Trends and Risks in Mergers and Acquisitions: A Review

Abstract

1. Introduction

2. Conceptual Background

2.1. The M&A Process

2.1.1. Acquisition Planning and Targeting

2.1.2. Deal Structuring and Closing

2.1.3. Post-Merger Performance and Control

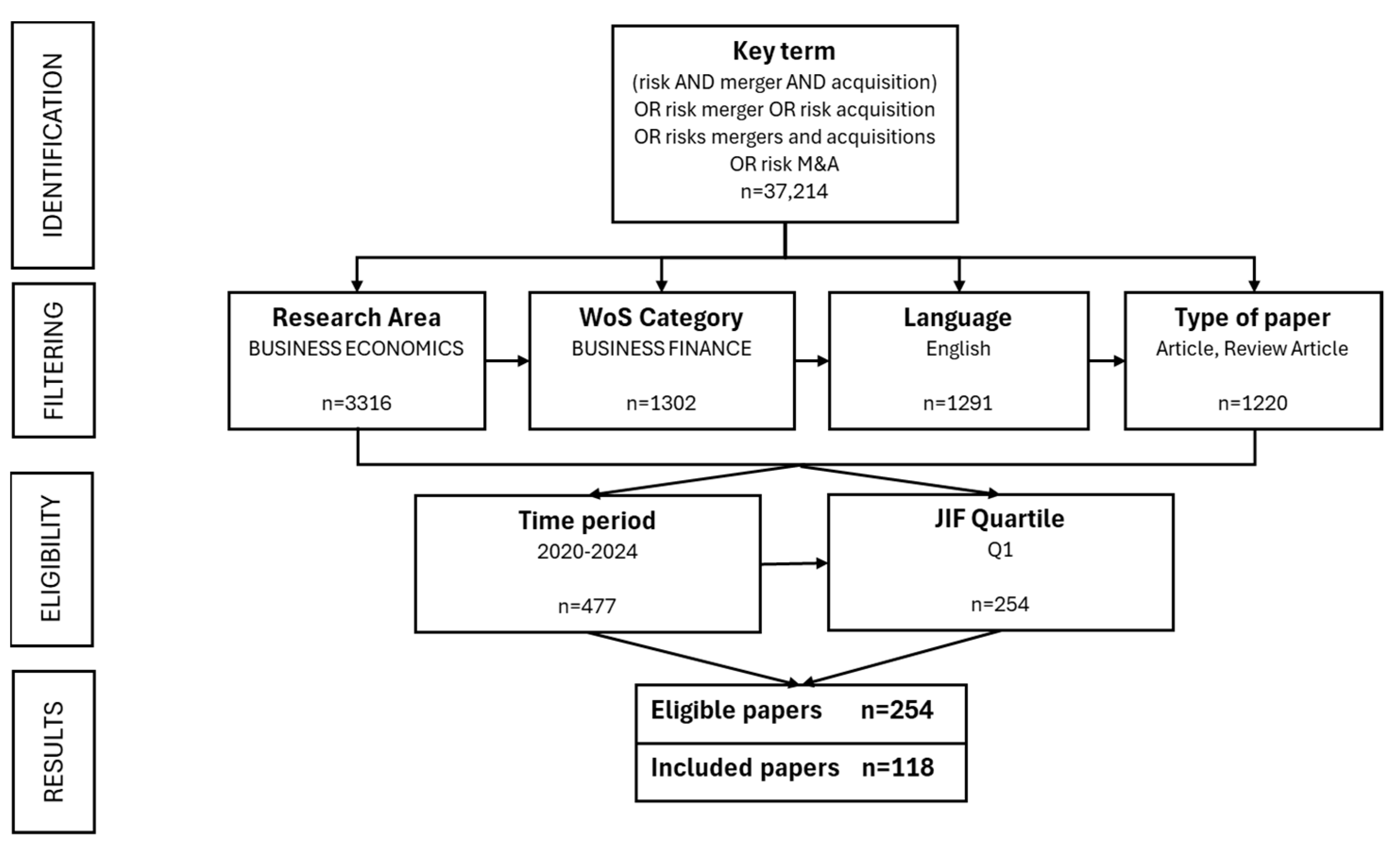

3. Methodology

3.1. Database and Searching Strategy

3.2. Data Refining and Analysis

4. Findings

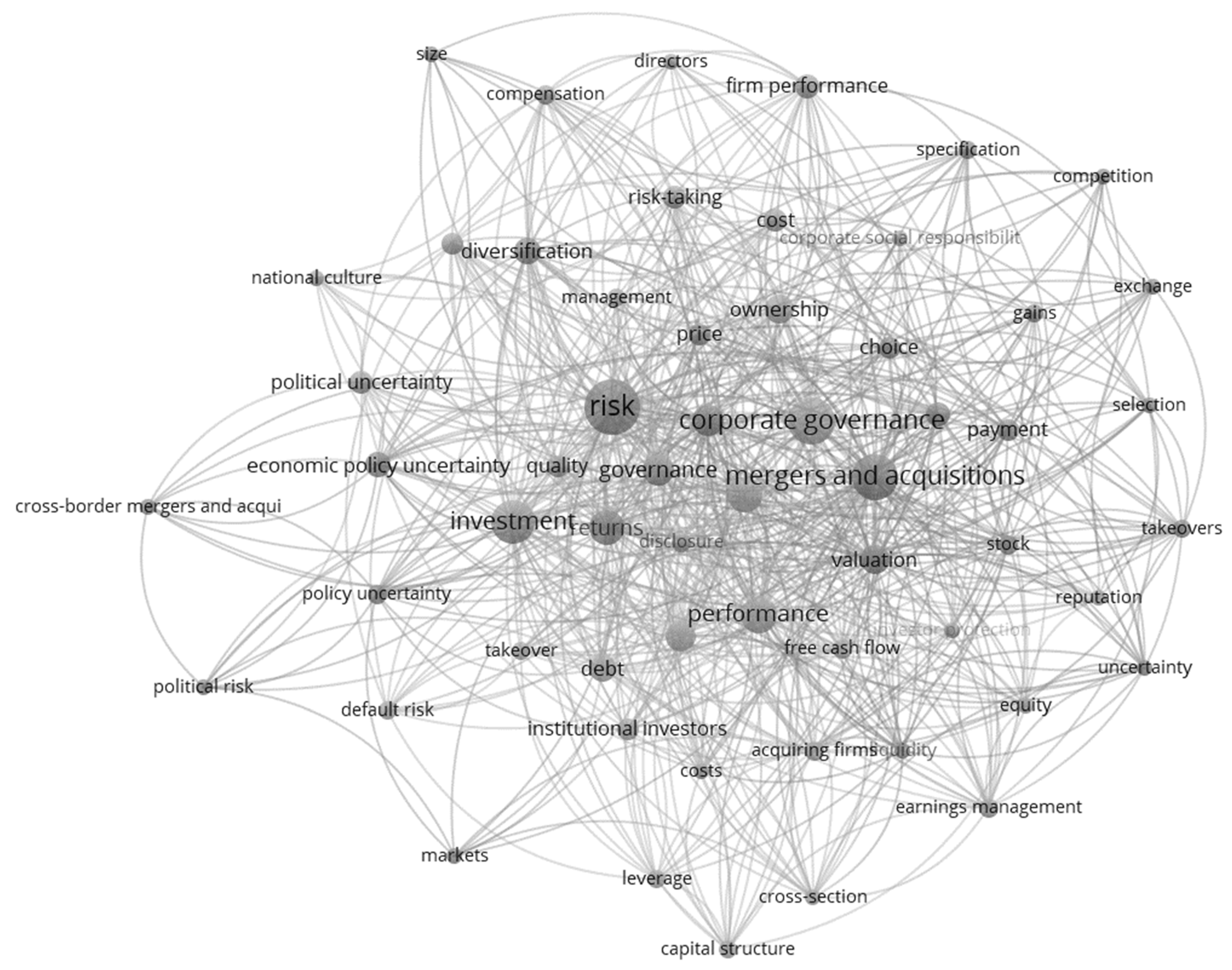

4.1. Keyword Co-Occurrence Analysis

4.2. Geopolitical Risks

4.3. Information Asymmetry Risks

4.4. Investor Protection and Litigation Risks

4.5. Performance and Reputational Risks

4.6. Aggregate Analysis of Key Areas

5. Conclusions and Future Directions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Ahsan, Faisal Mohammad, Manish Popli, and Vikas Kumar. 2024. Formal institutions and cross-border mergers and acquisitions: A systematic literature review and research agenda. International Business Review 33: 102306. [Google Scholar] [CrossRef]

- Alam, Ahmed W., M. Kabir Hassan, and Hasanul Banna. 2024. An empirical investigation of banks’ sustainability performance under economic policy uncertainty. Journal of Sustainable Finance and Investment 2024: 2309499. [Google Scholar] [CrossRef]

- Argimón, Isabel, and María Rodríguez-Moreno. 2022. Risk and control in complex banking groups. Journal of Banking and Finance 134: 106038. [Google Scholar] [CrossRef]

- Balachandran, Balasingham, Huu Nhan Duong, Hoang Luong, and Lily Nguyen. 2020. Does takeover activity affect stock price crash risk? Evidence from international M&A laws. Journal of Corporate Finance 64: 101697. [Google Scholar] [CrossRef]

- Barbopoulos, Leonidas G., Samer Adra, and Anthony Saunders. 2020. Macroeconomic News and Acquirer Returns in M&As: The Impact of Investor Alertness. Journal of Corporate Finance 64: 101583. [Google Scholar] [CrossRef]

- Battauz, Anna, Stefano Gatti, Annalisa Prencipe, and Luca Viarengo. 2021. Earnouts: The real value of disagreement in mergers and acquisitions. European Financial Management 27: 981–1024. [Google Scholar] [CrossRef]

- Bauer, Florian, and Martin Friesl. 2024. Synergy Evaluation in Mergers and Acquisitions: An Attention-Based View. Journal of Management Studies 61: 37–68. [Google Scholar] [CrossRef]

- Boone, Audra, and Vahap B. Uysal. 2020. Reputational concerns in the market for corporate control. Journal of Corporate Finance 61: 101399. [Google Scholar] [CrossRef]

- Bose, Sudipta, Kristina Minnick, and Syed Shams. 2021. Does carbon risk matter for corporate acquisition decisions? Journal of Corporate Finance 70: 102058. [Google Scholar] [CrossRef]

- Buehlmaier, Matthias M. M., and Josef Zechner. 2020. Financial Media, Price Discovery, and Merger Arbitrage. Review of Finance 25: rfaa037. [Google Scholar] [CrossRef]

- Choi, Wonseok, Chune Young Chung, and Kainan Wang. 2022. Firm-level political risk and corporate investment. Finance Research Letters 46: 102307. [Google Scholar] [CrossRef]

- Dahlen, Niklas, Alexander Lahmann, and Maximilian Schreiter. 2024. Panacea for M&A dealmaking? Investor perceptions of earnouts. Finance Research Letters 60: 104850. [Google Scholar] [CrossRef]

- Daley, Brendan, Thomas Geelen, and Brett Green. 2024. Due Diligence. The Journal of Finance 79: 2115–61. [Google Scholar] [CrossRef]

- Darbyshire, Madison, Nicholas Megaw, and James Fontanella-Khan. 2024. How the investment world is trying to navigate geopolitics. Financial Times. July 5. Available online: https://www.ft.com/content/23ce295d-bf65-47fd-bebd-808b5a7bcab5 (accessed on 4 August 2024).

- DePamphilis, Donald M. 2018. Mergers, Acquisitions, and Other Restructuring Activities: An Integrated Approach to Process, Tools, Cases and Solutions, 9th ed. Amsterdam and New York: Elsevier and Academic Press. [Google Scholar]

- Dong, Feng, and John Doukas. 2021. The effect of managers on M&As. Journal of Corporate Finance 68: 101934. [Google Scholar] [CrossRef]

- D’Souza, Reagan, Choy Yeing (Chloe) Ho, and Joey W. Yang. 2024. The cost of corporate social irresponsibility for acquirers. Journal of Banking and Finance 162: 107132. [Google Scholar] [CrossRef]

- Du, Julan, and Yifei Zhang. 2024. ISDS disputes, adjudication and cross-border M&As. Journal of Corporate Finance 87: 102594. [Google Scholar] [CrossRef]

- Even-Tov, Omri, James Ryans, and Steven Davidoff Solomon. 2022. Representations and warranties insurance in mergers and acquisitions. Review of Accounting Studies 29: 423–50. [Google Scholar] [CrossRef]

- Feldman, Emilie R., and Exequiel Hernandez. 2022. Synergy in Mergers and Acquisitions: Typology, Life Cycles, and Value. Academy of Management Review 47: 549–78. [Google Scholar] [CrossRef]

- Florackis, Chris, Christodoulos Louca, Roni Michaely, and Michael Weber. 2022. Cybersecurity Risk. The Review of Financial Studies 36: 351–407. [Google Scholar] [CrossRef]

- Gu, Ming, Dongxu Li, and Xiaoran Ni. 2022. Too much to learn? The (un)intended consequences of RegTech development on mergers and acquisitions. Journal of Corporate Finance 76: 102276. [Google Scholar] [CrossRef]

- Hemrajani, Pragati, Muskan Khan, and Rahul Dhiman. 2023. Financial risk tolerance: A review and research agenda. European Management Journal 41: 1119–33. [Google Scholar] [CrossRef]

- Hickman, L. Emily. 2019. Information Asymmetry in CSR Reporting: Publicly-Traded versus Privately-Held Firms. Sustainability Accounting, Management and Policy Journal 11: 207–32. [Google Scholar] [CrossRef]

- Hoang, Khanh, Cuong Nguyen, and Hailiang Zhang. 2021. How does economic policy uncertainty affect corporate diversification? International Review of Economics and Finance 72: 254–69. [Google Scholar] [CrossRef]

- Huang, Chenchen, Neslihan Ozkan, and Fangming Xu. 2023. Shareholder Litigation Risk and Firms’ Choice of External Growth. Journal of Financial and Quantitative Analysis 58: 574–614. [Google Scholar] [CrossRef]

- Huang, Jingong, and Taojun Xie. 2023. Technology centrality, bilateral knowledge spillovers and mergers and acquisitions. Journal of Corporate Finance 79: 102366. [Google Scholar] [CrossRef]

- IMAA—Institute for Mergers, Acquisitions, and Alliances. 2024. M&A Statistics: Transactions and Activity by Year. M&A Trends|IMAA. Available online: https://imaa-institute.org/mergers-and-acquisitions-statistics/ (accessed on 27 July 2024).

- Imperatore, Claudia, Gabriel Pündrich, Rodrigo S. Verdi, and Benjamin P. Yost. 2024. Litigation risk and strategic M&A valuations. Journal of Accounting and Economics 78: 101671. [Google Scholar] [CrossRef]

- Jeon, Chunmi, Seongjae Mun, and Seung Hun Han. 2022. Firm-level political risk, liquidity management, and managerial attributes. International Review of Financial Analysis 83: 102285. [Google Scholar] [CrossRef]

- Klitzka, Michael, Jianan He, and Dirk Schiereck. 2022. The rationality of M&A targets in the choice of payment methods. Review of Managerial Science 16: 933–67. [Google Scholar] [CrossRef]

- Kuo, Ya-Fen, Yi-Mien Lin, and Hsiu-Fang Chien. 2021. Corporate social responsibility, enterprise risk management, and real earnings management: Evidence from managerial confidence. Finance Research Letters 41: 101805. [Google Scholar] [CrossRef]

- Li, Fengchun, Ting Liang, and Hailian Zhang. 2021. Does economic policy uncertainty affect cross-border M&As?—A data analysis based on Chinese multinational enterprises. International Review of Financial Analysis 73: 101631. [Google Scholar] [CrossRef]

- Li, Hong-yan, Ruiqing He, and Qiang Fu. 2023. Does corporate social responsibility affect the performance of cross-border M&A of emerging market multinationals? Finance Research Letters 58: 104320. [Google Scholar] [CrossRef]

- Li, Keming. 2020. Does Information Asymmetry Impede Market Efficiency? Evidence from Analyst Coverage. Journal of Banking and Finance 118: 105856. [Google Scholar] [CrossRef]

- Liu, Tingting, Tao Shu, Erin Towery, and Jasmine Wang. 2024. The Role of External Regulators in Mergers and Acquisitions: Evidence from SEC Comment Letters. Review of Accounting Studies 29: 451–92. [Google Scholar] [CrossRef]

- Makrychoriti, Panagiota, and Emmanouil G. Pyrgiotakis. 2024. Firm-level political risk and stock price crashes. Journal of Financial Stability 74: 101303. [Google Scholar] [CrossRef]

- Mandas, Marco, Oumaima Lahmar, Luca Piras, and Riccardo De Lisa. 2024. ESG Reputational Risk and Market Valuation: Evidence from the European Banking Industry. Research in International Business and Finance 69: 102286. [Google Scholar] [CrossRef]

- Maung, Min, Craig Wilson, and Weisu Yu. 2020. Does reputation risk matter? Evidence from cross-border mergers and acquisitions. Journal of International Financial Markets, Institutions and Money 66: 101204. [Google Scholar] [CrossRef]

- Mingers, John, and Liying Yang. 2017. Evaluating journal quality: A review of journal citation indicators and ranking in business and management. European Journal of Operational Research 257: 323–37. [Google Scholar] [CrossRef]

- Nguyen, Hien T., Hieu V. Phan, and Hong Vo. 2023. Agency problems and corporate social responsibility: Evidence from shareholder-creditor mergers. International Review of Financial Analysis 90: 102937. [Google Scholar] [CrossRef]

- Ni, Xiaoran. 2020. Does stakeholder orientation matter for earnings management: Evidence from non-shareholder constituency statutes. Journal of Corporate Finance 62: 101606. [Google Scholar] [CrossRef]

- Ott, Christian. 2020. The risks of mergers and acquisitions—Analyzing the incentives for risk reporting in Item 1A of 10-K filings. Journal of Business Research 106: 158–81. [Google Scholar] [CrossRef]

- Page, Matthew J., Joanne E. McKenzie, Patrick M. Bossuyt, Isabelle Boutron, Tammy C. Hoffmann, Cynthia D. Mulrow, Larissa Shamseer, Jennifer M. Tetzlaff, Elie A. Akl, Sue E. Brennan, and et al. 2021. The PRISMA 2020 statement: An updated guideline for reporting systematic reviews. Systematic Reviews 10: 89. [Google Scholar] [CrossRef] [PubMed]

- Pan, Yihui, Stephan Siegel, and Tracy Yue Wang. 2020. The Cultural Origin of CEOs’ Attitudes toward Uncertainty: Evidence from Corporate Acquisitions. The Review of Financial Studies 33: 2977–3030. [Google Scholar] [CrossRef]

- Paudyal, Krishna, Chandra Thapa, Santosh Koirala, and Sulaiman Aldhawyan. 2021. Economic policy uncertainty and cross-border mergers and acquisitions. Journal of Financial Stability 56: 100926. [Google Scholar] [CrossRef]

- Peng, Zhen, Fan Bai, and Feng Zhao. 2024. Digital finance, life cycle, and enterprise mergers and acquisitions. Finance Research Letters 67: 105784. [Google Scholar] [CrossRef]

- Piesse, Jenifer, Cheng-Few Lee, Lin Lin, and Hsien-Chang Kuo. 2022. Merger and Acquisition: Definitions, Motives, and Market Responses. In Encyclopedia of Finance. Berlin and Heidelberg: Springer. [Google Scholar]

- PricewaterhouseCoopers. 2024. Global M&A Industry Trends: 2024 Mid-Year Outlook. PwC. Available online: https://www.pwc.com/gx/en/services/deals/trends.html (accessed on 26 August 2024).

- Ranaldo, Angelo, and Fabricius Somogyi. 2021. Asymmetric information risk in FX markets. Journal of Financial Economics 140: 391–411. [Google Scholar] [CrossRef]

- Shen, Huayu, Yue Liang, Hanwen Li, Jie Liu, and Guangxi Lu. 2021. Does geopolitical risk promote mergers and acquisitions of listed companies in energy and electric power industries. Energy Economics 95: 105115. [Google Scholar] [CrossRef]

- Snyder, Hannah. 2019. Literature review as a research methodology: An overview and guidelines. Journal of Business Research 104: 333–39. [Google Scholar] [CrossRef]

- Song, Sangcheol, Yuping Zeng, and Bing Zhou. 2021. Information asymmetry, cross-listing, and post-M&A performance. Journal of Business Research 122: 447–57. [Google Scholar] [CrossRef]

- Souissi, Yasmine, Ferdaws Ezzi, and Anis Jarboui. 2024. Blockchain Adoption and Financial Distress: Mediating Role of Information Asymmetry. Journal of the Knowledge Economy 15: 3903–26. [Google Scholar] [CrossRef]

- Swem, Nathan. 2022. Information in Financial Markets: Who Gets It First? Journal of Banking & Finance 140: 106488. [Google Scholar] [CrossRef]

- Tampakoudis, Ioannis, and Evgenia Anagnostopoulou. 2020. The effect of mergers and acquisitions on environmental, social and governance performance and market value: Evidence from EU acquirers. Business Strategy and the Environment 29: 1865–75. [Google Scholar] [CrossRef]

- Vo, Hong, Hien T. Nguyen, and Hieu V. Phan. 2024. Corporate social responsibility and the choice of payment method in mergers and acquisitions. International Review of Financial Analysis 94: 103241. [Google Scholar] [CrossRef]

- Wang, Muyun, and Ying Zhang. 2024. Excess goodwill and enterprise litigation risk. Finance Research Letters 67: 105819. [Google Scholar] [CrossRef]

- Wangerin, D. 2019. M&A Due Diligence, Post-Acquisition Performance, and Financial Reporting for Business Combinations. Contemporary Accounting Research 36: 2344–78. [Google Scholar] [CrossRef]

- Welch, Xena, Stevo Pavićević, Thomas Keil, and Tomi Laamanen. 2020. The Pre-Deal Phase of Mergers and Acquisitions: A Review and Research Agenda. Journal of Management 46: 843–78. [Google Scholar] [CrossRef]

- Wilson, Jared I. 2020. The Consequences of Limiting Shareholder Litigation: Evidence from Exclusive Forum Provisions. Journal of Corporate Finance 64: 101712. [Google Scholar] [CrossRef]

- Xue, Hao. 2024. Investors’ Information Acquisition and the Manager’s Value-Risk Tradeoff. Review of Accounting Studies. [Google Scholar] [CrossRef]

- Zhang, Cheng, Chunhong Yang, and Cheng Liu. 2021. Economic policy uncertainty and corporate risk-taking: Loss aversion or opportunity expectations. Pacific-Basin Finance Journal 69: 101640. [Google Scholar] [CrossRef]

| M&A Phase | Associated Risks | Mitigation Strategies |

|---|---|---|

| Acquisition Planning and Targeting | Operating risk: Managing a company outside the core business (DePamphilis 2018) Financial risk: Maintaining credit ratings (Hemrajani et al. 2023) Overpayment risk: Exceeding the economic value of the target (DePamphilis 2018) | Selecting targets similar to previous acquisitions (Welch et al. 2020) Increasing analyst coverage (Welch et al. 2020) Using representations and warranties (Even-Tov et al. 2022) |

| Deal Structuring and Closing | Overvaluation risk (Welch et al. 2020) Identification of post-merger risk factors (Welch et al. 2020) Information asymmetry (Daley et al. 2024) | Extending due diligence duration for higher deal prices (Daley et al. 2024) Integrating technological advances for better accuracy (Florackis et al. 2022; Gu et al. 2022) Implementing stringent cybersecurity measures (Florackis et al. 2022) |

| Post-Merger Performance and Control | Litigation risk: Disputes over performance measures (Huang et al. 2023) Market reaction risk: Over/undervaluation of synergies (Song et al. 2021) | Tighter performance controls (Dahlen et al. 2024) Reducing information asymmetry through cross-listing (Huang et al. 2023; Song et al. 2021) |

| Clusters | Key Terms | Main Theme |

|---|---|---|

| Cluster 1— (18 items) | corporate governance; performance; market; agency costs; ownership; debt; institutional investors; acquiring firms; free cash flow; capital structure; takeover; leverage; default risk; management; cross-section; equity; corporate social responsibility; reputation | Performance and Reputational risks |

| Cluster 2— (16 items) | mergers and acquisitions; information; valuation; information asymmetry; price; payment; choice; stock; takeovers; gains; specification; liquidity; uncertainty; exchange; selection; competition | Information Asymmetry risks |

| Cluster 3— (15 items) | investment; governance; firm performance; risk-taking; cost; ceo overconfidence; quality; earnings management; compensation; disclosure; costs; investor protection; directors; national culture | Investor Protection |

| Cluster 4— (9 items) | risk; returns; diversification; economic policy uncertainty; policy uncertainty; cross-border mergers and acquisitions; political risk; size; markets | Geopolitical risks |

| Geopolitical Risk | ||

|---|---|---|

| Definition | Geopolitical risks are threats from political instability and conflicts that affect government policies, investor confidence, and firm behaviors. | (Choi et al. 2022; Ott 2020; Shen et al. 2021) |

| Sources of risk | Weak regulation Political tensionsh Policy polarization | (Du and Zhang 2024; Paudyal et al. 2021) |

| Risk Effects | Valuation uncertainty Reduced M&A activity Information asymmetry Cross-border impact Higher equity costs Lower M&A competition | (Jeon et al. 2022; Makrychoriti and Pyrgiotakis 2024; Du and Zhang 2024; Shen et al. 2021; Ahsan et al. 2024; Paudyal et al. 2021; Balachandran et al. 2020) |

| Mitigation strategies | Geographical diversification through outbound M&As Cautionary financial policies and enhanced transparency Improved corporate governance and institutional investor involvement Enhanced ESG scores and focus on CSR initiatives | (Ahsan et al. 2024; Alam et al. 2024; Choi et al. 2022; Hoang et al. 2021; Jeon et al. 2022; Makrychoriti and Pyrgiotakis 2024; Paudyal et al. 2021; Shen et al. 2021) |

| Sources of Asymmetry | Definition |

|---|---|

| Infrastructural Organizations | Differences in information access due to the hierarchical distribution of employees, including directors, managers, and lower-level staff. |

| Dealership Chains | Potential for miscommunication and information discrepancies within dealership chains. |

| Agency Issues | Variations in information among agents, leading to systematic information asymmetry and adverse selection. |

| Electronic and Automated Trading | The use of electronic and automated trading tools can create imbalances in information availability and market fragmentation. |

| Political Factors | Uncertainty and decisions by political entities, such as central banks, can create information asymmetry premiums. |

| Temporal Heterogeneity | Variations in information asymmetry over time, influenced by intraday patterns and differing trading hours of various market participants. |

| Information Asymmetry Risks | ||

|---|---|---|

| Definition | Risks arise from disparities in information between stock market investors and firm managers, affecting transaction outcomes and integration | (Song et al. 2021; Huang and Xie 2023; Barbopoulos et al. 2020) |

| Sources of risk | Hierarchical structures Dealership chains Agency issues Electronic and automated trading Political fact Temporal heterogeneity | (Ranaldo and Somogyi 2021; Makrychoriti and Pyrgiotakis 2024; Swem 2022) |

| Risk Effects | Weakening alignment between market reactions and post-acquisition performance Increased likelihood of M&A engagement Higher excess returns Misvaluation of firms Risk aversion and cautionary management | (Buehlmaier and Zechner 2020; Ranaldo and Somogyi 2021; Welch et al. 2020; Li 2020) |

| Mitigation strategies | Robust corporate governance Comprehensive risk management plans Implement digital finance technologies (e.g., blockchain) Focus on disclosure-regulated markets Engage in CSR reporting | (Balachandran et al. 2020; Peng et al. 2024; Souissi et al. 2024; Liu et al. 2024; Hickman 2019) |

| Litigation Risks | ||

|---|---|---|

| Definition | Litigation risks refer to the potential for legal challenges a firm may face, including disputes arising from shareholder lawsuits, regulatory non-compliance, or contractual disagreements. | (Dahlen et al. 2024; Wang and Zhang 2024) |

| Sources of risk | Shareholder lawsuits Regulatory non-compliance Inadequate disclosures Earnings management in earnouts Political instability | (Huang et al. 2023; Dahlen et al. 2024; Du and Zhang 2024) |

| Risk Effects | Reduction in M&A volume Cautious and selective deal-making Downward adjustments in firm valuations Increased operational costs and reputational damage Risk aversion in managerial decision-making | (Imperatore et al. 2024; Huang et al. 2023; Dong and Doukas 2021) |

| Mitigation strategies | Accumulating substantial cash reserves Incorporating indemnity clauses Litigation risk insurance Enhancing enterprise risk management frameworks Engaging in CSR activities Strengthening corporate governance structures | (Klitzka et al. 2022; Wilson 2020; Even-Tov et al. 2022; Kuo et al. 2021) |

| Reputational Risks | ||

|---|---|---|

| Definition | Reputational risks are the potential negative impacts a company may face due to damage to its corporate reputation, which reflects stakeholders’ perceptions of its ethics, credibility, and adherence to corporate social responsibility and ESG criteria. | (Maung et al. 2020; D’Souza et al. 2024) |

| Sources of risk | Environmental and social incidents CSR and governance issues Lack of disclosure and transparency | (Vo et al. 2024; Balachandran et al. 2020; D’Souza et al. 2024; Bose et al. 2021; Boone and Uysal 2020) |

| Risk Effects | Reduced investment attractiveness Financial losses for acquirers Adverse investor reactions Preference for cash payments over stock Reduced corporate value | (Vo et al. 2024; Balachandran et al. 2020; D’Souza et al. 2024; Bose et al. 2021; Boone and Uysal 2020) |

| Mitigation strategies | Enhancing disclosure Leveraging dual holders Develop ESG strategies Improving financial reporting quality Pairing with targets with similar reputation CSR-focused culture | (Balachandran et al. 2020; Nguyen et al. 2023; Li et al. 2023; Ni 2020; Maung et al. 2020; Boone and Uysal 2020) |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

García-Nieto, M.; Bueno-Rodríguez, V.; Ramón-Jerónimo, J.M.; Flórez-López, R. Trends and Risks in Mergers and Acquisitions: A Review. Risks 2024, 12, 143. https://doi.org/10.3390/risks12090143

García-Nieto M, Bueno-Rodríguez V, Ramón-Jerónimo JM, Flórez-López R. Trends and Risks in Mergers and Acquisitions: A Review. Risks. 2024; 12(9):143. https://doi.org/10.3390/risks12090143

Chicago/Turabian StyleGarcía-Nieto, Manuel, Vicente Bueno-Rodríguez, Juan Manuel Ramón-Jerónimo, and Raquel Flórez-López. 2024. "Trends and Risks in Mergers and Acquisitions: A Review" Risks 12, no. 9: 143. https://doi.org/10.3390/risks12090143

APA StyleGarcía-Nieto, M., Bueno-Rodríguez, V., Ramón-Jerónimo, J. M., & Flórez-López, R. (2024). Trends and Risks in Mergers and Acquisitions: A Review. Risks, 12(9), 143. https://doi.org/10.3390/risks12090143