Multifactor Risk Attribution Applied to Systemic, Climate and Geopolitical Tail Risks for the Eurozone Banking Sector

Abstract

:1. Introduction

2. Methodology

2.1. Expected Capital Shortfall

2.2. Multifactor Risk Attribution

- (1)

- for the return of the market factor MKT;

- (2)

- for the return of the climate factor CFE;

- (3)

- for the return of the geopolitical factor GFE;

- (4)

- for the return of the bank;

- G—only GFE above (−thresh), with frequency f(G)

- C—only CFE below thresh, with frequency f(C);

- CG—only CFE below thresh and GFE above (−thresh), with frequency f(CG)

- S—only MKT below thresh, with frequency f(S);

- SG—only MKT below thresh and GFE above (−thresh), with frequency f(SG)

- SC—only MKT below thresh and CFE below thresh, with frequency f(SC)

- SCG—MKT below thresh, CFE below thresh, and GFE above (−thresh), with frequency f(SCG)

- (a)

- MCRISK-Xt is the deficit exceeding attributed to climate risk, computed as

- (b)

- MGRISK-Xt is the excess shortfall over resulting from geopolitical risk, quantified as

- (c)

- INTt is the negative equity surpassing attributable to the interaction of all factors, calculated as

2.3. Conditional Correlation Models (CCC and DCC)

- (1)

- Univariate volatility and standardized residual estimation using an appropriate GARCH model;

- (2)

- Constant correlations estimation using the standardized residuals.

- (1)

- “DE-GARCHING”—univariate volatility and standardized residuals estimation using the selected GARCH model;

- (2)

- Dynamic quasi-correlations estimation using the standardized residuals;

- (3)

- Rescaling of the quasi-correlations to produce a correlation matrix.

3. Multifactor Risk Attribution Applied to the Eurozone Banking Sector

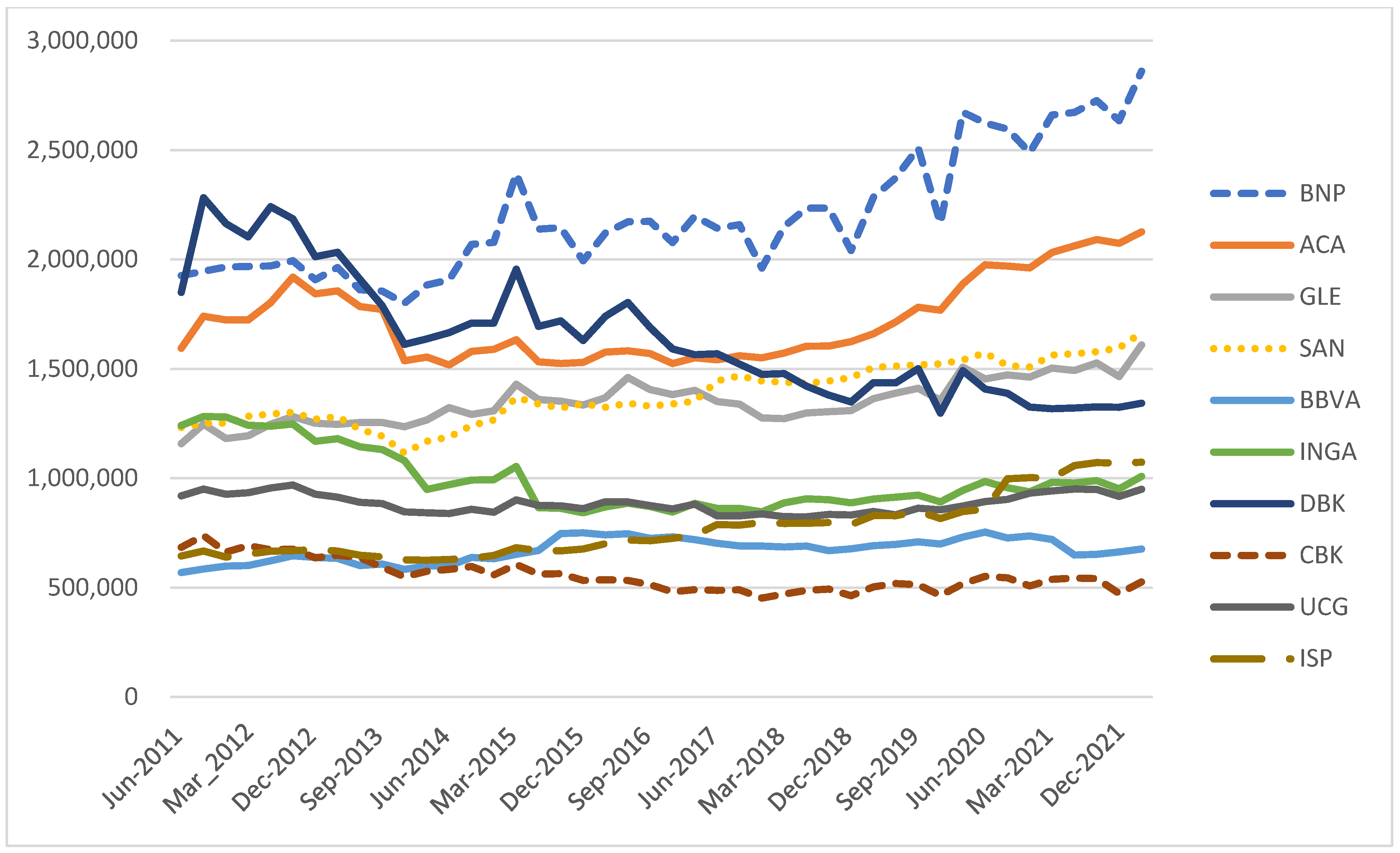

3.1. Sample Selection

3.2. Systemic Risk Factor

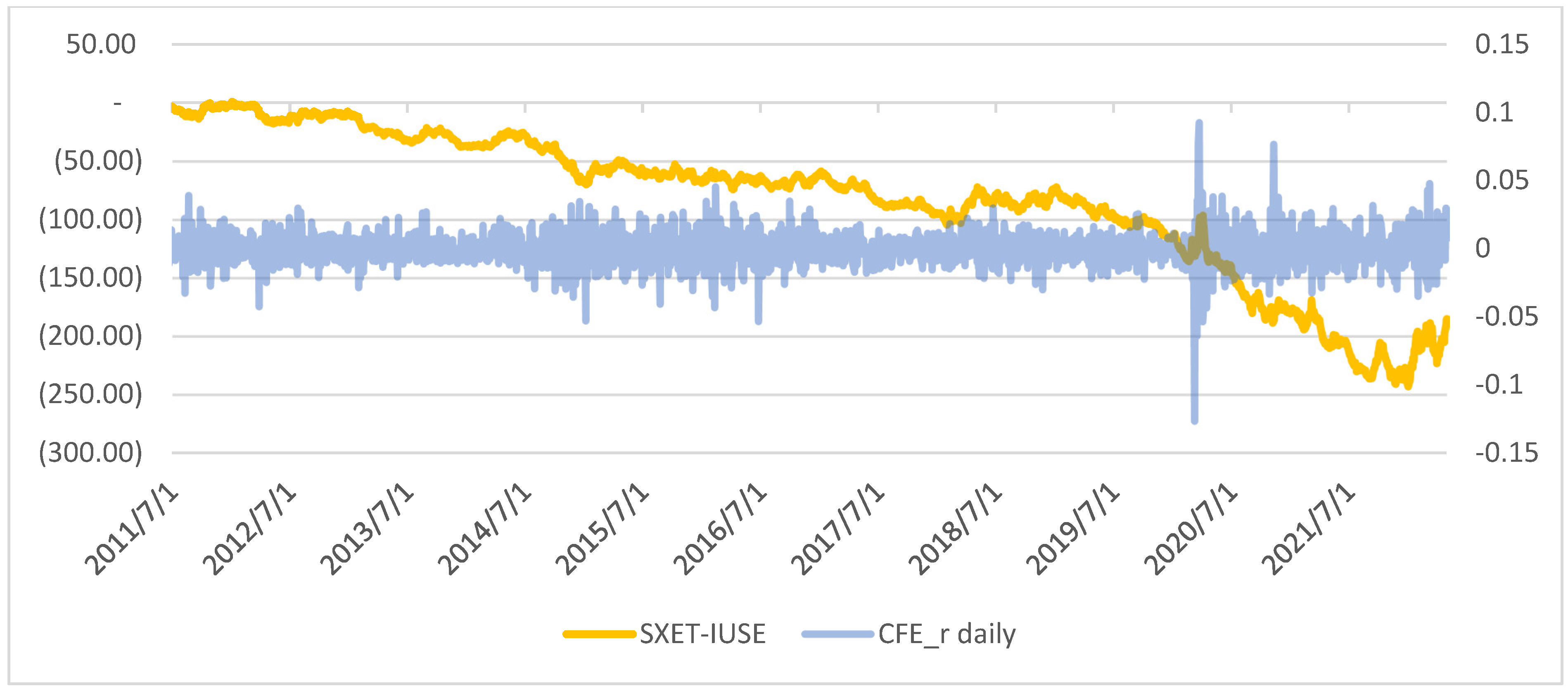

3.3. Climate Risk Factor

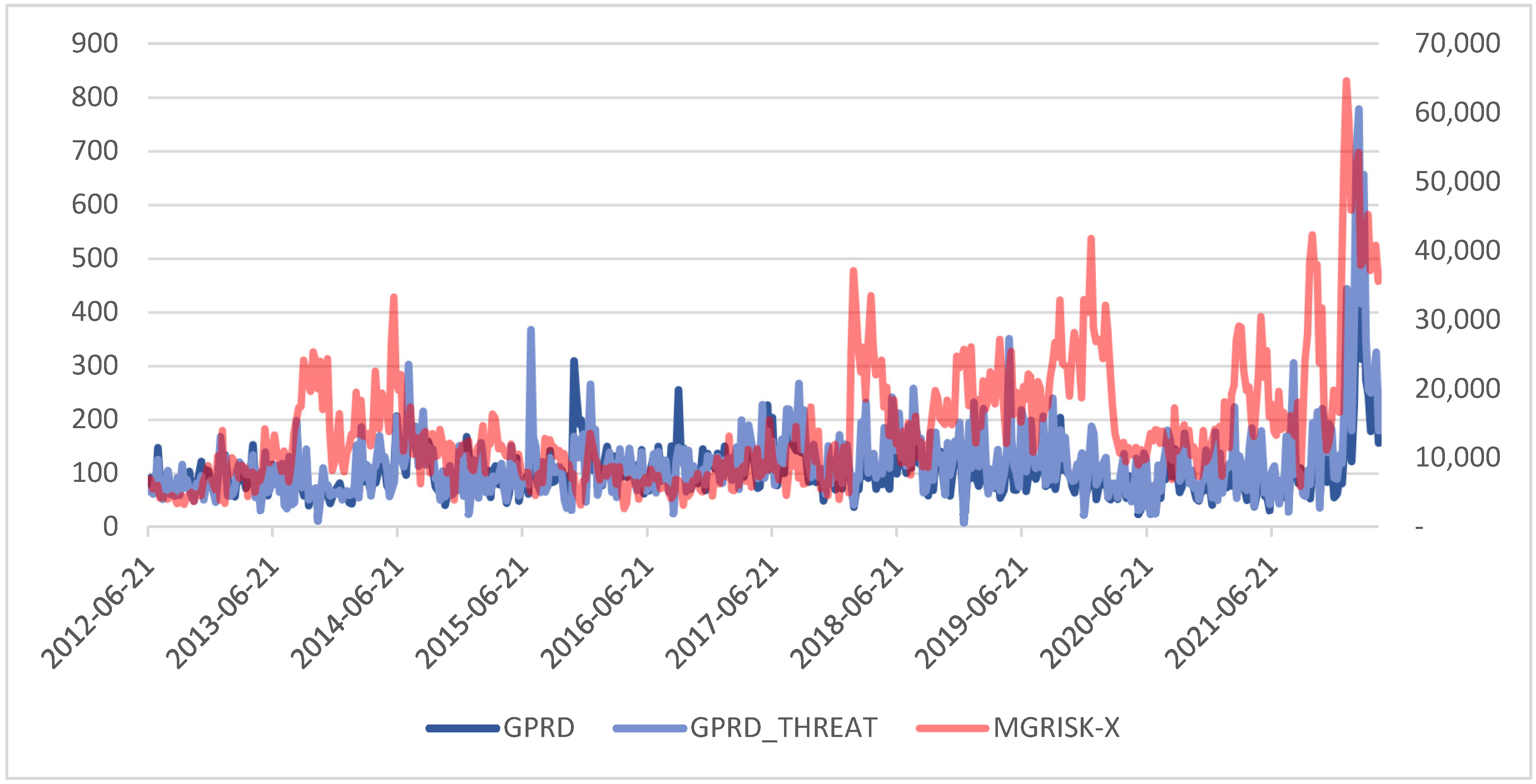

3.4. Geopolitical Risk Factor

4. Results

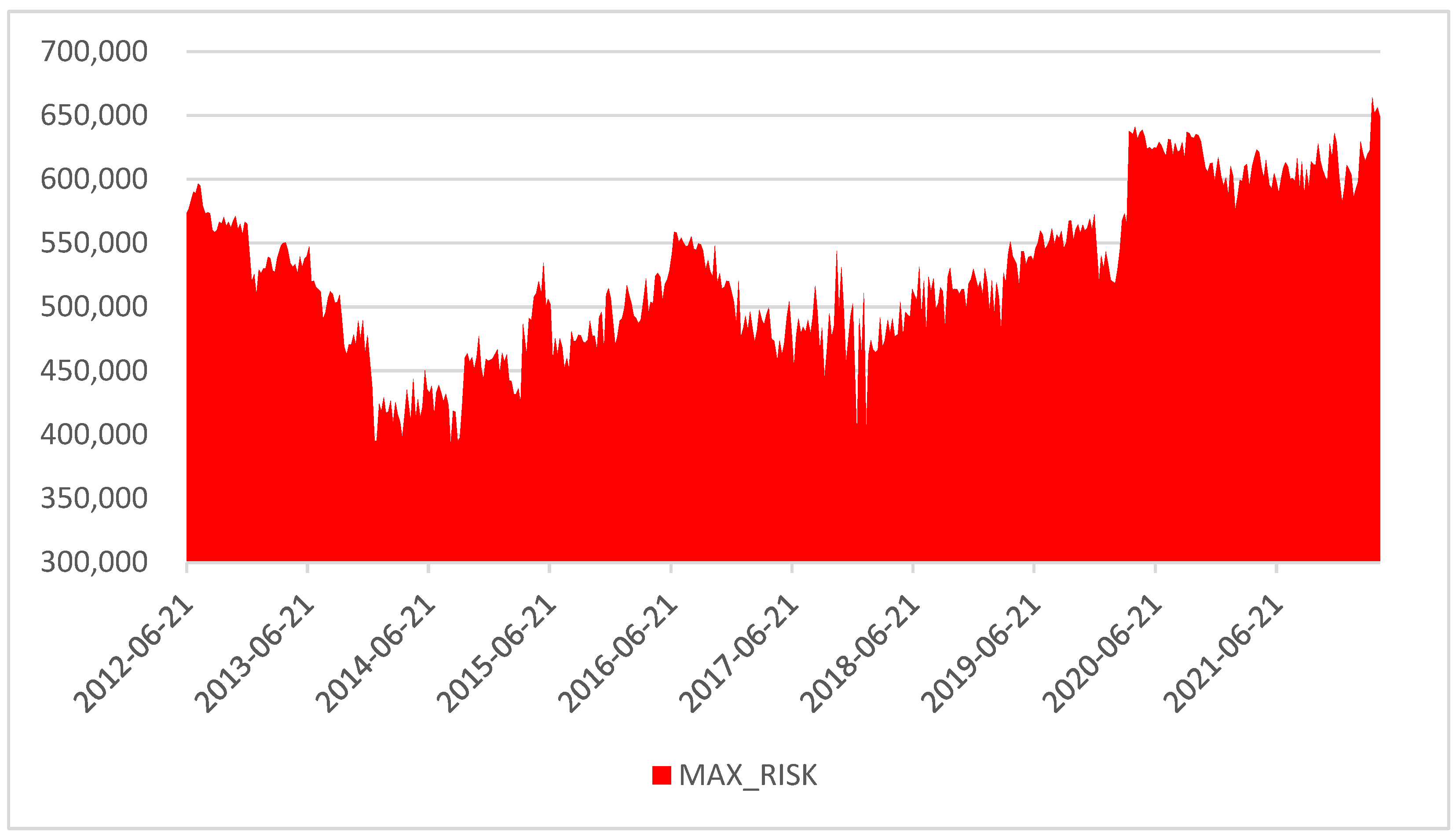

4.1. Data

4.2. Simulation Procedure

- Generate a quartet of data composed of the standardized shocks, i.e., three factors and one bank;

- Select the best-fitting multivariate GARCH model (CCC or DCC) based on likelihood;

- Generate the parameters to be used in the simulation;

- Perform a coarse sampling with replacement of the shocks;

- Simulate conditional log returns for the selected number of runs over a time window w using, as a starting set, the last parameters generated by the multivariate GARCH;

- Convert the log returns to arithmetic returns;

- Compute the Monte Carlo average capital shortfall conditional on either factor, or a combination thereof, breaking the crisis threshold thresh (MKT and CFE below thresh; GFE above minus thresh). Taking into consideration all seven non-zero breaks’ possible occurrences, we record both the size of the deficit and the frequency of each specific type of event resulting from the simulation.

4.3. Tail Risk Estimation and Attribution

4.4. Sensitivity Analysis and Robustness Checks

| Ratio_35/30 | Ratio_40/35 | Ratio_40/30 | |

|---|---|---|---|

| Mean: | 97.0% | 93.3% | 90.5% |

| StdDev: | 14.8% | 19.9% | 23.2% |

| Min: | 38.3% | 18.5% | 17.1% |

| Max: | 164.0% | 205.9% | 195.7% |

| Ratio_35/30 | Ratio_40/35 | Ratio_40/30 | |

|---|---|---|---|

| Mean: | 100.8% | 100.3% | 100.7% |

| StdDev: | 25.0% | 33.9% | 39.3% |

| Min: | 23.0% | 0.0% | 0.0% |

| Max: | 281.8% | 330.4% | 401.0% |

| Ratio_35/30 | Ratio_40/35 | Ratio_40/30 | |

|---|---|---|---|

| Mean: | 94.7% | 93.9% | 90.5% |

| StdDev: | 20.4% | 28.8% | 37.2% |

| Min: | 0.0% | 0.0% | 0.0% |

| Max: | 186.8% | 233.8% | 253.0% |

5. Conclusions

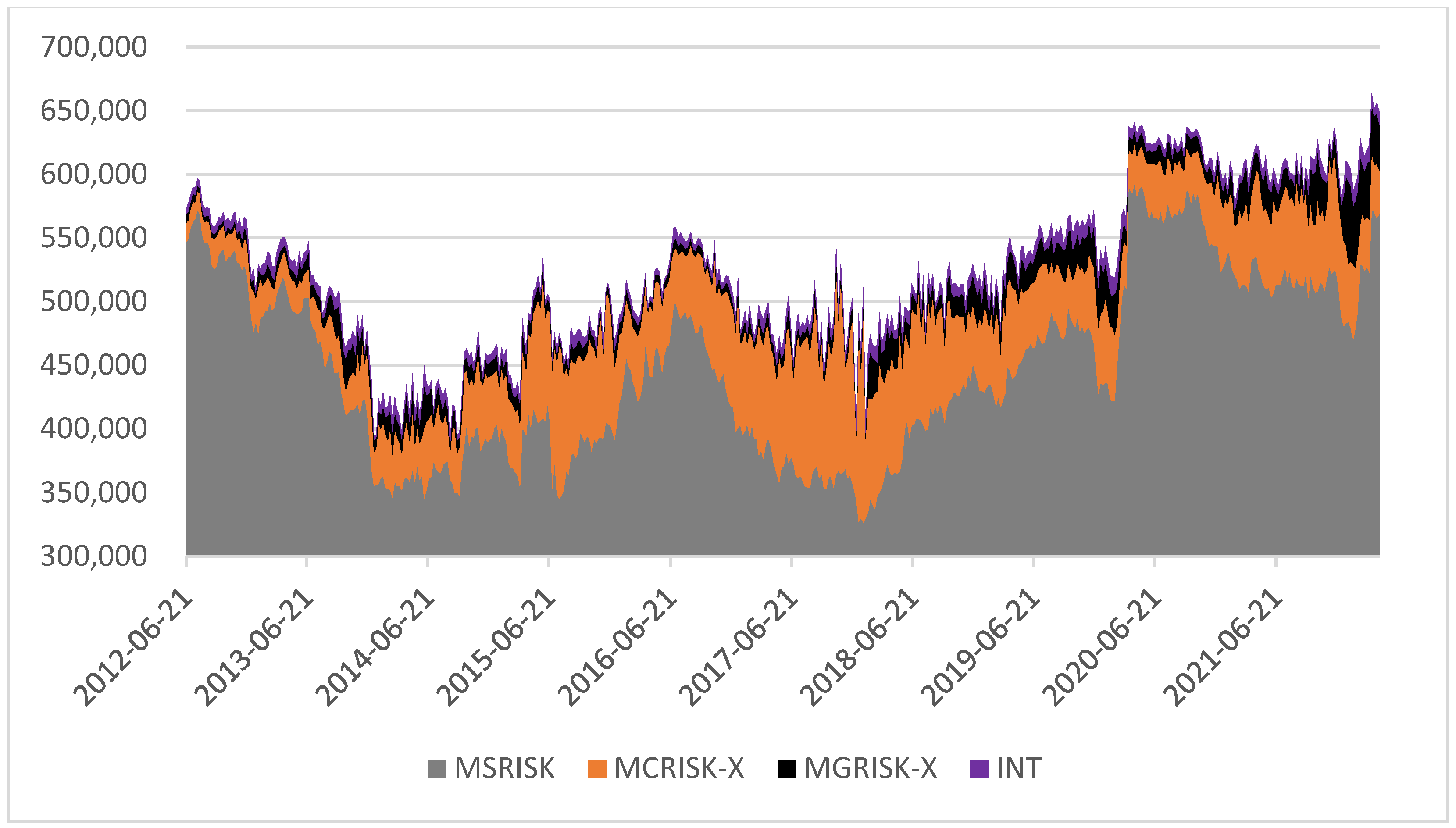

- (1)

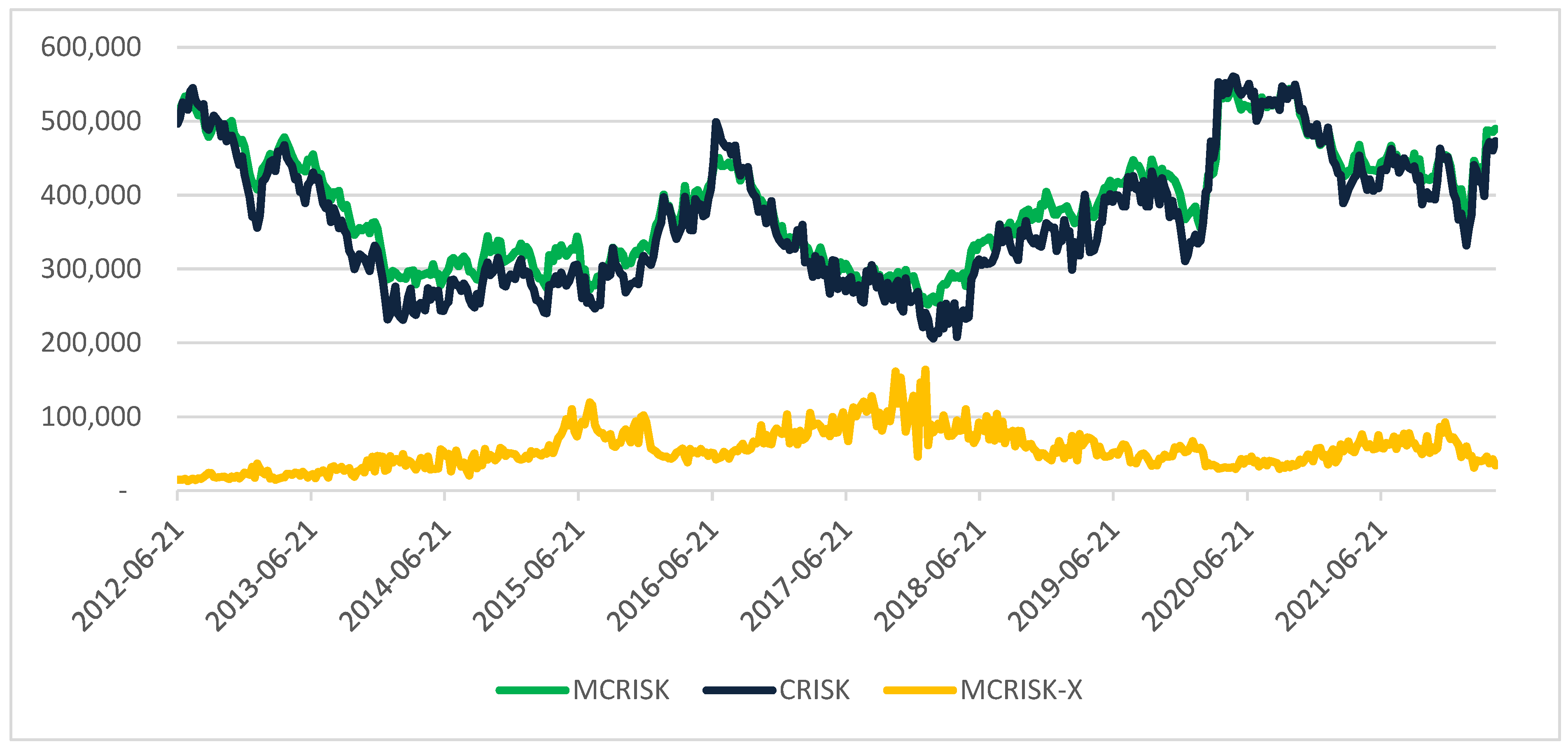

- Systemic risk is identified as the dominant risk factor for Eurozone banks. Furthermore, our analysis indicates that, on average, current systemic risk estimates obtained using a bivariate approach underestimate potential aggregate losses by EUR 77.1 billion (median: EUR 75.6 billion), or 18.1% (median: 17.1%). This undershooting is caused by the effects of the interaction between the different types of risk and can be captured only via a multivariate analysis.

- (2)

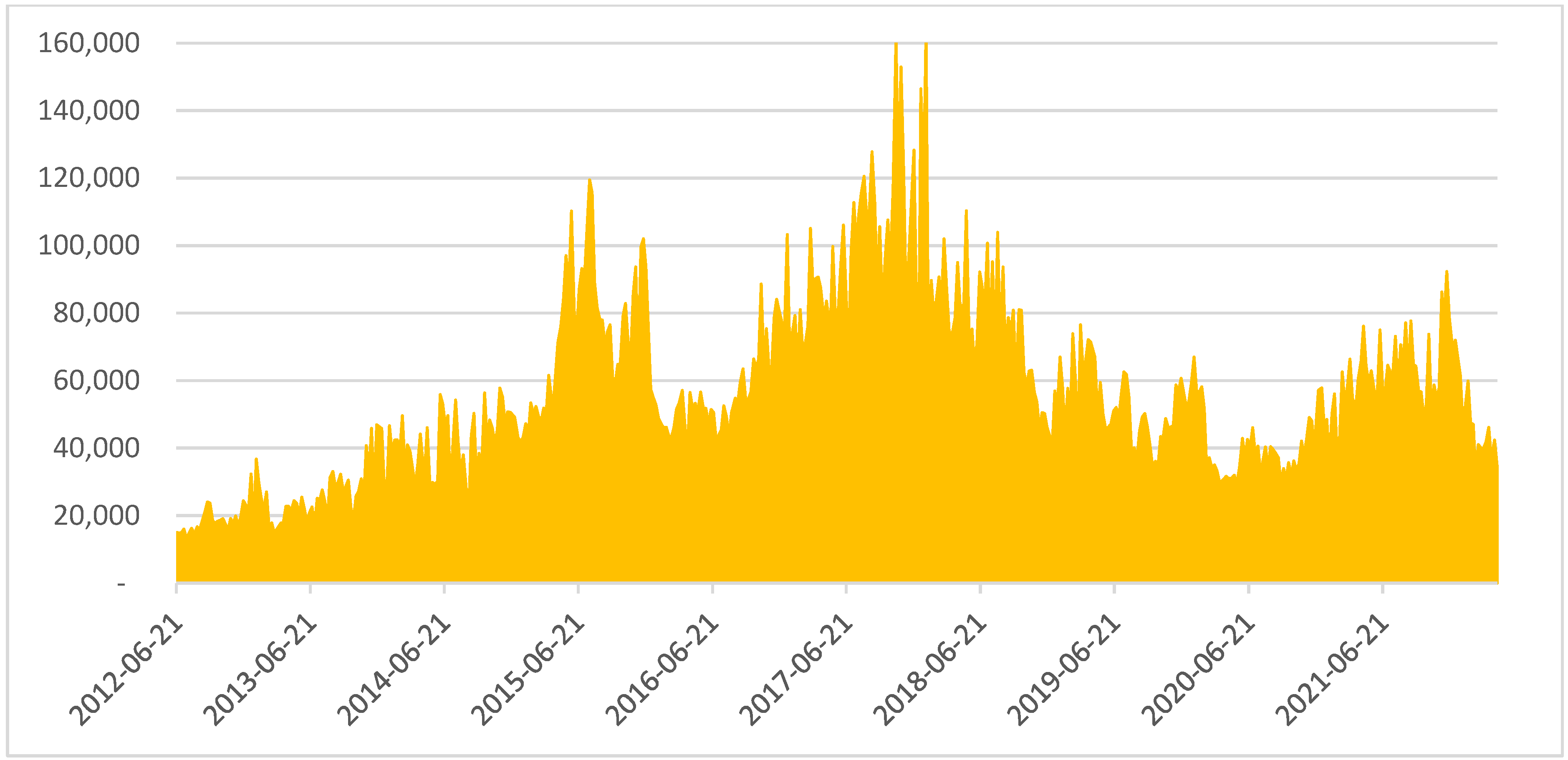

- The proposed climate tail risk attribution model produces a result that is comparable with the ECB climate stress test’s appraisal, even though their EUR 53 billion transition risk assessment is likely to be moderately optimistic (i.e., lower than the actual risk). Conversely, bivariate approaches overestimate climate risk by almost one order of magnitude. This overshooting is provoked by the overlapping of capital shortfall estimates that fails to consider the dominant risk, that is, systemic risk, as the major source of potential negative equity comprising the losses of isolated events of different natures. However, climate risk does constitute a dangerous source or tail risk if combined with systemic and geopolitical issues. Its mean addition to systemic risk is, on average, EUR 55.7 billion (median: EUR 51.6 billion), representing 10.8% of the maximum potential aggregate shortfall (median: 9.9%). It can account for up to 32.1% of maximum combined losses during energy bear markets. In the period considered, despite its late drop, climate tail risk more than doubled. This methodology is ineffective in measuring physical risk, which, due to its nature, requires a granular geospatial database that cannot be effectively replaced by using only market data. The ECB CST has quantified physical risk as one third of transition risk, or a quarter of total climate risk.

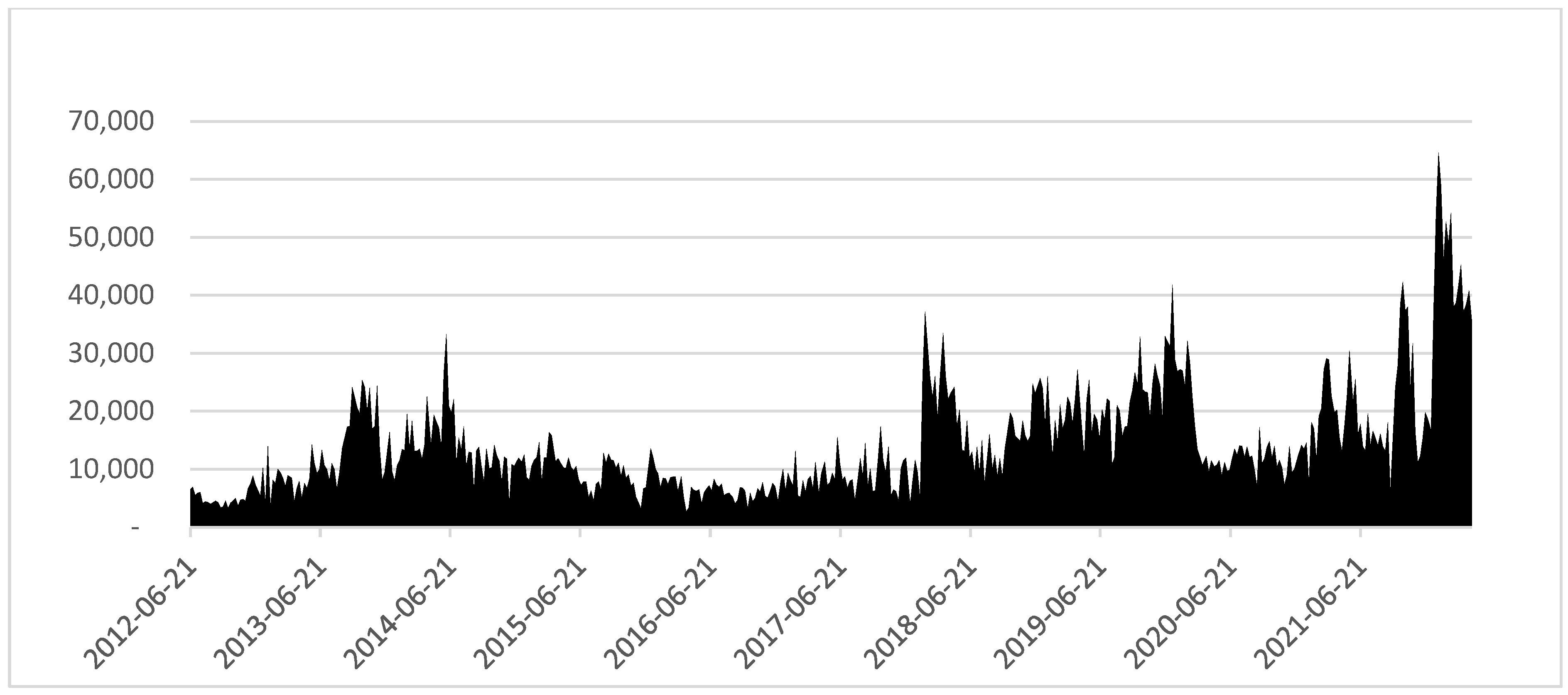

- (3)

- Geopolitical risk adds EUR 14.3 billion (median: EUR 11.9 billion) to mean systemic risk, representing, on average, 2.7% (median: 2.3%) of the aggregate maximum risk if combined with systemic and climate events. During the dramatic period leading to the breakout of the war in Ukraine, tail risk linked to the geopolitical factor surged to EUR 64.7 billion, or 10.6% of maximum aggregate losses, thereby reaching the maximum incidence across the entire period analyzed. Further refinements in the geopolitical factor (GFE) would certainly improve the accuracy and timeliness of the results, which are significantly correlated with Caldara and Iacoviello’s (2022) Threats index.

- (4)

- Interaction risk is a byproduct of the simultaneous occurrence of multiple crises that can be measured only within this type of multivariate framework. It does not show any specific trend and represents, on average, 1.4% (median: 1.3%) of total risk. However, it never drops to zero and can reach 3.6% of combined aggregate losses, thereby indicating latent potential excess shortfall.

- (5)

- Our results are in line with those acquired by Gehrig and Iannino (2021) in suggesting that the relative stability of risk-weighted exposure reported by Eurozone banks does not reflect the actual trajectory of their aggregate risk, which was higher in 2022 than in 2011.

- (6)

- These findings could be used to develop portfolio construction techniques robust to multiple shocks. Lin et al. (2023) have introduced a suite of metrics based on bivariate designed to identify portfolios of banks able to overperform during systemic crises, whereas MCRISK-X and MGRISK_X could be utilized to perform sectoral stock selection to minimize the impact of climate and geopolitical shocks on portfolio returns. We are currently in the process of investigating this subject further with our forthcoming “Identifying green banks” paper.

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

| LM Test for Constant Correlation of Tse (2000) |

| LMC: 38.0318 [0.0000000] |

| p-value in brackets. LMC~X2(N*(N − 1)/2)) under H0: CCC model, with N = #series |

| E-S Test(5) = 70.3061 [0.0000000] |

| E-S Test(10) = 116.544 [0.0000000] |

| p-values in brackets. E-S Test(j)~X2(j + 1) under H0: CCC model |

| Model | T | p | Log-Likelihood | SC | HQ | AIC |

|---|---|---|---|---|---|---|

| MG@RCH(1) | 2735 | 3 | 26970.570 | −19.714 | −19.718 | −19.720 |

| MG@RCH(2) | 2735 | 5 | 27078.285 | −19.787< | −19.794< | −19.798< |

| 8/15/2011, 5/1/2012, 8/15/2012, 12/24/2012, 12/31/2012, 5/1/2013, 8/15/2013, 12/24/2013, 12/26/2013, 12/31/2013, 5/1/2014, 8/15/2014, 10/3/2014, 12/24/2014, 12/26/2014, 12/31/2014, 5/1/2015, 5/25/2015, 12/24/2015, 12/31/2015, 5/16/2016, 8/15/2016, 10/3/2016, 12/26/2016, 5/1/2017, 6/5/2017, 8/15/2017, 10/3/2017, 10/31/2017, 5/1/2018, 5/21/2018, 8/15/2018, 10/3/2018, 12/24/2018, 12/31/2018, 5/1/2019, 6/10/2019, 8/15/2019, 10/3/2019, 12/24/2019, 12/31/2019, 5/1/2020, 6/1/2020, 12/24/2020, 12/31/2020, 5/24/2021, 12/24/2021, 12/31/2021. |

| 1 | The work by Battiston et al. (2017) laid the basis for including the evolution of carbon emissions and temperatures in a comprehensive climate stress-test effort, whereas Roncoroni et al. (2021) proposed combining the stress test approach with network evaluation analysis to investigate the higher-round effects of a climate crisis on the financial sector. |

| 2 | European Central Bank (ECB-ESBR) (2022), “2022 climate risk stress test”, July. |

| 3 | For an alternative, network-based approach, see Roncoroni et al. (2021). |

| 4 | See Caldara and Iacoviello (2022), “Measuring Geopolitical Risk”, American Economic Review, April, 112(4), pp. 1194–1225, https://www.matteoiacoviello.com/gpr.htm accessed on 3 November 2022. |

| 5 | See, for example, https://vlab.stern.nyu.edu/georisk (accessed on 3 November 2022) published by the NYU. |

| 6 | For example, the Blackrock Investment Institute Geo-political risk dashboard. |

| 7 | For a comprehensive discussion on this matter, see Admati and Hellwig (2013). |

| 8 | During times of crisis, the total amount of bank debt tends to have small absolute fluctuations, even if its composition might vary: a reduction in deposits might be compensated by an increase in other types of funding, often provided by central banks. The no bail-in assumption implies that bank bonds are set to be reimbursed without haircuts. |

| 9 | A geopolitical event causing flight-to-quality flows is likely to produce an increase, and not a fall, in GFE. |

| 10 | See Section 4.3 for the details. |

| 11 | Under the constraint φ + λ + γ/2 < 1 for a Gaussian distribution. |

| 12 | See Threshold Arch Models and Asymmetries in Volatility by Rabemananjara and Zakoian (1993). |

| 13 | See index provider Qontigo—https://www.stoxx.com/index-details?symbol=sxxe (accessed on 12 July 2022). |

| 14 | During the period considered, the S&P500 index represented more than 60% of the MSCI World Index. |

| 15 | There are valid alternatives to IUSE, such as Lyxor’s SP5H/SPXH, but not with a price history encompassing the entire period considered. |

| 16 | IUSE was launched in the fall of 2010; since then, it has tracked the dollar-denominated SPX very well: in the period considered, the iShare ETF cumulated daily and yearly log returns show a 99.9% correlation with the corresponding SPX USD return statistics. Given the currency hedge and the fact that the price of IUSE is arbitraged until the close of European business, it is our opinion that the characteristics of this ETF eliminate the need to account for lagged returns in this type of analysis. |

| 17 | See the Appendix A, Table A4, for a full list of excluded dates. |

| 18 | A preliminary analysis on the full sample was conducted using the Tse (2000) and the Engle and Sheppard (2001) tests. See Appendix A Table A1 and Table A2 for details. |

| 19 | OxMetrics 8.2 and Matlab R2021b, integrated with the MFE Toolbox developed by K. Sheppard and the Parallel Computing module. |

| 20 | Jung et al. (2021) uses a 50% climate factor drop in 6 months as a crisis threshold. Considering the distributions of realized returns in our sample, we deem such a steep fall unrealistic for our specific purpose. |

| 21 | Sectoral stock selection robust to climate risk is discussed in our forthcoming study, “Identifying green banks”. |

| 22 | On their VLAB website, the NYU publishes bivariate CRISK estimates. (see https://vlab.stern.nyu.edu/climate), accessed on 13 June 2022. |

| 23 | In the cases when does exceed , we found that is, on average, larger than by 2.8%. |

| 24 | As explained in Section 4.2, the observation period spans from the beginning of July 2011 to the end of April 2022, using a 5-day interval between measurements, amounting to a total of 498 dates. The threshold thresh was set at −30%, whereas the Monte Carlo simulation was conducted with 75,000 runs over a 63-day period (3 months) per date per bank. |

| 25 | In both instances, Brent crude prices dropped more than 50%. |

| 26 | These findings are in line with the NYU V-Lab output: for the selected sample, the C event generated a multivariate MCRISK estimate on 29 April, 2022, equal to EUR 490 billion, which can be compared with a bivariate V-LAB measurement of USD 469 billion: considering the prevailing FX rate at the time of EUR/USD = 1.05, this equates to a EUR 446 billion bivariate CRISK, or 91.1% of our MCRISK estimate produced in a multivariate context using a different climate factor. Site accessed on 13 June 2022. |

| 27 | Such as the annexation of Crimea in 2014, the fall of the ISIS Caliphate in late 2017–2018, and the North Korean crisis in 2018–2019. |

References

- Acharya, Viral V., Lasse H. Pedersen, Thomas Philippon, and Matthew Richardson. 2017. Measuring systemic risk. The Review of Financial Studies 30: 2–47. [Google Scholar] [CrossRef]

- Admati, Anat, and Martin Hellwig. 2013. The Bankers’ New Clothes: What’s Wrong with Banking and What to Do about It, 9th ed. Princeton and Oxford: Princeton University Press. ISBN 978-0-691-16238-6. [Google Scholar]

- Adrian, Thobias, and Markus K. Brunnermeier. 2016. CoVaR. American Economic Review 106: 1705–41. [Google Scholar] [CrossRef]

- Allen, Franklin, and Elena Carletti. 2013. What Is Systemic Risk? Journal of Money, Credit and Banking 45: 121–27. [Google Scholar] [CrossRef]

- Battiston, Stefano, Antoine Mandel, Irene Monasterolo, Franziska Schütze, and Gabriele Visentin. 2017. A climate stress test of the financial system. Nature Climate Change 7: 283–88. [Google Scholar] [CrossRef]

- Battiston, Stefano, Domenico Delli Gatti, Mauro Gallegati, Bruce Greenwald, and Joseph E. Stiglitz. 2012. Liaisons dangereuses: Increasing connectivity, risk sharing, and systemic risk. Journal of Economic Dynamics and Control 36: 1121–41. [Google Scholar] [CrossRef]

- Bollerslev, Tim. 1990. Modelling the Coherence in Short-Run Nominal Exchange Rates: A Multivariate Generalized Arch Model. The Review of Economics and Statistics 72: 498–505. [Google Scholar] [CrossRef]

- Brownlees, Christian, and Robert F. Engle. 2017. SRISK: A conditional capital shortfall measure of systemic risk. The Review of Financial Studies 30: 48–79. [Google Scholar] [CrossRef]

- Caldara, Dario, and Matteo Iacoviello. 2022. Measuring Geopolitical Risk. American Economic Review 112: 1194–225. [Google Scholar] [CrossRef]

- Engle, Robert F. 2002. Dynamic Conditional Correlation: A Simple Class of Multivariate Generalized Autoregressive Conditional Heteroskedasticity Models. Journal of Business & Economic Statistics 20: 339–50. [Google Scholar] [CrossRef]

- Engle, Robert F. 2009. Anticipating Correlations. Princeton: Princeton University Press. ISBN 9780691116419. [Google Scholar]

- Engle, Robert F. 2016. Dynamic Conditional Beta. Journal of Financial Econometrics 14: 643–67. [Google Scholar] [CrossRef]

- Engle, Robert F., and Kevin Sheppard. 2001. Theoretical and Empirical Properties of Dynamic Conditional Correlation Multivariate GARCH. No 8554, NBER Working Papers, National Bureau of Economic Research, Inc. Available online: https://EconPapers.repec.org/RePEc:nbr:nberwo:8554 (accessed on 11 March 2022).

- Engle, Robert F., Eric Jondeau, and Michael Rockinger. 2015. Systemic Risk in Europe. Review of Finance 19: 145–90. [Google Scholar] [CrossRef]

- European Central Bank (ECB-ESRB). 2021. Climate-Related Risk and Financial Stability. July. Available online: https://www.ecb.europa.eu/press/pr/date/2021/html/ecb.pr210701~8fe34bbe8e.en.html (accessed on 4 April 2022).

- European Central Bank (ECB-ESBR). 2022. 2022 Climate Risk Stress Test. July. Available online: https://www.ecb.europa.eu/press/pr/date/2022/html/ecb.pr220726~491ecd89cb.en.html (accessed on 31 August 2022).

- Gehrig, Thomas, and Maria C. Iannino. 2021. Did the Basel Process of capital regulation enhance the resiliency of European banks? Journal of Financial Stability 55: 100904. [Google Scholar] [CrossRef]

- Glosten, Lawrence, Ravi Jagannathan, and David E. Runkle. 1993. On the relation between the expected value and the volatility of the excess returns on stocks. The Journal of Finance 48: 1779–801. [Google Scholar] [CrossRef]

- Gouriéroux, Christian, Alain Monfort, and Jean-Paul Renne. 2022. Required Capital for Long-Run Risks. Journal of Economic Dynamics and Control 144: 104502. [Google Scholar] [CrossRef]

- Hull, John C. 2023. Risk Management and Financial Institutions, 6th ed. Hoboken: Wiley. ISBN 978-1-119-93249-9. [Google Scholar]

- Jung, Hyeyoon, Robert F. Engle, and Richard Berner. 2021. CRISK: Measuring the Climate Risk Exposure of the Financial System. FRB of New York Staff Report No. 977, Rev. March 2023. Previous title: “Climate Stress Testing”. Available online: https://ssrn.com/abstract=3931516.html (accessed on 4 April 2022).

- Lin, Weidong, Jose Olmo, and Abderrahim Taamouti. 2023. Portfolio Selection under Systemic Risk. Journal of Money, Credit and Banking. early view. [Google Scholar] [CrossRef]

- Rabemananjara, Roger, and Jean-Michel Zakoian. 1993. Threshold Arch Models and Asymmetries in Volatility. Journal of Applied Econometrics 8: 31–49. [Google Scholar]

- Roncoroni, Alan, Stefano Battiston, Luiso O. L. Escobar-Farfán, and Serafin Martinez-Jaramillo. 2021. Climate risk and financial stability in the network of banks and investment funds. Journal of Financial Stability 54: 100870. [Google Scholar] [CrossRef]

- Tse, Yiu Kuen. 2000. A test for constant correlations in a multivariate GARCH model. Journal of Econometrics 98: 107–27. [Google Scholar] [CrossRef]

- Zhang, Xingmin, Qiang Fu, Liping Lu, Qingyu Wang, and Shuai Zhang. 2021. Bank liquidity creation, network contagion and systemic risk: Evidence from Chinese listed banks. Journal of Financial Stability 53: 100844. [Google Scholar] [CrossRef]

| EVENT | MKT < Thresh | CFE < Thresh | GFE > (−Thresh) | FREQ |

|---|---|---|---|---|

| G | X | f(G) | ||

| C | X | f(C) | ||

| CG | X | X | f(CG) | |

| S | X | f(S) | ||

| SG | X | X | f(SG) | |

| SC | X | X | f(SC) | |

| SCG | X | X | X | f(SCG) |

| MAX_RISK Threshold Ratios | SRISK Threshold Ratios | |||||

|---|---|---|---|---|---|---|

| Ratio_35/30 | Ratio_40/35 | Ratio_40/30 | Ratio_35/30 | Ratio_40/35 | Ratio_40/30 | |

| Mean: | 103.7% | 102.9% | 106.7% | 104.8% | 104.3% | 109.3% |

| StdDev: | 2.5% | 2.5% | 3.9% | 1.8% | 1.7% | 3.4% |

| Min: | 91.9% | 92.8% | 85.3% | 101.6% | 101.1% | 103.0% |

| Max: | 122.0% | 119.3% | 125.8% | 110.0% | 109.7% | 119.4% |

| GPRD | THREATS | MGRISK-X | |

|---|---|---|---|

| GPRD | 1 | ||

| THREATS | 0.8980 *** | 1 | |

| MGRISK-X | 0.3043 *** | 0.4560 *** | 1 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bettin, G.; Mensi, G.M.; Recchioni, M.C. Multifactor Risk Attribution Applied to Systemic, Climate and Geopolitical Tail Risks for the Eurozone Banking Sector. Risks 2023, 11, 173. https://doi.org/10.3390/risks11100173

Bettin G, Mensi GM, Recchioni MC. Multifactor Risk Attribution Applied to Systemic, Climate and Geopolitical Tail Risks for the Eurozone Banking Sector. Risks. 2023; 11(10):173. https://doi.org/10.3390/risks11100173

Chicago/Turabian StyleBettin, Giulia, Gian Marco Mensi, and Maria Cristina Recchioni. 2023. "Multifactor Risk Attribution Applied to Systemic, Climate and Geopolitical Tail Risks for the Eurozone Banking Sector" Risks 11, no. 10: 173. https://doi.org/10.3390/risks11100173