Cultured Meat Prospects for a Billion!

Abstract

:1. Introduction

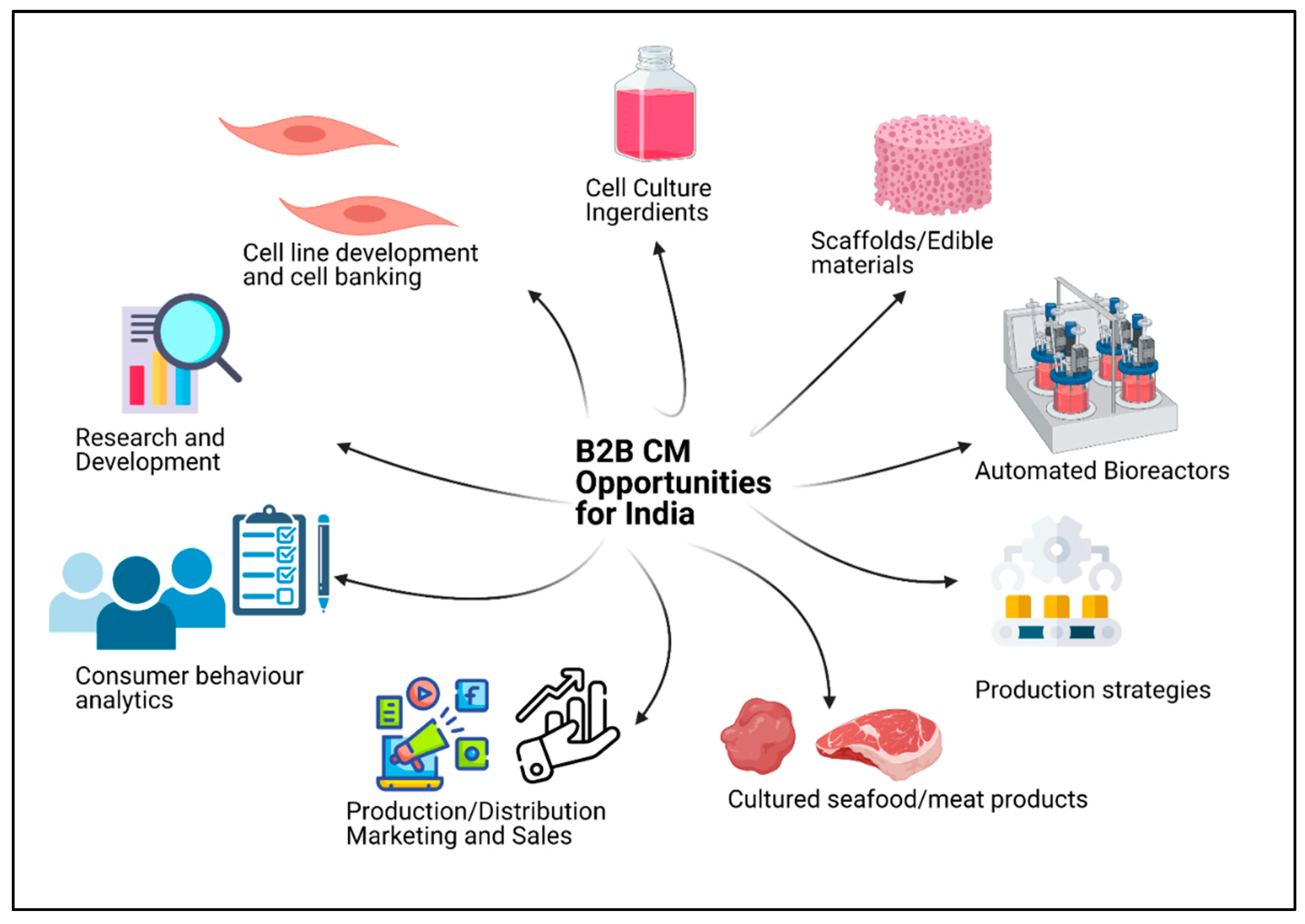

2. Need for Cultured Meat in India

3. Business Aspects of the CM Industry

4. Technical Aspects of the CM Industry

4.1. Upstream Processes

4.1.1. Custom Optimisation, Formulation, and Production of Media

4.1.2. Cell Line Development and Cell Banking Strategies

4.1.3. Customised Bioreactors for CM

4.1.4. Scaffolds for CM Applications

4.1.5. Plant-Based Proteins with Better Functionality for CM Applications

4.1.6. Protein Variants as CM Ingredients

4.1.7. Characterisation of CM Ingredients

4.1.8. Supply of Fermented Ingredients for CM Applications

4.1.9. Characterisation and Sensor Technologies

4.2. Downstream Processes

4.2.1. Contract Manufacturing Organisation (CMO) and Co-Manufacturing Units

4.2.2. Distribution, International Import and Export, and Licensing

4.2.3. Regulatory and Safety Certifications for CM in India

5. Product Focus for CM Development

5.1. CM Product Mind Map

5.2. CM Products Similar to Meat

5.3. Processed CM Products

5.4. Blended Meat Products

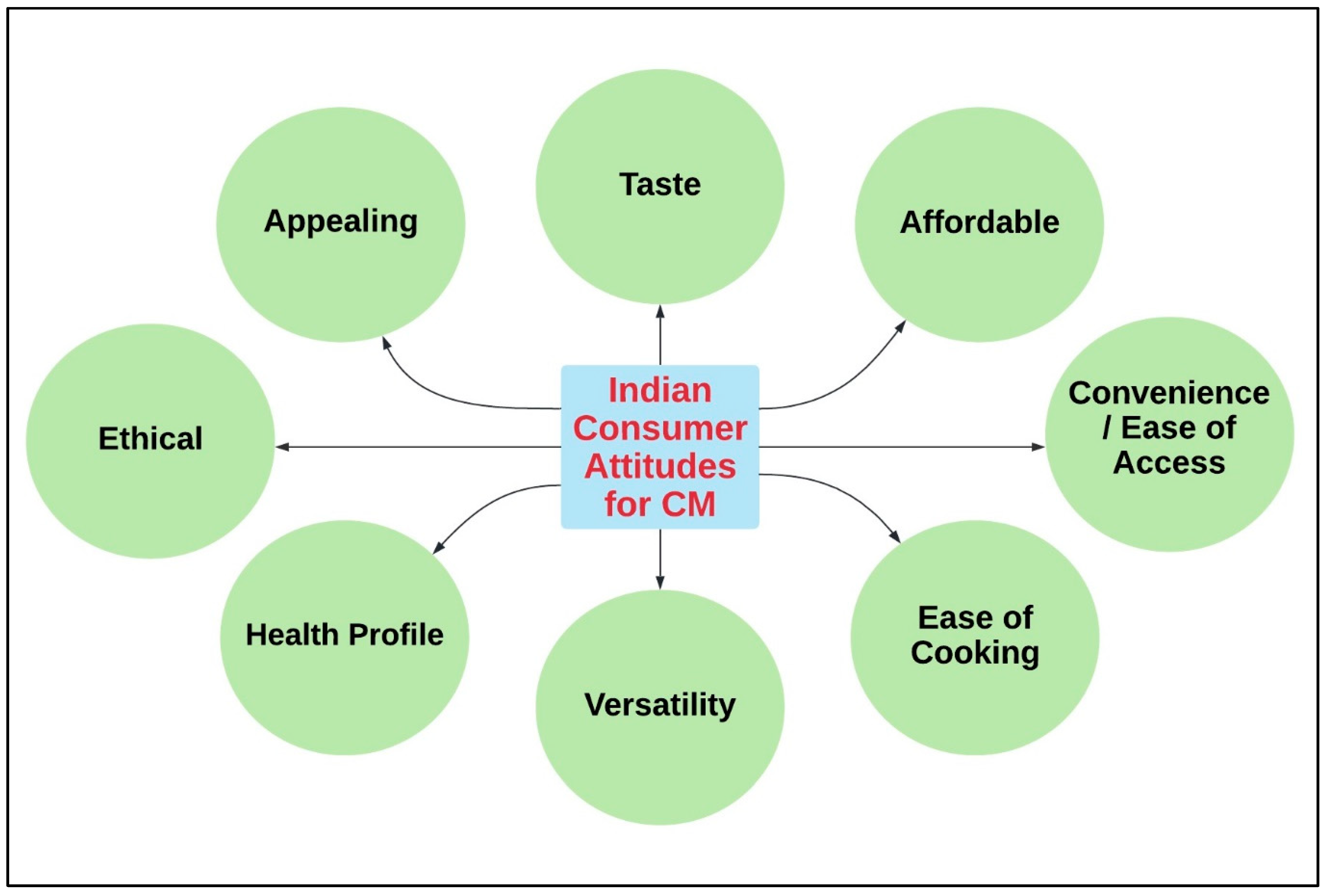

6. Consumer Insights and Behaviour towards CM

Concerns about CM

7. Conclusions and Future Outlook for the Indian CM Market

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Choudhury, D.; Singh, S.; Seah, J.S.H.; Yeo, D.C.L.; Tan, L.P. Commercialization of Plant-Based Meat Alternatives. Trends Plant Sci. 2020, 25, 1055–1058. [Google Scholar] [CrossRef]

- Gahukar, R.T. Food Security in India: The Challenge of Food Production and Distribution. J. Agric. Food Inf. 2011, 12, 270–286. [Google Scholar] [CrossRef]

- Rahman, C.K.F.; Khan, S.; Kumar, R.; Chand, S.; Bardhan, D.; Dhama, K. Impact of COVID-19 pandemic and lock-down on the meat consumption pattern in India: A preliminary analysis. J. Exp. Biol. Agric. Sci. 2021, 9, 172–182. [Google Scholar] [CrossRef]

- FAO. Meat Market Review 2021, Food and Agriculture Organization of the United States. Available online: https://www.fao.org/3/cb3700en/cb3700en.pdf2021 (accessed on 15 September 2021).

- Alae-Carew, C.; Bird, F.A.; Choudhury, S.; Harris, F.; Aleksandrowicz, L.; Milner, J.; Joy, E.J.M.; Agrawal, S.; Dangour, A.D.; Green, R. Future diets in India: A systematic review of food consumption projection studies. Glob. Food Secur. 2019, 23, 182–190. [Google Scholar] [CrossRef] [PubMed]

- Arora, R.S.; Brent, D.A.; Jaenicke, E.C. Is India Ready for Alt-Meat? Preferences and Willingness to Pay for Meat Alternatives. Sustainability 2020, 12, 4377. [Google Scholar] [CrossRef]

- Post, M.J.; Levenberg, S.; Kaplan, D.L.; Genovese, N.; Fu, J.; Bryant, C.J.; Negowetti, N.; Verzijden, K.; Moutsatsou, P. Scientific, sustainability and regulatory challenges of cultured meat. Nat. Food 2020, 1, 403–415. [Google Scholar] [CrossRef]

- Choudhury, D.; Tseng, T.W.; Swartz, E. The Business of Cultured Meat. Trends Biotechnol. 2020, 38, 573–577. [Google Scholar] [CrossRef]

- Rubio, N.R.; Xiang, N.; Kaplan, D.L. Plant-based and cell-based approaches to meat production. Nat. Commun. 2020, 11, 6276. [Google Scholar] [CrossRef]

- Ong, S.; Choudhury, D.; Naing, M.W. Cell-based meat: Current ambiguities with nomenclature. Trends Food Sci. Technol. 2020, 102, 223–231. [Google Scholar] [CrossRef]

- Morrison, O. Lab-Grown Meat Prices to ‘Reach Parity with Regular Meat before Analogues’. Available online: https://www.foodnavigator.com/Article/2020/11/19/Lab-grown-meat-prices-to-reach-parity-with-regular-meat-before-analogues (accessed on 15 September 2021).

- Macdonald, C. Cost Barrier to Cultured Meat Could Vanish within Five Years. Available online: https://www.insights.figlobal.com/new-product-development/cost-barrier-cultured-meat-could-vanish-within-five-years (accessed on 15 September 2021).

- Morrison, O. Start-up Offers Diy Solution to Cut the Cost of Lab-Grown Meat. Available online: https://www.foodnavigator.com/Article/2020/05/18/Start-up-offers-DIY-solution-to-cut-cost-of-lab-grown-meat (accessed on 15 September 2021).

- Yaman, R. Vertical Integration in Plant-Based and Cell-Based Meat. Available online: https://www.robertyaman.com/blog/vertical-integration-in-plant-based-and-cell-based-meat (accessed on 15 September 2021).

- Alfajora, F. The Future of Meat. Available online: https://www.medium.com/swlh/the-future-of-meat-f2150a9e2b34 (accessed on 15 September 2021).

- Cosgrove, E. Five Cultured Meat Startups Raise Funding as Fledgling Industry Comes into Focus. Available online: https://www.agfundernews.com/cultured-meat-startups-raise-funding.html (accessed on 15 September 2021).

- Bhat, Z.F.; Morton, J.D.; Mason, S.L.; Bekhit, A.E.-D.A.; Bhat, H.F. Technological, Regulatory, and Ethical Aspects of In Vitro Meat: A Future Slaughter-Free Harvest. Compr. Rev. Food Sci. Food Saf. 2019, 18, 1192–1208. [Google Scholar] [CrossRef] [Green Version]

- Bryant, C.J. Culture, meat, and cultured meat. J. Anim. Sci. 2020, 98, skaa172. [Google Scholar] [CrossRef] [PubMed]

- AIC-CCMB. Innovation Challenge 2019: Technologies on Clean Meat. Available online: http://aic.ccmb.res.in/cleanmeat.html (accessed on 15 September 2021).

- Hansen, J. Is India Ready for Lab-Grown Meat? (Part 2). Available online: https://www.supertrends.com/is-india-ready-for-lab-grown-meat-part-2/ (accessed on 15 September 2021).

- NBRIC. NBRIC—Announcement of Richcore Life Sciences. Available online: http://www.nbric.in/announcement/announcement-of-richcore-life-sciences/ (accessed on 15 September 2021).

- VeganFirst. World’s First Regulatory Approval for Cultivated Meat Begins “New Space Race For The Future of Food”. Available online: https://www.veganfirst.com/article/worlds-first-regulatory-approval-for-cultivated-meat-begins-new-space-race-for-the-future-of-food (accessed on 15 September 2021).

- Neo, P. Affordable Lab-Grown Meat: India Looks to Become Global Cell-Based Meat Hub. Available online: https://www.foodnavigator-asia.com/Article/2019/05/10/Affordable-lab-grown-meat-India-looks-to-become-global-cell-based-meat-hub (accessed on 15 September 2021).

- Hiranandani, A. Plant-Based and Lab-Grown Meat: An Indian Opportunity. Available online: https://www.indianexpress.com/article/opinion/plant-based-and-lab-grown-meat-an-indian-opportunity-7260672/ (accessed on 15 September 2021).

- Treich, N. Cultured Meat: Promises and Challenges. Environ. Resour. Econ. 2021, 79, 33–61. [Google Scholar] [CrossRef]

- Narayanan, J. Plant-Based Meat: Is This Sustainable Food Trend Here to Stay? Available online: https://indianexpress.com/article/lifestyle/food-wine/plant-based-meat-mock-vegan-veganism-sustainability-benefits-soy-jackfruit-peas-beans-7383111/2021 (accessed on 15 September 2021).

- Ambwani, M.V.; Narayanan, C. Meat Alternatives Get More Pizzazz. Available online: https://www.thehindubusinessline.com/catalyst/meat-alternatives-become-popular/article34465258.ece2021 (accessed on 15 September 2021).

- Dolgin, E. Will Cell-Based Meat Ever Be a Dinner Staple? Available online: https://www.nature.com/articles/d41586-020-03448-1 (accessed on 15 September 2021).

- Stephens, N.; Di Silvio, L.; Dunsford, I.; Ellis, M.; Glencross, A.; Sexton, A. Bringing cultured meat to market: Technical, socio-political, and regulatory challenges in cellular agriculture. Trends Food Sci. Technol. 2018, 78, 155–166. [Google Scholar] [CrossRef] [PubMed]

- NewScientist. Accelerating the Cultured Meat Revolution. Available online: https://www.newscientist.com/article/mg24032080-400-accelerating-the-cultured-meat-revolution/ (accessed on 15 September 2021).

- Merckgroup, b. Clean Meat—The Food of The Future? Available online: https://www.merckgroup.com/en/research/science-space/envisioning-tomorrow/scarcity-of-resources/cleanmeat.html (accessed on 15 September 2021).

- Merckgroup, A. Innovation Feilds. Available online: https://www.merckgroup.com/en/research/innovation-center/innovation-fields.html (accessed on 15 September 2021).

- CMMC. CMMC Reveals New Bioreactor Modeling Technology. Available online: https://www.thecmmc.org/news/cmmc-reveals-new-bioreactor-modeling-technology (accessed on 15 September 2021).

- Wu, J. Hormel and Kellogg Launch Plant-Based Meat Product Lines. Available online: https://www.cnbc.com/2019/09/04/kellogg-to-produce-its-own-plant-based-burger-and-imitation-chicken.html (accessed on 15 September 2021).

- Mitsui. Cultured Meat Production Technology: Challenges and Future Development. Available online: https://www.mitsui.com/mgssi/en/report/detail/__icsFiles/afieldfile/2021/01/18/2011t_sato_e.pdf (accessed on 15 September 2021).

- Witte, B.; Obloj, P.; Koktenturk, S.; Morach, B.; Brigl, M.; Rogg, J.; Schulze, U.; Walker, D.; Koeller, E.V.; Dehnert, N.; et al. Food for Thought: The Protein Transformation. Available online: https://www.bcg.com/en-in/publications/2021/the-benefits-of-plant-based-meats (accessed on 15 September 2021).

- India, H. First collaboration to Promote Clean Meat in India takes off. Available online: https://www.hsi.org/news-media/laboratory-grown-meat-india-032818/ (accessed on 15 September 2021).

- HSI. India Hosts Its First Food-Tech Revolution Summit in Hyderabad. Available online: https://www.hsi.org/news-media/india-hosts-summit-on-plant-based-meat-082418/ (accessed on 15 September 2021).

- NRCMeat. National Research Centre-Meat—Ongoing Projects. Available online: https://www.nrcmeat.icar.gov.in/ONGOING_PROJECTS.aspx (accessed on 15 September 2021).

- BigIdeaVentures. Big Idea Ventures & Ashika Group Announce First India Alt Protein Fund & Accelerator. Available online: https://www.bigideaventures.com/big-idea-ventures-ashika-group-announce-first-india-alt-protein-fund-accelerator/ (accessed on 15 September 2021).

- Inc42. Meet The 3 Agritech Startups Selected for Gastrotope’s Second Acceleration Programme. Available online: https://www.inc42.com/buzz/meet-the-3-agritech-startups-selected-for-gastrotopes-second-acceleration-programme/ (accessed on 15 September 2021).

- Ho, S. ClearMeat: India’s First Cell-Based Chicken Maker Files Patent for Cultivated Meat Technology. Available online: https://www.greenqueen.com.hk/clearmeat-indias-first-cell-based-chicken-maker-files-patent-for-cultivated-meat-technology/ (accessed on 15 September 2021).

- Vegconomist. Indian Cell-Based Meat Company Claims it Has Achieved Price Parity. Available online: https://www.vegconomist.com/companies-and-portraits/indian-cell-based-meat-company-claims-it-has-achieved-price-parity/ (accessed on 15 September 2021).

- Neo, P. Quicker Marketability: India’s Myoworks Develops ‘Off the Shelf’ Scaffolding to Speed Up Cell-Based Meat NPD. Available online: https://www.foodnavigator-asia.com/Article/2020/12/22/Quicker-marketability-India-s-Myoworks-develops-off-the-shelf-scaffolding-to-speed-up-cell-based-meat-NPD (accessed on 15 September 2021).

- IndiaToday. Iit-Guwahati Researchers Develop Lab-Grown Meat Which Is Eco-Friendly and More Nutritious. Available online: https://www.indiatoday.in/education-today/news/story/iit-guwahati-researchers-develop-lab-grown-meat-which-is-eco-friendly-and-more-nutritious-1591471-2019-08-25 (accessed on 15 September 2021).

- EconomicTimes. Transforming Methane Gas to Meat Equivalent. String Bio Is Making It Possible. Available online: https://www.m.economictimes.com/small-biz/startups/features/transforming-methane-gas-to-meat-equivalent-string-bio-is-making-it-possible/articleshow/73079312.cms (accessed on 15 September 2021).

- Swartz, E. Meeting the Needs of the Cell-Based Meat Industry. Available online: https://www.aiche.org/resources/publications/cep/2019/october/meeting-needs-cell-based-meat-industry (accessed on 15 September 2021).

- Merckgroup. Optimising Media for Cultured Meat Products. Available online: https://www.merckgroup.com/en/research/innovation-center/highlights/mediaforculturedmeat.html (accessed on 15 September 2021).

- Zhang, G.; Zhao, X.; Li, X.; Du, G.; Zhou, J.; Chen, J. Challenges and possibilities for bio-manufacturing cultured meat. Trends Food Sci. Technol. 2020, 97, 443–450. [Google Scholar] [CrossRef]

- Choi, K.-H.; Yoon, J.W.; Kim, M.; Lee, H.J.; Jeong, J.; Ryu, M.; Jo, C.; Lee, C.-K. Muscle stem cell isolation and in vitro culture for meat production: A methodological review. Compr. Rev. Food Sci. Food Saf. 2021, 20, 429–457. [Google Scholar] [CrossRef]

- Miller, R.K. A 2020 synopsis of the cell-cultured animal industry. Anim. Front. 2020, 10, 64–72. [Google Scholar] [CrossRef]

- Handral, H.K.; Hua Tay, S.; Wan Chan, W.; Choudhury, D. 3D Printing of cultured meat products. Crit. Rev. Food Sci. Nutr. 2020, 1–10. [Google Scholar] [CrossRef]

- Ben-Arye, T.; Shandalov, Y.; Ben-Shaul, S.; Landau, S.; Zagury, Y.; Ianovici, I.; Lavon, N.; Levenberg, S. Textured soy protein scaffolds enable the generation of three-dimensional bovine skeletal muscle tissue for cell-based meat. Nat. Food 2020, 1, 210–220. [Google Scholar] [CrossRef]

- Waltz, E. Club-Goers Take First Bites of Lab-Made Chicken. Available online: https://www.nature.com/articles/s41587-021-00855-1 (accessed on 15 September 2021).

- Fernandes, A.M.; de Souza Teixeira, O.; Palma Revillion, J.P.; de Souza, Â.R.L. Conceptual evolution and scientific approaches about synthetic meat. J. Food Sci. Technol. 2020, 57, 1991–1999. [Google Scholar] [CrossRef]

- Young, J.F.; Skrivergaard, S. Cultured meat on a plant-based frame. Nat. Food 2020, 1, 195. [Google Scholar] [CrossRef]

- Askew, K. Feeding Plant-Based Innovation: ‘Fermentation is the Future of the Alternative Protein Industry’. Available online: https://www.foodnavigator.com/Article/2020/04/30/Feeding-plant-based-innovation-Fermentation-is-the-future-of-the-alternative-protein-industry (accessed on 15 September 2021).

- DiMaio, T. This Lab-On-A-Chip Could Lower the Cost of Cell-Based Meat. Available online: https://www.gfi.org/blog/this-lab-on-a-chip-could-lower-the-cost-of-cell-based-meat/#:~:text=GFI%20research%20grant%20recipient%20Dr,during%20cell%2Dbased%20meat%20production (accessed on 15 September 2021).

- Meat, B. Beyond Meat® Expands Local Production Capabilities in Europe. Available online: https://www.investors.beyondmeat.com/news-releases/news-release-details/beyond-meatr-expands-local-production-capabilities-europe (accessed on 15 September 2021).

- Martyn-Hemphill, R. Where Are the World’s First ‘Lab Burger’ Growers Now? Enlarging Their Series B Raise. Available online: https://www.agfundernews.com/where-are-the-worlds-first-lab-burger-growers-now-enlarging-their-series-b-raise.html (accessed on 15 September 2021).

- Watson, E. Japanese Cell Cultured Meat Co IntegriCulture raises $7.4 m, Aims to Scommercialise Foie Gras in 2021. Available online: https://www.foodnavigator-usa.com/Article/2020/05/27/Japanese-cell-cultured-meat-co-IntegriCulture-raises-7.4m-aims-to-commercialize-foie-gras-in-2021 (accessed on 15 September 2021).

- Specht, L. Meat by the molecule: Making meat with plants and cells. Biochemist 2018, 40, 18–21. [Google Scholar] [CrossRef]

- Specht, L. Is the Future of Meat Animal-Free? Available online: https://www.ift.org/news-and-publications/food-technology-magazine/issues/2018/january/features/cultured-clean-meat (accessed on 15 September 2021).

- Coyne, A. Eyeing Alternatives—Meat Companies with Stakes in Meat-Free and Cell-Based Meat. Available online: https://www.just-food.com/analysis/eyeing-alternatives-meat-companies-with-stakes-in-meat-free-and-cell-based-meat_id139678.aspx (accessed on 15 September 2021).

- Bryant, C.; Barnett, J. Consumer Acceptance of Cultured Meat: An Updated Review (2018–2020). Appl. Sci. 2020, 10, 5201. [Google Scholar] [CrossRef]

- Mancini, M.C.; Antonioli, F. To what Extent are Consumers’ Perception and Acceptance of Alternative Meat Production Systems Affected by Information? The Case of Cultured Meat. Anim. Open Access J. MDPI 2020, 10, 656. [Google Scholar] [CrossRef] [PubMed]

- Bryant, C.; Szejda, K.; Parekh, N.; Deshpande, V.; Tse, B. A Survey of Consumer Perceptions of Plant-Based and Clean Meat in the USA, India, and China. Front. Sustain. Food Syst. 2019, 3. [Google Scholar] [CrossRef]

- Joe, T. Eat Just Serves Cultured Meat to Diners at 1880 Restaurant Singapore in a World First. Available online: https://www.greenqueen.com.hk/eat-just-serves-cultured-meat-to-diners-at-1880-restaurant-singapore-in-a-world-first/ (accessed on 15 September 2021).

- Waltz, E. Lab-Made Chicken Reaches Select Diners in Singapore. Available online: https://www.scientificamerican.com/article/lab-made-chicken-reaches-select-diners-in-singapore/ (accessed on 15 September 2021).

| S. No | Value-Chain Entry Point | Prospective Strategies/Growth Avenues | Stakeholders Involved |

|---|---|---|---|

| Upstream/Production | |||

| 01 | Cell Line Development |

| DBT India; AIC-CCMB; ICT Mumbai; CECA; NRC Meat; GFI India; HSI India; Clear Meat; IIT Guwahati |

| 02 | Cell Culture Media and Ingredients |

| DBT India; AIC-CCMB; ICT Mumbai; CECA; NRC Meat; GFI India; HSI India; Clear Meat; IIT Guwahati; RichCore Life Sciences |

| 03 | Scaffolding |

| DBT India; AIC-CCMB; ICT Mumbai; CECA; NRC Meat; GFI India; HSI India; Clear Meat; IIT Guwahati; MyoWorks |

| 04 | Bioreactors/Cell Cultivation Systems |

| DBT India; AIC-CCMB; ICT Mumbai; CECA; NRC Meat; GFI India; HSI India |

| Downstream/Collateral | |||

| 05 | Manufacturing/Production |

| DBT India; ICT Mumbai; CECA; GFI India; HSI India |

| 06 | Sales and Distribution |

| DBT India; ICT Mumbai; CECA; GFI India; HSI India |

| 07 | Supply Chain Management |

| DBT India; ICT Mumbai; CECA; GFI India; HSI India |

| 08 | Regulatory and Business |

| DBT India; AIC-CCMB; ICT Mumbai; CECA; IIT Guwahati; GFI India; HSI India; Clear Meat; BIV; Gastrotope; String Bio 19 |

| S. NO | Organisation | Type | Ongoing Activities | Website | References |

|---|---|---|---|---|---|

| 1 | Department of Biotechnology (DBT), India | Govt | Intellectual and funding resources to stakeholders for the acceleration of CM R&D in India. | http://dbtindia.gov.in/ accessed on 15 September 2021 | [23] |

| 2 | Atal Incubation Centre—Centre for Cellular and Molecular Biology (AIC-CCMB) | Govt and Technology Incubator | Hae been awarded a grant of $640,000 from DBT India for research on in vitro muscle stem cell cultivation. Collaborations: GFI India, DBT India, HSI India, NRC Meat. | http://aic.ccmb.res.in/ accessed on 15 September 2021 | [19,23,37,38] |

| 3 | Institute of Chemical Technology (ICT) Mumbai. | Govt | Setting up the Centre of Excellence in Cellular Agriculture. Collaborations: GFI India, DBT India. | https://www.ictmumbai.edu.in/ accessed on 15 September 2021 | [23] |

| 4 | Centre of Excellence in Cellular Agriculture (CECA) | Govt | ICT Mumbai and GFI India set up the CECA in Maharashtra for CM R&D in India. Collaborations: GFI India, ICT Mumbai, DBT India. | N/A | [23] |

| 5 | National Meat Research Centre (NRC Meat) | Govt | Research on the culture and differentiation of muscle stem cells in serum-free media. Collaborations: AIC-CCMB, GFI India, HSI India, DBT India. | https://nrcmeat.icar.gov.in/ accessed on 15 September 2021 | [19,39] |

| 6 | Good Food Institute (GFI) India | Non-Profit Global | They publish detailed CM guides, white papers, and research articles. Provide services to CM industry stakeholders in govt, academic, and corporate sectors. Collaborations: AIC-CCMB, NRC Meat, HSI India, ICT Mumbai. DBT India, BIV, Ashika Group. | https://www.gfi.org.in/ accessed on 15 September 2021 | [19,23,38,40] |

| 7 | Humane Society International (HSI) India | Non-Profit Global | Funding support for the promotion of open-access publication of in-depth reviews and conceptualisations of accessory technologies for accelerating CM industrialisation in India. Collaborations: AIC-CCMB, GFI India. | https://www.hsi.org/ accessed on 15 September 2021 | [19,37,38] |

| 8 | Big Idea Ventures | Private Accelerator | Creation of the BIV-Ashika India Alternative Protein Fund and an accelerator to promote CM startups. Collaborations: GFI India, Ashika group, Kolkata. | https://bigideaventures.com/ accessed on 15 September 2021 | [40] |

| 9 | Gastrotope | Farm-to-fork accelerator | Incubating Clear Meat for CM research. Collaborations: Clear Meat. | https://gastrotope.com/ accessed on 15 September 2021 | [41] |

| 10 | RichCore LifeSciences | Private | R&D of ‘Non-Animal-Origin’ (NAO) recombinant proteins including media components, reagents, and excipients for the CM industry. Collaborations: DBT India. | http://www.richcoreindia.com/ accessed on 15 September 2021 | [21] |

| 11 | Clear Meat | Private | R&D and patent filed for the development of technology for cultured meat (chicken mince). Collaborations: DBT India, JNU, New Delhi, Gastrotope. | https://www.clearmeat.com/ accessed on 15 September 2021 | [41,42,43] |

| 12 | MyoWorks at the Society for Innovation and Entrepreneurship (SINE) incubator at IIT Mumbai. | Private | Awarded a grant of INR 5 million/USD 67,314 from DBT India. R&D on the creation of edible, vegan scaffolds for the CM industry. Collaborations: DBT India, IIT Mumbai. | NA | [44] |

| 13 | IIT Guwahati | Govt | R&D and technology patent obtained for a muscle progenitor cell culture on edible scaffold materials. Collaborations: DBT India. | https://www.iitg.ac.in/ accessed on 15 September 2021 | [45] |

| 14 | String Bio19 | Private | Patented a String-Integrated Methane Platform (SIMP) for utilisation of methane as a carbon source for bacterial growth leading to the production of alternative protein to be developed as CM ingredients. Collaborators and Investors: Ankur capital, ONGC, Seventure Partners, Kitven, and Srinivasa Hatcheries. | http://www.stringbio.com/ accessed on 15 September 2021 | [46] |

| Certification/Organisation/Authority | Website | |

|---|---|---|

| Quality assurance | Hazard Analysis Critical Control Point (HACCP) by the National Centre for HAACP | https://www.haccpindia.org/ accessed on 15 September 2021 |

| International Organisation for Standardisation (ISO:9000) | https://www.iso.org/home.html accessed on 15 September 2021 | |

| General Society of Surveillance (SGS) India | https://www.sgsgroup.in/ accessed on 15 September 2021 | |

| Good Manufacturing Practices (GMP) India | https://fssai.gov.in/cms/hygiene-requirements.php accessed on 15 September 2021 | |

| Good Hygienic Practices (GHP) India | https://fssai.gov.in/cms/hygiene-requirements.php accessed on 15 September 2021 | |

| Export Inspection Council of India (EIC) | http://eicindia.gov.in/ accessed on 15 September 2021 | |

| Product processing | Prevention of Cruelty to Animals Act 1960 | http://www.awbi.in/policy_acts_rules.html accessed on 15 September 2021 |

| Bureau of Indian Standards (BIS) 2007 | https://bis.gov.in/ accessed on 15 September 2021 | |

| The Food Safety and Standards Act 2006 (FSS Act) | https://www.fssai.gov.in/cms/food-safety-and-standards-act-2006.php accessed on 15 September 2021 | |

| Authorities | Agricultural and Processed Food Products Export Development Authority (APEDA) | https://apeda.gov.in/apedawebsite/ accessed on 15 September 2021 |

| Food Safety and Standards Authority of India (FSSAI) | https://www.fssai.gov.in/ accessed on 15 September 2021 | |

| Department of Animal Husbandry and Dairying | http://dahd.nic.in/ accessed on 15 September 2021 | |

| Ministry of Agriculture and Farmer’s Welfare | http://dare.nic.in/ accessed on 15 September 2021 | |

| Ministry of Food Processing Industries | https://mofpi.nic.in/ accessed on 15 September 2021 | |

| Marine Products Export Development Authority (MPEDA) | https://mpeda.gov.in/ accessed on 15 September 2021 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kamalapuram, S.K.; Handral, H.; Choudhury, D. Cultured Meat Prospects for a Billion! Foods 2021, 10, 2922. https://doi.org/10.3390/foods10122922

Kamalapuram SK, Handral H, Choudhury D. Cultured Meat Prospects for a Billion! Foods. 2021; 10(12):2922. https://doi.org/10.3390/foods10122922

Chicago/Turabian StyleKamalapuram, Sishir K, Harish Handral, and Deepak Choudhury. 2021. "Cultured Meat Prospects for a Billion!" Foods 10, no. 12: 2922. https://doi.org/10.3390/foods10122922