Did the Islamic Stock Index Provide Shelter for Investors during the COVID-19 Crisis? Evidence from an Emerging Stock Market

Abstract

:1. Introduction

2. Literature Review

2.1. Economic Impact and Pandemics

2.2. Stock Market and Pandemic

2.3. Stock Market Volatility and Pandemic

3. Material and Methods

Econometric Model

4. Results and Discussion

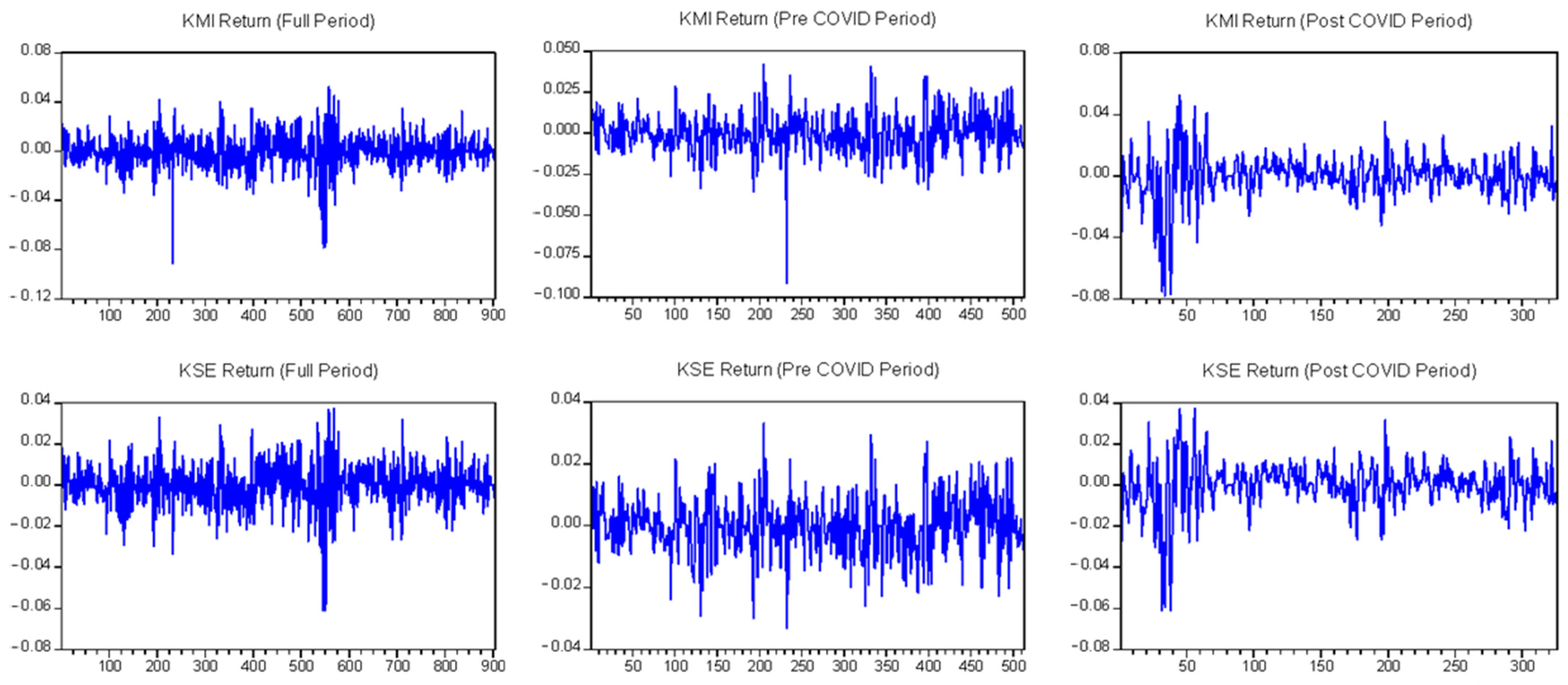

4.1. Descriptive Statistics

4.2. Volatility Results

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Abduh, Muhamad. 2020. Volatility of Malaysian conventional and Islamic indices: Does financial crisis matter? Journal of Islamic Accounting and Business Research 11: 1–11. [Google Scholar] [CrossRef]

- Abdullahi, Shafiu Ibrahim. 2021. Islamic equities and COVID-19 pandemic: Measuring Islamic stock indices correlation and volatility in period of crisis. Islamic Economic Studies 29: 50–66. [Google Scholar] [CrossRef]

- Ahmar, Ansari Saleh, and Eva Boj del Val. 2020. SutteARIMA: Short-term forecasting method, a case: COVID-19 and stock market in Spain. Science of The Total Environment 729: 138883. [Google Scholar] [CrossRef] [PubMed]

- Akhtar, Shahzad, Haroon Hussain, and Rana Yassir Hussain. 2021. Contributing role of regulatory compliance and Islamic operations in bank risk: Evidence from Pakistan. Nankai Business Review International 12: 618–35. [Google Scholar] [CrossRef]

- Akhtaruzzaman, Md, Sabri Boubaker, and Ahmet Sensoy. 2021. Financial contagion during COVID-19 crisis. Finance Research Letters 38: 101604. [Google Scholar] [CrossRef]

- Albuquerque, Rui, Yrjo Koskinen, Shuai Yang, and Chendi Zhang. 2020. Resiliency of environmental and social stocks: An analysis of the exogenous COVID-19 market crash. The Review of Corporate Finance Studies 9: 593–621. [Google Scholar] [CrossRef]

- Al-Awadhi, Abdullah M., Khaled Al-Saifi, Ahmad Al-Awadhi, and Salah Alhamadi. 2020. Death and contagious infectious diseases: Impact of the COVID-19 virus on stock market returns. Journal of Behavioral and Experimental Finance 27: 100326. [Google Scholar] [CrossRef]

- Al-Khazali, Osamah, Hooi Hooi Lean, and Anis Samet. 2014. Do Islamic stock indexes outperform conventional stock indexes? A stochastic dominance approach. Pacific-Basin Finance Journal 28: 29–46. [Google Scholar] [CrossRef]

- Ashraf, Badar Nadeem. 2020. Stock markets’ reaction to COVID-19: Cases or fatalities? Research in International Business and Finance 54: 101249. [Google Scholar] [CrossRef]

- Ashraf, Badar Nadeem. 2022. The performance of Islamic versus conventional stocks during the COVID-19 shock: Evidence from firm-level data. Research in International Business and Finance 60: 101622. [Google Scholar] [CrossRef]

- Baek, Seungho, Sunil K. Mohanty, and Mina Glambosky. 2020. COVID-19 and stock market volatility: An industry level analysis. Finance Research Letters 37: 101748. [Google Scholar] [CrossRef] [PubMed]

- Baig, Ahmed S., Hassan Anjum Butt, Omair Haroon, and Syed Aun Raza Rizvi. 2021. Deaths, panic, lockdowns and US equity markets: The case of COVID-19 pandemic. Finance Research Letters 38: 101701. [Google Scholar] [CrossRef] [PubMed]

- Baker, Scott R., Nicholas Bloom, Steven J. Davis, Kyle Kost, Macro Sammon, and Tasaneeya Viratyosin. 2020. The unprecedented stock market reaction to COVID-19. The Review of Asset Pricing Studies 10: 742–58. [Google Scholar] [CrossRef]

- Bayram, Kamola, and Anwar Hassan Abdullah Othman. 2019. Islamic versus conventional stock market indicates performance: Empirical evidence from Turkey. Iqtishadia: Jurnal Kajian Ekonomi dan Bisnis Islam 12: 74–86. [Google Scholar] [CrossRef] [Green Version]

- Bhowmik, Roni, and Shouyang Wang. 2020. Stock market volatility and return analysis: A systematic literature review. Entropy 22: 522. [Google Scholar] [CrossRef] [PubMed]

- Blake, Adam, M. Thea Sinclair, and Guntur Sugiyarto. 2003. Quantifying the impact of foot and mouth disease on tourism and the UK economy. Tourism Economics 9: 449–65. [Google Scholar] [CrossRef]

- Bollerslev, Tim. 1986. Generalized autoregressive conditional heteroskedasticity. Journal of Econometrics 31: 307–27. [Google Scholar] [CrossRef] [Green Version]

- Bora, Debakshi, and Daisy Basistha. 2020. The outbreak of COVID-19 pandemic and its impact on stock market volatility: Evidence from a worst-affected economy. Journal of Public Affairs 21: e2623. [Google Scholar] [CrossRef]

- Burns, William J., Ellen Peters, and Paul Slovic. 2012. Risk perception and the economic crisis: A longitudinal study of the trajectory of perceived risk. Risk Analysis: An International Journal 32: 659–77. [Google Scholar] [CrossRef]

- Chakraborty, Madhumita. 2006. Market efficiency for the Pakistan stock market: Evidence from the Karachi Stock Exchange. South Asia Economic Journal 7: 67–81. [Google Scholar] [CrossRef]

- Chen, Ming-Hsiang, Soo-Cheong Shawn Jang, and Woo-Gon Kim. 2007. The impact of the SARS outbreak on Taiwanese hotel stock performance: An event-study approach. International Journal of Hospitality Management 26: 200–12. [Google Scholar] [CrossRef] [PubMed]

- Chien, Grace CL, and Rob Law. 2003. The impact of the Severe Acute Respiratory Syndrome on hotels: A case study of Hong Kong. International Journal of Hospitality Management 22: 327–32. [Google Scholar] [CrossRef]

- Chou, Ray Yeutien. 1988. Volatility persistence and stock valuations: Some empirical evidence using GARCH. Journal of Applied Econometrics 3: 279–94. [Google Scholar] [CrossRef]

- Choudhry, Taufiq. 1996. Stock market volatility and the crash of 1987: Evidence from six emerging markets. Journal of International Money and Finance 15: 969–81. [Google Scholar] [CrossRef]

- Chowdhury, Emon Kalyan, Iffat Ishrat Khan, and Bablu Kumar Dhar. 2021. Catastrophic impact of Covid-19 on the global stock markets and economic activities. Business and Society Review. [Google Scholar] [CrossRef]

- David, Kiss Gabor, and Isaac Kwesi Ampah. 2018. Macroeconomic volatility and capital flights in Sub-Saharan Africa: A dynamic panel estimation of some selected HIPC countries. Mediterranean Journal of Social Sciences 9: 165–76. [Google Scholar] [CrossRef] [Green Version]

- Dharani, Munusamy, M. Kabir Hassan, Mustafa Raza Rabbani, and Tahsin Huq. 2022. Does the COVID-19 pandemic affect faith-based investments? Evidence from global sectoral indices. Research in International Business and Finance 59: 101537. [Google Scholar] [CrossRef]

- Donadelli, Micheal, Renatas Kizys, and Max Riedel. 2017. Dangerous infectious diseases: Bad news for Main Street, good news for Wall Street? Journal of Financial Markets 35: 84–103. [Google Scholar] [CrossRef]

- Dunford, Daniel, Dale Becky, Stylianou Nassos, Lowther Ed, Maryam Ahmed, and Irene de la Torre Arenas. 2020. Coronavirus: The World in Lockdown in Maps and Charts. Available online: https://www.bbc.com/news/world-52103747 (accessed on 26 March 2022).

- Fama, Eugene F., Lawrence Fisher, Michael C. Jensen, and Richard Roll. 1969. The adjustment of stock prices to new information. International Economic Review 10: 1–21. [Google Scholar] [CrossRef]

- Goodell, John W. 2020. COVID-19 and finance: Agendas for future research. Finance Research Letters 35: 101512. [Google Scholar] [CrossRef]

- Hai, Wen, Zhong Zhao, Jian Wang, and Zhen-Gang Hou. 2004. The short-term impact of SARS on the Chinese economy. Asian Economic Papers 3: 57–61. [Google Scholar] [CrossRef]

- Hayat, Raphie, and Roman Kraeussl. 2011. Risk and return characteristics of Islamic equity funds. Emerging Markets Review 12: 189–203. [Google Scholar] [CrossRef]

- In, Francis, Sangbae Kim, and Jai Hyung Yoon. 2002. International stock market linkages: Evidence from the Asian financial crisis. Journal of Emerging Market Finance 1: 1–29. [Google Scholar] [CrossRef]

- Khan, Sher, Fazale Wahid, Aftab Rahim, Arshad Ali, and Ahtasham Ahmad. 2021. Investigating the Momentum Effect in the Merging Market: Evidence from Pakistan. Global Business Review, 1–11. [Google Scholar] [CrossRef]

- Lee, Jong-Wha, and Warwick J. McKibbin. 2004. Globalization and disease: The case of SARS. Asian Economic Papers 3: 113–31. [Google Scholar] [CrossRef]

- Leong, Wei Ruen. 2018. GARCH (1, 1) at Small Sample Size and Pairs Trading with Cointegration. Aarhus: Aarhus BSS, Aarhus University. [Google Scholar]

- Li, Wai Keung, Shiqing Ling, and Michael McAleer. 2002. Recent theoretical results for time series models with GARCH errors. Journal of Economic Surveys 16: 245–69. [Google Scholar] [CrossRef]

- Liu, HaiYue, Aqsa Manzoor, CangYu Wang, Lei Zhang, and Zaira Manzoor. 2020. The COVID-19 outbreak and affected countries stock markets response. International Journal of Environmental Research and Public Health 17: 2800. [Google Scholar] [CrossRef] [Green Version]

- Liu, Yuna. 2020. The importance of trust distance on stock market correlation: Evidence from emerging economics. Borsa Istanbul Review 20: 37–47. [Google Scholar] [CrossRef]

- Lumsdaine, Robin L. 1995. Finite-sample properties of the maximum likelihood estimator in GARCH (1,1) and IGARCH (1,1) models: A Monte Carlo investigation. Journal of Business and Economic Statistics 13: 1–10. [Google Scholar] [CrossRef]

- Marinč, Riste Ichev Matej. 2016. Geographic Proximity of Information to Financial Markets and Impact on Stock Prices: Evidence from the Ebola Outbreak. Paper presented at UBT International Conference, Durres, Albania, October 28; pp. 13–21. [Google Scholar] [CrossRef] [Green Version]

- Mazur, Mieszko, Man Dang, and Miguel Vega. 2021. COVID-19 and the march 2020 stock market crash. Evidence from S&P1500. Finance Research Letters 38: 101690. [Google Scholar] [CrossRef]

- Moradi, Mahdi, Andrea Appolloni, Grzeg Zimon, Hossein Tarighi, and Maede Kamali. 2021. Macroeconomic Factors and Stock Price Crash Risk: Do Managers Withhold Bad News in the Crisis-Ridden Iran Market? Sustainability 13: 3688. [Google Scholar] [CrossRef]

- Mousa, Musaab, Adil Saleem, and Judit Sági. 2021. Are ESG shares a safe haven during COVID-19? Evidence from the arab region. Sustainability 14: 208. [Google Scholar] [CrossRef]

- Nawaz, Huma, Maira Abrar, Asma Salman, and Syed Muhammad Hassan Bukhari. 2019. Beyond finance: Impact of Islamic finance on economic growth in Pakistan. Economic Journal of Emerging Markets 11: 8–18. [Google Scholar] [CrossRef] [Green Version]

- Onali, Enrico. 2020. COVID-19 and Stock Market Volatility. Available online: https://ssrn.com/abstract=3571453 (accessed on 21 March 2022).

- Phan, Dinh Hoang Bach, and Paresh Kumar Narayan. 2020. Country responses and the reaction of the stock market to COVID-19—A preliminary exposition. Emerging Markets Finance and Trade 56: 2138–50. [Google Scholar] [CrossRef]

- ProMED. 2019. The International Society for Infectious Diseases. 2019. Undiagnosed Pneumonia—China (HU): RFI. Retrieved 13 October. Available online: https://promedmail.org/promed-post/?id=6864153%20#COVID19 (accessed on 20 January 2022).

- Rana, Md Ejaz, and Waheed Akhter. 2015. Performance of Islamic and conventional stock indices: Empirical evidence from an emerging economy. Financial Innovation 1: 1–17. [Google Scholar] [CrossRef] [Green Version]

- Salisu, Afees A., and Muneer Shaik. 2022. Islamic Stock indices and COVID-19 pandemic. International Review of Economics & Finance 80: 282–93. [Google Scholar] [CrossRef]

- Saleem, Adil, Judit Bárczi, and Judit Sági. 2021. COVID-19 and Islamic Stock Index: Evidence of Market Behavior and Volatility Persistence. Journal of Risk and Financial Management 14: 389. [Google Scholar] [CrossRef]

- Sharif, Arshian, Chaker Aloui, and Larisa Yarovaya. 2020. COVID-19 pandemic, oil prices, stock market, geopolitical risk and policy uncertainty nexus in the US economy: Fresh evidence from the wavelet-based approach. International Review of Financial Analysis 70: 101496. [Google Scholar] [CrossRef]

- Sharma, Susan Sunila. 2020. A note on the Asian market volatility during the COVID-19 pandemic. Asian Economics Letters 1: 1–6. [Google Scholar] [CrossRef]

- Sherif, Mohamed. 2020. The impact of Coronavirus (COVID-19) outbreak on faith-based investments: An original analysis. Journal of Behavioral and Experimental Finance 28: 100403. [Google Scholar] [CrossRef]

- Siu, Alan, and Yue-chim Richard Wong. 2004. Economic impact of SARS: The case of Hong Kong. Asian Economic Papers 3: 62–83. [Google Scholar] [CrossRef] [Green Version]

- Smith, Richard Dale. 2006. Responding to global infectious disease outbreaks: Lessons from SARS on the role of risk perception, communication and management. Social Science & Medicine 63: 3113–23. [Google Scholar] [CrossRef]

- Sohrabi, Catrin, Zaid Alsafi, Niamh O’Neill, Mehdi Khan, Ahmed Kerwan, Ahmed Al-Jabir, Christos Iosifidis, and Riaz Agha. 2020. World Health Organization declares global emergency: A review of the 2019 novel coronavirus (COVID-19). International Journal of Surgery 76. [Google Scholar] [CrossRef] [PubMed]

- Theil, Stefan. 2014. The Media and Markets: How Systematic Misreporting Inflates Bubbles, Deepens Downturns and Distorts Economic Reality. Politics and Public Policy Discussion Paper Series; Cambridge: Shorenstein Center on Media. [Google Scholar]

- Topcu, Mert, and Omer Serkan Gulal. 2020. The impact of COVID-19 on emerging stock markets. Finance Research Letters 36: 101691. [Google Scholar] [CrossRef] [PubMed]

- Tóth, Andrea. 2021. Students’ perception regarding digital education amid the COVID-19 pandemic. SKASE Journal of Translation and Interpretation 14: 1–13. [Google Scholar]

- Trabelsi, Lotfi, Slah Bahloul, and Fatma Mathlouthi. 2020. Performance analysis of Islamic and conventional portfolios: The emerging markets case. Borsa Istanbul Review 20: 48–54. [Google Scholar] [CrossRef]

- Tsay, Ruey S. 2002. Nonlinear models and forecasting. In A Companion to Economic Forecasting. Oxford: Wiley-Blackwell, pp. 453–84. [Google Scholar]

- Uddin, Moshfique, Anup Chowdhury, Keith Anderson, and Kausik Chaudhuri. 2021. The effect of COVID–19 pandemic on global stock market volatility: Can economic strength help to manage the uncertainty? Journal of Business Research 128: 31–44. [Google Scholar] [CrossRef]

- UNDP. 2014. Human Development Report 2014: Sustaining Human Progress—Reducing Vulnerabilities and Building Resilience. Retrieved 20 May 2022. Available online: https://hdr.undp.org/en/content/human-development-report-2014 (accessed on 15 January 2022).

- Wang, Yi-Hsien, Fu-Ju Yang, and Li-Ji Chen. 2013. An investor’s perspective on infectious diseases and their influence on market behavior. Journal of Business Economics and Management 14: S112–S127. [Google Scholar] [CrossRef] [Green Version]

- Waugh, Butler. 2003. Economics Recovery in the Wake of SARS (Taiwan Review). Retrieved 10 October. Available online: https://taiwantoday.tw/news.php?post=12681&unit=8 (accessed on 25 March 2022).

- WHO. 2020. WHO Timeline—COVID-19. Retrieved 13 October. Available online: https://www.who.int/news-room/detail/27-04-2020-who-timeline---covid-19 (accessed on 25 March 2022).

- Yarovaya, Larisa, Ahmed H. Elsayed, and Shawkat M. Hammoudeh. 2020. Searching for Safe Havens during the COVID-19 Pandemic: Determinants of Spillovers between Islamic and Conventional Financial Markets. Available online: https://ssrn.com/abstract=3634114 (accessed on 25 March 2022).

- Zhang, Dayong, Min Hu, and Qiang Ji. 2020. Financial markets under the global pandemic of COVID-19. Finance Research Letters 36: 101528. [Google Scholar] [CrossRef]

| Mean | Median | SD | Kurtosis | Jarque Bera | ADF | |

|---|---|---|---|---|---|---|

| Full Period (2 January 2018–30 July 2021) | ||||||

| KSE | 0.00001 | 0.00000 | 0.0105 | 7.159 | 721.47 * | 0.0000 |

| KMI | −0.00024 | −0.00004 | 0.0138 | 8.982 | 1443.34 * | 0.0000 |

| Pre-Crisis Period: (2 January 2018–30 January 2020) | ||||||

| KSE | 0.000043 | 0.00000 | 0.00954 | 3.650 | 9.171 * | 0.0000 |

| KMI | −0.000239 | −0.00030 | 0.01291 | 7.847 | 517.54 * | 0.0000 |

| Post-Crisis Period: (31 January 2020–30 July 2021) | ||||||

| KSE | 0.000089 | 0.00018 | 0.01159 | 8.881 | 648.43 * | 0.0000 |

| KMI | −0.000236 | 0.00000 | 0.01486 | 9.520 | 772.46 * | 0.0000 |

| F Test | Probability | Result | |

|---|---|---|---|

| Full Period | |||

| KSE Index return | 14.419 | 0.0001 | Present |

| KMI Index return | 13.341 | 0.0003 | Present |

| Pre-COVID Period | |||

| KSE Index return | 5.125 | 0.0236 | Present |

| KMI Index return | 4.972 | 0.0132 | Present |

| Post-COVID Covid | |||

| KSE Index return | 4.566 | 0.0451 | Present |

| KMI Index return | 7.164 | 0.0074 | Present |

| ARCH-LM | Q24 | |||||

|---|---|---|---|---|---|---|

| Whole Period | ||||||

| KSE Index | 0.00006 (3.056) a | 0.119 (5.787) a | 0.824 (25.01) a | 0.943 | 0.324 (0.569) | 25.127 (0.399) |

| KMI Index | 0.00001 (2.706) a | 0.146 (3.823) a | 0.792 (16.691) a | 0.938 | 0.122 (0.727) | 20.003 (0.697) |

| Pre-COVID Period | ||||||

| KSE Index | 0.00001 (2.057) a | 0.099 (2.758) a | 0.784 (9.724) a | 0.883 | 0.0019 (0.966) | 17.796 (0.813) |

| KMI Index | 0.00002 (1.834) b | 0.125 (2.357) a | 0.769 (8.636) a | 0.896 | 0.043 (0.837) | 20.893 (0.645) |

| Post-COVID Period | ||||||

| KSE Index | 0.00005 (2.046) a | 0.167 (3.851) a | 0.797 (16.382) a | 0.964 | 1.399 (0.237) | 20.869 (0.646) |

| KMI Index | 0.00001 (2.132) a | 0.159 (3.737) | 0.798 (16.533) a | 0.957 | 0.651 (0.420) | 20.133 (0.689) |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ali, K.; Ashfaque, M.; Saleem, A.; Bárczi, J.; Sági, J. Did the Islamic Stock Index Provide Shelter for Investors during the COVID-19 Crisis? Evidence from an Emerging Stock Market. Risks 2022, 10, 109. https://doi.org/10.3390/risks10060109

Ali K, Ashfaque M, Saleem A, Bárczi J, Sági J. Did the Islamic Stock Index Provide Shelter for Investors during the COVID-19 Crisis? Evidence from an Emerging Stock Market. Risks. 2022; 10(6):109. https://doi.org/10.3390/risks10060109

Chicago/Turabian StyleAli, Kashif, Muhammad Ashfaque, Adil Saleem, Judit Bárczi, and Judit Sági. 2022. "Did the Islamic Stock Index Provide Shelter for Investors during the COVID-19 Crisis? Evidence from an Emerging Stock Market" Risks 10, no. 6: 109. https://doi.org/10.3390/risks10060109

APA StyleAli, K., Ashfaque, M., Saleem, A., Bárczi, J., & Sági, J. (2022). Did the Islamic Stock Index Provide Shelter for Investors during the COVID-19 Crisis? Evidence from an Emerging Stock Market. Risks, 10(6), 109. https://doi.org/10.3390/risks10060109