1. Introduction

Food delivery has now become an integral part of the urban lifestyle. Since the mid-2000s with the development of internet technology and the general trend towards e-commerce, increased urban living, and changing social behaviors, the online food delivery (OFD) market has been thriving [

1,

2], expected to reach USD 200 billion in the global output value by 2025 [

3]. Online food delivery platforms give a plethora of choices and convenience along with cashback benefits, rewards, great deals, and discounts, allowing customers to order from a wide range of restaurants and doorstep delivery options with a single tap of their mobile phone. Forthwith before the ominous COVID-19 started to make headlines around the world, online food delivery was reaping the benefits of more widespread digitalization and a greater abundance of delivery apps. Without a doubt, the unprecedented pandemic has accelerated consumer adoption of these delivery services, with an incredible increase in new customers joining the platforms, especially in developing countries. While millions of businesses, mainly those in the aviation, tourism, and hospitality industries, were hard hit by the COVID-19 crisis and experienced a real threat of significant declines in revenue, the OFD industry has grown drastically, with the global OFD industry’s turnover increasing about 140%, thanks to the pandemic [

4].

Food delivery services are similar to courier services in that the ordered meal is brought from the restaurant to the customer by either staff or food ordering delivery agents. This process, of course, is dependent on how a customer places his or her order. The process of ordering meals from a food cooperative or restaurant is implemented over a call, mobile apps or webpages, or through the restaurant’s direct online portals, as well as their aggregator apps. Customers are frequently charged a flat delivery fee, which is sometimes waived based on purchase volume. Contactless delivery has been commonplace since the pandemic outbreak. Technological interventions have further made food delivery services prompt and quick to gain traction among consumers.

With a surge in demand, OFD has been under the spotlight as an option in Vietnam for a good number of years now. Along with many factors proliferating the growth of the market, the COVID-19 pandemic proved to be a key accelerant that has seen OFD adoption skyrocket in the country over the past year. Moreover, the existence of a robust population of millennial consumers in the country is further anticipated to boost the market expansion. Whereas Vietnam’s OFD market is still in its development compared to other countries in Asia, it is exciting as increasingly more businesses have aggressively entered this field. Revenue from OFD in Vietnam stood at USD 302 million in 2020, and is expected to reach USD 557 million by 2027 [

5]. Currently, the biggest players in the country’s food delivery market are Grab Food and Now financed by the SEA Group, a major internet platform in Southeast Asia and Taiwan, followed by other aggressive players such as Baemin and Go Food (Indonesian decacorn Gojek). To entice merchants and customers, these companies are spending aggressively. The top ride-hailing players in Vietnam are Grab and its major competitor Gojek. Grab will invest another

$500 million in the country between 2020 and 2025, focusing on transportation, food delivery, and internet-based payments [

6]. Baemin, the South Korean player funded by Woowa Brothers tech unicorn that made its debut in Vietnam in May 2019, has seen tremendous growth in terms of delivery usage in 2020 and surprisingly achieved the highest score regarding app satisfaction by brands, according to the latest survey [

7].

However, with increasingly more customers opting for ordering food online, the evolving marketplace is rapidly becoming very competitive and challenging for current players in the landscape. The growth of OFD has transformed the way the OFD companies interact with customers in the presence of service quality, technology advancements, and risk factors, with significant implications for sustainability, as defined by the three pillars of economic, social, and environmental [

8]. For example, from an economic perspective, OFD provides jobs and sale opportunities while being criticized for the high commissions it charges restaurants and questionable working conditions for delivery employees. From a social standpoint, OFD affects the relationship between consumers and food quality, mainly relating to public health outcomes and traffic systems. Considering the environmental dimension, the composition of alarming amounts of garbage and its substantial carbon footprints by this industry have negative consequences. Thus, in the fiercely competitive OFD market, it is essential for decision-makers and stakeholders to effectively evaluate their businesses under well-rounded aspects to ensure it is sustainable and moving forward. This assessment, therefore, can be conceptualized as a complex decision-making process with the goal of considering the dimensions’ impacts on the OFD business operation in light of sustainable development.

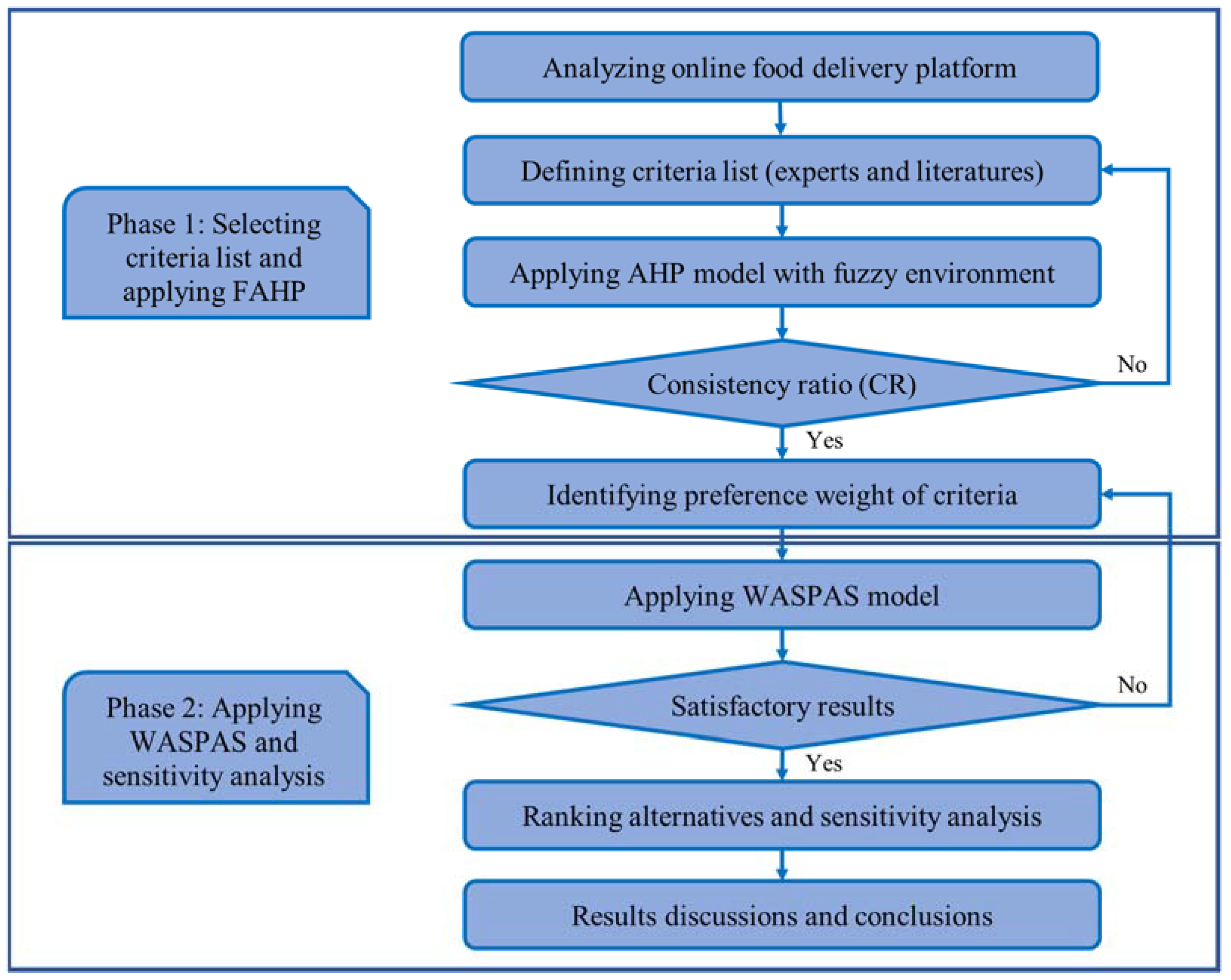

This paper proposes a multi-criteria decision-making (MCDM)-based framework to assess the sustainable development of the OFD market in Vietnam. Initially, evaluation social and environmental dimensions (healthy and safety, information security, environ and mental impact) and conventional dimensions including economic (delivery cost, operational capability, and risk management), service quality (order fulfillment, delivery speed, convenience of payment, online/offline service level, and customer feedback), and technology (web design, real-time tracking systems, and marketing techniques) have been identified through literature review and expert’s opinions to employ MCDM approach. Six major players in the OFD industry in Vietnam, namely, Baemin, Foody, GoFood, GrabFood, Loship, and Now, are deliberated in the assessment to demonstrate the proposed framework applicability.

The MCDM approach proposed in this study incorporates the analytic hierarchy process (AHP) using triangular fuzzy sets and the weighted aggregated sum product assessment (WASPAS). AHP is a common MCDM method used for the determination of criteria weights. Because of its features, such as ease of application and the capacity to examine benefit and cost criteria simultaneously, the AHP method is a viable approach to solving MCDM problems [

9]. AHP makes weighting using pairwise comparisons easy to understand, in addition to being a method that may be readily comprehended and simplify even complex situations. Furthermore, AHP enables the decision-maker to assess the consistency of their decisions and undertake sensitivity analysis. All of these benefits make AHP more applicable than other approaches in a variety of situations. Additionally, fuzzy set theory is involved in the AHP to handle the uncertainties and vagueness that exist extensively in the experts’ judgment, which are characterized by linguistic variables [

10]. In this way, the ideas of the experts were turned to triangular fuzzy numbers to obtain more viable results and weights, which were then normalized, weighted, and completed the weighted normalized fuzzy decision matrix. To be able to prioritize the alternatives, WASPAS is a new approach that has recently been presented and has improved consistency and accuracy [

11]. WASPAS also becomes an appropriate MCDM method for evaluating alternatives because it avoids difficult multiplication calculations and simplifies calculations. Thus, a method that is a combination of fuzzy AHP (FAHP) and WASPAS is proposed and used in this paper. The outcomes of this study could be used as a road map for the decision-makers and stakeholders in the OFD and other industries.

To the best of the authors’ knowledge, there has not been carried out a thorough assessment of the OFD market in Vietnam using the proposed approach as previously outlined. In order to fill the research gaps, the following objectives are identified for the presented case study. First, the evaluation criteria in the OFD context are investigated, especially in Vietnam’s market. Second, the relative weights of the OFD evaluation criteria are determined. Third, with the derived weights of criteria, OFD companies performing the best in terms of sustainable development, are suggested. Finally, the managerial implications of the proposed work are discussed. Those objectives addressed can constitute the novelty of this study. One significant advantage of this research is the comprehensive development of the OFD market evaluation criteria from the literature and consulting field experts. Moreover, this is the first study that takes the merits of the FAHP and WASPAS methodologies to evaluate the OFD market. A case study in Vietnam is discussed to present the trustworthiness of the proposed integrated framework. Additionally, the robustness of the approach is tested by performing sensitivity analysis. Finally, the managerial implications of the applied methodology and its analysis will provide insight to decision-makers of the OFD industry not only in Vietnam, but also in the global market.

The rest part of this paper is presented as follows. Literature on previous studies in the field of the OFD industry and related sectors along with MCDM approaches is reviewed in

Section 2. Materials and methods are explained in

Section 3. Result analysis of the case study in Vietnam is covered in

Section 4. Additionally, sensitivity analysis is conducted and presented in

Section 5 to analyze the ranking results. The managerial implications and discussions are presented in

Section 6, while main contributions of the research along with directions for forthcoming work are well-depicted in

Section 7.

6. Discussions

In the presented research work, a hybrid MCDM framework for the assessment of the OFD market in Vietnam is established concerning a comprehensive set of criteria: social and environmental dimensions (healthy and safety, information security, and environmental impact), economic aspects (delivery cost, operational capability, and risk management), service quality (order fulfillment, delivery speed, convenience of payment, online/offline service level, and customer feedback), and technology (web design, real-time tracking systems, and marketing techniques). In view of the discussion by exhaustively reviewing the literature, the combination of FAHP and WASPAS has been proposed for the first time in the current research to solve the problem. By using the triangular fuzzy sets in the AHP, experts’ judgments in linguistic terms can be translated to obtain more scientific and accurate attribute weights of the criteria. Moreover, the consistency test was performed to check the uniformity of the expert’s input while the sensitivity analysis was implemented to test the robustness of the approach. With the presented case study being successfully addressed, the trustworthiness of the proposed integrated framework is demonstrated. The results illustrate that the applied model reach common green OFD company rankings.

From the FAHP findings, three criteria of the service quality aspect (convenience of payment, delivery speed, online service level, order fulfillment) and one criterion of the economic factor (delivery cost) have been ranked as the topmost OFD evaluation criteria. From

Figure 4, it is noteworthy to look at the “convenience of payment” criterion which obtains a dominant weight. In Vietnam, the convenience of payment for online shopping is extremely essential to fulfill the customer’s need in the first place. While the benefits of cashless payment such as credit or internet banking have been proven, reducing costs and bringing many conveniences to customers and businesses, a vast majority of Vietnamese still prefer cash-on-delivery payment over online transactions [

50], compared to many other countries. The reason is due to the Vietnamese shopping behaviors, and the experience of not using cash is still inconvenient in this country. Thus, not only businesses especially those in e-commerce but also the Vietnamese government have faced an uphill task to encourage cashless payments, that is creating a sustainable digital payments market that is easy for people to use [

51]. From other perspectives, it is an exceptional competitive advantage for the OFD companies to devise cutting-edge technology solutions that promise more effective order fulfillment while saving time and reducing costs. Merging orders, multi-delivery options via robots and drones, and cloud kitchens are among trends for OFD businesses to stay afloat and win customers [

52].

From the final ranking by WASPAS analysis, the best performing OFD company in today’s OFD market in Vietnam with respect to the selected evaluation criteria is Foody (0.7), followed by GrabFood (0.6023), Now (0.5421), GoFood (0.4667), Baemin (0.4104), and Loship (0.3410), according to

Figure 5. The obtained results can be utilized as a guideline for the OFD managers and decision-makers to assess their businesses by considering broader aspects and determining major determinants in the industry. All selected evaluation criteria in the current study will help OFD businesses to handle numerous challenges and encourage them to look at the efforts of sustainable development. While several aspects such as service quality, economic factors, and technology have been focused on in the OFD market assessment in Vietnam and other markets, bearing in mind social and environmental subjects still remains a challenge.

7. Conclusions and Future Works

The potential of the food delivery industry is endless and the OFD services are becoming an indispensable part of people’s day-to-day lives. The OFD businesses are fast catching up across markets of America, Asia, Europe, and the Middle East. In Vietnam, six foremost players in the OFD industry, namely Baemin, Foody, GoFood, GrabFood, Loship, and Now, are taking over the major market share. Even though there is a bright future with numerous possibilities for these current players, in particular, and those entrepreneurs planning to start their OFD businesses, this sector has a competitive landscape. Thus, it is essential for the OFD businesses to take a number of measures and relevant aspects into consideration for the sake of sustainable development in this competing market.

The main contributions of this paper can be summarized as follows. First, the comprehensive development of the OFD market assessment criteria employing industry expert’s responses and literature is the significant advantage of this research. Second, to the best of the authors’ knowledge, none of the existing studies presented a case study of assessing the OFD companies in Vietnam using the proposed framework (i.e., FAHP and WASPAS). The applied sensitivity analysis will allow the decision-makers to test the observation stability. Finally, the managerial implications of the applied methodology and its analysis will provide insight to decision-makers of the OFD industry not only in Vietnam but also in the global market. For future studies, the proposed method in this paper can be associated with more novel factors that affect the market. Methodologically, different MCDM techniques such as TOPSIS, VIKOR, PROMETHEE, DEA, and combinations of them could be utilized [

53,

54]. Further research could also apply the proposed method or relevant approaches to specific cases of industries especially those relating to e-commerce to test the general validity of the results.