Due to some discontinuities in data, in order to avoid biases or discrepancies, the numerical analysis performed in this article relates to the 1970–2017 period. Further, the pricing model is going to be calibrated using data from 1970 to 2016 while data of 2017 will be used to validate WD prices.

Traditionally, many areas in Tuscany are devoted to the production of high-quality agricultural produce. This is also the case of the province of Arezzo, so that, not only from a theoretical point of view, it is clear that a way to hedge against climatic risk is somehow required.

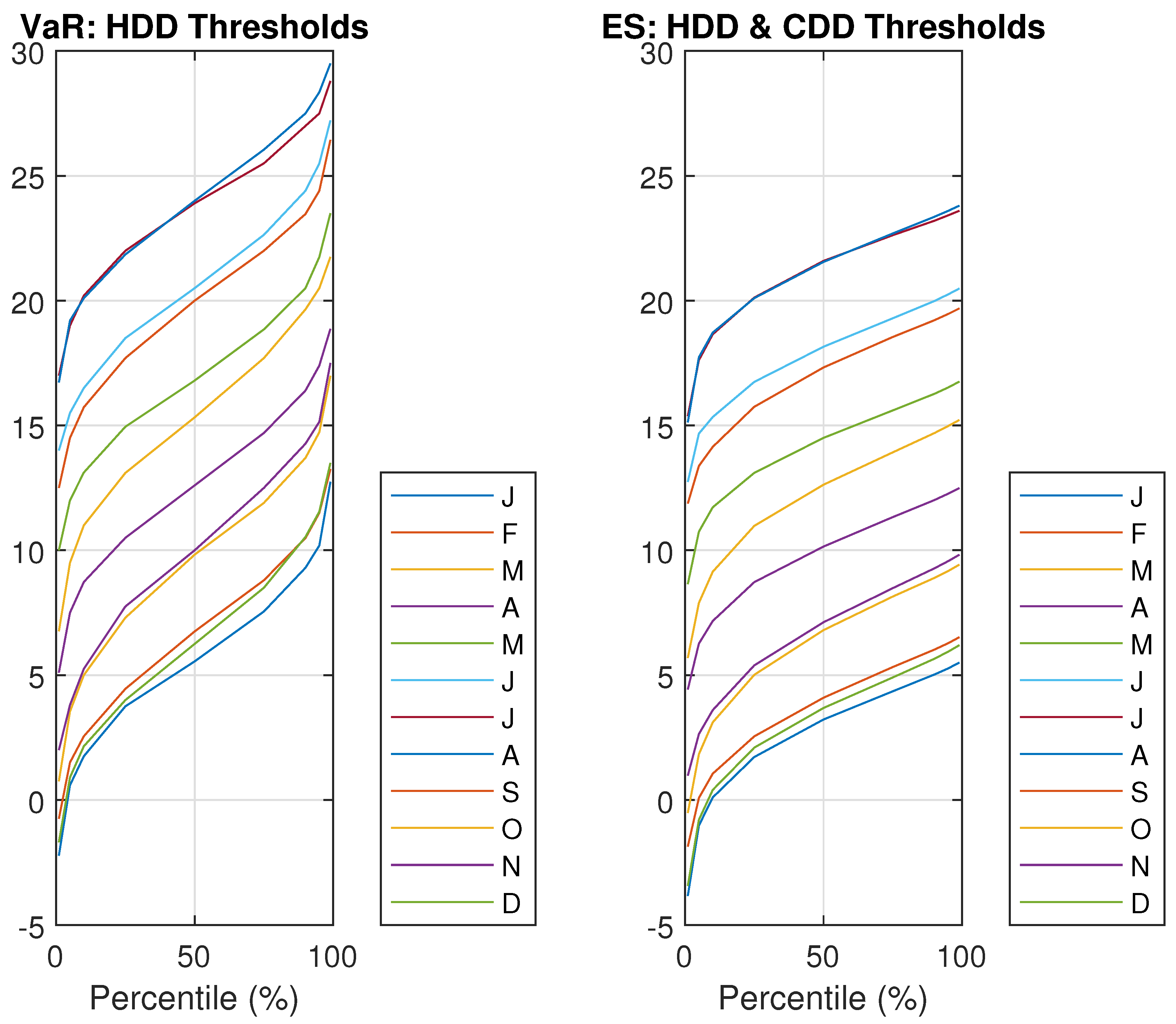

Strike values that correspond to percentiles from 0% to 50% are HDDs observed thresholds, while those corresponding to percentiles from 50% to 100% are CDDs observed thresholds.

Estimation of VaR and ES Using Historical and Parametric Approaches

In this paper, a range of methods for estimating VaR and ES have been exploited (see, for instance,

McNeil et al. (

2005)): these are the historical (see, e.g.,

Rockafellar and Uryasev (

2002)), the normal, the ‘T5’ and ‘T10’ ones. While the historical method has no a priori assumptions, the normal, T5, and T10 are assumed parametric because they rely on some underlying distribution: the normal distribution for the normal method and a Student’s-

t distribution with 5 and 10 degrees of freedom for the remaining two.

However, while the normal and Student’s-

t distributions quite efficiently fit a number of financial time series; this is not the case for most meteorological data (see

Figure 2).

As it is well known, historically speaking the first theoretical distribution applied in mathematical finance is the normal one. Empirical investigation has shown that real financial data are characterized almost ubiquitously by extreme events; in fact, large losses occur with a frequency that the normal distribution is unable to predict.

VaR and ES are risk measures developed to hedge such potential losses. Their numerical results depend, of course, on the assumed underlying distribution; for a number of distributions (for instance, Student’s-t) explicit formulae exist.

When dealing with temperatures, at least in the area scrutinized in this article, it occurs that historical distribution is bimodal and with thin tails. This leads to the fact that, in this case, VaR and ES become very conservative and prudent ways of representing risk.

The following analysis shows that meteorological data are usually characterized by ‘thin’, rather than ‘fat’, tails.

To this end, an analysis of the tails of the distribution of observed temperatures has been attempted. As it is known, the normal distribution is thin tailed, which is, its upper tail declines to zero faster than exponentially (

Pindyck 2011) and that the exponential distribution, whose probability density function is

is thin-tailed.

The right tail of such distribution is assumed to be composed of all temperatures that are larger or equal to the 90%th percentile (24 C) of the temperature data-set.

In

Figure 3, in order to apply the exponential distribution, the 90% percentile has been subtracted to all temperatures. The estimated

is equal to

with 95% confidence interval

.

Similarly, the left tail of the distribution under scrutiny is assumed to be composed of all temperatures that are smaller or equal to the 10% percentile (C) of the temperature data-set.

In

Figure 4, in order to apply again the exponential distribution, temperatures have been firstly changed in sign (obtaining a right tail). Further, in order to deal with positive numbers, the 10% percentile has been added to all temperatures. The estimated

is here equal to

with 95% confidence interval

.

In conclusion, the temperature distribution shows thin tails. Therefore, the econometric analysis on VaR and ES must keep proper account of this feature. This is achieved by considering the historical and normal methods.

The first method used is the historical one (see

Figure 5). The estimation rolling window size is set equal to 365 days, so that a full year of data is used to estimate for both the historical VaR and ES; the sample window runs from the beginning of 2003 through the end of 2016. Following

Basel Committee on Banking Supervision (

2019), a VaR confidence level of

is used.

According to

Rockafellar and Uryasev (

2002), the historical VaR and ES are computed, as follows:

and

where

,

N is the length of the historical data under study, while

z is the vector containing all sorted historical data.

Figure 5 shows that the historical simulation curve has a piece-wise constant profile. The reason for this is that quantiles do not change for several days until extreme events occur. Thus, the historical simulation method is slow to react to changes in volatility.

Another estimation method uses parametric models (

McNeil et al. 2005); this approach requires computing the volatility of daily average temperatures.

Given this volatility, VaR and ES can be analytically computed assuming that temperatures follow a normal distribution with mean

and variance

:

and

where

and

denote density of standard normal distribution and cumulative standard normal distribution, respectively.

is the

-quantile of

. A non-zero mean is assumed and it is estimated as a sum of all yearly means. For the normal distribution, the estimated volatility is directly used to obtain the VaR and ES (see

Figure 6).

The data-set under scrutiny has a kurtosis far away from 3, as can be seen from

Table 1. To properly test this claim,

Table 2 carries the results for two tests for normality of data:

The null hypothesis (data are normally distributed) is rejected by both of them.

To tackle this issue, a more flexible theoretical distribution can be applied. The key point here is to choose a distribution that could somehow be compatible with observed data. A plausible choice is the Student’s-

t one. In fact, denoting with

the number of its degrees of freedom, its skewness is 0 for

, while its kurtosis is

for

, a number compatible with the kurtosis observed (see

Table 1).

VaR and ES Formulas for a Student’s-

t with

degrees of freedom

distribution are

and

where

is the standard

t-distribution c.d.f,

is the standard

t-distribution quantile and

is the standard

t-distribution p.d.f.

Figure 7 shows the daily temperatures, VaR and ES estimated values with Student’s-

t distribution with 10 and 5 degrees of freedom.

No theoretical model can fully catch reality, as is almost always the case. Still, financial literature has deeply analyzed the results obtained by theoretical models applied to real data. On top of this, closed formulas for VaR and ES, for the distributions used in this section, exist. Looking at data under scrutiny, it results that temperatures, at least in this case, have thin tails. Financial agents are, instead, worried about fat fails. This explains why the normal distribution performs better, when compared to the Student’s-t distribution, with the latter being characterized by fatter tails. This observation leads to the idea, to be developed in a subsequent paper, to apply theoretical distributions with thinner tails when compared to the normal distribution ones.

A back-test on ES, which is based on available data, is in

Appendix B. Its main result is that the Historical and Normal models perform better and, therefore, will be used in what follows.

Of course, the fact that Arezzo’s temperatures show thin tails could be the result of the fact that Tuscany is located in a very favorable area, meteorologically speaking.

As the aim of the paper is to present a novel approach in pricing weather derivatives by means of VaR and ES, its findings has to be standard and consistent. This leads to the claim that what has been presented here could be possibly used everywhere, regardless of the behavior of the observed meteorological data.

The historical method, of course, does not assume any underlying distribution. On the other hand, as said, the normal method, assuming tails fatter than the observed ones, will give results that are more conservative than taking a better fitting distribution. The claim is that the normal method is the best financial compromise in choosing an underlying distribution, according to the universal standards, without leaving the freedom of applying different methods for finding VaR and ES. In any case, the final results in pricing and hedging are found to be very similar using the historical or the normal method.