Coordination of Renewable Energy Integration and Peak Shaving through Evolutionary Game Theory

Abstract

Featured Application

Abstract

1. Introduction

- Development of a benefit coordination game model between renewable energy and power grid enterprises: This study adopts Evolutionary Game Theory (EGT) to construct a game model between renewable energy generation enterprises and power grid companies within the electricity market. The model focuses on analyzing the interaction process between these two stakeholders in terms of grid connection and benefit distribution. This provides a theoretical foundation for understanding how to coordinate interests during the integration of renewable energy into the power grid.

- Introduction of a game analysis for thermal power enterprises participating in peak shaving under large-scale wind power integration: Addressing the challenges posed by large-scale wind power integration, this study investigates the game strategies of thermal power enterprises participating in peak shaving services. The analysis explores how revenue from peak shaving influences the bidding behavior of thermal power enterprises. By modeling the game behavior of thermal power plants in the context of wind power integration, the study further examines the impact of introducing peak shaving services on system evolution outcomes.

- Dynamic simulation and variable parameter analysis: Dynamic simulations are employed to verify the theoretical model, with all findings based on theoretical assumptions rather than empirical data. The simulations explore the relationships between key parameters (e.g., electricity prices, subsidy rates) under various scenarios, replicating potential real-world dynamics in the context of renewable energy integration. This study analyzes how these variables influence the stability of the benefit coordination game between renewable energy generation companies and grid enterprises.

- Stability analysis based on evolutionary game theory: In addition to theoretical modeling, the study integrates Lyapunov stability theory to derive and analyze the stability of the system’s equilibrium points. This approach reveals how different strategy choices can influence the long-term evolution of the system.

- Further, the key innovations of this paper are elaborated as follows:

- Proposal of a novel benefit coordination mechanism in the electricity market based on evolutionary game theory: This research introduces a new analytical framework by applying evolutionary game theory to the problem of benefit distribution in the electricity market. The framework effectively models the dynamic and uncertain interactions between power generation enterprises and grid companies, capturing their evolving strategies over time.

- Incorporation of peak shaving ancillary service revenue into evolutionary game analysis: An innovative aspect of this study is the inclusion of peak shaving ancillary service revenue in the evolutionary game model. This study analyzes how peak shaving revenue impacts the bidding strategies of thermal power enterprises and their interactions with grid enterprises in the context of large-scale wind power integration. This contribution is significant in addressing the challenges of balancing the interests of renewable energy and conventional power generation.

- Construction of a game strategy model for thermal power enterprises under large-scale wind power integration: This study develops a novel game strategy model for thermal power enterprises engaged in peak shaving under conditions of large-scale wind power integration. This model fills a gap in existing research by providing insights into the strategic interactions between thermal power enterprises and renewable energy providers, particularly in relation to peak shaving capacity and system stability.

- Policy recommendations for enhancing cooperation between renewable energy and power grid enterprises: Based on the dynamic evolutionary analysis of the game model, this study offers practical policy recommendations for optimizing renewable energy pricing, enhancing grid company enthusiasm for renewable energy integration, and improving the stability of the electricity market. These recommendations provide theoretical guidance for government departments in formulating relevant policies.

2. Literature Review

2.1. Electricity Market Game Models

2.2. Game Theory and Its Application to Electricity Markets

2.3. Development of the Bidding Model Used in Power Generators

2.4. Current Structure of China’s Energy Market

- (1)

- Key Stakeholders in China’s Energy Market. The primary stakeholders in China’s energy market can be categorized into the following groups.

- (2)

- Energy Generation. China’s energy generation is still heavily dependent on coal, which accounted for approximately 56.8% of total energy consumption in 2020 [52]. However, there has been significant growth in renewable energy generation. By 2021, renewable energy (primarily hydro, wind, and solar power) constituted nearly 30% of China’s electricity generation mix [1].

- (3)

- Electricity Transmission and Distribution. Electricity transmission and distribution in China are managed primarily by two state-owned grid companies as follows.

- (4)

- Market Reforms. Over the past decade, China has implemented significant reforms aimed at liberalizing the electricity market and increasing the role of competition. Prior to these reforms, the energy market was characterized by a single-buyer model, where electricity prices were set by the government, and power generators sold electricity directly to grid companies at fixed rates [56].

- (5)

- Challenges and Future Directions. While the reforms have made significant progress, there are still challenges in China’s energy market. One major issue is the curtailment of renewable energy, where wind and solar power generation is restricted due to grid limitations. The lack of flexibility in the grid infrastructure and the dominance of coal in the energy mix make it difficult to fully integrate renewable energy [61,62].

3. Evolutionary Game-Theoretic Model

3.1. Core Concepts in Evolution Game Theory

3.1.1. Bounded Rationality Assumption

3.1.2. Evolutionary Game Theory Framework

- Step I: Parameter setting. This includes four main parameters: participants, strategy set, payment matrix, and order of decision selection.

- Step II: Strategy change. The result of the game cannot achieve a balance in one or two times, but can only reach the equilibrium of evolutionary game through repeated games. Games played under different parameter conditions often yield different equilibrium points.

- Step III: Parameter dynamic solution. Solve to obtain fixed time and probability.

- Step IV: Equilibrium strategy solution. Different games have different solution processes. For example, deterministic evolutionary games are solved using RD dynamic equation, and stochastic evolutionary games usually require the consideration of various stochastic factors and are usually solved based on stochastic differential equation theory.

3.1.3. Evolutionarily Stable Strategy (ESS)

3.1.4. Replicator Dynamics (RD)

3.2. A Basic Model of Two-Group Asymmetric Evolutionary Game

- (a)

- Bounded Rationality. The participants (i.e., power grid companies and renewable energy generation enterprises) are assumed to have bounded rationality. This means that while they aim to maximize their respective payoffs, they do so under limited information and cognitive constraints. Therefore, instead of making fully rational decisions, they adapt their strategies based on historical payoffs and observed behaviors.

- (b)

- Groups and Strategies. The first group consists of the renewable energy generation enterprises (Group A), and the second group consists of the power grid companies (Group B). Both groups are provided with two pure strategies: Group A (Renewable Energy): Strategy 1 (Cooperate) and Strategy 2 (Not Cooperate); Group B (Grid Companies): Strategy 1 (Cooperate) and Strategy 2 (Not Cooperate).

- (c)

- Payoff Parameters. a, b, c, d, e, f, g, h are the payoff parameters when different strategies are selected by the groups. For example, the payoff of Group A selecting Strategy 1 (Cooperate) when Group B selects Strategy 2 (Not Cooperate) is denoted by a, while the reverse scenario would be denoted by another payoff parameter.

- (d)

- Structure of the Evolutionary Game. The interaction between the two groups is represented as a two-player asymmetric evolutionary game. The strategies selected by both groups result in certain payoffs, and the model tracks how the strategies evolve over time. To evaluate the long-term behavior of the system, we calculate the Jacobian matrix from the replicator dynamic equations, which helps to assess the local stability of equilibrium points.

- (e)

- Stability Analysis and Simulation. By analyzing the determinant and trace of the Jacobian matrix, we can classify the stability of the equilibrium points: Evolutionarily stable strategies (ESS), which mean that if the determinant of the Jacobian is positive and the trace is negative, the equilibrium point is evolutionarily stable; Unstable Equilibria, which mean that if the trace is positive, the equilibrium is unstable; and Saddle Points, which mean that if the trace is zero and the determinant is positive, the equilibrium is a saddle point.

3.2.1. Mathematical Modeling

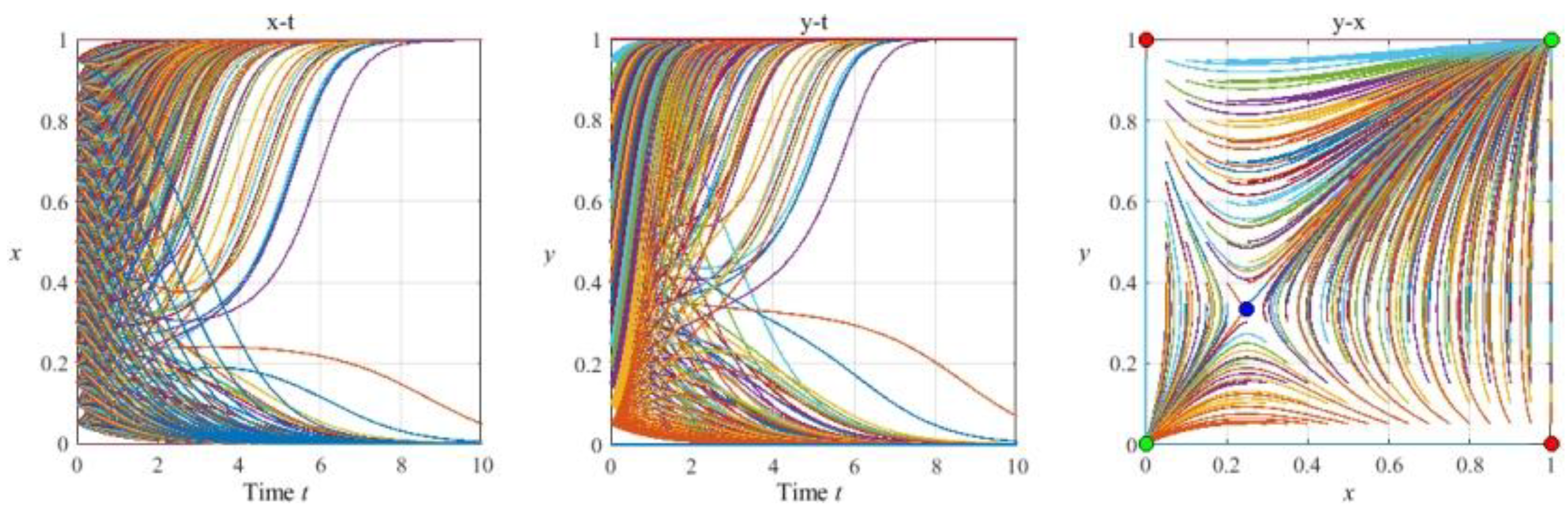

3.2.2. Simulation Verification

4. Evolutionary Game Analysis of Thermal Power Enterprise Groups’ Participation in Peak Shaving

4.1. General Evolutionary Game Model of Thermal Power Peak Shaving in Normal Situations

4.1.1. Evolutionary Game Model without Considering Peak Shaving Auxiliary Service Revenue for Thermal Power Plant Group

4.1.2. Evolutionary Game Model of Thermal Power Plant Group Considering Peak Shaving Auxiliary Service Revenue

4.2. Long-Term Evolutionary Stability Analysis for Peak Regulation Involving Thermal Power Units

4.2.1. Peak Shaving Ancillary Service Revenue Not Considered

4.2.2. Peak Shaving Ancillary Service Revenue Is Considered

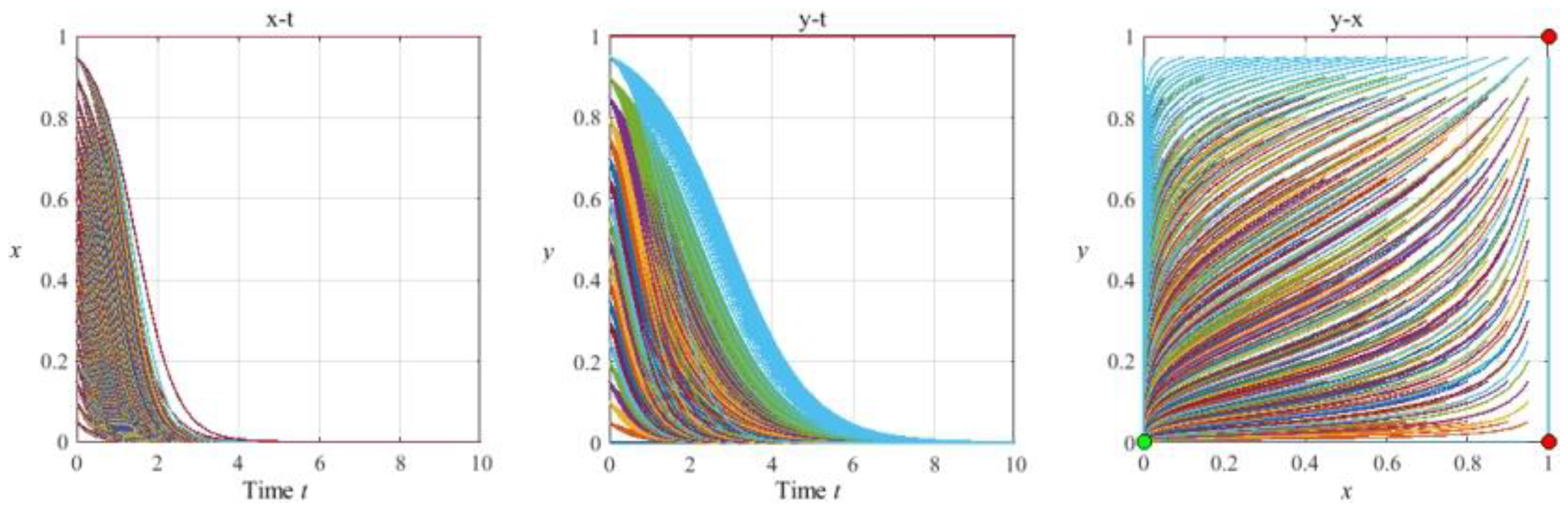

4.3. Example Verification

4.3.1. Peak Shaving Ancillary Service Revenue Not Considered

4.3.2. Consider Peak Shaving Ancillary Service Revenue

5. Evolutionary Game Analysis of Renewable Energy Integration Benefits Coordination

5.1. Parameters Setting

- : The payoff for Game Player 1 when both players choose cooperation (x and y).

- : The payoff for Game Player 2 when both players choose cooperation (x and y).

- : The payoff for Game Player 1 when Game Player 1 cooperates (x), but Game Player 2 does not cooperate (1 − y).

- : The payoff for Game Player 2 when Game Player 1 cooperates (x), but Game Player 2 does not cooperate (1 − y).

- : The payoff for Game Player 1 when Game Player 1 does not cooperate (1 − x), but Game Player 2 cooperates (y).

- : The payoff for Game Player 2 when Game Player 1 does not cooperate (1 − x), but Game Player 2 cooperates (y).

- : The payoff for Game Player 1 when both players choose not to cooperate (1 − x and 1 − y).

- : The payoff for Game Player 2 when both players choose not to cooperate (1 − x and 1 − y).

5.2. Simulation Analysis

5.3. Discussion

- (1)

- Literature Integration: We will integrate forecasts from credible sources such as the Intergovernmental Panel on Climate Change (IPCC) and the World Meteorological Organization (WMO) that provide data on future environmental conditions likely to impact renewable energy production. These forecasts will be used to contextualize the assumptions of our evolutionary game model, especially in scenarios related to the availability and variability of solar and wind energy.

- (2)

- Model Sensitivity Analysis: We propose to extend our simulations to include sensitivity analyses that explore how varying projections of wind speed, solar radiation, and river flows could affect the evolutionarily stable strategies of the stakeholders involved. This would help in understanding the resilience and adaptability of grid and generation enterprises to likely future environmental scenarios.

- (3)

- Policy Implications: By embedding these environmental forecasts into our discussion, we can offer more nuanced policy recommendations that account for potential future shifts in energy production capabilities and their impact on market dynamics and regulatory needs.

- (1)

- Comparison with Other Studies.

- (a)

- Stakeholder Interaction: Prior research has predominantly focused on isolated aspects of market interactions without a comprehensive understanding of how multiple players dynamically influence each other. For instance, while some studies have emphasized the role of government policies in influencing grid operations, they have not fully captured the adaptive strategies of energy companies in response to evolving market conditions. This paper’s application of evolutionary game theory uniquely contributes by illustrating how the strategies of power grid companies and renewable energy providers evolve towards an equilibrium that optimally balances the interests of both parties, reflecting a deeper understanding of market dynamics.

- (b)

- Role of Subsidies and Pricing: The influence of peak shaving compensation on bidding strategies, as explored in this study, has been less emphasized in traditional analyses, which tend to focus on static pricing strategies. This research extends the analysis by integrating dynamic incentives such as peak shaving benefits, showing how they can modify the strategic behavior of energy companies. This aligns with findings from Ref. [4] but goes further by quantifying the impacts within a replicator dynamics framework.

- (c)

- System Stability and Efficiency: The stability analysis provided through Lyapunov functions and the derived conditions for evolutionary stability offer a novel contribution to the literature. Most previous studies do not provide a methodological framework for assessing the stability of strategic outcomes in energy markets, which is crucial for policy formulation and ensuring grid reliability.

- (2)

- Implications for Policy and Practice.

- (a)

- Policy Recommendations: Effective regulatory frameworks can be designed to encourage cooperation between renewable energy firms and grid operators. The evolutionary game theory model suggests that policies should focus on adjusting the initial conditions and incentives to guide the system towards desirable equilibria.

- (b)

- Operational Strategies: For power grid companies, the strategic implications involve adjusting their bidding and operational strategies based on the expected behavior of renewable energy firms. This includes considering the long-term benefits of cooperative strategies over aggressive competitive tactics, which may lead to suboptimal outcomes.

- (c)

- Market Design: Enhancing the design of electricity markets to accommodate the nuances of renewable integration, as revealed by the game-theoretic analysis, can improve both the economic efficiency and the reliability of energy supply.

6. Conclusions

- (i)

- Evolution of strategic choices for peak shaving and coordination of renewable energy integration. The strategic choices of thermal power plants in peak shaving tend to collectively adopt either high-price or low-price bidding strategies, which are closely related to initial parameters. The formation of an interest equilibrium between thermal power plants and grid companies is a dynamic process. Increasing regulatory oversight is crucial in improving the peak shaving capacity of thermal power units.

- (ii)

- Dynamic evolution of interest equilibrium between renewable energy and grid companies. The balance of interests between renewable energy generation companies and grid enterprises evolves gradually. The evolution of strategies is influenced by the payment matrices and initial conditions, with factors such as electricity prices, revenues, and system load levels playing a pivotal role in determining the peak shaving capability and stability of the electricity market.

- (iii)

- Impact of government policy on market stability and renewable energy integration. Government policies and incentives play a significant role in stabilizing the electricity market and promoting the integration of renewable energy. This study recommends that policymakers consider equitable interest distribution among stakeholders to ensure cooperation between renewable energy generation companies and grid companies, thereby enhancing the long-term stability and development of the electricity market.

- (iv)

- In the context without considering peak shaving, the specific setting of the evolutionary strategy and parameters of thermal power generation is irrelevant and has similarities. In the context of peak shaving, the final strategy choices of thermal power plants tend to collectively adopt high prices or collectively adopt low prices and are closely related to the initial choices. The stable strategy choices with and without considering peak shaving have similar results and are interrelated.

- (v)

- In the game evolution process, the evolution direction of the strategies of both sides of the game depends on their payoff matrix. The initial values and changes of certain parameters in the payoff functions of the participating parties will lead the game evolution system to evolve along different paths, converging to different equilibrium points. The parameter variables that affect the cooperative evolution results between renewable energy generation companies and grid companies include: the excess profit S generated by cooperation, the conventional energy price P, the subsidy rate V, the initial input marginal cost l, and the distribution coefficient λ, where λ is a function of P, V, and l. If the conventional energy price P, subsidy rate V, and marginal cost l meet the prerequisite conditions for the system to evolve towards complete cooperation, then whether the distribution of excess profits between renewable energy companies and grid companies is fair and reasonable will directly determine the direction of the system’s evolution.

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Abbreviations and Nomenclature

| Symbol/Abbreviation | Definition |

| CCHP | Combined Cooling, Heating, and Power |

| CO2 | Carbon Dioxide |

| EGT | Evolutionary Game Theory |

| ESS | Evolutionary Stable Strategy |

| MOMVO | Multi-objective Multiverse Algorithm |

| MCP | Market Clearing Price |

| PSO | Particle Swarm Optimization |

| PAB | Pay-as-Bid Settlement Mechanism |

| RD | Replicator Dynamics |

| UHV | Ultra-high Voltage |

| x | Proportion of renewable energy generators using a strategy |

| y | Proportion of grid companies using a strategy |

| SA1 | Strategy 1 for renewable energy generators (cooperate) |

| SA2 | Strategy 2 for renewable energy generators (non-cooperate) |

| SB1 | Strategy 1 for grid companies (cooperate) |

| SB2 | Strategy 2 for grid companies (non-cooperate) |

| R1 | Normal returns earned by renewable energy generators (non-cooperative strategy) |

| R2 | Normalized benefits received by grid companies (non-cooperative strategy) |

| Sall | Total excess profit earned by both parties (cooperative strategy) |

| Qn | Output of renewable energy generators (non-cooperative strategy) |

| Qy | Yield of renewable energy generators (cooperative strategy) |

| l1 | Incremental cost for adding renewable electricity (marginal cost of renewable energy generator) |

| l2 | Incremental cost for adding renewable electricity service (marginal cost for grid company) |

| V1 | Unit subsidy for renewable energy electricity supply |

| V2 | Unit subsidy for renewable electricity services |

| Cj | Peak shaving auxiliary cost subsidy |

| Peak load capability level | |

| Pj | Unit capacity of generator |

| Fj | Average output of generator |

| Minimum load rate | |

| Wj | Critical output value |

| Start-stop status of units | |

| Sprice1 | High-bid strategy for thermal power plant groups |

| Sprice2 | Low-bid strategy for thermal power plant groups |

| f1(x) | Intermediate result in equation breakdown |

| f2(x) | Scaled intermediate result in equation breakdown |

| λ | Grid firm’s allocation coefficient for total excess profit |

| P | Price at which grid companies sell electricity from conventional energy sources |

| S | System state representing strategies of two-player games |

| det(J) | Determinant of Jacobian matrix |

| tr(J) | Trace of Jacobian matrix |

| T | Number of peak shaving operations in the power system |

| Cj | Peak shaving benefit of thermal power plant j |

| ηj | Start-stop status of units of thermal power plant j |

| αj | Peak load capability level of each unit |

| Sjzz | Benchmark compensation standard for peak load regulation behavior |

| Pj | Unit capacity of the unit j |

| Fj | Average output size of the unit j during a certain period |

| Bj | Actual peaking behavior of the unit j |

References

- International Energy Agency (IEA). World Energy Outlook 2021. International Energy Agency. 2021. Available online: https://www.iea.org/reports/world-energy-outlook-2021 (accessed on 5 September 2024).

- BP. Statistical Review of World Energy 2022. BP. 2022. Available online: https://www.bp.com/en/global/corporate/energy-economics/statistical-review-of-world-energy.html (accessed on 5 September 2024).

- International Renewable Energy Agency (IRENA). Renewable Capacity Statistics 2023. International Renewable Energy Agency. 2023. Available online: https://www.irena.org/Publications/2023/Mar/Renewable-Capacity-Statistics-2023 (accessed on 5 September 2024).

- REN21. Renewables 2022 Global Status Report. REN21. 2022. Available online: https://www.ren21.net/reports/global-status-report/ (accessed on 5 September 2024).

- Lazard. Levelized Cost of Energy and Levelized Cost of Storage 2022. Lazard. 2022. Available online: https://www.lazard.com/perspective/levelized-cost-of-energy-levelized-cost-of-storage/ (accessed on 5 September 2024).

- Zhang, X.; Li, Y.; Wang, J. China’s renewable energy development: Status and policy directions. Energy Policy 2022, 160, 112789. [Google Scholar] [CrossRef]

- Xu, H.; Wang, M.; Lin, Z. The evolution of renewable energy policies in China. Renew. Energy 2023, 198, 1356–1364. [Google Scholar] [CrossRef]

- Li, S.; Liu, T. Grid integration challenges for renewable energy in China. J. Clean Energy 2023, 28, 500–512. [Google Scholar] [CrossRef]

- Zhou, Y.; Yang, Q.; He, L. Wind energy integration in China: Barriers and solutions. Renew. Sustain. Energy Rev. 2023, 182, 113481. [Google Scholar] [CrossRef]

- Wang, Z.; Chen, L.; Wu, Y. Balancing grid operator and renewable energy producer interests: A policy perspective. Energy Rep. 2023, 9, 274–289. [Google Scholar] [CrossRef]

- Zhang, C.; Du, S.; Su, J. Study on bidding strategies of regional electricity markets based on evolutionary game theory. Mod. Electr. Power 2010, 27, 87–90. [Google Scholar]

- Mei, S.W.; Wei, W.; Liu, F. Game theoretical perspective of power system control and decision making: A brief review of engineering game theory. Control Theory Appl. 2018, 35, 578–587. [Google Scholar]

- Sassi, D.B.; Chaieb, M. A game theory competitive intelligence solution stimulated from a Stackelberg game: A three players scenario. Eng. Appl. Artif. Intell. 2024, 135, 108825. [Google Scholar] [CrossRef]

- Wang, B.; Evergreen, S.; Forest, J. Game Theory in Smart Grids: Strategic decision-making for renewable energy integration. Sustain. Cities Soc. 2024, 108, 105480. [Google Scholar] [CrossRef]

- Liu, L.; Tang, C.; Zhang, L.; Liao, S. Liao. A generic approach for network defense strategies generation based on evolutionary game theory. Inf. Sci. 2024, 677, 120875. [Google Scholar] [CrossRef]

- Dashtbali, M.; Mirzaie, M. The impact of vaccination and social distancing on COVID-19: A compartmental model and an evolutionary game theory approach. J. Frankl. Inst. 2024, 361, 106994. [Google Scholar] [CrossRef]

- Yu, N.; Lu, M. Analysis of the dynamic evolution game of government, enterprise and the public to control industrial pollution. Sustainability 2024, 16, 2760. [Google Scholar] [CrossRef]

- Zhao, X.G.; Ren, L.Z.; Wan, G. Renewable portfolio standards, the strategic behavior of power producers and evolution. Chin. J. Manag. Sci. 2019, 27, 168–179. [Google Scholar]

- Wang, X.T. Non-cooperation game analysis of wind power integration. J. Henan Inst. Eng. 2015, 30, 5–8. [Google Scholar]

- Lu, Q.; Chen, L.; Mei, S. Typical applications and prospects of game theory in power system. Proc. CSEE 2014, 34, 5009–5017. [Google Scholar]

- Liu, X.; Gao, B.; Li, Y. Review on application of game theory in power demand side. Power Syst. Technol. 2018, 42, 2704–2711. [Google Scholar]

- Zhang, S.X.; Li, Q.F.; Fu, C. Game analysis of power generation companies and grid companies in tariff. J. Shanghai Univ. Electr. Power 2015, 31, 389–392. [Google Scholar]

- Zhao, E.; Wang, H.; Lin, H. Research on ladder bidding strategy of thermal power enterprises according to evolutionary game in spot market. Electr. Power Constr. 2020, 41, 68–77. [Google Scholar]

- Li, B. Study on the Behavioral Decision Analysis Model of Generation Market from the Perspective of Renewable Portfolio Standard. Ph.D. Thesis, North China Electric Power University, Beijing, China, 2018. [Google Scholar]

- Gao, J.; Sheng, Z.H. Elementary groping for evolutionary game theory and its application in electricity market. Autom. Electr. Power Syst. 2003, 27, 18–21. [Google Scholar]

- Wang, X.J.; Quan, J.; Liu, W.B. Study on evolutionary games and cooperation mechanism within the framework of bounded rationality. Syst. Eng. Theory Pract. 2011, 31, 82–93. [Google Scholar]

- Da, Q.L.; Zhang, J.X. Stability of evolutionary equilibrium under bounded rationality. Syst. Eng. Theory Methodol. Appl. 2006, 15, 279–284. [Google Scholar]

- Wang, X.T.; Xue, H.F.; Zhang, Q. Evolutionary game analysis on the interest coordination of grid-connected renewable energy power generation. Syst. Eng. 2012, 30, 94–99. [Google Scholar]

- Wang, Y.M. Simulation and Study on the Bidding Behavior of Power Generation Companies by Evolutionary Game. Master’s Thesis, North China Electric Power University, Beijing, China, 2014. [Google Scholar]

- Cheng, L.F. Theoretical Investigation on the Long-Term Evolutionarily Stable Equilibrium of Multi-Population Strategic Games in Electricity Market. Ph.D. Thesis, South China University of Technology, Hengyang, China, 2019. [Google Scholar]

- Zhou, M.; Yan, Y.; Ding, Q.; Wu, Z.; He, Y.; Long, S. Transaction and settlement mechanism for foreign representative power markets and its enlightenment for Chinese power market. Autom. Electr. Power Syst. 2017, 41, 1–8. [Google Scholar]

- Fei, Z. A Research of Generation Companies’ Bidding Strategies in China Regional Electricity Markets. Ph.D. Thesis, Jiangsu University, Zhenjiang, China, 2011. [Google Scholar]

- Shi, G.R.; Wang, C.; Li, K.L. Long run equilibrium model in generation-side electric power market based on the evolutionary game theory. Math. Pract. Theory 2004, 34, 1–6. [Google Scholar]

- Ma, X.D. The Impacts of Smart Grid and Renewable Source Connected to Power Grid on Power Marketing. Master’ Thesis, North China Electric Power University, Beijing, China, 2011. [Google Scholar]

- Taylor, P.D.; Jonker, L.B. Evolutionarily stable strategies and game dynamics. Math. Biosci. 1978, 40, 145–156. [Google Scholar] [CrossRef]

- Smith, M.; Price, G.R. The logic of animal conflict. Nature 1973, 246, 15–18. [Google Scholar] [CrossRef]

- Plank, M. Some qualitative differences between the replicator dynamics of two player and n player games. Nonlinear Anal. 1997, 30, 1411–1417. [Google Scholar] [CrossRef]

- Oechssler, J.; Riedel, F. On the dynamic foundation of evolutionary stability in continuous models. J. Econ. Theory 2002, 107, 223–252. [Google Scholar] [CrossRef][Green Version]

- Peng, C.; Sun, H.; Guo, J.; Liu, G. Multi-objective optimal strategy for generating and bidding in the power market. Energy Convers. Manag. 2012, 57, 13–22. [Google Scholar] [CrossRef]

- Ma, X.; Wen, F.; Ni, Y.; Liu, J. Towards the development of risk-constrained optimal bidding strategies for generation companies in electricity markets. Electr. Power Syst. Res. 2004, 73, 305–312. [Google Scholar] [CrossRef]

- Ren, Y.; Galiana, F. Pay-as-bid versus marginal pricing-part I: Strategic generator offers. IEEE Trans. Power Syst. 2004, 19, 1771–1776. [Google Scholar] [CrossRef]

- Zhang, P.D.; Yang, Y.L.; Shi, J.; Zheng, Y.H.; Wang, L.S.; Li, X.R. Opportunities and challenges for renewable energy policy in China. Renew. Sustain. Energy Rev. 2007, 13, 439–449. [Google Scholar]

- Thurber, M.C.; Davis, T.L.; Wolak, F.A. Simulating the interaction of a renewable portfolio standard with electricity and carbon markets. Electr. J. 2015, 28, 51–65. [Google Scholar] [CrossRef]

- Li, G.; Shi, J.; Qu, X. Modeling methods for GenCo bidding strategy optimization in the liberalized electricity spot market—A state-of-the-art review. Energy 2011, 36, 4686–4700. [Google Scholar] [CrossRef]

- Mei, S. Game approaches for hybrid power system planning. IEEE Trans. Sustain. Energy 2012, 3, 506–517. [Google Scholar]

- Wang, X.; Lu, H.; Li, G.; Yang, J.; Chen, Y.Q.; Liu, D.N. Microgrid participation in peak-shaving assistant services under the background of ubiquitous power internet of things. Smart Power 2019, 47, 1–9. [Google Scholar]

- Wen, X.; Yang, K.; Mao, R.; Zhao, Y.L.; Kuang, Z.Q.; Luo, B.S.; Fan, D. Construction of peak regulation auxiliary service market for southwest power grid with high proportion of hydropower in China. J. Glob. Energy Interconnect. 2021, 4, 309–319. [Google Scholar]

- Wu, F.; Sun, J.; Yuan, X. Competitive bidding and renewable energy integration in China: An overview of recent reforms. Energy Policy 2020, 139, 111248. [Google Scholar] [CrossRef]

- Qi, Y.; Ma, L.; Zhang, Z. China’s renewable energy policy and its impact on energy security. Energy Res. Soc. Sci. 2020, 60, 101326. [Google Scholar] [CrossRef]

- National Energy Administration. China’s 14th Five-Year Plan for Renewable Energy Development. National Energy Administration. 2020. Available online: http://www.nea.gov.cn/2020-12/20/c_1126889364.htm (accessed on 5 September 2024).

- National Bureau of Statistics. China Statistical Yearbook 2021. National Bureau of Statistics of China. 2021. Available online: http://www.stats.gov.cn/tjsj/ndsj/2021/indexeh.htm (accessed on 5 September 2024).

- Liu, Z.; Zhang, W. Renewable energy development and its impact on China’s energy transition. J. Clean. Prod. 2021, 289, 125654. [Google Scholar] [CrossRef]

- Zhang, J.; Gao, X. The role of renewable energy in China’s global industrial positioning. Energy Strategy Rev. 2021, 34, 100632. [Google Scholar] [CrossRef]

- Zhang, M.; Zhao, J.; Sheng, L. China’s ultra-high voltage grid: Supporting renewable energy integration. Energy Rep. 2021, 7, 2023–2035. [Google Scholar] [CrossRef]

- Chen, X.; Xu, Y. Evolutionary game theory in China’s electricity market: A review of recent developments. Energy Policy 2019, 124, 456–465. [Google Scholar] [CrossRef]

- Zhao, Y.; Lin, J.; Wu, X. Renewable Portfolio Standards in China: A critical analysis of implementation and outcomes. Energy Policy 2021, 145, 111754. [Google Scholar] [CrossRef]

- Sun, J.; Yuan, X. Grid integration challenges for wind power in China: A comprehensive review. Renew. Energy 2021, 175, 270–280. [Google Scholar] [CrossRef]

- Sun, J.; Wu, F.; Zhang, Y. Market mechanisms and grid integration of renewable energy in China. Energy Policy 2021, 156, 112416. [Google Scholar] [CrossRef]

- Liu, Z.; Wang, P.; Zhang, L. Green certificates and carbon trading in China: An analysis of market performance. Energy Policy 2022, 159, 112645. [Google Scholar] [CrossRef]

- Gao, S.; Sheng, Y. The challenge of integrating renewable energy into China’s electricity grid. Energy Econ. 2020, 89, 104796. [Google Scholar] [CrossRef]

- Gao, X.; Sheng, Y. Renewable energy curtailment in China: Causes and solutions. Energy Rep. 2021, 7, 53–61. [Google Scholar] [CrossRef]

- Chen, J.; Wang, X.; Liu, Y. Regional disparities in China’s renewable energy market: Challenges and opportunities. Renew. Sustain. Energy Rev. 2021, 143, 110954. [Google Scholar] [CrossRef]

- Li, H.; Wang, Y. Power market reform in China: Current status and future prospects. Energy Policy 2021, 152, 112227. [Google Scholar] [CrossRef]

- Cheng, L.; Liu, G.; Huang, H.; Wang, X.; Chen, Y.; Zhang, J.; Meng, A.; Yang, R.; Yu, T. Equilibrium analysis of general N-population multi-strategy games for generation-side long-term bidding: An evolutionary game perspective. J. Clean. Prod. 2020, 276, 124123. [Google Scholar] [CrossRef]

- Cheng, L.; Yin, L.; Wang, J.; Shen, T.; Chen, Y.; Liu, G.; Yu, T. Behavioral decision-making in power demand-side response management: A multi-population evolutionary game dynamics perspective. Int. J. Electr. Power Energy Syst. 2021, 129, 106743. [Google Scholar] [CrossRef]

- Dong, F.G.; Wu, N.N.; Yao, J.; Li, H.J.; Bai, H.K.; Jin, C.X. Study on evolutionary game model of thermal power regulation in large-scale wind power grid integration. Electr. Power 2018, 51, 151–157. [Google Scholar]

- Cheng, L.; Yu, T. Nash equilibrium-based asymptotic stability analysis of multi-group asymmetric evolutionary games in typical scenario of electricity market. IEEE Access 2018, 6, 32064–32086. [Google Scholar] [CrossRef]

- Zhang, Y. Evolutionary Game Theory on Thermal Power Peaking under Large Scale of Wind Power Integration. Master’ Thesis, North China Electric Power University, Bejing, China, 2017. [Google Scholar]

- Liu, J.K.; Huang, J. Evolutionary game analysis on behavioral decision of coal mine leaders and supervisors. J. Saf. Sci. Technol. 2022, 18, 100–105. [Google Scholar]

- Chai, Y.G.; He, X.Y.; Su, Y.J.; Ding, B.L.; Hu, W.M.; Yang, Z.P. Economic research on peak shaving of thermal power units considering safety-environmental protection and compensation. Electr. Power 2021, 54, 199–205. [Google Scholar]

- Cheng, L.; Chen, Y.; Liu, G. 2PnS-EG: A general two-population n-strategy evolutionary game for strategic long-term bidding in a deregulated market under different market clearing mechanisms. Int. J. Electr. Power Energy Syst. 2022, 142, 108182. [Google Scholar] [CrossRef]

- Cheng, L.F.; Yu, T. Game-theoretic approaches applied to transactions in the open and ever-growing electricity markets from the perspective of power demand response: An overview. IEEE Access 2019, 7, 25727–25762. [Google Scholar] [CrossRef]

| (x, y) | det(J) | tr(J) | Evolutionary Stability |

|---|---|---|---|

| (0, 0) | 6 | 5 | Evolutionarily unstable strategy |

| (0, 1) | 8 | −6 | Evolutionarily stable strategy (ESS) |

| (1, 0) | 9 | −6 | ESS |

| (1, 1) | 12 | 7 | Evolutionarily unstable strategy |

| (2/5, 3/7) | −35/72 | 0 | Saddle point (it also remains evolutionarily unstable) |

| Quotation Strategy | Sprice1 (High-Bid Strategy by Group 2) | Sprice2 (Low-Bid Strategy by Group 2) |

|---|---|---|

| Sprice1 (high-bid strategy by group 1) | (a1 + b + d, a2 + e + d) | (a1 − e, a2 + e) |

| Sprice2 (low-bid strategy by group 1) | (a1 + b, a2 − b) | (a1, a2) |

| Unit Category | Capacity Range/MW | Compensation for Peak Shaving Limit/% |

|---|---|---|

| 1 | 29 | |

| 2 | 40 |

| Quotation Strategy | Sprice1 (High-Bid Strategy) from the Second Type of Unit Group | Sprice2 (Low-Bid Strategy) from the Second Type of Unit Group |

|---|---|---|

| Sprice1 (high-bid strategy) from the first type of unit group | ||

| Sprice2 (low-bid strategy) from the first type of unit group |

| Internal Equilibrium Points | det (J) | tr(J) | Asymptotic Stability Analysis Results |

|---|---|---|---|

| (0, 0) | be (positive) | −b − e (negative) | ESS |

| (0, 1) | db (positive) | d + b (positive) | Evolutionarily unstable |

| (1, 0) | de (positive) | d + e (positive) | Evolutionarily unstable |

| (1, 1) | d2 (positive) | −2d (negative) | ESS |

| (negative) | 0 | Saddle point (also evolutionarily unstable) |

| Internal Equilibrium Points | det (J) | tr(J) | Asymptotic Stability Analysis Results |

|---|---|---|---|

| (0, 0) | ESS | ||

| (0, 1) | Uncertain | ||

| (1, 0) | Uncertain | ||

| (1, 1) | ESS | ||

| 0 | Saddle point (also evolutionarily unstable) |

| 300 MW | Generating Capacity Bidding Sections | |||||

| (120 150] | (150 180] | (180 210] | (210 240] | (240 270] | (270 300] | |

| Sprice1 (high-bid strategy) | 280 | 290 | 300 | 310 | 315 | 320 |

| Sprice2 (low-bid strategy) | 144.23 | 154.23 | 164.23 | 174.23 | 179.23 | 184.23 |

| 600 MW | Generating capacity bidding sections | |||||

| (240 300] | (300 360] | (360 420] | (420 480] | (480 540] | (540 600] | |

| Sprice1 (high-bid strategy) | 282 | 292 | 302 | 312 | 316 | 320 |

| Sprice2 (low-bid strategy) | 106.49 | 116.49 | 126.49 | 136.49 | 140.49 | 144.49 |

| Quotation Strategy | Sprice1 (High-Bid Strategy by Group 2) | Sprice2 (Low-Bid Strategy by Group 2) |

|---|---|---|

| Sprice1 (high-bid strategy by group 1) | (94,125, 68,907) | (26,424.3, 23,710.2) |

| Sprice2 (low-bid strategy by group 1) | (52,928.2, 1206.3) | (44,043, 10,091.5) |

| Quotation Strategy | Sprice1 (High-Bid Strategy by Group 2) | Sprice2 (Low-Bid Strategy by Group 2) |

|---|---|---|

| Sprice1 (high-bid strategy by group 1) | (350, 350) | (160, 540) |

| Sprice2 (low-bid strategy by group 1) | (540, 160) | (350, 350) |

| Quotation Strategy | Sprice1 (High-Bid Strategy by Group 2) | Sprice2 (Low-Bid Strategy by Group 2) |

|---|---|---|

| Sprice1 (high-bid strategy by group 1) | (175, 350) | (160, 350) |

| Sprice2 (low-bid strategy by group 1) | (270, 350) | (175, 350) |

| Internal Equilibrium Points | det (J) | tr(J) | Asymptotic Stability Analysis Results |

|---|---|---|---|

| (0, 0) | (+) | (−) | ESS |

| (0, 1) | (+) | (+) | Evolutionarily unstable |

| (1, 0) | (+) | (+) | Evolutionarily unstable |

| (1, 1) | (+) | (−) | ESS |

| (0.177, 0.23) | (−) | 0 | Saddle point (also evolutionarily unstable) |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sun, J.; Wu, F.; Shi, M.; Yuan, X. Coordination of Renewable Energy Integration and Peak Shaving through Evolutionary Game Theory. Processes 2024, 12, 1995. https://doi.org/10.3390/pr12091995

Sun J, Wu F, Shi M, Yuan X. Coordination of Renewable Energy Integration and Peak Shaving through Evolutionary Game Theory. Processes. 2024; 12(9):1995. https://doi.org/10.3390/pr12091995

Chicago/Turabian StyleSun, Jian, Fan Wu, Mingming Shi, and Xiaodong Yuan. 2024. "Coordination of Renewable Energy Integration and Peak Shaving through Evolutionary Game Theory" Processes 12, no. 9: 1995. https://doi.org/10.3390/pr12091995

APA StyleSun, J., Wu, F., Shi, M., & Yuan, X. (2024). Coordination of Renewable Energy Integration and Peak Shaving through Evolutionary Game Theory. Processes, 12(9), 1995. https://doi.org/10.3390/pr12091995