A Tail Dependence-Based MST and Their Topological Indicators in Modeling Systemic Risk in the European Insurance Sector

Abstract

:1. Introduction

- (1)

- To check whether the time series of topological indicators of the network of connections between insurance companies obtained using the proposed hybrid approach reflect the situation on the financial market and whether they can be used as predictors of systemic risk in the insurance sector.

- (2)

- An empirical analysis of 38 European insurance institutions selected from the top 50 insurance companies in Europe. We indicate which of the largest companies not on the G-SIIs list are of great importance in the context of SR.

- (3)

- An analysis of the situation in the insurance sector in the context of SR, taking into account the latest political and economic situation in Europe, distinguishing four market states: The normal state, the state related to the subprime mortgage crisis, the state related to the immigration crisis in Europe, and the state related to the crises in France and Italy.

- (4)

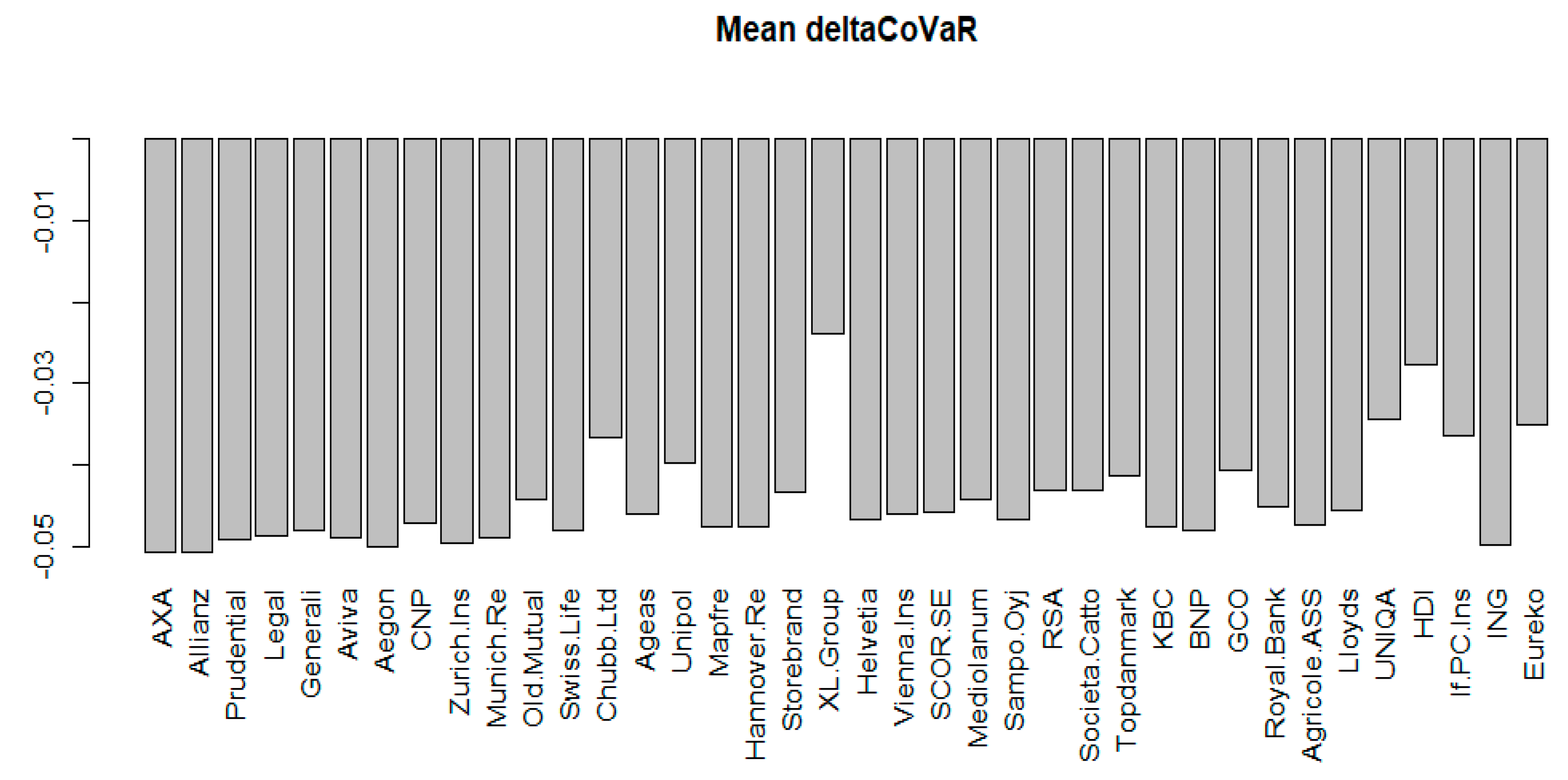

- An analysis of the contribution to the SR of the insurance sector.

2. Systemic Risk in the Insurance Sector

3. Methodology

- Average path length—APL,

- Maximum degree—Max.Deg,

- The parameters α of the vertex degree distribution required to follow a power law,

- Network diameter—D,

- Rich club effect—RCE,

- Assortativity,

- Betweenness centrality—BC,

- Vertex strength (centrality),

- Vertex degree,

- Closeness centrality.

4. Data and Results of Empirical Analysis

4.1. Degree Distribution

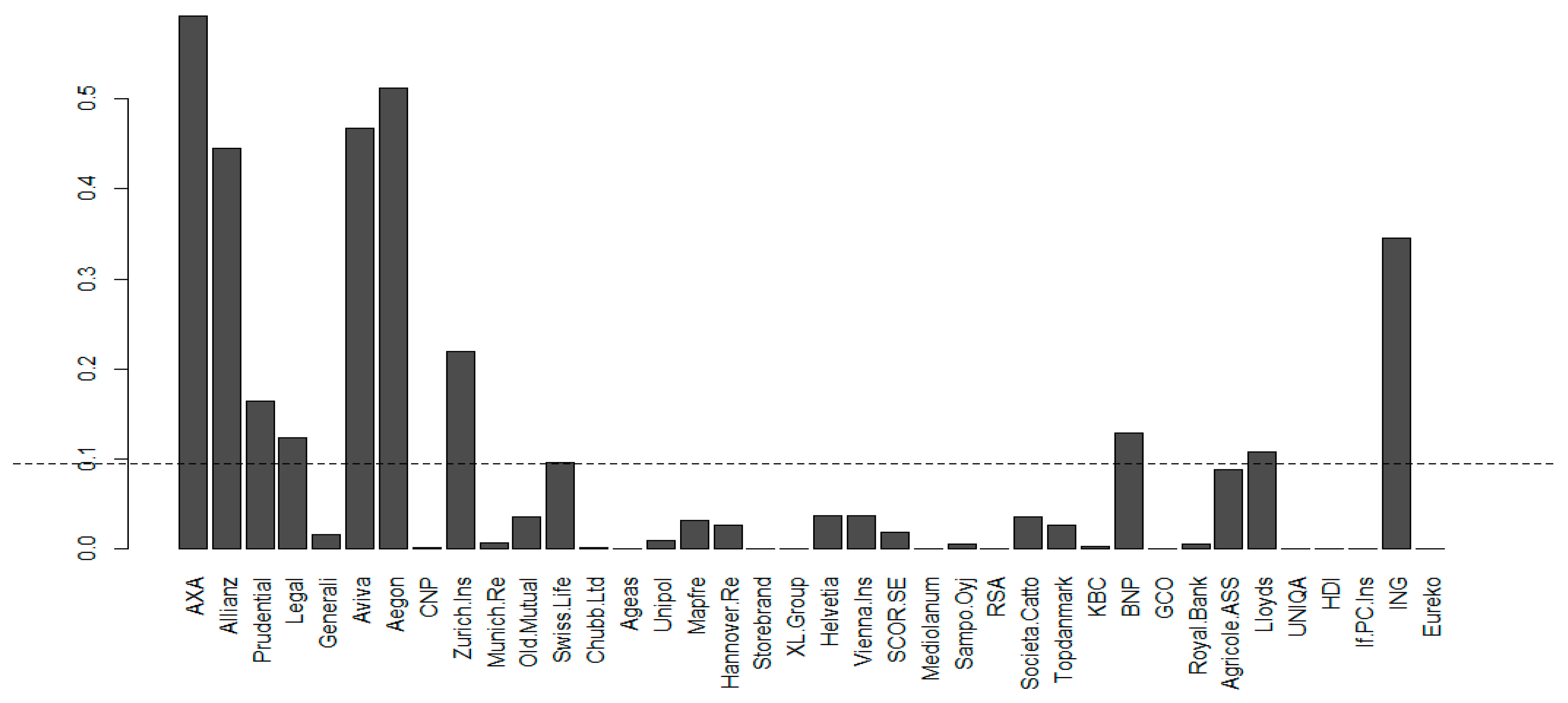

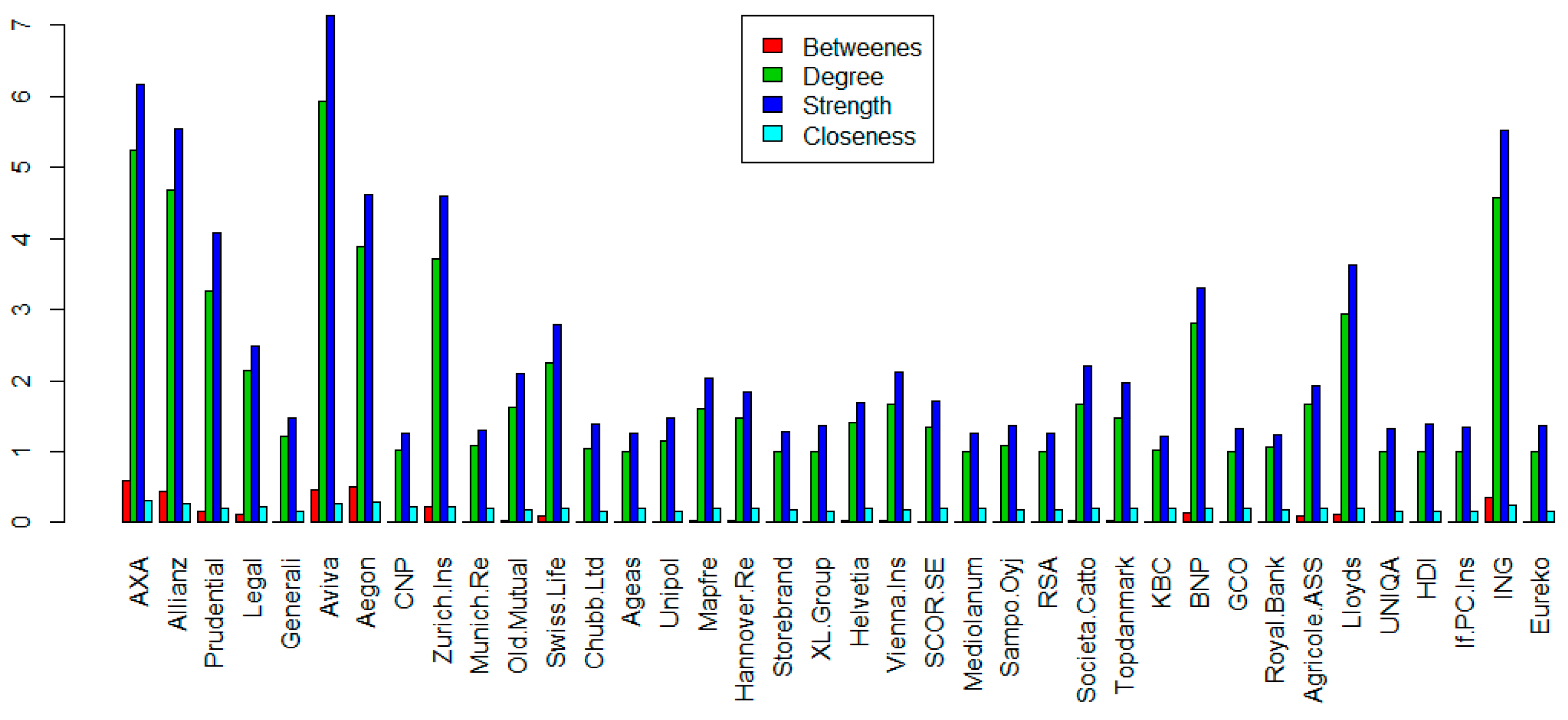

4.2. Betweenness Centrality—BC

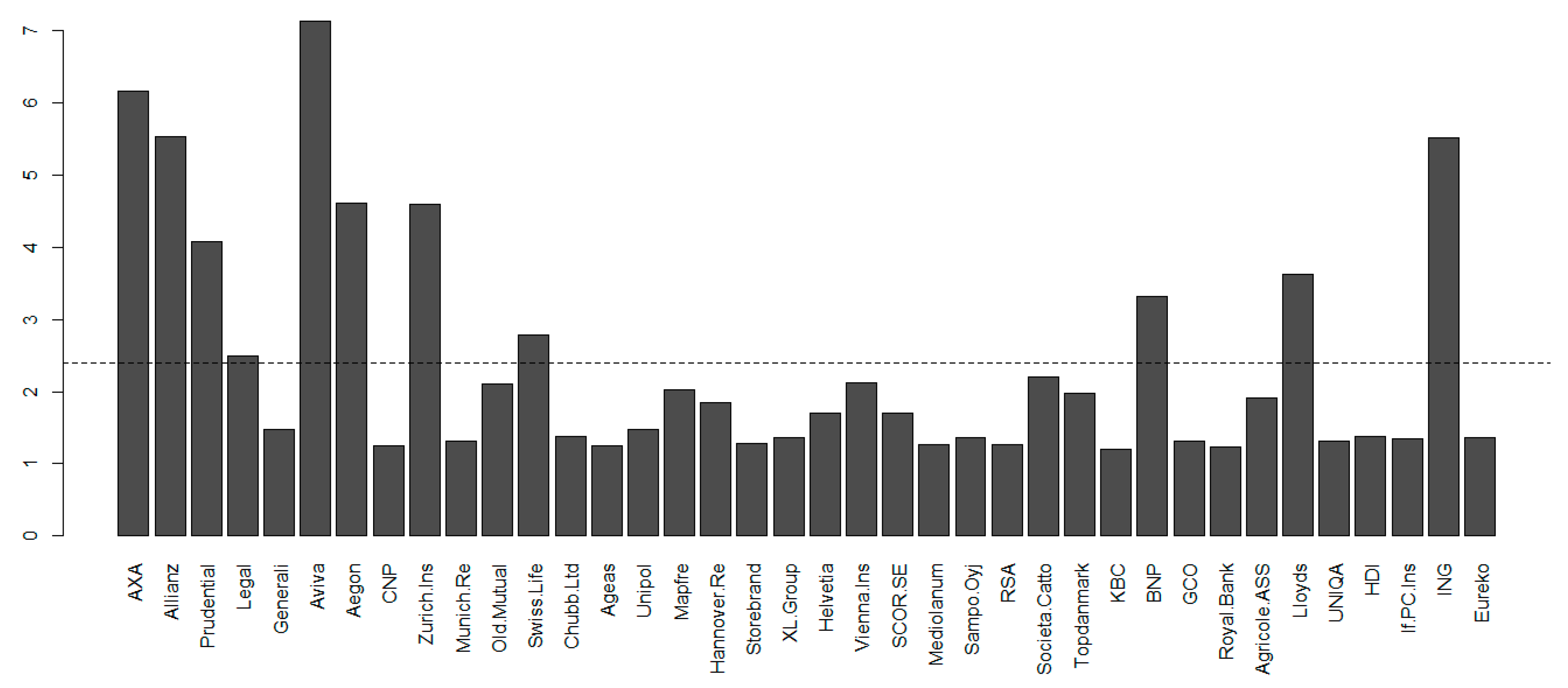

4.3. Vertex Strength (Centrality)

4.4. Closeness Centrality

4.5. Average Path Lentgth (APL)

4.6. Maximum Degree—Max.Deg

4.7. Parameter α of the Vertex Degree Distribution Required to Follow a Power Law

4.8. Diameter of the Network (Diameter)

4.9. Rich Club Effect–RCE

4.10. Assortativity

- -

- The period which we call normal state—normal (N).

- -

- A period of two subprime crises and excessive public debt, which began in 2008 and lasted until around 2013. This period in our time series falls exactly between 8 February 2008 and 1 March 2013—subprime mortgage crisis (SMC).

- -

- The period of crisis associated with the beginning of the migration crisis in Europe, falling on 2015/2016. This period on our time series falls exactly between 7 August 2015 and on 23 September 2016—immigrant (I).

- -

- The period of the beginning of the crisis in the countries of the European Union related to the crisis in France associated with strikes, and in Italy due to the ever-growing public debt (which is now seven times higher than the debt in Greece), falling at the turn of 2017 and 2018. In our case it is exactly the period from 21 April 2017 until 11 May 2018—France and Italy crisis (FIC).

5. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Acharya, Viral V., John Biggs, Hanh T. Le, M. Richardson, and S. Ryan. 2011. Systemic risk and the regulation of insurance companies. In Regulating Wall Street—The Dodd-Frank Act and the New Architecture of Global Finance. Edited by V. V. Acharya, T. F. Cooley, M. Richardson and I. Walter. Hoboken: John Wiley & Sons, pp. 241–301. [Google Scholar]

- Adrian, Tobias, and Markus K. Brunnermeier. 2011. CoVaR, Working Paper. New York: Federal Reserve Bank of New York. [Google Scholar]

- Adrian, Tobias, and Markus K. Brunnermeier. 2016. CoVar. American Economic Review 106: 1705–41. [Google Scholar] [CrossRef]

- Alves, Ivan, Jeroen Brinkhoff, Stanislav Georgiev, Jean-Cyprien Héam, Iulia Moldovan, and Marco Scotto di Carlo. 2015. Network Analysis of the EU Insurance Sector. ESRB Occasional Paper Series 07. Frankfurt: European Systemic Risk Board. [Google Scholar]

- Bach, Wolfgang, and Tristan Nguyen. 2012. On the systemic relevance of the insurance industry: Is a macroprudential insurance regulation necessary? Journal of Applied Finance & Banking 2: 127–49. [Google Scholar]

- Baluch, Faisal, Stanley Mutenga, and Chris Parsons. 2011. Insurance, systemic risk and the financial crisis. Geneva Papers on Risk and Insurance—Issues and Practice 36: 126–63. [Google Scholar] [CrossRef] [Green Version]

- Baur, Patrizia, Rudolf Enz, and Aurelia Zanetti. 2003. Reinsurance—A Systemic Risk? Zürich: Swiss Reinsurance Company. [Google Scholar]

- Bavelas, Alex. 1950. Communication patterns in task-oriented groups. The Journal of the Acoustical Society of America 22: 725–30. [Google Scholar] [CrossRef]

- Bednarczyk, Teresa. 2013. Czy sektor ubezpieczeniowy kreuje ryzyko systemowe? Studia Oeconomica Posnaniensia 11: 7–17. [Google Scholar]

- Bégin, Jean-François, Mathieu Boudreault, Delia A. Doljanu, and Geneviève Gauthier. 2017. Credit and SystemicRisks in the Financial Services Sector: Evidence from the 2008 Global Crisis. Journal of Risk and Insurance 86: 263–96. [Google Scholar] [CrossRef]

- Bell, Marian, and Benno Keller. 2009. Insurance and Stability: The Reform of Insurance Regulation. Zürich: Zurich Financial Services Group. [Google Scholar]

- Benoit, Sylvain, Jean-Edouard Colliard, Christophe Hurlin, and Christophe Pérignon. 2017. Where the Risks Lie: A Survey on Systemic Risk. Review of Finance, European Finance Association 21: 109–52. [Google Scholar] [CrossRef]

- Bierth, Christopher, Felix Irresberger, and Gregor N. F. Weiß. 2015. Systemic risk of insurers around the globe. Journal of Banking & Finance 55: 232–45. [Google Scholar] [CrossRef]

- Billio, Monica, Mila Getmansky, Andrew W. Lo, and Loriana Pelizzon. 2012. Econometric measures of connectedness and systemic risk in the finance and insurance sectors. Journal of Financial Economics 104: 535–59. [Google Scholar] [CrossRef]

- Bisias, Dimitrios, Mark Flood, Andrew W. Lo, and Stavros Valavanis. 2012. A Survey of Systemic Risk Analytics. Annual Review of Financial Economics 4: 255–96. [Google Scholar] [CrossRef] [Green Version]

- Brownlees, Christian, and Robert F. Engle. 2017. SRISK: A Conditional Capital Shortfall Measure of Systemic Risk. The Review of Financial Studies 30: 48–79. [Google Scholar] [CrossRef]

- Camerer, Colin, and Martin Weber. 1992. Recent developments in modelling preferences: Uncertainty and ambiguity. Journal of Risk and Uncertainty 5: 325–70. [Google Scholar] [CrossRef]

- Chen, Fang, Xuanjuan Chen, Zhenzhen Sun, Tong Yu, and Ming Zhong. 2013a. Systemic risk, financial crisis, and credit risk insurance. Financial Review 48: 417–42. [Google Scholar] [CrossRef]

- Chen, Hua, J. David Cummins, Krupa S. Viswanathan, and Mary A. Weiss. 2013b. Systemic Risk and the Interconnectedness between Banks and Insurers: An Econometric Analysis. Journal of Risk and Insurance 81: 623–52. [Google Scholar] [CrossRef]

- Chen, Hua, J. David Cummins, Krupa S. Viswanathan, and Mary A. Weiss. 2013c. Systemic Risk Measures in the Insurance Industry: A Copula Approach. Working Paper. Philadelphia, PA, USA: Temple University. [Google Scholar]

- Colizza, Vittoria, Alessandro Flammini, M. Angeles Serrano, and Alessandro Vespignani. 2006. Detecting rich-club ordering in complex networks. Nature Physics 2: 110–15. [Google Scholar] [CrossRef]

- Cummins, J. David, and Mary A. Weiss. 2011. Systemic Risk and the U.S. Insurance Sector. Working Paper. Philadelphia, PA, USA: Temple University. [Google Scholar]

- Cummins, J. David, and Mary A. Weiss. 2013. Systemic Risk and Regulation of the U.S. Insurance Industry. Working Paper. Philadelphia, PA, USA: Temple University. [Google Scholar]

- Cummins, J. David, and Mary A. Weiss. 2014. Systemic Risk and the U.S. Insurance Sector. Journal of Risk and Insurance 81: 489–528. [Google Scholar] [CrossRef]

- Czerwińska, Teresa. 2014. Systemic risk in the insurance sector. Problemy Zarzadzania 12: 41–63. [Google Scholar] [CrossRef]

- De Bandt, Olivier, and Philipp Hartmann. 2000. Systemic Risk: A Survey. Working Paper. Frankfurt, Germany: European Central Bank. [Google Scholar]

- Denkowska, Anna, and Stanisław Wanat. 2019. A Dynamic MST-deltaCovar Model of Systemic Risk in the European Insurance Sector. arXiv, arXiv:2951270. [Google Scholar]

- Di Cesare, Antonio, and Anna Rogantini Picco. 2018. A Survey of Systemic Risk Indicators. In Questioni di Economia e Finanza (Occasional Papers). Roma: Bank of Italy, p. 458. [Google Scholar]

- Eling, Martin, and David Antonius Pankoke. 2016. Systemic Risk in the Insurance Sector: A Reviewand Directions for Future Research. Risk Management and Insurance Review 19: 249–84. [Google Scholar] [CrossRef] [Green Version]

- Fan, Yan, Wolfgang Karl Härdle, Weining Wang, and Lixing Zhu. 2018. Single-Index-Based CoVaR with Very High-Dimensional Covariates. Journal of Business & Economic Statistics 36: 212–26. [Google Scholar]

- Giglio, Stefano, Bryan Kelly, and Seth Pruitt. 2016. Systemic risk and the macroeconomy: An empirical evaluation. Journal of Financial Economics 119: 457–71. [Google Scholar] [CrossRef]

- Härdle, Wolfgang Karl, Weining Wang, and Lining Yu. 2016. TENET: Tail-Event Driven NETwork Risk. Journal of Econometrics 192: 499–513. [Google Scholar] [CrossRef]

- Harrington, Scott E. 2009. The financial crisis, systemic risk, and the future of insurance regulation. Journal of Risk and Insurance 76: 785–819. [Google Scholar] [CrossRef]

- Hautsch, Nikolaus, Julia Schaumburg, and Melanie Schienle. 2015. Financial Network Systemic Risk Contributions. Review of Finance 19: 685–738. [Google Scholar] [CrossRef] [Green Version]

- Huang, Xin, Hao Zhou, and Haibin Zhu. 2009. A framework for assessing the systemic risk of major financial institutions. Journal of Banking & Finance 33: 2036–49. [Google Scholar]

- IAIS. 2009. Systemic Risk and the Insurance Sector. Basel: Bank for International Settlements, International Association of Insurance Supervisors (IAIS), October 25. [Google Scholar]

- Jajuga, Krzysztof, Marta Karaś, Katarzyna Kuziak, and Witold Szczepaniak. 2017. Ryzyko systemu finansowego. Metody oceny i ich weryfikacja w wybranych krajach. In Materiały i Studia. Warszawa: Narodowy Bank Polski, p. 329. [Google Scholar]

- Jobst, Andreas A. 2014. Systemic risk in the insurance sector: A review of current assessment approaches. Geneva Papers on Risk and Insurance 39: 440–70. [Google Scholar] [CrossRef] [Green Version]

- Joe, Harry. 1997. Multivariate Models and Dependence Concepts. London: Chapman-Hall. [Google Scholar]

- Jurkowska, Aleksandra. 2018. Polski Sektor Bankowy Wobec Ryzyka Systemowego: Analiza Banków Giełdowych. Kraków: Wydawnictwo Uniwersytetu Ekonomicznego w Krakowie. [Google Scholar]

- Kanno, Masayasu. 2016. The network structure and systemic risk in the global non-life insurance market. Insurance: Mathematics and Economics 67: 38–53. [Google Scholar] [CrossRef]

- Kaserer, Christoph, and Christian Klein. 2018. Supplementary Material to ’Systemic Risk in Financial Markets: How Systemically Important Are Insurers? Journal of Risk and Insurance 86: 729–59. [Google Scholar] [CrossRef]

- Klein, Robert W. 2011. Insurance Market Regulation: Catastrophe Risk, Competition and Systemic Risk. In Handbook of Insurance, 2nd ed. Working Paper. Edited by G. Dionne. New York: Springer. [Google Scholar]

- Knight, Frank H. 1921. Risk, Uncertainty and Profit. Chicago: Chicago University Press. [Google Scholar]

- Koijen, Ralph S. J., and Motohiro Yogo. 2016. Shadow Insurance. Econometrica 84: 1265–87. [Google Scholar] [CrossRef] [Green Version]

- Kou, Gang, Xiangrui Chao, Yi Peng, Fawaz E. Alsaadi, and Enrique Herrera-Viedma. 2019. Machine learning methods for systemic risk analysis in financial sectors. Technological and Economic Development of Economy 25: 716–42. [Google Scholar] [CrossRef]

- Kress, Jeremy C. 2011. Credit default swaps, clearinghouses, and systemic risk: Why centralized counterparties must have access to central bank liquidity. Harvard Journal of Legislation 48: 49–93. [Google Scholar]

- Lautier, Delphine, and Franck Raynaud. 2013. Systemic risk and complex systems: A graph-theory analysis. In Econophysics of Systemic Risk and Network Dynamics. Milano: Springer, pp. 19–37. [Google Scholar]

- Mantegna, Rosario N., and H. Eugene Stanley. 1999. Introduction to Econophysics: Correlations and Complexity in Finance. Cambridge: Cambridge University Press. [Google Scholar]

- Matesanz, David, and Guillermo J. Ortega. 2015. Sovereign public debt crisis in europe. a network analysis. Physica A: Statistical Mechanics and Its Applications 436: 756–66. [Google Scholar] [CrossRef]

- Mühlnickel, Janina, and Gregor N. F. Weiß. 2015. Consolidation and Systemic Risk in the International Insurance Industry. Journal of Financial Stability 18: 187–202. [Google Scholar] [CrossRef]

- Newman, M. 2002. Assortative mixing in networks. Physical Review Letters 89: 11. [Google Scholar] [CrossRef] [Green Version]

- Onnela, Jukka Pekka, Anirban Chakraborti, Kimmo Kaski, and Janos Kertesz. 2002. Dynamic asset trees and portfolio analysis. The European Physical Journal B-Condensed Matter and Complex Systems 30: 285–88. [Google Scholar] [CrossRef] [Green Version]

- Onnela, Jukka Pekka, Anirban Chakraborti, Kimmo Kaski, Janos Kertesz, and Antti Kanto. 2003. Asset trees and asset graphs in financial markets. Physica Scripta 2003: 48. [Google Scholar] [CrossRef]

- Patton, Andrew J. 2006. Modelling asymmetric exchange rate. International Economic Review 47: 527–56. [Google Scholar] [CrossRef]

- Radice, Marc Philippe. 2010. Systemische Risiken im Versicherungssektor? Working Paper. Bern, Switzerland: FINMA. [Google Scholar]

- Rodríguez-Moreno, Maria, and Juan Ignacio Peña. 2013. Systemic Risk Measures: The Simpler theBetter? Journal of Banking & Finance 37: 1817–31. [Google Scholar]

- Sensoy, Ahmet, and Benjamin M. Tabak. 2014. Dynamic spanning trees in stock market networks: The case of Asia-Pacific. Physica A: Statistical Mechanics and Its Applications 414: 387–402. [Google Scholar] [CrossRef]

- Tang, Yong, Janson Jie Xiong, Zi-Yang Jia, and Yi-Cheng Zhang. 2018. Complexities in financial network topological dynamics: Modeling of emerging and developed stock markets. Complexity 2018: 4680140. [Google Scholar] [CrossRef] [Green Version]

- Tracy, Ryan, and Erik Holm. 2016. Metlife Wins Bid to Shed ‘Systemically Important’ Label. Wall Street Journal, March 30. [Google Scholar]

- Tversky, Amos, and Daniel Kahneman. 1992. Advances in prospect theory: Cumulative representation of uncertainty. Journal of Risk and Uncertainty 5: 297–323. [Google Scholar] [CrossRef]

- Wanat, Stanisław, and Anna Denkowska. 2018. Dependencies and Systemic risk in the European Insurance Sector: Some New Evidence Based on Copula-DCC-GARCH Model and Selected Clustering Methods. arXiv, arXiv:1905.03273. [Google Scholar]

- Wanat, Stanisłąw, and Anna Denkowska. 2019. Linkages and Systemic Risk in the European Insurance Sector: Some New Evidence Based on Dynamic Spanning Trees. arXiv, arXiv:1908.01142. [Google Scholar]

- Wang, Gang-Jin, Chi Xie, Peng Zhang, Feng Han, and Shon Chen. 2014. Dynamics of Foreign Exchange Networks: A Time-Varying Copula Approach. In Hindawi Publishing Corporation Discrete Dynamics in Nature and Society. London: Hindawi, 11p. [Google Scholar]

- Weiß, Gregor, and Janina Mühlnickel. 2014. Why do some insurers become systemically relevant? Journal of Financial Stability 13: 95–117. [Google Scholar] [CrossRef]

- Zweifel, Peter, and Roland Eisen. 2012. Insurance Economics. Heidelberg: Springer. [Google Scholar]

| 1 | These are: Achmea (Eureko Group), Aegon Group/Unirobe Meeùs Group, AGEAS, Allianz, Aviva, AXA, BNP Paribas, Grupo Catalana Occidente, CNP Assurances, Royal Bank of Scotland Group, Generali, Groupe Crédit Agricole Assurances, HDI/Talanx, If P&C Insurance, ING Group, KBC, Legal & General Group plc, Mapfre, Munich Re, Old Mutual plc, Prudential, RSA Insurance Group, SCOR, Lloyds Banking Group, Unipol, UNIQA Insurance Group, Vienna Insurance Group, Zurich Insurance, Swiss Life, Chubb Ltd, Hannover Re, Storebrand, XL Group, Helvetia Holding, Mediolanum, Sampo Oyj, Societa Cattolica di Assicurazione, Topdanmark A/S. |

| 2 | We used nonparametric tests since none of the indicators satisfied the normal distribution requirement. |

| 3 | Signif. codes: 0.001 ‘***’ 0.01 ‘**’ 0.05 ‘*’. |

| Indicator | Kruskal–Wallis chi-Squared | p-Value |

|---|---|---|

| APL | 347.78 | <2.2 × 10−16 |

| Alpha | 9.35 | 0.02499 |

| Max. Deg | 99.63 | <2.2 × 10−16 |

| RCE | 15.34 | 0.00155 |

| Diameter | 269.03 | <2.2 × 10−16 |

| Assort. Deg | 25.60 | 1.155 × 10−5 |

| Compared Market States | Difference | p-Value | Signif3. | LCL | UCL |

|---|---|---|---|---|---|

| APL | |||||

| N-SMC | 307.27 | 0.0000 | *** | 281.11 | 333.43 |

| N-I | 247.72 | 0.0000 | *** | 202.00 | 293.45 |

| N-FIC | 318.21 | 0.0000 | *** | 271.08 | 365.33 |

| SMC-I | −59.55 | 0.0135 | * | −106.77 | −12.33 |

| SMC-FIC | 10.93 | 0.6587 | −37.64 | 59.51 | |

| I-FIC | 70.48 | 0.0244 | * | 9.11 | 131.85 |

| Alpha | |||||

| N-SMC | 3.36 | 0.9135 | −57.23 | 63.94 | |

| N-I | −112.92 | 0.0366 | * | −218.81 | −7.03 |

| N-FIC | −124.66 | 0.0252 | * | −233.79 | −15.53 |

| SMC-I | −116.28 | 0.0372 | * | −225.63 | −6.92 |

| SMC-FIC | −128.02 | 0.0257 | * | −240.51 | −15.52 |

| I-FIC | −11.74 | 0.8714 | −153.86 | 130.38 | |

| Max.Deg | |||||

| N-SMC | −166.35 | 0.0000 | *** | −197.31 | −135.38 |

| N-I | −108.68 | 0.0001 | *** | −162.81 | −54.56 |

| N-FIC | −77.98 | 0.0062 | ** | −133.76 | −22.20 |

| SMC-I | 57.66 | 0.0432 | * | 1.77 | 113.56 |

| SMC-FIC | 88.36 | 0.0026 | ** | 30.86 | 145.86 |

| I-FIC | 30.70 | 0.4070 | −41.94 | 103.34 | |

| RCE | |||||

| N-SMC | 27.31 | 0.1223 | −7.34 | 61.96 | |

| N-I | 25.66 | 0.4058 | −34.90 | 86.23 | |

| N-FIC | −99.12 | 0.0019 | ** | −161.54 | −36.70 |

| SMC-I | −1.64 | 0.9589 | −64.19 | 60.90 | |

| SMC-FIC | −126.43 | 0.0001 | *** | −190.77 | −62.09 |

| I-FIC | −124.78 | 0.0027 | ** | −206.07 | −43.50 |

| Diameter | |||||

| N-SMC | 280.91 | 0.0000 | *** | 252.47 | 309.36 |

| N-I | 107.97 | 0.0000 | *** | 58.25 | 157.69 |

| N-FIC | 257.93 | 0.0000 | *** | 206.69 | 309.17 |

| SMC-I | −172.94 | 0.0000 | *** | −224.29 | −121.60 |

| SMC-FIC | −22.99 | 0.3932 | −75.80 | 29.83 | |

| I-FIC | 149.95 | 0.0000 | *** | 83.23 | 216.68 |

| Assort.Deg | |||||

| N-SMC | −46.91 | 0.0079 | ** | −81.47 | −12.35 |

| N-I | −150.22 | 0.0000 | *** | −210.63 | −89.81 |

| N-FIC | −27.48 | 0.3865 | −89.74 | 34.78 | |

| SMC-I | −103.31 | 0.0012 | ** | −165.70 | −40.92 |

| SMC-FIC | 19.43 | 0.5525 | −44.75 | 83.61 | |

| I-FIC | 122.74 | 0.0031 | ** | 41.66 | 203.82 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Denkowska, A.; Wanat, S. A Tail Dependence-Based MST and Their Topological Indicators in Modeling Systemic Risk in the European Insurance Sector. Risks 2020, 8, 39. https://doi.org/10.3390/risks8020039

Denkowska A, Wanat S. A Tail Dependence-Based MST and Their Topological Indicators in Modeling Systemic Risk in the European Insurance Sector. Risks. 2020; 8(2):39. https://doi.org/10.3390/risks8020039

Chicago/Turabian StyleDenkowska, Anna, and Stanisław Wanat. 2020. "A Tail Dependence-Based MST and Their Topological Indicators in Modeling Systemic Risk in the European Insurance Sector" Risks 8, no. 2: 39. https://doi.org/10.3390/risks8020039