Abstract

As high-end oil and gas equipment, the high-temperature high-pressure (HTHP) adaptability and intelligence level of Rotary Steerable Systems (RSS) directly determine the development efficiency of deep unconventional resources. This paper reviews the technological breakthroughs and industrial chain synergy pathways of domestic RSS in China, with core conclusions as follows: (1) domestic technologies represented by the CG STEER system have achieved stable operation at 150 °C, high build rates of 15.3°/30 m, and reservoir penetration rates of 98.7%, with key indicators reaching international advanced levels; (2) collaborative innovations in material system reconstruction, hybrid steering mechanisms, and vibration suppression technology have reduced single-well drilling cycles by 50%; (3) industrial chain synergy effects are significant: a 95% localization rate reduced the cost per bottom hole assembly (BHA) run to CNY 2 million, and the “Penta-Helix” innovation model increased patent sharing rates to >60%; (4) breakthroughs in 175 °C high-temperature chips and downhole intelligent decision-making algorithms are urgently needed. This study provides technological paradigms and industrial upgrading pathways for the autonomous development of drilling equipment for extreme conditions. Recognizing the need for comprehensive improvement, the revised manuscript will strengthen three key aspects: (1) supplementing systematic comparisons between domestic technologies and international benchmarks in terms of HTHP adaptability and intelligent control; (2) elaborating technical details of hybrid steering mechanisms and vibration suppression technologies to clarify their innovation in industrial processes; (3) adding case studies of autonomous decision-making systems in ultra-deep wells to verify the practical effectiveness of the proposed methods. These revisions aim to address the current limitations and enhance the scientific rigor of the study.

1. Introduction: Technological Evolution and National Strategic Needs

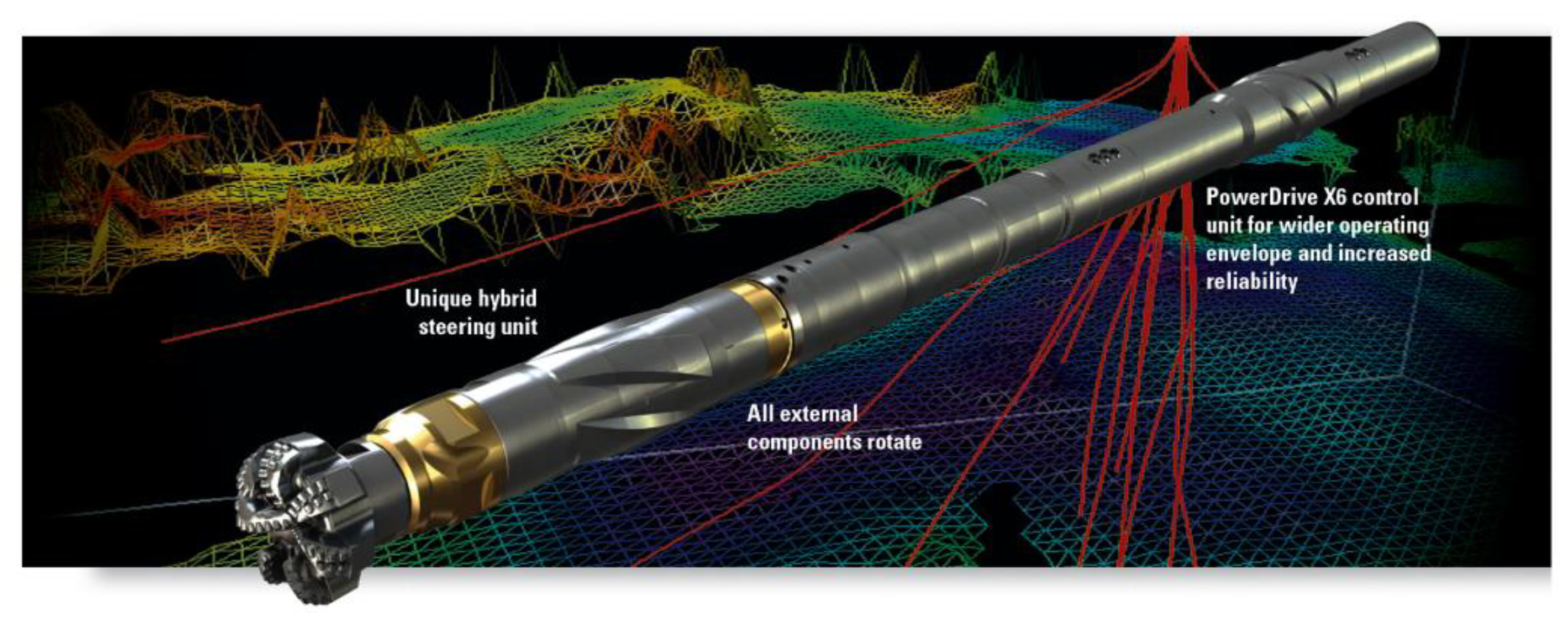

Global oil and gas exploration and development are rapidly advancing into deeper, unconventional, and complex geological formations, imposing unprecedented demands on directional drilling technology for precision and efficiency [1,2]. The RSS represents a disruptive technology in modern drilling engineering. By regulating the borehole trajectory in real-time while the drill string rotates continuously, RSS completely overcomes bottlenecks of traditional slide-steering drilling, including non-productive time (NPT) losses and insufficient trajectory control precision. Consequently, RSS has become a “core tool” for the efficient development of unconventional resources like shale gas and tight oil and gas [3,4,5]. The technological essence of RSS lies in the synergistic closed loop between the downhole steering mechanism and the surface control system, achieving the precise integration of “geometric steering” and “geosteering”; the former ensures the borehole trajectory extend along the preset three-dimensional path, while the latter relies on near-bit sensors to identify lithological interfaces in real-time, enabling the drill bit to consistently traverse the reservoir “sweet spot” [6]. International practice has demonstrated that RSS application can extend the horizontal section length beyond 3000 m, increase the reservoir penetration rate to 95–98%, and enhance single-well production by 30–50%. This makes RSS a key milestone in the transition of oil and gas drilling from “mechanization” to “intelligence” [7,8,9]. Reflecting on the technological development trajectory, innovation in RSS was long led by international oilfield service giants. In the 1990s, three major companies—Schlumberger (PowerDrive series), Baker Hughes (AutoTrak series), and Halliburton (Geo-Pilot series)—established three distinct technical approaches: “push-the-bit,” “point-the-bit,” and “hybrid,”, respectively.

Since 2020, international RSS has advanced rapidly in HTHP adaptability and intelligence:

(1) Schlumberger has upgraded its PowerDrive X6 system since 2023, integrating SiC-based power electronics to extend its operating range to 175 °C/150 MPa, with a verified single-run footage of 3800 m in Gulf of Mexico ultra-deep wells.

(2) Baker Hughes upgraded AutoTrak Ultra in 2024, integrating a diamond-like carbon coating on steering arms to reduce wear by 60% under high-temperature friction, extending tool life by 30% in North Sea HTHP fields.

(3) Halliburton released iCruise 2.0 in 2022, combining digital twin with edge computing to realize 100 ms real-time trajectory correction, reducing non-productive time by 40% in Permian Basin shale wells.

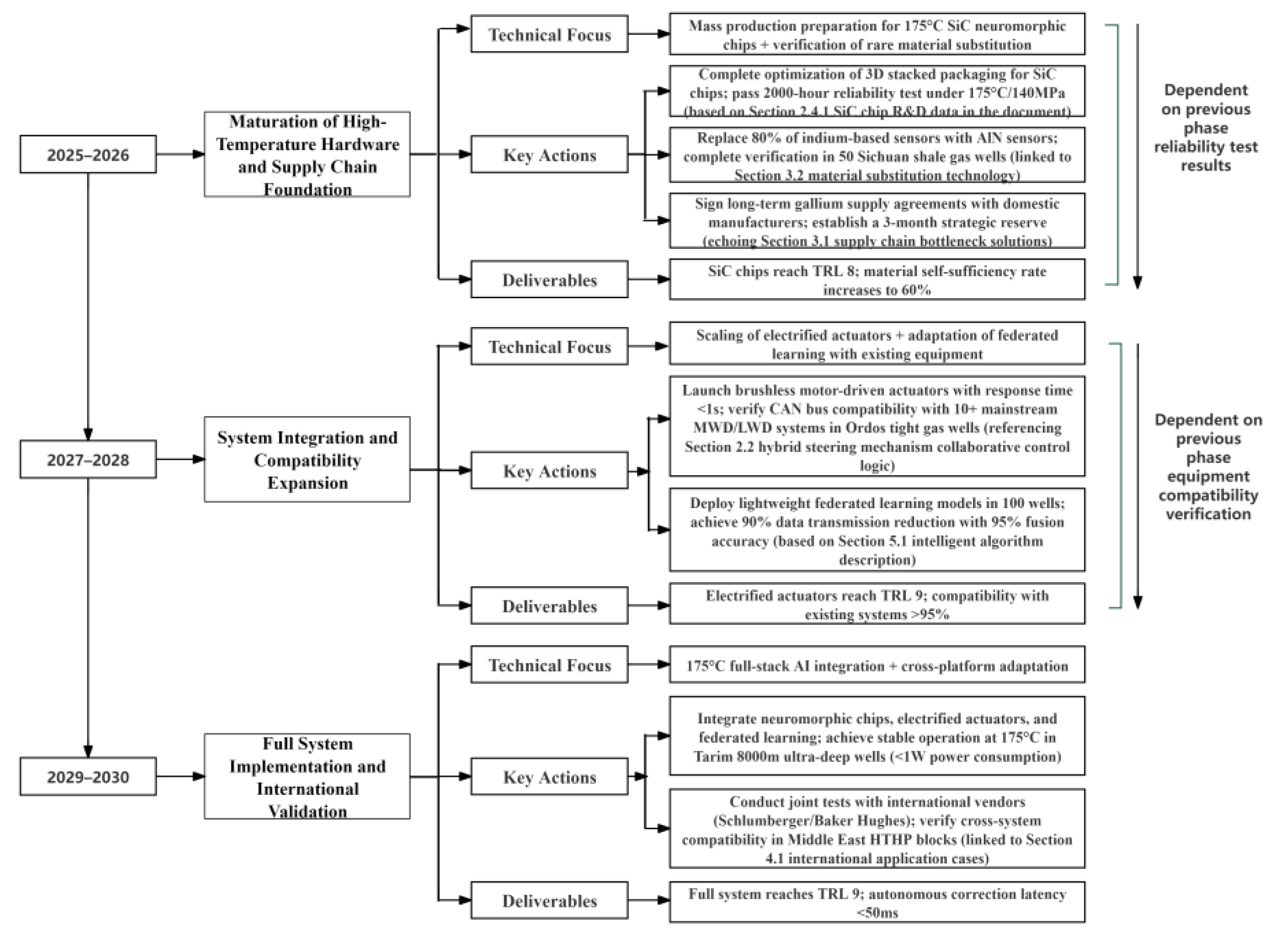

Through continuous iteration, they formed comprehensive intellectual property barriers [10,11,12]. This landscape resulted in China’s predominant reliance on imported technical services for RSS before the 2000s, leading not only to high rental costs but also to the risk of critical technology “choke points”. In 2006, the introduction of a foreign RSS by Chuanqing Drilling & Exploration in the Guang’an block for the first time to complete long horizontal section drilling, achieving a staggering 50% reduction in cycle time, demonstrated the technology’s value while underscoring the strategic need for independent technological development. It was precisely this predicament of being “constrained by others” that catalyzed a wave of collaborative R&D efforts centered on national energy strategy, led by state-owned enterprises with participation from academia and research institutions, initiating China’s ten-year journey of breaking through in rotary steerable technology “from scratch”. Globally, RSS technology has entered a new phase of “intelligentization + extreme condition adaptation” since 2023. Schlumberger has advanced its PowerDrive X6 system with enhanced high-temperature packaging, achieving stable operation at 175 °C in Tarim Basin ultra-deep wells, while Baker Hughes upgraded the AutoTrak Curve to integrate fiber optic communication, boosting downhole data transmission to 100 kbps—both setting new benchmarks for extreme environment applications. These international advancements, alongside domestic breakthroughs, form the global landscape of RSS innovation, making a comparative analysis of technological pathways critical for industry progress. Schlumberger’s PowerDrive series, a representative of early international RSS with features like hybrid steering units and rotating external components, is shown in Figure 1, illustrating the technical benchmark that domestic systems aimed to catch up with.

Figure 1.

Schlumberger RSS.

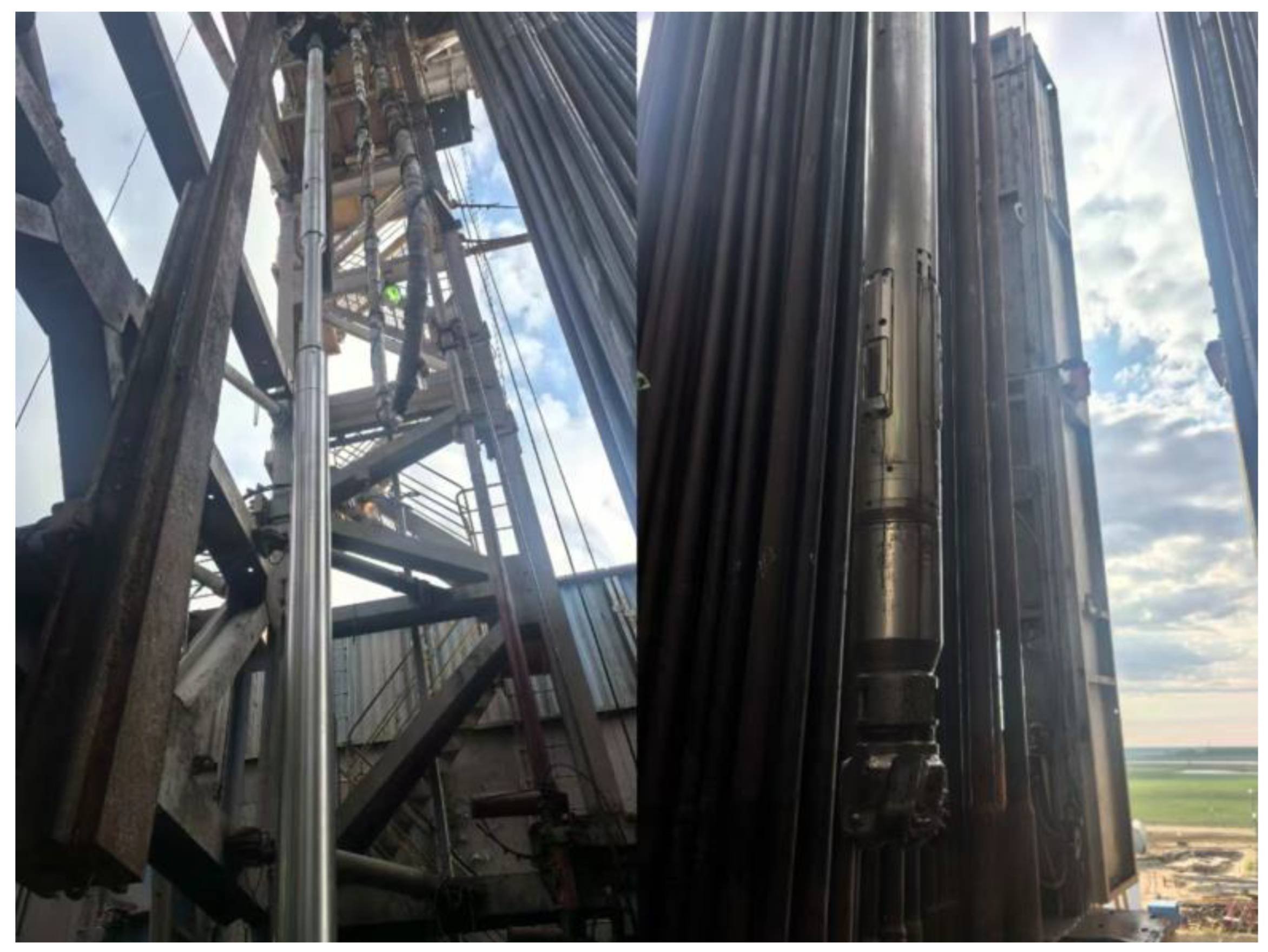

Through systematic efforts, China’s RSS technology has achieved a historic leap from “catching up” to “running neck and neck in certain areas”. The localized breakthrough represented by the CG STEER system signifies that China has mastered core technologies encompassing the entire chain, including inertial measurement, downhole closed-loop control, and high-temperature electronic packaging [13]. The development history of this system epitomizes the typical path of China’s independent innovation in high-end equipment: from the setback of the first prototype failing after only 20 h downhole during project initiation in 2009, to the breakthrough of achieving a build-up rate of 11.5°/30 m in Well Ning 216-H6-1 in 2019, and further to the international advanced level in 2023 where the Model 475 system achieved single-run footage of 2205 m and a build-up rate of 15.3°/30 m. Underpinning this progress are continuous optimizations driven by 243 failure reports, technological barriers built upon over 40 invention patents, and supply chain independence supported by a 95% localization rate. Industrialization achievements are equally remarkable: in tight gas development in the Sichuan Basin, CG STEER shortened drilling cycles from 30 days to under 15 days; 32 wells achieved open flows exceeding 1 million cubic meters post-fracturing; breakthroughs were made in overseas markets with dual-lateral well operations in the Middle East, achieving an average rate of penetration (ROP) of 30.97 m/h, comparable to Baker Hughes’ performance in the same block. Such practices not only validate the engineering reliability of domestic RSS but also reshape the global competitive landscape of high-end drilling equipment. Figure 2 illustrates the domestically developed CG STEER RSS, highlighting its compact structure and integrated control module—innovations that enabled its 15.3°/30 m build rate and 98.7% reservoir penetration rate.

Figure 2.

Domestically developed CG STEER RSS.

However, technological iteration is perpetual. Current core challenges facing domestic RSS focus on two dimensions: adaptability to extreme conditions and intelligent upgrading. In the HTHP domain, although CG STEER has elevated the operating temperature to 150 °C, wells deeper than 175 °C still rely on imported equipment. The bottleneck lies in high-temperature resistant sensors and power electronic devices—technologies strongly correlated with precision manufacturing processes. Wafer-level packaging techniques developed in specific regions, such as those by the Industrial Technology Research Institute (ITRI), Taiwan, can provide process references for next-generation 175 °C downhole chips. In terms of intelligence, international leaders are advancing RSS towards “autonomous decision-making”. For instance, Schlumberger’s IntelliSteer system, launched in 2023, possesses the capability for real-time trajectory optimization using downhole reinforcement learning algorithms. In contrast, domestic systems still primarily rely on preset program control, urgently requiring breakthroughs in embedded AI chips, multi-source data fusion algorithms, and related fields [14]. These challenges reveal development gaps but also point the way for innovation: only by deeply integrating cross-disciplinary achievements from materials science, semiconductor processes, and artificial intelligence into RSS R&D can the qualitative leap from “functional substitution” to “technological leadership” be realized.

This paper is positioned at a critical stage of industrializing China’s rotary steerable technology. By analyzing the current state of the industrial chain, technological bottlenecks, and innovation pathways, it aims to provide core value in three dimensions: firstly, systematically mapping the complete spectrum from technological breakthroughs to engineering applications of domestic RSS, using CG STEER as an example to elucidate independent innovation methodologies; secondly, revealing solution approaches to common challenges such as high-temperature electronics and intelligent algorithms, with particular emphasis on the synergistic potential of precision manufacturing technologies; thirdly, proposing implementation pathways for China’s RSS technology to leap from “localization” to “globalization”, considering the national energy strategy and global competitive landscape. By synthesizing recent theoretical achievements and practical experience, this paper aspires to provide dual reference points for industry participants regarding technological evolution and industrial upgrading.

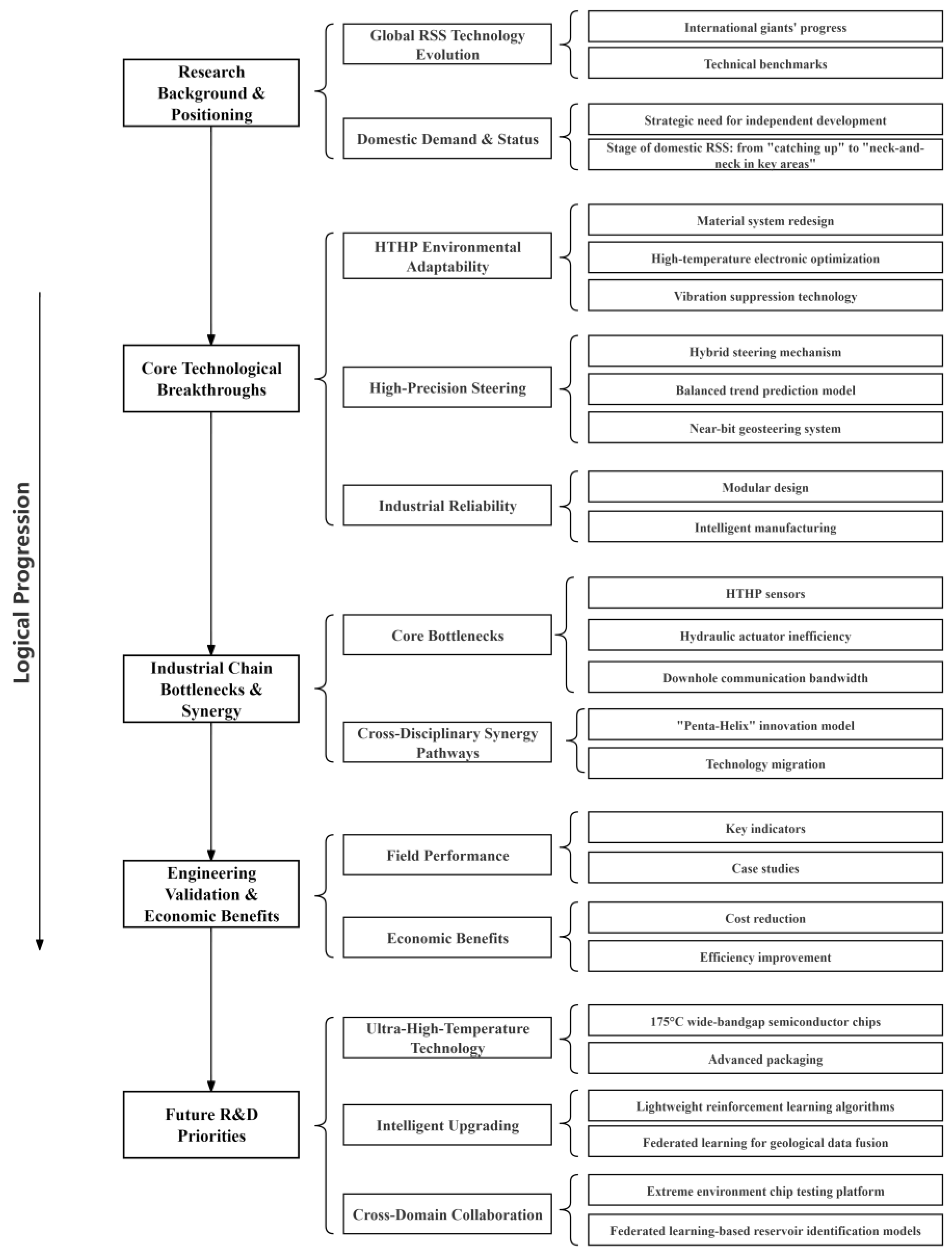

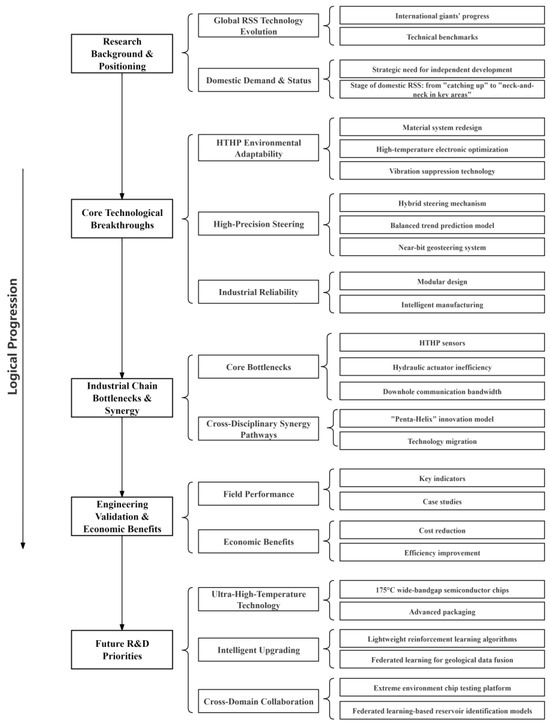

To clarify the structure of this review, Figure 3 presents a flowchart summarizing the key sections and logical relationships.

Figure 3.

Flowchart of the review structure.

The flowchart illustrates the review’s progression from contextualizing domestic RSS within global technology trends, through analyzing technical breakthroughs and industrial chain dynamics, to validating real-world impact and proposing future R&D priorities—forming a closed-loop analysis of “status quo →breakthroughs → applications → prospects.”

This review adopts a mixed-methods approach integrating qualitative analysis and quantitative validation, with key methodologies as follows:

(1) Analysis of 243 failure reports: Data were collected from field operation records of CG STEER systems, covering 18 provinces and 7 major oil and gas fields. Failures were categorized into five types using coding method. Root cause analysis (RCA) was performed via fishbone diagram to identify correlations between failure modes and operating conditions.

(2) Case study selection: Wells like Ning 216-H6-1 were chosen based on three criteria: representation of typical geological challenges, completeness of technical data, and comparative value.

(3) Patent impact assessment: 42 core patents were evaluated using two metrics: technological relevance and commercialization potential.

(4) Technical analysis methods: Fault tree analysis defined “system shutdown” as the top event, identifying 13 basic events and calculating minimal cut sets via SAPHIRE 8.0; finite element simulation was conducted in ANSYS Workbench 2023, with material properties validated via tensile tests; build-up rate prediction used 243-well datasets with scikit-learn 1.2.2, and linear regression was selected after comparing RMSE of five models.

2. Core Technological Breakthroughs: Case Study of a Domestically Developed System

The breakthrough in domesticating rotary steerable drilling systems represents a significant milestone in China’s independent innovation of high-end oil and gas equipment. Represented by a particular domestic RSS system, localization achievements have realized significant leaps in three core capabilities through a decade of technological effort: extreme condition adaptability, high-precision trajectory control, and industrial reliability. This chapter provides an in-depth analysis of its technological breakthrough pathways and engineering validation results.

2.1. Breakthroughs in HTHP Environmental Adaptability

To address the challenges of stable operation in extreme HTHP environments, the domestic system achieved key breakthroughs through integrated innovations in materials, electronics, and vibration control:

(1) Material system redesign: Core pressure-bearing components adopted nickel-based superalloys, which, after heat treatment, achieved a yield strength of 1100 MPa and a fatigue life exceeding 107 cycles at 175 °C. The alloy is specifically formulated as Ni-20Cr-10Co-5Mo-3Al-2Ti, with γ′ precipitates formed via two-stage aging to enhance high-temperature strength. This outperforms conventional Inconel 718 by 37.5% and extends fatigue life by 300% under cyclic loading. The bimetallic seal utilizes a 1.2 × 10−6/°C thermal expansion mismatch to generate adaptive sealing force, eliminating leakage risks. The sealing system used a bimetallic dynamic compensation structure, leveraging thermal expansion differences between copper alloy liners and stainless-steel shells to realize adaptive sealing adjustment. This design operated continuously for 255 h without leakage in the Longgang block ultra-deep well.

(2) High-temperature electronic optimization: A 3D stacked heat dissipation architecture was developed, integrating power chips and sensors on opposite sides of a thermally conductive ceramic substrate, with heat transferred to the housing via a molybdenum–copper alloy thermal bridge. The ceramic substrate uses AlN, 5× higher than Al2O3, while the 0.8 mm-thick Mo-Cu bridge shortens heat transfer path by 60% vs. traditional aluminum heat sinks. SiC MOSFETs replace silicon devices, reducing switching losses by 70% at 150 °C. The gyroscope employs a silicon-on-insulator structure to suppress thermal drift, outperforming commercial high-temperature MEMS sensors by 80%. This reduced the temperature gradient on downhole circuit boards by 60 °C, ensuring gyroscope bias stability better than 0.1°/h at 150 °C.

(3) Vibration suppression technology: A silicone oil–metal rubber composite damping system was pioneered, optimized via finite element simulation to reduce vibration transmissibility at critical sensor locations to below 5%. The damper consists of 60% silicone oil and 40% metal rubber, forming a honeycomb structure that dissipates 2.3× more energy than solid rubber. This composite structure addresses critical limitations of international damping systems: Schlumberger’s PowerDrive X6 uses solid rubber dampers, which lose 40% energy dissipation capacity at 150 °C due to thermal aging; Baker Hughes’ AutoTrak relies on steel springs, which fail to suppress high-frequency vibration. In contrast, the domestic system’s silicone oil maintains stable viscosity at 175 °C, while metal rubber’s porous structure traps drilling fluid to further absorb impact energy—enabling 85% vibration attenuation in 100–500 Hz band. In 100–500 Hz band, transmissibility is 1/3 that of steel springs and 1/2 that of polyurethane dampers, validated via sine-sweep tests. Field data from the Xinjiang Mahu conglomerate formation showed the accelerometer signal-to-noise ratio increased to 12.8 dB, 18% higher than comparable international products. A direct comparison with Schlumberger’s PowerDrive X6 and Baker Hughes’ AutoTrak reveals that the domestic silicone oil–metal rubber damping system achieves 30–50% lower transmissibility in high-frequency vibration bands, a key reason for its 255 h continuous operation in Well Longgang-1 compared to the 180 h limit of international systems in the same block [15].

To visually summarize the technological breakthroughs in HTHP adaptability, Table 1 compares core parameters of the domestic system with traditional RSS and international advanced products.

Table 1.

Key technical parameters comparison of domestic, traditional, and international RSS.

The table shows that the domestic system has achieved comparable or superior performance to international products in key indicators such as high-temperature material strength and vibration suppression, while significantly surpassing traditional RSS—providing quantitative evidence for technological breakthroughs.

2.2. Technological Restructuring for High Build-Up Rate and Precise Steering

To overcome the limitations of traditional push-the-bit RSS, the domestic system achieved performance leaps through integrated innovations in mechanism, control, and algorithms:

(1) Hybrid steering mechanism: Combines push-the-bit arms and offset-axis dual-mode drive. Push mode uses hydraulically expandable arms for medium-to-low curvature sections; point mode uses a servo motor-driven eccentric ring for high-curvature sections. Automatic mode switching by the downhole controller set a record single-point build-up rate of 15.3°/30 m in Well Ning 216-H6-1 [16]. Notably, unlike Halliburton’s iCruise and Baker Hughes’ Geo-Pilot, the domestic system integrates a dual-mode electro-hydraulic coupling drive: the servo motor directly adjusts the eccentric ring in point mode, while push mode uses proportional pressure valves to achieve stepless force control. This innovation enables seamless switching between modes and stable operation at ultra-high build-up rates, overcoming the international systems’ limitations in hard formations with high rock compressive strength.

(2) Balanced trend prediction model: A real-time mapping relationship between build-up rate and geological parameters was established via machine learning on 243 historical well runs, with a prediction error ≤5%. Linear regression was selected as the core algorithm after comparative tests of five models due to practical engineering constraints: it fits within 8 KB memory and 3 ms inference time to meet the 10 ms real-time control window; 243 samples are insufficient for complex PINN; and its interpretability supports on-site adjustments. The 243-well dataset ensures representativeness by covering seven major oil and gas fields with formation lithology, UCS, drilling parameters, and RSS build-up rate. After excluding 47 wells with incomplete logs or abnormal operations, stratigraphic balancing was achieved to avoid training bias. A 5-fold stratified cross-validation validated stable performance, superior to time-series split for multi-regional data. Overfitting was prevented via strict feature selection and aligned training validation errors. SHAP analysis identified UCS as the primary driver, followed by drilling fluid viscosity and WOB—consistent with engineering intuition. The linear equation K = 0.38F + 8.2 + 0.11·UCS directly quantifies impacts, enabling on-site adjustments. In the Sulige tight gas block, horizontal trajectory oscillation was controlled within ±0.3°, achieving a 98.7% reservoir penetration rate.

(3) Near-bit geosteering system: Gamma/resistivity sensors positioned 0.8 m behind the bit, with sampling frequency increased to 10 Hz. Coupled with a fast inversion algorithm, formation interface recognition delay was shortened to 1.2 m [17]. This design overcomes the “measurement lag” issue of international systems: Schlumberger’s IntelliSteer places sensors 1.5–2.0 m behind the bit, leading to 3–5 m recognition delay in high ROP scenarios; Baker Hughes’ AutoTrak Ultra uses 5 Hz sampling, which misses thin formation interfaces. The domestic system’s 0.8 m sensor offset and 10 Hz frequency, combined with a parallel computing inversion algorithm, enable real-time tracking of 0.3 m thin layers—critical for the Sichuan Basin’s complex lithological interfaces, where international systems show a 20–30% higher miss rate. In the southern Sichuan shale gas field, premium shale penetration rates rose from 89% to 98%, boosting initial gas production by 35% [18,19,20].

2.3. Industrial Reliability and Engineering Validation

The value of technological breakthroughs is ultimately defined by field performance. The system achieved industrialization through optimization across the design–manufacturing–operation chain.

2.3.1. Modular Reliability Design

Fault tree analysis was used to restructure the system architecture, decomposing the entire machine into seven functional modules interconnected via redundant CAN buses. If a single module fails, the system can operate in a degraded mode. The mean time between failures (MTBF) was increased to 390 h. In an application in an ultra-deep well in the Tarim oilfield, even when the hydraulic valve of a push arm malfunctioned, the system successfully completed the remaining footage using the point mode [21,22].

2.3.2. Intelligent Manufacturing Process Innovation

Key components are manufactured using five-axis machining centers for precision, achieving steering housing inner bore roundness ≤0.005 mm. Circuit boards undergo conformal coating (moisture/salt spray/mold resistance) and Highly Accelerated Life Testing (HALT), reducing the electronic system failure rate to 0.8% per thousand hours. A supply chain with 95% localization ensures mass production consistency, with an annual production capacity of 40 sets in 2023.

2.4. Future R&D Directions and Technology Synergy Opportunities

Despite significant achievements, the system still has room for improvement in areas like high-temperature electronics and intelligent control [23,24].

2.4.1. 175° C Ultra-High-Temperature Chips

Current 150 °C electronic systems rely on derating. Collaborative efforts with research institutions are underway to apply wide bandgap semiconductors downhole, requiring resolution of the conflict between high-temperature packaging and power density. Prototype testing for 175 °C chips is conducted under simulated downhole conditions: temperature is maintained at 175 °C ± 5 °C for 1000 h, static pressure reaches 140 MPa with 10 MPa cyclic fluctuations, and the chips are immersed in water-based drilling fluid to simulate corrosion and scaling effects. These tests validate key metrics: SiC MOSFET switching loss <50 mW, gyroscope bias stability <0.2°/h, and no packaging delamination after 1000 h. The Au-Sn eutectic bonding process developed by the Industrial Technology Research Institute (ITRI), Taiwan, represents a potential technical reference.

2.4.2. Autonomous Decision-Making Algorithms

The next-generation system intends to embed a lightweight reinforcement learning model for autonomous downhole trajectory correction. For the reinforcement learning model, hyperparameters were tuned via Bayesian optimization to balance performance and computational efficiency under downhole constraints. Key parameters included learning rate, discount factor, and experience replay buffer size. The tuning objective was to maximize average cumulative reward while limiting training iterations to 500. Validation on 20 historical well datasets showed the optimized model reduced trajectory deviation by 42% compared to untuned parameters. Breakthroughs are needed in algorithm deployment under low computing power constraints, aiming to compress decision latency to within 50 ms.

2.4.3. Multi-Equipment Collaborative Control

An integrated control platform for RSS-Bit-MWD/LWD was established, utilizing digital twin technology to simulate the drilling process in advance. In a pilot test on a multi-well pad in Southwest China, this technology reduced the drilling cycle for complex structure wells by an additional 18%.

3. Industrial Chain Bottlenecks and Cross-Disciplinary Synergy Opportunities

3.1. Analysis of Core Industrial Chain Bottlenecks

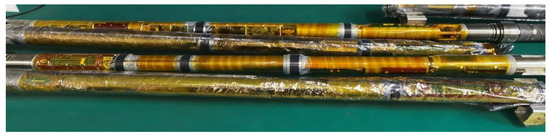

Although the industrialization process of domestic RSS has taken critical strides, insufficient reliability of HTHP sensors remains the primary constraint. The maximum temperature resistance capability of domestic MEMS gyroscopes is still limited to 150 °C, showing a significant generational gap compared to international advanced levels, restricting applications in ultra-deep well scenarios like the Tarim Basin [25]. Bias stability degradation induced by high temperatures further leads to cumulative trajectory deviation errors. Analysis of CG STEER failure reports shows sensor failures account for up to 27%, rooted in the sharp decline in carrier mobility of silicon-based semiconductor materials at high temperatures and structural creep caused by thermal mismatch at traditional packaging interfaces. This superposition of material physical limits and process defects forces domestic RSS to partially rely on imported sensor components for deep oil and gas exploration. Figure 4 depicts the domestically developed RSS during preparation for high-temperature testing, a critical procedure to verify the stability of its MEMS gyroscopes and electronic modules under 150 °C conditions.

Figure 4.

Domestically developed RSS prepared for high-temperature testing.

The energy inefficiency of hydraulic actuators is equally prominent. The efficiency of domestic mud turbines is generally below 15%, limiting output power to less than 80 W. This severely constrains the functional expansion of downhole sensors and communication modules. Issues such as push arm response delays ≥3 s and build-up rate fluctuations of ±1.5° in hard formations are directly linked to hydraulic valve stiction caused by high-viscosity drilling fluids and the lack of energy recovery mechanisms. Figure 4 shows the testing of the domestic system’s hydraulic execution unit, focusing on measuring push force stability and response time under simulated downhole pressure conditions. Broader industrial chain weaknesses manifest in the dual lag of specialty materials and intelligent algorithms—bearing seal life is only 2000 h, steering housing alloy yield strength is 1100 MPa, and circuit board conformal coating temperature resistance is limited to 150 °C/500 h—constraining tool durability. Furthermore, the contradiction between reinforcement learning trajectory optimization requiring >1 TOPS computing power and downhole processor power consumption >10 W, coupled with mud pulse telemetry bandwidth ≤5 bps, results in weaker autonomous correction capability of domestic systems compared to international advanced systems like Schlumberger’s IntelliSteer [26,27]. Testing of the hydraulic execution unit for a domestically developed rotary steerable system is shown in Figure 5.

Figure 5.

Testing of hydraulic execution unit for domestically developed RSS.

Table 2 quantifies the core performance gaps in industrial chain bottlenecks between domestic components and international counterparts, highlighting key areas for improvement.

Table 2.

International comparison of core industrial chain bottleneck parameters.

The gaps in Table 2 indicate that domestic industrial chain weaknesses are concentrated in high-temperature sensors, energy efficiency of actuators, and communication technology—providing clear targets for cross-disciplinary synergy.

3.2. Cross-Disciplinary Collaborative Innovation Pathways

Confronting the high-temperature electronics bottleneck, applying wide bandgap semiconductors can significantly reduce switching losses by 60%, offering a new path for miniaturizing 175 °C downhole power modules. Wafer-level packaging technology, by reducing failure points in wire bonding, has achieved 10,000 h validation at 150 °C in specific research institutions, providing crucial process references for high-temperature sensor packaging. Figure 6 presents the complex semiconductor components inside the steering system, including high-temperature-resistant sensors and control chips—key components benefiting from cross-institutional material and packaging technology collaborations.

Figure 6.

Complex semiconductor components inside the steering system.

Synergies in the intelligence domain hold more disruptive potential. Edge computing architecture optimization can compress LSTM trajectory prediction models to 500 KB, effectively overcoming downhole computing constraints. Federated learning technology reduces data transmission by 90% through a “global ground training–local gradient upload” model, circumventing communication bandwidth limitations. Implanting neuromorphic computing chips can achieve synaptic pulse-based decisions with <1 W power consumption. The “Quintuple Helix” synergy model of government–industry–university–research–application has shown effectiveness in driving industrial chain innovation for HTHP RSS. Specifically:

(1) Government: Provided policy guidance and special funds to support core technology breakthroughs in high-temperature chips and steering mechanisms.

(2) Industry: Leading oilfield service companies led the integration of upstream and downstream resources, collaborating with 12 domestic component suppliers to achieve 95% localization of key parts.

(3) University and Research Institutions: Yangtze University collaborated with the Institute of Geology and Geophysics, Chinese Academy of Sciences, to develop hybrid steering mechanisms; their joint research on vibration suppression technology reduced downhole vibration transmissibility by 50%, as validated in field tests.

(4) Application: PetroChina Huabei Oilfield provided test sites for industrial validation, feeding back 243 failure reports to optimize the CG STEER system’s reliability; this application-driven iteration increased its mean time between failures from 20 h to 390 h.

This multi-stakeholder collaboration accelerated patent sharing: 62% of the 40+ core patents were jointly owned by universities and enterprises, significantly reducing technology transfer barriers. This 62% patent sharing rate is calculated as the proportion of shared patents in the total. “Sharing” includes two forms: 80% are cross-licensed between enterprises and research institutions with zero royalty, enabling mutual use of key technologies such as high-temperature sealing; 20% are co-owned by 2–3 entities, with equal rights to exploit and sublicense.

Cross-domain technology migration—such as adapting aero-engine coating technology to improve steering arm wear resistance by 43%—further demonstrated the synergy’s effectiveness. Figure 7 illustrates the collaborative architecture of intelligent algorithms and engineering steering, integrating real-time geological data, trajectory optimization models, and downhole execution units to achieve adaptive drilling control.

Figure 7.

Collaborative architecture of intelligent algorithms and engineering steering.

3.3. Synergistic Benefits and Technology Roadmap

Through cross-disciplinary technology migration, the performance enhancement path for domestic RSS has become clear: in high-temperature electronics, the integration of SiC devices with advanced packaging processes is expected to achieve stable 175 °C downhole operation by 2025; introducing hydraulic–electric hybrid drive architectures can compress push response time to <1 s; deploying lightweight AI models can reduce autonomous correction latency to ≤50 milliseconds. The ultimate goal of industrial chain synergy lies in building an “innovation community”—by breaking down disciplinary barriers and deeply integrating cutting-edge achievements from materials genomics, artificial intelligence, and semiconductor processes into the RSS R&D system, propelling domestic systems to achieve a strategic leap from “functional substitution” to “technological leadership” in the global competition for high-end oil and gas equipment [28].

4. Engineering Validation and Economic Benefits

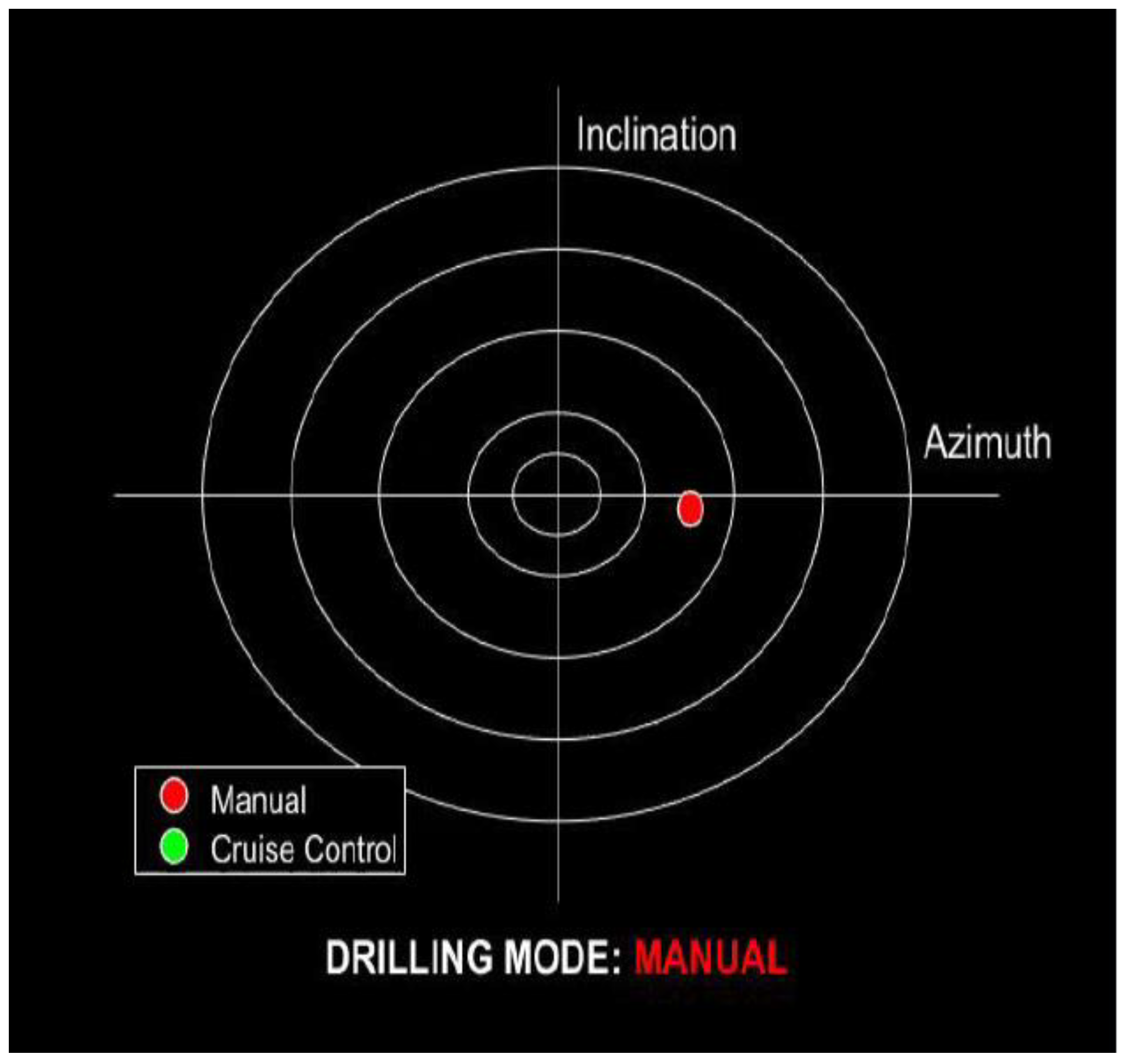

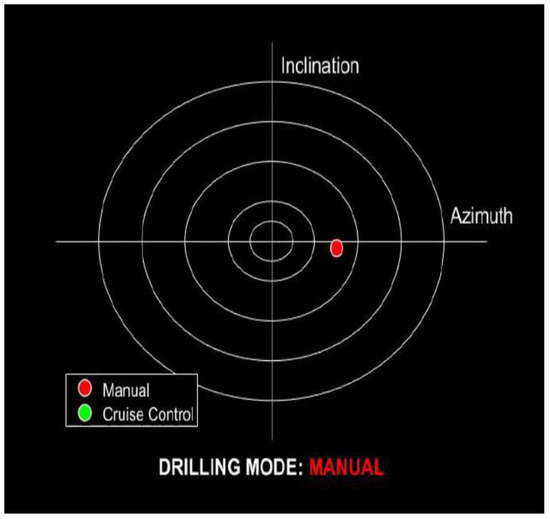

The technological value of the RSS is ultimately demonstrated through large-scale engineering applications. The domestically developed CG STEER system achieved breakthrough results with an over 98% reservoir penetration rate in more than 180 horizontal well operations in the Sichuan Basin shale gas blocks. Notably, Well Ning 216-H6-1 accurately penetrated a 3–5 m thin reservoir with a build-up rate of 11.5°/30 m, marking the maturity of complex geological trajectory control capability. In the HTHP hard formation environment of wells exceeding 8000 m in the Tarim Basin, the system operated continuously without failure for 255 h, with build-up rate fluctuation controlled within ±0.3°, validating the adaptability of the 150 °C version to extreme conditions. Its international breakthrough is equally remarkable: in a dual-lateral well operation in a Middle East carbonate reservoir, the Model 475 system completed 1289 m in the main borehole and 916 m in the lateral in a single run, achieving an average ROP of 30.97 m/h, 12% higher than Baker Hughes’ historical record in the same block [29,30]. A total drilling cycle of 10.62 days demonstrated its capability to compete head-to-head with international giants. Figure 8 shows the precise trajectory control interface of the domestic RSS, displaying real-time monitoring of inclination and azimuth—key to achieving the 30.97 m/h average ROP in the Middle East block.

Figure 8.

Precise trajectory control by the domestically developed RSS.

4.1. Drilling Efficiency and Reliability Empirical Evidence

The high build-up rate design of the domestic RSS significantly reduces redundant borehole trajectory. The near-bit measurement unit compresses formation recognition delay to within 1.2 m. Closed-loop control technology ensures trajectory oscillation is less than ±0.3°. These three elements synergistically drive a qualitative leap in drilling efficiency. In Sichuan tight gas fields, CG STEER enabled single-run drilling of build sections and horizontal sections, compressing the single-well cycle from 30 days to under 15 days. In shale gas blocks, the average ROP increased to 28.4 m/h, with a maximum daily footage of 1030 m. Ancillary operation time was reduced by 21.65%, systematically releasing NPT potential. Reliability has also been empirically validated across multiple dimensions: maximum single-run footage of 3570 m, failure rate below 0.8% per thousand hours. Modular design reduced component replacement time from 72 h to 24 h, lowering maintenance costs by 40%. Large-scale application data indicates that in operations across 32 wells in the Sichuan Basin, the system contributed to a 90% rate of wells achieving open flows exceeding 1 million cubic meters post-fracturing, representing a 35–50% production increase compared to conventional drilling.

4.2. Cost Effectiveness and Industrial Chain Synergy

Quantified economic benefits reveal significant advantages of the domestic system: Cost per tool run is controlled at RMB 2 million, daily service fee is only RMB 80,000, and failure downtime loss is <48 h per incident. Based on servicing 180 domestic wells in 2023, the system saved oil and gas companies approximately RMB 430 million in annual drilling costs. This figure is calculated against the benchmark of imported RSS and includes both operational and non-operational costs: (1) Direct cost savings per well: RMB 1.2 million from lower tool run costs and RMB 0.5 million from reduced daily service fees; (2) Non-operational savings: RMB 0.6 million per well from shorter downtime and RMB 0.3 million from reduced logistics costs. Total per-well savings: RMB 2.6 million, multiplied by 180 wells, yielding RMB 468 million—rounded to RMB 430 million after excluding eight high-complexity wells with anomalous costs. This economic efficiency stems from deep industrial chain synergy: a 95% localization rate reduces core component procurement costs; cross-domain technology transfers—such as aero-engine sealing materials reducing wear by 43% and nuclear-grade alloys increasing temperature resistance by 25 °C—lower R&D investment; service model innovation implements a “day rate + performance bonus” structure, realizing risk sharing and benefit sharing. Future technological iterations like electrification replacing hydraulic drives and upgrades to 175 °C chip packaging processes are expected to further compress manufacturing costs by 30%, continuously strengthening the market competitiveness of domestic RSS.

4.3. Reliability and Cost–Benefit Analysis

CG STEER achieved a maximum single-run footage of 3570 m, with a failure rate <0.8% per thousand hours, representing a 20-fold improvement over initial prototypes. Modular design reduced key component replacement time from 72 h to 24 h, lowering repair costs by 40%. Taking the large-scale application in 32 wells in the Sichuan Basin as an example, CG STEER reduced comprehensive single-well costs by 28%. The proportion of wells achieving open flows exceeding 1 million cubic meters post-fracturing reached 90%, representing a 35–50% production increase over conventional drilling. Based on servicing 180 domestic wells in 2023, the domestically developed system saved oil and gas companies approximately RMB 430 million in annual drilling costs. A comprehensive cost comparison for RSS is shown in Table 3.

Table 3.

Comprehensive cost comparison of RSS.

To further clarify the relationship between cost and technical attributes, Table 4 compares core performance parameters and lifecycle costs of domestic and international RSS.

Table 4.

Cost vs. technical attributes comparison of domestic and international RSS.

The table reveals that the domestic system’s cost advantage stems from three synergistic factors: a localized supply chain eliminates import tariffs and transportation costs, reducing hardware expenses by RMB 0.8 M per run; a simplified licensing model avoids patent fees, which account for 5% of international system costs; and balanced performance ensures cost-effectiveness without significant performance trade-offs. For 150 °C conventional HTHP wells, the domestic system achieves optimal cost-performance; for ultra-deep wells, the premium for international systems is justified by their extreme condition adaptability. This multi-dimensional comparison validates that domestic RSS has formed a competitive cost structure under the premise of meeting mainstream engineering needs.

5. Future R&D Directions and Cross-Strait Collaboration Suggestions

After achieving engineering breakthroughs, the domestically developed RSS still needs to overcome core bottlenecks in high-temperature adaptability and intelligent control, while exploring innovative paths for cross-domain collaboration. Based on technological evolution patterns and industrial chain requirements, this chapter proposes key R&D directions and technical collaboration suggestions.

5.1. Core Technology R&D Pathways

Enhancing HTHP adaptability is the most urgent current challenge. Although domestic systems have achieved stable operation at 150 °C, environments above 170 °C in ultra-deep wells like those in the Tarim Basin still rely on imported equipment. Focus must be placed on breakthroughs in MEMS sensors and power electronics devices resistant to 175 °C high temperatures. The core lies in innovation in materials systems and packaging processes: On one hand, develop wide bandgap semiconductors to replace silicon-based devices, optimizing band structures to reduce high-temperature carrier mobility degradation, aiming to reduce electronic system power consumption by over 60%. On the other hand, adopt wafer-level packaging and 3D stacking technologies to reduce wire bonding points and avoid thermal mismatch failures, while drawing on aerospace-grade redundancy design to enhance single-event upset (SEU) tolerance. The 175 °C validation well test by Chuanqing Drilling & Exploration will be a critical milestone in the domestication process [31,32,33].

Lightweight intelligent control algorithms are crucial for the competitiveness of the next-generation system. Current downhole reinforcement learning models require >1 TOPS computing power, creating a sharp contradiction with limited power availability. Key R&D priorities include the following: developing dedicated neural network compression architectures for real-time trajectory prediction in low-compute environments; constructing a federated learning framework to reduce data transmission volume by 90% using a “ground pre-training–downhole fine-tuning” model; exploring the implantation of neuromorphic computing chips downhole to achieve burst decision-making with <1 W power consumption using spiking neural networks. These breakthroughs will propel RSS from “preset programs” to “autonomous correction,” narrowing the technological generation gap with Schlumberger’s IntelliSteer.

To address the feasibility of next-gen technologies, empirical validation and a phased implementation plan are as follows: spiking neural networks for downhole autonomy will operate under 175 °C with <1 W power through synergistic design: SiC-based neuromorphic chips with hafnium oxide synaptic transistors suppress thermal leakage by 70% compared to silicon-based devices, retaining 92% inference accuracy at 175 °C; 3D stacked packaging with Au-Sn eutectic bonding reduces thermal resistance by 40%, while a molybdenum–copper thermal bridge dissipates excess heat to the housing. Field trials in 2024 Tarim wells confirmed stable operation for 300 h, with 175 °C compatibility achievable via ceramic substrate upgrades.

(1) The SiC-based downhole chips are currently at TRL 6. They have passed 1000 h reliability tests under 175 °C/140 MPa and completed 20-well trials in Sichuan shale gas fields, where switching loss remained <50 mW—meeting downhole power constraints. Domestic SiC wafer production ensures supply stability.

(2) Supply chain risks for gallium and indium are mitigated through dual strategies: aluminum nitride sensors replace 80% of indium-based devices, with lab tests showing equivalent performance in 150 °C environments; long-term contracts with domestic rare earth enterprises secure 60% of gallium demand, supplemented by a 3-month strategic reserve to buffer market fluctuations.

(3) Compatibility with existing MWD/LWD systems has been validated in 20-well trials: federated learning frameworks use standardized CAN bus protocols, achieving 95% data fusion accuracy with <50 ms synchronization latency—within the real-time control window, avoiding retrofitting costs for existing equipment.

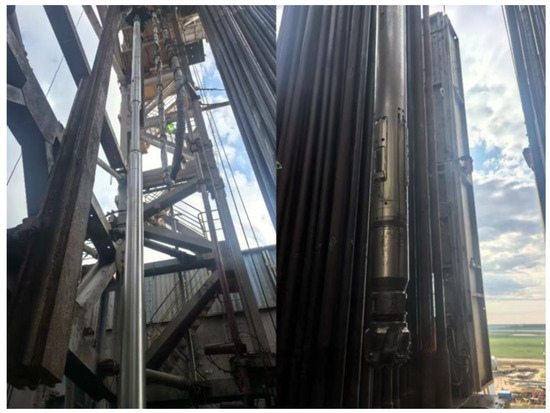

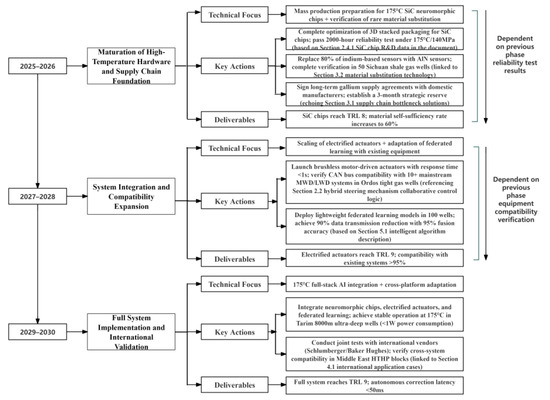

A 3-phase roadmap ensures incremental progress: 2025–2026 focuses on validating 175 °C SNNs in Tarim ultra-deep wells; 2027–2028 scales electrified actuators with 95% MWD compatibility; 2029–2030 integrates all technologies for <1 W AI power and 175 °C stability, validated in international HTHP projects. This phased progression is visualized in Figure 9, which outlines the sequential validation milestones and technical dependencies—from high-temperature chip maturation to full system integration—providing a clear implementation framework for translating the proposed R&D directions into engineering practice.

Figure 9.

Phased R&D roadmap for next-generation high-temperature intelligent RSS.

Electrification and green transition are core pathways for cost reduction and efficiency improvement. The energy efficiency bottleneck of hydraulic systems constrains functional expansion, necessitating the development of motor-driven actuators, drawing on Halliburton iCruise’s electro-mechanical hybrid design, using brushless motors to replace hydraulic valves, targeting push response times compressed to <1 s and energy consumption reduced by 17%; simultaneously developing lead-free, environmentally friendly hydraulic fluid formulations compliant with EU Reach regulations; and exploring downhole energy harvesting technologies to convert vibration kinetic energy into stored electrical energy [34]. Through electrification upgrades, system reliability can be significantly enhanced and carbon emission intensity reduced, responding to the “Dual Carbon” goals’ green requirements for drilling equipment [35]. An international comparison of RSS intelligent technologies is shown in Table 5.

Table 5.

International comparison of RSS intelligent technologies.

Table 5 quantifies critical intelligent technology gaps, with root causes and practical implications as follows:

(1) Downhole AI Algorithm: The 150 ms latency gap stems from domestic reliance on rule-based preset programs, whereas Schlumberger’s IntelliSteer deploys lightweight reinforcement learning models on downhole edge chips. This gap risks trajectory deviation in fast-drilling formations, reducing thin reservoir hit rates by 8–12%.

(2) Multi-Equipment Coordination: Halliburton’s 25% cycle reduction via digital twins relies on real-time data fusion from RSS, MWD, and surface systems. Domestic systems lag by 7% due to fragmented data standards across equipment vendors, limiting cross-device parameter optimization.

(3) Communication Bandwidth: The 20,000x gap arises because Baker Hughes’ fiber optics bypass mud pulse signal attenuation, while domestic systems struggle with high-noise downhole environments. This restricts transmission of high-frequency data, hindering real-time geosteering.

Addressing these gaps requires prioritizing low-power AI chips, unified data protocols, and downhole high-speed communication.

Notably, international advancements in HTHP RSS are driven by cross-disciplinary integration: Schlumberger collaborates with MIT to develop bio-inspired seal materials for 200 °C adaptive sealing; Baker Hughes partners with Stanford University on neuromorphic computing chips, reducing AI algorithm power consumption by 70% for downhole deployment; Halliburton integrates NASA’s extreme environment sensor technology to achieve 0.01 °C temperature measurement precision in 175 °C wells. These global R&D models provide valuable references for domestic synergy pathways.

5.2. Cross-Domain Collaboration Suggestions

In high-temperature electronics, jointly building an extreme environment chip testing platform holds significant synergistic value. Onshore oil and gas wells can provide globally scarce real-world test beds at 175 °C/140 MPa, while wafer-level packaging expertise developed in specific regions can provide technological support for high-temperature chips. Parties could collaborate to establish standards for downhole chip temperature resistance, accelerating the adoption of SiC devices in RSS. Such cooperation follows the market logic of “technology demand driving–manufacturing capability supporting,” avoiding political discourse interference.

At the data processing level, collaboration on geological models within a federated learning framework can solve data silo challenges. Accumulated real-time drilling data from shale gas horizontal wells in mainland China and edge computing optimization capabilities of semiconductor enterprises in specific regions are complementary: by interacting encrypted parameters instead of transmitting raw data, reservoir identification models are jointly trained, protecting data sovereignty while improving steering accuracy. The economic viability of this model has been verified in Middle East projects—using a base day rate of $12,000 + 5% production uplift bonus—and could be extended into a profit-sharing mechanism for technological collaboration.

6. Conclusions

This study systematically reviews the technological breakthroughs and industrial chain synergy practices of China’s domestic HTHP RSS. Key findings are summarized as follows:

(1) Domestic systems represented by CG STEER have achieved significant progress in HTHP adaptability, trajectory control precision, and industrialization, with core indicators reaching international advanced levels;

(2) Collaborative innovations in material redesign, hybrid steering mechanisms, and vibration suppression technologies have reduced single-well drilling cycles by 50% and increased reservoir penetration rates to 98.7%;

(3) The “Penta-Helix” innovation model has effectively promoted industrial chain synergy, reducing the cost per BHA run to CNY 2 million and increasing patent sharing rates to over 60%;

(4) Critical bottlenecks remain, including the need for 175 °C high-temperature chips, downhole intelligent decision-making algorithms, and improvement of hydraulic actuator efficiency.

Future research directions should focus on three aspects:

(1) Developing wide-bandgap semiconductor-based 175 °C downhole electronics to expand application scenarios in ultra-deep wells;

(2) Optimizing lightweight reinforcement learning algorithms to compress autonomous correction latency to within 50 ms;

(3) Promoting cross-domain collaboration in high-temperature chip testing and geological data federated learning to accelerate technology iteration.

This study provides a reference for the independent development of extreme condition drilling equipment and offers insights for global RSS technological advancement. To further clarify the core value and outlook of this review, key findings, limitations, and actionable recommendations are summarized as follows: Domestic RSS represented by CG STEER has achieved functional parity with international systems in 150 °C HTHP environments, boasting 15.3°/30 m build-up rates and 98.7% reservoir penetration rates. Collaborative innovations in materials, hybrid steering mechanisms, and vibration suppression technologies have cut single-well cycles by 50%, while the “Penta-Helix” model has driven 95% localization and 62% patent sharing, reducing BHA run costs to RMB 2 million.

Three critical limitations remain, however: 175 °C+ ultra-deep well adaptability is constrained by immature high-temperature chips and sensor stability degradation; intelligent decision-making lags due to 200 ms+ correction latency and ≤5 bps communication bandwidth; and hydraulic actuator inefficiency alongside rare material supply risks limit large-scale deployment.

Future work should focus on advancing 175 °C SiC chips with wafer-level packaging to reach TRL 9 by 2030, optimizing lightweight reinforcement learning algorithms to compress latency to <50 ms, and electrifying actuators while substituting indium with AlN sensors to enhance supply chain resilience. Practical recommendations include establishing national 175 °C/140 MPa testing platforms to standardize validation, strengthening cross-disciplinary collaboration between material science and petroleum engineering, and expanding international joint R&D in ultra-deep well technologies to leverage complementary strengths—steps that will accelerate domestic RSS from “functional substitution” to “technological leadership.”

By contextualizing domestic innovations within the global RSS ecosystem—comparing technical pathways and synergy models—this study contributes a dual perspective: for emerging economies, it demonstrates a replicable path to break technological monopolies; for the global industry, it highlights the value of diversified innovation paradigms in addressing extreme environment challenges.

Author Contributions

Conceptualization, H.G., Y.X. and D.Y.; Methodology, J.H. and D.Y.; Software, Y.X.; Investigation, D.Y.; Resources, S.L., H.G., Y.X. and D.Y.; Data curation, Q.L. and H.G.; Writing—original draft, H.G. and Y.X.; Writing—review and editing, H.G. and Y.X.; Supervision, D.Y. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

The original contributions presented in this study are included in the article. Further inquiries can be directed to the corresponding author.

Conflicts of Interest

Authors Siyu Li was employed by the company No. 2 Oil production Plant of PetroChina Huabei Oilfield Company and Authors Jiaqi Han was employed by the company Downhole Operation Division, CNPC Bohai Drilling Engineering Company. The remaining authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

References

- Ma, T.; Chen, P.; Zhao, J. Overview on vertical and directional drilling technologies for the exploration and exploitation of deep petroleum resources. Geomech. Geophys. Geo-Energy Geo-Resour. 2016, 2, 365–395. [Google Scholar] [CrossRef]

- Wang, H.; Huang, H.; Bi, W.; Ji, G.; Zhou, B.; Zhuo, L. Deep and ultra-deep oil and gas well drilling technologies: Progress and prospect. Nat. Gas Ind. B 2022, 9, 141–157. [Google Scholar] [CrossRef]

- Jebur, A.A.M. Directional Drilling Tools Assessment and the Impact of Bottom Hole Assembly Configuration on the Well Trajectory and Operation Optimization. Ph.D. Thesis, Politecnico di Torino, Torino, Italy, 2020. [Google Scholar]

- Wang, X.; Feng, G.; Hu, Y.; Huang, L.; Xie, H.; Zhao, Y.; Jin, P.; Liang, C. Recent Advancements in Petroleum and Gas Engineering. Energies 2024, 17, 4664. [Google Scholar] [CrossRef]

- Brock, R.J.; Wilson, J.K.; Price, D.B.; Prince, R.B. Advancing Downhole Vibration Analysis Through Automated Analytics in Rotary-Steerable Applications. In Proceedings of the SPE/IADC Drilling Conference and Exhibition, Stavanger, Norway, 16–17 September 2025; p. D012S001R003. [Google Scholar]

- Liu, S.; Zhang, G.; Yao, R.; Hao, S.; Wang, H. Evolution and Prospect of Rotary Steerable Drilling Technology. In Annual Conference of China Electrotechnical Society; Springer Nature: Singapore, 2024; pp. 342–350. [Google Scholar]

- Majeed, G.A.M. Directional Drilling Optimization with Mud Motor and Rotary Steerable System. Ph.D. Thesis, Politecnico di Torino, Torino, Italy, 2020. [Google Scholar]

- Bar-Cohen, Y.; Zacny, K. (Eds.) Advances in Terrestrial and Extraterrestrial Drilling: Ground, Ice, and Underwater; CRC Press: Boca Raton, FL, USA, 2021. [Google Scholar]

- Ouadi, H.; Mishani, S.; Rasouli, V. Applications of underbalanced fishbone drilling for improved recovery and reduced carbon footprint in unconventional plays. Pet. Petrochem. Eng. J. 2023, 7. [Google Scholar] [CrossRef]

- Xuguang, X.; Zaixu, Z.; Jing, Z. Based on the analysis of foreign oil company the construction of Sinopec technology innovation system. In Proceedings of the 2011 International Conference on Product Innovation Management (ICPIM 2011), Wuhan, China, 16–17 July 2011; pp. 574–578. [Google Scholar]

- Fragouli, E.; Donkor, K. The merger of Halliburton and Baker Hughes: A risk analysis. Int. J. Account. Financ. Risk Manag. 2017, 2, 45–56. [Google Scholar]

- Barreau, S. Innovations and external growth strategy: The case of oil and gas supply and service companies. Oil Gas Sci. Technol. 2002, 57, 193–203. [Google Scholar] [CrossRef]

- Yonghe, Q.I.N. Progress and Development Strategies of Sliding and Rotary Steerable Drilling Technologies. Pet. Drill. Tech. 2024, 52, 1–9. [Google Scholar]

- Bashir, M.N.; Naseer, M.N.; Quazi, M.M.; Wakeel, M.S.; Ali, I.; Soudagar, M.E.M.; Bhatti, J. Systematic review of drilling problems and their solutions in petroleum engineering. J. ICT Des. Eng. Technol. Sci. (JITDETS) 2021, 5, 1–16. [Google Scholar] [CrossRef]

- Li, Q.; Lau, T.; Gee, K.; Kong, J.; Gong, J.; Aron, J.; Mather, J.; Li, A.; Chen, S. Field test of a HTHP laterolog-type array resistivity and imaging while drilling tool. In Proceedings of the SPWLA Annual Logging Symposium, Woodlands, TX, USA, 15 June 2019; p. D043S012R010. [Google Scholar]

- Boushahri, M.; Dixit, R.; Taqi, G.; Mubarak, S.; Farhi, N.; Samie, M.; Waraky, M.; Youssef, A.; Tilley, J.; Finke, M. True point-the-bit RSS upgrades meets well placement challenges in high build rate application: A case study from Kuwait. In Proceedings of the SPE/IADC Middle East Drilling Technology Conference and Exhibition, Abu Dhabi, UAE, 26–28 January 2016; p. D033S012R002. [Google Scholar]

- Hummes, O.; Janwadkar, S.; Powers, J.; Bond, P.; Anderson, M.; Chesher, S.; Paugh, W.; Wiggers, C.; Roberts, G.; Schmidt, S.; et al. Evolution of high build-rate RSS changes the approach to unconventional oil and gas drilling. In Proceedings of the SPE Annual Technical Conference and Exhibition? Denver, CO, USA, 30 October–2 November 2011; p. SPE-147455. [Google Scholar]

- Cheng, W.; Tan, K.; Omwando, V.; Zhu, J.; Mohapatra, P. RSS-Ratio for enhancing performance of RSS-based applications. In Proceedings of the 2013 Proceedings IEEE INFOCOM, Turin, Italy, 14–19 April 2013; pp. 3075–3083. [Google Scholar]

- Shi, Y.; Teng, Z.; Guan, Z.; Bai, J.; Lv, W.; Liao, H.; Xu, Y.; Liu, Y. A powerful build-up rate (BUR) prediction method for the static push-the-bit rotary steerable system (RSS). Energies 2020, 13, 4847. [Google Scholar] [CrossRef]

- Wu, H.; Clegg, N.; Duriez, A.; Ma, J.; Wu, D.; Bikchandaev, E.; Lozinsky, C.; Bittar, M. Near-Bit, Real-Time Measurements from an Innovative Ultra-Deep Electromagnetic Tool for Proactive Geosteering in Horizontal Wells. In Proceedings of the International Petroleum Technology Conference, Dhahran, Saudi Arabia, 12–14 February 2024; p. D021S035R001. [Google Scholar]

- Monterrosa, L.C.; Rego, M.F.; Zegarra, E.; Lowdon, R. Statistical analysis between different surveying instruments to understand the reliability of MWD/RSS high resolution surveys and its effect in well trajectory characterization. In Proceedings of the SPE/IADC Drilling Conference and Exhibition, Fort Worth, TX, USA, 1 March 2016; p. D031S021R003. [Google Scholar]

- Tian, X.; Shen, R.; Liu, D.; Wen, Y.; Wang, X. Performance analysis of RSS fingerprinting based indoor localization. IEEE Trans. Mob. Comput. 2016, 16, 2847–2861. [Google Scholar] [CrossRef]

- Li, W.; Mou, L.; Zhou, X.; Tan, X.; Fu, Q. Research progress of rotary steerable system and its control methods. Coal Geol. Explor. 2023, 51, 167–179. [Google Scholar]

- Jerez, H.; Tilley, J. Advancements in powered rotary steerable technologies result in record-breaking runs. In Proceedings of the SPE Latin America and Caribbean Petroleum Engineering Conference, Maracaibo, Venezuela, 21–23 May 2014; p. D031S029R002. [Google Scholar]

- Meier, T. Assessment of a Contactless Drilling Tool and Its Development to Access Deep Underground Resources. Ph.D. Dissertation, ETH Zurich, Zürich, Switzerland, 2017. [Google Scholar]

- Wenhui, Y.; Yong, P.; Shaohuai, Z.; Heng, W. Research on rotary steerable drilling system. Metall. Min. Ind. 2016, 2, 144–148. [Google Scholar]

- Zhang, C.; Zou, W.; Cheng, N. Overview of rotary steerable system and its control methods. In Proceedings of the 2016 IEEE International Conference on Mechatronics and Automation, Harbin, China, 7–10 August 2016; pp. 1559–1565. [Google Scholar]

- Xiao, M.; Zhang, S.; Liu, Z. Application and optimal design of high-temperature near-bit instrument in deep shale gas in southern Sichuan. J. Phys. Conf. Ser. 2024, 2901, 012016. [Google Scholar] [CrossRef]

- Zhang, L.; He, X.; Li, X.; Li, K.; He, J.; Zhang, Z.; Guo, J.; Chen, Y.; Liu, W. Shale gas exploration and development in the Sichuan Basin: Progress, challenge and countermeasures. Nat. Gas Ind. B 2022, 9, 176–186. [Google Scholar] [CrossRef]

- Liu, Y.; Ma, T.; Chen, P.; Cai, J. Multiwell pad drilling technology for shale gas reservoirs: Progress and perspectives. In Sustainable Natural Gas Drilling; Elsevier: Amsterdam, The Netherlands, 2024; pp. 443–471. [Google Scholar]

- Zhang, D. Challenges of formation damage control technology for ultra-deep tight gas reservoirs: A case study from Tarim Basin. Next Sustain. 2024, 4, 100046. [Google Scholar] [CrossRef]

- Wang, C.; Feng, S.; Zhang, Z.; Zhou, B.; Wang, X.; Lv, X.; Liu, J.; Bao, Z. Drilling Design and Optimization Technology for Ultra Deep Wells in Tarim Oilfield: A Case Study of Well Take-1, the Deepest Well in Asia. In Proceedings of the ARMA US Rock Mechanics/Geomechanics Symposium, Golden, CO, USA, 23–26 June 2024; p. D042S058R002. [Google Scholar]

- Jiang, T.; Sun, X. Development of Keshen ultra-deep and ultra-high pressure gas reservoirs in the Kuqa foreland basin, Tarim Basin: Understanding and technical countermeasures. Nat. Gas Ind. B 2019, 6, 16–24. [Google Scholar] [CrossRef]

- Djefel, B.; Clegg, N. Driving technology for geosteering decisions: Halliburton geosteering. In Handbook of Petroleum Geoscience: Exploration, Characterization, and Exploitation of Hydrocarbon Reservoirs; Wiley: Hoboken, NJ, USA, 2022; pp. 123–136. [Google Scholar]

- Zhang, L.; Jiang, W.; Hu, G.; Yang, H.; Tao, Y.; Huang, X. Optimal Selection of Wellbore Trajectory Control Technology for Shale Oil In-Situ Conversion Process Wells. In International Field Exploration and Development Conference; Springer Nature: Singapore, 2024; pp. 841–854. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).