How Do Spillover Effects Influence the Food Safety Strategies of Companies? New Orientation of Regulations for Food Safety

Abstract

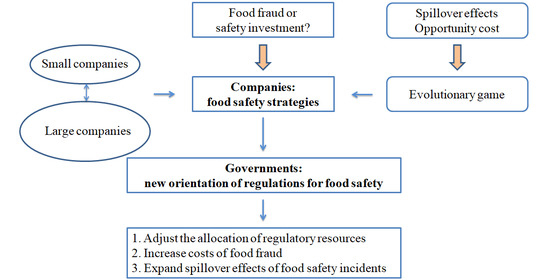

:1. Introduction

2. Theoretical Framework

2.1. The Relationship between Food Safety Risks, Food Safety Strategies, and Food Safety Issues

2.2. Behavioral Logic of the Food Safety Strategies of Companies

3. Methods and Models

3.1. Model Assumptions

3.2. Model Construction

4. Results and Discussion

4.1. Opportunity Cost of the Companies’ Strategies and Food Safety Strategies Equilibrium

4.2. Conditions for Companies to Realize Ideal Food Safety Strategies Equilibrium

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Kang, Y. Food safety governance in China: Change and continuity. Food Control 2019, 106, 106752. [Google Scholar] [CrossRef]

- Kendall, H.; Kuznesof, S.; Dean, M.; Chan, M.-Y.; Clark, B.; Home, R.; Stolz, H.; Zhong, Q.; Liu, C.; Brereton, P.; et al. Chinese consumer’s attitudes, perceptions and behavioural responses towards food fraud. Food Control 2019, 95, 339–351. [Google Scholar] [CrossRef]

- The Joint Action Group on Food Safety Release Ten Typical Cases. Available online: http://www.samr.gov.cn/xw/xwfbt/201911/t20191129_308924.html (accessed on 18 December 2020).

- Yasuda, T. Food Safety Regulation in the United States an Empirical and Theoretical Examination. Independent Review, 2nd ed.; Independent Institute: Oakland, CA, USA, 2010; Volume 15, pp. 201–226. [Google Scholar]

- Scallan, E.; Hoekstra, R.M.; Mahon, B.E.; Jones, T.F.; Griffin, P.M. An assessment of the human health impact of seven leading foodborne pathogens in the United States using disability adjusted life years. Epidemiol. Infect. 2015, 143, 2795–2804. [Google Scholar] [CrossRef] [Green Version]

- Ding, J.; Moustier, P.; Ma, X.; Huo, X.; Jia, X. Doing but not knowing: How apple farmers comply with standards in China. Agric. Hum. Values 2018, 36, 61–75. [Google Scholar] [CrossRef]

- Cadieux, B.; Goodridge, L.D.; Spink, J. Gap analysis of the Canadian food fraud regulatory oversight and recommendations for improvement. Food Control 2019, 102, 46–55. [Google Scholar] [CrossRef]

- Pham, H.V.; Dinh, T.L. The Vietnam’s food control system: Achievements and remaining issues. Food Control 2020, 108, 106862. [Google Scholar] [CrossRef]

- Zanin, L.M.; Luning, P.A.; Da Cunha, D.T.; Stedefeldt, E. Influence of educational actions on transitioning of food safety culture in a food service context: Part 1–Triangulation and data interpretation of food safety culture elements. Food Control 2021, 119, 107447. [Google Scholar] [CrossRef]

- Delicious Melamine Detected in Ordinary Milk Powder of 20 Dairy Companies. Available online: http://paper.people.com.cn/rmrbhwb/html/2008-10/01/content_111979.htm (accessed on 18 December 2020).

- China HACCP Application Development Report. Available online: http://www.cnca.gov.cn/xxgk/jgdt/201506/t20150611_35790.shtml (accessed on 18 December 2020).

- Toledo, C.; Villas-Boas, S.B. Safe or Not? Consumer Responses to Recalls with Traceability. Appl. Econ. Perspect. Policy 2018, 41, 519–541. [Google Scholar] [CrossRef]

- Roehm, M.L.; Tybout, A.M. When Will a Brand Scandal Spill Over, and how Should Competitors Respond? J. Mark. Res. 2006, 43, 366–373. [Google Scholar] [CrossRef]

- Dahlén, M.; Lange, F. A Disaster Is Contagious: How a Brand in Crisis Affects Other Brands. J. Advert. Res. 2006, 46, 388–397. [Google Scholar] [CrossRef] [Green Version]

- Ngo, H.M.; Liu, R.; Moritaka, M.; Fukuda, S.; Ngo, M.H. Urban consumer trust in safe vegetables in Vietnam: The role of brand trust and the impact of consumer worry about vegetable safety. Food Control 2020, 108, 106856. [Google Scholar] [CrossRef]

- Romley, J.; Shih, T. Product safety spillovers and market viability for biologic drugs. Int. J. Health Econ. Manag. 2016, 17, 135–158. [Google Scholar] [CrossRef]

- Soon, J.; Krzyzaniak, S.; Shuttlewood, Z.; Smith, M.; Jack, L. Food fraud vulnerability assessment tools used in food industry. Food Control 2019, 101, 225–232. [Google Scholar] [CrossRef]

- Liu, P.; Ma, L. Food scandals, media exposure, and citizens’ safety concerns: A multilevel analysis across Chinese cities. Food Policy 2016, 63, 102–111. [Google Scholar] [CrossRef]

- Parfitt, J.; Barthel, M.; Macnaughton, S. Food waste within food supply chains: Quantification and potential for change to 2050. Philos. Trans. R. Soc. B Biol. Sci. 2010, 365, 3065–3081. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Bachev, H.B.H. Risk Management in the Agri-food Sector. Contemp. Econ. 2013, 7, 45–62. [Google Scholar] [CrossRef] [Green Version]

- Starbird, S.A. Moral Hazard, Inspection Policy, and Food Safety. Am. J. Agric. Econ. 2005, 87, 15–27. [Google Scholar] [CrossRef]

- Akerlof, G. The Market for “Lemons”: Quality Uncertainty and the Market Mechanism. Essent. Read. Econ. 1995, 84, 175–188. [Google Scholar] [CrossRef]

- Fehr, E.; Gächter, S. Altruistic punishment in humans. Nat. Cell Biol. 2002, 415, 137–140. [Google Scholar] [CrossRef]

- Santos, F.C.; Santos, M.D.; Pacheco, J.M. Social diversity promotes the emergence of cooperation in public goods games. Nat. Cell Biol. 2008, 454, 213–216. [Google Scholar] [CrossRef]

- Nowak, M.A. Five Rules for the Evolution of Cooperation. Science 2006, 314, 1560–1563. [Google Scholar] [CrossRef] [Green Version]

- Gao, H.; Knight, J.G.; Zhang, H.; Mather, D. Guilt by association: Heuristic risks for foreign brands during a product-harm crisis in China. J. Bus. Res. 2013, 66, 1044–1051. [Google Scholar] [CrossRef]

- Roy, V.; Tata, S.V.; Parsad, C. Consumer response to brand involved in food safety scandal: An exploratory study based on a recent scandal in India. J. Consum. Behav. 2018, 17, 25–33. [Google Scholar] [CrossRef]

- Yinghua, S.; Ningzhou, S.; Dan, L. Evolutionary game and intelligent simulation of food safety information disclosure oriented to traceability system. J. Intell. Fuzzy Syst. 2018, 35, 2657–2665. [Google Scholar] [CrossRef]

- Yang, S.; Zhuang, J.; Wang, A.; Zhang, Y. Evolutionary Game Analysis of Chinese Food Quality considering Effort Levels. Complexity 2019, 2019, 1–13. [Google Scholar] [CrossRef] [Green Version]

- Luo, J.; Ma, B.; Zhao, Y.; Chen, T. Evolution Model of Health Food Safety Risk Based on Prospect Theory. J. Heal. Eng. 2018, 2018, 1–12. [Google Scholar] [CrossRef] [Green Version]

- Santos, F.C.; Pacheco, J.M. Scale-Free Networks Provide a Unifying Framework for the Emergence of Cooperation. Phys. Rev. Lett. 2005, 95, 098104. [Google Scholar] [CrossRef] [Green Version]

- Perc, M.; Szolnoki, A. Coevolutionary games—A mini review. BioSystems 2010, 99, 109–125. [Google Scholar] [CrossRef] [Green Version]

- Smith, J.M. Evolution and the Theory of Games. In Did Darwin Get It Right? Springer: Boston, MA, USA, 1988; Volume 64, pp. 202–215. [Google Scholar] [CrossRef]

- Friedman, D. On economic applications of evolutionary game theory. J. Evol. Econ. 1998, 8, 15–43. [Google Scholar] [CrossRef] [Green Version]

- Barrieu, P.; Sinclair-Desgagné, B. On Precautionary Policies. Manag. Sci. 2006, 52, 1145–1154. [Google Scholar] [CrossRef]

- Zan, H.; Lambea, M.; McDowell, J.; Scharff, R.L. An Economic Evaluation of Food Safety Education Interventions: Estimates and Critical Data Gaps. J. Food Prot. 2017, 80, 1355–1363. [Google Scholar] [CrossRef] [PubMed]

- Zhang, W.Y.; Deng, F. Information, incentive and joint responsibility: A legal and economic interpretation of Lian Zuo and Bao-jia systems in ancient China. J. Econom. Res. 2003, 3, 99–112. [Google Scholar]

| No. | Incidents | First Report | Recent Report | Severity of Major Consequence |

|---|---|---|---|---|

| 1 | Aquatic product “Malachite Green” | 2005 | 2018 | Long-term harm |

| 2 | Livestock Products “Sudan Red” | 2006 | 2013 | Long-term harm |

| 3 | Dairy Products “Melamine” | 2008 | 2008 | Illness and Death |

| 4 | Edible Oil Product “Ditch oil” | 2010 | 2019 | Long-term harm |

| 5 | Livestock and Poultry Products “Clenbuterol” | 2011 | 2019 | Long-term harm |

| 6 | Health products, Liquor “Plasticizer” | 2011 | 2019 | Long-term harm |

| 7 | Dairy Products “Industrial Gelatin” | 2011 | 2019 | Long-term harm |

| 8 | Livestock Products “Saccharin” | 2013 | 2019 | Long-term harm |

| 9 | Livestock Products “Zombie Meat” | 2015 | 2019 | Long-term harm |

| 10 | Takeaway Products “Unhygienic Production” | 2016 | 2019 | Illness |

| 11 | Takeaway Product “Inferior Cooking Bag” | 2018 | 2019 | Long-term harm |

| 12 | Bee Products “Fake Honey” | 2018 | 2019 | Long-term harm |

| Food Fraud | Orientation of Influence | Safety Investment | Orientation of Influence | |

|---|---|---|---|---|

| Costs analysis | Industry losses after participants identify companies’ behavior | Rise | Production costs of food | Rise |

| Direct companies’ losses (e.g., government penalties) after participants identify companies’ behavior | Rise | |||

| Indirect companies’ losses (e.g., reduced willingness to pay by consumers) after participants identify companies’ behavior | Rise | |||

| Benefit analysis | Production costs of food | Fall | Benefit from fulfilling social responsibility of food safety | Rise |

| Benefit from capital investment as well as product premiums | Rise |

| Large Companies | Small Companies | |

|---|---|---|

| Safety Investment (y) | Food Fraud (1−y) | |

| Safety investment (x) | , | , |

| Food fraud (1−x) | , | , |

| Symbol of | Number of Equilibrium Points | ESS | ||||

|---|---|---|---|---|---|---|

| Condition 1 | - | - | + | + | 5 | |

| Condition 2 | + | + | + | + | 4 | |

| Condition 3 | - | - | - | - | 4 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Xue, Y.; Geng, X.; Kiprop, E.; Hong, M. How Do Spillover Effects Influence the Food Safety Strategies of Companies? New Orientation of Regulations for Food Safety. Foods 2021, 10, 451. https://doi.org/10.3390/foods10020451

Xue Y, Geng X, Kiprop E, Hong M. How Do Spillover Effects Influence the Food Safety Strategies of Companies? New Orientation of Regulations for Food Safety. Foods. 2021; 10(2):451. https://doi.org/10.3390/foods10020451

Chicago/Turabian StyleXue, Yangchen, Xianhui Geng, Emmanuel Kiprop, and Miao Hong. 2021. "How Do Spillover Effects Influence the Food Safety Strategies of Companies? New Orientation of Regulations for Food Safety" Foods 10, no. 2: 451. https://doi.org/10.3390/foods10020451