An Assessment Model for Wealth Management Banks Based on the Fuzzy Evaluation Method

Abstract

1. Introduction

2. Literature Review

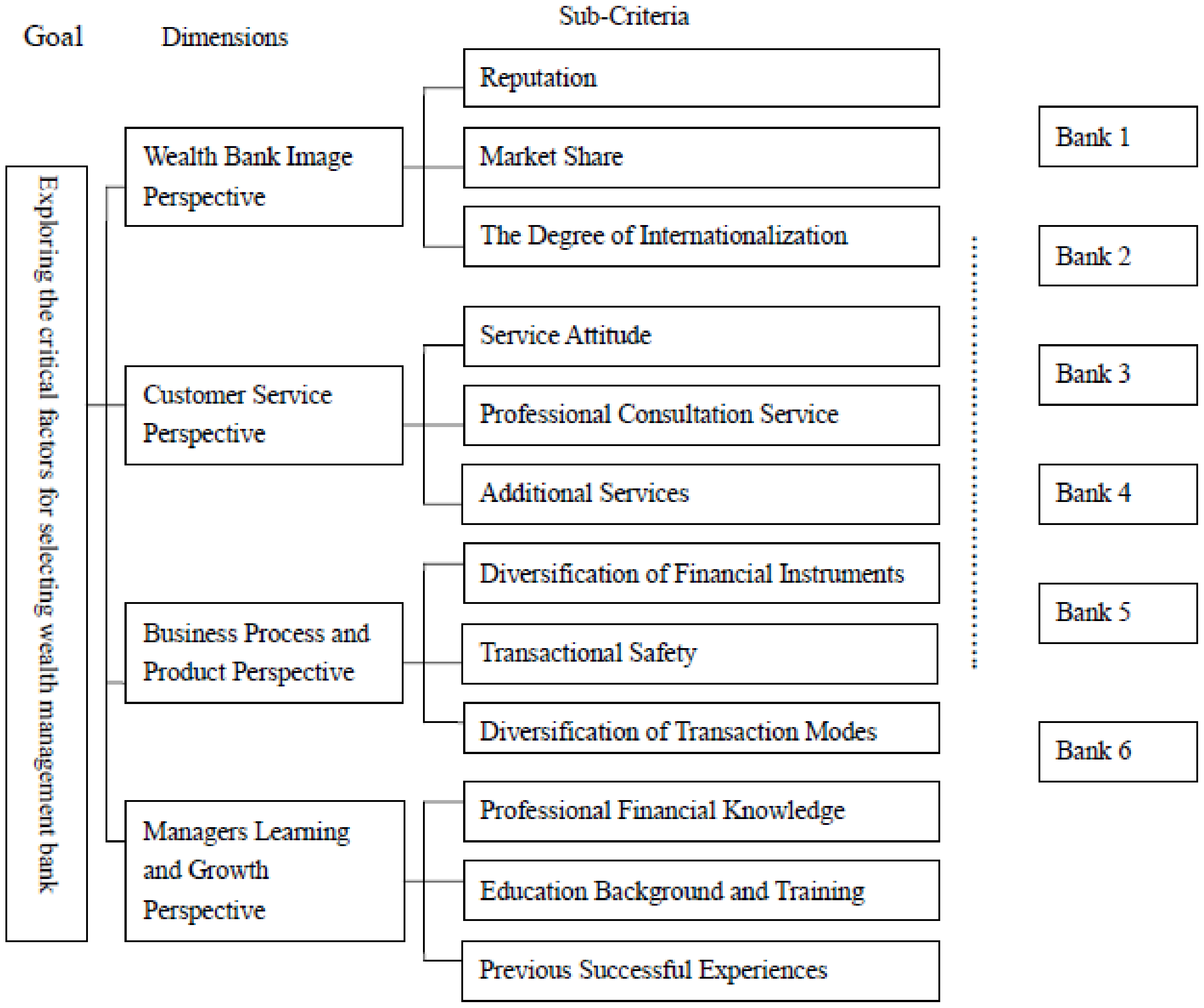

2.1. Wealth Bank Image Perspective

2.1.1. Reputation

2.1.2. Market Share

2.1.3. Degree of Internationalization

2.2. Customer Service Perspective

2.2.1. Service Attitude

2.2.2. Professional Consultation Service

2.2.3. Additional Services

2.3. Business Process and Product Perspective

2.3.1. Financial Instrument Diversification

2.3.2. Transaction Safety

2.3.3. Transaction Mode Diversification

2.4. Managers’ Learning and Growth Perspective

2.4.1. Professional Financial Knowledge

2.4.2. Educational Background and Training

2.4.3. Previous Success

- Bank 1 is a popular international US bank and the buyer managing a pioneer account in financial services. It operates in more than 100 countries worldwide. In addition to maintaining standard money exchanges, the bank offers protections, credit cards, and speculation items. Their online service division is among the most successful within the field. Thus, this bank has been the leader and pioneer in wealth management in Taiwan.

- Bank 2 is a prestigious European bank with worldwide operations and organized into four trades: commercial account managing, keeping money and markets internationally, personal financial services (retail keeping money and buyback), and global private banking. This bank is more popular among locals in the Asia-Pacific than other non-Asian banks.

- Bank 3 is a rapidly developing Australian bank and is one of the thriving international banks after merging with other European banks. This bank has been highly active in Taiwan, with its trade centered on high-end clients and providing innovative services.

- Bank 4 offers different items and administration in addition to experienced staff committed to ensuring the success of their customers’ ventures. It offers clients diverse options for keeping monetary items to meet the monetary needs of individuals and families.

- Bank 5 has been established over the past 50 years from property and casualty safety net providers into a supplier of various financial, real estate, telecommunications, and media segments. It has also extended its commerce to China.

- Bank 6 is a creative bank in Taiwan that primarily provides inventive administrations, such as ATMs in 7–11 convenience stores in Taiwan.

3. Expert Interview

4. Fuzzy TOPSIS Method

5. Empirical Study

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Gao, S.; Wang, H.; Wang, Y.F.; Shen, W.; Yeung, S. Web-service-agents-based family wealth management system. Expert Syst. Appl. 2005, 29, 219–228. [Google Scholar] [CrossRef]

- Wu, C.R.; Lin, C.T.; Tsai, P.H. Evaluating business performance of wealth management banks. Eur. J. Oper. Res. 2010, 207, 971–979. [Google Scholar] [CrossRef]

- Méndez, M.; Frutos, M.; Miguel, F.; Aguasca-Colomo, R. TOPSIS Decision on Approximate Pareto Fronts by Using Evolutionary Algorithms: Application to an Engineering Design Problem. Mathematics 2020, 8, 72. [Google Scholar] [CrossRef]

- Liu, J.; Hu, Y.; Wang, F. A Model for Evaluating the Influence Factors in Trademark Infringement Based on Fuzzy Analytical Hierarchy Process. J. Intell. Fuzzy Syst. 2020, 38, 6777–6784. [Google Scholar] [CrossRef]

- Chang, T.W.; Lo, H.W.; Chen, K.Y.; Liou, J.J.H. A Novel FMEA Model Based on Rough BWM and Rough TOPSIS-AL for Risk Assessment. Mathematics 2019, 7, 874. [Google Scholar] [CrossRef]

- D’Acunto, M.; Martinelli, M.; Moroni, D. From Human Mesenchymal Stromal Cells to Osteosarcoma Cells Classification by Deep Learning. J. Intell. Fuzzy Syst. 2019, 37, 7199–7206. [Google Scholar] [CrossRef]

- Kotha, S.; Rajgopal, S.; Rindova, V. Reputation Building and Performance: An Empirical Analysis of the Top-50 Pure Internet Firms. Eur. Manag. J. 2001, 19, 571–586. [Google Scholar] [CrossRef]

- Ou, W.M.; Abratt, R.; Dion, P. The influence of retailer reputation on store patronage. J. Retail. Consum. Serv. 2006, 13, 221–230. [Google Scholar] [CrossRef]

- Chen, K.Y.; Hogg, T. Reputation mechanisms in an exchange economy. Electron. Commer. Res. Appl. 2010, 9, 446–459. [Google Scholar] [CrossRef]

- Babić-Hodović, V.; Mehić, E.; Arslanagić, M. Influence of Banks’ Corporate Reputation on Organizational Buyers Perceived Value. Procedia—Soc. Behav. Sci. 2011, 24, 351–360. [Google Scholar] [CrossRef][Green Version]

- Mitra, R. Framing the corporate responsibility-reputation linkage: The case of Tata Motors in India. Public Relat. Rev. 2011, 37, 392–398. [Google Scholar] [CrossRef]

- Ohtsuki, H.; Iwasa, Y. How should we define goodness-reputation dynamics in indirect reciprocity. J. Theor. Biol. 2004, 231, 107–120. [Google Scholar] [CrossRef] [PubMed]

- Cornelissen, J.; Thorpe, R. Measuring a Business School’s Reputation: Perspectives, Problems and Prospects. Eur. Manag. J. 2002, 20, 172–178. [Google Scholar] [CrossRef]

- Cravens, K.; Oliver, E.G.; Ramamoorti, S. The Reputation Index: Measuring and Managing Corporate Reputation. Eur. Manag. J. 2003, 21, 201–212. [Google Scholar] [CrossRef]

- Cravens, K.S.; Oliver, E.G. Employees: The key link to corporate reputation management. Bus. Horiz. 2006, 49, 293–302. [Google Scholar] [CrossRef]

- Wang, Y.; Nakao, A. Poisonedwater: An improved approach for accurate reputation ranking in P2P networks. Future Gener. Comput. Syst. 2010, 26, 1317–1326. [Google Scholar] [CrossRef]

- Papaioannou, T.G.; Stamoulis, G.D. Reputation-based policies that provide the right incentives in peer-to-peer environments. Comput. Netw. 2006, 50, 563–578. [Google Scholar] [CrossRef]

- Helm, S.; Garnefeld, I.; Tolsdorf, J. Perceived corporate reputation and consumer satisfaction—An experimental exploration of causal relationships. Australas. Mark. J. 2009, 17, 69–74. [Google Scholar] [CrossRef]

- Helm, S.; Salminen, R.T. Basking in reflected glory: Using customer reference relationships to build reputation in industrial markets. Ind. Mark. Manag. 2010, 39, 737–743. [Google Scholar] [CrossRef]

- Wolitzky, A. Indeterminacy of reputation effects in repeated games with contracts. Games Econ. Behav. 2011, 73, 595–607. [Google Scholar] [CrossRef]

- Ailawadi, K.L.; Farris, P.W.; Parry, M.E. Market share and ROI: Observing the effect of unobserved variables. Int. J. Res. Mark. 1999, 16, 17–33. [Google Scholar] [CrossRef]

- Chan, K.; Ikenberry, D.L.; Lee, I. Do managers time the market? Evidence from open-market share repurchases. J. Bank Financ. 2007, 31, 2673–2694. [Google Scholar] [CrossRef]

- Veiga, B.D.; Chan, F.; McAleer, M. Evaluating the impact of market reforms on Value-at-Risk forecasts of Chinese A and B shares. Pac. Basin Financ. J. 2008, 16, 453–475. [Google Scholar] [CrossRef]

- Uncles, M.D.; East, R.; Lomax, W. Market share is correlated with word-of-mouth volume. Australas. Mark. J. 2010, 18, 145–150. [Google Scholar] [CrossRef]

- DeSarbo, W.S.; Degeratu, A.M.; Ahearne, M.J.; Saxton, M.K. Disaggregate market share response models. Int. J. Res. Mark. 2002, 19, 253–266. [Google Scholar] [CrossRef]

- Ritz, R.A. Strategic incentives for market share. Int. J. Ind. Organ. 2008, 26, 586–597. [Google Scholar] [CrossRef]

- Danaher, P.J. Comparing naive with econometric market share models when competitors’ actions are forecast. Int. J. Forecast. 1994, 10, 287–294. [Google Scholar] [CrossRef]

- Mixon, F.G., Jr.; Hsing, Y. The determinants of market share for the dominant firm’ in telecommunications. Inf. Econ. Policy 1997, 9, 309–318. [Google Scholar] [CrossRef]

- Riahi-Belkaoui, A. The effects of the degree of internationalization on firm performance. Int. Bus. Rev. 1998, 7, 315–321. [Google Scholar] [CrossRef]

- Riahi-Belkaoui, A. The degree of internationalization and the value of the firm: Theory and evidence. J. Int. Account. Audit. Tax. 1999, 8, 189–196. [Google Scholar] [CrossRef]

- Mockaitis, A.I.; Vaiginienė, E.; Giedraitis, V. The internationalization efforts of lithuanian manufacturing firms-strategy or luck. Res. Int. Bus. Financ. 2006, 20, 111–126. [Google Scholar] [CrossRef]

- Hong, P.; Roh, J. Internationalization, product development and performance outcomes: A comparative study of 10 countries. Res. Int. Bus. Financ. 2009, 23, 169–180. [Google Scholar] [CrossRef]

- Pangarkar, N. Internationalization and performance of small- and medium-sized enterprises. J. World Bus. 2008, 43, 475–485. [Google Scholar] [CrossRef]

- Hsu, C.C.; Pereira, A. Internationalization and performance: The moderating effects of organizational learning. Omega 2008, 36, 188–205. [Google Scholar] [CrossRef]

- Granstrand, O. Internationalization of corporate R&D: A study of Japanese and Swedish corporations. Res. Policy 1999, 28, 275–302. [Google Scholar]

- Knudsen, M.P.; Servais, P. Analyzing internationalization configurations of SME’s: The purchaser’s perspective. J. Purch. Supply Manag. 2007, 13, 137–151. [Google Scholar] [CrossRef]

- Kafouros, M.I.; Buckley, P.J.; Sharp, J.A.; Wang, C. The role of internationalization in explaining innovation performance. Technovation 2008, 28, 63–74. [Google Scholar] [CrossRef]

- Lee, S.; Lee, S.; Park, Y. A prediction model for success of services in e-commerce using decision tree: E-customer’s attitude towards online service. Expert Syst. Appl. 2007, 33, 572–581. [Google Scholar] [CrossRef]

- Kwon, O. Psychological model based attitude prediction for context-aware services. Expert Syst. Appl. 2010, 37, 2477–2485. [Google Scholar] [CrossRef]

- Mazaheri, E.; Basil, D.Z.; Yanamandram, V.; Daroczi, Z. The impact of pre-existing attitude and conflict management style on customer satisfaction with service recovery. J. Retail. Consum. Serv. 2011, 18, 235–245. [Google Scholar] [CrossRef]

- Zhang, X.; Wang, L.; Zhu, X.; Wang, K. Knowledge, attitude and practice survey on immunization service delivery in Guangxi and Gansu. China Soc. Sci. Med. 1999, 49, 1125–1127. [Google Scholar] [CrossRef]

- Susskind, A.M.; Borchgrevink, C.P.; Kacmar, K.M.; Brymer, R.A. Customer service employees’ behavioral intentions and attitudes: An examination of construct validity and a path model. Int. J. Hosp. Manag. 2000, 19, 53–77. [Google Scholar] [CrossRef]

- Gilbert, A.L.; Han, H. Understanding mobile data services adoption: Demography, attitudes or needs. Technol. Forecast Soc. Chang. 2005, 72, 327–337. [Google Scholar] [CrossRef]

- Culpan, O. Attitudes of end-users towards information technology in manufacturing and service industries. Inf. Manag. 1995, 28, 167–176. [Google Scholar] [CrossRef]

- Gultek, M.M.; Dodd, T.H.; Guydosh, R.M. Attitudes towards wine-service training and its influence on restaurant wine sales. Int. J. Hosp. Manag. 2006, 25, 432–446. [Google Scholar] [CrossRef]

- Payne, S.C.; Webber, S.S. Effects of Service Provider Attitudes and Employment Status on Citizenship Behaviors and Customers’ Attitudes and Loyalty Behavior. J. Appl. Psychol. 2006, 91, 365–378. [Google Scholar] [CrossRef] [PubMed]

- Tzeng, G.H.; Chiang, C.H.; Li, C.W. Evaluating intertwined effects in e-learning programs: A novel hybrid MCDM model based on factor analysis and DEMATEL. Expert Syst. Appl. 2007, 32, 1028–1044. [Google Scholar] [CrossRef]

- Teo, T.; Noyes, J. An assessment of the influence of perceived enjoyment and attitude on the intention to use technology among pre-service teachers: A structural equation modeling approach. Comput. Educ. 2011, 57, 1645–1653. [Google Scholar] [CrossRef]

- Williams, P.; Khan, M.S.; Ashill, N.J.; Naumann, E. Customer attitudes of stayers and defectors in B2B services: Are they really different. Ind. Mark. Manag. 2011, 40, 805–815. [Google Scholar] [CrossRef]

- Bugge, C.; Entwistle, V.A.; Watt, I.S. The significance for decision-making of information that is not exchanged by patients and health professionals during consultations. Soc. Sci. Med. 2006, 63, 2065–2078. [Google Scholar] [CrossRef]

- Hazel, C.E.; Laviolette, G.T.; Lineman, J.M. Training Professional Psychologists in School-Based Consultation: What the Syllabi Suggest. Train. Educ. Prof. Psychol. 2010, 4, 235–243. [Google Scholar] [CrossRef]

- Lynn, S.A. Segmenting a business market for a professional service. Ind. Mark. Manag. 1986, 15, 13–21. [Google Scholar] [CrossRef]

- Landeta, J.; Barrutia, J.; Lertxundi, A. Hybrid Delphi: A methodology to facilitate contribution from experts in professional contexts. Technol. Forecast Soc. Chang. 2011, 78, 1629–1641. [Google Scholar] [CrossRef]

- Wiggers, J.H.; Sanson-Fisher, R. Duration of general practice consultations: Association with patient occupational and educational status. Soc. Sci. Med. 1997, 44, 925–934. [Google Scholar] [CrossRef]

- Yu, B.; Guo-sun, Z.; Liang, Z. Additional service security of e-commerce in mine enterprises. Procedia Earth Planet. Sci. 2009, 1, 1574–1580. [Google Scholar] [CrossRef]

- Salunke, S.; Weerawardena, J.; McColl-Kennedy, J.R. Towards a model of dynamic capabilities in innovation-based competitive strategy: Insights from project-oriented service firms. Ind. Mark. Manag. 2011, 40, 1251–1263. [Google Scholar] [CrossRef]

- Laeven, L.; Levine, R. Is there a diversification discount in financial conglomerates. J. Financ. Econ. 2007, 85, 331–367. [Google Scholar] [CrossRef]

- Goddard, J.; McKillop, D.; Wilson, J.O.S. The diversification and financial performance of US credit unions. J. Bank Financ. 2008, 32, 1836–1849. [Google Scholar] [CrossRef]

- Lin, J.B.; Pantzalis, C.; Park, J.C. Corporate use of derivatives and excess value of diversification. J. Bank. Financ. 2007, 31, 889–913. [Google Scholar] [CrossRef]

- Mercieca, S.; Schaeck, K.; Wolfe, S. Small European banks: Benefits from diversification. J. Bank. Financ. 2007, 31, 1975–1998. [Google Scholar] [CrossRef]

- Zhou, C. Dependence structure of risk factors and diversification effects Insurance. Math. Econ. 2010, 46, 531–540. [Google Scholar] [CrossRef]

- Yoon, S.J. The antecedents and consequences of trust in online-purchase decisions. J. Interact. Mark. 2002, 16, 47–63. [Google Scholar] [CrossRef]

- Chang, J.H.; Lee, W.S. Finding recently frequent itemsets adaptively over online transactional data streams. Inf. Syst. 2006, 31, 849–869. [Google Scholar] [CrossRef]

- Kleist, V. A Transaction Cost Model of Electronic Trust: Transactional Return, Incentives for Network Security and Optimal Risk in the Digital Economy. Electron. Commer. Res. 2004, 4, 41–57. [Google Scholar] [CrossRef]

- He, Y.J.; Lee, M.C. Improving WTLS Security for WAP Based Mobile e-Commerce. Wirel. Pers. Commun. 2009, 51, 17–29. [Google Scholar] [CrossRef]

- Georgiou, S.N.; Fanti, K.A. A transactional model of bullying and victimization. Soc. Psychol. Educ. 2010, 13, 295–311. [Google Scholar] [CrossRef]

- Park, K.; Jang, S.C. Effect of diversification on firm performance: Application of the entropy measure. Int. J. Hosp. Manag. 2012, 31, 218–228. [Google Scholar] [CrossRef]

- Hanna, M.E.; Kiymaz, H.; Perdue, G. Portfolio diversification in a highly inflationary emerging market. Financ. Serv. Rev. 2001, 10, 303–314. [Google Scholar] [CrossRef]

- Tong, Z. Firm diversification and the value of corporate cash holdings. J. Corp. Financ. 2011, 17, 741–758. [Google Scholar] [CrossRef]

- Wilson, B. Diversification of risk and saving. Q. Rev. Econ. Financ. 2003, 43, 697–712. [Google Scholar] [CrossRef]

- Fukui, Y.; Ushijima, T. Corporate diversification, performance, and restructuring in the largest Japanese manufacturers. J. Jpn. Int. Econ. 2007, 21, 303–323. [Google Scholar] [CrossRef]

- Shae, Z.Y.; Wang, X.; Kaenel, J.V. Transactional Multimedia Banner as Web Access Point. Electron. Commer. Res. 2001, 1, 53–68. [Google Scholar] [CrossRef]

- King, N. Electronic Monitoring to Promote National Security Impacts Workplace Privacy. Empl. Responsib. Rights J. 2003, 15, 127–147. [Google Scholar] [CrossRef]

- Kaufman, H.G. Relationship of early work challenge to job performance, professional contributions, and competence of engineers. J. Appl. Psychol. 1974, 59, 377–379. [Google Scholar] [CrossRef]

- Awuah, G.B. A professional services firm’s competence development. Ind. Mark. Manag. 2007, 36, 1068–1081. [Google Scholar] [CrossRef]

- DeJaeghere, J.G.; Cao, Y. Developing U.S. teachers’ intercultural competence: Does professional development matter. Int. J. Intercult. Relat. 2009, 33, 437–447. [Google Scholar] [CrossRef]

- Chang, L.; Birkett, B. Managing intellectual capital in a professional service firm: Exploring the creativity–productivity paradox. Manag. Account. Res. 2004, 15, 7–31. [Google Scholar] [CrossRef]

- Baartman, L.K.J.; Bruijn, E.D. Integrating knowledge, skills and attitudes: Conceptualising learning processes towards vocational competence. Educ. Res. Rev. 2011, 6, 125–134. [Google Scholar] [CrossRef]

- Alam, M.; Gale, A.; Brown, M.; Kidd, C. The development and delivery of an industry led project management professional development programme: A case study in project management education and success management. Int. J. Proj. Manag. 2008, 26, 223–237. [Google Scholar] [CrossRef]

- Hinkemeyer, B.; Januszewski, N.; Julstrom, B.A. An expert system for evaluating Siberian Huskies. Expert Syst. Appl. 2006, 30, 282–289. [Google Scholar] [CrossRef]

- Cay, T.; Iscan, F. Fuzzy expert system for land reallocation in land consolidation. Expert Syst. Appl. 2011, 38, 11055–11071. [Google Scholar] [CrossRef]

- Zagradjanin, N.; Pamucar, D.; Jovanovic, K. Cloud-Based Multi-Robot Path Planning in Complex and Crowded Environment with Multi-Criteria Decision Making Using Full Consistency Method. Symmetry 2019, 11, 1241. [Google Scholar] [CrossRef]

- Sicard, M.; Baudrit, C.; Leclerc-Perlat, M.N.; Wuillemin, P.H.; Perrot, N. Expert knowledge integration to model complex food processes: Application on the camembert cheese ripening process. Expert Syst. Appl. 2011, 38, 11804–11812. [Google Scholar] [CrossRef]

- Lin, H.T.; Chang, W.L. Order selection and pricing methods using flexible quantity and fuzzy approach for buyer evaluation. Eur. J. Oper. Res. 2008, 187, 415–428. [Google Scholar] [CrossRef]

- Chen, T.Y.; Tsao, C.Y. The interval-valued fuzzy TOPSIS method and experimental analysis. Fuzzy Sets. Syst. 2008, 159, 1410–1428. [Google Scholar] [CrossRef]

- Ashtiani, B.; Haghighirad, F.; Makui, A.; Montazer, G.A. Extension of fuzzy TOPSIS method based on interval-valued fuzzy sets. Appl. Soft Comput. 2009, 9, 457–461. [Google Scholar] [CrossRef]

- Mahdavi, I.; Mahdavi-Amiri, N.; Heidarzade, A.; Nourifar, R. Designing a model of fuzzy TOPSIS in multiple criteria decision making. Appl. Math. Comput. 2008, 206, 607–617. [Google Scholar] [CrossRef]

- Büyüközkan, G.; Feyzioğlu, O.; Nebol, E. Selection of the strategic alliance partner in logistics value chain. Int. J. Prod. Econ. 2007, 113, 148–158. [Google Scholar] [CrossRef]

- Kahraman, C.; Çevik, S.; Ates, N.Y.; Gülbay, M. Fuzzy multi-criteria evaluation of industrial robotic systems. Comput. Ind. Eng. 2007, 52, 414–433. [Google Scholar] [CrossRef]

- Benítez, J.M.; Martín, J.C.; Román, C. Using fuzzy number for measuring quality of service in the hotel industry. Tour Manag. 2007, 28, 544–555. [Google Scholar] [CrossRef]

- Dinçer, H.; Yüksel, S.; Martínez, L. Interval type 2-based hybrid fuzzy evaluation of financial services in E7 economies with DEMATEL-ANP and MOORA methods. Appl. Soft Comput. 2019, 79, 186–202. [Google Scholar] [CrossRef]

- Alizadeh, R.; Allen, J.K.; Mistree, F. Managing computational complexity using surrogate models: A critical review. Res. Eng. Des. 2020, 31, 275–298. [Google Scholar] [CrossRef]

- Tadić, D.; Arsovski, S.; Aleksic, A.; Stefanovic, M.Z. A fuzzy evaluation of projects for business processes’ quality improvement. In Intelligent Techniques in Engineering Management 2015, 87, 559–579. [Google Scholar]

- Yilmaz, M.K.; Kusakci, A.O.; Tatoglu, E.; Icten, O.; Yetgin, F. Performance evaluation of real estate investment trusts using a hybridized interval type-2 fuzzy AHPDEA approach: The case of Borsa Istanbul. Int. J. Inf. Technol. Decis. Mak. 2019, 18, 1785–1820. [Google Scholar] [CrossRef]

- Kaleibari, S.S.; Beiragh, R.G.; Alizadeh, R.; Solimanpur, M. A framework for performance evaluation of energy supply chain by a compatible network data envelopment analysis model. Sci. Iran. 2016, 23, 1904–1917. [Google Scholar] [CrossRef][Green Version]

- Wu, H.Y.; Tzeng, G.H.; Chen, Y.H. A fuzzy MCDM approach for evaluating banking performance based on Balanced Scorecard. Expert Syst. Appl. 2009, 36, 10135–10147. [Google Scholar] [CrossRef]

- Roghanian, E.; Rahimi, J.; Ansari, A. Comparison of first aggregation and last aggregation in fuzzy group TOPSIS. Appl. Math. Model. 2010, 34, 3754–3766. [Google Scholar] [CrossRef]

- Tsai, W.H.; Hsu, W. A novel hybrid model based on DEMATEL and ANP for selecting cost of quality model develop-ment. Total. Qual. Manag. Bus. Excell. 2010, 21, 439–456. [Google Scholar] [CrossRef]

- Park, J.H.; Park, I.Y.; Kwun, Y.C.; Tan, X. Extension of the TOPSIS method for decision making problems under inter-val-valued intuitionistic fuzzy environment. Appl. Math. Model. 2011, 35, 2544–2556. [Google Scholar] [CrossRef]

- Tsai, W.H.; Hsu, W.; Chou, W.C. A gap analysis model for improving airport service quality. Total. Qual. Manag. Bus. Excell. 2011, 22, 1025–1040. [Google Scholar] [CrossRef]

- Chamodrakas, I.; Martakos, D. A utility-based fuzzy TOPSIS method for energy efficient network selection in hetero-geneous wireless networks. Appl. Soft Comput. 2011, 11, 3734–3743. [Google Scholar] [CrossRef]

- Wu, M.Y.; Weng, Y.C. A study of supplier selection factors for high-tech industries in the supply chain. Total. Qual. Manag. Bus. Excell. 2010, 21, 391–413. [Google Scholar] [CrossRef]

- Zhao, J.; You, X.Y.; Liu, H.C.; Wu, S.M. An Extended VIKOR Method Using Intuitionistic Fuzzy Sets and Combination Weights for Supplier Selection. Symmetry 2017, 9, 169. [Google Scholar] [CrossRef]

- Zadeh, L.A. Fuzzy sets. Inf. Control. 1965, 8, 338–353. [Google Scholar] [CrossRef]

- Yang, Z.L.; Bonsall, S.; Wang, J. Approximate TOPSIS for vessel selection under uncertain environment. Expert Syst. Appl. 2011, 38, 14523–14534. [Google Scholar] [CrossRef]

- Yang, T.; Hung, C.C. Multiple-attribute decision making methods for plant layout design problem. Robot Comput. Integr. Manuf. 2007, 23, 126–137. [Google Scholar] [CrossRef]

- Chen, C.T.; Lin, C.T.; Huang, S.F. A fuzzy approach for supplier evaluation and selection in supply chain management. Int. J. Prod. Econ. 2006, 102, 289–301. [Google Scholar] [CrossRef]

- Weng, S.S.; Chen, K.Y.; Li, C.Y. Application of the Analytic Hierarchy Process and Grey Relational Analysis for Vendor Selection of Spare Parts Planning Software. Symmetry 2019, 11, 1182. [Google Scholar] [CrossRef]

- Chen, C.H.; Tzeng, G.H. Creating the aspired intelligent assessment systems for teaching materials. Expert Syst. Appl. 2011, 38, 12168–12179. [Google Scholar] [CrossRef]

- Chen, A.; Chen, N.; Li, J. During-incident process assessment in emergency management: Concept and strategy. Saf. Sci. 2012, 50, 90–102. [Google Scholar] [CrossRef]

- Safari, H.; Faghih, A.; Fathi, M.R. Fuzzy multi-criteria decision making method for facility location selection. Afr. J. Bus. Manag. 2012, 6, 206–212. [Google Scholar]

- Rouyendegh, B. Developing an Integrated ANP and Intuitionistic Fuzzy TOPSIS Model for Supplier Selection. J. Test Eval. 2015, 43, 664–672. [Google Scholar] [CrossRef]

- Lin, C.; Lin, C. Evaluating Convention Destination Images in Australia and Asia. J. Test Eval. 2013, 41, 851–857. [Google Scholar] [CrossRef]

- Vavrek, R. An Analysis of Usage of a Multi-Criteria Approach in an Athlete Evaluation: An Evidence of NHL Attackers. Mathematics 2021, 9, 1399. [Google Scholar] [CrossRef]

- Vinnari, M. The future of meat consumption-Expert views from Finland. Technol. Forecast Soc. Chang. 2008, 75, 893–904. [Google Scholar] [CrossRef]

- Xing, H.; Song, L.; Yang, Z. An Evidential Prospect Theory Framework in Hesitant Fuzzy Multiple-Criteria Deci-sion-Making. Symmetry 2019, 11, 1467. [Google Scholar] [CrossRef]

- Lo, H.W.; Hsu, C.C.; Huang, C.N.; Liou, J.J.H. An ITARA-TOPSIS Based Integrated Assessment Model to Identify Poten-tial Product and System Risks. Mathematics 2021, 9, 239. [Google Scholar] [CrossRef]

- Chen, F.H.; Hsu, T.S.; Tzeng, G.H. A balanced scorecard approach to establish a performance evaluation and relation-ship model for hot spring hotels based on a hybrid MCDM model combining DEMATEL and ANP. Int. J. Hosp. Manag. 2011, 30, 908–932. [Google Scholar] [CrossRef]

- Tavana, M.; Hatami-Marbini, A. A group AHP-TOPSIS framework for human spaceflight mission planning at NASA. Expert Syst. Appl. 2011, 38, 13588–13603. [Google Scholar] [CrossRef]

| Experts | Background | Experience (in Years) | Major Suggestion for the Evaluation Framework |

|---|---|---|---|

| A | Banking industry | 20 |

|

| B | Banking industry | 15 |

|

| C | Finance and investment professor | 12 |

|

| D | Finance and investment professor | 8 |

|

| E | Marketing professor | 5 |

|

| F | Existing customer | 35 |

|

| G | Existing customer | 15 |

|

| H | Existing customer | 10 |

|

| Linguistic Numbers | Comparing Triangular Value |

|---|---|

| Very low | (0.0, 0.1, 0.3) |

| Low | (0.1, 0.3, 0.5) |

| Medium | (0.3, 0.5, 0.7) |

| High | (0.5, 0.7, 0.9) |

| Very high | (0.7, 0.9, 1.0) |

| BNP | |||

|---|---|---|---|

| Reputation | (0.540, 0.740, 0.890) | 0.723 | 5 |

| Market share | (0.310, 0.510, 0.700) | 0.507 | 11 |

| Degree of internationalization | (0.380, 0.580, 0.770) | 0.577 | 8 |

| Service attitude | (0.580, 0.780, 0.925) | 0.762 | 4 |

| Professional consultation service | (0.630, 0.830, 0.960) | 0.807 | 3 |

| Additional services | (0.365, 0.560, 0.745) | 0.557 | 10 |

| Financial instrument diversification | (0.290, 0.490, 0.685) | 0.488 | 12 |

| Transaction safety | (0.670, 0.870, 0.985) | 0.842 | 1 |

| Transaction mode diversification | (0.380, 0.580, 0.770) | 0.577 | 8 |

| Professional financial knowledge | (0.650, 0.850, 0.975) | 0.825 | 2 |

| Educational background and training | (0.420, 0.620, 0.805) | 0.615 | 6 |

| Previous successful experiences | (0.400, 0.600, 0.785) | 0.595 | 7 |

| Bank 1 | Bank 2 | Bank 3 | Bank 4 | Bank 5 | Bank 6 | |

|---|---|---|---|---|---|---|

| Reputation | (4.05, 6, 7.85) | (4.8, 6.8, 8.6) | (2.95, 4.8, 6.8) | (3.5, 5.5, 7.5) | (4.4, 6.4, 8.25) | (3.6, 5.6, 7.55) |

| Market share | (4.8, 6.8, 8.7) | (4.1, 6.1, 8.1) | (2.7, 4.6, 6.55) | (3.5, 5.5, 7.45) | (3.8, 5.8, 7.7) | (4.2, 6.2, 8.1) |

| Degree of internationalization | (6.3, 8.3, 9.65) | (5.3, 7.3, 8.9) | (4.4, 6.4, 8.25) | (2.6, 4.5, 6.5) | (3.05, 5, 7) | (3.1, 5.1, 7.05) |

| Service attitude | (4.05, 6, 8) | (4.2, 6.2, 8.2) | (3.5, 5.5, 7.5) | (3.9, 5.9, 7.9) | (4.2, 6.2, 8.1) | (3.4, 5.4, 7.35) |

| Professional consultation service | (4.4, 6.4, 8.35) | (4.4, 6.4, 8.35) | (3.6, 5.6, 7.6) | (3.6, 5.6, 7.6) | (4, 6, 7.95) | (3.7, 5.7, 7.7) |

| Additional services | (3.7, 5.7, 7.65) | (3.5, 5.5, 7.5) | (3.1, 5.1, 7.1) | (3.4, 5.4, 7.35) | (3.6, 5.6, 7.55) | (3.7, 5.7, 7.65) |

| Diversification of financial instruments | (4.9, 6.9, 8.65) | (4.7, 6.7, 8.55) | (3.9, 5.9, 7.85) | (3.7, 5.7, 7.7) | (4.4, 6.4, 8.4) | (4.2, 6.2, 8.15) |

| Transaction safety | (3.7, 5.7, 7.7) | (4.1, 6.1, 8.1) | (3.5, 5.5, 7.5) | (3.9, 5.9, 7.85) | (4, 6, 7.95) | (3.7, 5.7, 7.65) |

| Transaction mode diversification | (4.5, 6.5, 8.4) | (4.2, 6.2, 8.15) | (3.7, 5.7, 7.7) | (3.5, 5.5, 7.5) | (4.2, 6.2, 8.15) | (3.9, 5.9, 7.85) |

| Professional financial knowledge | (4.3, 6.3, 8.25) | (4.1, 6.1, 8.05) | (3.3, 5.3, 7.25) | (3.5, 5.5, 7.5) | (4.1, 6.1, 8.05) | (3.6, 5.6, 7.6) |

| Educational background and training | (4.6, 6.6, 8.45) | (4.2, 6.2, 8.1) | (3.5, 5.5, 7.45) | (3.6, 5.6, 7.5) | (3.8, 5.8, 7.75) | (3.95, 5.9, 7.8) |

| Previous successful experiences | (3.8, 5.8, 7.75) | (3.5, 5.5, 7.5) | (3, 5, 7) | (3.1, 5.1, 7.1) | (3.4, 5.4, 7.4) | (3.2, 5.2, 7.2) |

| Bank 1 | Bank 2 | Bank 3 | Bank 4 | Bank 5 | Bank 6 | |

|---|---|---|---|---|---|---|

| Reputation | (0.420, 0.622, 0.813) | (0.539, 0.764, 0.966) | (0.358, 0.582, 0.824) | (0.443, 0.696, 0.949) | (0.524, 0.762, 0.982) | (0.442, 0.687, 0.926) |

| Market share | (0.497, 0.705, 0.902) | (0.461, 0.685, 0.910) | (0.327, 0.558, 0.794) | (0.443, 0.696, 0.943) | (0.452, 0.690, 0.917) | (0.515, 0.761, 0.994) |

| Degree of internationalization | (0.653, 0.860, 1.000) | (0.596, 0.820, 1.000) | (0.533, 0.776, 1.000) | (0.329, 0.570, 0.823) | (0.363, 0.595, 0.833) | (0.380, 0.626, 0.865) |

| Service attitude | (0.420, 0.622, 0.829) | (0.472, 0.697, 0.921) | (0.424, 0.667, 0.909) | (0.494, 0.747, 1.000) | (0.500, 0.738, 0.964) | (0.417, 0.663, 0.902) |

| Professional consultation service | (0.456, 0.663, 0.865) | (0.494, 0.719, 0.938) | (0.436, 0.679, 0.921) | (0.456, 0.709, 0.962) | (0.476, 0.714, 0.946) | (0.454, 0.699, 0.945) |

| Additional services | (0.383, 0.591, 0.793) | (0.393, 0.618, 0.843) | (0.376, 0.618, 0.861) | (0.430, 0.684, 0.930) | (0.429, 0.667, 0.899) | (0.454, 0.699, 0.939) |

| Financial instrument diversification | (0.508, 0.715, 0.896) | (0.528, 0.753, 0.961) | (0.473, 0.715, 0.952) | (0.468, 0.722, 0.975) | (0.524, 0.762, 1.000) | (0.515, 0.761, 1.000) |

| Transaction safety | (0.383, 0.591, 0.798) | (0.461, 0.685, 0.910) | (0.424, 0.667, 0.909) | (0.494, 0.747, 0.994) | (0.476, 0.714, 0.946) | (0.454, 0.699, 0.939) |

| Transaction mode diversification | (0.466, 0.674, 0.870) | (0.472, 0.697, 0.916) | (0.448, 0.691, 0.933) | (0.443, 0.696, 0.949) | (0.500, 0.738, 0.970) | (0.479, 0.724, 0.963) |

| Professional financial knowledge | (0.446, 0.653, 0.855) | (0.461, 0.685, 0.904) | (0.400, 0.642, 0.879) | (0.443, 0.696, 0.949) | (0.488, 0.726, 0.958) | (0.442, 0.687, 0.933) |

| Educational background and training | (0.477, 0.684, 0.876) | (0.472, 0.697, 0.910) | (0.424, 0.667, 0.903) | (0.456, 0.709, 0.949) | (0.452, 0.690, 0.923) | (0.485, 0.724, 0.957) |

| Previous successful experiences | (0.394, 0.601, 0.803) | (0.393, 0.618, 0.843) | (0.364, 0.606, 0.848) | (0.392, 0.646, 0.899) | (0.405, 0.643, 0.881) | (0.393, 0.638, 0.883) |

| Bank 1 | Bank 2 | Bank 3 | Bank 4 | Bank 5 | Bank 6 | |

|---|---|---|---|---|---|---|

| Reputation | (0.227, 0.460, 0.724) | (0.291, 0.565, 0.860) | (0.193, 0.431, 0.734) | (0.239, 0.515, 0.845) | (0.283, 0.564, 0.874) | (0.239, 0.508, 0.824) |

| Market share | (0.154, 0.359, 0.631) | (0.143, 0.350, 0.637) | (0.101, 0.284, 0.556) | (0.137, 0.355, 0.660) | (0.140, 0.352, 0.642) | (0.160, 0.388, 0.696) |

| Degree of internationalization | (0.248, 0.499, 0.770) | (0.226, 0.476, 0.770) | (0.203, 0.450, 0.770) | (0.125, 0.330, 0.634) | (0.138, 0.345, 0.642) | (0.145, 0.363, 0.666) |

| Service attitude | (0.243, 0.485, 0.767) | (0.274, 0.543, 0.852) | (0.246, 0.520, 0.841) | (0.286, 0.583, 0.925) | (0.290, 0.576, 0.892) | (0.242, 0.517, 0.834) |

| Professional consultation service | (0.287, 0.550, 0.831) | (0.311, 0.597, 0.901) | (0.275, 0.563, 0.884) | (0.287, 0.588, 0.924) | (0.300, 0.593, 0.909) | 0(.286, 0.580, 0.907) |

| Additional services | (0.140, 0.331, 0.591) | (0.144, 0.346, 0.628) | (0.137, 0.346, 0.641) | (0.157, 0.383, 0.693) | (0.156, 0.373, 0.670) | (0.166, 0.392, 0.699) |

| Financial instrument diversification | (0.147, 0.350, 0.614) | (0.153, 0.369, 0.658) | (0.137, 0.350, 0.652) | (0.136, 0.354, 0.668) | (0.152, 0.373, 0.685) | (0.149, 0.373, 0.685) |

| Transaction safety | (0.257, 0.514, 0.786) | (0.309, 0.596, 0.896) | (0.284, 0.580, 0.895) | (0.331, 0.650, 0.979) | (0.319, 0.621, 0.932) | (0.304, 0.608, 0.925) |

| Transaction mode diversification | (0.177, 0.391, 0.670) | (0.179, 0.404, 0.705) | (0.170, 0.401, 0.719) | (0.168, 0.404, 0.731) | (0.190, 0.428, 0.747) | (0.182, 0.420, 0.742) |

| Professional financial knowledge | (0.290, 0.555, 0.834) | (0.299, 0.583, 0.882) | (0.260, 0.546, 0.857) | (0.288, 0.592, 0.926) | (0.317, 0.617, 0.934) | (0.287, 0.584, 0.909) |

| Educational background and training | (0.200, 0.424, 0.705) | (0.198, 0.432, 0.733) | (0.178, 0.413, 0.727) | (0.191, 0.439, 0.764) | (0.190, 0.428, 0.743) | (0.204, 0.449, 0.770) |

| Previous successful experiences | (0.158, 0.361, 0.630) | (0.157, 0.371, 0.662) | (0.145, 0.364, 0.666) | (0.157, 0.387, 0.706) | (0.162, 0.386, 0.692) | (0.157, 0.383, 0.693) |

| Rank | ||||

|---|---|---|---|---|

| Bank 1 | 7.008 | 5.988 | 0.4607 | 6 |

| Bank 2 | 6.741 | 6.417 | 0.4877 | 3 |

| Bank 3 | 7.060 | 6.141 | 0.4652 | 4 |

| Bank 4 | 6.820 | 6.508 | 0.4883 | 2 |

| Bank 5 | 6.740 | 6.504 | 0.4911 | 1 |

| Bank 6 | 6.814 | 6.454 | 0.4865 | 5 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sun, C.-C. An Assessment Model for Wealth Management Banks Based on the Fuzzy Evaluation Method. Mathematics 2021, 9, 2442. https://doi.org/10.3390/math9192442

Sun C-C. An Assessment Model for Wealth Management Banks Based on the Fuzzy Evaluation Method. Mathematics. 2021; 9(19):2442. https://doi.org/10.3390/math9192442

Chicago/Turabian StyleSun, Chia-Chi. 2021. "An Assessment Model for Wealth Management Banks Based on the Fuzzy Evaluation Method" Mathematics 9, no. 19: 2442. https://doi.org/10.3390/math9192442

APA StyleSun, C.-C. (2021). An Assessment Model for Wealth Management Banks Based on the Fuzzy Evaluation Method. Mathematics, 9(19), 2442. https://doi.org/10.3390/math9192442