The Challenges of a Biodiesel Implementation Program in Malaysia

Abstract

:1. Introduction

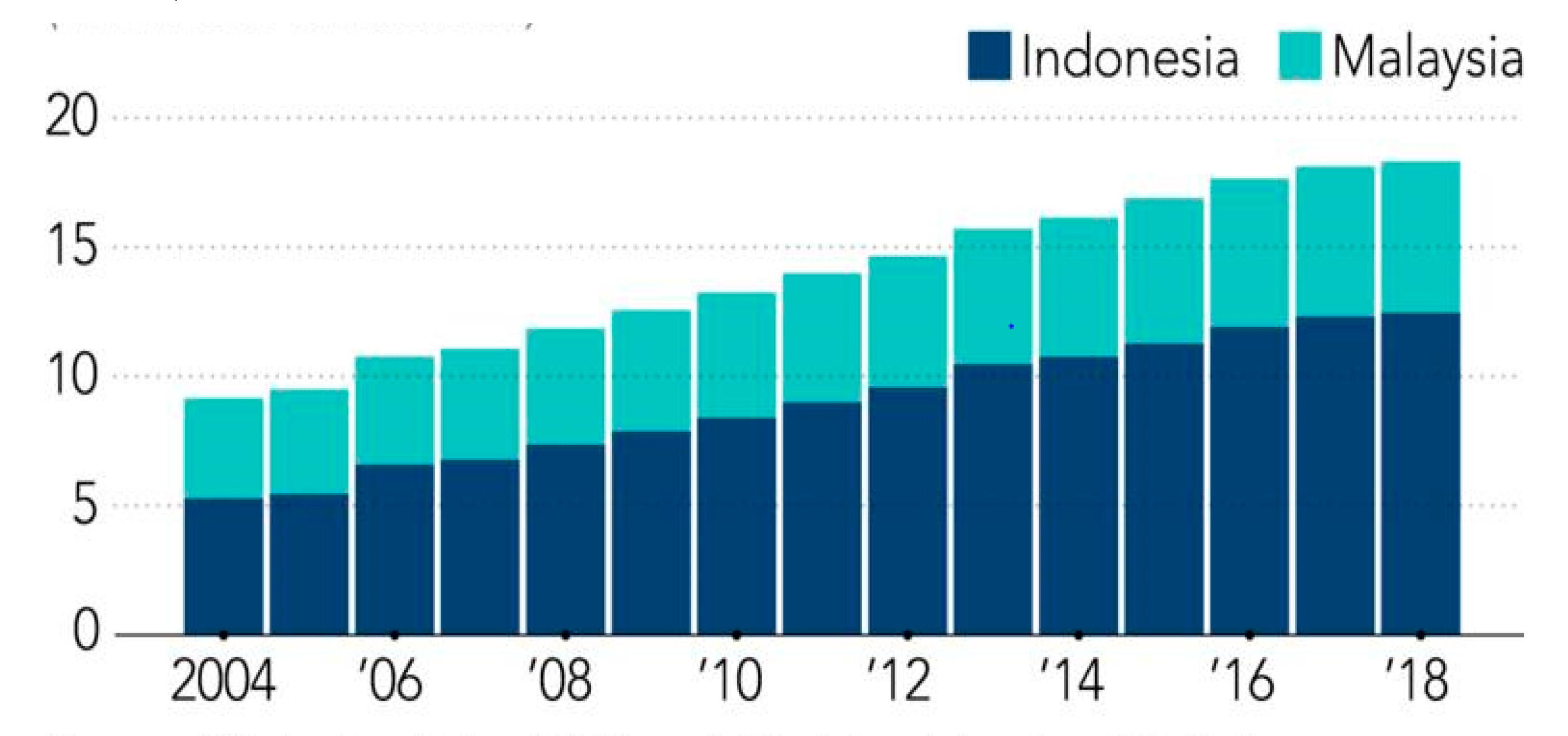

2. State of the Palm Oil Industry in Malaysia

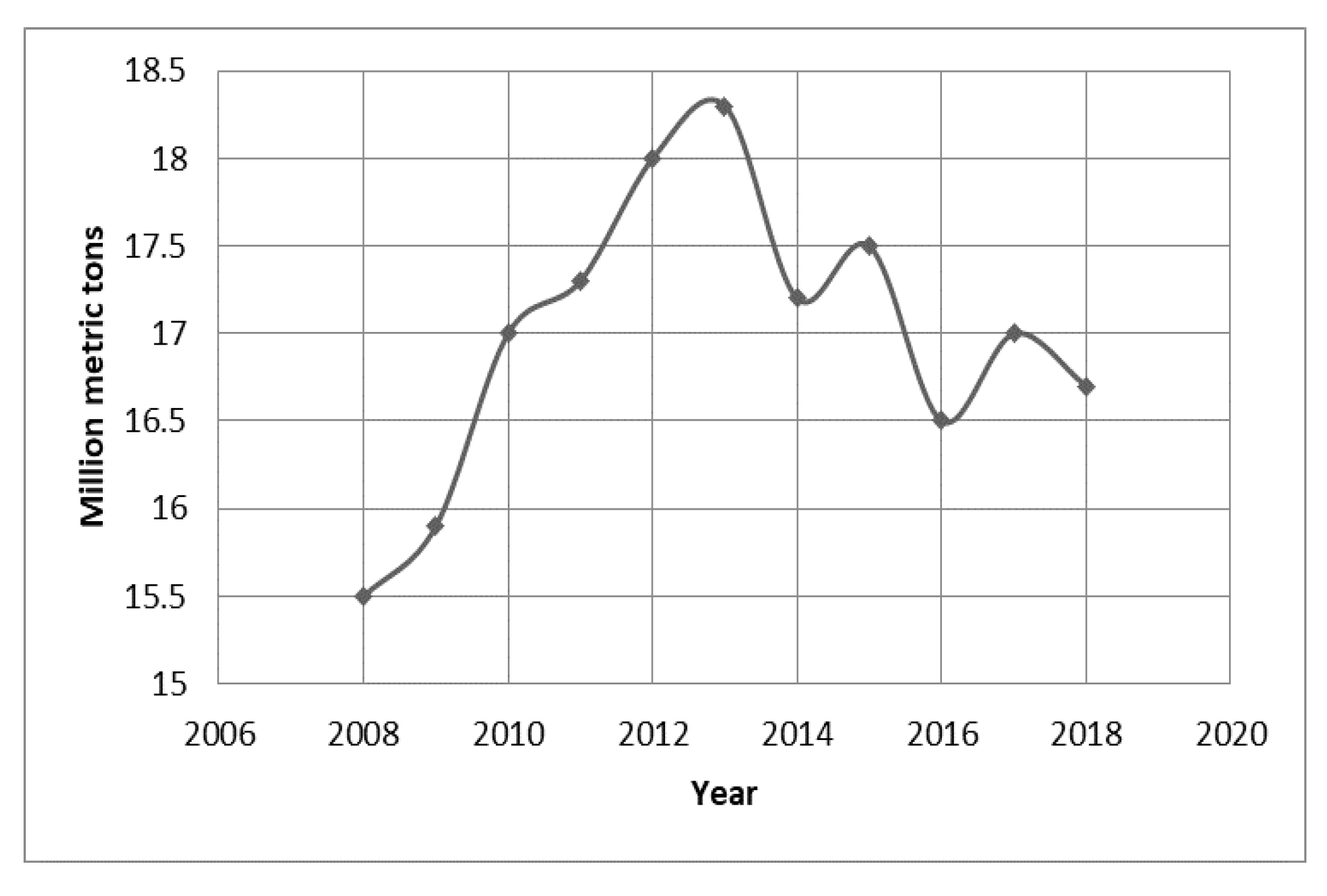

2.1. Crude Palm Oil Production Versus Market Price

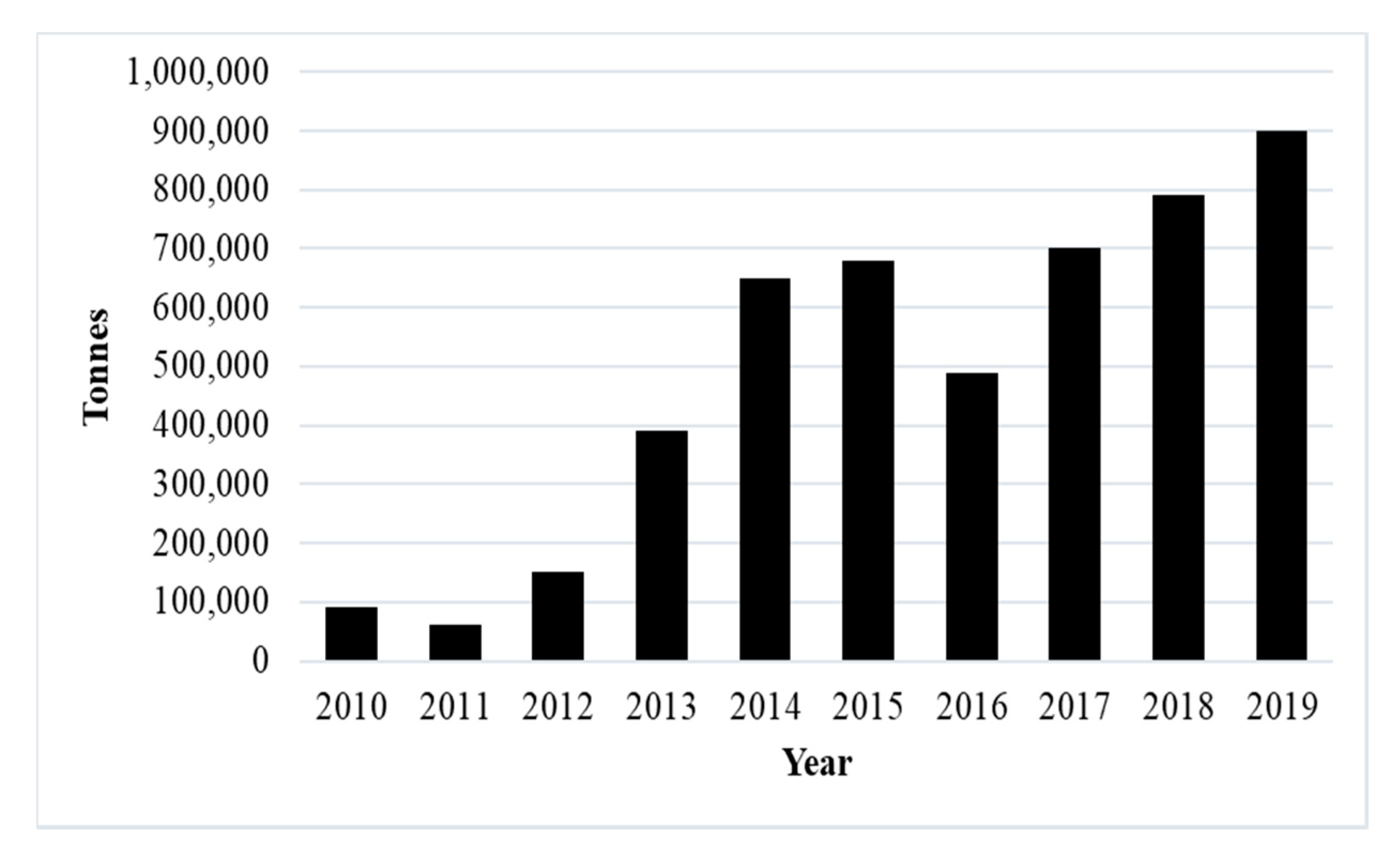

2.2. Crude Palm Oil Export Versus Demand

2.3. Export Duty

3. Current Status of Palm Biodiesel in Malaysia

3.1. Challenges of Biodiesel Implementation in Malaysia

3.2. Biodiesel Blends Performance and Emissions

3.2.1. Combustion Characteristics of Biodiesel Blends

3.2.2. Greenhouse Gases Emission for Biodiesel Blends

3.2.3. Cold-Start Performance of Engines for Biodiesel Blends

Engine Starting Time

Speed Stability

Opacity Peaks for Biodiesel Blends

3.3. Government Initiatives

3.3.1. Negotiation on the Warranty Issues

3.3.2. Field Tests

3.3.3. Research and Development

3.3.4. Promotion and Public Awareness

3.4. Palm Oil Market in Malaysia

3.4.1. Improvement of Palm Oil Industry

3.4.2. Main Issues with B10 Biodiesel Implementation

4. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Baskar, G.; Selvakumari, I.A.E.; Aiswarya, R. Biodiesel production from castor oil using heterogeneous Ni doped ZnO nanocatalyst. Bioresour. Technol. 2018, 250, 793–798. [Google Scholar] [CrossRef] [PubMed]

- Fazal, M.A.; Suhaila, N.; Haseeb, A.; Rubaie, S.; Al-Zahrani, A. Influence of copper on the instability and corrosiveness of palm biodiesel and its blends: An assessment on biodiesel sustainability. J. Clean. Prod. 2018, 171, 1407–1414. [Google Scholar] [CrossRef]

- Lau, H.L.N.; Choo, Y.M.; Ma, A.N.; Chuah, C.H. Quality of residual oil from palm-pressed mesocarp fiber (Elaeis guineensis) using supercritical CO2 with and without ethanol. J. Am. Oil Chem. Soc. 2006, 83, 893–898. [Google Scholar] [CrossRef]

- Umar, M.S.; Urmee, T.; Jennings, P. A policy framework and industry roadmap model for sustainable oil palm biomass electricity generation in Malaysia. Renew. Energy 2018, 128, 275–284. [Google Scholar] [CrossRef]

- Chung, C.H. Recovery of Residual Oil from Palm Oil Mill Effluent Using Polypropylene Nanofiber: A Field Trial. Matter Int. J. Sci. Technol. 2017, 3, 276–294. [Google Scholar] [CrossRef]

- Kushairi, A. Oil Palm Economic Performance in Malaysia and R&D Progress in 2018. J. Oil Palm Res. 2019. [Google Scholar] [CrossRef]

- Akia, M.; Yazdani, F.; Motaee, E.; Han, D.; Arandiyan, H. A review on conversion of biomass to biofuel by nanocatalysts. Biofuel Res. J. 2014, 1, 16–25. [Google Scholar] [CrossRef]

- Yusoff, M.H.M.; Sultana, S.; Ahmad, M. Prospects and current status of B5 biodiesel implementation in Malaysia. Energy Policy 2013, 62, 456–462. [Google Scholar] [CrossRef]

- Oh, T.H.; Pang, S.Y.; Chua, S.C. Energy policy and alternative energy in Malaysia: Issues and challenges for sustainable growth. Renew. Sustain. Energy Rev. 2010, 14, 1241–1252. [Google Scholar] [CrossRef]

- Kurnia, J.C.; Jangam, S.V.; Akhtar, S.; Sasmito, A.P.; Mujumdar, A.S. Advances in biofuel production from oil palm and palm oil processing wastes: A review. Biofuel Res. J. 2016, 3, 332–346. [Google Scholar] [CrossRef]

- Adnan, Z.S.A.H. A Century of Growth. 2020. Available online: http://www.thestar.com.my/business/business-news/2017/01/10/a-century-of-growth/ (accessed on 7 August 2020).

- Lau, L.C.; Tan, K.T.; Lee, K.T.; Mohamed, A.R. A comparative study on the energy policies in Japan and Malaysia in fulfilling their nations’ obligations towards the Kyoto Protocol. Energy Policy 2009, 37, 4771–4778. [Google Scholar] [CrossRef]

- Indexmundi. Palm Oil Production by Country in 1000 MT. 2020. Available online: http://www.indexmundi.com/agriculture/?commodity=palm-oil (accessed on 8 July 2020).

- Lozada, I.; Islas, J.; Grande, G. Environmental and economic feasibility of palm oil biodiesel in the Mexican transportation sector. Renew. Sustain. Energy Rev. 2010, 14, 486–492. [Google Scholar] [CrossRef]

- Reuters. Malaysia Palm Oil Output, Exports Forecast to Rise in—MPOB. 2018. Available online: http://www.theedgemarkets.com/article/malaysia-palm-oil-output-exports-forecast-rise-2018-%E2%80%94-mpob (accessed on 8 July 2020).

- MPOC. Monthly Palm Oil Trade Statistics-December, 2019. Malays. Export. Imports 2019, 4, 22. [Google Scholar]

- Isa, A. Slowdown in Malaysia’s Palm oil Inventory Growth. 2019. Available online: http://www.thestar.com.my/business/business-news/2017/01/11/slowdown-in-malaysias-palm-oil-inventory-growth/#SZ3iD48ybPjL0×0B.99 (accessed on 8 July 2020).

- Wong, K.K.S.; Shamsudin, M.N.; Mohamed, Z.A.; Sharifuddin, J. Effects of Export Duty Structure on the Performance of the Malaysian Palm Oil Industry. J. Food Prod. Mark. 2014, 20, 193–221. [Google Scholar] [CrossRef]

- Ahuja, I.P.S.; Khamba, J.S. Total productive maintenance: Literature review and directions. Int. J. Qual. Reliab. Manag. 2008, 25, 709–756. [Google Scholar] [CrossRef] [Green Version]

- Awalludin, M.F.; Sulaiman, O.; Hashim, R.; Nadhari, W.N.A.W. An overview of the oil palm industry in Malaysia and its waste utilization through thermochemical conversion, specifically via liquefaction. Renew. Sustain. Energy Rev. 2015, 50, 1469–1484. [Google Scholar] [CrossRef]

- Gaveau, D.L.A.; Salim, M.A.; Hergoualc’H, K.; Locatelli, B.; Sloan, S.; Wooster, M.J.; Marlier, M.E.; Molidena, E.; Yaen, H.; DeFries, R.; et al. Major atmospheric emissions from peat fires in Southeast Asia during non-drought years: Evidence from the 2013 Sumatran fires. Sci. Rep. 2014, 4, srep06112. [Google Scholar] [CrossRef] [Green Version]

- Reuters. Malaysia lowers August crude palm oil export tax to 5.5%. In MPOB 2019; Reuters: London, UK, 2019. [Google Scholar]

- Oxford Business Group. Economic Update. Malaysia: Oiling the Economy. 2019. Available online: http://www.oxfordbusinessgroup.com/economic_updates/malaysia-oiling-economy (accessed on 3 July 2020).

- Mahat, S.B.A. The Palm Oil Industry from the Perspective of Sustainable Development: A Case Study of Malaysian Palm Oil Industry. J. Dev. Econ. 2012, 126. Available online: https://core.ac.uk/download/pdf/60541187.pdf (accessed on 3 September 2020).

- Phan, T.N.; Baird, K.; Su, S. Environmental activity management: Its use and impact on environmental performance. Account. Audit. Account. J. 2018, 31, 651–673. [Google Scholar] [CrossRef]

- Forge, S.; Srivastava, L. ITU cost model and methodology to assist national regulatory authorities to engage with international mobile roaming. Digit. Policy Regul. Gov. 2018, 20, 125–148. [Google Scholar] [CrossRef]

- MPOB. Malayisa’s palm oil exports. In MPOB 2019; Reuters: London, UK, 2020. [Google Scholar]

- Okposin, S.B.; Halim, A.; Ong, H.B. The Changing Phases of Malaysian Economy. Subang Jaya 1999, 1, 308. [Google Scholar]

- Grifth-Jones, S.; Luz Martínez, S.M.; Petersen, J. The role of CORFO in Chile’s development: Achievements and challenges. In The Future of National Development Banks; In, S., Grifth, J., Ocampo, J.A., Eds.; Oxford University Press: New York, NY, USA, 2018. [Google Scholar]

- Manurung, R.; Ramadhani, D.A.; Maisarah, S. One step transesterification process of sludge palm oil (SPO) by using deep eutectic solvent (DES) in biodiesel production. Aip. Conf. Proc. 2017, 1855, 1–9. [Google Scholar]

- Athukorala, P.C. Industrialisation through state-Mnc partnership: Lessons from Malaysia’s national car project. Malays. J. Econ. Stud. 2017, 113, 131–156. [Google Scholar]

- Reuters. Malaysia Palm Oil Output, Exports Forecast to Rise in—MPOB. 2017. Available online: http://www.theedgemarkets.com/article/malaysia-palm-oil-output-exports-forecast-rise--%E2%80%94-mpob (accessed on 5 July 2020).

- Khalid, N.; Hamidi, H.N.A.; Thinagar, S.; Marwan, N.F. Nur Fakhzan Marwan Crude Palm Oil Price Forecasting in Malaysia: An Econometric Approach. J. Ekon. Malays. 2018, 52, 247–259. [Google Scholar]

- Oikawa, H. Resource-Based Industrialization of the Malaysian Palm Oil Industry. In Varieties and Alternatives of Catching-up; Springer Science and Business Media LLC: London, UK; Palgrave Macmillan: London, UK, 2016; pp. 247–276. [Google Scholar]

- Anyaoha, K.E.; Sakrabani, R.; Patchigolla, K.; Mouazen, A.M. Critical evaluation of oil palm fresh fruit bunch solid wastes as soil amendments: Prospects and challenges. Resour. Conserv. Recycl. 2018, 136, 399–409. [Google Scholar] [CrossRef] [Green Version]

- Mohammed, M.; Salmiaton, A.; Azlina, W.W.; Amran, M.M.; Fakhru’L-Razi, A.; Taufiq-Yap, Y. Hydrogen rich gas from oil palm biomass as a potential source of renewable energy in Malaysia. Renew. Sustain. Energy Rev. 2011, 15, 1258–1270. [Google Scholar] [CrossRef]

- Reuters. Malaysia Palm Oil Output, Exports Forecast to Rise in—MPOB. 2019. Available online: http://www.theedgemarkets.com/article/malaysia-palm-oil-output-exports-forecast-rise--%E2%80%94-mpob (accessed on 20 August 2020).

- Rahman, N.; Bruun, T.B.; Giller, K.E.; Magid, J.; Van De Ven, G.W.J.; De Neergaard, A. Soil greenhouse gas emissions from inorganic fertilizers and recycled oil palm waste products from Indonesian oil palm plantations. GCB Bioenergy 2019, 2019, 1–19. [Google Scholar] [CrossRef] [Green Version]

- Chips, Y. The case for B10 biodiesel in Malaysia 2017. J. Ekon. Malays. 2014, 48, 29–40. [Google Scholar]

- Zainuddin, A. Malaysia to Export Excess Biodiesel Products. 2019. Available online: https://themalaysianreserve.com/2017/07/20/malaysia-export-excess-biodiesel-products/ (accessed on 8 July 2020).

- Malaysia, E.P.U. Eleventh Malaysia Plan, 2016–2020: Anchoring Growth on People. Prime Minister’s Department. 2015. Available online: http://www.sarawakdga.org.my/wp-content/uploads/2015/09/11th_Malaysian_Plan.pdf (accessed on 8 August 2020).

- Naylor, R.L.; Higgins, M.M. The political economy of biodiesel in an era of low oil prices. Renew. Sustain. Energy Rev. 2017, 77, 695–705. [Google Scholar] [CrossRef]

- Lam, M.K.; Lee, K.T. Renewable and sustainable bioenergies production from palm oil mill effluent (POME): Win–win strategies toward better environmental protection. Biotechnol. Adv. 2011, 29, 124–141. [Google Scholar] [CrossRef]

- Rivero, C.; Chirenje, T.; Ma, L.Q.; Martinez, G. Influence of compost on soil organic matter quality under tropical conditions. Geoderma 2004, 123, 355–361. [Google Scholar] [CrossRef]

- Verma, P.; Pickering, E.; Jafari, M.; Guo, Y.; Stevanovic, S.; Fernando, J.F.; Golberg, D.; Brooks, P.; Brown, R.; Ristovski, Z.D. Influence of fuel-oxygen content on morphology and nanostructure of soot particles. Combust. Flame 2019, 205, 206–219. [Google Scholar] [CrossRef]

- Verma, P.; Dwivedi, G.; Behura, A.K.; Patel, D.K.; Verma, T.N.; Pugazhendhi, A. Experimental investigation of diesel engine fuelled with different alkyl esters of Karanja oil. Fuel 2020, 275, 117920. [Google Scholar] [CrossRef]

- EPA. A Comprehensive Analysis of Biodiesel Impacts on Exhaust Emissions; EPA420-P-02-001; Environmental Protection Agency: Ann Arbor, MI, USA, 2002. [Google Scholar]

- Verma, P.; Rahman, S.A.; Rahman, S.A.; Pickering, E.; Stevanovic, S.; Dowell, A.; Brown, R.; Ristovski, Z.D. The impact of chemical composition of oxygenated fuels on morphology and nanostructure of soot particles. Fuel 2020, 259, 116167. [Google Scholar] [CrossRef]

- Shirneshan, A. HC, CO, CO2 and NOx Emission Evaluation of a Diesel Engine Fueled with Waste Frying Oil Methyl Ester. Procedia Soc. Behav. Sci. 2013, 75, 292–297. [Google Scholar] [CrossRef] [Green Version]

- Broatch, A.; Tormos, B.; Olmeda, P.; Novella, R. Impact of biodiesel fuel on cold starting of automotive direct injection diesel engines. Energy 2014, 73, 653–660. [Google Scholar] [CrossRef] [Green Version]

- Ching, O.T. B10 from Dec, a Boon for Palm Oil Sector. 2018. Available online: https://www.nst.com.my/news/2016/11/185737/b10-dec-2016-boon-palm-oil-sector (accessed on 12 September 2019).

- Chin, M. Biofuels in Malaysia: An Analysis of the Legal and Institutional Framework; Center for International Forestry Research (CIFOR): Bogor, Indonesia, 2011. [Google Scholar]

- Malaysia, M. The National Green Technology Policy; KeTTHA: Sagaing, Malaysia, 2010. [Google Scholar]

- Rahyla, R.; Firdaus, R.R.; Purwaningrum, F. Upgrading of Malaysian palm oil biofuel industry: Lessons learned from the USA and Germany’s policies. Cogent Food Agric. 2017, 3, 1279760. [Google Scholar] [CrossRef]

- Iskandar, M.J.; Baharum, A.; Anuar, F.H.; Othaman, R. Palm oil industry in South East Asia and the effluent treatment technology—A review. Environ. Technol. Innov. 2018, 9, 169–185. [Google Scholar] [CrossRef]

- Zhai, N.; Zhang, T.; Yin, D.; Yang, G.; Wang, X.; Ren, G.; Feng, Y. Effect of initial pH on anaerobic co-digestion of kitchen waste and cow manure. Waste Manag. 2015, 38, 126–131. [Google Scholar] [CrossRef]

- Huang, Y.; WU, J. Analysis of biodiesel promotion in Taiwan. Renew. Sustain. Energy Rev. 2008, 12, 1176–1186. [Google Scholar] [CrossRef]

- Lim, S.; Teong, L.K. Recent trends, opportunities and challenges of biodiesel in Malaysia: An overview. Renew. Sustain. Energy Rev. 2009, 14, 938–954. [Google Scholar] [CrossRef]

- Chen, Y.; Xiao, K.; Jiang, X.; Shen, N.; Zeng, R.J.; Zhou, Y. Long solid retention time (SRT) has minor role in promoting methane production in a 65 °C single-stage anaerobic sludge digester. Bioresour. Technol. 2018, 247, 724–729. [Google Scholar] [CrossRef] [PubMed]

- Dram, T. Biofuels for the Malaysian Transport Sector. Renewable energy and energy efficiency component. In Malaysian-Danish Environmental Cooperation Programme; KeTTHA: Sagaing, Malaysia, 2006. [Google Scholar]

- Klabsong, M. Feasibility Study of Biodiesel Production from Residual oil of Palm oil Mill Effluent. Int. J. Geomate 2017, 12, 60–64. [Google Scholar] [CrossRef]

- Jam, M. Malaysia initial national communication. In Kuala Lumpur; Ministry of Science, Technology and Environment: Calle Línea, Malaysia, 2000. [Google Scholar]

- Shahid, E.M.; Jamal, Y. A review of biodiesel as vehicular fuel. Renew. Sustain. Energy Rev. 2008, 12, 2484–2494. [Google Scholar] [CrossRef]

| Country | Export (Million Ton) 2016 | Export (Million Tonnes) 2017 | Export (Million Tonnes) 2018 |

|---|---|---|---|

| India | 2.83 | 2.02 | 2.5 |

| China | 1.88 | 1.92 | 1.8 |

| Pakistan | 0.88 | 1.02 | 1.16 |

| Netherlands | 1.02 | 1.00 | - |

| Turkey | 0.66 | 0.68 | 6.31 |

| Philippine | 0.63 | 0.75 | 6.89 |

| Vietnam | 0.56 | 0.63 | - |

| USA | 0.59 | 0.55 | 5.4 |

| Others | - | - | 7.18 |

| Total | 9.04 | 8.58 | 16.48 |

| CPO Market Price | Export Duty (%) |

|---|---|

| <RM 2250 | Not Applicable |

| RM 2250–RM 2400 | 4.5 |

| RM 2401–RM 2550 | 5.0 |

| RM 2551–RM 2700 | 5.5 |

| RM 2701–RM 2850 | 6.0 |

| RM 2851–RM 3000 | 6.5 |

| RM 3001–RM 3150 | 7.0 |

| RM 3151–RM 3300 | 7.5 |

| RM 3301–RM 3450 | 8.0 |

| >RM 3450 | 8.5 |

| Biodiesel Blend | Implementation Date | Current Status |

|---|---|---|

| B5 | 2011 (Central region: Putrajaya, Kuala Lumpur, Selangor, and Malacca) 2012 (Southern region: Johor) 2013 (Northern region: Perlis, Kedah, Penang, and Perak) 2014 (Eastern region: Kelantan, Pahang, and Terengganu) Eastern Malaysia (Labuan, Sabah, and Sarawak) | The implementation has expanded to transportation and other subsidized sectors. |

| B7 | December 2014 (Whole peninsular Malaysia) January 2015 (Nationwide) | |

| B10 | To be confirmed | As of August 2017, no action has been taken. |

| B7 | To be confirmed |

| Crude Palm Oil (Year) | Price (RM/Ton) |

|---|---|

| September 2001 | 900 |

| November 2002 | 1400 |

| January 2004 | 2000 |

| March 2005 | 1500 |

| May 2006 | 1510 |

| July 2007 | 3700 |

| September 2008 | 1500 |

| November 2009 | 2800 |

| January 2011 | 2500 |

| March 2012 | 3500 |

| May 2013 | 2400 |

| July 2014 | 2200 |

| September 2015 | 2000 |

| July 2017 | 2400 |

| November 2018 | 1831 |

| Country | Current and Future Biodiesel Mandate |

|---|---|

| Argentina | B10 |

| Brazil | B8 (2017), B9 (2018) and B10 (2019) |

| Colombia | B10 |

| Indonesia | B20 (2016), B30 (2020) |

| Malaysia | B7 (2016) and B15 (2021) |

| Thailand | B5 (2016) and B10 (2018) |

| B0 (Pure Diesel) | B100 (Pure Biodiesel) | B20 (20% Biodiesel) | B50 (50% Biodiesel) | |

|---|---|---|---|---|

| Density (kg/m3) | 837.90 | 860.00 | 842.32 | 848.95 |

| Viscosity (cSt) | 2.64 | 4.82 | 3.08 | 3.73 |

| Higher heating value (MJ/kg) | 44.79 | 39.9 | 43.81 | 42.35 |

| Lower heating value (MJ/kg) | 41.77 | 37.20 | 40.86 | 39.49 |

| Cetane number | 53.30 | 58.60 | 54.36 | 55.95 |

| Air-to-fuel ratio | 14.66 | 12.49 | 14.22 | 13.56 |

| C (wt.%) | 86.35 | 76.31 | 84.30 | 81.26 |

| H (wt.%) | 13.65 | 12.15 | 13.35 | 12.89 |

| O (wt.%) | 0.00 | 11.54 | 2.36 | 5.84 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zulqarnain; Yusoff, M.H.M.; Ayoub, M.; Jusoh, N.; Abdullah, A.Z. The Challenges of a Biodiesel Implementation Program in Malaysia. Processes 2020, 8, 1244. https://doi.org/10.3390/pr8101244

Zulqarnain, Yusoff MHM, Ayoub M, Jusoh N, Abdullah AZ. The Challenges of a Biodiesel Implementation Program in Malaysia. Processes. 2020; 8(10):1244. https://doi.org/10.3390/pr8101244

Chicago/Turabian StyleZulqarnain, Mohd Hizami Mohd Yusoff, Muhammad Ayoub, Norwahyu Jusoh, and Ahmad Zuhairi Abdullah. 2020. "The Challenges of a Biodiesel Implementation Program in Malaysia" Processes 8, no. 10: 1244. https://doi.org/10.3390/pr8101244