholar] [CrossRef] [Green Version]

| Country | Abbreviation |

|---|---|

| Bosnia and Herzegovina | Birs |

| Bulgaria | Sofix |

| Croatia | Crobex |

| Czechia | Px |

| Hungary | Budapest |

| Poland | Wig |

| Romania | Bet |

| Serbia | Belex |

| Slovakia | Sax |

| Slovenia | Sbi |

| Ukraine | Pfts |

| Country/Dates | Event 1 | Event 2 | Event 3 | Event 4 | Event 5 |

|---|---|---|---|---|---|

| Bosnia and Herzegovina | 30 January | 11 February | 5 March | 11 March | 24 March |

| Bulgaria | 8 March | 13 March | |||

| Croatia | 25 February | 18 March | |||

| Czechia | 1 March | 16 March | |||

| Hungary | 4 March | 28 March | |||

| Poland | 4 March | 13 March | |||

| Romania | 26 February | 25 March | |||

| Serbia | 6 March | 15 March | |||

| Slovakia | 6 March | 13 March | |||

| Slovenia | 5 March | 12 March | |||

| Ukraine | 3 March | 17 March |

| Day | Theta 1 | p-v | Theta 2 | p-v | Sign | p-v | Sign (Normal Approx) | p-v | Wilcoxon | p-v |

|---|---|---|---|---|---|---|---|---|---|---|

| −10 | −0.400 | 0.344 | −0.302 | 0.382 | 10 | 0.006 *** | 2.412 | 0.008 *** | 2.356 | 0.009 *** |

| −9 | −0.266 | 0.395 | 0.302 | 0.618 | 6 | 0.5 | ≈0 | 0.5 | 1.022 | 0.158 |

| −8 | −0.251 | 0.401 | −0.302 | 0.382 | 6 | 0.5 | ≈0 | 0.5 | 0.044 | 0.484 |

| −7 | −0.550 | 0.291 | −1.508 | 0.066 * | 6 | 0.5 | ≈0 | 0.5 | −0.044 | 0.484 |

| −6 | 0.057 | 0.523 | 1.508 | 0.934 | 8 | 0.113 | 1.206 | 0.114 | 2.000 | 0.027 ** |

| −5 | −0.095 | 0.462 | −1.508 | 0.066 * | 8 | 0.113 | 1.206 | 0.114 | 1.912 | 0.028 * |

| −4 | −0.002 | 0.499 | 0.905 | 0.817 | 8 | 0.113 | 1.206 | 0.114 | 0.933 | 0.087 * |

| −3 | −0.599 | 0.275 | −2.111 | 0.017 ** | 7 | 0.278 | 0.603 | 0.547 | 0.756 | 0.225 |

| −2 | −0.479 | 0.316 | −0.302 | 0.382 | 9 | 0.065 * | 1.809 | 0.070 * | 2.445 | 0.015 ** |

| −1 | −0.916 | 0.180 | −1.508 | 0.066 * | 6 | 0.5 | ≈0 | 0.5 | 0.044 | 0.484 |

| 0 | −0.929 | 0.176 | 0.302 | 0.618 | 8 | 0.227 | 1.206 | 0.228 | 2.089 | 0.037 ** |

| 1 | −0.869 | 0.192 | 0.302 | 0.618 | 6 | 0.5 | ≈0 | 0.5 | 0.044 | 0.015 ** |

| 2 | −1.076 | 0.141 | 0.302 | 0.618 | 6 | 0.5 | ≈0 | 0.5 | 0.044 | 0.484 |

| 3 | −0.849 | 0.198 | 1.508 | 0.934 | 6 | 0.5 | ≈0 | 0.5 | 0.049 | 0.362 |

| 4 | −0.927 | 0.177 | 0.905 | 0.817 | 8 | 0.113 | 1.206 | 0.114 | 2.089 | 0.018 ** |

| 5 | −0.415 | 0.339 | 1.508 | 0.934 | 7 | 0.278 | 0.603 | 0.278 | 1.289 | 0.098 * |

| 6 | −0.329 | 0.371 | −0.302 | 0.382 | 8 | 0.113 | 1.206 | 0.114 | 1.467 | 0.071 * |

| 7 | −0.397 | 0.346 | −1.508 | 0.066 * | 6 | 0.5 | ≈0 | 0.5 | 0.133 | 0.447 |

| 8 | −0.581 | 0.281 | −0.302 | 0.382 | 8 | 0.113 | 1.206 | 0.114 | 1.022 | 0.258 |

| 9 | −0.772 | 0.220 | −0.302 | 0.382 | 6 | 0.5 | ≈0 | 0.5 | 0.400 | 0.344 |

| 10 | −0.541 | 0.294 | 0.905 | 0.817 | 6 | 0.5 | ≈0 | 0.5 | −0.044 | 0.484 |

| Day | Theta 1 | p-v | Theta 2 | p-v | Sign | p-v | Sign (Normal Approx) | p-v | Wilcoxon | p-v |

|---|---|---|---|---|---|---|---|---|---|---|

| −10 | −0.048 | 0.481 | −0.302 | 0.382 | 6 | 0.5 | ≈0 | 0.5 | 0.044 | 0.482 |

| −9 | −0.325 | 0.373 | −1.508 | 0.066 | 8 | 0.113 | 1.206 | 0.114 | 2.089 | 0.037 ** |

| −8 | −0.372 | 0.355 | 0.302 | 0.618 | 6 | 0.5 | ≈0 | 0.5 | 0.044 | 0.482 |

| −7 | −0.349 | 0.363 | 0.302 | 0.618 | 6 | 0.5 | ≈0 | 0.5 | 0.044 | 0.482 |

| −6 | −0.511 | 0.305 | 0.302 | 0.618 | 6 | 0.5 | ≈0 | 0.5 | 0.049 | 0.362 |

| −5 | −0.263 | 0.396 | 1.508 | 0.934 | 6 | 0.5 | ≈0 | 0.5 | 0.049 | 0.362 |

| −4 | −0.130 | 0.448 | 0.905 | 0.817 | 8 | 0.113 | 1.206 | 0.114 | 2.089 | 0.037 ** |

| −3 | 0.103 | 0.541 | 1.508 | 0.934 | 7 | 0.274 | 0.603 | 0.274 | 1.289 | 0.098 * |

| −2 | 0.135 | 0.554 | −0.302 | 0.382 | 8 | 0.113 | 1.206 | 0.114 | 1.467 | 0.071 * |

| −1 | 0.157 | 0.562 | −1.508 | 0.066 * | 6 | 0.5 | ≈0 | 0.5 | 0.133 | 0.223 |

| 0 | 0.189 | 0.575 | −0.302 | 0.382 | 8 | 0.113 | 1.206 | 0.114 | 1.022 | 0.153 |

| 1 | 0.305 | 0.620 | −0.302 | 0.382 | 6 | 0.5 | ≈0 | 0.5 | 0.400 | 0.344 |

| 2 | 0.242 | 0.596 | 0.905 | 0.817 | 6 | 0.5 | ≈0 | 0.5 | −0.044 | 0.482 |

| 3 | 0.259 | 0.602 | 0.905 | 0.817 | 7 | 0.274 | 0.603 | 0.274 | 0.222 | 0.412 |

| 4 | 0.489 | 0.688 | 0.905 | 0.817 | 7 | 0.274 | 0.603 | 0.274 | 0.311 | 0.378 |

| 5 | 0.094 | 0.538 | 0.302 | 0.618 | 7 | 0.274 | 0.603 | 0.274 | 1.022 | 0.152 |

| 6 | 0.305 | 0.620 | 0.905 | 0.817 | 6 | 0.5 | ≈0 | 0.5 | 0.400 | 0.344 |

| 7 | 0.018 | 0.507 | −2.111 | 0.017 ** | 9 | 0.037 ** | 1.809 | 0.035 ** | 2.000 | 0.045 ** |

| 8 | −0.135 | 0.446 | −0.905 | 0.183 | 7 | 0.274 | 0.603 | 0.274 | 1.022 | 0.079 * |

| 9 | −0.942 | 0.173 | −2.111 | 0.017 ** | 9 | 0.037 ** | 1.809 | 0.035 ** | 2.356 | 0.009 ** |

| 10 | −0.958 | 0.169 | −1.508 | 0.066 * | 8 | 0.113 | 1.206 | 0.114 | 1.823 | 0.034 ** |

| Day | Theta 1 | p-v | Theta 2 | p-v | Sign | p-v | Sign (Normal Approx) | p-v | Wilcoxon | p-v |

|---|---|---|---|---|---|---|---|---|---|---|

| −10 | −0.056 | 0.478 | 0.302 | 0.618 | 6 | 0.5 | ≈0 | 0.5 | 0.400 | 0.344 |

| −9 | −0.111 | 0.456 | −0.905 | 0.183 | 7 | 0.274 | 0.603 | 0.274 | 0.577 | 0.281 |

| −8 | −0.240 | 0.405 | −0.302 | 0.382 | 6 | 0.5 | ≈0 | 0.5 | 0.222 | 0.412 |

| −7 | −0.351 | 0.363 | −0.302 | 0.382 | 6 | 0.5 | ≈0 | 0.5 | 0.133 | 0.412 |

| −6 | −0.547 | 0.292 | −0.302 | 0.382 | 6 | 0.5 | ≈0 | 0.5 | 0.756 | 0.275 |

| −5 | −0.922 | 0.178 | −0.905 | 0.183 | 7 | 0.274 | 0.603 | 0.274 | 1.823 | 0.034 ** |

| −4 | −1.221 | 0.111 | −2.111 | 0.017 ** | 9 | 0.037 ** | 1.809 | 0.035 ** | 1.734 | 0.041 ** |

| −3 | −1.520 | 0.064 * | −2.714 | 0.003 *** | 10 | 0.006 *** | 2.412 | 0.008 *** | 2.356 | 0.009 *** |

| −2 | −1.584 | 0.057 * | −1.508 | 0.066 * | 8 | 0.113 | 1.206 | 0.114 | 1.289 | 0.098 * |

| −1 | −1.153 | 0.124 | 0.302 | 0.618 | 6 | 0.5 | ≈0 | 0.5 | 0.044 | 0.482 |

| 0 | −1.095 | 0.137 | −1.508 | 0.066 * | 8 | 0.113 | 1.206 | 0.114 | 1.546 | 0.050 * |

| 1 | −1.280 | 0.100 | −0.905 | 0.183 | 7 | 0.274 | 0.603 | 0.274 | 0.579 | 0.281 |

| 2 | −1.879 | 0.030 ** | −1.508 | 0.066 * | 8 | 0.113 | 1.206 | 0.114 | 1.912 | 0.028 ** |

| 3 | −1.585 | 0.057 * | −1.508 | 0.066 * | 8 | 0.113 | 1.206 | 0.114 | 1.378 | 0.084 * |

| 4 | −1.874 | 0.030 ** | −1.508 | 0.066 * | 8 | 0.113 | 1.206 | 0.114 | 1.823 | 0.034 ** |

| 5 | −2.451 | 0.007 *** | −0.905 | 0.183 | 7 | 0.274 | 0.603 | 0.274 | 2.000 | 0.027 ** |

| 6 | −2.321 | 0.010 ** | −1.508 | 0.066 * | 8 | 0.113 | 1.206 | 0.114 | 1.912 | 0.028 ** |

| 7 | −2.347 | 0.009 *** | −2.111 | 0.017 ** | 9 | 0.037 ** | 1.809 | 0.035 ** | 1.912 | 0.028 ** |

| 8 | −2.773 | 0.003 *** | −1.508 | 0.066 * | 8 | 0.113 | 1.206 | 0.114 | 1.378 | 0.084 * |

| 9 | −2.950 | 0.002 *** | −0.905 | 0.183 | 7 | 0.274 | 0.603 | 0.274 | 1.378 | 0.084 * |

| 10 | −3.787 | 0.000 *** | −1.508 | 0.066 * | 8 | 0.113 | 1.206 | 0.114 | 1.556 | 0.060 * |

| Day | Theta 1 | p-v | Theta 2 | p-v | Sign | p-v | Sign (Normal Approx) | p-v | Wilcoxon | p-v |

|---|---|---|---|---|---|---|---|---|---|---|

| −10 | 1.055 | 0.854 | 2.714 | 0.997 | 7 | 0.274 | 0.603 | 0.274 | 0.311 | 0.378 |

| −9 | 0.025 | 0.510 | −0.905 | 0.183 | 7 | 0.274 | 0.603 | 0.274 | 1.823 | 0.034 * |

| −8 | −0.461 | 0.322 | −0.905 | 0.183 | 9 | 0.037 ** | 1.809 | 0.035 ** | 2.534 | 0.005 *** |

| −7 | −0.908 | 0.182 | −2.111 | 0.017 ** | 6 | 0.5 | ≈0 | 0.5 | 0.934 | 0.174 |

| −6 | −0.736 | 0.231 | 0.302 | 0.618 | 7 | 0.274 | 0.603 | 0.274 | 1.378 | 0.084 * |

| −5 | −0.456 | 0.324 | 0.905 | 0.817 | 8 | 0.006 *** | 1.206 | 0.114 | 1.022 | 0.153 |

| −4 | −0.694 | 0.244 | −1.508 | 0.066 * | 7 | 0.274 | 0.603 | 0.274 | 1.734 | 0.041 ** |

| −3 | −1.391 | 0.082 * | −0.905 | 0.183 | 10 | 0.006 *** | 2.412 | 0.016 ** | 2.712 | 0.004 *** |

| −2 | −1.790 | 0.037 ** | −2.714 | 0.003 *** | 10 | 0.006 *** | 2.412 | 0.016 ** | 2.801 | 0.002 *** |

| −1 | −1.879 | 0.030 ** | −2.714 | 0.003 *** | 6 | 0.5 | ≈0 | 0.5 | 0.400 | 0.344 |

| 0 | −1.681 | 0.046 ** | −0.302 | 0.382 | 8 | 0.006 *** | 1.206 | 0.114 | 2.356 | 0.009 *** |

| 1 | −3.069 | 0.001 *** | −1.508 | 0.066 * | 10 | 0.006 *** | 2.412 | 0.016 ** | 2.800 | 0.002 *** |

| 2 | −2.704 | 0.003 *** | −2.714 | 0.003 *** | 6 | 0.5 | ≈0 | 0.5 | 0.400 | 0.344 |

| 3 | −2.341 | 0.010 *** | 0.302 | 0.618 | 10 | 0.006 *** | 2.412 | 0.016 ** | 2.623 | 0.004 *** |

| 4 | −3.399 | 0.000 *** | −2.714 | 0.003 *** | 6 | 0.5 | ≈0 | 0.5 | 0.311 | 0.378 |

| 5 | −3.124 | 0.001 *** | −0.302 | 0.382 | 11 | 0.000 *** | 3.015 | 0.001 *** | 2.890 | 0.001 *** |

| 6 | −4.218 | 0.000 *** | −3.317 | 0.000 *** | 7 | 0.274 | 0.603 | 0.274 | 0.756 | 0.275 |

| 7 | −5.218 | 0.000 *** | −0.905 | 0.183 | 7 | 0.274 | 0.603 | 0.274 | 1.556 | 0.006 * |

| 8 | −5.326 | 0.000 *** | 0.905 | 0.817 | 10 | 0.006 *** | 2.412 | 0.016 ** | 2.801 | 0.002 *** |

| 9 | −7.124 | 0.000 *** | −2.714 | 0.003 *** | 8 | 0.006 *** | 1.206 | 0.114 | 2.178 | 0.019 ** |

| 10 | −5.163 | 0.000 *** | 1.508 | 0.934 | 9 | 0.037 ** | 1.809 | 0.035 ** | 2.178 | 0.019 ** |

| Day | Theta 1 | p-v | Theta 2 | p-v | Sign | p-v | Sign (Normal Approx) | p-v | Wilcoxon | p-v |

|---|---|---|---|---|---|---|---|---|---|---|

| −10 | −0.068 | 0.473 | −0.302 | 0.382 | 6 | 0.5 | ≈0 | 0.5 | 0.044 | 0.487 |

| −9 | −0.237 | 0.406 | −0.905 | 0.183 | 7 | 0.279 | 0.603 | 0.273 | 1.111 | 0.183 |

| −8 | −0.447 | 0.327 | −2.111 | 0.017 ** | 9 | 0.037 ** | 1.809 | 0.035 ** | 1.823 | 0.034 ** |

| −7 | −0.900 | 0.184 | −2.111 | 0.017 ** | 9 | 0.037 ** | 1.809 | 0.035 ** | 2.356 | 0.009 *** |

| −6 | −0.785 | 0.216 | 0.302 | 0.618 | 6 | 0.5 | ≈0 | 0.5 | 0.222 | 0.824 |

| −5 | −1.261 | 0.104 | −2.111 | 0.017 ** | 9 | 0.037 ** | 1.809 | 0.035 ** | 1.734 | 0.045 ** |

| −4 | −1.314 | 0.094 * | −2.111 | 0.017 ** | 9 | 0.037 ** | 1.809 | 0.035 ** | 2.178 | 0.015 ** |

| −3 | −1.141 | 0.127 | −0.905 | 0.183 | 7 | 0.279 | 0.603 | 0.273 | 0.400 | 0.344 |

| −2 | −1.611 | 0.054 * | −0.905 | 0.183 | 7 | 0.279 | 0.603 | 0.273 | 1.734 | 0.046 ** |

| −1 | −1.594 | 0.055 * | −0.905 | 0.183 | 7 | 0.279 | 0.603 | 0.273 | 1.200 | 0.165 |

| 0 | −1.795 | 0.036 ** | −1.508 | 0.066 * | 8 | 0.113 | 1.206 | 0.113 | 1.645 | 0.050 * |

| 1 | −3.074 | 0.001 *** | −2.111 | 0.017 ** | 9 | 0.037 ** | 1.809 | 0.035 ** | 2.178 | 0.015 ** |

| 2 | −3.237 | 0.001 *** | −0.905 | 0.183 | 7 | 0.279 | 0.603 | 0.273 | 0.845 | 0.199 |

| 3 | −3.486 | 0.000 *** | −1.508 | 0.066 * | 8 | 0.113 | 1.206 | 0.113 | 1.200 | 0.115 |

| 4 | −4.301 | 0.000 *** | 1.508 | 0.934 | 8 | 0.113 | 1.206 | 0.113 | 0.756 | 0.224 |

| 5 | −4.392 | 0.000 *** | −0.302 | 0.382 | 6 | 0.5 | ≈0 | 0.5 | 0.400 | 0.344 |

| 6 | −4.007 | 0.000 *** | 0.302 | 0.618 | 6 | 0.5 | ≈0 | 0.5 | 0.222 | 0.824 |

| 7 | −3.643 | 0.000 *** | −0.302 | 0.382 | 6 | 0.5 | ≈0 | 0.5 | 0.311 | 0.472 |

| 8 | −5.519 | 0.000 *** | 0.905 | 0.817 | 7 | 0.279 | 0.603 | 0.273 | 1.378 | 0.084 * |

| 9 | −5.427 | 0.000 *** | 0.905 | 0.817 | 7 | 0.279 | 0.603 | 0.273 | 1.467 | 0.071 * |

| 10 | −5.404 | 0.000 *** | −1.508 | 0.066 * | 8 | 0.113 | 1.206 | 0.113 | 0.845 | 0.199 |

| Index | 3 January 2019–1 July 2020 | 3 January 2019–1 April 2020 | ||

|---|---|---|---|---|

| Mean Equation | Variance Equation | Mean Equation | Variance Equation | |

| Belex | −0.001 ** | −0.003 * | ||

| Bet | 3.03 × 10−5 * | −0.009 * | 0.0002 * | |

| Birs | −0.0004 *** | |||

| Budapest | 0.0001 * | −0.012 * | ||

| Crobex | 6.02 × 10−5 ** | 0.0003 * | ||

| Pfts | ||||

| Px | 8.07 × 10−5 * | −0.014 *** | ||

| Sax | ||||

| Sbi | 8.07 × 10−5 ** | |||

| Sofix | ||||

| Wig | 0.0004 ** | −0.003 * | 0.001 * | |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Škrinjarić, T. Profiting on the Stock Market in Pandemic Times: Study of COVID-19 Effects on CESEE Stock Markets. Mathematics 2021, 9, 2077. https://doi.org/10.3390/math9172077

Škrinjarić T. Profiting on the Stock Market in Pandemic Times: Study of COVID-19 Effects on CESEE Stock Markets. Mathematics. 2021; 9(17):2077. https://doi.org/10.3390/math9172077

Chicago/Turabian StyleŠkrinjarić, Tihana. 2021. "Profiting on the Stock Market in Pandemic Times: Study of COVID-19 Effects on CESEE Stock Markets" Mathematics 9, no. 17: 2077. https://doi.org/10.3390/math9172077

APA StyleŠkrinjarić, T. (2021). Profiting on the Stock Market in Pandemic Times: Study of COVID-19 Effects on CESEE Stock Markets. Mathematics, 9(17), 2077. https://doi.org/10.3390/math9172077