Abstract

Climate risk is the negative effect of climate change on several aspects of the environment, business, and society. There are two categories of climate risks: physical risks include direct impacts due to extreme events and chronic changes due to climate modifications that have become commonplace; the transition risk arises from the economic and regulatory adjustments required to shift toward reducing greenhouse gas emissions and the transition to renewable energy. The problem, in financial terms, is the correct assessment and quantification of transition risk, as it is not univocal in the literature. This research aims to provide a literature review on transition risk that permits filling this gap and identifying the proxies used for its representation and evaluation. Moreover, the analysis considers the critical aspect of the connection between transition and credit risk, as firms exposed to high transition risks may face challenges in maintaining creditworthiness. Results highlight the most commonly used proxies, including carbon pricing, CO2 or GHG emissions, and metrics from various databases. However, the findings emphasize the importance of integrating these indicators with broader factors, such as a company’s negative environmental impacts (e.g., waste production and water usage) and delays in technological adaptation from a forward-looking perspective.

1. Introduction

Climate risk refers to the potential financial, social, and environmental damage resulting from climate change, which ranges from acute hazards like extreme weather events to gradual changes such as rising sea levels at transition risk (; ; ; ; ). There are several opportunities related to climate change, including introducing resource efficiency that permits cost savings, adopting green energy sources, developing new products and services, gaining access to new markets, and enhancing supply chain resilience. However, to take advantage of these opportunities, it is necessary to have well-defined categories of climate risks and what is included within them (; ; ; ). The physical risk represents the economic and financial losses caused by the frequency and severity of climate-related extreme events and their long-term effects. The first events are, for example, cyclones, cold or heat waves, or cyclones, and they are defined as acute physical risks. The second category is chronic physical risks (; ). Physical risks have after-effects on organizations, indirectly through the interruption of the supply chain and directly through the value of the assets.

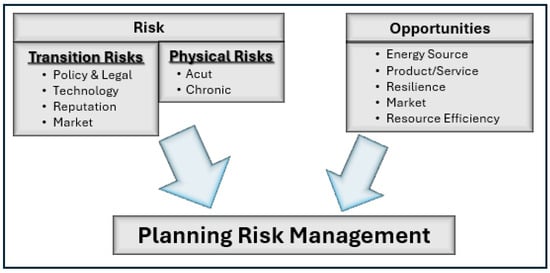

Transition risk for an organization is associated with changes aimed at reducing greenhouse gas emissions and switching to renewable energy sources. The transition is driven by political, legal, technological, and market changes necessary to address the mitigation and adaptation requirements related to the mutations resulting from climate change (see Figure 1).

Figure 1.

Classification of climate-related risks. Source: Elaboration of figure ().

Policy and legal risk (the first of the classifications) continuously evolve. Their targets are divided into two categories: the action policy to push adaptation to climate change and the action that would limit the adverse effects of climate change. Examples include implementing sustainable and efficient practices, transitioning to renewable energy, conscious water use, and a cap-trade of carbon price mechanism that reduces greenhouse gas emissions. Instead, legal risk has increased due to climate litigation demands from various institutions, public interest organizations, and property owners. The failure of organizations causes them to soften and resign themselves to the impact of climate change and poor disclosure of material financial risks rather than change to achieve goals. Technological risk (the second of the classification) is the basis of innovations that support the transition to a neutral carbon economy. As a result of new technologies, old systems are being replaced with clean energy, energy efficiency, battery storage, and carbon capture and storage. These improvements positively impact competitiveness, productivity, production, and distribution, thus influencing the sales of goods and services. Reputation risk (the third of the classification) is relative to customers’ perceptions of the changing behavior of the companies versus the transition to reduce greenhouse gas emissions.

Last but not least, there is the market risk. The markets can react in several ways, but one of the most important is the change in supply and demand for certain raw materials, products, and services, as they are closely related to climate-related risks.

In summary, the transition to a low-carbon economy is a complex challenge that involves technological, economic, social, and political aspects. However, it is an unavoidable challenge to ensure a sustainable future and limit the damage caused by climate change, making it one of the crucial issues of our time.

It is a major concern for businesses, investors, and policymakers, as climate-related threats can significantly affect asset valuations, operational stability, and overall economic resilience (; ; ; ; ; ; ; ). According to an ECB study (), climate risk factors are exposed in specific European financial intermediaries. Regarding physical risk, the banking system’s credit exposures to companies identified as high-risk are highly concentrated, held by only 25 banks. They are large, with total assets ranging from 68 to 2355 billion euros. However, they are well diversified between types of activity and geographical areas and have additional capital reserves as they belong to the categories of global banks or systemically important banks. Concerning the transition risk, the bank’s loan exposition of the Climate Policy Relevant Sectors (CPRS) () amounts to circa half of total loans to non-financial corporations. In particular, over two-thirds are owned by real estate exposure, followed by the energy-intensive industry.

Understanding these risks is crucial for crafting effective mitigation strategies and enhancing adaptive capacities in a rapidly evolving environment.

These risks can lead to significant financial implications, including increased operational costs, stranded assets, and reputational challenges, particularly for high-emission industries. As climate change accelerates, effective risk assessment and management becomes paramount. Organizations are increasingly leveraging data-driven approaches to evaluate their exposure to climate-related hazards, helping to prioritize risks and allocate resources more efficiently. In particular, the exposition of the banks to climate-related risk can be direct and/or indirect. In the first case, for example, when an extreme climate event causes the interruption of financial services, and in the second case, the possibility that the bank’s borrowers or the counterparty may not fulfill their obligations as agreed. Basel Committee on Banking Supervision defines the potential effects of climate risk drivers and, in particular, affirms that “Credit risk increases if climate risk drivers reduce borrowers’ ability to repay and service debt (income effect) or banks’ ability to fully recover the value of a loan in the event of default (wealth effect)” (Cfr. ). In light of this, it is necessary to implement research with more granular data that would assess the impact of transmission channels on firms, households, and sovereigns for specific types of products. Moreover, the interplay between climate risk and economic stability () underscores the necessity of addressing these challenges to safeguard financial systems and promote sustainable growth. While the risks associated with climate change pose formidable challenges, they also present opportunities for innovation and market leadership. Companies actively engaging in sustainability initiatives are better positioned to enhance their reputation and gain market competitive advantages.

The ongoing dialogue around climate risk highlights the urgency of integrated policy frameworks and adaptive strategies to navigate the complexities of a transitioning economy, ultimately aiming for resilience in the face of escalating climate challenges.

Through a literature review, this research aims to identify the best proxy for assessing transition risk, which allows us to quantify the transition risk of a country or a company. Some studies highlight how the literature is not univocal in identifying the most appropriate proxy for assessing transition risk. For example, () underline the complexity of quantifying transition risk and the lack of consensus on which proxies to use. We also consider all this concerning credit risk. Interest in the link between transition risk and credit risk has increased in parallel with the growth of climate regulation and pressure from investors and central banks. Bodies such as the Task Force on Climate-related Financial Disclosures (TCFD) and central banks, through the Network for Greening the Financial System (NGFS), have started to require financial institutions to consider the impact of climate change, including transitions to low-carbon technologies, in their credit risk assessments. This shift has attracted broader academic and economic attention, but this phenomenon has become more evident since 2020. This paper is the first step of research that will allow us to build a corporate resilience score that could, subsequently, allow us to make a more complete and dynamic indicator of transition risk. The final goal is to assess how corporate resilience scores and geopolitical risks influence a bank’s credit risk. For the analysis, the provider used is Scopus by Elsevier. Through two different queries that combined the words “transition risk” and “credit risk”, we obtained the articles highlighting which proxies are used for transition risk and the connection between transition risk and credit risk.

This research offers several relevant contributions both in the academic and practical fields. First, the work represents an important synthesis of the existing literature on transition risk, highlighting the lack of consensus on which proxies are most effective in representing it. Through a systematic analysis based on two queries in the Scopus database, the study identifies the most used metrics, such as greenhouse gas (GHG) emissions, carbon prices, and indicators provided by specialized databases (e.g., Refinitiv and Sustainalytics). This approach provides a comprehensive overview of the methodologies employed to quantify transition risk and their strengths and weaknesses.

A second relevant contribution is the attention to the link between transition risk and credit risk. The work highlights how firms exposed to high transition risks may face difficulties in maintaining their creditworthiness, a topic of growing interest for financial institutions and policymakers. In particular, the study highlights how the banking sector is exposed directly, through its investments, and indirectly, through the financial risks associated with its customers. This aspect is fundamental to understanding how climate risks can affect financial stability at a systemic level.

Finally, the paper lays the foundation for developing a dynamic framework for assessing transition risk. The final objective of the research is to build a corporate resilience indicator that allows the assessment of the exposure of companies and countries to this risk more comprehensively and dynamically. This multidimensional approach, integrating environmental, economic, and technological indicators, can support strategic decisions at both the corporate and political levels, promoting sustainability and financial stability. Furthermore, the study highlights the need to develop analytical tools that consider regional and sectoral differences, paving the way for future research on a larger scale.

2. Methodology Used

We used “Scopus” by Elsevier Editor as a search provider for this analysis.

The reasons that pushed us towards this direction are several: (a) most of the publications in the field of accounting, management, and economics have been archived in Scopus (; ); (b) in terms of accuracy and coverage, Scopus performs better than other search engines such as PubMed, Web of Science, and Google Scholar (; ). The Scopus database combined the characterizing elements of two different databases, PubMed and Web of Science. These joint features are more useful for academic needs (citation analysis). Furthermore, it was chosen because it offers different types of searches: basic, by author, advanced, and by source. Already, from the basic search for the results, it is possible to make numerous customizations being limited by the publication date, the addition to Scopus, the type of document, and the thematic areas, while the author search is based only on the names of the authors. The advanced search screen allows you to perform complex search queries by entering multiple search terms that you can link together using Boolean operators (AND, OR, NOT). “AND” allows you to connect two or more words. In this way, the database will return in response to all the indexed documents containing all the words entered, not just one of them considered individually. “OR” is used when the search focuses on several terms, and it is unnecessary to include all of them but only one. The database will, therefore, return documents that contain both terms and only one of them.

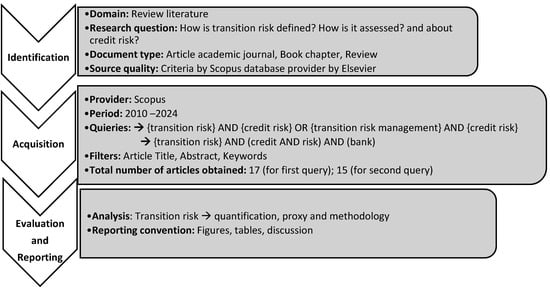

Moreover, the provider offers two principal phrase-searching options: the exact phrase, in which the words are included in curly brackets and requires that the terms are next to each other, without spaces, punctuation, or truncation, and find exactly the words, or the loose phrase, in which the words must be in the same field in quotation marks. In this case, the research includes the plural of the words, the single word, and eventually the truncated words. Moreover, we delimited the timeframe between 2010 and 2024 because, only during the first decade of the 2000s, the topic became a central theme for the financial sector when the Stern report (The Economics of Climate Change) () highlighted the economic costs of inertia against climate change, introducing a quantitative perspective on climate risk. In 2015, the Paris Agreement consolidated climate risk as a theme that took on global significance until 2019 and 2020, when the European Union introduced more stringent regulations on sustainability, such as the Taxonomy Regulation and the Disclosures Regulation. These regulations requiring financial institutions and firms to assess and disclose climate change risks, including transition and physical risks, have attracted increasing attention from researchers. Figure 2 shows the work divided into three steps: identification, acquisition, evaluation, and reporting.

Figure 2.

The step of the analysis.

The figure permits a clear representation of each step. In the “Identification” phase, the focus is on the literature regarding transition risk to understand how it is defined and assessed, including credit risk. The documents considered are academic articles, book chapters, and review articles, chosen according to the quality criteria of Elsevier’s Scopus database. In the “Acquisition” phase, the provider is defined, and the research is conducted through Scopus for 2010–2024, using a query combining terms related to transition risk, credit risk, and bank.

Query development for literature reviews is based on well-established methodologies in academic research, particularly in Systematic Literature Reviews (SLR) and Scoping Reviews (; ; ; ). In general, query construction follows some fundamental principles: use of Boolean operators (AND, OR, NOT) to combine key concepts and balance breadth and relevance; careful choice of keywords based on an exploratory phase of the literature to identify the most used terms in the main studies; iteration and progressive refinement, testing different combinations of words and analyzing the results to avoid both dispersion and excessive restriction; and finally query stratification, as in our case, to distinguish between a general search on the topic and one more focused on a specific sub-sector (in this case, the banking sector). The low degree of overlap between queries is not necessarily a problem but rather a reflection of the specialization of the topic. The first query is more general and collects contributions on transition and credit risk in different contexts, while the second is more targeted to the banking sector, excluding studies that deal with credit risk in other contexts. This approach is consistent with SLR methodologies, where multiple queries are used to obtain a comprehensive view of the phenomenon without precluding relevance and specificity.

We implemented two different queries:

- (a)

- First, in the box of “Search within” were selected “Article title, Abstract, Keywords”, while in the box of “Search document” were inserted the words “{transition risk} AND {credit risk} OR {transition risk management} AND {credit risk}”; these were implemented on 18 October 2024.

- (b)

- In the second section, “Search within,” we selected “Article title, Abstract, Keywords”, while in the box of “Search document,” we added the “{transition risk} AND (credit AND risk) AND (bank)”; these were implemented on 7 November 2024.

The two queries respond to specific methodological and analytical needs to explore transition risk with credit risk and the banking system.

The first query was designed to identify studies directly addressing the link between transition and credit risk without sectoral or contextual limitations. This methodological choice allows the collect a broad and general overview of the articles that discuss transition risk about credit risk, regardless of the context (e.g., industrial, geographic, or financial); furthermore, it allows the exploration of different interpretations and methodologies used in the literature to quantify and represent transition risk. Finally, it identifies the most commonly adopted metrics to assess transition risk, such as greenhouse gas (GHG) emissions, carbon price, and other specific indicators. This query is particularly useful to obtain an overview of the research field, including theoretical and practical articles that contribute to the general understanding of the relationship between the two risks. The second query, instead, was formulated to focus the analysis on a more specific context: the banking sector. This approach allows us to analyze the impact of transition risk on banks, which represent a crucial actor in the global financial system and are directly exposed to climate risks through their credit portfolios, focusing the analysis on data relevant to the banking system, excluding documents that deal with credit risk in contexts less pertinent to our research objective.

The choice to modify the query was not random but derived from the desire to restrict the first to studies that specifically and explicitly deal with “credit risk” as a consolidated and well-defined concept. The second broader query allows studies that use more varied terminologies (e.g., “risk associated with credit” or “credit-related risk”) to be included. Adding the term “bank” makes the second query more targeted to the banking sector.

Since credit risk in the banking context can be described differently, using (credit AND risk) allows the interception of more relevant studies that could otherwise be excluded. In conclusion, we can state that the modification of the second query is justified by the need to have a more inclusive search for the banking sector, overcome any limitations in the terminology of the articles, and refine the results for the specific objective that is, the link between transition risk and credit risk in the banking sector.

This balanced approach covers the general and the sectoral dimensions, ensuring a deep and targeted understanding of the research topic.

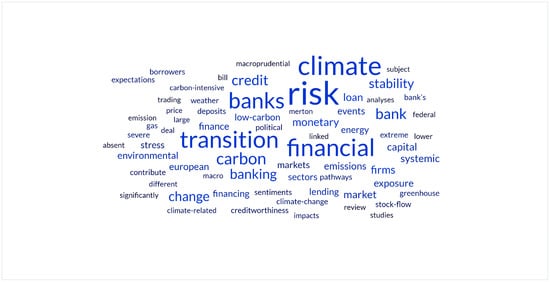

The selection of articles was filtered based on title, abstract, and keywords, resulting in 17 relevant articles for the first query and 15 for the second. Figure 3 shows the keywords cloud of the study papers in this literature. The first step was to read all the documents obtained, and then we classified them according to the proxy used to identify the transition risk (). We opted for this methodology to acquire a clearer overview of the different approaches to quantifying the transition risk that is not univocal in the literature. The papers were then classified using a thematic coding system to group the results into three key macro categories: greenhouse gas emissions, carbon price, and other proxies.

Figure 3.

Keywords cloud.

Finally, in the “Evaluation and Reporting” phase, the analysis focuses on quantifying transition risk, the estimation methods, and the methodologies used, with the results presented through figures, tables, and discussions.

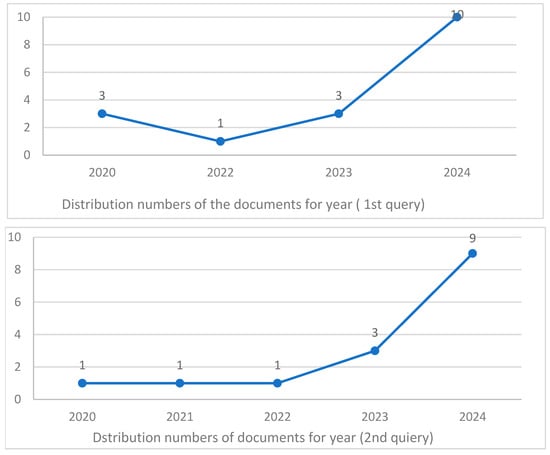

By analyzing them, we can see the topics that have developed in the last few years (Figure 4). The connection between transition and credit risk is a rather new study area. Initial studies in sustainability and finance focused on more general aspects of environmental risk management. At the same time, only recently has a deep exploration of how risks arising from the energy transition may affect financial markets, particularly credit risk (i.e., the likelihood that a debtor will default on its obligations due to transition-related pressures).

Figure 4.

Distribution numbers of the documents for years.

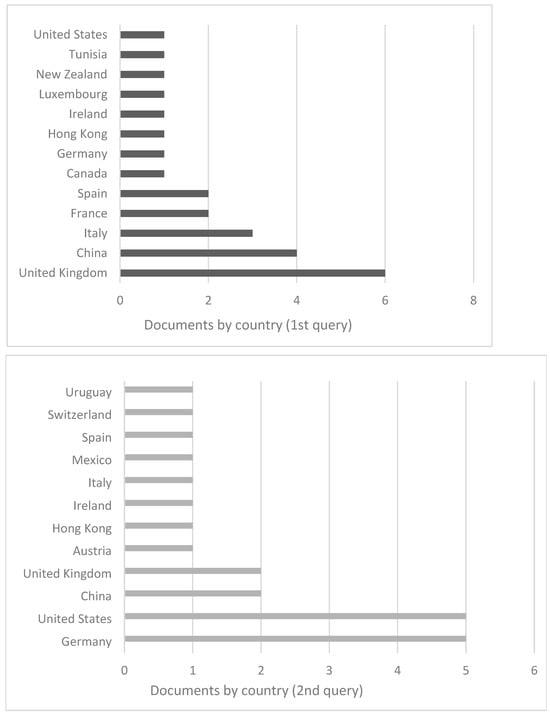

Figure 5 shows that the top works on the topic are written by authors whose institutional affiliations are in the United Kingdom, followed by China and Italy for the first query and Germany and the United States for the second.

Figure 5.

Geographical distribution of the articles.

This evidence can be explained by several factors related to national policies, regulations, academic dynamics, and economic interests. The UK has long been a global leader in the financial sector and in efforts to integrate sustainability and climate risks into financial management. London is one of the world’s leading financial centers, and many pioneering initiatives on sustainable finance and climate risk disclosure originate here. For example, the UK authorities strongly support the Force on Climate-related Financial Disclosures (TCFD), which is aimed at promoting transparency of climate risks, making climate risk disclosure a requirement for many companies and financial institutions. Many UK universities, such as the University of Oxford, the London School of Economics (LSE), and Imperial College, have developed advanced research programs in finance and climate, creating a favorable environment for developing studies on transition and credit risks. The Bank of England was among the first central banks to consider climate risks a systemic financial stability risk. This has increased attention to academic research and support for scientific studies. China is the world’s largest emitter of CO2 but is also one of the largest investors in renewable energy and clean technologies. China seeks to accelerate the transition to cleaner energy sources, reducing its reliance on coal (, ). This commitment requires a profound economic transformation and carries financial risks for traditional businesses and sectors. Besides, the Chinese government has formally committed to achieving carbon neutrality by 2060. This has stimulated a strong push in academia and industry to study and manage transition risks. Italy stands out for its commitment to sustainable finance and attention to transition risk issues, thanks to the growing awareness of climate risks and its economy based on sectors particularly vulnerable to climate change and energy transitions. Bank of Italy and other financial institutions have started integrating climate risk into their risk assessments. The Bank of Italy is also an active member of the Network for Greening the Financial System (NGFS). This international group promotes the management of financial risks related to climate change. Italy also has an economy with strong ties to energy-intensive sectors, such as manufacturing and agriculture, which could be significantly affected by the energy transition. This has prompted Italian academia and industry to study how such risks could affect credit risk and economic stability.

The change highlighted in the second graph instead shows the differences in the economic and academic context of the two countries. The United States and Germany have complex and very influential banking systems, with a strong interest in credit risk management. In the United States, the banking system is highly developed and includes large investment and commercial banks that play a crucial role in the global economy. Similarly, Germany has a significant European banking sector, with a strong presence of local and cooperative banks and large institutions such as Deutsche Bank. As for the academic focus, credit risk is a priority research topic in both countries, particularly due to past financial crises (such as the one in 2008) and banking regulation regulations (such as Basel III). Germany and the United States have universities and research institutes that invest heavily in studying credit risk, especially concerning banks, to prevent future systemic risks.

Regarding the subject areas Scopus uses, it maps global interdisciplinary scientific information, covering the macro area of science, technology, medicine, social sciences, arts, and humanity. The classification is performed by internal experts when the serial titles are imported for Scopus coverage. Moreover, the classification is based on the objectives, the scope of the title, and the content it publishes. This means that Scopus directly provides the subject areas of membership.

The subject areas of several papers are the same for the two queries, with similar rates percent. About 50% of the works were developed in the economic, financial, and econometric fields, 26% fall within business, management, and accounting, and 7–8% are concerned with environmental sciences. The only area that assumed a different weight in the two queries is decision science, which assumes a greater weight, especially in the works that concern bank credit risk.

3. Discussion of the Results

The main research question of your study focuses on identifying the best proxies to assess transition risk and the link between transition risk and credit risk, focusing on the banking sector. This objective is well supported by the conducted analysis and the discussions presented in the paper.

The literature review performed through the two queries identified the most commonly used proxies to represent transition risk, including:

- Greenhouse gas emissions (GHG) are recognized as a universal metric that classifies companies into “green” and “brown,” and they are key indicators for quantifying transition risk.

- Carbon price is used to measure the economic impact of climate policies and as a tool to incentivize emissions reduction.

- Indicators from specialized databases, such as Refinitiv and Sustainalytics, offer structured transition risk assessments.

These results directly address the research question, providing a basis for developing more standardized and dynamic tools for assessing transition risk.

Moreover, the paper highlights how transition risk impacts the ability of firms to maintain their creditworthiness directly and indirectly. Directly, financial institutions are exposed through credit portfolios, significantly impacting the default rates of the most vulnerable clients to regulatory and market pressures related to the transition; indirectly, through the deterioration of the economic conditions of firms exposed to transition risk, which can negatively impact their balance sheets and their repayment capacity.

These links demonstrate how transition risk is not only an environmental challenge but also a determinant of financial stability, thus answering the part of the research question related to the link between the two risks.

The second query, focused on the banking sector, offers a detailed analysis of the strategies adopted by banks to manage transition risk. The discussions highlight the increasing use of climate stress tests to assess banks’ resilience; tools such as carbon pricing are important to guide credit decisions; and the regional and sectoral differences in transition risk exposure require tailored approaches for effective management.

Although the queries may appear very similar, the degree of overlap is very low; only 2 out of 32 articles (; ). This indicates that they extract distinct sets of articles with very little intersection.

The low overlap between the results can be attributed to several methodological and content factors.

First, the syntax differences between the two queries influenced the results obtained. In the first query, the term “credit risk” was placed in curly brackets {credit risk}, requiring the two terms to appear in exactly that sequence. This narrowed the search to articles using this precise wording. In the second query, instead, the terms “credit” and “risk” were separated by the Boolean operator AND within round brackets (credit AND risk). This broadened the results, including studies in which the two terms appear, although not necessarily as a single expression. However, introducing the term “bank” introduced a restriction, excluding articles that dealt with the relationship between transition risk and credit risk without an explicit reference to the banking sector.

A second relevant element is that the first query was designed to identify studies that analyze the link between transition risk and credit risk in a general context without sectoral limitations. The second query, instead, restricted the field of investigation to the banking sector, automatically excluding studies that examined the relationship between these two risks in other contexts, such as the industrial, energy, or insurance sectors. This methodological choice inevitably reduced the overlap between the two lists of results.

A further factor concerns the sources and methods used in the selected studies. The first query has identified articles with a theoretical or macroeconomic approach, while the second has privileged studies using specific banking data. Furthermore, the different disciplinary scopes of the publications may have had an impact: some articles on energy transition and credit risk may have been published in general economics journals without being explicitly labeled as banking studies and, therefore, excluded from the second query.

Finally, the dynamics of editorial classification and keywords play a significant role. Articles published in the financial or banking field may not have included “transition risk” among the keywords or in the title, excluding them from the first query, while their presence in sector journals facilitated their selection in the second query.

In conclusion, the low overlap between the two queries is not an anomaly but the result of structural differences in the formulation of the searches, the disciplinary and methodological coverage of the identified studies, and the classification criteria of academic publications. This evidence underlines the importance of an integrated approach in the literature review, combining different search strategies to obtain a more complete view of the phenomenon analyzed.

This paragraph shows the results of the two research queries. After the readers of all papers, they are classified based on the variable that represents and quantifies the transition risk.

3.1. The First Query

Table 1 contains the result of the first query. This query allows us to obtain the papers that exactly present the words “transition risk” and “credit risk” in the title, abstract, or keywords. Thus, the results highlight the studies specifically addressing the impact and assessment of transition risk on credit risk. The provider supplied 17 papers, and after reading them, we deleted that of () because, despite the keyword considered relevant to the sample, it concerns physical risks that we do not consider for this work. As we have already highlighted, most papers (10) are from 2024, and the oldest is from 2020. The documents can be divided into three typologies: those that used greenhouse gas emissions (GHG) or carbon dioxide emissions (CO2), the carbon allowance price, and, at the end, those that used the indicators supplied by different providers such as Refinitiv or Sustainalytics. The carbon allowance price or EU Emissions Trading System is an instrument to reduce the GHG. If a company reduces emissions and does not use all its permits, it can sell the excess to other companies needing them (). In this way, the market rewards companies that commit to reducing emissions and penalizes those who persist in polluting behaviors with large amounts of greenhouse gases.

Table 1.

Summary table of the Scopus’ results of the first query.

3.1.1. The Greenhouse Gas Emissions

The literature reviewed contributes significantly to understanding transition risk, highlighting how greenhouse gas (GHG) emissions represent a key proxy to quantifying and modeling such risk concerning financial sustainability. Greenhouse gases, responsible for global warming, include several gases, such as carbon dioxide (CO2), methane (CH4), and nitrous oxide (N2O), which can retain heat in the atmosphere. Through GHG, it is possible to assess the climate impact of a company and its transition risk, which is associated with the costs and changes necessary to adapt to a low-carbon society. The transition risk directly impacts companies’ credit risk and sustainability (). () highlight the importance of GHGs in the classification of companies into “green” and “brown”, demonstrating how this distinction directly affects credit ratings. The proposed methodology that integrates a structural credit risk model with an emissions analysis provides a valid tool to quantify transition risk and its impact on corporate financial health. This work is complemented by (), who use emissions as a variable to simulate the effect of transition risk in the European electricity sector. ’s () contribution extends this perspective by directly linking firms’ operational performance to their adaptation capabilities to a decarbonized economy and effectively integrating financial and environmental implications, providing a basis for further empirical analysis.

Moving to another geographical context, such as China, () explore rural institutions, highlighting how GHGs, along with other environmental indicators such as PM2.5 concentration, can be used to analyze credit risk in a specific context. Although the approaches of Leaton and Wang et al. are geographically and methodologically distinct, the common thread remains the use of GHGs as a proxy to understand the impact of transition risk on various sectors and areas. Finally, () and (), offer complementary perspectives, linking transition risk to technological evolution and digitalization.

The analysis has clear points of convergence: greenhouse gas emissions as a universal proxy, the diversity of application contests, the implication for credit rating, and the use of integrated empirical models. Greenhouse gas emissions are proposed as a cross-cutting variable, capturing both the environmental and financial consequences of transition risk across sectors and geographical areas and highlighting the direct relationship between environmental performance and financial stability.

3.1.2. The Carbon Price

The Emissions Trading System (ETS) or carbon quota is an environmental policy tool to reduce greenhouse gas (GHG) emissions efficiently and economically sustainably. Based on a market mechanism, a maximum limit of pollutants to be released into the environment is established, and “permits” are distributed to participating companies, each representing a ton of CO2 equivalent. Companies that reduce emissions can sell excess permits as “credits,” generating revenue and thus an economic incentive to limit pollution. The European Union ETS is one of the largest trading systems in the world. The price of permits varies according to supply and demand, thus reflecting the actual cost of emissions and incentivizing companies to reduce pollution as costs increase (; ). The flexibility of these systems, combined with the possibility of carbon offsetting through projects such as reforestation, has made ETSs an effective tool for guiding the transition to a low-carbon economy. A work previously cited by () used as a second proxy of the transition risk, the carbon allowances that allowed carbon dioxide into the atmosphere. The paper contributes to capturing the impact of transition risk +on the credit risk of European companies, which is divided into green and brown. These categories are based on the GHG emissions, particularly Scope 1 and 2, normalized by revenues. In detail, the Scope 1 emissions are direct emissions from sources owned or controlled by the company, such as the combustion of fuels in company vehicles or machinery, while the Scope 2 emissions are the indirect emissions from energy developed and consumed by the company, such as electricity, heating or cooling supplied by an external supplier.

In summary, Scope 1 represents emissions generated directly, while Scope 2 includes indirect emissions related to energy purchases. This perspective is reinforced (), using three climate scenarios from the Network for Greening the Financial System, highlighting that the increase in carbon price leads to an increase in operating costs and a reduction in profits. Hence, companies’ default probability increases, together with the level of bank credit risk. A further connection emerges from the works focused on China. () and () show how introducing Chinese ETS markets has significant but differentiated effects on the banking system and firms. () highlight a short-term impact on the returns of domestic mixed-capital banks, with a subsequent improvement in profitability thanks to the integration of climate risk in credit management. () highlight how regions with high scores in the low-carbon economic transition index suffer higher costs, aggravating the credit risk for carbon-intensive firms. () affirm that the companies’ solvency sustains a deterioration caused by two factors: coercive regulations on the reduction in carbon emission that increase the investment and operative costs, and the direct costs of the higher carbon price that reduce their ability to repay the obligations. This is complementary to the work of (), who used several variables and proxies to analyze the transition risk associated with climate change. In particular, the document introduces an approach that, through the ETS price, verifies companies’ exposure to the cost of compliance with climate regulations and the adoption of competitive products and services for the long-term goal of low carbon emissions. It also allows us to evaluate the company’s ability to repay bonds through their revenues, especially in those sectors with high carbon intensity. Also, for these aspects, the literature converges on some key themes: using ETS as a proxy for transition risk, the impact on operating costs and profitability, the regional and sectoral differences, and the integration of climate risk in credit management. Although initially costly, introducing ETS markets can incentivize banks and companies to integrate climate risk into their financial strategies, improving long-term profitability. It is possible to affirm that the ETS is a tool for reducing GHG emissions and represents an effective proxy for assessing transition risk and its impact on financial stability. Using emissions as key variables allows companies to be classified based on their exposure and resilience, providing a solid basis for credit risk analysis and developing mitigation strategies.

3.1.3. Other Proxies of the Transition Risk

Contrary to previous literature, () affirm that investors’ expectation regarding the transition versus net zero carbon emissions is in the medium-to-long term. Following the classification of the firms made by (), the database is composed of 56 European firms from 12 countries that are divided into 28 “polluting” and 28 “clean” from 2013 to 2019. () extended the literature on the climate stress test, showing the credit risk assessments; in particular, they used the NGFS scenario stress test methodology and the ZRE credit-factor portfolio approach. In comparison, () and () use the transition risk data supply by several sources such as Renifitiv or Moody’s Default and Recovery Database (DRD) and published Moody’s data, Standard and Poor (S&P) transition data via S&P Credit Pro, and Fitch’s transition data. These databases are a key resource for analyzing transition risk globally, allowing comparisons of risk metrics across jurisdictions and sectors. Integrating these sources into credit risk models allows for a more detailed and empirically based analysis. This literature highlights two fundamental factors: the importance of the availability of global databases and advanced tools, a broader temporal perspective that can improve the understanding and management of this risk, and the importance of clear metrics to identify companies most exposed to transition risk.

3.2. The Second Query

In the second query of our analysis, the word “bank” has also been included to make it even more detailed, recalling that this paper represents the first step of a project to build a resilience score that can consider the exposure to climate risks of borrowers to perceive the direct and indirect effects. Therefore, the results are concentrated on the banking sector. The results show that the literature on climate transition risks is recent, highlighting 16 papers from the 2020–2024 timeframe (Table 2). It offers a detailed and complex picture of these risks’ impact on the banking system and financial stability at a global level, highlighting how banks are adapting their strategies to manage these new challenges.

Table 2.

Summary table of the Scopus’ results of the second query.

() show a general macroeconomic model that explores the effectiveness of sectoral capital requirements in mitigating transition risk, highlighting that, although useful in combination with carbon taxes, such instruments may compromise financial stability without complementary fiscal policies. () show that carbon pricing policies significantly and negatively affect credit terms for emission-intensive firms, with stronger effects for private firms, highlighting the rapid responsiveness of banks to transition risks and the increasing role of shadow banks through the reallocation of loans. This transfer of exposure to shadow banks allows traditional banks to reduce the risk associated with carbon pricing regulations. Still, since they are not subject to the same regulatory requirements as the latter, it could increase systemic risk. () and () focus on the crucial role of climate stress in measuring the banking sector’s resilience to transition risks. While Schult et al. quantify the impacts of a carbon tax on the default risk and capital ratios of European banks, Milkau introduces a methodological approach to distinguish between extreme climate events linked to climate change and “normal” ones. This study highlights how political uncertainty and the lack of social consensus can amplify transition risks, requiring sophisticated models to assess expected losses and mitigate systemic risks. () are on the same wavelength we analyzed in the first query’s results. They analyze the heterogeneous responses of Chinese banks to climate risks, demonstrating that hydrological disasters and the launch of the carbon emissions market directly influence bank returns. Other contributions, such as (), show how it is a determinant for deposit flows and credit provision in areas more exposed to climate risk. () and () analyze the effect of risk transition on the syndicated loan. () analyze data on a global geographical scope and argue that syndicated lending banks have adopted and adapted their lending policy in response to climate transition risk since the 2015 Paris Agreement. The results show a heterogeneous behavior, suggesting that the effectiveness of climate policies strongly depends on the institutional and geographical context. The authors also highlight a further criticality in separating the effects of transition risk from other economic and political factors. At the same time, () analyze emerging markets and examine how banks’ transition risk influences their lending decisions. The study shows that eco-friendly banks (defined as “green banks”) apply higher spreads to so-called “brown companies”, which are therefore more polluting, compared to non-green banks, thus adopting diversified climate risk management policies. Finally, (), using a consistent stock flow to examine the role of fiscal and banking policies in supporting an orderly transition, affirm the need for redistributive policies to mitigate negative effects on financial stability and household balance sheets. Moreover Baldassarri Höger von () improve this perspective by examining how carbon taxation scenarios can affect firms’ financial soundness in global banking systems, highlighting the most vulnerable sectors.

We must first underline that we excluded three papers from the results as they are not consistent with the direct analysis of transition risks for banks. In detail, (), while addressing relevant issues such as dual materiality and joint modeling of physical and transition risks, mainly serve as an introduction to a Special Issue without providing original empirical or modeling analysis. In the same way, () and () propose a theoretical framework for the “Monetary Architecture” to finance the green transition but do not directly address the implications for the banking sector, focusing instead on systemic and procedural aspects of transition financing. While relevant to understanding the broader context, these works do not specifically contribute to the debate on banking transition risks and have been excluded from the main analysis. Critically, these studies show a fragmented but converging landscape: the need for an integrated and multidimensional approach to understand and manage transition risks in the banking sector, balancing environmental sustainability objectives with financial stability and economic growth.

4. Implication and Limitations

This research has relevant implications in both academic and operational fields. From a theoretical point of view, the work significantly contributes to understanding transition risk, which is still an evolving area of study. By identifying the most widely used metrics, such as greenhouse gas (GHG) emissions and carbon prices, the paper lays the foundation for a systematic and standardized assessment and quantification of transition risk. Furthermore, the possibility and willingness to integrate complementary indicators, such as negative environmental impacts (e.g., waste generation and water use) and delays in technological adoption, highlight the need for a holistic approach that also considers qualitative and prospective factors. This multidimensional approach can support the development of more accurate predictive models that are useful for assessing the exposure of companies and economic sectors to the risks associated with the transition to a low-carbon economy. At a practical level, the results can directly interest financial institutions, investors, and policymakers. Identifying and quantifying transition risk is crucial for improving the financial system’s resilience and promoting sustainable economic growth. For example, banks must integrate transition risk into their credit risk management; therefore, the proposed indicators can help enhance the assessment of their customers’ repayment capabilities. Similarly, policymakers can use these results to develop more targeted regulations that incentivize the energy transition without compromising economic stability.

However, the work has some limitations that offer suggestions for future research. First, relying on specific proxies, such as carbon price or greenhouse gas emissions, may not adequately capture the transition risk’s complexity and multidimensional nature, especially in diversified regional or sectoral contexts. For example, agriculture or heavy industry sectors may respond differently to regulatory and market pressures than service sectors, resulting in inequalities (with transition costs falling disproportionately on the most vulnerable groups). Second, the scarcity of granular and longitudinal data presents a challenge for the empirical validation of the proposed models. The lack of a univocal consensus in the literature on the best indicators to represent transition risk further limits the comparability of the results.

5. Conclusions

Through two queries on the Scopus database, this study has analyzed the literature on transition risk related to climate change, highlighting its significant impact on economic and financial sectors, with particular attention to their interaction with credit risk.

We formulated these two queries with a precise methodological goal: to explore the link between transition risk and credit risk, first in a general sense and then with a specific focus on the banking sector. The choice of the two queries was driven by the need to obtain a comprehensive overview of the literature on transition risk applied to credit risk while ensuring targeted sector segmentation. The first query aimed to collect as many studies as possible that address transition risk in relation to credit risk, regardless of the sector of application. This choice allowed us to identify common metrics and methodologies in the literature.

The second query was specifically refined to include only studies that involve transition risk in the banking context. This allowed us to focus on the effects of transition risk on financial institutions, which is key to our study. The queries’ formulation resulted from preliminary tests on different terms and combinations of Boolean operators. A too-broad approach (e.g., including other financial risks such as market risk or operational risk) would have dispersed the analysis. An overly restrictive filter (e.g., focusing only on specific transition risk metrics) would have risked excluding relevant studies. These two queries effectively trade off breadth and specificity. This methodological choice is consistent with established practices in the Systematic Literature Review (SLR) literature, where multiple queries balance coverage and specificity, avoiding the loss of relevant information and information noise.

The literature has highlighted how transition risks represent a complex challenge whose drivers are regulatory, technological, and market factors. Still, at the same time, it also represents an opportunity to promote a more sustainable economy. The most used proxies for risk representation are greenhouse gas emissions and carbon prices. However, there is no lack of use of indicators provided by specialized databases (e.g., Refinitiv or Sustainalytics). These indicators have proven to be fundamental to quantifying and modeling such risks. However, the need for integration with broader metrics considering technological adoption delays, negative environmental impacts (e.g., waste and water use), and regulatory pressures has emerged.

Another aspect that should be highlighted is how managing transition risks requires a multidimensional approach, which can simultaneously mix environmental sustainability objectives, financial stability, and economic growth. Therefore, the evidence listed thus far shows the need to develop analytical tools and evaluation models at both the macro (national) and micro (company) levels to manage the challenges posed by carbon neutrality.

The paper represents a first step towards the definition of a dynamic framework for the assessment of transition risk, intending to provide a resilience indicator that allows the evaluation of the exposure of companies and countries to this risk.

Future developments could expand this analysis by exploring regional and sectoral differences, providing a more detailed understanding of local dynamics and the most effective adaptation strategies. This would allow policymakers, banks, and investors to manage better the risks associated with the climate transition, promoting financial stability and sustainable economic growth. Moreover, it would also become essential to analyze and quantify the indirect effects of transition risk on the credit risk that banks face in terms of the repayment capacity of their borrowers.

Funding

This research was funded by the European Union–Next Generation EU, Mission 4 Component 1, Cup D53D23006550006.

Data Availability Statement

Data sharing is not applicable.

Acknowledgments

The author wishes to express his sincere gratitude to Eliana Angelini for her invaluable guidance and for securing the funding that made this work possible.

Conflicts of Interest

The author declares no conflict of interest.

References

- Aguais, Scott D., and Laurence R. Forest. 2023. Climate-Change Scenarios Require Volatility Effects to Imply Substantial Credit Losses: Shocks Drive Credit Risk Not Changes in Economic Trends. Frontiers in Climate 5: 1127479. [Google Scholar] [CrossRef]

- Alogoskoufis, Spyros, Sante Carbone, Wouter Coussens, Stephan Fahr, Margherita Giuzio, Friderike Kuik, Laura Parisi, Dilyara Salakhova, and Martina Spaggiari. 2021. Climate-Related Risks to Financial Stability. Financial Stability Review 1: 1–15. [Google Scholar]

- Baldassarri Höger von Högersthal, Giorgio, Arsene Lui, Hrvoje Tomičić, and Luka Vidovic. 2020. Carbon Pricing Paths to a Greener Future, and Potential Roadblocks to Public Companies’ Creditworthiness. Journal of Energy Markets 13: 1–24. [Google Scholar] [CrossRef]

- Basel Committee on Banking Supervision. 2021. Climate Related Risk Drivers and Their Transmission Channels. Edited by BIS. Basel: Basel Committee on Banking Supervision. ISBN 9789292594725. [Google Scholar]

- Batoon, Aimee Jean, and Edit Rroji. 2024. Analyzing the Impact of Carbon Risk on Firms’ Creditworthiness in the Context of Rising Interest Rates. Risks 12: 16. [Google Scholar] [CrossRef]

- Battiston, Stefano, Antoine Mandel, Irene Monasterolo, Franziska Schütze, and Gabriele Visentin. 2017. A Climate Stress-Test of the Financial System. Nature Climate Change 7: 283–88. [Google Scholar] [CrossRef]

- Blasberg, Alexander, Rüdiger Kiesel, and Luca Taschini. 2021. Carbon Default Swap-Disentangling the Exposure to Carbon Risk Through CDS. SSRN Electronic Journal. [Google Scholar] [CrossRef]

- Brunetti, Celso, Benjamin Dennis, Dylan Gates, Diana Hancock, David Ignell, Elizabeth K. Kiser, Gurubala Kotta, Anna Kovner, Richard J. Rosen, and Nicholas K. Tabor. 2021. Climate Change and Financial Stability. Washington, DC: Board of Governors of the Federal Reserve System. [Google Scholar]

- Bruno, Brunella, and Sara Lombini. 2023. Climate Transition Risk and Bank Lending. Journal of Financial Research 46: S59–S106. [Google Scholar] [CrossRef]

- Chabot, Miia, and Jean-Louis Bertrand. 2023. Climate Risks and Financial Stability: Evidence from the European Financial System. Journal of Financial Stability 69: 101190. [Google Scholar] [CrossRef]

- Choi, Daewoung, Yong Kyu Gam, and Hojong Shin. 2023. Environmental Reputation and Bank Liquidity: Evidence from Climate Transition. Journal of Business Finance & Accounting 50: 1274–304. [Google Scholar] [CrossRef]

- Committee on Banking Supervision. 2021. Climate-Related Financial Risks–Measurement Methodologies. Basel: Committee on Banking Supervision. [Google Scholar]

- Cooper, Chris, Andrew Booth, Jo Varley-Campbell, Nicky Britten, and Ruth Garside. 2018. Defining the Process to Literature Searching in Systematic Reviews: A Literature Review of Guidance and Supporting Studies. BMC Medical Research Methodology 18: 85. [Google Scholar] [CrossRef]

- Cormack, Christopher, Charles Donovan, Alex Koberle, and Anastasiya Ostrovnaya. 2020. Estimating Financial Risks from the Energy Transition: Potential Impacts from Decarbonisation in the European Power Sector. SSRN Electronic Journal. [Google Scholar] [CrossRef]

- Darko, Amos, and Albert P. C. Chan. 2016. Critical Analysis of Green Building Research Trend in Construction Journals. Habitat International 57: 53–63. [Google Scholar] [CrossRef]

- Dietz, Simon, Alex Bowen, Charlie Dixon, and Philip Gradwel. 2016. Climate Value at Risk’ of Global Financial Assets. Nature Climate Change 6: 676–79. [Google Scholar] [CrossRef]

- Dunz, Nepomuk, Asjad Naqvi, and Irene Monasterolo. 2021. Climate Sentiments, Transition Risk, and Financial Stability in a Stock-Flow Consistent Model. Journal of Financial Stability 54: 100872. [Google Scholar] [CrossRef]

- Ellerman, A. Denny, and Barbara K. Buchner. 2007. The European Union Emissions Trading Scheme: Origins, Allocation, and Early Results. Review of Environmental Economics and Policy 1: 66–87. [Google Scholar] [CrossRef]

- European Banking Authority EBA. 2021. European Banking Authority Eba Report on Management and Supervision of Esg Risks for Credit Institutions and Investment Firms. Paris: European Banking Authority EBA. [Google Scholar]

- European Central Bank. 2020. European Central Bank Guide on Climate-Related and Environmental Risks. Frankfurt: European Central Bank, pp. 1–54. [Google Scholar]

- European Central Bank. 2021. Climate-Related Risk and Financial Stability ECB/ESRB Project Team on Climate Risk Monitoring. Frankfurt: European Central Bank. [Google Scholar]

- European Commission. 2023. EU Emissions Trading System. Brussels: European Commision. [Google Scholar]

- Fan, Wenna, Feng Wang, Hao Zhang, Rui Ling, and Hongfei Jiang. 2024. Heterogeneous Responses of Commercial Banks to Various Climate Risks: Evidence from 42 a-Share Listed Banks in China. Climate Change Economics 15: 1–32. [Google Scholar] [CrossRef]

- Ferrazzi, Matteo, Sanne Zwart, and Fotios Kalantzis. 2021. Assessing Climate Change Risks at the Country Level: The EIB Scoring Model. Paris: European Investment Bank. [Google Scholar]

- Galletta, Simona, Sebastiano Mazzù, Valeria Naciti, and Andrea Paltrinieri. 2024. A PRISMA Systematic Review of Greenwashing in the Banking Industry: A Call for Action. Research in International Business and Finance 69: 102262. [Google Scholar] [CrossRef]

- Garcia-Villegas, Salomon, and Enric Martorell. 2024. Climate Transition Risk and the Role of Bank Capital Requirements. Economic Modelling 135: 106724. [Google Scholar] [CrossRef]

- Ge, Zekun, Qian Liu, and Zi Wei. 2024. Assessment of Bank Risk Exposure Considering Climate Transition Risks. Finance Research Letters 67: 105903. [Google Scholar] [CrossRef]

- Guter-Sandu, Andrei, Armin Haas, and Steffen Murau. 2024. Green Macro-Financial Governance in the European Monetary Architecture: Assessing the Capacity to Finance the Net-Zero Transition. Competition & Change. [Google Scholar] [CrossRef]

- Haites, Erik. 2018. Carbon Taxes and Greenhouse Gas Emissions Trading Systems: What Have We Learned? Climate Policy 18: 955–66. [Google Scholar] [CrossRef]

- Hałaj, Grzegorz, Serafin Martinez-Jaramillo, and Stefano Battiston. 2024. Financial Stability through the Lens of Complex Systems. Journal of Financial Stability 71: 101228. [Google Scholar] [CrossRef]

- Ho, Kelvin, and Andrew Wong. 2023. Effect of Climate-Related Risk on the Costs of Bank Loans: Evidence from Syndicated Loan Markets in Emerging Economies. Emerging Markets Review 55: 100977. [Google Scholar] [CrossRef]

- Hong, Yuming, and Daniel W. M. Chan. 2014. Research Trend of Joint Ventures in Construction: A Two-Decade Taxonomic Review. Journal of Facilities Management 12: 118–41. [Google Scholar] [CrossRef]

- Huang, Henry He, Joseph Kerstein, Chong Wang, and Feng Wu. 2022. Firm Climate Risk, Risk Management, and Bank Loan Financing. Strategic Management Journal 43: 2849–80. [Google Scholar] [CrossRef]

- Ivanov, Ivan T., Mathias S. Kruttli, and Sumudu W. Watugala. 2024. Banking on Carbon: Corporate Lending and Cap-and-Trade Policy. Review of Financial Studies 37: 1640–84. [Google Scholar] [CrossRef]

- Le, Anh-Tuan, Thao Phuong Tran, and Anil V. Mishra. 2023. Climate Risk and Bank Stability: International Evidence. Journal of Multinational Financial Management 70–71: 100824. [Google Scholar] [CrossRef]

- Leaton, James. 2020. Mapping Out When and Where Climate Risk Becomes a Credit Risk. In Palgrave Studies in Sustainable Business in Association with Future Earth. Berlin: Springer, pp. 69–90. [Google Scholar] [CrossRef]

- Livieri, Giulia, Davide Radi, and Elia Smaniotto. 2024. Pricing Transition Risk with a Jump-Diffusion Credit Risk Model: Evidences from the CDS Market. Review of Corporate Finance 4: 177–201. [Google Scholar] [CrossRef]

- Milkau, Udo. 2022. Climate Change Risk: Demands and Expectations Imposed on Banks. Journal of Risk Management in Financial Institutions 15: 278–300. [Google Scholar]

- Moher, David, Alessandro Liberati, Jennifer Tetzlaff, Douglas G. Altman, Gerd Antes, David Atkins, Virginia Barbour, Nick Barrowman, Jesse A. Berlin, Jocalyn Clark, and et al. 2009. Preferred Reporting Items for Systematic Reviews and Meta-Analyses: The PRISMA Statement. Annals of Internal Medicine 151: 264–69. [Google Scholar] [CrossRef]

- Murau, Steffen, Armin Haas, and Andrei Guter-Sandu. 2024. Monetary Architecture and the Green Transition. Environment and Planning A: Economy and Space 56: 382–401. [Google Scholar] [CrossRef]

- NGFS. 2021. A Call for Action: Climate Scenarios for Central Banks and Supervisors. Paris: Network for Greening the Financial System. [Google Scholar] [CrossRef]

- Nieto, Maria J. 2019. Banks, Climate Risk and Financial Stability. Journal of Financial Regulation and Compliance 27: 243–62. [Google Scholar] [CrossRef]

- Noth, Felix, and Ulrich Schüwer. 2023. Natural Disasters and Bank Stability: Evidence from the U.S. Financial System. Journal of Environmental Economics and Management 119: 102792. [Google Scholar] [CrossRef]

- Oguntuase, Oluwaseun James. 2020. Climate Change, Credit Risk and Financial Stability. Banking and Finance 12: 1–17. [Google Scholar]

- Peterdy, Kyle. 2024. What Are Transition Risks & Climate Risks?—Definition. Available online: https://corporatefinanceinstitute.com/resources/esg/transition-risks/ (accessed on 26 September 2024).

- Pineau, Edouard, and Elizabeth Zuñiga. 2024. Sectoral Credit Sensitivity to Carbon Price with Value Chain Effects. Review of World Economics. [Google Scholar] [CrossRef]

- Ramos-García, Daniel, Carmen López-Martín, and Raquel Arguedas-Sanz. 2023. Climate Transition Risk in Determining Credit Risk: Evidence from Firms Listed on the STOXX Europe 600 Index. Empirical Economics 65: 2091–114. [Google Scholar] [CrossRef]

- Redondo, Helena, and Elisa Aracil. 2024. Climate-Related Credit Risk: Rethinking the Credit Risk Framework. Global Policy 15: 21–33. [Google Scholar] [CrossRef]

- Ren, Yi-Shuai, Imen Derouiche, Majdi Hassan, and Pei-Zhi Liu. 2024. Do Creditors Price Climate Transition Risks? A Natural Experiment Based on China’s Carbon Emission Trading Scheme. International Review of Economics and Finance 91: 138–55. [Google Scholar] [CrossRef]

- Schult, Alexander, Sebastian Müller, Gunther Friedl, and Alberto Spagnoli. 2024. The Impact of Transitory Climate Risk on Firm Valuation and Financial Institutions: A Stress Test Approach. Schmalenbach Journal of Business Research 76: 63–111. [Google Scholar] [CrossRef]

- Sharpe, J., F. Ginghina, G. Mehta, and A. D. Smith. 2023. Calibration of Transition Risk for Corporate Bonds. British Actuarial Journal 28: e8. [Google Scholar] [CrossRef]

- Snyder, Hannah. 2019. Literature Review as a Research Methodology: An Overview and Guidelines. Journal of Business Research 104: 333–39. [Google Scholar] [CrossRef]

- Sobehart, Jorge R. 2022. Quantifying Climate Risk Uncertainty in Competitive Business Environments. Journal of Risk Management in Financial Institutions 15: 26–37. [Google Scholar]

- Stern, Nicholas. 2007. The Economics of Climate Change. Cambridge: Cambridge University Press. [Google Scholar]

- Stroebel, Johannes, and Jeffrey Wurgler. 2021. What Do You Think about Climate Finance? Journal of Financial Economics 142: 487–98. [Google Scholar] [CrossRef]

- Task Force on Climate-related Financial Disclosures (TCFD). 2017. Final Report: Recommendations of the Task Force on Climate-Related Financial Disclosures. Basel: TCFD. [Google Scholar]

- Tranfield, David, David Denyer, and Palminder Smart. 2003. Towards a Methodology for Developing Evidence-Informed Management Knowledge by Means of Systematic Review. British Journal of Management 14: 207–22. [Google Scholar] [CrossRef]

- Wang, Bing, Ge Hong, Chao-Qun Cui, Hao Yu, and Tad Murty. 2019. Comprehensive Analysis on China’s National Climate Change Assessment Reports: Action and Emphasis. Frontiers of Engineering Management 6: 52–61. [Google Scholar] [CrossRef]

- Wang, Jiaji, Qianting Ma, Chao Wang, and Tianxiang Sheng. 2024. Climate Change and Credit Risk in Rural Financial Institutions: A Study Based on Transition Risk. Managerial and Decision Economics 45: 4208–26. [Google Scholar] [CrossRef]

- Wang, Jianliang, Zonghan Li, Hongkai Ye, Yingdan Mei, Jiaxin Fu, and Qi Li. 2021. Do China’s Coal-to-Gas Policies Improve Regional Environmental Quality? A Case of Beijing. Environmental Science and Pollution Research 28: 57667–85. [Google Scholar] [CrossRef]

- Westcott, Mark, John Ward, Swenja Surminski, Paul Sayers, and David N. Bresch. 2019. Physical Risk Framework: Understanding the Impacts of Climate Change on Real Estate Lending and Investment Portfolios. Zurich: ETH Zurich. Cambridge: Cambridge Institute for Sustainability Leadership. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).